Addressing corporate fundamentals, we saw a solid crop of quarterly earnings results for the fourth quarter with overall double-digit year-over-year growth once again, although selected subsectors continued to face headwinds related to the coronavirus. Economic activity, especially in the service sector, was hurt by the spike related to the proliferation of the Omicron variant. Many companies are experiencing ongoing challenges stemming from persistent supply chain disruptions, jump in energy and transportation costs, and a tight labor market, resulting in forward outlooks being reduced. As well, economic growth forecasts have been trimmed over recent months due to some of the aforementioned supply chain issues, sporadic virus-driven lockdowns seen in China as well as collateral damage from the Ukraine invasion and Russian sanctions, which will likely be most acutely felt in Europe apart from Russia. While we anticipate aggregate credit metrics will continue to improve, we expect companies to continue to look to pass through higher wage costs on to customers but top line growth could suffer if price increases meet resistance in an environment of multidecade-high inflation. The drops in U.S. consumer confidence measures, especially expectations, and small business optimism, if not reversed, represent cautionary signs as we have entered a thornier environment in the second quarter with the Federal Reserve and other central banks poised to tighten monetary policy aggressively, elevated inflation, and heightened market volatility.

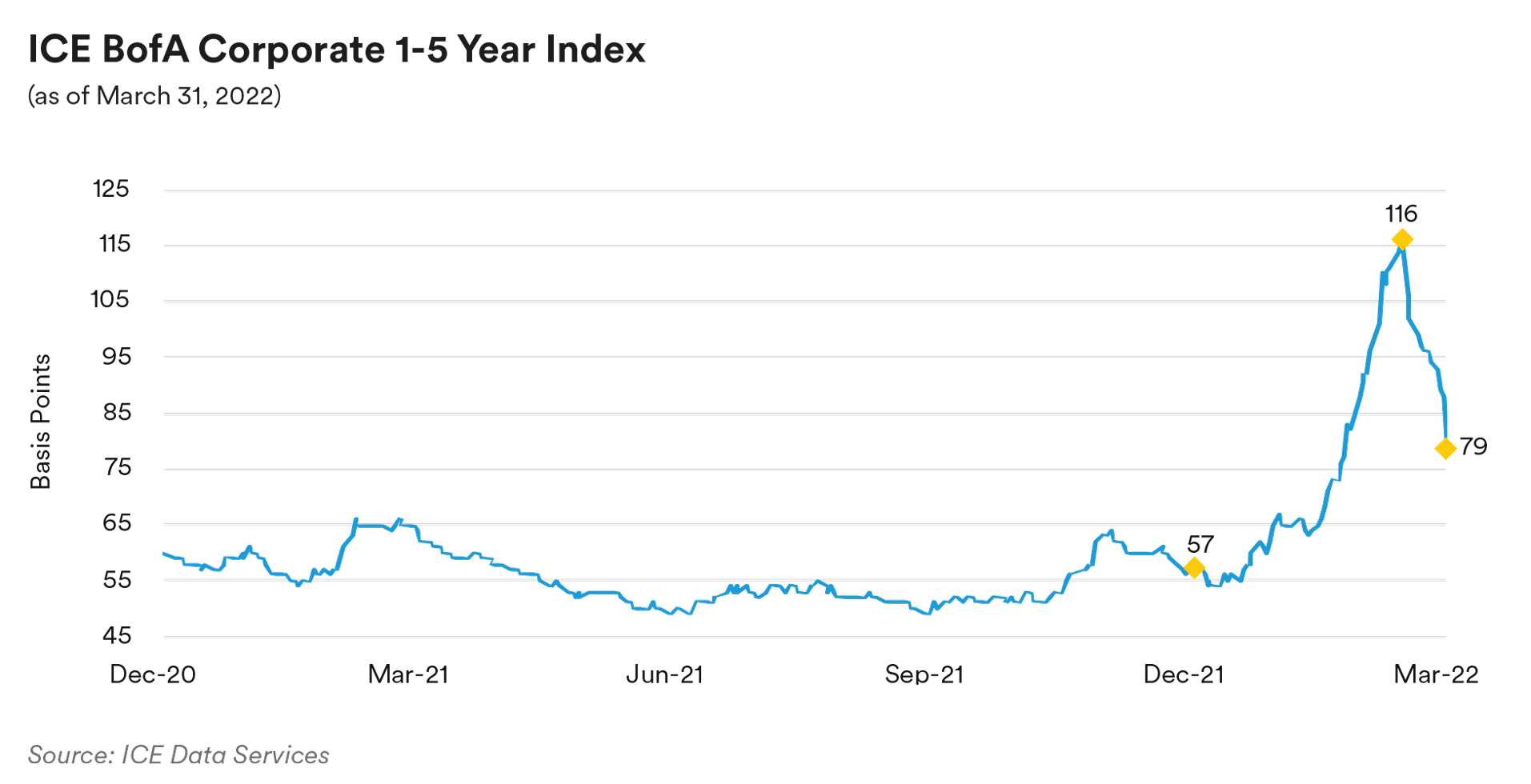

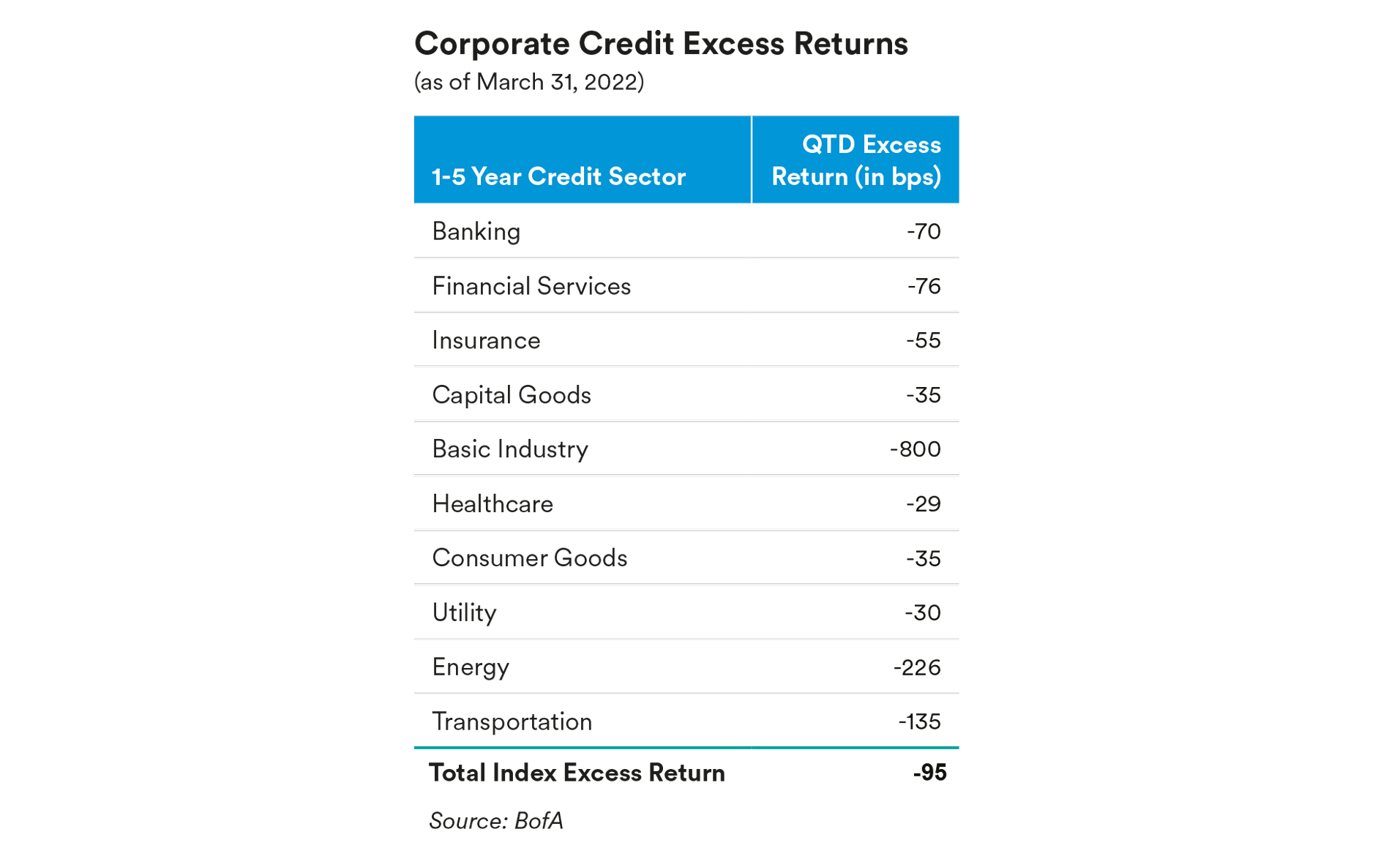

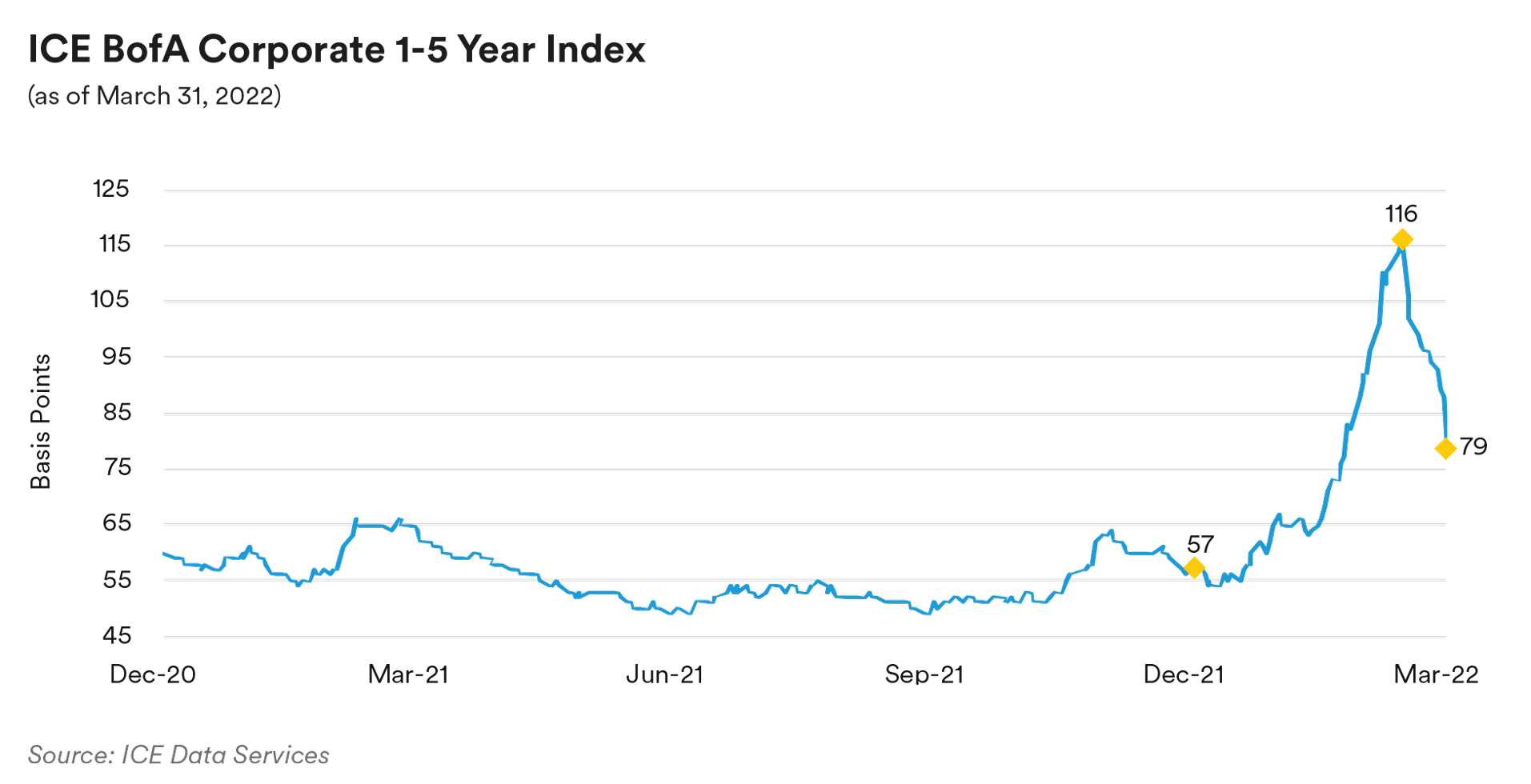

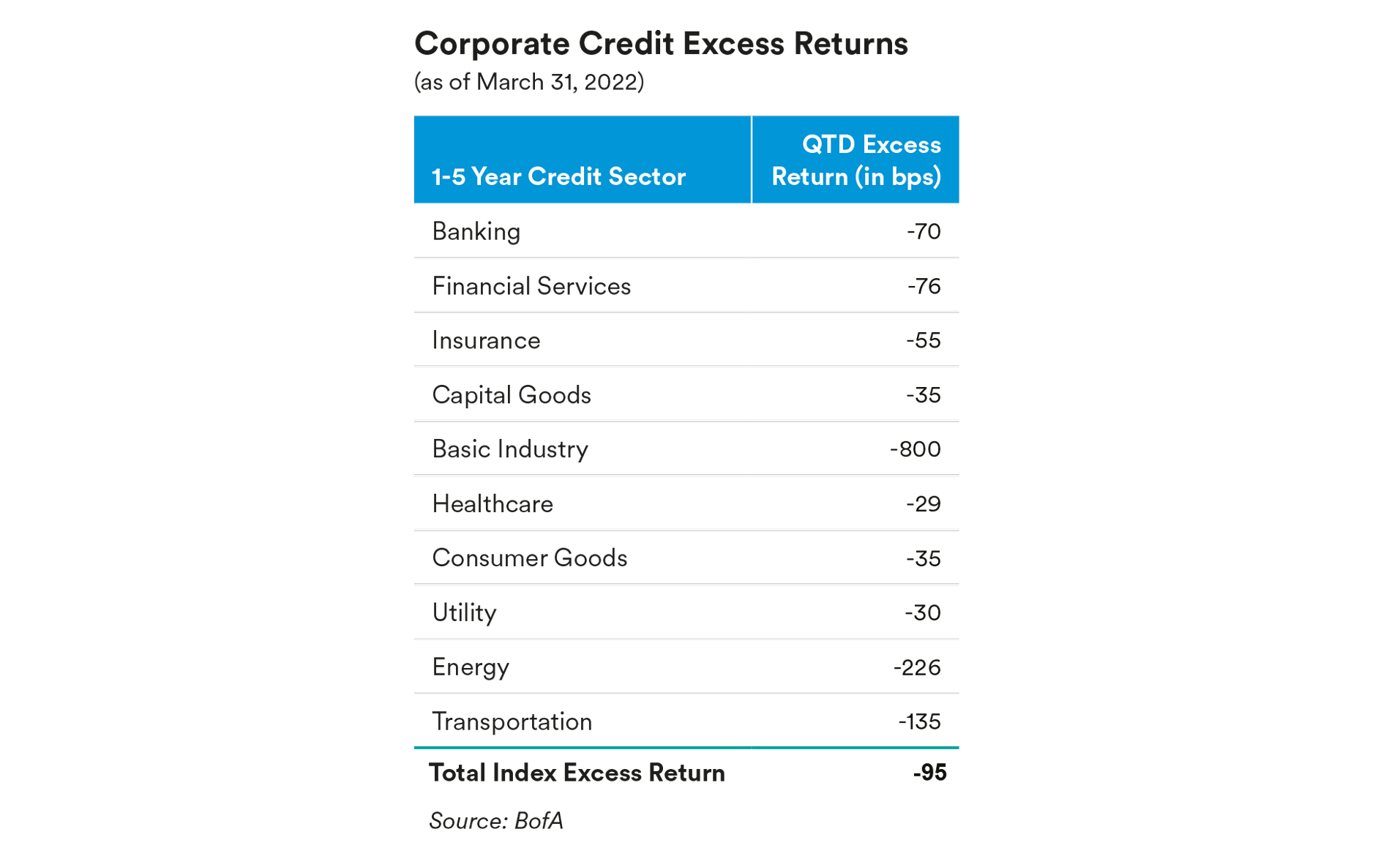

Portfolio Actions & Outlook: The ICE BofA 1-5 Year U.S. Corporate Index, our bellwether front-end investment grade corporate index, finished the quarter at an option-adjusted spread (OAS) of 79 basis points, 22 basis points wider than where it began the year. Given that corporate credit fundamentals across subsectors remain on a solid footing, at a high level we took advantage of the widening in credit spreads and reshaping of the yield curve, particularly the sell-off in shorter dated U.S. Treasuries, pushing front-end yields substantially higher, to methodically raise sector exposure. We added mainly up-in-quality corporate bonds across strategies as we meaningfully reduced our holdings of floating-rate corporates. We saw the significant increase in all-in yields as presenting an attractive opportunity to swap out of floaters and into fixed-rate securities, often of similar tenors, while picking up considerable yield. This came against a backdrop of materially negative subsector excess returns across investment grade credit with the most negative subsectors comprising Russia country of risk securities or subsectors exposed to the Ukraine situation and resulting sanctions, specifically concentrated in the basic industry, energy and transportation subsectors.

Drilling down further on first-quarter trading activity, we maintained our disciplined and selective approach across strategies in focusing on primarily adding fixed-rate bonds via the new issue calendar and the secondary market after benchmark yields began to track higher and spreads widened in higher-quality issuers in our favored, more defensive subsectors like banking, consumer non-cyclicals, technology, and electric utilities. In our shorter strategies across portfolios, highlighted secondary purchases included several money center banks’ one-year bonds, a cell tower operator’s AAA-rated secured one-year, fixed-rate bonds, an A-rated health insurer’s one-year, fixed-rate bonds, and an A-rated German auto maker’s U.S. finance company’s new issue three-year, fixed-rate bonds. Many of our purchases were funded by selling lower yielding 2024 floating-rate securities.

We were also very active in raising sector exposure and repositioning our 1-3 year portfolios over the first quarter, utilizing both new issues and the secondary market. Notable new issue buys included Canadian bank’s three-year, fixed-rate bonds, a telecommunication company’s entertainment business two-year, fixed-rate bonds, a Japanese auto finance company’s two-year, fixed-rate bonds, a U.K. pharmaceutical company’s consumer health two-year, fixed-rate bonds, and a U.S. insurer’s life and retirement services business three-year, fixed-rate bonds. Highlighted secondary purchases included a German truck finance company’s two-year, fixed-rate bonds (swapped out of their like-maturity floating-rate bonds) and a Japanese pharmaceutical company’s consumer health two-year, fixed-rate bonds, both bought in the midst of the move higher in spreads and all-in yields in mid-late March.

In our 1-5 year portfolios, the same themes played out as we raised sector exposure utilizing both the active new issue market as well as secondaries in an attempt to build on our yield advantage vs. benchmark indices. We carried this out as spreads widened and all-in yields increased by mainly purchasing fixed-rate bonds and aggressively paring down our floating-rate securities position over the quarter. Most of our activity was in new issue where we purchased a utility generation company’s five-year bonds, a snack company’s five-year bonds, the aforementioned telecommunication company’s entertainment business three-year, fixed-rate bonds, a German auto maker’s U.S. finance company’s new issue five-year bonds, a German truck finance company’s five-year bonds, and the U.S. insurer’s life and retirement services business three-year, fixed-rate bonds, also bought for the 1-3 year portfolios. As noted, our purchases in Credit were funded almost solely by selling floating-rate securities in the quarter.

As the tailwinds from an historic amount of fiscal and monetary policy support fades, we are certainly destined to see financial conditions tighten with a Federal Reserve seemingly determined to play catch up from its current position of being well behind the curve. This should cause the pace of both nominal and real growth to decline over the quarters ahead even if inflation fails to roll over and move down closer to the Fed’s long-term 2% average target. While the impact of the coronavirus in terms of supply chain challenges, labor shortages and distortions in consumer behavior begins to diminish more decidedly, moving forward corporate credit fundamentals are expected to be maintained at current levels or see only modest improvement. This past quarter’s widening in spreads and reset to higher all-in yields presented us with attractive opportunities to increase our sector exposure slightly in investment grade credit and invest selectively in areas where we saw value.

Looking ahead we are mindful of what a reshaping of the yield curve, particularly the inverted yields of certain time-tested measures like the two-year/ten-year benchmark Treasuries, seen by many observers as a cautionary sign of a recession approaching over the next one to two years. Against that backdrop, we continue to see some signs of dislocation in the credit market in terms of pockets of reduced liquidity, inverted credit spread curves in our short duration space and secondary offerings occasionally carrying yields much wider than we would expect given where recent trades were executed. Thus, with valuations more attractive than they were for much of 2020 and credit fundamentals still in decent shape, we are comfortable continuing to edge our credit sector exposure a little higher, keeping rising cost pressures and margin compression in mind. That said, we remain biased to remain a bit more defensive and focus on up-in-quality securities and select subsectors given we do not really see the benefit or sufficient spread pickup in broadly moving down in credit quality given the relatively modest spread pickup available.

We view the aggressive monetary policy path of raising the federal funds rate and quantitative tightening signaled by the Federal Reserve with more than eight additional rate hikes priced in this year as likely to produce occasional bouts of volatility and spread widening as the rest of 2022 unfolds. Undoubtedly, whether the Federal Reserve can successfully execute a soft landing and avoid a major downturn or a recession is open for debate but a Federal Reserve seemingly committed to hiking rates at the fastest pace in more than 25 years while slashing the size of its balance sheet by trillions can be expected to foster some market dislocations.

In the near term, the strength of U.S. consumer balance sheets and the labor market should continue to buoy the economy but rougher waters may lie ahead. While we will look to continue to maintain a strong liquidity profile in the credit sector and more broadly, we will also continue to seek opportunities to add exposure selectively when opportunities present themselves. We anticipate this will not require us “stretching” to move out the credit spectrum given we may be moving into more of a “late cycle” phase, and will maintain our discipline in favored subsectors and issuers within banking, insurance, consumer non-cyclicals, communications, technology, and electric utilities which we see as better positioned to protect operating margins, preserve strong credit metrics and avoid rating downgrades.

Performance: As with all spread sectors which saw spread widening in the first quarter, the investment grade credit sector was a negative contributor to relative performance across strategies given the biggest move wider in spreads over a quarter since fourth-quarter 2018 (ex. the onset of the pandemic in first-quarter 2020). Essentially, there was nowhere to hide in Credit per se with all investment grade credit subsectors generating negative excess returns over the quarter. It was the same the same story across our short dated, 1-3 year and 1-5 year strategy portfolios where our holdings saw spreads widen with the market. Notable weakness was seen in some of the more liquid, traditionally well supported subsectors like banking, insurance and automotive, which represent some of the most liquid subsectors as the gap wider in credit spreads was most acutely felt in these subsectors where investors could most easily sell bonds to reduce exposure or meet fund redemptions, among some of the market dislocations characteristic of the first quarter.

Treasuries / Agencies

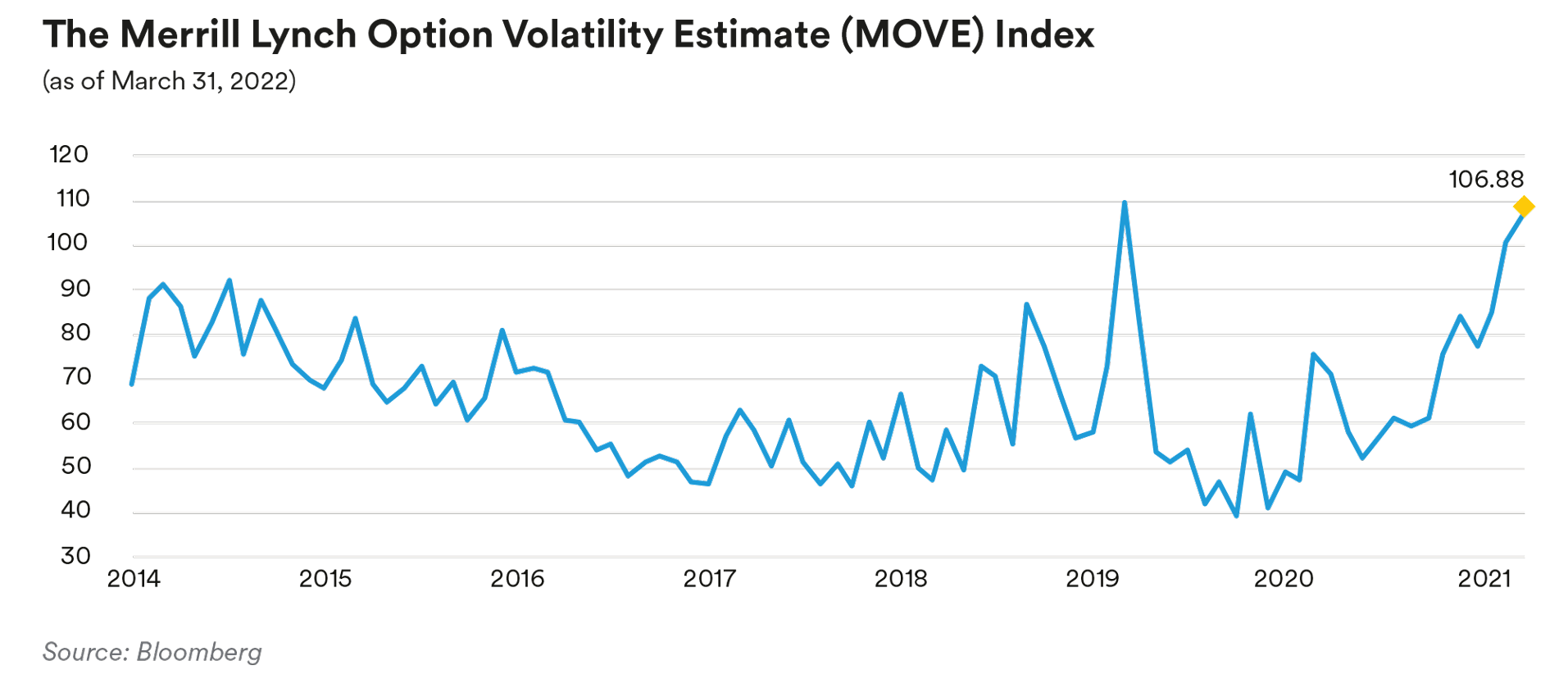

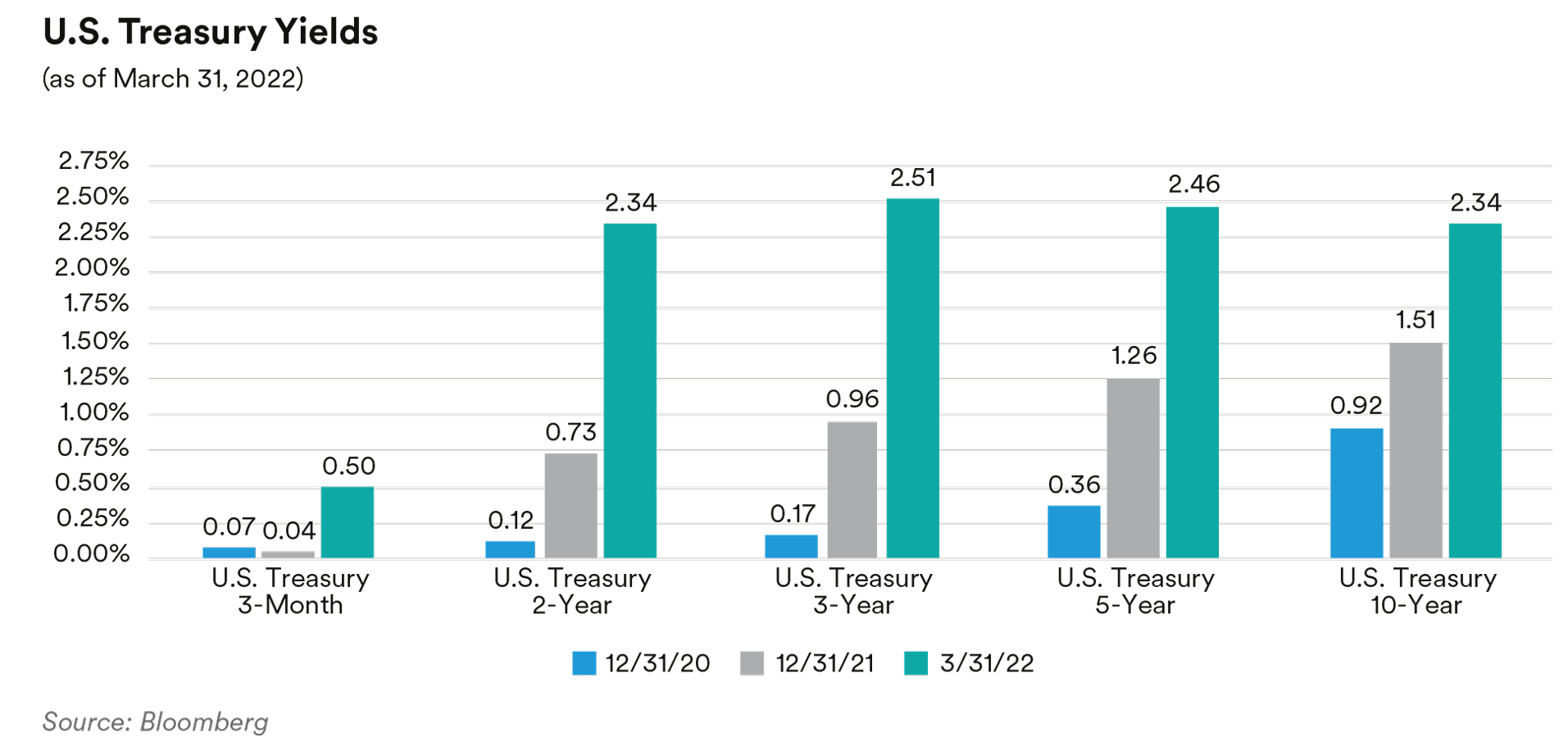

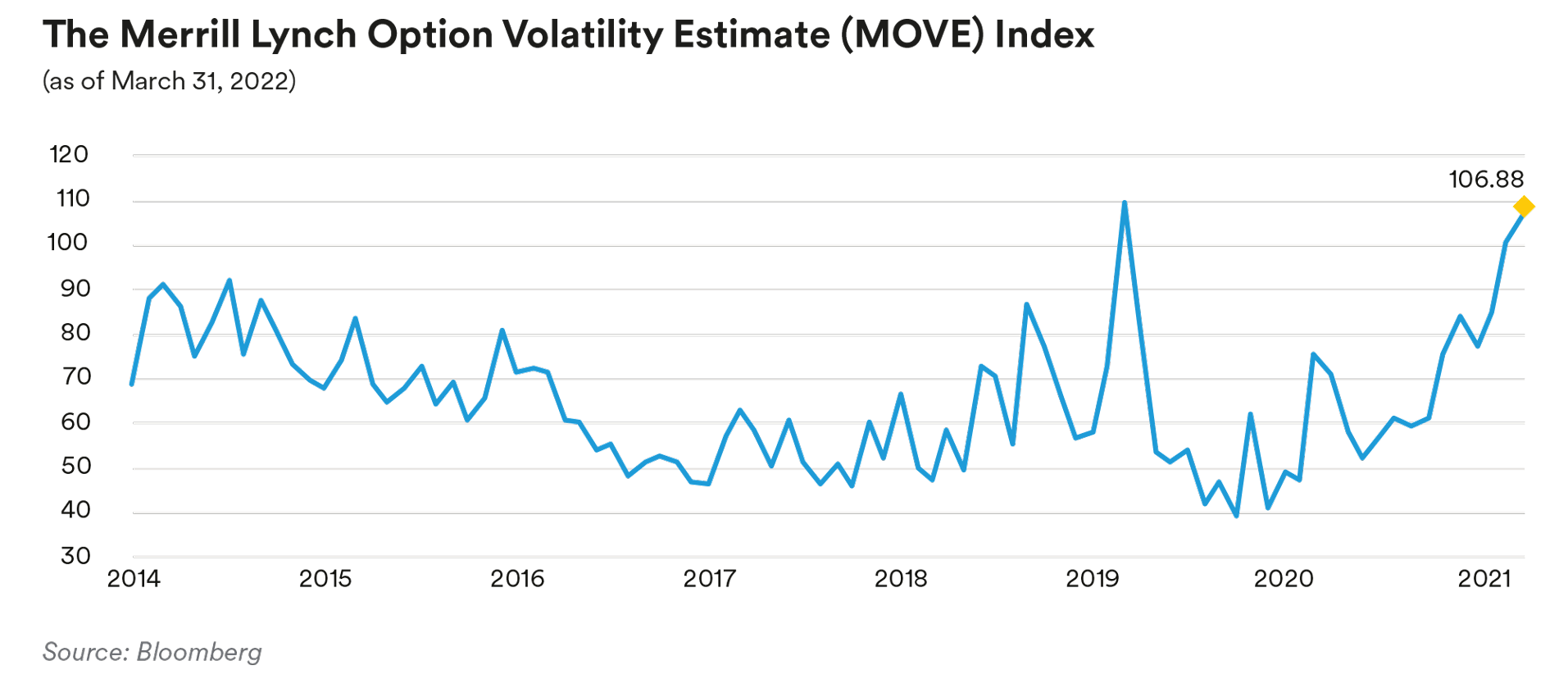

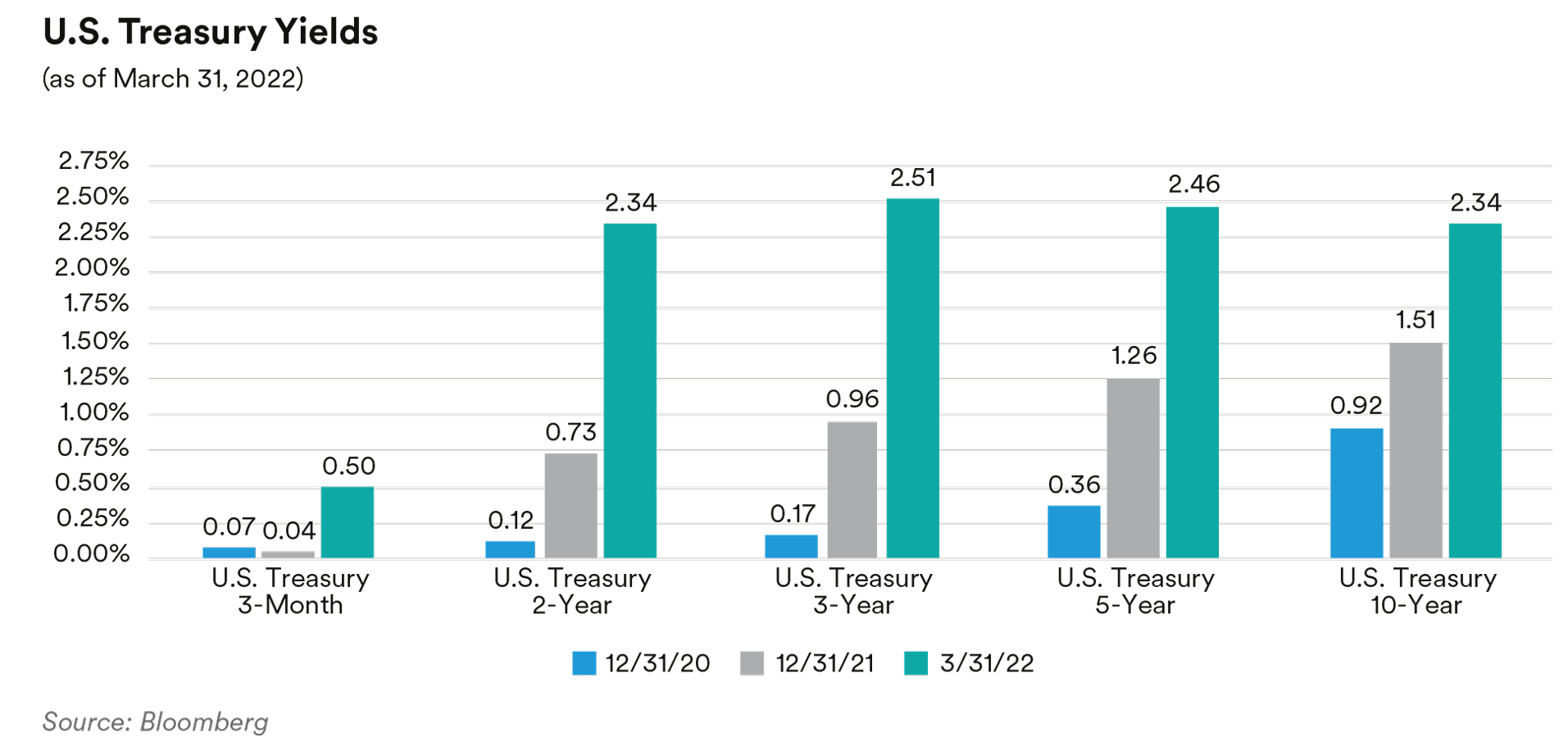

Recap: The first quarter of the year was unquestionably defined by a bear flattening in the U.S. Treasury market and its yield curve as persistently elevated inflation drove a growing hawkishness from the Federal Reserve, which pushed the FOMC to deliver its first policy rate hike of this cycle after concluding quantitative easing in March. Several parts of the yield curve inverted with the quarterly moves in Treasury rates representing the largest since the Global Financial Crisis (GFC) back in 2008. The repricing of Fed expectations in the front end of the market also led to a surge in volatility, which also hit its highest levels since the GFC. Daily basis point moves in volatility being priced into the front end of the Treasury market moved from close to 5 basis points a day at the start of the quarter to over 8 basis points a day by the end of the quarter, a 60% increase. One measure of interest rate volatility is the Merrill Lynch Option Volatility Estimate (MOVE) Index which is a yield curve weighted index of the normalized implied volatility on Treasury options across the maturity spectrum. As shown in the chart below, volatility spiked higher over the quarter in tandem with rates.

Regarding Fed policy, the central bank delivered its first 25 basis point hike of the cycle as the median Fed forecast showed policy rates reaching 1.875% by the end of 2022 with the terminal rate projected to be achieved by 2023. Following the meeting, Chair Powell acknowledged that he was open to a 50 basis point move at the May meeting and suggested that the start of the balance sheet rundown will be revealed at that meeting as well. Over the quarter the market repriced Fed hiking expectations dramatically with the year-end 2022 projected federal funds rate moving from 85 basis points at the start of the year up to 240 points by the end of the first quarter. The peak federal funds rate was also recalibrated significantly with expectations for a 3% funds rate around the summer of 2023.

The front end of the market led the sell-off in the first quarter as short rates responded to liftoff and the promise of more rate hikes to come. We saw the two-year Treasury move 160 basis points higher during the quarter, ending at 2.34%. This represented the largest quarterly sell-off in almost 40 years. In addition, the five-year Treasury sold off less but still moved 120 basis points higher over the quarter (the largest sell-off since 2004). Similarly, the ten-year Treasury sold off even less, moving 83 basis points higher during the quarter (like what was seen in Q1 2021). The flattening of the yield curve was dramatic with the spread between the ten-year Treasury and the two-year Treasury moving from 77 basis points at the start of the year to slightly inverted by the end of the quarter (largest flattening since 2011). The spread between the five-year Treasury and two-year Treasury moved from 54 basis points at the beginning of the year to 12 basis points at the end of the quarter, also the largest quarterly flattening since 2011. The very front end of the yield curve also moved significantly higher with more anticipated Federal Reserve rate hikes being priced in. Three-month, six-month and one-year Treasury bill yields were 45, 83 and 122 basis points higher during the quarter, respectively. The outright size of the Fed’s $9 trillion dollar balance sheet and the ongoing surplus of reserves in the system continued to push cash into the Reverse Repo Facility (RRP), although as the Fed begins to shrink its holdings, the RRP uptake may start to decline. The move higher in yield in the very front end of the Treasury curve was largely driven by inflation expectations. Looking at the two-year TIPS breakeven inflation rate, it moved from 321 basis points at the start of the year to 441 basis points at the end of the quarter, largely due to the surge in commodity prices. Further out the curve, TIPS breakeven inflation rates also moved higher but not as much as the very front end. The five-year TIPS breakeven rate moved 74 basis points higher during the quarter while the ten-year TIPS breakeven rate was 60 basis points higher. Overall inflation expectations as measured by TIPS breakeven rates reached levels never seen since the introduction of TIPS back in the late 1990s.

Front-end Government-Sponsored Enterprise (GSE) agency spreads moved marginally wider over the first quarter as the option-adjusted spread (OAS) of the ICE BofA 1-5 Year U.S. Bullet (fixed maturity) Agency Index ended the first quarter at 2 basis points, 3 basis points wider from the beginning of the year. In the SSA subsector, U.S. dollar-denominated fixed-maturity securities saw spreads widen by six basis points and finished the quarter, on average, at 23 basis points over comparable-maturity Treasuries. As the selloff in rates pushed investment grade credit spreads wider, we also saw agency/SSA spreads move wider in sympathy. There was some initial concern over the quarter surrounding major supranational banks with exposure to Russia and if the ongoing sanctions would hurt these issuers, which have been considered generally safe during times of uncertainty. Several major supranational banks that have very limited exposure to Russia that we have owned in the past include IBRD and IFC, both members of World Bank Group; however, we did not hold exposure to either of those issuers at the end of the quarter. On March 2, the World Bank Group issued statements that they have not approved any new loans to or investments in Russia since 2014. There has also been no new lending approved since Belarus since mid-2020. The World Bank also halted all their current active programs in Russia and Belarus effective immediately. The IBRD and IFC’s exposure to Russia in their lending portfolios is around 1-3%, or in dollar terms, less than $1.2 billion. Given the very limited exposure, IBRD and IFC spreads are trading in line with their AAA-rated peers that do not have exposure to Russia.

Portfolio Actions & Outlook: In the fourth quarter of last year, we increased the liquidity and floating-rate exposure in our portfolios given our expectation of a further rise in interest rates. Over the first quarter, as we saw rates move violently higher where two-year Treasury yields moved 90 basis points higher in March, the largest selloff on a month-over-month basis since 1984, we opportunistically used nominal Treasuries to add duration across our portfolios, selling floating-rate securities to fund the duration purchases. Although we continued to maintain our sector underweight in agencies, we did find attractive opportunities to add to agency callable securities as the upper left portion of the volatility surface spiked higher. Specifically, we thought three-month, three-year swaption volatility looked especially attractive as it reached highs last seen in 2008. We added to three-year non-call three-month structures as issuers cheapened up their funding levels across most strategies.

As we enter the second quarter, market expectations are for the Federal Reserve to tighten monetary policy extremely aggressively with 12 total hikes priced in by Q3 2023 and 250 basis points of total hikes priced in by year-end 2022. This implies that the market is expecting the Fed to overshoot neutral and then have to cut rates in the future as growth slows down. We have seen Fed members take a hawkish turn and be very vocal about their being behind the curve and the need to bring inflation levels lower. Our thoughts are that too much Federal Reserve hiking may be priced into the market with the potential for financial conditions to tighten dramatically at some point during the hiking cycle, increasing the probability of a recession sometime in 2023 or 2024. Overall Treasury yields across the curve may be near peak and we have adjusted our portfolios from our prior short duration posture to be neutral to slightly long duration relative to our benchmark indices. The TIPS market also seems fully priced for future inflation expectations and we would expect nominal Treasuries to outperform TIPS in the near term. Given our view that uncertainty is likely to stay high in the short run, we see volatility likely to remain high as market pricing for hikes continues to evolve. As some of the supranationals announce new packages to support Ukraine, the efforts could lead to more issuance in the SSA space as issuers’ funding needs increase.

Performance: Our slightly short to neutral duration posture relative to benchmark indices was a positive contributor across all our strategies except for our Cash Plus portfolios that have single point, six-month Treasury-bill indices. Curve positioning detracted from our shorter duration Cash Plus and Enhanced Cash strategies as we had positions longer than their respective single, fixed point indices as yields moved higher. On the other hand, our longer strategies benefited, and our short duration and yield curve positioning were positive contributors to performance. The Agency sector saw modestly negative excess returns as spreads moved wider across most Agency subsectors.

ABS

Recap: ABS spreads widened over the course of the first quarter as macro volatility returned to the market in the wake of Russia’s invasion of Ukraine. Spreads on two-year, fixed-rate AAA-rated credit card, prime auto, and subprime auto tranches moved 16, 26 and 66 basis points wider to end the quarter at 42, 62 and 117 basis points over Treasuries, respectively. Three-year, floating-rate FFELP student loan tranches also widened 31 basis points over the quarter to finish March at a spread of 75 basis points over LIBOR.

First-quarter ABS issuance was robust with over $65 billion of new deals coming to the market compared to $60 billion in the first quarter of 2021. Issuance was fairly evenly distributed across the quarter with each month seeing more than $20 billion of new deals. As usual, auto issuance was the largest contributor with over $31 billion of new auto ABS deals pricing, followed by $10 billion of issuance in the “other ABS” subsector (which includes collateral like cell phone payment plans, timeshares, mortgage servicer advances, insurance premiums, aircraft leases, etc.) and $6.5 billion of new equipment deals.

With their concentration in seasoned, prime underlying account receivables, credit card trust performance continues to remain stable compared to historical levels. As noted in our prior commentaries, we anticipated that performance metrics would deteriorate as pandemic-related stimulus programs wound down and this now appears to be happening. Data from recent remittance reports as measured by J.P. Morgan’s credit card performance indices shows that charge-offs have ticked up each month since reaching an all-time low of 0.87% in October 2021 and stood at 10.7% in February (as reflected in the March reporting cycle). Likewise, 30+- day delinquencies have inched up from a record low of 0.79% in August 2021 to reach 0.87% in February 2022. We expect this negative trend to continue for the foreseeable future but given the strong labor market, we regard the downturn as just a normalization of trust performance rather than indicative of major stresses on the consumer. In addition, we do not expect any material impact on AAA-rated credit card tranches due to their significant levels of credit enhancement.

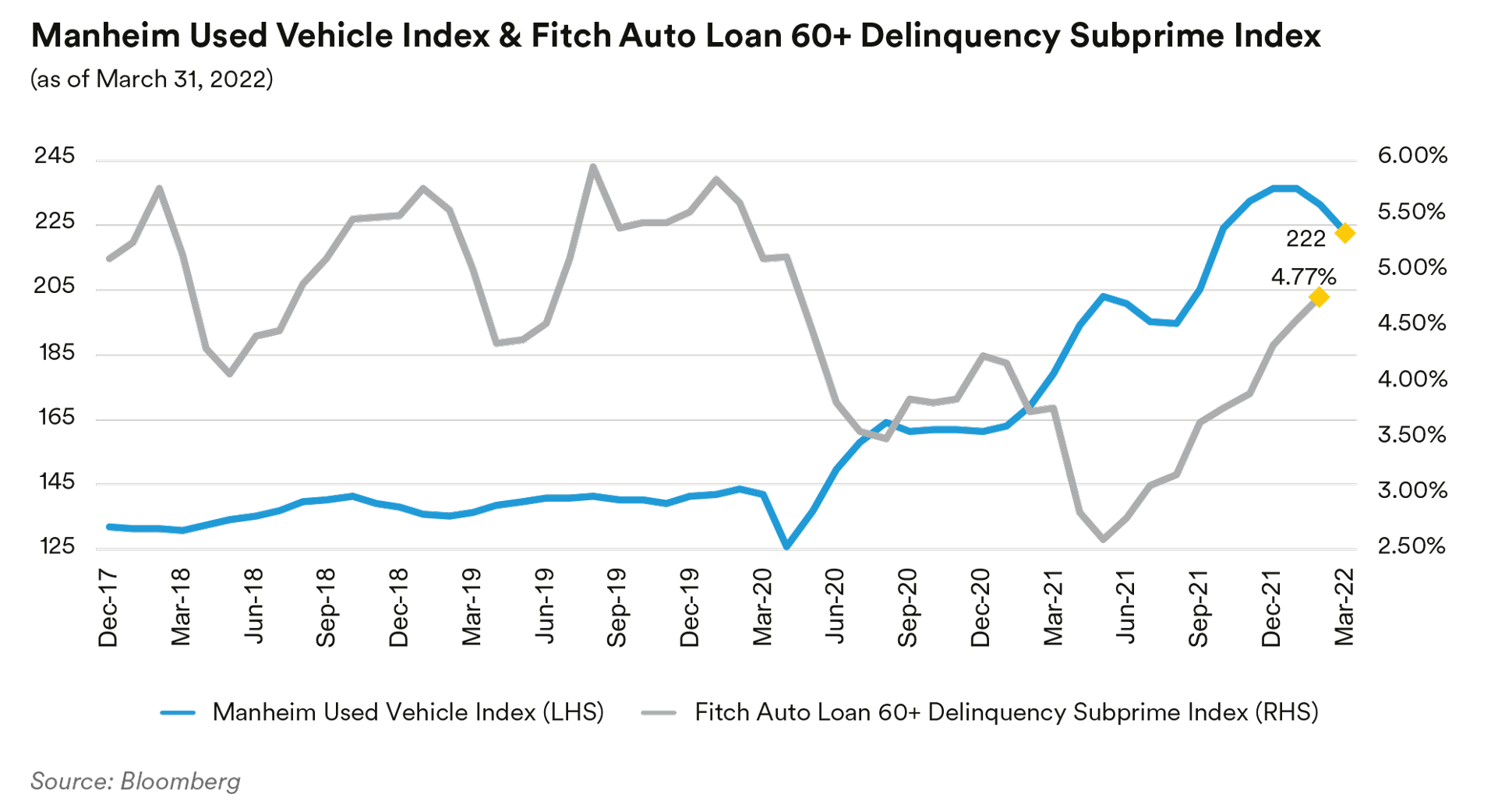

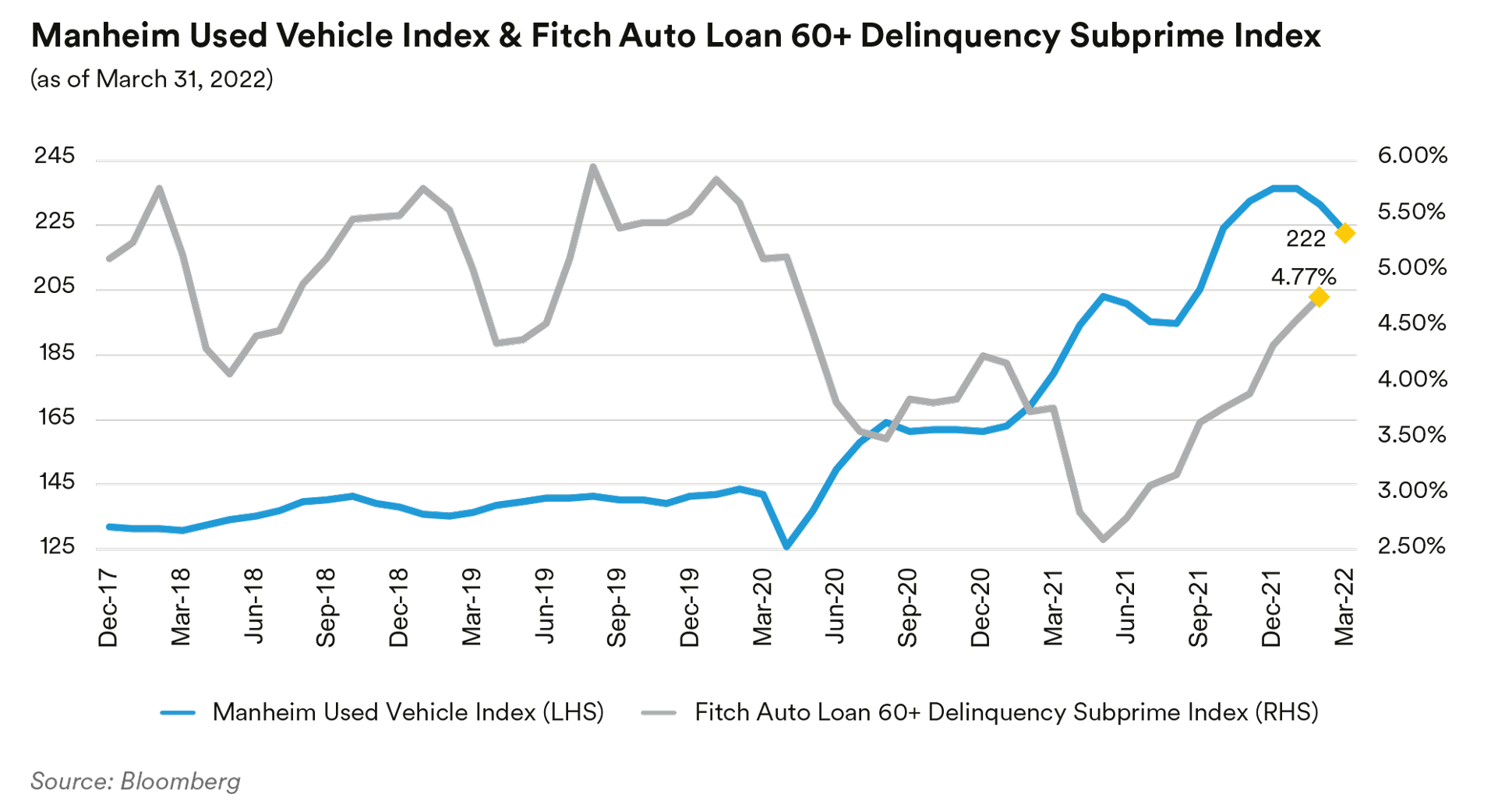

New vehicle sales numbers rebounded in January but declined over the rest of the quarter as low dealer inventory numbers impacted sales volumes. Dealer inventories have been constrained by semiconductor shortages and supply chain disruptions caused by the Covid pandemic. In addition, new vehicle production is now facing additional challenges from commodity price volatility caused by the war in Ukraine. After posting sales at a 15.0 million SAAR (seasonally-adjusted annualized rate) pace in January, volumes declined to a pace of 14.1 million SAAR in February and 13.3 million SAAR in March. In our view, the current headwinds facing unit sales are likely to impede vehicle sales numbers for the foreseeable future. After reaching a record high at the start of the year, used vehicle prices fell in both February and March. The Manheim Used Vehicle Index printed at 223.5 in March, a 3.3% decline from February’s level and a 5.4% drop from the record high of 236.3 seen in January. Despite the recent pullback, the index is still up 24.8% year-over-year. Manheim noted that all market segments saw higher year-over-year prices in March, with vans and compact cars showing the best performance. In our view, used car prices should remain elevated as long as new vehicle inventories remain low.

The strength of the car market continues to support ABS auto trust performance. However, as we noted in our 2021 fourth-quarter commentary, we have begun to observe a divergence of performance between prime and subprime indices. This continued over the first quarter with the Fitch Auto Prime ABS index showing 0.25% annualized net losses and 0.24% 60+-day delinquencies through February, which reflected an 11 basis point improvement in losses and a 1 basis point improvement in delinquencies compared to year ago levels. In contrast, the Fitch Auto Subprime ABS index posted 5.97% annualized net losses and 4.77% 60+-day delinquencies in February, worse than year ago levels by 49 basis points and 103 basis points, respectively. We expect subprime auto credit metrics to worsen further due to a combination of the removal of pandemic-related stimulus support and forbearance programs and the disproportionate impact of higher inflation on lower-income consumers. While we remain cautious around subprime auto ABS generally, we continue to expect minimal impact on our very short-tenor ABS holdings due to their significant amounts of credit support.

Portfolio Actions and Outlook: Over the course of the first quarter, we generally reduced our ABS exposure across most of our strategies. The exception was in our “Cash Plus” strategy where the ABS weighting increased slightly as we took advantage of wider spreads to add credit card exposure which stood at zero at the beginning of the quarter. Across all of our strategies we reduced floating-rate exposure, as rising interest rates made yields on fixed-rate bonds relatively more attractive. Going forward, we expect to continue this strategy and would look to further reduce our floating-rate holdings, including our CLO position

Performance: As a result of wider benchmark spreads, our ABS holdings generated negative excess performance across almost all of our strategies over the first quarter after accounting for duration and yield curve exposure. The exception was again in our short “Cash Plus” strategy which saw modest positive performance. This was the result of the very short fixed-rate auto tranches held in that strategy. Due to their very short tenors, the price impact of wider spreads was muted on these positions and more than compensated for by coupon income. In our other strategies, fixed-rate autos were generally our top performers although wider spreads still resulted in negative excess performance. Our CLO holdings were generally flat or slightly negative as it relates to adding excess return.

CMBS

Recap: Compared to like-duration Treasuries, short-tenor CMBS spreads were generally wider over the course of the first quarter with the exception found in three-year agency CMBS where they were tighter. At the end of the quarter, spreads on three-year AAA-rated conduit tranches stood at 65 basis points over Treasuries (15 basis points wider) and spreads on five-year AAA[1]rated conduit tranches stood at 84 basis points over Treasuries (20 basis points wider). In contrast, spreads on three-year Freddie Mac “K-bond” tranches ended the quarter at 23 basis points over Treasuries (7 basis points tighter). These tranches found support from bank buyers looking to invest in short duration agency-backed securities with a superior convexity profile relative to residential mortgages. Over the course of the quarter, over $101 billion of new issue CBMS came to market, an increase of 20% relative to the $84 billion seen in the first quarter of 2021. This increase was attributable to the non-agency sector as agency issuance of $57 billion slightly trailed 2021’s first quarter agency volume of $59 billion. Over $44 billion of non-agencies came to market, an increase of over 75% relative to the $25 billion seen in the first quarter last year. Non-agencies saw heavy volume in both single-asset, single-borrower (“SASB”) deals (over $18.7 billion) and in the “Other” category (a catchall subsector which includes CRE-CLOs) which saw almost $15.1 billion of new issuance. Notable new issuance included the first-ever CMBS ESG “social” bond, a $1.45 billion SASB backed by 43 low income, affordable housing multifamily properties located across Florida.

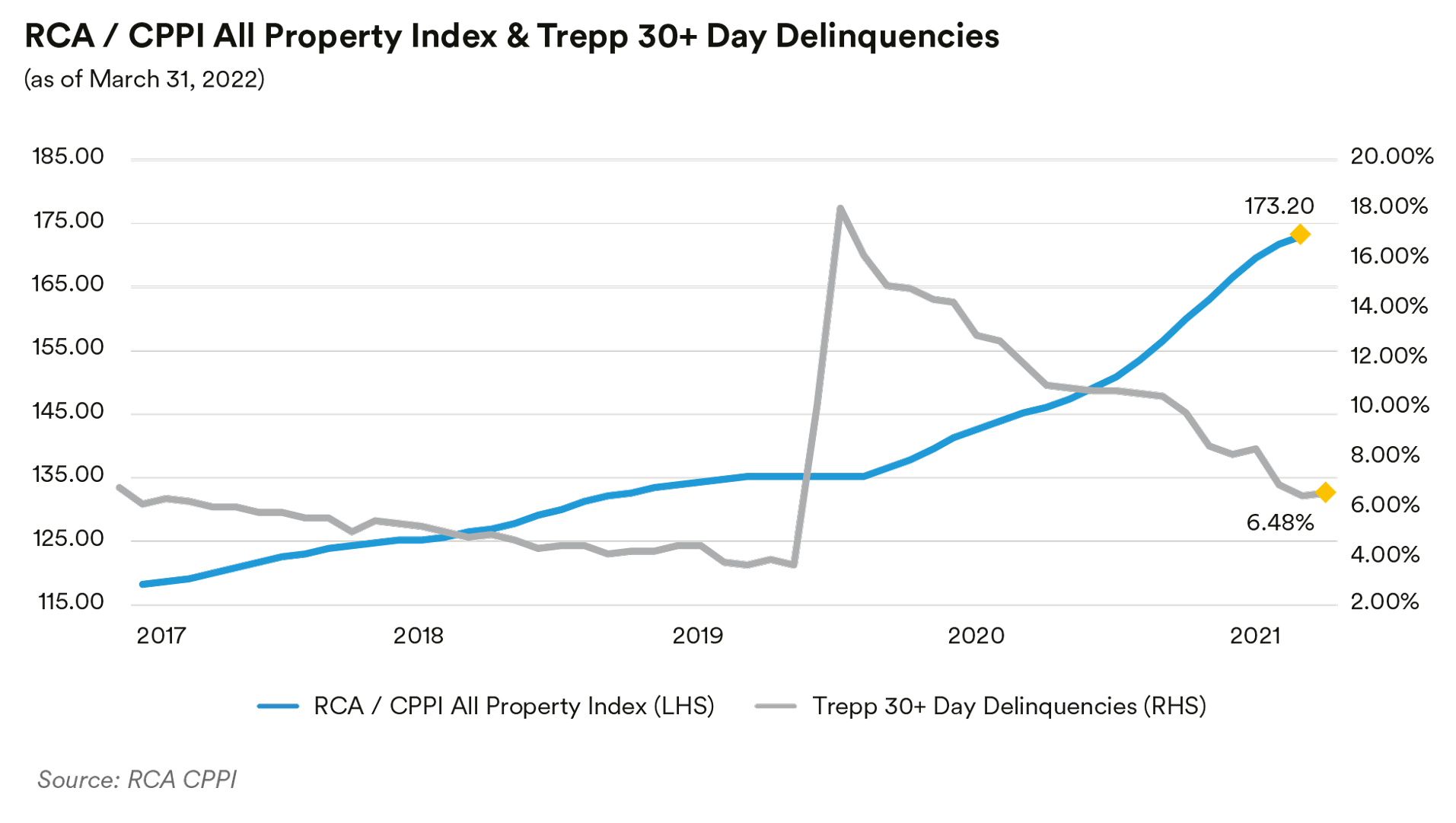

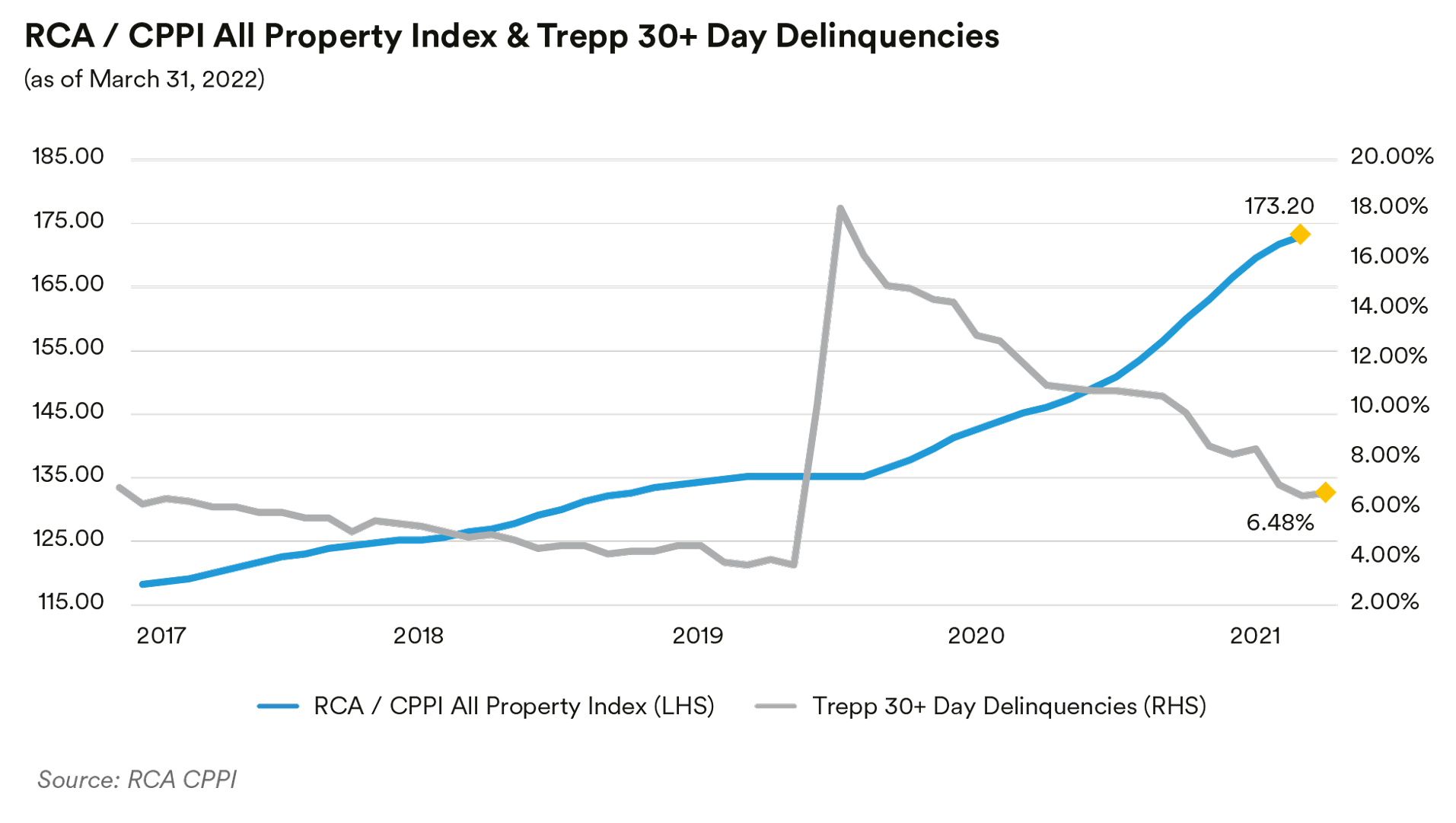

Continuing its long-running trend, CMBS delinquencies continued to drop over the course of the first quarter. As measured by the Trepp 30+-day delinquency rate, CMBS delinquencies ended the quarter at 3.73%, a decline of 14 basis points for the month of March and 84 basis points for the quarter. Delinquencies have now fallen for 20 of the last 21 months. Delinquencies surged in May and June 2020 due to the COVID-19 pandemic, reaching a peak of 10.32% (just below July 2012’s all-time high of 10.34%). Notably, hotel properties saw significant improvement over the quarter with delinquencies in that subsector falling 192 basis points to 6.87%. In the early months of the pandemic hotel delinquencies were around 25% and one year ago they were nearly 16%. Within the hotel sector, we are seeing relatively better performance in warm-weather and popular vacation destination hotels than in business and non-vacation hotels. We believe this reflects yet another change to the economy created by the work-from-home and virtual meeting dynamics which are also having a pronounced effect on the office subsector. Office properties saw delinquencies fall 88 basis points over the quarter to 1.65%. Industrial properties continue to show the best performance with delinquencies falling 4 basis points to 0.48%. With the improvement in hotels, retail is now the worst performing subsector with 7.50% delinquencies, even after accounting for a 78 basis point improvement over the quarter. Within other portfolios, we continue to be cautious about retail, select hotel and office properties and generally avoid deals with large exposures to these subsectors.

Commercial real estate prices continued to climb higher over the first quarter with the March release of the RCA CPPI National All-Property Composite Index showing prices rose 19.4% on an annualized basis through February to 173.2, another record high. All four major property types saw double-digit year-over-year price gains. Industrial properties were the best performers with prices rising 28.5% year-over-year, a record for any property type since the inception of the index in December 2000. RCA noted that in June 2021 the price growth rate for industrial properties surpassed its previous high seen prior to the Great Financial Crisis and the growth rate has accelerated every month since. Prices for apartment properties and retail properties also showed record annualized gains (rising 23.2% and 21.1%, respectively). Office properties continue to show the slowest growth with prices rising 10.3% year-over-year. Behind that number, the divergence between Central Business District office prices and suburban office prices continues. After falling for most of 2021, CBD offices posted positive annualized growth of 4.7% in February, while in contrast suburban office properties lost momentum and posted a gain of only 10.1%, compared to a 15.1% growth rate at the end of the fourth quarter last year. RCA noted that prices in the Non-Major Metros rose 21.9% year-over-year while prices in the six Major Metros (Boston, Chicago, Los Angeles, New York, San Francisco and Washington, D.C.) climbed 12.9%.

The headwinds facing the office subsector became the focus of the market’s attention late in the quarter as Blackstone, the borrower, handed the keys to the property back to lenders. Since loan origination, two large tenants elected not to renew their leases at the property. The loan was securitized as a SASB deal in 2015 and is now in special servicing. Standard and Poor’s subsequently downgraded all of the subordinate tranches (the senior “A” tranche retains its AAA rating). In our view, Blackstone’s action indicates that the Midtown NYC office submarket is particularly challenged relative to more prime locations in the city.

Portfolio Actions & Outlook: Over the course of the quarter, we generally maintained our level of CMBS exposure across all strategies. Our subsector exposures shifted somewhat, with our three-year and shorter strategies seeing a modest increase in our fixed-rate conduit investments while our longer strategies saw an increase in their floating-rate non-agency holdings. This was carried out by reinvesting paydowns on our existing holdings through secondary market purchases, as we did not participate in any new issue transactions during the quarter. At current spreads, we remain relatively neutral on CMBS with a bias to selling our floating-rate holdings in favor of purchasing similar tenor fixed-rate alternatives (both within CMBS and other spread sectors). In particular, we continue to look for 1.0 to 1.5 year weighted average life conduit tranches with favorable structures backed by attractive collateral (lower concentrations of real estate, office and lodging properties).

Performance: Our CMBS holdings detracted from performance across all strategies over the first quarter after adjusting for their duration and yield curve positioning. Our non-agency holdings were generally the worst performers in all of our strategies, as our agency CMBS positions were only slightly negative in most of our strategies. Within non-agencies, both our fixed-rate conduit holdings and our floating-rate SASB tranches were negative due to wider spreads in both subsectors, but amongst the two, our fixed-rate holdings performed relatively better.

RMBS

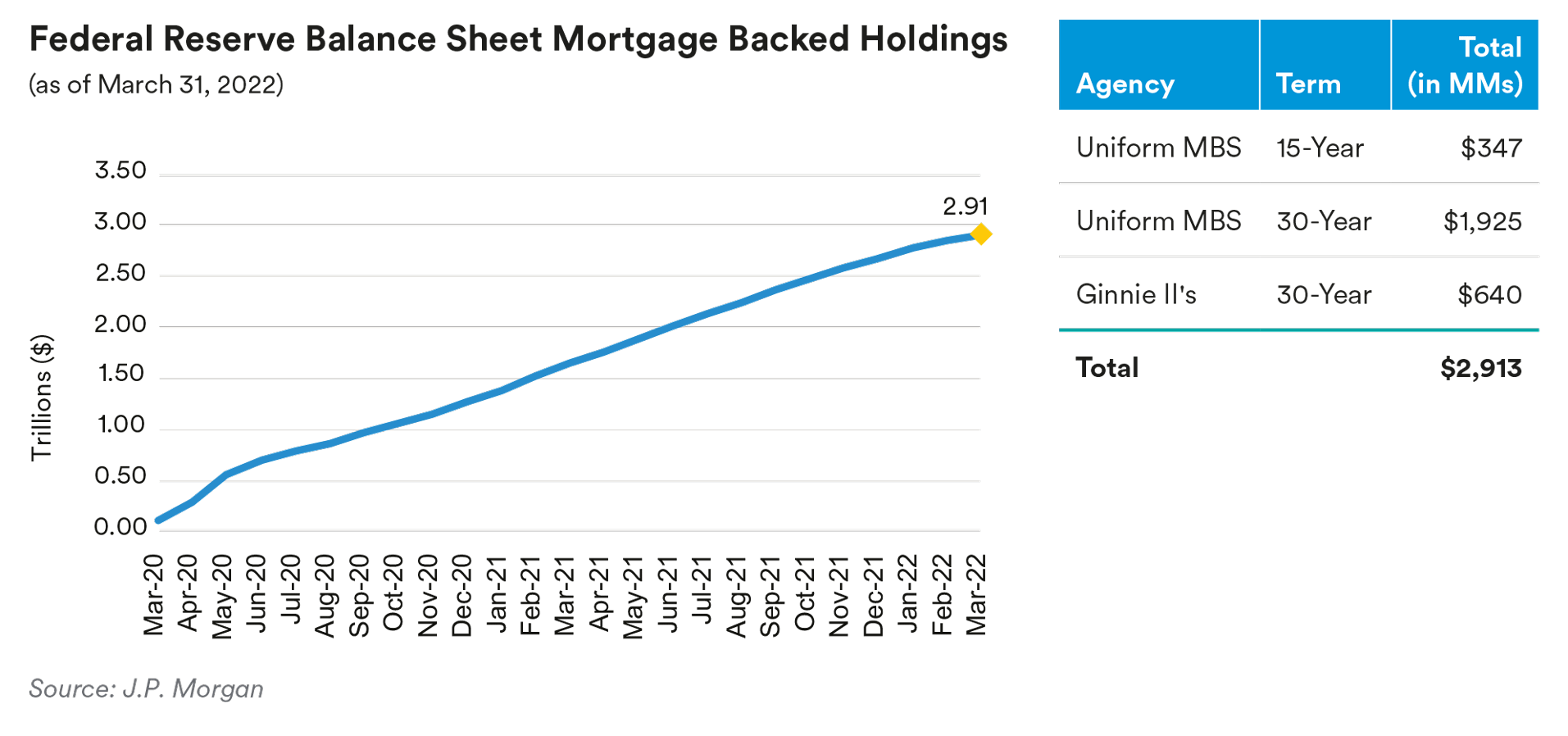

Recap: Residential mortgage-backed security spreads continued to widen over the first quarter driven by rising interest rates, the tapering of the Federal Reserve’s QE mortgage purchase program and macro market volatility stemming from the Russian invasion of Ukraine. Generic 30- year collateral ended the quarter at a spread of 115 basis points over ten-year Treasuries (59 basis points wider) while 15-year collateral ended the quarter at a spread of 36 basis points over five[1]year Treasuries (21 basis points wider). As we have noted in our last two quarterly commentaries, we believe the continued better relative performance of 15-year collateral reflects a combination of investor preference for shorter duration assets in a rising-rate environment and concerns that the Federal Reserve’s tapering plan will have a more severe impact on 30-year mortgages than on 15-year mortgages as 30-years comprise the vast majority of the Fed’s retained portfolio holdings. Non-agency spreads also widened over the quarter with prime jumbo front cashflow tranches ending the quarter at a spread of 154 basis points over Treasuries (31 basis points wider).

Mortgage rates moved dramatically higher over the quarter with the Freddie Mac 30-year fixed-rate mortgage commitment rate ending March at 4.67%, 156 basis points higher than the end of December 2021. As expected in this rate environment, mortgage prepayments continued to trend lower over the quarter. With rates at current levels, we estimate that only about 5% of the outstanding universe of agency mortgages are readily refinanceable, so we anticipate that mortgage prepayment rates will continue to fall over the next few months. Despite the affordability challenges exacerbated by the move higher in mortgage rates, limited inventories and robust housing demand caused home price growth to accelerate over the quarter with the S&P CoreLogic Case-Shiller 20-City Home Price Index showing home price growth rebounding after modestly declining to 18% growth rates in the second half of last year. March’s release showed home prices rising at a 19.1% annualized rate through January, close to last year’s July peak of 20.0%. For the 31st consecutive month, Phoenix had the strongest home price growth among the 20 cities in the index with prices rising 32.6% year-over-year. Tampa (+30.8%) and Miami (+28.1%) rounded out the top 3, while Washington, D.C. (+11.2%), Minneapolis (+11.8%), and Chicago (+12.5%) showed the lowest rates of growth. In our view, with higher mortgage rates likely to generate “lock in” effects on prospective sellers (who now have less incentive to sell and buy a new home with a higher mortgage rate), inventory levels are unlikely to increase materially in the foreseeable future so housing prices are likely to remain elevated despite the affordability challenges deepened by higher rates.

With higher mortgage rates presenting challenges for buyers and volumes constrained by lack of inventory, home sales numbers declined in the quarter. March’s data showed existing home sales fell to a 6.02 million annualized pace in February, a six-month low and below the consensus estimate of 6.1 million. Although the inventory of homes for sale in February increased relative to January, it was still 15.5% lower than year-ago levels. At the current sales pace it would take only 1.7 months to sell all the homes on the market, close to a record low. Realtors consider anything below five months of supply as indicative of a tight housing market. New home sales fell in February after declining in January. March’s release showed February new home sales at a 772,000 annualized pace and also revised January’s numbers down to a 788,000 pace. Homebuilder sentiment also fell in March with the National Association of Home Builders sentiment index dropping to a six-month low of 79, in the face of labor shortages and rising raw material prices.

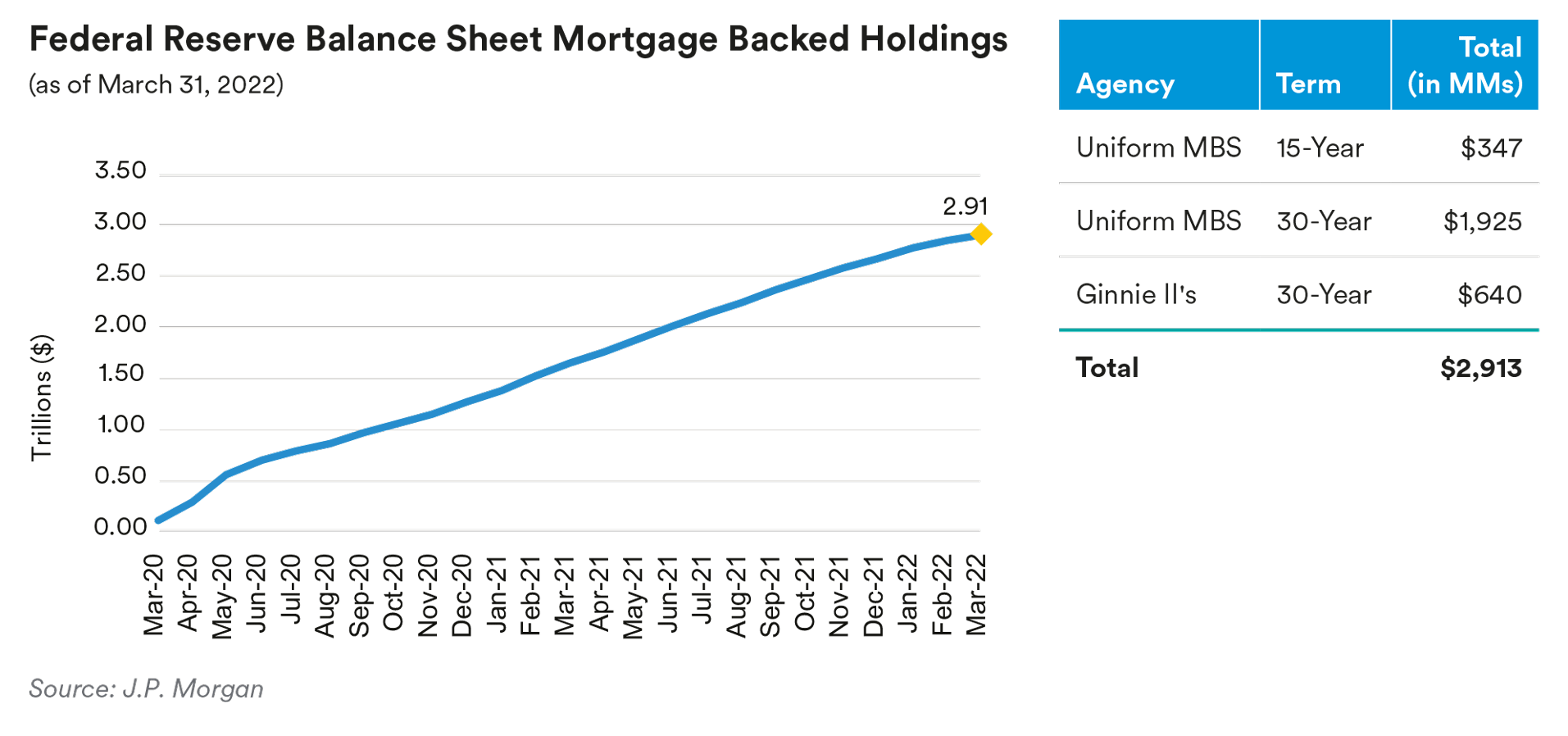

The quarter was marked by the end of the Fed’s QE new MBS purchase program. As a result, the Fed is no longer growing its MBS portfolio but is only purchasing mortgages to reinvest existing portfolio paydowns received each month. The market is anticipating that the Fed will move to reduce this level of reinvestment in the near future as it seeks to end QE and exit the mortgage market. However, with the rapid rise in mortgage rates, paydowns on the Fed’s portfolio are likely to drop significantly. In the past, the Fed has used portfolio reinvestment caps to reduce its MBS holdings (by only reinvesting paydowns that exceed the stated cap). Now, however, we believe that the Federal Reserve may announce both caps and a purchase floor which would mean they would actively sell MBS from their portfolio should paydowns drop below a certain level. Given this dynamic, we are still of the view that mortgage spreads are biased to move wider.

Portfolio Actions & Outlook: Over the course of the quarter, we either maintained or modestly reduced our RMBS exposure across our various strategies. Much like in the fourth quarter of last year, we selectively added some short-tenor non-agency tranches when we felt that they offered sufficient spread to compensate for their elevated negative convexity. We also took advantage of wider spreads to add small amounts of agency CMO exposure to some of the portfolios. Going forward, with spreads moving wider we anticipate increasing our mortgage exposure once the Federal Reserve’s plan to reduce its portfolio plays out. However, any such increase is likely to be modest and, as always, will be dependent upon the relative value of MBS compared to other spread sector alternatives.

Performance: Our RMBS positions generated negative excess returns for the quarter across all of our strategies driven by the widening in spreads across the sector. Our shorter portfolios performed the best due to their lower weightings in both pass-throughs and non-agency tranches, which posted worse relative performance compared to our agency CMO holdings. Among our specified pool holdings, our seasoned 2.5 pools generally performed worse than our seasoned 3.0 and 3.5 pools. The latter benefitted from higher coupon income, which somewhat mitigated the impact of wider spreads.

Municipals

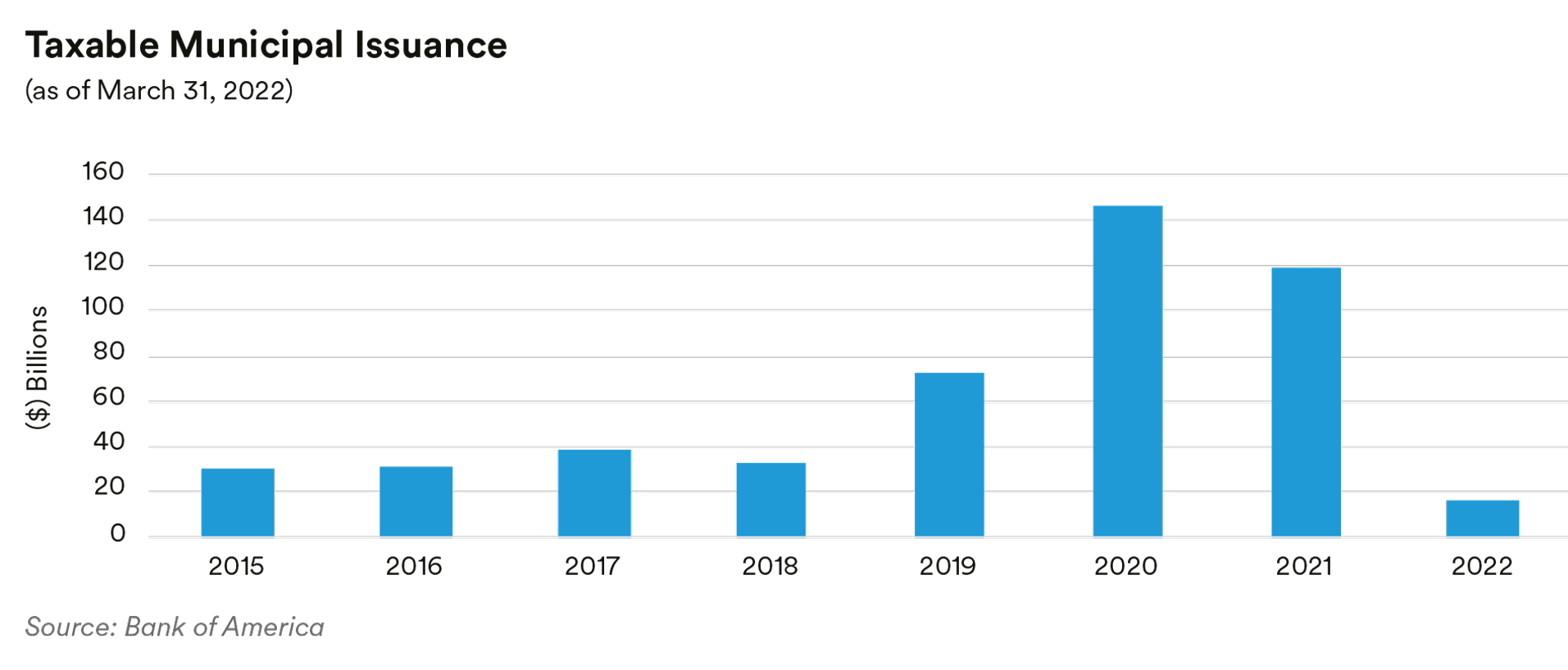

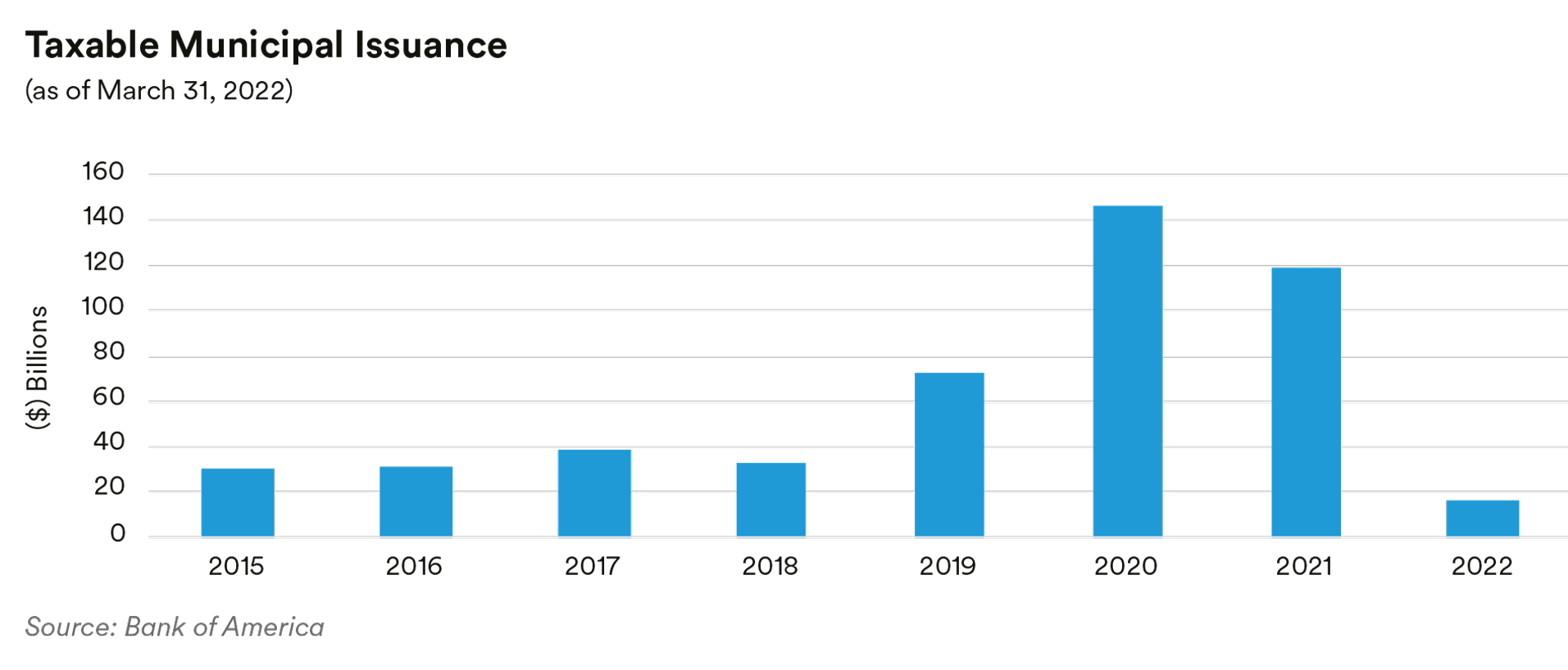

Recap: Total municipal new issue supply was $98.9 billion during the first quarter, 12% lower than last year’s first quarter. A volatile rate environment, spread widening, and projected budget surpluses resulted in lower economic benefits for issuers to capture budget savings by tapping the new issue market using advance refunding deals. Total refunding issuance was 43% lower compared to 2021’s first quarter and contributed to a decline in taxable municipal issuance of 47% for the same comparable period. The Taxable municipal sector lagged the spread recovery experienced in the corporate market during March, and unlike corporate spreads, finished the month wider on an OAS basis in the ICE BofA 1-5 Year U.S. Taxable Municipal Securities Index. Spread widening and market volatility resulted in negative absolute and excess returns for the overall Taxable Municipal sector.

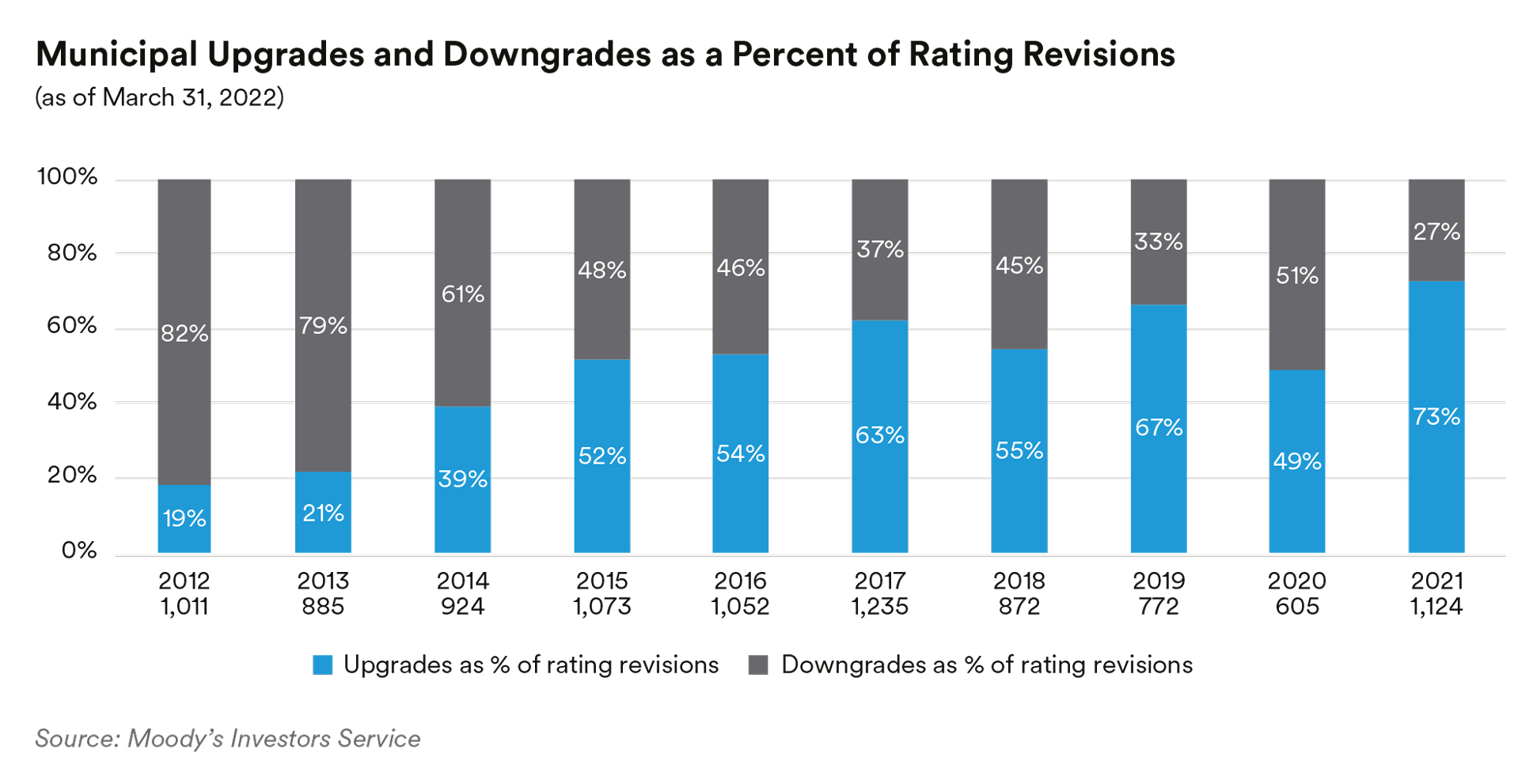

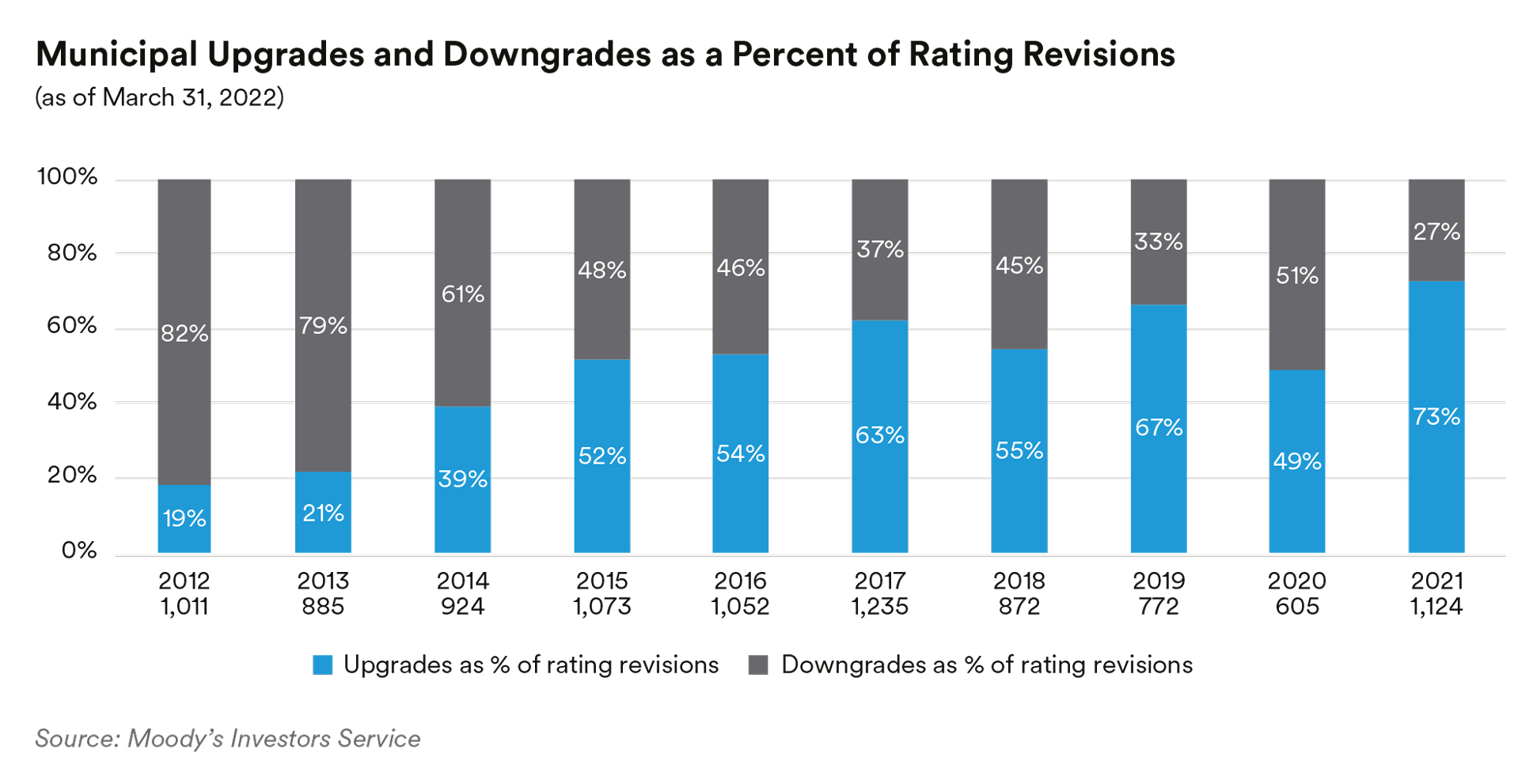

Municipal credit fundamentals have been improving, resulting in positive rating actions. The State of New Jersey was upgraded by Moody’s to A2 from A3 on March 2, the state’s first upgrade since 2005 followed by S&P upgrading it to A- from BBB+ on March 31. Both agencies cited improving revenue trends and liquidity, as well as actions taken to reduce New Jersey’s debt burden while increasing pension contributions. Also of note was the upgrade of Dallas-Fort Worth International Airport by S&P on March 18 to A+ from A. S&P pointed to strong recovery from enplanement trends, their rate-setting flexibility and demonstrated financial resilience. Municipal upgrades have outpaced downgrades at both Moody’s and S&P. For the first two months of the quarter, S&P upgraded 111 issuers versus 34 downgrades. As shown in the chart below, positive ratings actions at Moody’s for 2021 were greater than negative actions, reversing ratings activity during 2020. New ratings methodologies were the primary driver of the nearly doubling of the total number of ratings actions and impacted 9% of the approximately 12,000 obligors rated by Moody’s. According to Moody’s, upgraded debt accounted for 85% of the $369 billion in total debt of issuers with ratings changes in 2021.

Portfolio Actions & Outlook: Our allocation to Taxable Municipals increased over the first quarter. We were defensive in our purchase activity, however, focusing on higher-quality and lower duration securities. We continue to favor state and local general obligation and tax-backed debt. States have become less reliant on federal aid as tax receipts have been strong. Estimates from the Bureau of Economic Analysts’ show that during the fourth quarter of 2021, receipts from personal income taxes increased 22%, corporate income taxes were up 46% and sales taxes were up 13% on a year-over year basis. We believe ongoing inflation and wage pressures, coupled with the potential for moderation in revenue growth are likely to cause some pressure in FY23, however reserves at 16% of spending should offer increased flexibility.

Adds to the transportation sector were primarily in the Airport sector. On average for the first quarter, TSA throughput was only down 16.5% compared to 2019 levels, the lowest percentage decrease from pre-pandemic levels since the beginning of 2020. Many airports have switched their focus from surviving the pandemic to moving forward with expansion/modernization plans and making sure their debt profile is structured in a way to give them breathing room for the next couple of years. Given the uncertain timing of business travel recovery, we are cautious when buying airport debt where supporting revenues are more reliant on business travelers.

We remained selective in adds to higher education issues. We prefer colleges and universities with strong student demand driven by some combination of high selectivity, growing regional demographics, solid value for students, or robust demand for particular courses of study. Generally, we have pursued an up-in-quality investment strategy in this sector, seeking to buy higher quality names at relatively attractive spreads. Almost all colleges and universities resumed in-person instruction in the Fall of 2021 and welcomed students back on campus with rebounds expected in tuition and room and board revenues. Endowment returns were generally strong in FY21 with many institutions reporting investment gains in excess of 30%, further bolstering credit quality at institutions with large endowments. Many, highly selective institutions also saw the biggest rebounds in applications for Fall 2021 with record low admission rates and record-high matriculation rates.

Performance: Our municipal holdings generated negative performance across our strategies. On an excess return basis, some of our underperforming sectors included Airports, Highway, Power, and Tax-backed issues. Holdings in the Housing sector generated positive excess returns.

Disclaimers

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Fixed income investments are subject interest rate risk (the risk that interest rates may rise causing the face value of the debt instrument to fall) and credit risks (the risk that the issuer of the debt instrument may default).

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address Level 34 One Canada Square London E14 5AA United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is only being provided to general employees’ pension funds based in Japan, business owners who implement defined benefit corporate pension plans, etc. and Qualified Institutional Investors domiciled in Japan.

For Investors in Hong Kong: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”).

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MetLife, Inc. provides investment management services to affiliates and unaffiliated/third party clients through various subsidiaries.1 MetLife Investment Management (“MIM”), MetLife, Inc.’s institutional investment management business, has more than 900 investment professionals located around the globe. MIM is responsible for investments in a range of asset sectors, public and privately sourced, including corporate and infrastructure private placement debt, real estate equity, commercial mortgage loans, customized index strategies, structured finance, emerging market debt, and high yield debt. The information contained herein is intended to provide you with an understanding of the depth and breadth of MIM’s investment management services and investment management experience. This document has been provided to you solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. Unless otherwise specified, the information and opinions presented or contained in this document are provided as of the quarter end noted herein. It should be understood that subsequent developments may affect the information contained in this document materially, and MIM shall not have any obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a complete or comprehensive analysis of MIM’s investment portfolio, investment strategies or investment recommendations.

No money, securities or other consideration is being solicited. No invitation is made by this document or the information contained herein to enter into, or offer to enter into, any agreement to purchase, acquire, dispose of, subscribe for or underwrite any securities or structured products, and no offer is made of any shares in or debentures of a company for purchase or subscription. Prospective clients are encouraged to seek advice from their legal, tax and financial advisors prior to making any investment.

Confidentiality. By accepting receipt or reading any portion of this Presentation, you agree that you will treat the Presentation confidentially. This reminder should not be read to limit, in any way, the terms of any confidentiality agreement you or your organization may have in place with Logan Circle. This document and the information contained herein is strictly confidential (and by receiving such information you agree to keep such information confidential) and are being furnished to you solely for your information and may not be used or relied upon by any other party, or for any other purpose, and may not, directly or indirectly, be forwarded, published, reproduced, disseminated or quoted to any other person for any purpose without the prior written consent of MIM. Any forwarding, publication, distribution or reproduction of this document in whole or in part is unauthorized. Any failure to comply with this restriction may constitute a violation of applicable securities laws.

Past performance is not indicative of future results. No representation is being made that any investment will or is likely to achieve profits or losses or that significant losses will be avoided. There can be no assurance that investments similar to those described in this document will be available in the future and no representation is made that future investments managed by MIM will have similar returns to those presented herein.

No offer to purchase or sell securities. This Presentation does not constitute an offer to sell or a solicitation of an offer to buy any security and may not be relied upon in connection with the purchase or sale of any security.

No reliance, no update and use of information. You may not rely on this Presentation as the basis upon which to make an investment decision. To the extent that you rely on this Presentation in connection with any investment decision, you do so at your own risk. This Presentation is being provided in summary fashion and does not purport to be complete. The information in the Presentation is provided to you as of the dates indicated and MIM does not intend to update the information after its distribution, even in the event that the information becomes materially inaccurate. Certain information contained in this Presentation, includes performance and characteristics of MIM’s by independent third parties, or have been prepared internally and have not been audited or verified. Use of different methods for preparing, calculating or presenting information may lead to different results for the information presented, compared to publicly quoted information, and such differences may be material.

Risk of loss. An investment in the strategy described herein is speculative and there can be no assurance that the strategy’s investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment.

No tax, legal or accounting advice. This Presentation is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any statements of U.S. federal tax consequences contained in this Presentation were not intended to be used and cannot be used to avoid penalties under the U.S. Internal Revenue Code or to promote, market or recommend to another party any tax-related matters addressed herein.

Forward-Looking Statements. This document may contain or incorporate by reference information that includes or is based upon forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give expectations or forecasts of future events. These statements can be identified by the fact that they do not relate strictly to historical or current facts. They use words and terms such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will,” and other words and terms of similar meaning, or are tied to future periods in connection with a discussion of future performance. Forward-looking statements are based on MIM’s assumptions and current expectations, which may be inaccurate, and on the current economic environment which may change. These statements are not guarantees of future performance. They involve a number of risks and uncertainties that are difficult to predict. Results could differ materially from those expressed or implied in the forward-looking statements. Risks, uncertainties and other factors that might cause such differences include, but are not limited to: (1) difficult conditions in the global capital markets; (2) changes in general economic conditions, including changes in interest rates or fiscal policies; (3) changes in the investment environment; (4) changed conditions in the securities or real estate markets; and (5) regulatory, tax and political changes. MIM does not undertake any obligation to publicly correct or update any forward-looking statement if it later becomes aware that such statement is not likely to be achieved.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for the following affiliates that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC and MetLife Investment Management Europe Limited.