Breaking Down the CLO Market

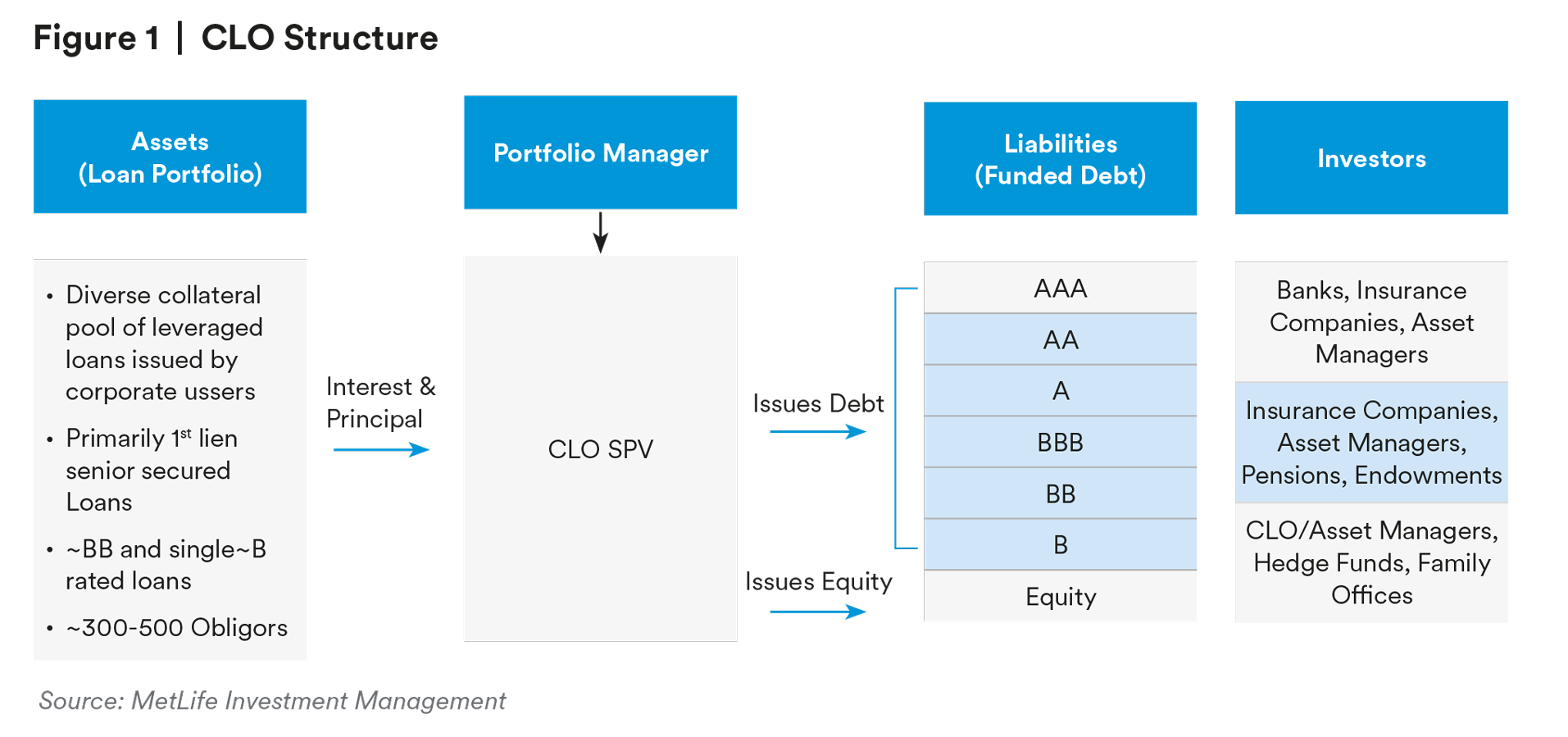

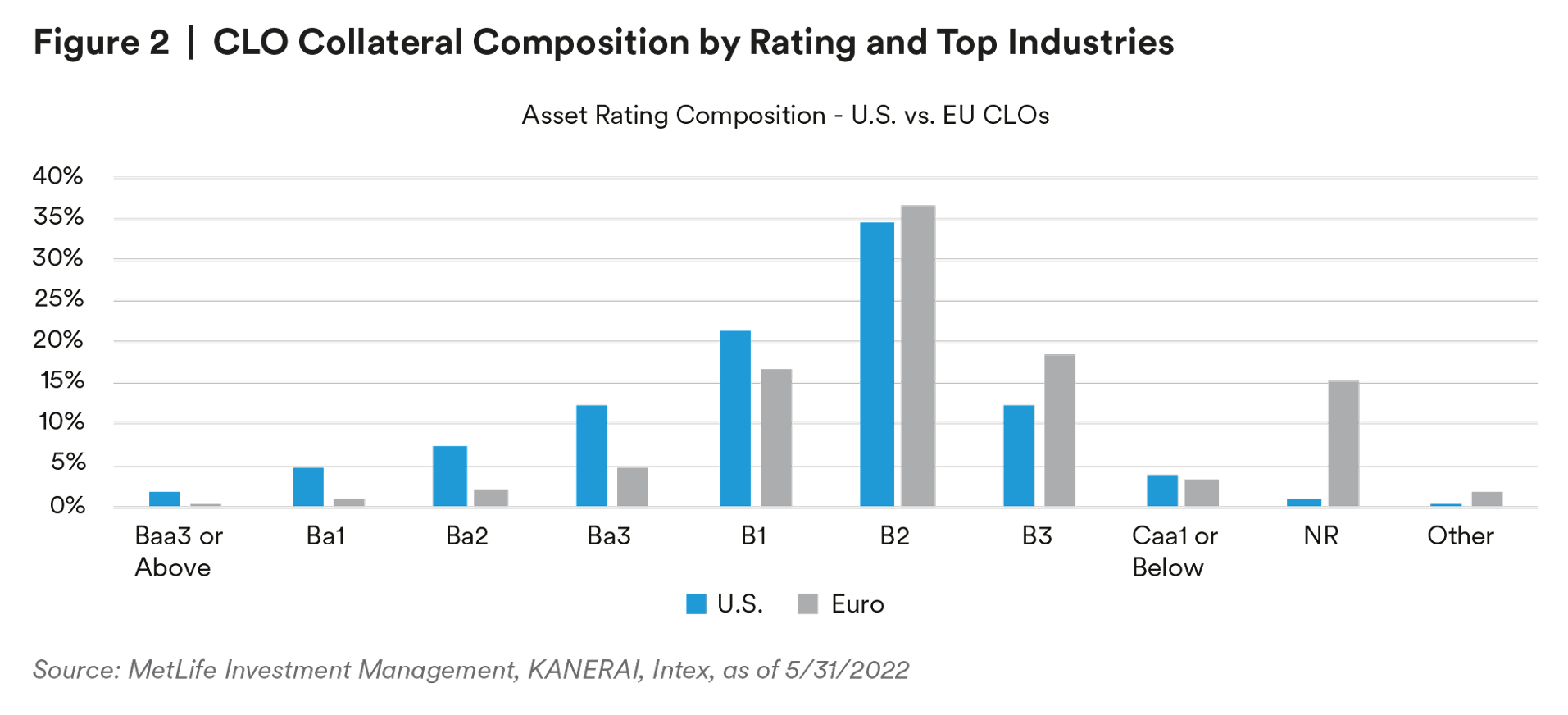

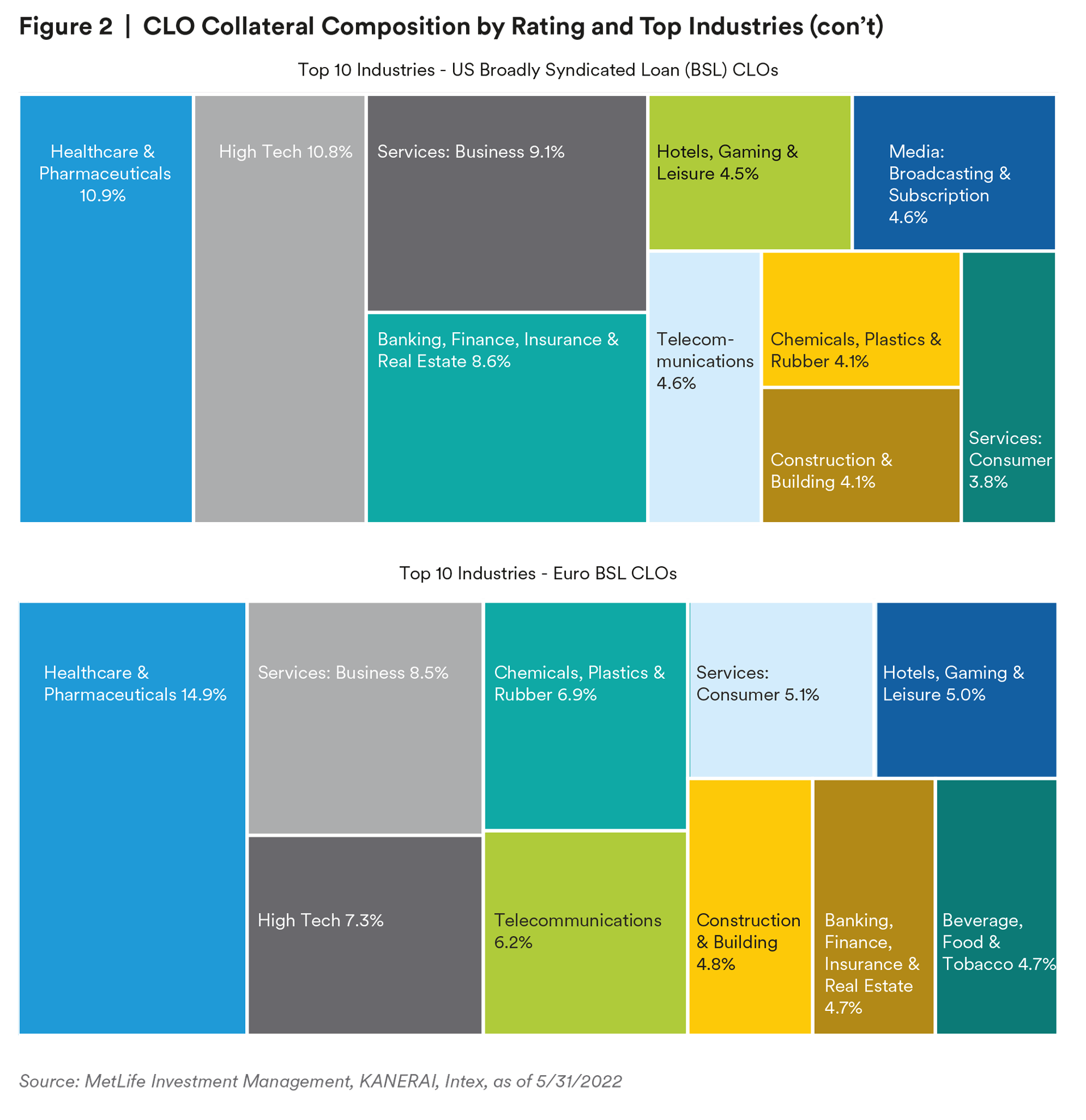

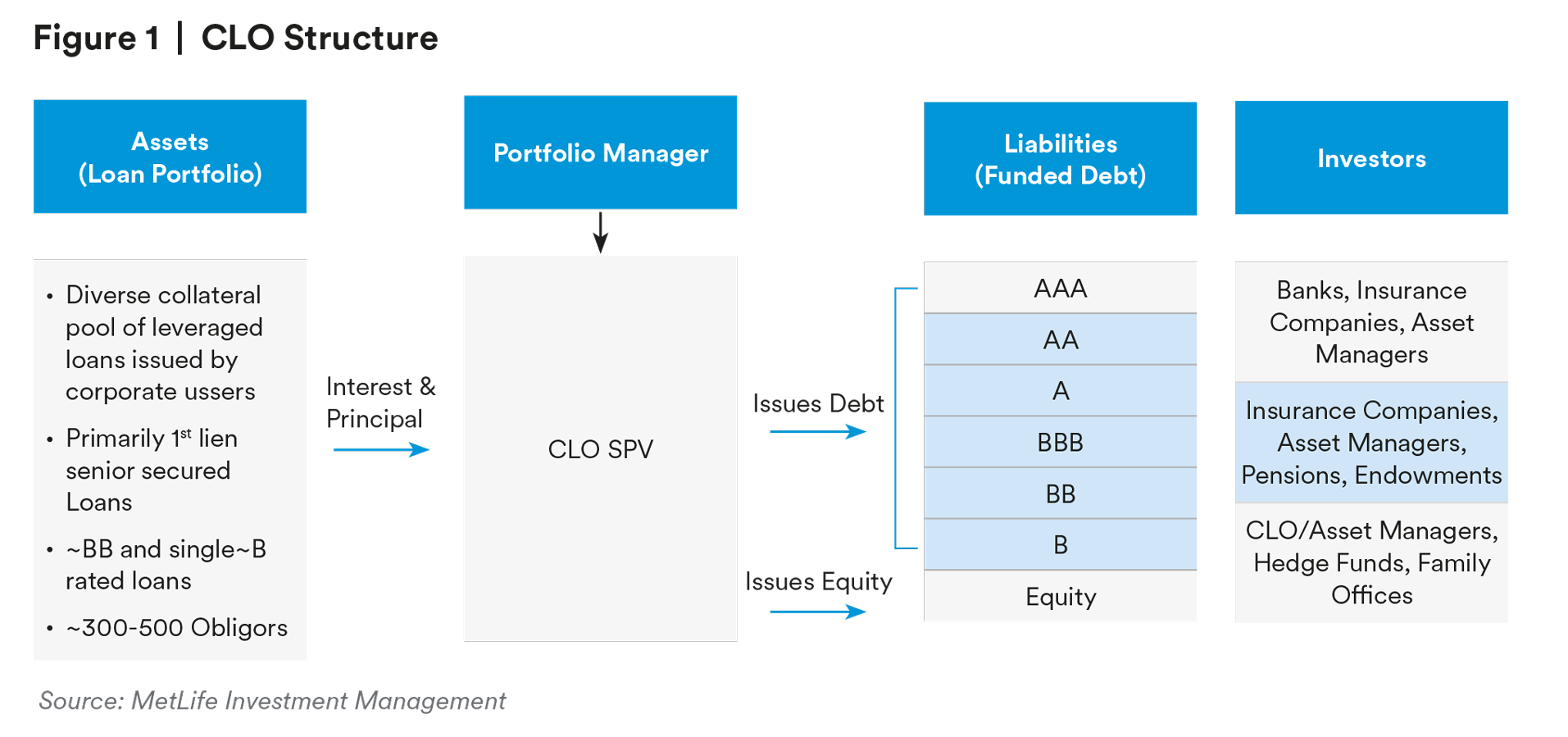

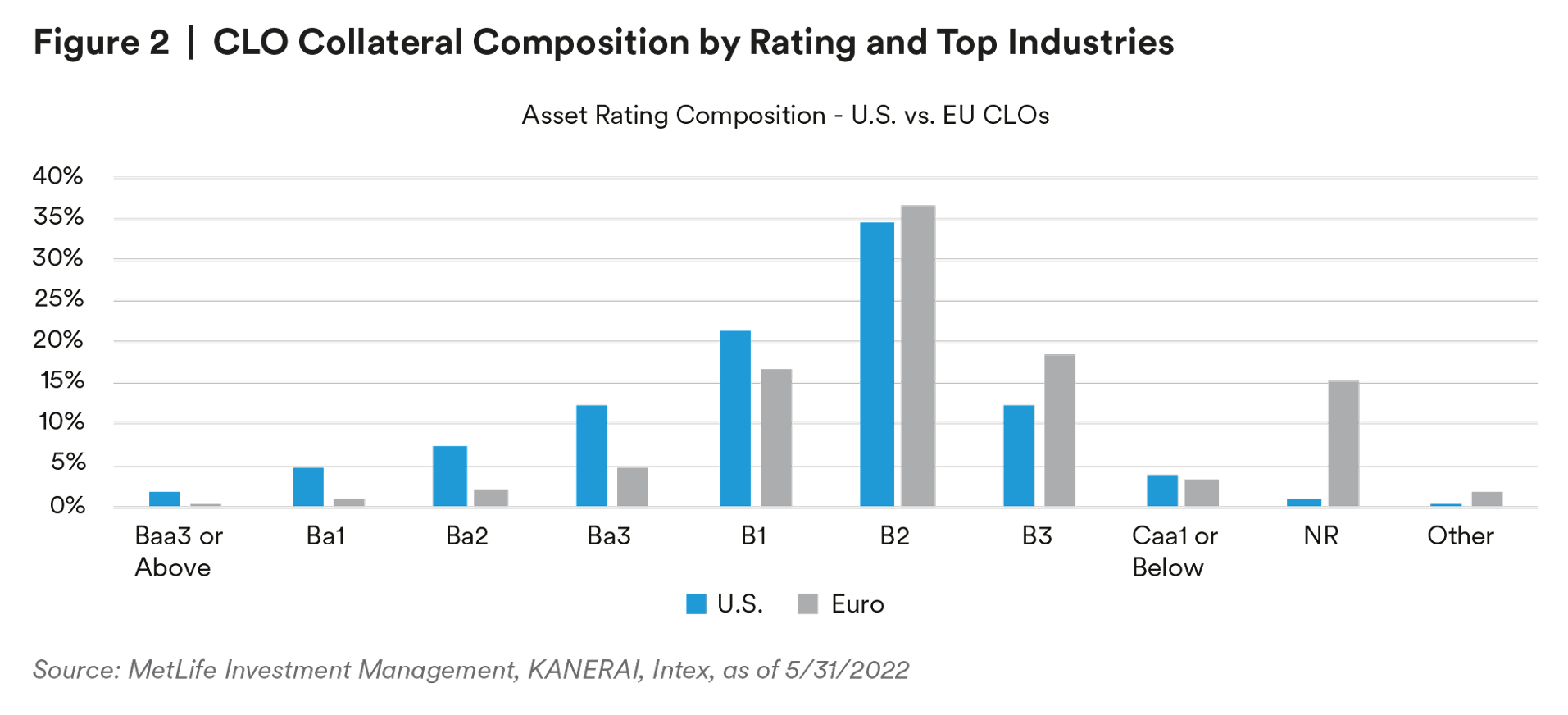

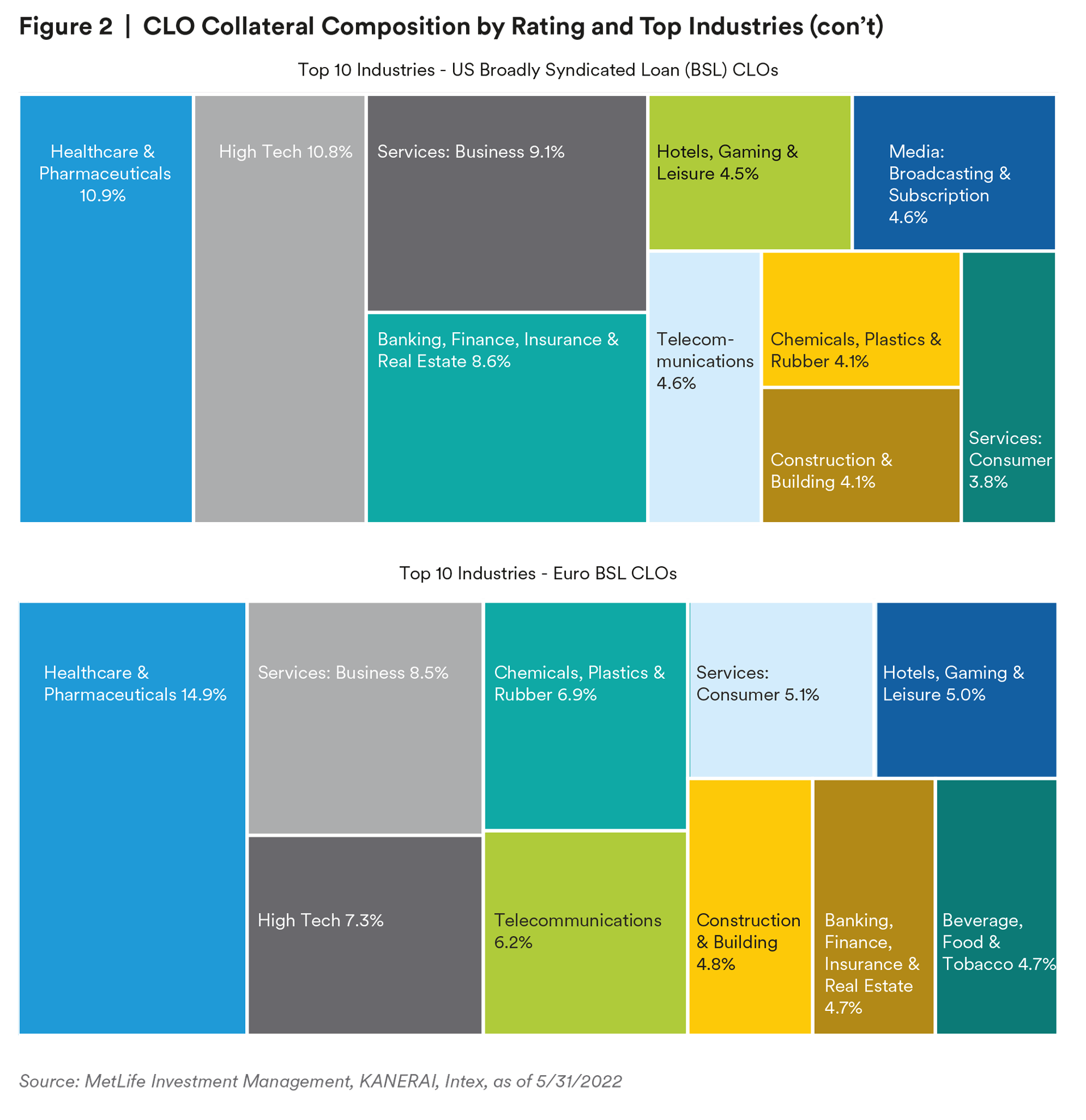

Established through a special purpose vehicle (“SPV”), a CLO is a securitized pool of diversified leveraged loans across issuers and industries predominately rated single B and BB, with the SPV issuing multiple tranches of debt to finance the acquisition of the loans. As shown in Figures 1 and 2, the assets are generally 1st lien senior secured loans to issuers across several industries, including Healthcare & Pharmaceuticals, High Tech, and Business Services. The issued tranches include rated debt and unrated equity which provide a range of risk and reward profiles, making them potentially suitable to a wide set of investors predominately across banks, insurance companies, asset managers, pensions, and endowments.

The most prominent sub-sectors in the CLO market include deals backed by the following types of colateral:

- US Loans: US broadly syndicated leveraged loans, primarily 1st lien senior secured.

- European Loans: European broadly syndicated leveraged loans, primarily 1st lien senior secured.

- Middle Market Loans: US 1st lien senior secured direct private loans to small and medium sized companies, typically with earnings before interest, taxes, depreciation, and amortization (EBITDA) of less than $100mm.

- Infrastructure Loans: 1st lien senior secured loans comprised of project finance loans and broadly syndicated loans to corporate borrowers within infrastructure sectors.

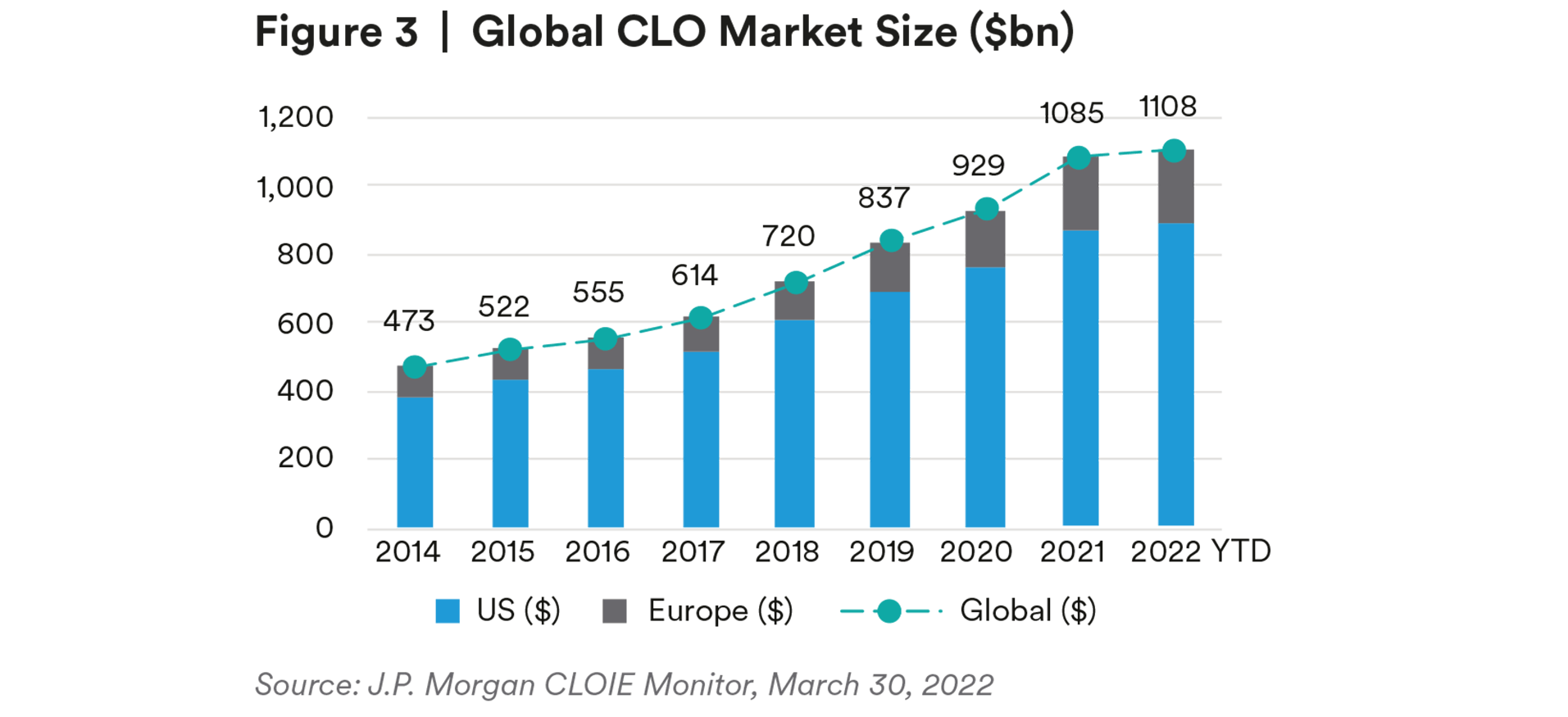

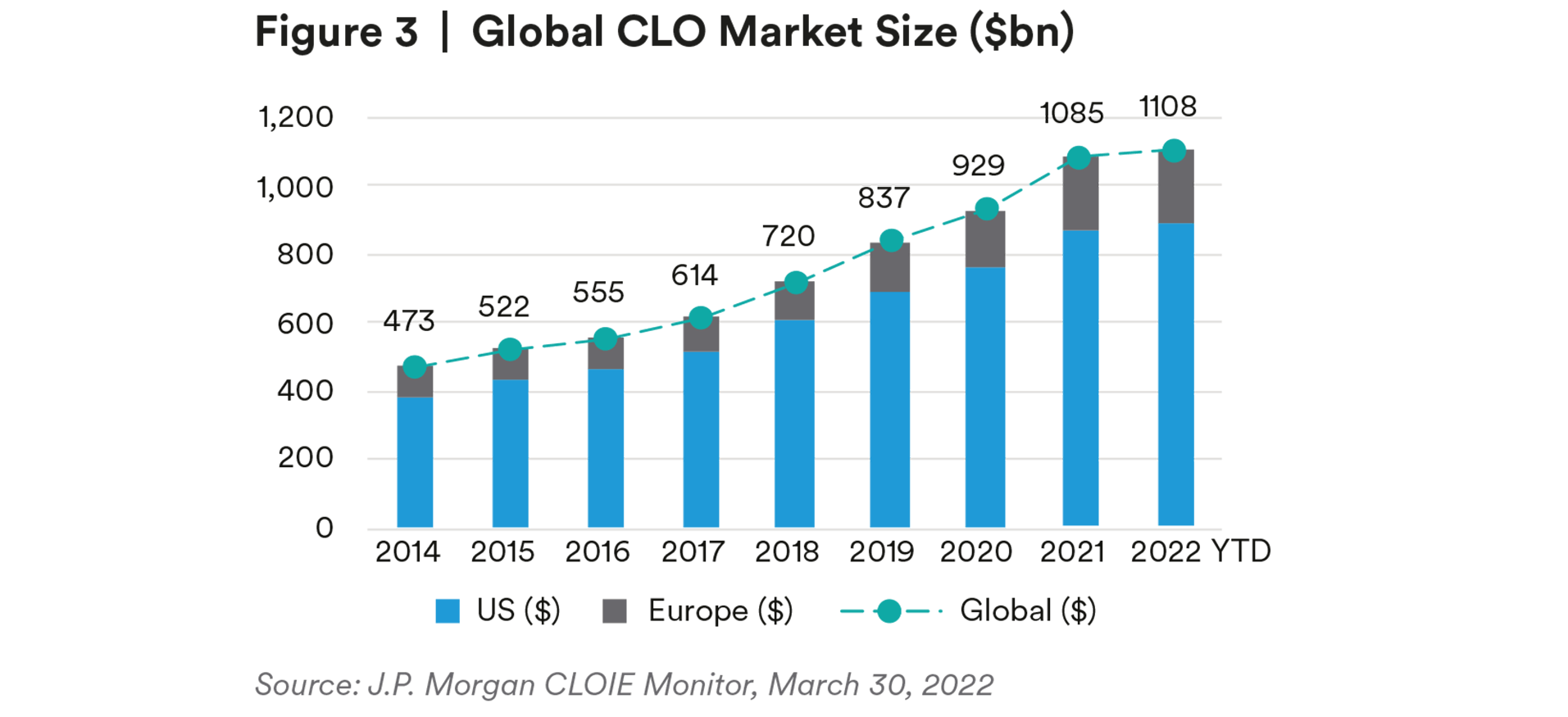

A relatively new entrant to the structured products sector, the CLO market began in 1990, growing slowly at first, but doubling in size over the last five years as institutional investors gravitated toward the market for its unique diversification benefits. As of the end of 2021, the asset class had matured to $1 trillion. Further, the market has a strong presence on both sides of the Atlantic. The global market is 83% USD CLOs and 17% EUR CLOs.2 Select CLO managers focus on the middle market sub-sector which represents ~10% of the US CLO universe.2 In 2021, the US CLO asset class experienced record issuance volume with $187bn issued across 127 active managers in the US.2

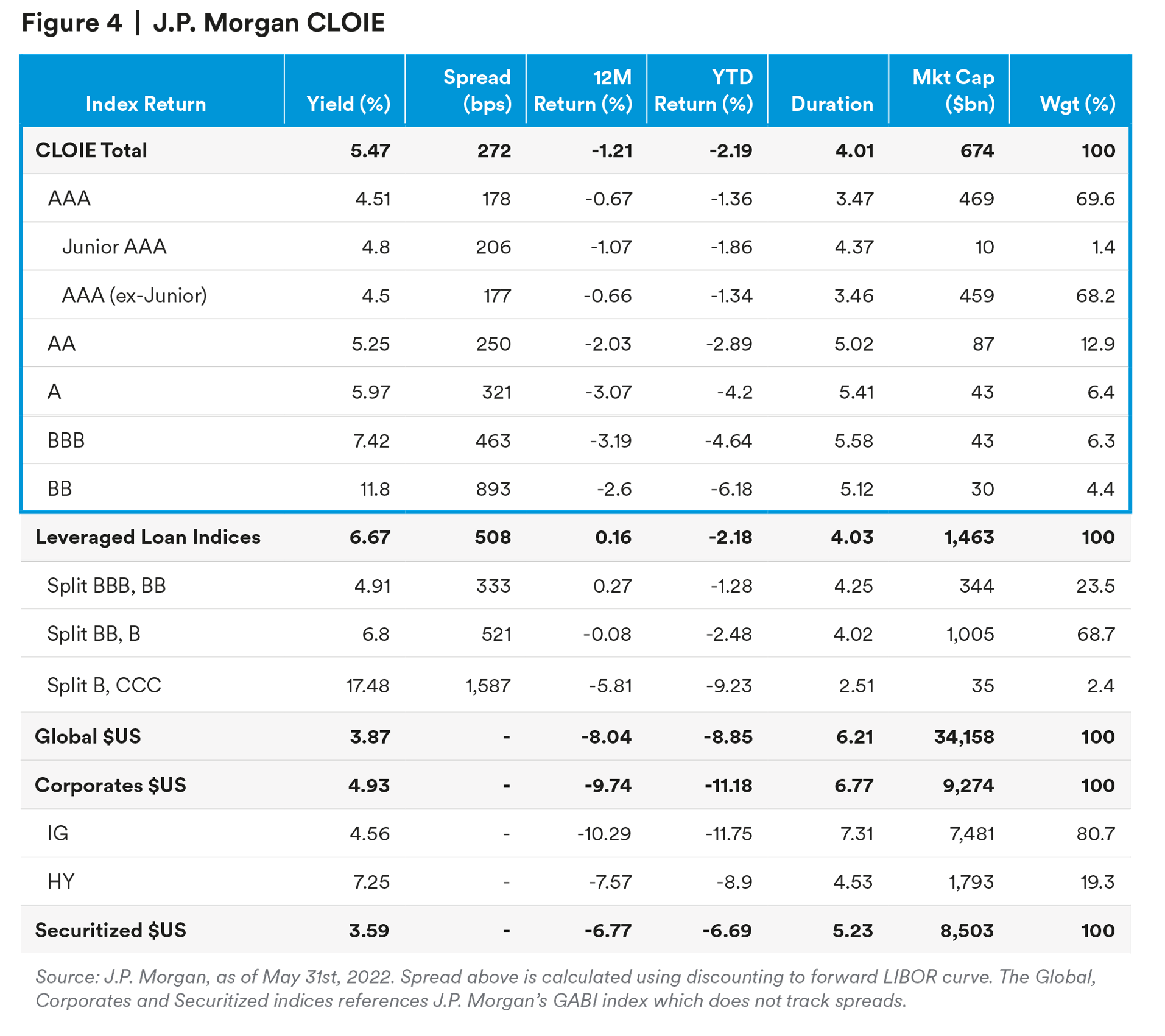

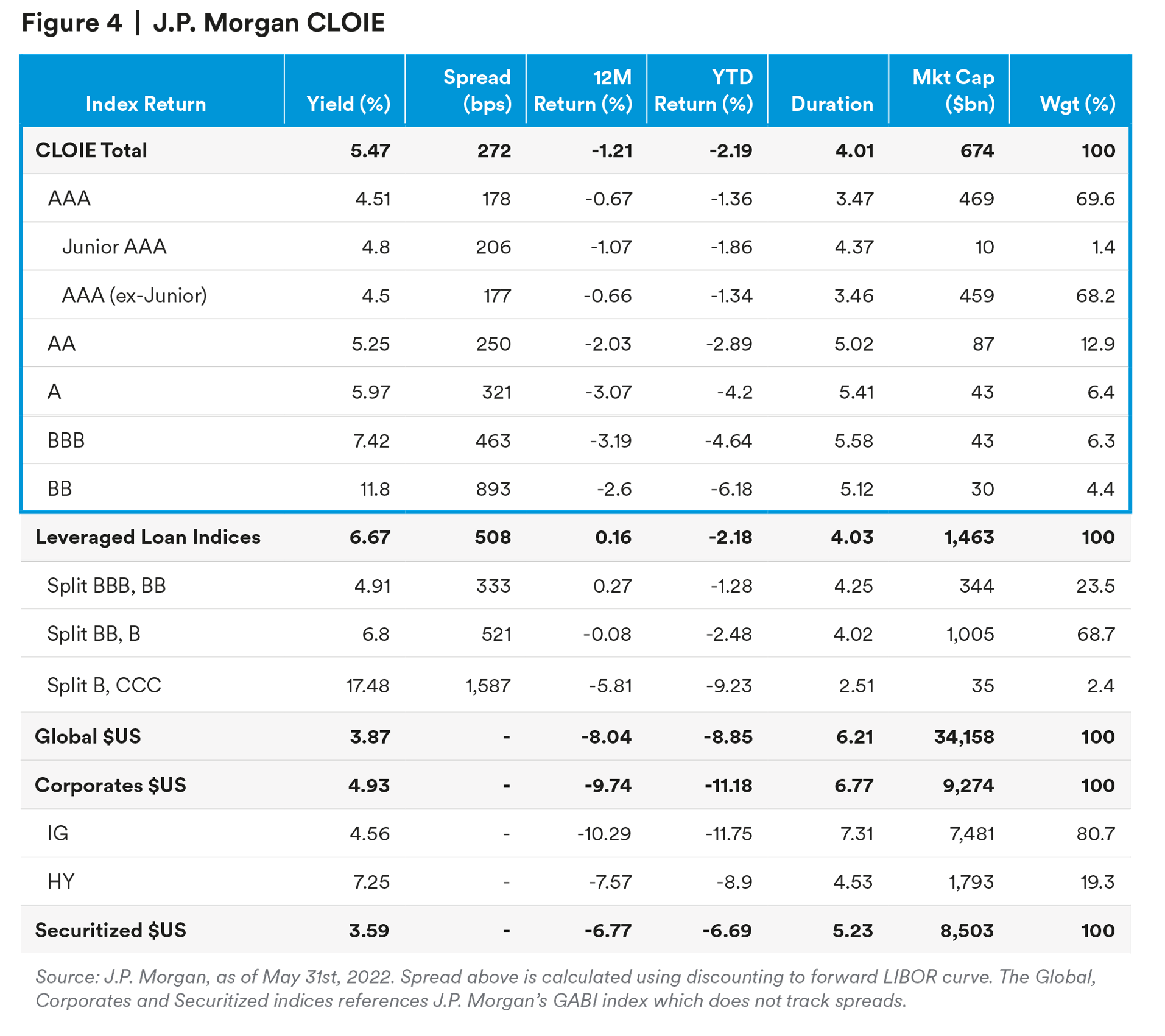

Performance tracking with total returns and analytics began in 2014 with the inception of the J.P. Morgan CLO Index (“J.P. Morgan CLOIE”) and in 2016 the Palmer Square CLO Index, which increased market awareness and use of a benchmark for performance and target allocations.

Credit Performance

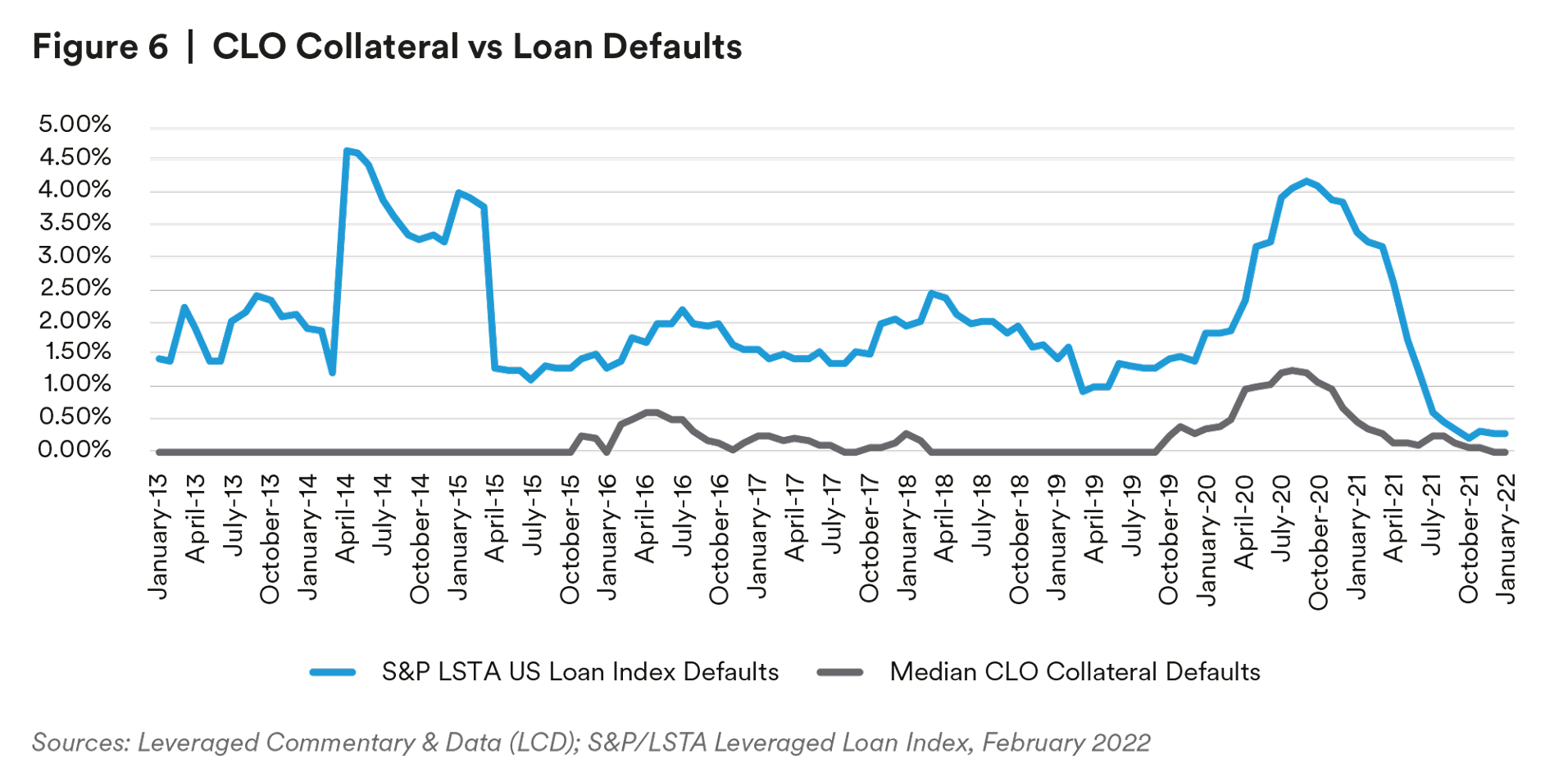

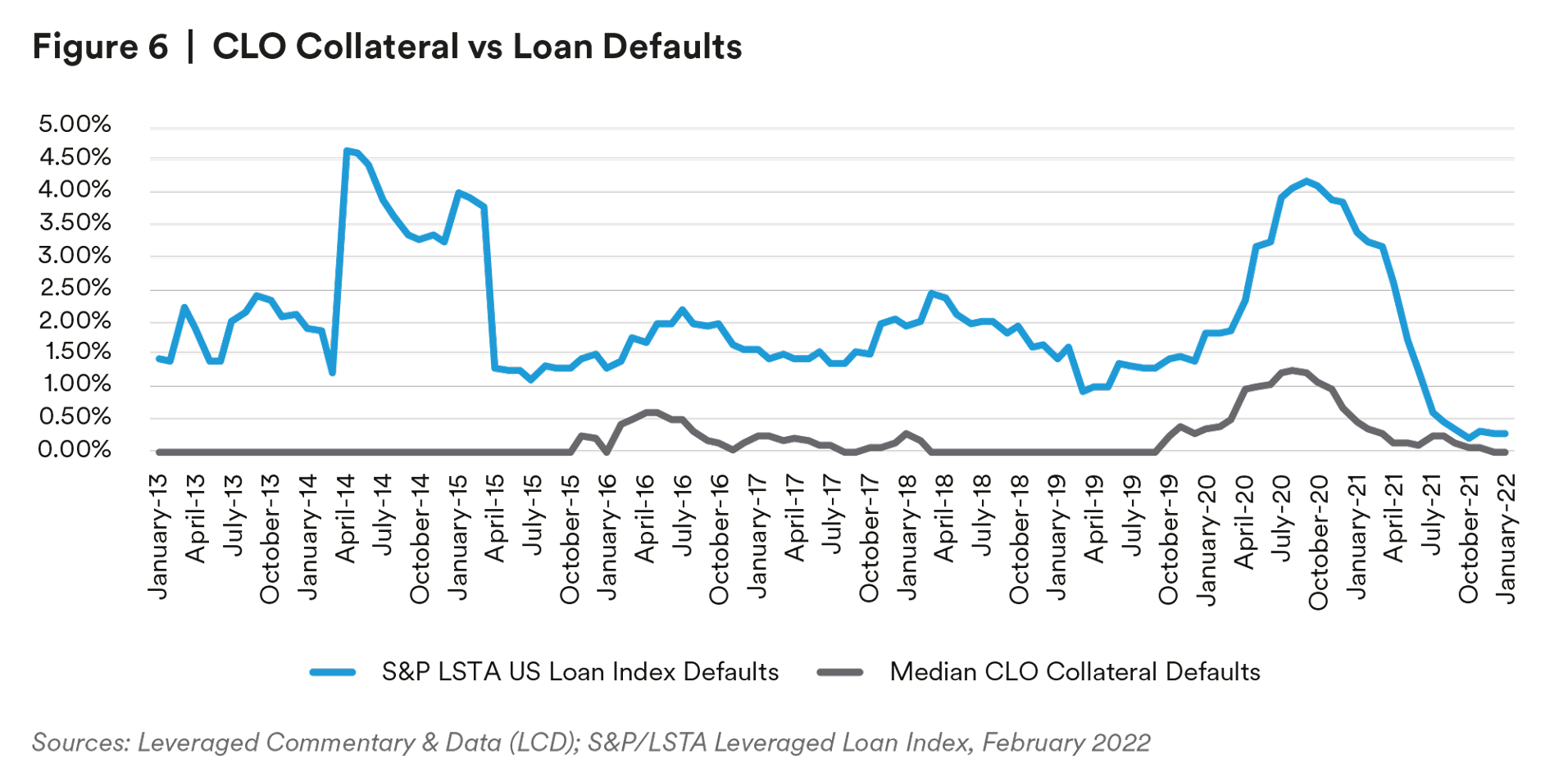

CLO historical loss experience, coupled with ratings resilience through the great financial crisis and COVID-19 pandemic, has demonstrated robust performance through tail risk events.

In 2020, the downgrade percentage of issuers within the leveraged loan universe reached 47%, the majority of which occurred in March and April. However, using the J.P. Morgan CLOIE index to give a perspective on the US CLO rating transitions, only 2% of US CLO bonds by volume and 9% by count were downgraded. 95% of those downgrades were primarily concentrated in Single-B, and BB-rated tranches and to a lesser extent BBB-rated tranches.3 Globally, rating agencies continue to unwind pandemic driven downgrades and positive rating migration in loans has been improving CLO collateral profiles leading to CLO upgrades in subordinated tranches. Approximately 54% of CLO tranches downgraded in 2020 have since been upgraded or had its rating withdrawn as a result of paydowns, refinancings and resets.4

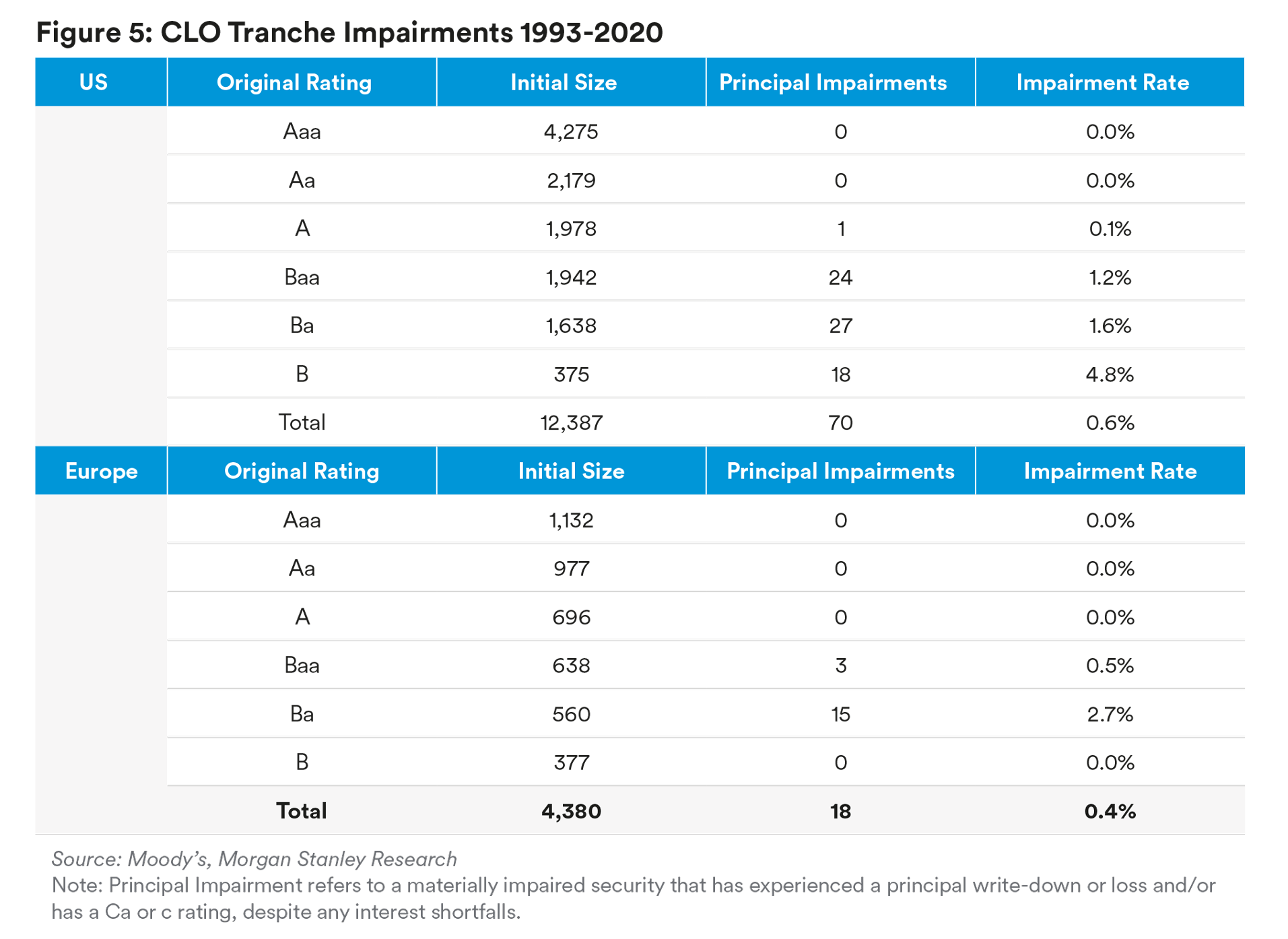

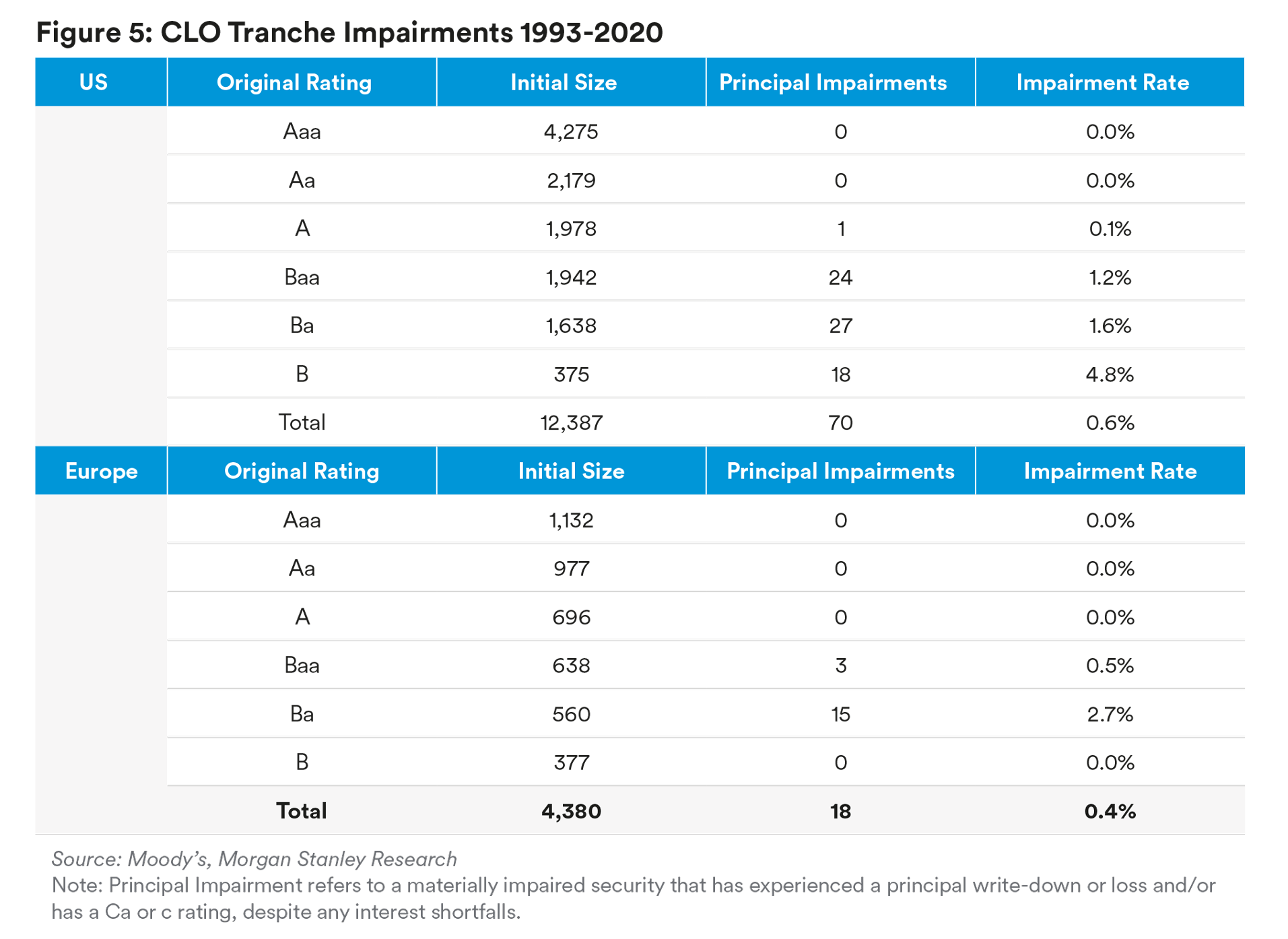

Structural protections have generally led to lower CLO tranche principal loss due to embedded credit enhancement, covenants, and portfolio quality criteria. Performance demonstrates low levels of principal loss based on historical impairment rates. Data on Moody’s rated CLOs from 1993- 2020 show an impairment rate of 0.6%, with no principal losses reaching AA and AAA rated bonds.

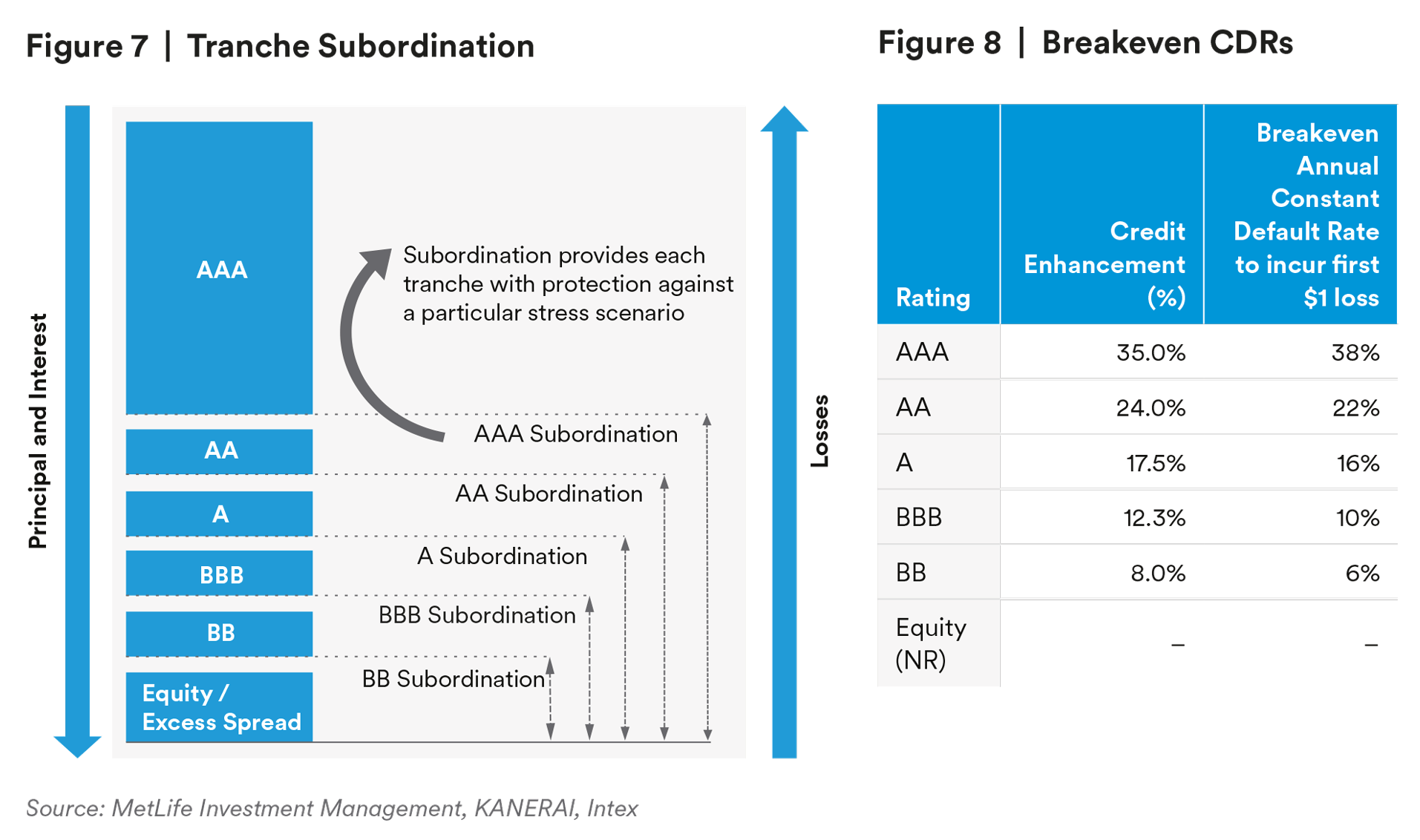

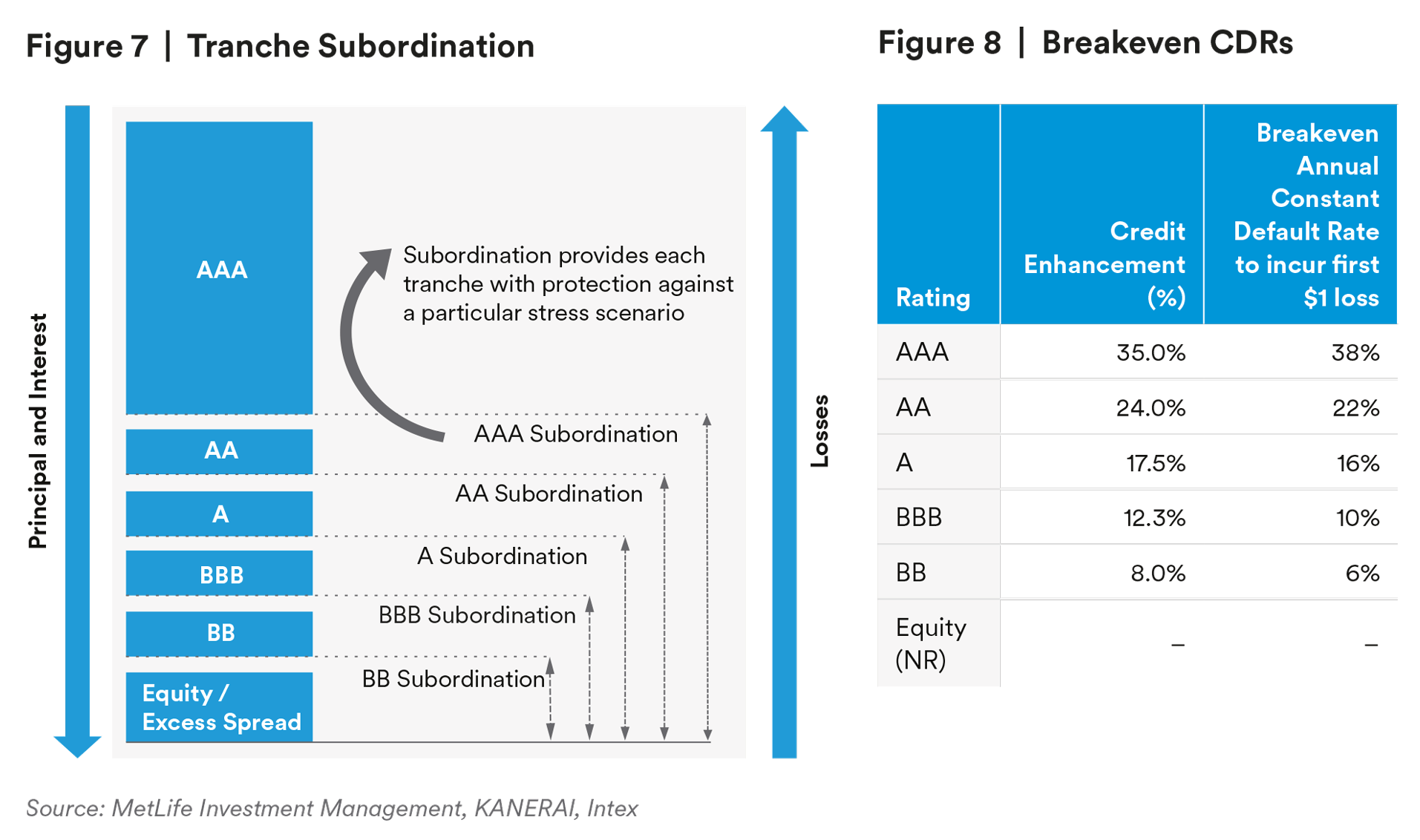

The key structural protections in CLOs are (1) credit enhancement in the form of subordination and (2) excess spread which together can absorb collateral losses before they impact bonds (Figure 7). As a result of these structural features, AAA-rated CLO tranches with 35% credit enhancement can withstand a 38% constant annual default rate (CDR) before incurring a first dollar of principal loss (Figure 8).

Several structural features of CLOs aim to help provide protection to investors in more senior tranches during times of stress, especially to investors in the senior parts of the CLO capital structure:

- The CLO structure penalizes excess holdings of loans rated Caa1/CCC+ or below

- Collateral Quality Tests (CQTs) restrict a manager’s ability to trade and add more risk to the portfolio

- Coverage tests ensure tranche interest and principal bond payments. If there is collateral deterioration, equity distributions are redirected to buy additional collateral to bolster the structure.

These structural features taken together are designed to help senior tranches to withstand significant collateral.

Relative Value

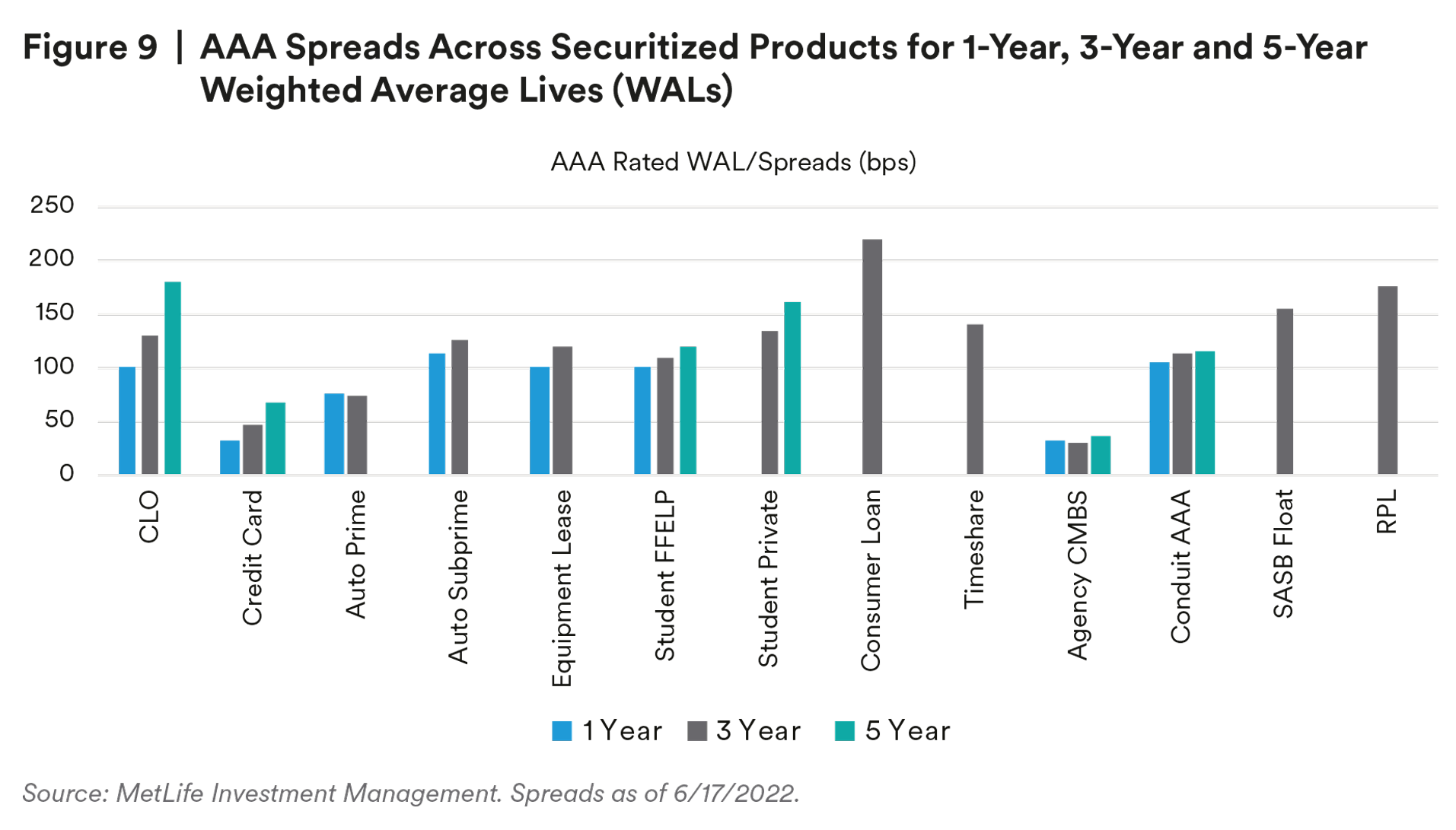

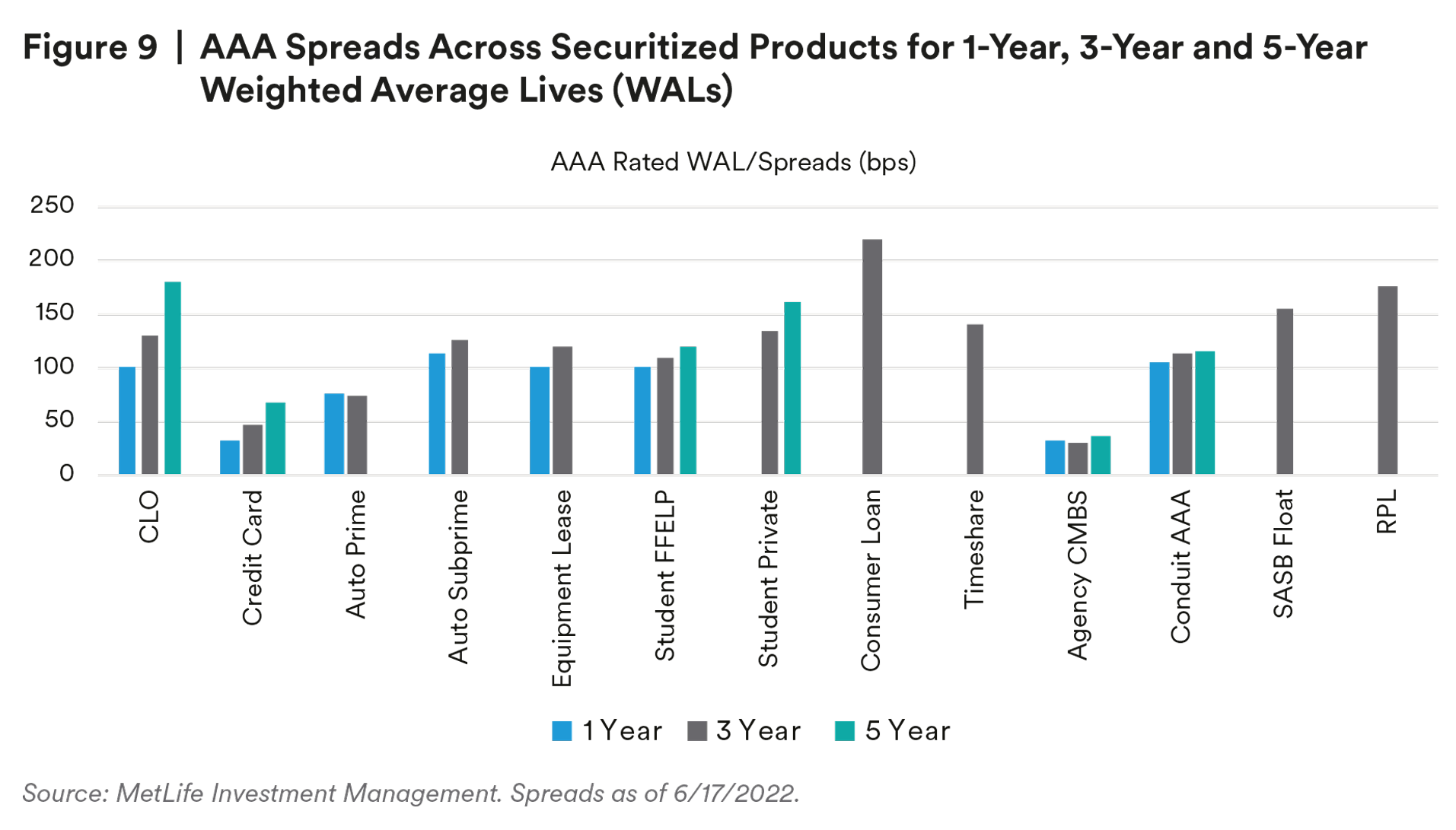

CLOs may offer compelling relative value against similarly rated floating rate asset classes across varying tenors and rating levels in the primary and secondary markets. Structurally, a typical AAA new issue has a 2-year non-call and a 5-year reinvestment period (5-6 Year Weighted Average Life (WAL)) along with a coupon of SOFR + 180 basis points.

CLO AAAs may provide attractive value as a short-term alternative. As shown in Figure 9, short AAA-rated CLOs (1-3 Year WAL) offer a spread of 100-130 basis points. Shorter duration tranches can offer value versus similar WAL/rating alternatives within securitized products. CLOs have consistently offered 60-100 basis points of excess spread compensation to traditional, AAA-rated structured finance investments as a result of their structural nuances and underwriting complexity, highlighted by their callability and negotiated governing documents.5

Liquidity

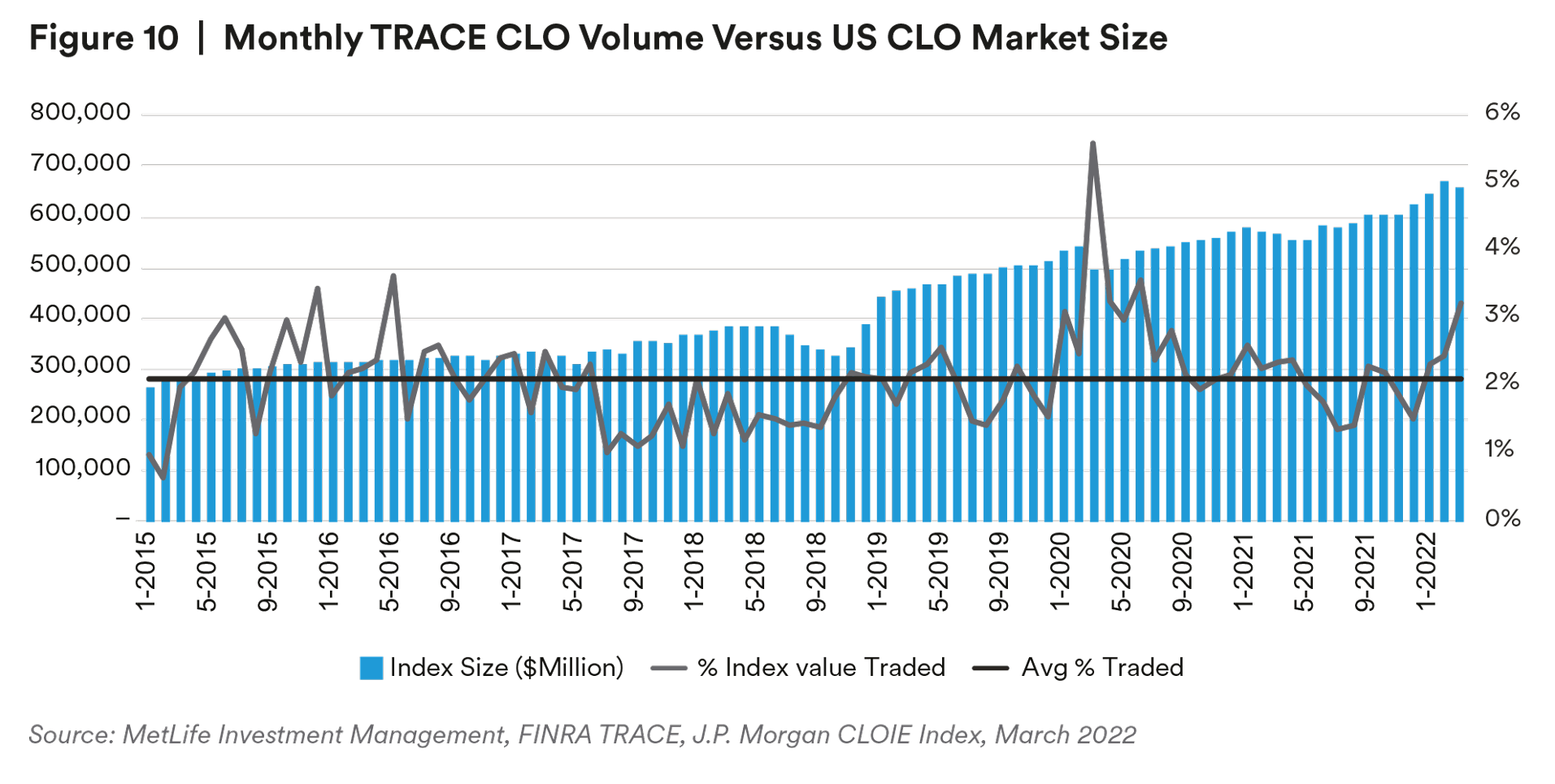

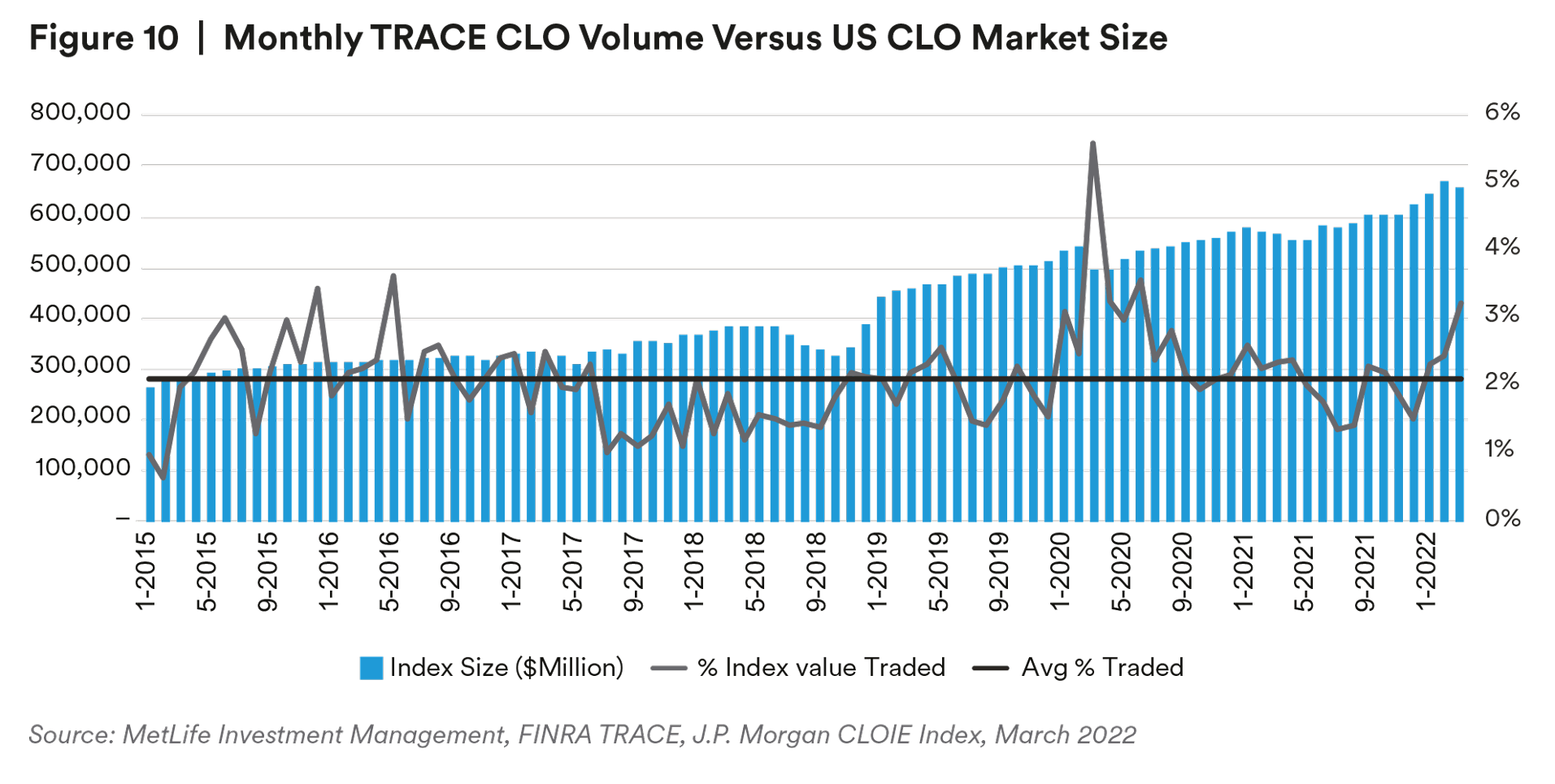

As the CLO sector continues to mature, trade volume reported by TRACE illustrates healthy liquidity in the asset class across many different risk environments. One way to measure liquidity is to refer to the trailing 24-month average of monthly trading volume which is ~$13.1bn. During the highly volatile COVID-19 pandemic, monthly trade volume peaked at $27.5bn in April 2020.6 CLO trading volumes in 2021 totaled $142bn, which is the 2nd highest year following the record of $187bn reached in 2020, with 2022 trending above both. AAAs comprise the largest portion of traded volume given that AAAs often represent over 60% of the deal structure. During times of market stress, the top of the capital stack tends to have greater volumes as investors look to sell higher dollar price assets to generate liquidity. Using the J.P. Morgan CLOIE as a proxy for outstanding market size, average trade volume as a percent of the market has kept pace with a growing market.

Investment Considerations

Dedicated CLO managers, with strict investment guidelines, actively manage the collateral pool through purchases and sales during the reinvestment period. CLO managers typically trade based on their fundamental outlook on the loan portfolio and industry exposures. We believe that a good manager will have a strong track record, disciplined credit process, and substantial infrastructure to support the investment process.

We expect investors to continue increasing their allocation to this asset class considering its historical performance through cycles, scalability, and relatively high spread compared to other fixed income alternatives.

We believe CLO investors must underwrite portfolios, structures, and managers to uncover investment opportunities. MIM has been investing in CLOs for over 20 years, with investments across the US Broadly Syndicated Loan, European Loan, Middle Market Loan and Infrastructure Loan CLO sub-sectors. The asset class has been embedded into our fixed income portfolios since its inception.

We summarize the key potential benefits and investment considerations below:

Benefits

- Diversification — CLOs enhance portfolio diversification given their relatively low historical correlation with most major asset classes. The low correlation is largely attributed to their floating rate structure. Investors with allocations to investment-grade credit and U.S. corporates may benefit by diversifying into CLOs.

- Structural Protections — CLO debt tranches have credit enhancement features in the form of par subordination and excess spread. Further protections are provided through underlying portfolio concentration limitations, collateral tests, and cashflow redirection from equity to debt tranches in periods of stress.

- Income — Total return is primarily from coupon income, which can increase to the extent that underlying interest rates rise since spreads are linked to a LIBOR/SOFR benchmark.

- Risk Profile: Performance demonstrates low levels of principal loss based on historical impairment rates.

Investment Considerations

- Interest Rate Risk — CLOs are a low duration product due to their floating rate nature. In general, coupons fall (negative) when rates fall and rise (positive) when rates rise.• Callability — CLOs are structured with non-call periods that typically last two years. After the non-call period, CLO managers and equity tranche holders have the option to refinance debt tranches at a lower spread, as market conditions and spread levels permit.

- Credit Risk — Below investment grade debt obligations are regarded as predominately speculative with respect to the borrower’s continuing ability to meet principal and interest payments. Lower quality debt obligations may be more susceptible to real or perceived adverse economic and individual corporate developments than would investment grade debt obligations.

- LIBOR to SOFR Transition — The primary market for U.S. CLOs and leveraged loans has made a nearly seamless transition into SOFR-based pricing. The majority of legacy deals still have LIBOR-based pricing, but most have been amended with language to address the transition to a new benchmark reference rate.

Endnotes

¹ MetLife Investment Management, KANERAI, Intex, as of 5/27/2022.

2 Source: MetLife Investment Management, KANERAI, Intex, as of 5/31/2022.

3 Source: J.P. Morgan CLOIE Rating Transitions, January 29,2021.

4 MetLife Investment Management, Barclays, and Bloomberg.

5 MetLife Investment Management.

6 MetLife Investment Management, FINRA TRACE

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. More specifically, investments in private structured credit involve significant risks, which include certain consequences as a result of, among other factors, borrower defaults and, fluctuations in interest rates. When originating a loan, a lender will rely significantly upon representations made by the borrower. There can be no assurance that such representations are accurate or complete, and any misrepresentation or omission may adversely affect the valuation of the collateral underlying the loan, or may adversely affect the ability of the lender to perfect or foreclose on a lien on the collateral securing the loan, or may result in liability of the lender to a subsequent purchaser of the loan.

Private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial market. The investments and strategies discussed herein may not be suitable for all investors. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. You should consult your tax or legal adviser about the issues discussed herein. The investments discussed may fluctuate in price or value. Investors may get back less than they invested.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda[1]ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC and MetLife Investment Management Europe Limited.

Unless otherwise noted, none of the authors of the articles on this page are regulated in Ireland.