As we head into 2023, the macro environment will remain the principal driver influencing fundamental developments in EM as well as asset market returns. Currently, market views oscillate between concerns around the persistence of inflation and fears of a looming recession. Will the Fed be able to navigate a soft landing? Will China’s Zero Covid Policy end for good and growth bounce back in 2023? Will the whispers of ceasefire soon bring an end of the war in Ukraine? With the data and news flow received over the last two months of 2022, we are growing increasingly hopeful that there may be a more constructive path ahead for EM. We believe that challenging market environments like this one can offer attractive entry points for patient and risk-tolerant investors with a medium to longer term investment horizon. History indicates that investing in EM debt through the cycle can offer positive risk-reward.

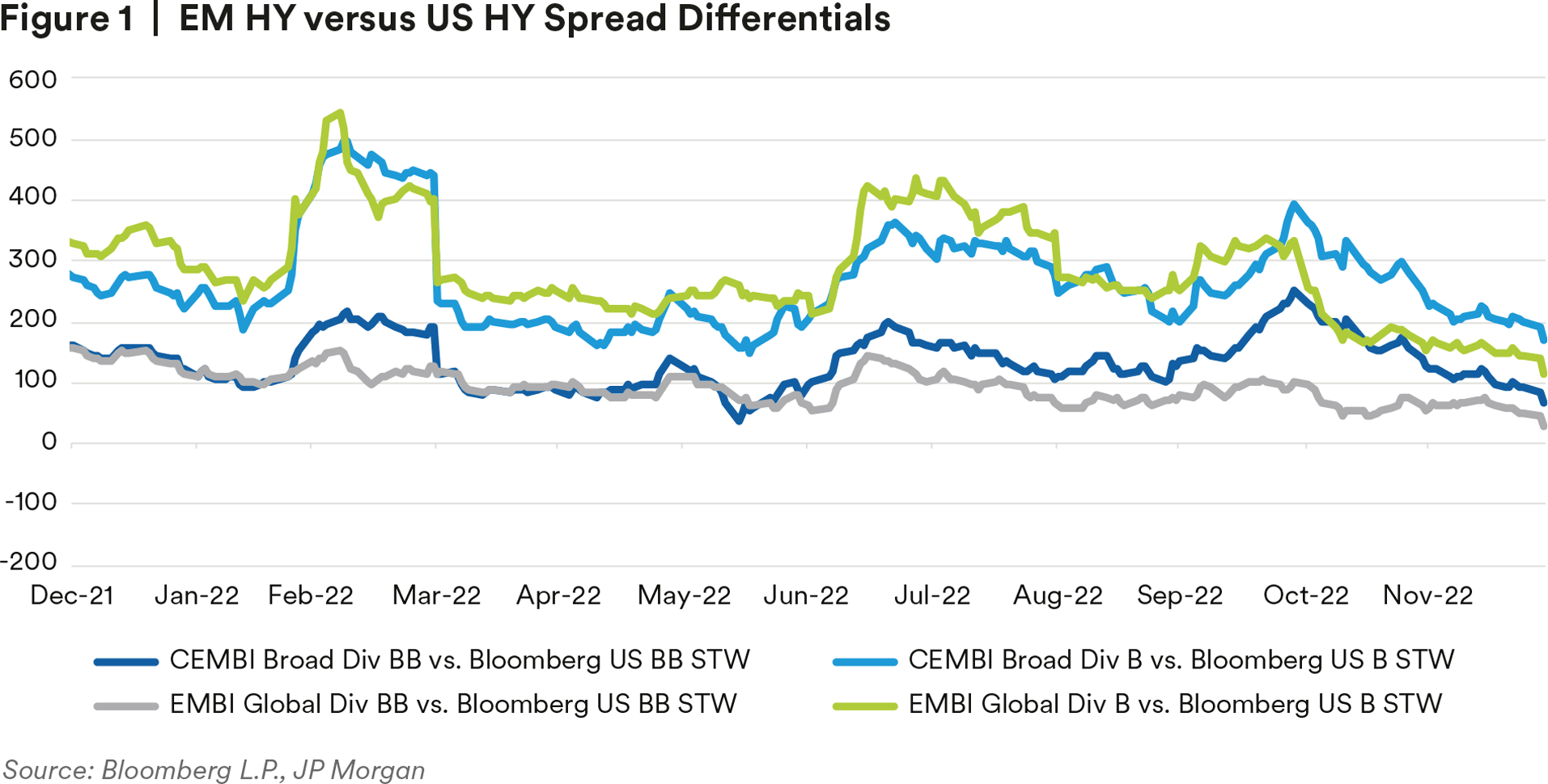

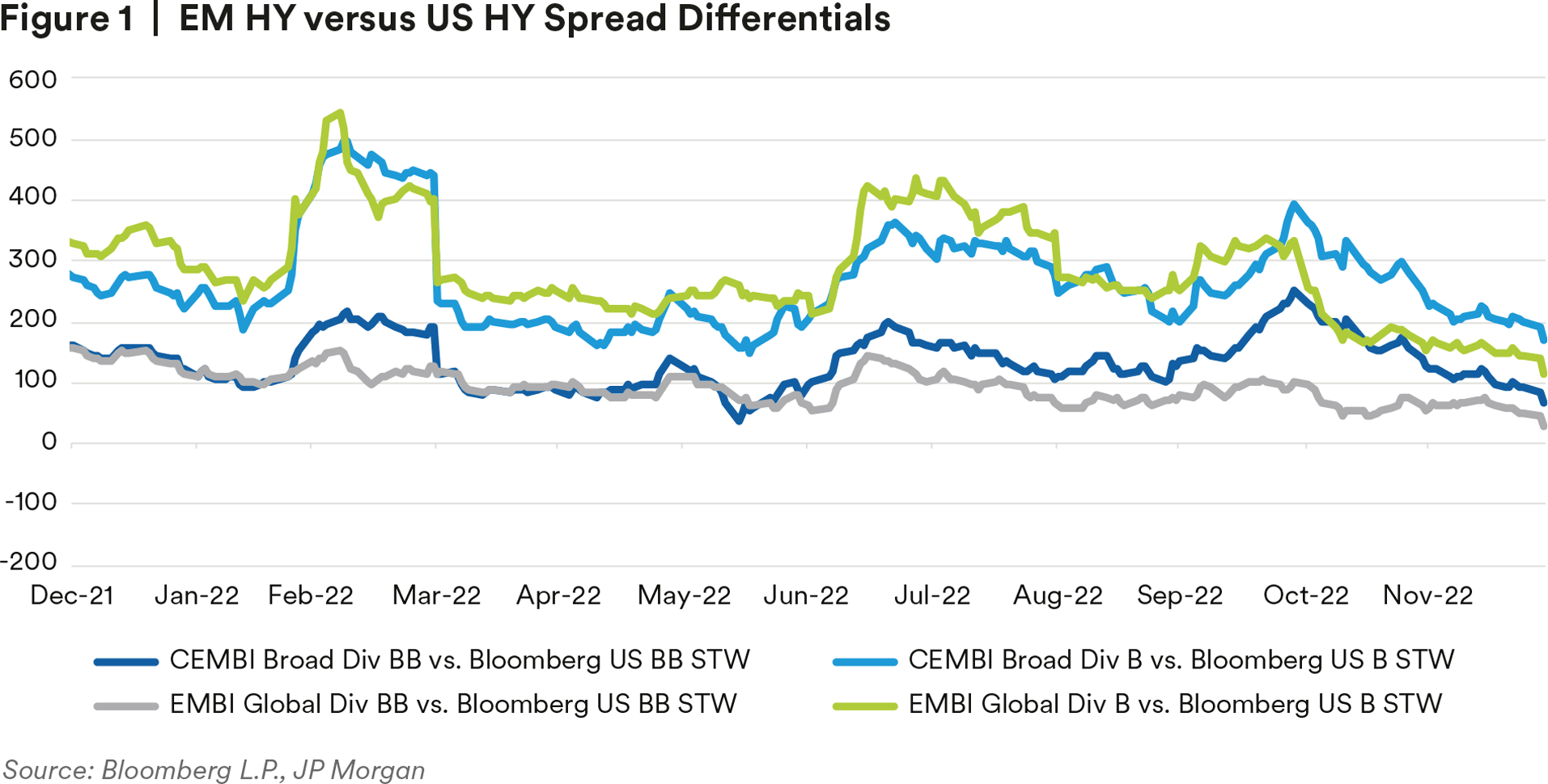

Indeed, Emerging Market Debt (EMD) has not been immune to this downcycle, and we have observed widening of EM spreads relative to DM during most of 2022, especially in subinvestment grade credit. We note that this is normal for this point of the cycle due to the higher beta nature of EM credit. In this paper, we will share our thoughts on where we are in the current cycle and discuss the impact on EM credit of both bullish and bearish macro scenarios. We will also discuss the basis for our concerns around EM sovereigns, and argue that far more will bend rather than break amidst the current headwinds. Conversely, EM corporate credit broadly speaking is having its finest moment, with strong margins and clean balance sheets. We conclude with thoughts on valuations and believe strongly that risk differentiation will remain a key driver; as such, there should be ongoing opportunities for investors to capture alpha through security selection.

EM Is No Stranger to Shocks

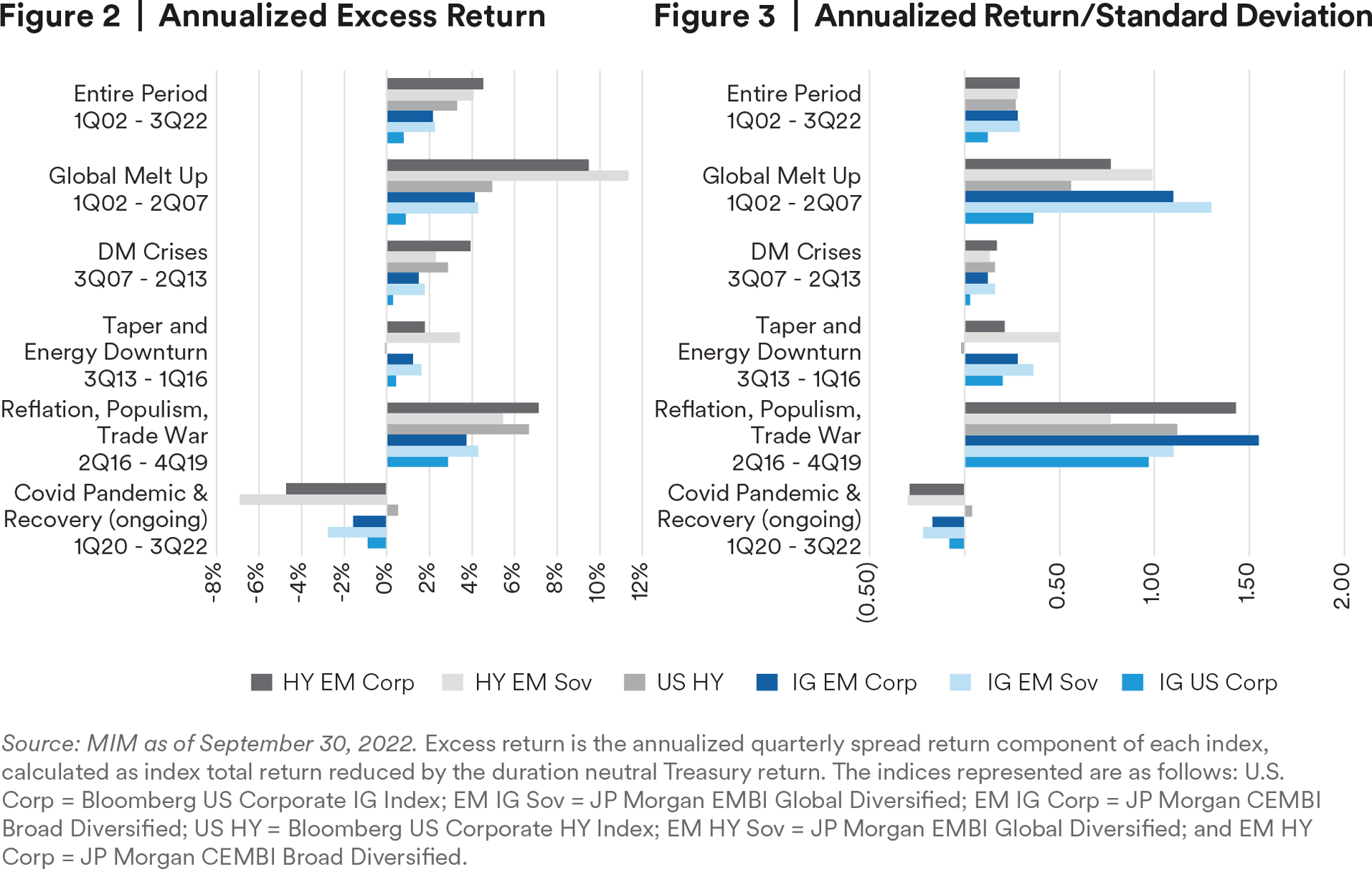

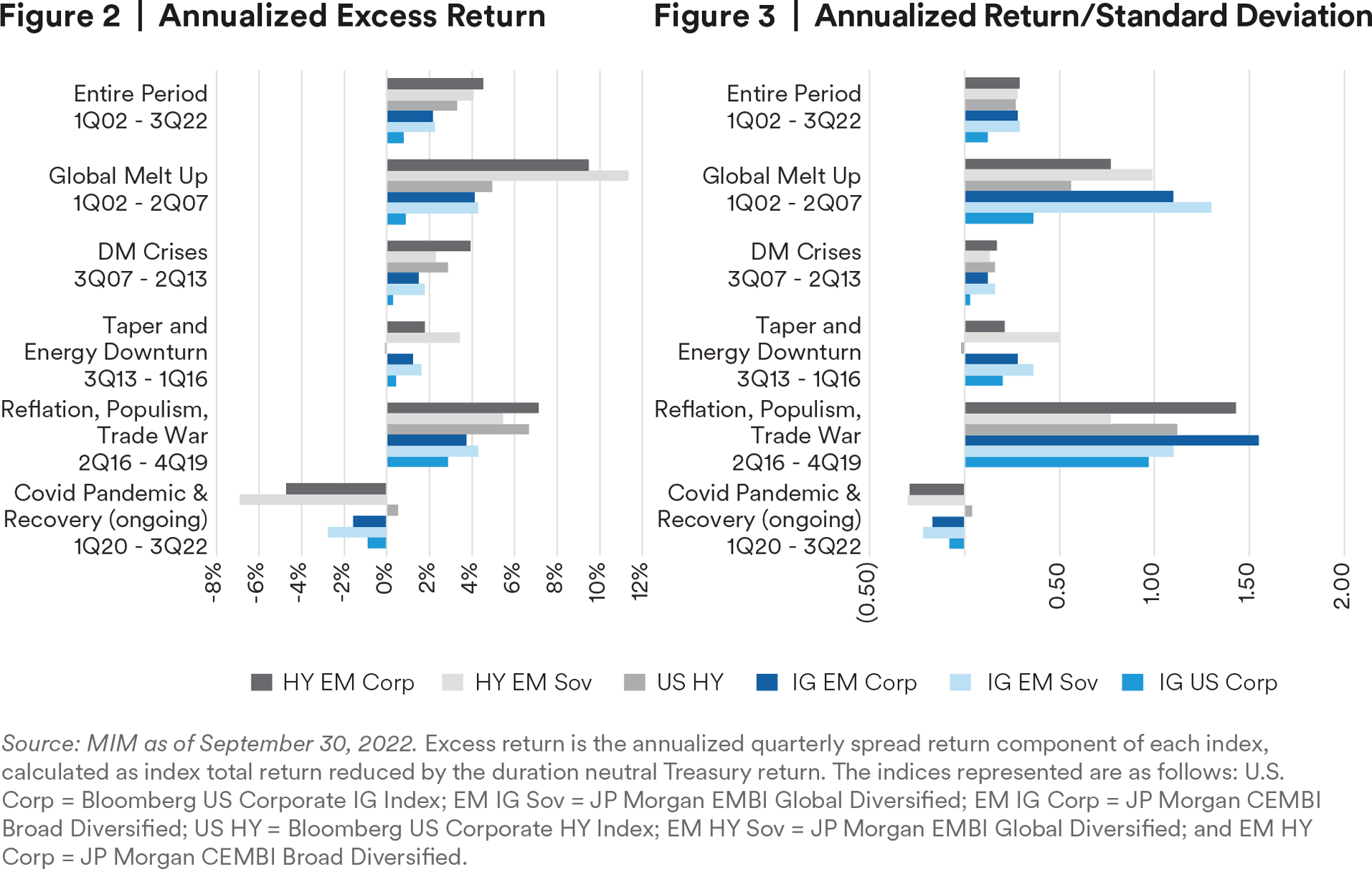

Historically, EM securities have a high-beta response to global events, with the recent year’s performance being no different. Going back to the early 2000s, there have been numerous cycles that demonstrated EM’s performance potential. Whether it was during the global melt up from 2002 to 2007 or the taper tantrum and energy downturn from 2013 to 2016, EM indices on an excess return basis have been able to outperform Developed Markets (DM). Additionally, despite the higher risk of the asset class, historical risk adjusted returns remain higher than developed peers.

During the current cycle since early 2020, EM returns are underperforming those of DM credit of the same quality, which isn’t surprising when considering that the cycle is not yet complete. We prefer to look through the cycle and anticipate EM outperformance once the cycle troughs and a new normal becomes more evident.

Where We Are

The macro headwinds afflicting Emerging Markets over the past 12 months have manifested in several areas including access to markets, commodity price volatility, the need for tight monetary policy and the difficulty of enacting fiscal adjustment. These conditions will likely ease as macro drivers improve, such as peaking global inflation, a continuous growth recovery in China, or a negotiated settlement/ceasefire to the Russia/Ukraine war. Recent data and news flow point in the right direction and has fueled a positive market response for EM assets since early November that could persist into 2023. Alternatively, we think some skepticism is prudent and would expect more volatility should there be a reversal in any of the recent trends. Certainly, EM assets would not take kindly to a prolonged period of spotty market access, volatile commodity prices, tighter monetary policy for longer, and further downgrades to EM sovereign ratings.

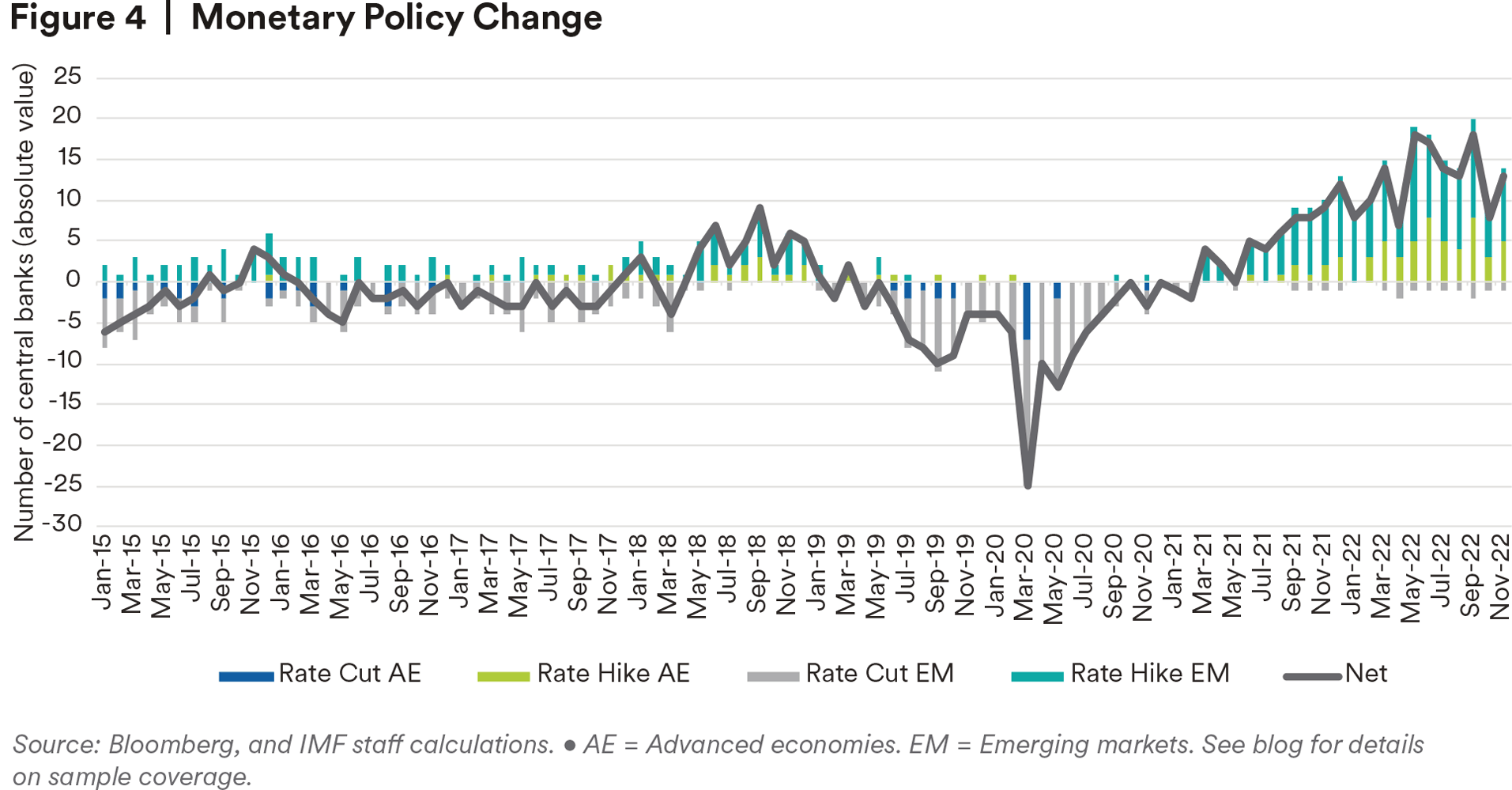

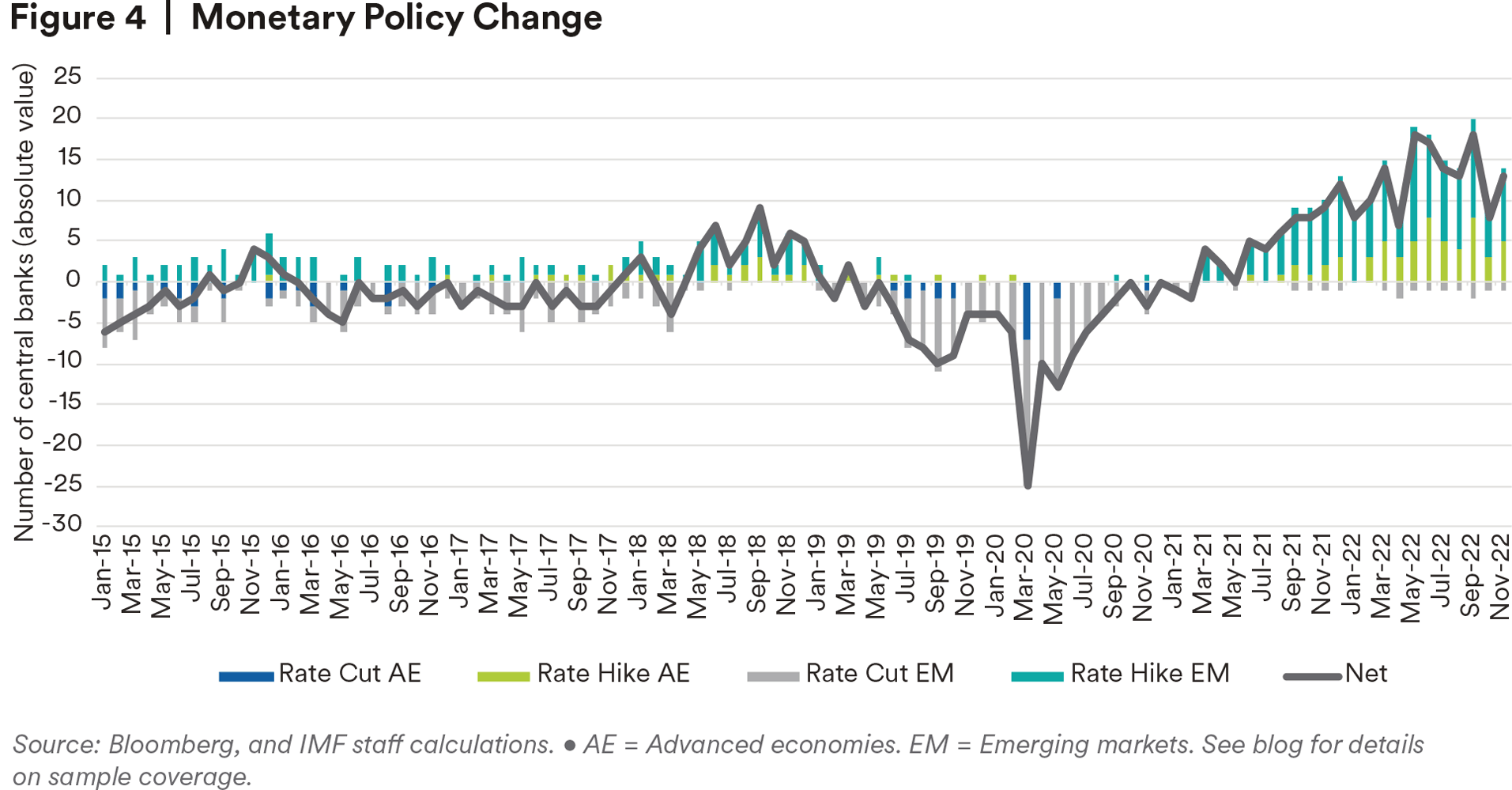

EM sovereigns had strong buffers that made them more resilient going into the pandemic shock of 2020. Central banks across EM were able to cut rates aggressively while governments enacted strong fiscal stimulus even while revenues languished. All of this led to a one-time jump in debt metrics in virtually every country around the world. Most EM governments were on the path of reviving their fiscal accounts when the poorly timed trifecta of macro headwinds hit in early 2022. Unfortunately, the combination of high inflation and high interest rates in many EM countries led to a stagflationary environment that perpetuates fiscal gaps and necessitates regular bond issuance, therefore requiring ongoing market access.

Despite the challenges, we remain comfortable with EM sovereigns more broadly because of key buffers that exist. For instance, we feel there is very low external vulnerability across the EM universe, and given the good starting point of balance sheets, few countries are at risk of ratings bucket changes, and no large countries are facing funding distress or default risk. EM central banks, gained credibility by tightening policy earlier and more aggressively than their developed market peers and should eventually be able to provide relief once local inflation begins to decline and global rates stabilize.

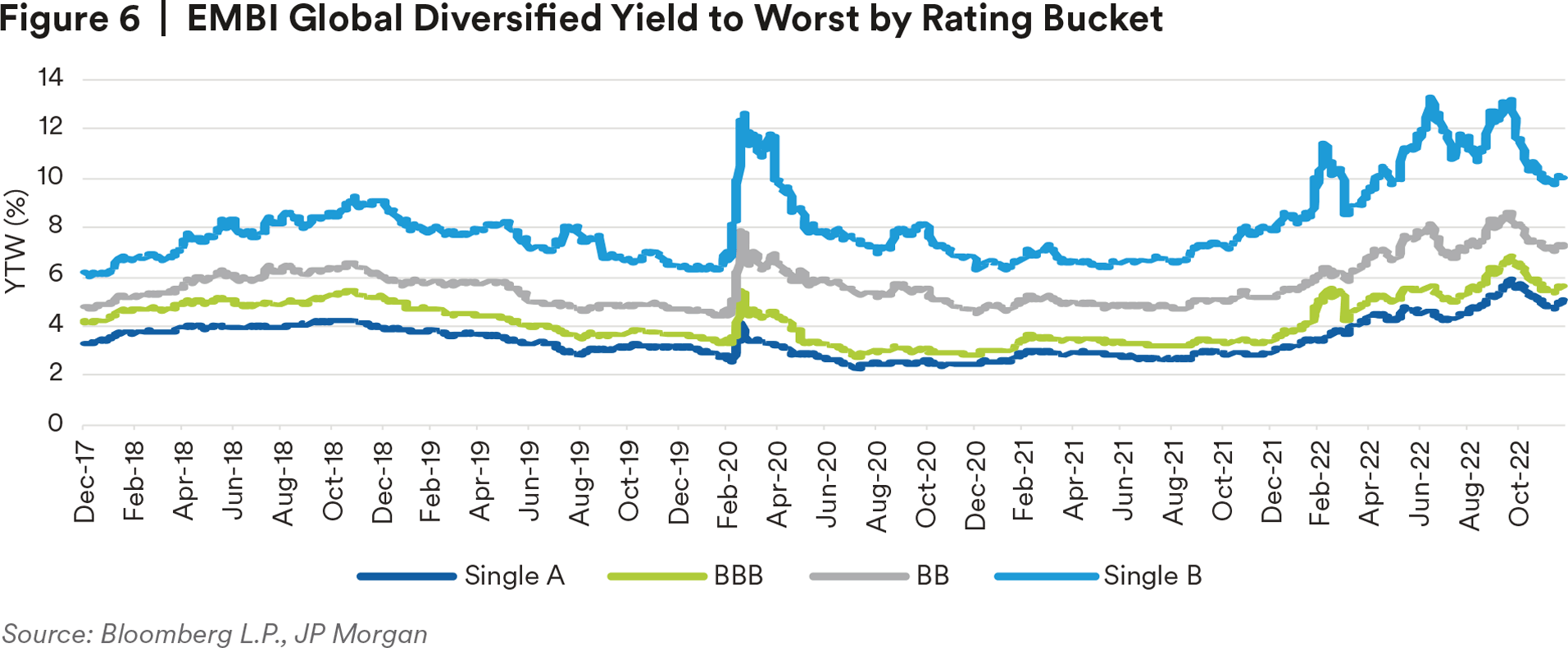

We have observed a recent uptick in EM sovereign defaults among smaller countries, and certainly could see more before the cycle is complete. With market access currently restricted for lower rated issuers, many sovereigns can still rely on local markets and multilateral funding sources. The IMF has remained supportive of countries that commit to reform programs. Over the coming 12-18 months we could envision a string of restructurings with more aggressive debt sustainability assumptions that lead to lower near-term recovery rates, but ultimately delivers better longer-term fundamentals. We believe this risk is more appropriately priced now within the single-B and below space and some countries offer significant longer-term upside.

Why Are We So Upbeat On EM Corporates?

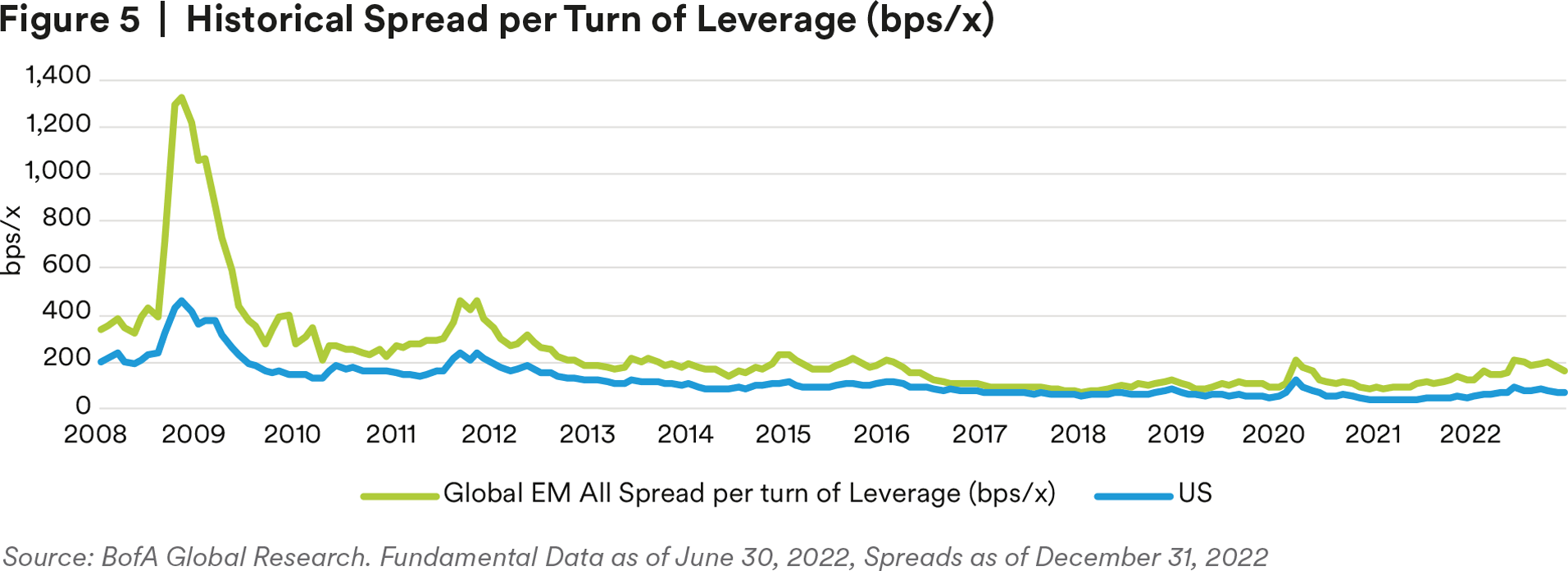

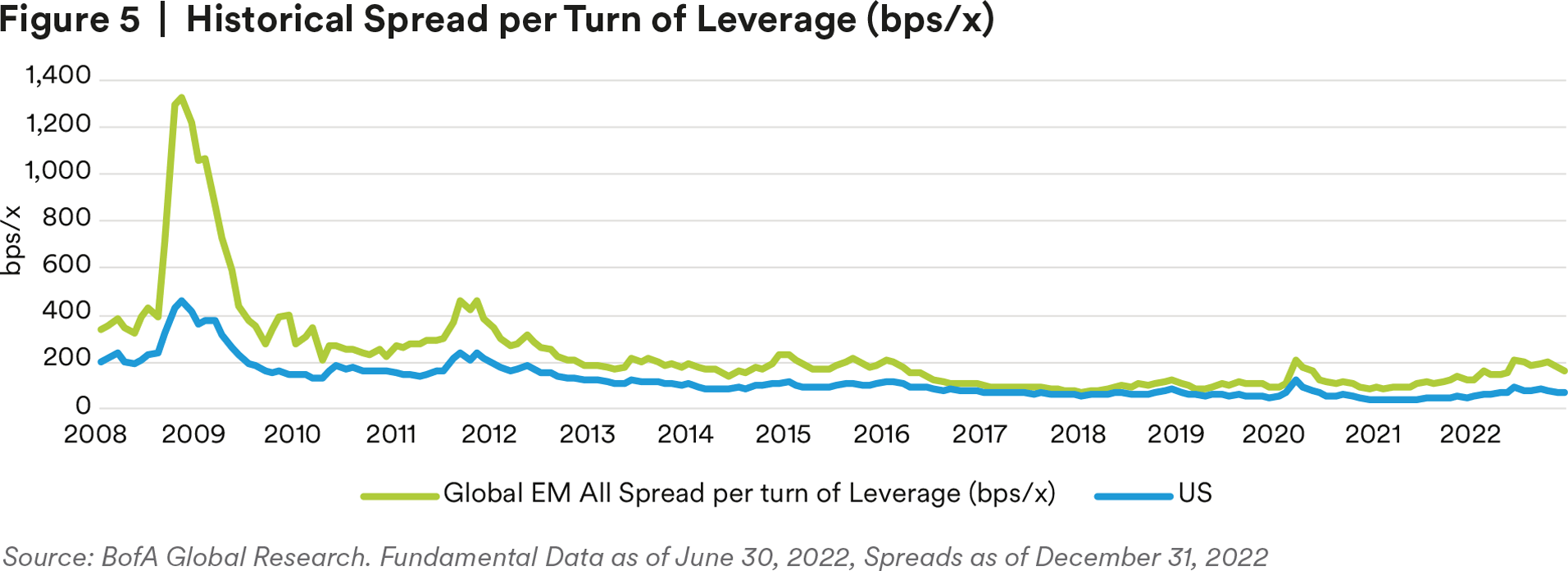

Corporate fundamentals have remained strong despite pressure on margins from higher inflation. Leverage metrics remain well inside of developed market companies; however, given country specific headwinds, spreads remain wide but have more room for compression when macro headwinds subside, as we expect later in the year. BBB and BB EM corporates both have 1x less turn of leverage versus equally rated US peers.1 Rating-to-rating, EM corporates do not screen cheap; however, with EM spread per turn of leverage over 2x higher than US,2 the current spread differentials are warranted given where we are in the cycle. EM corporates have been deleveraging, with record negative net issuance year-to-date (YTD), while US corporates have been doing share buybacks. Despite credit spreads being near recent tights, all-in yields are at attractive levels for long term investors.

EM Valuations Heading Into 2023

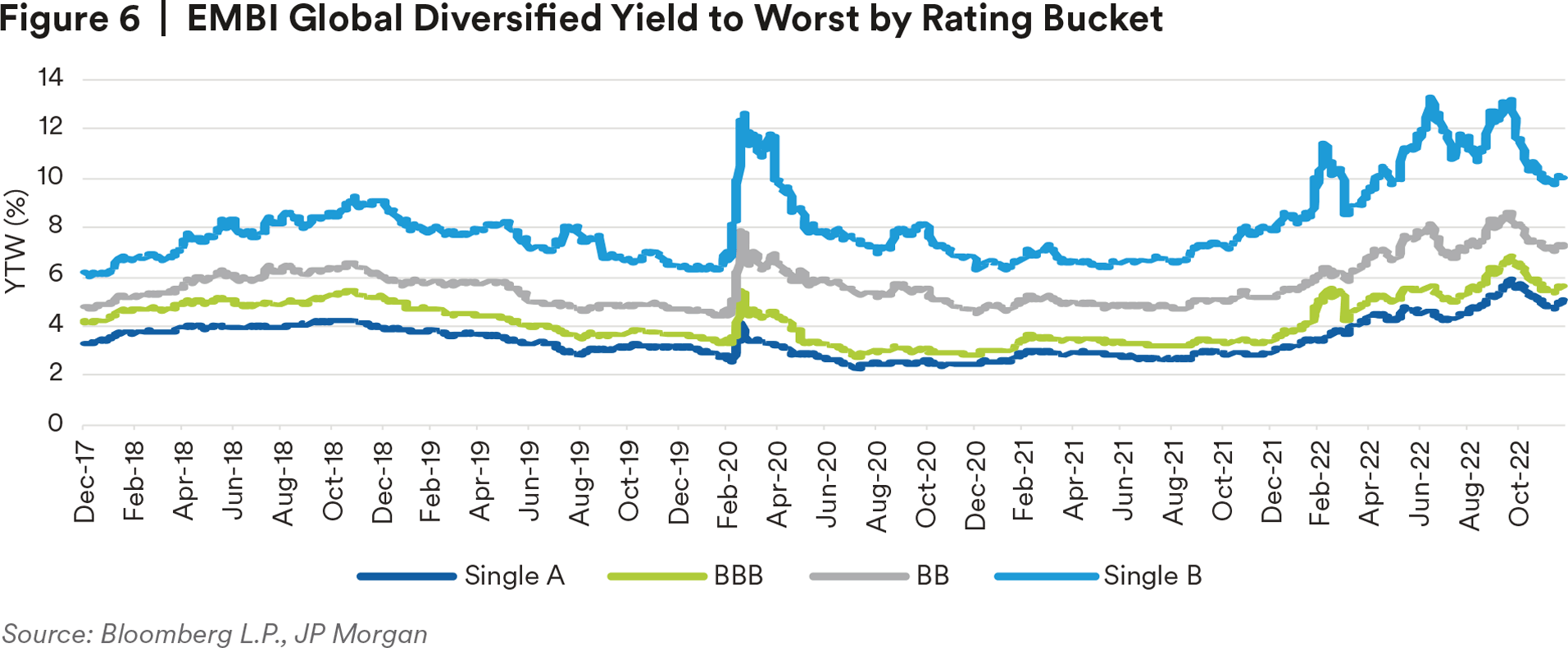

At the moment, we believe pockets of opportunity have been created in EM on an absolute and relative perspective with reasonable fundamentals supporting our assessment of the credit outlook. Spread widening has been relatively contained, with both the EMBI Global Diversified and CEMBI Broad Diversified less than 100 basis points wider YTD despite double digit negative returns.3 Nonetheless, spreads on the indices are still above their 5-year averages, coupled with a 200 basis point treasury move YTD to put all in yields at enticing levels. With idiosyncratic stories more prominent than ever, the dispersion between hard currency sovereigns, corporates, and local currency securities, along with differentiations between rating categories, opens the door to a variety of opportunities

Investment grade sovereign returns have been penalized by the aggressive treasury move but remained resilient from a spread basis, creating a notable dispersion from high yield countries. Higher beta sovereigns have been under pressure since the start of COVID-19, especially single-B and below sovereigns with limited funding options have notably underperformed for a large portion of the year. If it proves to be true that inflation has peaked and tightening cycles will come to an end early in 2023, there is significant room for spread compression on positive headlines. Further, commodity prices remaining at supportive levels for EM exporters has continued to be a net positive for the overall asset class. Whether high quality GCC countries or higher beta energy exporters in Africa, to metals exporters within Latin America, this ongoing strong commodity cycle has proven to be a supportive backdrop for the EM universe.

Despite the fact that a majority of recent issuance has been concentrated in the less than 10 year bucket, curves in EM are steep and therefore offer opportunity for spread pickup in longer duration securities. Additionally, because of constraints to market access, we have seen a predominance of higher quality issuers which has influenced the overall credit quality of the indices.

Local currency assets have witnessed a strong fourth quarter as the dollar has faced some weakening. Investors were aggressively long dollars for most of the year given the macro environment, but we expect the dollar to trade more two-way and eventually decline in 2023, as rates and inflation stabilize and economic growth cools. For local currency EMD, we believe the FX component will contribute a greater portion of total returns. The softening of US economic and inflation data suggest the Fed will not enact further interest rate hikes beyond what is currently priced into markets and if so the strong surge in the USD since 2021 should subside. The market is now reading the Fed as less hawkish than other central banks such as the European Central Bank (ECB) and most recently the Bank of Japan (BOJ) with the adjustment to their yield curve-control policy.

Conclusion

We believe that the macro landscape will remain the primary driver of EM fundamentals and asset returns during 2023. Recent inflation indicators and China’s economic reopening is encouraging, and EM asset prices have reacted positively. If these trends remain in place, we believe there is more room for EM assets to outperform, and should a ceasefire also occur in Ukraine, the upside for EM becomes even greater. That said, we are watching headlines with caution, and acknowledge downside risks, which would be negative for EM assets. We are inclined to maintain a more defensive positioning into the new year, focusing on securities that we feel are attractively priced but will prove resilient should the downcycle extend. We can identify several assets in hard currency sovereigns, corporates and local currency that meet these criteria. We do anticipate a turning point sometime in 2023 when EMD will begin to trade more on its own fundamentals, and with lower correlations that provide greater diversification benefits to global bond investors. As this scenario starts to unfold, we will act accordingly and adjust positioning to try and capture opportunities as the market presents them.

Endnotes

1 BofA Global Research

2 BofA Global Research

3 JP Morgan

Disclosures

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”) solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Particular risks of investing in emerging market securities include: smaller market capitalization of securities markets; potential for significant price volatility: potential restrictions on foreign investment; political instability; and possible seizure of a company’s assets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyodaku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.