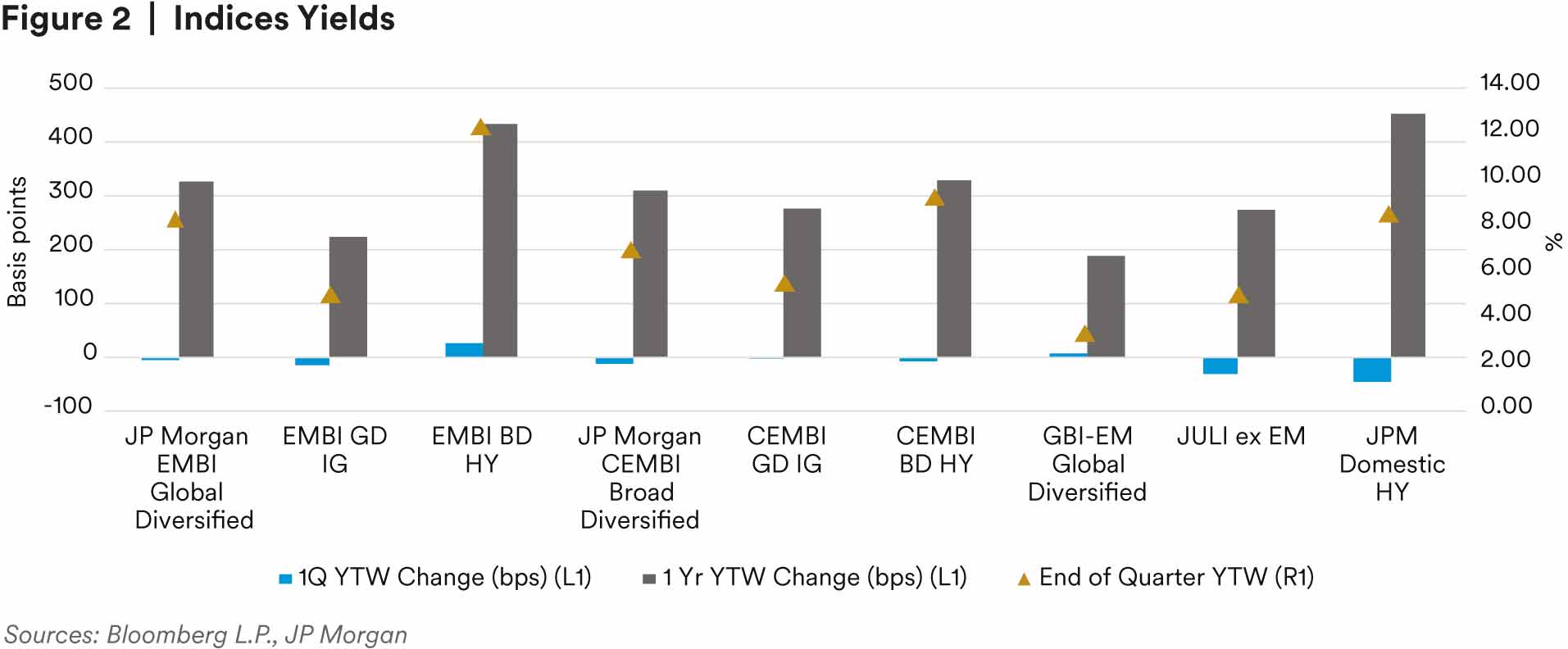

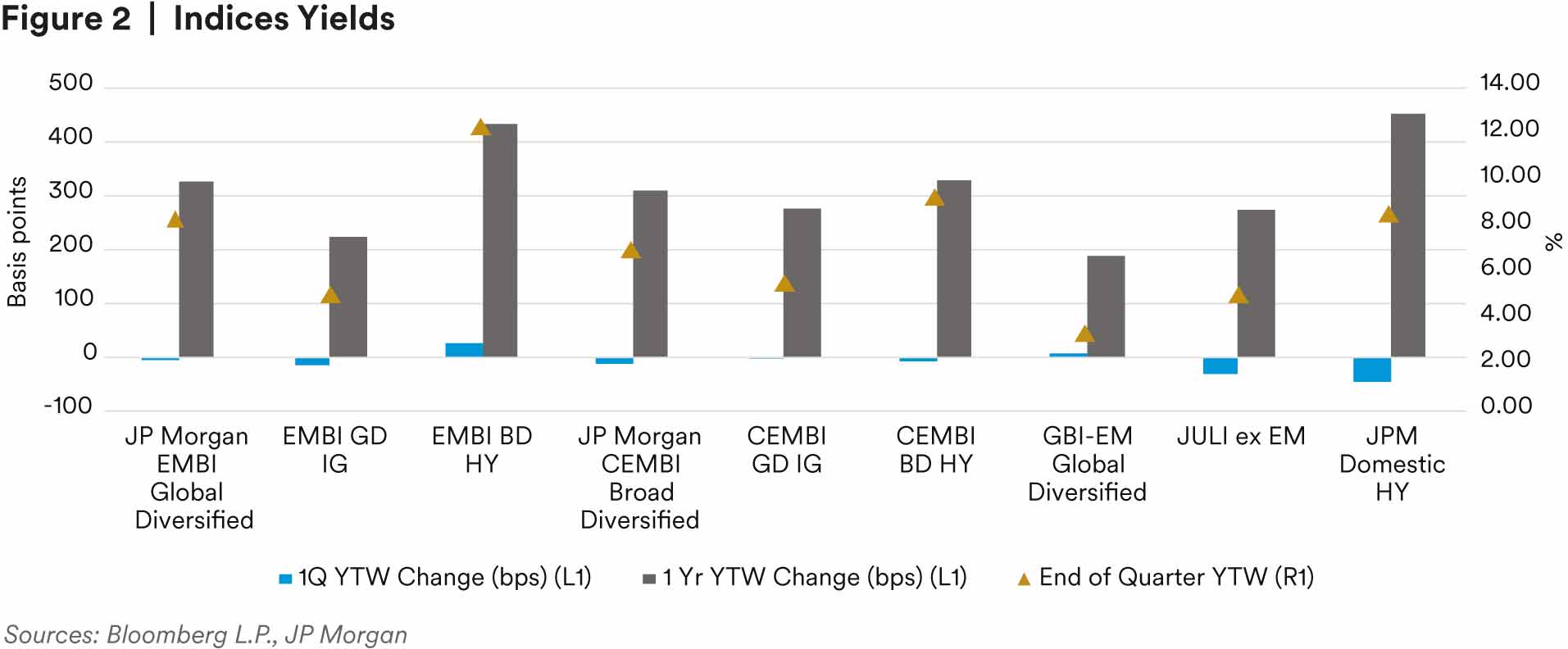

The 10-year Treasury remained volatile, hitting 4.05% in early March, only to close the quarter at 3.47% as the market grappled with the fallout from Silicon Valley Bank (SVB) and its implication for tighter lending standards going forward. The banking uncertainty within the U.S. and Europe has remained more of an idiosyncratic story rather than a systemic one, leaving EMs relatively detached from the headwinds. Therefore, while EM assets have traded down in sympathy with the market, EM banks have been well isolated from contagion risk and stand out for their strong capitalization.

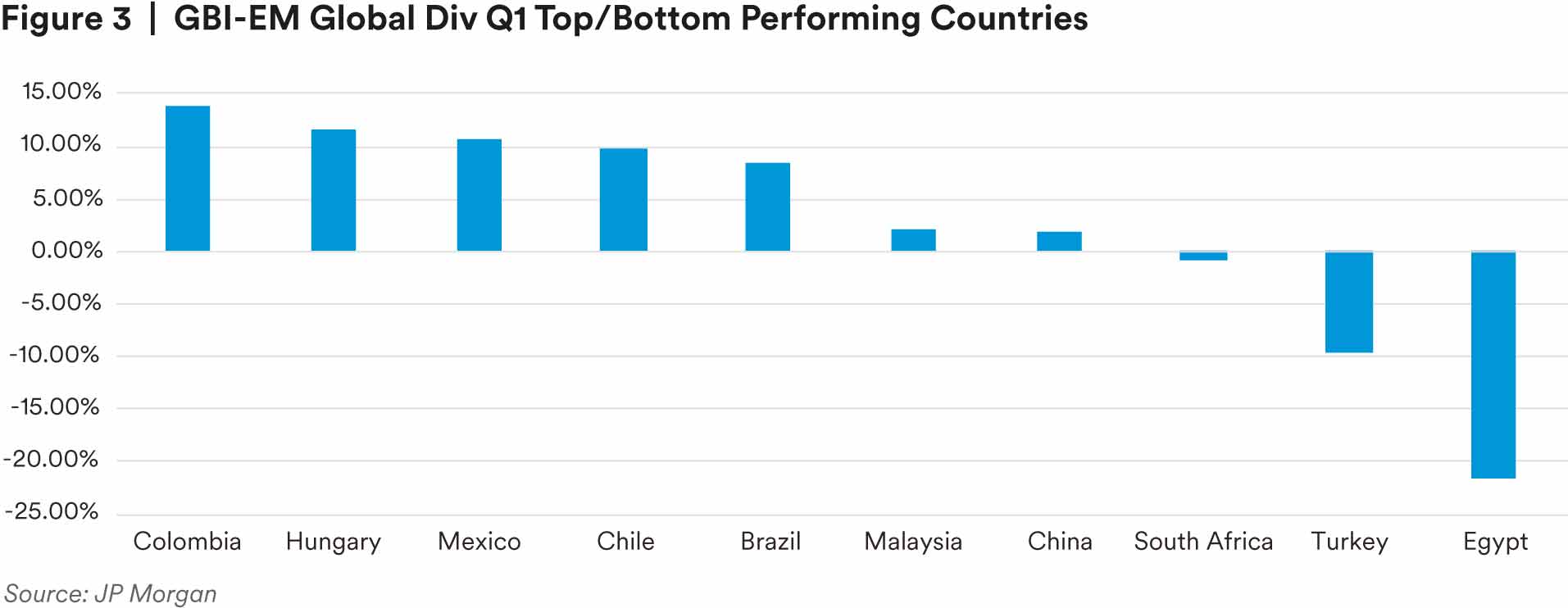

The Fed is facing a unique situation: Inflation remains stubbornly high, while the recent banking unrest, worsened by elevated interest rates, leaves a question mark around the trajectory of growth moving forward. The latest language by Fed Chair Powell, after the Fed’s ninth-consecutive rate hike, hinted at a soft-landing recession scenario, but that remains to be seen. Recent sentiment around a more predictable path of Fed policy, given the concerns around lending standards, continues to support non-dollar assets in both the developed and emerging worlds. As a result, higher-beta local currencies were able to rally for much of the quarter, largely unfazed by banking concerns and more focused on attractive real rates.

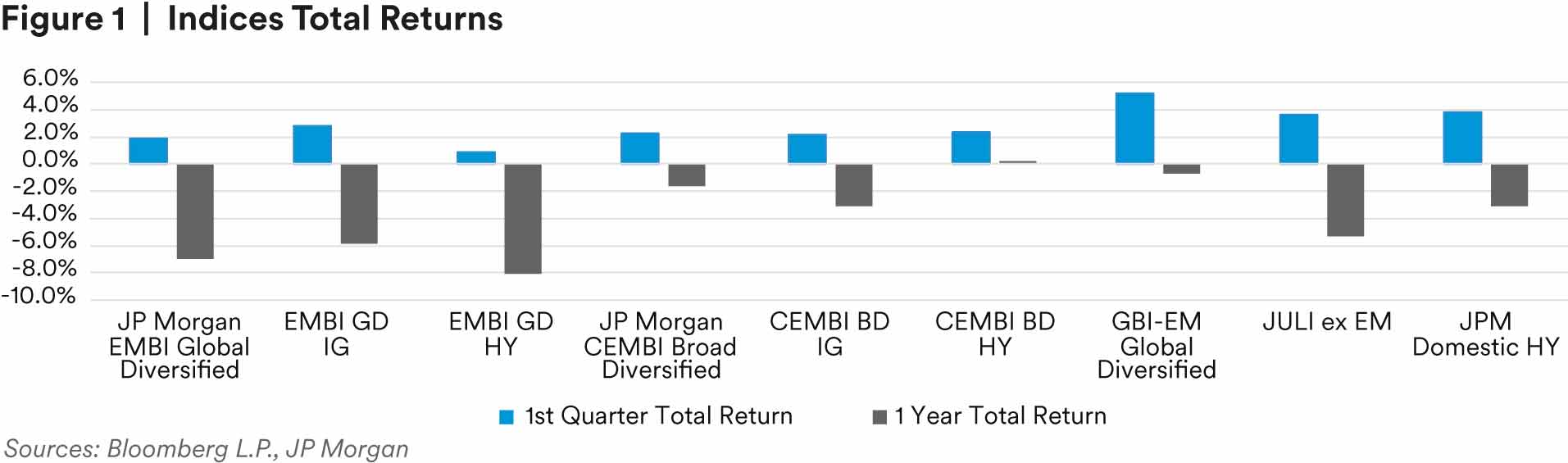

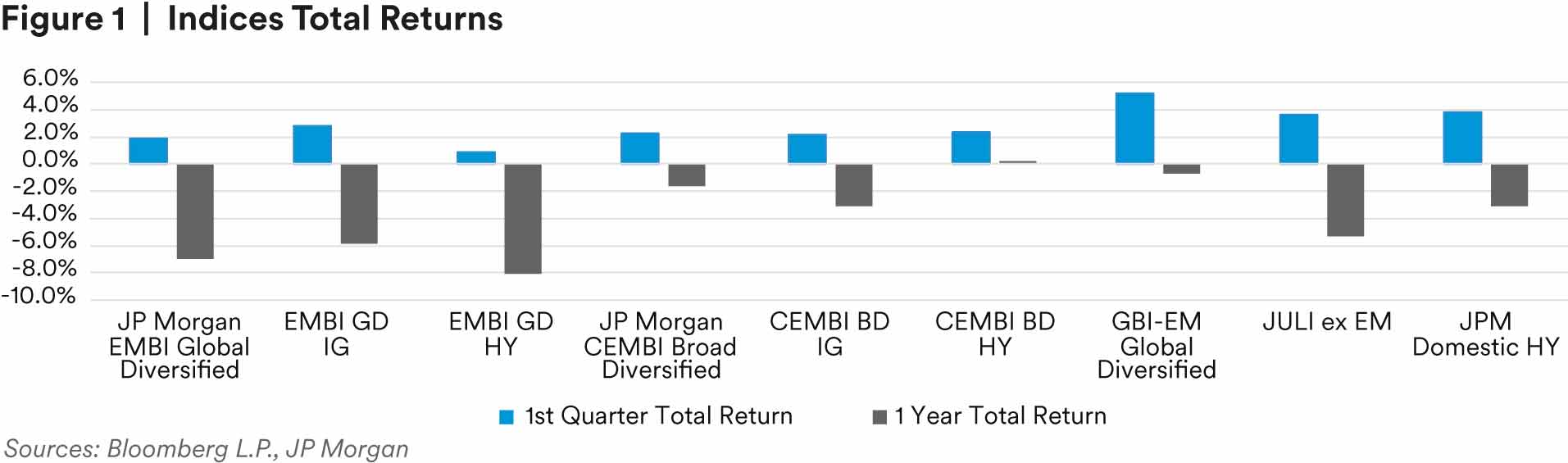

Investment-grade assets outperformed during the quarter. Investors rotated up in quality as uncertainty increased, reducing high-yield overweights and extending duration in high-quality, long-duration assets. Over the past few months, there has been an increased focus on sovereigns, with investors looking to increase portfolio liquidity, reduce tracking error in dedicated portfolios, and take advantage of recent issuance that priced attractively

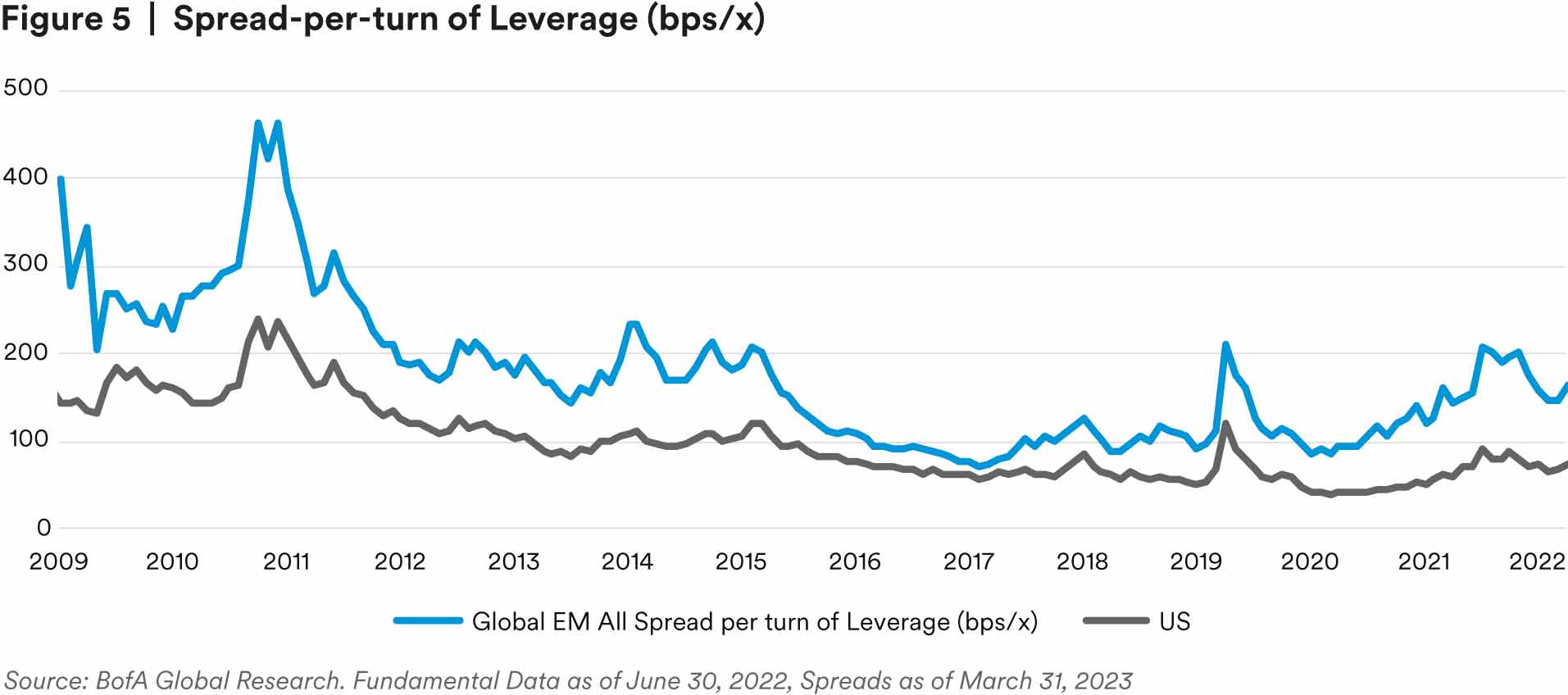

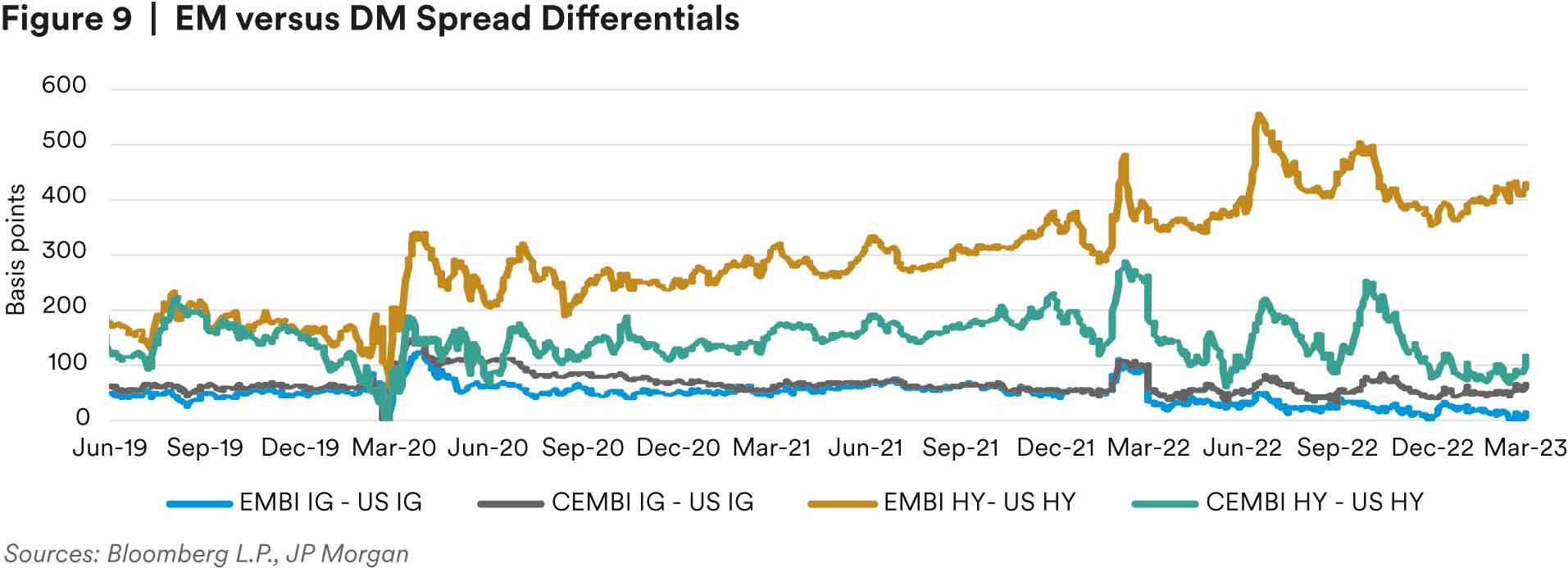

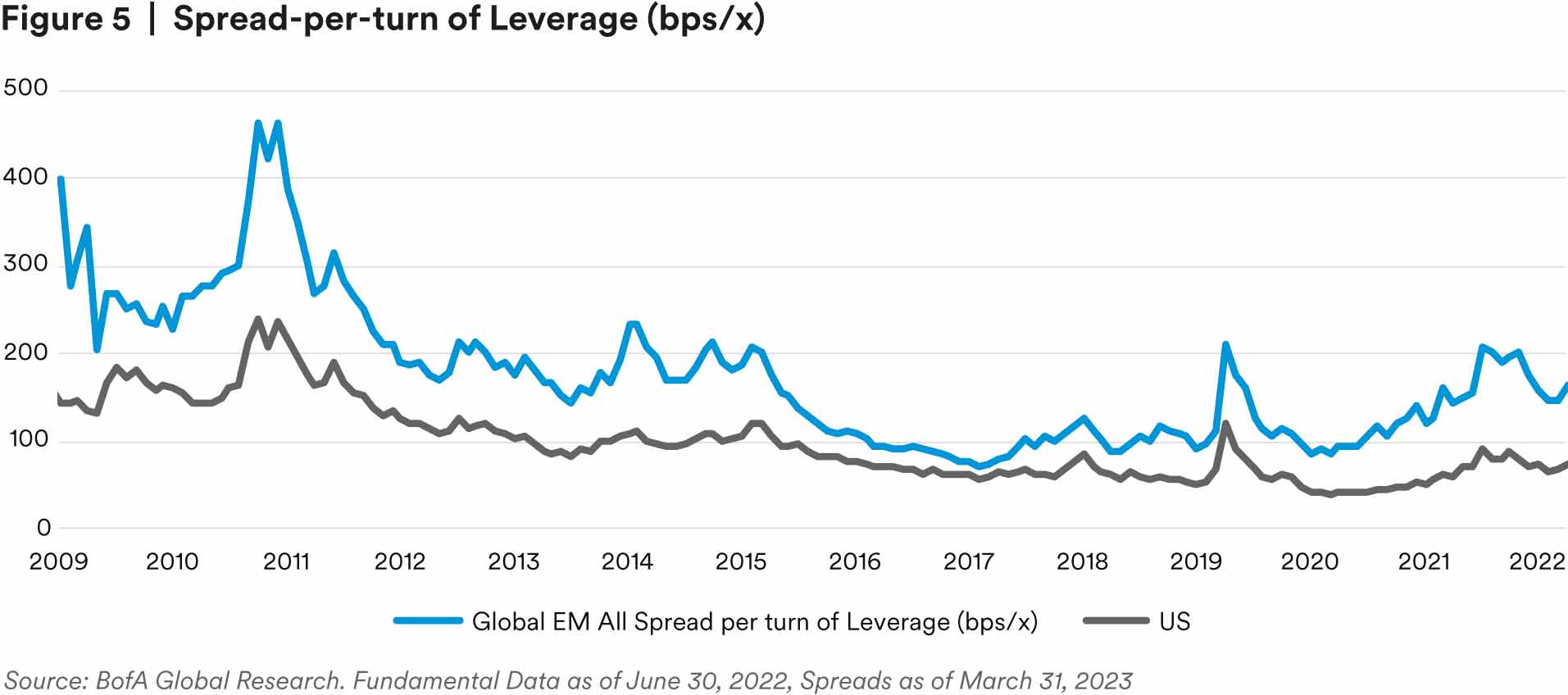

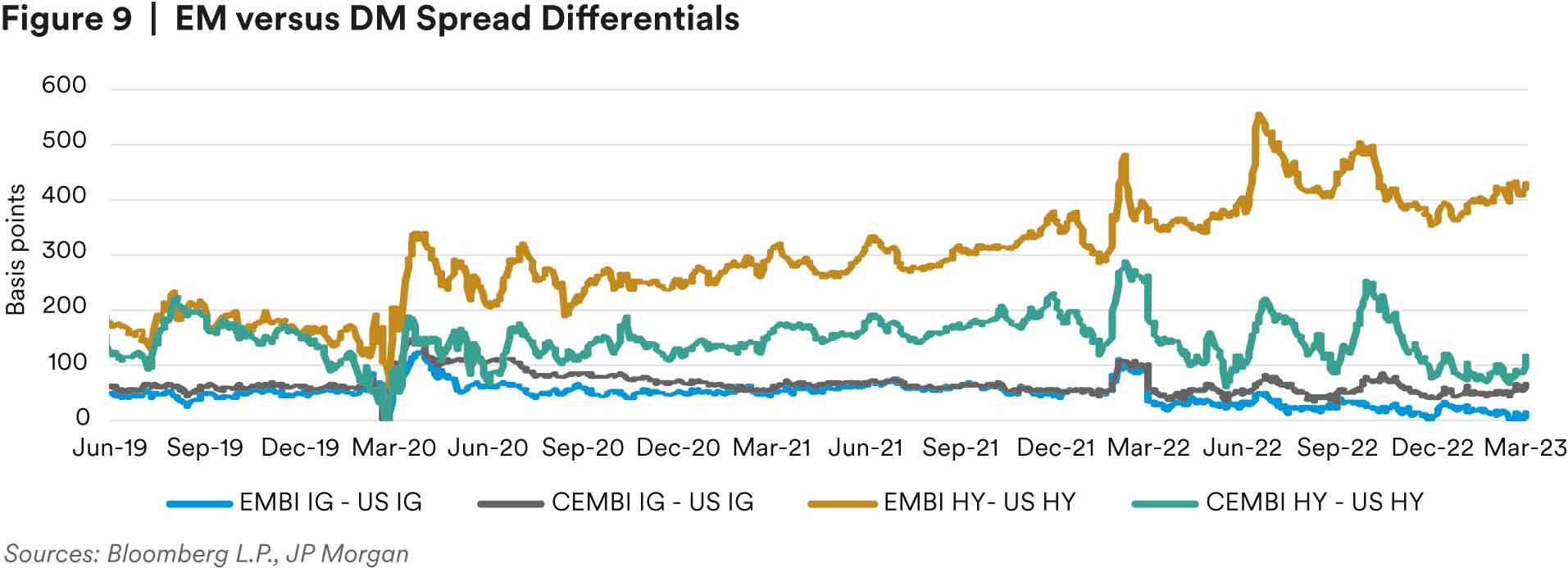

At the index level, strong fundamentals continue to be a theme among EM corporates. This has proven especially true as of late, with the recent banking turmoil putting pressure on developed market (DM) financials, while EM issuers have held more stable. Therefore, despite EM valuations screening tight relative to DM, EM corporate fundamentals remain durable. Positively, spread-per-turn of leverage continues to screen attractive across EM assets.

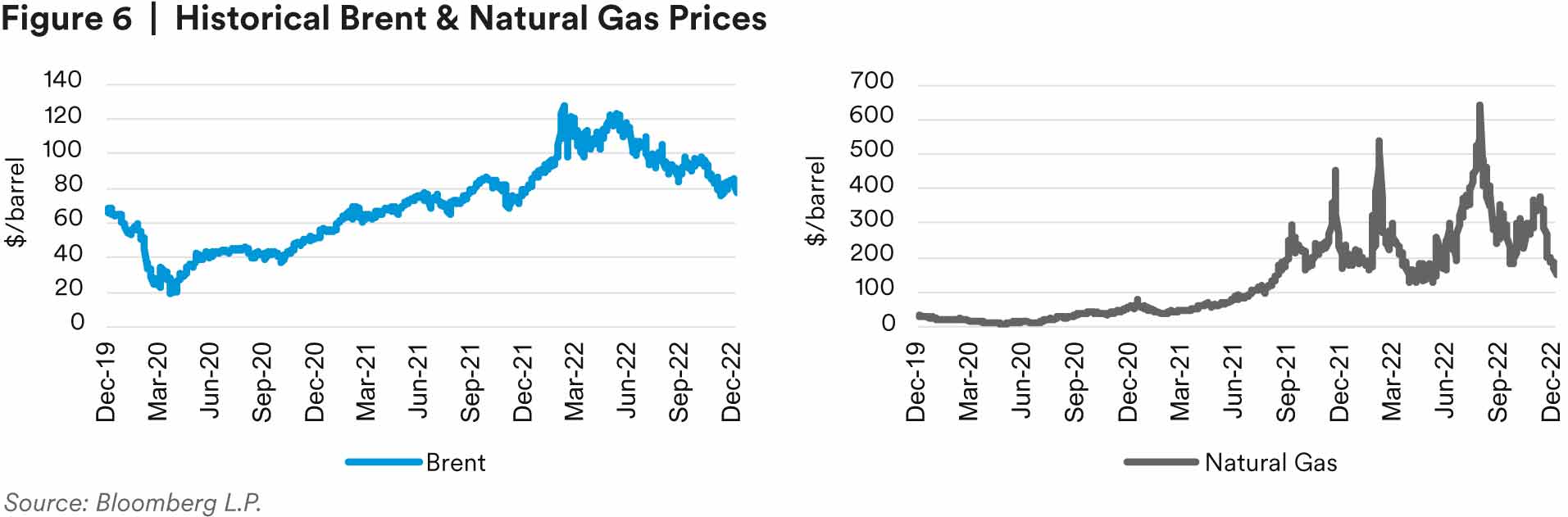

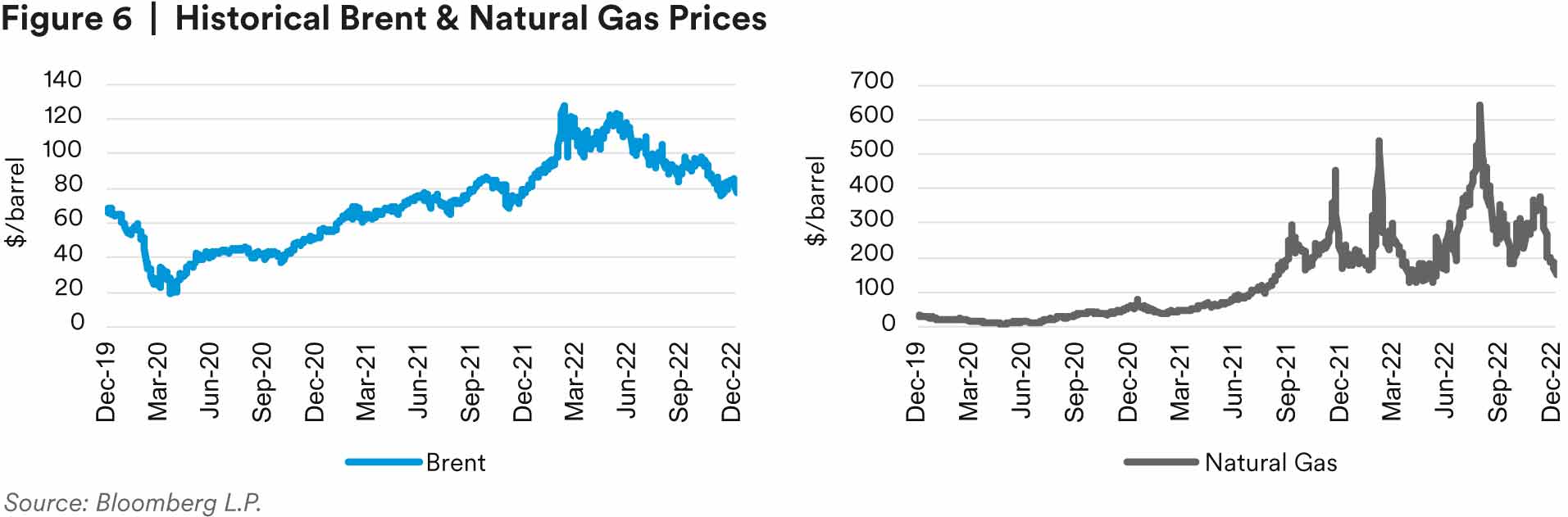

Europe has been able to avoid the worst-case energy shock scenario and does not face the same financial risks as the U.S., with Credit Suisse viewed as an isolated event. Gulf Cooperation Council (GCC) economies continue to persevere, as energy prices remained stable through January and February before growth concerns caused a sell-off in March. OPEC+’s delivery of a surprise production cut, after quarterend, helped support brent prices, providing an ongoing positive technical for many EM countries and companies.

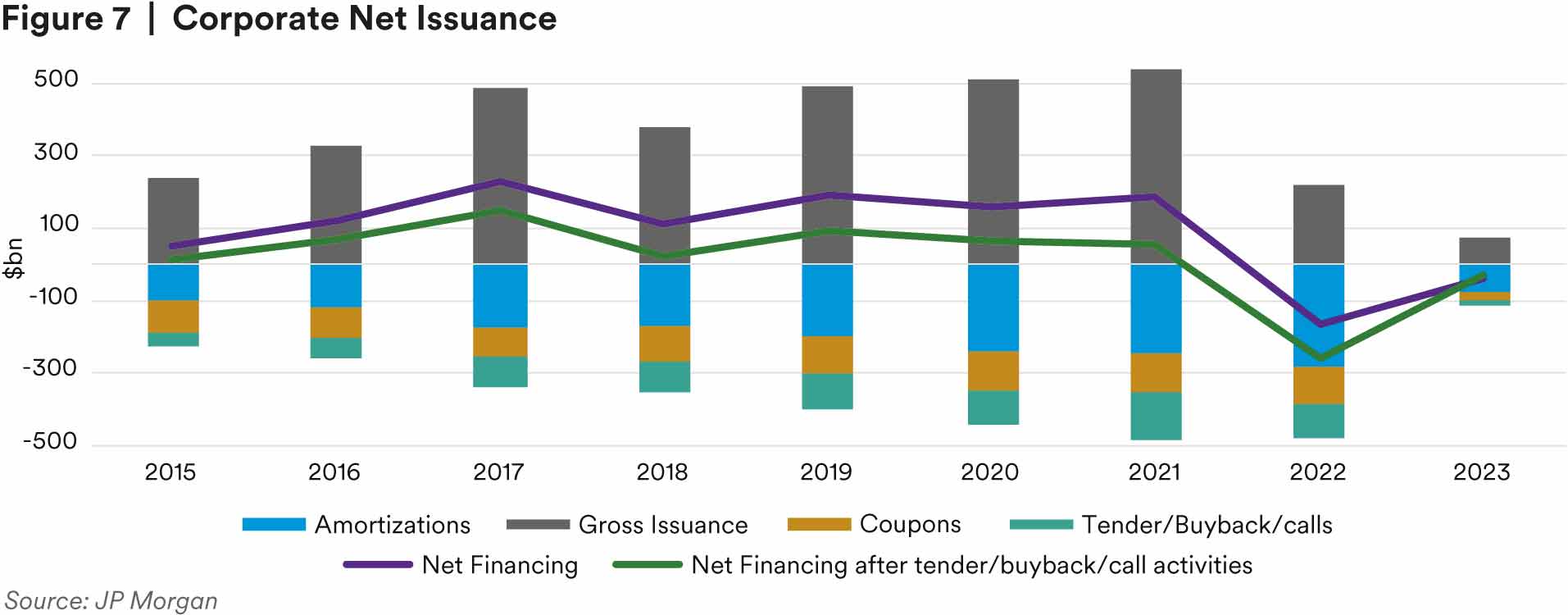

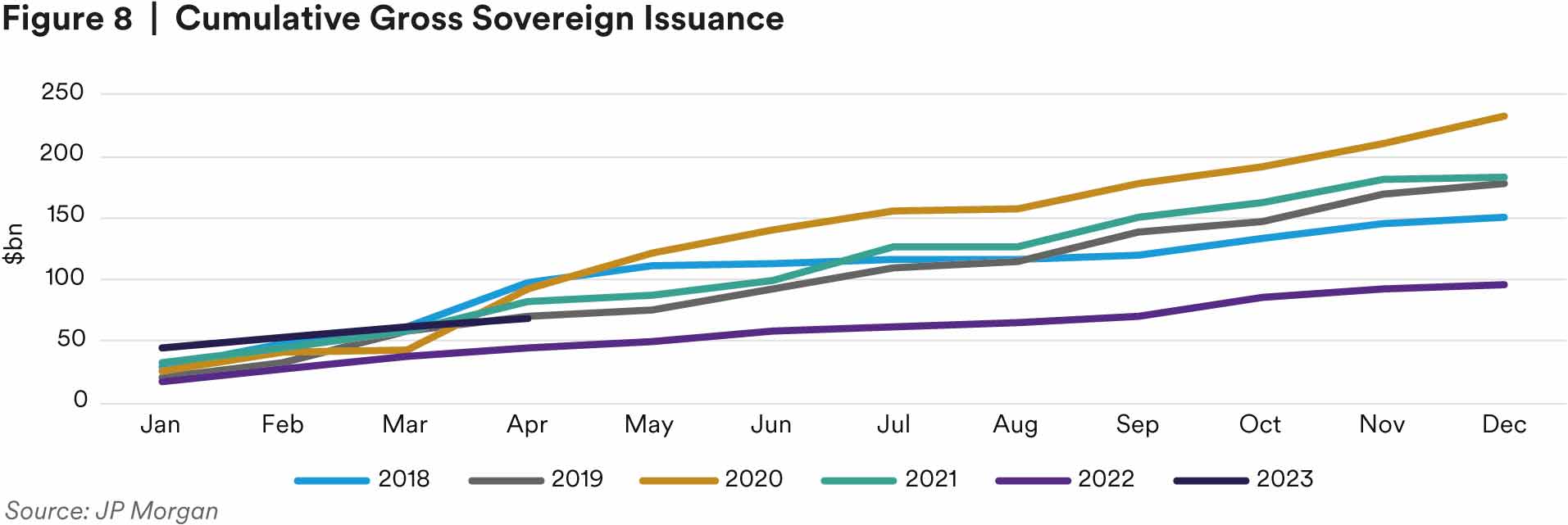

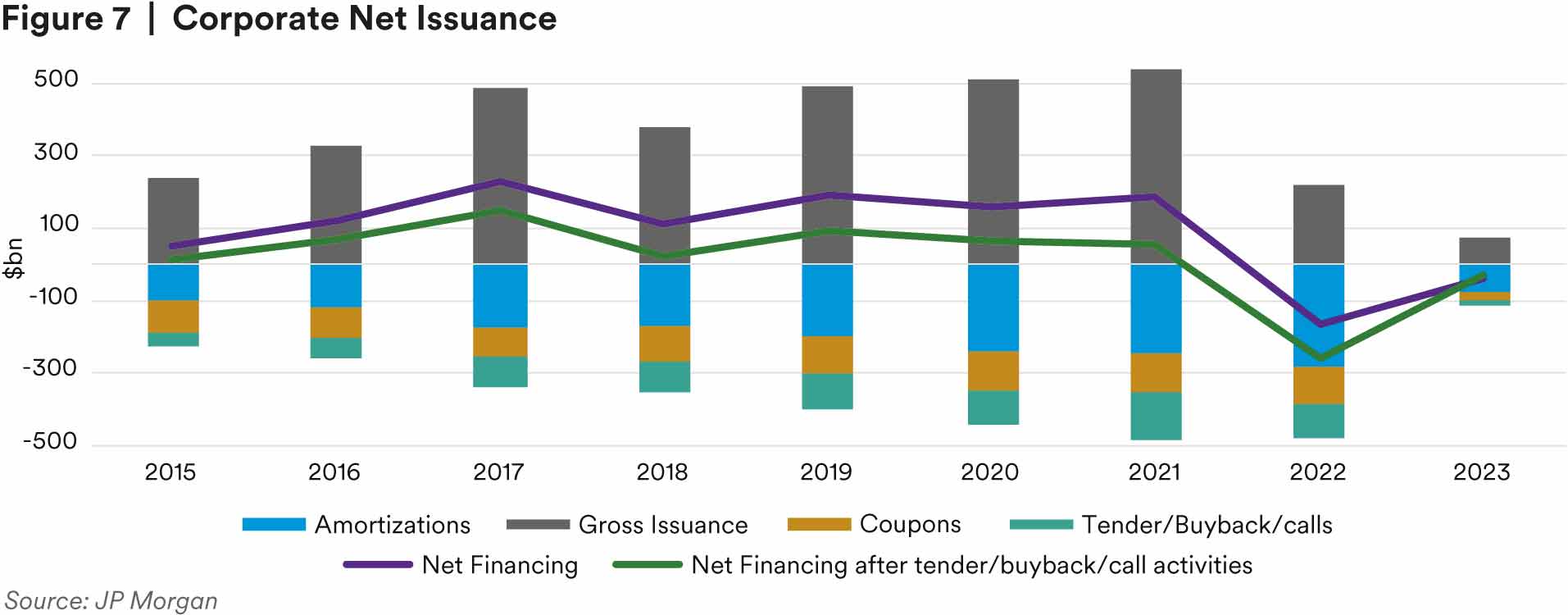

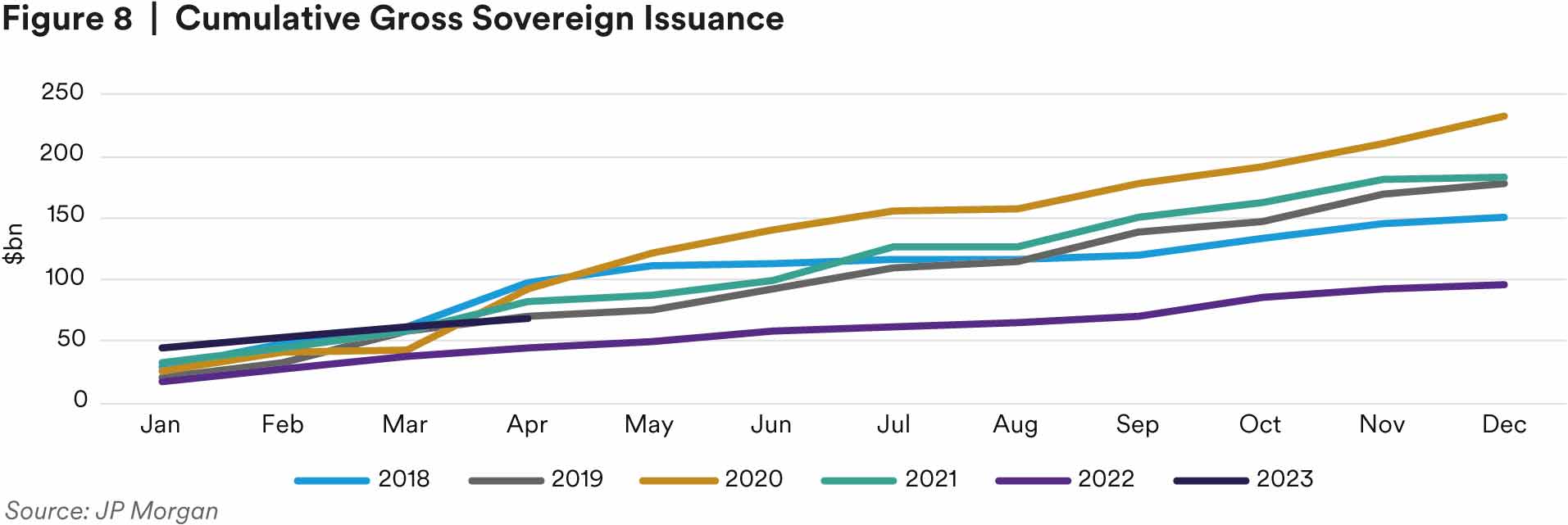

Issuance continues to be subdued, principal and interest payments remain high, and non-dedicated investors have low exposure to the asset class, leaving room for future demand and positive price reaction. Issuance trends followed spread movements, with January being the largest month of supply, representing 65% of the $68.2 billion in sovereign issuance for the quarter. Corporate year-to-date supply of $76 billion was the slowest first quarter of issuance since 2016 ($50 billion). Issuance is projected to remain light going into the second quarter. Corporates largely don’t need to issue; they have done a good job with their balance sheets, and some can issue locally at lower rates. This has been highlighted through the continued negative net financing (-$40 billion year to date) that we have seen consistently since 20221 .

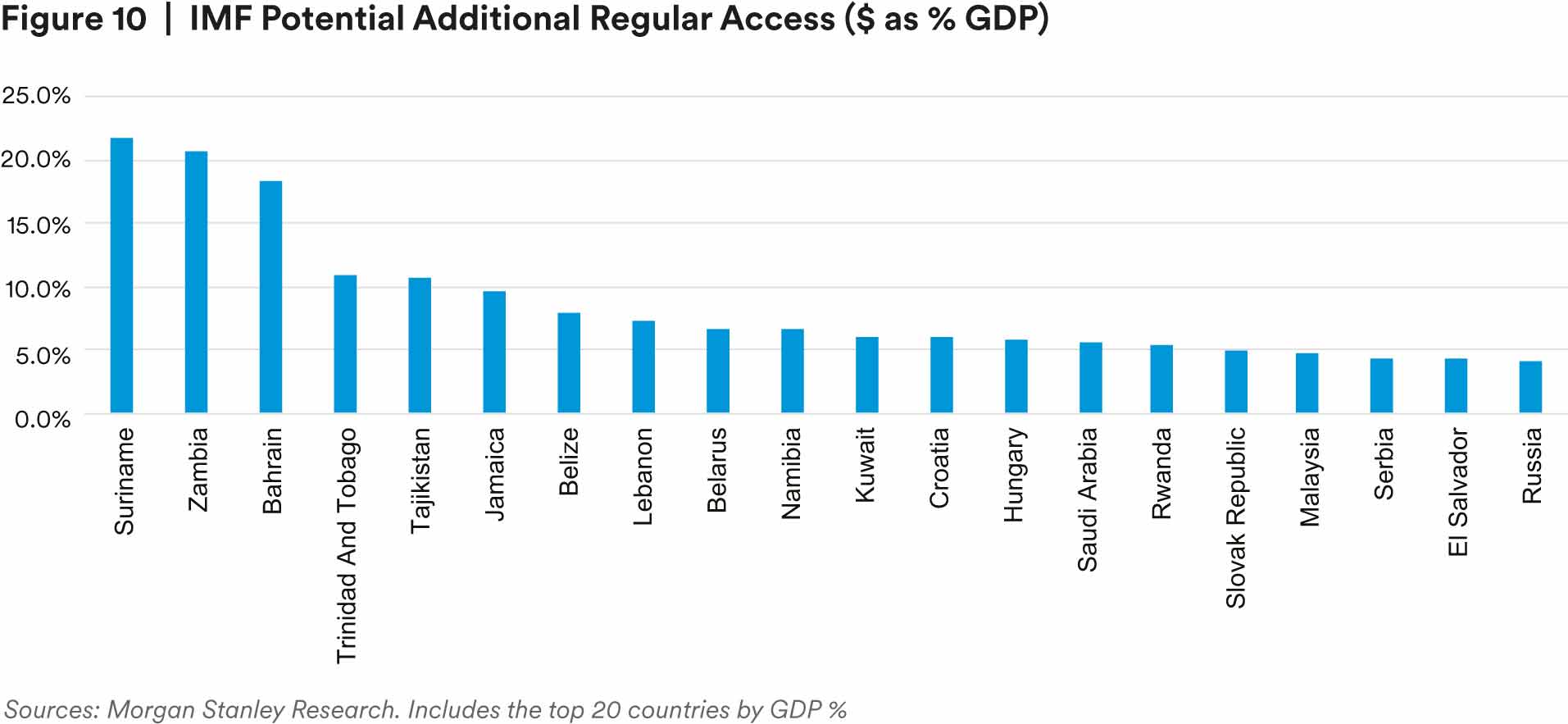

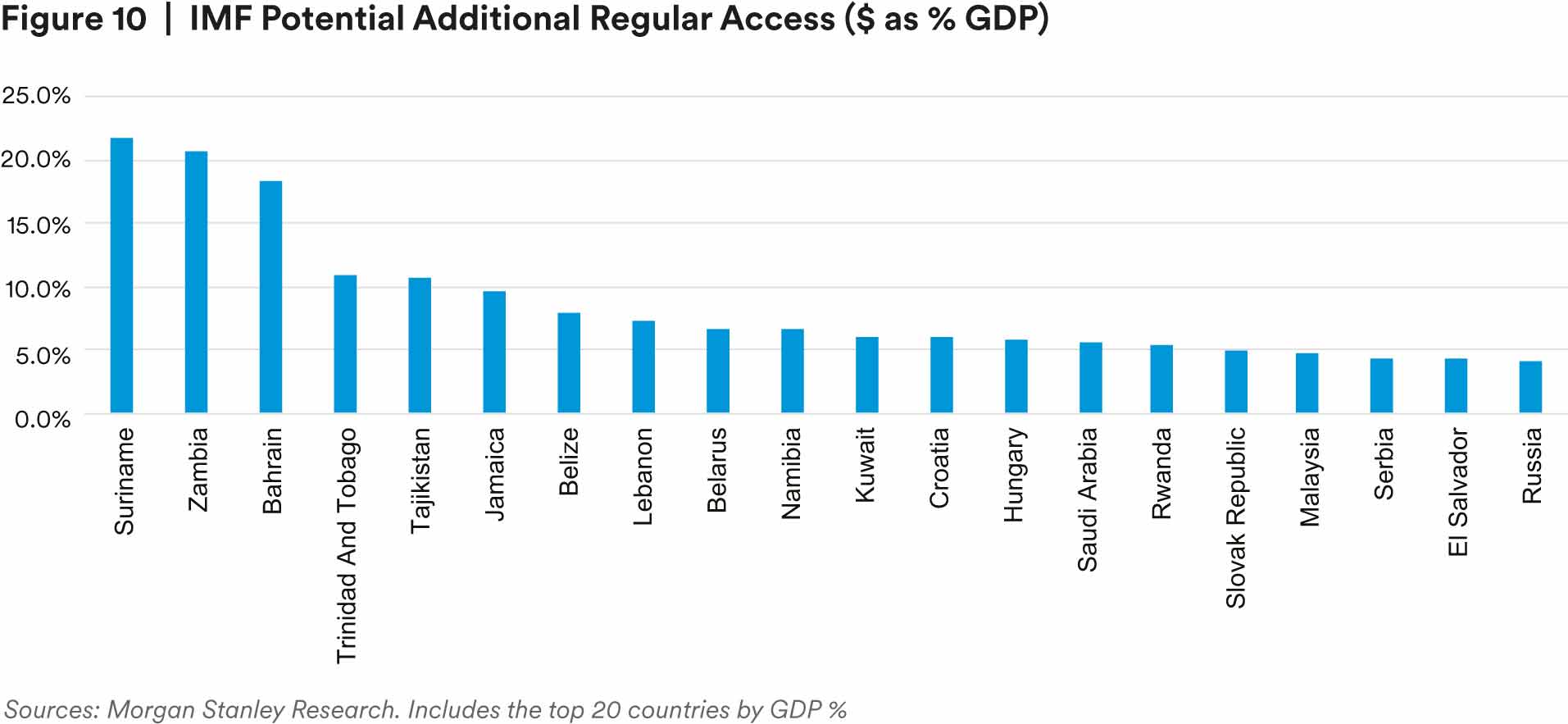

Defaults across EMs have been limited. From the sovereign side, the IMF has helped smaller countries by extending borrowing limits. Recent program advances with Sri Lanka, Papua New Guinea and Jamaica have provided an additional layer of comfort to higher-beta countries. While strong corporate fundamentals and access to local financing have helped the corporate default rate remain low, bonds trading at distressed levels remain elevated. This is driven by refinancing concerns in a higher developedmarket rate environment and worries about capital controls in distressed sovereign countries. Excluding the troubled sectors from last year, (Chinese property, Ukraine and Russia) over 10% of the HY Corporate index is trading at distressed levels2 .

Outlook:

The near-term outlook remains uncertain for fixed-income markets, with macro headlines and trends remaining the main driver of EM performance. Will the banking sector fears subside and the market return to a soft-landing scenario? If that is the case, will the Fed continue its higher-for-longer stance? Or will banking problems materialize, leading to contagion and further investor fears, forcing the Fed into rate cuts too soon and risking inflation progress reversing course? While we have more clarity around some of the idiosyncratic stories in EM countries, such as political concerns within Latin America, assets have still been weighed down by the broader unease. Any significant developments around global inflation, growth or geopolitical tensions would likely lead to a repricing of EM assets.

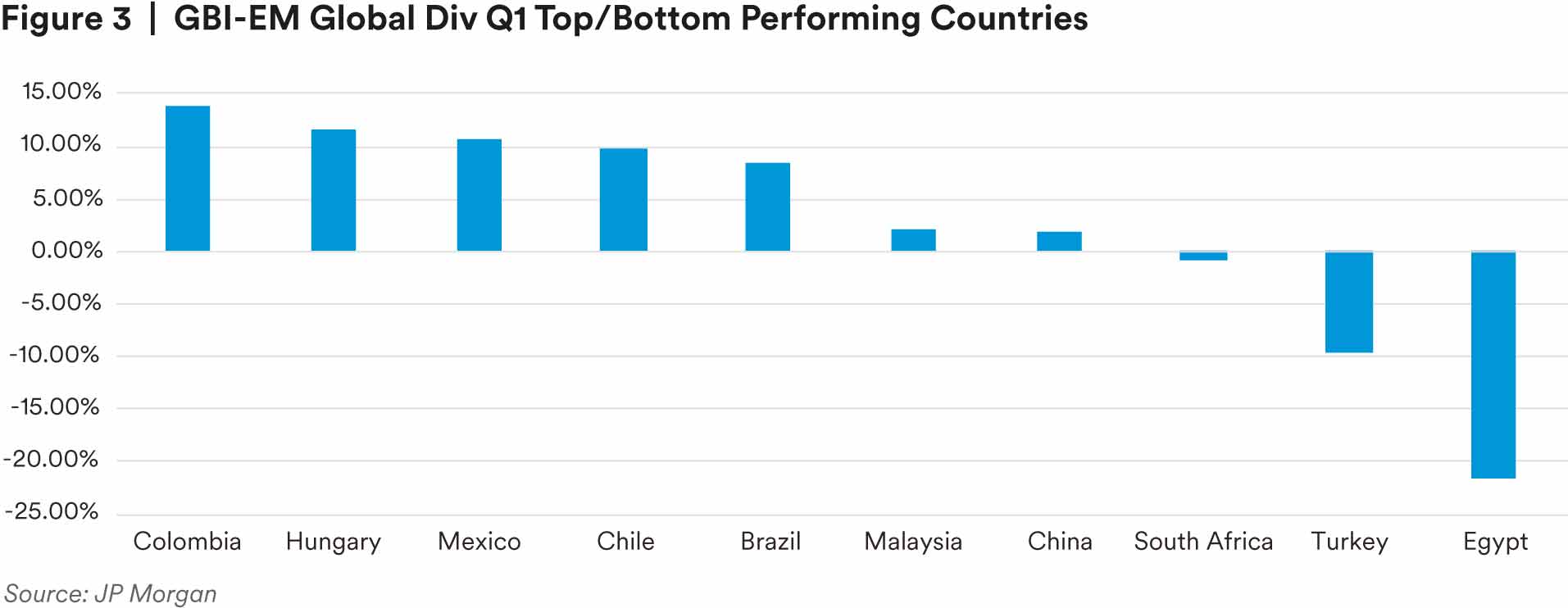

We do not want to discount the support from the China recovery. Despite being relatively quiet thus far, we expect that in the second half of this year, as growth accelerates, the positive support will help EM outperform DM. The recent pullback of Zero COVID Policy within China, along with the domestic authorities’ shift to a more pro-growth stance, could be constructive for the asset class. As of recently, good economic news out of China has been largely overshadowed by the relentless flow of geopolitical headlines. The shift to a more domestic-oriented growth policy should insulate China’s exposure to wobbles within the U.S. and Europe and provide a stable outlet for EM exports. Additionally, more active Chinese consumers would support the service sector within tourist destinations. This idea of consumption over investment is not like what we have seen in previous recoveries, helping some economies but not others, and leading to differentiation among countries.

The push and pull of DM uncertainty, coupled with a better Chinese growth outlook, will likely drive asset prices. We believe the market will reward data or dialogue that starts to remove some of the uncertainty around either Fed policy or worries of a hard landing. We see value in some of the better stories within high-yield and investment-grade assets that screen cheap to DM assets. The market focus remains on stories that need capital in both the sovereign and the corporate space, with official creditors in the driving seat in countries like Sri Lanka and Zambia, as well as bank lenders in control on the corporate side.

Along similar lines, the damage done to the economy from elevated financial risks, assuming risks dissipate from here, provides a near-term environment of lower growth, cooling inflation and a Fed near its peak. This backdrop, along with steady recovery in China, present opportunities for non-dollar assets. Given the policy moves over the past two years and the continued hawkish bias of many central banks, EM rates, especially out the curve, could provide a great opportunity as the market becomes more comfortable with the path of disinflation this year. Therefore, the unfolding environment proves favorable for high-quality, long-duration hard currency and local currency assets, in our view.

The combination of increased multilateral funding, governments waking up to a new world in which the cost of capital has increased, and political environments not being as nationalist as some initially thought, could lead to differentiated returns at the country level. Countries have been more fiscally disciplined, as local institutions have pushed back on governments to keep them more moderate and therefore limit spending. For example, Boric’s socialist agenda in Chile has stalled, and we believe Colombian reforms will need to be more moderate to pass. If these countries should need funding, the external market has been supportive of sovereign issuers, with deals largely oversubscribed and minimal concessions needed to spark investor demand. For distressed countries that are finding it more difficult to access the market, the IMF has continued to help ease economic challenges in the near term. With this support, defaults remain relatively contained, and in some cases, official sector-led restructurings may put multiple economies on more sustainable paths and help some distressed assets recover significantly higher than where they are currently trading.

The new issue market has remained below historical averages in the midst of a challenging market environment. With April being the highest cash flow month of the year for sovereigns3 , it is likely that sovereign issuers will use stability to fill their financing gaps. We continue to keep a healthy cash balance so we can be liquidity providers, given the day-to-day volatility, and remain focused on balance sheet liquidity and asset quality as the main driver of major portfolio shifts.

Developed market growth and inflation data will likely drive the near-term direction of risk assets, while the team will look for opportunities when short-term fluctuations provide good entry points for longerterm value. Expect portfolios to remain tactical with a bias to use noise to increase risk in our most favored names, including sovereigns that have low financing needs or demonstrated ability to tap the market. We will maintain a higher level of scrutiny with any sovereigns or corporates that are fully dependent on market financing or have untenable capital structures.

While corporates continue to perform well at the balance sheet level, we think credit quality has peaked, and operating metrics will begin to show some softening from here. Additionally, headlines around a few large issuers have increased investor questions, putting a larger focus on governance. We see opportunities in the telecom and consumer staples sectors in companies with hard assets that are free cash flow positive. With recent curve flattening, we have been looking to add risk in the belly of the curve. We like higher-beta BB risk that has recently come under pressure. We believe the market is underestimating some issuers’ ability to tap both bank lines and local markets, which will support better asset price performance moving forward.

Politics remain an important factor within EM countries. Upcoming elections in Turkey and Argentina are crucial, with polls currently pointing to regime changes. In Turkey, a victory by the opposition would likely bring an improving shift in macro policies that may not fully take hold until after local elections next March. The opposition in Argentina is projected to win in a narrower race than initially anticipated, but challenging social and economic conditions will continue to pose constraints to policy changes.

Endnote

1 Data in this paragraph sourced from JP Morgan

2 Data in this paragraph sourced from JP Morgan ]

3 Data in this paragraph sourced from JP Morgan

Disclosure

This document is being provided to you at your specific request. This document has been prepared by MetLife Investment Management LLC., a U.S. Securities Exchange Commission-registered investment adviser.

For investors in the United Kingdom, this document is being distributed by MetLife Investment Management Limited (“MIML”), authorized and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is only intended for, and may only be distributed to, investors in the EEA who qualify as a Professional Client as defined under the EEA’s Markets in Financial Instruments Directive, as implemented in the relevant EEA jurisdiction. The investment strategy described herein is intended to be structured as an investment management agreement between MIML (or its affiliates, as the case may be) and a client, although alternative structures more suitable for a particular client can be discussed.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

For Investors in Hong Kong: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities. This document is intended solely for Professional Investors (as defined in the Securities and Futures Ordinance (Cap. 571 of the laws of Hong Kong) (“the SFO”) and any rules made under the SFO).

For investors in Japan, this document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MAM provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors in Japan who are Qualified Institutional Investors (tekikaku kikan toshika) as defined in Article 10 of Cabinet Office Ordinance on Definitions Provided in Article 2 of the FIEA. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory.

MetLife, Inc. provides investment management services to affiliates and unaffiliated/third party clients through various subsidiaries.1 MetLife Investment Management (“MIM”), MetLife, Inc.’s institutional investment management business, has more than 900 investment professionals located around the globe. MIM is responsible for investments in a range of asset sectors, public and privately sourced, including corporate and infrastructure private placement debt, real estate equity, commercial mortgage loans, customized index strategies, structured finance, emerging market debt, and high yield debt. The information contained herein is intended to provide you with an understanding of the depth and breadth of MIM’s investment management services and investment management experience. This document has been provided to you solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. Unless otherwise specified, the information and opinions presented or contained in this document are provided as of the quarter end noted herein. It should be understood that subsequent developments may affect the information contained in this document materially, and MIM shall not have any obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a complete or comprehensive analysis of MIM’s investment portfolio, investment strategies or investment recommendations.

No money, securities or other consideration is being solicited. No invitation is made by this document or the information contained herein to enter into, or offer to enter into, any agreement to purchase, acquire, dispose of, subscribe for or underwrite any securities or structured products, and no offer is made of any shares in or debentures of a company for purchase or subscription. Prospective clients are encouraged to seek advice from their legal, tax and financial advisors prior to making any investment.

Confidentiality. By accepting receipt or reading any portion of this Presentation, you agree that you will treat the Presentation confidentially. This reminder should not be read to limit, in any way, the terms of any confidentiality agreement you or your organization may have in place with Logan Circle. This document and the information contained herein is strictly confidential (and by receiving such information you agree to keep such information confidential) and are being furnished to you solely for your information and may not be used or relied upon by any other party, or for any other purpose, and may not, directly or indirectly, be forwarded, published, reproduced, disseminated or quoted to any other person for any purpose without the prior written consent of MIM. Any forwarding, publication, distribution or reproduction of this document in whole or in part is unauthorized. Any failure to comply with this restriction may constitute a violation of applicable securities laws.

Past performance is not indicative of future results. No representation is being made that any investment will or is likely to achieve profits or losses or that significant losses will be avoided. There can be no assurance that investments similar to those described in this document will be available in the future and no representation is made that future investments managed by MIM will have similar returns to those presented herein.

No offer to purchase or sell securities. This Presentation does not constitute an offer to sell or a solicitation of an offer to buy any security and may not be relied upon in connection with the purchase or sale of any security.

No reliance, no update and use of information. You may not rely on this Presentation as the basis upon which to make an investment decision. To the extent that you rely on this Presentation in connection with any investment decision, you do so at your own risk. This Presentation is being provided in summary fashion and does not purport to be complete. The information in the Presentation is provided to you as of the dates indicated and MIM does not intend to update the information after its distribution, even in the event that the information becomes materially inaccurate. Certain information contained in this Presentation, includes performance and characteristics of MIM’s by independent third parties, or have been prepared internally and have not been audited or verified. Use of different methods for preparing, calculating or presenting information may lead to different results for the information presented, compared to publicly quoted information, and such differences may be material.

Risk of loss. An investment in the strategy described herein is speculative and there can be no assurance that the strategy’s investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. © 2023 MetLife Services and Solutions, LLC

No tax, legal or accounting advice. This Presentation is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any statements of U.S. federal tax consequences contained in this Presentation were not intended to be used and cannot be used to avoid penalties under the U.S. Internal Revenue Code or to promote, market or recommend to another party any tax-related matters addressed herein. Forward-Looking Statements. This document may contain or incorporate by reference information that includes or is based upon forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give expectations or forecasts of future events. These statements can be identified by the fact that they do not relate strictly to historical or current facts. They use words and terms such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will,” and other words and terms of similar meaning, or are tied to future periods in connection with a discussion of future performance. Forward-looking statements are based on MIM’s assumptions and current expectations, which may be inaccurate, and on the current economic environment which may change. These statements are not guarantees of future performance. They involve a number of risks and uncertainties that are difficult to predict. Results could differ materially from those expressed or implied in the forward-looking statements. Risks, uncertainties and other factors that might cause such differences include, but are not limited to: (1) difficult conditions in the global capital markets; (2) changes in general economic conditions, including changes in interest rates or fiscal policies; (3) changes in the investment environment; (4) changed conditions in the securities or real estate markets; and (5) regulatory, tax and political changes. MIM does not undertake any obligation to publicly correct or update any forward-looking statement if it later becomes aware that such statement is not likely to be achieved.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/ or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC..