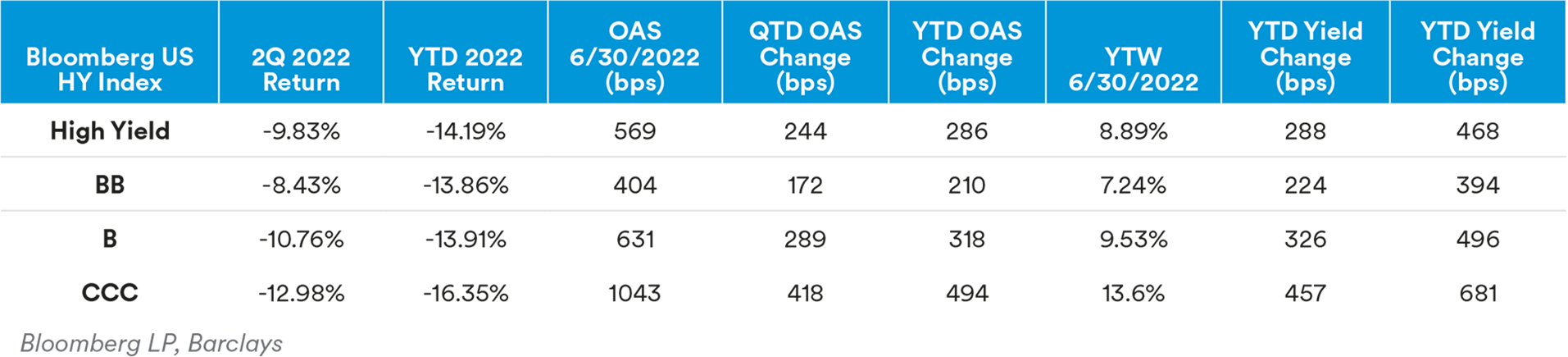

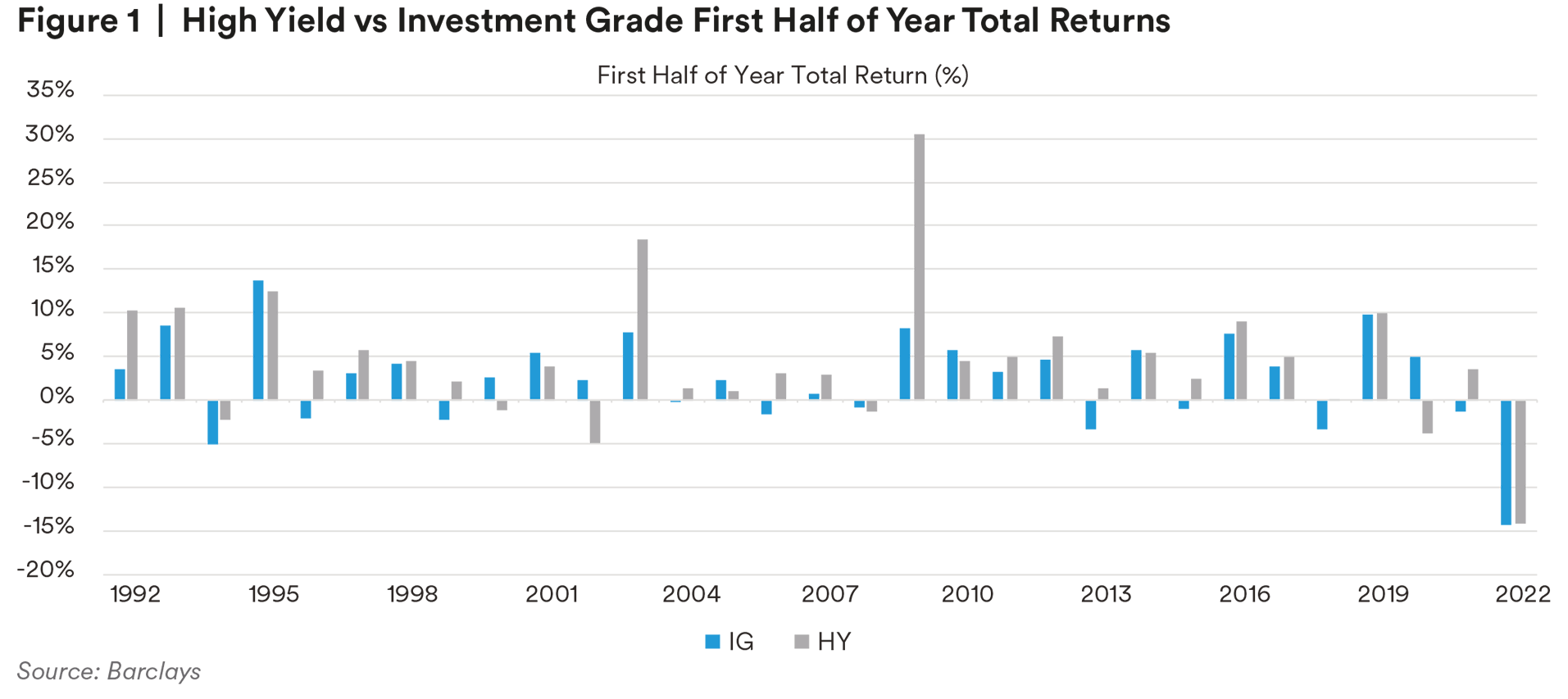

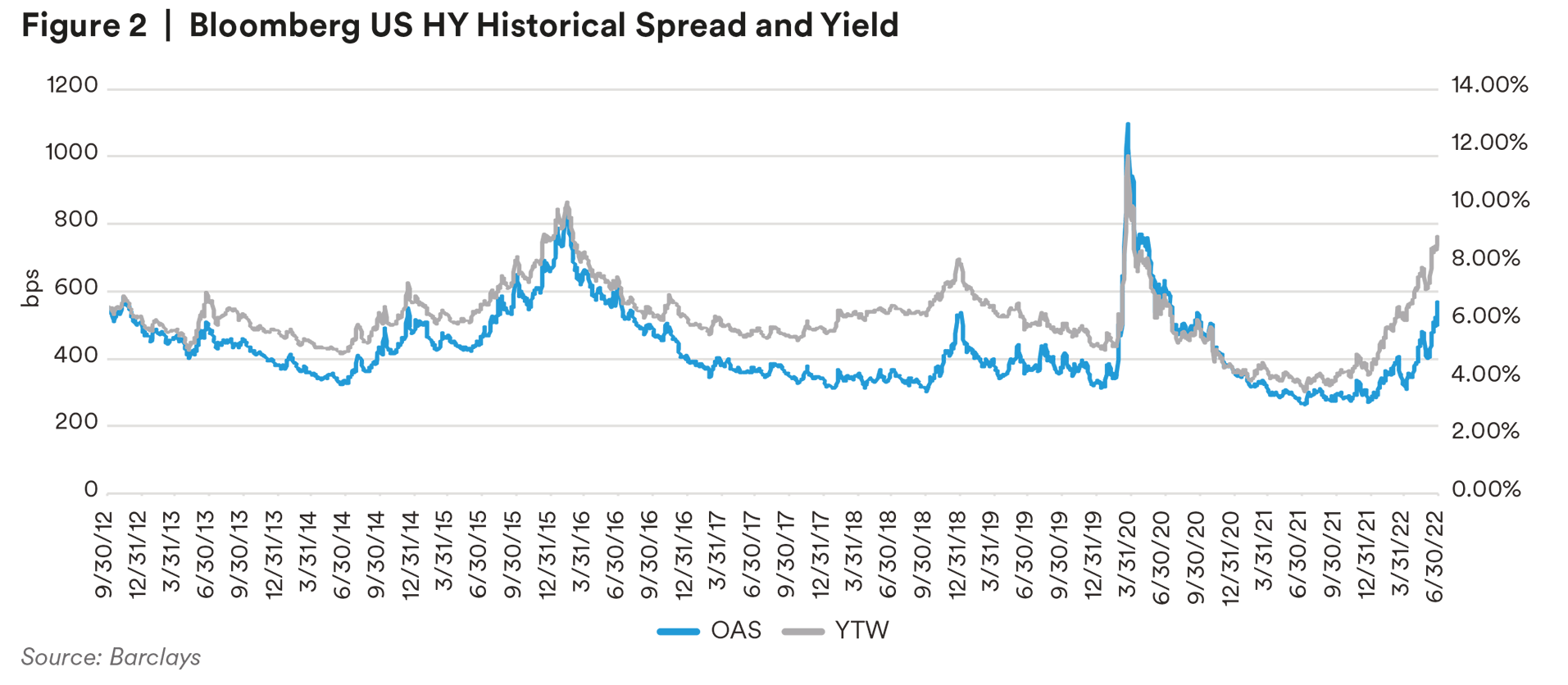

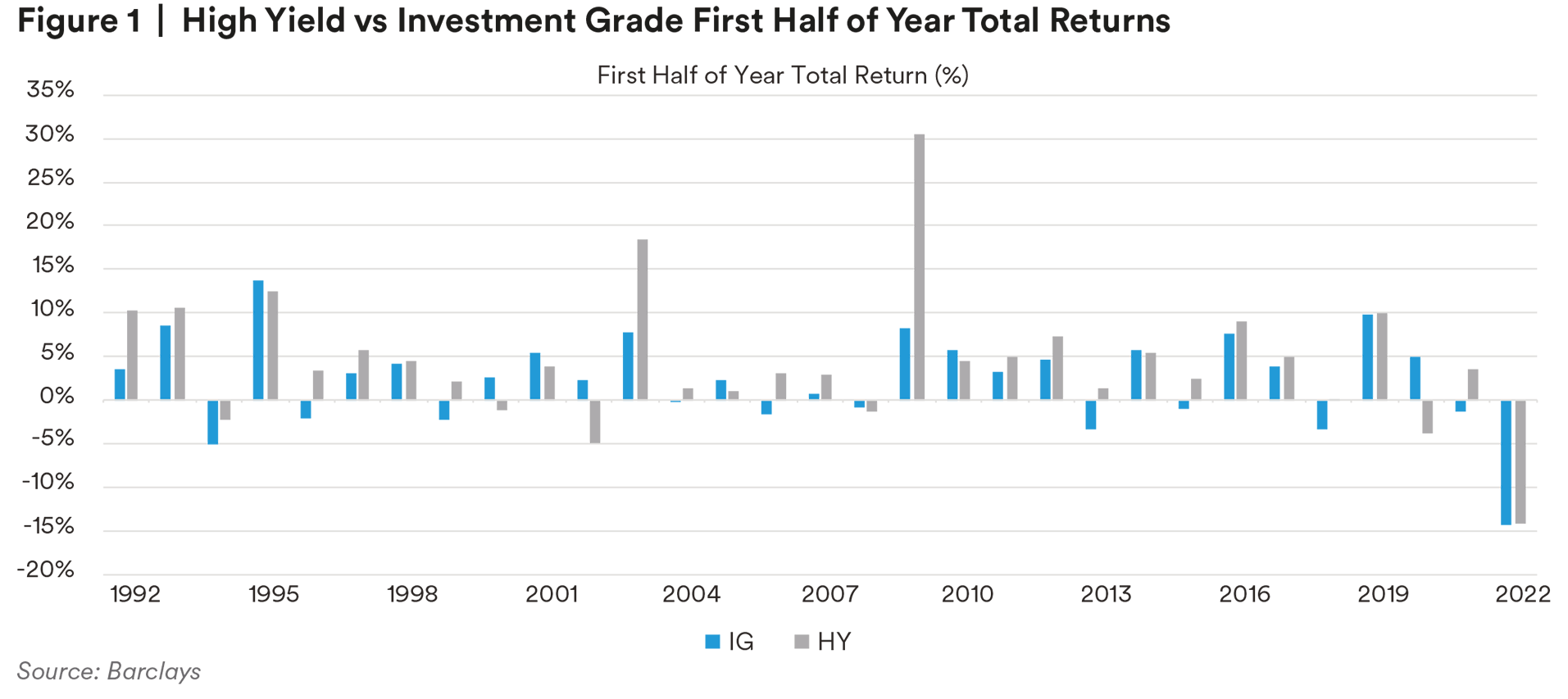

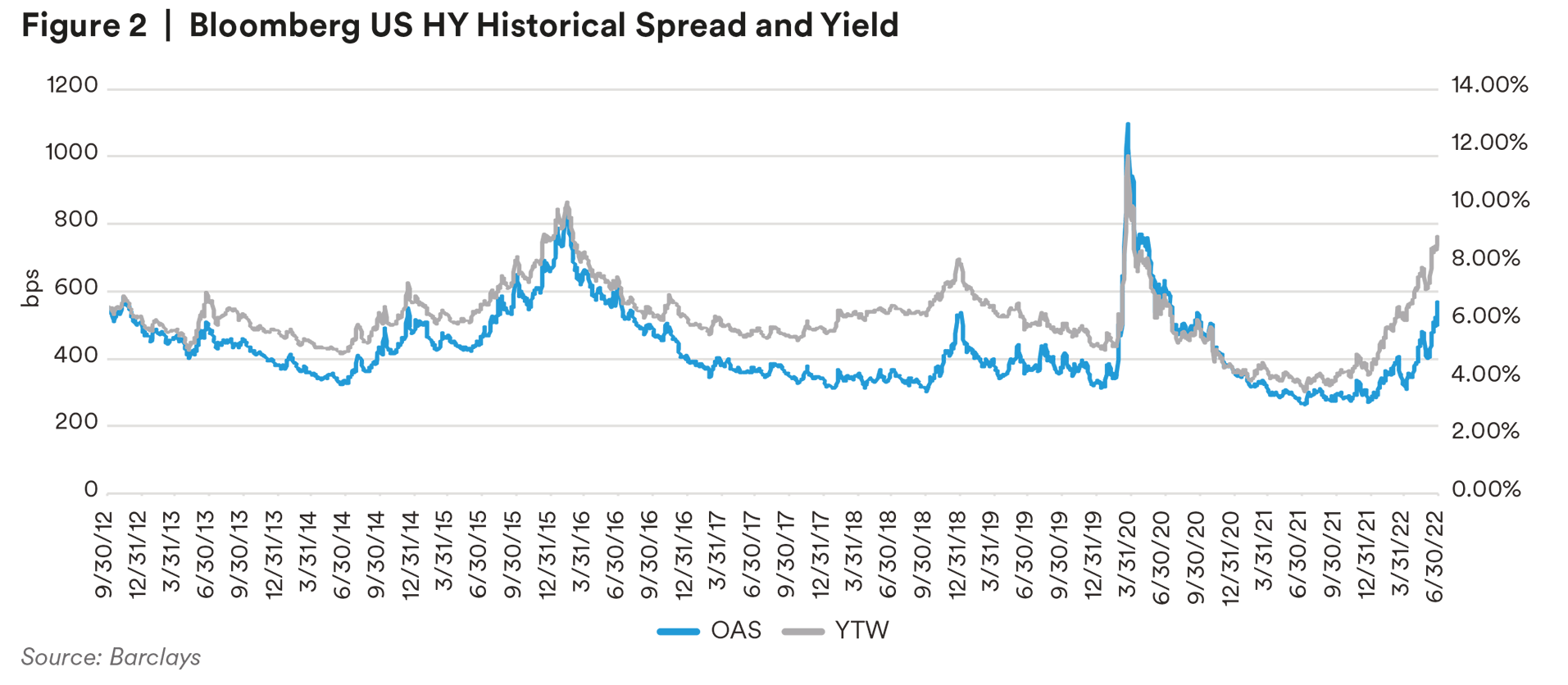

After modest spread widening in the first quarter, HY spreads widened 244 basis points in the second quarter to end at 569 basis points. HY spreads are 286 basis points wider on the year and in line with their long-term historical average. HY yields have also experienced a meaningful adjustment this year. Yields increased 288 basis points in the quarter to end June at 8.89%. As of Q2, HY yields are 468 basis points wider on the year, and about 100 basis points cheap to their long-term historical average.2

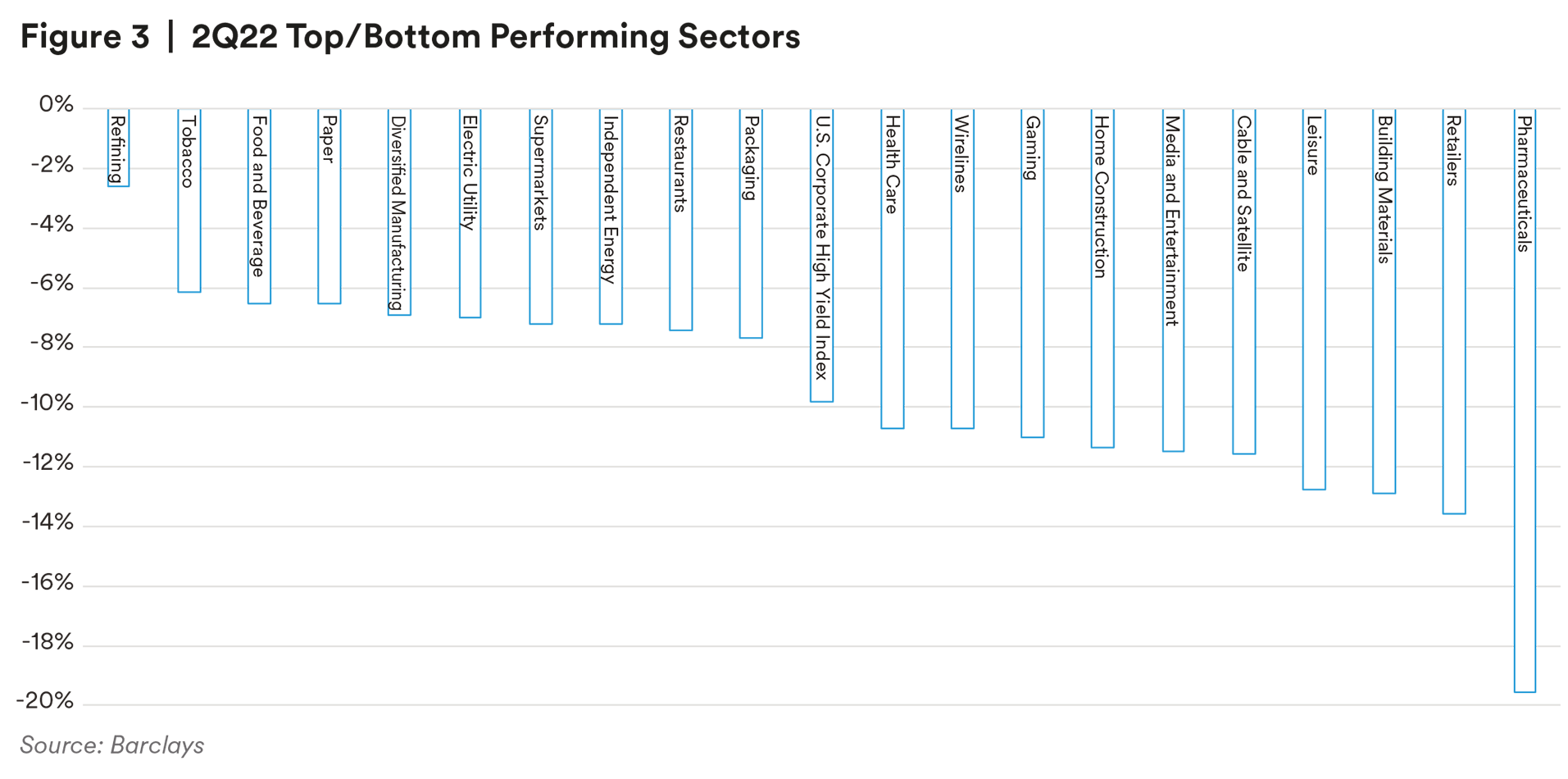

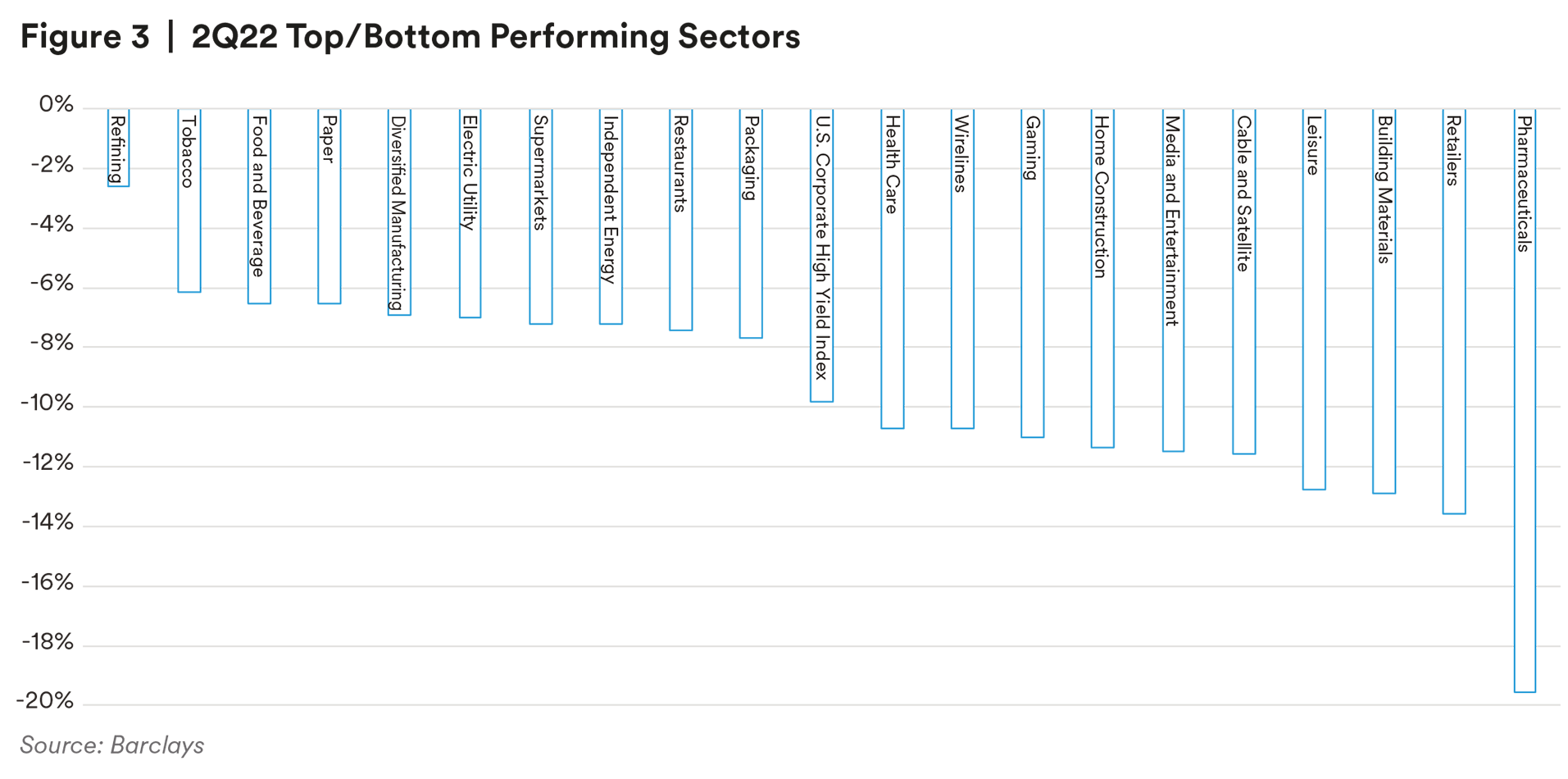

Higher quality bonds outperformed during the quarter as investor concern shifted more to credit risk in a potentially slowing economy. The BB index declined -8.43%, the B index was down -10.76%, and the CCC index returned -12.98%. All sectors had negative returns for the quarter. Cyclical sectors underperformed in the quarter as recession fears escalated. Retailers (-13%), Building Materials (-12.9%), and Leisure (-12.8%) were the worst performing cyclical sectors3.

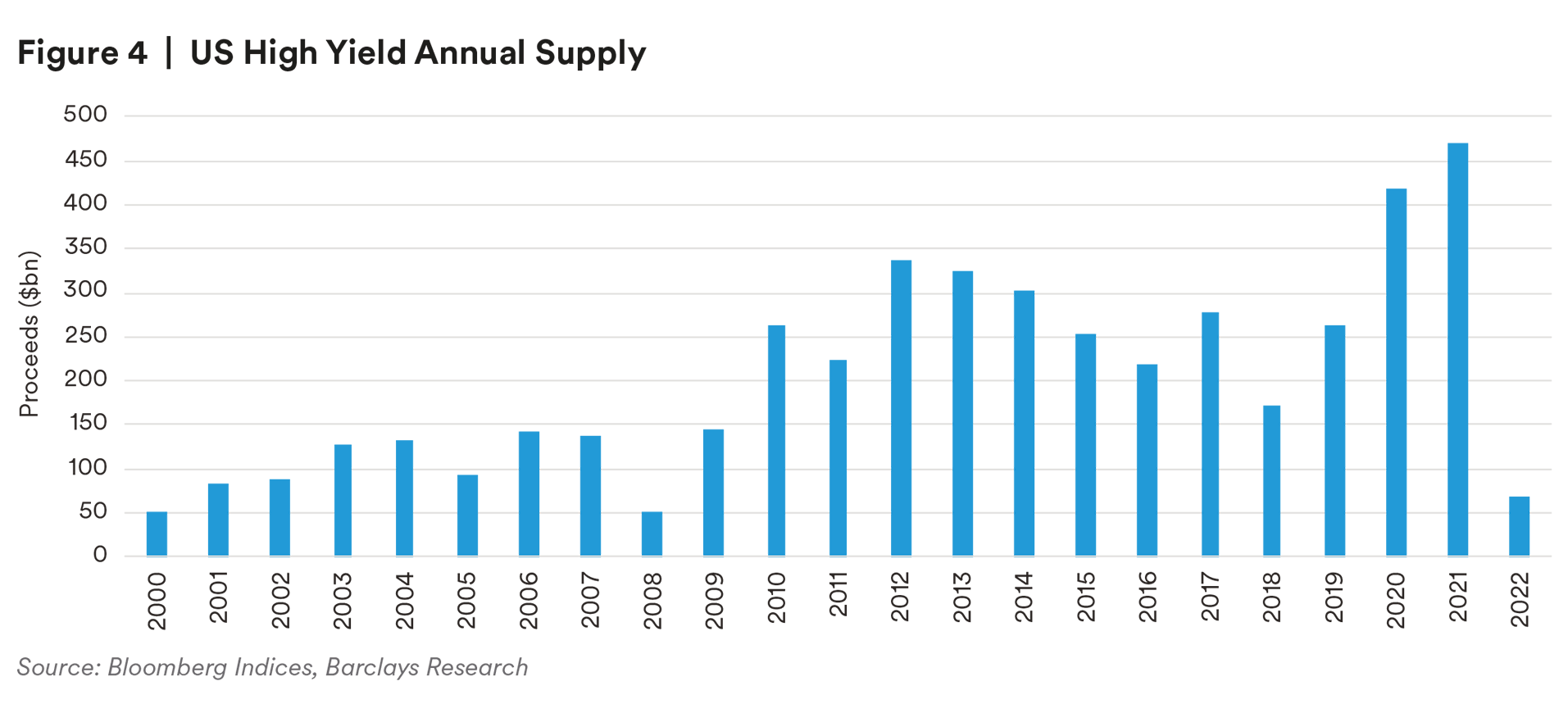

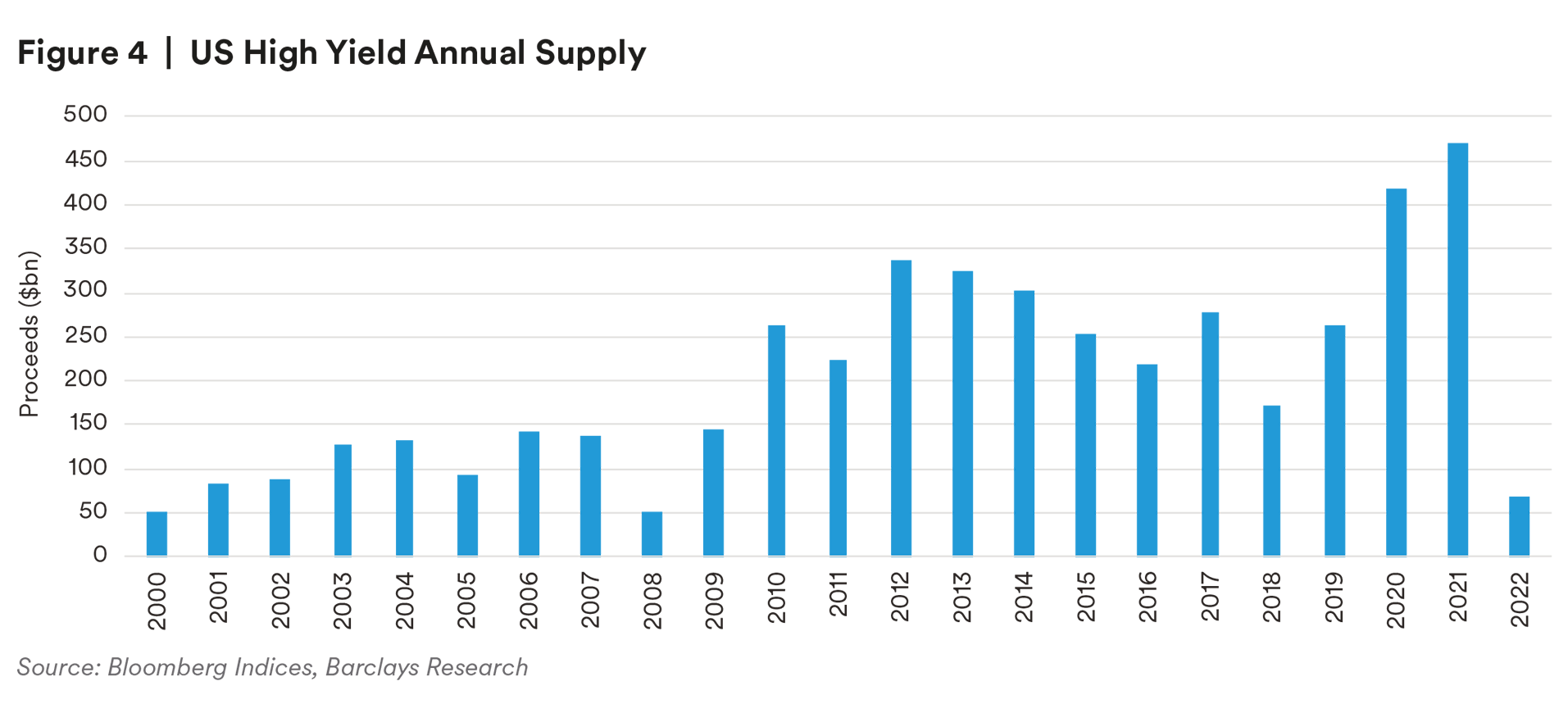

HY issuance remained extremely light again this quarter amid higher yields and increased market volatility. The last five month’s activity represents the lightest stretch of issuance since August 2011. Year-to-date issuance of $71 billion is down 76% from first half 2021 levels. We saw private debt step in and take down deals that otherwise would have come through the public universe4.

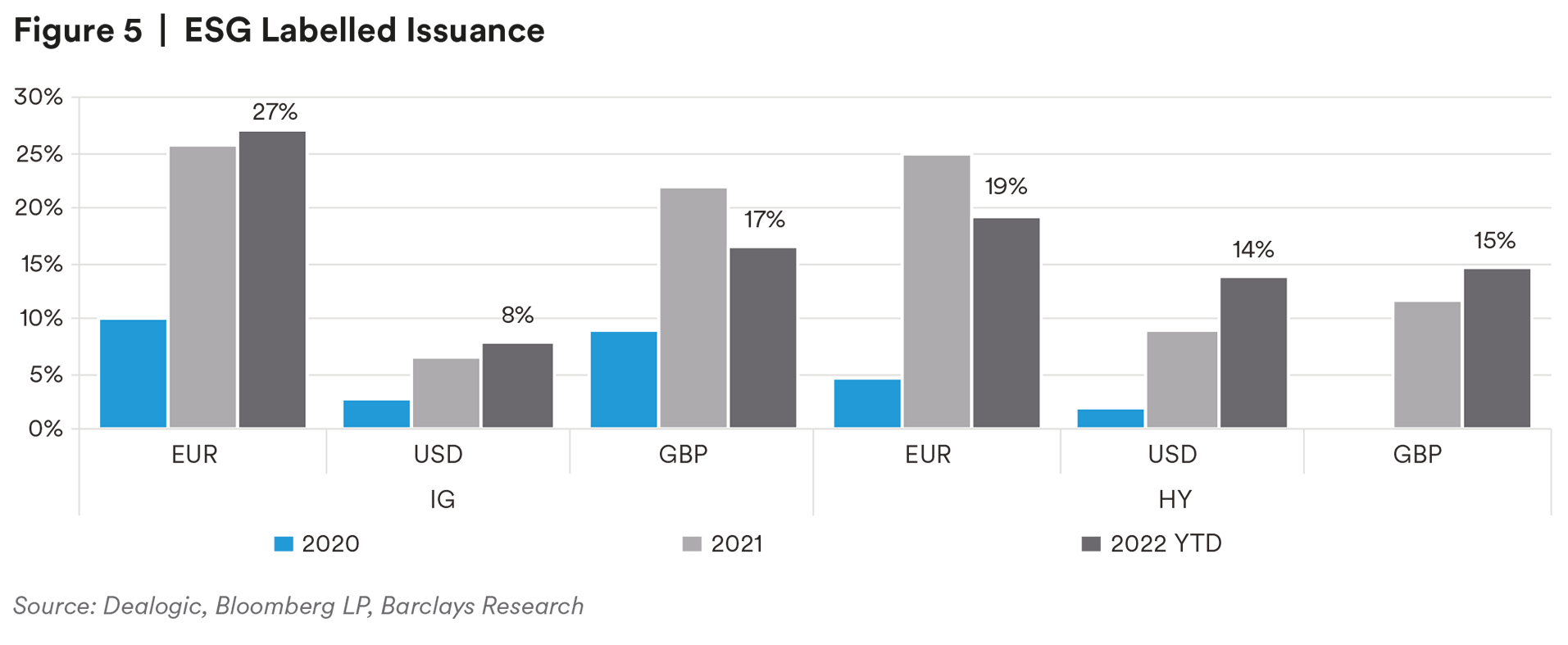

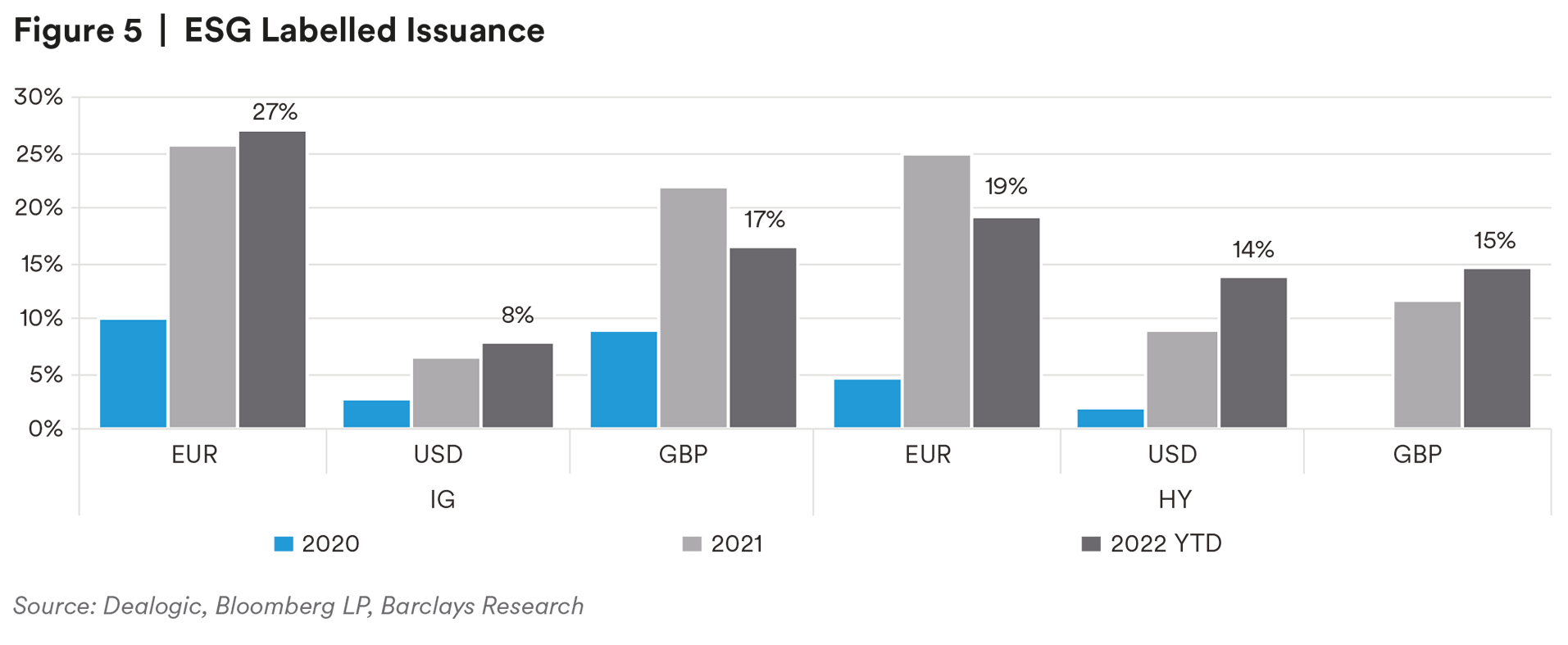

In conjunction with the slowdown in generic primary market activity, global ESG bond supply cooled during the second quarter with $86 billion of new volume vs $126 billion in the first quarter. This decline was largely driven by the slowdown in total corporate issuance. The percentage of all new deals with an ESG label actually increased vs 2021. In the US HY market specifically, the amount of ESG-labelled issuance as a percentage of total corporate supply increased from roughly 9% in 2021 to 14% year-to-date in 2022.

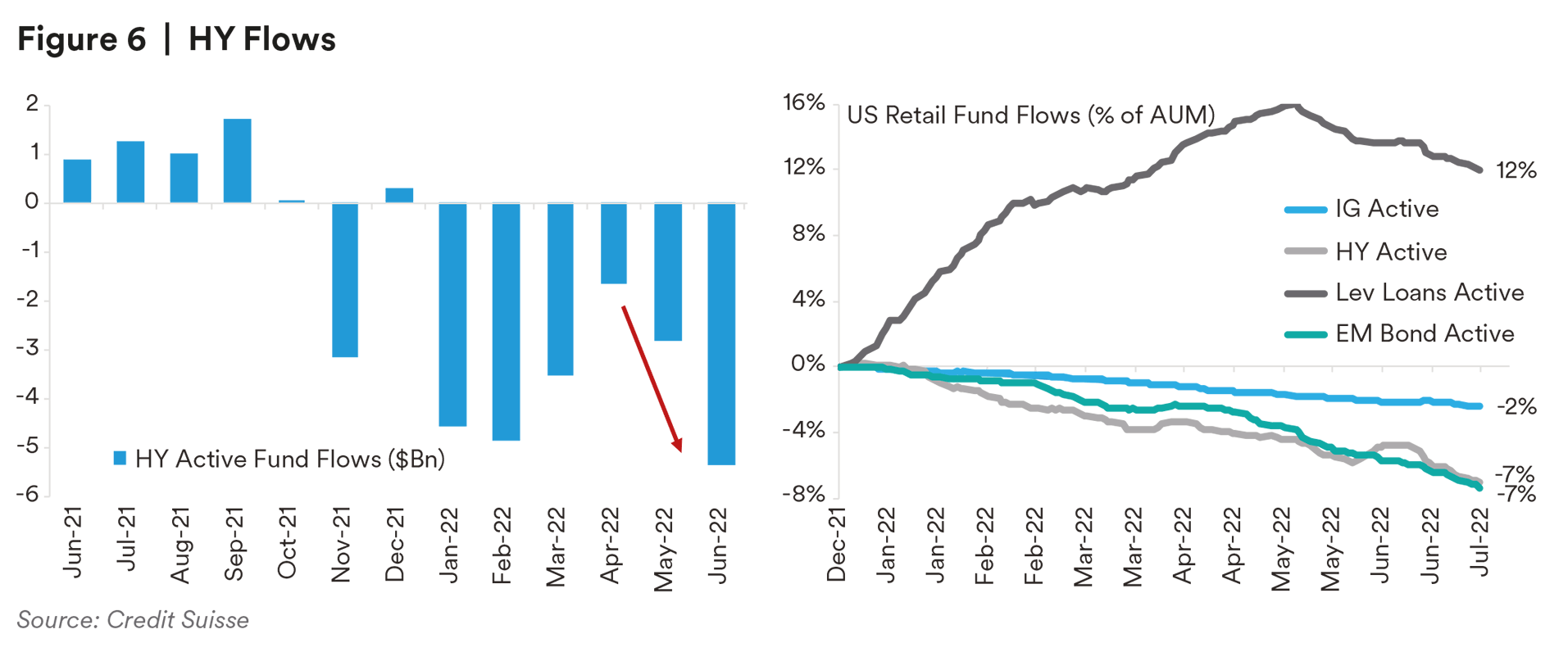

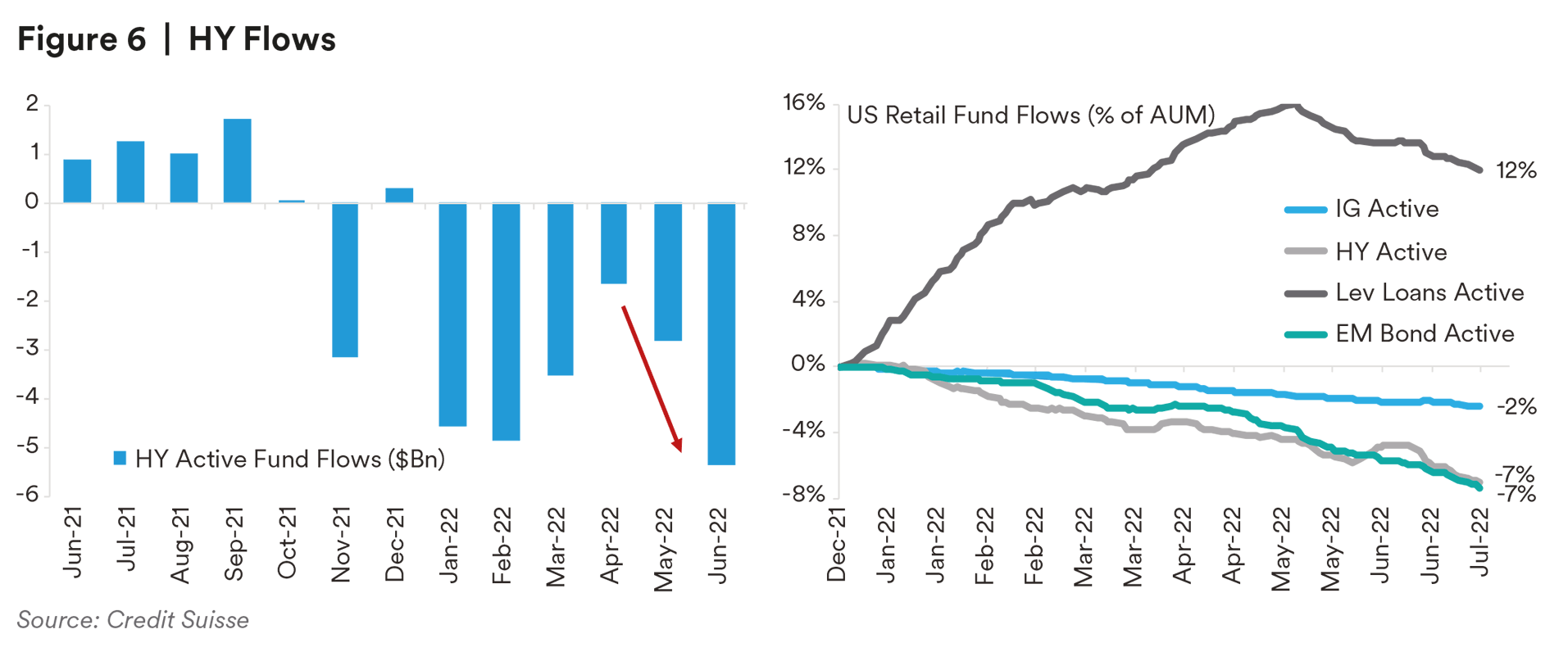

HY flows remained negative in the second quarter and outflows reaccelerated in June. Year-to-date outflows have reached -$42.1 billion with outflows representing 7% of HY retail active funds AUM6 .

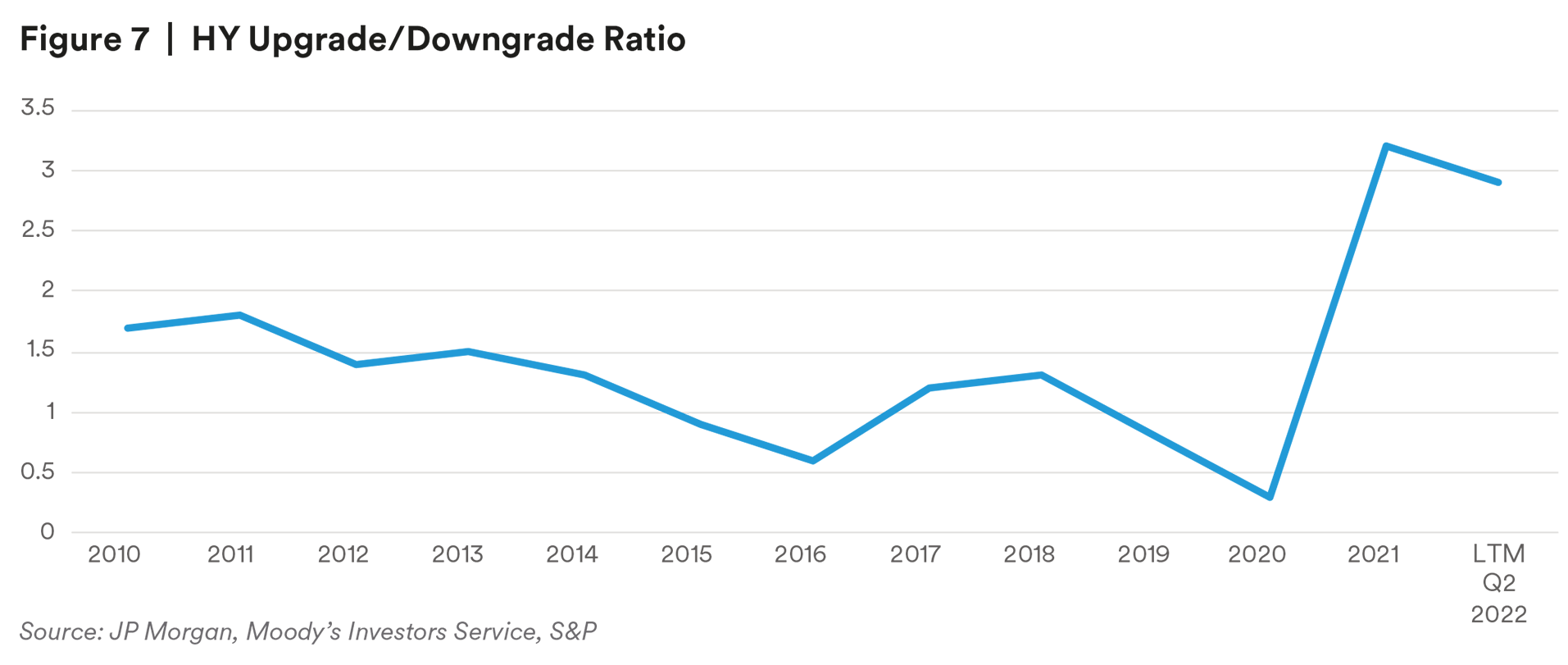

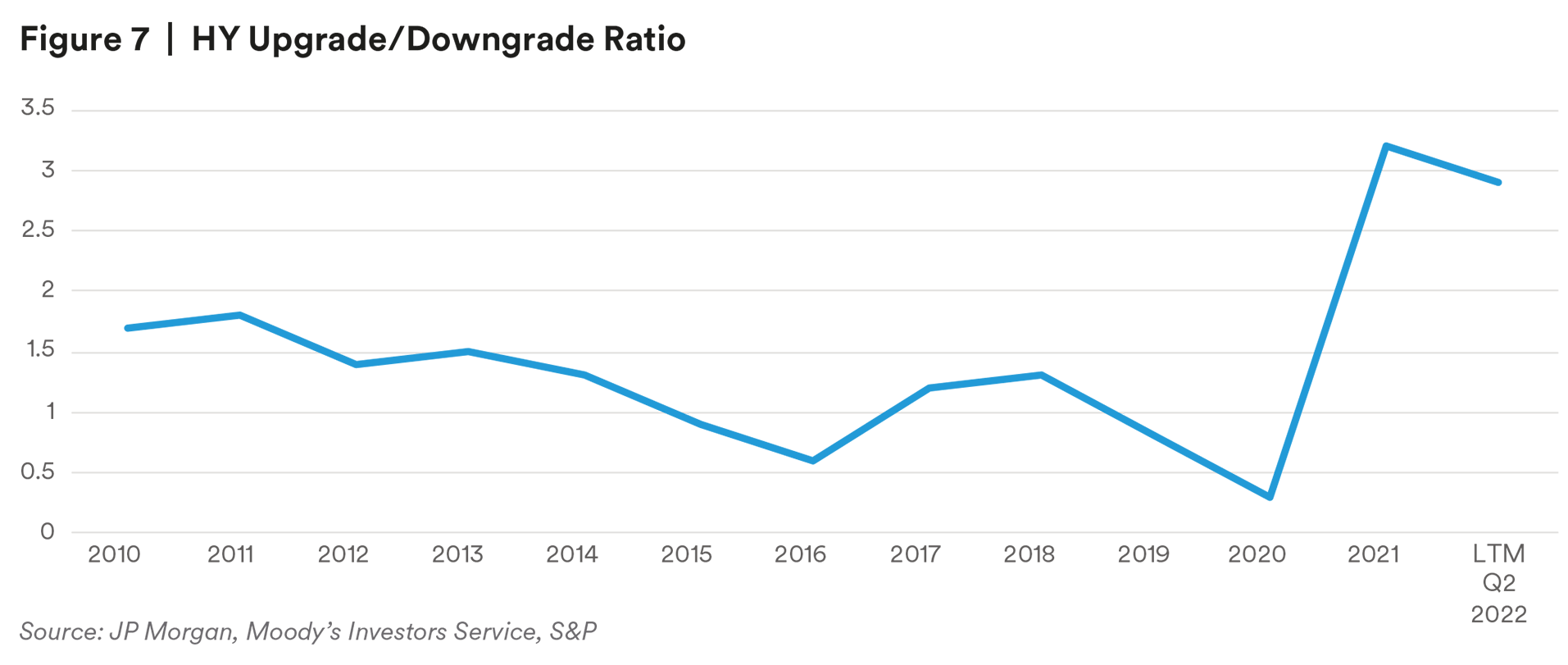

The upgrade trend and rising star momentum that the HY market experienced post Covid remains healthy but is showing signs of slowing. Upgrades continue to outpace downgrades by a ratio of almost 3x on a dollar basis but is showing signs of slowing. Rising stars continue at a healthy pace but in June we saw the largest volume of fallen angels since 2020.

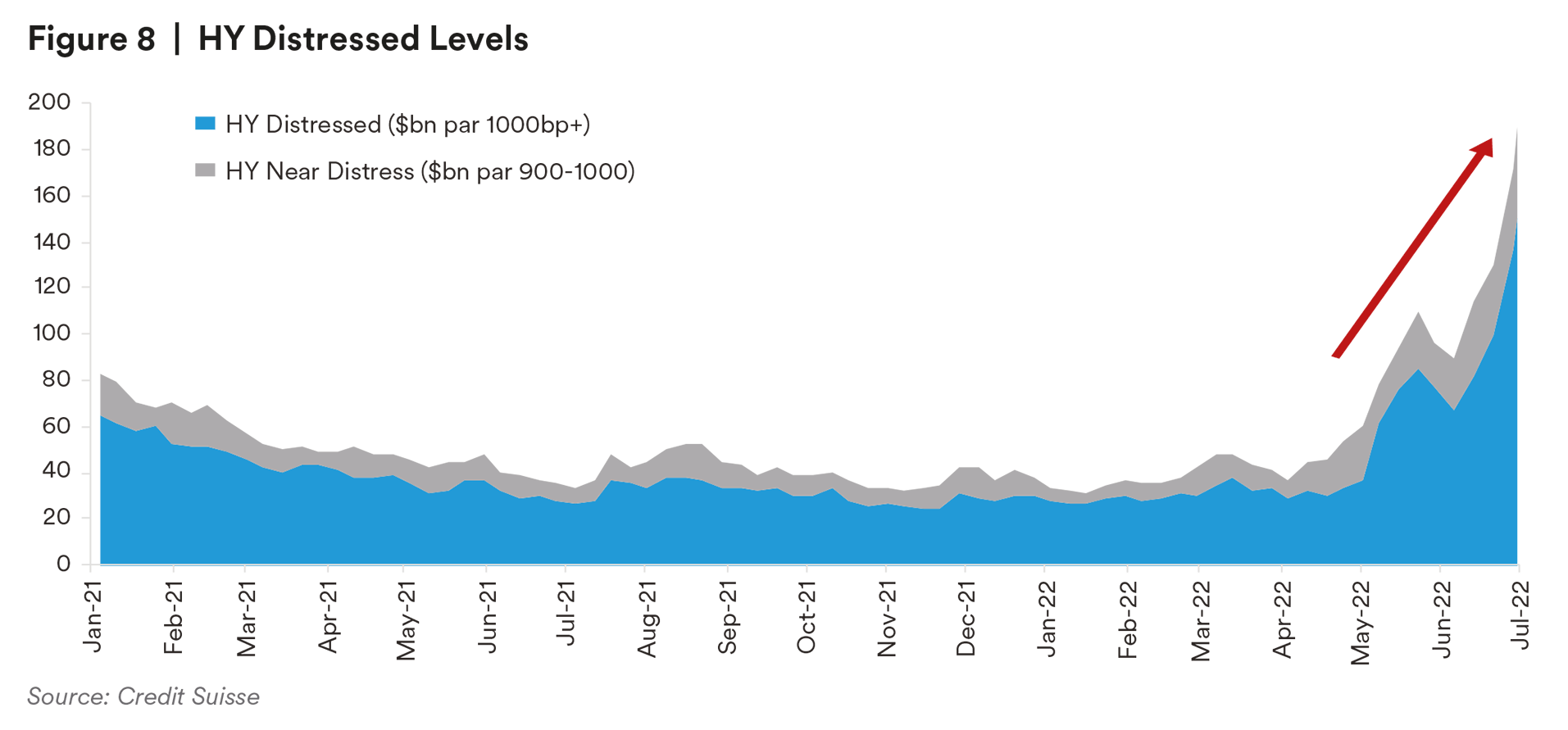

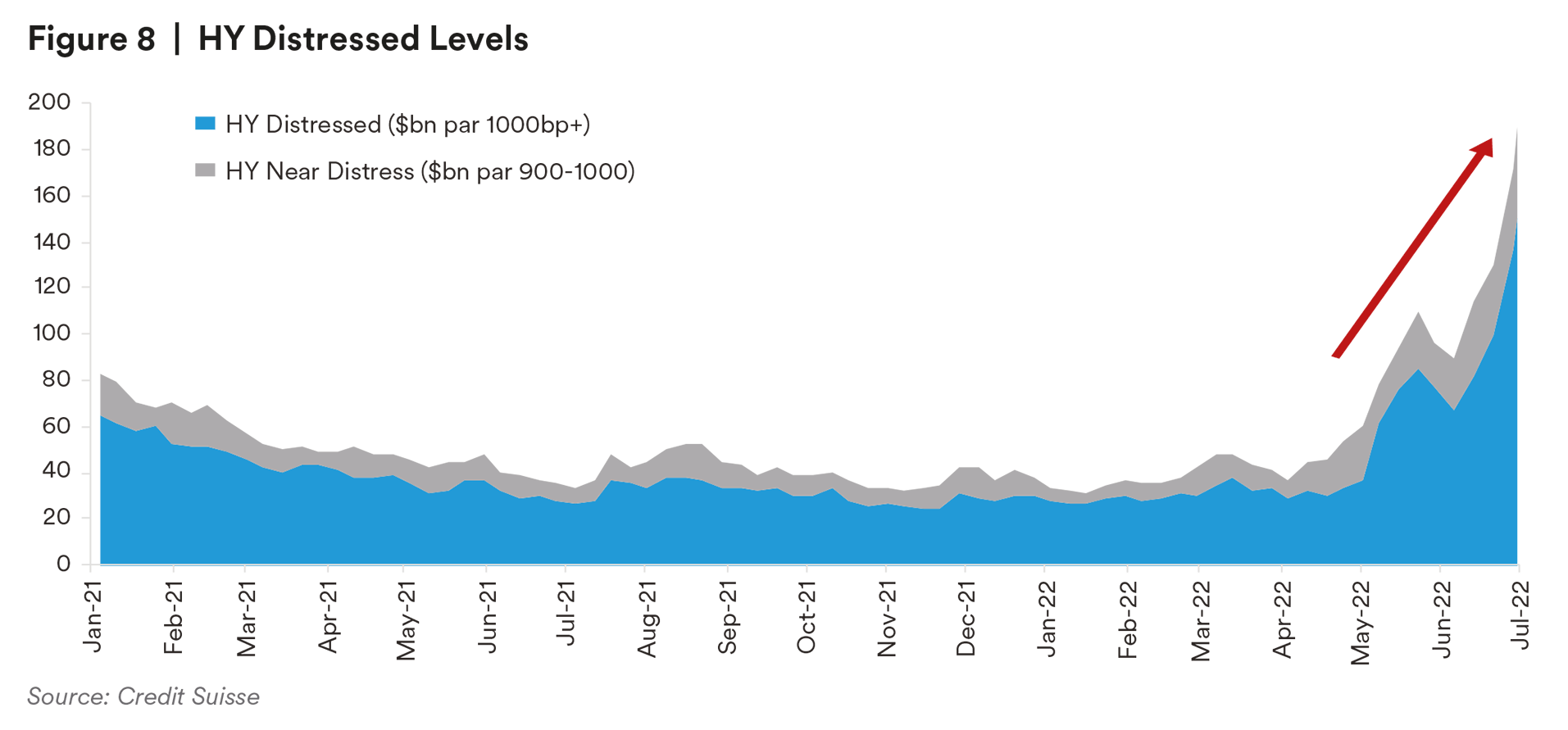

HY markets are seeing a rise in distressed debt (bonds trading at a spread greater than 1000 basis points). At the end of the second quarter, $150 billion in debt was trading at distressed level compared to $30 billion at the start of the year6 .

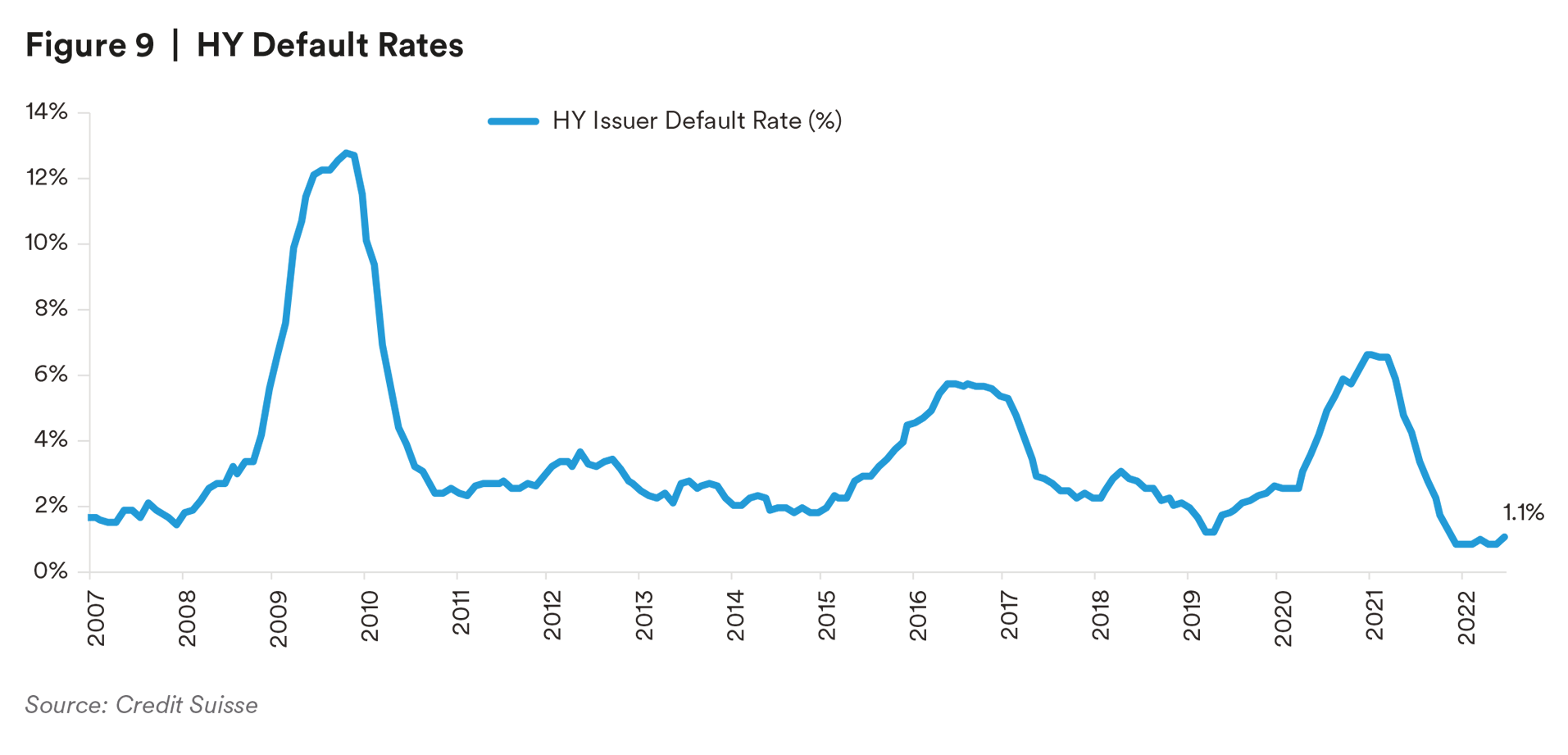

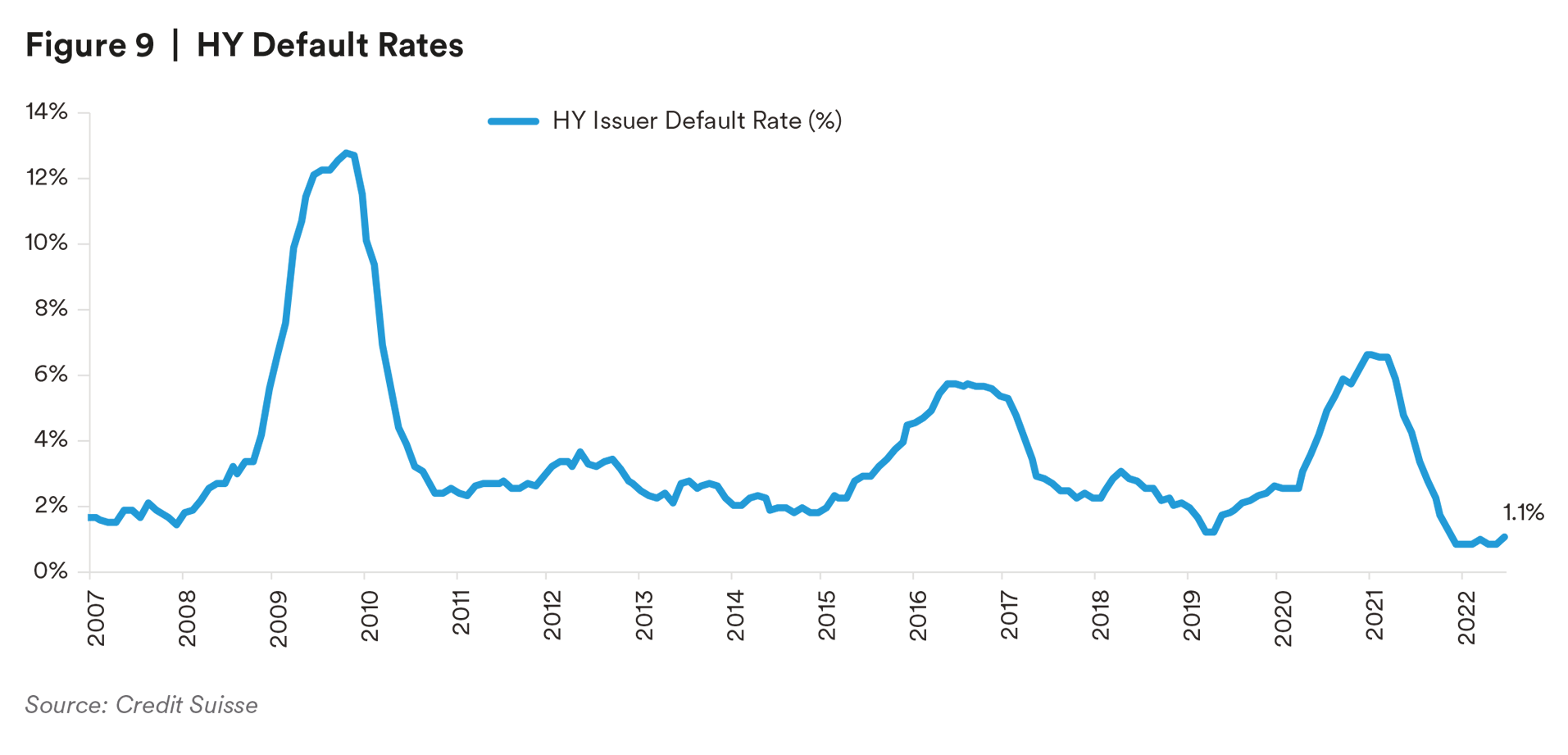

Distressed debt tends to be a leading indicator of default experience. The current default rate remains well below trend at around 1%7 , but we did see defaults pick up in June which, coupled with a rise in the distress ratio, may suggest a potential uptick in the default rate.

Outlook:

We expect macro factors to continue to drive the direction of the HY market and credit spreads over the near term. As a result, we remain cautious going into the third quarter and cognizant of increasing growth concerns and lingering inflation consequences. The Q2 earnings season will prove telling to how fundamentals are holding up in the current market environment. Corporate earnings are still expected to show year-over-year growth, but the outlook for the balance of the year may prove challenging. We expect earnings guidance and forecasts to likely be revised lower this quarter, and it will be difficult for risk to rally against this backdrop. We believe that earnings expectations are still slightly too elevated, and we will look to use the weakness from this scenario as an opportunity to add risk in the portfolio within names where we remain comfortable.

The uncertainty around the Fed’s upcoming actions may leave investors fearful in the near term, until they gain a better sense of market stability. We need to see tangible evidence that inflation is cooling before we think the Fed can pivot to a more moderate policy. If we begin to see data that suggests the Fed will be less aggressive than markets are anticipating, investors could respond positively and support higher beta assets. Based on backward looking data, there have been some indications that inflation has peaked; however, there is a possibility for the Fed to overtighten in this situation and cause additional volatility.

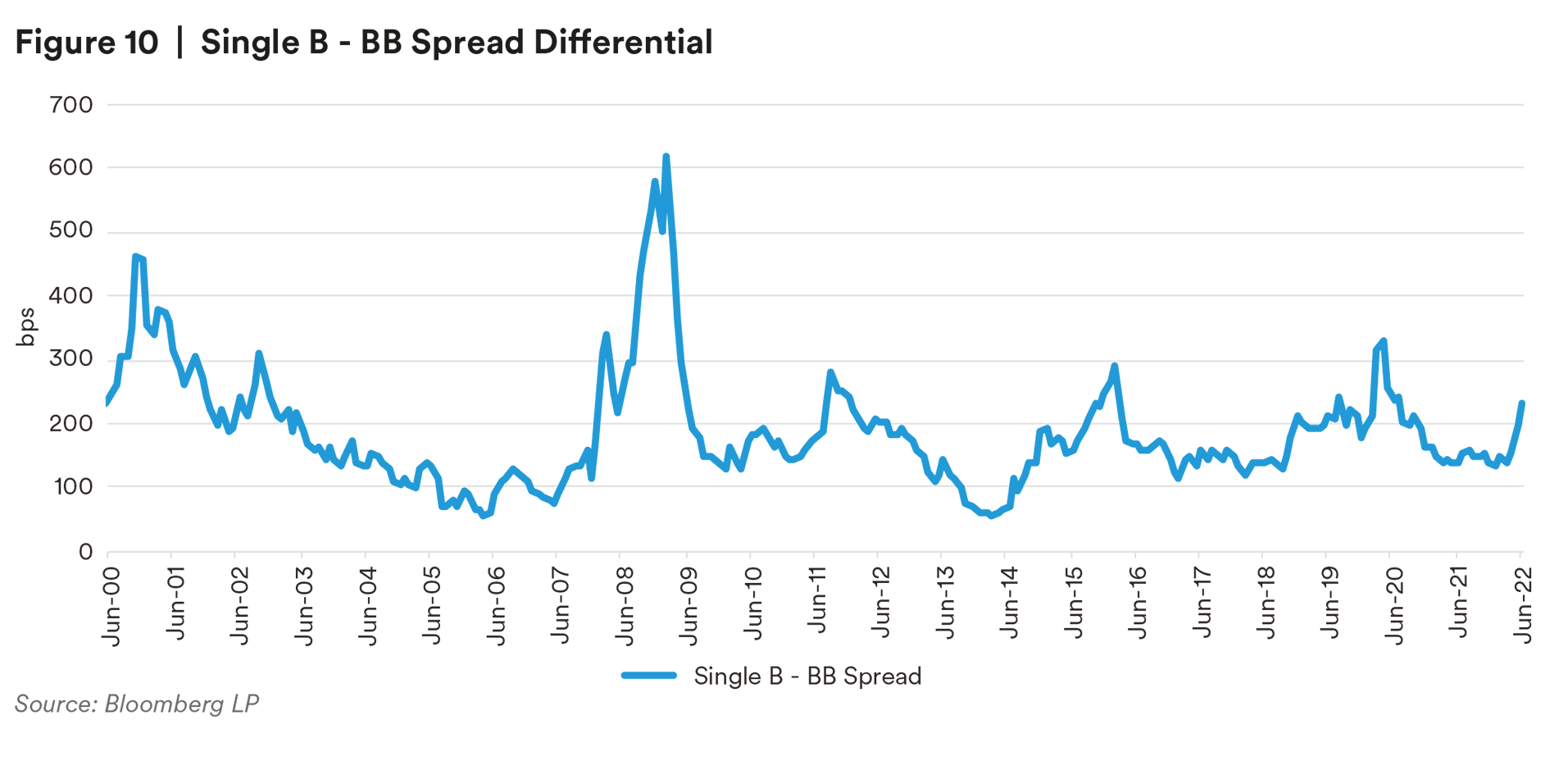

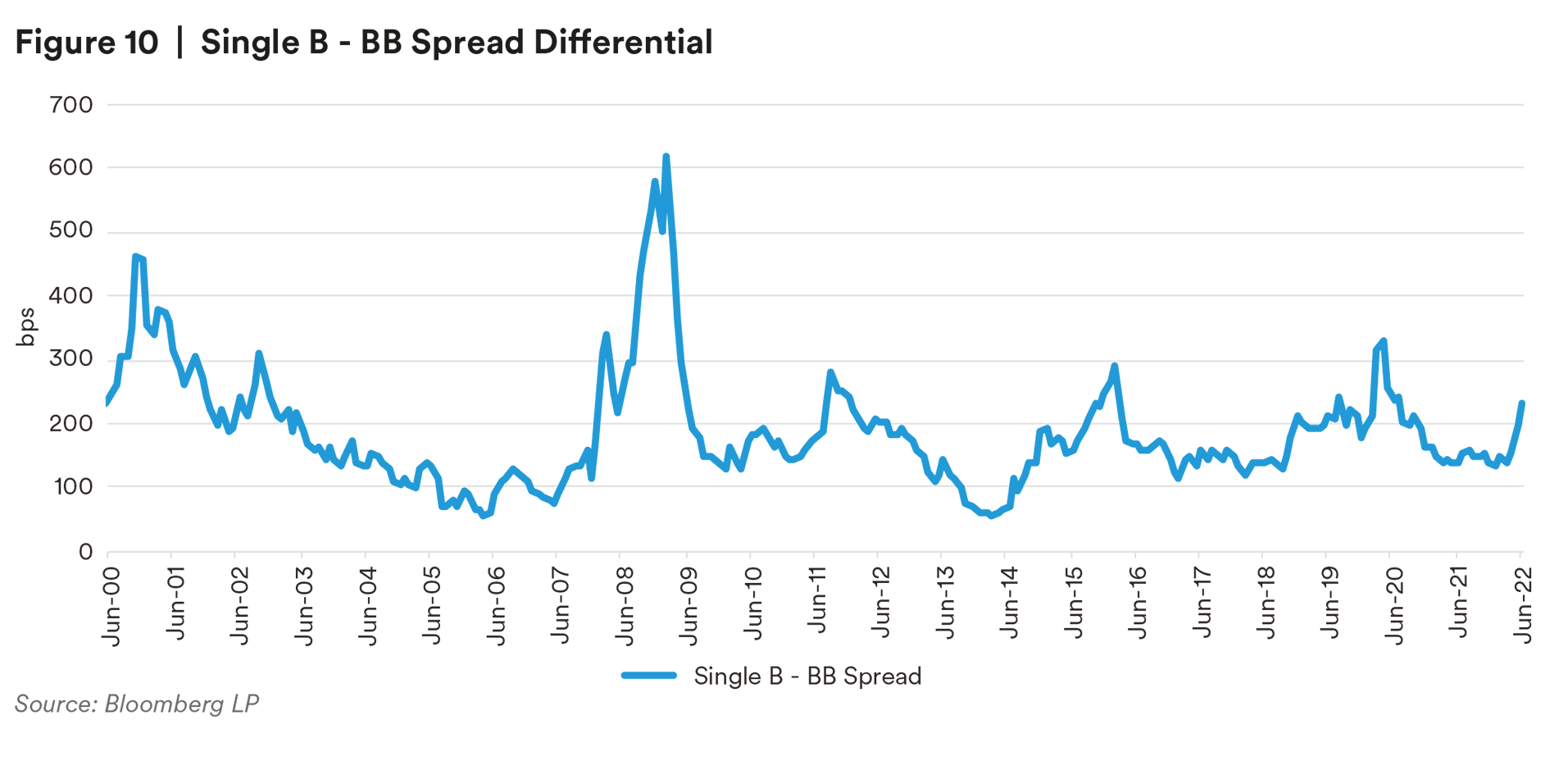

Recently in this technically driven market, even the strong companies have been penalized given the overall sell-off and rate move. Lower quality names suffered through spread widening, while higher quality names were punished with the rate selloff. However, in the second half of the year we expect to see a dispersion between issuers. As the market digests Fed actions, inflation comes down, and slower growth impacts the economy, we will likely see the higher quality names remain resilient, while the very low quality names will feel pain from the macro environment. With this bifurcation in the market, we can expect to see downgrades accelerate, along with a tick up in default rates.

We believe that the significant decline in dollar price across corporate credit during a period of broadly healthy credit fundamentals provides some attractive opportunities within the high yield market. With GDP and corporate earnings slowing, we expect higher quality credit to outperform and security selection to be a critical driver of performance over the near term. Valuations have adjusted to reflect these rising risks and are trading in line with long-term historical averages, but have not fully priced in a recession. We like opportunities within the BB portion of the market, especially the less cyclical sectors and issuers with pricing power. We will also look for opportunities within the primary market, where stronger issuers have access to the market despite volatility, and additionally are paying new issue concessions to get deals done.

Endnotes

1 Bloomberg L.P.

2 Bloomberg L.P.

3 Barclays

4 Barclays

5 Barclays

6 Credit Suisse

7 Credit Suisse

Disclosures

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Fixed income investments are subject interest rate risk (the risk that interest rates may rise causing the face value of the debt instrument to fall) and credit risks (the risk that the issuer of the debt instrument may default).

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address Level 34 One Canada Square London E14 5AA United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102- 0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under U.S. law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/ or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC.

Unless otherwise noted, none of the authors of the articles on this page are regulated in Ireland.