Brent crude rose almost 30%, to close out its best quarter since 1Q2022, as lower supply and increased global demand have supported prices. This revival of a stronger energy environment has mixed impact on EM nations. Higher oil prices may impact real incomes and growth of net importing countries, putting downward pressure on currencies and causing Central Banks to reconsider the timing and intensity of monetary easing. However, energy exporters benefit from these elevated prices, as margins remain high and well above fiscal budget break even levels. Nonetheless, for investors, these elevated levels are dampening hopes that interest rates will fall anytime soon as price pressures rise.

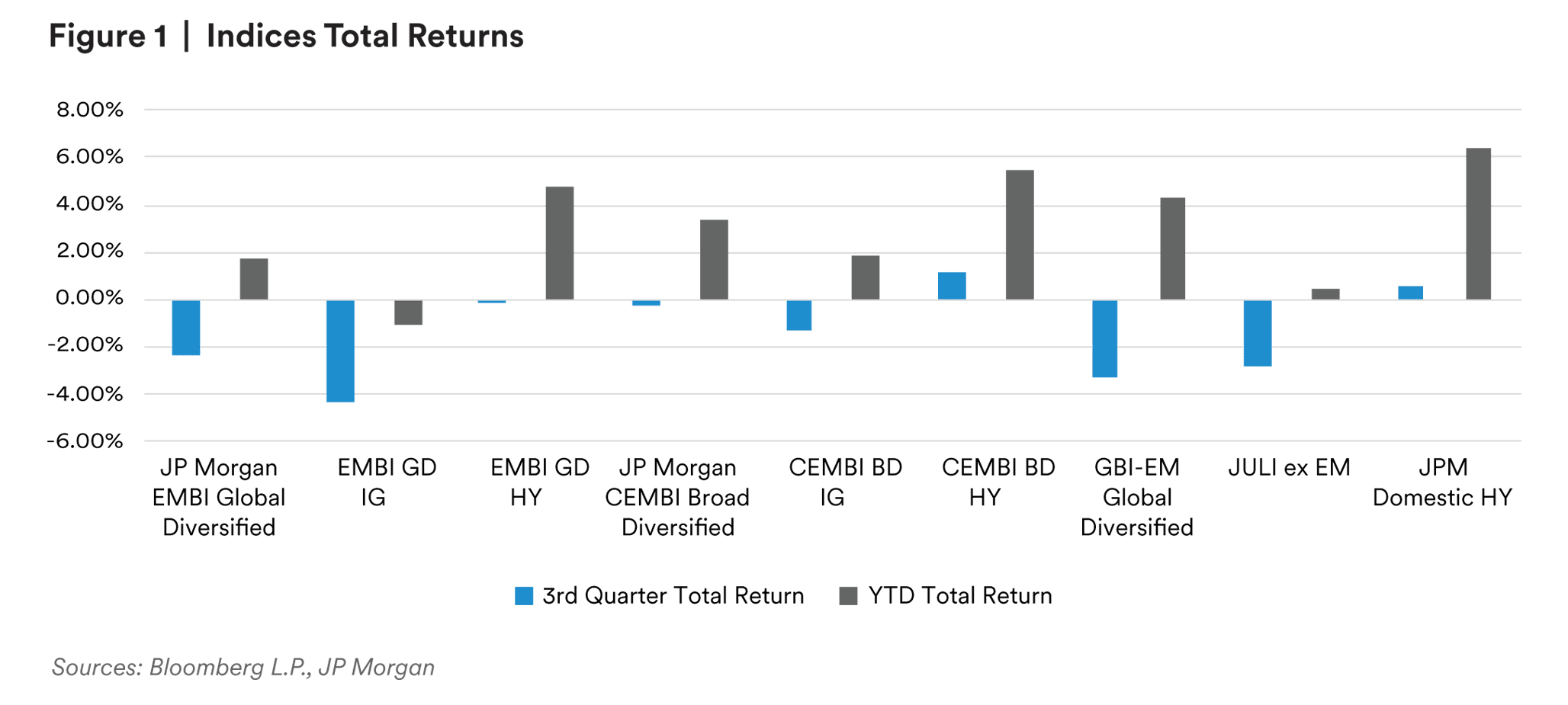

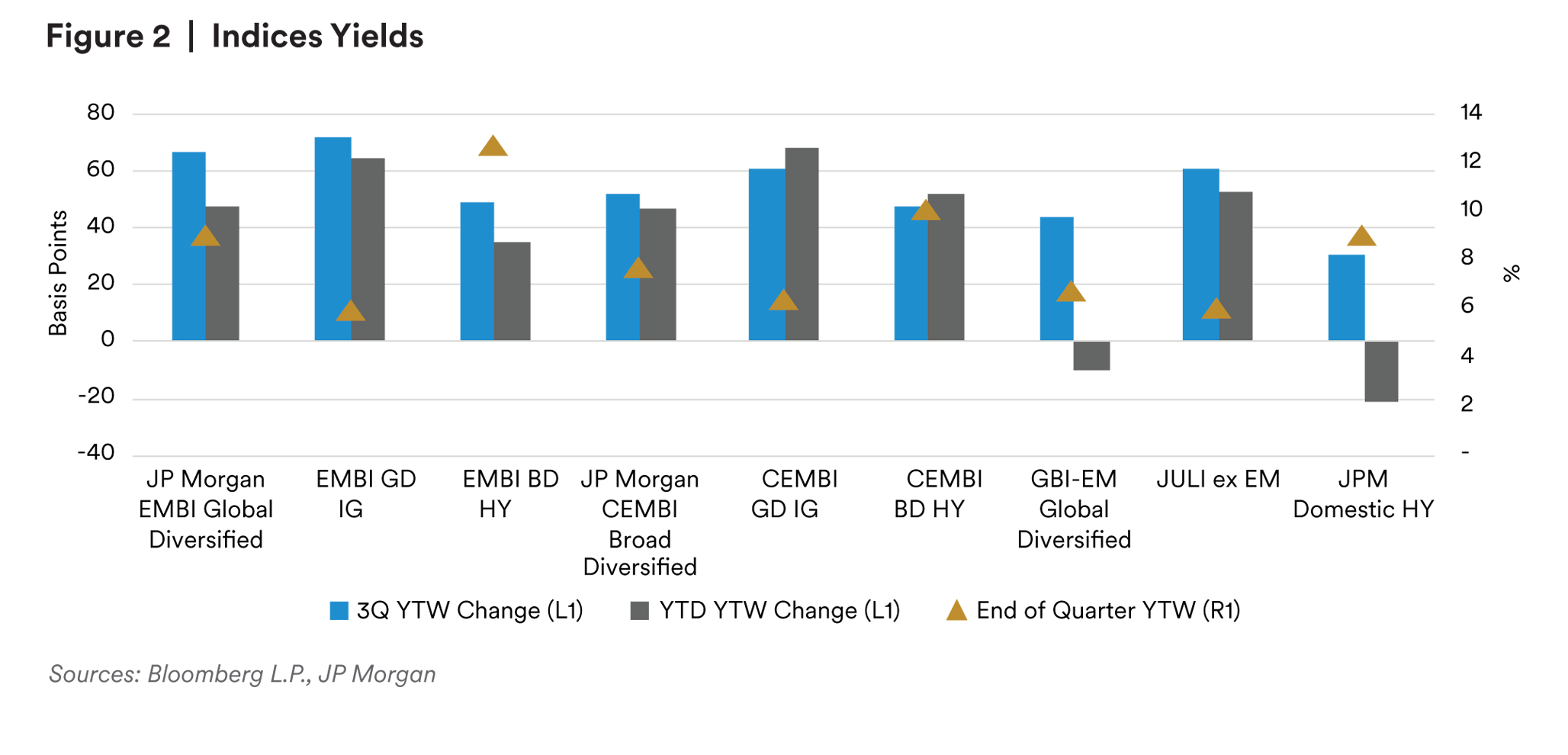

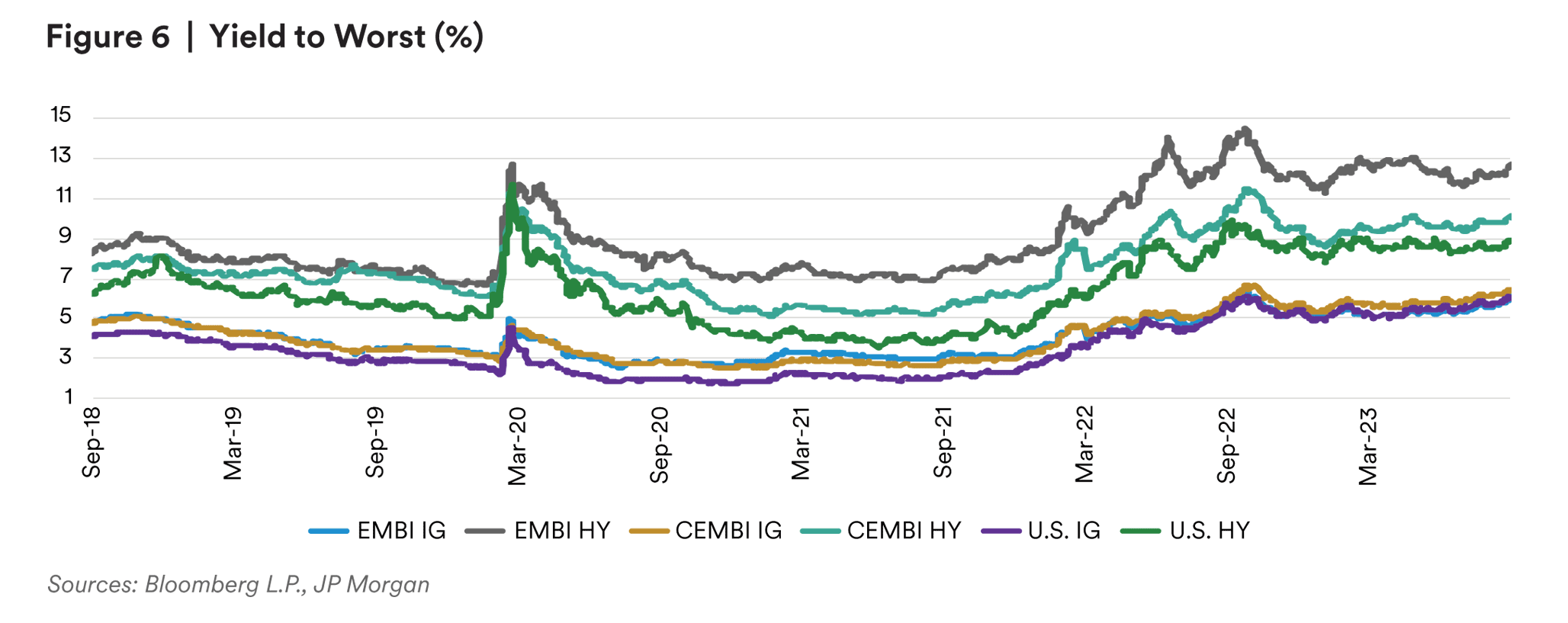

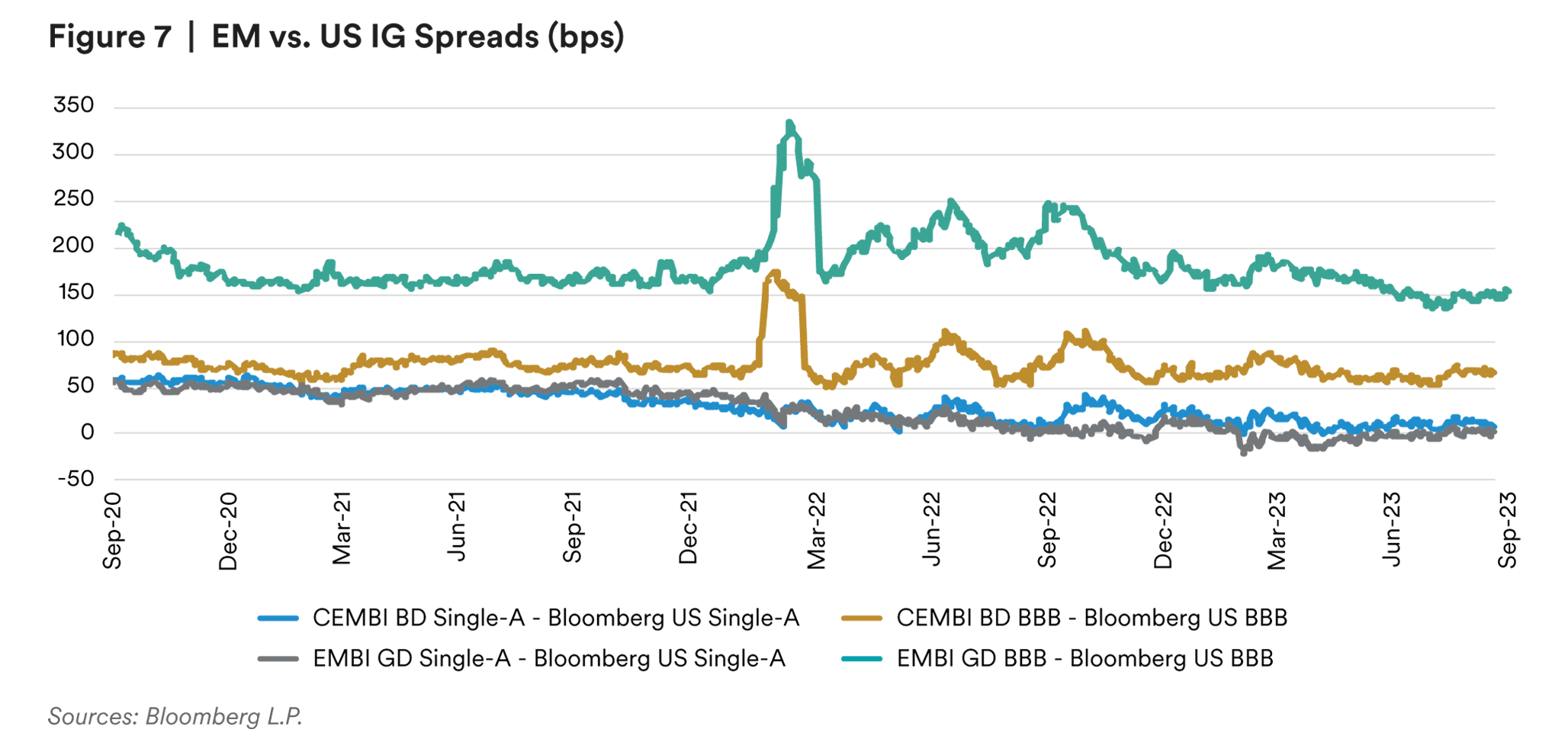

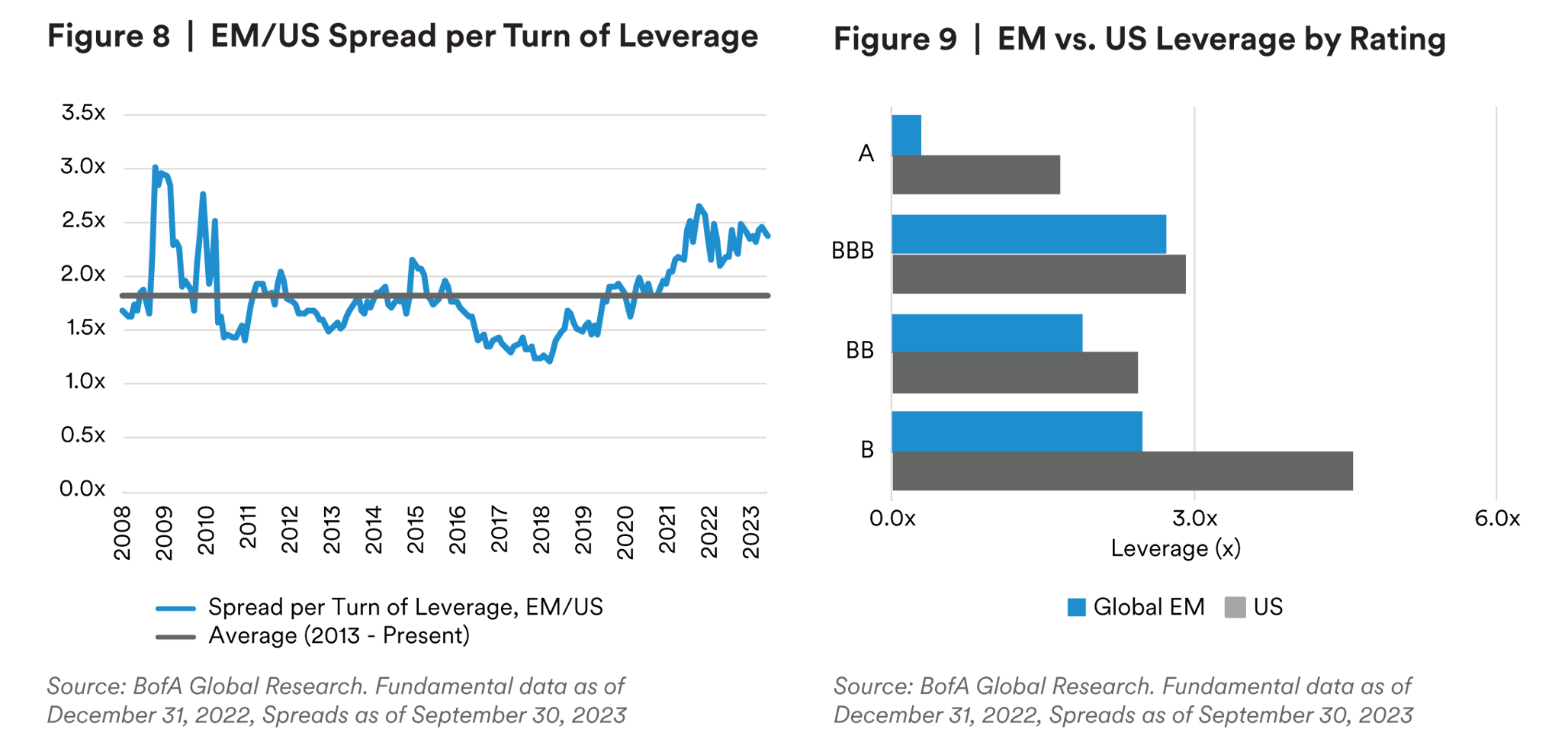

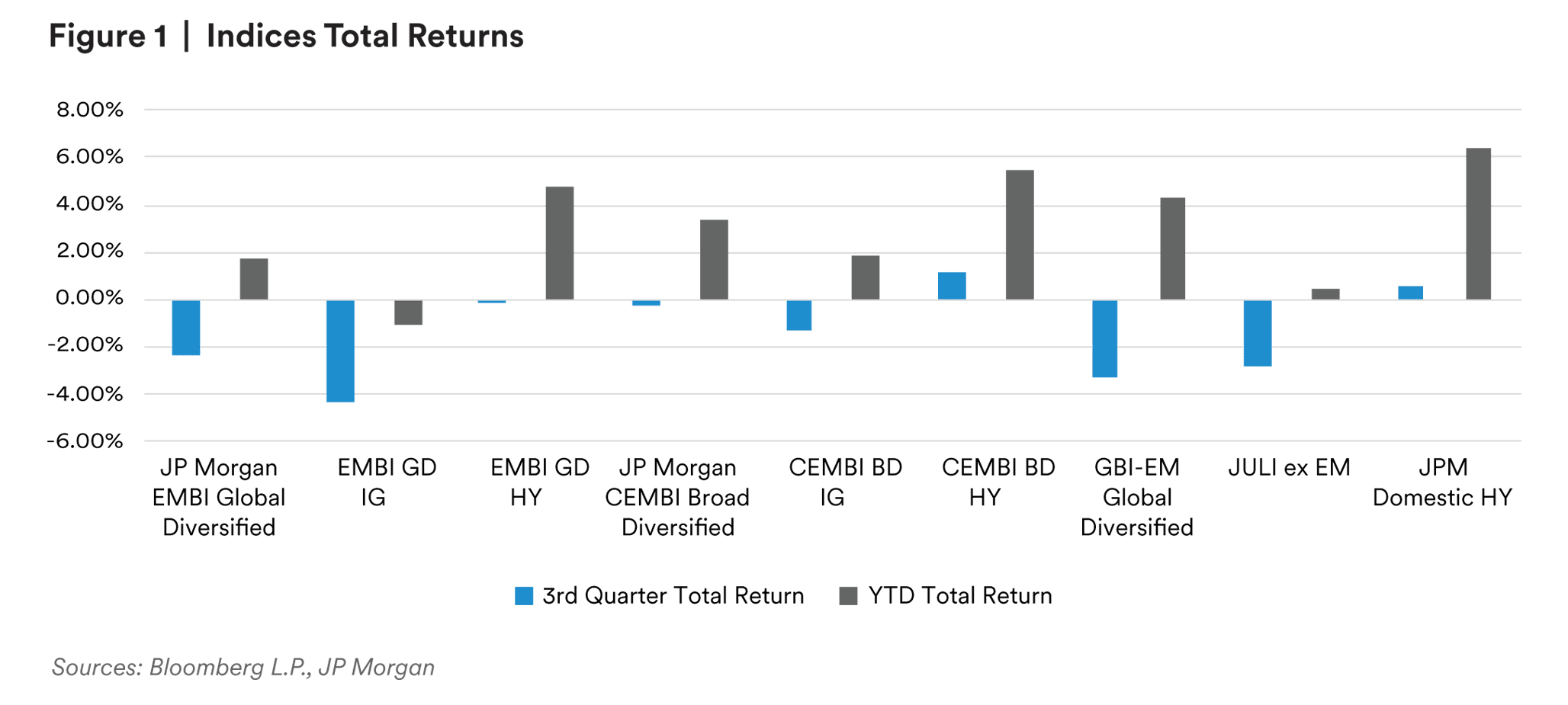

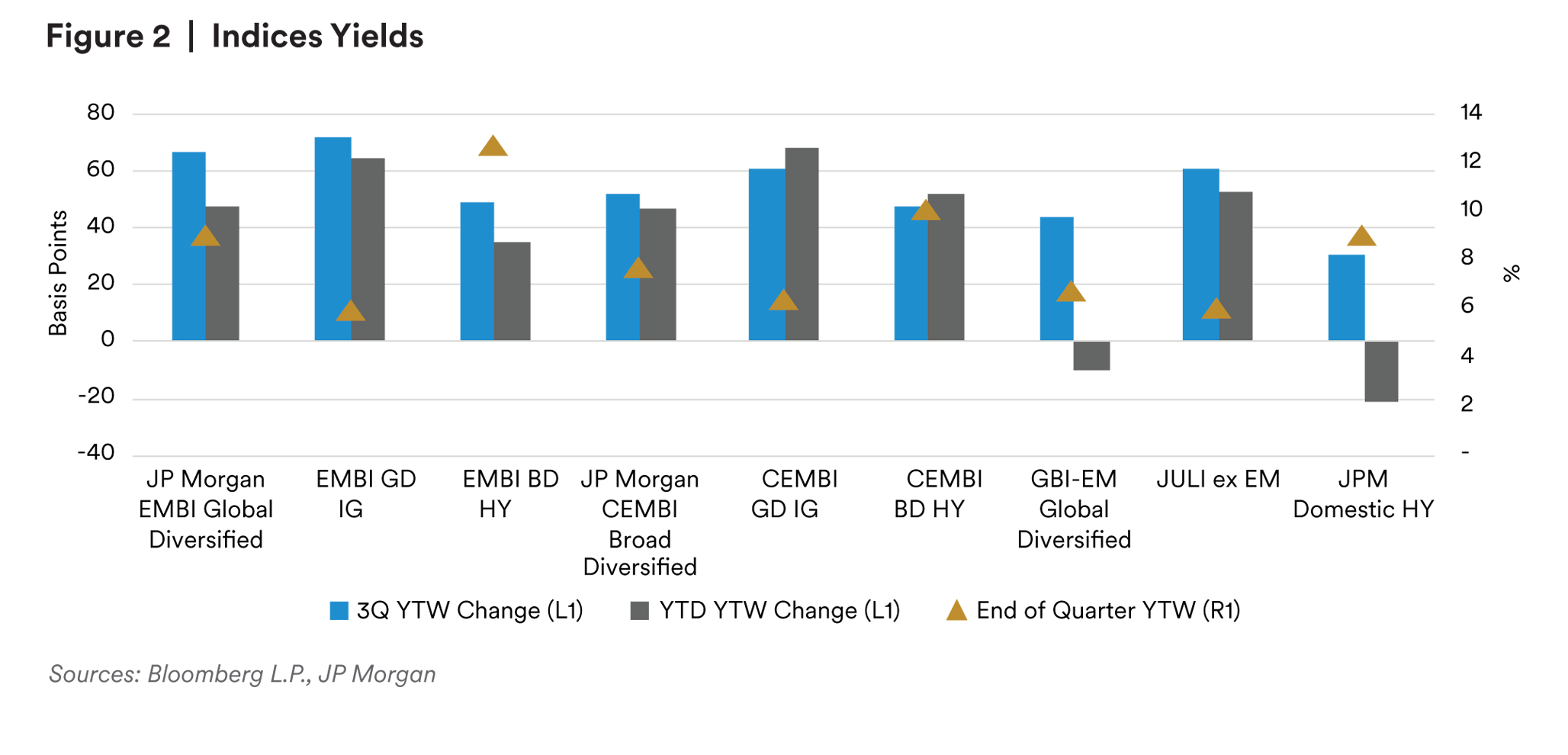

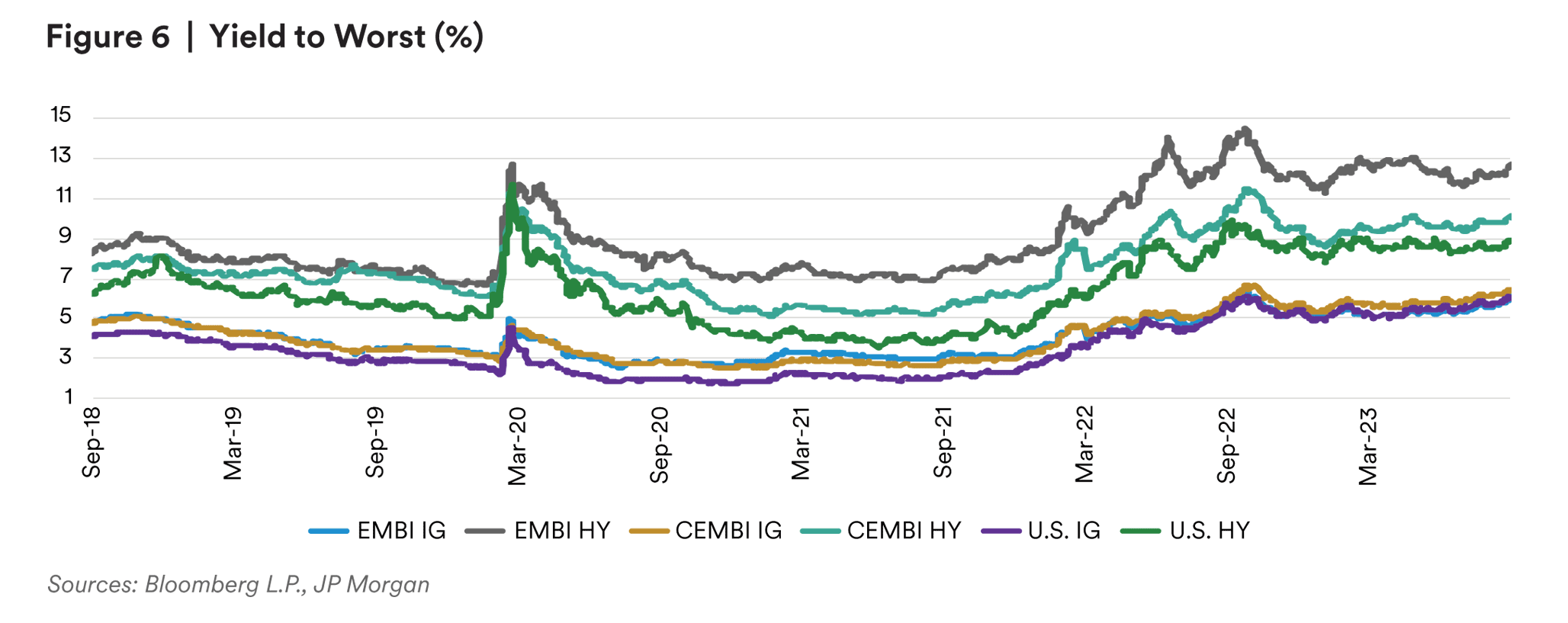

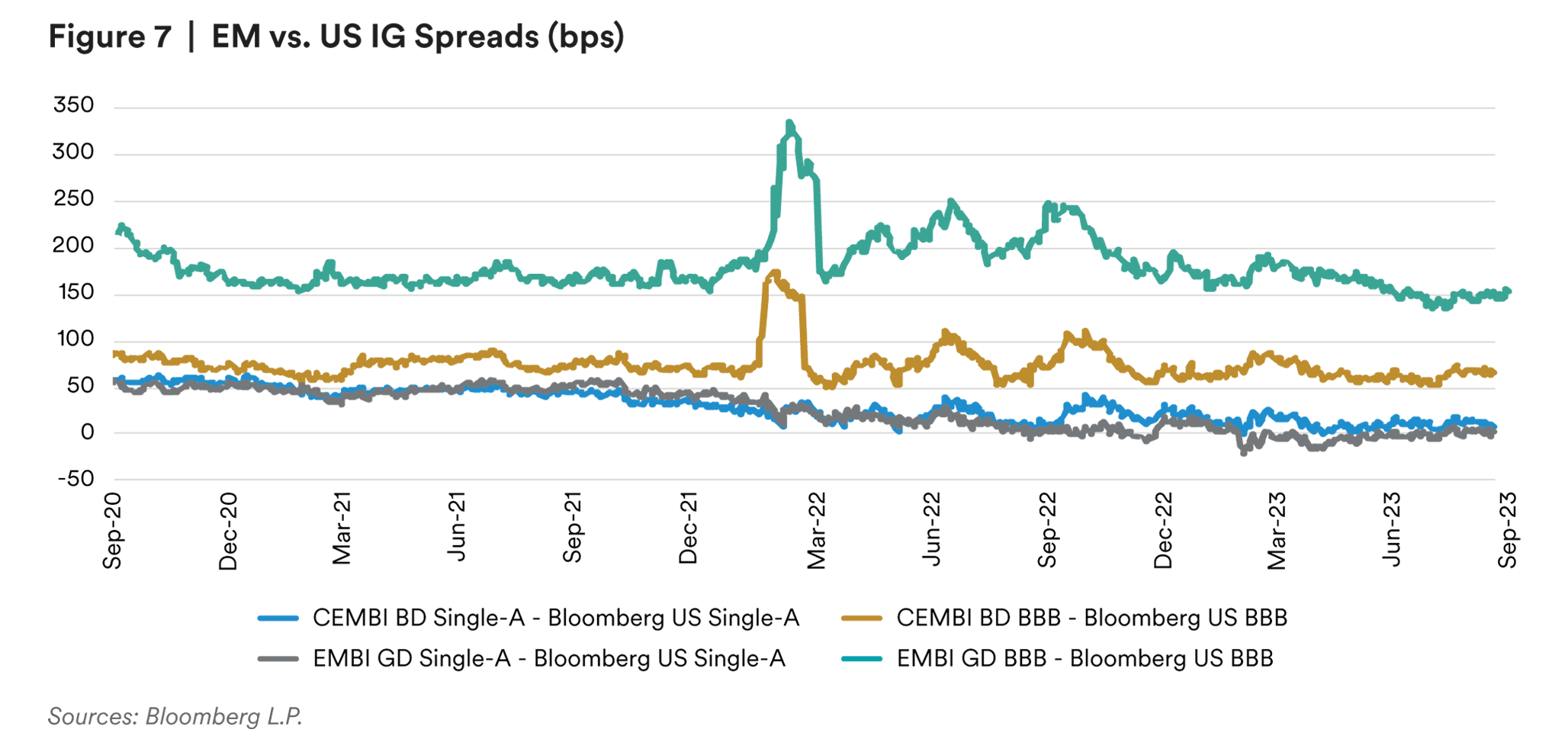

The rate move largely dictated the performance of EM assets, with longer duration high quality sovereigns weighed down the most. Corporates on the other hand, were slower to reprice as trading liquidity was more readily available in sovereigns for investors to raise cash. Increased refinancing costs due to this recent treasury move led to further decompression in EM between Investment Grade (IG) and High Yield (HY) issuers. Even with the macro-overhang, lack of issuance coupled with limited real money outflows has helped EM perform relatively in line with DM assets despite tight relative value.

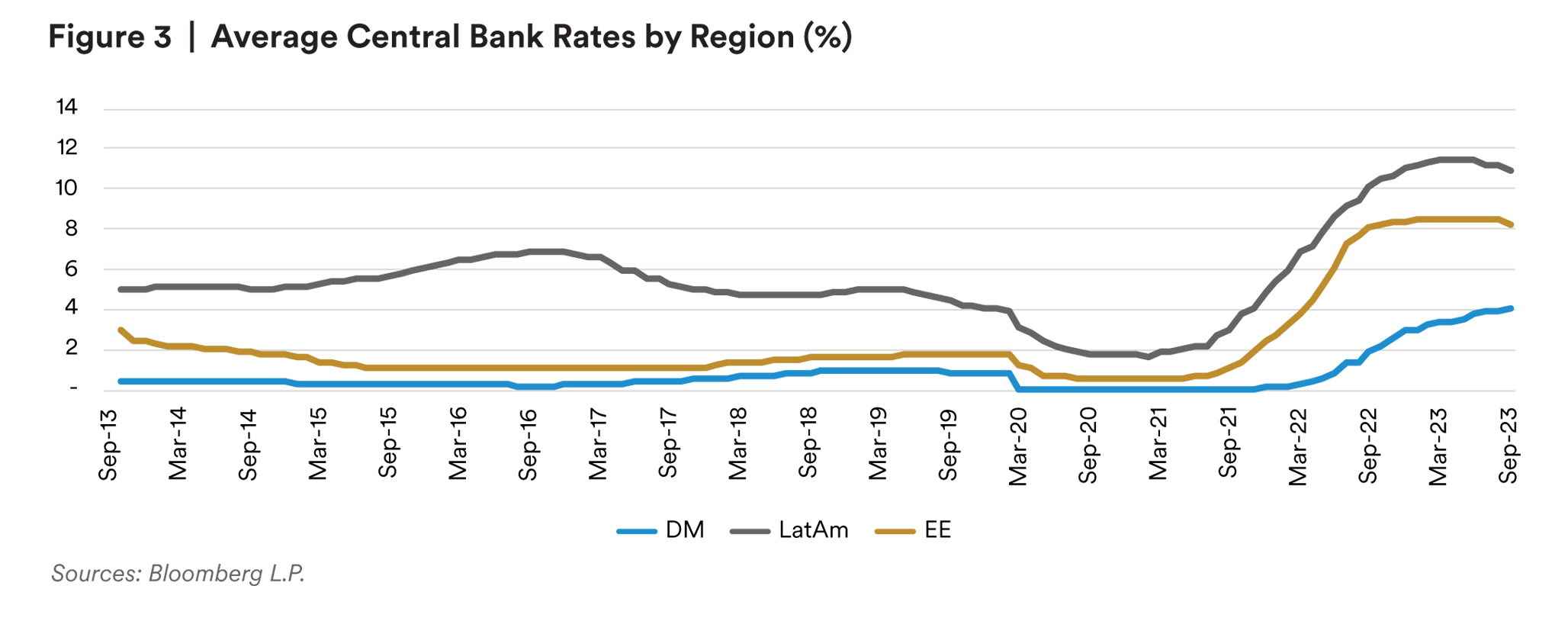

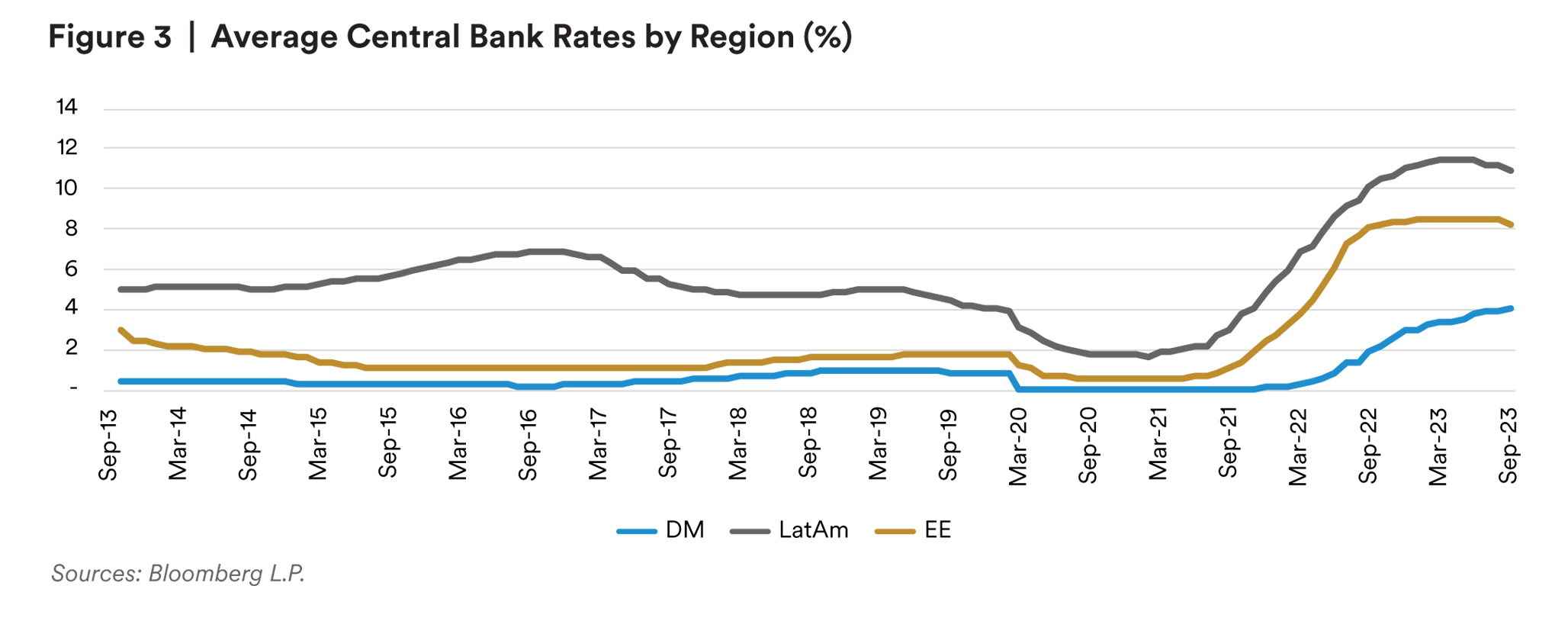

EM local currency assets faced a different path during this US rate volatility. The proactive response ofEM central banks to hike rates at the beginning of the COVID-19 pandemic proved supportive for manycountries. Now, as inflation has been largely tamed across these countries and is trending downward,central banks including Chile, Brazil, Peru, Hungary, and Poland have begun cutting rates. All the whilesticky inflation is keeping US rates higher for longer, strengthening the dollar.

Politics and elections remain an important driver for the EM landscape. Ecuador held snap general elections just two weeks after one of the candidates was assassinated. Bonds initially rallied following the incident on optimism over changes to address a surge in crime during the next regime. However, after results pointed to a runoff between socialist candidate Luisa Gonzales and entrepreneur Daniel Noboa, bonds retraced gains. Turkish President Erdogan was reelected and has adopted more conventional economic policies, highlighting a shift from previous measures that were blamed for sky high inflation and a mass exodus offoreign money. Four days after Gabon’s election, military officers in the country announced that they seized power from President Ali Bongo. Bongo had been declared the winner of the election with over 60% of the vote. However, the elections took place in a media blackout as the government denied entry to all foreign news outlets and the government shut down the internet at the last minute to combat ‘disinformation and manipulation’. Albert Ossa, leader of the opposition coalition, claimed victory before the results were announced and called into question the legitimacy of the electoral process.

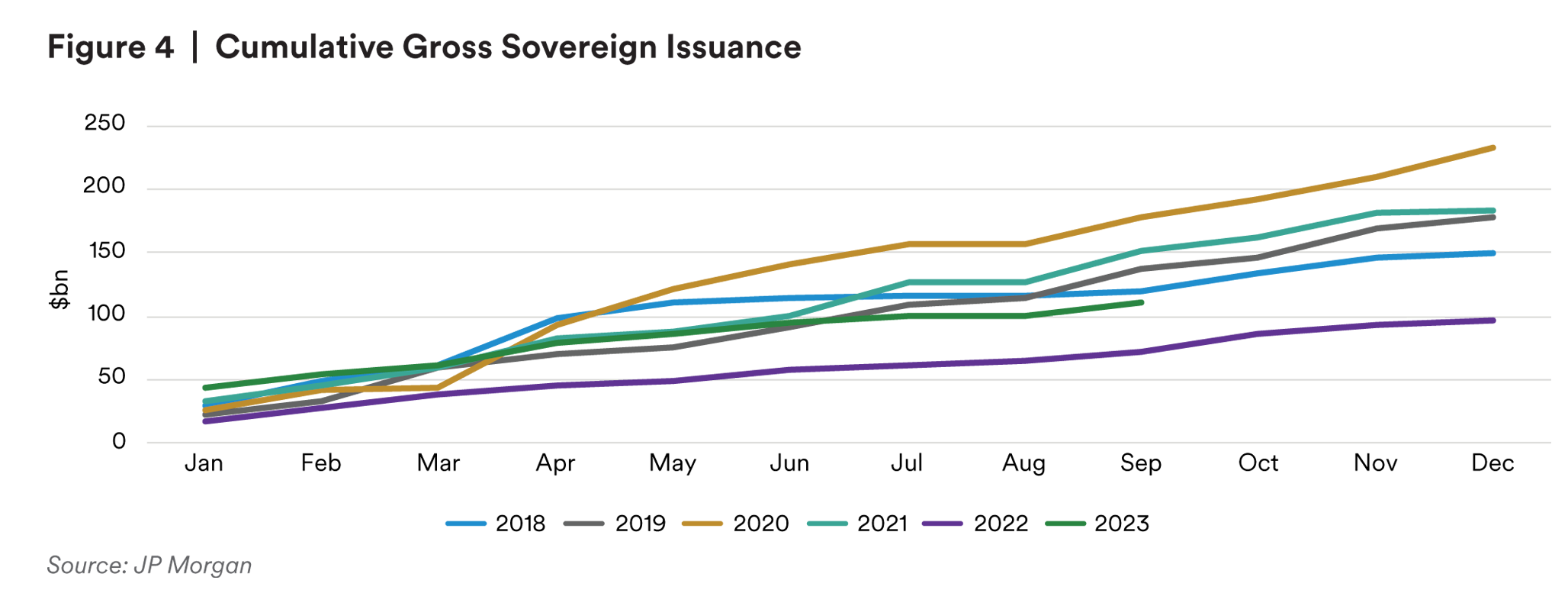

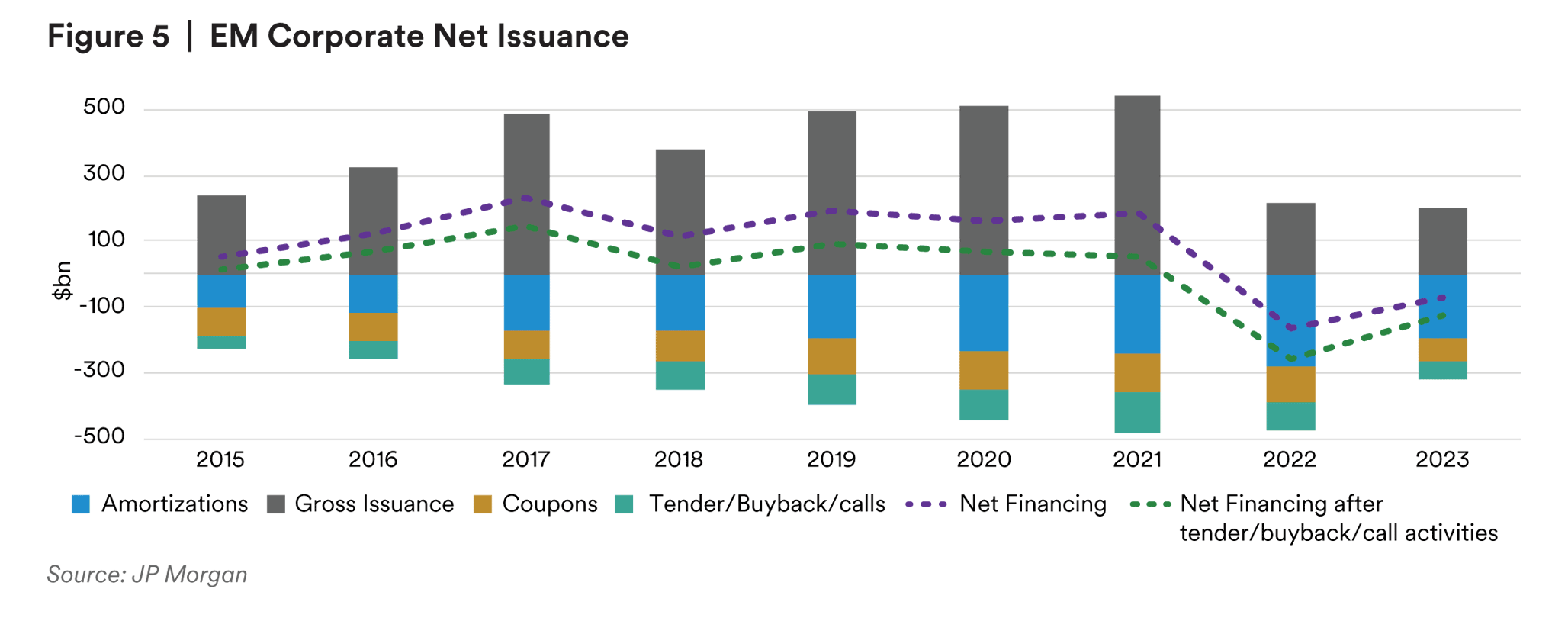

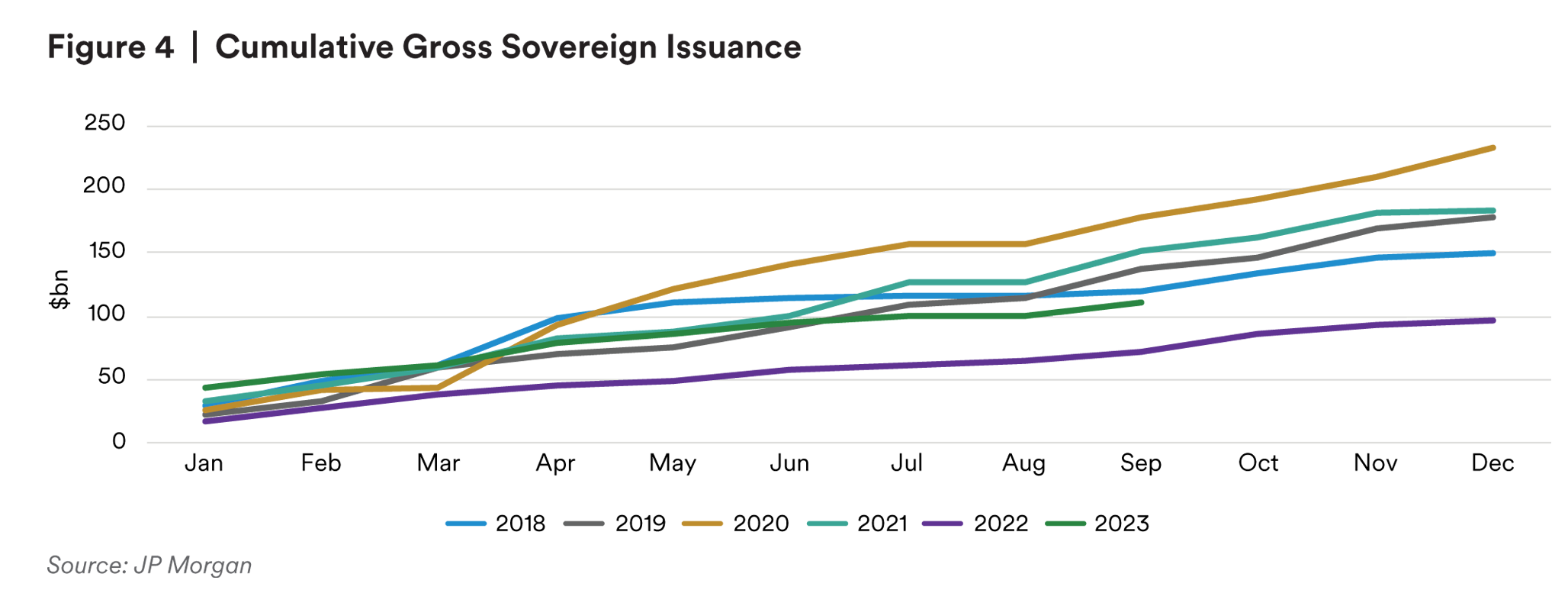

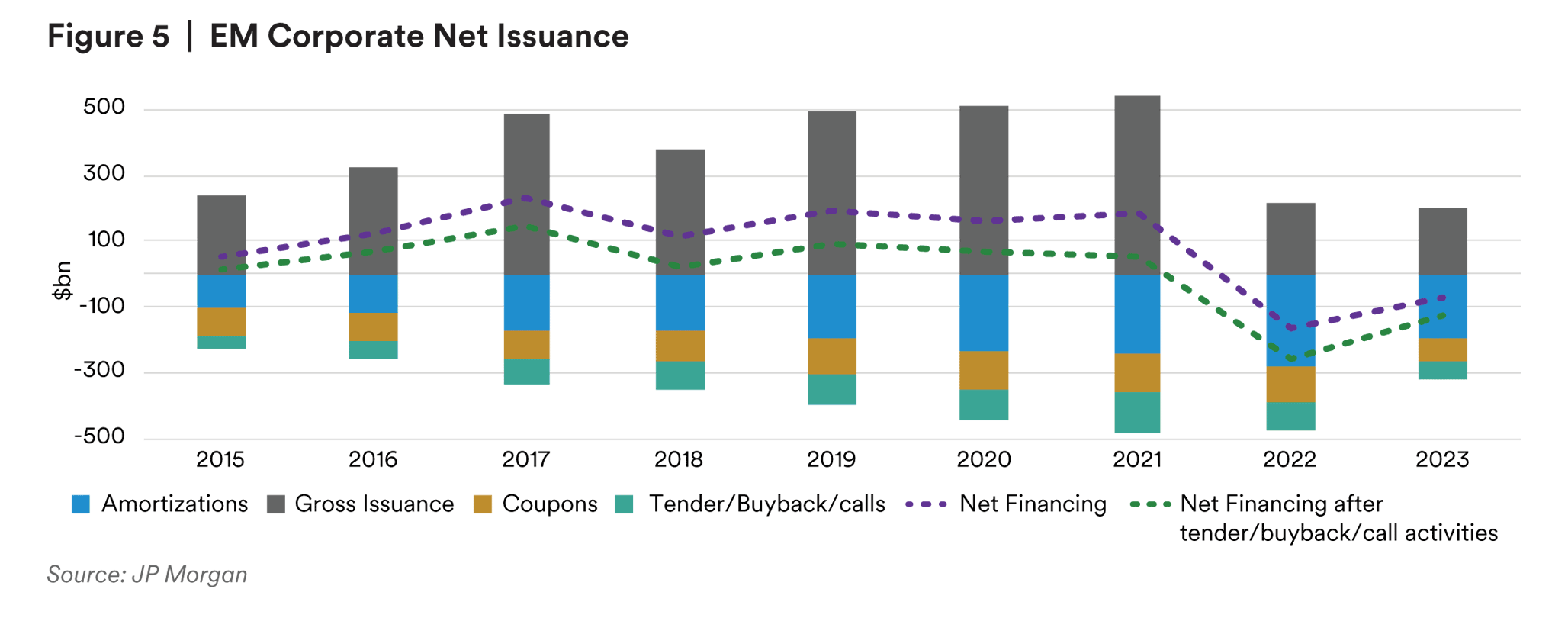

Issuance has remained under whelming in EM, as high-quality issuers delayed coming to market and high yield issuers faced prohibitive yields. Early September provided a temporary period of improved liquidity and decent risk backdrop; however, the subsequent sharp spike in rates sidelined investors. If issuers start to project that rates will stay higher for longer, higher quality sovereigns may resume issuance topre-fund for next year. Only $16.8 billion of sovereigns issued during the quarter, with investment grade issuers representing 74% of that total. Corporate issuance of $59 billion was almost double the Q3 2022 issuance level, but still well below the $100 billion five-year average for the quarter. Despite the September rebound being the most active supply month of the 2023, corporate net financing remained negative dueto robust scheduled cash flows and elevated liquidity management exercises. As investors shift to more ESG awareness, issuers have been structuring deals to include various relevant targets and metrics such greenhouse gas intensity, social equality, and environmental causes, to help reduce borrowing costs.

While outflows have continued across both hard currency and local currency accounts, -$17.4 billion of combined outflows year-to-date, the biggest selling derived from ETFs which recorded 8 consecutive weeks of outflows. Real money accounts on the other hand have kept their allocations fairly steady. Non dedicated investors continue to prefer DM risk given relative value and uncertainty over economic data and interest rates.

While outflows have continued across both hard currency and local currency accounts, -$17.4 billion of combined outflows year-to-date, the biggest selling derived from ETFs which recorded 8 consecutive weeks of outflows. Real money accounts on the other hand have kept their allocations fairly steady. Non dedicated investors continue to prefer DM risk given relative value and uncertainty over economic data and interest rates.

Outlook

Investors remain cautious for the remainder of the year as the path of US interest rates remains uncertain and is the major driver of performance and sentiment. Investors are looking for a combination of the US inflation slowing and a consistent rebound in China’s economy. We will continue to monitor global growth, inflation, and geopolitical tensions as they are the main drivers of EM outlook. The recent conflict in Israelis the newest geopolitical concern weighing on sentiment; as such, the escalated uncertainty and fluidity of the situation factors into portfolio positioning. Additionally, the outlook around energy prices into year-end is now even more uncertain, as Middle Eastern tensions may increase volatility. The recent market environment has highlighted the importance of security selection within portfolio construction. The overall market volatility has led to a bifurcation in performance between strong sought after credits and those which may face refinancing risks.

As a result of current valuations and volatility of interest rates and commodities, our portfolios have reduced risk and began shifting to higher quality, more interest rate sensitive sovereigns with low financing needs and ability to tap the market. Given attractive all-in yields with US treasury yields above 4.5% and relatively neutral portfolio duration, we feel more comfortable going out the curve in higher quality names where you historically were not compensated for the risk. While the overall beta of our portfolios remain slower than historical levels, we continue to look for more focused risk opportunities in idiosyncratic special situations that we believe are likely to rally in a better market environment and in worst case scenarios have recovery values at or above current levels. The primary market has been another place where we look to opportunistically add exposure and take advantage of new issue concessions.

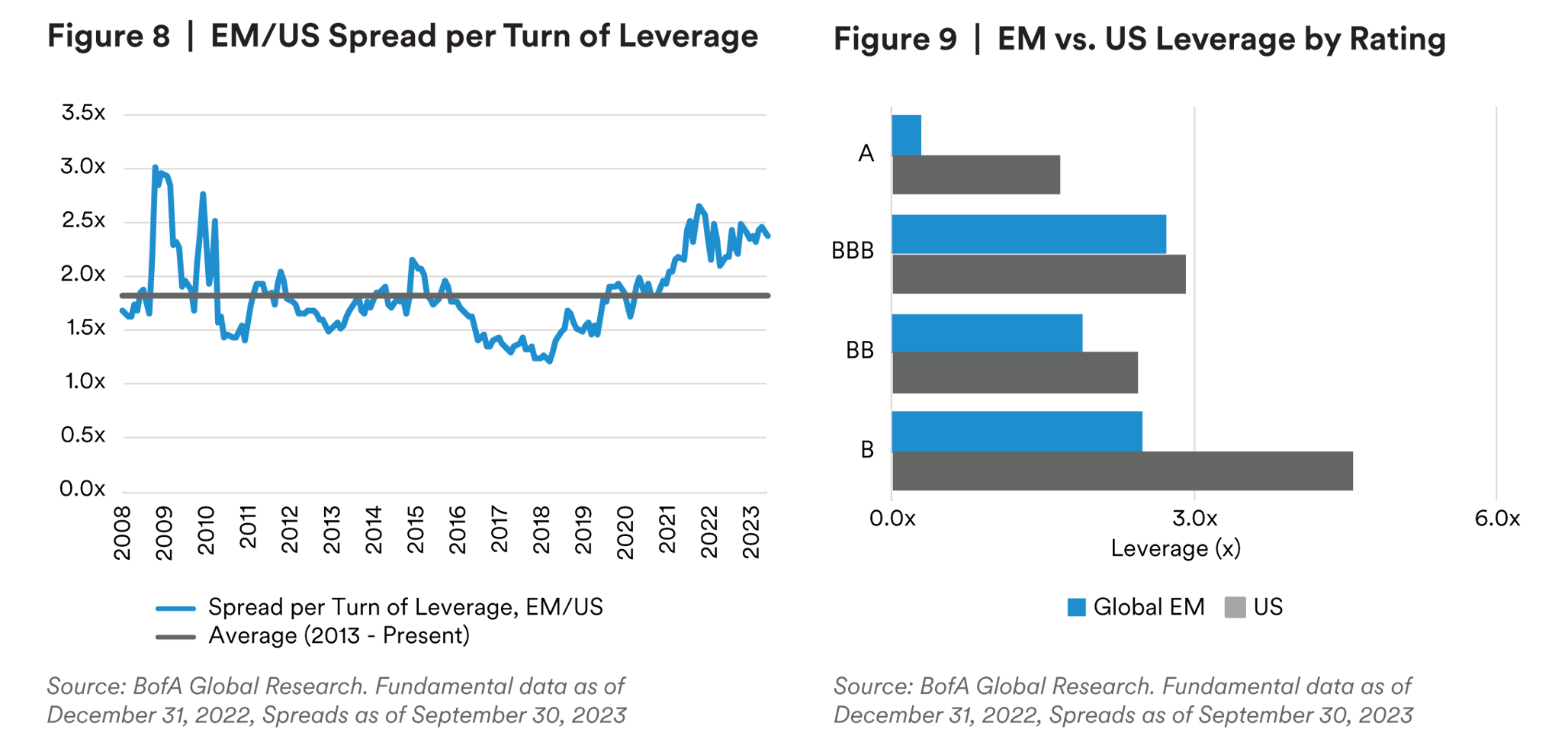

While corporates continue to perform well at the balance sheet level, we think credit quality has peaked and operating metrics will begin to show some softening from here. Additionally, headlines around a few large issuers have increased investor questions, putting a larger focus on governance. We like hard currency revenue-generating BB corporates as well as BBBs, where balance sheets remain supportive and access to capital is not challenged by either more uncertain macro conditions or the rise of interest rates. While we historically do not take much China risk directly given persistent overvaluations, recent repricing of the Asian financials space has presented some compelling opportunities.

The current strong dollar, US Fed actions, and lingering uncertainties around global growth are providing a challenging backdrop for EM local currency bonds to outpace hard currency assets in the current environment. However, the recent interest rate sell-off has coincided with continued downward pressure on inflation globally. This has provided good entry levels for some high yielding markets such as Colombia, Mexico, and Brazil. The compelling real rate environment in Latin America is most enticing, while Europe is valued more fairly, and Asia screens rich.

The political landscape continues to shift with a number of critical elections coming up during 4Q23. Argentina’s sky-high inflation, loose fiscal and monetary policies, and lack of international reserves are setting the stage for the challenges the next regime will step into starting in December. Egypt’s inflation has risen to new highs as the country heads towards its own election in December where current President Abdel-Fattah El-Sisi is likely to win his third term. The country is looking for an uneventful election cycle to help access more financing from its IMF rescue package while facing pressure to devalue its currency once again. The upcoming election in Poland may socially and politically steer the direction of the country further from Western Europe and reveal if European constituencies will put aside growing war fatigue to remain united in their support of Ukraine. While a new draft of the Chilean constitution was approved by the Constitutional Council, Chilean voters remain unimpressed with the new document, and it is unlikely to pass as written in the December referendum. President Boric has signaled that if rejected, the government will not seek a third constitutional rewrite process, therefore the current business-friendly constitution from 1980 will remain in place despite 4 years of attempting to rewrite a new constitution. The upcoming Colombian regional election at the end of October will likely result in a loss for Petro’s coalition, pressuring reforms to be diluted or overall less likely to advance as moderation is expected. Ecuador will also transition to a new government following its elections in mid-October, hopefully with the ability to tighten fiscal policy and remain engaged with the IMF

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors.

This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed here in are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the view sheld by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document asproviding, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is aspecialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document isapproved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors inthe UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the variousjurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute orform part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyodaku, Tokyo 102-0094, Tokyo Garden Terrace Kioi Cho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respectof the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none ofthe authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of September 30, 2023, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC.