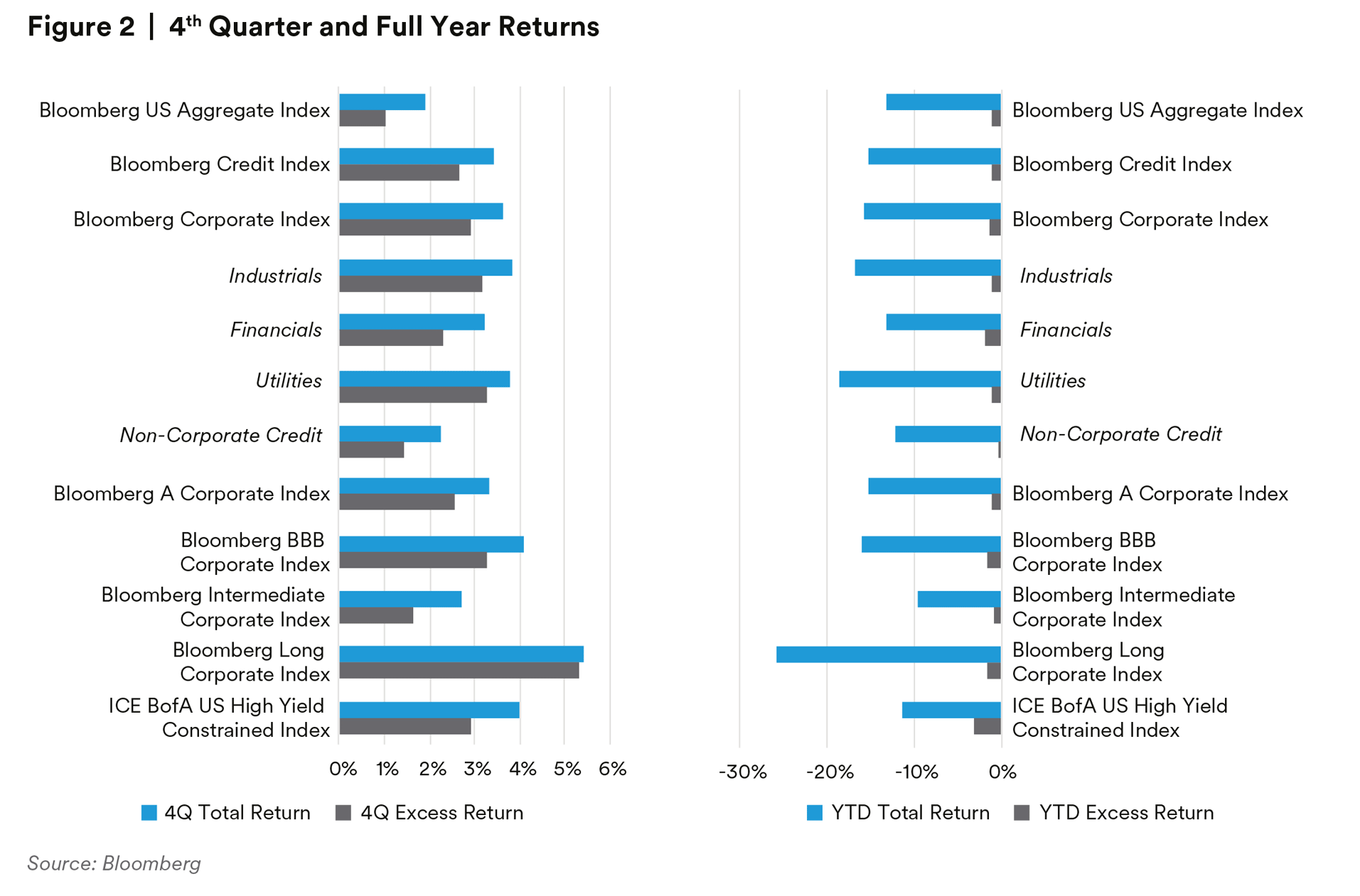

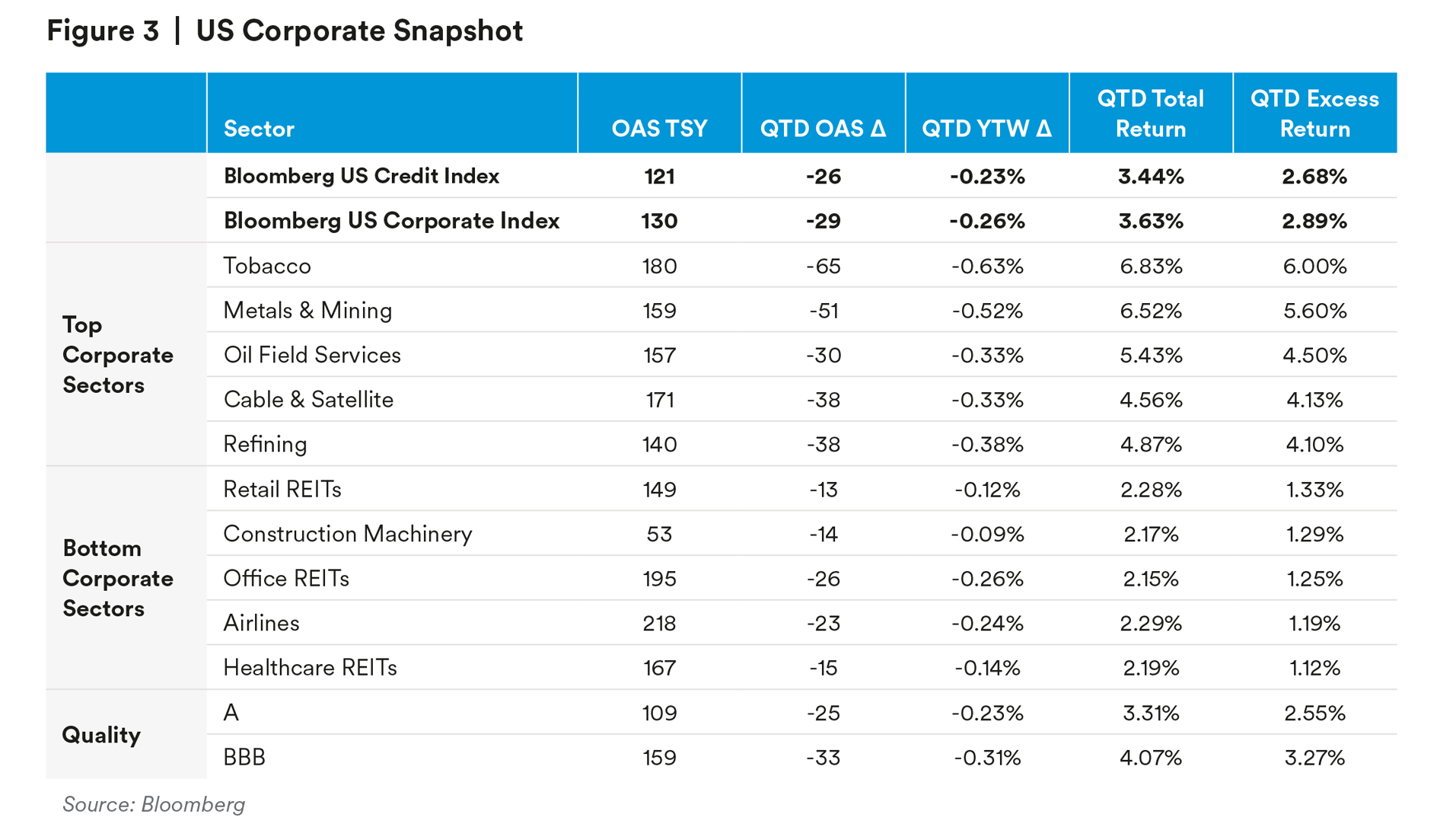

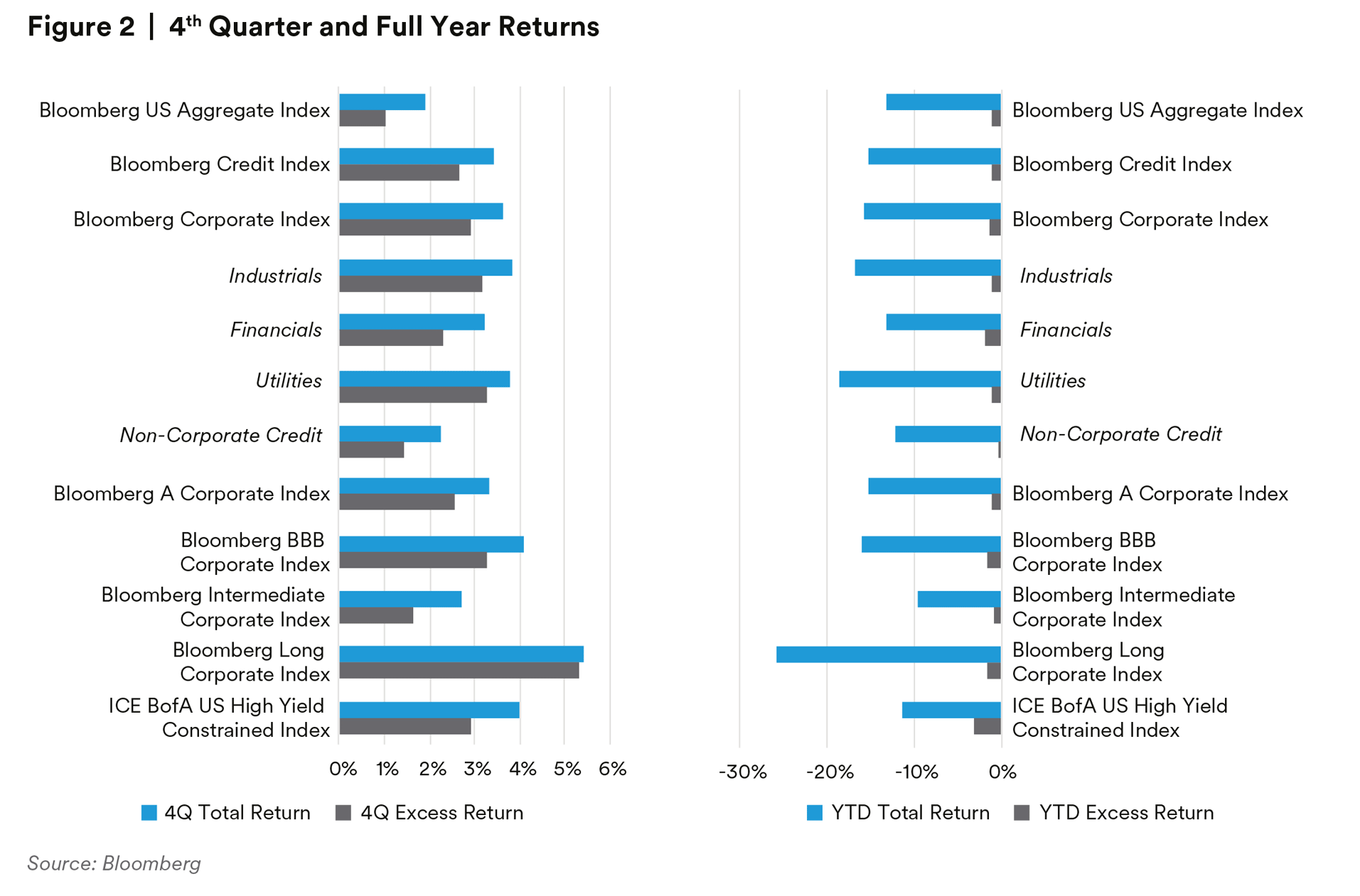

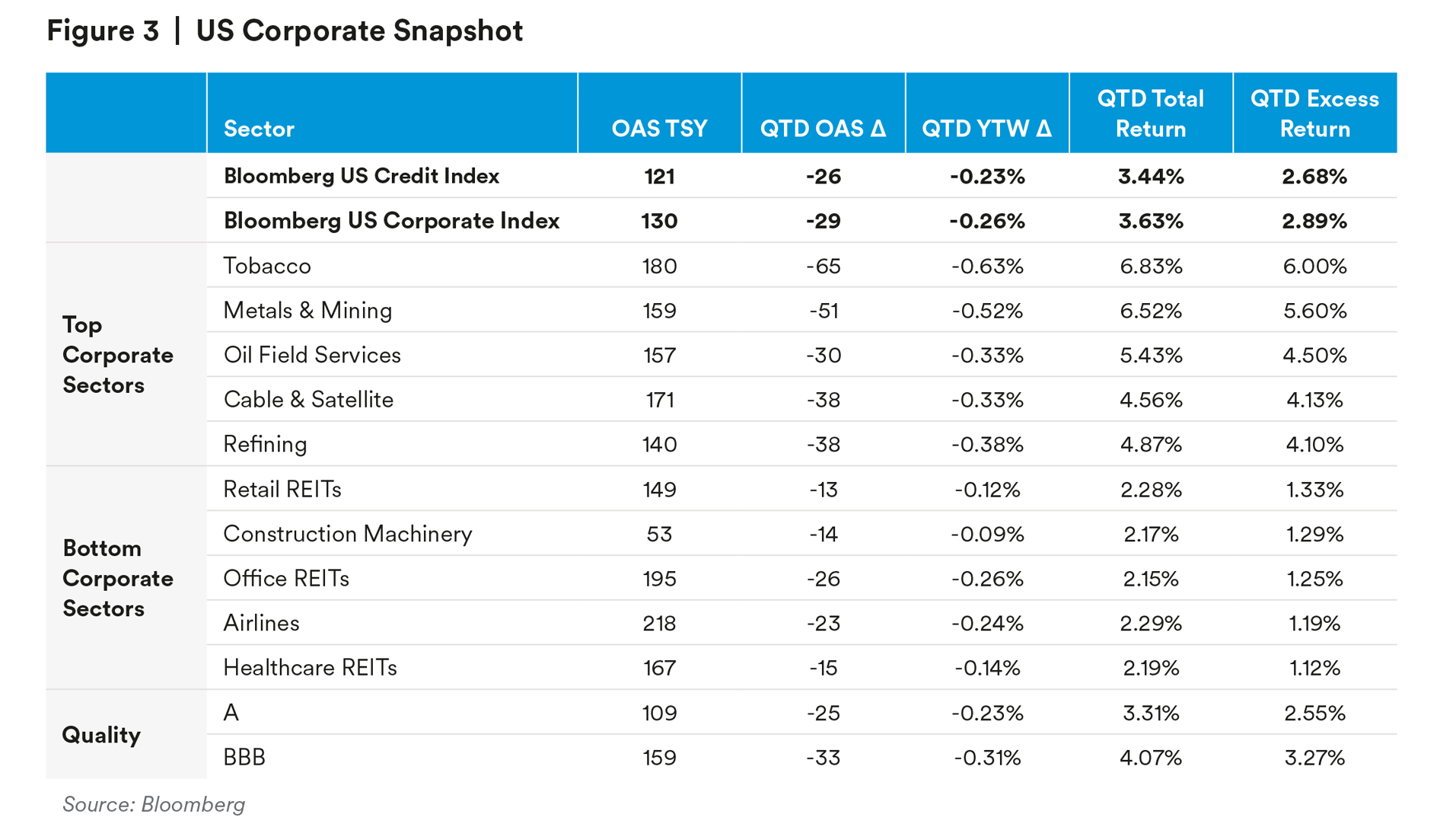

Despite macro uncertainty, Credit markets rallied in the fourth quarter, offsetting much of the negative performance seen in prior quarters. The Bloomberg US Credit Index generated a total return of 3.44% for the quarter and an excess return of 2.68% over similar duration US Treasuries. Spreads slightly widened from 147 basis points at the beginning of the quarter to a wide of 151 basis points in October, then tightened to end the quarter at 121 basis points. Within the index, the Long Corporate segment rebounded and outperformed its shorter-dated counterparts for the first time this year, while BBBs converged closer to single-A credit. At the sector level, Utilities and Industrials outperformed, while Financials lagged the index.2 Within corporate credit, excess returns were positive across all sectors and maturities. Overall, corporate sectors rallied as spreads came off the wides of the year. In Industrials, high beta subsectors such as Tobacco and Cable & Satellite outperformed during the quarter as the overall market rebounded. In Basics, Metals & Mining outperformed during the period amid a rebound in iron ore prices with optimism around China’s reopening and subsequent commodities demand. Despite oil price volatility, commodity-based sectors also outperformed, with Oil Field Services and Refining outperforming within Energy. The low beta REITs space lagged the overall index, especially Healthcare REITs as they continued to be affected by deteriorating tenant health. Additionally, the poor economic outlook led to underperformance in several large-cap issuers. 3

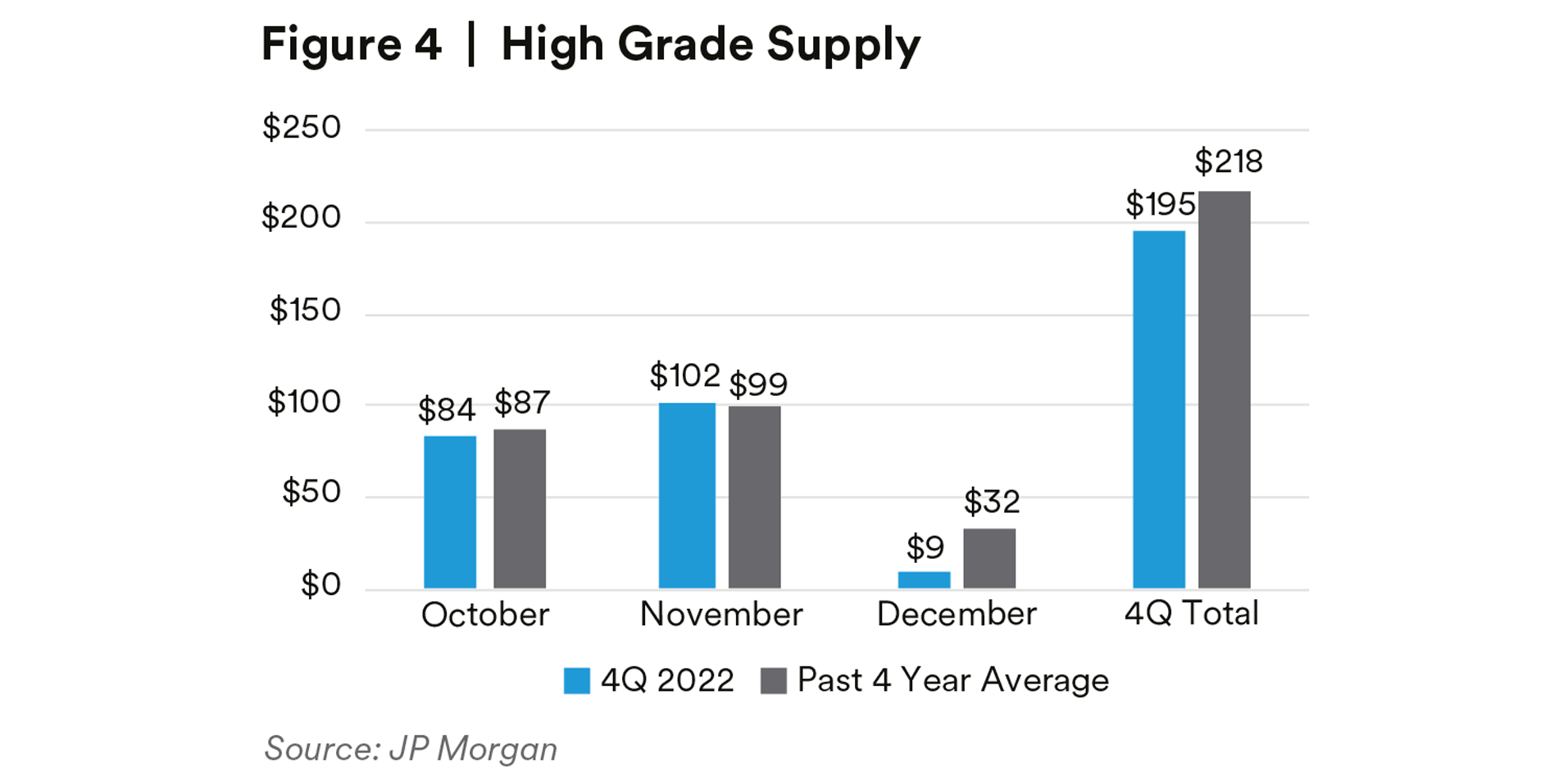

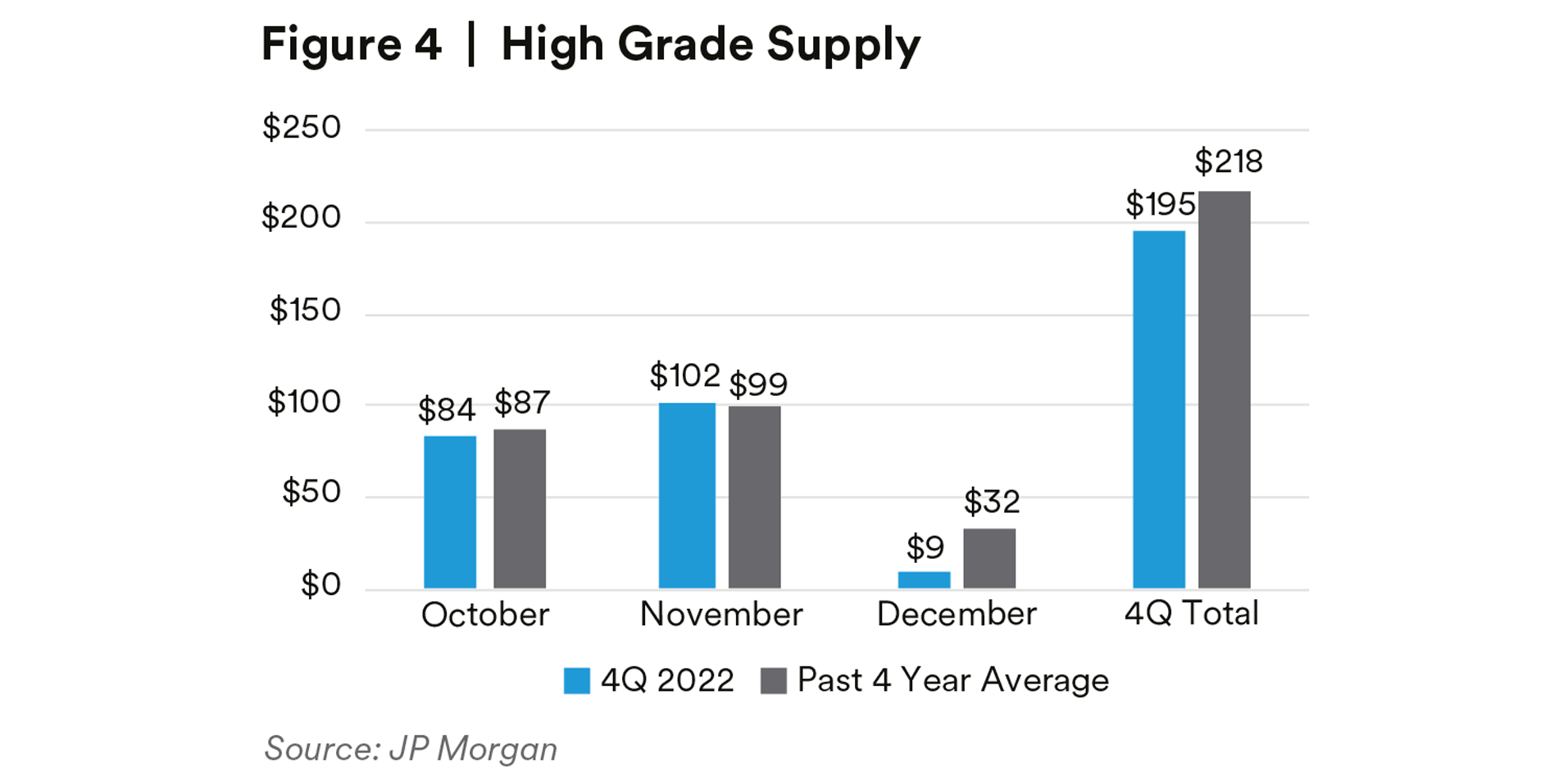

Full year 2022 supply came at $1.2 trillion, which although down 12% year-over-year, was the fourth highest issuance year on record. Financials contributed 49% of total supply, the highest percentage in over 15 years and a record issuance in dollar terms.4

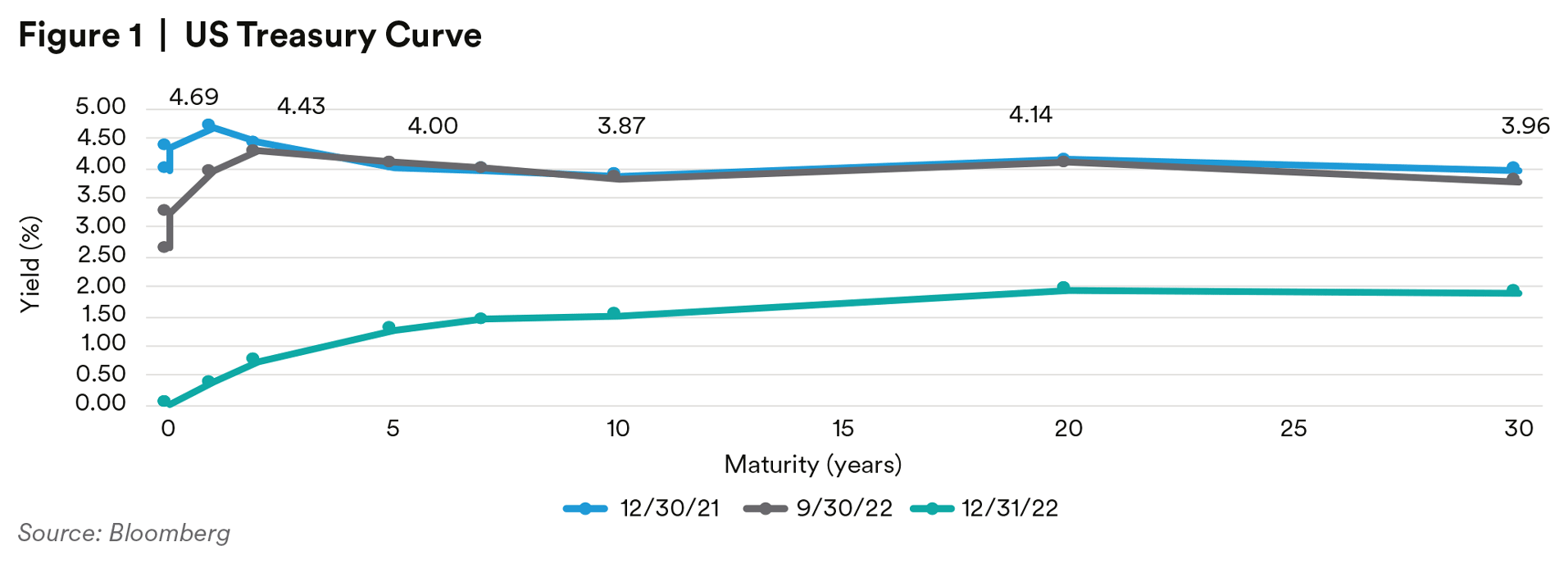

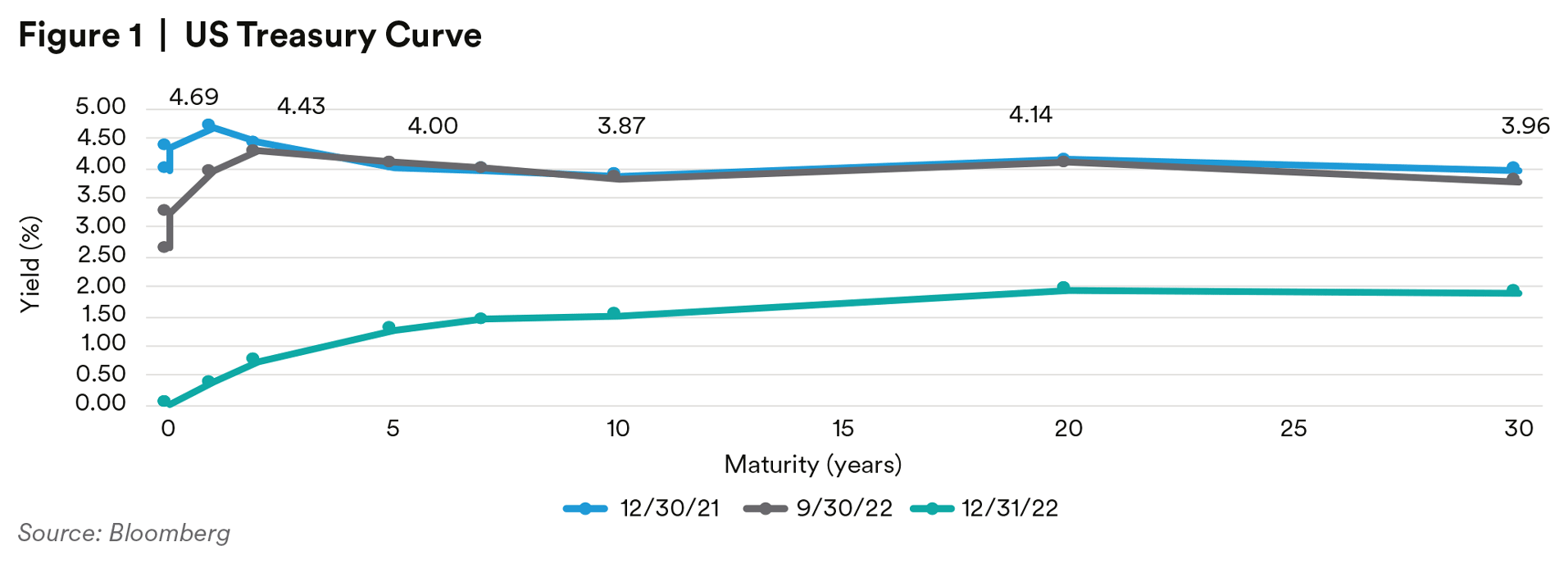

Count us among the many that are happy to turn the page on 2022. It was the worst year ever for total returns in the High Grade market – a market which failed to provide the refuge that is commonly associated with fixed income. We could spill unlimited ink on the unprecedented carnage across global bond markets, but we think it is best to look ahead. 2023 presents an entirely different backdrop for the asset class than one year ago, when we bemoaned the tight valuations, paltry yields, and limited opportunity set. Two of these three conditions have changed in a dramatic and positive fashion – there is once again yield in the market and the opportunity set is plentiful. Gone are the days of strategists quoting the global market size of negative yielding debt. The phrase “reach for yield” can be retired right alongside “TINA”. The alternatives to equities are plentiful, and bonds, dare we say, are cool again.

We believe the ability to generate compelling total returns in fixed income can be found across the maturity and quality spectrum. In credit, dispersion is prevalent, and the market is willing to differentiate sectors and issuers based on their underlying fundamentals. This was evident most of last year as well, with the correlation between spreads and spread directionality breaking down. Said another way, prior history would suggest that a year of wider spreads should have led to underperformance of lower quality, wide trading sectors such as Independent Energy and Metals & Mining and outperformance of a higher quality, tight trading sectors such as Healthcare and Banking. However, this playbook did not hold true last year, and we expect differentiated performance again this year. Security selection will matter in 2023.

That is not to suggest this market is ready to look past the macro factors that have been a driving force in the market for the last three years. The macro backdrop will likely play a starring role again, and though the drivers are well understood, the outcomes and timing are not. Central banks across the globe are still tightening, though the Fed is clearly in the later innings of its hiking cycle. Frankly we are not overly focused on the precision of the terminal rate forecasts. We do; however, struggle to embrace the market’s optimism for a Fed “pivot”. The most damaging thing the Fed can do to the economy is to cut rates before inflation is tamed. Curiously, many market participants have seemingly been unwilling to heed the repeated emphasis from Fed speakers on the importance of their mission. We choose to take them at their word (alongside our belief that they will take all precautions to not tarnish their legacy) and so we do not believe a near term “pivot” will be the magic elixir the market is seeking. Rather, this lengthy and painstaking process to reduce inflation requires a growth slowdown and higher unemployment. Of course, those are not underlying conditions that would generally cause us to scream “BUY CREDIT” from the rooftops – unless we were being appropriately compensated, which unfortunately is not the case currently.

In our view, valuations, much like at the start of 2022, are not appropriately reflecting the risks in the market. We are the first to admit we staked a similar claim in last quarter’s review, only to witness the first quarter of spread tightening since mid-2021. Tighter spreads only reinforce our conviction that there will be a better entry point for credit in the months ahead. Corporate spreads at a 130 OAS are merely bumping up against their average of the last decade, but we suggest these are anything but average times. It is widely expected that we will likely enter into a recession this year, and fundamentals should gradually erode as margins come under pressure – though they are starting from a fairly healthy place. Volatility will likely remain elevated as the market hangs on every economic data release to glean further insight into the evolution of Fed policy adjustments. This will likely lead to periods of market stress and dislocations. Thus, we do not believe the right question to ask is whether spreads will widen at some point in 2023, but rather to what extent?

All of this being said, we acknowledge the answer and timing here is more art than science. Previous periods of market stress this decade have seen credit spreads surpass 200 basis points. In gambling parlance, we will take the under, as the underlying structural demand for credit will likely be too powerful to allow for a meaningful drawdown. Despite the recent rally off the highs, yield sensitive investors can still invest at levels of yield not seen since the Great Financial Crisis. Additionally, given the extremely challenging outlook for equities, fixed income is likely to regain its status as a safe haven for retail investors, buttressed by historically elevated breakeven spreads that will provide a cushion against the wider spread environment we envision and potentially equity-like total returns. These tailwinds are likely to overwhelm a decline in foreign demand on back of higher hedging costs.

However, our gameplan is not to pick a level and sit on our hands until we get there, but rather to gradually reallocate our healthy allocation to Treasuries into credit at progressively wider spreads. We do not know precisely when spread widening will occur, but we do know we are being compensated for our patience with a healthy yield advantage. Our favored place right now continues to be on the front end of the credit curve where we can take advantage of inverted yield curves and clear short-term visibility. Additionally, we remain focused on rotating the portfolio into credits that are best positioned to weather a rocky economic backdrop. The ability to maneuver the portfolio is largely synonymous with the liquidity of positions, and so even though liquidity premiums are gradually expanding, we believe this adjustment period is likely only in the middle innings. With that in mind, we are most focused on using the primary market as our preferred vehicle for risk addition. The primary market should be active, particularly in the first quarter as issuers look to take advantage of relative calm and depressed spreads. For those portfolios that allow for out-of-benchmark exposures, we are finding ample opportunities within the High Grade market and do not believe the additional compensation in the High Yield market is worthy of an increased allocation.

In all, 2023 promises to be an eventful year. We enter the year with firm conviction that we have built portfolios with issuers who are well positioned for an economy on the brink of recession – albeit one likely to cause much less damage to credit than previous episodes. Of equal importance will be seeking to avoid those issuers that are likely to struggle under such conditions. We think that our healthy liquidity profile (via a Treasury allocation) and significant yield advantage leave us well positioned to increase credit exposure at more attractive valuations.

Endnotes

1 Bloomberg

2 Bloomberg

3 Bloomberg

4 JP Morgan

Disclosures

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”) solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Particular risks of investing in emerging market securities include: smaller market capitalization of securities markets; potential for significant price volatility: potential restrictions on foreign investment; political instability; and possible seizure of a company’s assets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyodaku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. Unless otherwise stated, none of the authors of the articles on these pages are regulated in Ireland.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.