BNPL – Gen Z’s Credit Card Alternative

BNPL loans allow consumers to split transactions (typically less than $1,000) into smaller installments, usually four, spread over a few weeks. BNPL is appealing compared to traditional credit cards or installment loans for a few reasons.

First, BNPL loans have faster and easier approval processes and high approval rates (~70%+). The services can be easily accessed from merchants’ websites directly at checkout or through a lender’s app, and only basic personal information is required. Some firms do no credit checks at all, while others perform soft pulls; a borrower’s repayment history with a lender can also be used for underwriting and credit increases. Historically, loans were not reported on credit reports.

Additionally, BNPL loans do not generally charge interest, giving consumers fixed and predictable payments. Firms make money from merchant fees and commonly charge fees for late payments. Avoiding the variable APR of credit cards is especially appealing in the current rate environment.

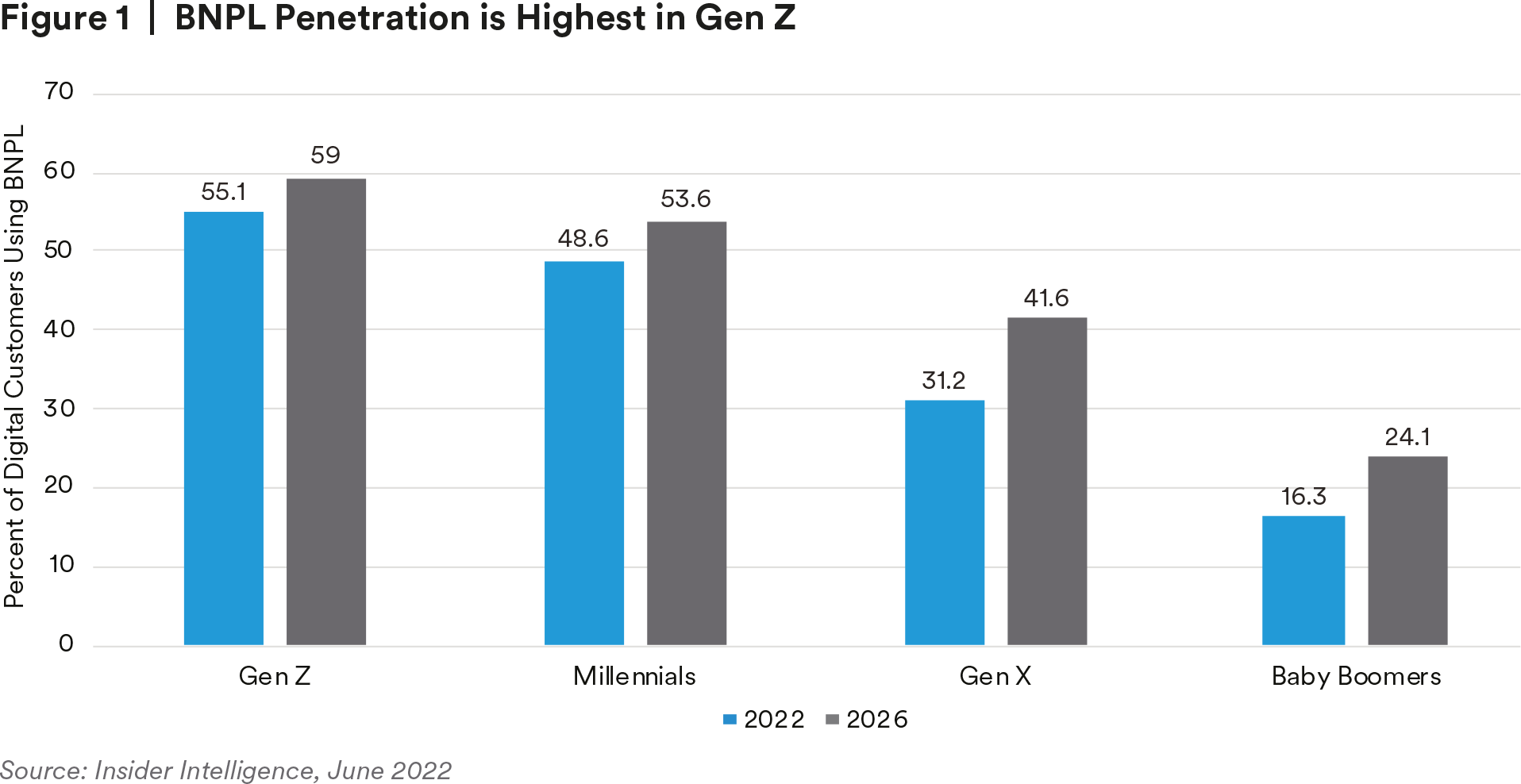

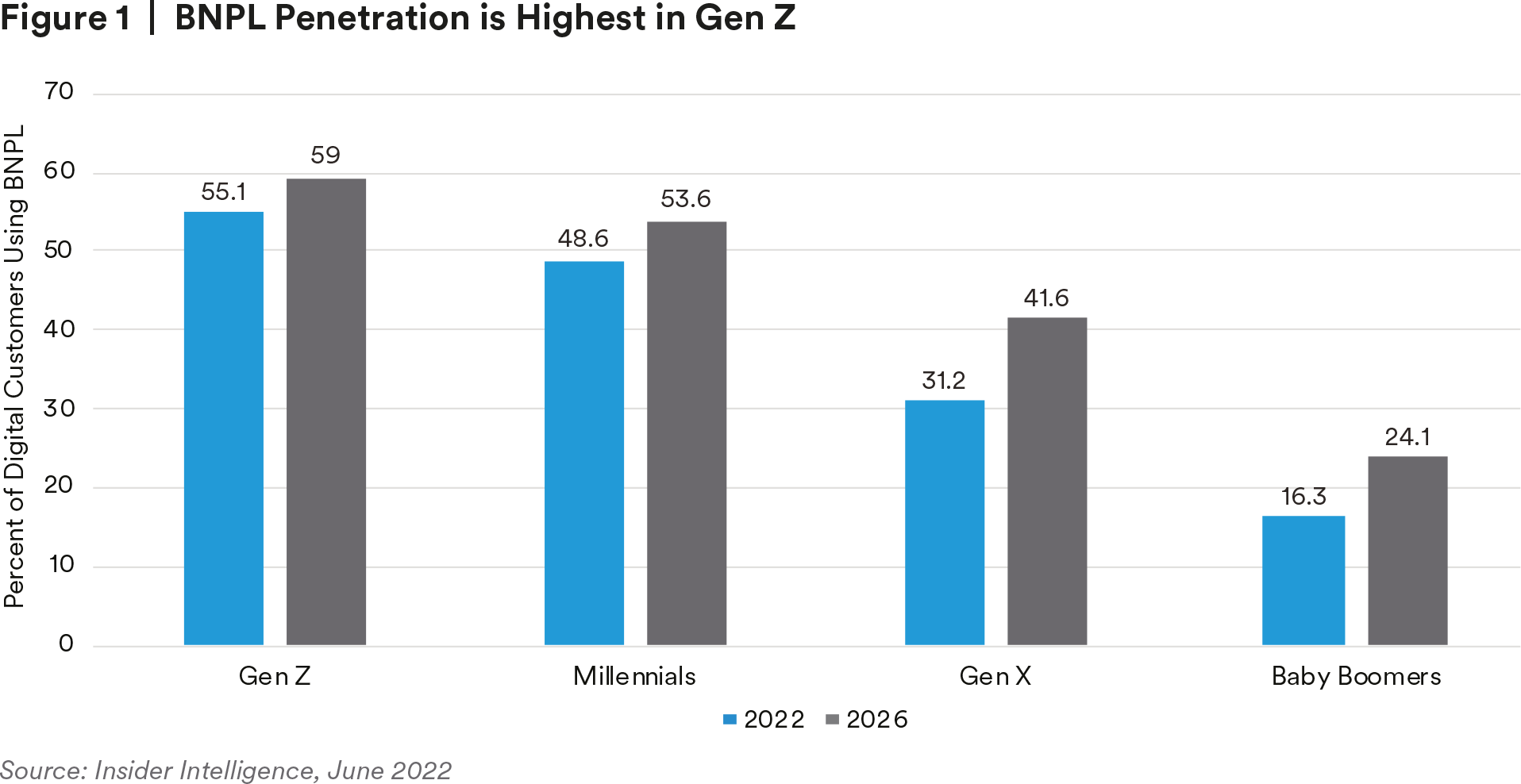

These characteristics make BNPL services particularly attractive to borrowers who have lower incomes or lower credit scores, are credit averse, or simply younger and financially less established. In 2021, 49.4% of BNPL borrowers from five, large lenders were under 33 years of age, and 55.1% of Gen Z is predicted to use a BNPL service at least once in 2022.1 Borrowers that had a very poor-to-fair, self-reported credit score, were not college educated and had a family income less than $50,000 (roughly the bottom-40% of earners), were more likely to use BNPL services.2 Half of BNPL borrowers struggle with monthly bills.3

The BNPL industry grew rapidly as an alternative to credit cards during the pandemic online shopping boom, but more competition (from both traditional finance and fintech firms) has caused consolidation as the industry matures. A CFPB report on five, large BNPL lenders showed originations grew from $2 billion in 2019 to over $24 billion in 2021, consisting of over 180 million loans. Dollar originations for the five lenders grew almost 200% in 2021 alone.4 BNPL volume is currently dwarfed by traditional credit cards, which had a U.S. purchase volume of $4,564 billion in 2021.5 However, total U.S. BNPL transactions are forecast to surpass $100 billion by 2024,6 and the global BNPL market is expected to be worth $3,680 billion by 2030.7

BNPL Consumers Showing Signs of Stress

Macroeconomic headwinds pose challenges to BNPL-using consumers.

Directly, higher inflation disproportionately affects lower- and middle-income consumers. In a 2021 BNPL consumer survey, 46% of respondents indicated they are likely to make a late payment in the next 12 months.8 Another study found 84% of people surveyed used BNPL to make purchases they otherwise would not be able to afford, and 39% say they “regularly” pay late fees due to missed payments.9 According to the Federal Reserve SHED survey, 51% of consumers cited using BNPL services because it was the only way they could afford the transaction.

The effect can be seen from firms’ perspectives as well. BNPL charge-offs (when the lender has very low expectations of collecting) have increased. The charge-off rate for the five lenders in the CFPB report increased to 3.79% in 2021. The trend has extended into 2022: one lender reported its dollar charge-off rate (net charge-offs as a percentage of gross merchandise volume) increased to 3.03% in the first half of 2022, from 2.31% in the second half of last year. Late fees, which will occur before a charge-off, are also increasing; borrowers paying late fees increased by between 3% and 10% between 2020 and 2021. Virtually all BNPL loans are set up with autopay, so a late payment likely indicates a lack of funds rather than the borrower forgetting to make a payment.

Looking Forward: Will the Current Problems Spread?

Even though the BNPL market is still relatively small compared to other traditional credit sources, it is a rapidly growing and dynamic industry especially appealing to younger and/or less financially established consumers. This concentration may make it a useful guide for judging increasing consumer struggles in lower-income quintiles.

While higher-income consumers still have savings and continue to spend, lower- and lowermiddle-income consumers are having more difficulty. Consumer struggles may be moving up the income brackets and signaling the start of a broadening consumer weakness.

Endnotes

1 “Buy Now Pay Later Transactions Will Surpass $100 billion by 2024,” Insider Intelligence, June 2022

2 “Economic Well-Being of U.S. Households (SHED),” Federal Reserve, May 2022

3 Lux, Marshall and Bryan Epps, “Grow Now, Regulate Later? Regulation Urgently Needed to Support Transparency and Sustainable Growth for Buy-Now, Pay-Later,” Harvard Kennedy School, Mossavar-Rahmani Center for Business and Government, April 2022

4 “Buy Now, Pay Later: Market Trends and Consumer Impacts,” CFPB, September 2022

5 “Credit Cards in the U.S.,” Nilson Report, January 2022

6 “Buy Now Pay Later Transactions Will Surpass $100 billion by 2024,” Insider Intelligence, June 2022

7 “Buy Now Pay Later Market Size is projected to reach USD 3.68 Trillion by 2030, growing at a CAGR of 45%: Straits Research,” Global Newswire, July 2022.

8 “Buy Now, Pay Later Statistics and User Habits,” C+R Research, 2021

9 Manya Saini, “U.S. BNPL consumer debt set to hit $15 bln by 2025 – study,” Reuters, September 2022

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”) solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyodaku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414. For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.

Unless otherwise noted, none of the authors of the articles on this page are regulated in Ireland.