In Europe, we believe risks related to the region’s energy security are now lower than they appeared in January. However, the Russia-Ukraine war grinds on and continues to represent a highly unpredictable situation for the region. Moreover, inflation has proven to be stickier than generally expected so far this year, and we judge the risks related to controlling inflation to be as elevated as in January. While the EU and U.K. financial systems have so far proven to be largely resilient to spillovers from intensified periods of stress in the U.S. banking system earlier this year, they share market risks related to the adjustments resulting from a rapid tightening of monetary policy.

In Asia, our primary concern is the headline risk associated with the escalating tension between China and the U.S. We believe risks have increased since our January report as the two countries have failed to establish guardrails to the evolving relationship.

Risk: Central Banks Fail to Tame Inflation

In our January Global Risks 2023 report, we expressed concern about the possibility of central banks failing to get inflation under control despite sustained efforts to tighten monetary policy.

Six months on, we are more—not less—worried about this possibility, particularly in the U.S., Eurozone and the U.K.

In the U.S., inflation is now substantially lower than it was in January 2023. We believe consumers are worried and saving a higher share of their income. Certain prices—particularly among goods—have weakened as supply-chain stresses have eased, and consumers and businesses have likely become more cautious.

However, inflation has not decelerated at the speed we expected at the beginning of the year. The labor market has remained strong, meaning consumers are likely to continue to have the means to spend. There also remain substantial restraints on supply in certain products—cars and shelter in particular—that are preventing a quick deceleration of prices. Our base case is still that the Fed gets inflation (specifically, core personal consumption expenditures) under 3%, year on year, by December, but we have less conviction about it than we did in January 2023.

The most optimistic reading of elevated inflation at year-end would be that we miss by only a few months, with year-on-year inflation falling below 3% in early 2024. We would expect such an outcome to hew somewhat closely to our own forecast, albeit with our year-end 2023 forecast actualizing instead in early 2024.

In a pessimistic scenario, inflation remains sticky and triggers another round of rate hikes by the Fed. This could mean higher short-term rates and a steeper yield curve inversion. It may also lead to a deeper recession than we currently expect as the Fed applies more pressure to slow demand.

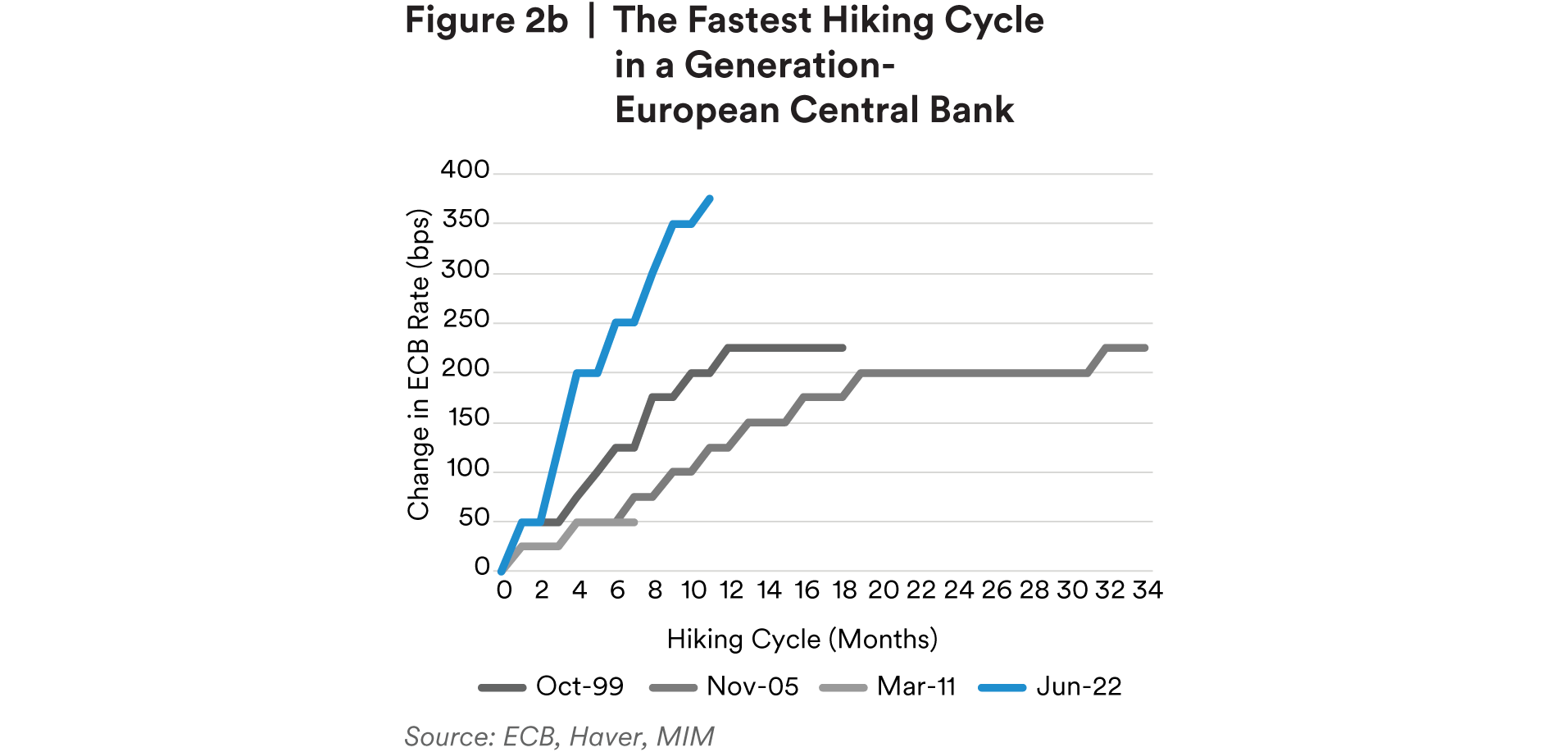

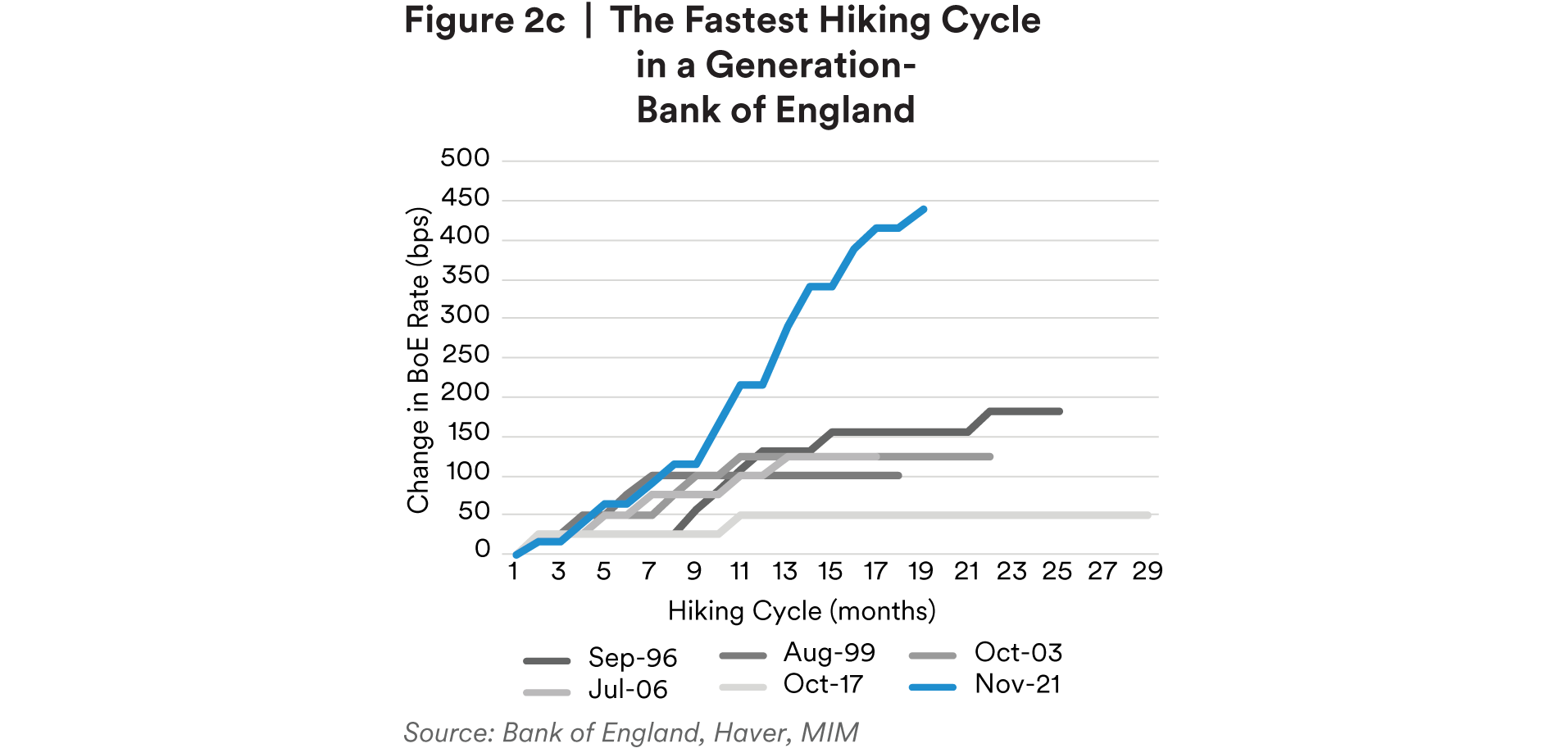

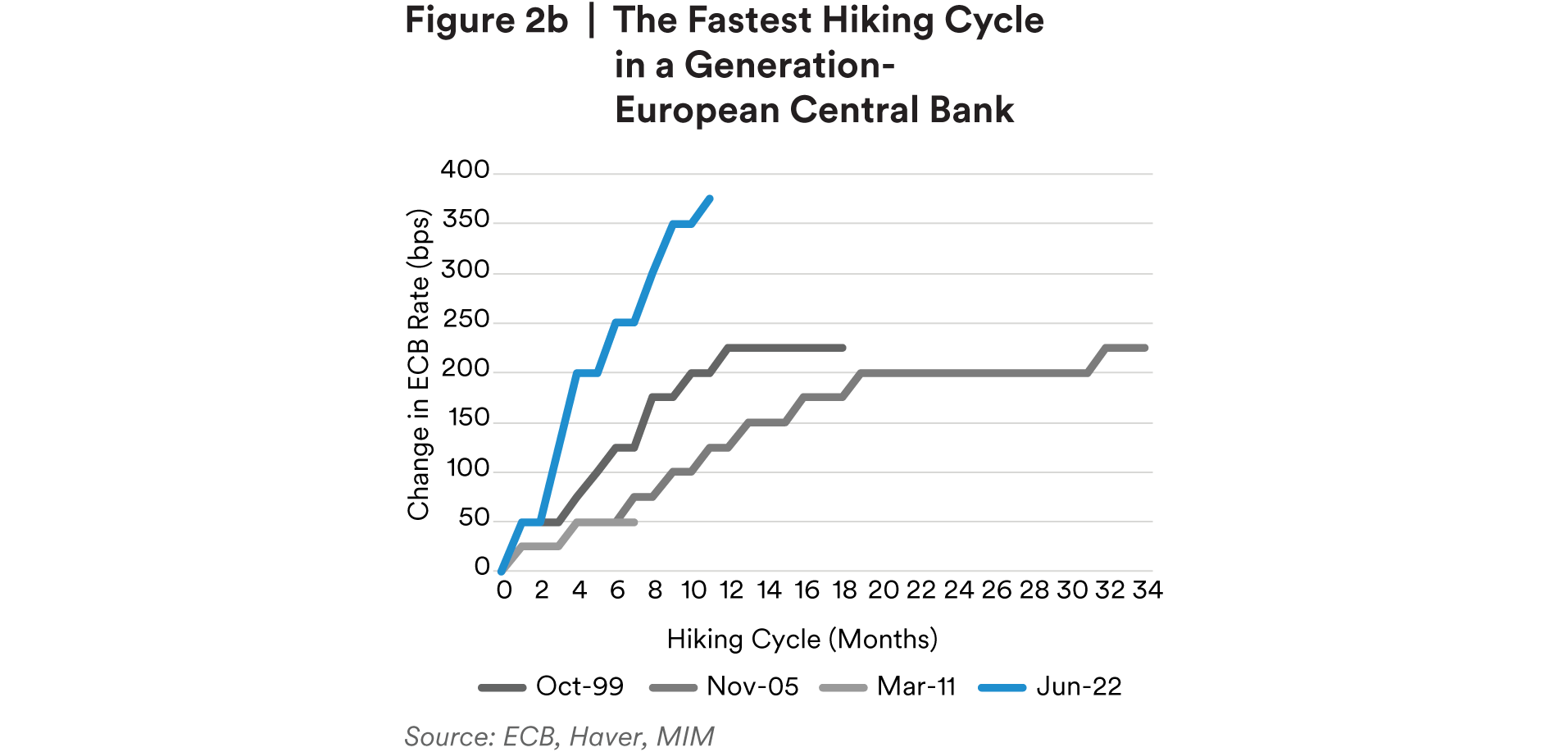

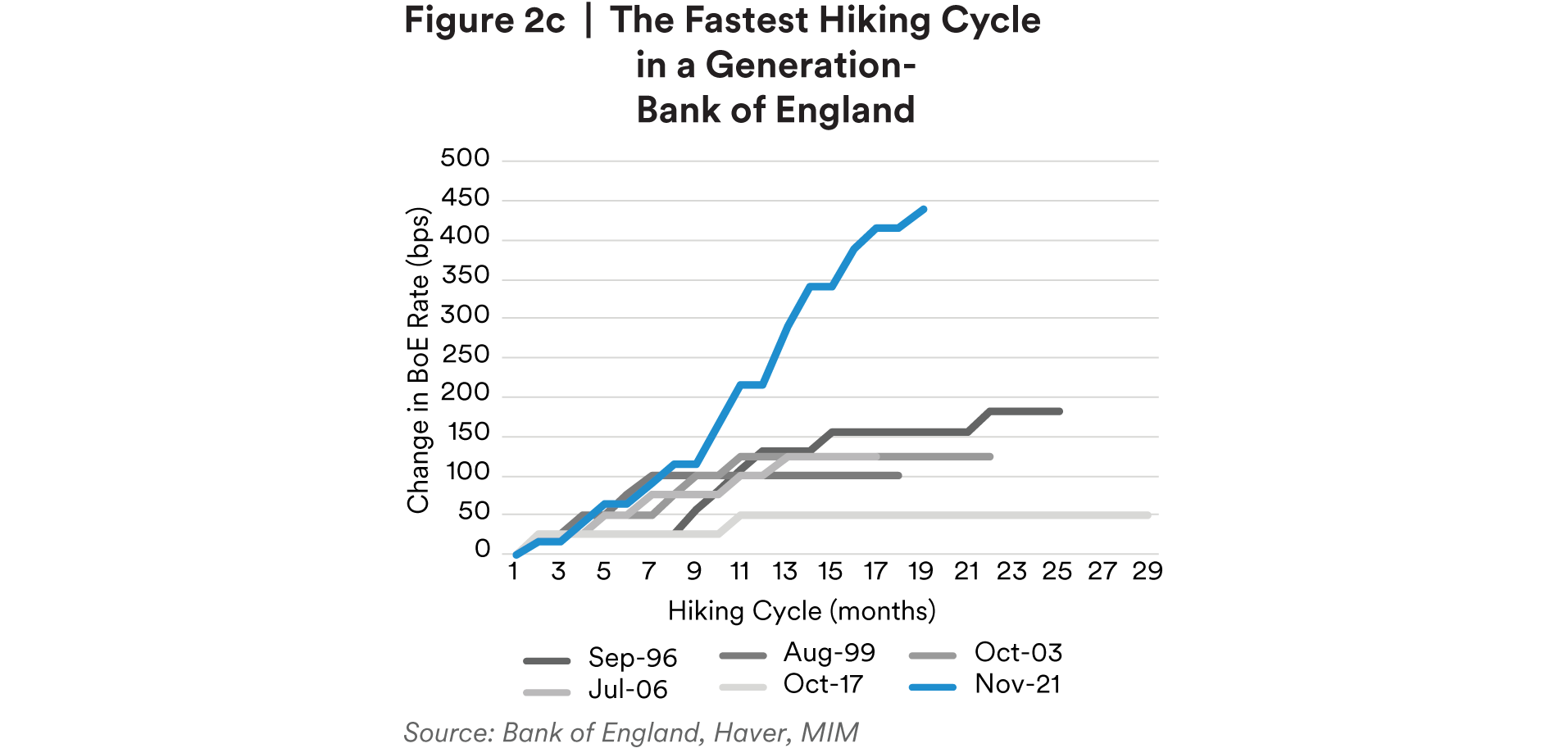

In Europe, the headline disinflation trend looked to be gaining traction, thanks partly to increasingly flattering, year-on-year base effects from the sharp rise in energy prices in 2022. However, both headline and core inflation remain high. We expect that the downward path of headline inflation back to around 2% year on year has been pushed back further into 2024 and is unlikely to be smooth, particularly as the impact of energy-price base effects wanes later this year. Core inflation is expected to remain stubbornly high in both the euro area and the U.K. Elevated services-price inflation remains a challenge in Europe and sensitive to robust wage-growth dynamics at a time when labor markets have yet to weaken from historically tight levels, despite the material monetary policy tightening already undertaken by the Bank of England (BoE) and European Central Bank (ECB).

While we still expect labor markets to weaken over coming quarters, wage growth could well remain sticky well in to 2024, even after demand for employment starts to ease, as employees continue to seek to recover some of the loss of income (in real terms) that they’ve experienced during a prolonged period of high inflation, and employee contracts adjust with a lag in the continent’s relatively regulated labor markets.

We believe there is a risk that both the BoE and ECB may need to keep policy for tighter than longer or implement more rate hikes than currently expected. This would likely generate sharper falls in domestic demand and move inflation sustainably back down to around their policy targets of 2%, albeit with the risk of a more material economic downturn.

Risk: Fallout from Rates Staying Higher for Longer

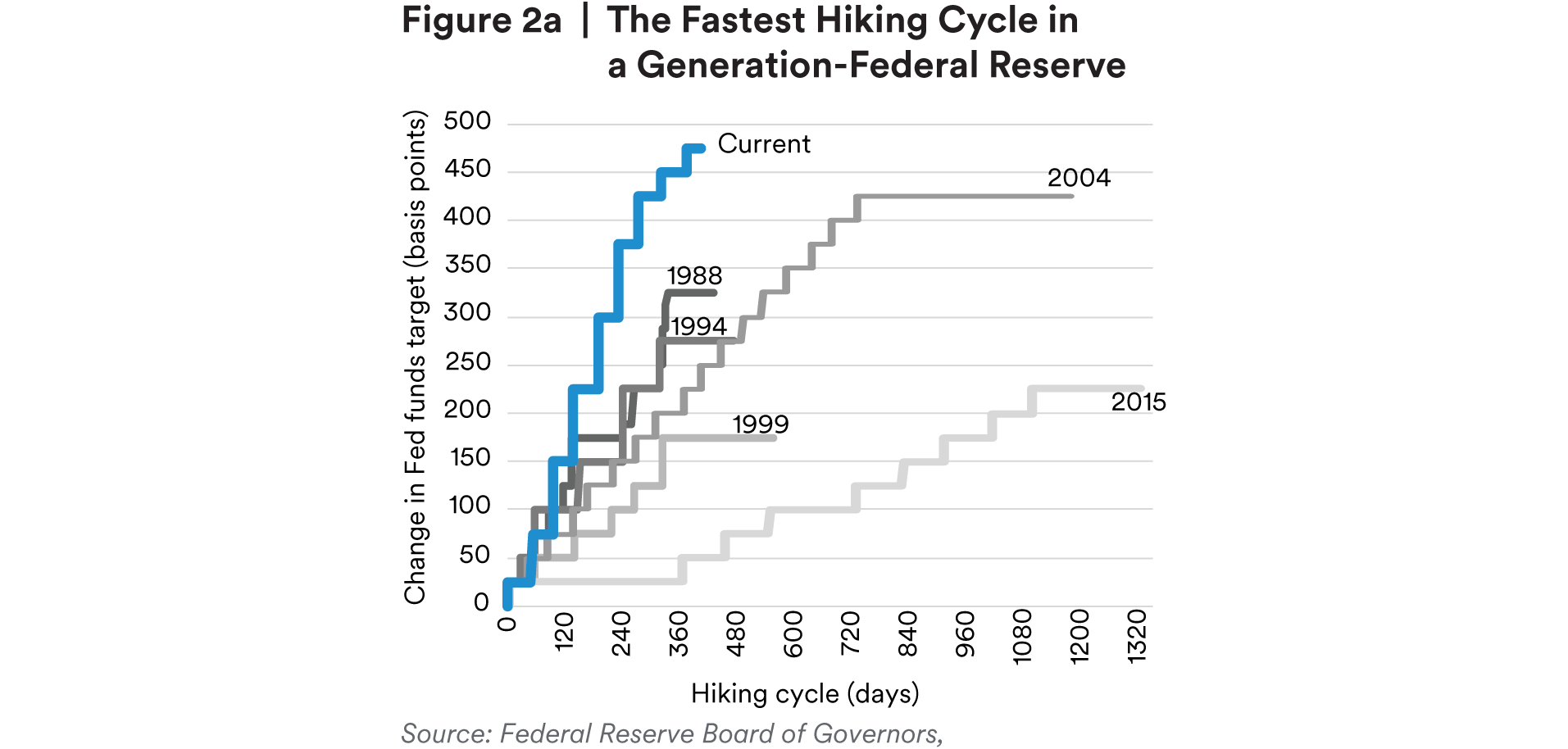

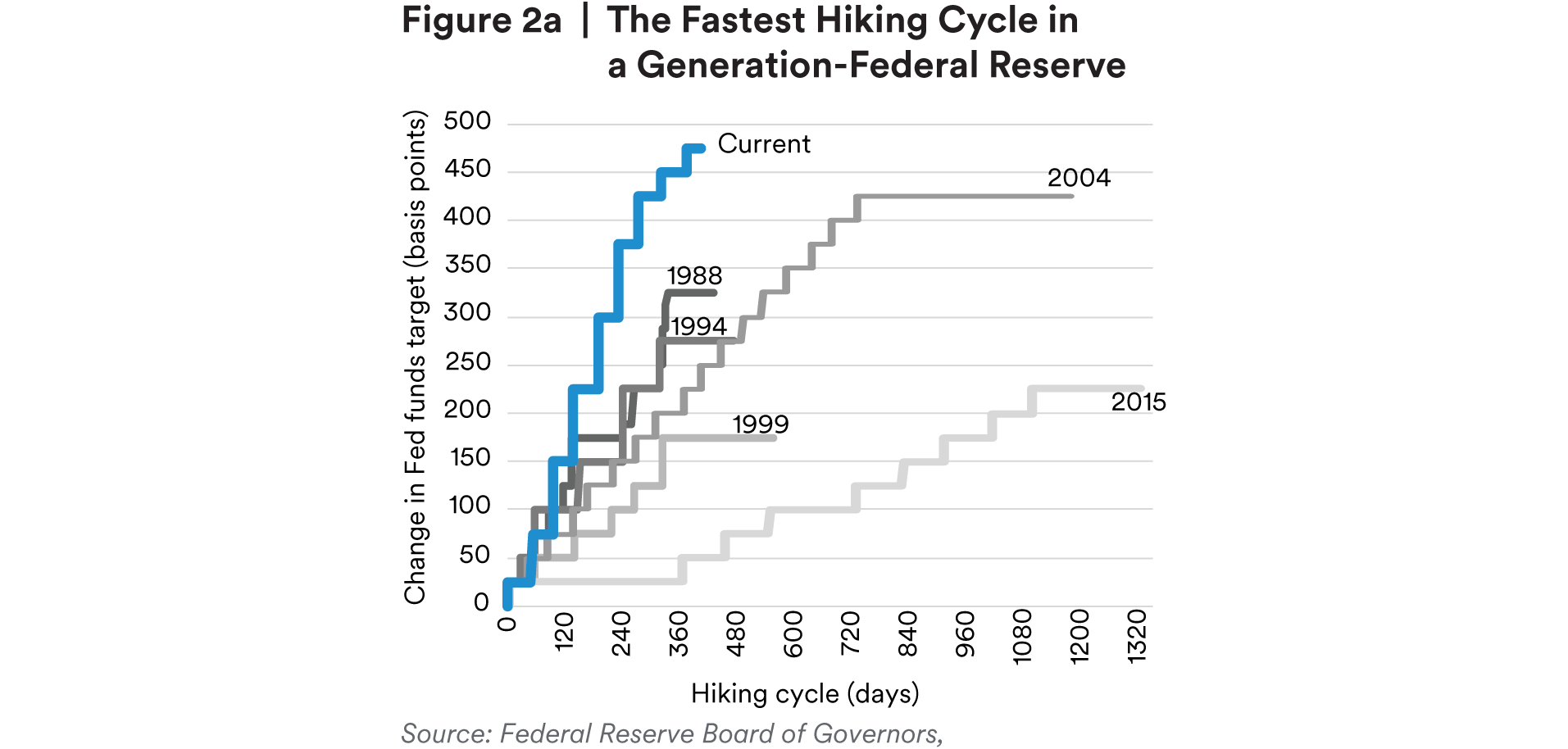

In the current monetary tightening cycle, the Fed has raised rates higher over the shortest period of time since the stagflation era of the 1970s and 1980s. With such a sudden change, it was perhaps inevitable that something “broke”—in this case, that some banks failed. After around 15 years of fed funds rates mostly at zero, companies and households have become conditioned to low rates. We see a risk of economic actors continuing to wait in vain for lower rates.

In the U.S. residential housing market, potential sellers appear to be waiting for rates to fall (and prices to rise) before they sell. A sluggish acceptance of higher rates may mean more stubborn inflation as market normalization drags out.

Financial sector vulnerability remains a significant risk.

As has been well documented, some financial firms, including those in the shadow banking sector, remain vulnerable in a prolonged high-rate environment. This is true both in the U.S. and other countries that are experiencing a sustained and sharp tightening of monetary policy and related tightening of financial conditions.

Acute anxiety about the sector appears to have abated for now, but we see risks of potentially more fallout as rates remain elevated. Commercial real estate and holders of commercial real estate securities are both exposed to the risk of higher-for-longer interest rates.

In Europe, we believe post-Great Financial Crisis financial regulations have improved the resilience of the banking system to shocks. However, the region has experienced periods of stress as rates have risen—witness the U.K. fixed-income market stress in late-2022 and the collapse of Credit Suisse. The risk that stresses in the non-bank financial system could emerge remains an underlying one going into the second half of the year, as policy interest rates continue to rise, and the ECB and BoE accelerate their quantitative tightening (QT) programs. As in the U.S., we believe markets and economies in Europe have yet to fully absorb the lagged impact of a relatively rapid period of monetary policy tightening—one that started less than a year ago—in July 2022 at the ECB, and at the end of 2022 at the BoE.

Moreover, while household balance sheets on the whole appear resilient, higher rates and tighter financing conditions are negatively affecting the region’s property sector, with many markets now experiencing falling house prices after a prolonged period of appreciation. Risks that underlying inflation could prove harder to tame than currently expected (see above risk), forcing central banks to tighten policy materially further and/or keep rates high for longer, would intensify the challenges facing credit and property markets.

Risk: No Recession in 2023

While our baseline forecast calls for a U.S. recession in the second half of the year, we have raised the risk of no recession in 2023. In our view, two main pathways create this possibility.

First, there is a chance that the Fed executes a soft landing. The successful execution of a soft landing is difficult because it depends on numerous factors coinciding: inflation must fall off as expected; unemployment rates cannot rise significantly; and consumers must remain stable. If everything falls into place, the Fed could hold rates steady to provide stability or even cut rates, resulting in yield curve normalization. We believe the chance of a soft landing is less than it was at the start of the year, but the possibility remains.

While a soft landing may be the “ideal” macroeconomic outcome, the effects of one may be unevenly distributed across the economy. Any increase in unemployment may be limited to lower-paid workers or to interest-rate sensitive sectors like financial services or real estate. Manufacturing is already effectively experiencing a recession, while services may escape. Further down the road, the fed funds rate cuts that are expected by both the Fed and the markets may not be needed, leading to relatively high rates at the short end of the yield curve.

The second pathway we foresee is the Fed needing more time to get inflation under control, delaying the onset of a recession. This would delay a recession out to 2024, although we expect the characteristics of the recession to be similar to the one in our baseline forecast. The Fed may also implement a few additional rate hikes by the end of the year in order to bring inflation fully under control. We attach more probability to this scenario than the soft-landing one, implying that the increase in our no-recession-in-2023 risk is not necessarily benign with respect to the struggle against inflation.

Risk: Ongoing Headline Risk from Political Tensions Between the United States and China

We believe U.S.-China tensions have worsened since the January 2023 edition of our Global Risks series. Both the White House and Congress have taken increasingly assertive action toward China to protect U.S. economic and national security interests. The Biden Administration has stepped up efforts to contain China’s technological advancement, including expanded restrictions on exports of advanced semiconductors and manufacturing equipment to China. More recently, a “new Washington consensus” has emerged, reflecting, in our view, a more confrontational China policy and an explicit pivot toward domestic industrial policy and broader national security alignment. Beijing’s decision to blacklist U.S. semiconductor company Micron was seen as retaliation for Washington’s more assertive posture. Raids of U.S. consultancy firms in China are also seen as forms of retaliation against regulatory crackdowns on Chinese U.S.-listed companies.

There is some possibility of tensions being mitigated in the coming months. President Biden has spoken of a likely “thaw” in relations, reflecting attempts by both Washington and Beijing to improve bilateral dialogue. Various meetings have taken place in good faith, including between U.S. national security adviser, Jake Sullivan, and China’s top diplomat, Wang Yi. The two countries’ top commerce officials also held talks. It is also hoped that China’s new ambassador to the U.S. will help put the relationship on a more stable footing. Most recently, U.S. Secretary of State Antony Blinken held a series of meetings in Beijing with his counterparts, as well as a short meeting with President Xi, during which Blinken reaffirmed the U.S.’ commitment to the One-China policy. Both sides called the meetings constructive, but significant work remains. However, the stage is now set for additional dialogue, with Secretary of Treasury Janet Yellen also expected to travel to Beijing for meetings.

That said, as U.S. presidential elections approach, tough rhetoric from the U.S. is likely to re-emerge as Congress and the White House attempt to “out-hawk” each other, particularly on issues related to containing China’s tech advancement. As the competition around artificial intelligence (AI) becomes more acute, we believe Washington will be increasingly determined to establish chokepoints to counter China’s development of AI with further export controls that block access to advanced semiconductors. Meanwhile, we believe the lack of more formal “guardrails” or mechanisms for regular communications on key issues of sensitivity, such as Taiwan, expose both sides to ongoing fallout or accidents, including from military excursions in the South China Sea.

Risk: Russia-Ukraine War

In January we highlighted the risk of energy and other commodity price shocks arising from the Russia-Ukraine war. These concerns have largely not come to pass, and Europe emerged from the cold season with gas reserves at relatively high levels (about 20 percentage points above typical levels as the refilling season started). That has reduced our concern that the region will face potential energy shortages in winter 2023/4. However, the risk cannot be entirely discounted. Plans to once again actively reduce consumption of energy later in the year will likely be needed to ensure the sufficiency of supply during the coming winter, particularly in the event of an unusually cold season.

The non-renewal of the Black Sea Grain Initiative continues to pose an upside risk to global, primary commodity prices, as we highlighted in January. The deal has been renewed three times and is up for renewal again in July; however, Russia appears increasingly reluctant to extend. Combined with the potential negative impact of the destruction of the Kakhovka dam on Ukraine’s agricultural output and grain storage facilities, as well as predicted El Nino weather patterns, an ultimate failure of the Black Sea Grain deal could see food prices move sharply higher.

Our baseline expectation is that the war in Ukraine will continue into 2024 without a ceasefire. Ukraine is in the early stages of a counteroffensive, deploying newly formed battalions trained and equipped with Western military hardware. The outcome of this operation will have important ramifications. Incentives for Ukraine to engage in ceasefire talks may increase toward the end of the year if it becomes clear that the pipeline of weapons deliveries from Western backers is starting to dry up. This could arise from a shift in U.S. domestic politics in the runup to the 2024 elections, or a growing consensus that neither side is able to make significant gains in the wake of a lackluster summer counteroffensive. By contrast, a successful counteroffensive—one that recaptures significant territory—may encourage Ukraine’s backers to keep the pipeline of weapons systems supplied for a further push in 2024.

In an alternative scenario of a ceasefire being agreed in late 2023, it would be very fragile in our view, given that both sides would likely see it primarily as an opportunity to regroup rather than as a path to a sustainable peace agreement. That said, this scenario may be taken positively by the markets. In a tail-risk scenario of a major escalation of the conflict (such as the use of tactical nuclear weapons in the battlefield, or direct Russian action against NATO member countries’ infrastructure), the market response would likely be a dramatic flight to safety, given the unprecedented nature of the crisis. We assign a low, but non-negligible, risk to this scenario.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of March 31, 2023, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC