Investment-driven growth combined with labor market friction could mean that both sides of the Fed’s mandates remain under threat throughout the year.

In our base case, we expect the investment growth we saw in 2025 to continue into 2026, driven by AI as well as new rules about R&D expensing taking effect. Supply and demand for labor both fell in tandem in 2025, keeping the unemployment rate low. In 2026, we expect that balance to continue.

But the risk of labor market deterioration is heightened.

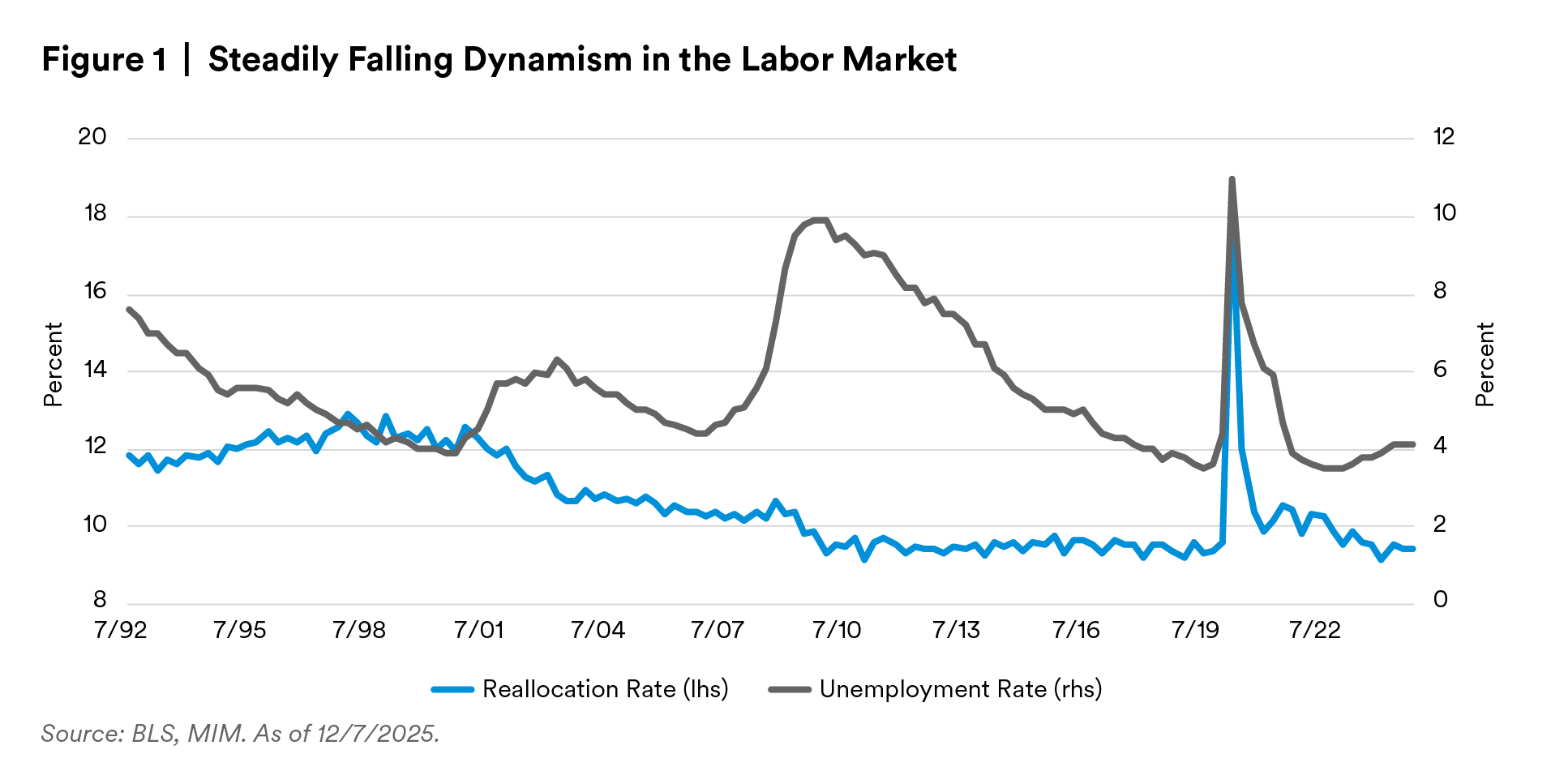

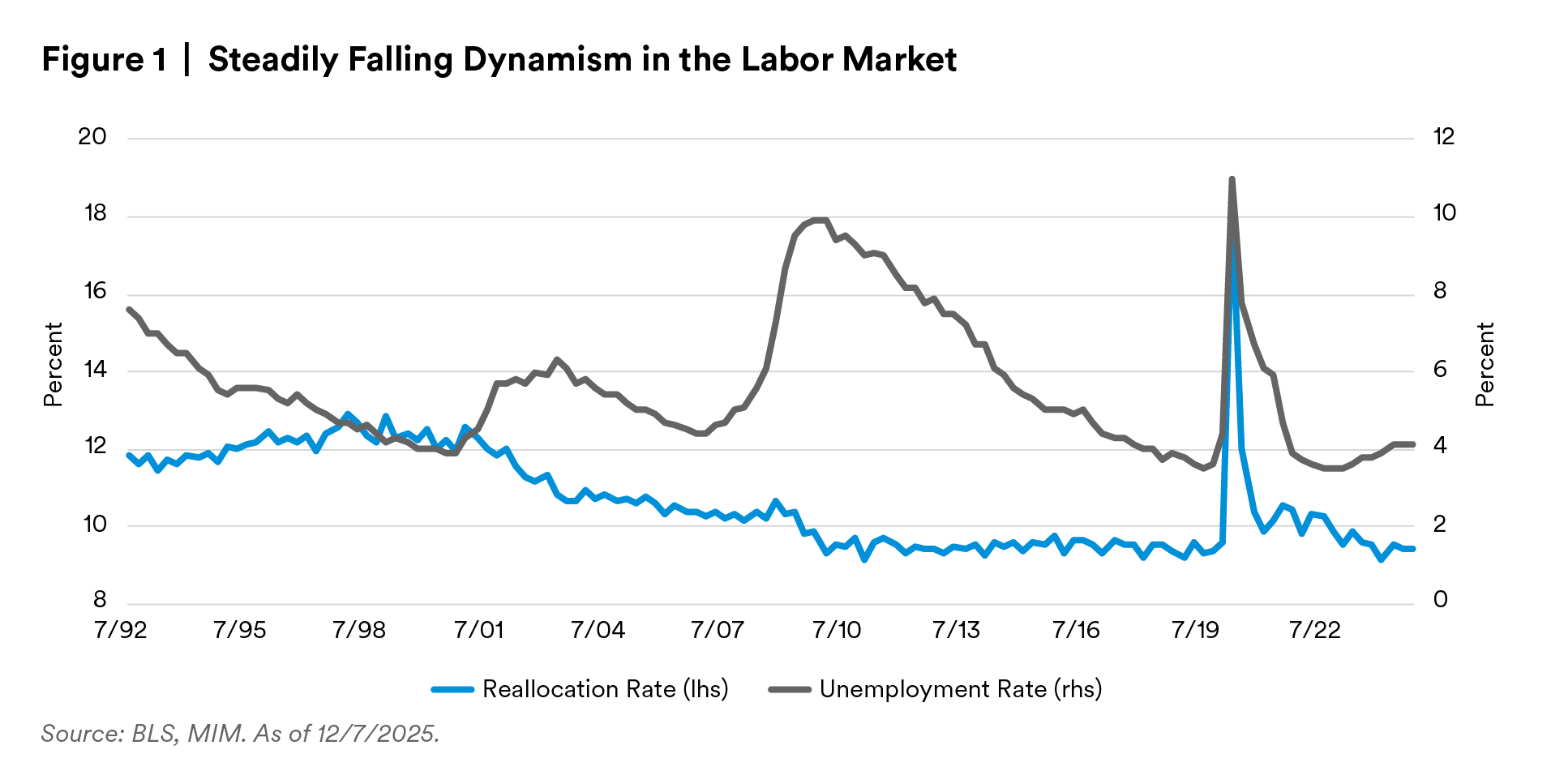

If 2026 is characterized by wider-spread adoption of AI across sectors, then we may see job losses from efficiency gains. Job openings in or using AI would likely increase, but we worry about a mismatch in skills between the job losers and the new jobs openings, which would be difficult to resolve in the near term. The structural mismatch is exacerbated by low labor market dynamism.

In a normal labor market, the impact of a spike in layoffs should be mitigated (to various extents) by workers getting re-hired at other firms. However, in the current environment, which we see continuing into next year, a spike in layoffs may result in an outsized increase in unemployment and a potentially longer recovery because firms are not hiring. Labor market dynamism, as measured by the labor reallocation rate, is likely to stay low.

We are also concerned about dislocations from tariff and immigration policies, which have influenced both the supply and demand of labor. A fuller reckoning may yet become clearer in 2026.

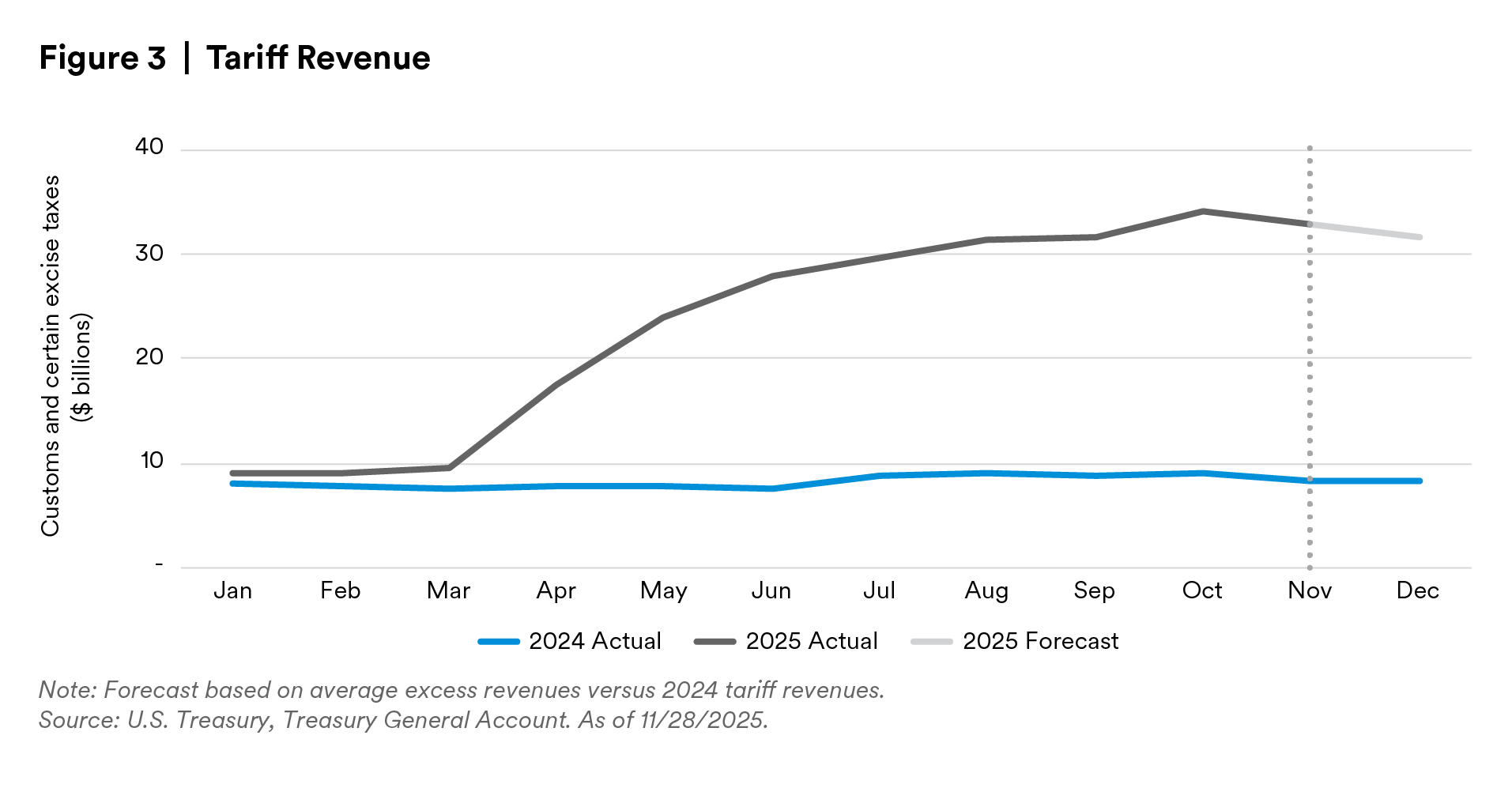

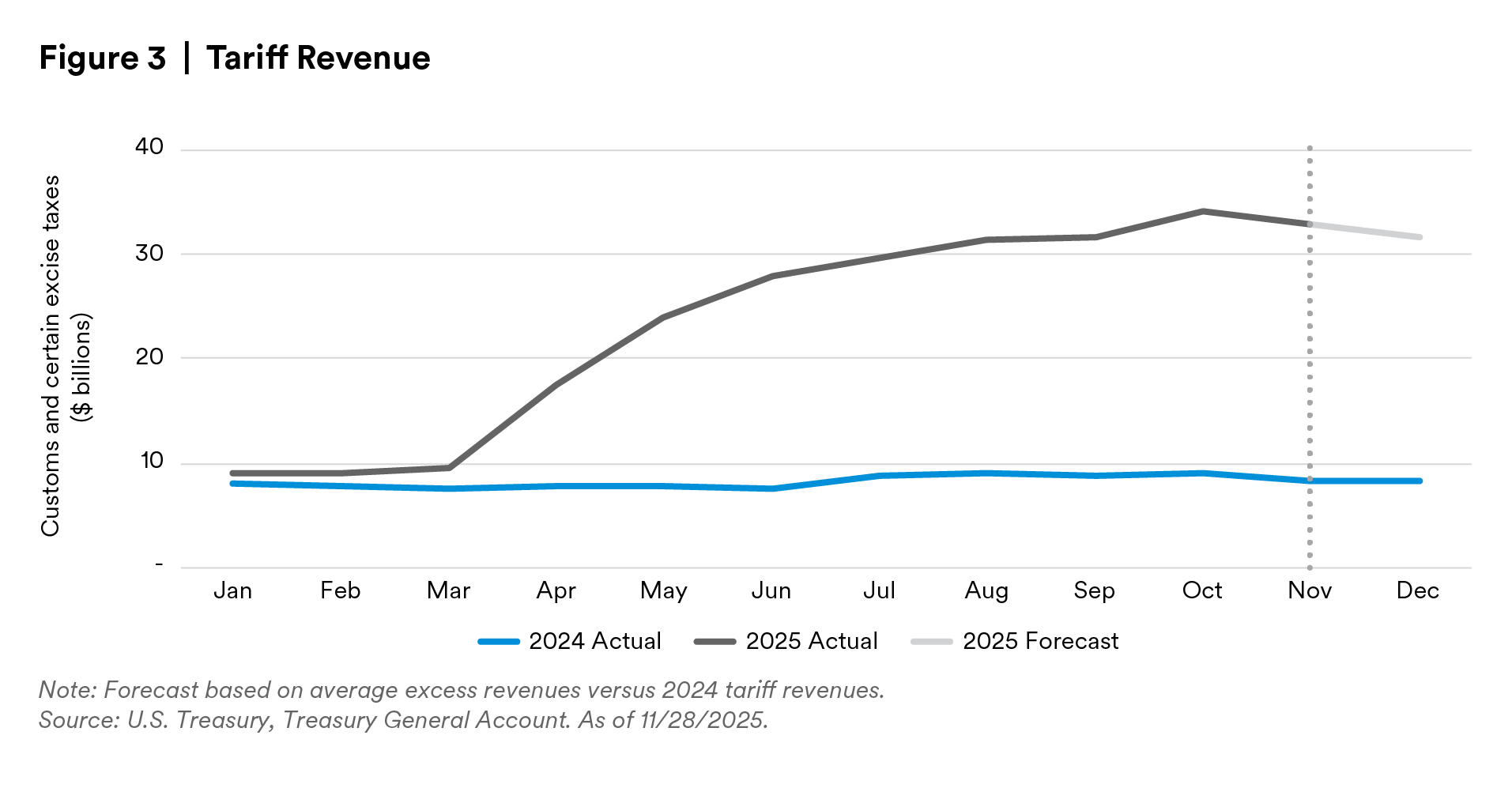

Under our base scenario, companies adapt to the current tariff reality and begin to make longer-term growth decisions, which would be positive for committing to new workers and expanding business. But if tariff policy volatility picks up again, businesses may once again feel the need to protect margins and suspend expansion plans.

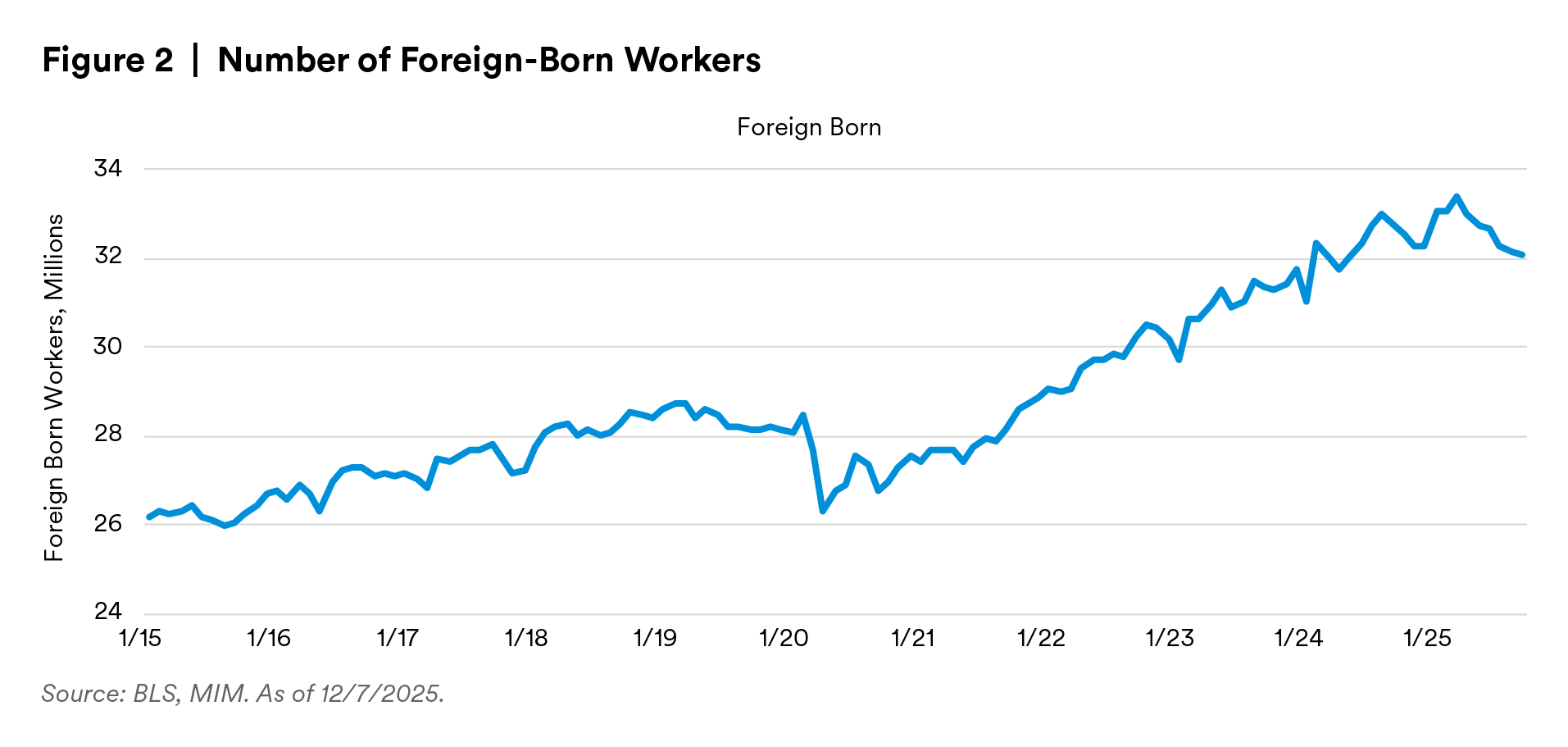

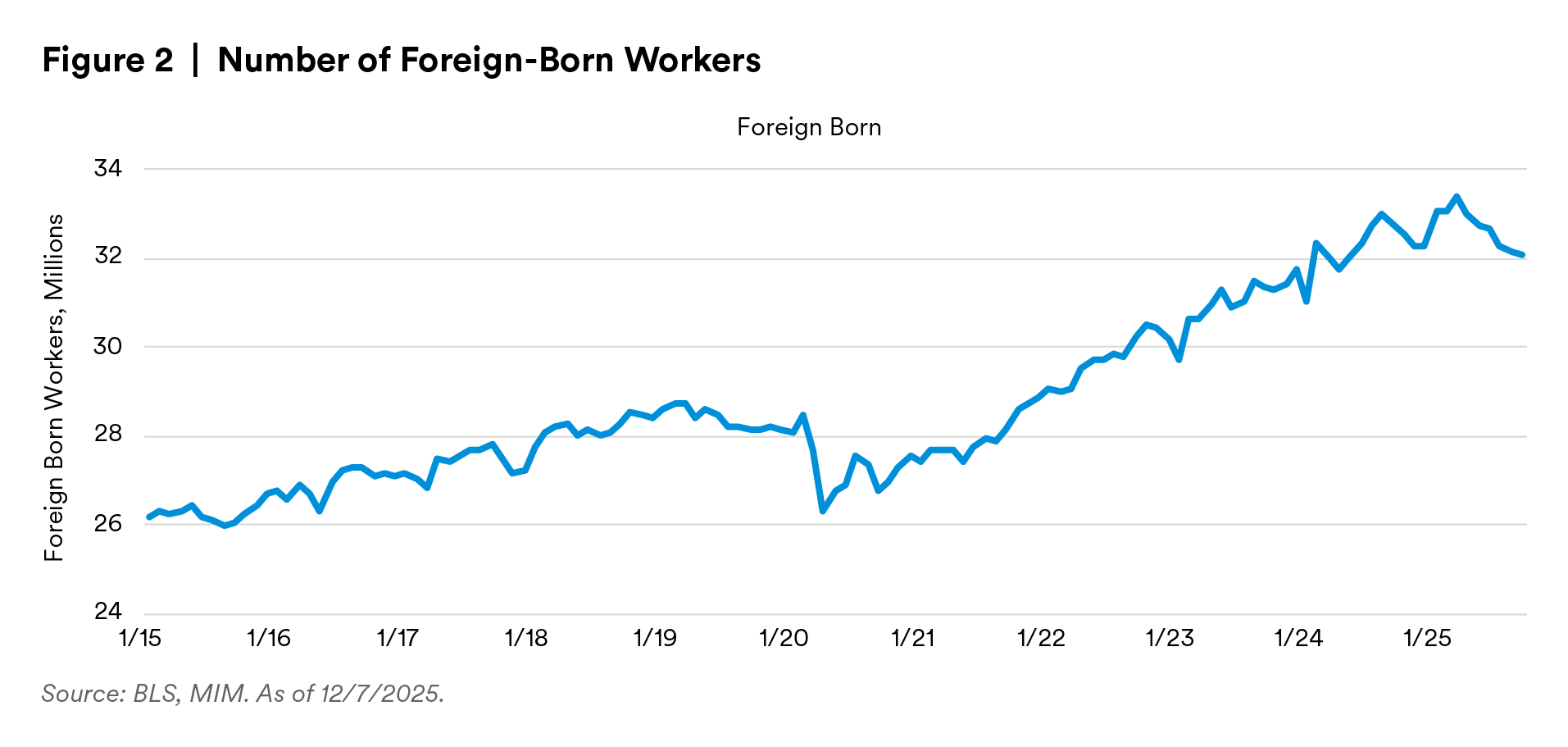

So far, more restrictive immigration policies have not upset labor supply and demand. Over the 12 months ending September 2025, 700,000 foreign-born workers have exited the labor force. Further declines in labor supply among foreign-born workers could upset the balance in the labor market if demand remains stable.

We expect trade policy volatility to continue to settle down, particularly given the upcoming midterm elections in the U.S. and their expected focus on inflation and affordability.

However, we see material risks to this base case. The most significant question is likely the Supreme Court decision on IEEPA, with other risks coming from USMCA negotiations and general trade negotiations with other countries.

On IEEPA tariffs, we are less worried about the Supreme Court ruling against the Trump administration, given the administration’s preparations to find alternative approaches. But if the Supreme Court rules in Trump’s favor, it could result in a qualitative shift in trade policy with tariffs going from a tool of economic regulation to a tool for geopolitics. The historical linkage of tariffs to taxation has enabled a pro-free-trade slant to U.S. commercial policy. If that link is broken, current and future administrations may have free reign to shift away from global trade and subordinate commerce to geopolitics.

There is also the possibility for a ruling that is neither a decisive win for the Trump administration nor for the plaintiffs, but rather something in between. For example, SCOTUS could broadly permit some kind of tariff-like barrier by the executive branch but not the exact approach that is currently being carried out. Or they could let the tariffs stand and force Congress to explicitly take back powers it has delegated to the executive.1

A less consequential, though still relevant, risk for the U.S. is the USMCA extension. We expect that most of the risk is in a positive direction. The Trump administration has already injected substantial uncertainty into the U.S.-Canadian (and Mexican) relationship, where effectively none had existed. If this is resolved with an agreement over USMCA extension, it would herald a reduction in uncertainty. If it is not, there remains a likely scenario that a future administration would have a more sanguine view of the U.S.-Canada relationship and would negotiate it to a new settled agreement.

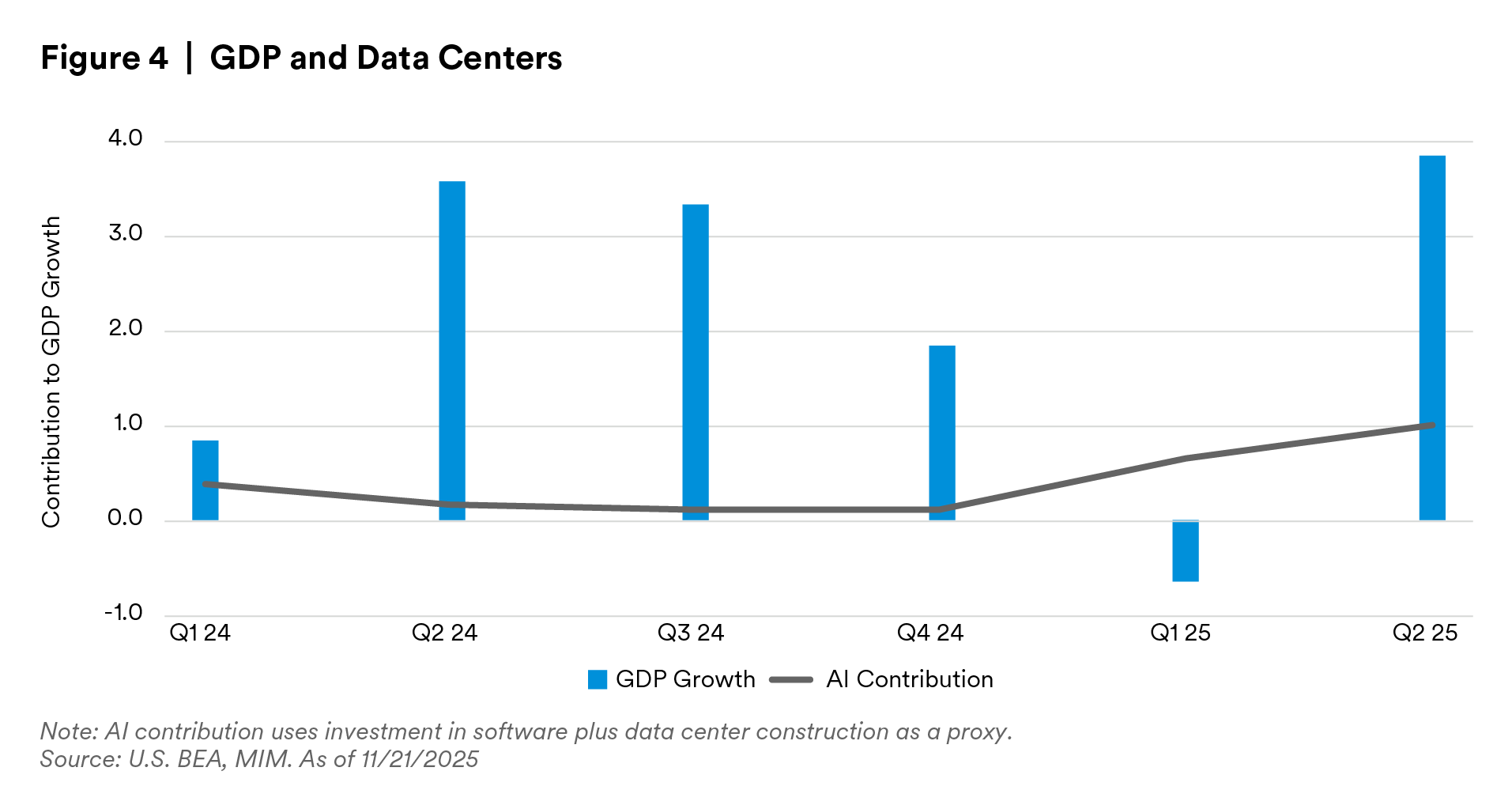

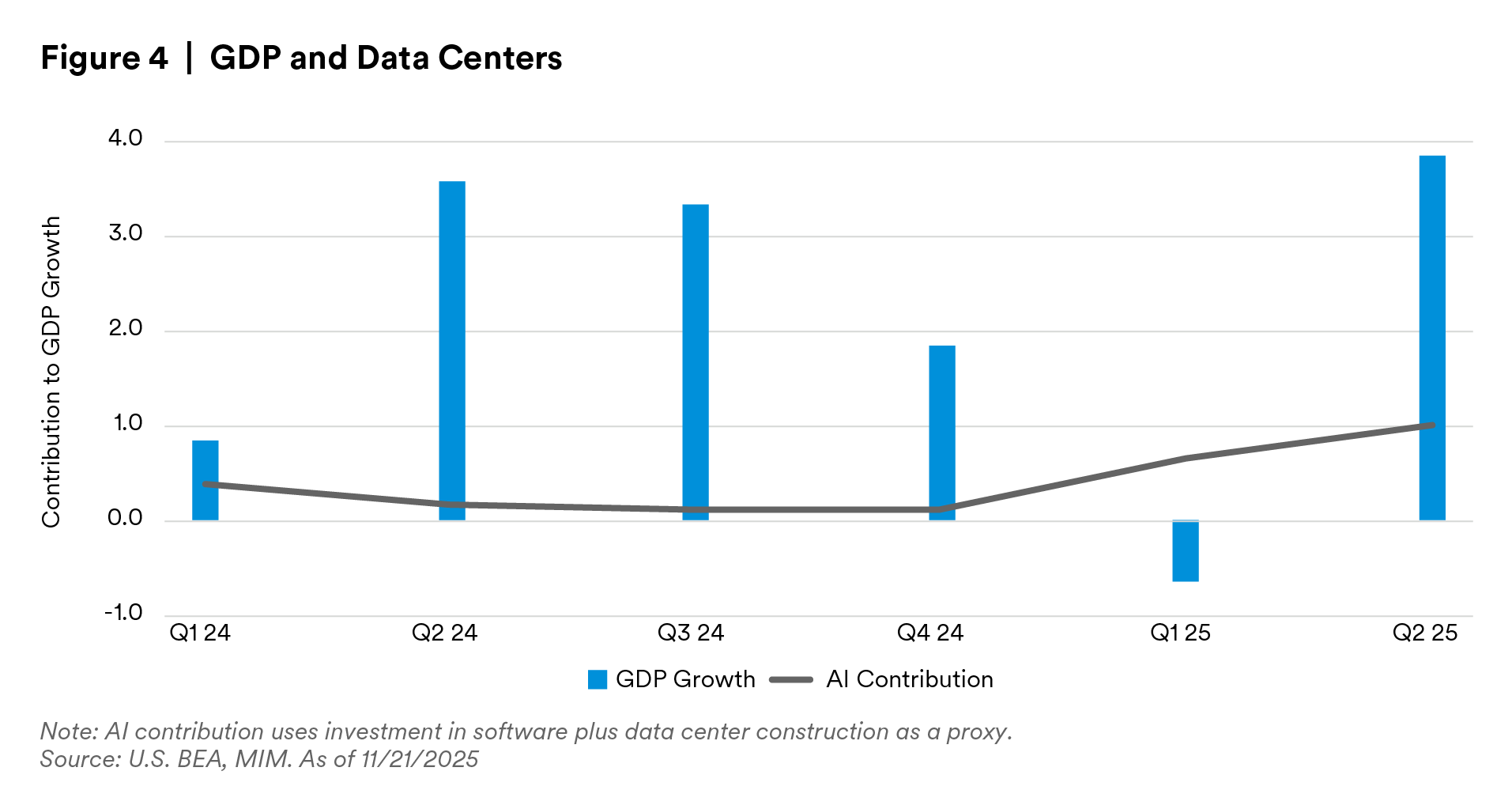

More broadly, the Trump administration continues to engage in negotiations with U.S. trade partners. That is, the trade war is not over, despite the sense that policy volatility has decreased. Companies — aside from AI-related companies — have “learned to weather the uncertainty” by basically doing nothing. Roughly two-thirds of nonresidential fixed investment in the first half of 2025 was concentrated in AI. Broadening of investment activity is likely dependent on the continued perception that trade policy volatility remains within acceptable bounds for firms.

For Europe, we expect that the sharply higher U.S. tariffs on imports from the EU and U.K. will be a mild drag on Europe’s growth performance next year, largely offset by a stabilization of confidence, the lagged tailwind to growth from monetary policy easing cycles and, in the euro area, the first full year of Germany’s expansionary fiscal policy.

However, the potential for trade tensions with the U.S. to reemerge is a key downside tail risk to Europe’s growth outlook in 2026. Triggers for renewed tensions could include unfavorable outcomes of section 232 investigations into important export sectors for Europe (e.g., non-generic pharma, chemicals, etc.) or the U.S. abandoning its support for Ukraine in its ongoing war with Russia. A key reason for the lack of European tit-for-tat responses to higher U.S. tariff rates in 2025 was the continent’s desire to keep the U.S. on side in that conflict. Should the U.S. unilaterally decide to pull back on its support for Ukraine, European governments may well calculate that they can afford to be more aggressive in their response to U.S. trade policies.

There are also trade risks around the U.S.-China relationship, which we discuss in the last section of our piece.

Risks Around AI

In the first half of 2025, U.S. GDP growth was heavily dependent on AI investment — nearly half of the 1.6% average growth rate of H1 2025 could be attributed to AI.2 We expect 2026 to see the trend continue, with some moderation in both AI investment growth and GDP growth.

An upside risk to our GDP forecast is the possibility of a continued acceleration in investment. Given recent GDP levels, each $29 billion of true value-added capital investment would lead to 0.1% of GDP growth. Projections of CapEx spending on AI in 2026 have been rising and could continue to do so throughout the year.

A key risk that would emanate from this is electricity usage and its potential for raising inflation in a destabilizing way. AI is currently pressuring the electricity grid in places; if this becomes more widespread in 2026, it could have significant political consequences as households are extremely sensitive to electricity prices and its effect on utility bills. This could result in inflation or regulatory measures.

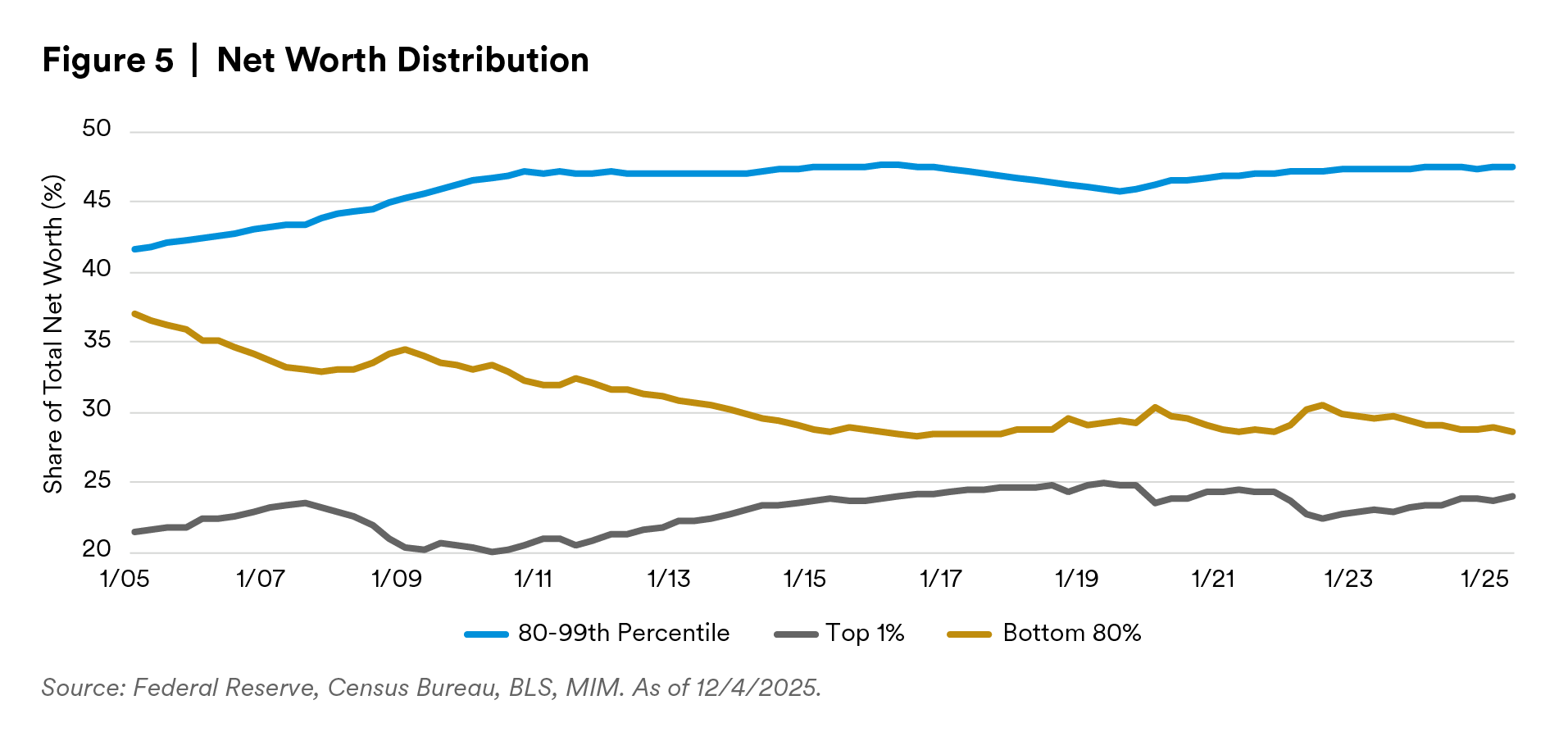

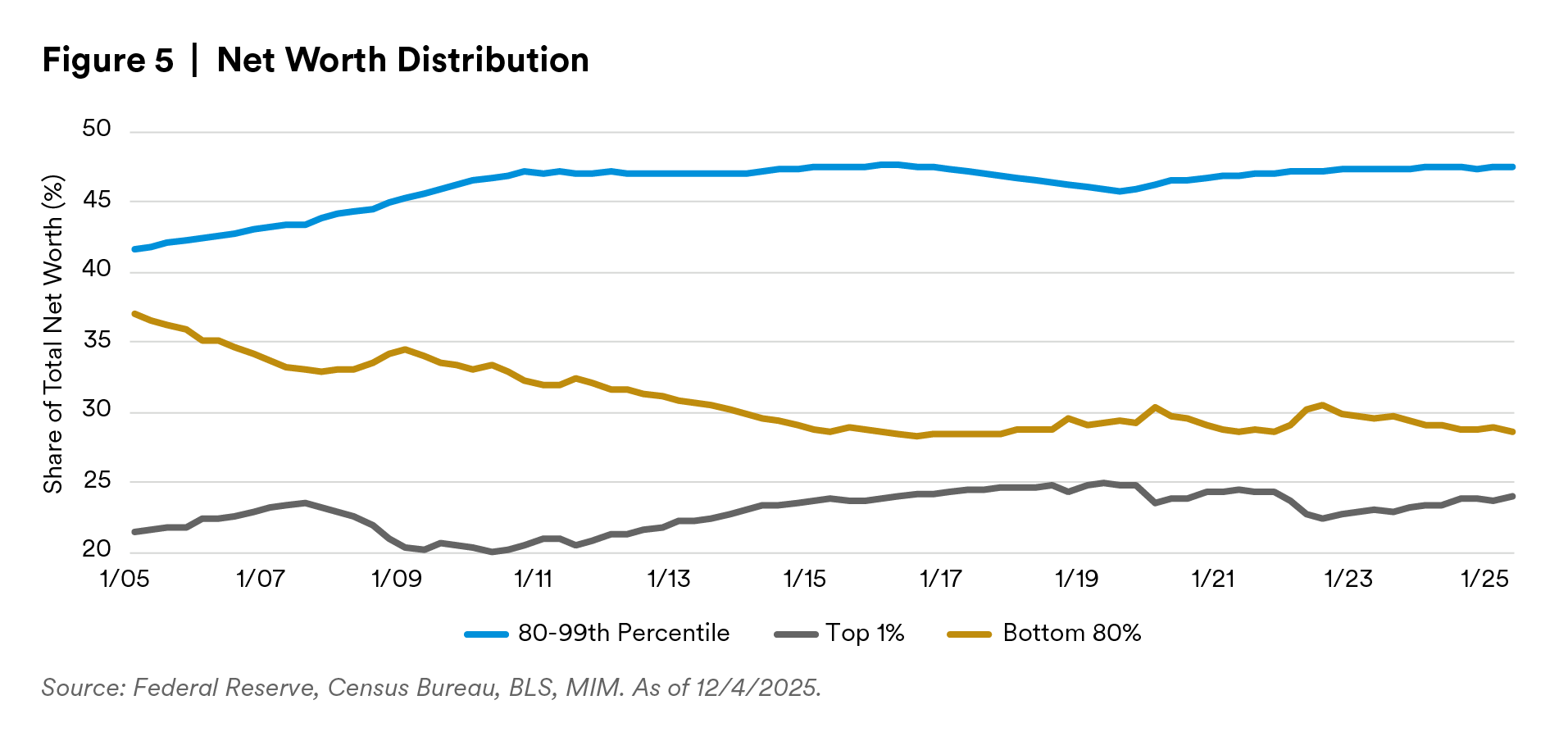

Risks Around a K-shaped Recession

We expect moderate consumption growth in 2026. We see the risks to this view as balanced but substantial on either side.

Risks to the downside include an equity market crash or housing price declines, which would disproportionately hit that 20% of consumers that have been supporting growth for a few years now. Labor market deterioration would hurt consumption, with AI hurting white collar workers more than in a more conventional downturn.

Risks to the upside rest on the continued resilience of the consumer. The shift toward a K-shaped economy dates to the post-GFC era. Since that time, there has been no recession other than an extremely brief one induced by the pandemic. It’s possible that consumer spending that relies on a narrow, less economically vulnerable, cohort of people is slightly less likely to fall into a recession because fewer consumers need to be happy to keep spending.

This, of course, sets aside questions of whether this is a desirable, sustainable or politically stable arrangement in the long term.

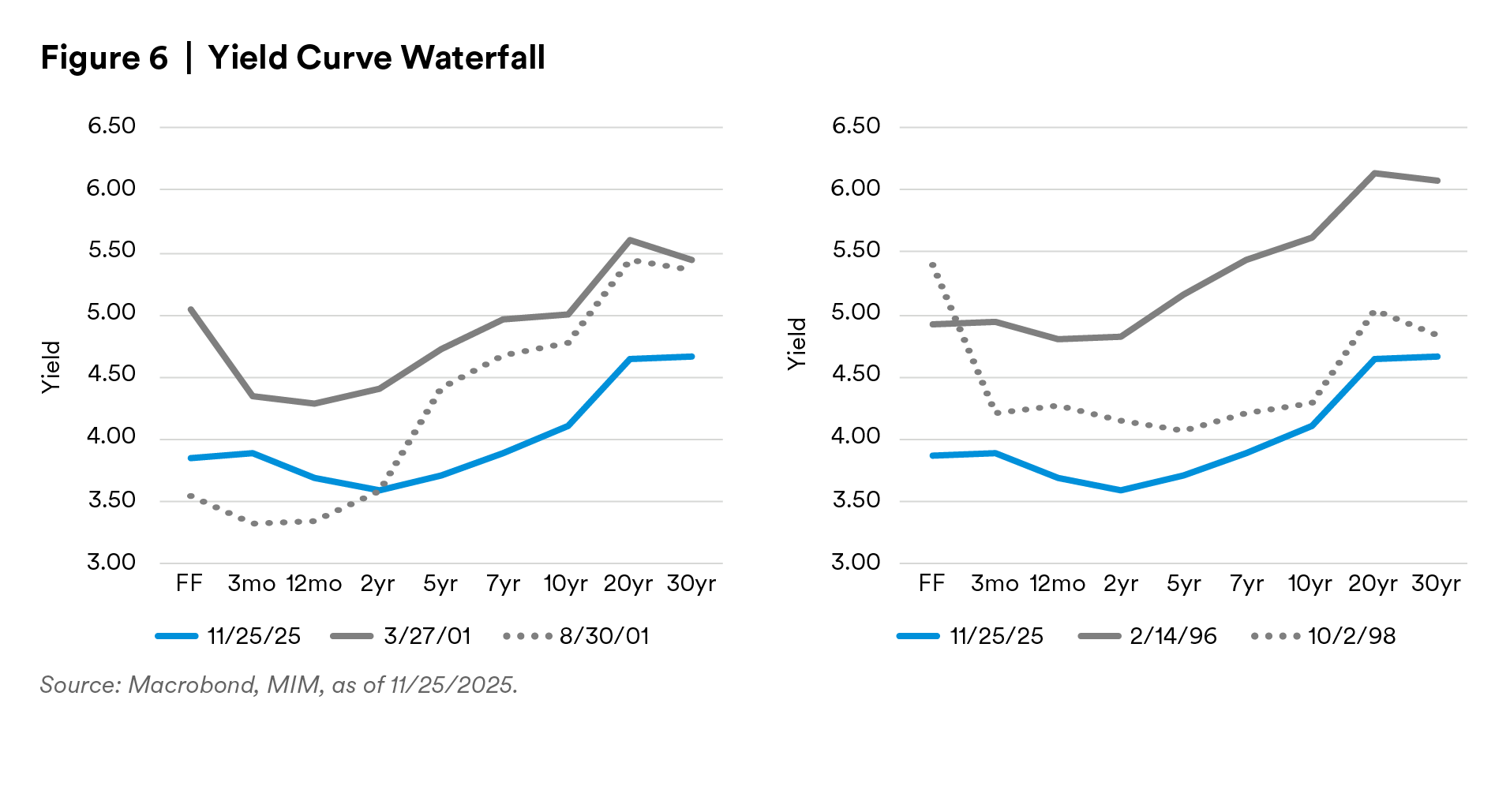

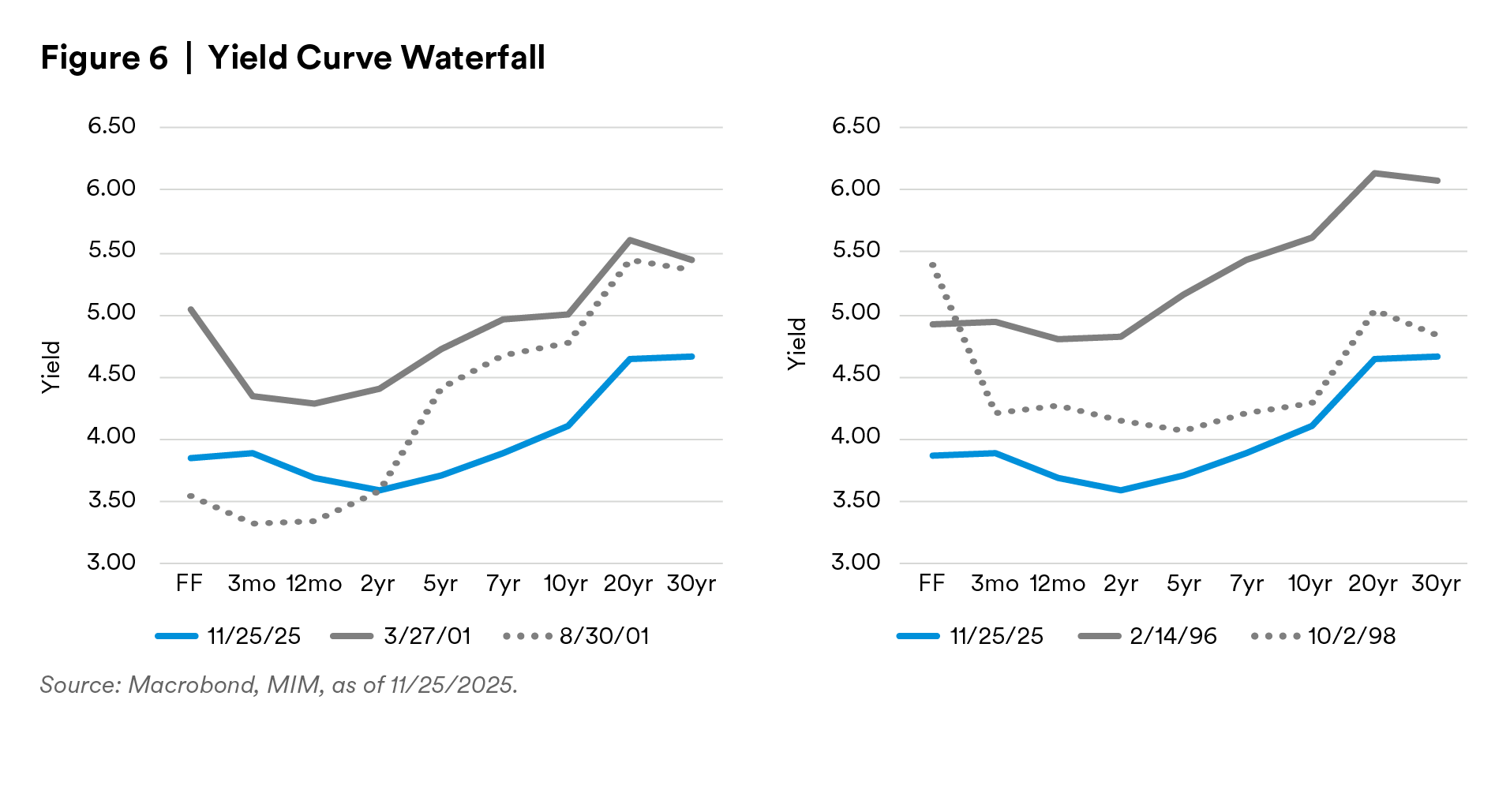

We expect the U.S. yield curve to continue to normalize during 2026 as the Fed cuts four more times by year-end 2026.

We see risks tilted toward fewer cuts. While larger rate cuts — or even a recession — are possible, we believe the consumption and investment risks noted above tilt the overall balance toward fewer rate cuts. Additionally, there are inflation risks stemming from the One Big Beautiful Bill Act (OBBBA), which is expected to provide stimulus via larger-than-expected tax rebates.

Our base case is for a situation similar to that of March 2001. The yield curve at that time was similar to the current yield curve. In 2001, the Fed was already in a cutting cycle and continued to cut. However, the current (Q4 2025) yield curve has so far also resembled the July 1996 yield curve. Markets also expected rate cuts then, but they did not take place for another two years.

U.S.

Our expectation is for a less active, more gridlocked, U.S. economic policy in 2026. The most persuasive party on inflation control and affordability is likely to have control of the House after the midterms. This should provide some discipline on economic policy. We already see some jockeying among Republicans for the post-Trump future, which may constrain the Trump administration’s hand as others seek to press their case.

Markets are expecting a more favorable regulatory environment, one of President Trump’s key unfulfilled campaign promises. Failure to follow through on this — or indeed, if the administration increases regulatory burdens — is a negative risk. Given the administration’s enthusiasm for getting involved in market mechanisms, we believe regulatory risks may be underestimated.

Europe

MIM’s base-case expectation is that, despite ongoing U.S. efforts to broker a settlement, the Ukraine-Russia war will continue through 2026. However, there are tail risks that a settlement will be imposed on Ukraine, or Russia effectively wins through military means. That would likely drive global energy prices lower, as markets anticipate some loosening of sanctions on Russia’s energy exports. It would also raise the potential for further interest rate cuts from the ECB (which our base-case forecasts assume will remain on hold in 2026) and the BoE (where MIM forecasts the Bank Rate to reach 3.25% by mid-year). Finally, there would be additional pressure on European governments to accelerate defense spending to counter an emboldened Russia and compensate for weaker confidence in the post-WW2 western alliance as the role of the U.S. as a reliable ally erodes further.

U.S.-China Tensions

Our baseline is for the U.S.-China “fragile truce” to remain in 2026, given the mutual interest in keeping relations on track. Planned meetings between Trump and Xi next year are seen as an anchor and incentive to maintain dialogue toward a yet undefined deal, while avoiding worst-case outcomes. The potential disruptors to our baseline are lack of follow-through on the Busan agreements, including poor progress on the fentanyl issue or disagreement around China rare earths and U.S. tech export restrictions.

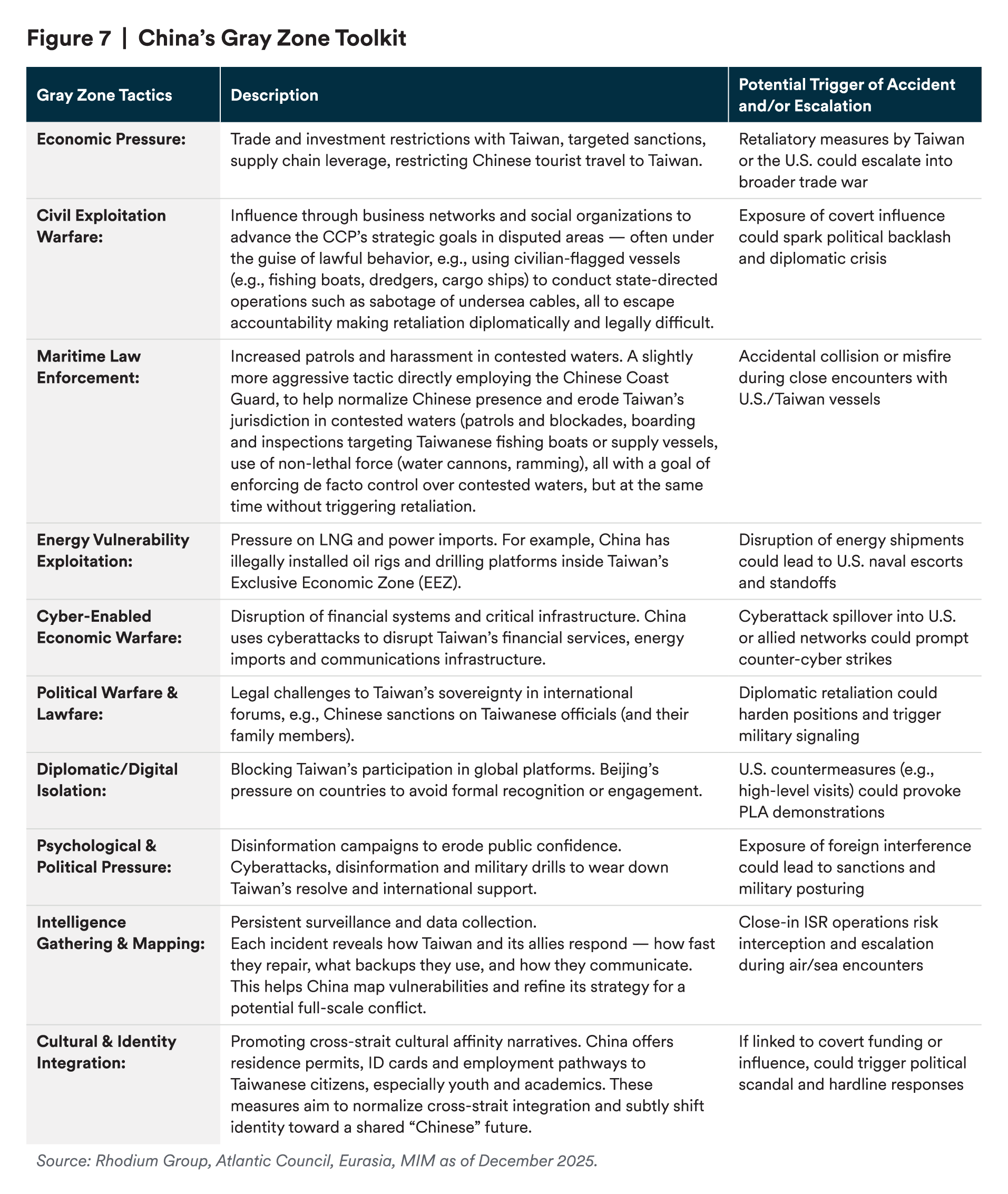

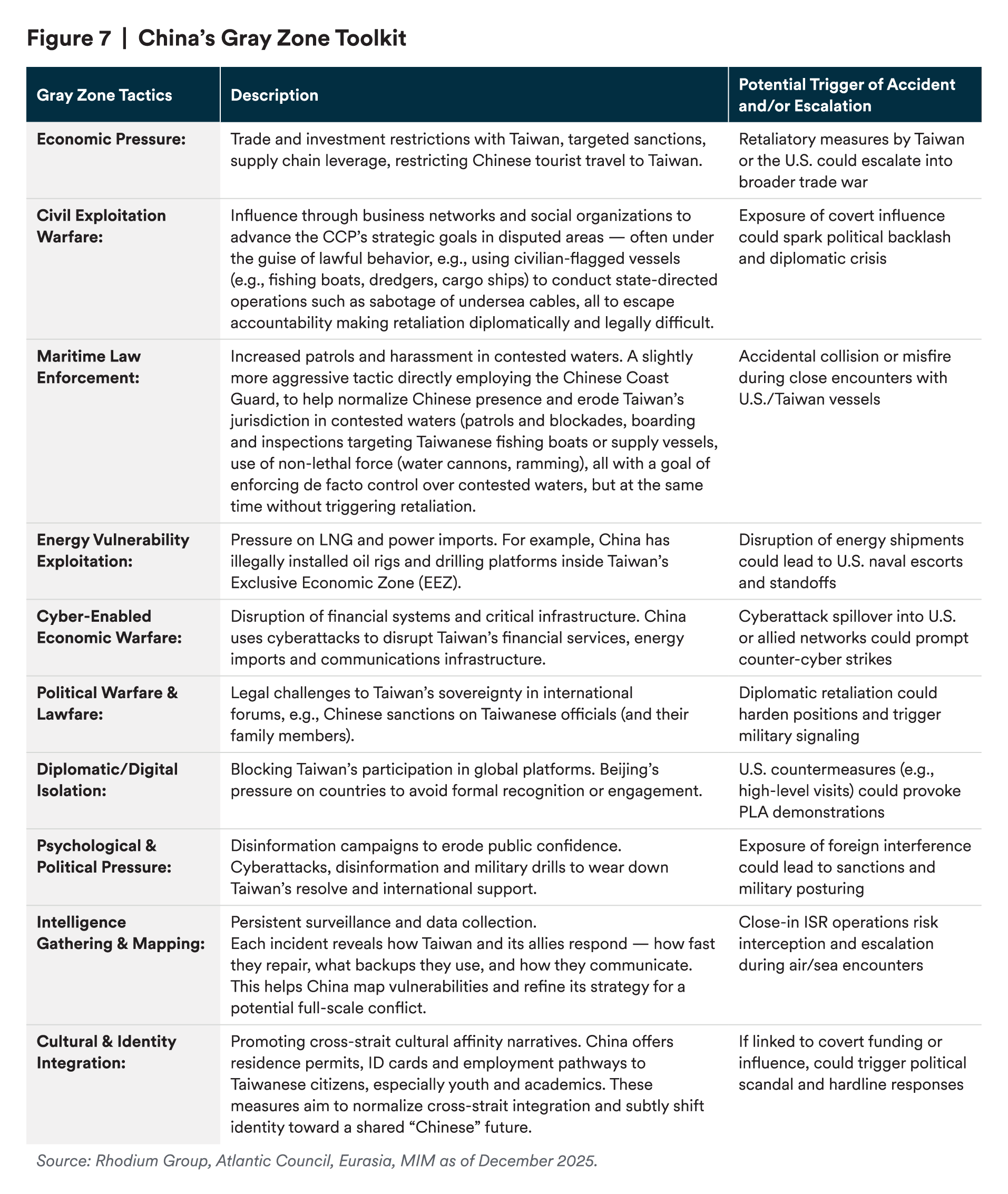

Over the next few years, we anticipate continued medium-to-high intensity “gray zone coercion” by China against Taiwan, without escalation to full conflict. Gray zone tactics blur the line between war and peace, using non-military, ambiguous, and incremental measures to pressure Taiwan without crossing the threshold into open warfare. These tactics are designed to erode Taiwan’s resilience, weaken its economic and political stability, and advance Beijing’s strategic goals without triggering a U.S. or allied military response.

Beijing will likely leverage non-military tactics like incremental pressure and influence operations to shape Taipei’s political and economic environment, especially given the upcoming January 2028 Taiwan general elections, which may see the return of the more China-friendly Kuomintang party (KMT). Although the risk of a hot conflict remains low over the next few years in MIM’s view, gray zone tactics raise the risk of an accident and/or escalation (see Table 1).

As highlighted in Table 1, gray zone tactics such as civil exploitation warfare or maritime law enforcement heighten the risk of accidental collisions or miscalculations on the high seas. Cyber-enabled economic warfare targeting Taiwan’s infrastructure could inadvertently affect U.S. or allied systems, prompting retaliatory measures. Military drills and coercive maneuvers intended as political signaling could be misread by Washington as pre-invasion staging, leading to force posture changes and a spike in tension. U.S. freedom-of-navigation operations and allied naval presence increase the complexity of interactions, making flashpoints harder to control.

Endnotes

1 Guide to SCOTUS Tariff Ruling

2 This includes a sharp and material increase in software investment and an extremely sharp increase, but still tiny contribution, of data center construction.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

For investors in the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees’ pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being distributed by MetLife Investments Asia Limited (“MIAL”), licensed by the Securities and Futures Commission (“SFC”) for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities in Hong Kong S.A.R. This document is intended for professional investors as defined in the Schedule 1 to the SFO and the Securities and Futures (Professional Investor) Rules only. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are licensed by the SFC to carry on regulated activities in Hong Kong S.A.R. The information contained in this document is for information purposes only and it has not been reviewed by the Securities and Futures Commission.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

For investors in the EEA: This document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of 31 March 2025, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC and MetLife Investment Management Europe Limited