State-Level Unemployment on the Rise

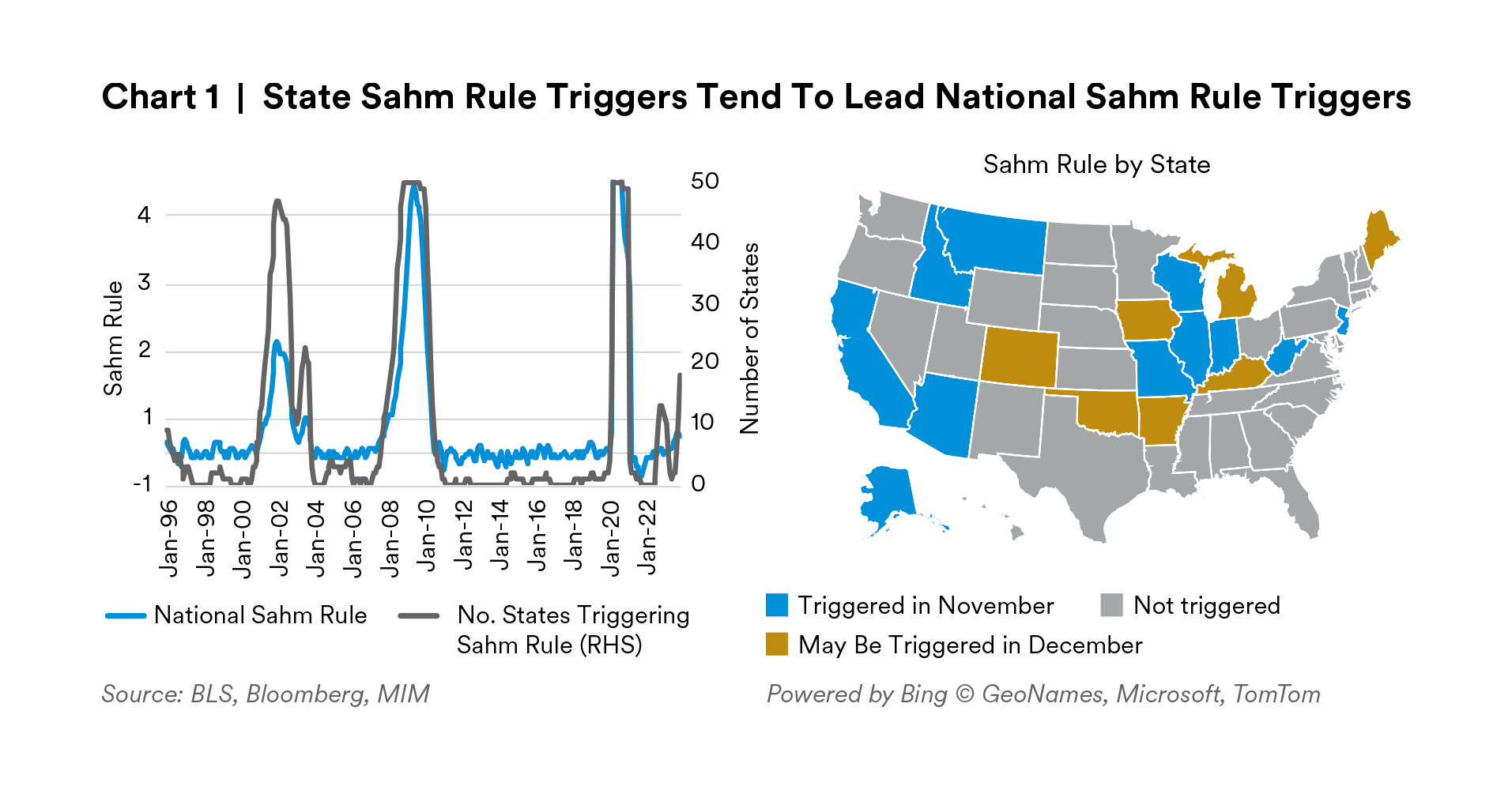

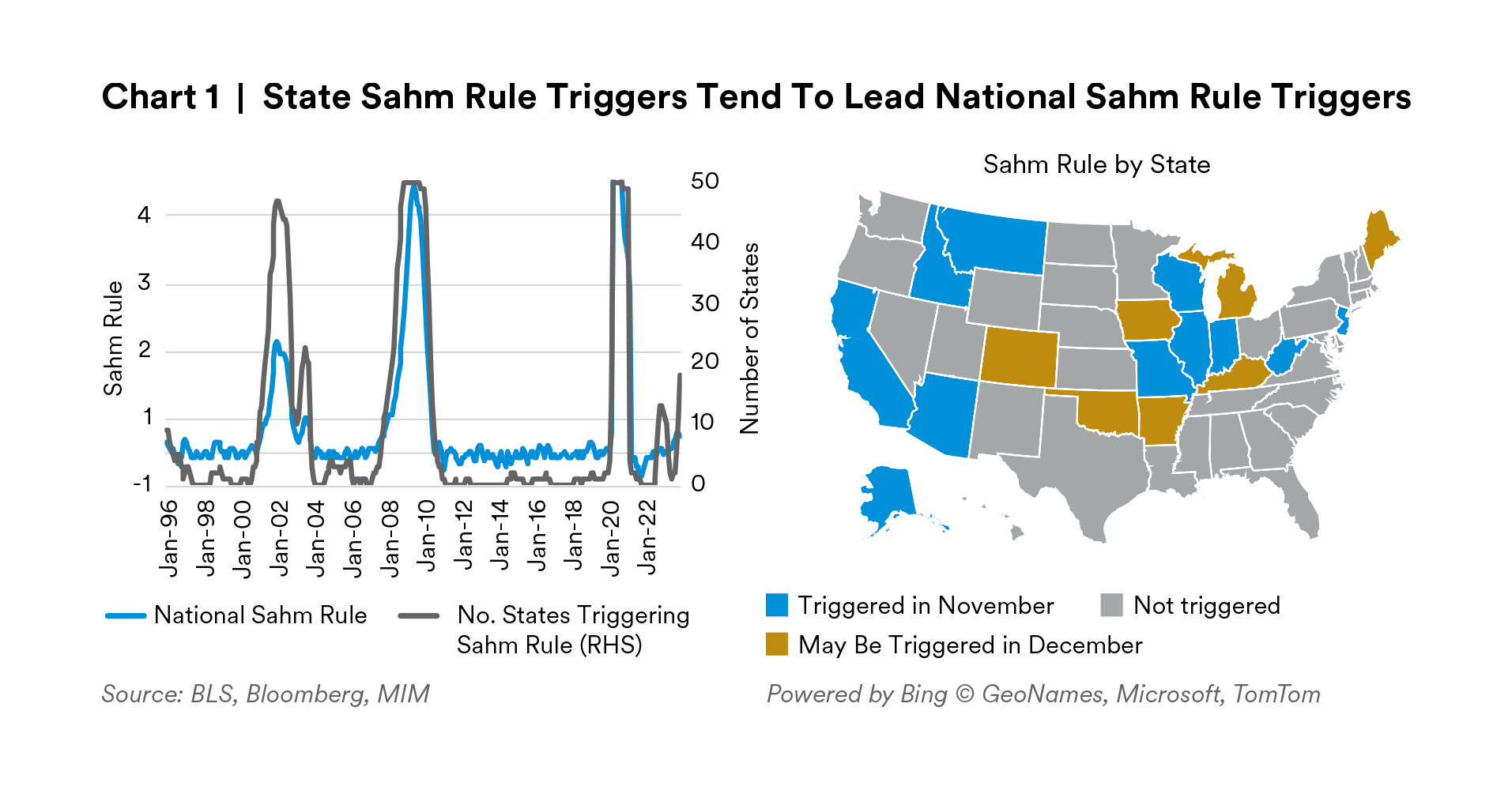

Although national level unemployment is still at a tight 3.7%, state-level unemployment shows a growing number of states under pressure. When looking at state-level unemployment using the Sahm rule, we see a significant number of states triggering the rule, suggesting weakness, if not an increasing likelihood of recession.1

In the November edition of our Economic Monthly, we applied the Sahm rule at the national level and showed that it may be triggered soon. Applying the Sahm rule at the state level shows a similar concern.

Historically, triggers to state-level Sahm rules have tended to be leading indicators to a triggering of the Sahm rule at the national level. Localized strength can obscure creeping labor market softness.

In November, despite the national unemployment rate declining, 11 states triggered the Sahm rule, together comprising some 30% of U.S. GDP. The national level of unemployment stayed at 3.7% in December, unchanged from November. While the BLS has not yet released December data at the state level yet, if we assume that state-level unemployment also remains unchanged in December, an additional seven states comprising 8% of U.S. GDP would also trigger the Sahm rule. Setting aside the pandemic era, that would result in the largest number of states under the Sahm rule since June 2010. More instructively, a rapid increase in the number of states triggering the Sahm rule started in August 2007, foreshadowing the increase in the national unemployment rate and the 2008 recession.

Although this isn’t a smoking gun for a recession—indeed the Sahm rule pulled back at the national level in December—its triggering remains a distinct possibility over the next several months.

No Cruel Summer for Services?

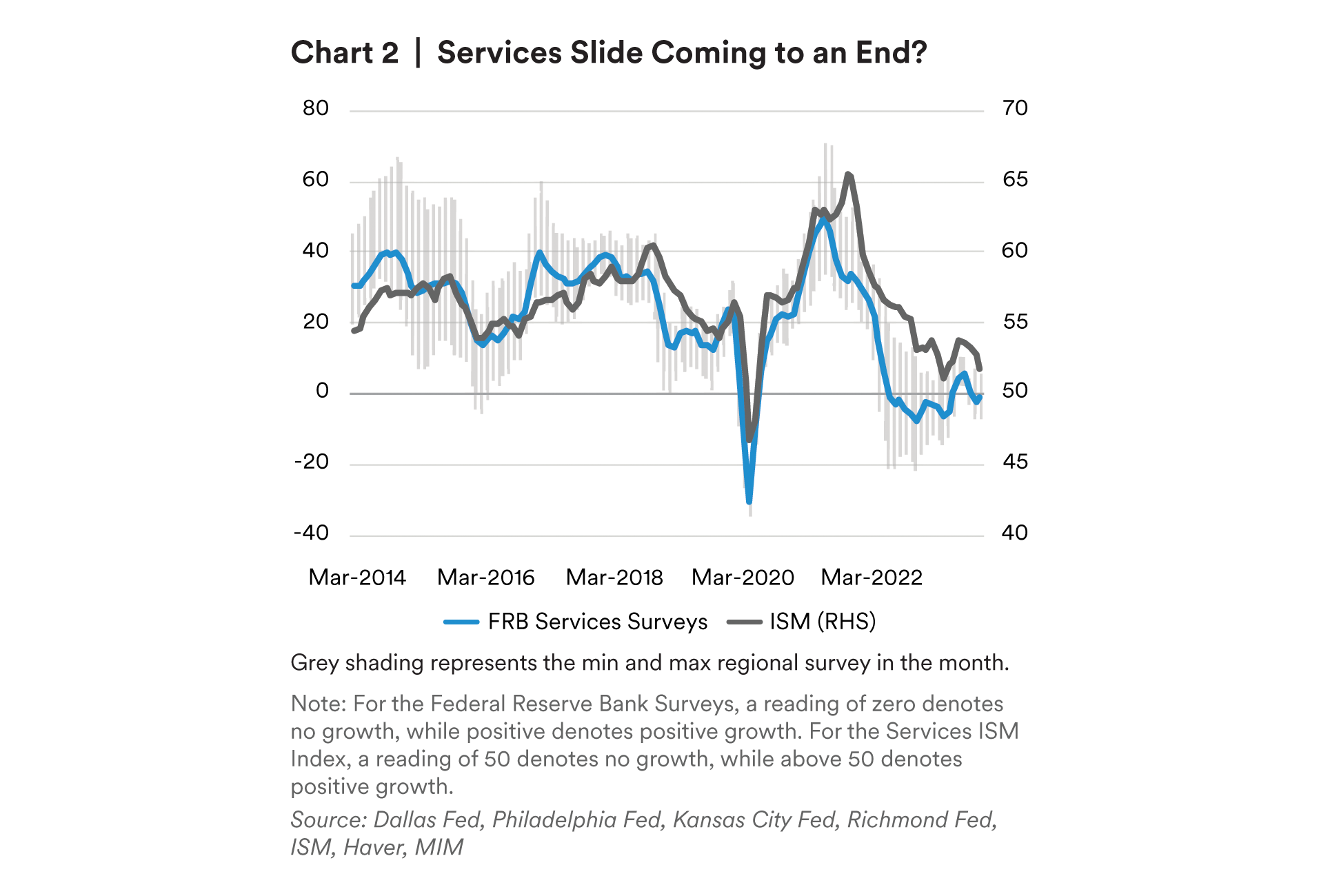

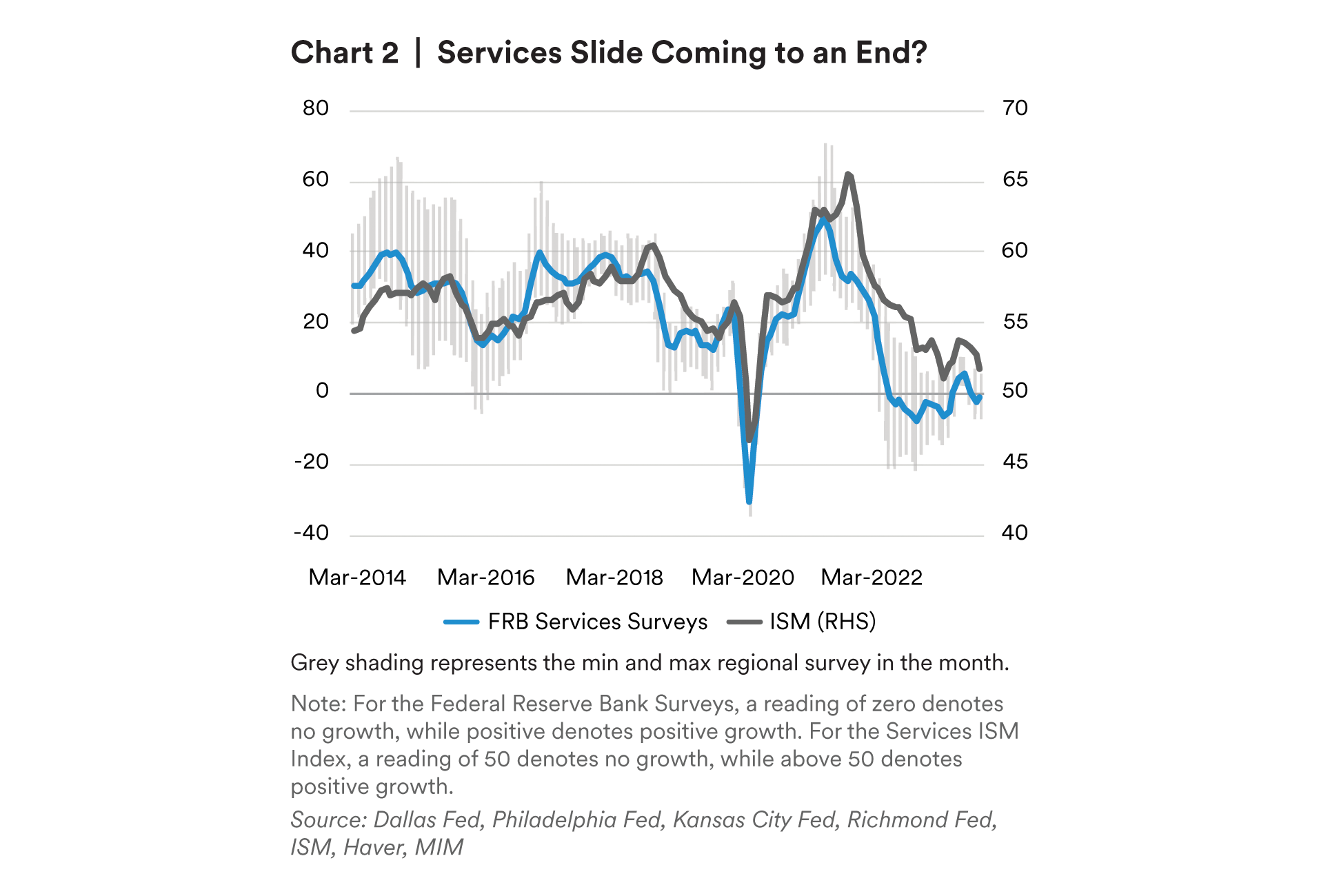

Much has been made of the summer of services spending by fans of Taylor Swift and Beyonce and by anyone else itching to be part of a crowd. And it looks like there were concerns that the summer of 2023 would be a high-water mark—six-month expectations from services firms surveyed by various Federal Reserve Banks largely expected a deterioration in conditions.

But those concerns seem to have dissipated. Most recently—in the last few months of 2023—the surveys appear to show firms more optimistic about the next six months.

The ISM services index—which is national but only asks for current opinion rather than expectations—shows a slowing of activity from 2022, which most recently has plateaued. Negative growth in services generally indicates a recession, as it is a much larger part of consumer spending, although it moves more gradually. If services spending stabilizes at its current pace—as has been happening in recent months, and as services firms appear to be expecting—it will do a great deal to help the U.S. avoid a recession.

Businesses Haven’t Been Pulling Their Weight.

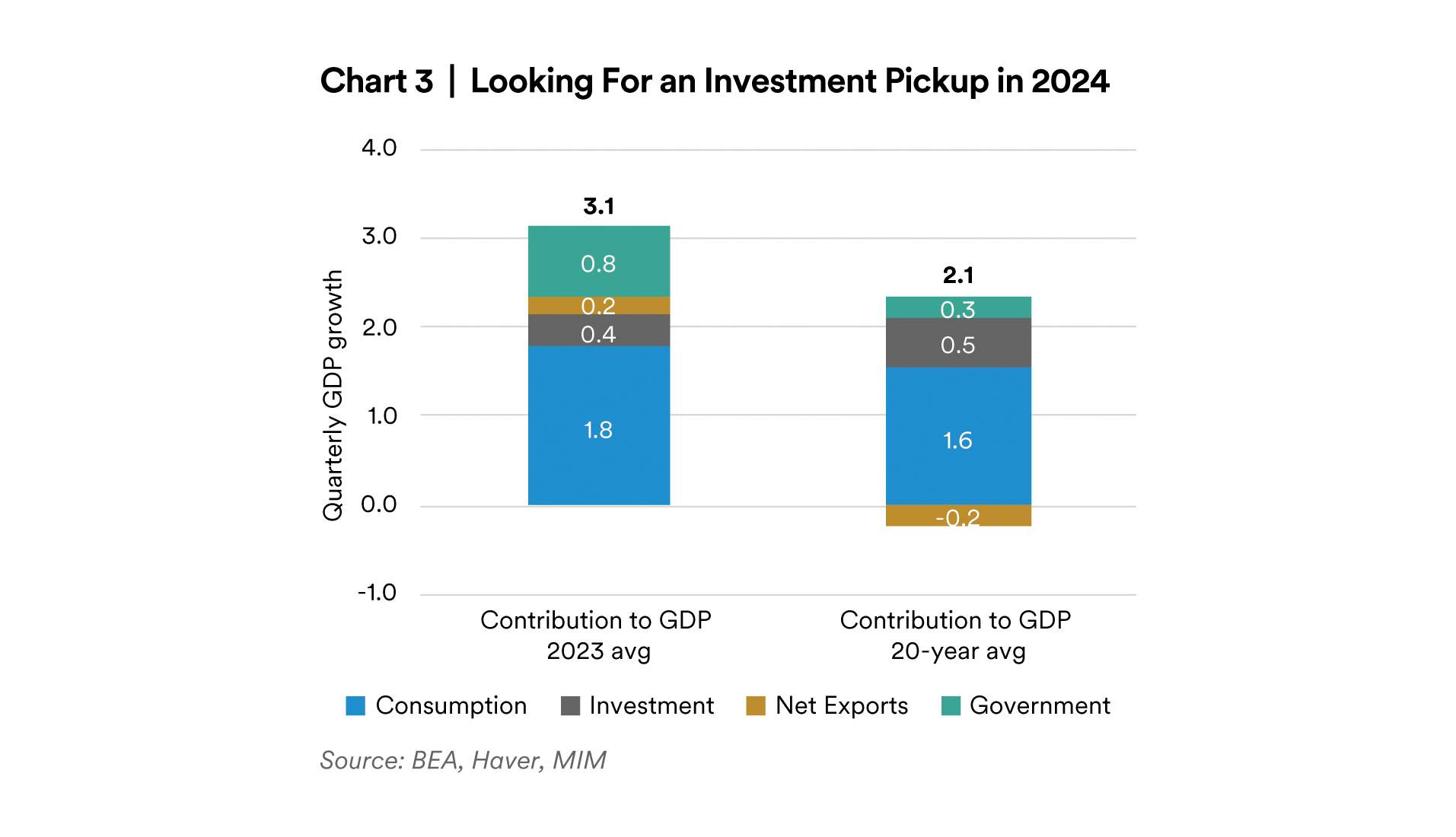

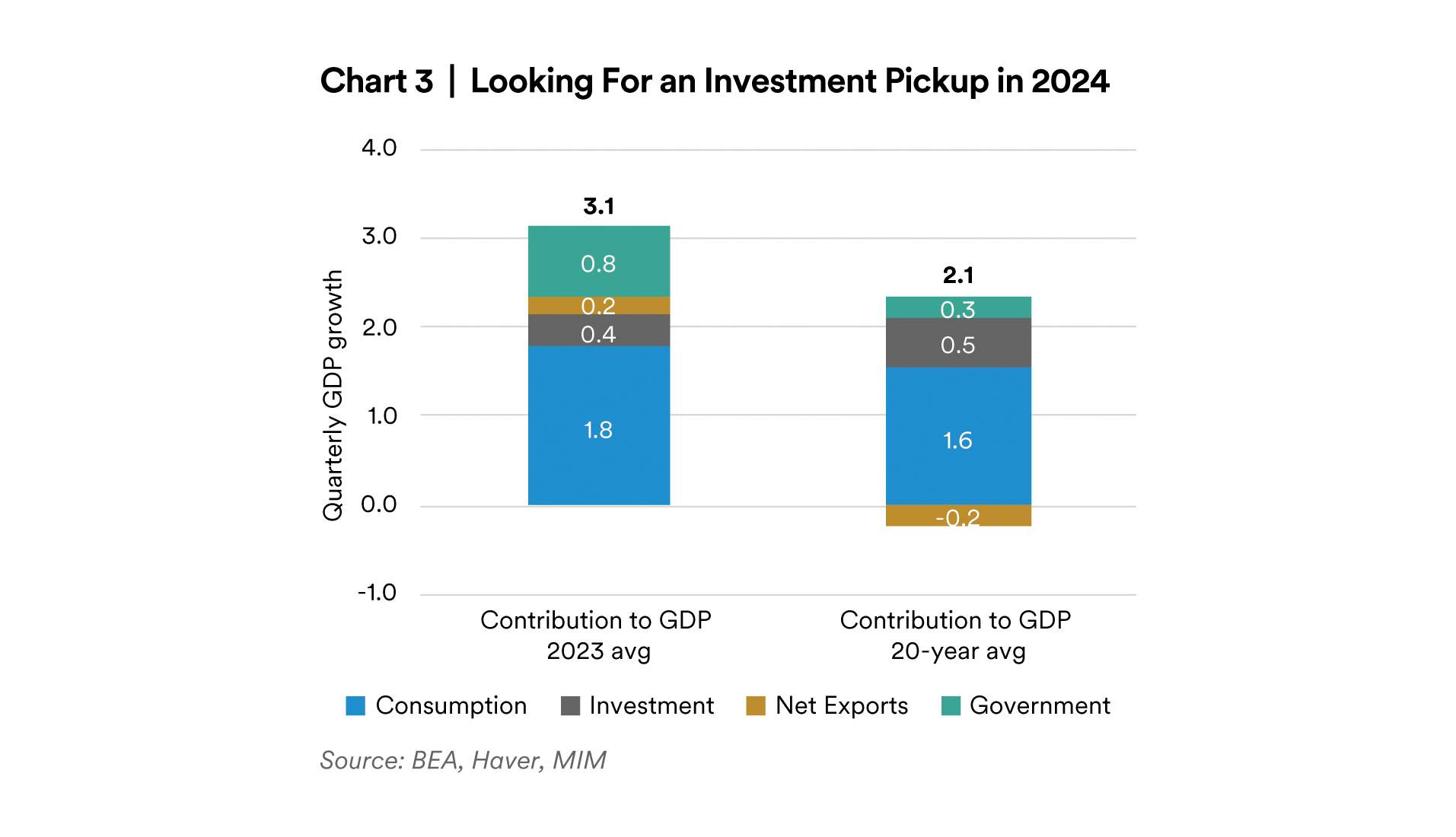

The consumer did well in 2023. But GDP growth in the first three quarters of 2023 revealed a strange composition that relied less on consumption than on government spending, weak import demand and the construction of manufacturing facilities. Avoiding a recession in 2024 may rely less on the consumer and more on business investment.

Historically, personal consumption contributes around 1.6 percentage points to GDP growth, with business investment adding another 0.5 percentage points. Government and net exports more or less cancel each other out, contributing small positive and negative amounts respectively.

Consumers did well, contributing 1.77 percentage points. But it was government that truly outperformed, providing 0.8 percentage points. Net exports also contributed positively, due to weak import demand. By contrast, investment contributed less than usual—and most of this came from a surge in building manufacturing facilities for computer, electronic and electrical equipment, supported in part by the three industrial policy acts passed by Congress at the urging of the Biden Administration.2

What does this mean for growth in 2024? While government spending is likely to remain robust due to the industrial policy acts, consumers are likely facing constraints on further spending and cannot be counted on to carry growth the way they did in 2024.

A non-recessionary scenario would likely rely on businesses to increase investment. A few clear opportunities exist. Residential investment is likely to improve in 2024, given stronger demand and moderating rates. Investment in equipment could see improvement as manufacturing facilities are finalized and come online. The biggest question mark remains investment capacity, given tighter corporate margins, tighter lending standards and persistently high interest rates.

U.S. Outlook Summary

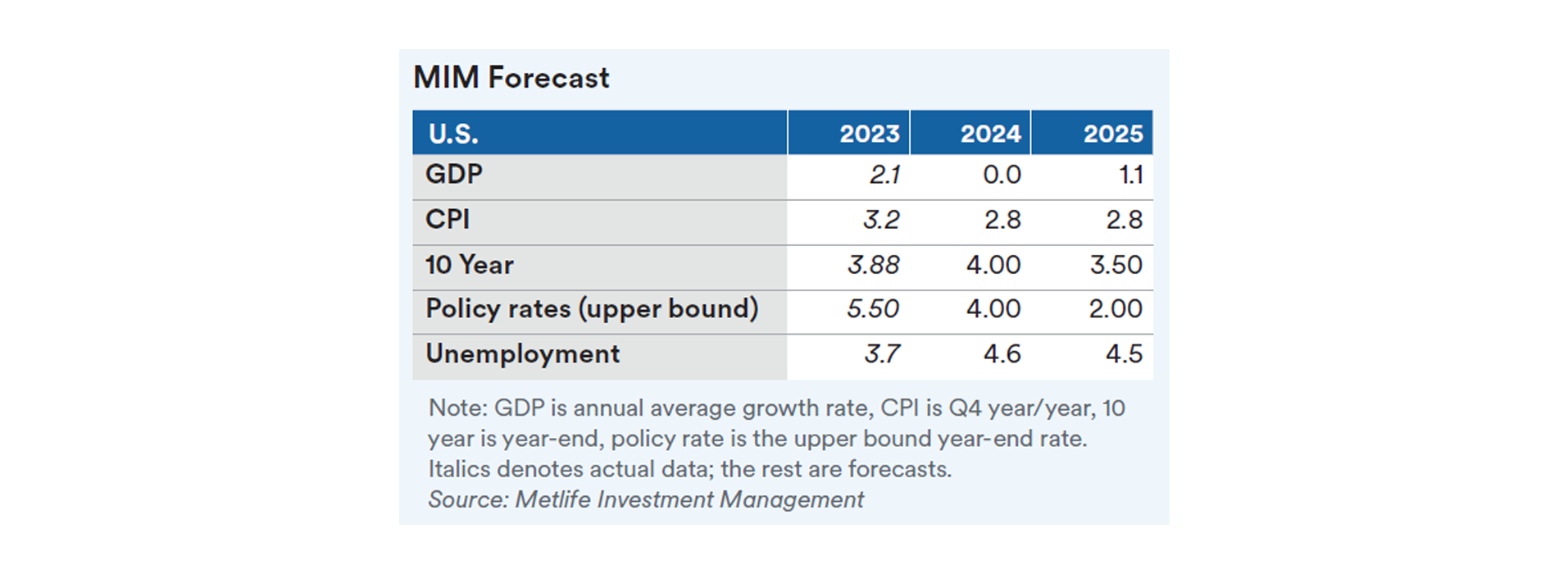

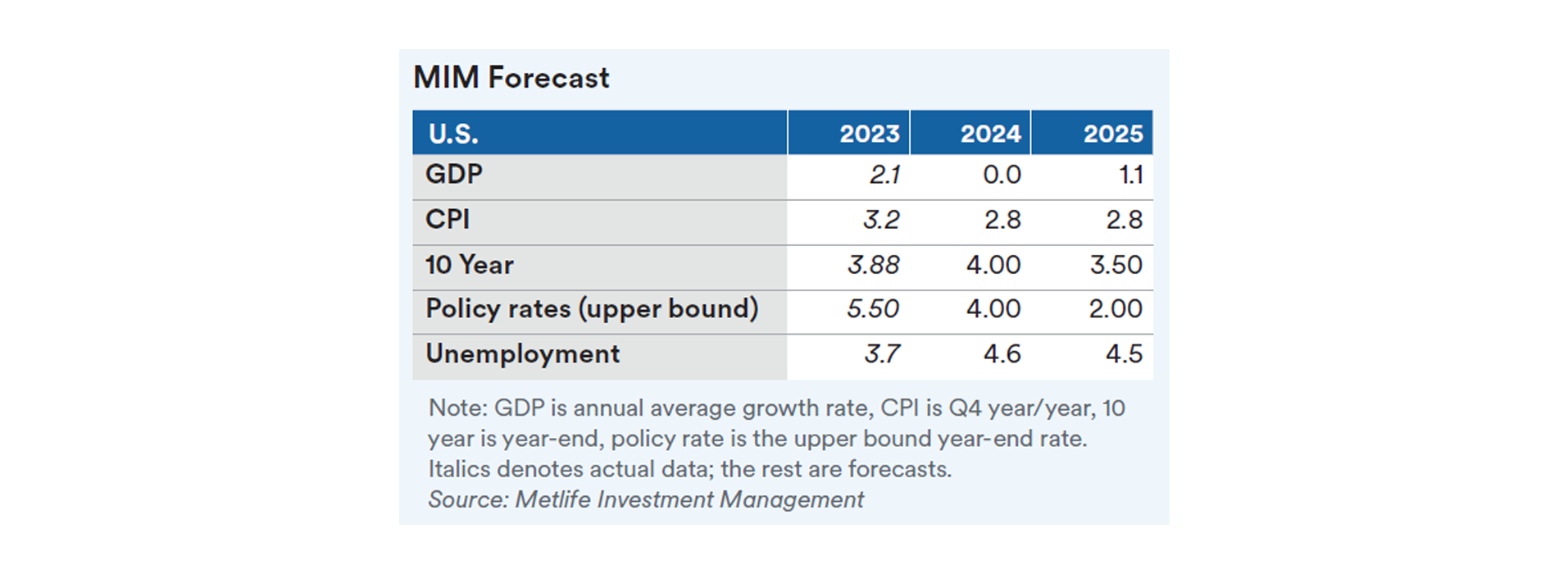

We continue to expect a recession in 2024. Several concerns factor into this view, including the following.

First, credit conditions continue to tighten, with lending contracting on a real basis. This tightening is part of the fallout from tighter monetary policy. Second, delinquency rates are rising—particularly for consumer loans and commercial real estate. Third, the labor market is loosening, with the increase in payrolls approaching “replacement rates” (i.e., the rate at which labor force participation remains stable). As for healthcare, government and food and accommodation services—together, these sectors comprised 72% of payroll additions in 2023—reaching satiation. As a result, much of the drive to hire is likely to dissipate through 2024.

We believe the Fed has finished hiking rates this cycle, given that core PCE moderated to 3.2 percent by yearend. We expect 150 basis points worth of fed funds rate cuts beginning around midyear 2024. Whether or not there is a recession, the Fed is likely to cut as it eases from the current tight conditions.

We expect a particularly mild increase in unemployment, given that prior recessions have seen unemployment increase by at least two percentage points, reflecting the unusually tight labor market conditions.

After a wild fourth quarter, the 10-year Treasury fell to 3.88% in the last few trading days of the year. Yields have historically peaked ahead of cuts to the fed funds rate; with cuts on the horizon and inflation on a downward path, we expect yields to have peaked for the cycle. We expect yields to remain flat for the year, especially if our expectation of a struggle to get inflation to 2% holds.

Risks to the Outlook

We continue to recognize mitigating factors that work against our call for a recession in the first part of 2024. First, labor market robustness could continue to support consumer spending. Consumer confidence improved in December, and goods and services spending were strong in December. Second, the manufacturing sector has shown some signs of recovery and may continue to boost GDP in 2024, as industrial policy spending ramps up. Finally, single-family home starts picked up gradually in 2023, giving some hope to a moderation of housing and rent inflation.

Endnotes

1 As a reminder, the Sahm rule examines the most recent three-month moving average unemployment rate less the lowest three-month moving average over the past year. Triggering the Sahm rule means the difference is 0.5 or greater, meaning there has been a 50-basis-point spike in unemployment relative to its recent history. Triggering the Sahm rule has also historically been associated with the onset of a recession.

2 These coincided with the trio of industrial policy Acts passed by the Biden Administration, the Infrastructure Investment and Jobs Act, the Inflation Reduction Act, and the CHIPS Act, and likely were in part fueled by these.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102- 0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities. For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on requestto, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of December 31, 2023, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC.