Rightsizing the Fed’s Balance Sheet

Against the aggressive expansion of the balance sheet in response to the COVID pandemic, the Federal Reserve expanded its balance sheet from $4.1 trillion, or 18.8% of GDP, to a peak of $9.0 trillion, or 35.6% of GDP, in Q1 2022. This is nearly double the pre-COVID level, which was already elevated relative to the balance sheet seen in the wake of the Great Financial Crisis.

The Federal Reserve has been shrinking its balance sheet, or conducting “Quantitative Tightening” (QT), since Q2 2022 and, over that time, has reduced the balance sheet by $1.9 trillion, reducing the balance sheet as a percentage of GDP to 24.8%, still well above the 2019 level.

How much further does the balance sheet need to shrink?

How much further the balance sheet needs to shrink is a question that requires an explanation of what the Federal Reserve’s balance sheet is used for in the first place. Simply put, the balance sheet is the asset backing the dollar. The math can be seen in the table below with the assets of the Federal Reserve comprising their holdings of securities in what is known as the “System Open Market Account” (SOMA), loans to banks via repurchase agreements or other loan types, loans to other central banks, gold, claims on the International Monetary Fund and currency holdings. The liabilities are currency, borrowings from banks, the Treasury General Account which can be thought of as the Treasury’s checking account, and other factors. How each of these have evolved and the announced goals for the structure of the balance sheet offer insight into the final size of the balance sheet.

Since the balance sheet supports the liabilities of the Federal Reserve, it is useful to start there and see how those liabilities have evolved over time to determine how many assets must be held against them.

- Currency: The amount of currency outstanding has grown from $1.8 trillion to $2.4 trillion. The additional $554 billion outstanding suggests that, all else equal, the balance sheet would need to be at least $554 billion larger as, once cash is printed and distributed, it is difficult to reduce this segment. Currency outstanding should also grow naturally over time, so we assume an additional $100 billion in currency when the balance sheet reaches its optimal level.

- Reverse repurchase agreements: Pre-COVID, this category represented just $254 billion of liabilities, which was almost entirely the result of a cash-parking service for foreign governments. The program evolved to act as an absorption tool for excess banking system reserves and ballooned up to as high as $2.6 trillion. As of October 2024, it stands at $627 billion, of which $398 billion is for cash management on behalf of foreign governments. If this segment is returned to its traditional role, the overall level of usage should just be only $100-$200 billion higher than seen in 2019, we assume a level roughly $150 billion higher.

- Treasury General Account (TGA): The cash management tool for the US government and, as such, is not something subject to change via policy by the Federal Reserve. Its current level is almost $850 billion, which although a bit high is within the two-quarter range suggested by the Treasury Department at the most recent quarterly refunding. The figure is more than double the $350 billion level seen pre-COVID.

- Other and Federal Reserve capital: Not set by Federal Reserve policy and should be assumed to be roughly $100 billion.

On net, these liabilities and an expected normalization of tools used to manage the balance sheet would suggest that the assets held by the Federal Reserve could decline by a further $1.0 trillion. That would put excess reserves in the banking system (the difference between the asset and liability sides of the Federal Reserve’s balance sheet) at 7.5% of nominal GDP, the level seen immediately pre-COVID. (For historical reference, the excess reserves in the banking system prior to the GFC vacillated around 0.1% of nominal GDP). The vast majority of this reduction would need to be the result of maturities in the SOMA portfolio, specifically (in the long run), a significant reduction of mortgage-backed securities (MBS) holdings on the balance sheet.

How does the balance sheet need to change as it approaches an optimal level?

The answer is significant and will impact different asset classes, the shape of the Treasury yield curve and the amount of stimulus that is newly created each month by the ongoing rollover of a too-large balance sheet.

As noted, the table above suggests that the securities portfolio of the balance sheet needs to shrink by roughly $900 billion to reduce the overall level of excess reserves by $1.0 trillion. However, within that shrinkage figure is a $2.3 trillion reduction in mortgage-backed securities (MBS) holdings and a $1.4 trillion increase in Treasury Securities as the Federal Reserve moves towards its espoused goal of a “primarily Treasury securities” portfolio. As this shift occurs, we would also anticipate a shift toward normalizing the composition of the Treasury holdings by rebuilding the Treasury Bill portfolio to the ratio that existed in 2019 or even pre-Great Financial Crisis (GFC).

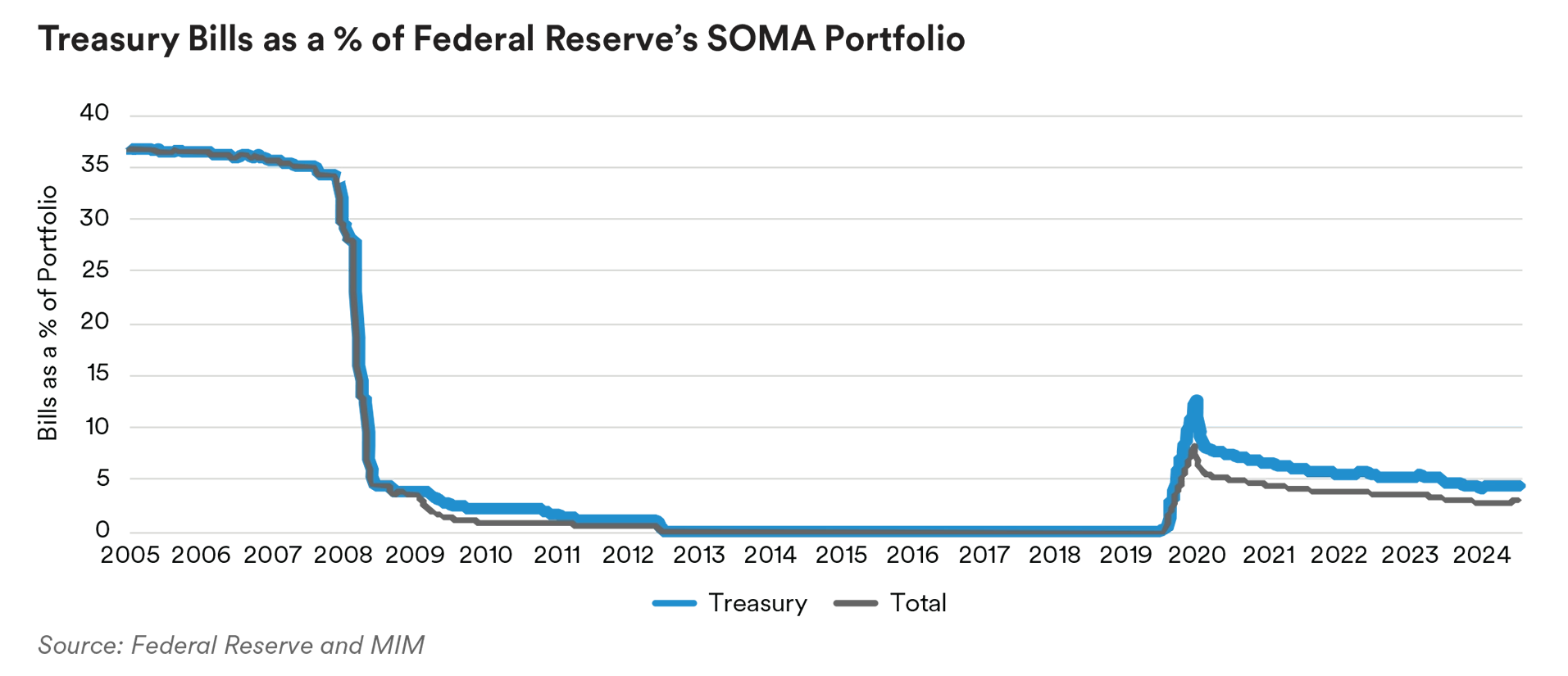

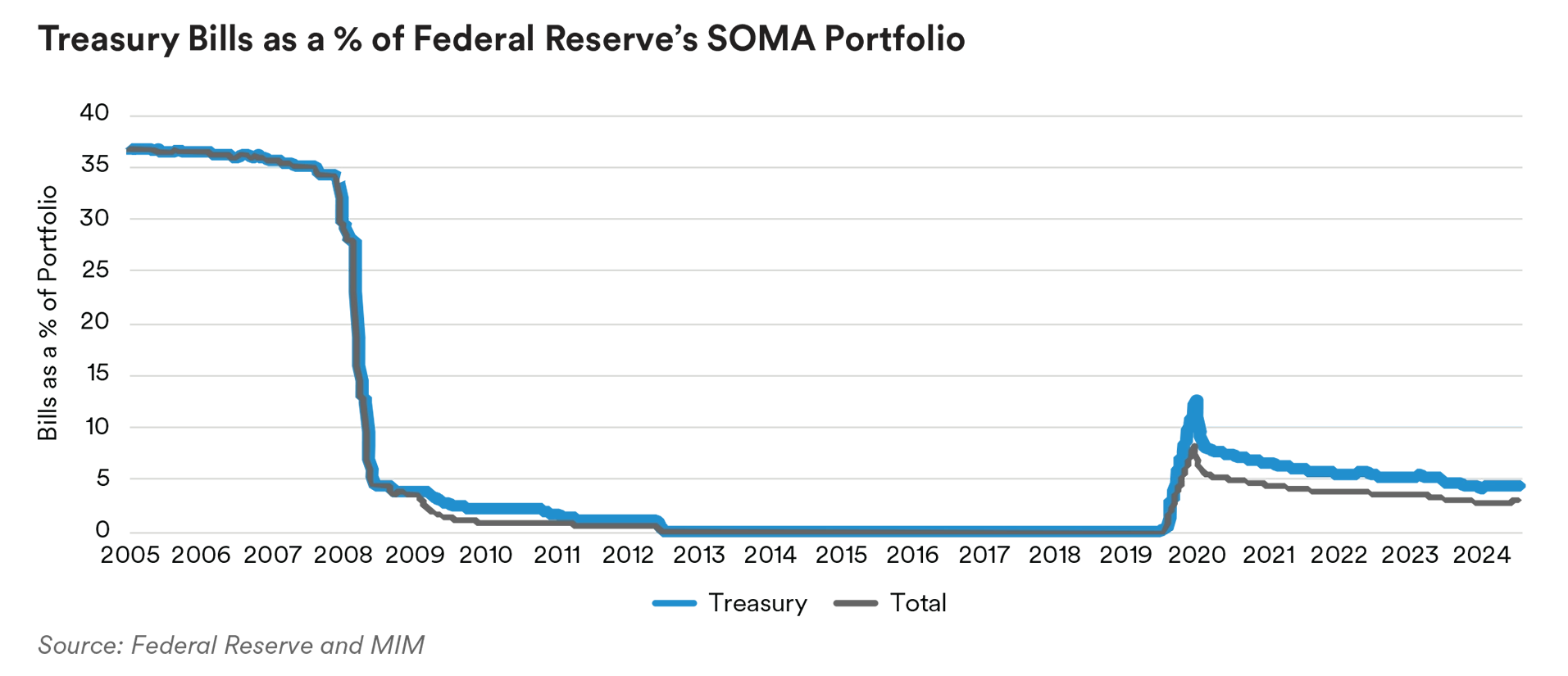

Treasury Bills had previously accounted for a substantial portion of the “System Open Market Account” (SOMA) portfolio. At year-end 2007, prior to the GFC, Treasury Bills accounted for $242 billion, or 32.1% of the total Treasury debt held by the Federal Reserve and, since the portfolio was Treasury-only, the same percentage of the SOMA portfolio. Prior to COVID, in December 2019 bill holdings were $170 billion, or 7.3% of Treasury holdings, or 4.5% of the expanded portfolio. Currently (as of October 2024), that figure had risen to $195 billion but that represents just 4.5% of the Treasury portfolio and just 2.9% of the SOMA portfolio.

A portfolio comprised entirely of 10-year Treasury notes is not only more stimulative to the economy on an ongoing basis than a Treasury Bill-only portfolio would be (hence “Operation Twist”*), it is also more rooted and less easy to adjust to evolving economic conditions given that, by definition, the holdings roll off more slowly and, as they do, maturing debt proceeds continue to be pushed into higher risk-duration securities. In contrast, a Treasury Bill-only portfolio does not provide the same absorption of risk duration while also providing the Federal Reserve with the option of tightening policy via balance sheet reduction without a corresponding coupon sale program.

*Operation Twist refers to the policy undertaken by the Federal Reserve in 2011 to lengthen the duration of their Treasury Securities portfolio. The Federal Reserve undertook sales of Treasuries with maturities of less than three years to purchase securities with maturities of between six and thirty years.

Returning to pre-COVID norms of 7.3% would, in the absence of MBS, mean more than doubling Treasury Bill holdings to $420 billion or that the Treasury-only portfolio expansion of $1.4 trillion required by the elimination of MBS holdings would boost Fed holdings of coupons by $1.2 trillion and bills by roughly $200 billion. Moving back to pre-GFC bill holding levels, which we view as ideal, would require the entire MBS-driven Treasury expansion of $1.4 trillion in additional to a further Operation “Untwist” of $250 billion.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a "professional client" as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees' pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1. As of July 22, 2024, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.