Slower Growth, Lower Inflation and More Supportive Monetary Policy

The downturn in the global manufacturing sector persists, suggesting slower growth globally in the next three to six months (see Figure 2). U.S.—We continue to look for a U.S. recession, which we expect to be short-lived, to begin in 2024, with growth and the labor market to weaken further. We are anticipating a rate-cut cycle to start in H1 2024. Europe—Growth momentum is likely to remain feeble into 2024, with a disinflation trend well underway and a hope for monetary policy easing next year. Asia—Although the region’s macro performance has held up relatively well, year to date, we are looking for more growth headwinds in 2024, including weaker external demands, and monetary policy to ease. Latin America—The region’s central banks may continue or start cutting policy rates in 2024, with growth expected to converge to a modest 1% to 2% across the region.

More Supportive Monetary Policy May Mean Lower Yields

U.S. Treasury (UST)—Given our expectation of slowing inflation and economic growth, we look for the 10-year yield to move lower in the next quarter or two, especially if the Fed is pivoting to conduct rate cuts. Japanese Government Bonds (JGBs)—Our baseline for Negative Interest Rate Policy remains on hold in 2024, but we will continue to revisit depending on incoming data from Japan and globally. Chinese Government Bonds (CGBs)—The 10-year yield will likely remain rangebound due to ongoing cross currents between growth headwinds and expected policy supports. Easing growth and still-low inflation next year may pose downside risks to our 10-year yield forecast. German Bunds—We expect the 10-year yield to fall to around 2% by year-end 2024, due to the ECB’s rate-cut cycle anticipated to begin around mid-2024. Valuations may also be supported by a tighter fiscal policy.

“Up-in-Quality” Still Reverberates Within Corporate Credits

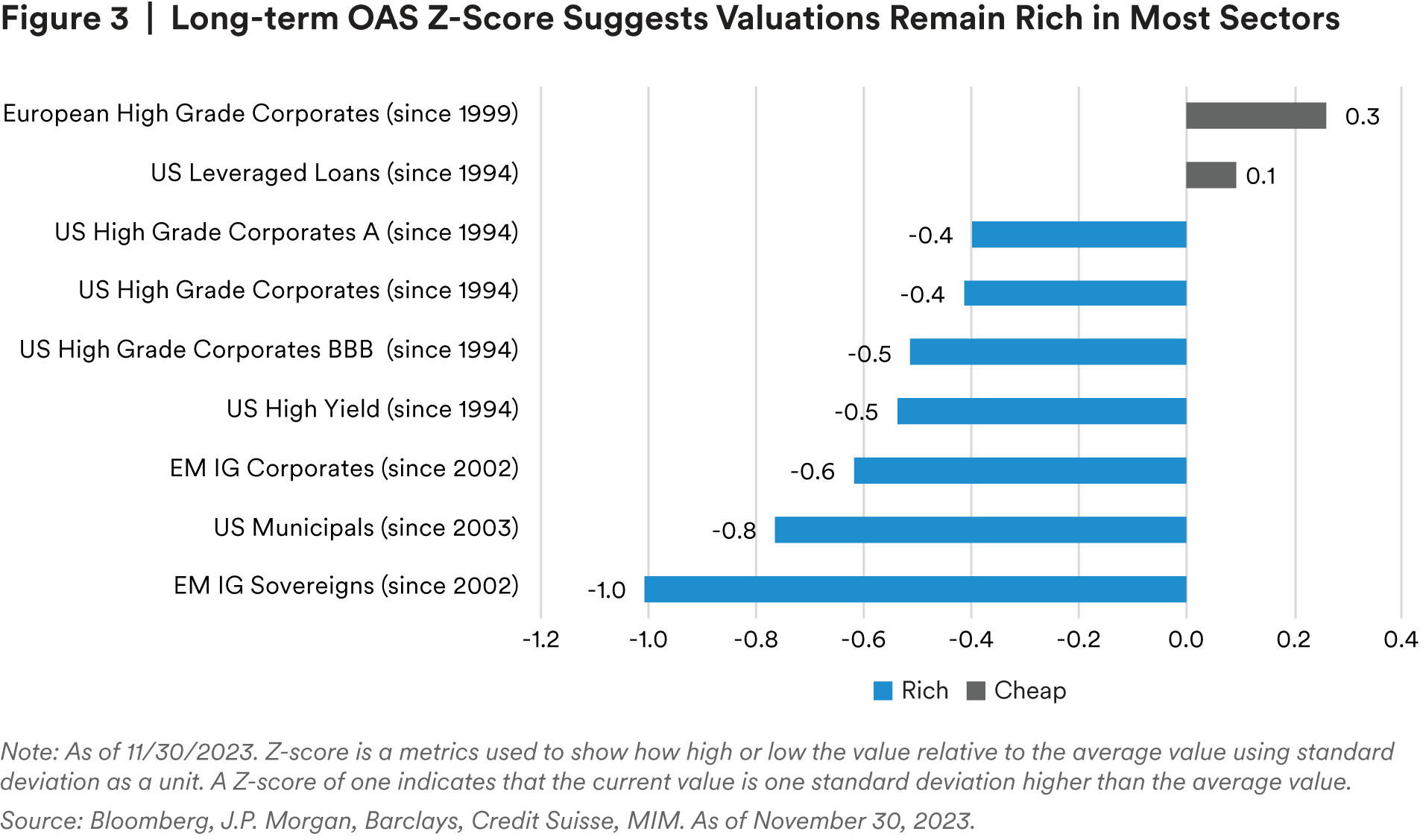

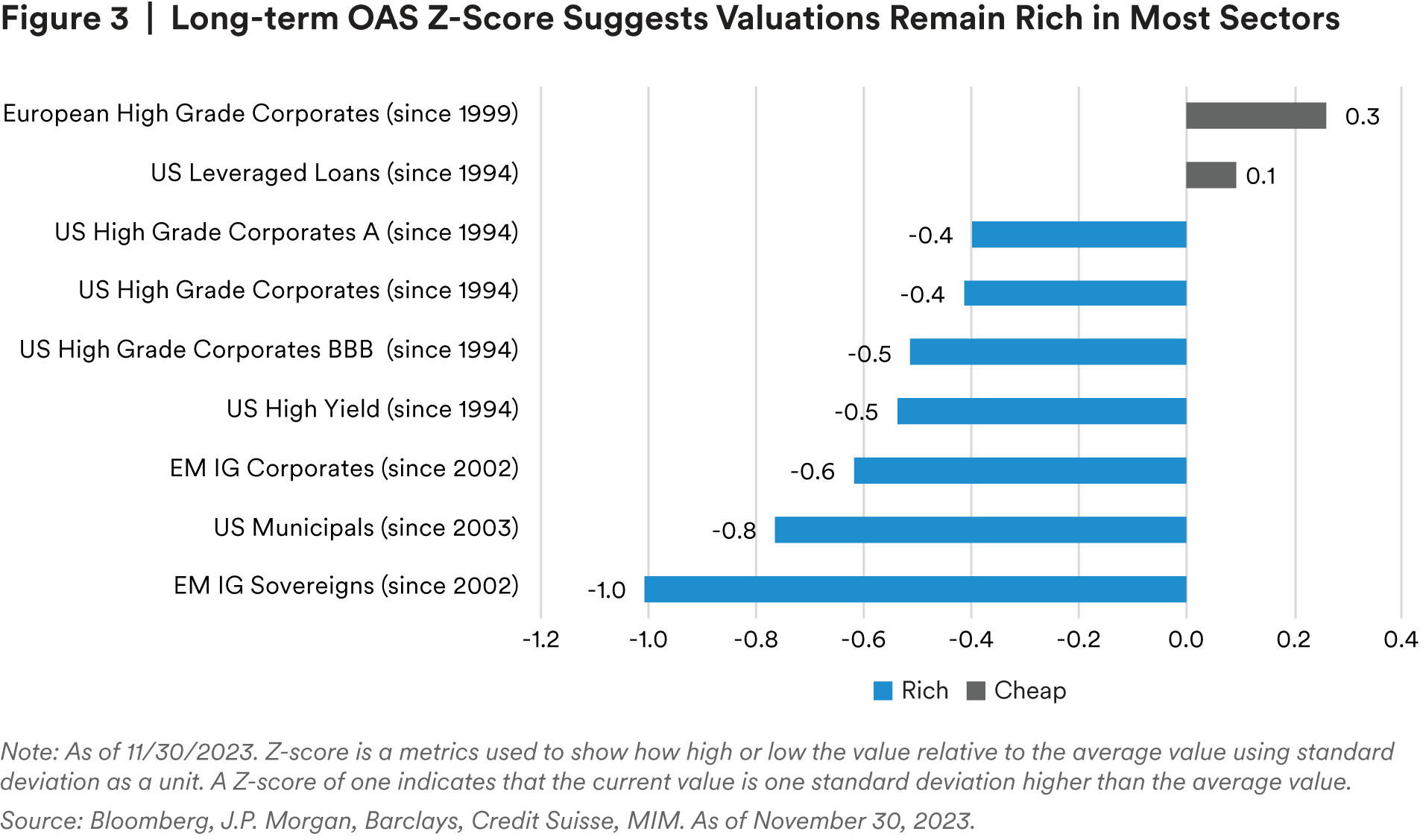

After weakening for three consecutive quarters, credit fundamentals appear to have stabilized and remain resilient across U.S., European and emerging markets, with corporate profits rebounding. Option-adjusted spreads (OAS) tightened to new year-to-date levels in most credit sectors, according to Bloomberg, thanks to stronger-than-expected Q3 earnings. However, we continue to believe the market is overly optimistic about the soft-landing scenario, and valuations remain rich (see Figure 3). We believe there is limited room for further spread compression. Given the lagged impacts of monetary policy and still-elevated recession risk in 2024, we continue to recommend an “up-in-quality” bias for the next quarter or two. U.S. Investment Grade (IG)—Credit fundamentals remained resilient with some mixed messages about both operating performance and credit metrics. Demand from investors chasing all-in yields was strong in the past quarter, further supporting U.S. IG bonds. Although spreads are generally near their year-to-date tights, we find all-in yields attractive on a historical basis.

European IG—Our credit outlook for 2024 is constructive. Fundamentals saw a slight deterioration mainly in the Chemicals and Consumer Discretionary sectors, but demand for European IG remained strong. Spreads have tightened driven by decent corporate performance in Q3. We view current valuations as fair, and we believe it will be difficult for spreads to narrow much further. High Yield (HY)—Credit fundamentals stabilized in Q3 2023 and remained strong relative to historical levels. The default outlook has improved for 2024, as issuers pushed out their maturity wall, based on Moody’s default report. While spreads remain tight, the HY market looks attractive from a yield perspective. Leveraged Loans—Our strategy is to maintain an “up-in-quality” bias to offset any potential impacts of macro risks (e.g., slowing growth) and continued credit deterioration. We expect the start of policy easing next year to be supportive of loan issuers’ credit fundamentals. Municipals—Credit fundamentals remained stable in Q3 2023. Looking forward, we are seeing some sources of potential volatility in 2024, including the election and a debate over the 2017 Tax Cuts and Jobs Act. Although current spreads are tight, they can be attractive for investors who are looking for tax-adjusted yields. With relatively long duration, municipal bonds can potentially reduce reinvestment risk, while also benefiting from potential rate cuts in 2024. Emerging Markets (EM)—EM sovereign fundamentals have largely stabilized from COVID-19- driven growth and inflation shocks. Most countries are seeing their growth running at- or above-potential, while those that are more exposed to China are seeing a drag. We believe that there are roughly one-third of EM countries that are facing some downgrade risk, due to rising debt dynamics that require fiscal adjustment. For EM corporates, fundamentals remained healthy. Balance sheets remained strong with active liability management that has reduced concerns over refinancing risks. Looking forward, we believe that credit metrics may moderate further.

Household Balance Sheets Generally Remain Strong

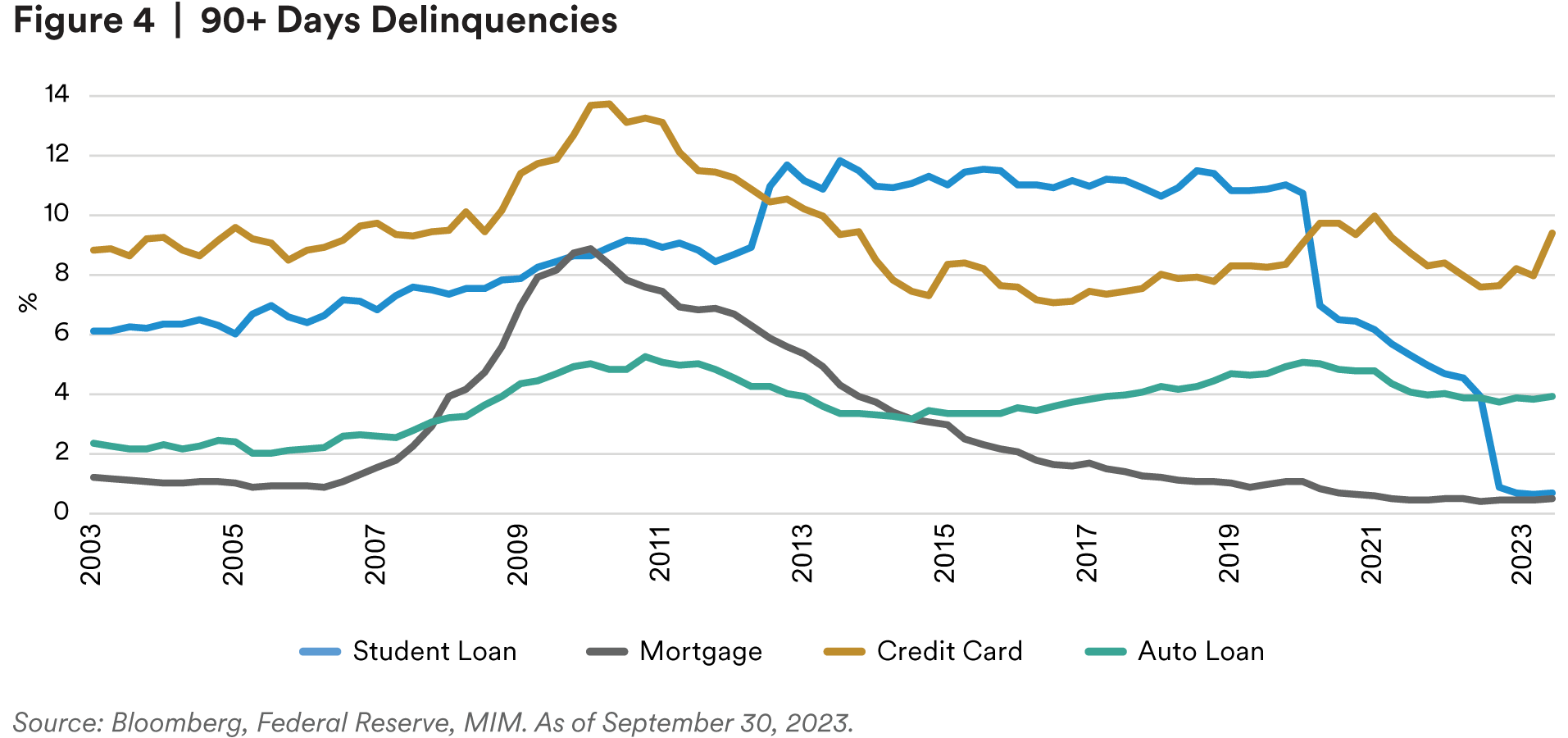

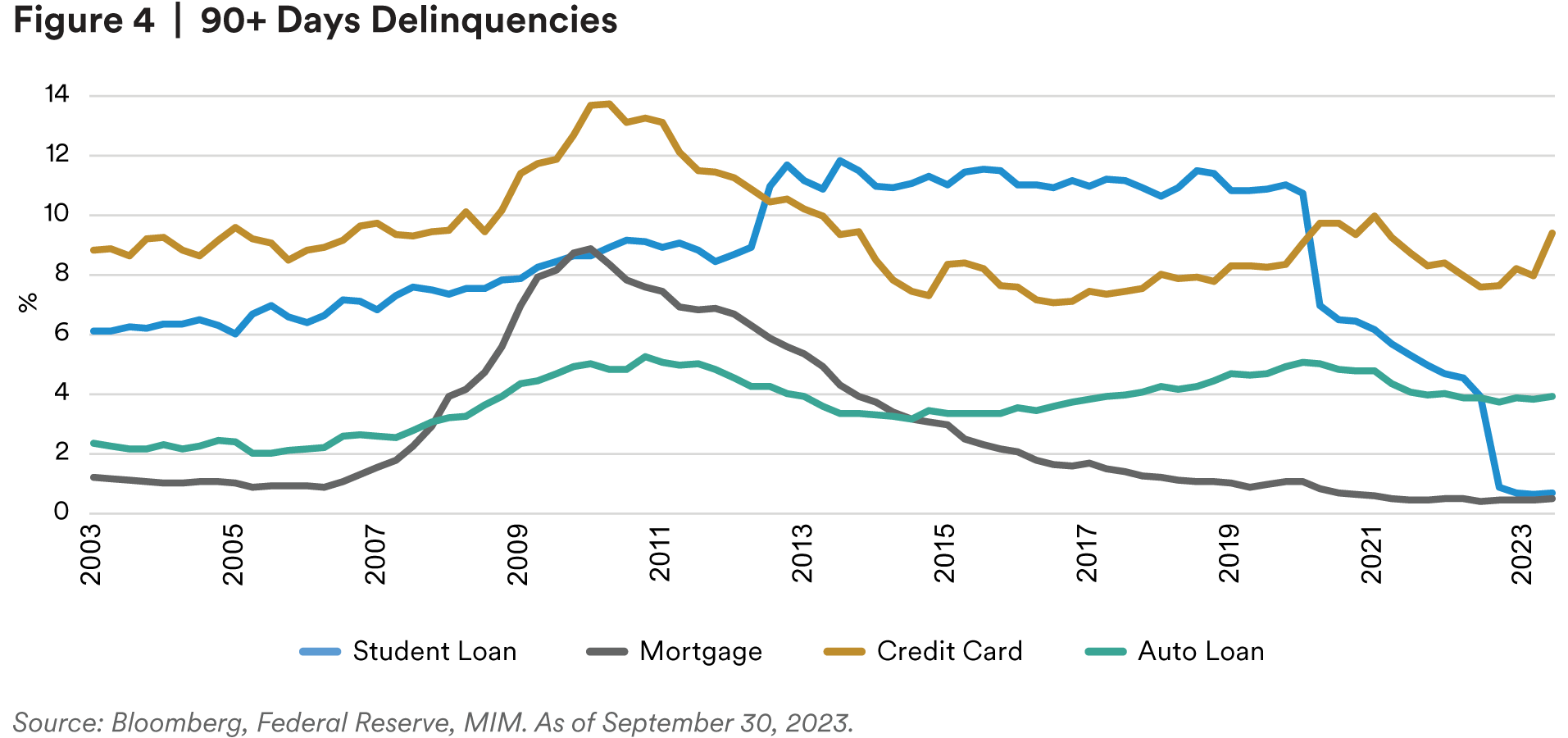

Residential Credit—Despite the surge in mortgage rates seen in 2023, the U.S. housing market remained resilient, with home prices rebounding over the past few months, thanks to a strong labor market and limited housing supply. Borrower fundamentals continued to be robust, with mortgage delinquencies staying near historical lows (see Figure 4). We continue to look for supply to remain under pressure as homebuilders have been conservative due to elevated costs and mortgage rates. Asset-backed Securities (ABS)—Excess savings and a strong labor market have supported consumers well throughout this year, but we are expecting some headwinds in 2024. Generally, household balance sheets are strong (see Figure 4), with credit card and auto loan delinquencies close to their long-term averages. However, younger borrowers need to be watched, as student loan payments restart (with high interest rates)—we are anticipating an uptick in student loan delinquencies. Collateralized Loan Obligations (CLOs)—Fundamentals trend weaker, in line with market expectations, as bank loan borrowers struggle with high borrowing costs. The Kanari database indicated that market value of CCC within CLO portfolios increased to above 10%. A recent JP Morgan report also indicated that recovery rates are historically low. We expect loan-only issuers to remain weak.

Commercial Mortgage-backed Securities (CMBS)—Commercial real estate fundamentals continued to face challenges, especially the office sector. The CRE Financial Council indicated that delinquencies and specially serviced loans continued to trend higher, reflecting greater risk in the asset class. We look for CMBS issuance to increase 25% next year from 2023 levels, but to remain well below the annual run rates seen prior to 2020. Agency MBS—Money managers continued to increase their allocation to Agency MBS in the past quarter, despite limited demand from banks. Current coupon spreads remained significantly wide to longer-run averages, which we find attractive. Prepayments are low and anticipated to decline further during the winter months, while mortgage originations continue to be muted. Private Structured Credit (PSC)—We expect consumer credit performance to remain under pressure in 2024, with an expectation of higher unemployment moderated partially by tight lending standards and still-strong household balance sheets. We look for deal flows to remain healthy going into the start of Q1 2024. Given some uncertainties in inflation, monetary policy and the labor market, our credit outlook remains constructive for 2024.

CRE Fundamentals Stable, but Office Remains Challenged

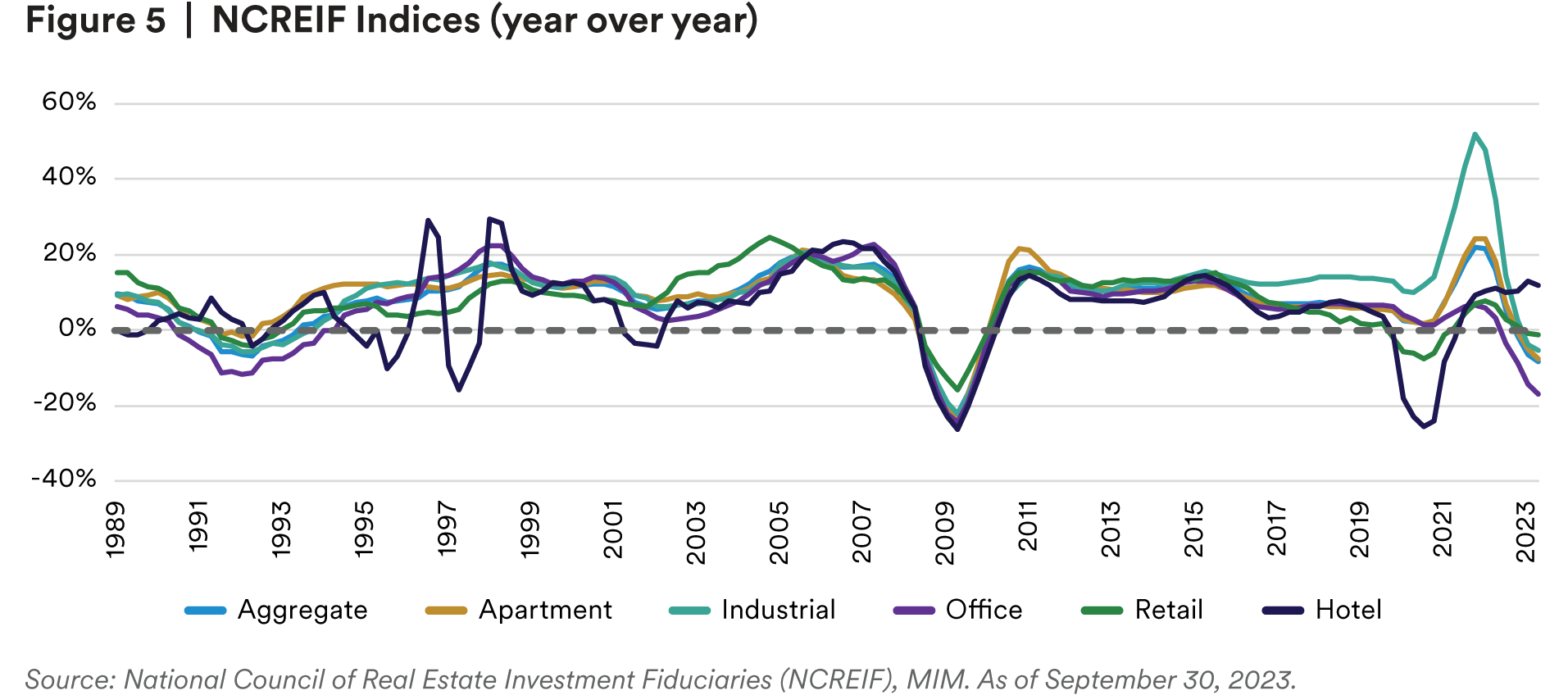

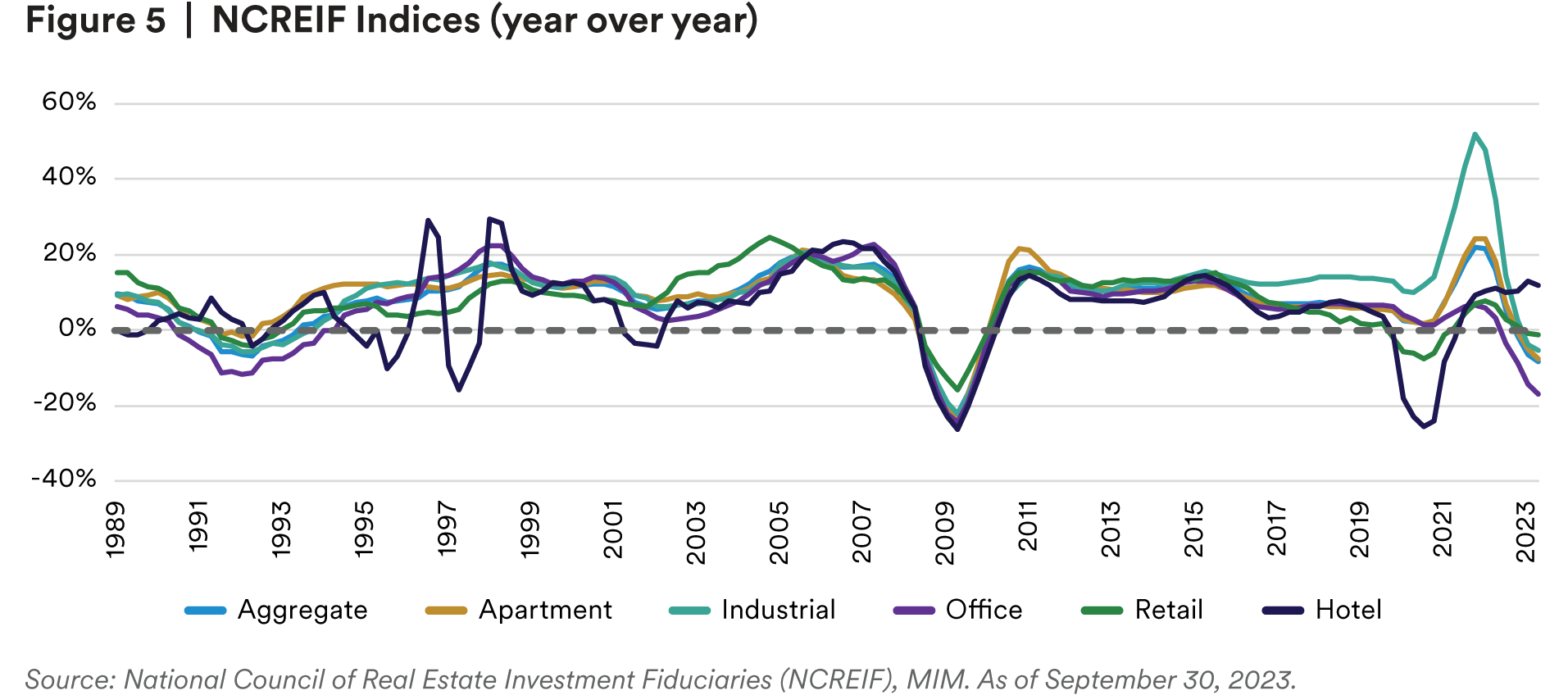

Similar to broader inflation trends, real estate fundamentals have cooled from historically elevated demand in 2021 and 2022. Still, vacancy rates that remain near historical averages for most property types are continuing to generate stable rent growth. In the apartment sector, pockets of oversupply in several sunbelt markets like Nashville and Phoenix could cause rents to remain flat or even fall modestly in 2024, but Coastal, Mid-Atlantic, and Midwestern markets are generally better positioned. Retail, industrial and hotel sectors are benefiting from healthy demand, and, in the case of retail, a dearth in new construction. The office sector is challenged, and we expect another year of deteriorating vacancy in 2024. The NCREIF office property index in September 2023 generated a total return of -17% over the past year (see Figure 5). Overall pricing has improved relative to the 2022 peak, as evidenced by values in the NCREIF property index which have declined 11% through 3Q 2023. Transaction volume is muted and will likely remain low next year.

The Farm Economy Remains Robust

2023 Net Farm Income (NFI) estimates by the United States Department of Agriculture (USDA) showed a decline of 17% from a year ago, due to an 8% year-over-year contraction in agricultural exports (e.g., corn, livestock, poultry, dairy, tree nut). Unfavorable weather conditions during growing seasons resulted in harvests wrapping up slightly behind the 2022 pace. Despite the elevated interest rate environment and the modest downtrend in NFI, 2023 will likely mark the third consecutive year of high farm incomes. We believe the farm economy is in a good shape. In 2023, farmland values remained strong on a year-over-year basis, which created steady capital flows to the sector. Delinquencies in agricultural mortgages dropped to all-time lows in 2023, according to Ag Finance Databook. Heading into 2024, we are looking for crop prices to stay in a moderate territory.

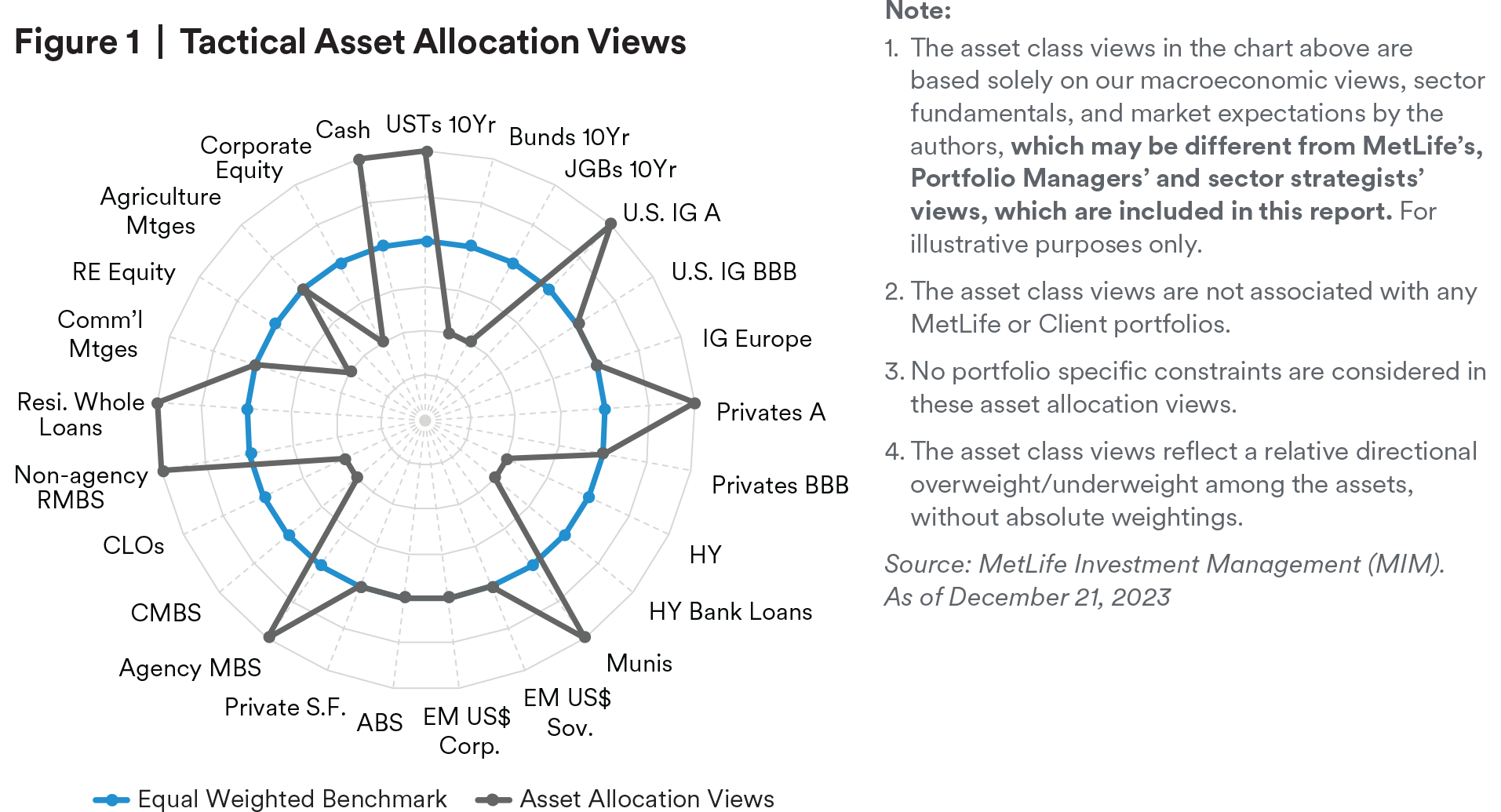

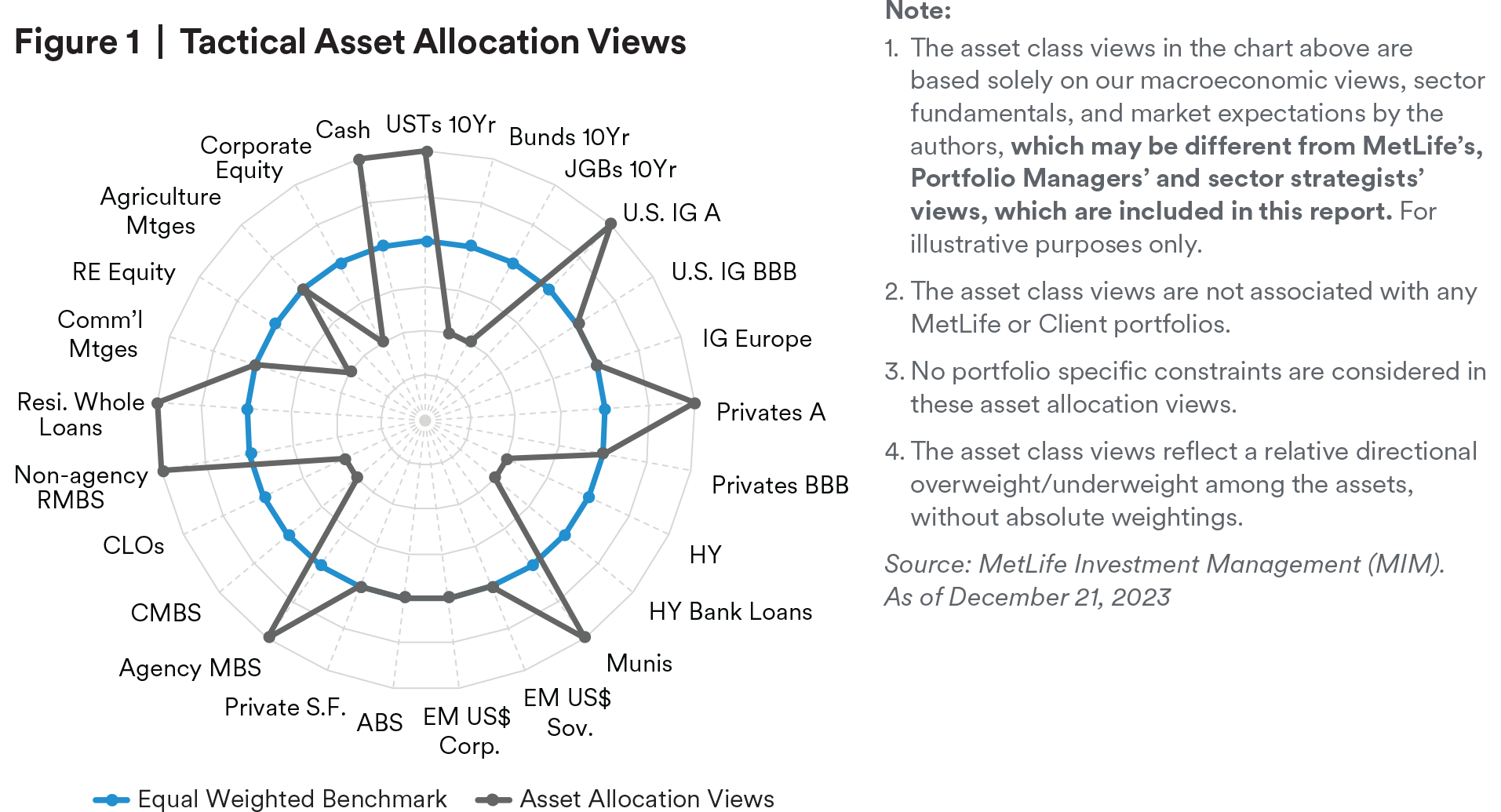

Valuation Risk Seems High in Equity, While Cash Looks Attractive

Given our recession call and “up-in-quality” strategy for H1 2024, we are expecting a more challenging macro backdrop for equity markets next year. We believe that consensus estimates of earnings per share for 2024 are overly optimistic, as equities are currently expensive, volatility is at its historical low, and geopolitical risks are likely to remain elevated—meaning that the uptrend in equity valuations may not be sustainable. Since the risk of a recession remains high, we believe the future for fixed-income markets is brighter for the next quarter or two, and cash investments remain attractive in the near term (3-month U.S. Treasury bills are at a multi-decade high, according to the U.S. Federal Reserve). Hence, we continue to remain underweight corporate equity and overweight cash investments from a tactical asset allocation perspective.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda[1]ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of March 31, 2023, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC.