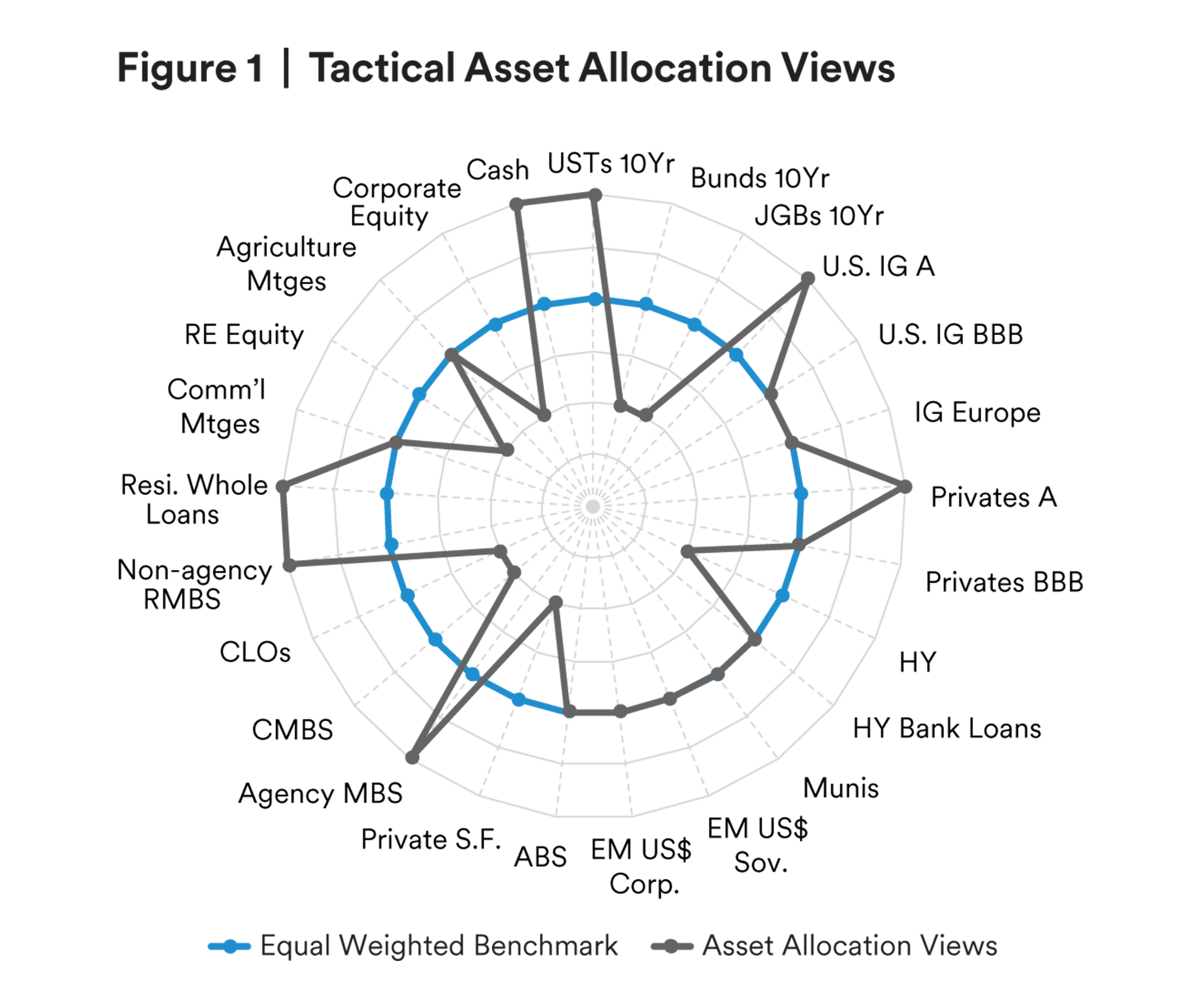

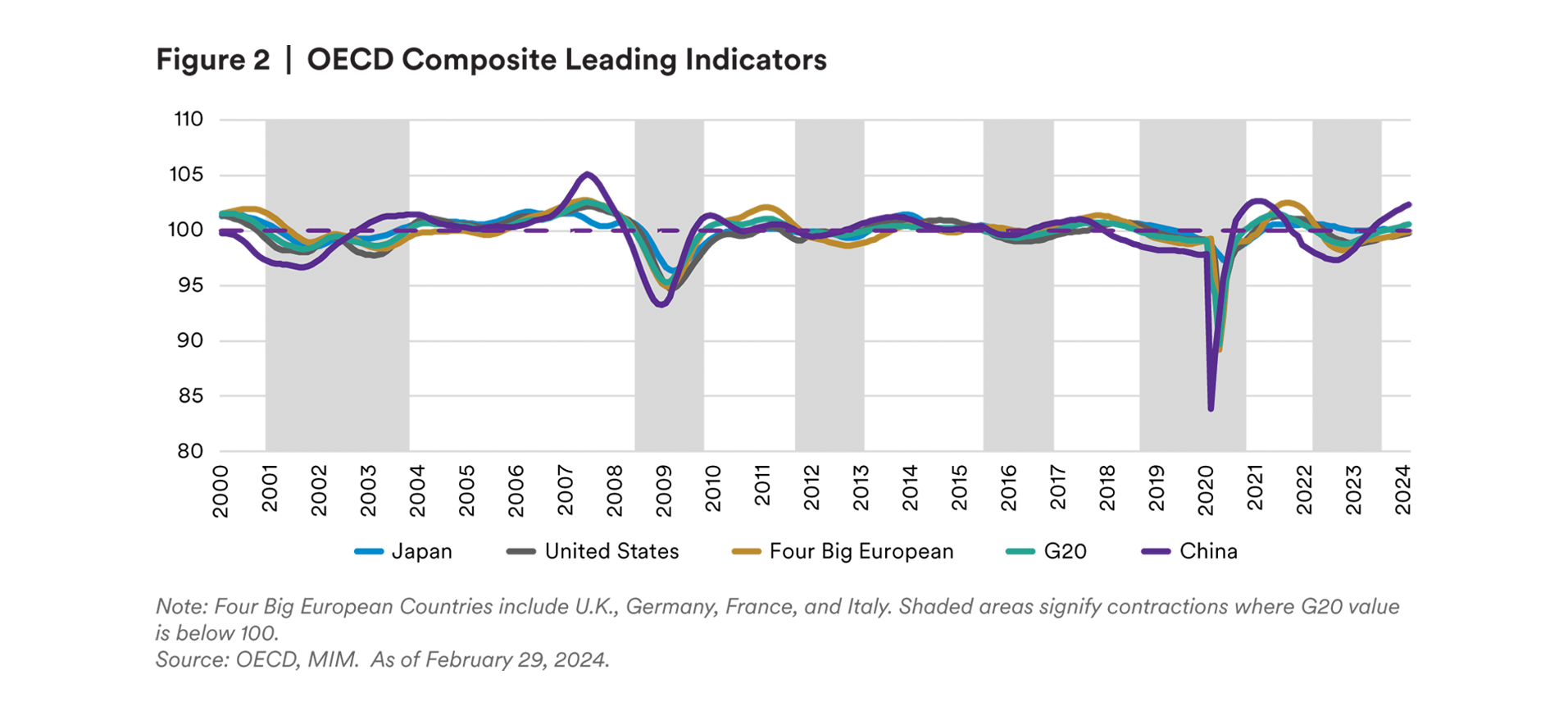

Global Economy is Weighed Down by Geopolitical Crises and Policy Uncertainties

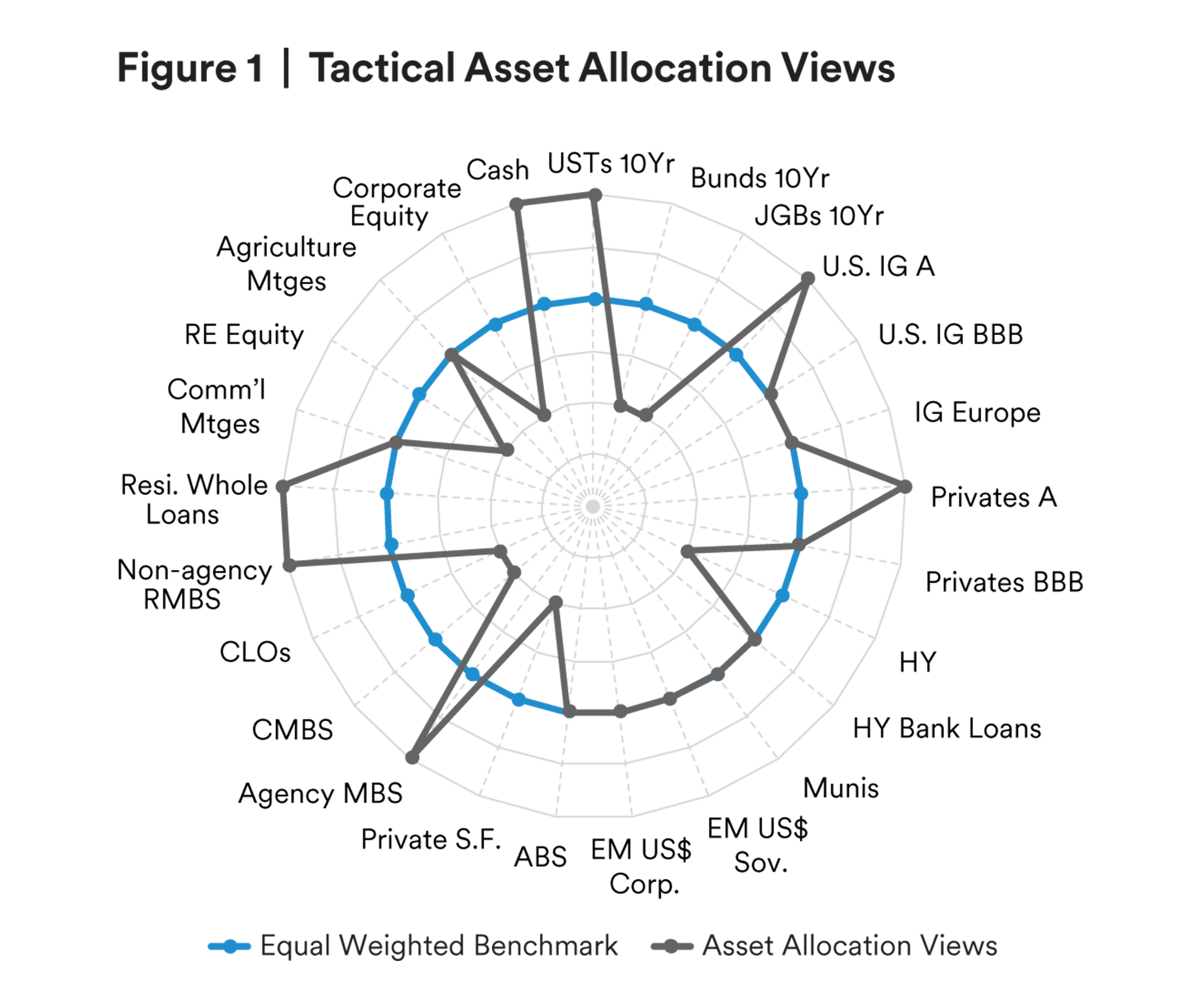

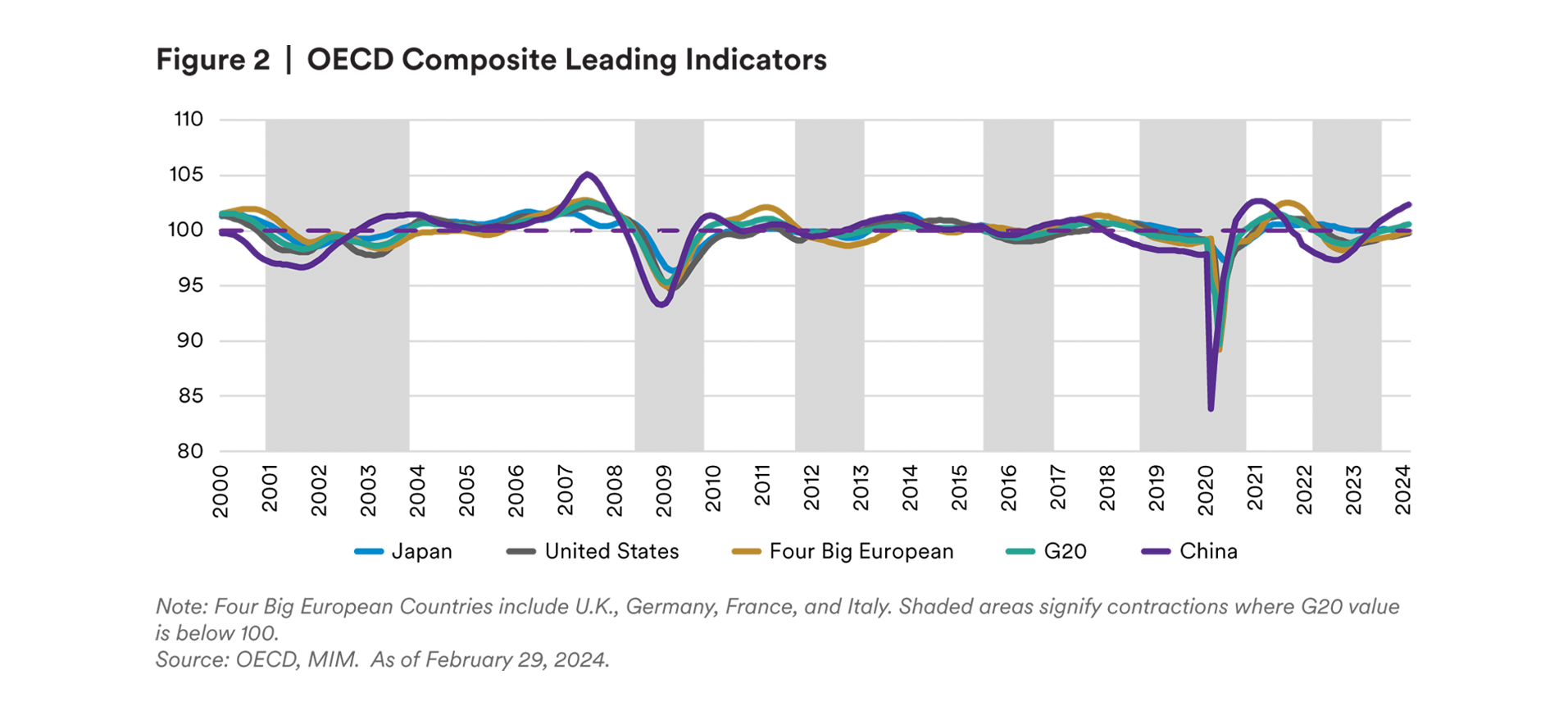

Major economies are looking for their GDP to run below long-term trend (see Figure 2), with China continuing to slow gradually despite economic re-opening and policy stimulus. U.S.—We continue to expect the United States to enter a recession in 2024, which may be similar to pre-Great Financial Crisis recessions, i.e. not particularly sharp or long. Europe—Overall growth momentum in the euro area and U.K. remains weak, with inflation moderating due to declines in energy costs. We anticipate the ECB and BoE to begin a cautious rate-cut cycle in 2H24. Asia—The growth backdrop remains stable due to a stronger-than-expected external demand. With disinflation persisting, central banks are in no rush for rate cuts. Latin America—We are looking for growth to converge to a modest 1% to 2% this year across the region, with central banks continuing or starting rate cuts.

Note:

1. The asset class views in Figure 1 are based solely on our macroeconomic views, sector fundamentals, and market expectations by the authors, which may be different from MetLife’s Portfolio Managers’ and sector strategists’ views, which are included in this report. For illustrative purposes only.

2. The asset class views are not associated with any MetLife or Client portfolios.

3. No portfolio specific constraints are considered in these asset allocation views

4. The asset class views reflect a relative directional overweight/underweight among the assets, without absolute weightings.

Source: MetLife Investment Management (MIM). As of March 21, 2024

The Valuations for UST, Bunds, and JGBs Seem Attractive Relative to CGBs

U.S. Treasury (UST)—We look for the yield curve to shift downward and remain inverted, given our expectation of a mild recession around mid-2024. The 10-year yield may be lower in the next several months. Japanese Government Bonds (JGBs)—The BoJ ended its policy framework of Quantitative and Qualitative Monetary Easing with Yield Curve Control. The BoJ is anticipated to reduce its JGB buying gradually in accordance with market conditions. Chinese Government Bonds (CGBs)—The 10-year CGB valuation remains rich. As the PBoC maintains its accommodative stance, we expect CGB rates to hover around current levels. German Bunds— Bunds are supported by strong demand for high quality, euro-denominated sovereign paper in a much larger common currency area. Net financing needs are expected to keep overall bund supply at relatively elevated levels in coming years.

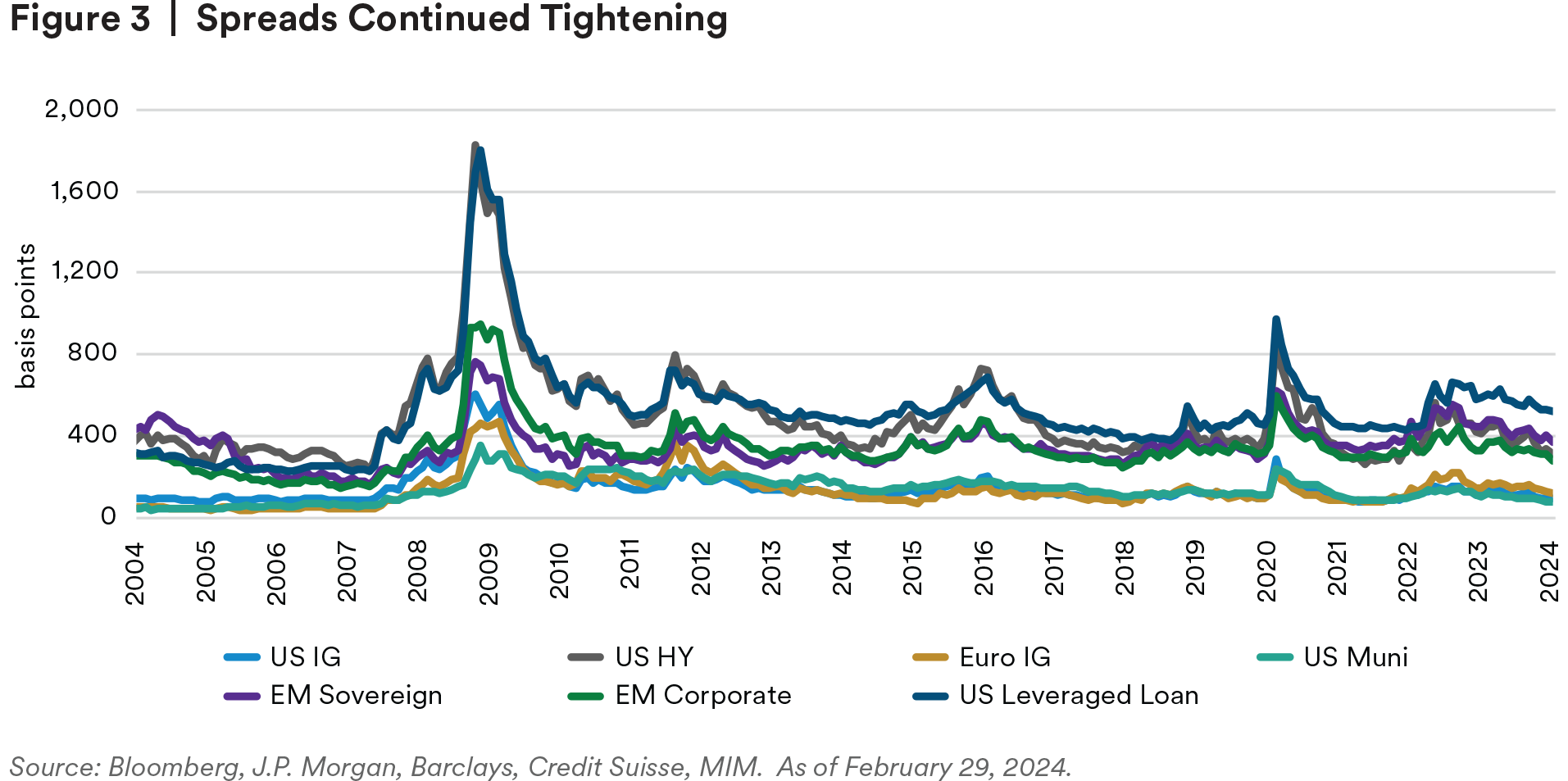

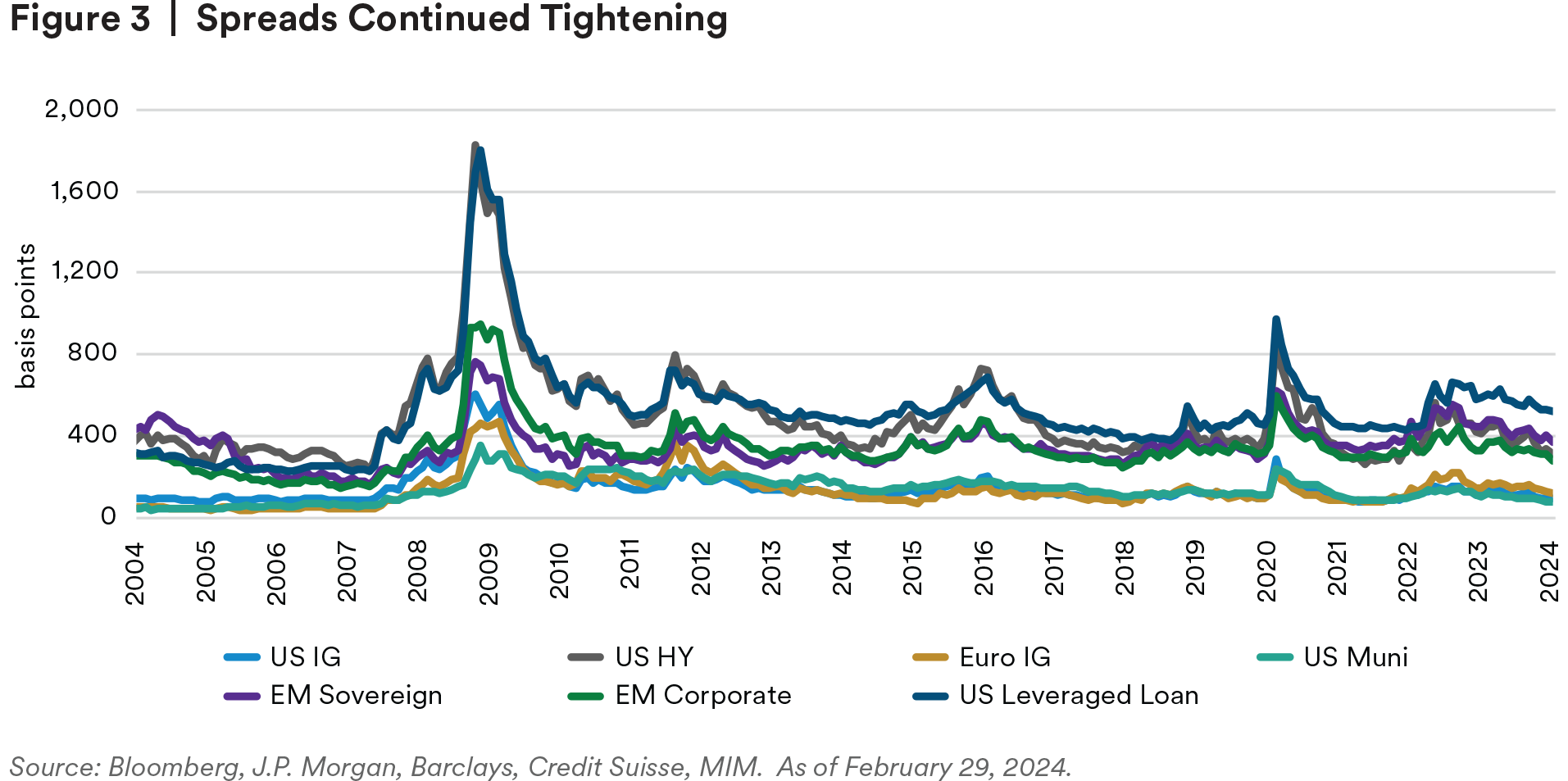

Current Credit Cycle Remains in Late Stage

Credit fundamentals remained resilient across U.S., European, and emerging markets as corporate profits improved during Q4 2023. We believe current credit metrics are at healthy levels, and they are likely to improve further in 1H24. Default and rating migration outlooks both improved for 2024. Thanks to stronger-than-expected earnings, robust technicals, and stable macroeconomic fundamentals in 1Q24, credit spreads tightened further (see Figure 3). We believe there is very limited room for further tightening. Given our recession expectation, we remain constructive on credit markets for the next quarter or two. U.S. Investment Grade (IG)—Credit fundamentals remained stable in the past quarter, with slight improvement in leverage ratios as well as a drop in the coverage ratio due to elevated interest costs. We continue to believe that spreads do not appropriately reflect market risks. Therefore, we are positioned relatively conservative, favoring higher quality.

European IG—We have seen a slight deterioration in overall metrics in the past quarter as well as a mild weakening in corporate health. However, overall fundamentals stayed healthy. Spreads have been decreasing since mid-October 2023 despite record issuance in January and February. As timing for rate cuts has been pushed out, elevating government yields, we continue to find all-in bond yields attractive. High Yield (HY)—Credit fundamentals remained stable with some mixed messages about both operating performance and credit metrics. Although spreads have continued to narrow in 2024, we still believe the HY market looks attractive from a yield perspective. Leveraged Loans—We continue to be constructive on the outlook for the leverage loan market, given a backdrop of slowing economic growth and a steadily increasing default rate. The relatively elevated yields are expected to continue playing a greater role in boosting total returns for this asset class. Municipals—During 4Q23, the fundamentals of municipals remained strong, and we look for credit quality to remain stable, thanks to the healthy “rainy day” fund balances. Due to the extremely tight spread levels, it’s not surprising to see a few issuers exercising Extraordinary Redemption Provisions (ERP). We continue to find all-in yields attractive on an historical basis. Emerging Markets (EM)—EM sovereign fundamentals continued to be stable in the past quarter. Aggressive central bank hiking has dragged down inflation, and some have begun to ease policy. The ratings trajectory is balanced, with roughly one-third of EM countries facing some downgrade risks. For EM corporates, fundamentals stayed healthy as of last quarter. Liability management has pushed out the maturity wall, especially for higher quality issuers. We are anticipating credit metrics to be resilient in the next quarter.

Commercial Mortgage-backed Securities (CMBS)—Commercial real estate remains under pressure with the NCREIF All Property Index down 7.9% yoy in 4Q23, mainly driven by the office sector which posted a 17.6% decline. The delinquency rate for all CMBS loans stands at 4.66% in January compared to 2.94% a year ago, according to CREFC. Agency MBS—Elevated rate volatility, Fed balance sheet run-off and a lack of bank demand may continue to be a headwind for the sector in the short term. However, with current coupon spreads remaining wide to longer-run averages, we continue to find Agency MBS attractive. Private Structured Credit (PSC)—Thanks to tactical positioning that aimed at locking in higher yields in advance of anticipated Fed rate cuts, demand for PSC has been robust in 1Q24. Valuations are under pressure. We think we may experience pressure on origination volume due to tighter pricing and credit considerations.

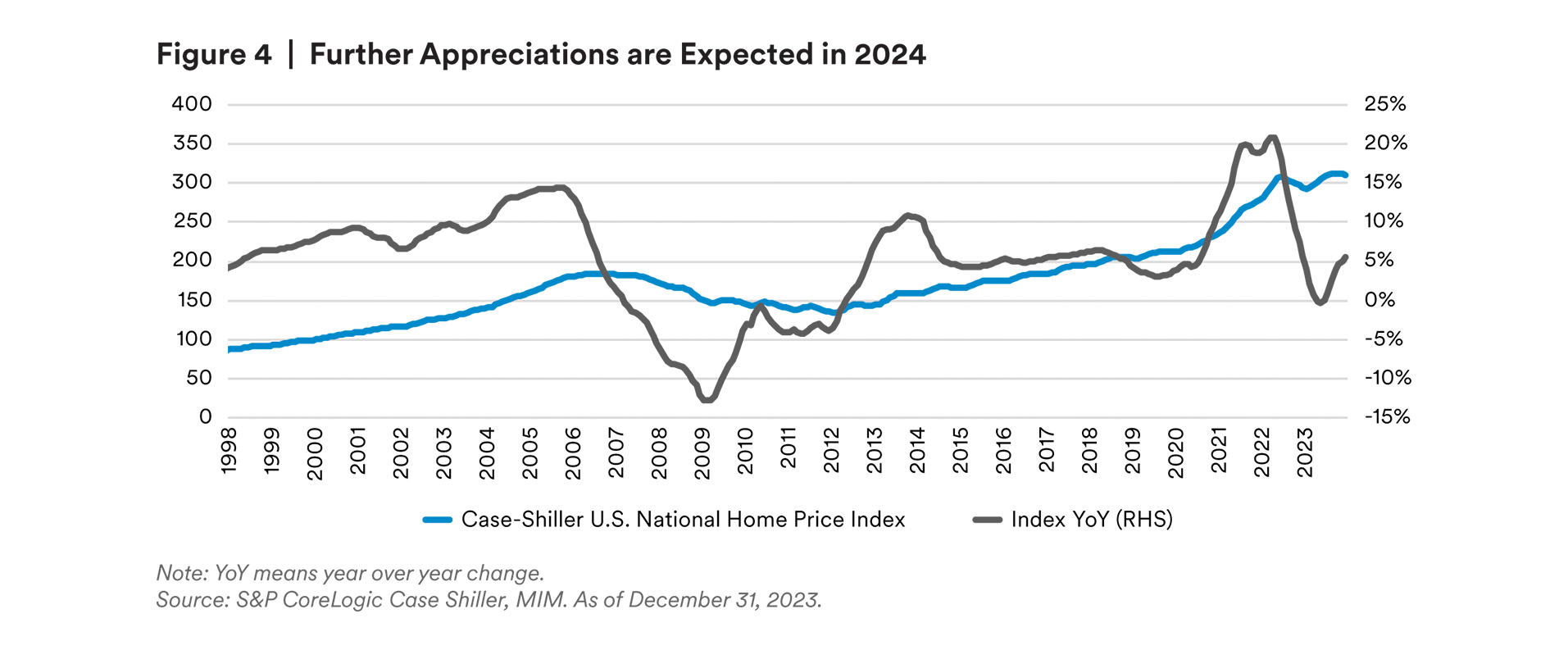

Enduring Trends and Challenges Continue to Hover Over the CRE Market

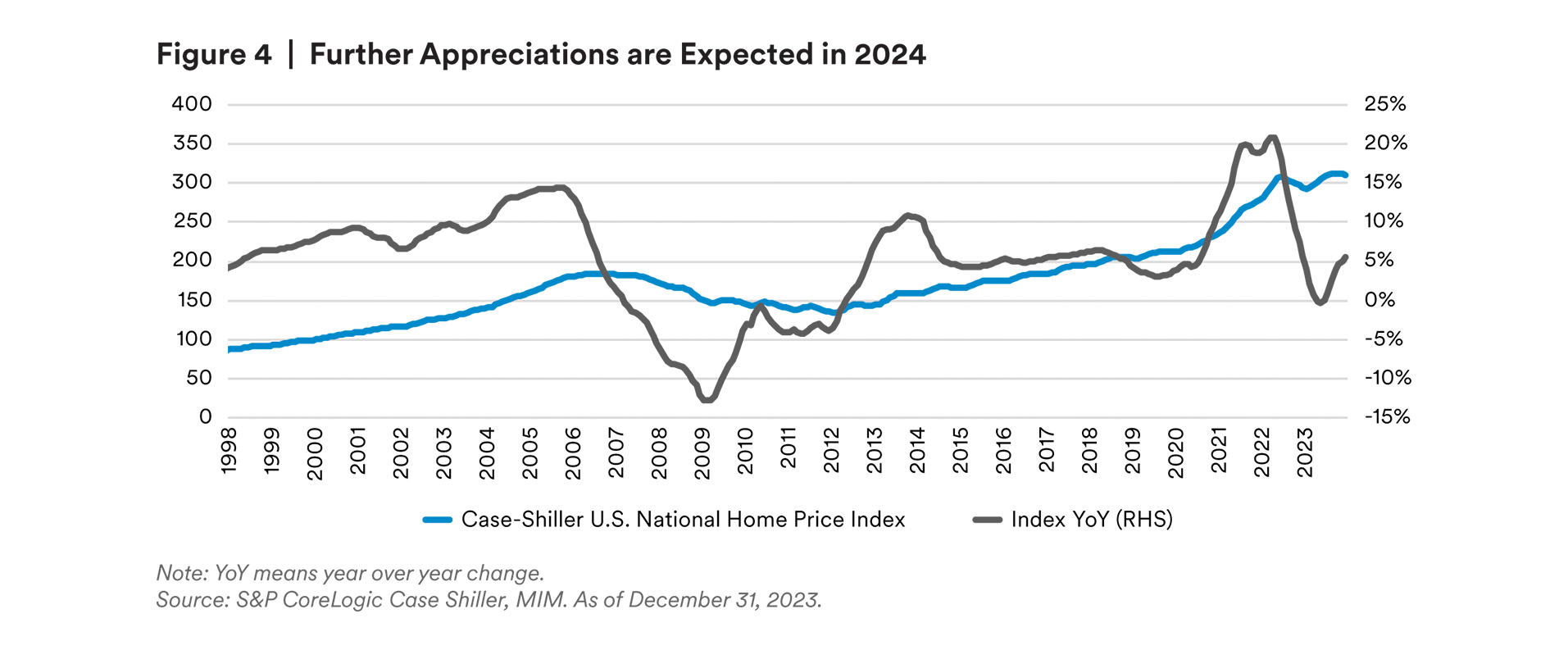

Real estate fundamentals are generally stable outside the office sector, and vacancies are near historical long-term averages across the commercial real estate (CRE) market. Office—We are expecting a continued deterioration in the sector’s fundamentals during 2024, due to high interest rates, economic uncertainty, and hybrid work. We are looking for the vacancy rate to advance further. Multifamily—Outside of sunbelt markets, the multifamily sector looks solid, and we expect positive national rent growth in 2024. Markets like Nashville and Austin may see vacancies exceed their historical averages. Industrial—The sector is experiencing a slowdown, with an uptick in the vacancy rate, which is still well below the historical average. Despite the slowdown, the sector is expected to continue generating healthy rent growth. Retail—Vacancy rates are at a historical low, which is beginning to generate decent rent growth for the sector. Although retail space rents remain higher than last year, the pace of growth has moderated. Hotel—The sector’s occupancy has not fully recovered to the pre-pandemic level, according to the National Association of Realtors, despite gains in average daily rates and revenue per available room.

The Net Farm Income is Expected to Return to the 10-year Average

The United States Department of Agriculture (USDA) predicts a 26% year-over-year decline in net farm income (NFI) for 2024, as commodity prices moderate. Input costs are forecasted to broadly decrease, while interest expense is projected to remain flat. Producers’ balance sheets continue to be strong amid steady farmland values and consecutive years of high farm incomes. A reduction in supplies from South America may favor appetite for US crops. Overall, we anticipate farm sector profitability to stabilize above the long-term average in 2024. Valuations remain neutral with agricultural mortgage spreads near historical averages. Delinquency rates stay historically low. We expect origination to rebound slightly in 2024.

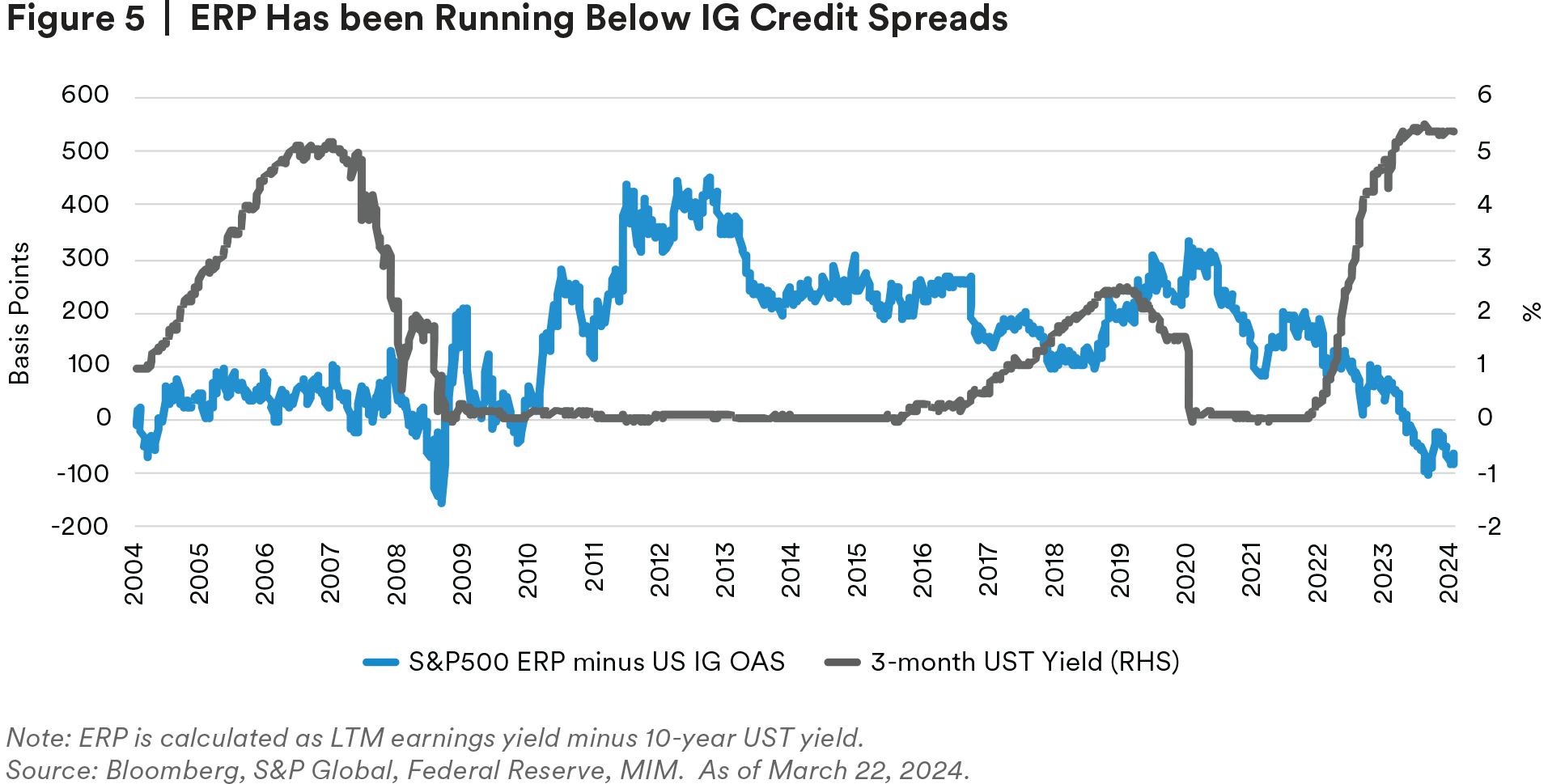

We Remain Underweight Corporate Equity and Overweight Cash Investments

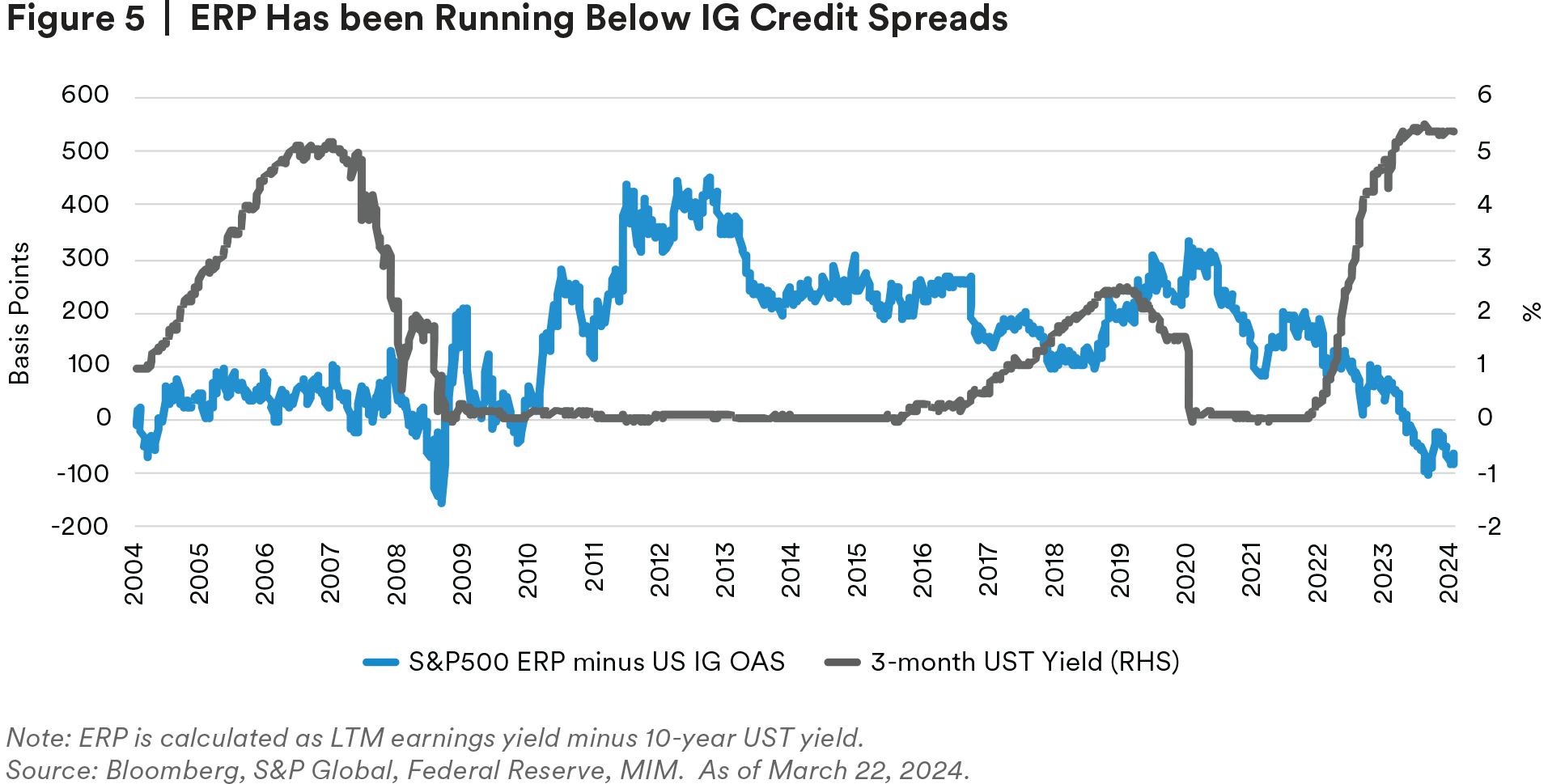

The S&P500 equity risk premium (ERP) has been running below the U.S. IG spread since July 2023 (see Figure 5), indicative of elevated equity valuations. Given our recession call, we continue to believe the future for fixed-income markets is brighter in the next quarter or two. We continue to remain underweight corporate equity from a relative value perspective. Thanks to a patient Fed, the yield on 3-month U.S. Treasury bills remains at a multi-decade high. Even if the Fed does cut rates in the near term, we expect cash investments to remain attractive on a historical basis.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein.

This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda- ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of March 31, 2023, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited.