It’s still too early for a recession, according to the yield curve.

In November, the spread between the Fed Funds rate and the 10-year Treasury yield returned to the deeply inverted position of late summer as the 10-year yield fell. About half of this decline was a reversal of the term premium gains we saw in October, and the other half was the market pricing in rate cuts in the first half of the year.

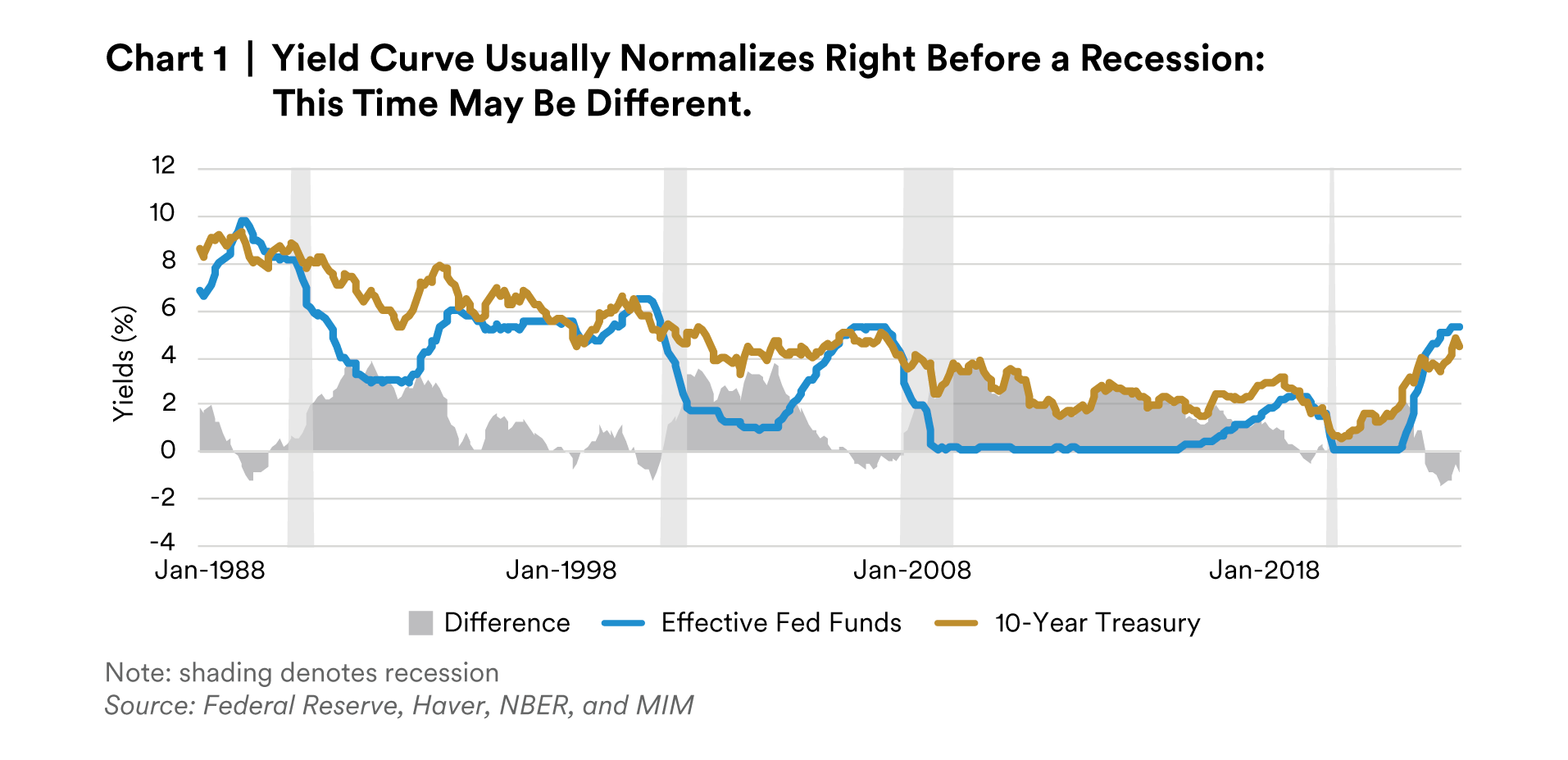

We feel the market is pricing in rate cuts for too early in the year. Ordinarily, the Fed starts cutting in advance of a recession and the yield curve normalizes right before recession onset (see chart 1). But we think this time may be different—the yield curve may take some time to normalize after recession onset.

First, this Fed has been particularly slow to switch policy paths given its heavy emphasis on data dependence. Second, a delayed cutting cycle may actually make sense: if the Fed wants to ensure that inflation is in fact vanquished, they will need to wait a little longer than usual. In the last several recessions, high inflation has not been a particular problem, and the Fed has had little reason to wait.

Finally, this is the first recession in which forward guidance is fully available. The Fed only began publishing the current incarnation of its Summary of Economic Projections in 2007, one month before the GFC recession began, and only added the Fed Funds projections to the economic variables in 2015. The yields on the 10-year may already have a lot more information priced in than they might have had in prior business cycles.

Given the current trajectory of unemployment and yields, we expect yield curve normalization and Fed Funds cuts around mid-year 2024, which would be after we expect the recession to start.

Housing: A Rebuilding Year

Housing remains a sticking point for inflation. Shelter prices remain the single biggest impediment to 2% inflation, with November inflation showing a 6% annualized inflation rate on shelter.

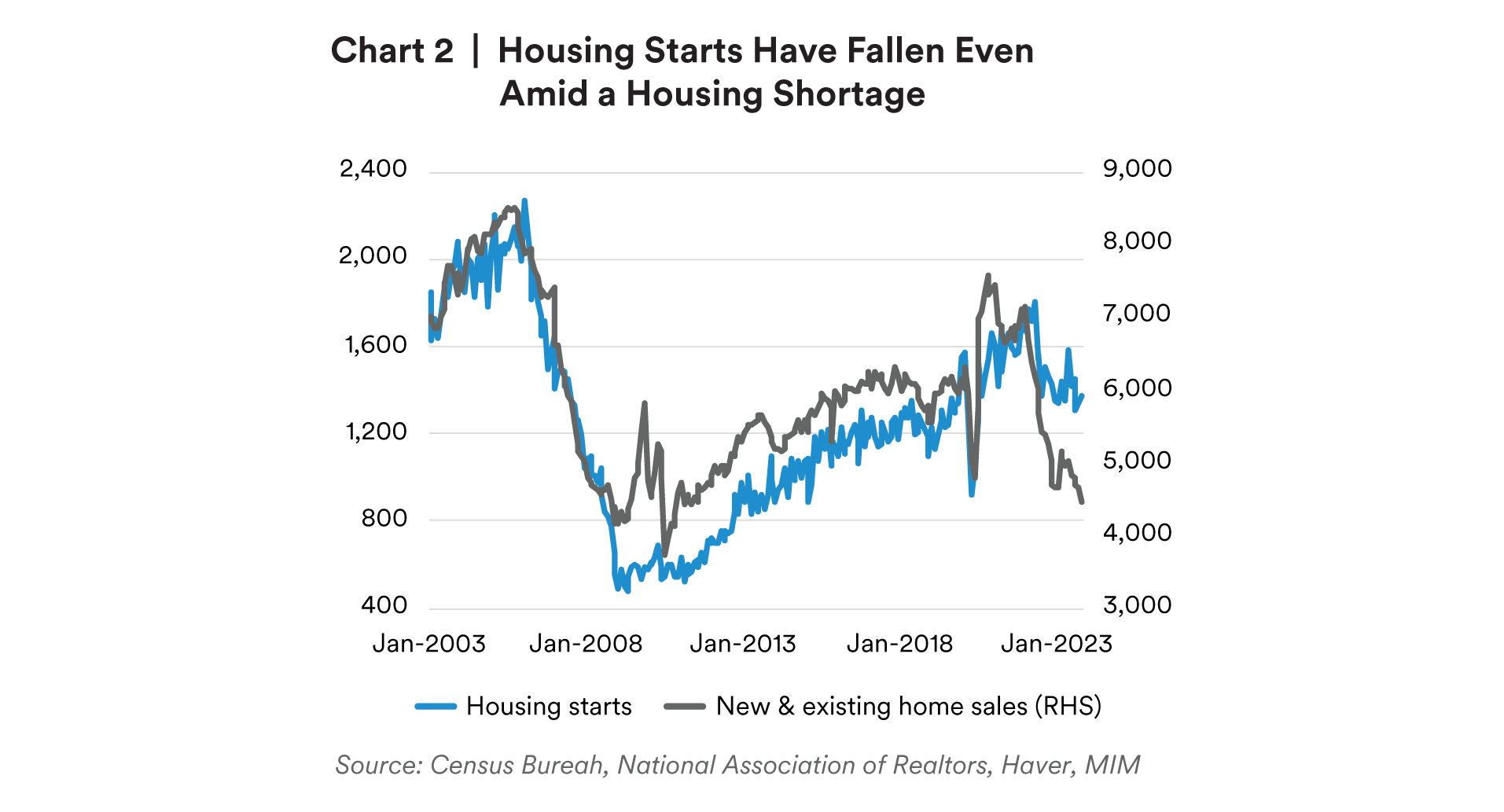

A key problem is the shortage of housing.

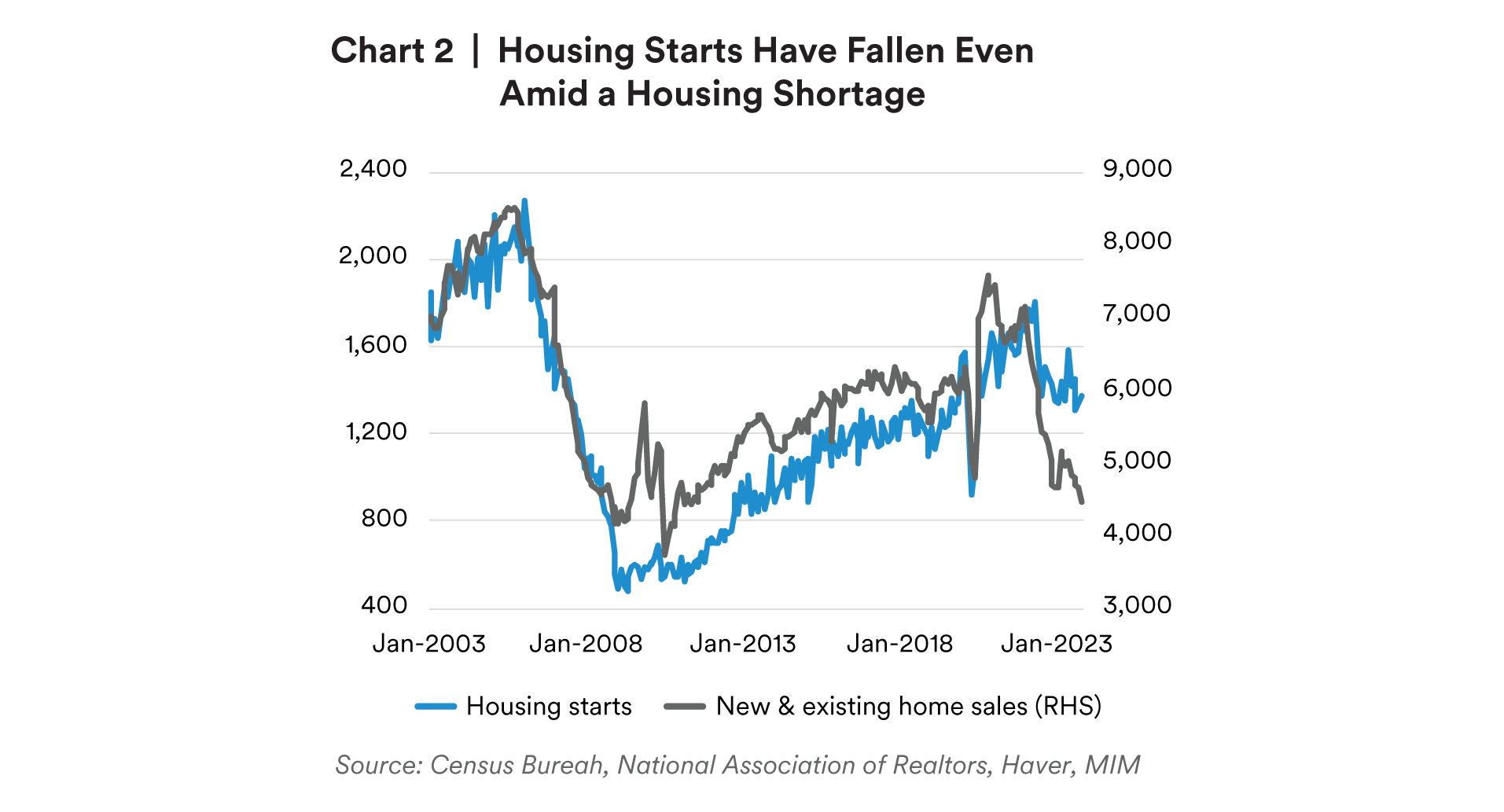

Housing starts tends to track transaction levels quite closely. As transactions fall, the incentive for building new houses falls (see chart 2). In the current environment, builders face the additional difficulty of high rates.

The one glimmer of hope is that housing starts haven’t fallen quite as quickly as transactions. There is some stabilization of the pace of new home building, which could improve the supply in the medium term, but getting houses ready for sale takes time so this process will likely play out over months. In the meantime, home sales prices continue to rise and contribute to inflation.

Ironically, a way to reduce shelter inflation is for the Fed to reduce the Fed Funds rate. But the Fed would balance that possibility with the possibility that cuts could reaccelerate economic activity.

Focus on What Consumers are Doing—Not on What They’re Feeling

In December, the University of Michigan’s Consumer Sentiment survey increased to 69.4, a 13% jump that undid four months of declines. This doesn’t necessarily mean that consumers will spend more money.

Traditionally, consumer sentiment has been viewed as insight into how consumers will spend and drive GDP, but in the last 10 years or so, this relationship has become more tenuous. Looking at monthly datapoints from 1981 to present, the relationship between year-over-year changes in University of Michigan’s current conditions index and the year-over-year changes in real personal consumption expenditures has become much more volatile.

As a result, these recent increases in consumer confidence may not necessarily indicate that consumers will continue to spend through the new year, especially when other indicators of consumer health such as credit usage and loan delinquencies put consumer health into question.

Risks to the Outlook

We continue to recognize mitigating factors that work against our call for a recession in the first part of 2024. First, labor market robustness could continue to support consumer spending even as other sources of strength like government support and excess savings fade. Second, the manufacturing sector may be showing signs of recovery, partly due to President Biden’s industrial policy bills, even as the services sector remains strong beyond the summer’s “revenge spending” era.

U.S. Outlook Summary

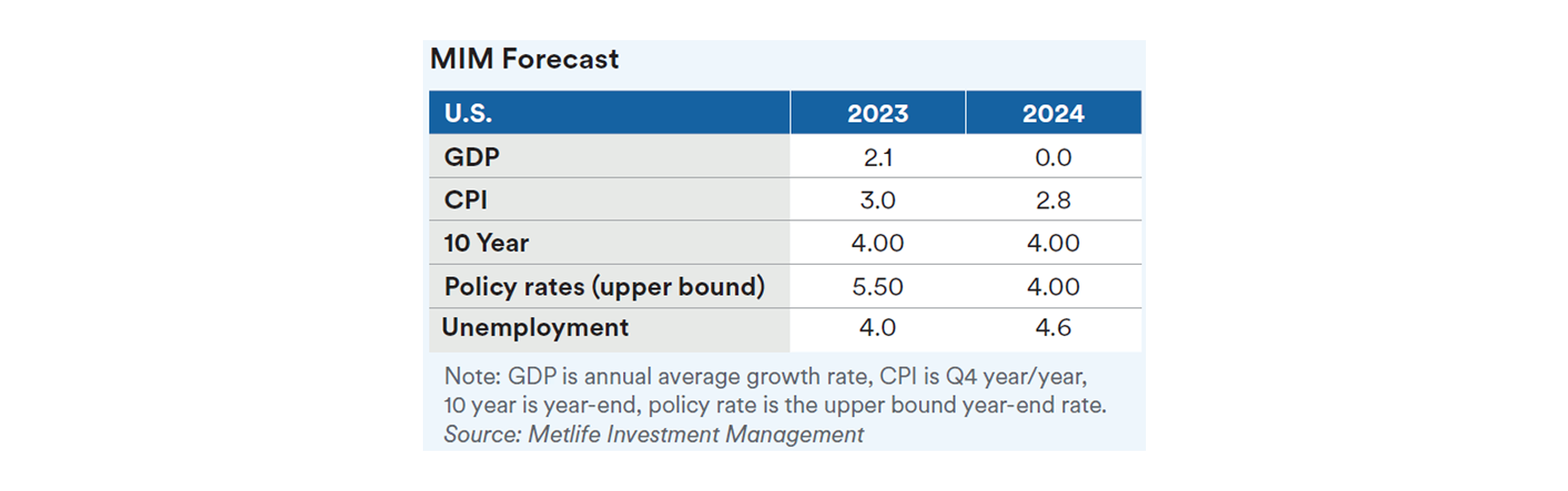

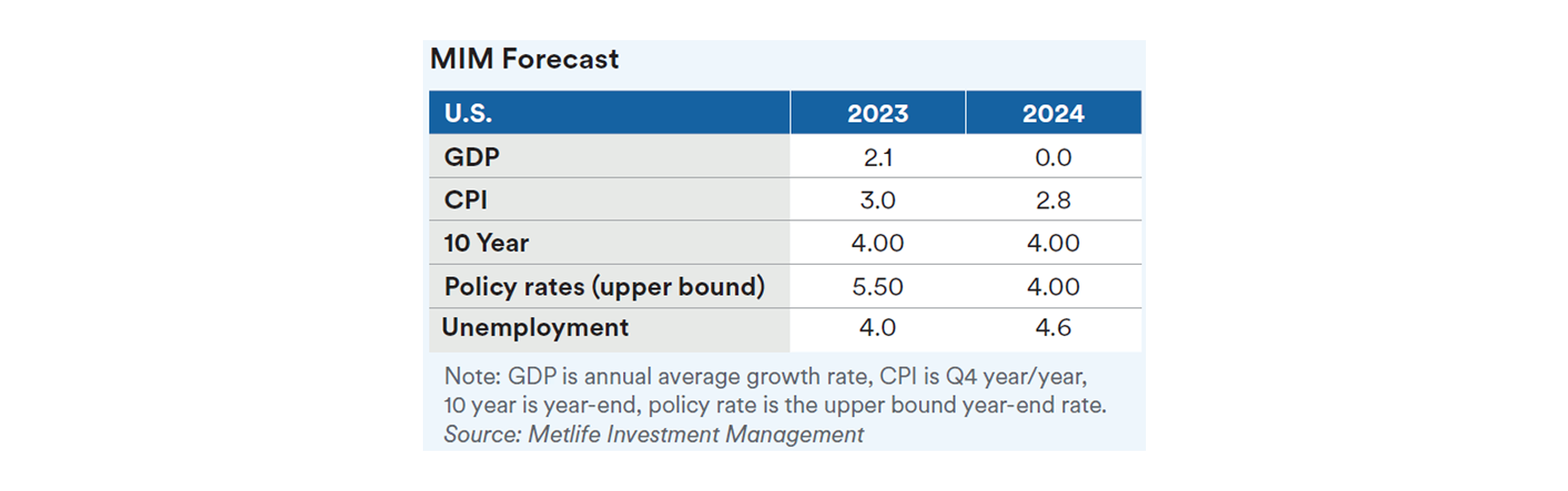

We continue to expect a recession in 2024. We believe the Fed is done with rate hikes this cycle. However, next year we expect 150bps of Fed Funds rate cuts beginning around midyear 2024. Even absent a recession, the Fed is likely to cut, as it eases from the current tight conditions.

Given our call for a recession in the first half of the year, we expect unemployment to rise. Our projected increase in the unemployment rate would be a particularly mild response, given that prior recessions have seen unemployment rate increases of at least 2 percentage points, and reflects the unusually tight labor market conditions.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102- 0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of September 30, 2023, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC.