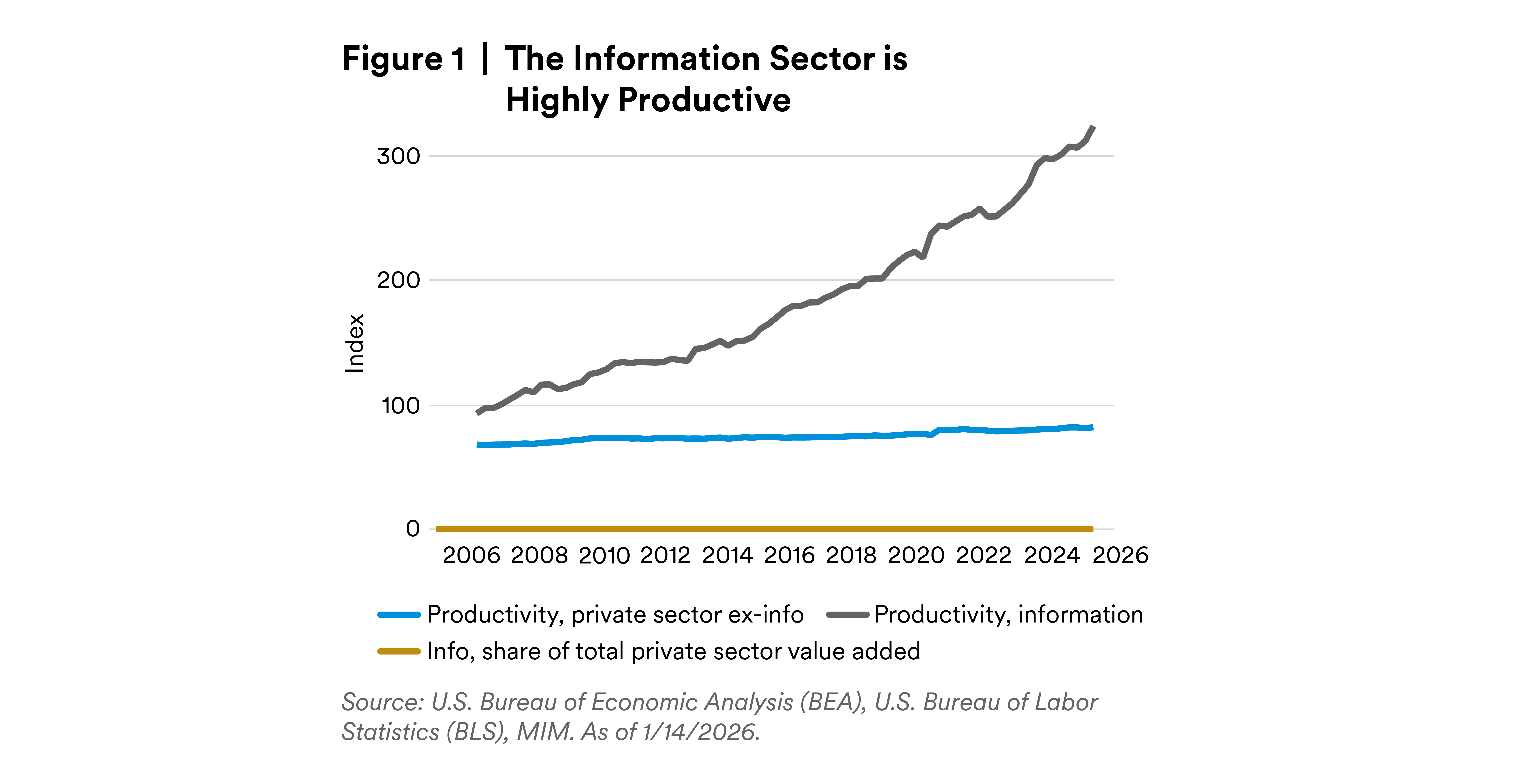

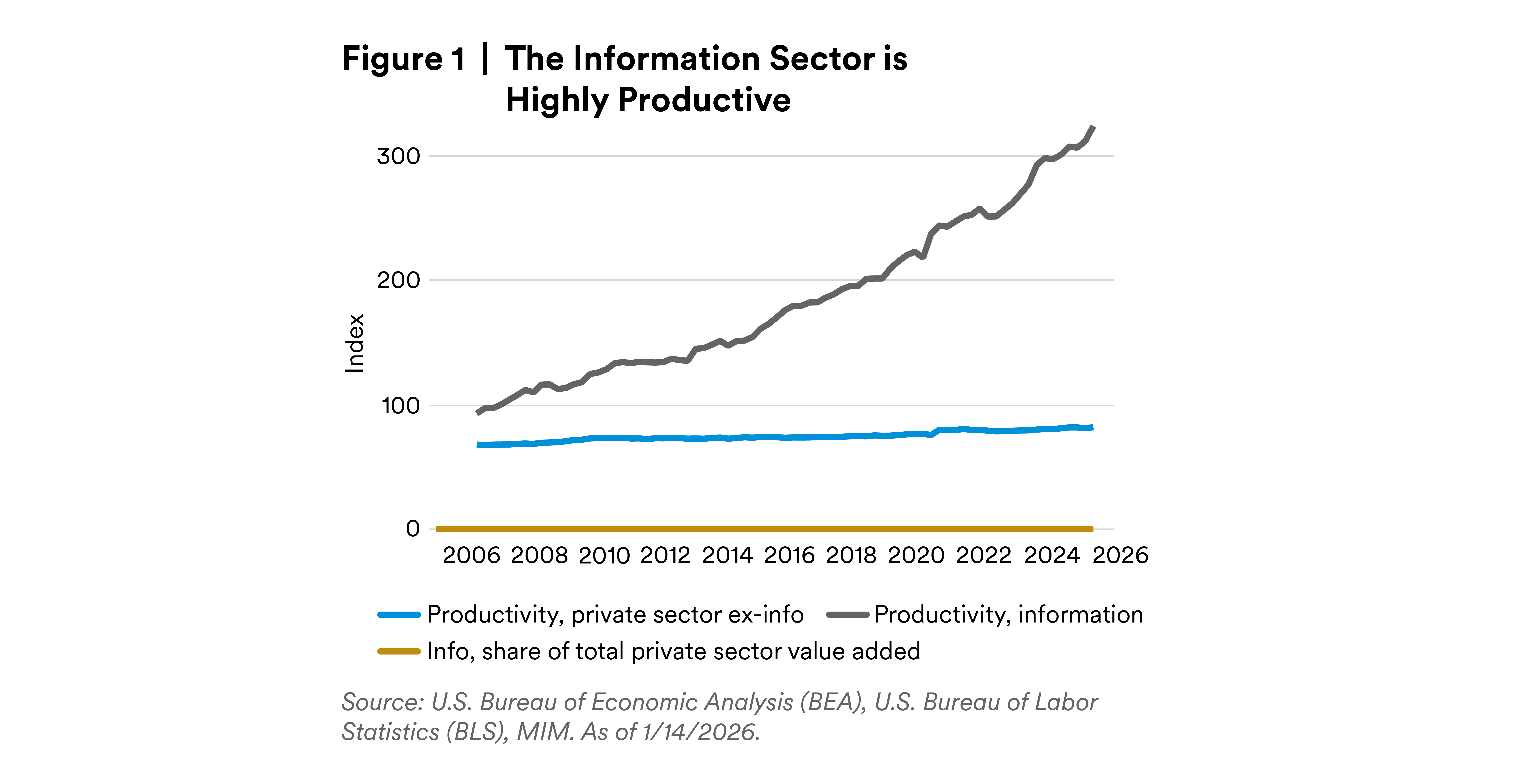

There are stark differences in productivity across sectors. The productivity of the information sector (which includes much of the technology sector) has grown rapidly. The growth preceded the most recent wave of AI innovation. The sector is still small – making up 8.6% of total value added – but its rapid growth is fueling much of the overall productivity growth.

The rest of the economy’s productivity growth is much more sluggish. A few other sectors – utilities, finance, and mining & logging – also display high productivity. But only mining & logging (a tiny sector at 2% of total value added) shows both high productivity and high productivity growth.

Although the information sector is clearly a “winner”, the concerning point for the U.S. economy is that total hours used by the sector has plateaued. Even discounting the decline in the labor force after the pandemic, the sector has stabilized at around 2.3% of total labor hours in the economy. That means only a relatively few lucky winners working in the information sector have been benefiting from its outsized growth. The substantial productivity gains of the U.S. economy are in fact narrowly distributed.

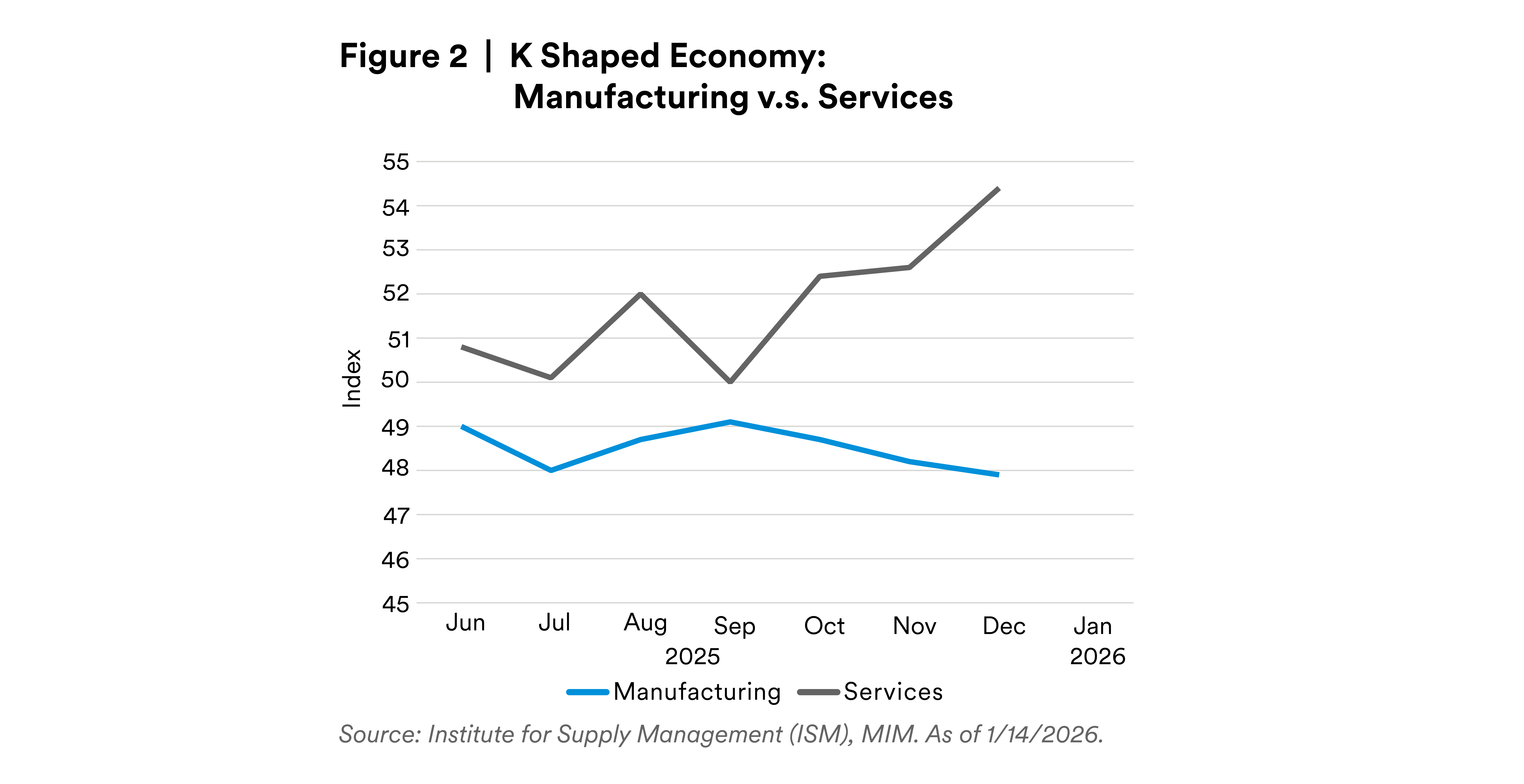

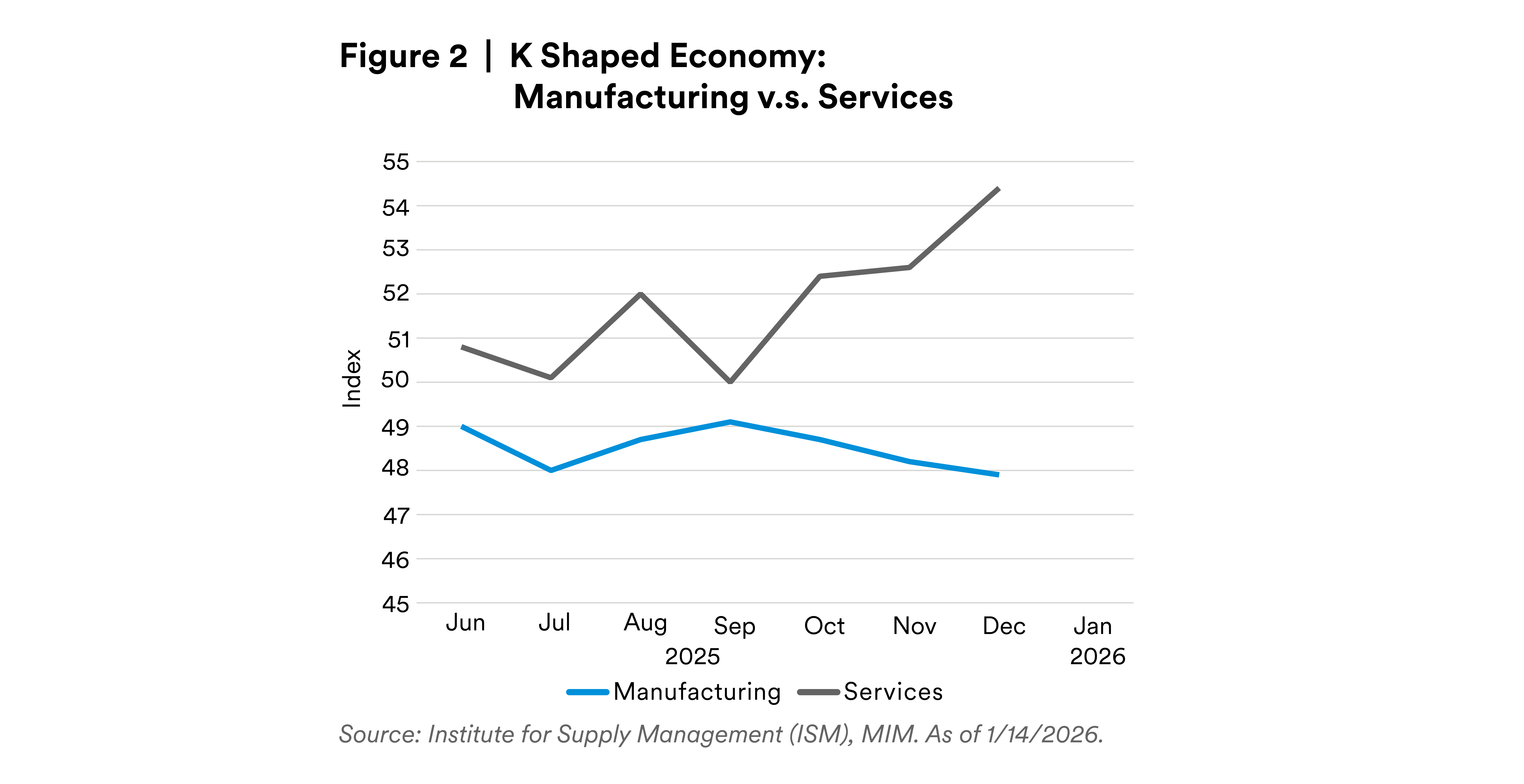

The ISM Services index ended the year at 54.4, its highest reading all year. All four subindices were also in expansion. At the same time, the ISM manufacturing index fell to 47.9 – the lowest level recorded in 2025. The manufacturing index has been in contraction territory for 34 out of the last 36 months, and only two out of the 15 tracked industries reported growing in December.

Even as talk about tariffs has subsided, high prices are likely disproportionately affecting manufacturing firms, many of which expect their woes to continue at least through the first half of 2026. We expect the upcoming mid-term elections and ongoing geopolitical tensions to cause continued economic volatility and uncertainty.

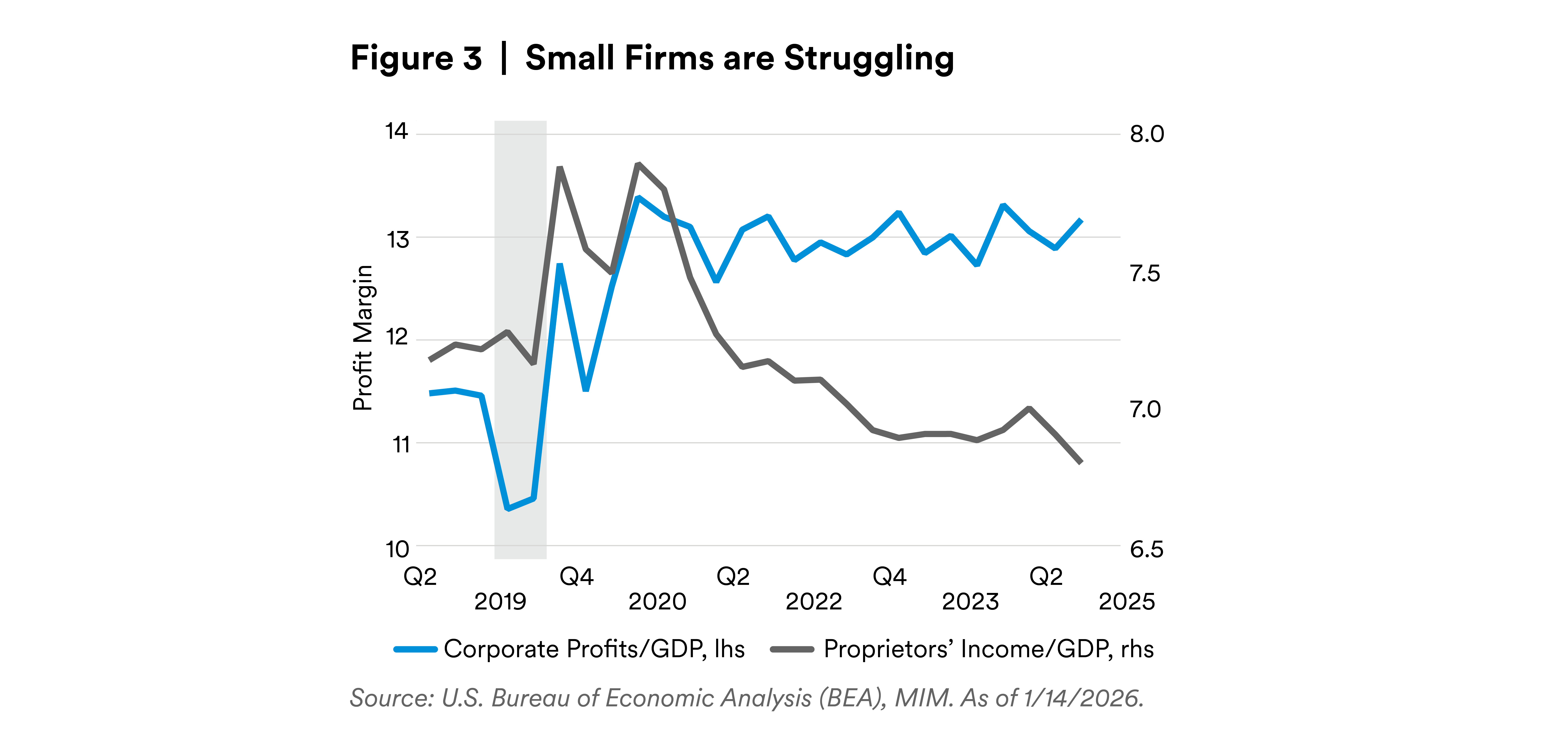

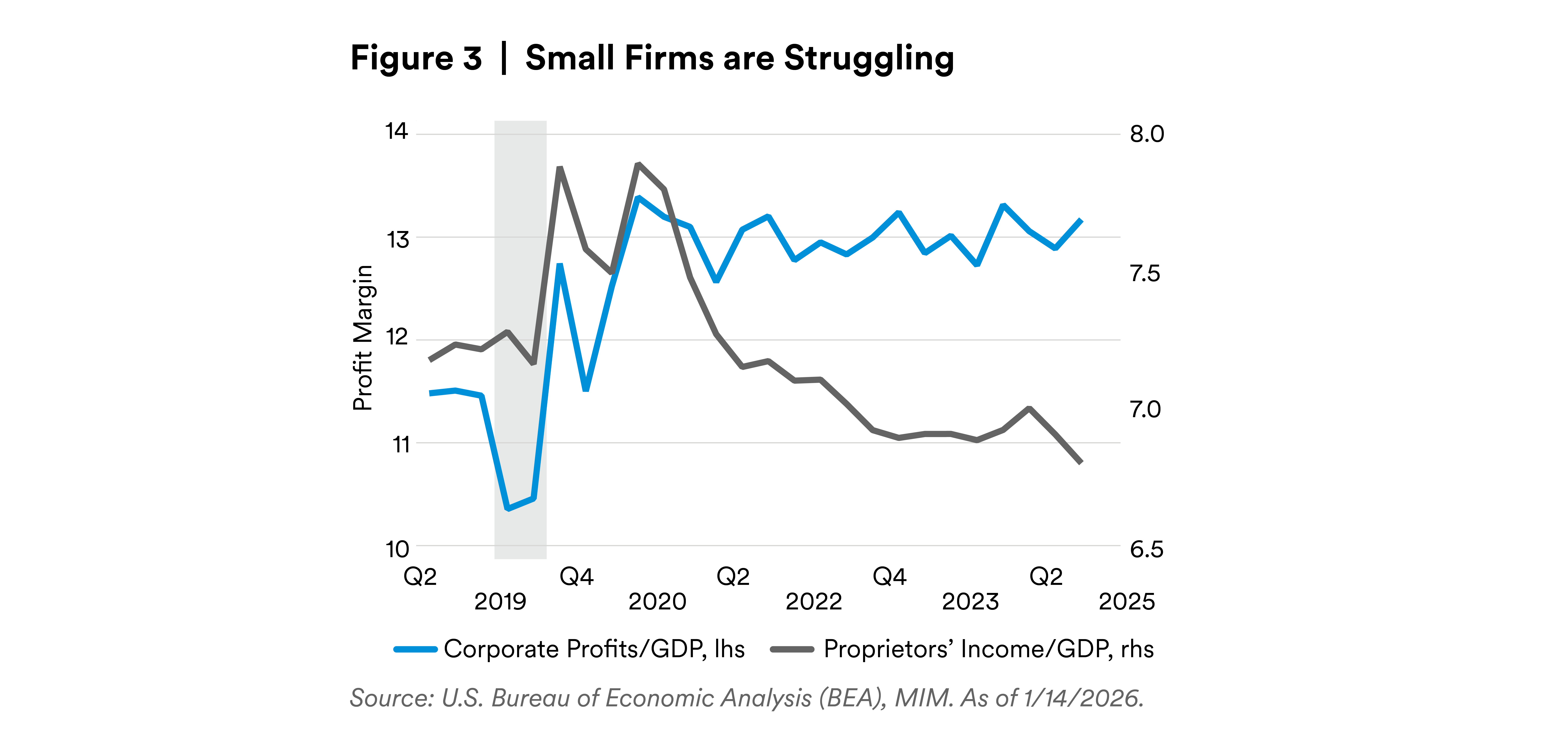

There is also a divide between larger and smaller companies.

Corporate profits are doing well. Public companies are moving from strength to strength, even as tariffs raise the cost of goods sold. Publicly traded earnings grew by more than 25% in the first three quarters of 2025, even as sales grew by around 7%, displaying extraordinary resilience.1 A broader measure, corporate profits as a share of GDP, has been remarkably high and stable at around 13% since 2021.

Proprietorships have been fairing less well. Their income as a share of GDP has fallen to 6.8%, the lowest since Q3 2007-Q3 2009. After a brief period of strength during the pandemic, proprietorships saw a sharp decline in either earnings, total market share, or both. The most recent data from Q3 elicits further concern as the measure shifts another leg down.

All of this is consistent with what we would expect from current economic policy. The smallest businesses generally are much more vulnerable to the abrupt changes in policy: they are mostly less resilient, have fewer financial and other resources, are less likely to have fat to cut out, and may have more difficulty keeping track of rapid changes in tariffs or other policies. Pain is ongoing for small businesses, although optimism has improved.

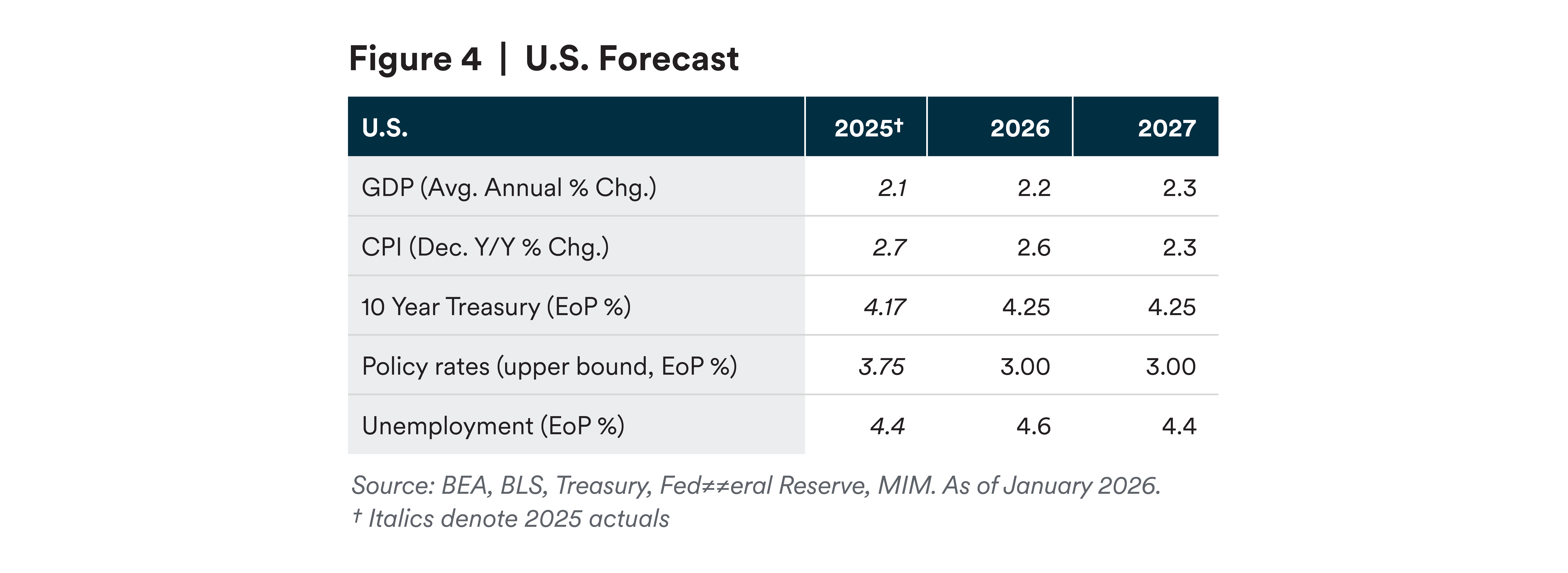

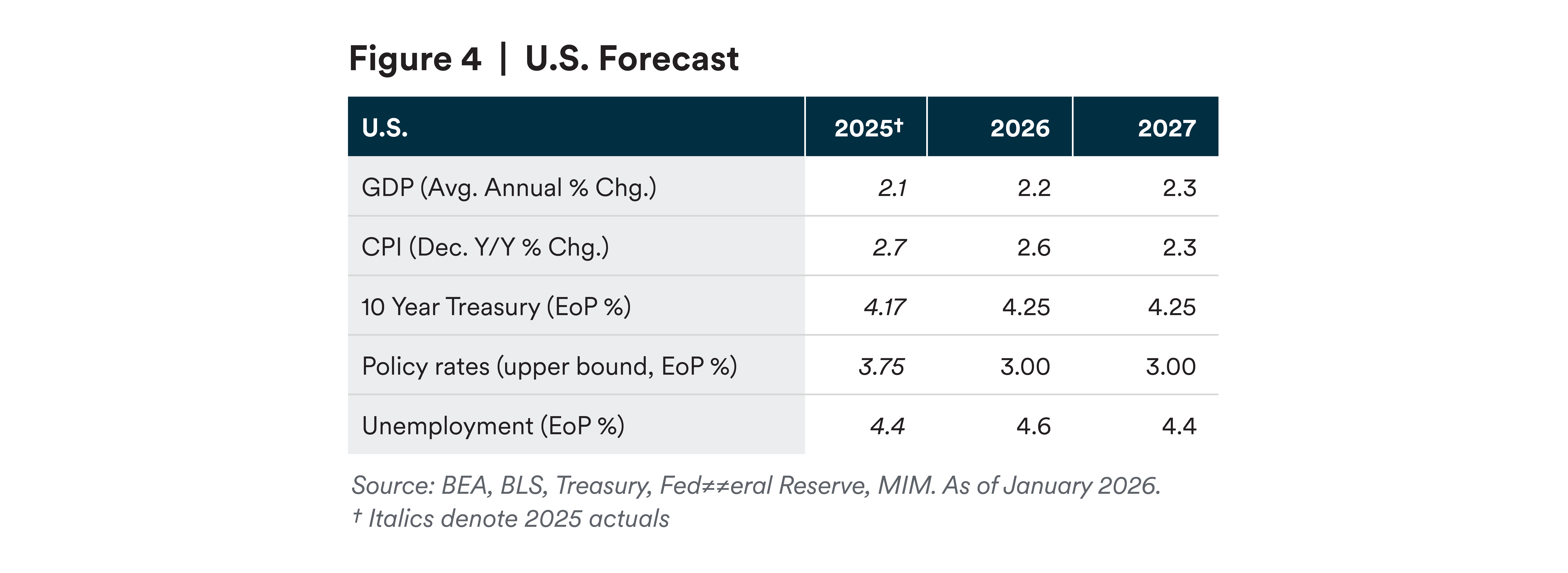

We have revised our forecasts for 2026 and released a new forecast for 2027. We expect 2026 growth to be just marginally higher than 2025, driven by stable consumption and solid non-residential investment. We expect net exports to remain strong as U.S. businesses try to shift away from import-driven businesses. The labor market remains moribund; we believe both labor supply and demand will remain lackluster while remaining in a low-growth equilibrium.

We expect inflation to continue to decline, but do not expect headline CPI to reach 2% this year. Price shocks from tariffs appear to be partly behind us, but some pass-throughs are likely to continue in the first half of the year (even barring additional tariffs). The Fed is facing enormous pressure from President Trump to cut rates, and we expect them to cut by a total of 75 bps given the ongoing weakness of labor market demand.

The most significant risk is a risk to the upside. With pressure on the Fed toward lower rates, tax refunds expected to be high, and perhaps other stimulus-type measures (Affordable Care Act subsidies?) yet to come, there are several ways in which we may see an economy running relatively hot. The number of cuts – slightly more than 2 cuts by year end as of publication date – may underestimate Fed pressure, and longer-term yields may underestimate the persistence of inflation.

Although we expect the wealthier consumer to remain engaged, there continue to be risks to the upside to an even stronger consumer – both in the U.S. and, as the dollar remains weak, abroad.

Some risks are likely to be resolved in the near term: the Supreme Court fights over IEEPA and President Trump’s attempt to dismiss Fed Governor Lisa Cook. Others are likely to remain persistent throughout the year, including those emanating from the suddenly active geopolitical tectonic movements. President Trump’s actions with respect to the U.S.’s influence over the Western Hemisphere, including its effect on Japan, Korea, and NATO, are all in play – and while we do not expect anything approaching outright war as a baseline, the risks are clearly elevated.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors.

MetLife Investment Management ("MIM") is MetLife, Inc.'s institutional investment management business. MIM is a group of international companies that provides investment advice and markets asset management products and services to clients around the world. The various global teams referenced in this document, including portfolio managers, research analysts and traders are employed by the various legal entities that comprise MIM.

All investments involve risk, including possible loss of principal; no guarantee is made that investments will be profitable. This document is solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. Views may be based on third-party data that has not been independently verified. MIM does not approve of or endorse any republication of this material. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

In the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK. © 2025 MetLife Services and Solutions, LLC.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also subdelegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees’ pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

For investors in the EEA: This document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 Bloomberg. Accessed Jan 14, 2026.