What Are the SDGs, and How Does Infrastructure Investment Help Meet Them?

In 2015, all United Nations member states adopted the ambitious 2030 Agenda for Sustainable Development, which encompasses 17 Sustainable Development Goals (SDGs) and “provides a shared blueprint for peace and prosperity for people and the planet, now and into the future.”3 These SDGs address a wide array of global challenges, including ending poverty, ensuring health and education improvements, fostering economic growth, mitigating climate change and safeguarding oceans and forests.4

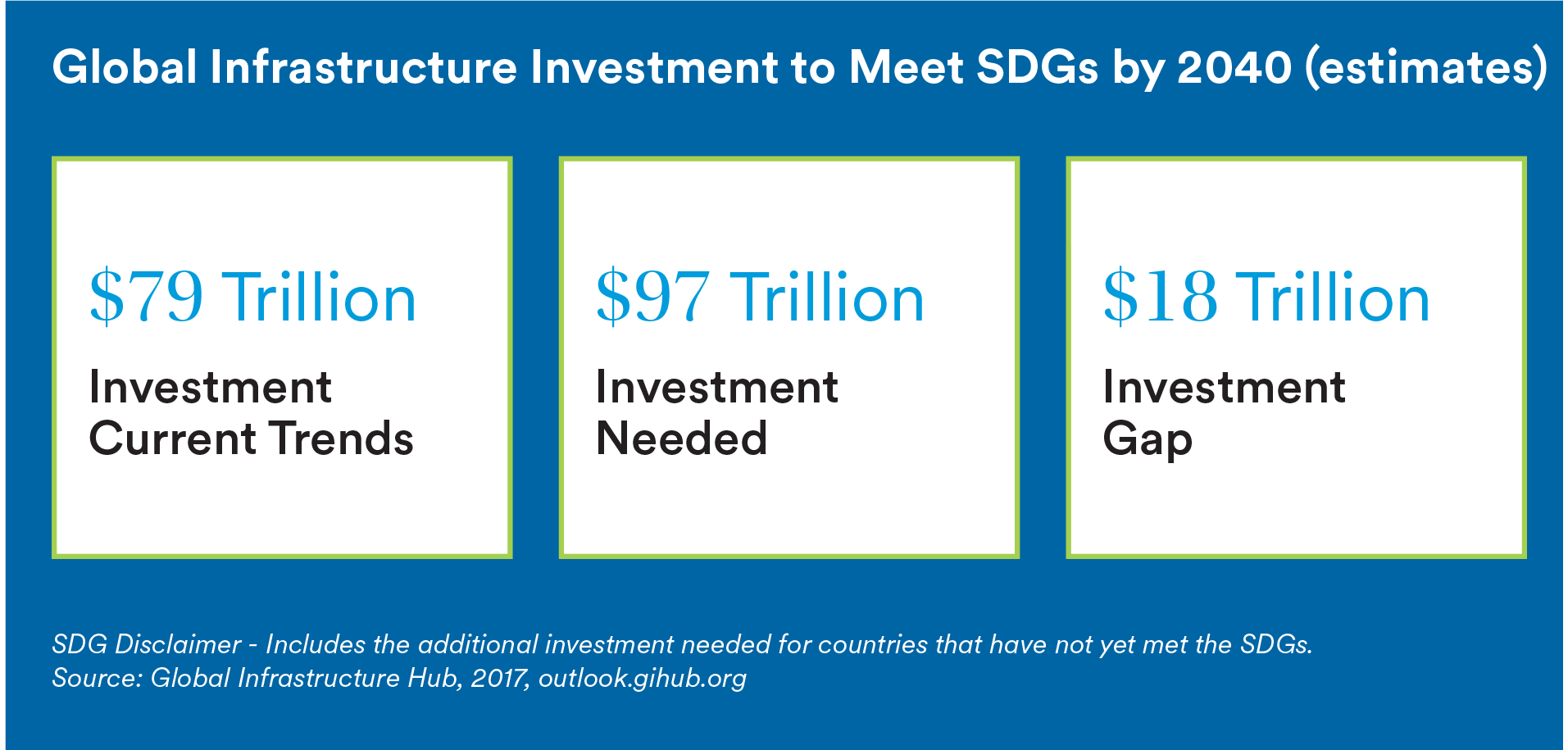

Infrastructure plays a central role in achieving the SDGs by providing essential physical assets and crucial services. However, infrastructure assets must be aligned to global sustainability trends to ensure long-term operational resilience in a world undergoing large-scale environmental and social shifts. For example, the physical effects of climate change or the energy transition from fossil fuel systems to renewables have long-term credit risk implications and can create the risk of stranded assets. We therefore view sustainability as an increasingly material credit risk factor.

It is imperative for infrastructure to be planned, designed, managed and decommissioned with a sustainability focus to maximise positive impacts and economic life, while minimising any negative impacts.

Sustainable Private Infrastructure Debt

We believe sustainable private infrastructure debt can offer an attractive opportunity for investors. Infrastructure assets typically generate stable cashflows via essential hard assets with high barriers to entry, often backed by government support. The asset class has historically provided investors with diversification from public bond markets, a potential spread premium over comparable public corporate bonds and risk mitigation through covenants and/or collateral as evidenced by low historical loss rates5.

MIM’s SDG Thematic Infrastructure Approach

MetLife Investment Management (MIM) advocates for a targeted approach in selecting infrastructure debt investments that align with the Sustainable Development Goals, while incorporating robust environmental, social and governance (ESG) risk management practices. We believe this approach can deliver both economic returns and positive impact benefits for investors. MIM has recently integrated Affirmative Investment Management (AIM), a specialist impact asset manager, into its operations. This strategic move combines MIM’s expertise in private infrastructure debt origination and portfolio management with AIM’s expertise in sustainability analysis, including independent verification and a commitment to impact measurement and reporting. The strategy utilises bottom-up, fundamental analysis by separate credit and sustainability research teams with stringent criteria on both sides.

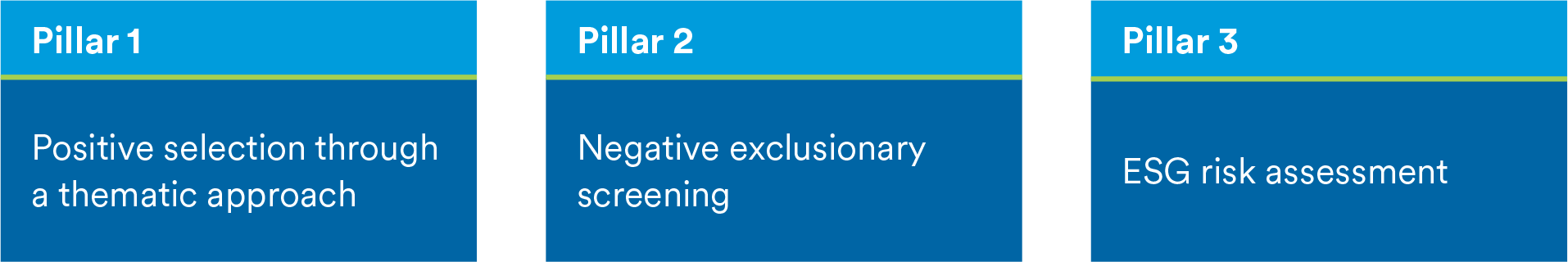

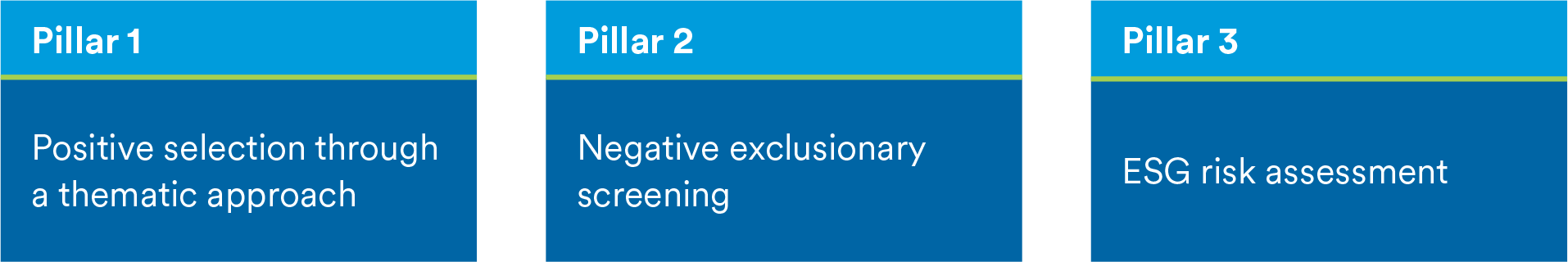

Our sustainability verification process follows a comprehensive three-pillar approach, comprised of positive thematic selection, negative exclusions and ESG risk assessment on each deal.

Our Private Credit Sustainability Research team conducts thorough analysis on how assets support key sustainability themes, align with specific SDGs based on their unique attributes and manage material ESG risks, while steering clear of harmful activities.

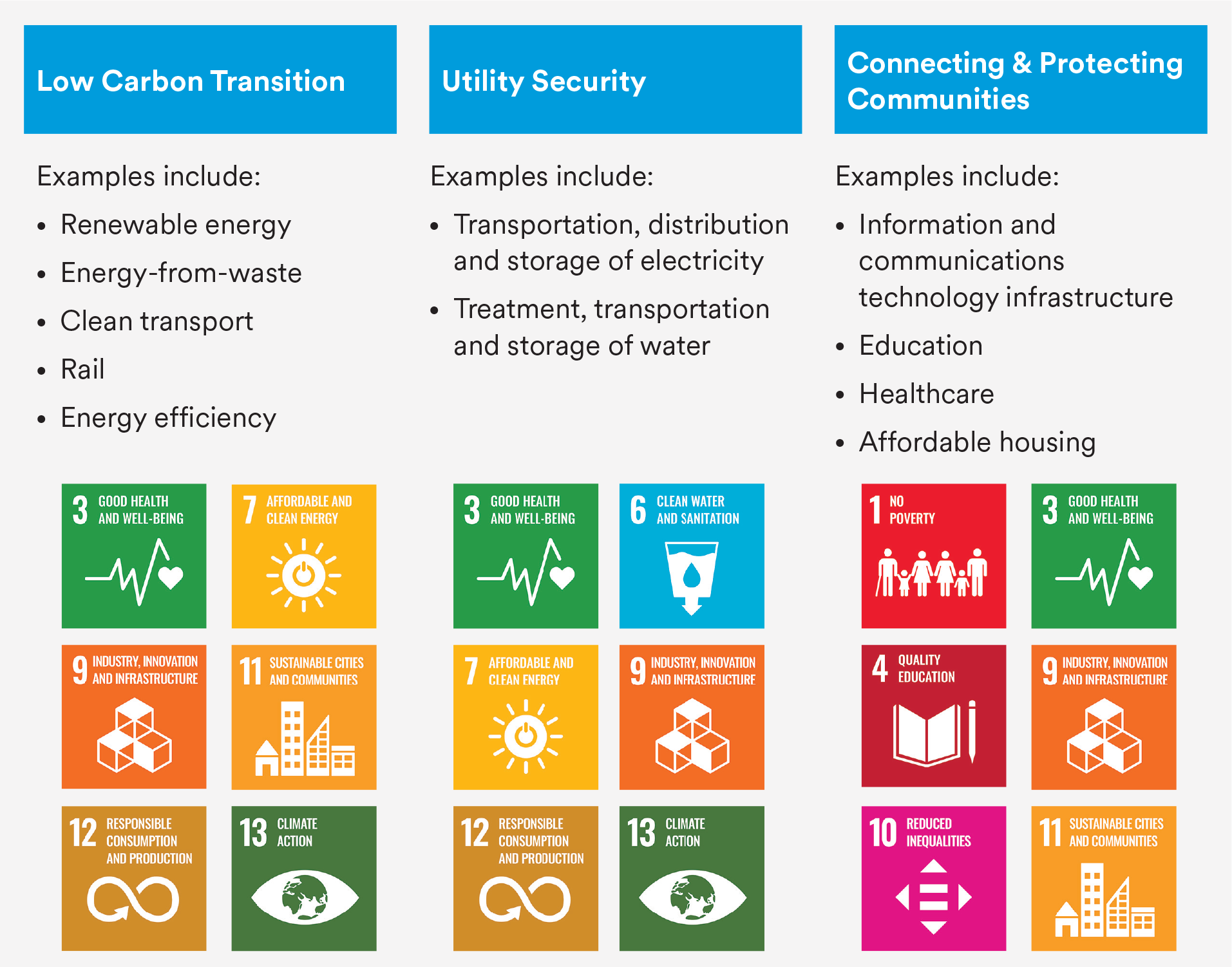

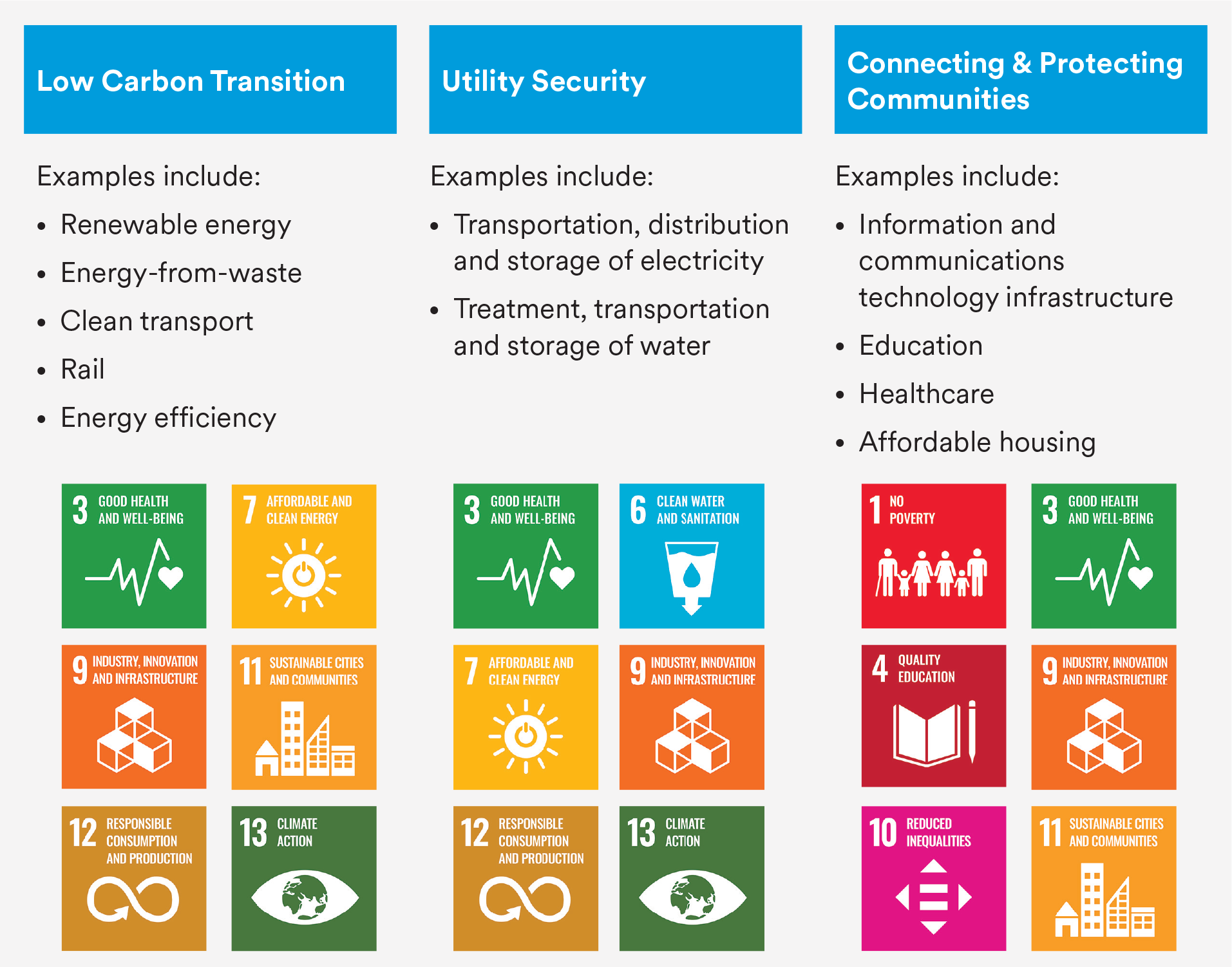

MIM’s SDG Thematic Infrastructure strategy targets three pivotal themes:

- Low carbon transition: Investments in essential infrastructure supporting the shift to a low carbon economy in critical sectors like energy, transport and the built environment.

- Utility security: Investments aimed at bolstering the reliability and efficiency of vital utilities for industry and households, such as water and electrification.

- Connecting and protecting communities: Infrastructure investments facilitating inclusive and connected communities, encompassing social and public services such as education and healthcare, as well as telecommunications and digitalisation.

Alignment with the SDGs is assessed at the asset level and follows a proprietary methodology that looks beyond the 17 headline SDGs, weighting each deal to the granular, underlying targets based on relevance and materiality.

Our comprehensive approach combines positive impact selection in Pillar one with avoidance of controversial activities and mitigation of negative impacts through Pillar two and Pillar three. This holistic perspective helps ensure that each deal is evaluated based on both its positive contribution to the SDGs and its ability to manage negative sustainability risks.

The Importance of Transparency

The data demands for a thorough approach to sustainability verification can be high, and it comes as no surprise that data gaps persist in private markets. To address these challenges, we employ a proprietary issuer questionnaire to gather the relevant quantitative and qualitative data, supplemented by external data vendors. Additionally, as sustainability disclosure regulations like the EU’s Corporate Sustainability Reporting Directive (CSRD) are gradually implemented, they should contribute to increased transparency over time. The relationship-based nature of the private infrastructure market, which allows for significant engagement opportunities, also helps support access to the information and disclosures necessary for in-depth sustainability analysis.

Prioritising sustainability disclosures and verification not only aids in identifying attractive investment prospects but also enables comprehensive reporting for investors. As investors seek evidence about how their portfolios align with sustainability objectives, providing robust sustainability reporting is a fundamental aspect of our SDG Thematic strategy. Moreover, the strategy goes further to provide annual impact reports to demonstrate the positive environmental and social impacts of the investments on a portfolio-weighted basis, including metrics such as clean transport capacity supported or number of beneficiaries of essential assets.

Conclusion

Now past the midway point between the adoption of the SDGs in 2015 and the 2030 target date, we think the infrastructure investment opportunity remains considerable, with sustainability playing a critical role in evaluating credit risk and ensuring long-term investment success. Seizing this opportunity requires expertise in infrastructure debt origination, underpinned by independent, research-based sustainability verification and clear impact reporting.

As a leader in investment-grade private credit, MIM manages $34.4 billion in private infrastructure debt globally. Our dedicated team of experienced professionals leverages its strong market relationships to originate attractive investment opportunities for our clients. Please contact us to learn more.

Case Study

European Rolling Stock¹

Transaction

Issuer is a leading provider of essential rolling stock for the passenger, freight, and wagon markets across Europe

Credit and Structure

- Well-diversified by country, asset type and customer

- Good visibility on future cash flows from both currently contracted revenues and high expectation of stock re-leasing based on successful track record

- Investment grade MIM internal rating

- Appropriate financial covenants and a requirement to maintain an external rating

SDG Thematic

- Eligible for SDG Thematic Infrastructure strategy under theme of Low Carbon Transition given the borrower’s function in supporting Europe’s modal shift to rail and rail electrification

- Moving both passenger and freight transport to rail will deliver important emission reductions within the transport sector, particularly for more carbon intensive and harder-to-abate modes such as passenger road vehicles, freight road vehicles and air transport

- Issuer has a long-term net zero target and a focus on continuing to grow its electrified fleet

- Sufficient ESG policies are in place, with the issuer being considered relatively low risk given activities and areas of operation

SDG Alignment Example

Following our proprietary SDG alignment methodology, we believe that the deal supported:

SDG 3 - Ensure healthy lives and promote well-being for all at all ages (20% weighting)

Target 3.9 By 2030, substantially reduce the number of deaths and illnesses from hazardous chemicals and air, water and soil pollution and contamination

SDG 9 - Build resilient infrastructure, promote inclusive and sustainable industrialization and foster innovation (40% weighting)

Target 9.1 Develop quality, reliable, sustainable and resilient infrastructure, including regional and transborder infrastructure, to support economic development and human well-being, with a focus on affordable and equitable access for all

SDG 11 - Make cities and human settlements inclusive, safe, resilient and sustainable (40% weighting)

Target 11.2 By 2030, provide access to safe, affordable, accessible and sustainable transport systems for all, improving road safety, notably by expanding public transport, with special attention to the needs of those in vulnerable situations, women, children, persons with disabilities and older persons

1 The case study described herein is meant to provide an example of certain considerations and terms in connection with a particular investment made by MIM’s Infrastructure Debt team; actual considerations and terms of investments made on behalf of an unaffiliated investor may vary. As of 31 December 2023.

Endnotes

1 Global Infrastructure Hub and Oxford Economics

2 ibid

3 https://unosd.un.org/content/sustainable-development-goals-sdgs

4 ibid

5 Infrastructure default and recovery rates, 1983-2022, Moody’s

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/ or unaffiliated/ third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC.