We see more investors from around the world who recognize the opportunity and are coming into the market,” said Syed Ahmed, director of infrastructure and project finance at MetLife Investment Management. “We believe asset owners are focused on private, investment-grade infrastructure debt because of its relatively stable and sustainable cash flows and its ability to match long-dated liabilities with long-dated assets.”

Infrastructure assets related to power, transportation and digital connectivity are needed by consumers and institutions on a daily basis — and over the long term. “In our view, with a buy-and-hold approach, infrastructure debt can accommodate changing macroeconomic scenarios, including inflationary spikes. Assets are typically structured to withstand moves in the market and avoid dramatic changes in cash flows,” said Jamie Clark, director of European infrastructure and project finance at MetLife IM.

“It’s always an opportune time to invest in infrastructure,” Ahmed said. “We’ve seen it perform through two cycles since the Global Financial Crisis, and both times the asset class has [proved] to be resilient in our view. Most of our assets are back to pre-pandemic levels, performing again as we expect.”

RESILIENCE THROUGH CYCLES

Infrastructure assets tend to be high quality: relatively stable, provide potential for a reliable return, well structured and tend to offer downside protection. “We believe the asset class itself is resilient. Most of the assets in our portfolio are under fixed-price contracts,” said Ahmed. Having fixed costs, whether on the construction side or in operations and maintenance, helps to provide a hedge against cost increases linked to inflation. The same applies to energy costs, which are factored into regulated utility tariffs, for instance.

While new projects coming to market have seen costs for labor, materials and general construction rise dramatically in the current inflationary cycle, in general, most projects are securing the financing they need. “We see the market is there, and it’s been supportive through this cycle,” he said.

In today’s environment, lenders and sponsors have reverted to slightly more conservative structures compared with five years ago. “Nothing extraordinary, but there’s a push from lenders to have more moderate base cases, somewhat tighter covenants and to increase the lock-up ratios for releasing dividends to equity sponsors,” said Clark

“Because of its stability, infrastructure is one of those asset classes in which issuers can come to market even in the choppiest of times. The assets themselves are more stable, and we don’t expect to see them suffer because of economic cycles,” said Annette Bannister, managing director and head of European infrastructure and project finance at MetLife IM, which has an infrastructure portfolio of approximately $40 billion.

REGIONAL INSIGHT

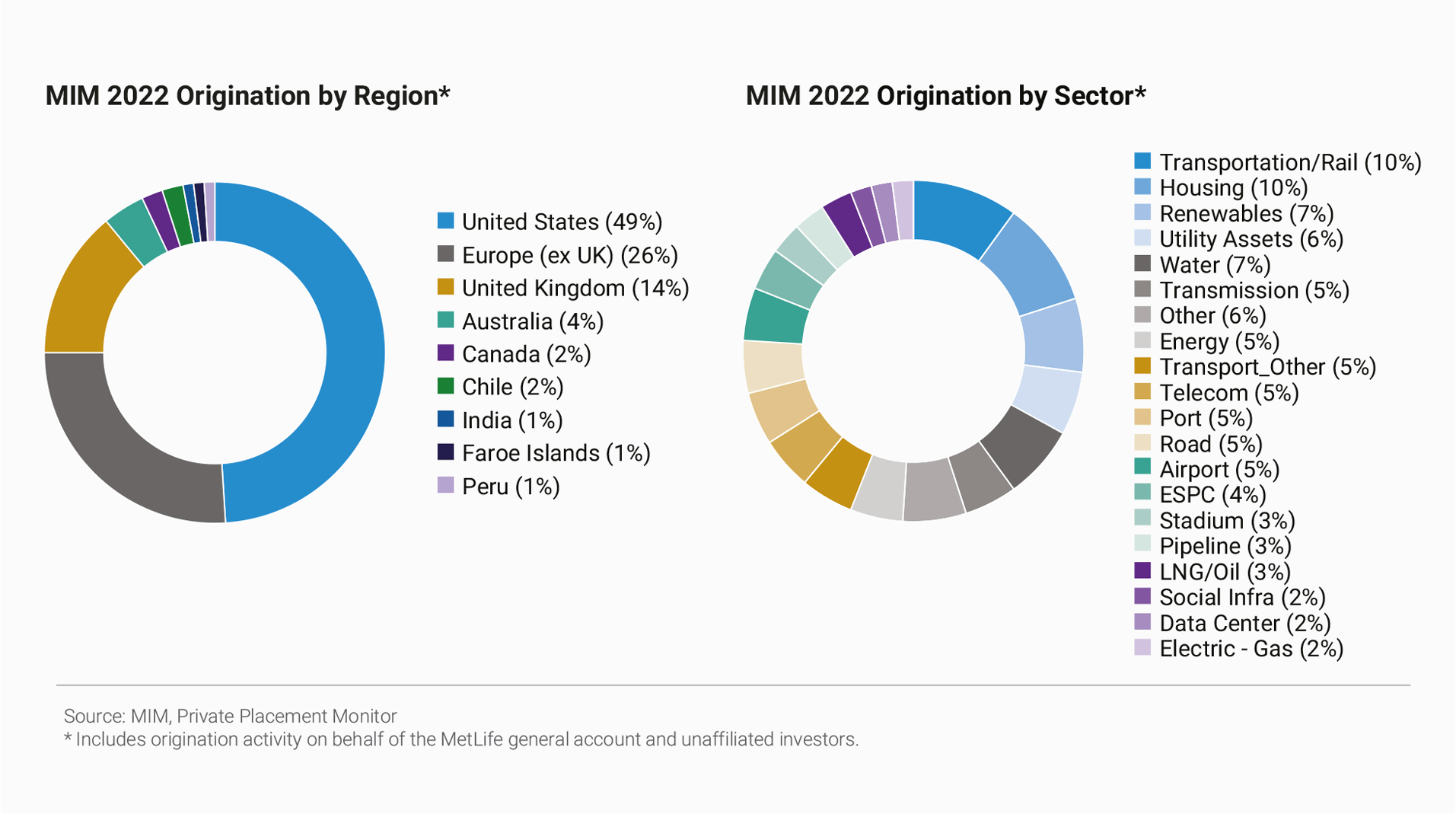

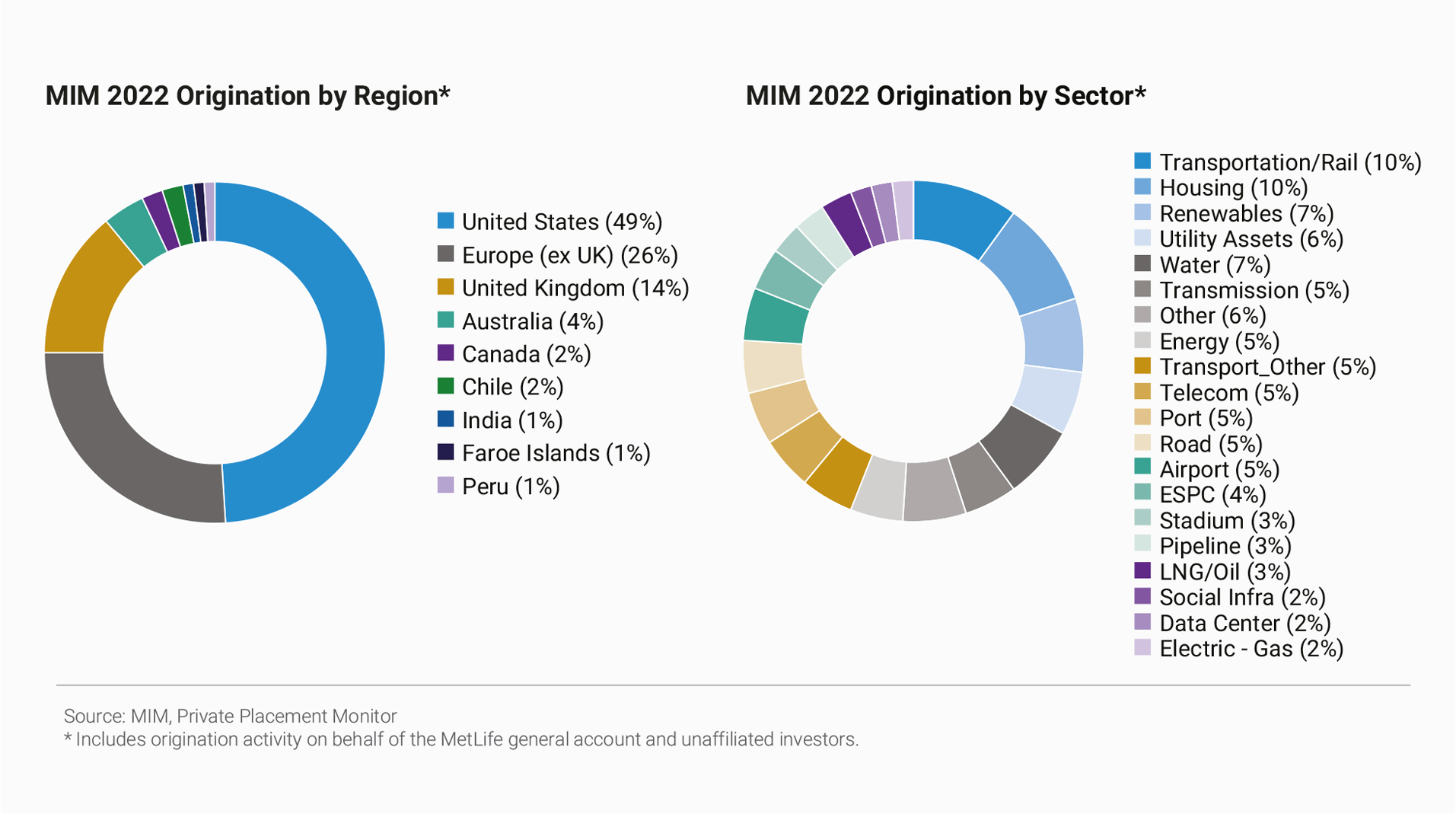

“Being present in [regional] markets helps us understand assets from both the bottom-up and top-down, and adds insight into the municipality, political environment and regulations specific to each market,” Ahmed said. MetLife IM has a 15-person team that sources deals worldwide. It has seen robust deal activity in the digital, core infrastructure, power and electric vehicle sectors across Europe and in the U.S. — and it carefully evaluates country fundamentals and regional sector characteristics.

Whichever region or sector is under consideration, MetLife IM tailors the infrastructure debt portfolio to meet specific client objectives for diversification and consistent returns. “We look carefully for assets that we believe will have stable cash flows, are based on proven technology and demonstrate good relative value with the aim of getting the economic return that we expect,” said Ahmed. An additional layer is ensuring that the investments have the appropriate amortization and covenants in place to protect against a downside scenario.

ON-THE-GROUND RELATIONSHIPS

Given the complexities of infrastructure projects, it is key for the asset manager to maintain a strong global network of equity sponsors, debt advisers and agents in order to create a viable base of transaction opportunities, said Clark. “Our relationships are an important part of our strategy and support both deal origination and portfolio management.”

On the origination side, relationships lead to participation in direct opportunities, such as transactions that are bilateral — or single-lender — and club- or multiple-lender loans. On the portfolio-management side, these partnerships “help to manage consents, waiver processes and ensure that everyone is working together, especially during challenging times. They also provide a seat at the table to make sure each deal is in a good place,” he said. “We look to grow along with the sponsors, issuers and debt advisers we work with.”

FIBER OPTICS MARKET

“As a relatively new subsector, digital infrastructure, including optical fiber, is increasingly becoming a core asset,” said Clark. Even five years ago, investors had questions about the potential risks of new technology and user demand, but now “we view these assets as utility-like, meaning they have become essential, with predictable cash flows and high barriers to entry,” he said.

In Europe, navigating fiber opportunities requires granular knowledge of each market. Depending on the country, credits can differ significantly based on the level of government support, existing fiber and cable coverage, and penetration rates. Other considerations are whether suppliers have first-mover advantage, the rural-versus-urban dynamic and considerations around undersea versus terrestrial fiber installations.

For example, in France, fiber optic suppliers tend to have monopoly positions that are driven by regulatory support and that provide high barriers to entry. In Germany, suppliers have more of a first-mover advantage, but ultimately there are also high barriers to entry because of high capital expenditure costs. Spain has an overcapacity of suppliers, although they can hold significant long-term contracts, said Clark. “Depending on where you’re investing in Europe, there are quite a few different factors to cover and analyze to find the best risk-reward” scenario,” he said.

In the U.S., opportunities differ by state, but overall the underlying fundamentals significantly contrast with Europe, said Ahmed. The U.S. fiber optics market is still in its infancy, despite the networks laid out by the large carriers and cable companies. “In metropolitan areas, it’s hard to compete, but there is still good potential in less-developed regions. There can be good opportunities in fiber companies that have operational contracted businesses and growth models funded by cash flows,” he said.

When considering fiber optic networks at the state level, key aspects include credit and capital expenditure support — whether it’s coming from the municipality or from internet service providers — and the level of guarantees. “There are a lot of moving parts, and the best strategy isn’t always obvious,” Ahmed said.

CORE INFRASTRUCTURE

In the core infrastructure subsector, the U.K. market differs from the rest of Europe in favoring private ownership, with most projects being privately financed. “Only utilities and the larger, more regulated airports and ports seek funding from the public markets,” said Clark. On the Continent, there’s a mix of public and private ownership and financing. Projects tend to be smaller in size, which makes public-market financing more difficult, but private placements are common, he said.

In the U.S., core infrastructure assets tend to be publicly owned. For example, airports in the U.S. are owned by port authorities, individual municipalities or states that have access to cheaper municipal financing. “But an interesting transition in the last several years is portions of those assets are being privatized,” Ahmed said, pointing to Terminal B at LaGuardia Airport (New York), two terminals at JFK (New York) and the automated-train system at LAX (Los Angeles). “It’s an avenue for private capital because the private sector specializes in optimization,” he said. “Each asset is unique. You have to understand the source of the cash flow and the factors it’s based on.”

A RENEWABLE PUSH

Europe is seeing growing activity in renewable energy. Green energy projects have also become highly competitive among banks and other funding sources. “There’s a lot of demand from investors for renewable projects, and for us, the key is to follow our investment thesis to make sure we’re comfortable with the underlying credits, deal structures, levels of merchant risk and market conditions,” said Clark.

Another promising area that has emerged over the past five years is European companies that provide services to the renewable energy sector. For example, “we finance service vessels that support operations and maintenance of offshore wind farms,” he said.

In the U.S., investors have focused on the Inflation Reduction Act of 2022, passed last August, which authorizes spending on energy and climate change. While its overall impact on the power sector remains to be seen, “on the renewable side, there is a lot more momentum around developing assets and more tax incentives to get to a greener future,” said Ahmed. Key themes include the early decommissioning of coal plants. “When we take baseload power offline, the grid still needs some sort of intermittent load to ensure stability,” said Ahmed. As renewable generation is not yet up to capacity, gas suppliers are still in the equation, he noted.

Solar power presents another opportunity. The U.S. Department of Commerce’s recent investigation into Chinese-made components in solar panels has led to a boost in U.S. development. “Many panel manufacturers are building facilities in the U.S., and we see opportunities among them,” said Ahmed. “We’re involved in a couple of offshore wind projects in the U.S. as well.”

THE EV BOOM

In Europe’s electric vehicle sector, financing depends on the market positions of the companies, the level of government support and the form of availability-based, concession-type models for subsectors like charging networks. “We’ve financed motorway service area and car park charging businesses. There’s an increasing understanding of the risks at play, and we’re starting to see the demand dynamics and revenue models develop more clearly,” Clark said.

As the EV and battery storage sectors develop in the U.S., the main focus is on cash flows and adequate equity support that can weather potential technology and demand risks, along with other uncertainties, said Ahmed. “We believe that equation will evolve, and battery storage will probably move faster than EV charging. The technology for both is still new, and the models need to be proven out.”

SUPPORTING THE TRANSITION

A sustainability and environmental, social and governance approach underpins infrastructure as an asset class because it advances the economic growth of communities and countries, and generates the development of clean technology, transportation and fuels. “ESG will continue to be more important, particularly with SFDR. So for us, it’s an evolving space,” said Bannister, referring to the European Union’s Sustainable Finance Disclosure Regulation.

“The obvious sectors are renewable power and clean transportation,” she said. “There are other types of assets that on [their face] may not look supportive of ESG, but they support the transition,” she added. For instance, assets like peaker plants supply supplementary power to grids during times of peak electricity demand, and they help manage the rollout of renewables. “We can’t just switch off fossil-fuel power generation today and expect we’ll be fine tomorrow. There’s a lot that we can do within infrastructure investment so we can have more sustainable power and clean technology to rely on in the future,” she said.

REGULATORY SUPPORT

Regulatory momentum continues to strongly support infrastructure across the core and renewable sectors, both in the U.S. and Europe. The U.S. Inflation Reduction Act is focused on both the renewable sector and manufacturing, said Ahmed. For instance, the act includes many incentives for individuals and businesses to purchase EVs and increase energy efficiency, such as with cheaper rooftop solar panels or LED lighting conversion. “All that is bundled into the act, and we believe it will lead to a lot of opportunities,” he said.

Ahmed also pointed to the Infrastructure Investment and Jobs Act, signed into law in November 2021, which allocated funds that support EVs, transportation, broadband access and electric grid renewal.

Across Europe and in the U.K., a host of regulatory models apply to the many infrastructure sectors. While they address different aspects, they are generally supportive of stakeholders, including investors. “European regulatory methodologies are well understood and transparent,” said Clark. “They attract and support investment, and overall, they’re credit positive in our view.”

For institutional investors with a long-term investment horizon, infrastructure debt can be an all-weather strategy underpinned by several positives: high-quality assets with stable cash flows, a broad opportunity set with several developing technologies and regulatory support. “This combination of factors is why we see so much interest and why it continues to grow,” said Bannister.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor. This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom.

This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited and Raven Capital Management LLC.