Spreads and Treasuries: The public markets had an active quarter. Credit markets generally tightened through the 1st quarter until the banking crisis created a widening of spreads while US treasury yields rallied. We are cautious that spreads could trend wider on heightened recession risk in 2H 23.

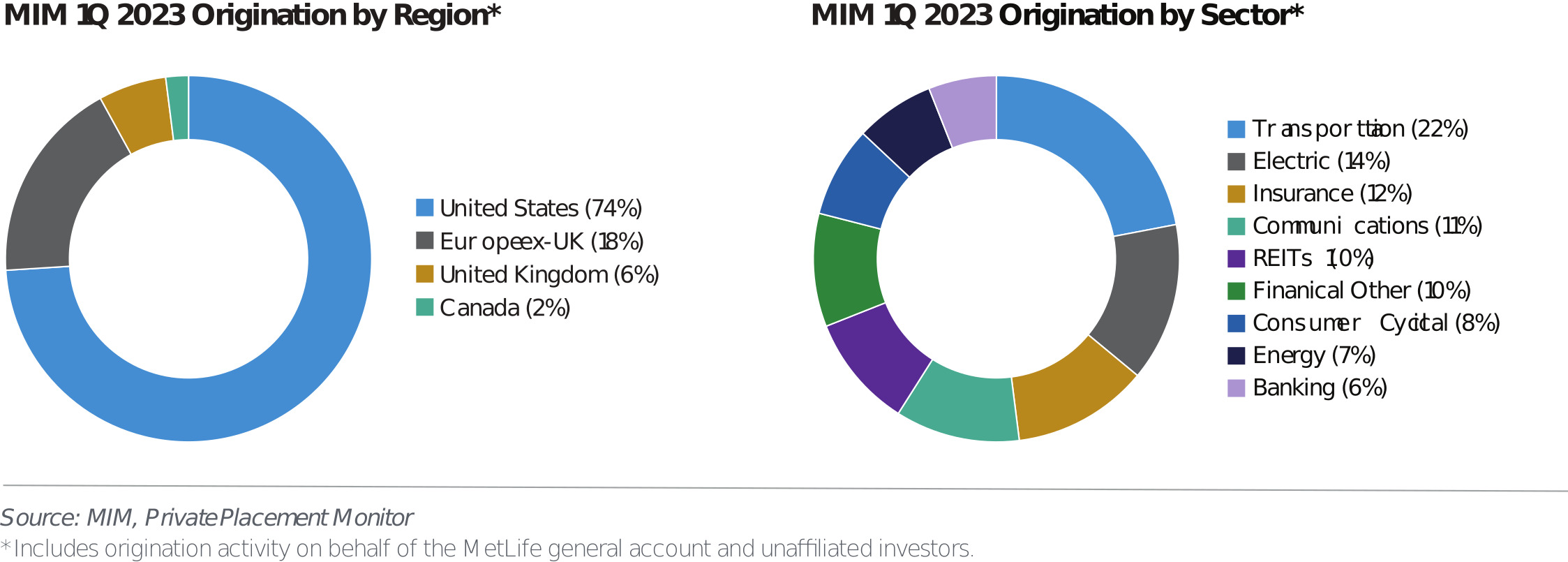

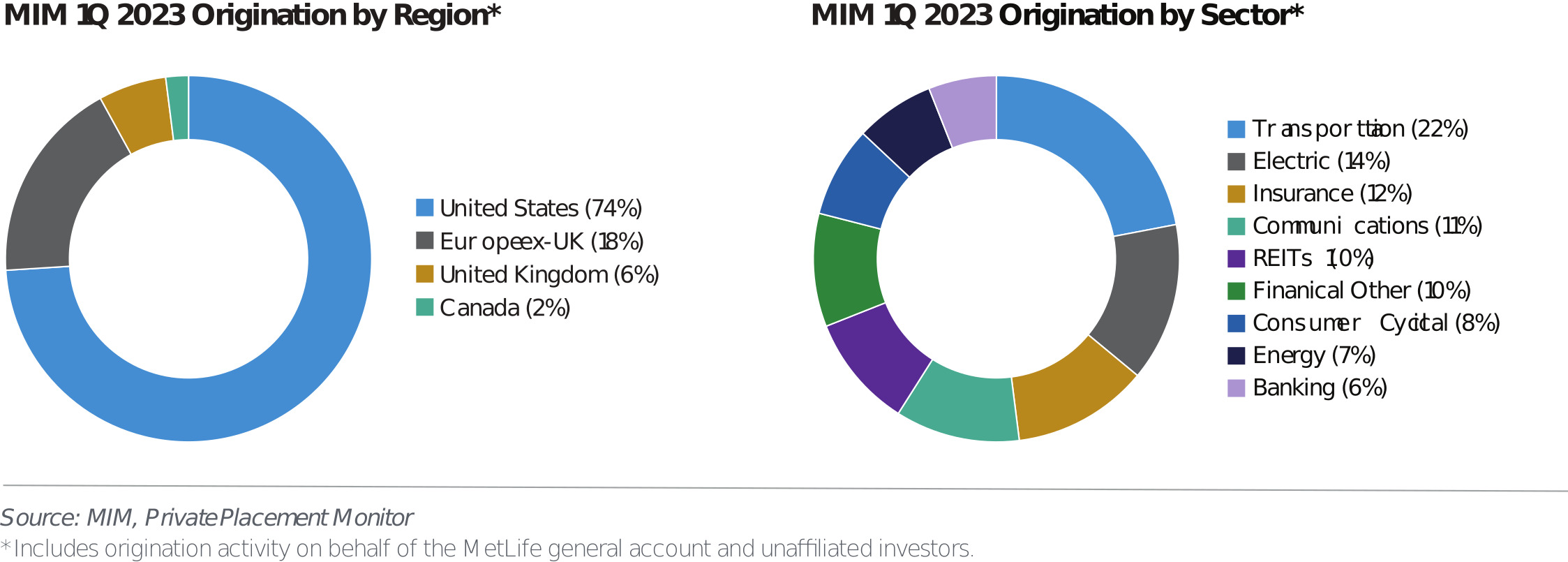

MIM Corporate Private Placement Activity: Origination was sharply lower for 1Q 23 at $0.9 billion versus $3.5 billion for the same period last year. MIM’s transaction volume was muted due to market volatility. While the market focused more on higher quality, tighter spread deals, MIM portfolios had less interest. Although origination was lower, the transactions that MIM originated were at very attractive spread levels compared to previous quarters.

MIM’s Outlook: We continue to prepare for a recession driven by sustained higher rates and potential rising unemployment. We see less probability of a “soft landing” as the heightened volatility in financial markets is likely to prompt excess caution. MIM anticipates an additional increase in the federal funds rate in May but that the 10-year UST rates will end 2023 near current levels at 3.50%. MIM continues to maintain a long-term perspective and strongly believes that disciplined underwriting coupled with strong structural protections will result in compelling opportunities for investors in this market. It should be noted that we believe issuers have continued to maintain steady margins, and leverage ratios have remained conservative. MIM will continue to maintain our sector specialist approach and relationships to uncover the broadest range of appropriate opportunities for our clients.

Infrastructure Debt Market:3

Infrastructure Debt Market: FY22 capital markets activity was impacted by the rise in rates and widening spreads causing a decrease in overall issuance. Year to date, issuance was down 42% to $37.5 billion compared to $64.8 billion during the same period last year. While investors continue to assess and navigate market volatility, several large transactions closed within the transportation, energy, and telecom space. The broader infrastructure market including bank financing was generally flat year-over-year. The total market was at $1.07 trillion compared to $1.04 trillion last year. These transactions were spread across transport (25%), energy (20%) followed by renewables (20%), telecom (17%), power (9%), social infrastructure (4%), and other (4%). Activity was focused in EMEA (41%), US & Canada (33%), Asia Pacific (18%), and Latin America (9%).

Global Sector Highlights:

- United States: 1Q 23 market activity has been strong with activity in renewable, transportation, transmission and digital infrastructure transactions. The disruptions experienced in the banking sector could also create additional opportunities for institutional investors to support infrastructure financing needs. The Inflation Reduction Act, signed in August 2022, is further expected to spur activity in the energy transition sectors as implementation begins to ramp up. During the quarter, some public authorities that are engaged in infrastructure PPP procurements have slowed down transaction timelines in response to the market environment. The pipeline remains strong with a focus on traditional core infrastructure projects including renewable, power, transportation, energy, digital, water and social infrastructure.

- EMEA: 2023 has opened with solid deal flow. Issuers in UK and Europe had paused in Q4 2022 as they assessed the economic environment and postponed transactions until the new year. We have seen a number of deals launched in the first quarter including transportation, digital, and utilities. The deals are spread across the UK and Europe and the focus is on 7 to 12-year tenors. Long dated deals do not currently appear to be favored by issuers given the higher rate environment.

- Latin America: LatAm resumed activity in the second half of 2022 with several transactions in transportation, power and energy across several countries. Governments across the region continue to push for the expansion of renewable generation, particularly Chile, Peru, Colombia and Brazil. Public bond markets have been gradually reopening since the beginning of the year, providing better price references to the private markets. MIM is seeing higher deal activity compared to 2022, with an active pipeline in the toll road, renewables, generation, transmission and digital sectors.

- Australia: Market activity continues to expand in 2023. There were three new transactions year to date within rail and energy. We expect issuance to pick up through the rest of 2023, though expect total issuance to be timid as banks remain aggressive and can offer up to 12-year floating rate products.

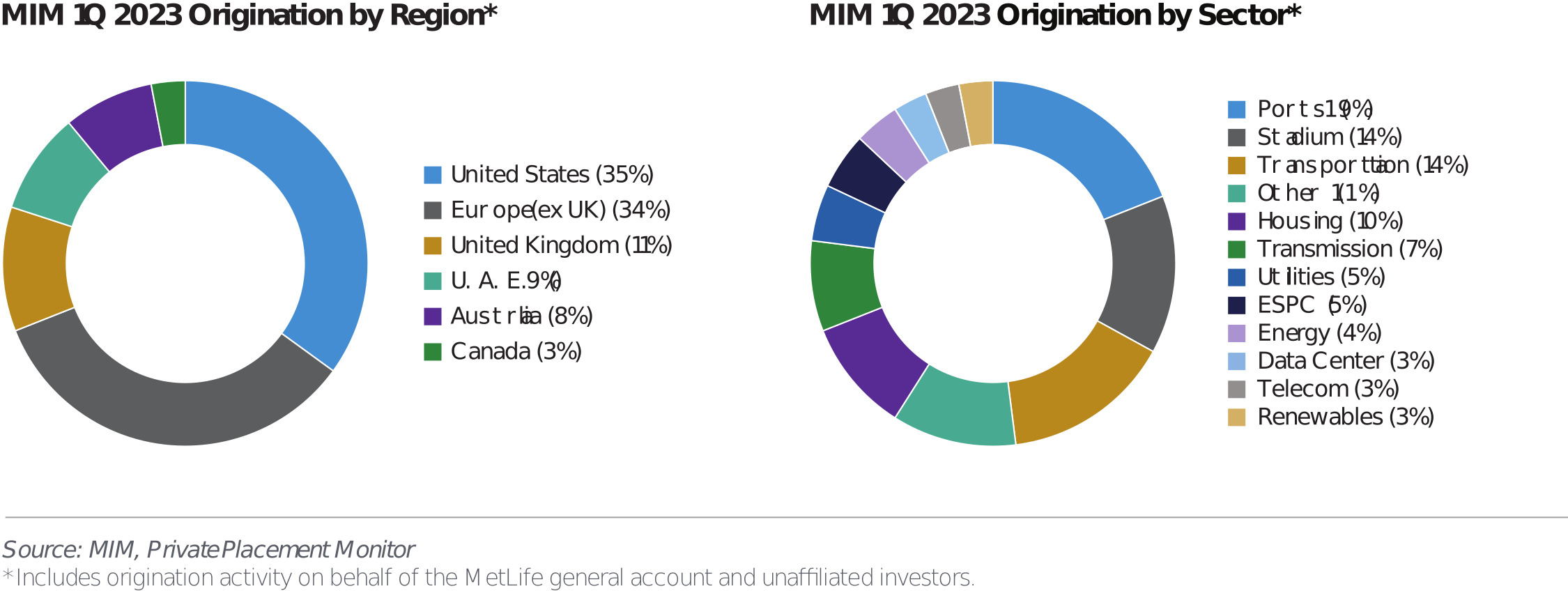

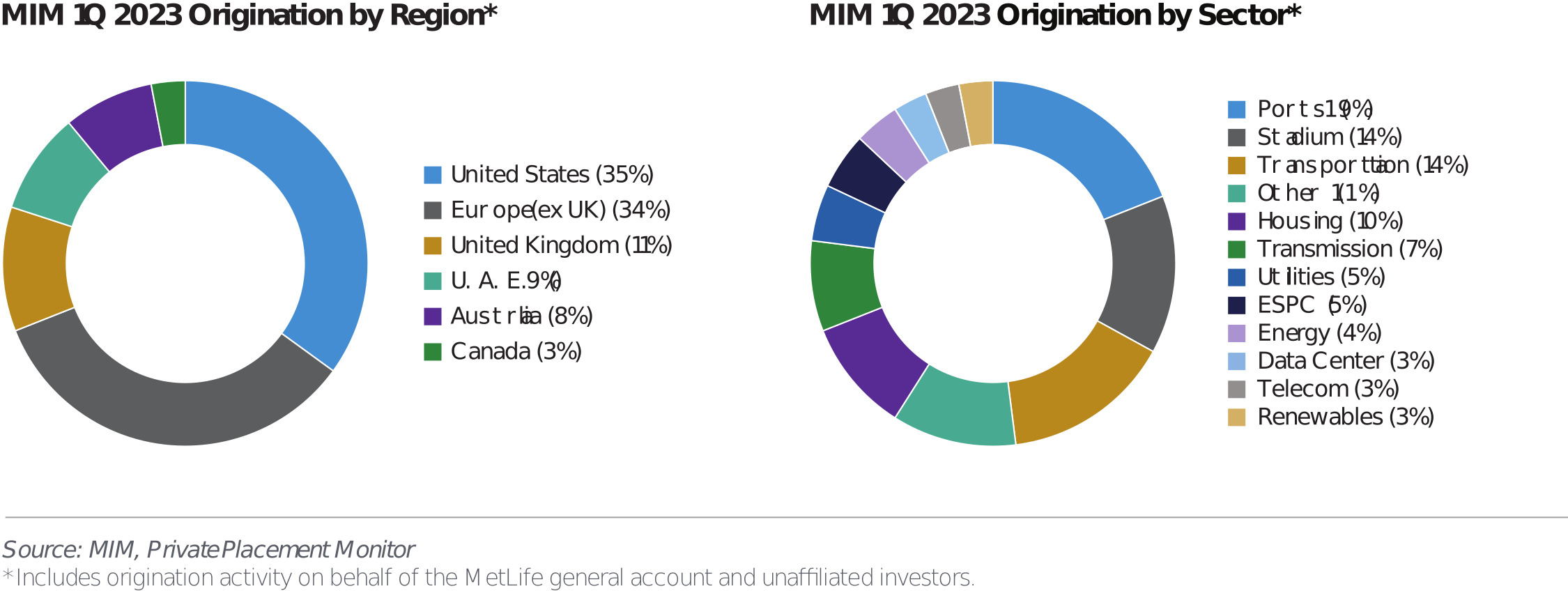

MIM Infrastructure Debt Activity: Origination was lower for 1Q 23 at $0.9 billion versus $1.5 billion for the same period last year. Although origination was lower, in our view, the transactions that MIM originated were at attractive spread levels compared to previous quarters.

MIM’s FY 2023 Outlook: We expect FY23 to continue some of the macro challenges markets faced in FY22 with interest rates and spreads. We expect greenfield activity to remain busy and continue to access the markets. Refinancing activity could be pushed to later in the year. MIM expects a pipeline driven by opportunities focused on renewables, transportation, pipelines, public-private-partnerships, digital infrastructure, and energy transition assets

Private Structured Credit Market:3

1Q 2023 in Review: At the start of the new year, investors received new capital allocations and spreads in esoteric ABS sectors compressed from the relatively wide levels seen at the end of last year resulting in private market spreads tightening in sympathy. Due to the private nature of our transactions and the time they take to structure and negotiate, we were able maintain attractive relative value with a healthy pick up to publics markets. We saw market volatility increase with the collapse of SVB but given the swift response by the Fed to provide liquidity, we saw no material impact to our alternatives financing portfolio

Looking to 2Q 2023: As we enter 2Q 2023, public structured finance markets remain open given solid investor appetite. We expect spreads to move sideways to modestly tighter in both public and private markets. Our pipeline of new transactions should be active although slightly slower than earlier in the year with a mix of potential opportunities in the consumer, commercial and residential credit sectors.

Performance across the portfolio remained stable during the quarter. Although within the consumer and in particular the subprime segment, delinquencies and defaults continue to rise as inflationary pressures and decreased savings have impacted consumers. We remain comfortable with our exposure at the transaction level given robust structural features in the form of both hard and soft credit enhancement. Our notes are protected by substantial overcollateralization, performance triggers and excess spread. We closely monitor deal performance on a monthly basis.

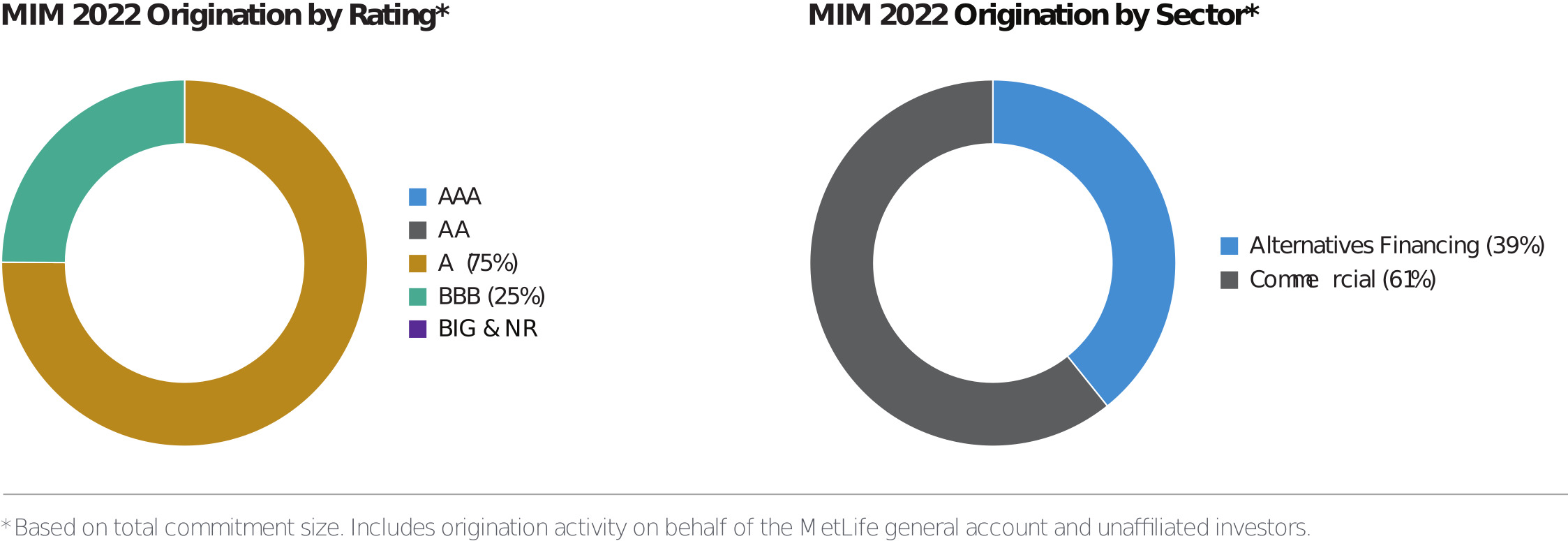

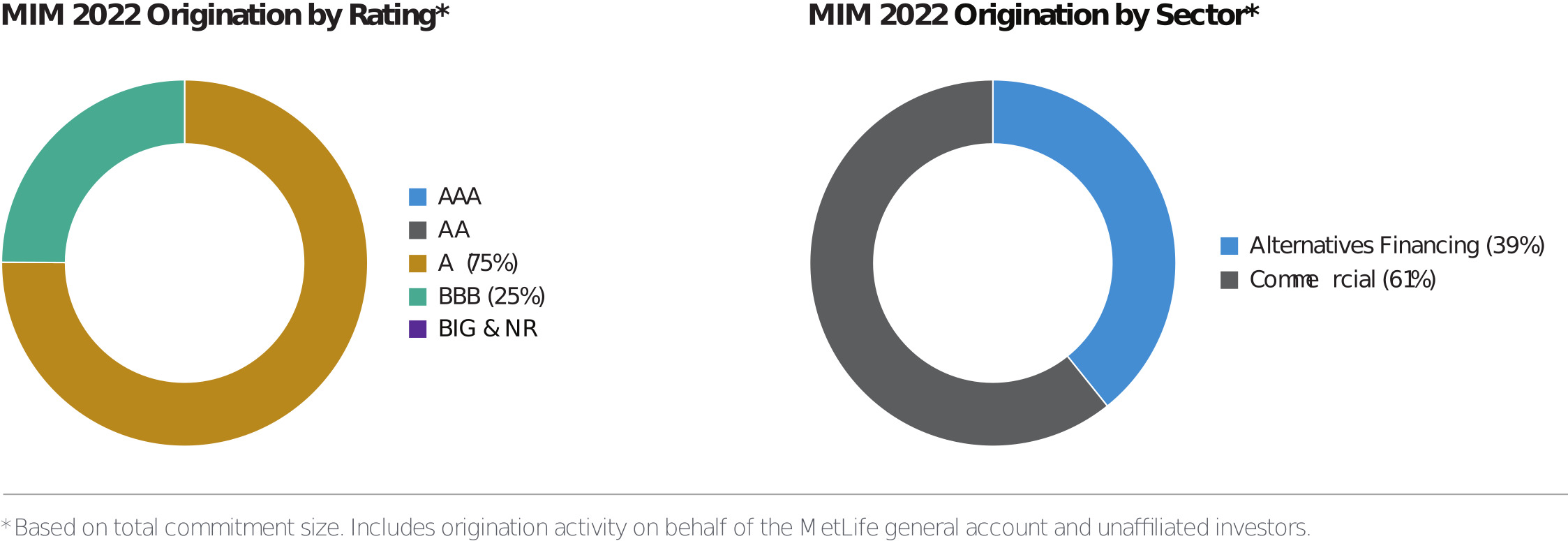

MIM Private Structured Credit Transaction Activity:* MIM started the year strong with $606 million of closed investments in the alternatives and commercial sectors.

Endnotes

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.

2 At estimated fair value as of 03/31/2023. Includes MetLife general account and separate account assets and unaffiliated/third party assets

3 Metlife Investment Management, Private Placement Monitor

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor. This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom.

This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited and Raven Capital Management LLC.