Corporate Private Placement Market

Q3 2022 private corporate issuance reached an initial total of $10.8 billion a significant decrease from $24.4 billion for Q2 2021. YTD market issuance stands at $55 billion versus $74 billion during the same period in 2021.3 After a strong first quarter emerging from Covid disruptions, the slowdown in issuance is mainly attributable to persistent inflation, the related sharp rise in interest rates and uncertainty over a potential recession. Quarterly deal flow was primarily driven by issuance in REITs, financials and utilities. The average deal size for Q3 2022 was $188 million across 56 transactions, versus Q3 2021 that included 113 transactions with an average deal size of $144 million. Issuance was led by activity in North America, comprising 70% of total issuance. European volume was 25% and Australia 5%, USD currency made up 78% of corporate issuance, GBP 11%, EUR 9%, and AUD at 2%.3

Ratings and Delayed Fundings: A-rated (NAIC-1) names were responsible for 36% of total quarterly issuance, relatively in-line with the historical norm (~40%) and BBB-rated companies (NAIC-2) comprised 63%. Delayed fundings continued to be utilized by issuers with 20% of Q3 2022 transactions having a delayed funding. We expect this trend to continue as private issuers approach the market for financing opportunities with concerns of anticipated inflation and the continued potential rise in interest rates.3

Spreads and Treasuries: Private credit spreads, following public spreads, widened through the quarter driven by increased inflation pressure and aggressive Fed policy. Private spreads have maintained a healthy premium over publics but have slowly contracted towards historic averages driven by the strong demand for private assets. This was particularly seen with broadly marketed deals from agent banks.

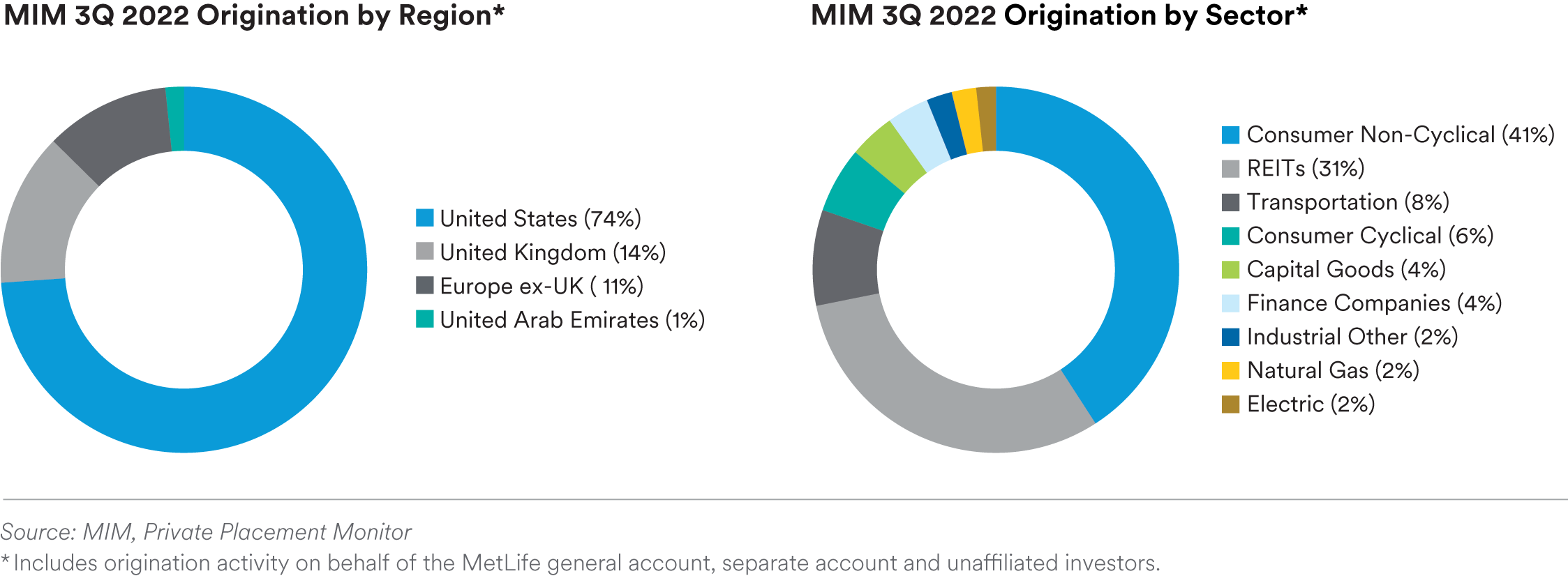

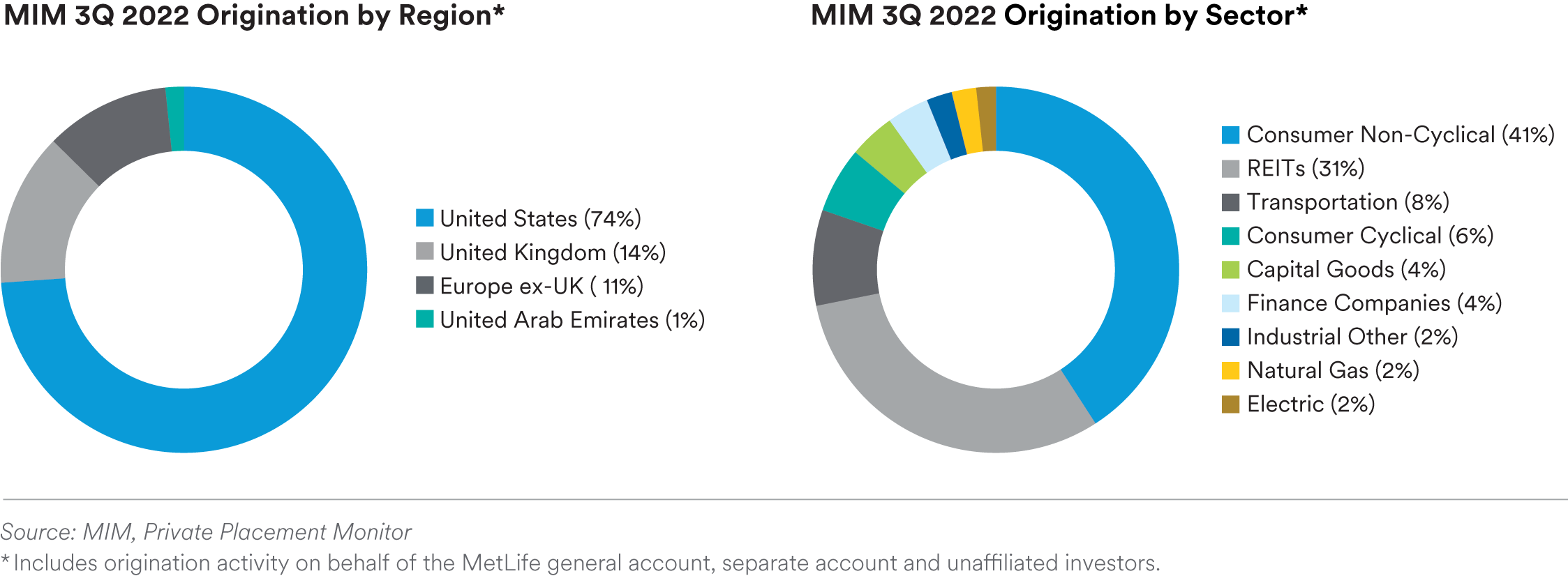

MIM Corporate Private Placement Activity: MIM’s origination activity for Q3 2022 was $1.1 billion compared to $1.8 billion in Q3 2021. Year-to-date, origination stands at $6.5 billion versus $5.8 billion for the same period in 2021. The reduction in origination was driven by the slower overall market as indicated above. However, MIM was able to somewhat offset the slowdown through our direct origination platform. MIM continues to benefit from both direct and club transactions which lead to larger allocations and more diverse deal flow.

MIM’s 2022 Outlook: As a result of continued, persistent inflation readings and the Fed’s aggressive response, MIM’s US GDP forecast was revised down to +1.7% growth YoY for the full year 2022 and the forecast for US inflation was revised up to 7.6%. MIM is projecting 10-year UST rates to remain elevated. Given the elevated rates, MIM expects issuance to remain somewhat muted throughout the remainder of the year. Corporate CFOs have begun to take a more selective approach to issuance with the potential of an economic slowdown. Despite this more conservative approach, MIM maintains an open dialogue with issuers in order to facilitate unique financing opportunities. MIM is closely monitoring the portfolio and notes issuers have continued to maintain steady margins and leverage ratios have remained conservative. MIM will continue to utilize our sector specialist approach and relationships to try and uncover the broadest range of appropriate opportunities for our clients.

Infrastructure Debt Market

Infrastructure Debt Market: Driven by the rise in rates and widening spreads, capital market activity remains sluggish. Year to date, issuance was down 42% to $37.5 billion compared to $64.8 billion during the same period last year.2 While investors continue to assess and navigate market volatility, several large transactions closed within the transportation, energy, and telecom space. The broader infrastructure market including bank financing was generally flat year-over-year. Through 3Q 2022, the broader market was at $678 billion compared to $652 billion last year. These transactions were spread across energy (23%), transportation (22%) followed by telecom (19%), renewables (19%), power (9%), social infrastructure (6%), and other (2%). Activity was focused in EMEA (38%), US & Canada (31%), Asia Pacific (22%), and Latin America (8%).3

Global Sector Highlights:

United States: While the market still waits to see the impacts from the $1.2 trillion infrastructure bill, the Inflation Reduction Act was signed in August 2022 which provides $369 billion to support energy transition. The Act will help confront the climate crisis by expanding tax credits for clean energy and electric vehicles, boosting energy efficiency and establishing a national climate bank. The Act includes $270 billion in tax incentives that will spur private investment in climate related sectors. Outside of energy, the US market remains active in the power, water, PPPs, transportation, and the digital space. Given the rising interest rate environment, we remain cautiously optimistic on new refinancing opportunities.

EMEA: Deal flow has been slower than normal. MIM has seen the return of UK utility names that have not been active in the private market for a couple of years due to the strength of the public markets. MIM continues to see opportunities in the digital space, mostly fiber and data centers. MIM expects utilities and some of the transportation names to come to the market.

Latin America: The rejection of the proposed constitution was positive news out of Chile and has led to moderation in public policy. Governments across the region continue to push for the expansion of renewable generation, particularly Chile, Peru, Colombia and Brazil. Congress in Chile approved key electricity storage and EV legislation. Public bond markets remained largely closed given the volatility in rates. Despite this, two relevant renewable USPP transactions closed in the quarter. Bank deals are generally unattractive, with pricing inside of publics. MIM has an active pipeline in the port, toll road, renewables, transmission and digital sectors.

Australia: Capital markets resumed activity with three transactions approaching the market. MIM expects three more transactions in the fourth quarter in transport, electricity distribution, and digital.

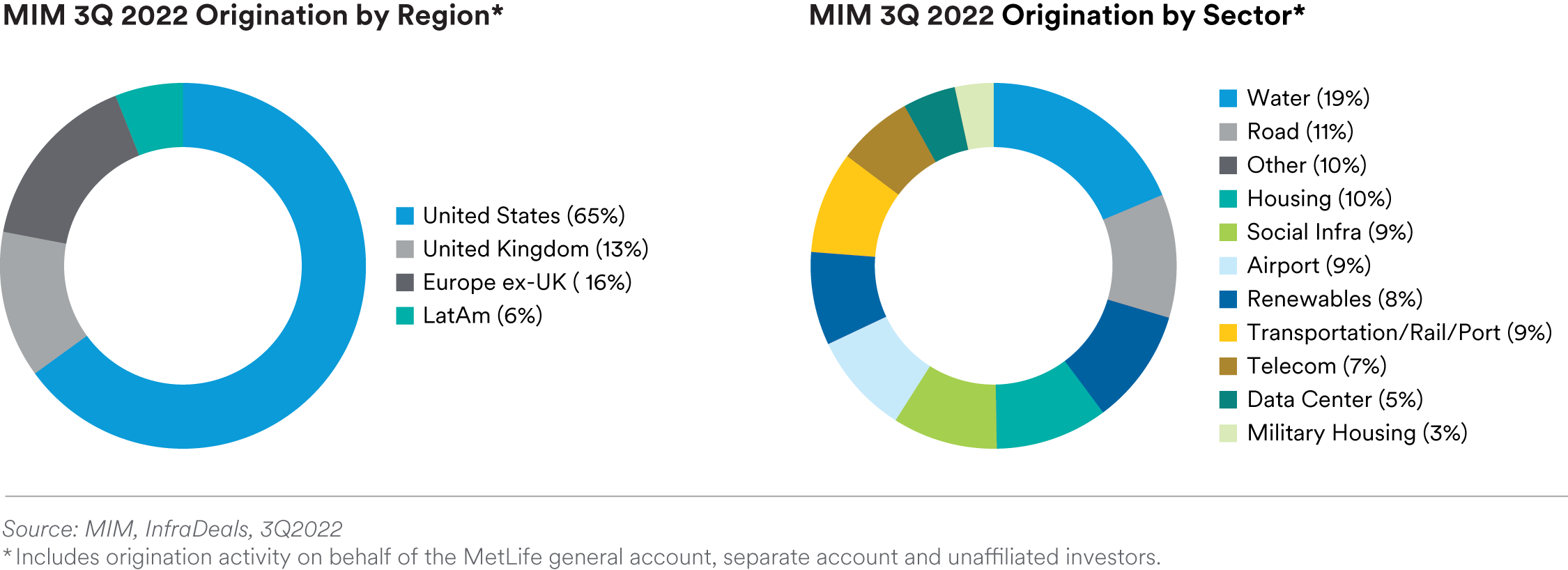

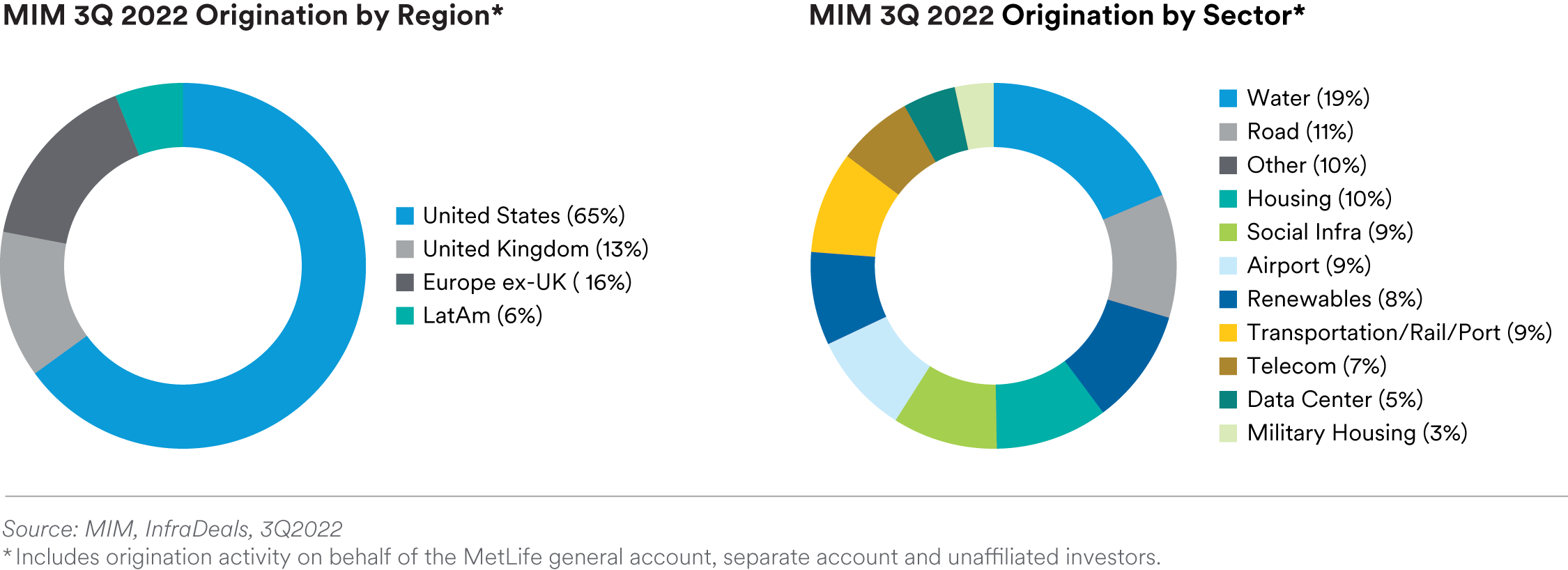

MIM Infrastructure Debt Activity: MIM had another strong quarter with $1.3 billion of origination across 22 transactions. Year-to-date, MIM has originated $3.9 billion across 60 transactions. MIM originated notably large transactions in both the US and the UK. MIM received outsized allocations given strong relationships with Sponsors, Agents, and Advisors.

MIM’s 4Q 2022 Outlook: Typically, the fourth quarter is the busiest for the market. However, given the macro environment with rising rates and spread widening, we are cautiously evaluating our pipeline as Sponsors assess the rising cost of debt. This has led to an increase in short term, floating rate deals where MIM is equally active and participating. MIM expects a continued pipeline driven by opportunities focused on renewables, transportation, pipelines, public-private-partnerships, digital infrastructure, and energy transition assets.

Private Structured Credit

Strong investor demand kept pricing spreads relatively tight as we entered Q3. Early in the quarter we continued to see deals where the premium to public markets remained narrow. However, later in the quarter, deal pricing in private structured credit had reestablished a healthy spread premium to public markets. Private issuers were initially slow to adjust to higher benchmark rates and wider credit spreads earlier this year but have since recalibrated to a higher cost of funding environment.

Looking to 4Q 2022: Deal flow has accelerated into Q4 after a seasonal summer slowdown. We currently have a diverse pipeline of transactions across various sectors, including equipment, solar, CRE CLOs, energy, low-income housing, C-PACE, residential and consumer credit. We remain disciplined in seeking the most attractive transactions that meet stringent underwriting criteria in terms of deal sponsor, credit, structure and pricing.

Across the portfolio, fundamentals remain stable although we observe performance metrics such as delinquency and default beginning to trend upward from historical lows back towards long-run averages. It is worth noting that a critical focus of our underwriting is assessing the robustness of transaction credit enhancement and structural features to protect against loss; downturn scenarios are run at multiples of historical worst vintage performance.

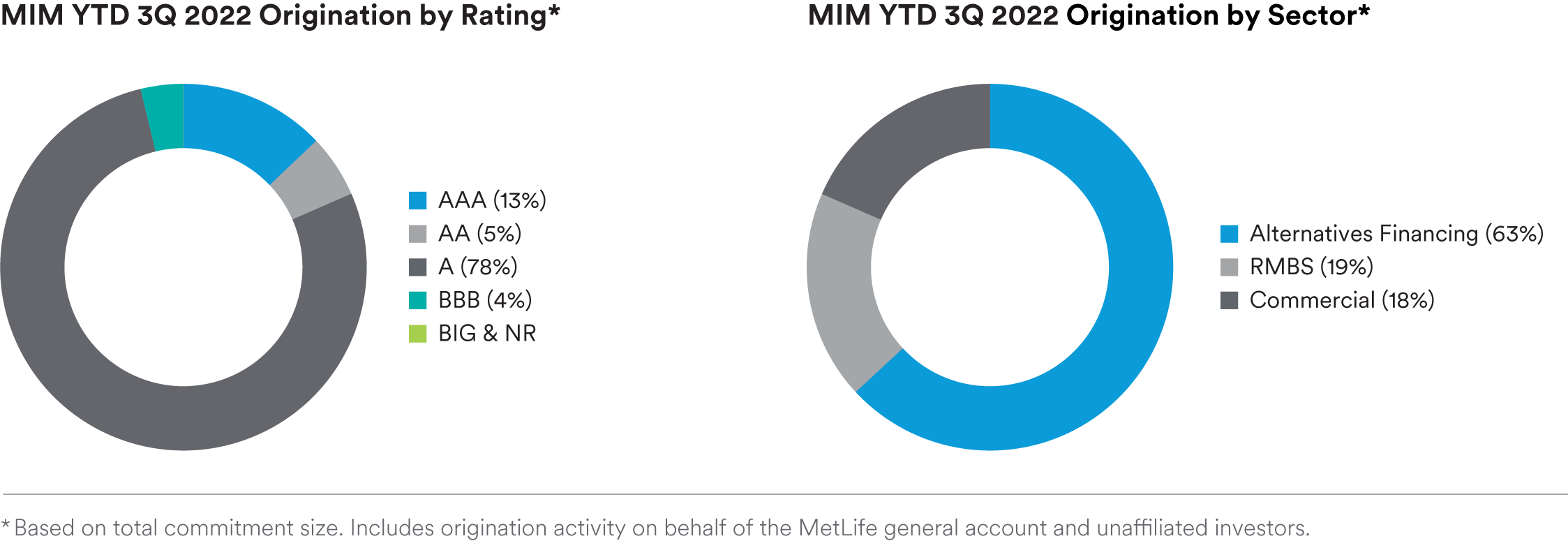

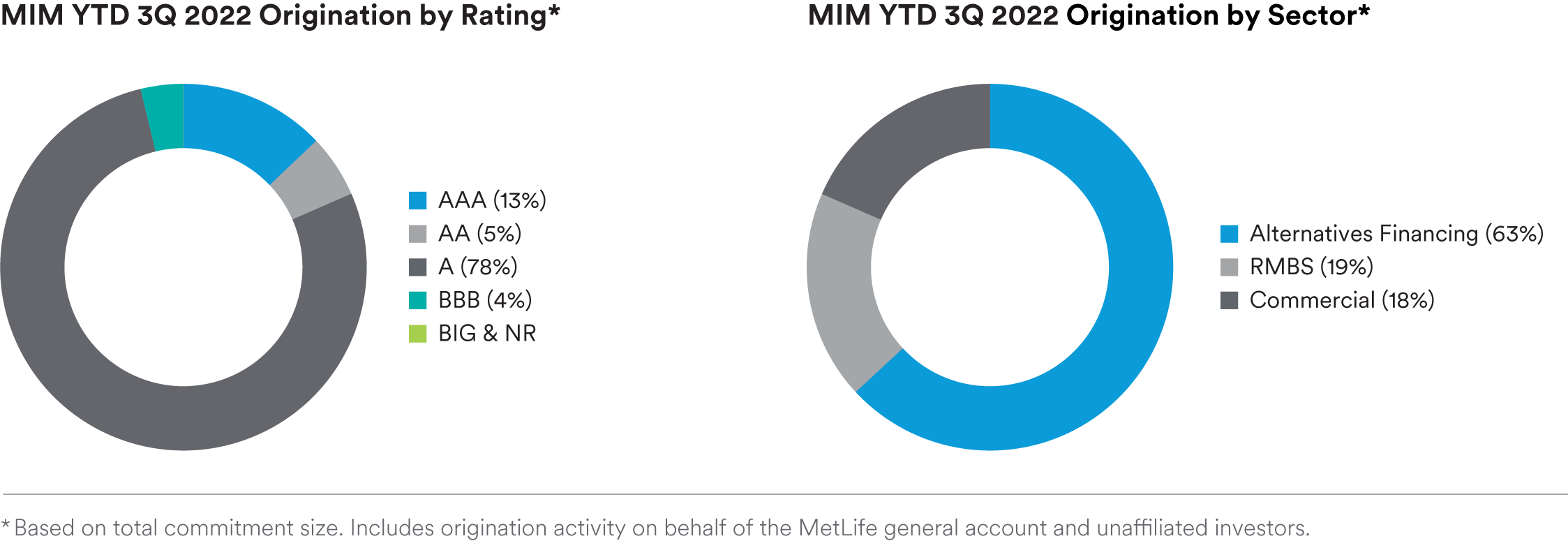

MIM Private Structured Credit Transaction Activity:1 Largely driven by relative value dynamics noted above, MIM activity for Q3 2022 was highly selective with $60 million of closed investments. Year-to-date origination through the end of Q3 was $1.4 billion.

Endnotes

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.

2 At estimated fair value as of 10/31/2022. Includes MetLife general account and separate account assets and unaffiliated/third party assets

3 Metlife Investment Management, Private Placement Monitor

Disclosures

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”) solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. More specifically, investments in private credit involve significant risks, which include certain consequences as a result of, among other factors, borrower defaults and, fluctuations in interest rates. Private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial market. The investments and strategies discussed herein may not be suitable for all investors.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/ EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.

Unless otherwise noted, none of the authors of the articles on this page are regulated in Ireland.