The Investment Opportunity

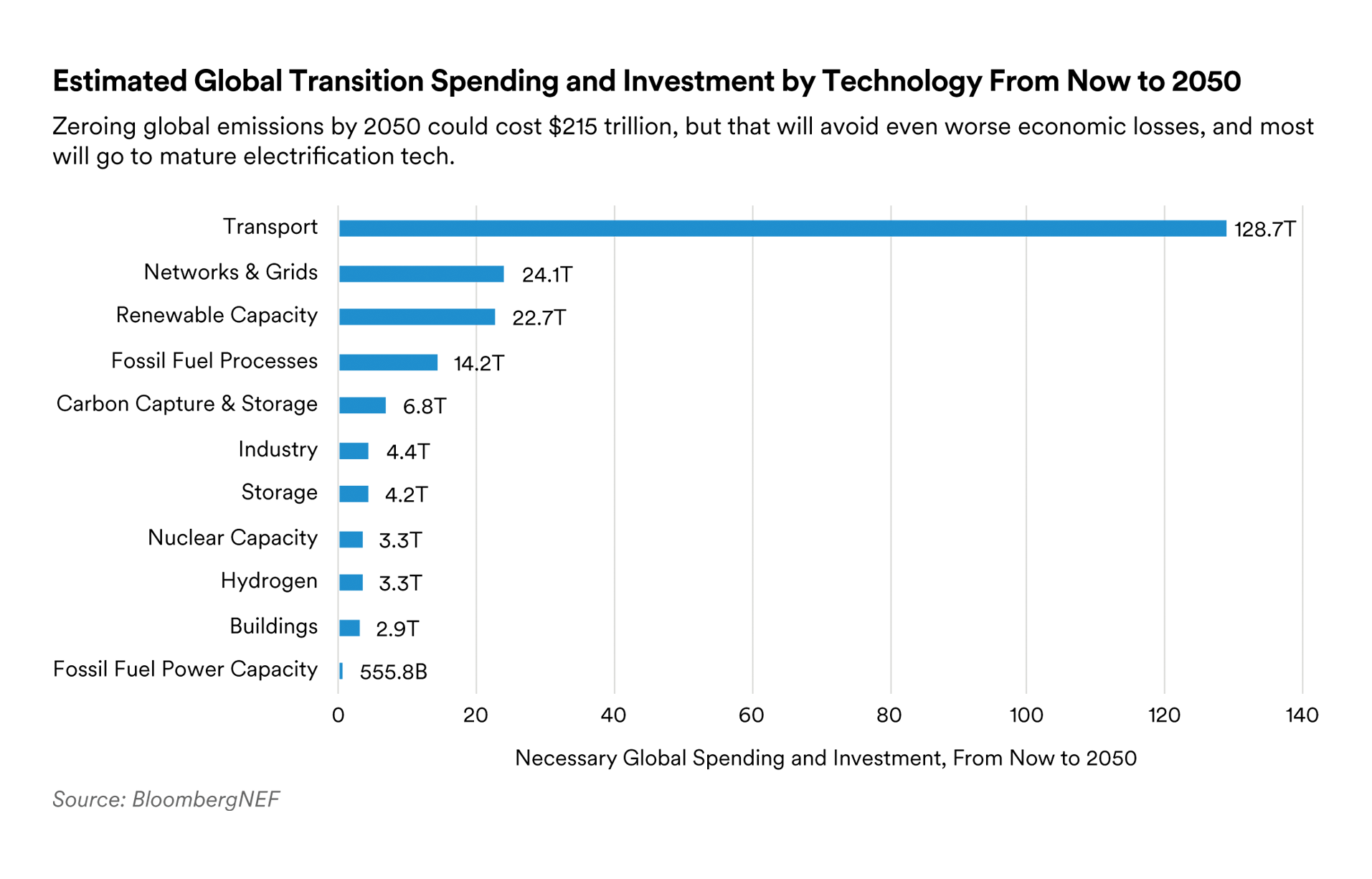

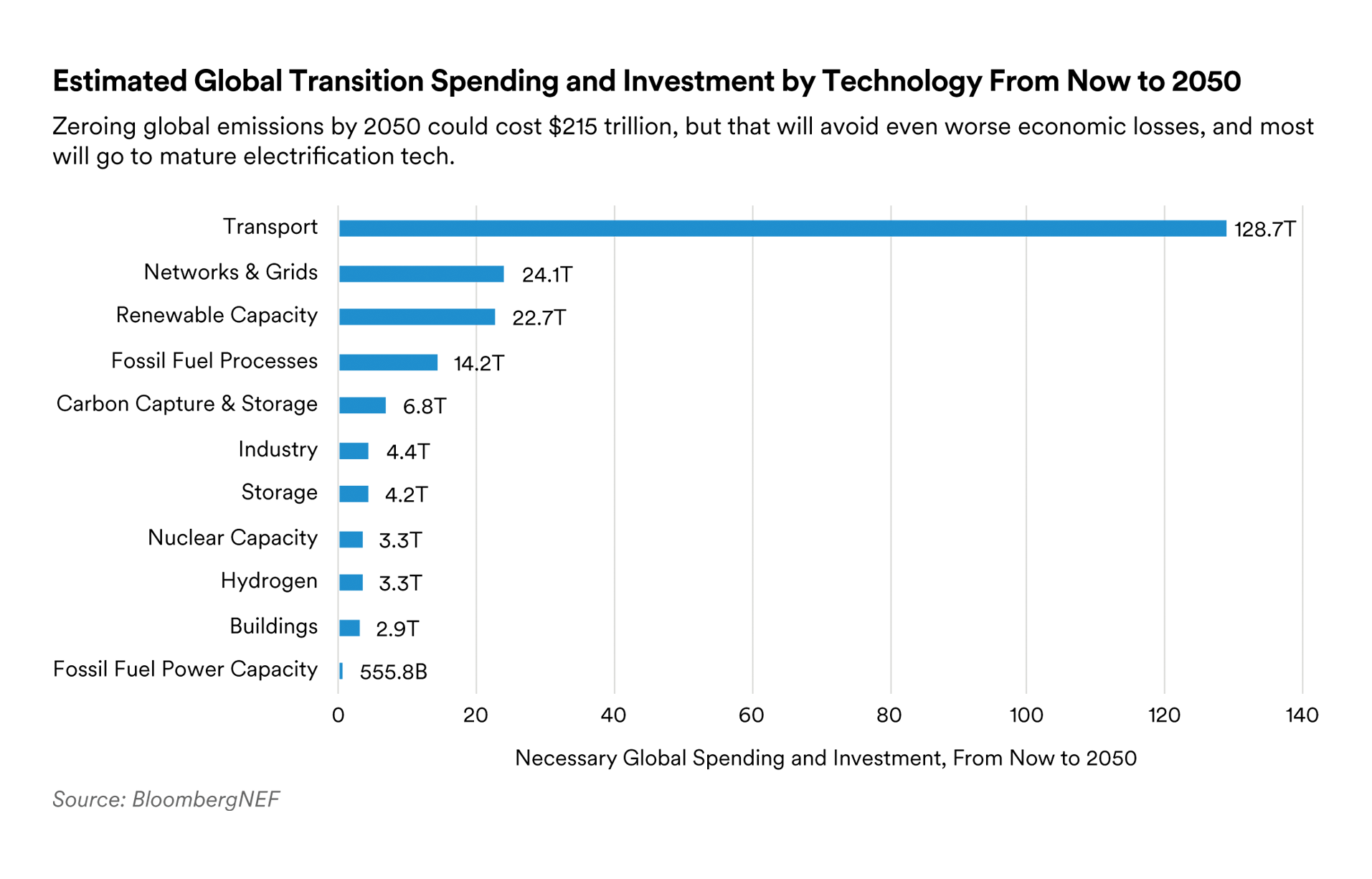

The funding required to facilitate the transition will be substantial. Bloomberg New Energy Finance (BNEF) reports that global energy transition investment in 2023 hit a record level of US$1.8 trillion, yet this falls well below the necessary pace. BNEF estimates that an average annual investment of US$8 trillion is needed from 2024 to 2050. This estimate, recently revised upward, reflects the escalating costs of transition due to current underinvestment. In total, BNEF’s revised forecast for achieving zero global emissions requires an investment of US$215 trillion between 2024 and 2050,2 up from the previous estimate of US$196 trillion. This represents a substantial opportunity for private investment.

The International Energy Agency (IEA) projects that approximately 70% of transition finance funding will come from the private sector as governments and supranational entities are unable to shoulder the enormous cost alone.3 To uphold the Paris Agreement and mitigate more severe global warming effects, a significant portion of this investment is required within this decade. This urgent need underscores the unique opportunity for investors to contribute to and invest in the transition, shaping our collective future for the coming decades.

While it’s often assumed that investment in transition primarily targets risky, emerging technologies, the reality is that investment is needed across all levels of the capital spectrum. Most of the funding is expected to support mature businesses and technologies, such as clean transportation and the expansion of electricity networks and grids. Furthermore, the evolution of some emerging technologies will likely be driven by leading firms in hard-to-abate sectors. These companies possess the necessary expertise and resources and are increasingly motivated by consumer demand and policy incentives to reduce their carbon footprint. This includes industries like steel and cement production, as well as complex, high-emission sectors like shipping and chemicals.

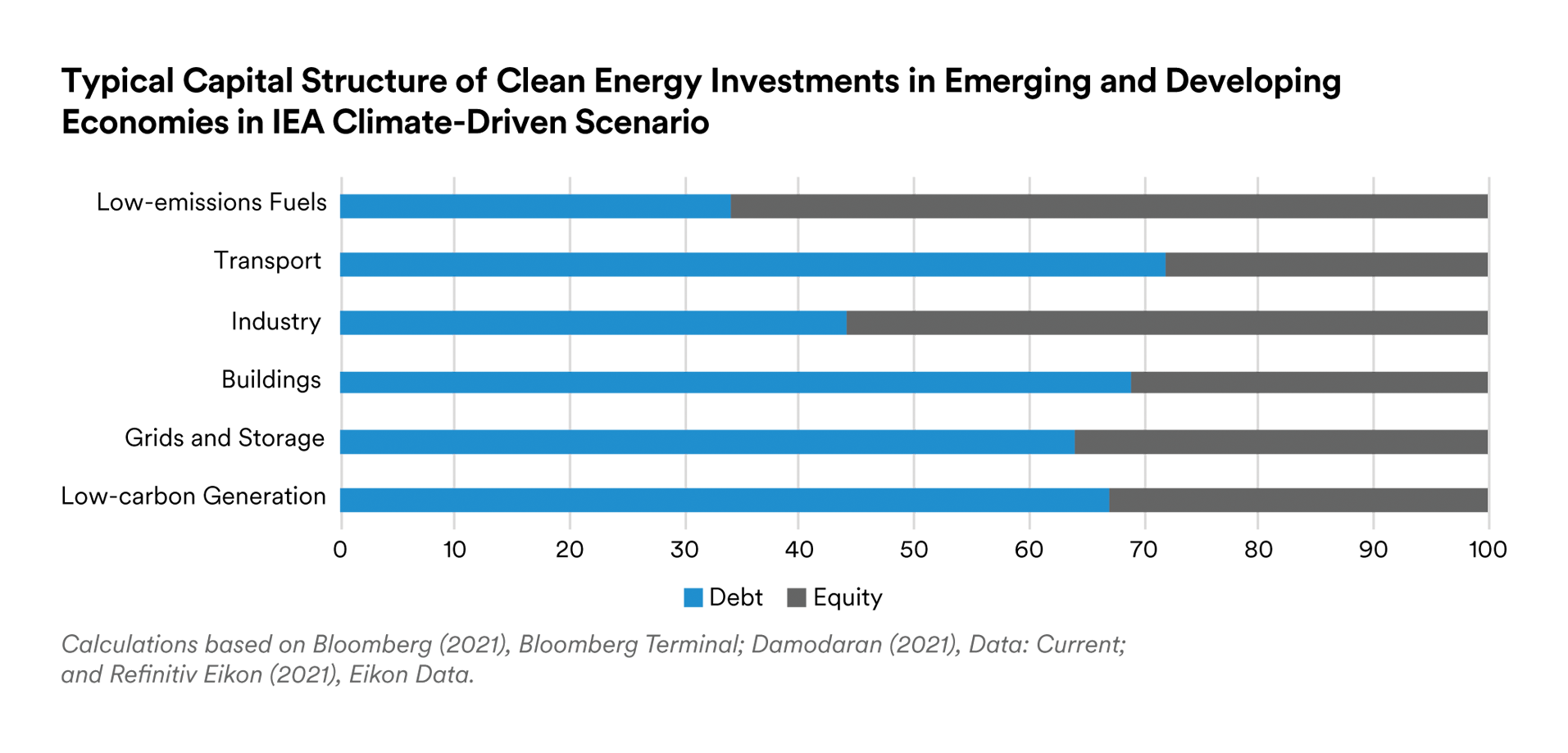

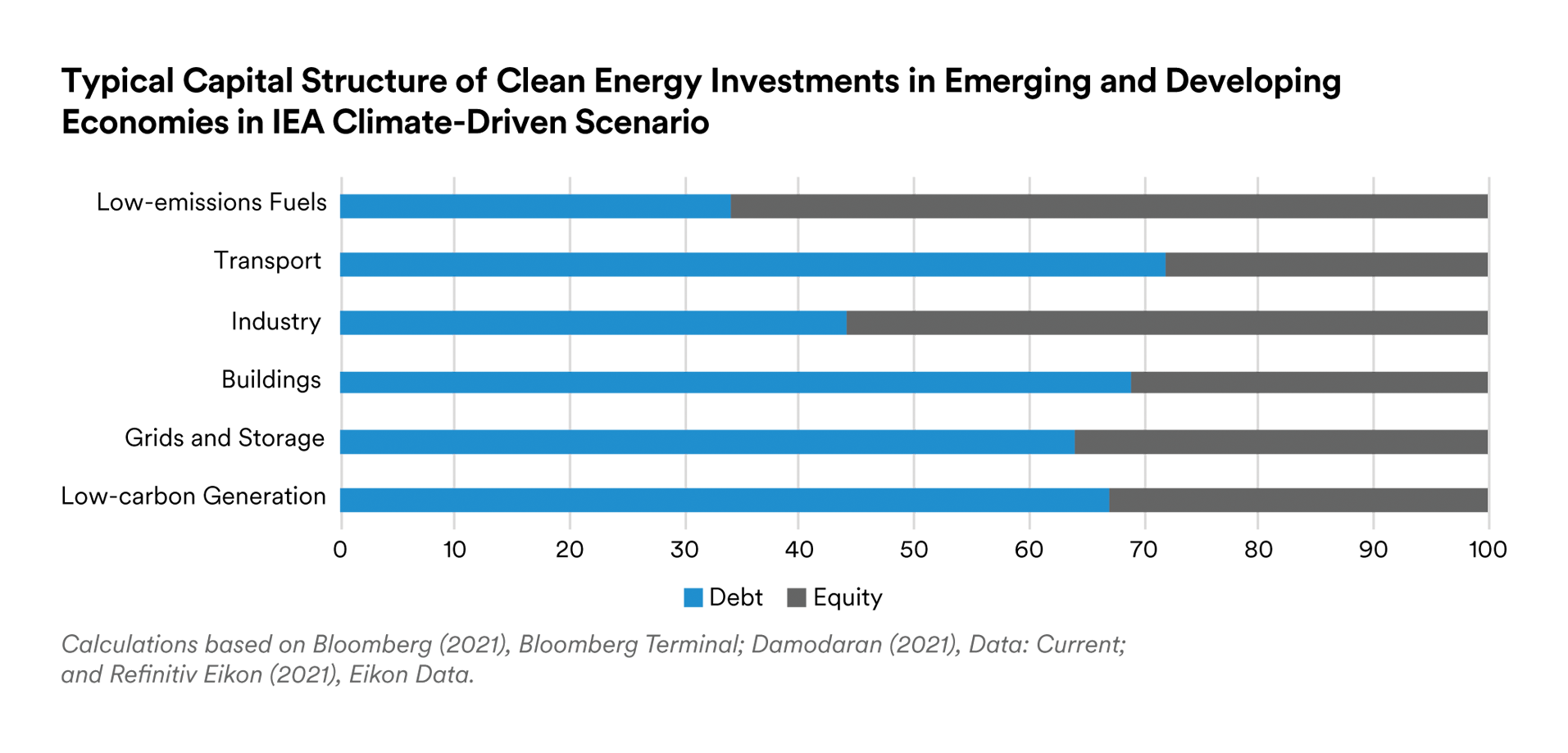

Significantly, the IEA estimates4 that the bulk of the necessary investment will likely be in the form of debt financing. This reflects the maturity of the industries under transformation and the potential high cost of equity.

Appears in The Cost of Capital in Clean Energy Transitions

Private Transition Finance

Considering the substantial need for transition finance investment this decade, primarily through debt financing, and the rising significance of private credit markets, we believe private credit transition strategies present a promising investment opportunity. These strategies, in our view allow investors to achieve higher yields than in recent years, generate positive impact and safeguard against the increasing materiality of climate risk.

Private credit markets, being largely relationship-based, enable collaboration between borrowers and investors and offer unique opportunities for engagement. Historically, private credit has offered investors diversification from public bond markets, a potential spread premium over comparable public corporate bonds, and risk mitigation through covenants and/or collateral. Therefore, properly structured private credit can deliver dual benefits of income generation and positive impact.

With over a century of experience in private credit markets, MIM has substantial expertise in corporate, infrastructure, and asset-backed credit and sustainability. Our emphasis on mature industries and technologies positions us to contribute significantly to the pivotal transition finance opportunity in areas like electrification and renewable energy, where the primary challenge lies in commercial deployment versus technological viability.

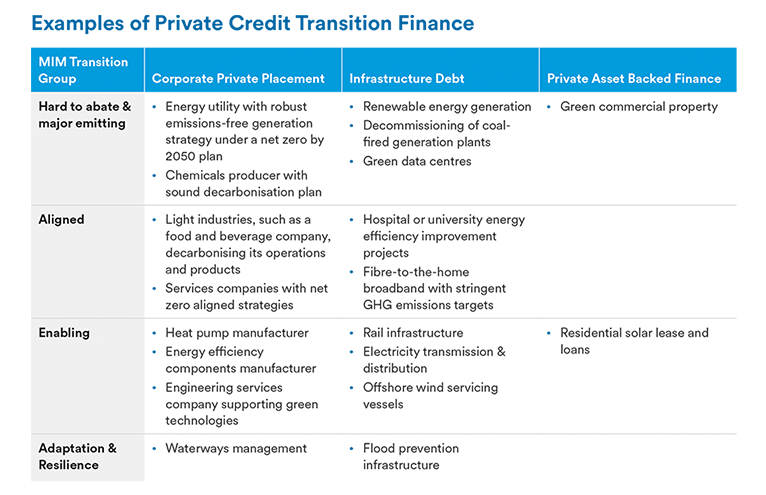

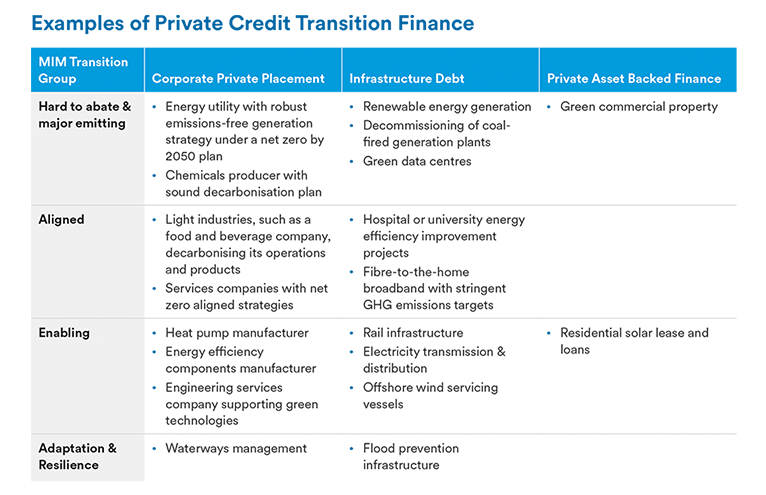

MIM’s private credit transition strategy supports the energy transition by providing loans to (i) forward-looking corporate borrowers well-positioned to capitalize on global decarbonisation trends; (ii) essential infrastructure assets like electricity networks, renewables, transport, and digital communications which are crucial for financing a just transition; and (iii) private asset-backed finance sectors such as residential solar and green buildings.

We categorize transition issuers into four groups, offering a wide range of opportunities. Addressing climate change requires a comprehensive approach, involving innovation and ambition in hard to abate sectors in addition to investment in assets and activities that are already green.

- Hard to Abate: Critical industries which account for a significant share of global GHG emissions. Technological solutions in these sectors are either nascent, or require significant capital investment and support to reach deployment at scale and cost parity with existing fossil fuel-based processes.

- Transition Aligned: Issuers undertaking ambitious steps to integrate climate change mitigation and risk management into their long-term business strategy to align their GHG emissions with the Paris Agreement targets.

- Transition Enabling: Products, services, technology, and infrastructure which enable, support or facilitate decarbonization.

- Adaptation and Resilience: Critical infrastructure and activities, such as water, waste management and agriculture which are vulnerable to effects of climate change.

Applying this framework, we believe our private credit transition strategy can offer investors a range of benefits:

Enables asset owners to align their portfolios with the net zero agenda and meet their net zero targets. Our transition strategy can directly help asset owners meet their own decarbonisation targets, including commitments under initiatives such as the Net-Zero Asset Owner Alliance. Our industry- inclusive approach supports real-world decarbonisation versus restricting investment to already low- carbon sectors, which while important, can lead to portfolio sector bias and fails to address the need to reduce GHG emissions in hard to abate sectors to achieve the Paris Agreement objective.

Provides diversification versus public bond issuers. This allows investors to support transition for companies not typically accessible through the public bond market, as well as investing directly in transition infrastructure. Examples include clean mass transport; clean energy and electrification; energy-efficient digitalisation; and promoting resilience, such as flood prevention infrastructure.

Holistic sustainability approach. Our transition strategy is based on bottom up, fundamental credit and sustainability research. Our credit and sustainability teams conduct independent analysis and each potential transition investment must pass separate review by both teams. The transition review involves an assessment of the borrower’s net zero alignment and/or enabling function coupled with a comprehensive ESG risk analysis. This two-fold approach therefore requires both positive transition impact and responsible ESG risk management to address climate change as a long-term systemic risk.

Engagement on sustainability topics. Private credit allows for a direct relationship with senior management and equity sponsors to help improve understanding of decarbonisation and responsible practice, both prior to investing and on an ongoing basis to monitor performance.

Promotion of greater transparency. Private credit issuers often disclose less sustainability data than public bond issuers. With growing investor and regulatory attention on private markets, as well as the acknowledgement of private credit’s important role to play in the transition, this is changing but requires forward-looking investors to help expedite improved disclosure. Our approach requires sufficiently high levels of disclosure to enable robust verification and reporting.

Comprehensive sustainability and impact reporting to evidence portfolio impact. We offer reporting that includes metrics under notable frameworks, such as the Taskforce on Climate-related Financial Disclosures (TCFD)5 and the EU’s Sustainable Finance Disclosure Regulation (SFDR), as well as proprietary methodologies to demonstrate portfolio net zero alignment. Our detailed sustainability and impact reporting is enabled by our fundamental research approach, supported by consistent engagement with borrowers and continuous innovation on impact measurement. MIM’s reporting has been recognized by Environmental Finance’s Sustainable Debt Awards 2024 for Impact Report of the Year.6

In summary, we believe transition finance poses one of the most exciting and wide-ranging investment opportunities available today, with private credit offering unique strengths to invest in this theme for both income generation and positive impact.

Endnotes

1 IPCC, 2022

2 BloombergNEF, New Energy Outlook 2024

3 International Energy Agency (IEA), The Cost of Capital in Clean Energy Transitions, 2021

4 IEA, The Cost of Capital in Clean Energy Transitions, 2021

5 TCFD recommendations to transition to IFRS Sustainability Disclosure Standards

6 Impact report of the year (for investors): MetLife Investment Management: Environmental Finance (environmental-finance.com). This award continues a multi-year award-winning track record under Affirmative Investment Management (AIM), a dedicated impact fixed income fund manager which MIM acquired in December 2022.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border license, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/ third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.