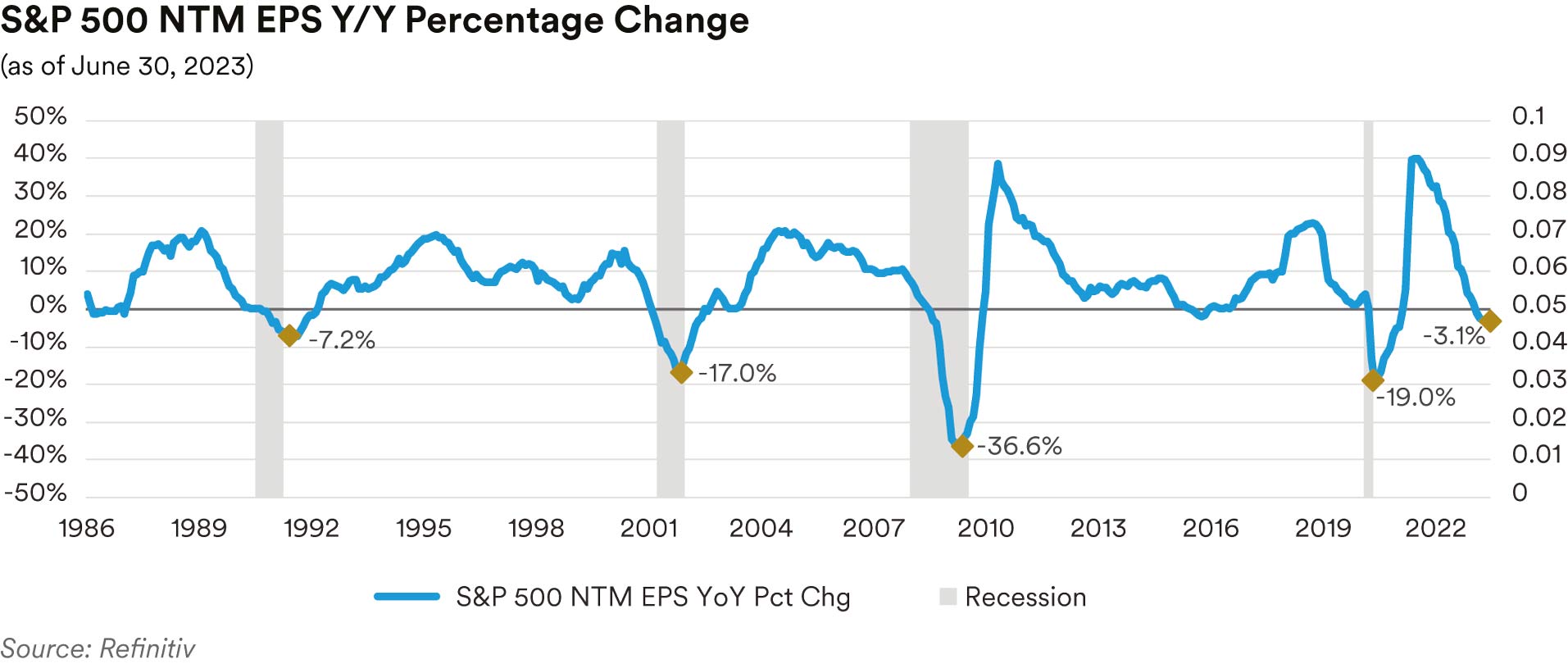

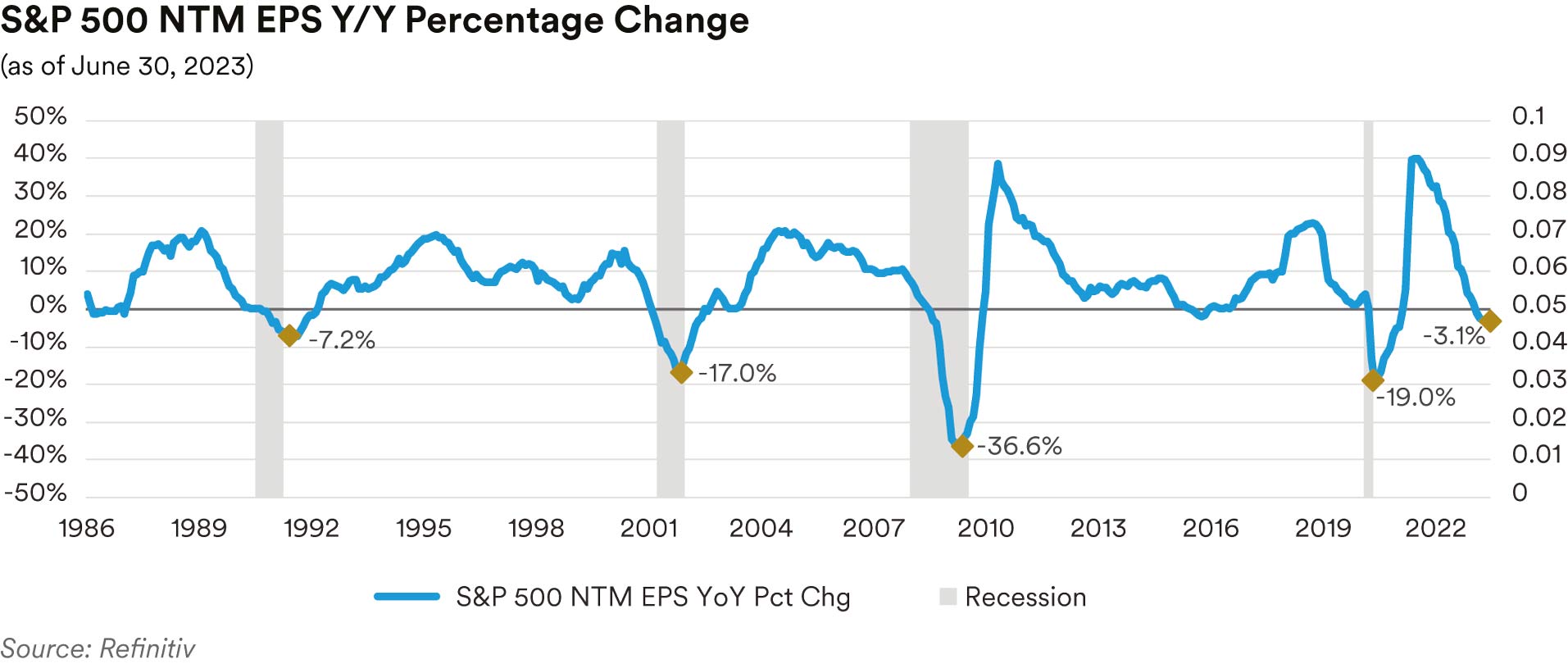

Shifting to fundamentals, we saw first-quarter earnings reports, which arrived throughout the second quarter, exhibit further deterioration with corporate earnings and operating margins across a number of subsectors declining on lower consumer demand in addition to wage and cost pressures. For the S&P 500 Index’s constituent companies, first-quarter year-over-year EPS according to Bloomberg was -3.6%, the second consecutive quarterly decline. We will get a further read on corporate health with the upcoming second-quarter earnings season about to kick off in early July. Overall EPS is expected to decline 7.2% from second-quarter 2022, which would represent the sharpest pullback since second-quarter 2020 when the onset of the pandemic caused earnings to drop precipitously.

Portfolio Actions & Outlook: Our bellwether front-end investment grade corporate index, the ICE BofA 1-5 Year U.S. Corporate Index, ended the second quarter at an OAS of 98 basis points, 21 basis points tighter vs. where the index started the quarter and 5 basis points below where the OAS entered 2023. Given our view that we are “late-cycle” in terms of economic growth and the potential we see for slipping into a recession, we were not overly enamored with the level of credit spreads entering the quarter in terms of adding spread risk. Nevertheless, despite our belief that credit spreads were biased to widen, we grew more comfortable increasing our sector weightings over the course of the second quarter in our shorter strategies as benchmark interest rates rose and all-in yields for corporate bonds reached levels not enjoyed since the aftermath of the global financial crisis. From our seat, the chance to lock in these yields represented an opportunity not to be passed up, despite our concern that credit spreads, especially out the maturity spectrum, do not adequately capture the uncertainties and risks in the current environment on top of the slow deterioration in fundamentals and credit metrics we have seen over the past several quarters. Simply from a break-even spread or yield standpoint and protection against downside risk afforded by shorter maturity corporates, adding these bonds across our shorter strategies was warranted in our view. We maintained a more cautious approach in the 1-3 year and 1-5 year strategies in terms of preserving our discipline and selectivity while not adding to our investment grade credit sector exposures or increasing our risk positioning.

Over the quarter in our Cash Plus strategy, we increased our sector weighting by purchasing roughly one-year maturity secondary bonds at what we deemed attractive yields. We also sold an 18-month technology sector new issue purchased in March at a much lower all-in yield to monetize a gain early in the quarter. In the Enhanced Cash strategy, we also lifted our sector weighting by adding 1-1.5-year duration secondary bonds at what we viewed as attractive yields as well as a pharmaceutical company’s two-year new issue tranche. We funded some of our purchases by selling short-dated, fixed-rate 2023 maturity securities. In the 1-3 year strategy portfolios, we selectively added some two-year duration secondary bonds in a number of our favored names and subsectors, including several AAA-rated Canadian covered bonds, and primarily sold shorter-dated 2024 maturity securities. In new issue, we bought the aforementioned pharmaceutical company’s two-year tranche, a money center bank’s operating company AA-rated, three-year issue, and a Korean automaker’s two-year new issue tranche. In the 1-5 year strategy portfolios, in secondary we purchased a AAA-rated, three-year U.S. insurer’s secured funding agreement-backed bond and a Canadian covered bond. On the new issue front, we added the above noted pharmaceutical company’s three-year tranche, a food and beverage issuer’s five-year bond, an electric utility’s five-year first-mortgage bond, and a AAA-rated, five-year Canadian bank covered bond. These purchases were also funded by selling shorter-dated 2024 maturity securities.

Turning to our outlook for the investment grade credit sector, we see credit spreads as more inclined to widen than tighten from their current levels, especially after materially tightening in the second quarter, despite signs of weakening fundamentals and a slowing economy in the U.S. and globally. In our view, the market seems to be pricing in a soft landing or a more benign end to the Fed’s hiking program, perhaps hanging its collective hat on the stubborn resiliency of the U.S. labor market, although it too has begun to show some early signs of downshifting. We believe corporate earnings and credit metrics continue to show deterioration with the potential for financial conditions to tighten further driven in part by the Federal Reserve’s quantitative tightening efforts and potential further policy rate hikes, which would increase pressure on issuers, as well as consumers. In terms of the health of the consumer, we are also concerned about the impact of the dwindling buffer of savings consumers built up during Covid and approaching end of the student loan payment moratorium, expected in September, which in our view, will surely curb spending.

We believe that corporate credit spreads will not be able to defy gravity indefinitely and will be forced to more closely reflect underlying fundamentals, which we see as staying on a weakening path over the near term. Borrowing conditions for corporate borrowers have been growing less advantageous and more challenging, typically a pre-cursor of an economic slowdown or recession (and much wider credit spreads) while we have already seen a pickup in corporate defaults and stresses in the system like worries over the regional banking crisis beginning in March. Consequently, we remain very selective in investment grade credit and will maintain a somewhat reduced weighting and more defensive, up-in-quality positioning relative to our historical norms until our outlook improves or valuations reset to a level more in tune with underlying fundamentals. We will continue to be disciplined, favoring more defensive subsectors like Banking, Insurance, Communications, Consumer Non-cyclicals, and Electric Utilities less susceptible to spread widening relative to other more cyclically exposed subsectors. We will focus on periodically taking advantage of market dislocations or one-off opportunities like the chance to add 1-1.5-year duration credit at very attractive all-in yields in our shorter strategies noted above after the reset higher in benchmark yields we saw in the second quarter.

Performance: We believe the investment grade credit sector was a solid contributor to relative performance across all strategies in the second quarter. This was mainly driven by the broad spread tightening of front-end corporate bonds over the quarter we observed. With markets distracted by debt ceiling-related uncertainty in May, most of the spread tightening took place in April and June, helped in our view by the increase in interest rates, which pushed front-end corporate bond yields to levels not seen since 2009. Despite the OAS of our front-end benchmark 1-5 year U.S. corporate index declining on a quarter-over-quarter basis to a level below where we began the year, the index’s second-quarter total return was a meager 0.12%, however, its excess return was 1.01%, the best quarterly figure since fourth-quarter 2020. Positive technicals powered by steadily strong investor inflows into investment grade corporates and attractive all-in yields helped spreads ratchet tighter and enabled the market to readily absorb new issues. Strongly performing investment grade credit subsectors that drove positive excess returns across most strategies included Banking, Insurance, Automotive, Pharmaceuticals and Electric Utilities. Weakness or slightly negative excess returns were observed in the Insurance subsector in our 1-3 year strategy portfolios as well as the Communications subsector.

Treasuries / Agencies

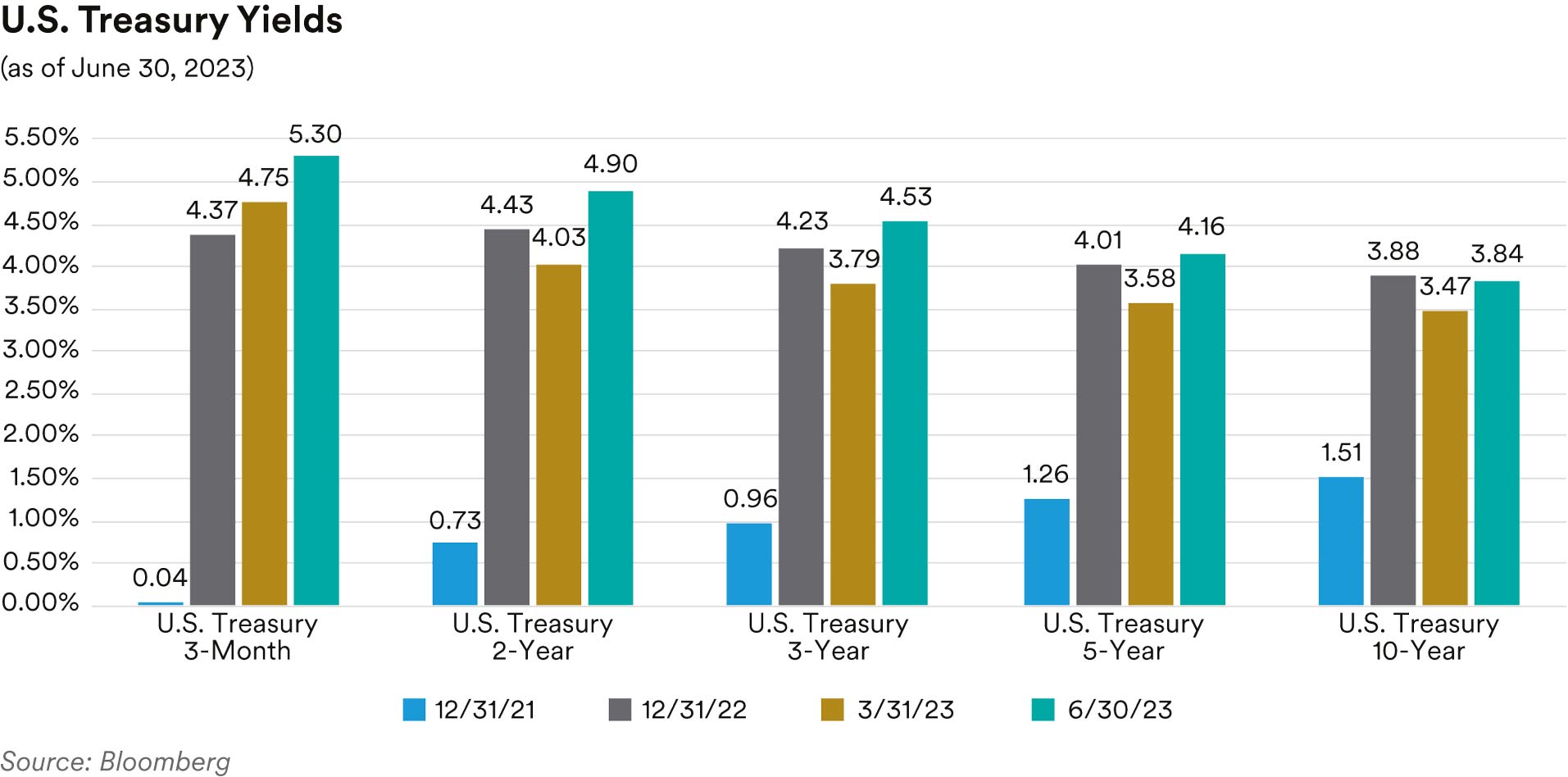

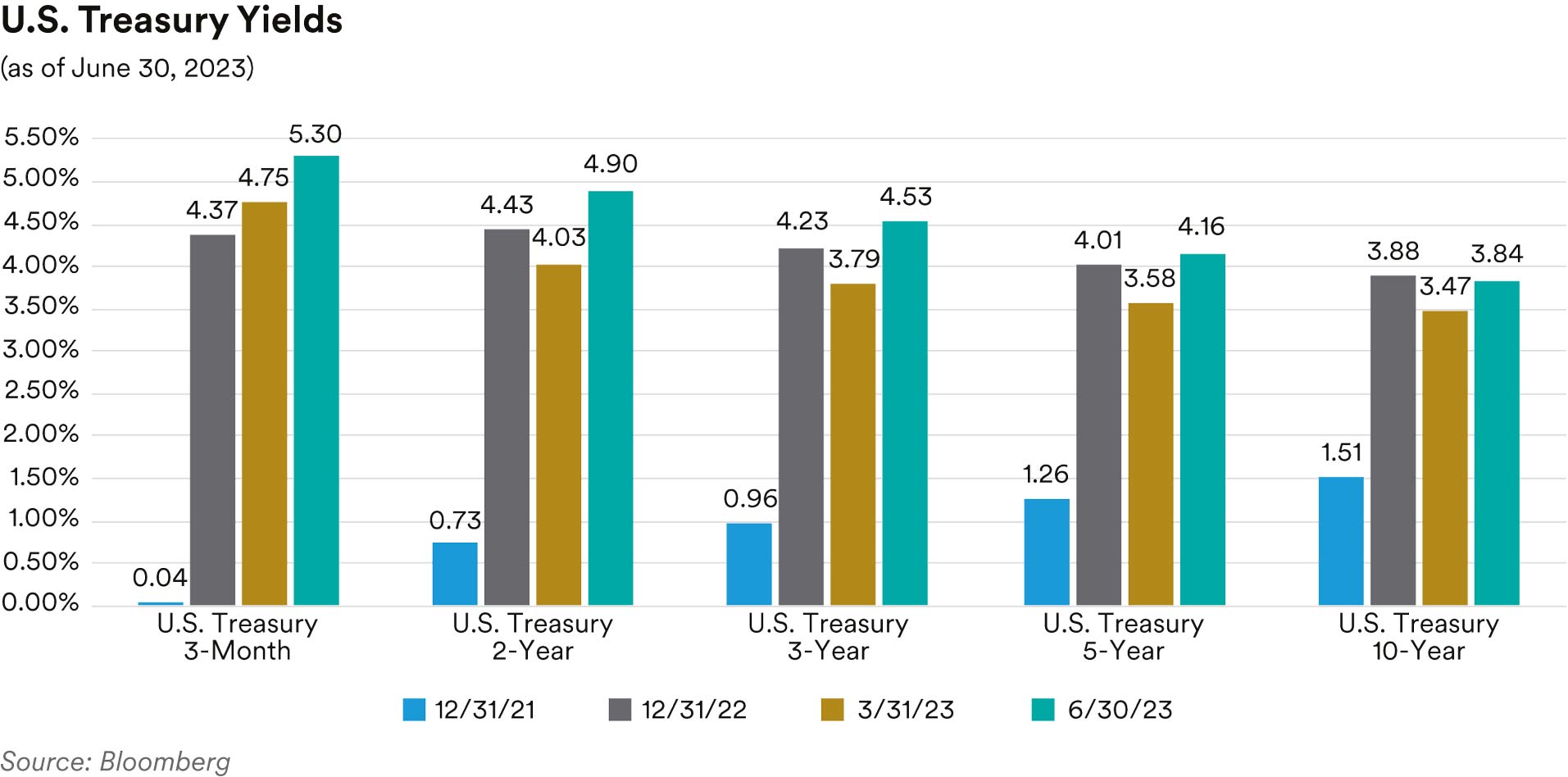

Recap: The Treasury market started the quarter coming out of the regional banking crisis with a cautious tone as the market traded in a range with the five-year trading between 3.25% to 3.75% and ten-year between 3.25% to 3.65%. The curve steepened early in the quarter as investors became skeptical the Fed would be able to follow through with additional policy tightening. However, as financial volatility faded, a series of strong data prints justified a 25-basis point hike in May and a hawkish pause at the June meeting. The yield curve flattened and the two-year Treasury underperformed the latter half of the quarter as the market priced in more rate hikes for 2023 and fewer rate cuts in 2024.

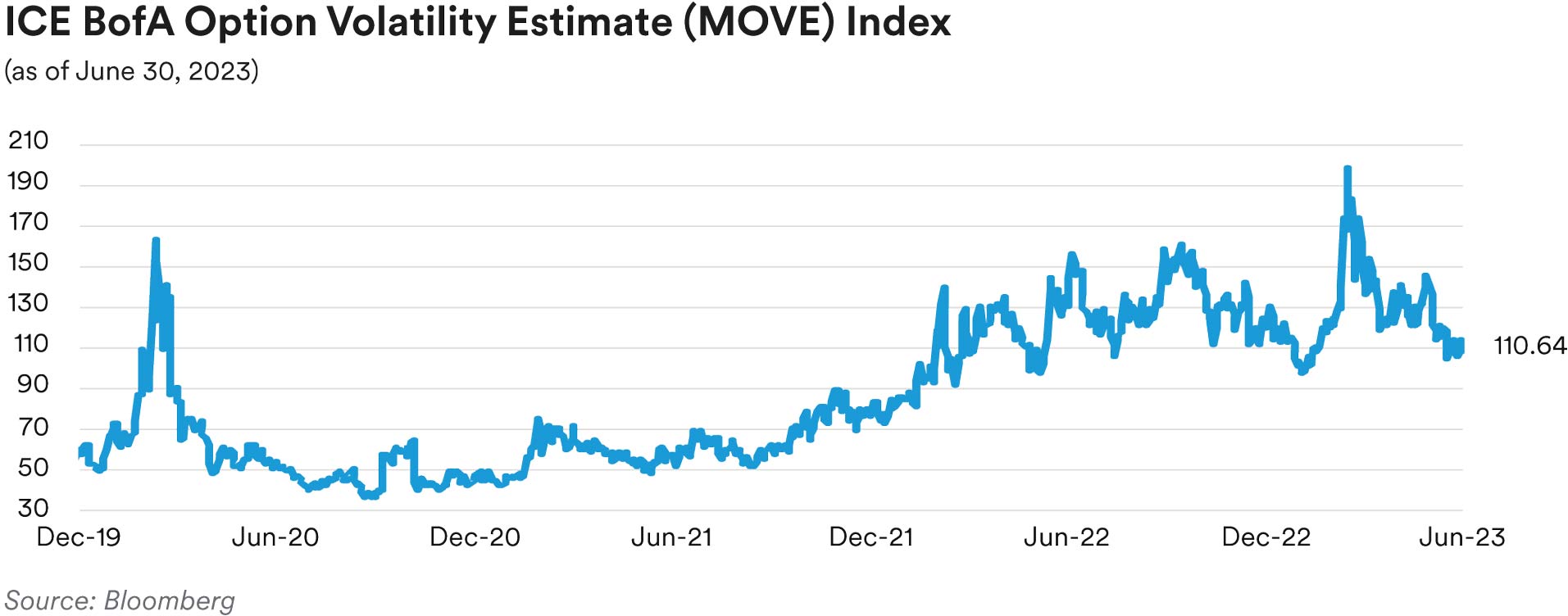

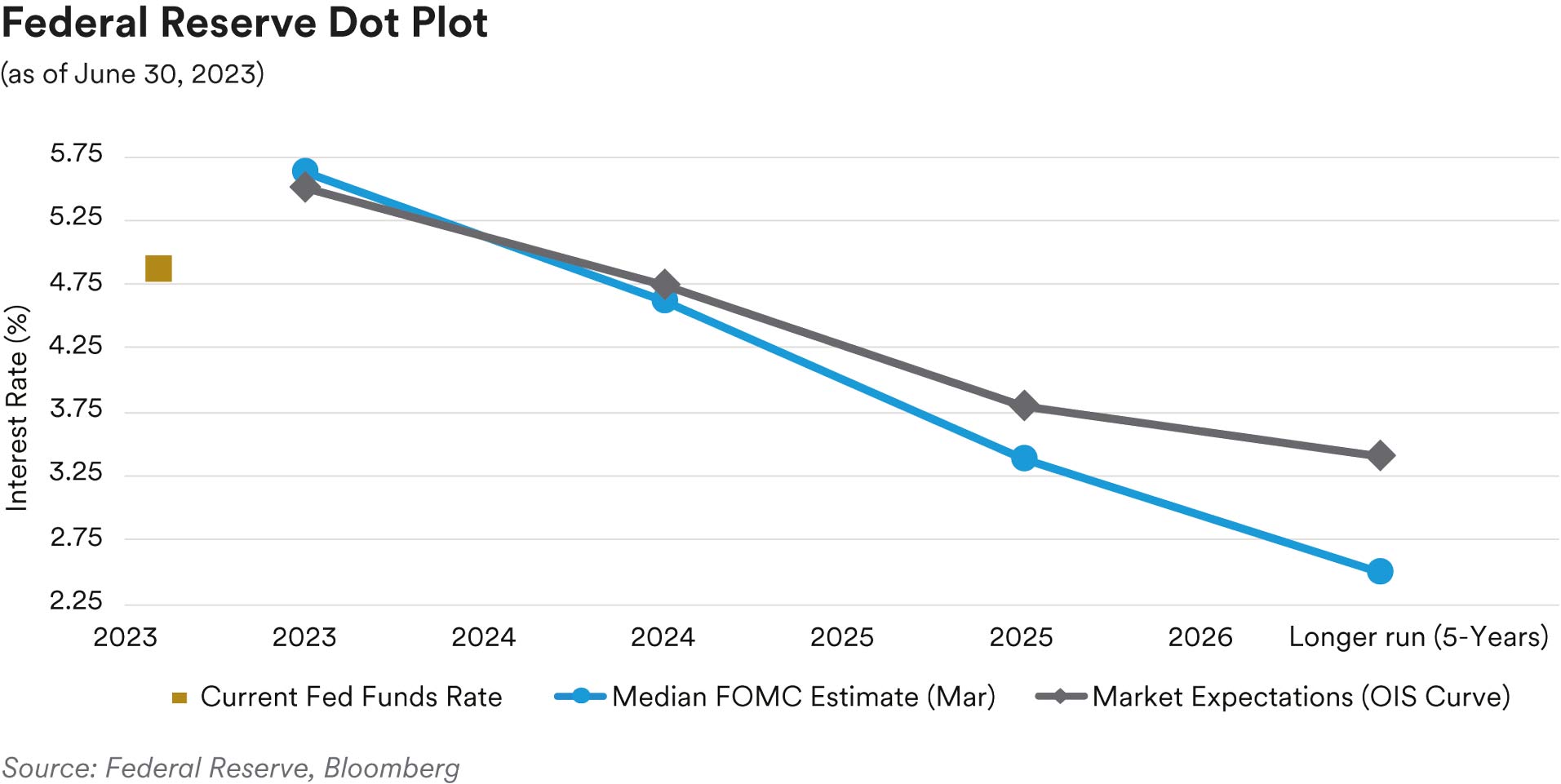

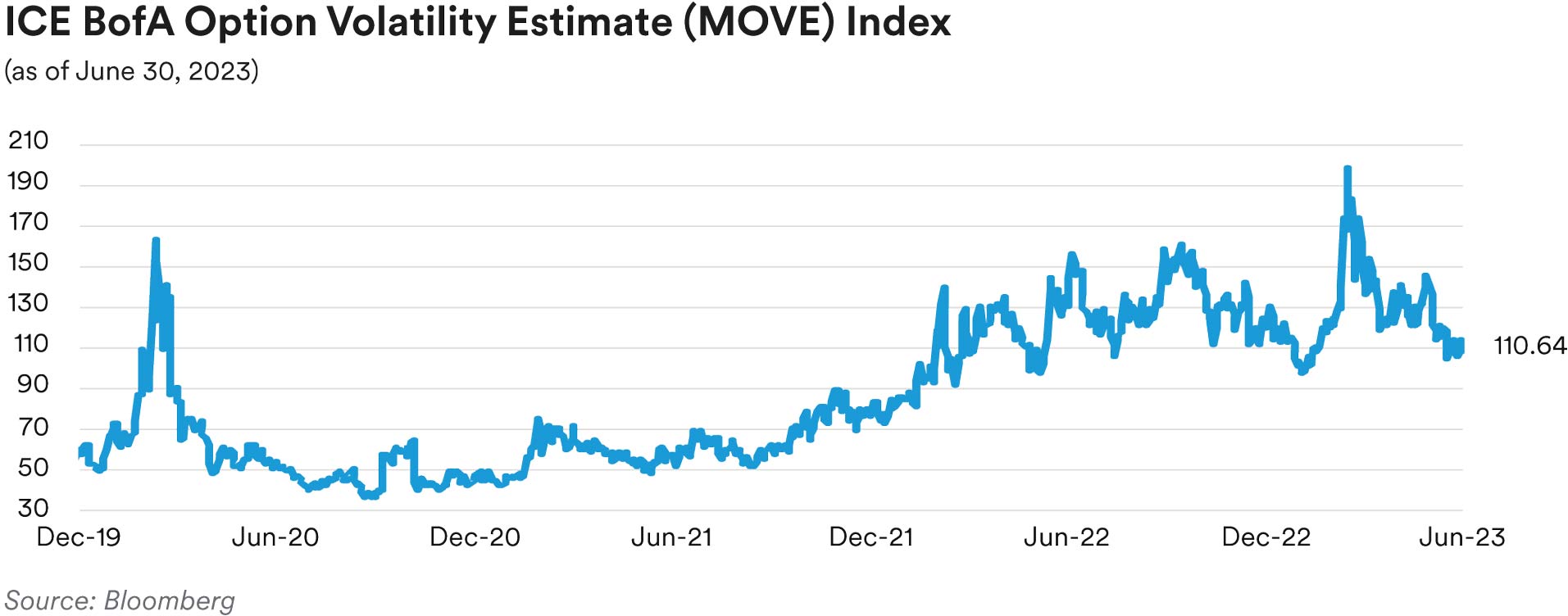

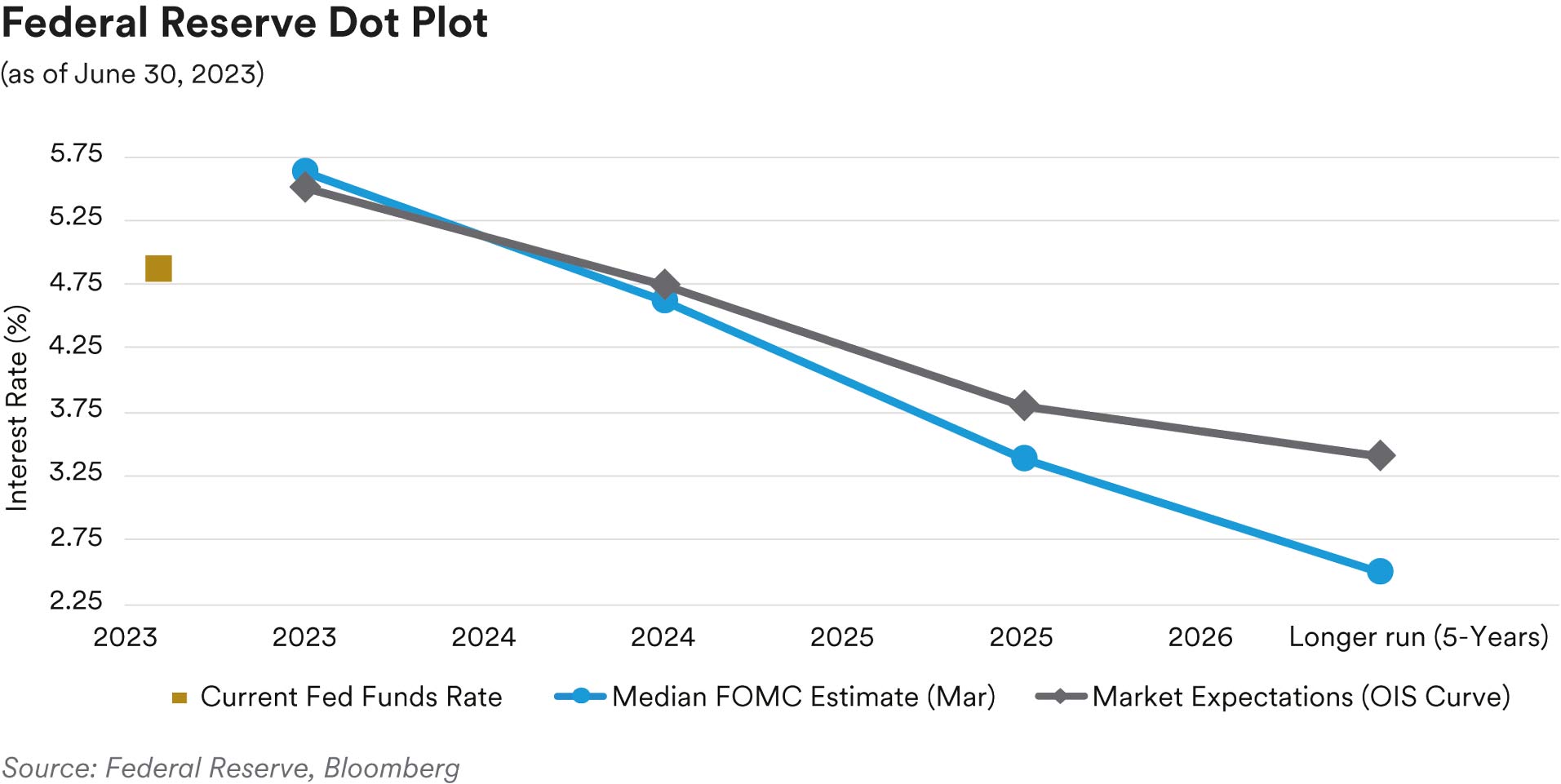

The Fed delivered a 25-basis point hike in May and at the press conference Chair Powell showed concern over the credit tightening implications and lagged impact of rate hikes. Partly, for those reasons, the Fed opted to pause at the June meeting for the first time after ten consecutive hikes, but the most important takeaway was a median 2023 dot that was revised higher by 50 basis points versus the market expectation for 25 basis points in forecasted additional tightening. This pushed the odds of a July hike dramatically higher, with the next real uncertainty being the September rate decision. The market’s expectation of the fed-funds rate at the end of 2023 went from 4.33% at the start of the quarter to 5.39% by quarter end, however, as the market grew more comfortable with the Fed potentially being close to the conclusion of its hiking cycle and on hold for longer thereafter, volatility in the front end of the Treasury curve declined. Daily basis point moves priced into the front end of the Treasury market moved from close to 10 basis points per day during the middle of the quarter to 8 basis points per day by the end of the quarter.

The very front end of the Treasury curve sold off in the second quarter as three-month and sixmonth Treasury bill yields were 59 basis points and 55 basis points higher during the quarter, finishing at 5.28% and 5.41% respectively, whereas the one-year Treasury bill moved 80 basis points higher during the quarter to 5.39%. The two-year Treasury, which traded in a 129-basis point range during the quarter, moved 87 basis points higher ending the quarter at 4.90% while the five-year Treasury sold off by 59 basis points and ended the quarter at 4.16%. The ten-year Treasury moved 37 basis points higher to end the quarter at 3.84%. The yield curve steepened early in the quarter before resuming its flattening trend the latter half of the quarter. The spread between the ten-year Treasury and the two-year Treasury moved from -56 basis points at the start of the quarter to -106 basis points at the end of the quarter. Conversely, the spread between the five-year Treasury and three-month Treasury began the quarter at -112 basis points before concluding the quarter at where it began at -112 basis points.

The funding markets remained orderly in the second quarter. The biggest hiccup, however, came from the debt ceiling debate that elevated default concerns and a kink in the Treasury bill curve that appeared in early June around dates with the highest probability of a delayed payment. Once the debt limit was suspended, the sharp increase in bill issuance was met with solid demand, and we saw the Fed’s reverse repo facility (RRP) balances begin to decline as capital was redeployed from the Fed’s overnight program to capture bill yields that were trading at more attractive levels.

Treasury Inflation-Protected Securities (TIPS) breakeven inflation rates stayed rangebound over the quarter, as the Fed’s hawkish commitment contained inflation expectations well within the prevailing range. In our view, the move higher in rates was entirely a function of higher real yields as growth optimism and a higher policy outlook pushed real yields through cycle highs in the fiveyear sector. The five-year real yield moved from 117 basis points at the start of the quarter to 199 basis points at the end of the quarter. The ten-year real yield went from 115 basis points to 162 basis points during the same period. Five-year TIPS breakeven rates went from 248 basis points at the start of the quarter to 220 basis points at the end of the quarter while ten-year TIPS went from 232 bps to 224 bps in the same period.

Front-end Government-Sponsored Enterprise (GSE) agency spreads narrowed along with credit spreads over the second quarter as the OAS of the ICE BofA 1-5 Year U.S. Bullet (fixed maturity) Agency Index ended the quarter at just 7 basis points, 3 basis points tighter from the start of the quarter. In the SSA subsector, U.S. dollar-denominated fixed-maturity security spreads tightened by 4 basis points and finished the second quarter on average at 26 basis points over comparablematurity Treasuries. Agency callable spreads relative to Treasuries tightened from their peak levels seen at the beginning of the year as short-dated and short-expiry volatility in the upper left portion of the volatility surface fell over the quarter. Two- and three-year maturity “Bermudan” callables, which feature quarterly calls with lockout periods of three months, were offered at spreads over Treasuries of 100 and 145 basis points, respectively.

Portfolio Actions: In the second quarter, we reduced our allocation to Treasuries in favor of high-quality spread sector alternatives. We sold shorter-term Treasuries to extend our portfolio durations in various spread sectors further out the curve. We also increased our allocation to Agency callables with current coupons and longer lockouts of six months across our shorter dated strategies at what we considered to be attractive yields. A trade we continue to favor is adding two- and three-year final maturity discounted callables. These bonds were issued between 2020 and 2021, have rolled down the curve and generally possess coupons of 1% or lower. Their optionadjusted durations trade to final maturity, meaning there is a low probability of them being called. We added to these positions when we found attractive opportunities, buying bonds at spreads of 30-40 basis points over Treasuries to target specific durations across the yield curve. We also maintained a bulleted posture with our adds to duration across various points on the yield curve.

Outlook: As we start the third quarter, we continue to get closer to the end of the hiking cycle that started in March 2022. From our duration standpoint, yields in the front end of the curve continue to look attractive. Two-year Treasury yields above 5% and five-year Treasury yields above 4.50% represented attractive entry points to extend duration. While some economic growth data are showing signs of softening, the labor market continues to be firm, and core inflation has continued to be “sticky”. These factors give the Fed additional runway for future hikes with Fed officials indicating there is more work needed to be done to ultimately reach their 2% inflation target. The FOMC, which meets July 25-26, is widely expected to raise the funds rate again at this meeting.

The more important question is whether Powell will cast the likely quarter-point hike in a hawkish or dovish light. The conversation will then quickly turn to whether September’s meeting is in play for a follow-on 25-basis point hike. Although we may have seen the highs in volatility, levels are still well above their one-year average in the front end of the curve and callable agencies can still provide good yield enhancement versus Treasuries by effectively selling short-dated volatility. GSE and SSA spreads should continue to perform well in the near term, as investors seek out additional yield and markets price in a soft landing. However, GSE and SSA spreads could widen in the latter part of the year, though we anticipate they should still outperform credit spreads in a downturn. The yield curve is likely to remain inverted over the near term as the Fed forecasts more hikes to come, but yields could continue to reprice as markets digest incoming data and adjust expectations on the timing of when a permanent Fed pause will occur.

Performance: We believe our neutral duration posture and yield curve positioning added to excess returns across most of our strategies with the exception of our shorter Cash Plus and Enhanced Cash strategies. In our shorter strategies, we were slightly long duration versus their respective benchmarks and were mainly overweight in the two-year part of the curve as we looked to lock in higher yields for longer. The Agency sector saw slightly negative excess returns in our shorter strategies, which hold a higher allocation to Agency securities. The move higher in front-end Treasury yields over the quarter was the driver of the underperformance of those securities.

ABS

Recap: ABS spreads ended the second quarter mixed as the market recovered from the firstquarter failures of Silicon Valley Bank and Signature Bank. Three-year, fixed-rate AAA-rated credit card and subprime auto tranches ended the quarter at spreads of 56 basis points and 96 basis points over Treasuries, 21 basis points and 14 basis points tighter, respectively. Three-year, floating-rate AAA-rate private student loan tranches ended the quarter at a spread of 138 basis points over SOFR, 22 basis points tighter. However, in contrast, three-year, fixed-rate AAA-rated prime auto tranches moved 5 basis points wider, to end the quarter at a spread of 90 basis points over Treasuries. We attribute the relative underperformance of prime auto tranches to the robust volume of new issue supply seen in that sector over the course of the quarter and concerns that regional banks might be less active in the sector going forward. Despite the volatility coming from the regional bank sector, ABS new issuance remained strong although below the levels seen at this time last year. For the first half of 2023, over $129 billion of new deals came to market compared to over $140 billion in the first half last year. The second quarter saw almost $70 billion of new deals price compared to over $73 billion in Q2 2022. As usual, the auto sector was the main contributor to supply over the quarter with almost $36 billion of new deals pricing, ahead of the $35 billion of auto deals priced in the second quarter last year. As we noted in our last quarterly commentary, auto issuance in the first quarter of the year also exceeded last year’s first-quarter volume. Following autos were the “other ABS” subsector (a “catch-all” category that includes deals collateralized by cell phone payment plans, timeshares, mortgage servicer advances, insurance premiums, aircraft leases, etc.) with over $10 billion of new issuance and the equipment subsector adding over $5 billion of new issuance. In comparison, in the second quarter last year, “other ABS” and equipment priced $17 billion and $4 billion of new deals, respectively. In notable new issue deals, a regional bank came to market with a $1.5 billion prime auto deal collateralized by loans from their retained portfolio. The bank has decided to close its long-standing prime auto loan origination business and plans to use securitization as a means to divest its portfolio. We participated in the deal and anticipate further deals from a regional bank over the next few quarters.

The second quarter saw significant developments on the student loan front. In June, President Biden signed a bill approved by the House and Senate to raise the debt ceiling. The bill included provisions ending the student loan payment moratorium implemented as an emergency shortterm relief measure in March 2020 by President Trump in response to the Covid-19 pandemic and extended multiple times by both presidents. With the moratorium ending, federal student loan interest will begin accruing again 60 days after June 30 or on August 29. Accordingly, the first billing dates for borrowers are likely to be in late September or October. Also, at the end of the quarter, the Supreme Court ruled against President Biden’s student loan forgiveness plan. As part of the HEROES Act, the president proposed forgiving up to $10,000 of student loan debt for borrowers with incomes up to $125,000 and up to $20,000 of student loan debt for Pell Grant recipients. The CBO estimated that this totaled about $400 billion in relief or about 25% of outstanding student loan debt. The Supreme Court ruled that the administration lacked the authority under the HEROES Act to implement such a broad-based plan. Following the Supreme Court’s decision, the president announced a new income-based repayment plan for student loan borrowers (the “SAVE” plan) and a temporary “on-ramp” (up to 12 months during which principal and interest payments would be due, but interest would not be capitalized) to assist borrowers in resuming student loan payments. In our view, the combined impact of these developments creates headwinds for consumer credit performance going forward although the “on-ramp” should mute any significant immediate impact. On balance, federal student loan delinquencies are almost certain to rise materially and performance metrics for other forms of consumer debt are likely to worsen going forward.

The close of the quarter also saw the official end of LIBOR, historically the benchmark reference rate for most floating-rate ABS. Term SOFR will replace LIBOR as the refence rate for most ABS floaters (except for FFELP floaters and their underlying assets which under Fed rules will use average SOFR). After many years of preparation, the formal end of LIBOR had no material impact on the market.

As we saw in the first quarter, credit card performance further deteriorated over the second quarter. Data from JP Morgan credit card performance indices reflecting the June remittance reporting period showed charge-offs and 60+-day delinquencies on bank credit card master trusts rising 35 basis points and 2 basis points respectively, to 1.78% and 0.82%, over the quarter. Despite the upward trend, charge-offs and delinquencies for bank credit card master trusts are still well below historic averages. In a positive sign, payment rates increased over the quarter, rising 233 basis points to 40.02%. We expect continued deterioration in credit card trust metrics going forward as consumers grapple with a slowing economy. In addition, as noted above, the resumption of federal student loan payments also creates a headwind for credit card trust performance going forward.

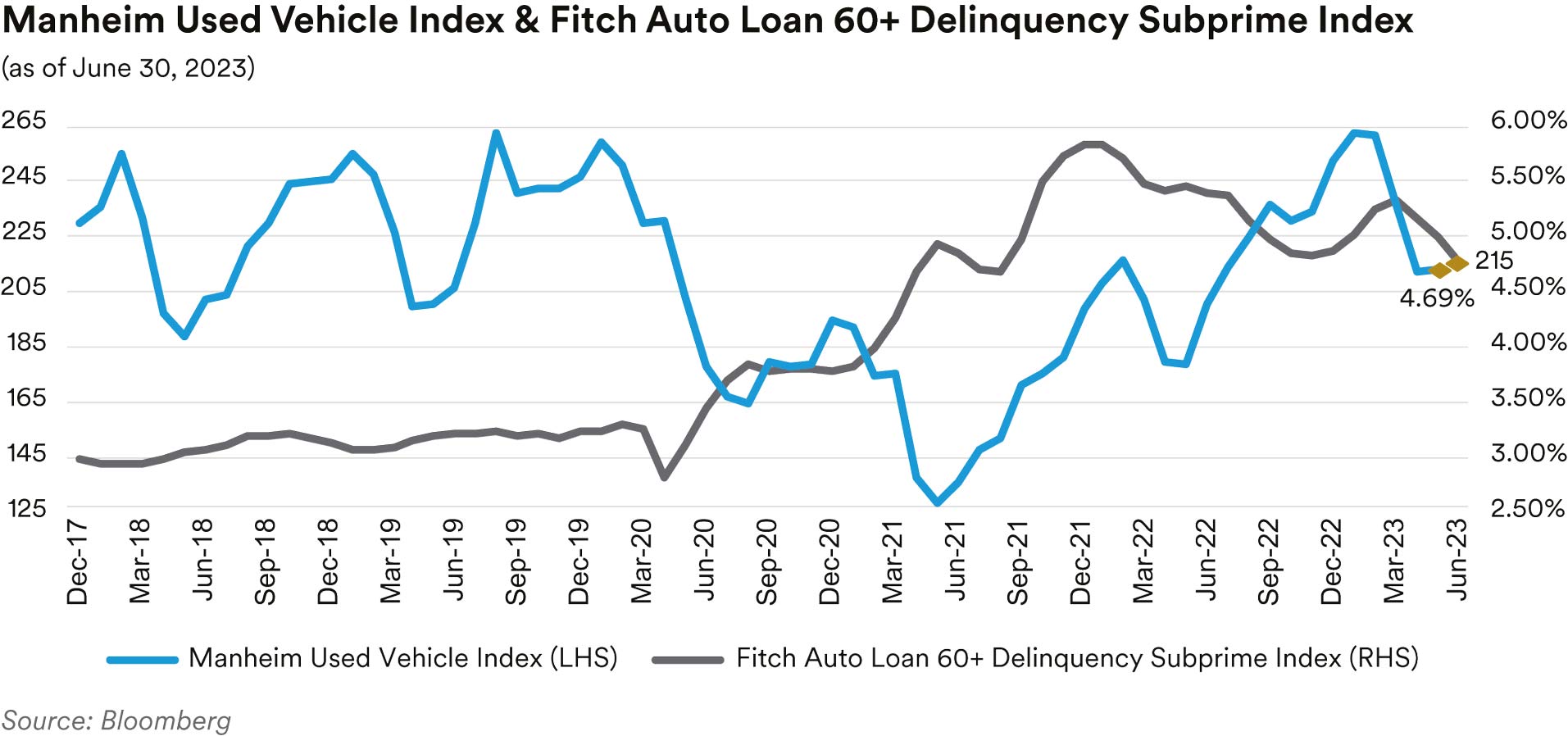

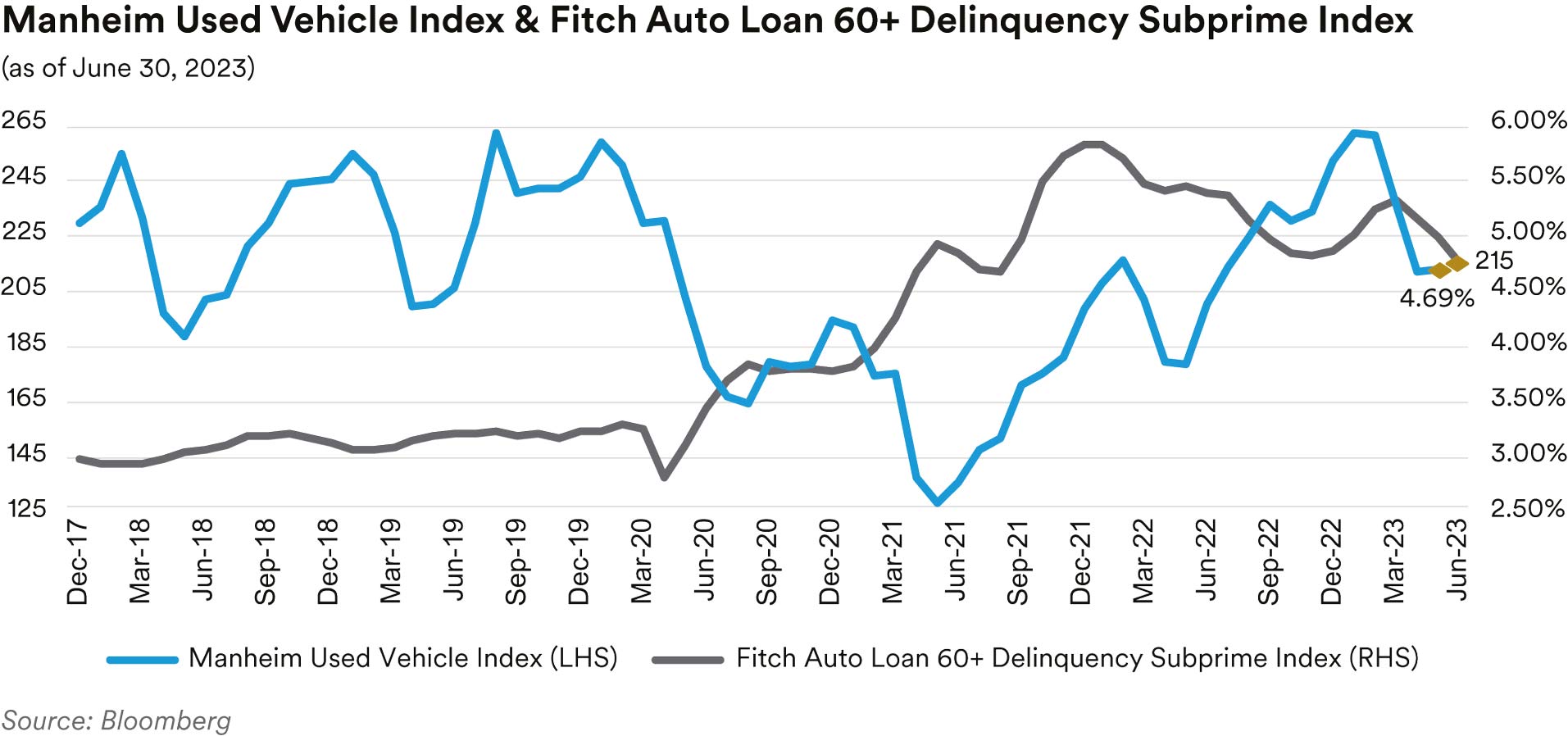

New vehicle sales numbers were firm over the quarter as improving supply chain dynamics and increasing new production bolstered inventories and the strong labor market and healthy fleet sales supported demand. June’s sales numbers came in at a 15.7 million SAAR (seasonally-adjusted annualized rate) which followed 15.9 million, and 15.0 million prints in April and May, respectively. June’s number reflects an almost 21% increase in the sales rate compared to last year. Commenting on the numbers, Cox Automotive noted that most companies increased sales in the first half of the year, with strong increases seen for Honda, Mazda, Nissan and Tesla. Higher incentives and in the case of Tesla, aggressive price cuts, have helped drive demand. In our view, supply constraints are likely to continue to support the new car market in the near term but with interest rates moving higher and prices at relatively elevated levels, we do not anticipate a dramatic increase in the pace of new vehicle sales going forward. Used vehicle prices, as measured by the Manheim Used Vehicle Index, fell over the quarter, erasing the gains seen in the first quarter of the year. The index came in at 215.1 in June, a monthly drop of 4.2%, a record decline for the month and the largest since the start of the pandemic in April 2020 when the index plunged 11.4%. The index is now down 10.3% year-over-year. Manheim noted that all major market segments saw seasonally adjusted year-over-year price declines in June, with pickups and vans losing the least, down 6.6% and 8.5%, respectively, and sports cars faring the worst, down 14.8%. Manheim estimated used car supply ended June at 45 days, down from 49 days at the end of May and below the 52 days of supply seen in June last year.

Buffeted by the retracement in used vehicle prices, ABS auto credit metrics weakened over the second quarter despite the positive seasonal impact of tax refunds. At the end of the quarter, the 60+-day delinquency rates on the Fitch Auto ABS indices were 0.25% for the prime index and 5.01% for the subprime index, 5 basis points and 64 basis points higher than year-ago levels, respectively. Similarly, annualized net loss rates for the indices stand at 0.20% for the prime index and 5.91% for the subprime index, reflecting year-over-year increases of 11 basis points and 185 basis points, respectively. We expect further deterioration going forward as it is unlikely that the recent decline in used car prices has been fully reflected in ABS trust performance. We anticipate that subprime auto loans will bear a disproportionately negative impact from the resumption of student loan payments compared to prime auto loans.

The most recent Federal Reserve Senior Loan Officer Opinion Survey, reflecting sentiment as of the first quarter, showed banks reporting tighter lending standards for all consumer loan categories, weaker demand for auto and other consumer loans, and unchanged demand for credit cards. The survey also contained a series of special questions relating to banks’ reasons for changing lending standards over the first quarter and their expectations for changes in lending standards going forward. Most banks cited a less favorable or more uncertain economic outlook, reduced tolerance for risk, deterioration in customer collateral values, and concerns about funding and liquidity as the rationale for tightening lending standards in the first quarter and expect to further tighten lending standards for all consumer loan categories in the future.

Portfolio Actions: Over the course of the second quarter we materially increased our ABS exposure across all of our strategies except our shortest Cash Plus strategy where we modestly decreased exposure. ABS exposure is typically highest in the Cash Plus portfolios and after the decrease it still remained among the highest across all of our strategies. In addition, behind the high-level exposure increase, the subsector mix of our ABS holdings shifted considerably over the quarter with an emphasis on increasing our prime auto and credit card holdings while decreasing subprime exposure. As noted above, we believe subprime autos will bear a greater impact from the resumption of student loan payments so we have become even more defensive regarding the subsector. Continuing our strategy from the first quarter, we purchased several front-pay ABS CP tranches (which stand at the top of the payment waterfall and carry short-term commercial paper ratings equivalent to AAA) from various auto and equipment deals. Most of these purchases were executed in the new issue market. For example, we purchased the 0.2-year A-1+/P-1 tranche of the inaugural prime auto deal from a credit union at a spread of 35 basis points over Treasuries. We also participated in a new issue credit card deal from a small bank card issuer who returned to the market after a long absence. We purchased the 3-year AAA-rated tranche at a spread of 130 basis points over Treasuries. As mentioned above, we also participated in the inaugural prime-auto deal from a regional bank. In that new issue we purchased the 0.2-year, 0.9-year and 2.2-year AAArated tranches at spreads of 35, 95 and 125 basis points over Treasuries, respectively.

Outlook: We continue to expect economic conditions to worsen for consumers going forward and ABS trust credit performance to deteriorate. Accordingly, we expect to maintain our current strategy of increasing the liquidity profile of the portfolios biasing our purchases towards more defensive tranches and subsectors. We still find value in short-tenor auto and equipment tranches. As noted above, we have a preference for prime auto over subprime. However, we remain comfortable with a select group of subprime issuers who have a demonstrated history of successfully operating through credit cycles and who have business models and underwriting practices with whom we are very familiar. As we expect the environment for leveraged loans to become more difficult going forward, we continue to avoid increasing our CLO exposure.

Performance: Our ABS holdings generated positive performance across all our portfolios in the second quarter after adjusting for their duration and yield curve positioning. Our fixed-rate auto holdings were generally the top performers in our 1-3 Year and shorter strategies while our fixedrate private student loan holdings were the best performers in our longer strategies. Private student loans have performed well this year as they recovered from their significant underperformance last year. Our shorter strategies have lower exposure to private student loans than our longer strategies and a much greater exposure to shorter tenor auto tranches which explains the differential in performance where held, while our CLO holdings were slightly positive contributors across all strategies.

CMBS

Recap: Short-tenor CMBS spreads moved tighter relative to like-duration Treasuries over the second quarter as macro risks around failing regional banks and raising the debt ceiling abated. At the end of the quarter, spreads on three-year AAA-rated conduit tranches stood at 145 basis points over Treasuries (7 basis points tighter) and spreads on five-year AAA-rated conduit tranches stood at 155 basis points over Treasuries (3 basis points tighter). Spreads on three-year Freddie Mac “K-bond” agency CMBS tranches ended the quarter at 24 basis points over Treasuries (25 basis points tighter). We attribute the outperformance of K-bond tranches to investor preference for liquid tranches with stable cashflow profiles. The new issue market continued to struggle in the face of rising interest rates, negative headlines about office properties, concerns about regional bank commercial real estate loan exposures, and tighter lending standards. Year to date, new issuance is down over 51% with just over $44 billion of new deals coming to market this quarter, well below the $70 billion seen in the second quarter last year. The majority of the decline can be traced to the non-agency sector, which saw only $12 billion of new issuance this quarter, compared to almost $32 billion in the second quarter last year. On a year-to-date basis, non-agency issuance is down over 75%. In comparison, agency issuance, while lower, is down approximately 30% yearover-year. The second quarter saw $32 billion of new agency CMBS deals price, compared to $39 billion in the second quarter of 2022.

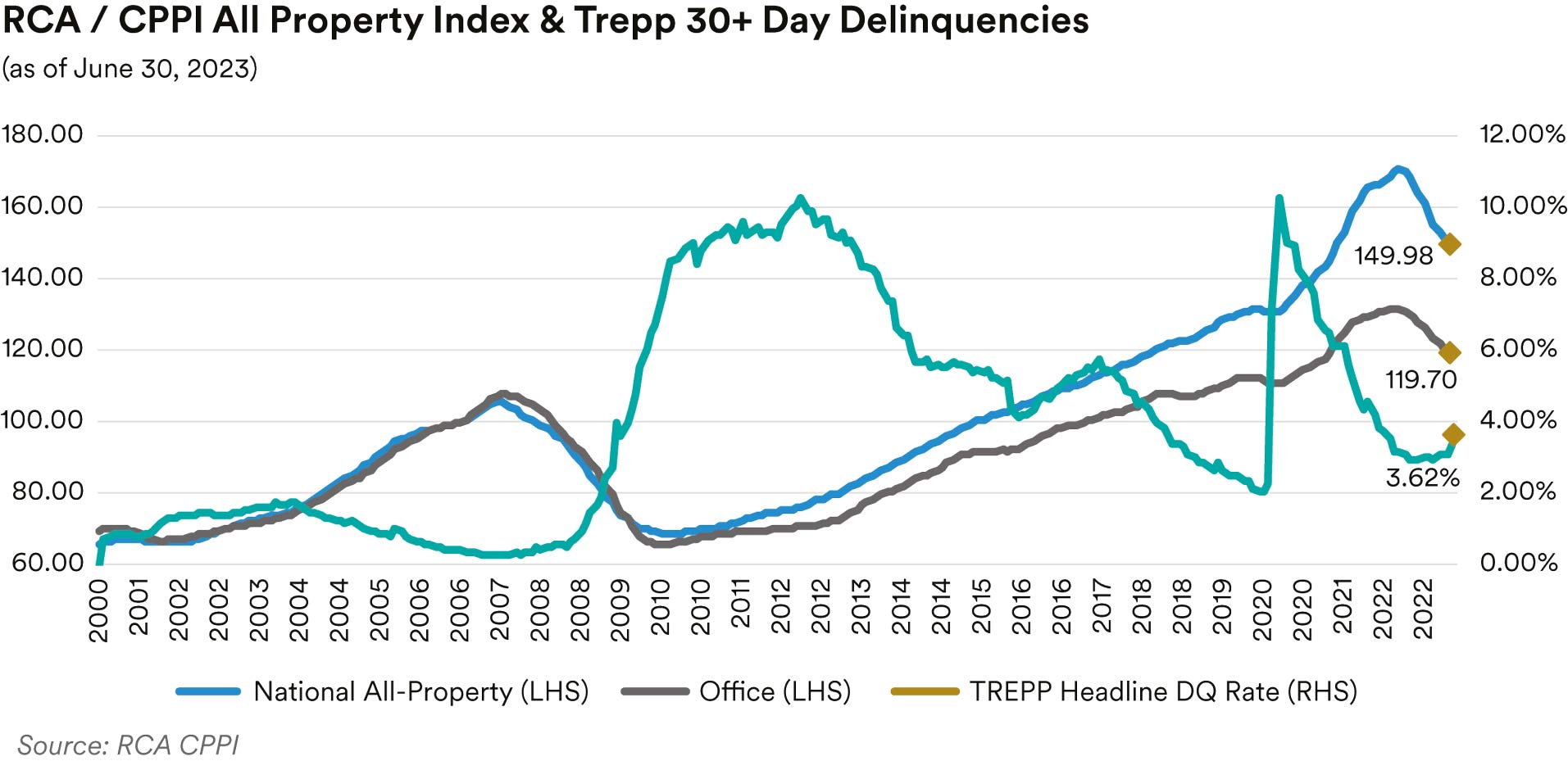

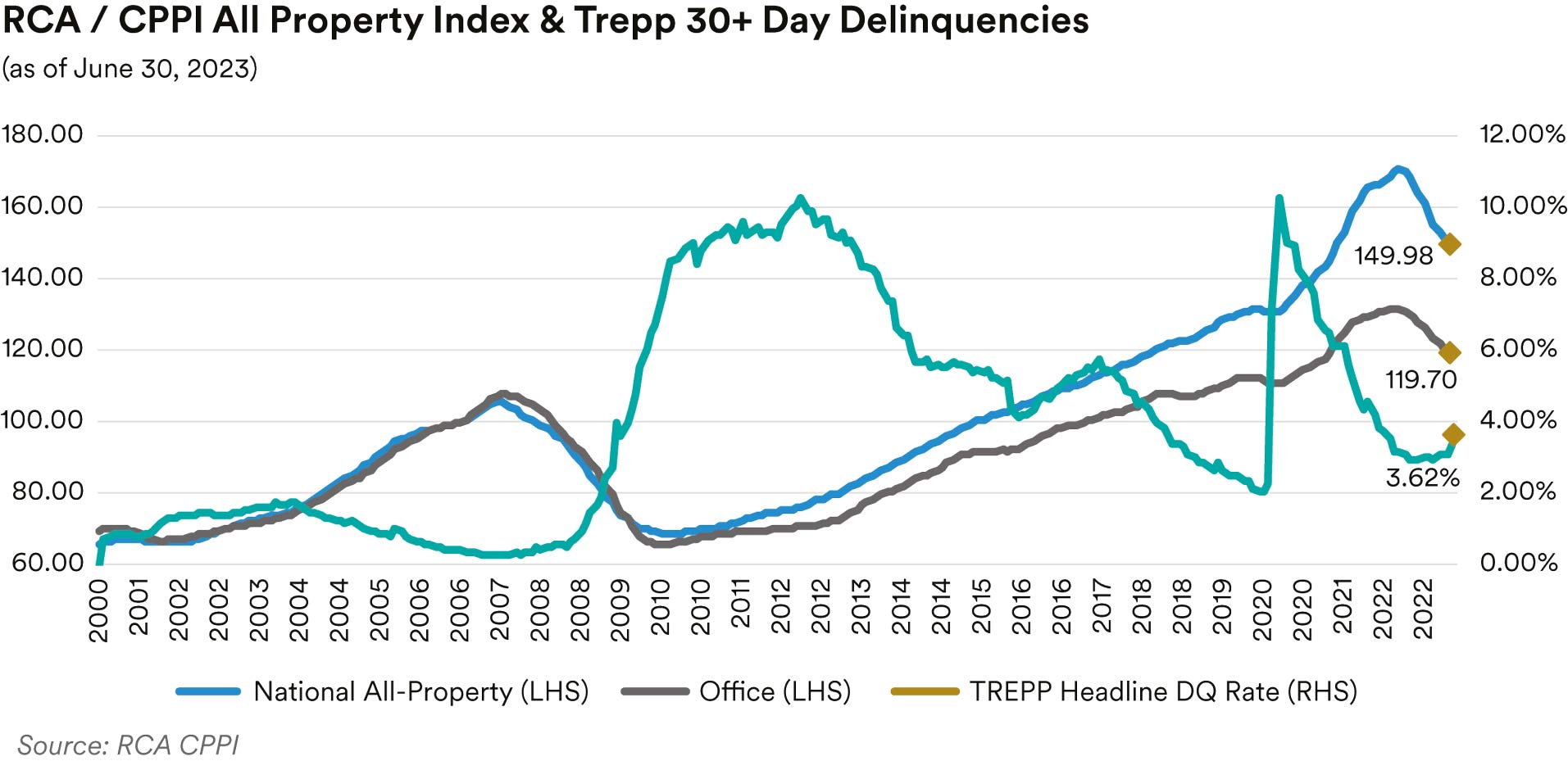

CMBS delinquencies increased significantly during the quarter. As measured by the Trepp 30+-day delinquency rate, CMBS delinquencies ended the quarter at 3.90%, reflecting an increase of 28 basis points in June. In total, delinquencies increased 79 basis points for the quarter and year over year, the overall delinquency rate has risen 70 basis points. Trepp noted that June’s increase was driven by a large jump in hotel delinquencies as a large single-asset, single-borrower (SASB) hotel loan missed its balloon payment. Retail and lodging properties continue to be the worst performing subsectors with delinquencies of 6.48% and 5.35%, respectively. Those levels reflect quarterly increases in delinquencies of 25 basis points and 94 basis points, respectively. The troubled office subsector saw delinquencies rise 189 basis points over the quarter to 4.50%. Industrial and multifamily properties remain the best performing subsectors with delinquencies of 0.42% (5 basis points higher on the quarter) and 1.59% (32 basis points lower on the quarter), respectively. In their report, Trepp noted that they do not include delinquent loans that are past their maturity date but current on interest payments in their calculations. Traditionally these loans were with borrowers who were in the process of finalizing extension options. Now, however, more CMBS borrowers are failing to exercise extension options and are instead opting to default. Trepp estimated that if they included loans past their maturity date but current on interest, the headline delinquency rate would be 4.66% (76 basis points higher).

Commercial property prices continued to fall throughout the quarter. As measured by the RCA CPPI National All-Property Composite Index, prices have declined every month since August of last year and, as of May, are now down 11.2% on a year-over-year basis. RCA noted that this annual decline is the largest since May 2010 as significant challenges with the cost of financing and the availability of credit have weighed on property pricing and deal activity. Notably, this quarter saw the first annual decline in industrial property prices. Industrial property prices fell 0.8% year-overyear in April, the first time since September 2010 that annual prices were down for all commercial real estate subsectors. Industrial prices dropped another 0.5% in May and are now down 2.3% year-over-year. Retail property prices have now fallen for ten straight months, dropping 0.6% in May for a 7.4% year-over-year decline while apartment properties dropped 0.9% and are showing the largest year-over-year decline with a drop of 12.5%. RCA noted that despite the large drop in apartment prices, they are still 19% above the level seen at the start of the pandemic in April 2020. Office properties fell another 0.9% in May and are now down 8.9% year over year. Suburban offices have been underperforming central business district (CBD) office properties recently with suburban offices dropping 0.7% in May for a 8.1% year-over-year decline, compared to a 0.4% May drop and a 6.9% year-over-year decline for CBD offices. Prices in the Six Major Metros (Boston, Chicago, Los Angeles, New York, San Francisco and Washington, D.C.) dropped 0.9% in May, and are now down 10.7% year-over-year, while the non-major metros saw prices drop 1.3% in May, resulting in a 10.3% year-over-year decline.

The CRE Finance Council (CREFC) industry conference held New York City in June was dominated by concerns about the health of the office sector. The general consensus view was that commercial real estate valuations are likely to further deteriorate for the entire sector leading to select opportunities to acquire some good properties at attractive prices. Likely rating agency downgrades and the withdrawal of regional banks from the CRE lending marketplace were also common topics of conversation. One surprising source of positive sentiment was the retail subsector as reduced lending competition and tighter post-Covid underwriting standards have resulted in better underwritten loans relative to other subsectors.

Portfolio Actions: Over the course of the quarter we increased our CMBS exposure across all of our strategies. The increase was targeted using the agency CMBS sector as we took the opportunity to add duration across the portfolios. All of these purchases were in the secondary market as we did not participate in any new issue deals during the quarter. We believe that agency tranches offer more liquidity and stable cashflows than conduit and SASB alternatives. The one exception, we believe, is found in non-agency conduit “ASB” tranches which we also added when we found them offered at attractive spreads in the market.

Outlook: We continue to believe that the headwinds facing the CMBS market are unlikely to abate in the near term. We expect to see further deterioration in CMBS collateral metrics and in office properties in particular. Accordingly, much like last quarter, we expect to continue our current defensive strategy. We are unlikely to materially increase our non-agency CMBS exposure and are likely to continue to avoid participating in most new issue conduit and SASB deals. We believe agency tranches are still attractive, although at current spreads they are less appealing than at the beginning of the quarter. Accordingly, while we are likely to add exposure to agency CMBS, it is unlikely to be at the same cadence as our recent activity.

Performance: Our CMBS holdings contributed positive performance across all our strategies after adjusting for their yield curve and duration exposure. Our non-agency holdings were generally the best performers led by strength in our floating-rate SASB holdings. Notable outperformance occurred in our Enhanced Cash portfolios, which have the largest exposure to the floating-rate SASB subsector. As our 1-3 Year and longer strategies no longer have any floating-rate SASB exposure, our fixed-rate agency CMBS tranches were the top performers in those portfolios. Within agency CMBS, much like in the first quarter of the year, our Freddie Mac “K-bond” positions outperformed our Fannie Mae DUS tranches, although both were positive net contributors.

RMBS

Recap: With interest rates moving higher over the course of the quarter, the negative convexity impact of mortgage extension into an inverted yield curve, pushed nominal mortgage spreads wider. In addition, negative technical pressure from the FDIC’s liquidation of the SVB/Signature Bank portfolios combined with continued headlines around the health of regional banks and the FHFA’s ongoing review of the Federal Home Loan Bank (FHLB) system, weighed negatively on market sentiment. On a spread basis, generic 30-year collateral ended the quarter at a spread of 179 basis points over ten-year Treasuries (21 basis points wider) and 15-year collateral ended the quarter at a spread of 110 basis points over five-year Treasuries (14 basis points wider). Despite wider nominal spreads, the carry advantage of mortgages relative to Treasuries enabled the Bloomberg mortgage index to post healthy positive excess returns of 0.45% in June and 0.41% in May after a lackluster -0.10% return in April. Non-agency spreads were flat for most of the quarter, before moving wider in June in the face of continued new issue supply. Prime jumbo front cashflow tranches ended the quarter at a spread of 200 basis points over Treasuries (15 basis points wider).

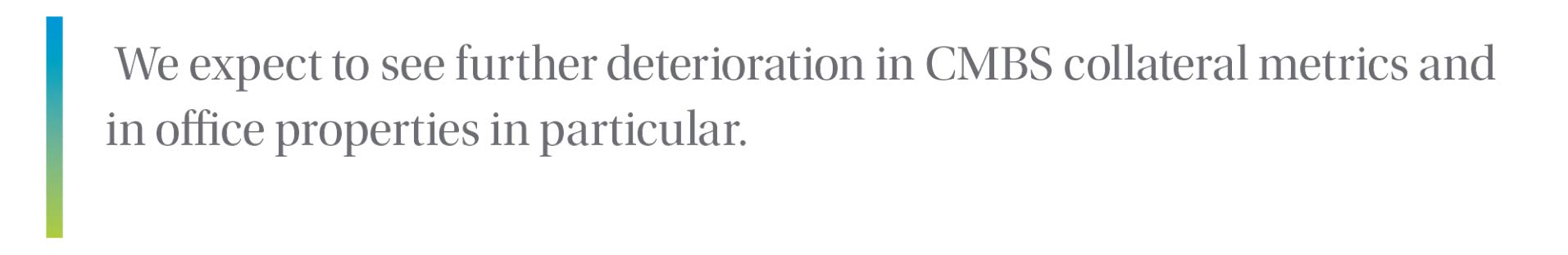

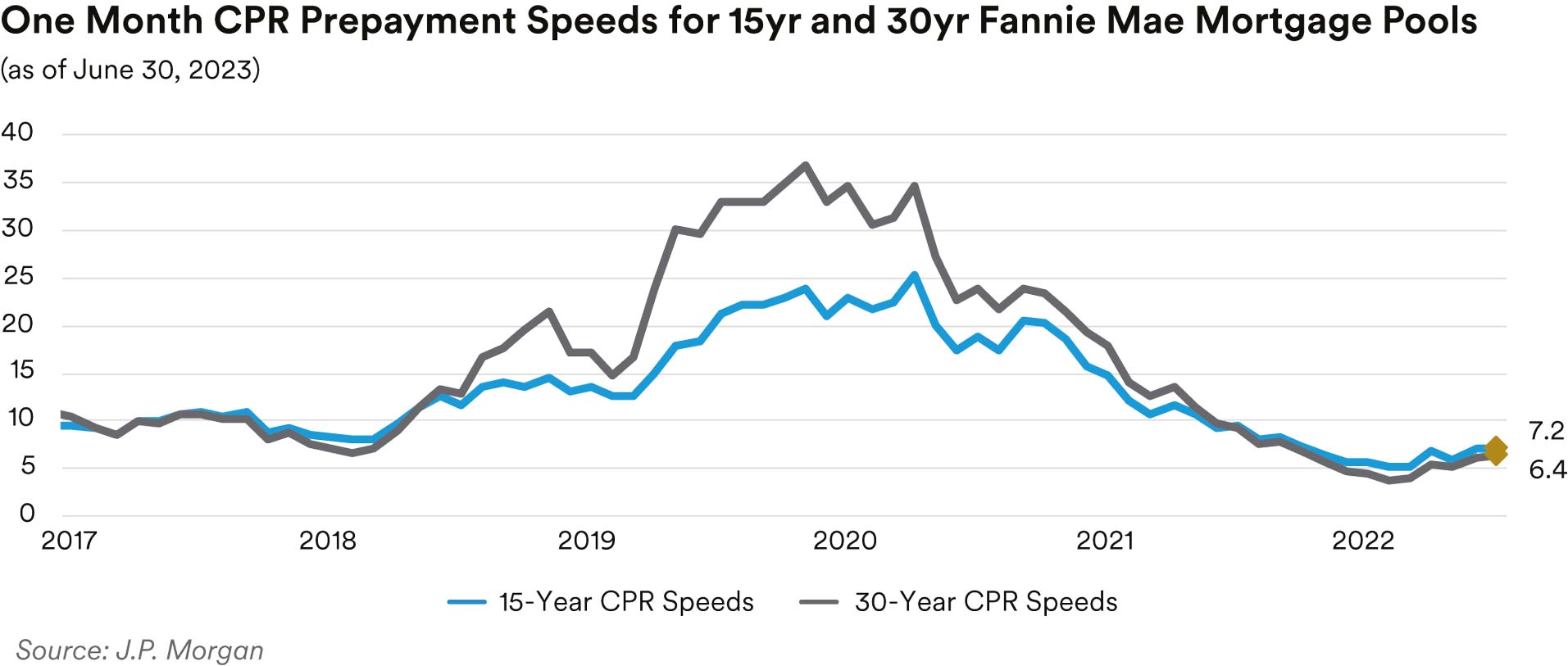

Mortgage rates moved higher over the quarter with the Freddie Mac 30-year fixed-rate mortgage commitment rate ending June at 6.70%, 46 basis points above the level seen at the end of the first quarter. Despite the increase in headline mortgage rates, prepayment speeds trended higher over the course of the quarter. July’s prepayment report showed 30-year Fannie Mae mortgage paying at 6.4 CPR in June, up from May’s 6.2 CPR print, which was 22% faster than the 5.1 CPR seen in April. Likewise, 15-year mortgages also saw faster prints, paying at 7.2 CPR in June, up 3% from May’s 7.0 CPR print, which was an increase of 19% relative to April’s 5.9 CPR number. With mortgage rates moving higher, we do not expect this recent trend towards rising prepayment speeds to persist going forward. Home prices moved higher over the quarter, with the Case-Shiller National Home Price Index rising for three straight months. June’s release showed home prices are up 2.9% this year through April and roughly flat year-over-year (-0.24%). Regional disparities continue to be strong with some areas seeing year-over-year gains while others are still showing marked declines. Miami, which posted a 5.2% year-over-year gain, has been the best performing city for nine consecutive months. Chicago is in second place (+4.1%), followed by Atlanta (+3.5%) and Charlotte (+3.4%). In contrast, Seattle (-12.4%) and San Francisco (-11.1%) are still posting double-digit annual declines, with Las Vegas (-6.6%) and Phoenix (-6.1%) rounding out the bottom four slots. Our near-term outlook for home prices remains the same: further gains are likely to remain muted given the affordability challenges facing the market.

Given the difficulties facing homebuyers, existing home sales numbers were unable to gain much momentum over the quarter and ranged from a 4.3 to 4.4 million seasonally-adjusted annualized rate. Sales are being impacted by rising mortgage rates and low inventory. June’s inventory numbers showed the number of homes on the market stood at 1.08 million at the end of May, the lowest level of May inventory since 1999, and an amount which would take only three months to sell at the current sales pace. Realtors consider anything below five months of supply as indicative of a tight housing market. With limited existing homes available for resale, new home sales were strong throughout the quarter. June’s number showed sales at a 763,000 annualized pace in May, the fastest in over a year, and the third straight monthly increase. Limited inventory and robust new home sales numbers have boosted home builder sentiment with the June release of the National Association of Home Builders sentiment index coming in at 55, an 11-month high. The index has now increased for six consecutive months despite concerns about high materials costs and a scarcity of skilled labor.

The April release of the Federal Reserve’s Senior Loan Officer Survey, reflecting sentiment during the first quarter of the year, showed banks tightened lending standards for most residential real estate loans other than GSE-eligible mortgages (for which standards remained largely unchanged).

Banks also reported weaker demand for residential real estate loans and HELOCs. As part of a set of special questions in the survey, banks were asked about their reasons for changing lending standards during the first quarter and their expectations for further changes over the remainder of the year. Banks indicated that a more uncertain economic outlook, reduced risk tolerance, deterioration in customer collateral values and concerns about funding and liquidity were the catalysts for recent tightening in lending standards. Banks also reported they expected to tighten lending standards further going forward.

Portfolio Actions: Over the second quarter we increased our RMBS exposure in our Enhanced Cash strategy, while modestly decreasing exposure in our other strategies by reinvesting portfolio paydowns into other spread sectors. In the “Enhanced Cash” strategy, we increased our nonagency holdings through opportunistic secondary market purchases of short-tenor, seasoned 2017 and 2018 vintage non-performing / re-performing (“NPL/RPL”) tranches. At current spreads, we continue to avoid new issue non-agency purchases.

Outlook: We anticipate remaining cautious around RMBS. While nominal spreads on specified pools are at the wider end of recent ranges, we believe the market faces challenges due to the continued problems at regional banks, persistent inflation, and hawkish comments from the Fed. In addition, we estimate that while the FDIC has sold over $50 billion of mortgages from the seized SVB/Signature Bank portfolios it still has close to $30 billion left to go. Finally, the FHFA’s review of the FHLB system creates uncertainty around bank demand, given the importance of the FHLB system in mortgage financing (member banks use residential mortgages as collateral to secure borrowings from the FHLBs, which can then be used to fund further lending). In this environment and with spreads at current levels, we are content to maintain rather than increase RMBS exposure. We remain opportunistic around non-agencies and, as in the past quarter, may look to add short-tenor tranches should we find them offered at attractive spreads in the secondary market. However, we remain very mindful of the lower liquidity and pronounced negative convexity characteristics of non-agencies relative to agency alternatives.

Performance: Our RMBS positions generated positive excess returns across all strategies in the second quarter. Our non-agency positions were generally the best performers although all subsectors were positive contributors except for our agency CMO holdings, which exhibited mixed performance. Within agency CMOs, performance was flat or slightly positive across the portfolios except for in our 1-3 Year strategies where performance was slightly negative due to weakness in some of our PAC holdings.

Municipals

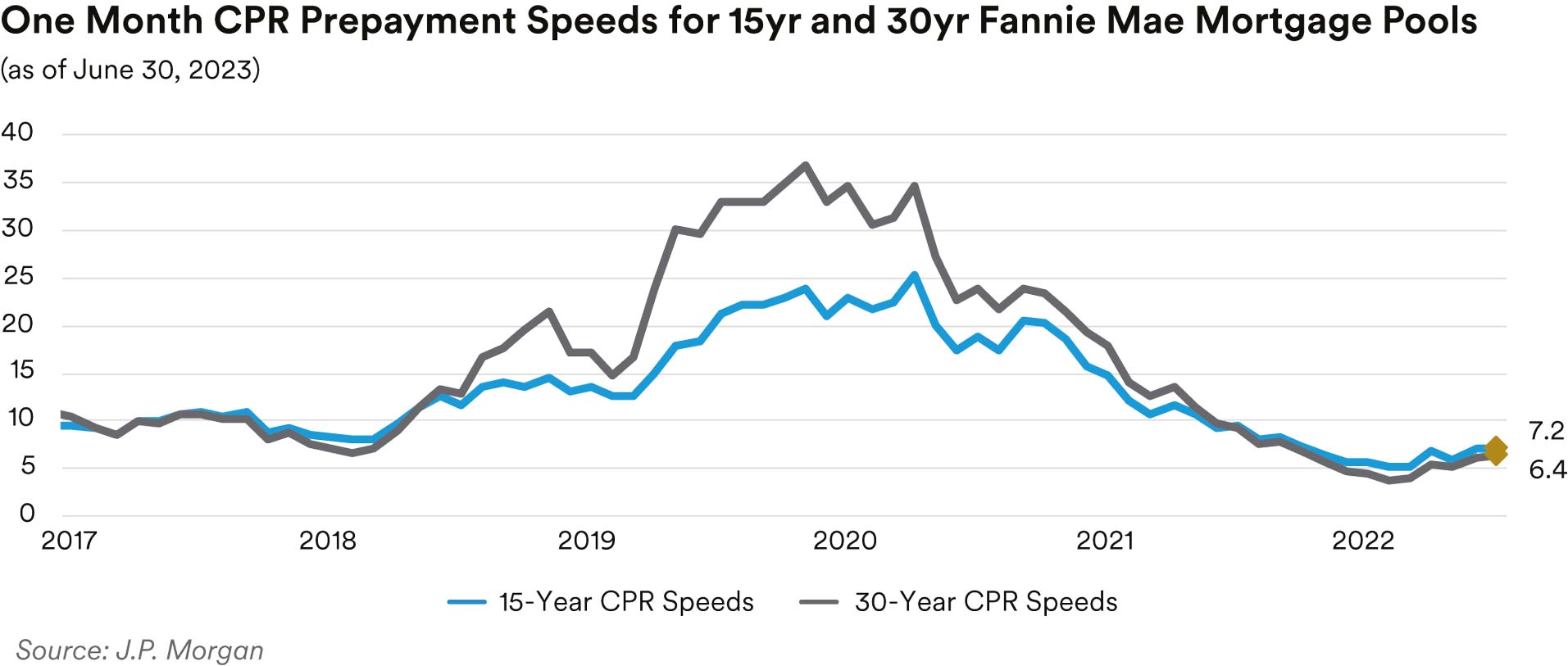

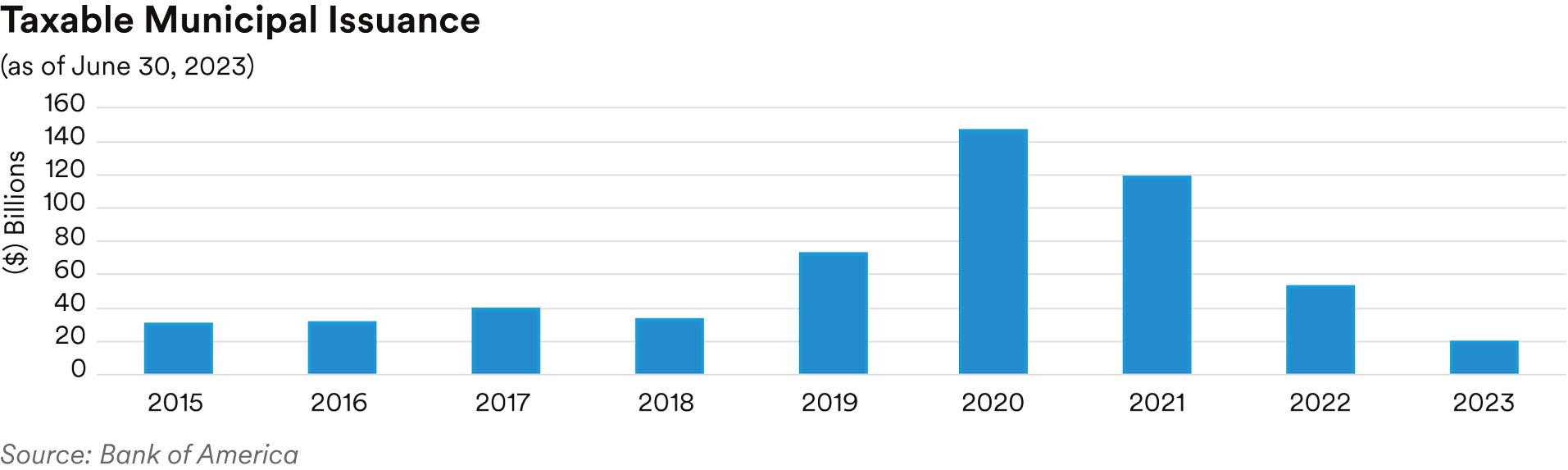

Recap: Total municipal new issue supply was $100 billion in the second quarter, a 13% decline from 2022’s second quarter. As a component of total supply, taxable municipal issuance was only $7 billion over the quarter, 59% lower on a comparative period basis. Despite interest rate volatility over the quarter, continued lack of supply and investor demand for higher quality assets provided some support in the taxable municipal market, which resulted in taxable municipals generating positive excess returns during the second quarter. For the quarter, the ICE BofA 1-5 Year U.S. Taxable Municipal Securities Index’s total return was -0.54% versus the ICE BofA 1-5 Year U.S. Treasury Index’s total return of -0.86%.

Credit fundamentals, as demonstrated by S&P’s upgrade to downgrade ratio of 4.3 to 1 over the first two months of the second quarter, have continued to be healthy. Notable rating actions during the quarter included the State of New Jersey upgrades to A1/A/A+ from A2/A-/A by Moody’s, S&P, and Fitch, respectively. Collectively, the rating agencies noted the state’s actions taken to strengthen budgetary flexibility and stability, reduction of long-term debt obligations, building reserve funds, improving pension funding levels and structural balance in their upgrade rationales. Improved reserve levels and budgetary discipline were similarly factors in Fitch’s upgrade of the State of Kentucky to AA from AA- in May. In addition, Moody’s upgraded the City of Philadelphia to A1 from A2 in April. The upgrade was a result of improvement in the city’s fund balance and liquidity resulting from administration actions to bolster financial oversight and governance controls

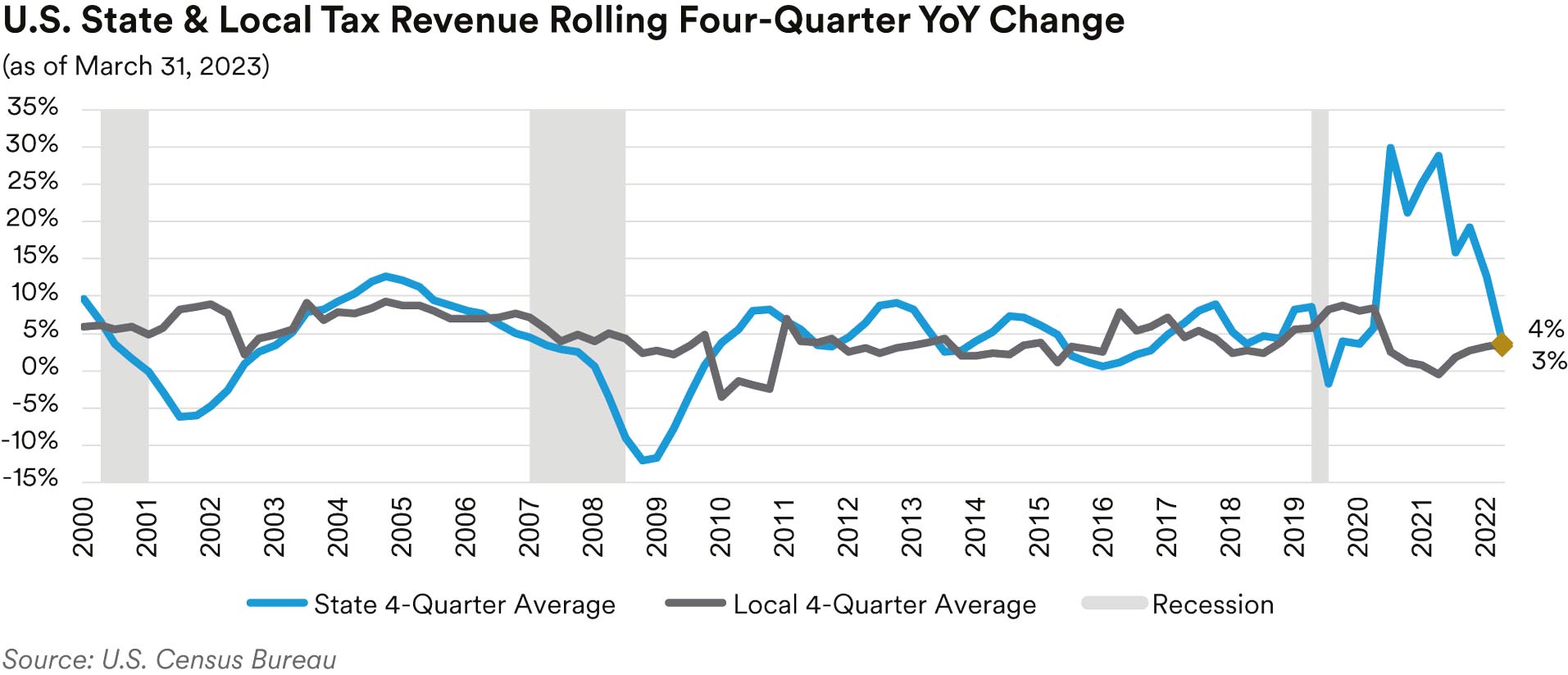

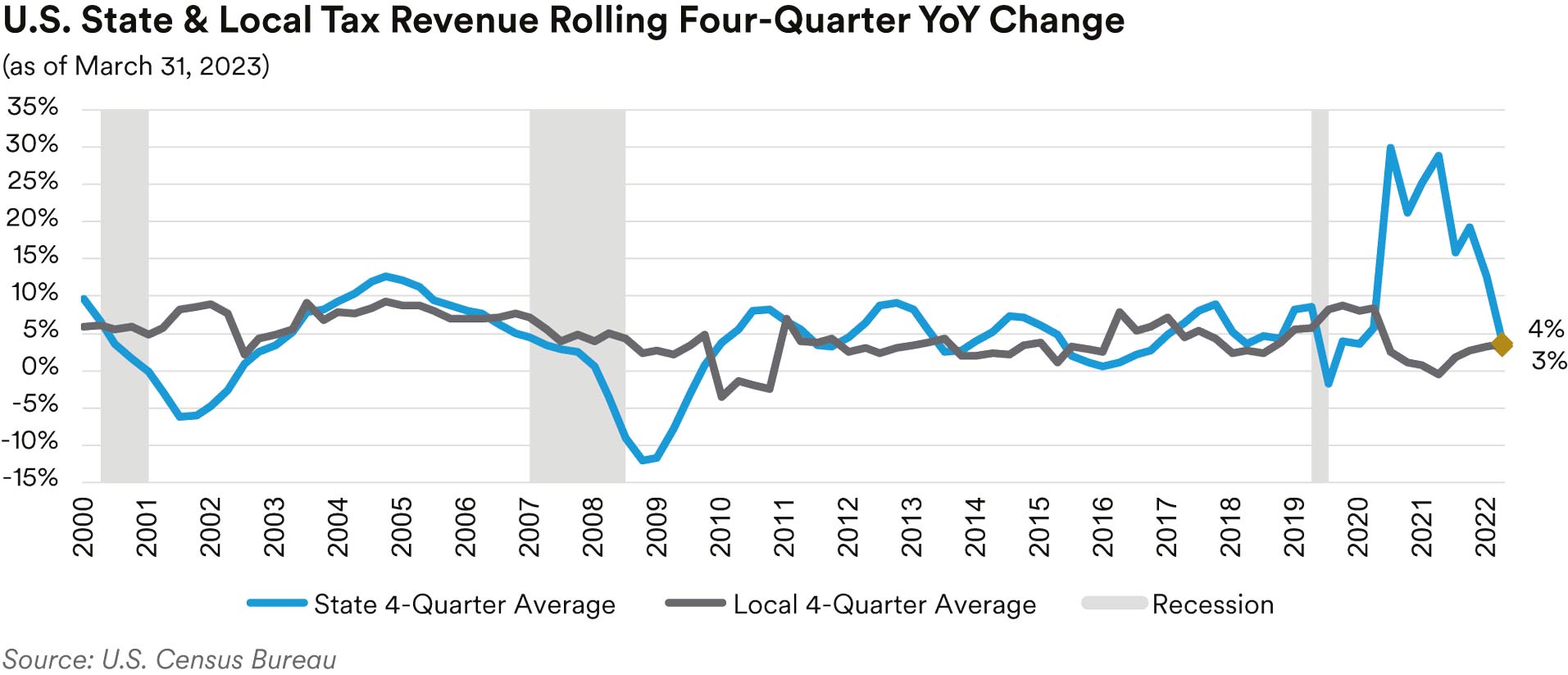

Based on U.S. Census Bureau data collected for state and local tax revenues through March 31, 2023, we continue to see a decline in the pace of revenue growth overall from the four major tax sources (personal income, corporate income, sales, and property taxes). The below graph highlights the moderation in revenue receipts at the state level, with a demonstrated lag effect at the local level, when comparing the year-over-year percentage change in revenues from these major sources on a trailing four-quarter average basis.

We continued to watch pension funding levels impact state budgets with lower levels having the potential to stress balance sheets with one indicator we monitor being Milliman’s Public Pension Funding Index, which is comprised of the 100 largest U.S. public pension plans. This index fluctuated slightly with market volatility and net negative cash flows during the first two months of the quarter. The Index increased to 74.8% at the end of April from 74.5% in March, and then declined to 73.7% at the end of May. While the index is showing stability, it remains below the 85.5% ratio reached at year-end 2021.

Portfolio Actions: Our allocation to taxable municipals decreased in our shortest duration strategies and exposure levels were maintained in our other strategies over the second quarter. With the continuation of municipal spread tightening and limited new issue supply, we monetized some holdings, selling shorter duration bonds with maturities under one year where we felt there was limited potential for further spread compression. As we remain defensively focused, our purchase activity was limited to select state and local tax-backed debt and transportation-related sectors, including airport and highway revenue bonds, along with select additions to healthcare and state housing issues.

Outlook: We anticipate tax revenue growth for state and local governments will continue to moderate against the backdrop of overall macroeconomic conditions. Real GDP quarter-overquarter growth, while positive, is showing some signs of slowing. Updated estimates show firstquarter GDP growth was 2.0% after printing +2.6% in the fourth quarter of 2022 and +3.2% in the 2022’s third quarter. Tax revenues are highly correlated to GDP, demonstrated by the slowing pace of revenue growth. We continue to be somewhat cautious on economic growth given sticky inflation, wage pressures, and the lagged impact of past and future Fed rate hikes. At the local level, the pace of tax revenue growth has trailed that experienced at the state level. The impact of the work-from-home dynamic on commercial real estate valuations, particularly on the office segment and related tax payments, has not yet been fully felt. This factor, combined with higher mortgage rate pressure and its knock-on effect on residential real estate valuations, is expected to pressure local budgets for the foreseeable future. Budget revisions along with total fund balances of over 25% at FYE 2023 should help mitigate credit-related pressure at the issuer level. In revenue-backed bonds, one sector that has been facing ongoing pressure is healthcare. Inflation and worker shortages have pressured hospital systems as increased labor and supply costs have resulted in declining operating margins within the sector. Repayment of federal loans has also pressured liquidity for some hospital systems. In evaluating healthcare credits, we prefer systems that are market share leaders in growing demographic regions with a demonstrated willingness to operate in a financially sustainable manner. Systems with well built-out integrated health systems, which offer continuity of care from doctor visits to inpatient and outpatient surgeries, can benefit from a greater share of a patient’s healthcare spending. In many cases, margin recovery will occur slowly in 2023-24 as hospitals look to improve productivity and cut costs to offset higher compensation required to retain core nursing staff. We favor hospital systems that have been open to evaluating their operations and taking necessary cost cutting measures like reducing the use of contract labor with a focus on improving operating margins.

As we evaluate taxable municipal investments in the primary and secondary markets, we continue to seek issues which not only demonstrate creditworthiness and those that fit with our defensive bias but also represent a relative value opportunity for our portfolios. While we remain constructive on overall credit fundamentals in the municipal space, we are cognizant of the potential for pressure on budgets driven by changes in the macroeconomic landscape. We continue to favor issuers who have well-positioned balance sheets and the operating and financial flexibility to manage through a potential economic downturn. In an investment environment characterized by macro market volatility and economic uncertainty, we view an allocation to the municipal sector as a defensive alternative to other spread sectors and will seek opportunities to increase this allocation as they arise.

Performance: Our taxable municipal holdings generated positive performance across all our strategies in the second quarter. On an excess return basis, some of our better performing sectors included Highway, Power, and Water. Holdings in Airport and Tax-backed issues were mixed but positive in aggregate while select holdings in Housing generated slightly negative excess returns.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyodaku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of March 31, 2023, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC.