Price Shocks

Initially in 2021 during the COVID-19 recovery phase, EM were already experiencing elevated inflation levels due to the pandemic related supply and demand shocks. However, we expected a peak sometime late in the first half of 2022 as pressures began to abate with inflation moderating and base effects improving. Now that we are witnessing extreme price shocks due to the geopolitical backdrop, this timeline has been extended, with the assumption that prices will be stickier for longer. Our base case scenario is that this war will continue in the near term and sanctions will remain in place with the geopolitical ripples to be felt for many months and quarters into the future.

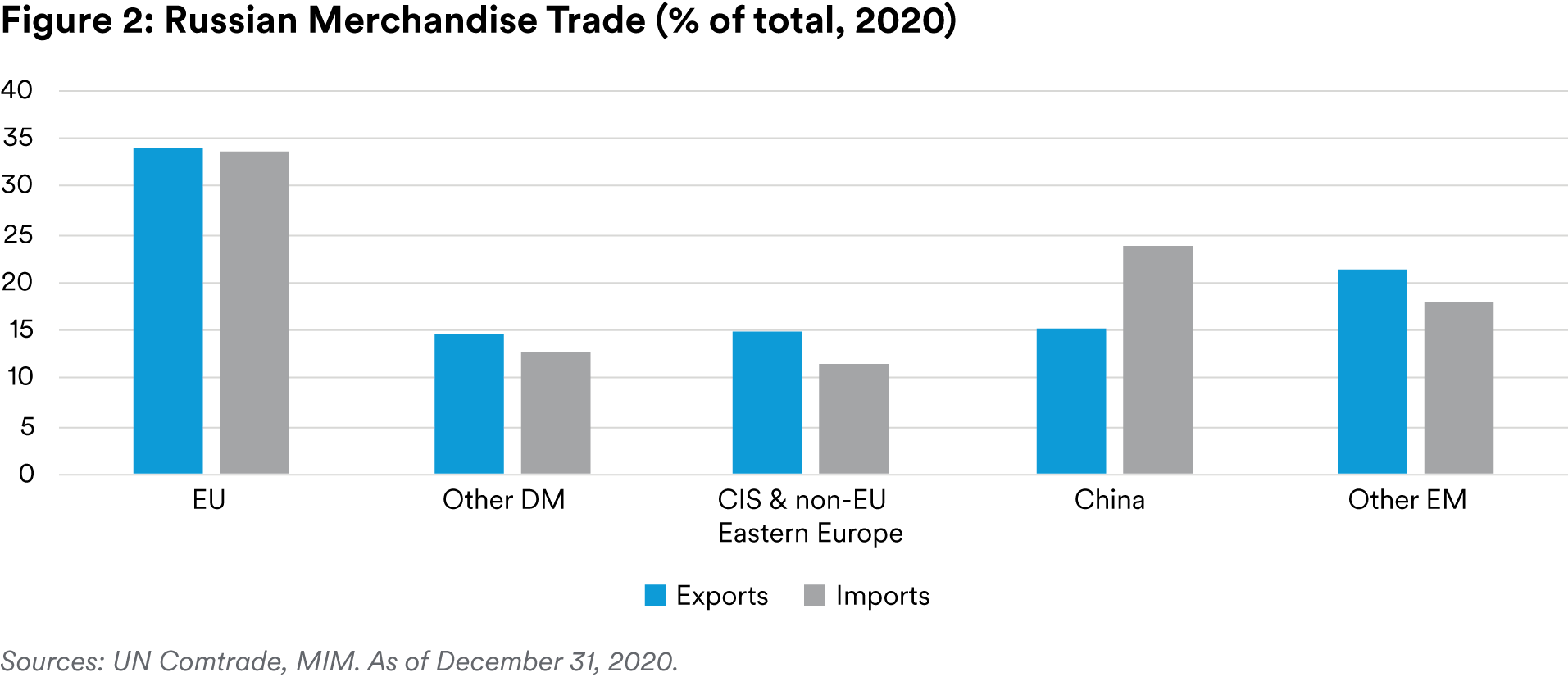

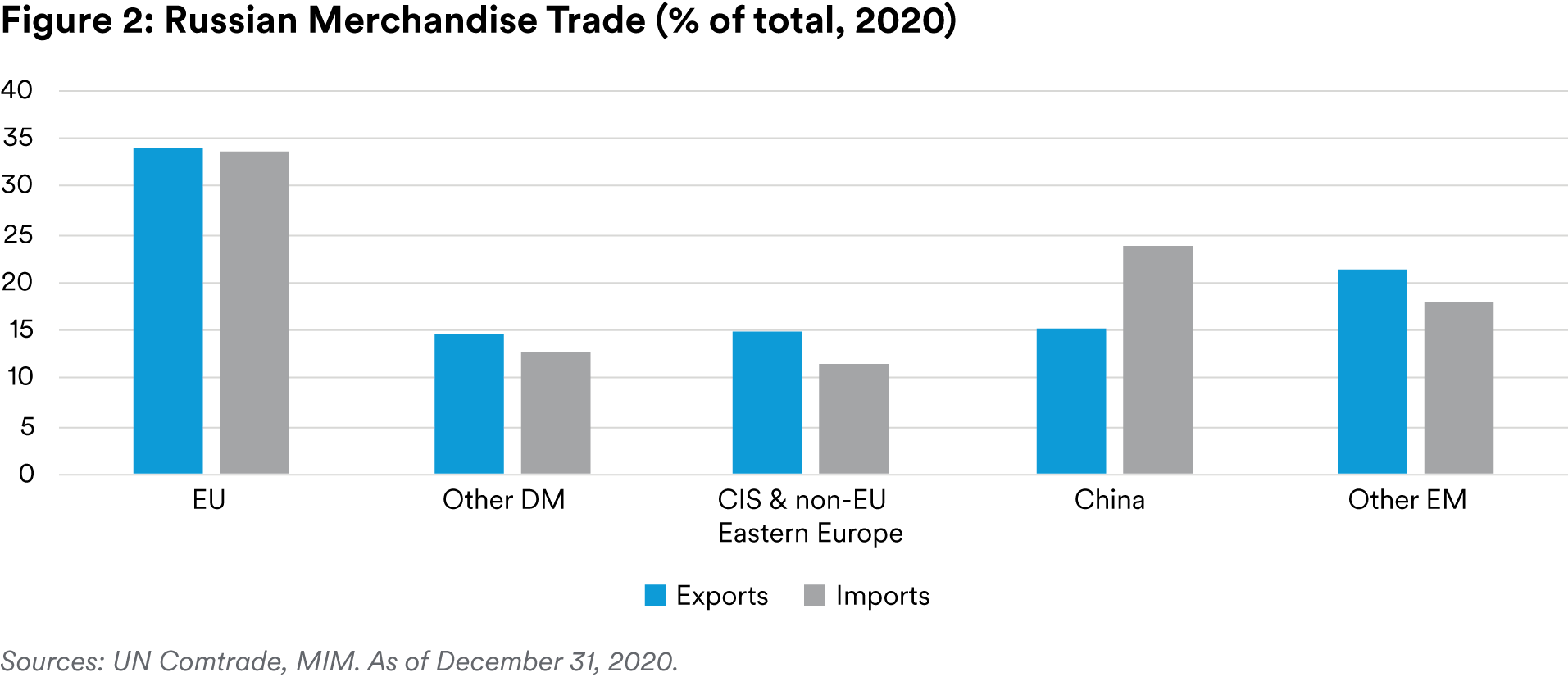

Russia is Europe’s fifth largest trading partner for exports, and third largest for imports. Over 25% of Europe’s imported crude oil, along with 40% of the region’s natural gas comes from Russia2 . Restricting access to these resources has placed significant pressure on supply chains not just in Europe, but throughout the globe as other countries try to adjust for the shortfall in supply.

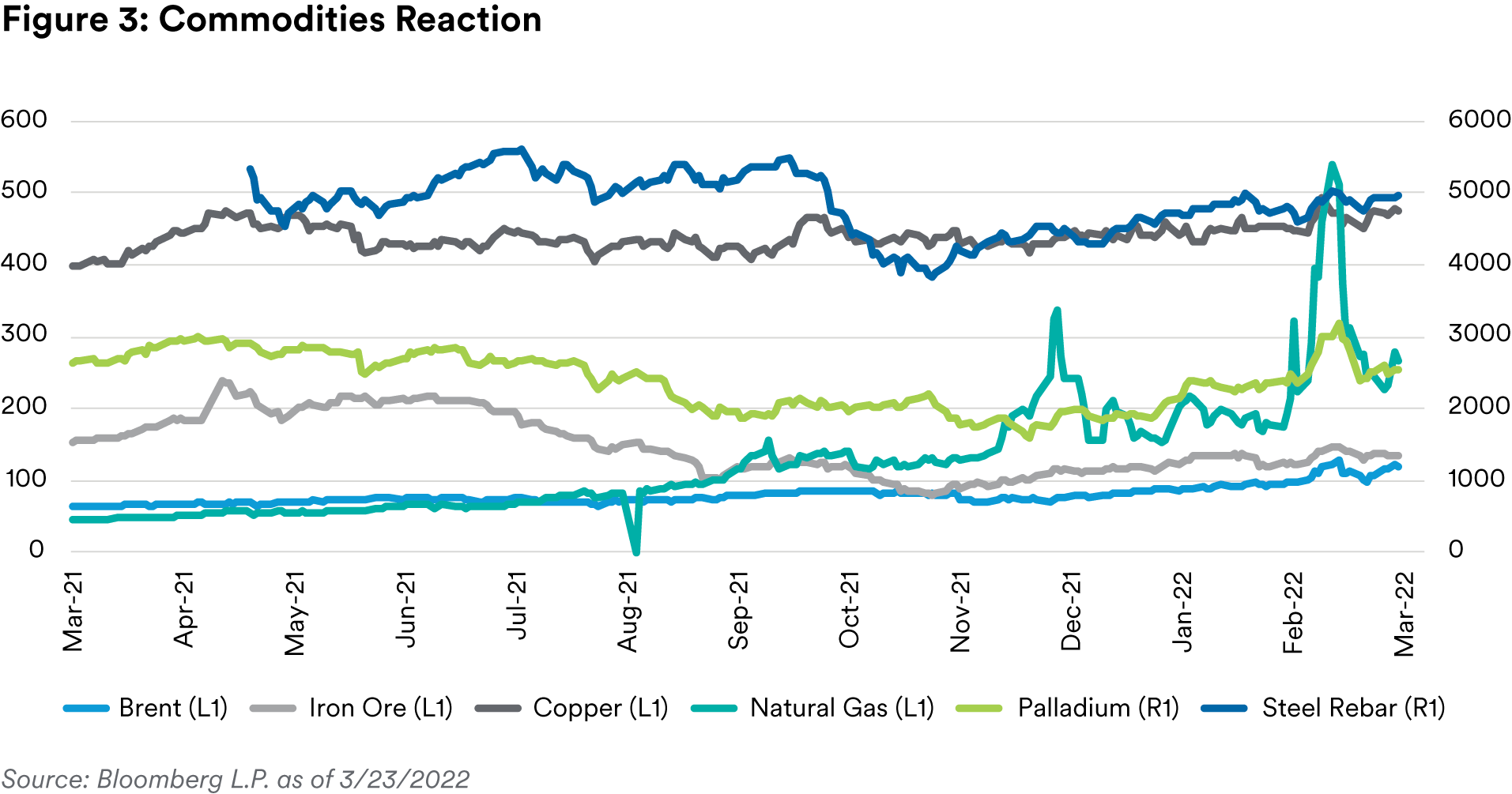

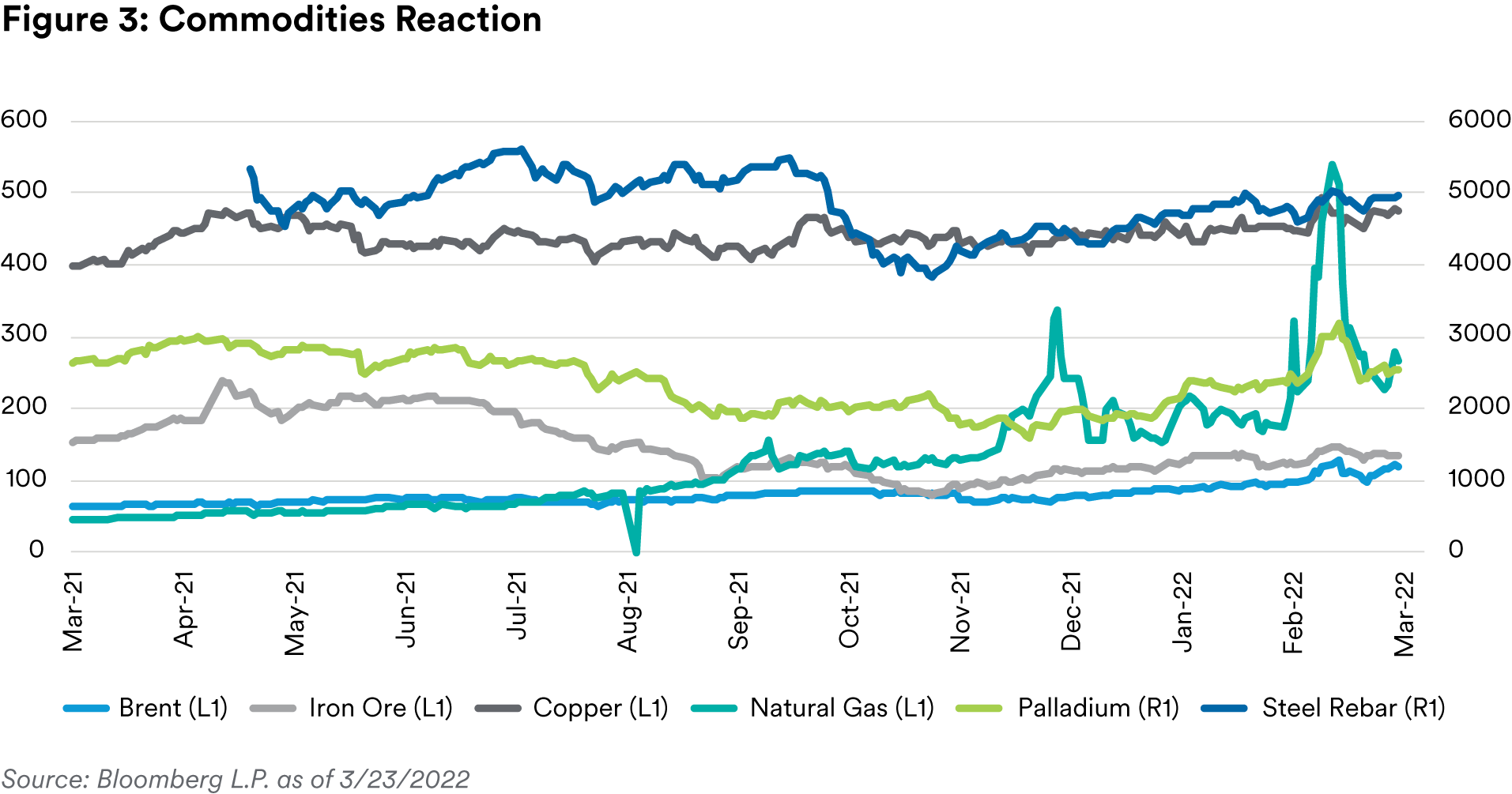

Given that Russia is a large supplier of raw materials for many economies, the restrictions are having a trickle-down effect to production. Russia is responsible for 4% of the global copper supply, along with being the largest exporter of slab and billet supply as it relates to steel3 . Russia and Ukraine represent 20% of the total iron ore pellet market. Ukrainian commodities related companies, have not been able to ship any materials since the start of the war due to the blockage of shipment routes4. Additionally, Russia and Ukraine are significant exporters of wheat, barley, and fertilizers, feeding into the rise in food prices.

Major shipping companies have been avoiding Ukrainian and Russian ports, and therefore the longer this war extends, the deeper the bottlenecks in Europe and beyond will grow. Over half of Russia’s exports go to Europe, US, Canada, and Ukraine markets. We could see those export numbers reduced by about one third this year given the restrictions, not only putting pressure on Russia’s economy but on supply chains across the globe.

Inflation

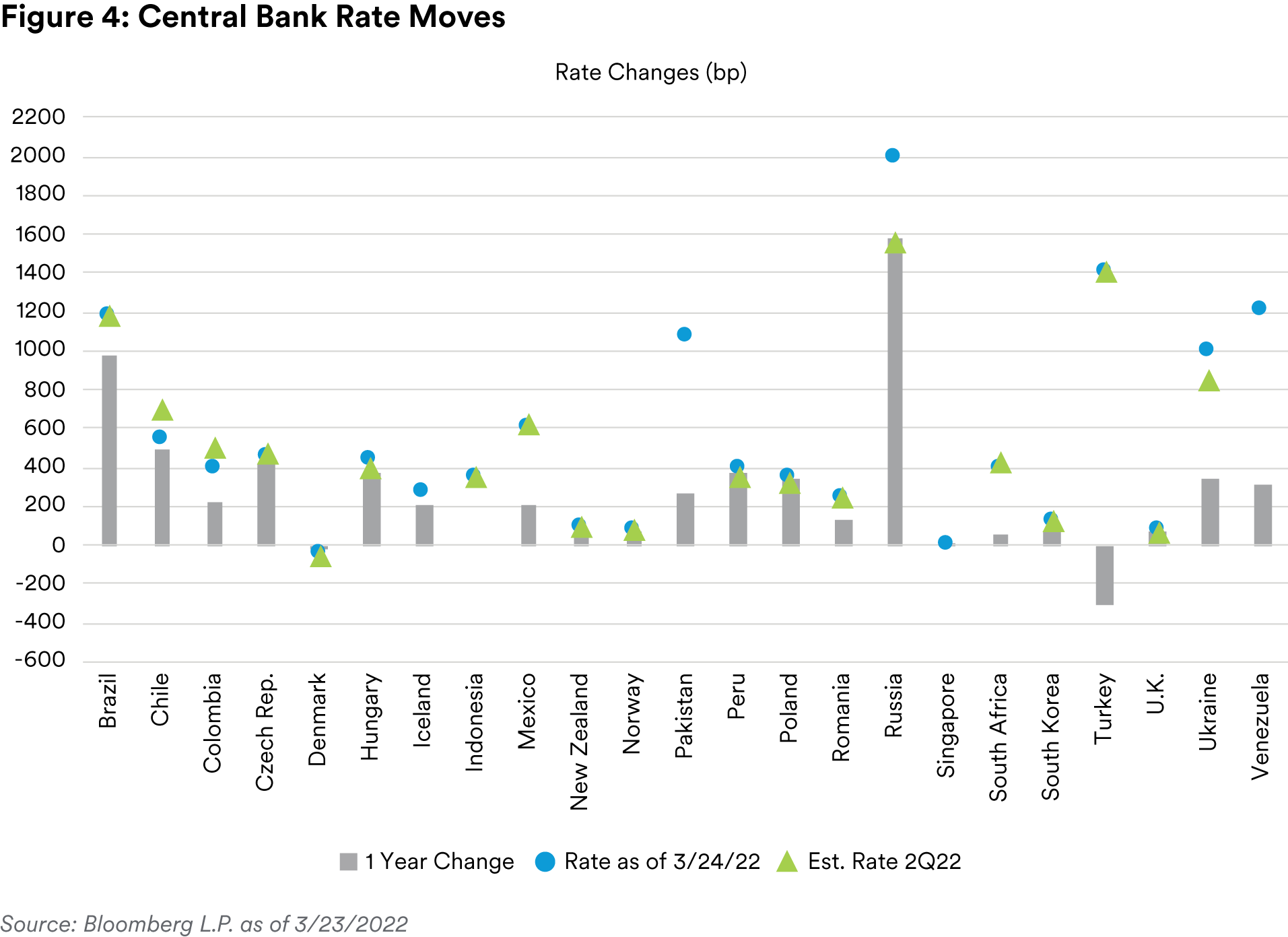

The US 10-year Treasury yield broke through 2% for the first time since 2019 amid inflation concerns. Since then, the Fed proceeded in line with expectations, hiking rates 25 basis points for the first time since 2018. Additionally, markets are expecting up to an additional six hikes this year, with the potential for a more aggressive 50 basis point hike at the coming meeting, and balance sheet reduction in order to continue curbing this extended inflationary environment that the RussiaUkraine war has made all the more complicated. This environment will challenge the Fed in a unique way—while prices continue going up, growth should be slowing and consumer confidence weakening. Yet, the moderating demand element that we would expect to see in this situation has yet to play out. One natural question we can ask ourselves is how much demand destruction needs to take place to dampen the current inflationary environment? The Fed cannot resolve labor and equipment shortages to help commodity producers. They cannot solve the uneven effects that the imposed sanctions are causing on other countries that are reliant on Russian and Ukrainian commodity imports. Their only tool at the moment is to tighten policy enough to dampen the demand for many of these supply strangled goods.

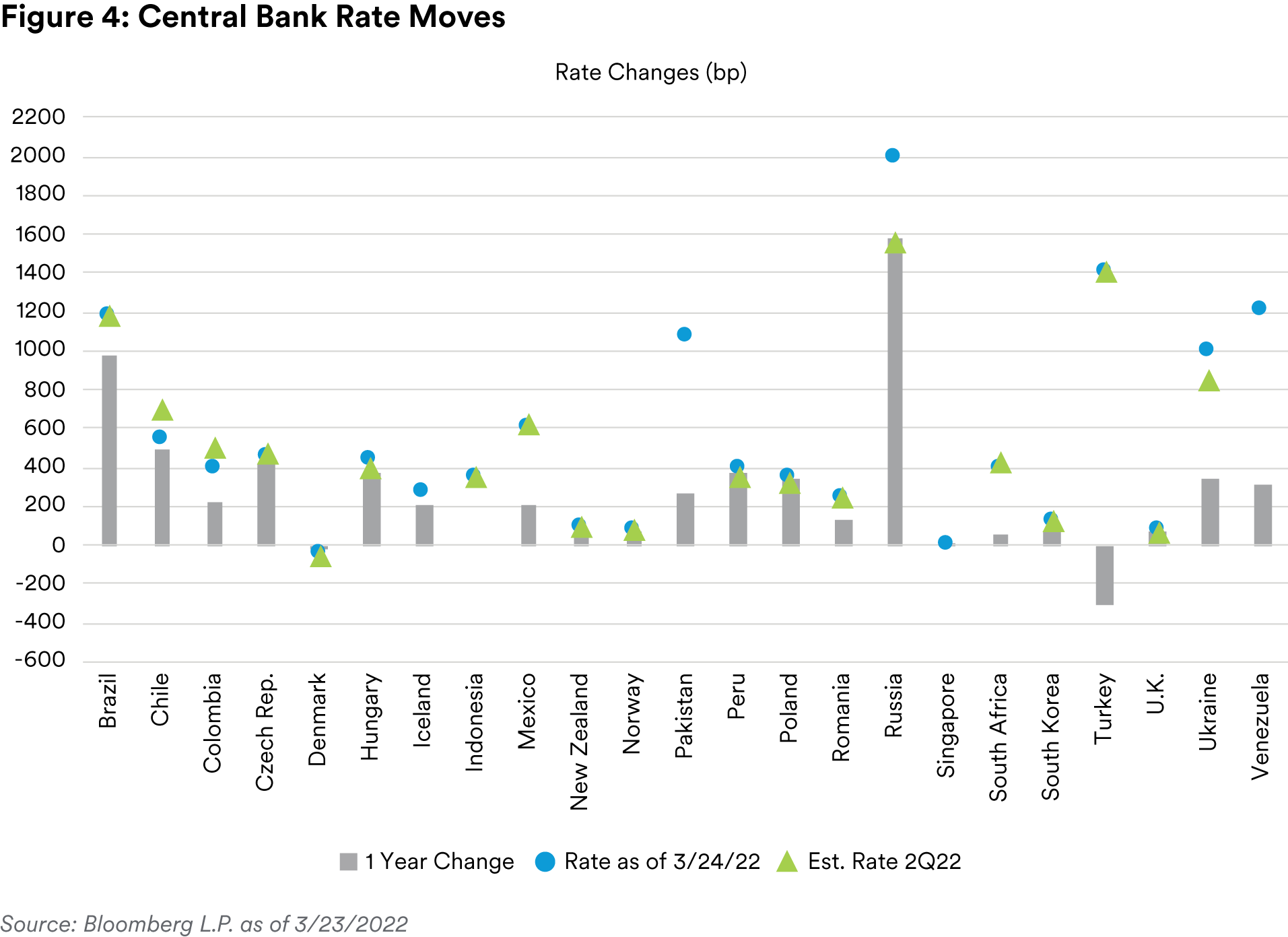

Despite EM countries being proactive and raising rates last year to curb inflation, this new unexpected inflation impulse, as a result of the war and extended supply chain disruptions, are forcing some central banks to continue hiking further. The commodity shock that we are witnessing strikes in a moment of already high inflation rates, rising interest rates, and economic deceleration. This scenario makes it more difficult to gauge the impact on growth of a positive Terms of Trade (for commodity exporters) on one side, and higher inflation/rates and possibly lower global growth on the other.

Food prices are soaring on the back of supply concerns, increased transportation costs, anticipated fertilizer shortages, and weakened currencies. Therefore, despite the increase in prices benefiting net exporters of these raw materials, the inflationary environment pressures growth potential, especially for the poorest of countries. For many EM countries specifically, rising food prices cause extreme concern given a very high amount of real disposable income is spent on food.

Winners and Losers

Net exporters have started to benefit from these sharp rises in commodity prices, while net importers have begun to feel the burden, and will likely continue to feel the lingering effects even if extreme prices recede. Brent hit a peak of $128/barrel on March 8th, after witnessing a low of $20/ barrel just two years prior5 . High quality GCC countries such as Saudi Arabia and Qatar are set to benefit from elevated energy prices, with their budget break-evens approximately $70/barrel. Therefore, anything beyond that contributes to the region’s fiscal surplus. On the other hand, Turkey and Egypt are likely to be some of the hardest hit countries, with their heavy reliance on Russian and Ukrainian trade for food and energy.

Given these extreme moves in energy and food prices, some governments that are net importers are looking for solutions. To avoid social unrest and/or political backlash, many countries may resort to price freezes or subsidies, which will have negative fiscal impacts creating higher financing needs for the governments and can exacerbate the inflationary problems.

The setback for these net importing countries is the current low availability of capital. The markets are extremely volatile both in EM as well as Developed Markets currently. In order to get deals done, countries are having to pay up to account for excess fear in the market, along with inflation expectations leading to increased yields. Some countries took advantage of the low yields in 2021 and prefunded; however, some countries such as Turkey and Egypt with large fiscal deficits will face challenges and might look to other sources of funding. Given these soaring prices and excess pressure on net importing countries, Pakistan is finding itself needing to expand issuance from initial projections but facing headwinds of an unfavorable market environment. With that said, historical issuance trends on the light side during conditions such as these, and we are seeing a similar situation playing out currently. Out of the $151bn of sovereign issuance projected for 2022, investors have only witnessed $40bn of deals price6.

In Latin America, social and political pressure on fuel subsidies will mount everywhere if oil prices remain at these high levels, which could offset the positive impact of higher commodity prices on fiscal revenues. Chile has increased the size of its stabilization mechanism and Mexico has cut the excise tax to zero and will give tax credits to contain the rise of fuel prices. Brazil has cut fuel taxes for diesel and cooking gas and is discussing measures for gasoline, while Colombia has not been passing higher oil prices to fuel prices, increasing the deficit at the stabilization fund and its debt obligation with Ecopetrol. Argentina´s energy subsidies will likely rise, presenting a challenge to meet fiscal targets agreed on with the IMF. In Asia, fuel subsidies will also weigh on fiscal burdens in countries including Thailand, Philippines, and Malaysia. In Thailand, the oil/coal/gas trade deficit represents approximately 4% of GDP on average, which represents one of the largest deficits in the region, with energy being 12% of the CPI basket7 .

The biggest impact to growth will be felt in surrounding countries. The indefinite cutoff of Russian tourists to countries including Turkey and Egypt will hinder the progress that has been made in the last few months to the tourism industry, which had been hit hard during COVID-19 and had still yet to fully recover. In Turkey, Russians were 19% of 2021 tourist arrivals and Ukrainians represented another 8%, with these two countries helping revive tourism within Turkey last year8 . Russia, Ukraine, Poland, and Belarus represent approximately 30% of Sri Lanka’s tourism, and the current strained tourism may weigh on growth potential9 . In this instance, given the ongoing strain that Sri Lanka was facing prior to this, the rising energy and food prices coupled with this strain on tourism could push the country towards the IMF quicker, or possibly to the route of default. Poland is facing knock-on effects from a neighboring war, coupled with high oil prices as an importer, which are dampening the country’s outlook.

Defaults

Does Russia’s lingering default open the door to other potential defaults? Other countries that are closely linked to Russia, such as Belarus, will likely be forced into default. Separately, other countries who are already on the brink of default, including Sri Lanka, may be pushed over the edge given the higher commodity prices coupled with increased borrowing costs that make it harder for vulnerable countries to finance debt costs.

ESG implications/changes

The ESG implications from this war range far and wide—which will be explored in depth separately. For an asset class that has been making progress towards more ESG friendly actions and issuance to please investors, this war is revealing just how far we still have to go. A notable portion of the EM universe including China, Saudi Arabia, Russia, Kazakhstan, and Oman still operates under autocracies. Therefore, the leaders are not elected by the population, and it is very difficult to get these rulers removed once they are in office, regardless of their actions. We have seen this unfold in Russia, with this concern coming to the forefront for other countries with similar structures. Additionally, investors are beginning to reconsider ESG restrictions around defense companies, sparked by the Russia-Ukraine war. Restricting security and stability undermines democracy and sustainability of nations

Valuations

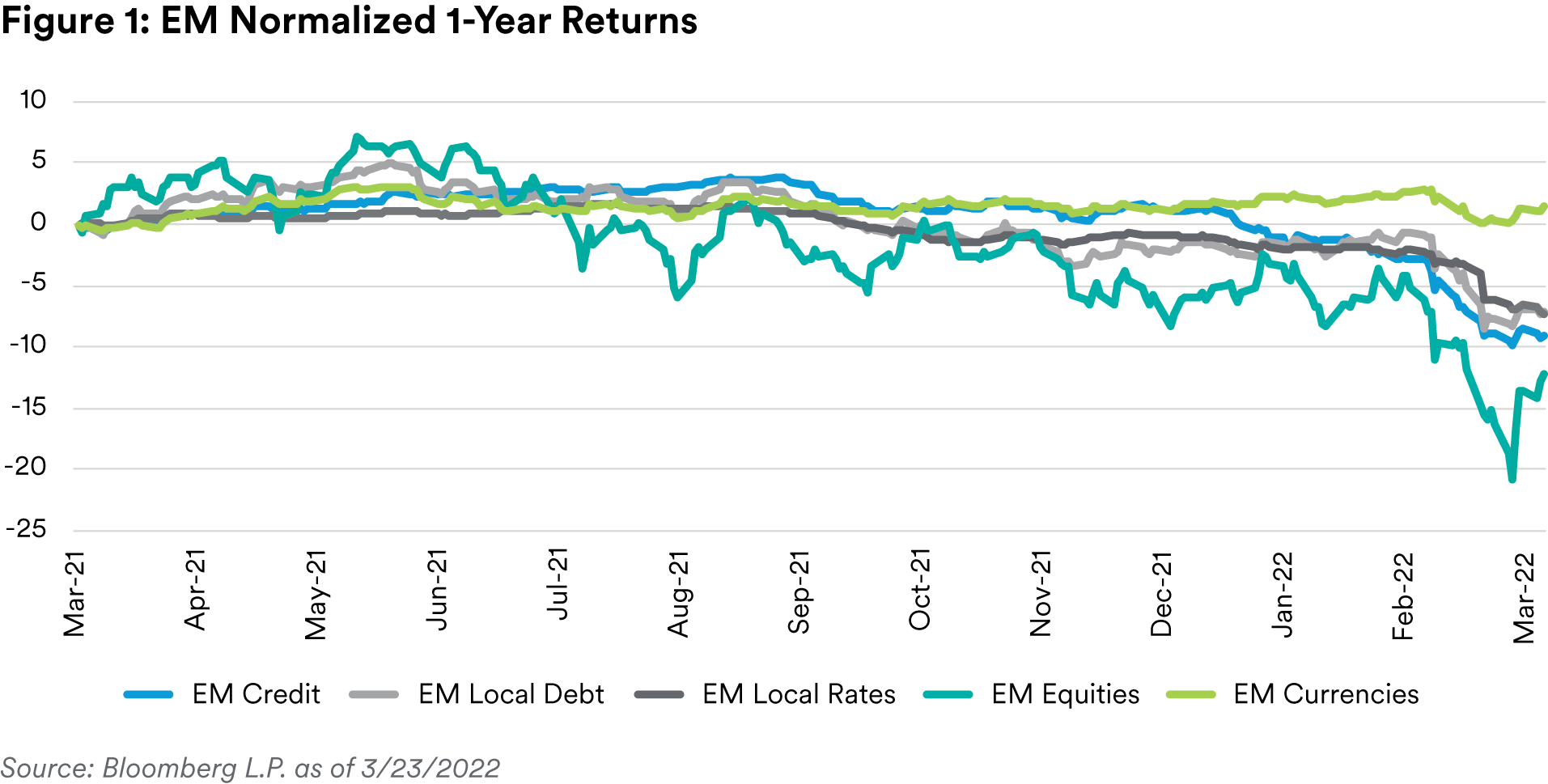

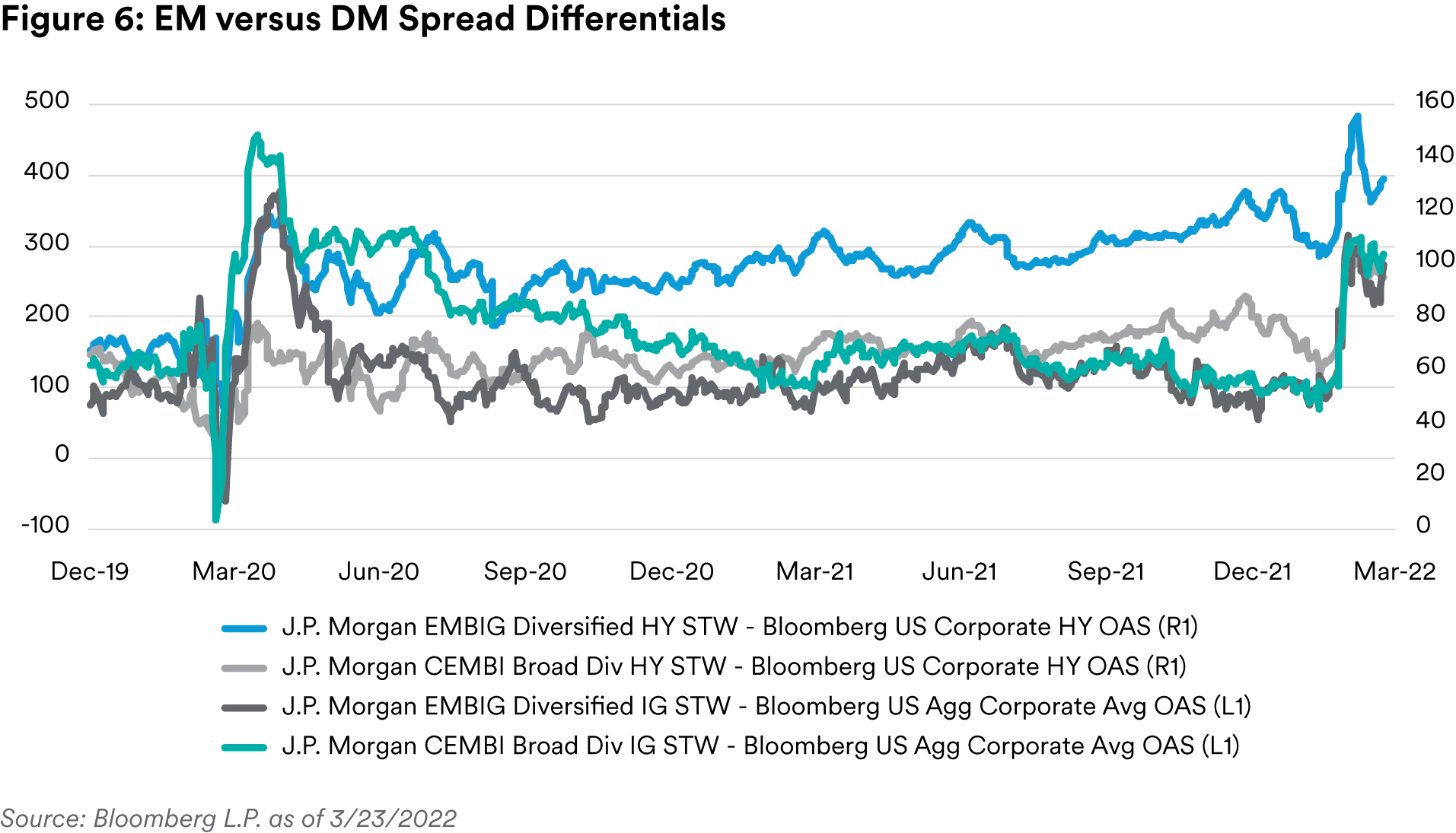

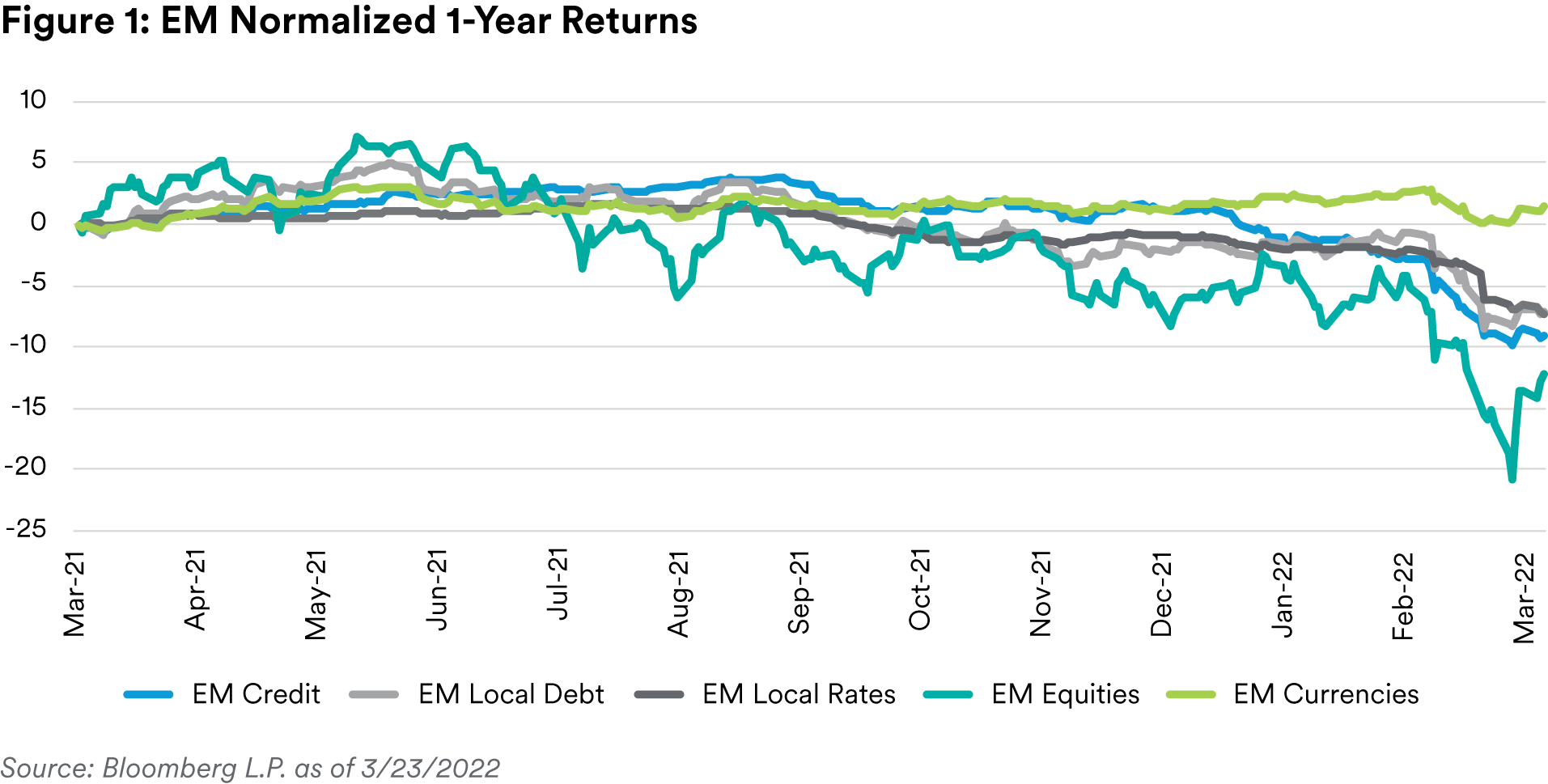

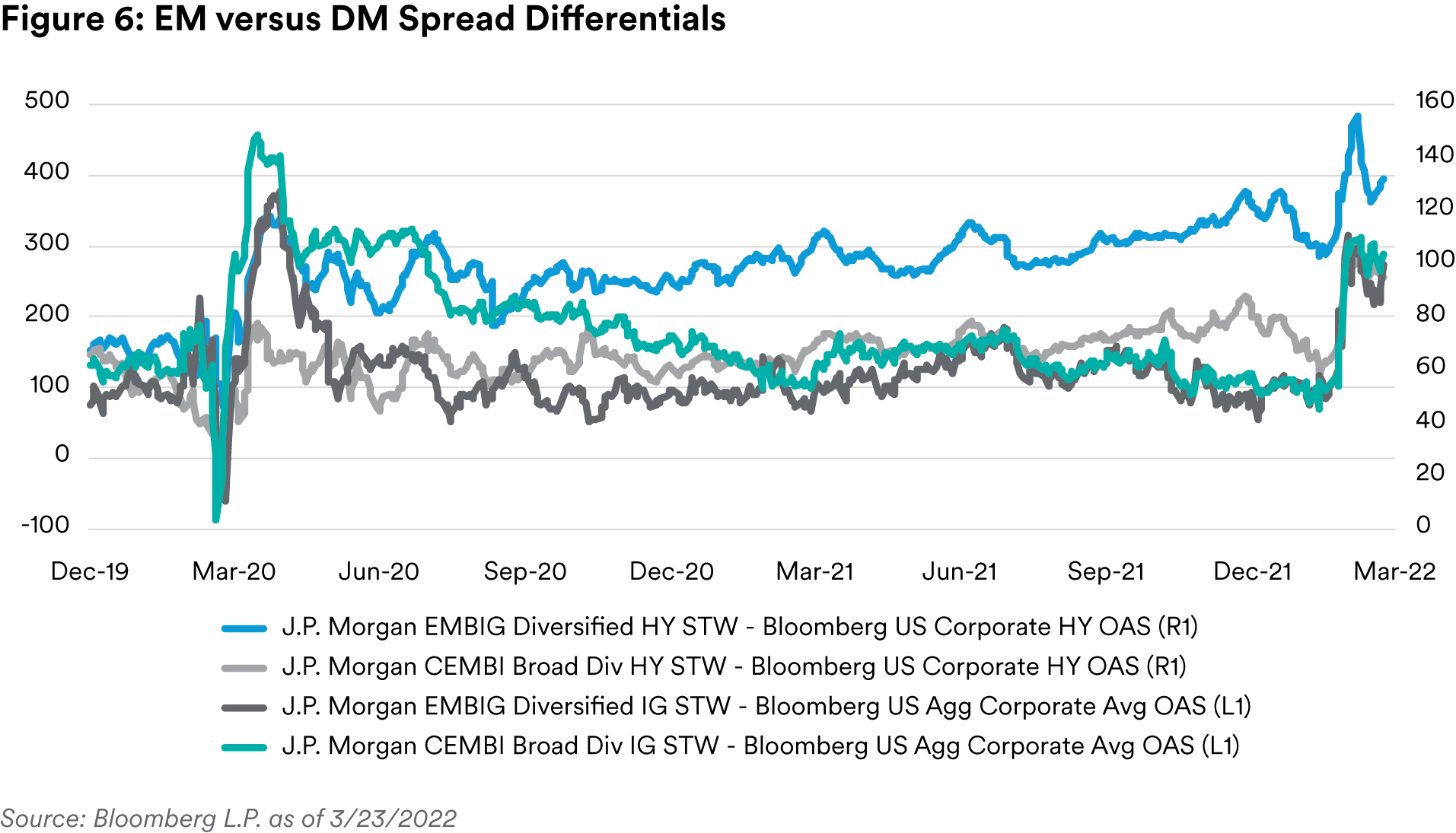

Throughout the pandemic, EM corporates remained resilient given their strong fundamentals. Now, the geopolitical tensions have caused overall market weakness, especially throughout the international markets, and EM corporates have been no exception to this sell-off. However, the strain from the ongoing conflict is heavily focused at the sovereign level with the overall higher financing needs that are now necessary. Commodity producing corporates throughout EM countries are set to benefit from the current strong commodities environment, especially those that are able to pass along some of the increasing expenses to consumers. Given this, we believe that corporates are even more attractive now than they had been, with spreads on the CEMBI Broad Diversified back to levels seen in July 2020, while balance sheets remain intact.

EM local currencies have potential room to rally in this current environment. For any commodity exporter, if demand remains strong, countries’ terms of trade will remain strong as well. We have already seen local currencies of some of these strong commodity exporters such as South Africa and Colombia outperform as countries ramp up production to meet these demands. Additionally, EM rates have become even more enticing, as rates are shifting higher to adjust for elevated inflation levels.

While we don’t see a quick resolution to the challenges facing EM markets today, we do recognize that progress is being made to lessen the impact of pricing pressures, inflationary pressures, and supply chain disruptions—and the conversation is constantly evolving. EM economies are likely to feel the impact of each throughout the remainder of this year, and we will continue to evaluate opportunities prudently and add to risk in a very measured way.

Endnotes

1 Georank

2 World Economic Forum

3 Bradesco bbi

4 Bradesco bbi

5 Bloomberg L.P.

6 JP Morgan, Bond Radar as of March 23, 2022

7 Citi

8 Haver, Turkey Ministry of Culture and Tourism

9 ThePrint

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Fixed income investments are subject interest rate risk (the risk that interest rates may rise causing the face value of the debt instrument to fall) and credit risks (the risk that the issuer of the debt instrument may default). Particular risks are associated with investing in emerging market securities; since these countries have historically experienced, and may continue to experience, high rate of inflation, high interest rate, exchange rate fluctuations, trade difficulties, extreme poverty and unemployment, confiscatory taxation, seizure, nationalization, or creation of governmental monopolies.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

In the U.K./E.E.A.: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address Level 34 One Canada Square London E14 5AA United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”)>

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/ or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC.

Unless otherwise noted, none of the authors of the articles on this page are regulated in Ireland.