As the quarter came to a close, Chinese PMI signaled expansion for the first time since September, further helping risk sentiment. Relief within the property space remains fleeting but ICBC, China’s largest bank, did its part to help the country’s economy, providing $41 billion of financing to stimulate tourism into China and earnings within the major non real estate sectors remained stable despite 2023 worries2.

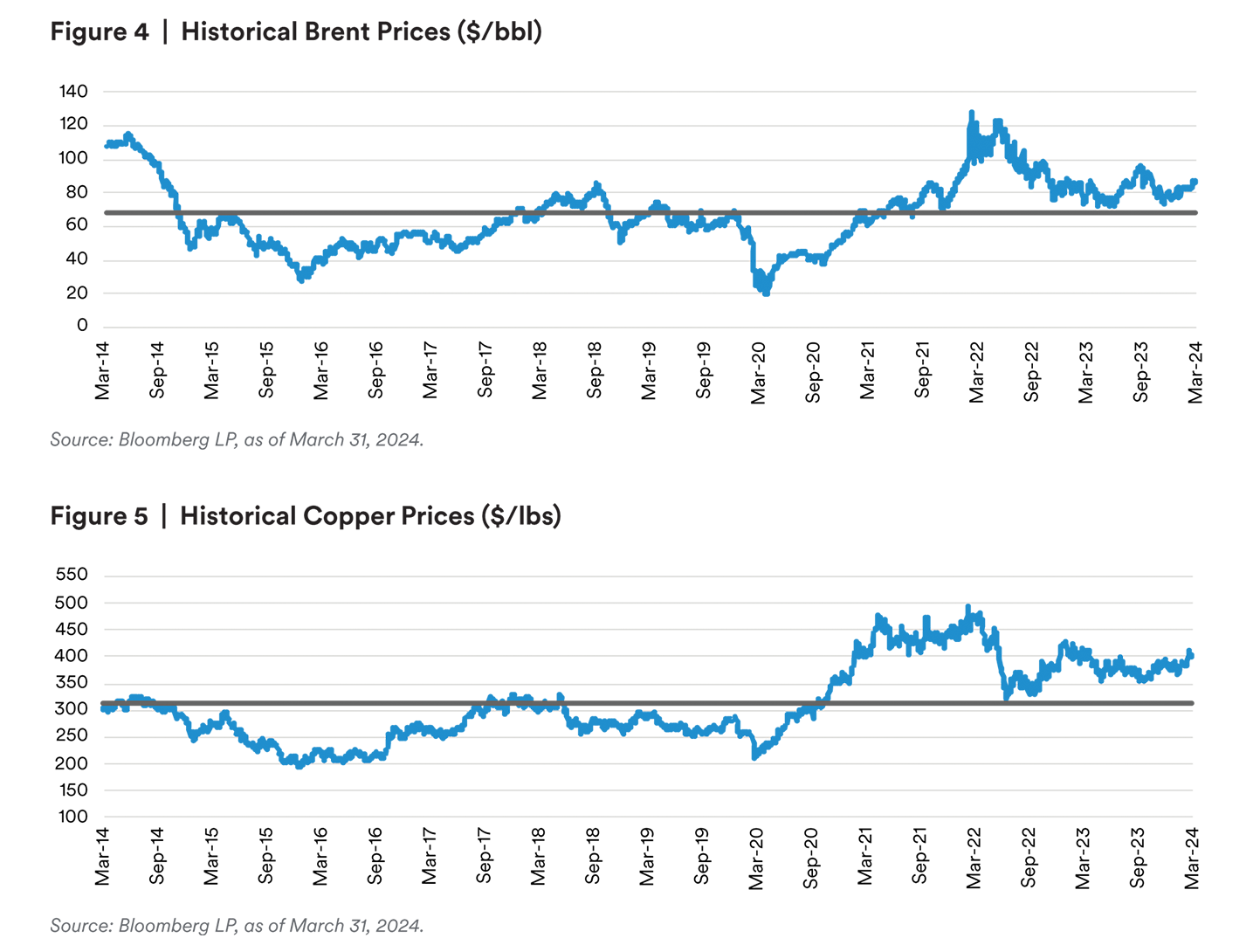

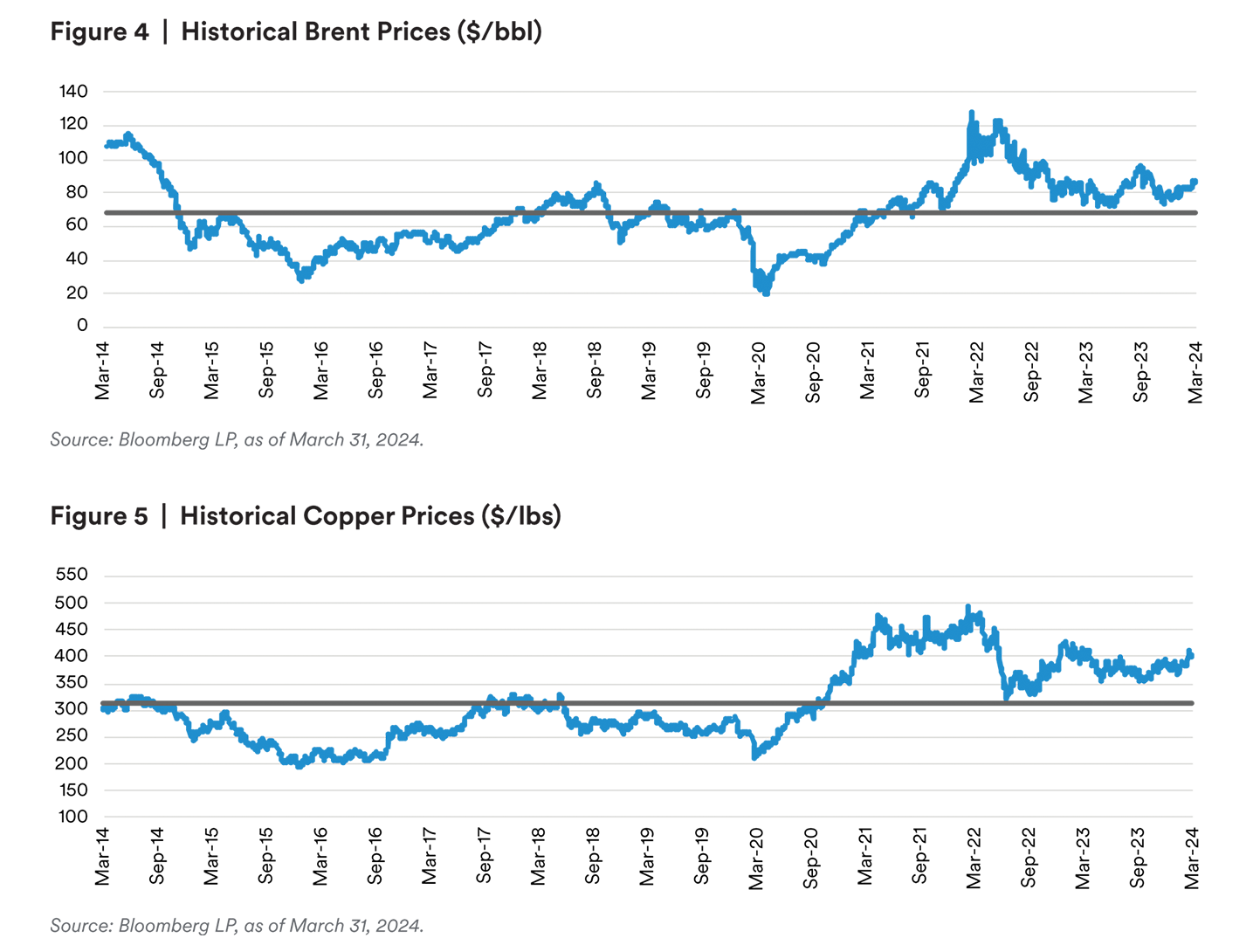

The combination of OPEC+, geopolitical pressures from Ukraine striking Russian oil refineries and Houthi militant attacks in the Red Sea causing delivery detours around South Africa have supported oil prices with Brent rallying 13%, closing the quarter at $87.503. Copper witnessed a rally into quarter end as positive factory data out of China, a top copper consumer, coupled with potential output cuts by leading smelters buoyed prices. After facing demand complications for the large part of the last year, copper recovered to levels last seen in April 2023. However, commodity prices overall are still facing a ceiling as the US Fed is moving slower than initially anticipated with cutting rates.

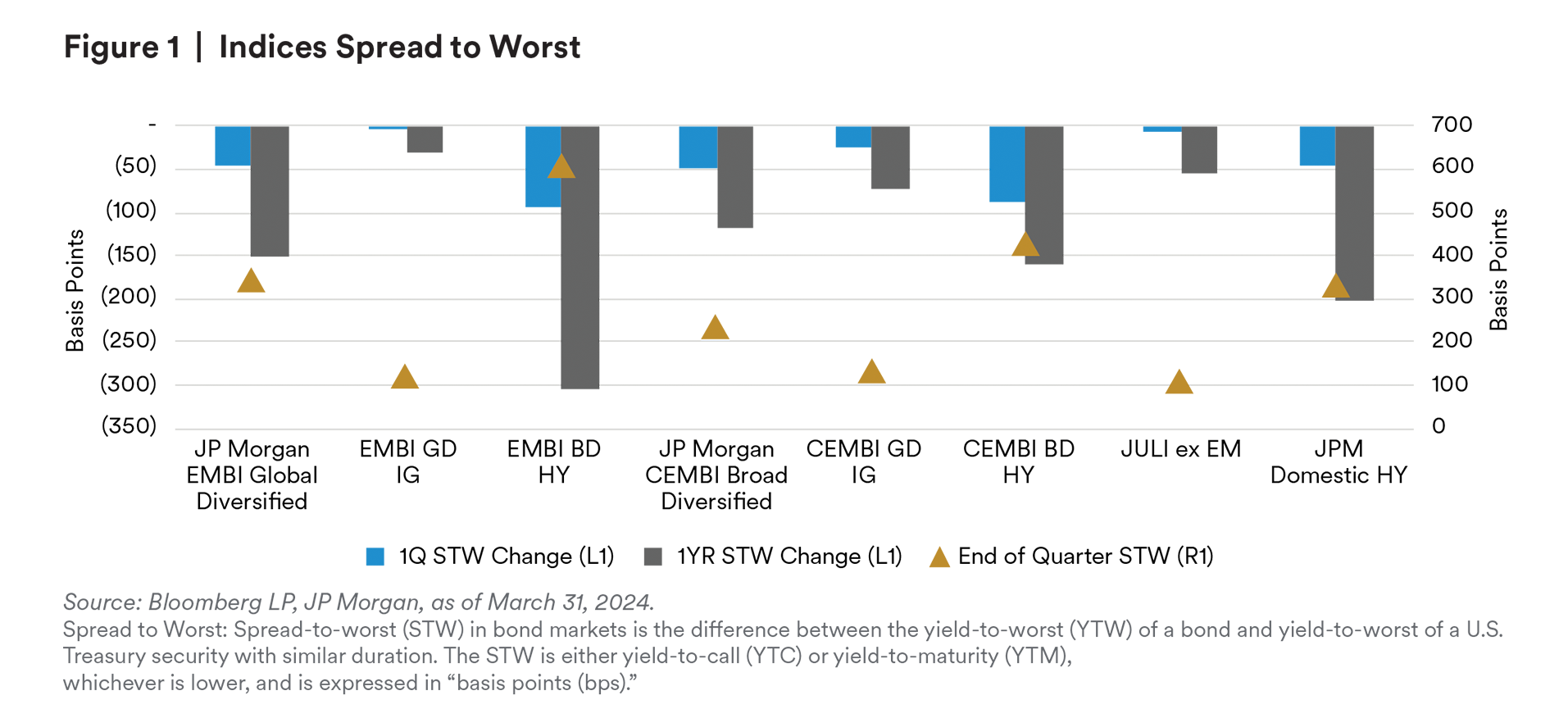

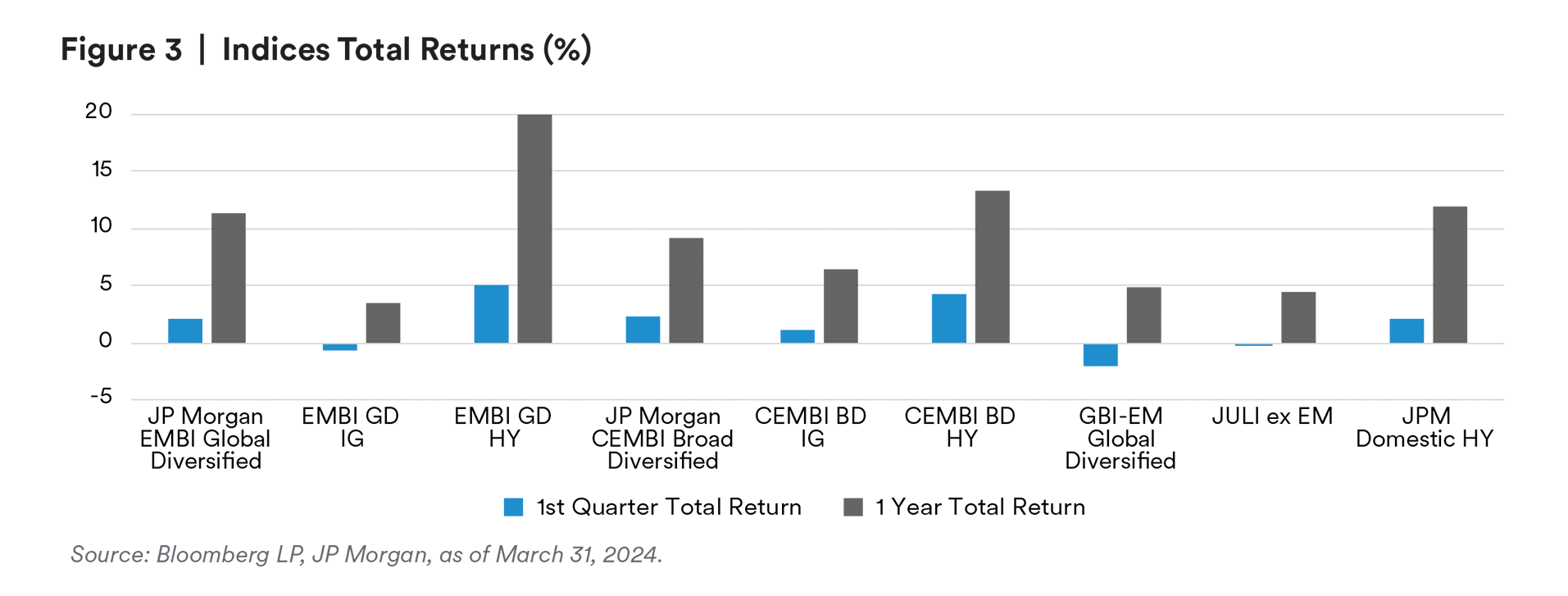

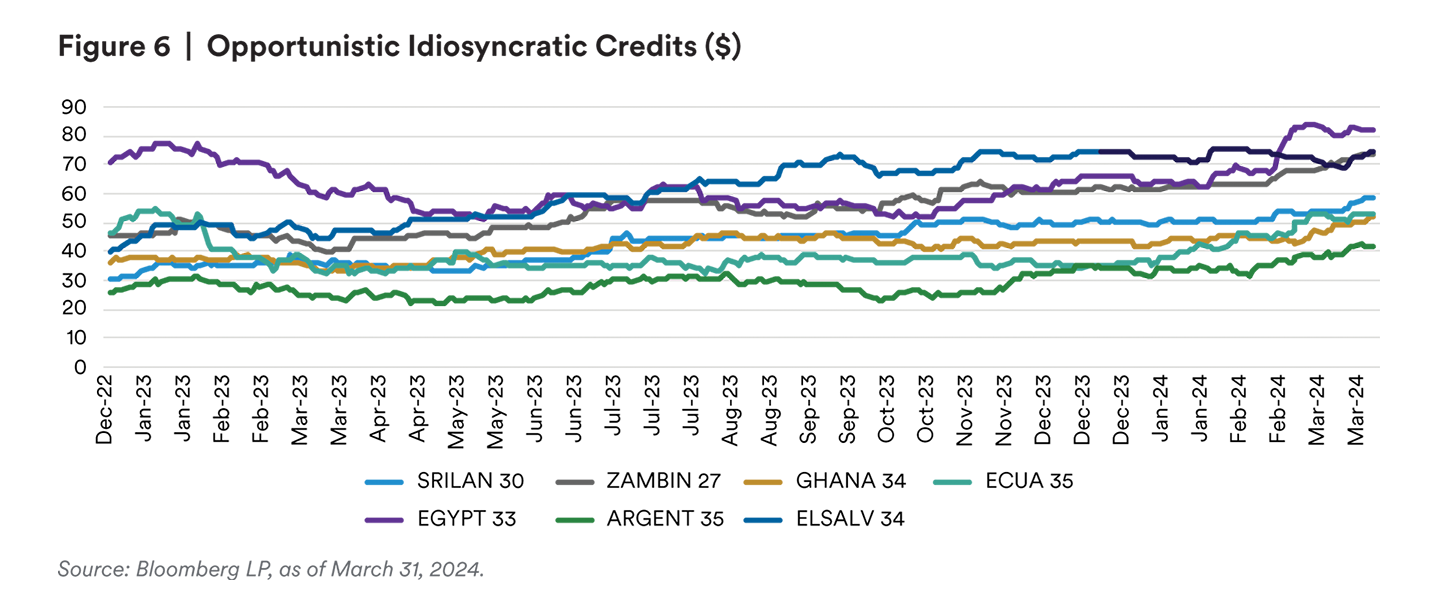

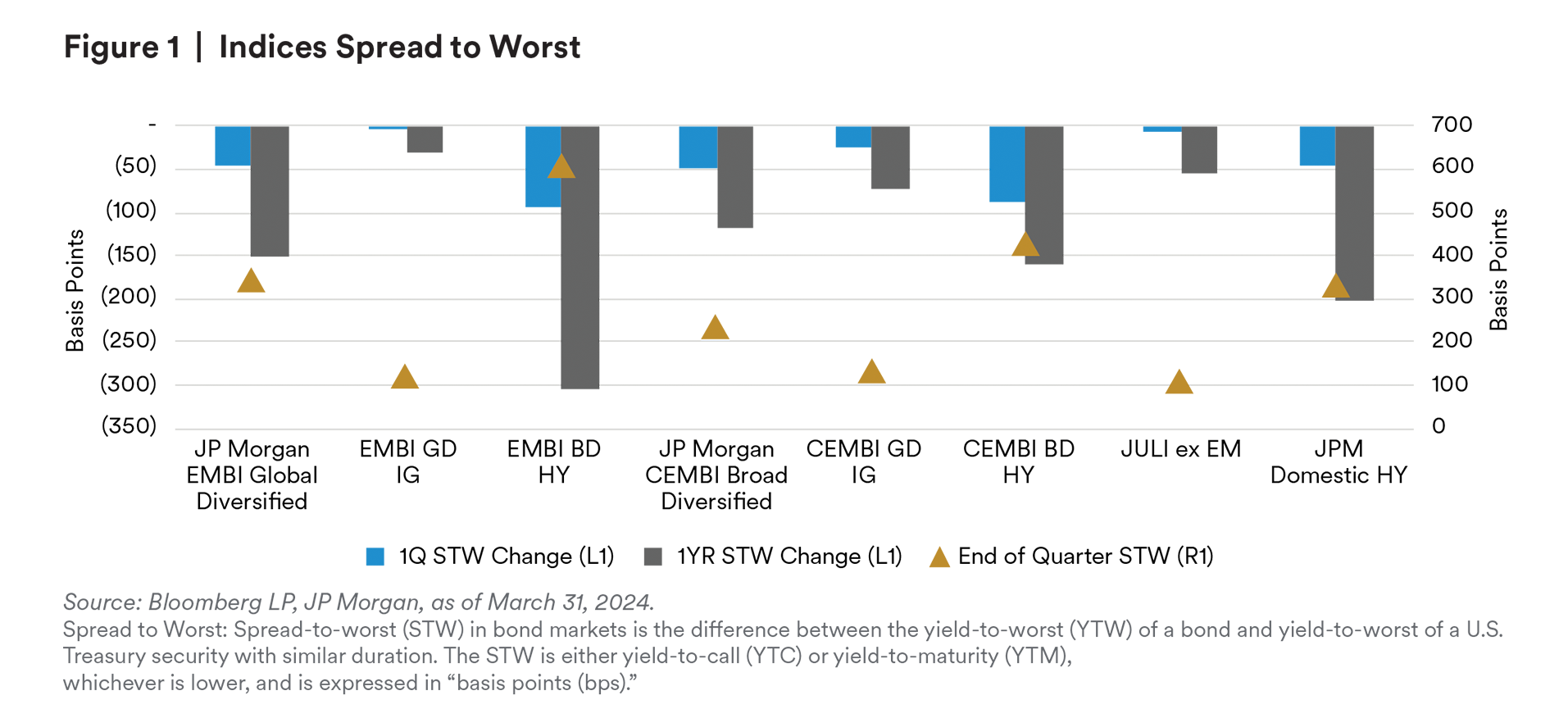

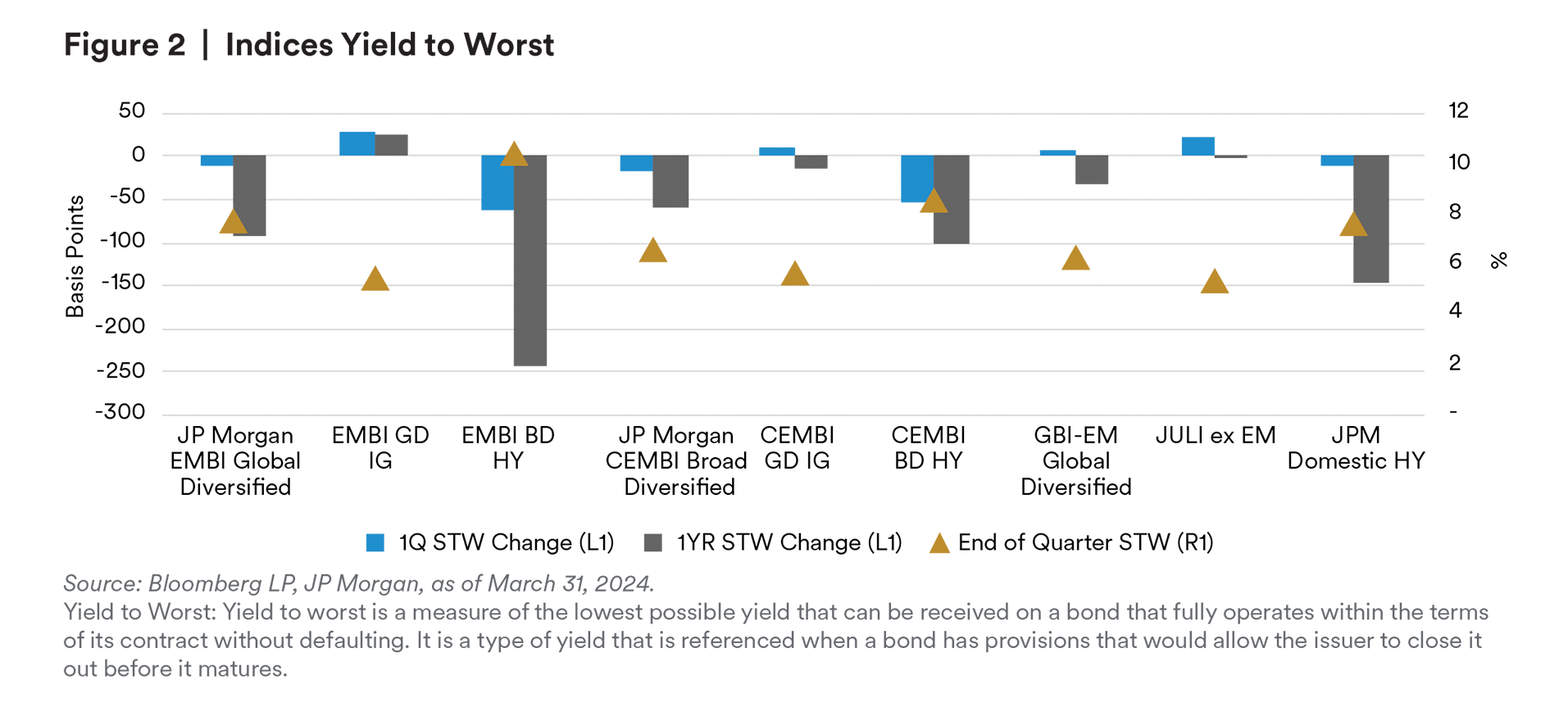

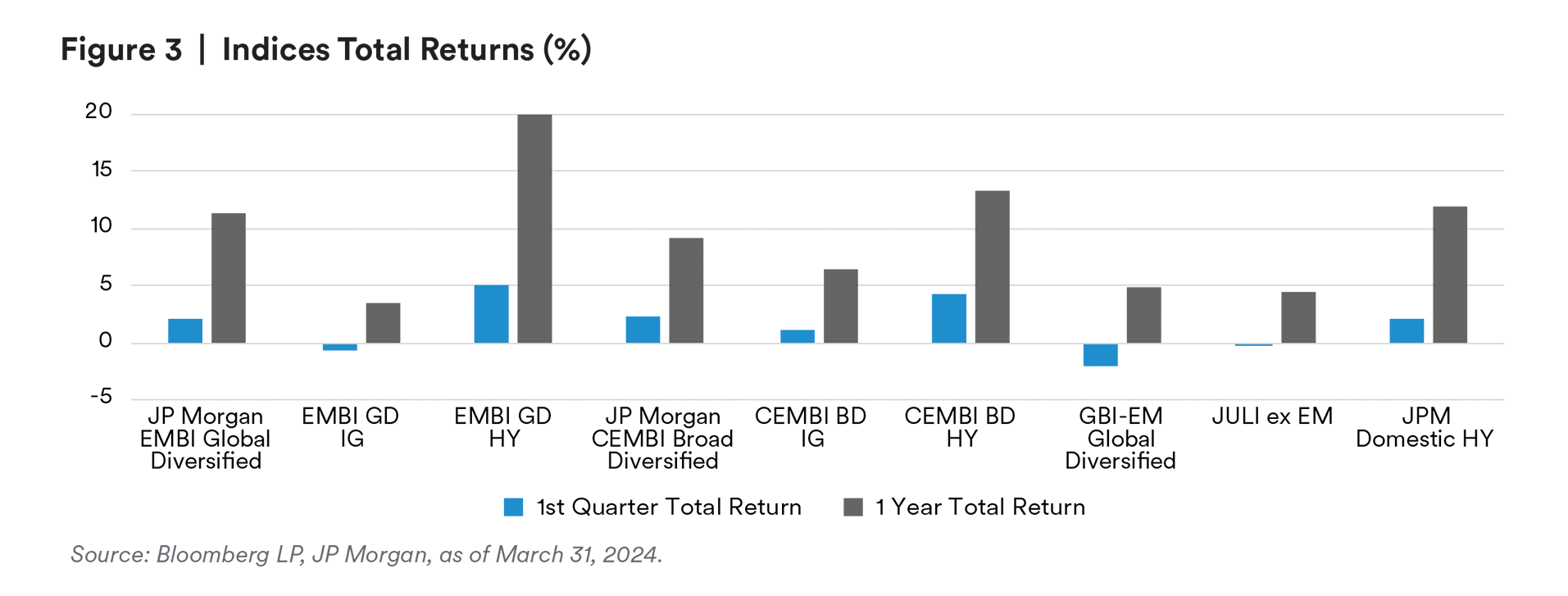

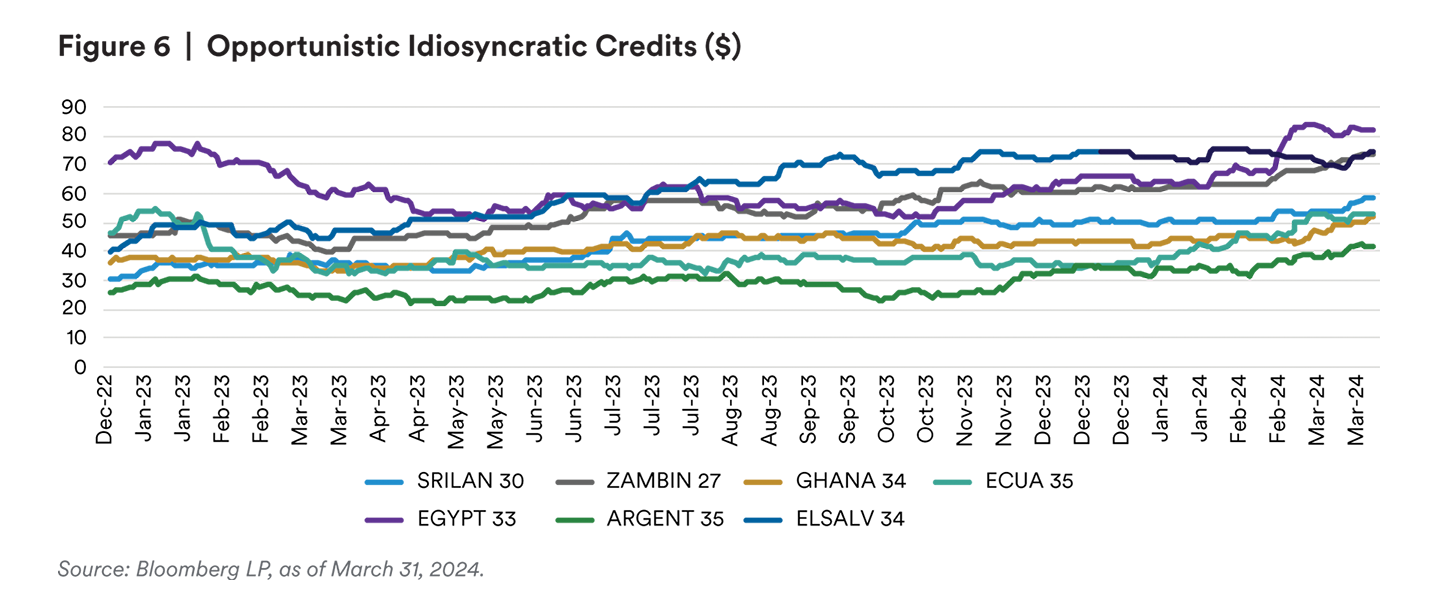

EM saw spread compression across both Investment Grade (IG) and High Yield (HY) assets as investors sought out attractive yield opportunities and technicals remained supportive. HY sovereigns outperformed as investors gained confidence in turnaround stories within idiosyncratic high beta countries. African sovereigns in aggregate returned +6.6% during first quarter (Q1), with Zambia, Pakistan, Lebanon, Ghana, and Egypt witnessing double digit returns, supported by positive progress with the IMF and access to capital markets4. Additionally, repeat defaulters Ecuador and Argentina were top performers as the governments stepped up policy reforms after bringing in new cabinet members post-elections.

Alternatively, IG sovereigns were mildly weighed down by primary deals and rising rates, despite being largely well absorbed and coming with modest concessions.

EM corporates were less preferred relative to sovereigns during the quarter as investors desired to keep more liquidity within portfolios. Despite this, negative net supply and less duration sensitivity helped spreads stay well supported. Corporate credit headlines were relatively benign after a difficult fourth quarter, and high yield assets were able to benefit from risk sentiment. The one outlier to this was WOM in Chile, where the telecom company failed to refinance short term maturities and witnessed multiple downgrades due to growing pressure on the company’s liquidity. This series of events ultimately led to the company filing for Chapter 11 bankruptcy protection just after quarter end.

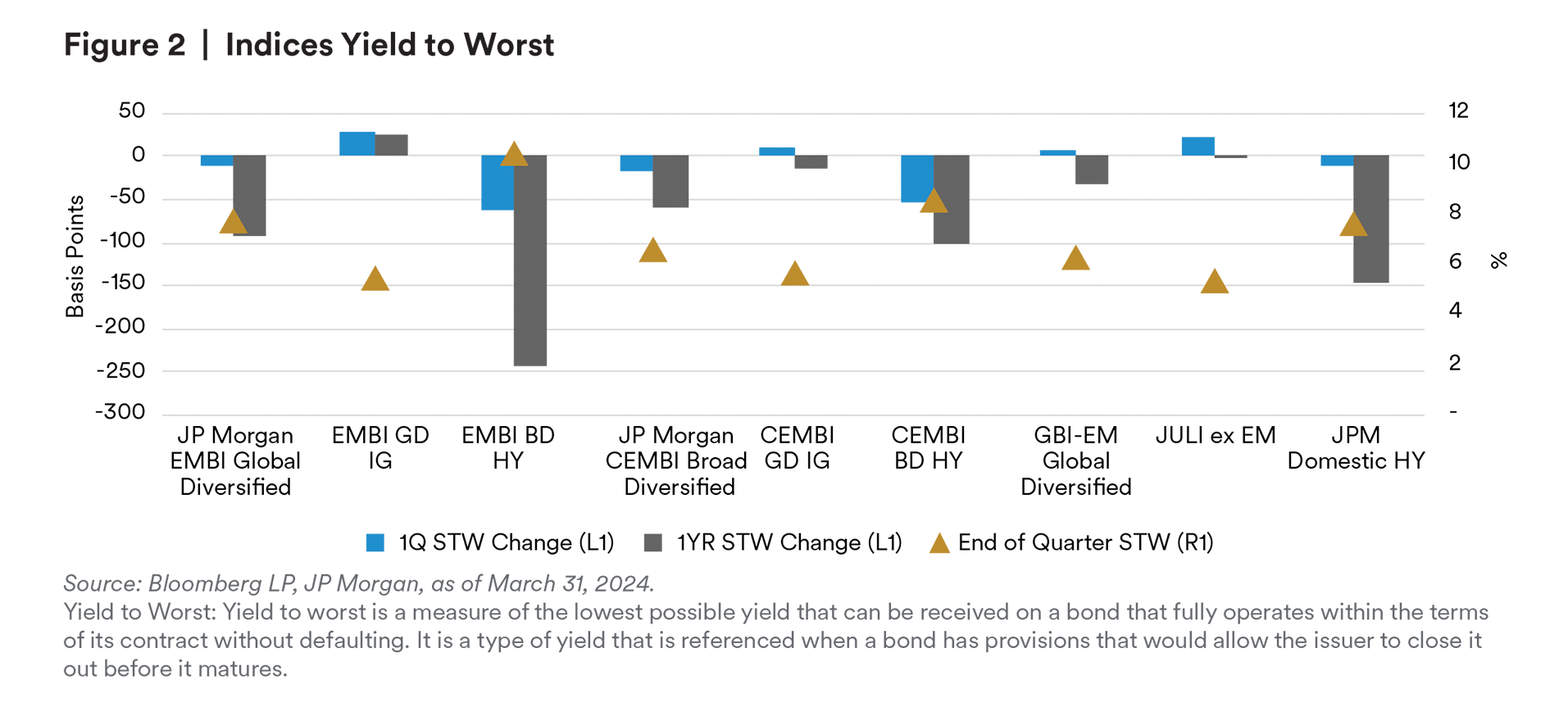

Local currency assets underperformed while the higher for longer stance prevailed. Resiliency of US data and therefore a stronger US dollar pressured performance of EM local assets. Into quarter end, there had been some support step in from investors as valuations look attractive relative to hard currency assets.

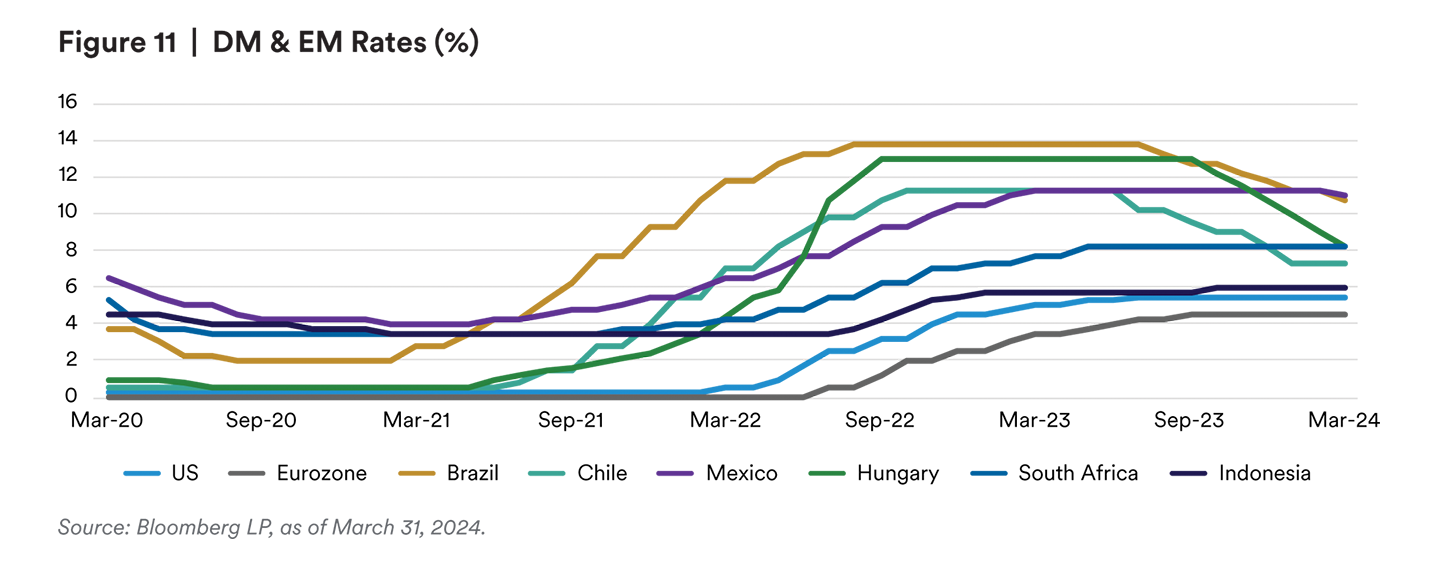

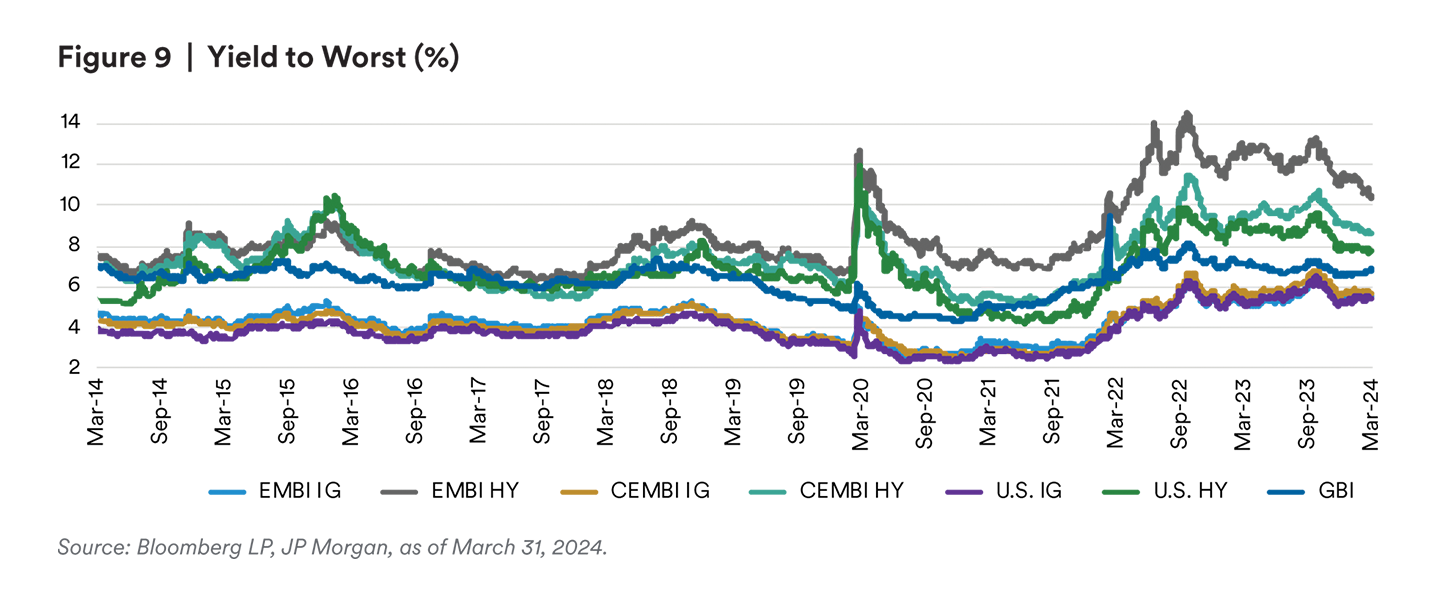

While EM inflation has been steadily receding, EM bond yields have not moved accordingly therefore leaving us with the highest real yield levels seen since 2009. The Mexican peso outperformed in Q15 as attractive yields, supportive growth, lower volatility, and more liquidity made it a favorable place for investors to deploy cash.

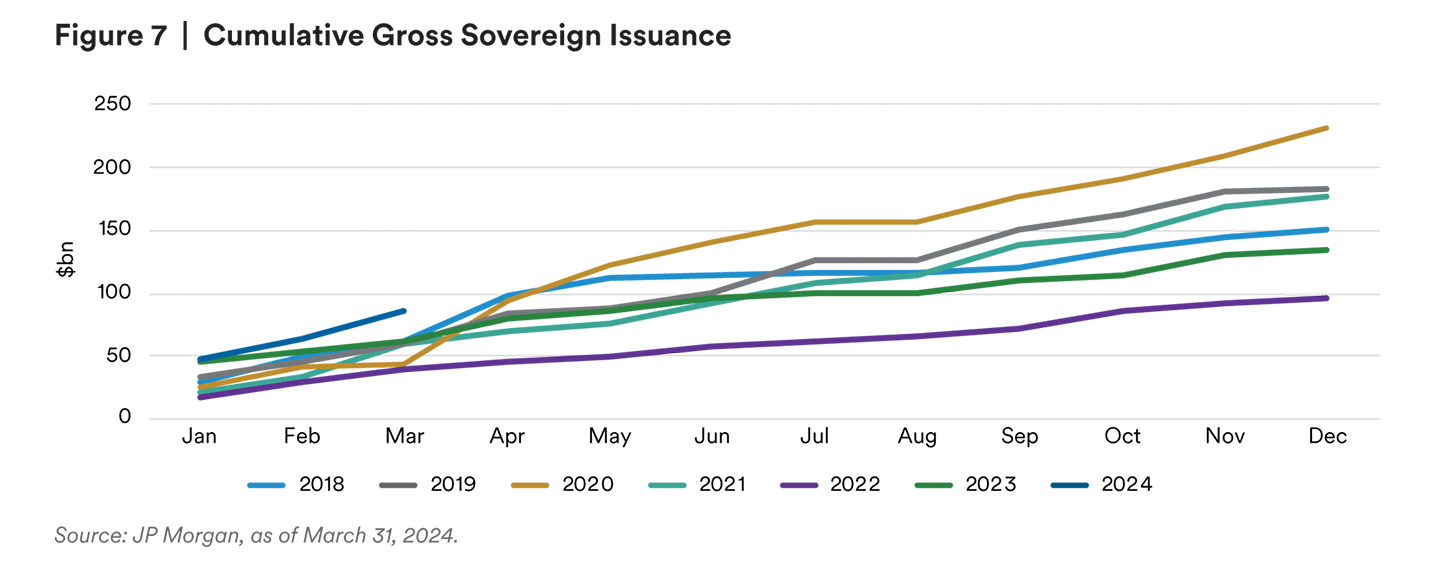

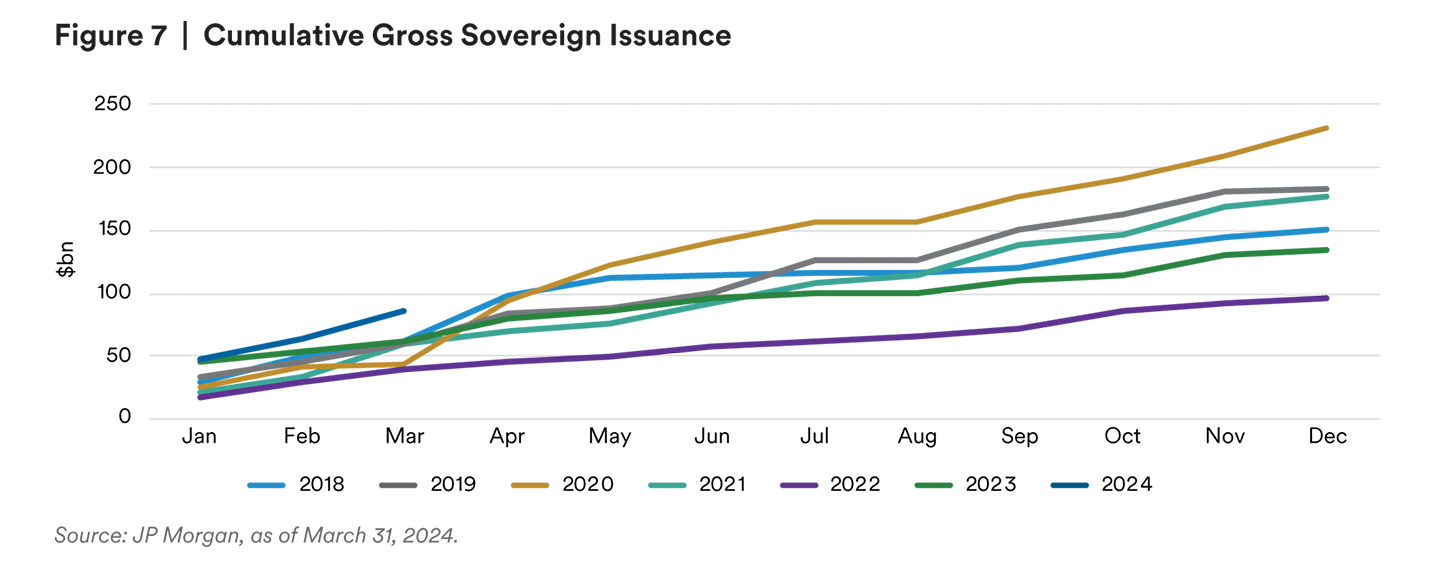

Issuance surpassed expectations in Q1, most notably within BBB sovereign issuers. Sovereign issuance was the highest on record for a first quarter ($85.6 billion), as investors used the firm market and bursts of rate rallies to come to the primary market. While 78% of sovereign issuance was from IG issuers, higher beta issuers have also been able to access the markets with reasonable concessions, therefore easing liquidity concerns. Sovereign issuance has surpassed 50% of projected gross issuance and represents over 75% of projected net issuance. Corporate issuance of $110 billion represents almost half of expected total issuance for 2024. While volumes remained below the 5-year average of $120 billion for Q1, this did represent a 50% increase year-over-year, and signified the highest issuance in the last 10 quarters6.

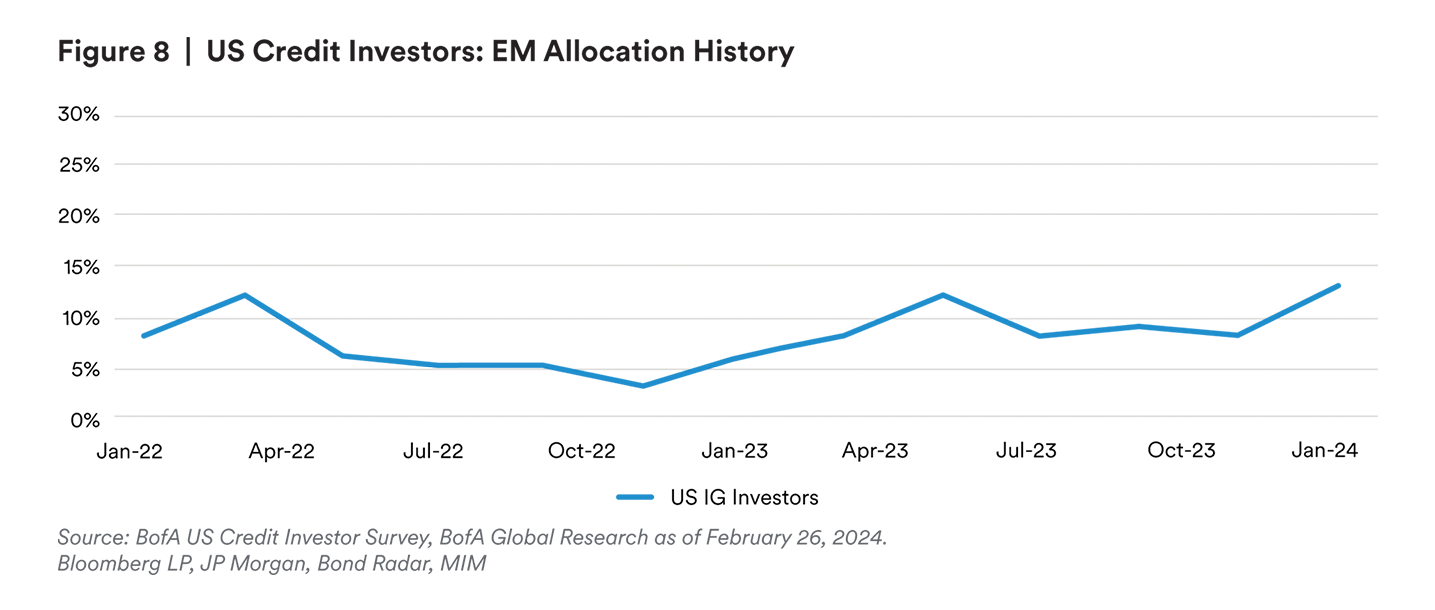

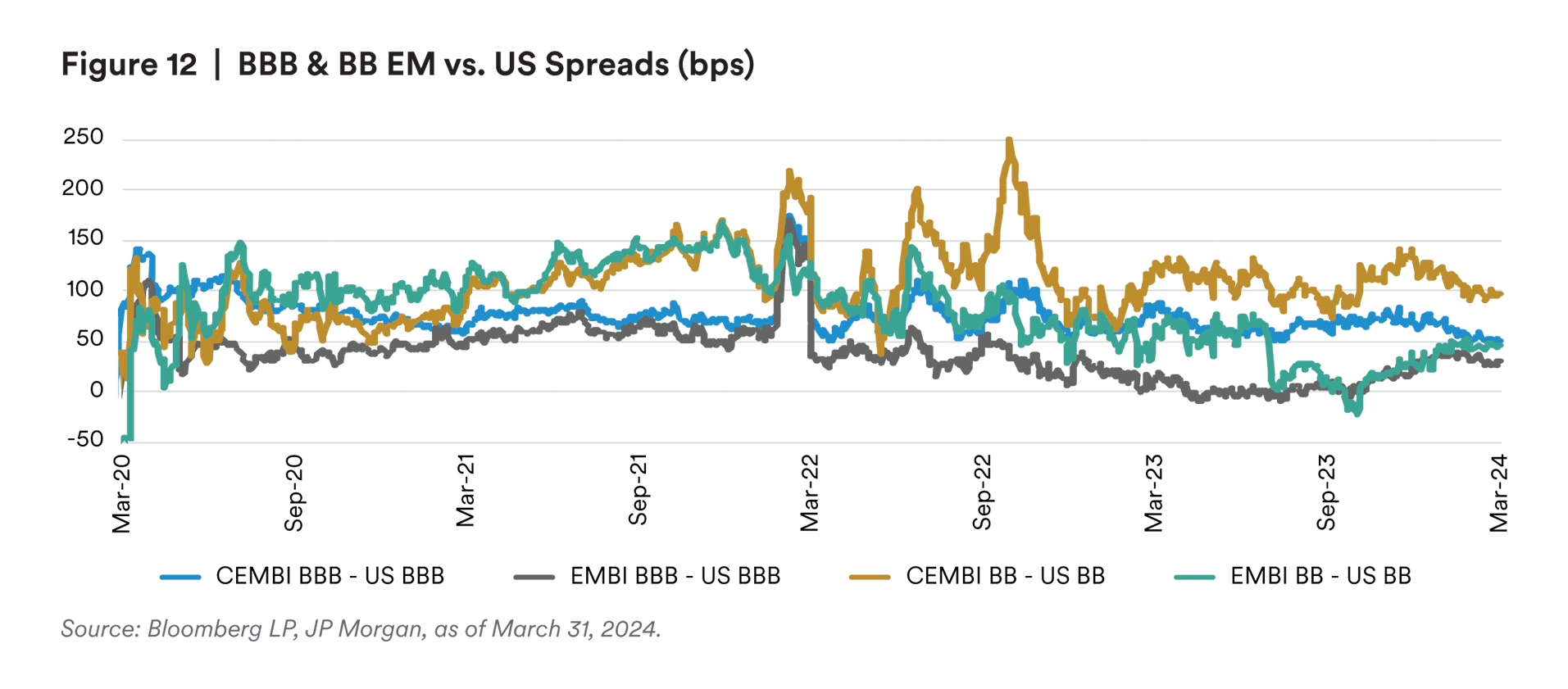

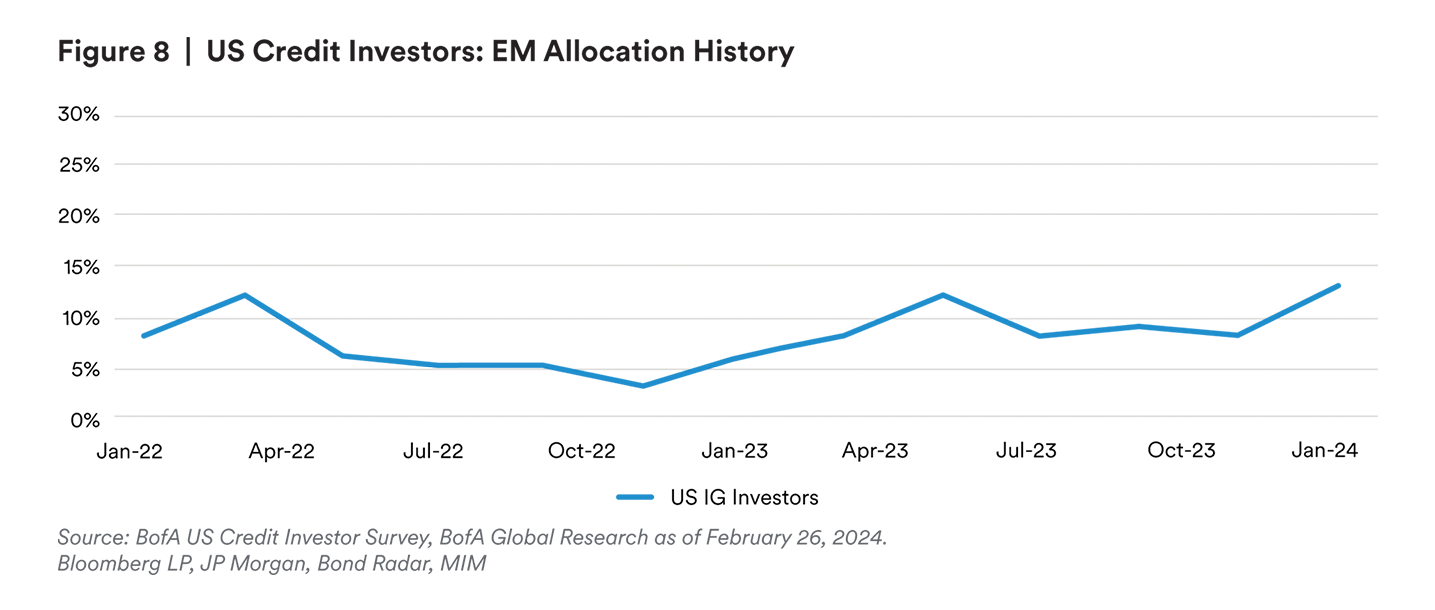

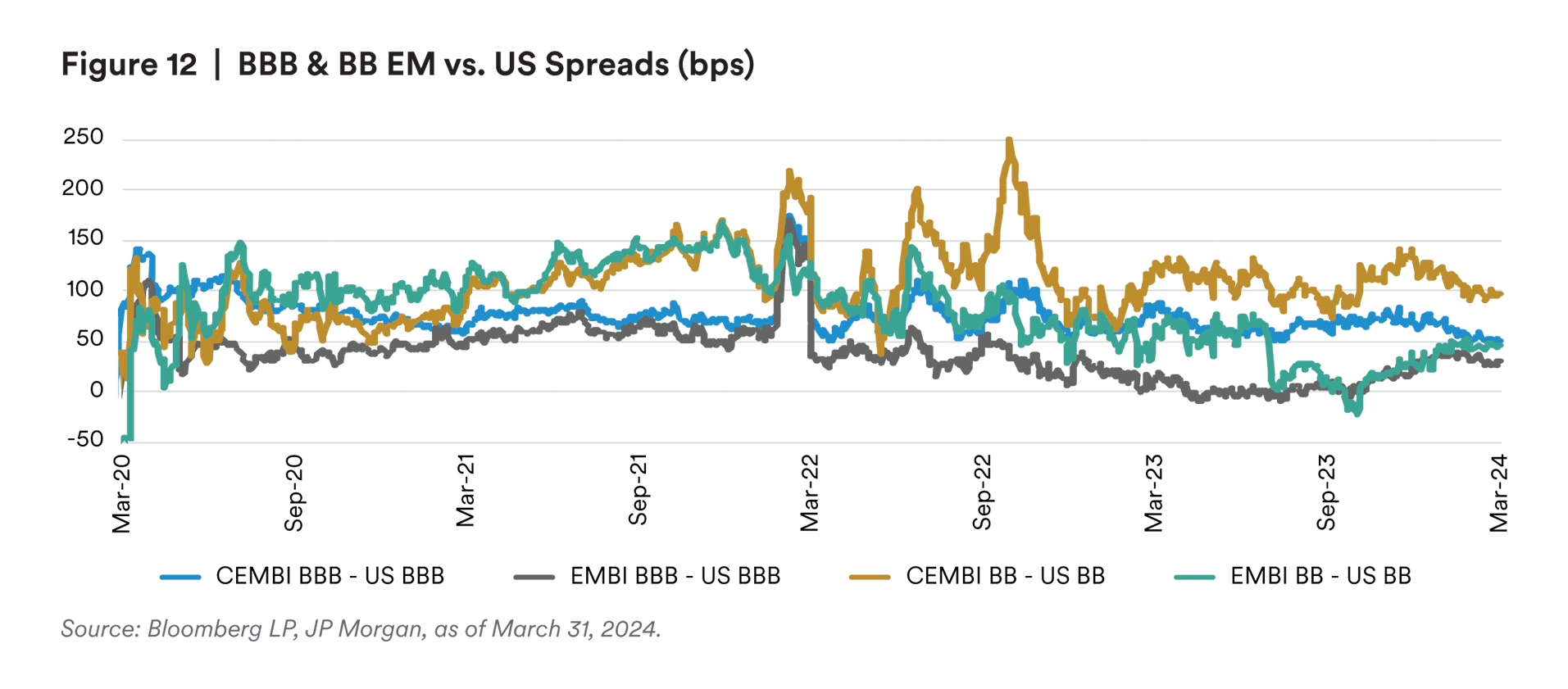

EM continued to see outflows from ETFs, with AUM of the seven major EM credit ETFs down 25% from their all-time highs7. However, non-dedicated interest in the asset class has reemerged since the beginning of the year, supported by the heavy burst of attractive primary issuance. Crossover investors have the most EM exposure seen in the last 3 years, as valuations relative to DM comparable credits have once again sparked interest.

Outlook

We are constructive on EM fundamentals and while yields at current levels are attractive, we recognize that EM spreads are tight relative to historical index levels. The macro picture is pointing towards a favorable backdrop with US inflation showing signs of slowing and some positive economic data out of China pointing in the right direction; however, EM remains vulnerable to backups from geopolitical headwinds. While China-US trade tensions remain in the spotlight, “friendshoring” has been supportive for other EM economies including India, Mexico, South Korea, and Taiwan, where US goods deficits have risen to a record high.

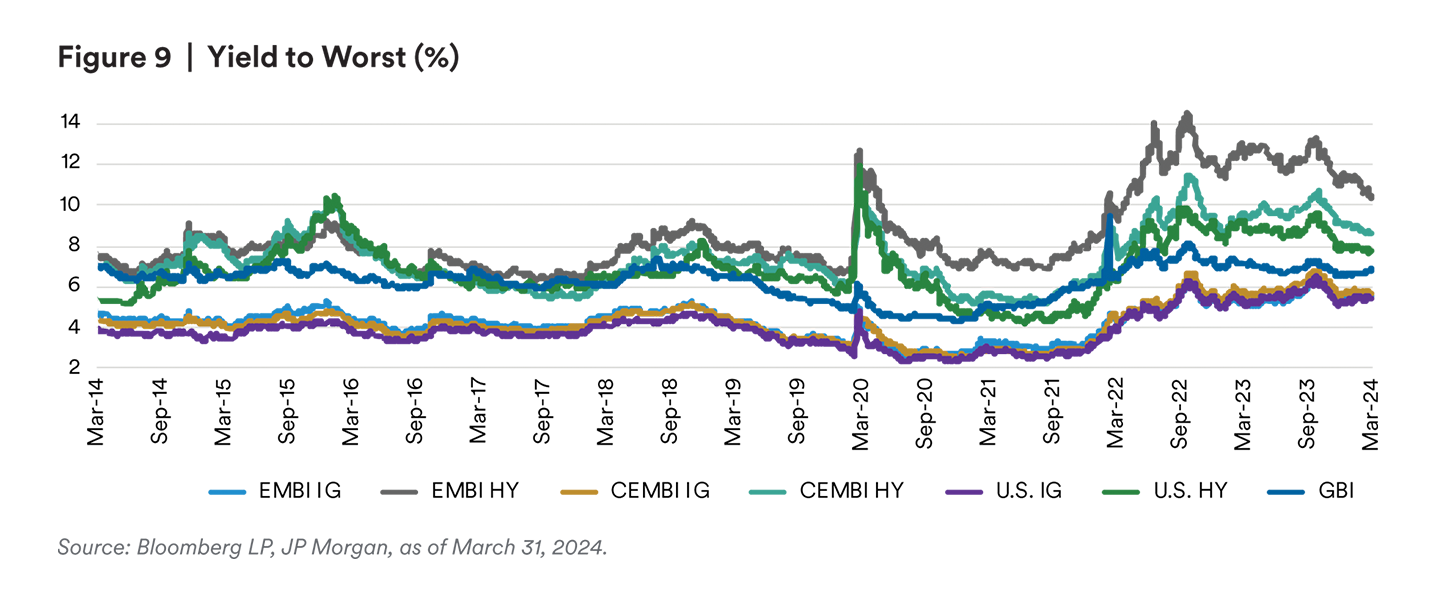

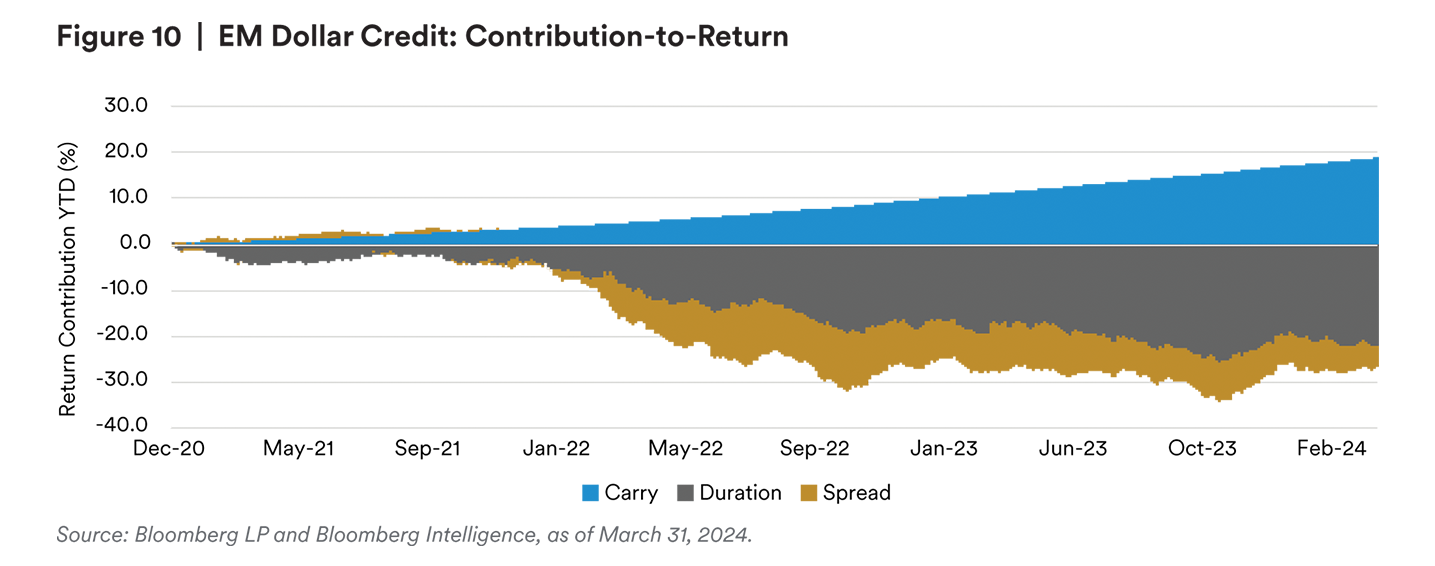

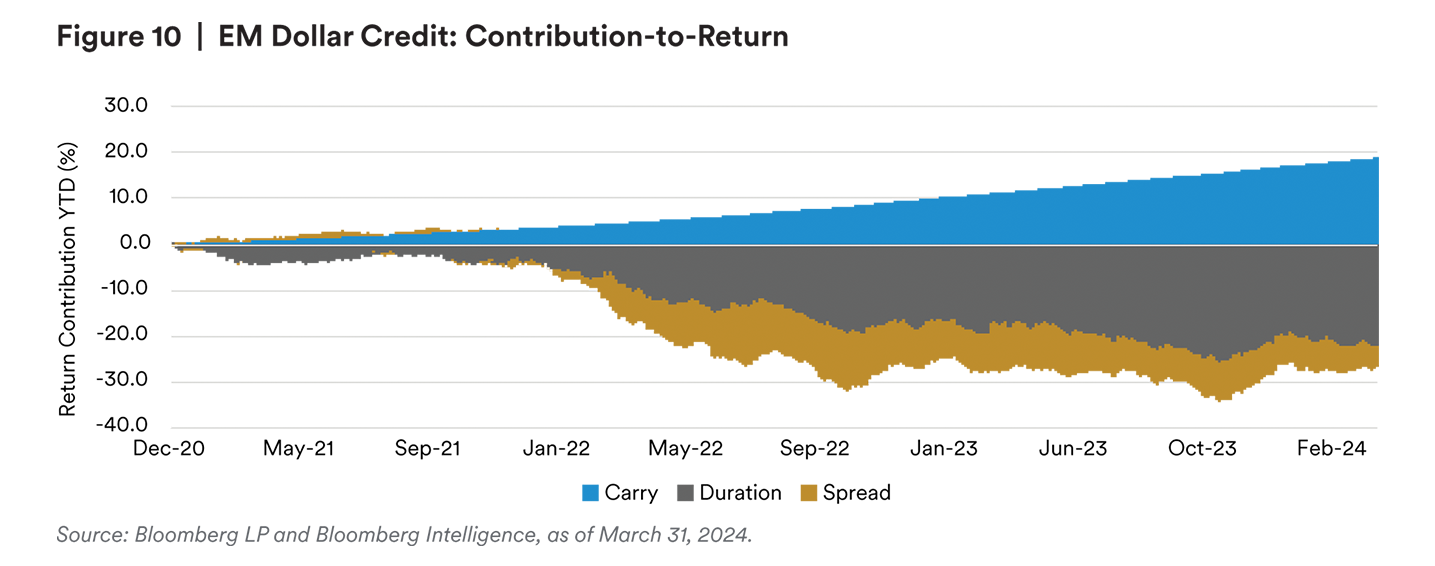

Coupled with this, we see EM opportunities for differentiation at both the sovereign and corporate levels which could lead to a better flow picture for the asset class. Net issuance continues to be subdued, principal and interest payments remain high, and non-dedicated investors have begun putting money back into the asset class, supporting demand and subsequently positive price reactions. With the belief that the hiking cycle is over, EM provides investors the ability to gain exposure to the combination of both yield and duration outside of Developed Markets (DM). This allows for interest rate exposure closer to the IG market while receiving income closer to the HY opportunity set. While duration has been a drag on EM performance YTD, the carry and spread the asset class provides has more than offset it. The aggressive spread tightening that we have seen within idiosyncratic, higher beta sovereigns has provided a supportive tailwind to EM. We expect for duration to positively contribute by year end if rates begin to come down, in addition to the support from coupon income, which is elevated relative to historical returns.

Going into this year’s election cycle, the market did not expect any shakeups from EM governments. Thus far, this has played out as expected, with none of the elections and subsequent political changes affecting the economic impact of these countries. Still upcoming in this heavy election year, our eyes are on Panama and South Africa in May and Mexico in June. Panama’s election has a wide range of potential outcomes, from a more fiscally conservative candidate to an extreme socialist candidate. This comes at a time where the country is on the brink of a downgrade to high yield and is facing fiscal stress from a lack of revenues due to the closure of the copper mine. South Africa’s national election could see the ANC party go below 50% wherein they need a coalition to form a government for the first time since Nelson Mandela formed the party. Mexico’s election is pointing towards the ruling party winning and therefore a continuation of current policy; however, with AMLO not running for a second term, we are guaranteed to have a new president in office. The most important election this year will be the US presidential election in November. This election will impact many facets of the geopolitical and financial world given the linkages of the US to every economy across the planet. We expect more noise as we get closer to the election, as the outcome will most likely be very binary.

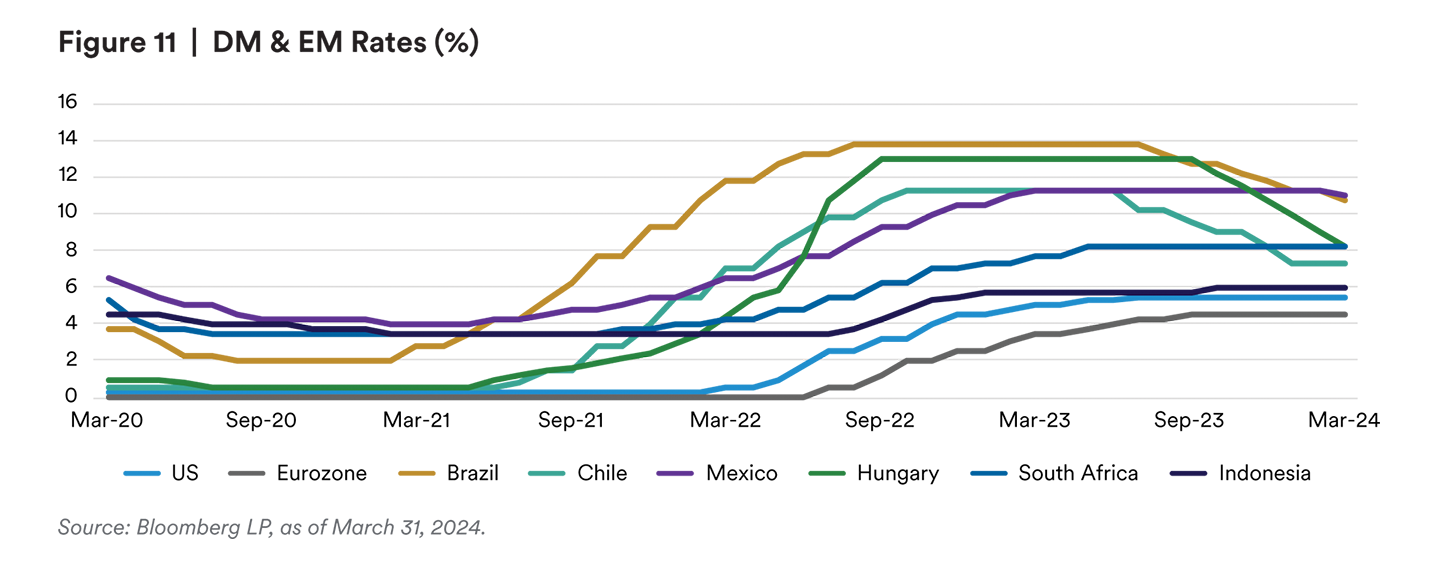

With inflation rampant post the outbreak of the COVID-19 pandemic, we saw EM central banks quickly respond by hiking interest rates throughout 2021. DM countries were reluctant to follow, but were aggressive when they started, with the first US rate increase in March 2022 and the ECB following in July 2022. For the better part of 2023, most of the globe was unified in a “wait and see” environment. Governments assessed how their economies and subsequently inflation were responding to a world of higher rates. More recently, we have seen a divergence resurface, with EM countries including Brazil, Chile, Hungary and others cutting rates as their inflation rates converge towards target while the path for the Fed remains less clear. This divergence in rate markets as well as policy flexibility should keep EM spreads, specifically local rate markets, well behaved as rate volatility dampens throughout 2024. This environment will allow investors to capitalize on attractive real yields across the local space and provide more confidence going down into the more idiosyncratic hard currency stories.

In the sovereign space, given the recent rally in idiosyncratic high beta sovereigns, we have looked to take profit and redeploy capital into high conviction names upon any weakness. With the 10-year remaining above 4% and the potential for rate cuts later this year, we like low-BBB sovereigns in the 7-10 year part of the curve where all in yields screen attractive. Our preference is for countries who face low financing needs or have demonstrated ability to tap the market. The primary market has been a place where we look to opportunistically add exposure, notably within higher quality issuers where existing bonds trade fair.

We see opportunities in BB and BBB corporates, in sectors that generate hard currency revenues or have effective FX liability management. In the utility space, we see value in assets with consistent cashflows that have strong structures, especially within Latin America. Infrastructure projects in the Middle East are enticing, where we can get a pickup of ~100bps over comparable DM credits. Given the outperformance of IG corporates relative to sovereigns during the first quarter, security selection is critical in identify high conviction names where valuations remain attractive. We like convexity and dollar price protection where we can get it.

Local performance YTD has been underwhelming given resiliency of US data and a mildly stronger US dollar. However, we believe this has created a better entry point for adding duration in the local currency space given valuations. These recent conditions have provided attractive opportunities in some high yielding markets such as Colombia, Mexico, and Brazil. The compelling real rate environment in Latin America is most enticing, while Europe is valued more fairly, while Asian local yields are overall lower and therefore less compelling. We use local exposure as a liquid way of expressing views on risk in the market, and give ourselves room to put money to work as opportunities present themselves.

Endnotes

1 Bloomberg LP

2 Bloomberg LP

3 Bloomberg LP

4 JP Morgan

5 JP Morgan

6 Data in this paragraph sourced from JP Morgan

7 Bloomberg LP

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan prior written approval. Copyright 2024, J.P. Morgan Chase $ Co.

All rights reserved.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered 8th Floor, 1 Angel Lane, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined in the UK under the retained EU law version of the Markets in Financial Instruments Directive (2014/65/EU).

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102- 0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/ third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited.