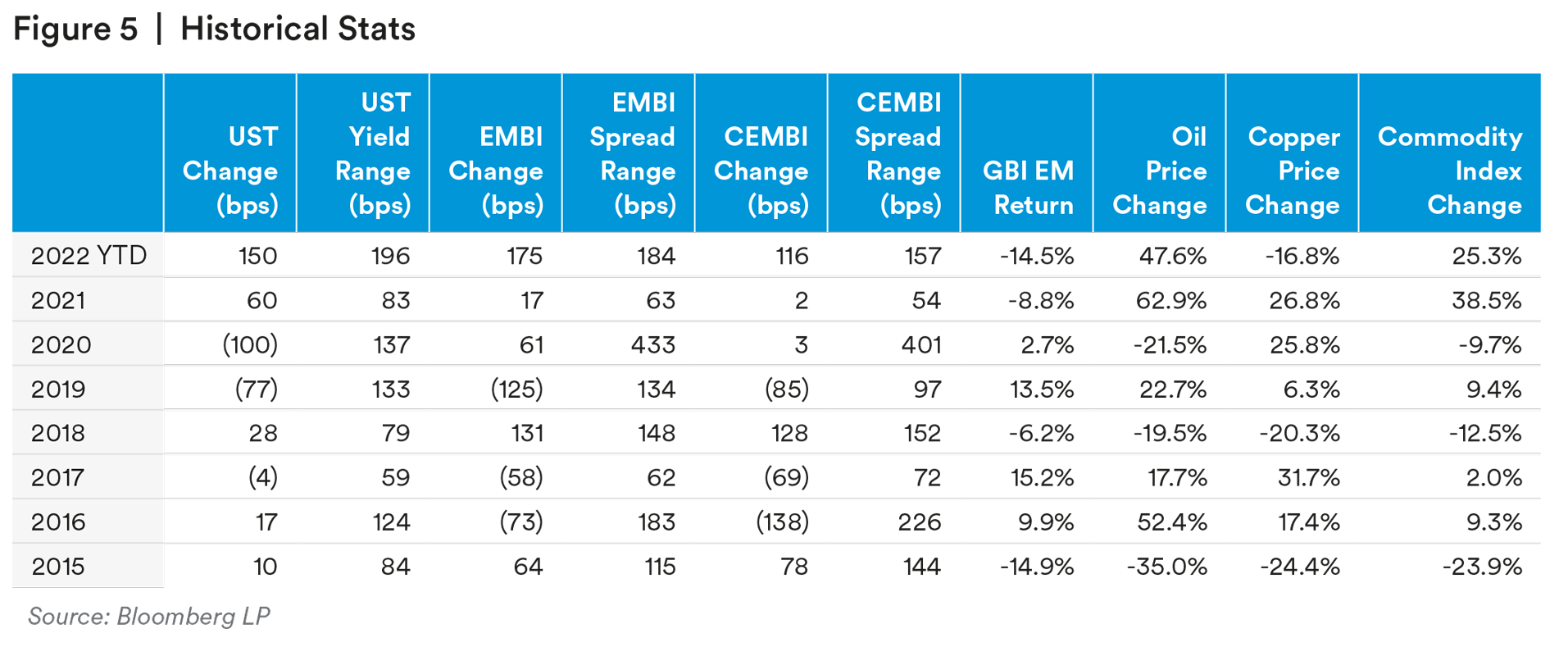

There was no shortage of global market volatility during the second quarter, with Emerging Markets (EM) vulnerable to much of the weakness. Inflation concerns dominated the first part of the quarter with recession concerns adding to the mix as the quarter progressed. Nothing highlighted the shift in sentiment more than the 10-year treasury yield which peaked in mid-June at 3.47% only to close the quarter at 3.01% as the recession worries began to overwhelm the long end of the curve.

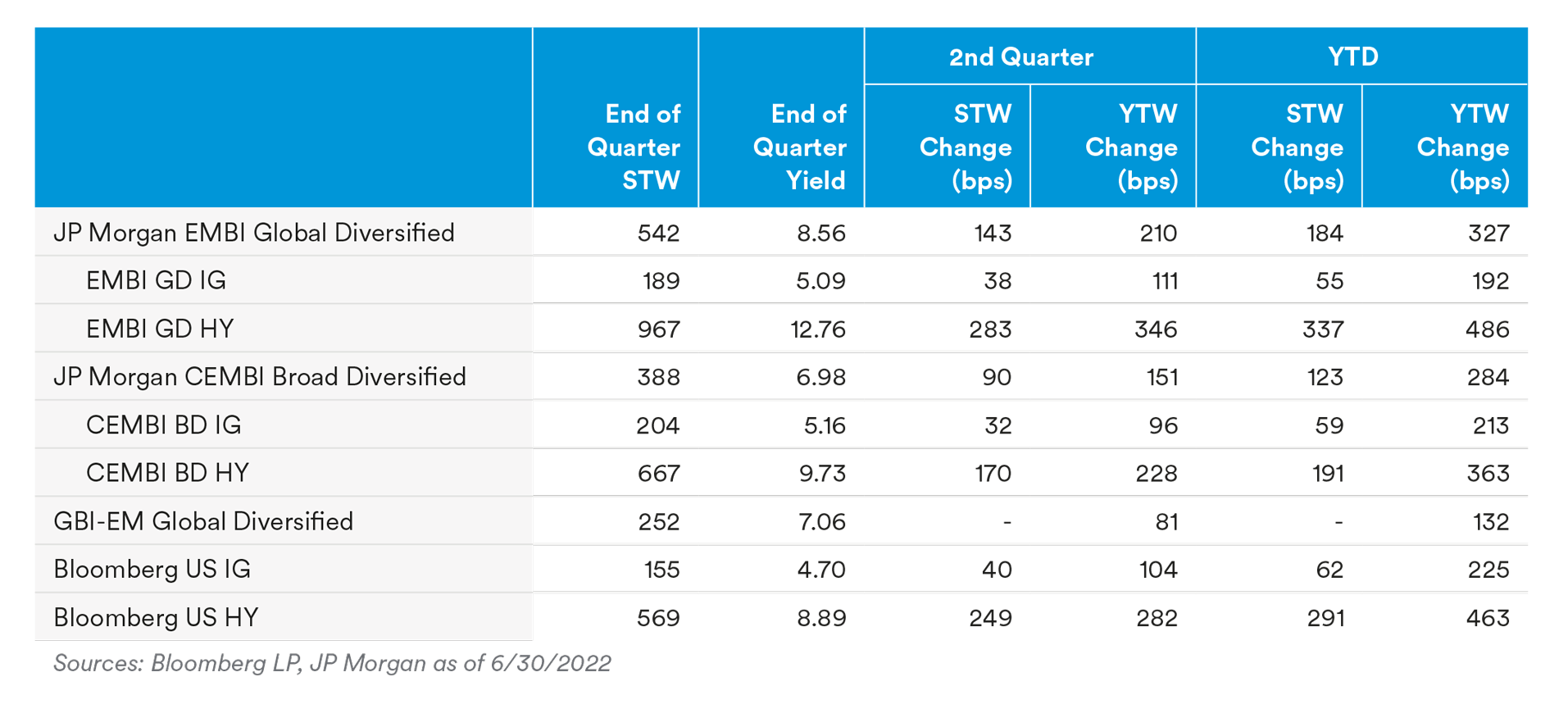

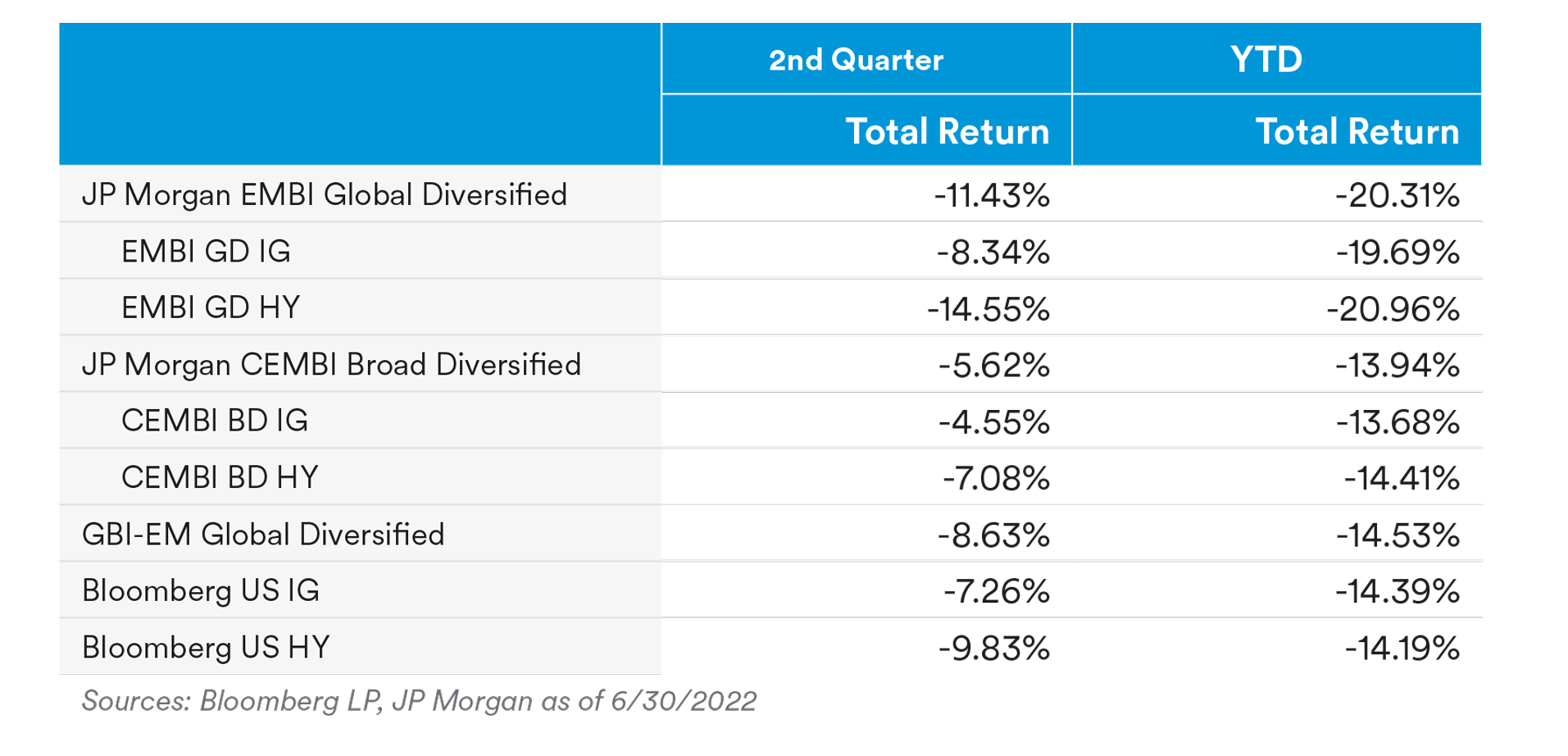

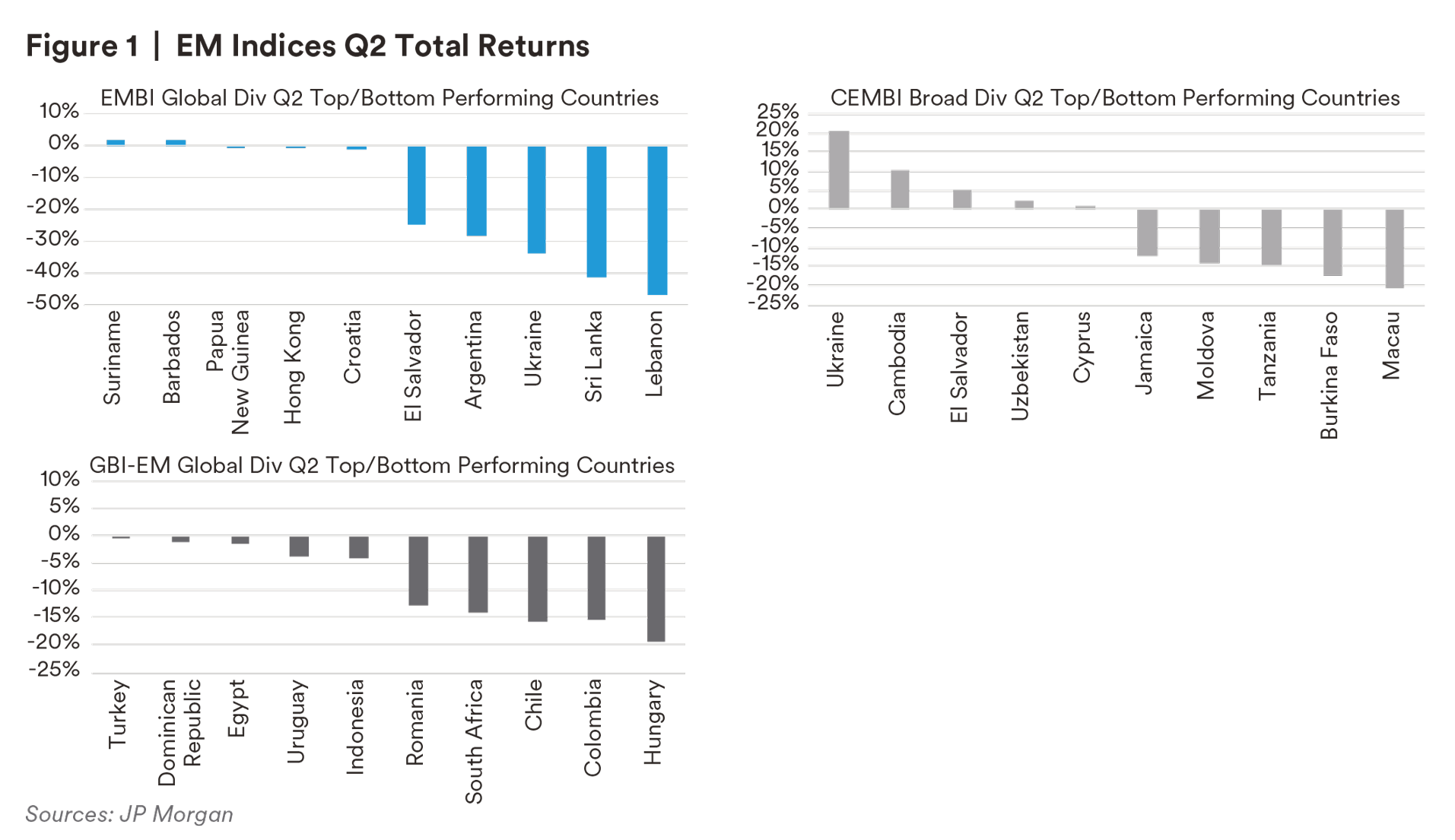

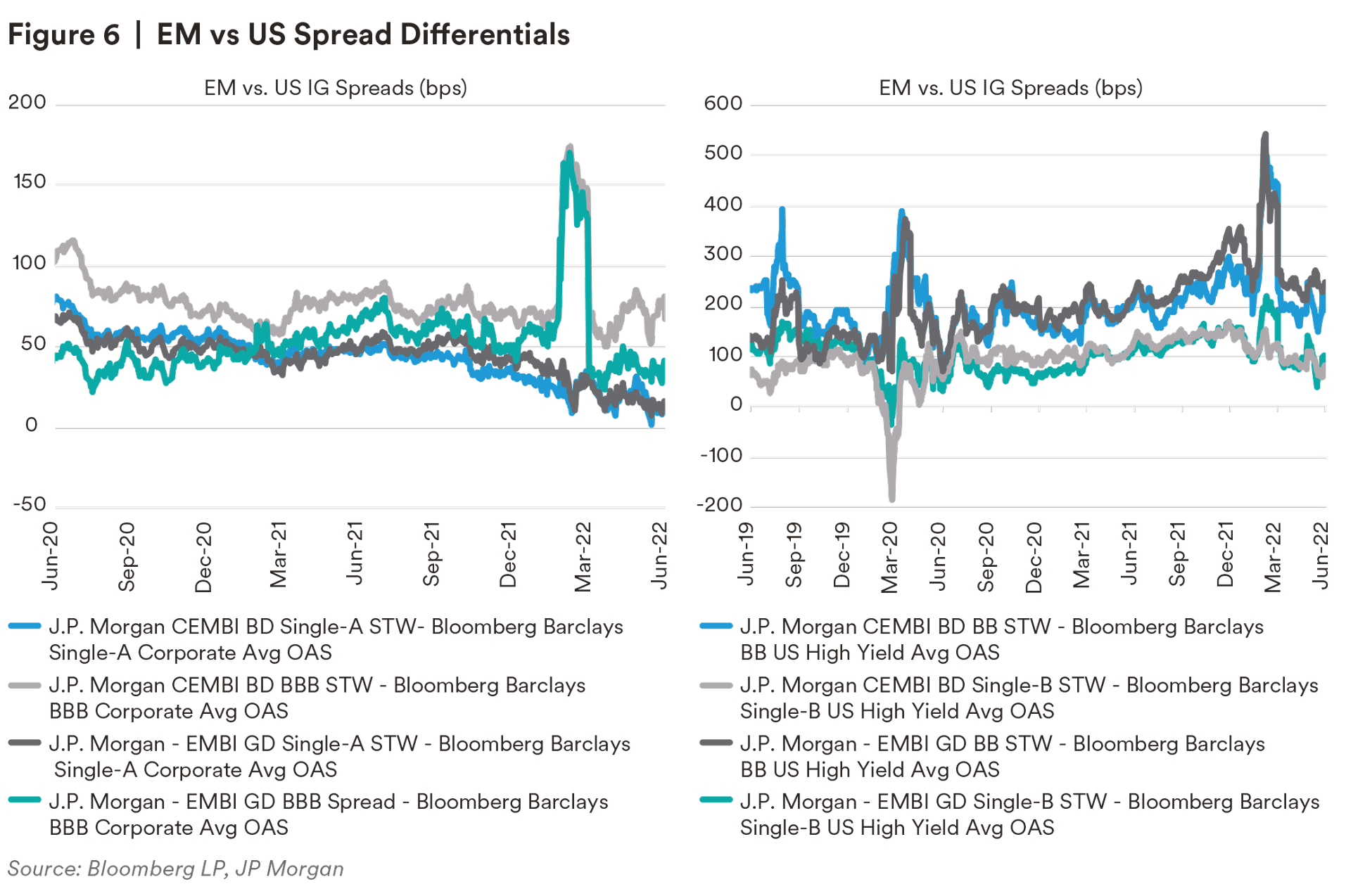

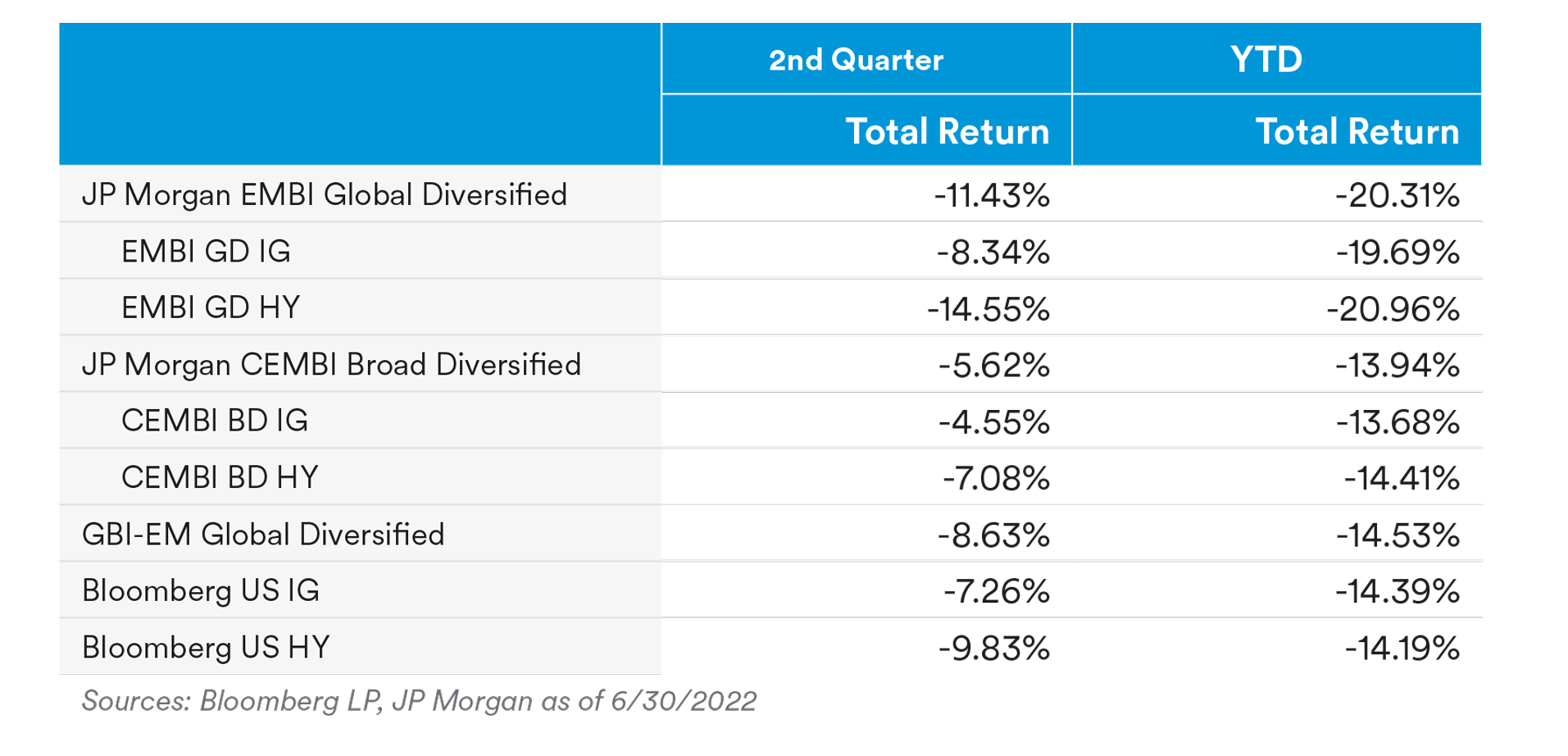

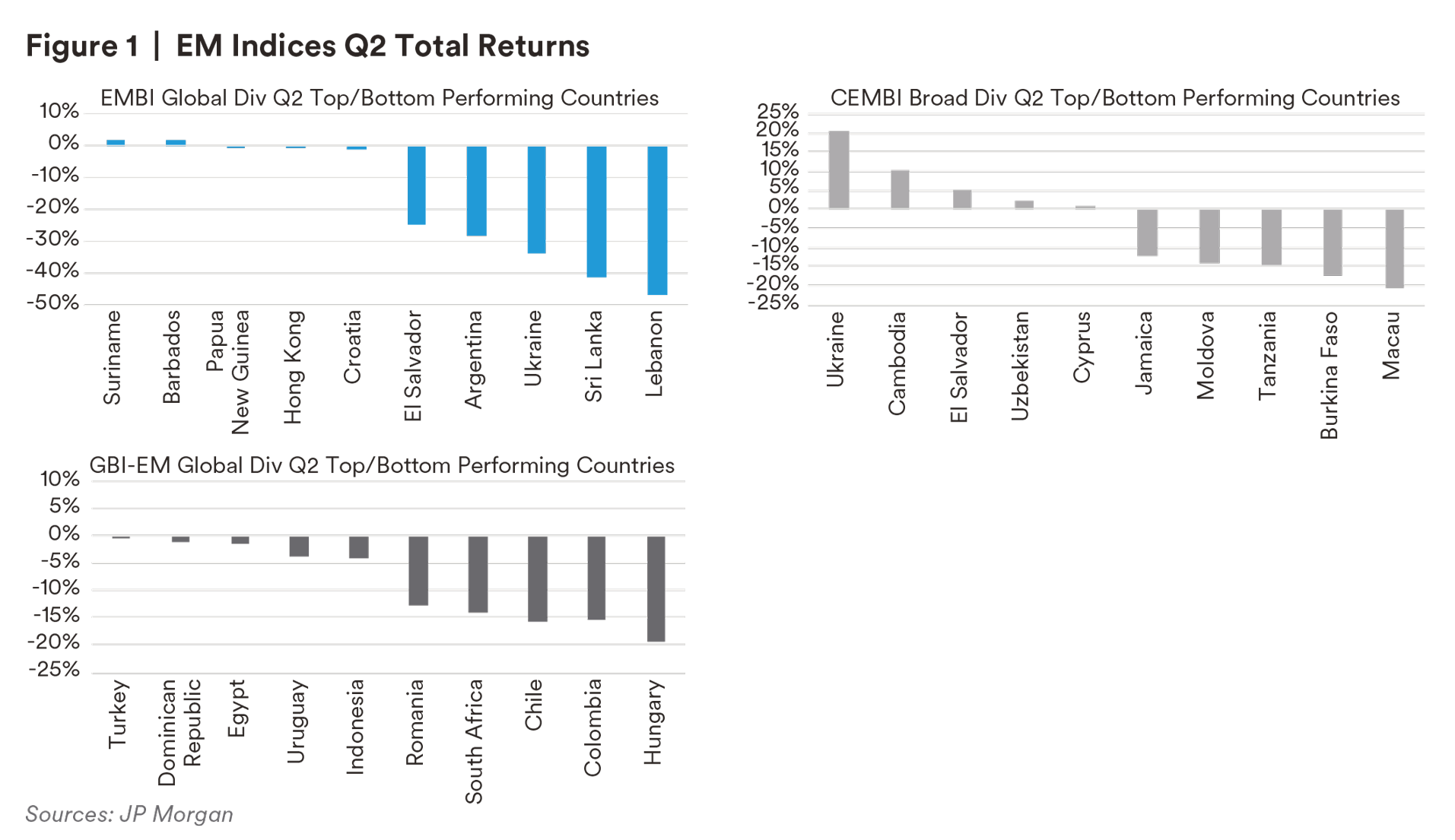

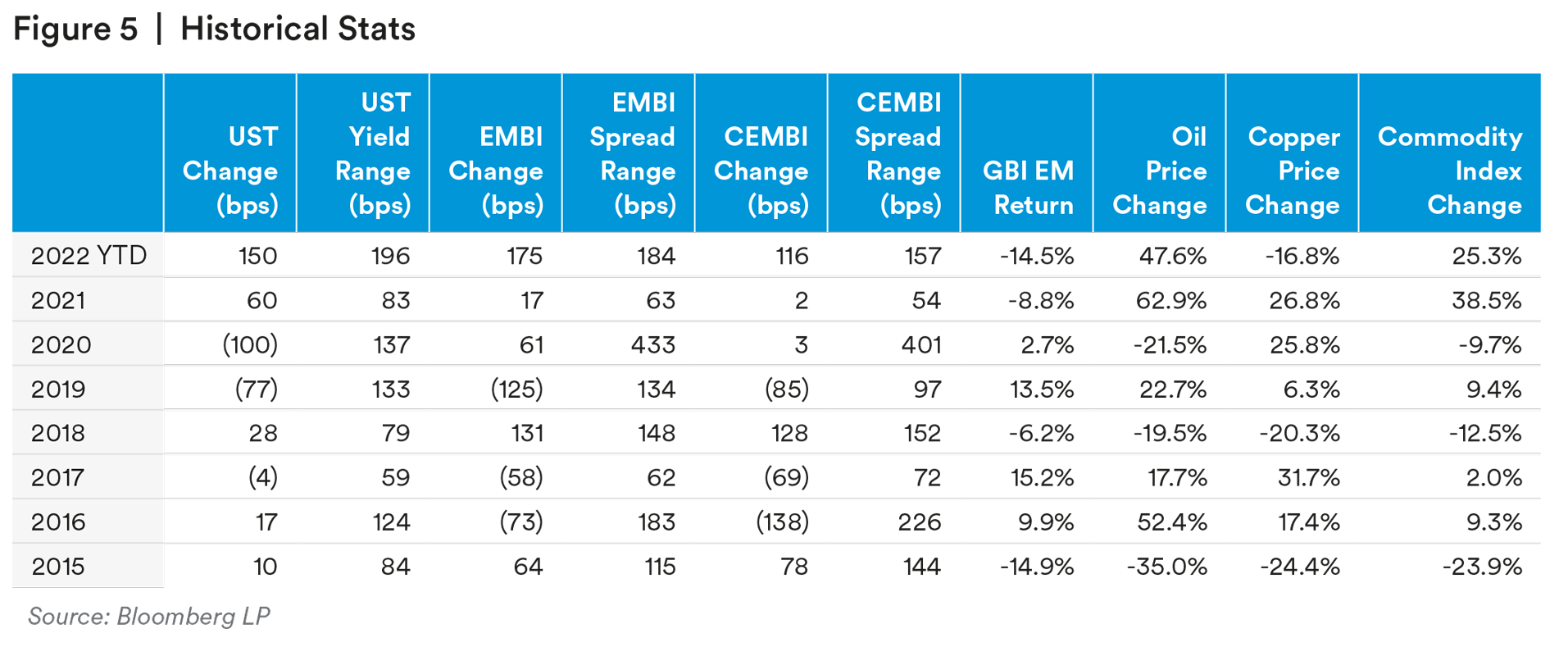

EM hard currency indices had their worst first half in decades as idiosyncratic stories coupled with global inflation concerns and a pivot to recession fears dampened investor confidence. The asset class witnessed aggressive outflows, historically low new issuance, a lack of liquidity, and heavy quarter-end repositioning which weighed on returns. High yield sovereigns faced the largest sell-off during the quarter with Africa as the worst performing region. The strong fundamentals of EM corporates could not even withstand the concerning macro picture; by the second half of the quarter EM corporates were underperforming Developed Markets (DM) in a reversal of recent trends. Local currencies were weaker despite ongoing support from the aggressive hikes that central banks carried out to curb inflation, with Asia outperforming as the region has remained somewhat sheltered from the inflationary environment1.

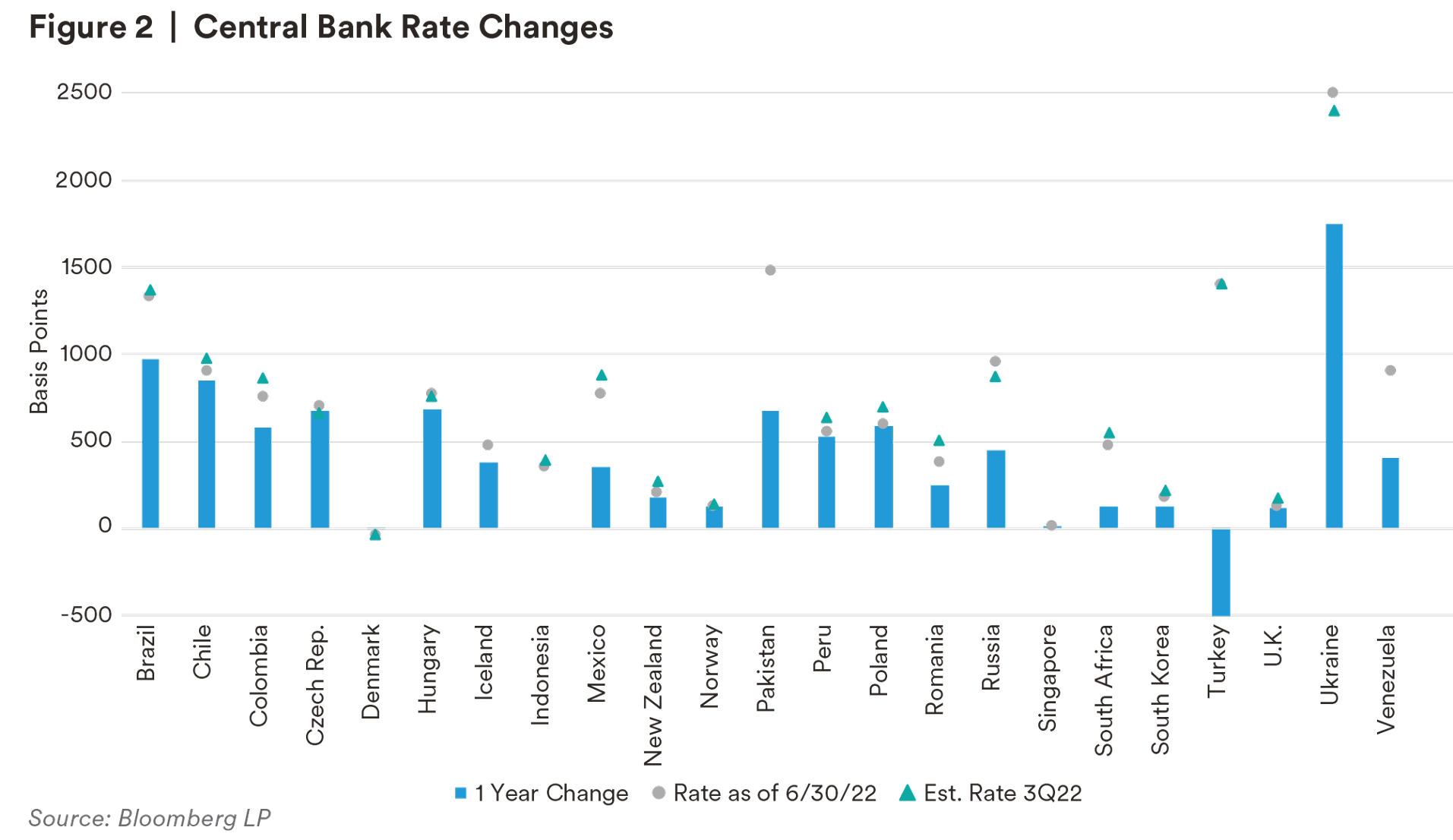

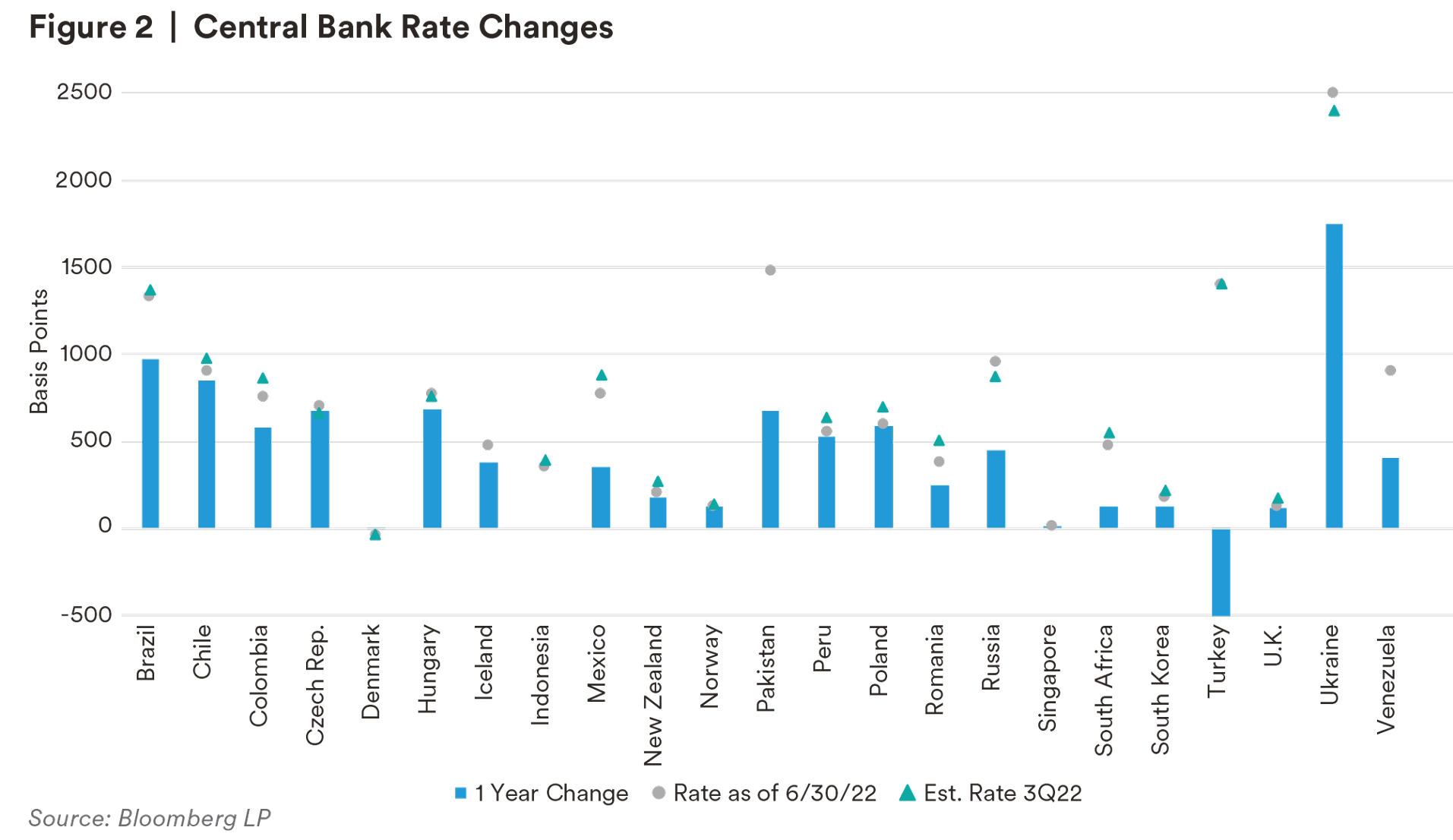

DM joined their EM brethren and started hiking aggressively to control inflation expectations. After the Fed hiked by 75 basis points in June, the largest single hike in the US since 1994, the Swiss National Bank and Bank of England raised rates to step up monetary policy tightening and to narrow the gap between Europe and the US. However, the Bank of Japan remains committed to its dovish stance, opting for daily bond purchases rather than touching rates, sending the yen spiraling to levels not seen since 1998. Year-to-date, EM countries have hiked over 7000 basis points in aggregate, with Latin American countries responsible for 35% of that hiking2 .

It has been two and a half years since China’s first reported case of COVID-19 out of Wuhan; however, the country has lagged other countries with loosening up on its Zero-COVID policy partly due to the lack of herd immunity and less effective vaccines. The implementation of this policy is limiting manufacturing, with national shutdowns leading to continued supply chain shortages. Despite the State Council announcing a set of measures to stabilize growth, the modest tone of them, mixed with a continuing weak property sector, is causing downward revisions of projected China growth for 2022. Most recently, China loosened COVID-19 restrictions, including shortening the length of hotel quarantine required upon entry into the country and Shanghai lifting its two-month lockdown. Reports have indicated a pickup in services and construction in China, along with an expansion in output, positive signs towards reducing supply chain shortages. The China property sector has also continued its downward spiral since February. Investor confidence levels are low, with declining property sales, negative rating actions, and shrinking financing channels dampening the outlook for the sector.

The leftist shift in Latin American politics has continued to play out. After Colombia’s first round election displayed a close race between leftist candidate Gustavo Petro and outsider businessman Rodolfo Hernandez, the markets reacted positively. Petro won in the 2nd round by a 3% margin, gaining support of traditional centralists by sending messages of moderation. Colombian assets weakened on the result, despite the challenges Petro would have in fully implementing a leftist government program given strong political division in the country and the lack of Congress majority. Post quarter end, Argentina witnessed a surprising shift left following the resignation of Economy Minister Martin Guzman, sending the currency and bonds tumbling as Silvina Batakis was appointed. Now the country faces even more concern around inflation and the pending IMF agreement despite her first few comments supporting the current program. In Chile, the Constitutional Convention has presented a draft of the New Constitution which includes significant changes to the Chilean institutional framework but public support may be harder to gather than originally thought, which could lead to moderation of the more aggressive proposals. Some areas of concern include a weaker Senate and lower legislative majorities, along with a new Justice Council and multiple systems leading to the complexity of the judicial structure.

Russia sovereign made two interest payments in May that got held up due to sanctions after Russia transferred them and were never received by bondholders. On June 26th, the grace period for these payments ran out, and bondholders did not receive the funds, which would normally trigger a default. The Russian Federation has demonstrated a high willingness to pay its debts and maintains a strong financial capacity to do so. The looming default is caused by US and European sanctions actions, effectively blocking the payment channels and requiring holders to reject payment. The default has yet to be officially declared as the rating agencies decide how to address this unfamiliar situation. Actions on the ground in Ukraine and their impact on energy and agricultural commodities will play a much more significant role going forward than Russia’s default which has been expected by the markets.

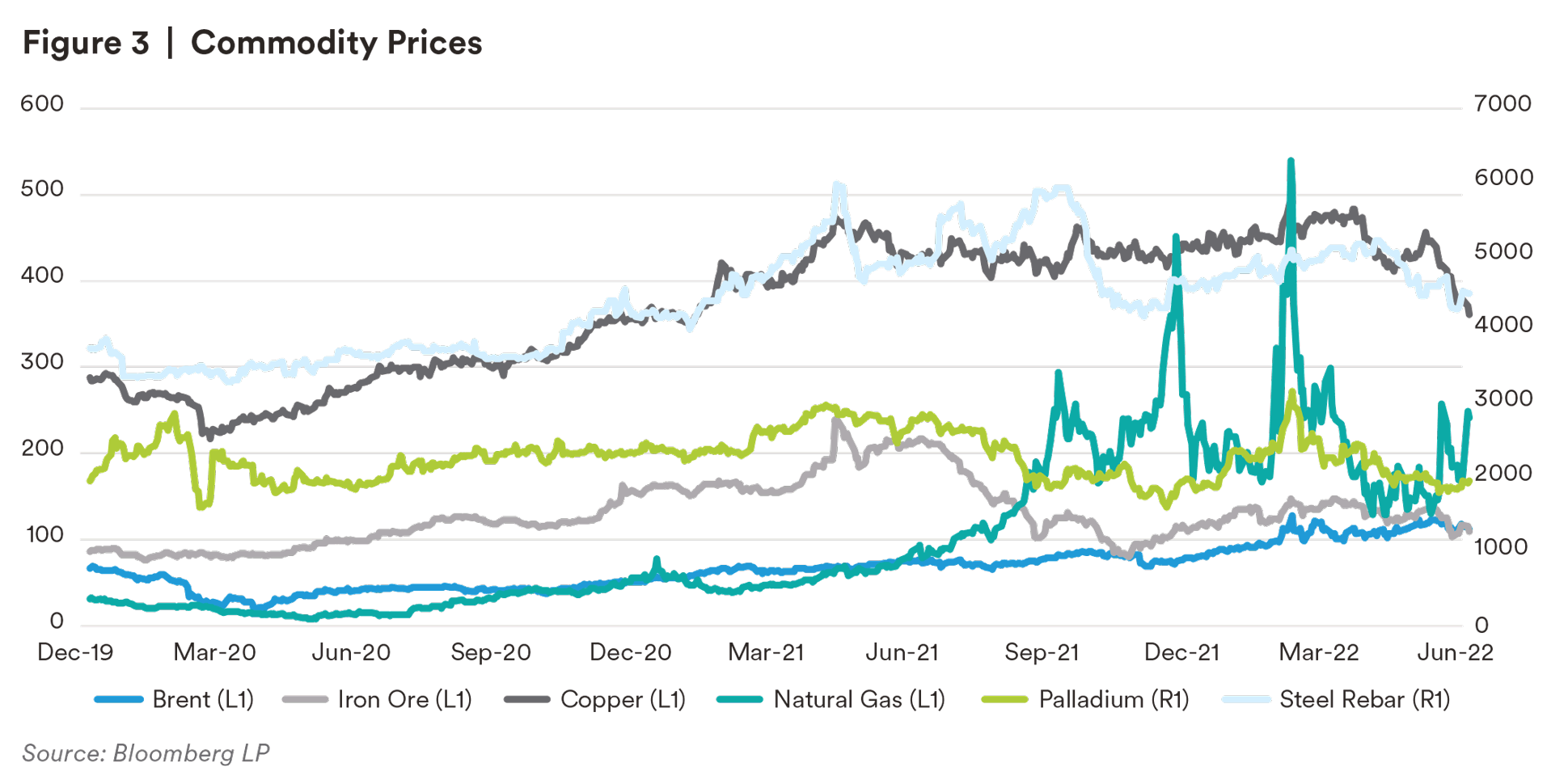

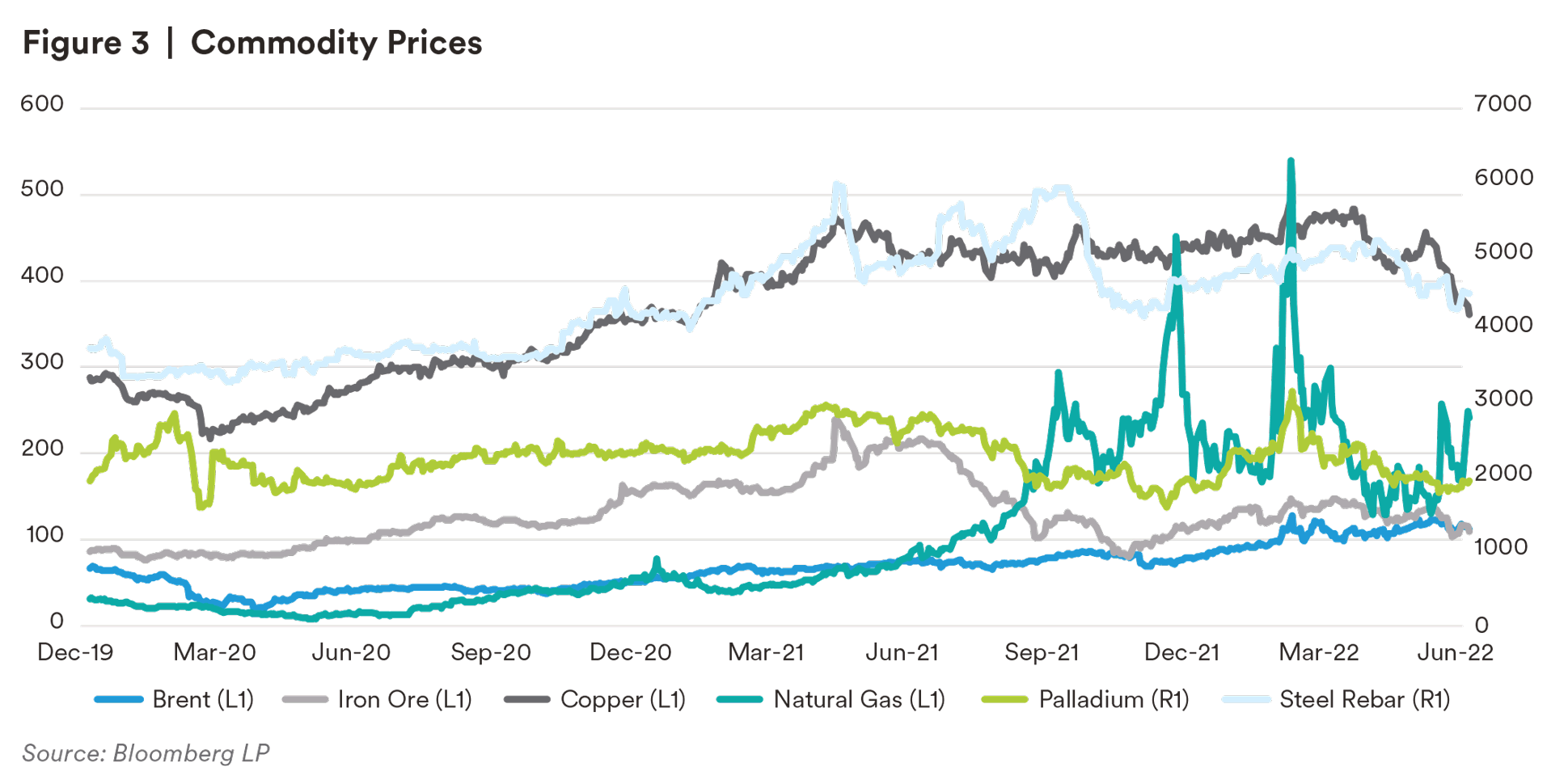

The Russia-Ukraine war has dampened agricultural supply from Ukraine, one of the world’s largest exporters of agriculture, as well as restricted significant supplies of fertilizer to the rest of the world. When combined with the continued threat of Russia weaponizing its gas supply to Europe, it was interesting to see the recession concerns overwhelm the supply concerns and have the entire commodity complex weaken significantly into quarter-end. Recent headlines around Russia’s potential shutdown of the CPC pipeline further heighten concerns that the oil story is still yet to fully play out.

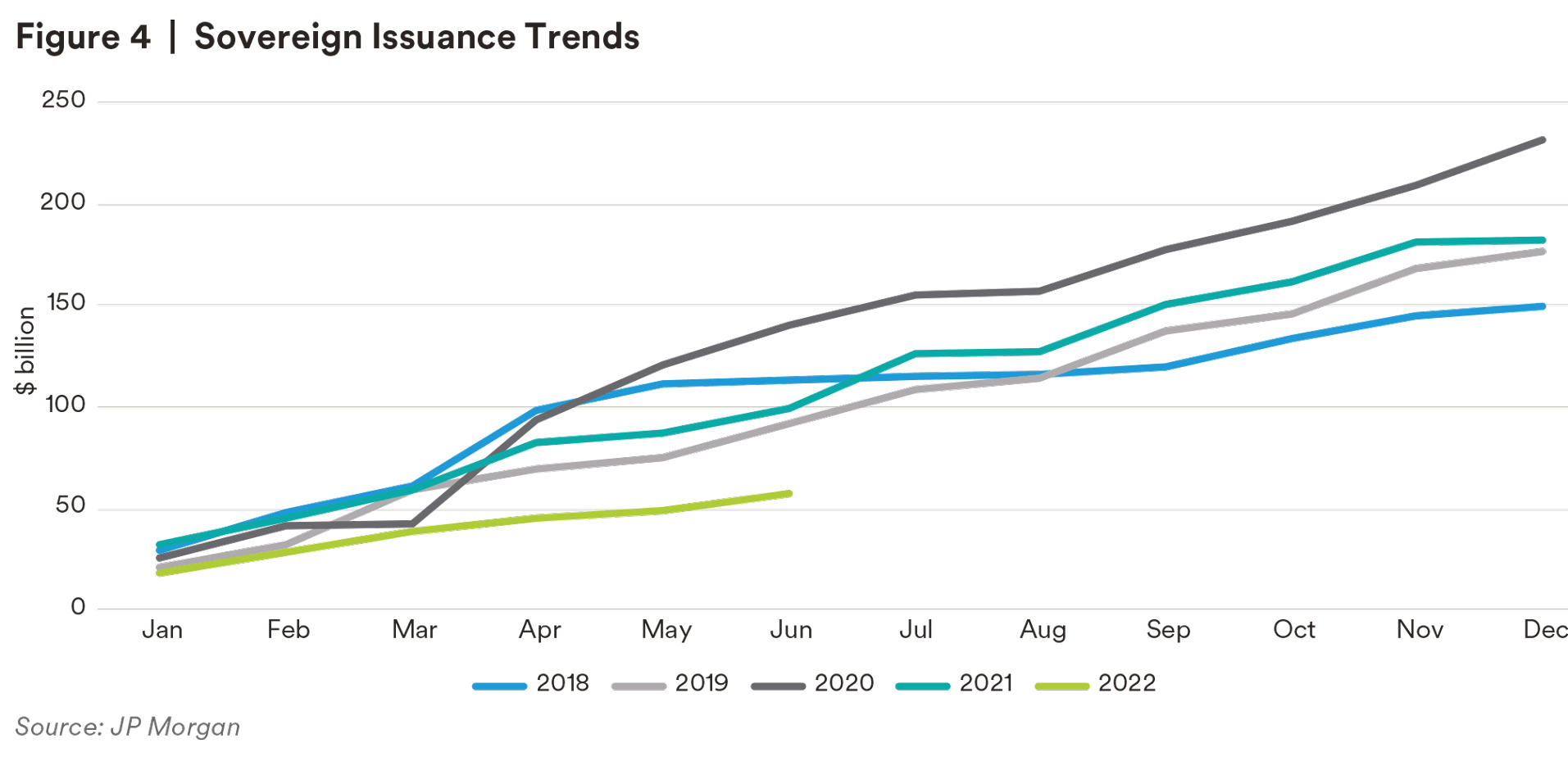

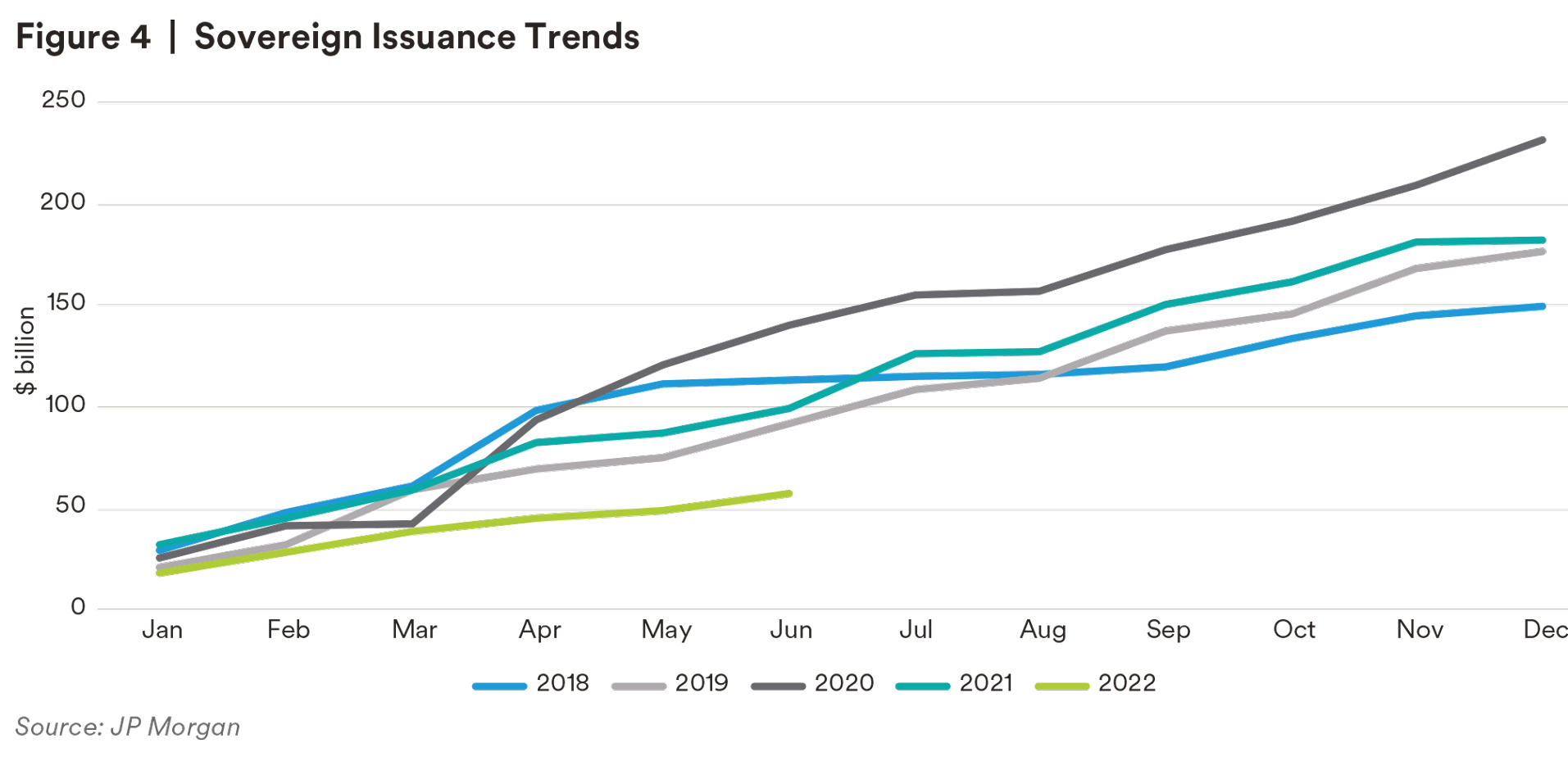

We have seen notable outflows from EM during the first half of the year, with $48 billion year-to-date, led by hard currency funds (-$26 billion). A significant contributor to outflows has been China funds; after recording over $35 billion of inflows during 2020-2021, almost 40% of the inflows into China funds have been unwound year-to-date. Following record issuance from corporates and sovereigns during 2021, the market has seen a halt in new deals as a result of the market volatility. Second quarter corporate issuance of $59 billion is the lowest Q2 supply since 2010, and year-to-date gross supply of $159 billion is the lowest half-year of issuance since 2016. This level is running at less than half of the pace we saw in 2021, and marks the fourth consecutive quarter of negative net financing for corporates. Sovereign issuance is trending far below average as financing costs remain extremely high. Of the $61.5 billion of sovereign supply year-to-date, 70% of it has been investment grade issuers3.

ESG flows and issuance remained above overall EM trends despite green bonds facing pressure during the quarter as energy was a top performing sector. Year-to-date corporate labeled bond issuance of over $40 billion is down only 11% year-over-year versus a 53% slowdown in issuance for the broader EM corporate space. Half of ESG issuance has been investment grade securities, with financials representing over half of issuance within EM sectors. Sovereign labeled bond issuance has gone silent, with Indonesia the only country issuing a green bond in Q2. ESG funds witnessed their first outflows of the last three years during the quarter4

Outlook:

The challenging macro environment is expected to continue through the second half of 2022, as the market awaits catalysts to bring down these elevated inflation levels. With the default rate still trending at low levels, we predict that this will rise somewhat notably as higher risk countries and issuers are unable to make it through this inflationary and recessionary period.

Primary markets are expected to be quiet as usual during the summer; however, given high financing needs for sovereigns, we expect to see issuance from countries following the summer lull during any periods of market stability. With many investors currently “locked out” from issuance in the primary market given high volatility and high concessions that are required, high beta countries will need to seek support from other means. Countries including Sri Lanka, Zambia, Pakistan, and Ghana are being forced even more so now to seek relief from the IMF, with more countries likely to join this list.

The concern now is that as inventories get rebuilt, the Fed’s response to inflation pushes the US into a recession. A recession scenario would dampen demand of commodities, leading to a reversal of any recent strength we have seen, most notably through base metals. The demand arising from the re-opening of China along with continued restrictions on oil supply should keep energy well supported.

Our baseline scenario remains that the Russia-Ukraine war will continue over the near term, and Russian sanctions will remain in place. This will continue to impact supply chains; however, as countries begin adjusting their supply chains to adjust for this shortage, we are hopeful that inventories can be rebuilt and prices and consequently inflation can slightly subside.

China growth is expected to pick up during the second half of the year, optimistically driven by reopening of manufacturing plants that will help ease supply chain shortages. The country made its biggest shift in the Zero-COVID policy yet by reducing quarantine time in a designated facility for travelers entering the country in half, to seven days. This loosening regulation not just provides optimism around manufacturing rebound, but additionally provides less complicated travel for Chinese companies to visit other countries once again. We believe that Chinese economic growth, while the US economy slows, can be supportive for EM credit.

The election calendar for the second half of the year is fairly quiet, with only Brazil in the pipeline in October. Former president Luiz Inacio Lula da Silva (Lula) is currently poised to win, with his agenda focused on promoting growth through active industrial and fiscal policies.

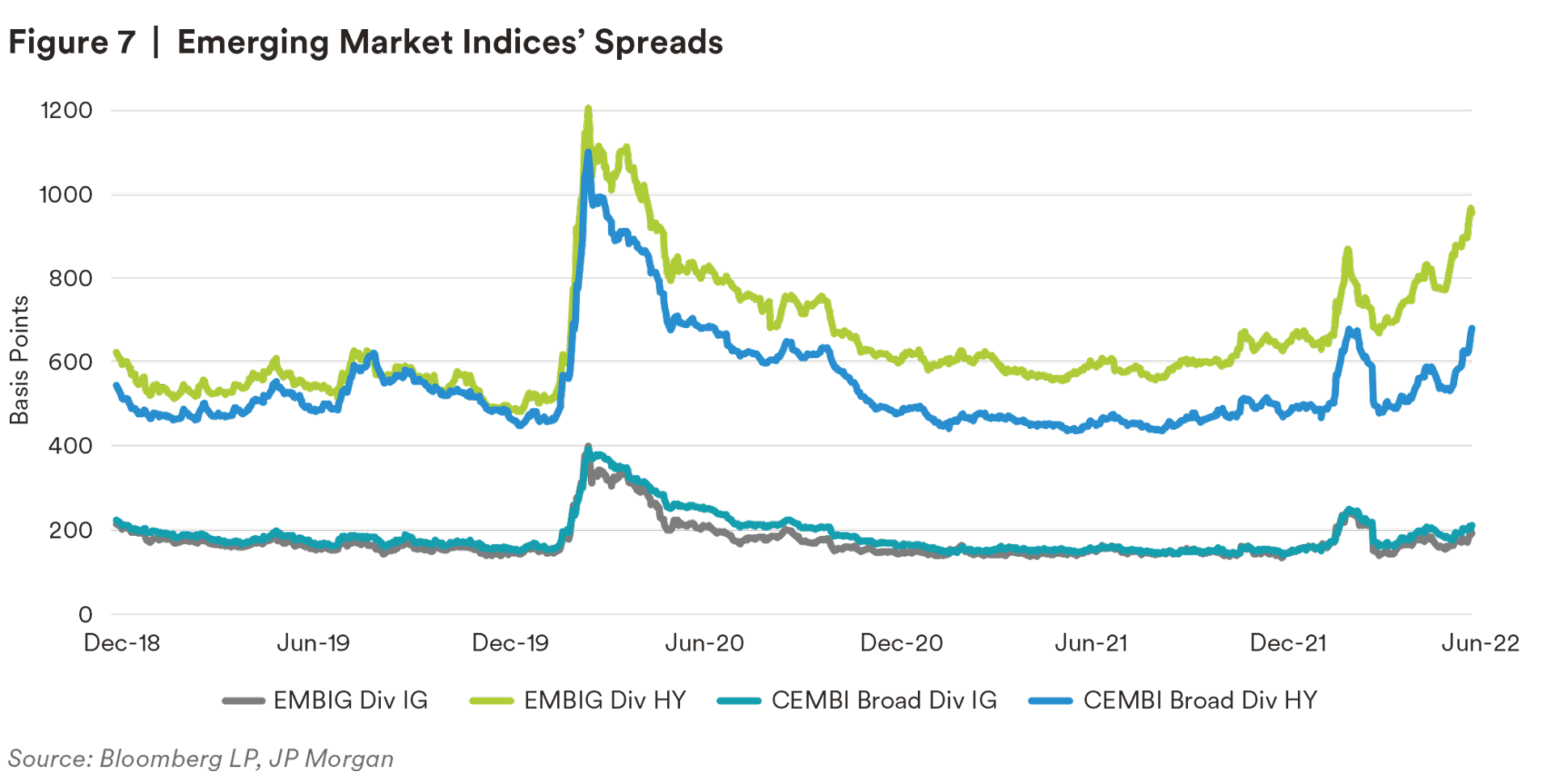

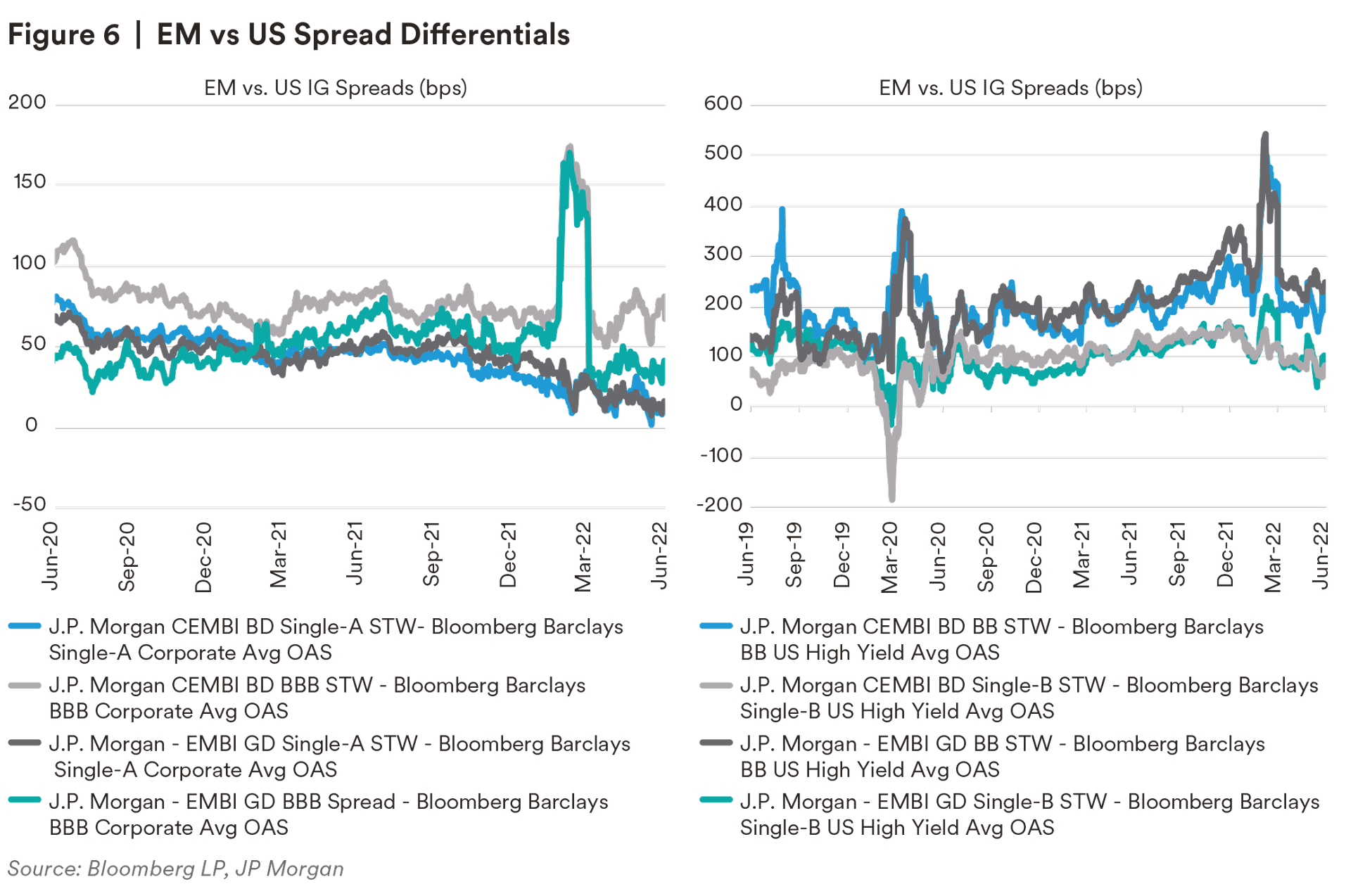

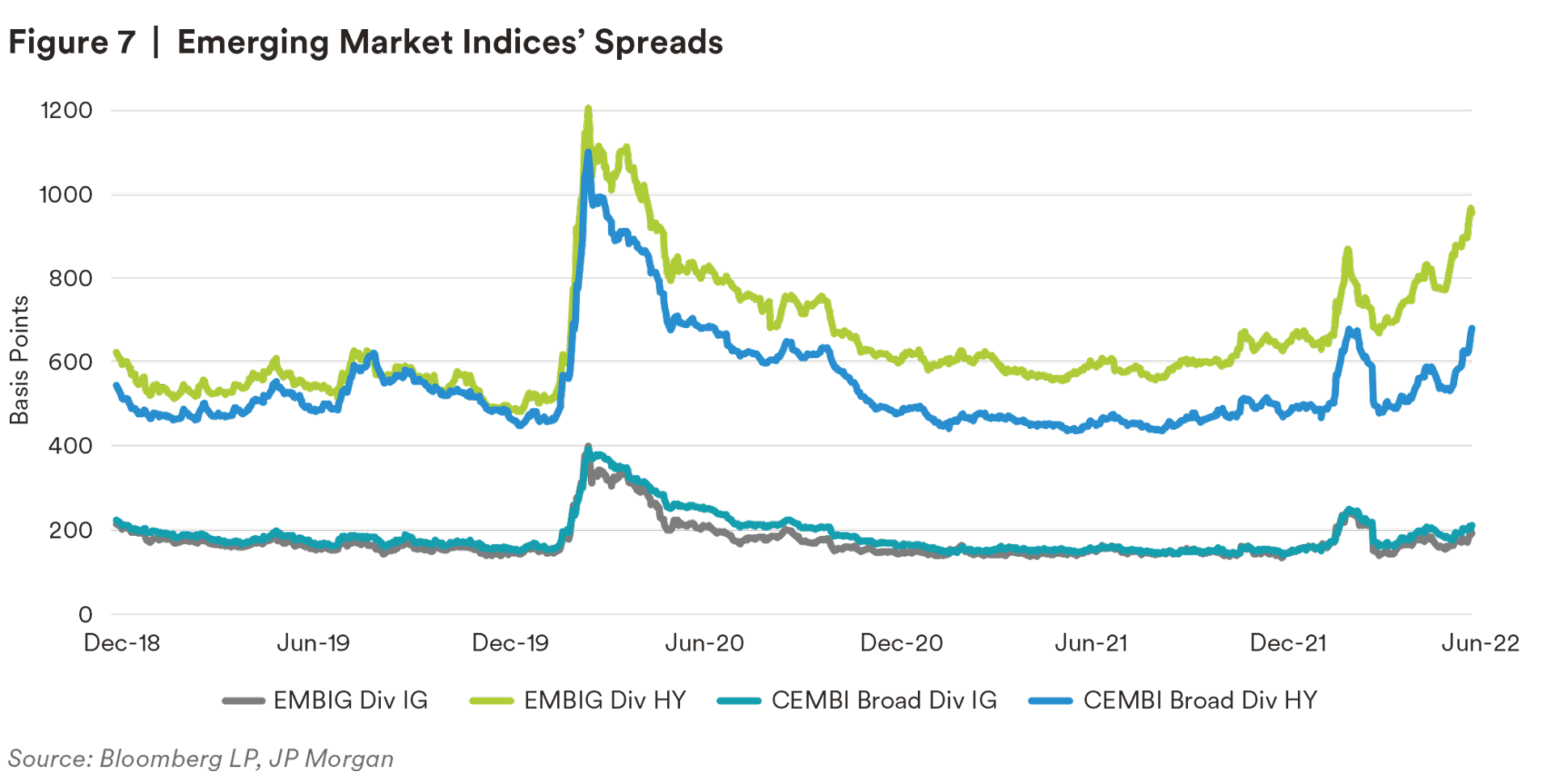

EM assets have seen notable spread widening during the quarter, coupled with higher treasury yields puts all-in yields at levels not seen since 2009. However, given the rising rate environment, inflationary concerns, recession fears, and geopolitical tensions, investors continue to question if these levels compensate enough for the risks of EM debt. Relative to DM, EM sovereigns, especially in the high yield space look cheap, while corporates have remained more resilient and look fair in relative terms.

In the sovereign space, we continue to monitor how growth projections are being affected by the newest geopolitical tensions. We remain cautious on the duration of our portfolios as rates continue down a path of volatility. We see potential opportunities in some energy-based high yield sovereigns including Oman and Angola. In the low beta space, we continue to like stable names such as Indonesia and Mexico. Mexico continues to be attractive based on relative fundamentals versus the rest of Latin America in our view.

Fundamentally, we believe corporates will continue to perform well at the balance sheet level, and commodity exporters’ current accounts are benefiting from elevated levels. However, recent market technicals have caused EM corporates to underperform based on market liquidity and outflows. We are focusing on telecom and consumer staples as well as our continued focus on hard asset companies that are free cash flow positive. Latin America and commodity-based African securities are places where we are more comfortable owning active risk.

EM central bank policy responses have been very front loaded, but we believe they may be now somewhat constrained. As the year progresses there could be a transition point when inflation peaks are better understood and EM central banks ease off the tightening which could bode well for non-dollar assets relative to the U.S. In the short-term we remain cautious given market volatility; however, we see potential medium-term opportunities in countries that have been aggressive with rate hikes and commodity exporting countries.

Endnotes

1 Data in this paragraph sourced from JP Morgan

2 Bloomberg LP

3 Data in this paragraph sourced from JP Morgan

4 Data in this paragraph sourced from BofA

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. More specifically, investments in private structured credit involve significant risks, which include certain consequences as a result of, among other factors, borrower defaults and, fluctuations in interest rates. When originating a loan, a lender will rely significantly upon representations made by the borrower. There can be no assurance that such representations are accurate or complete, and any misrepresentation or omission may adversely affect the valuation of the collateral underlying the loan, or may adversely affect the ability of the lender to perfect or foreclose on a lien on the collateral securing the loan, or may result in liability of the lender to a subsequent purchaser of the loan. Private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial market. The investments and strategies discussed herein may not be suitable for all investors. The material i s not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. You should consult your tax or legal adviser about the issues discussed herein. The investments discussed may fluctuate in price or value. Investors may get back less than they invested.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor. This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyodaku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”).

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC and MetLife Investment Management Europe Limited.

Unless otherwise noted, none of the authors of the articles on this page are regulated in Ireland.