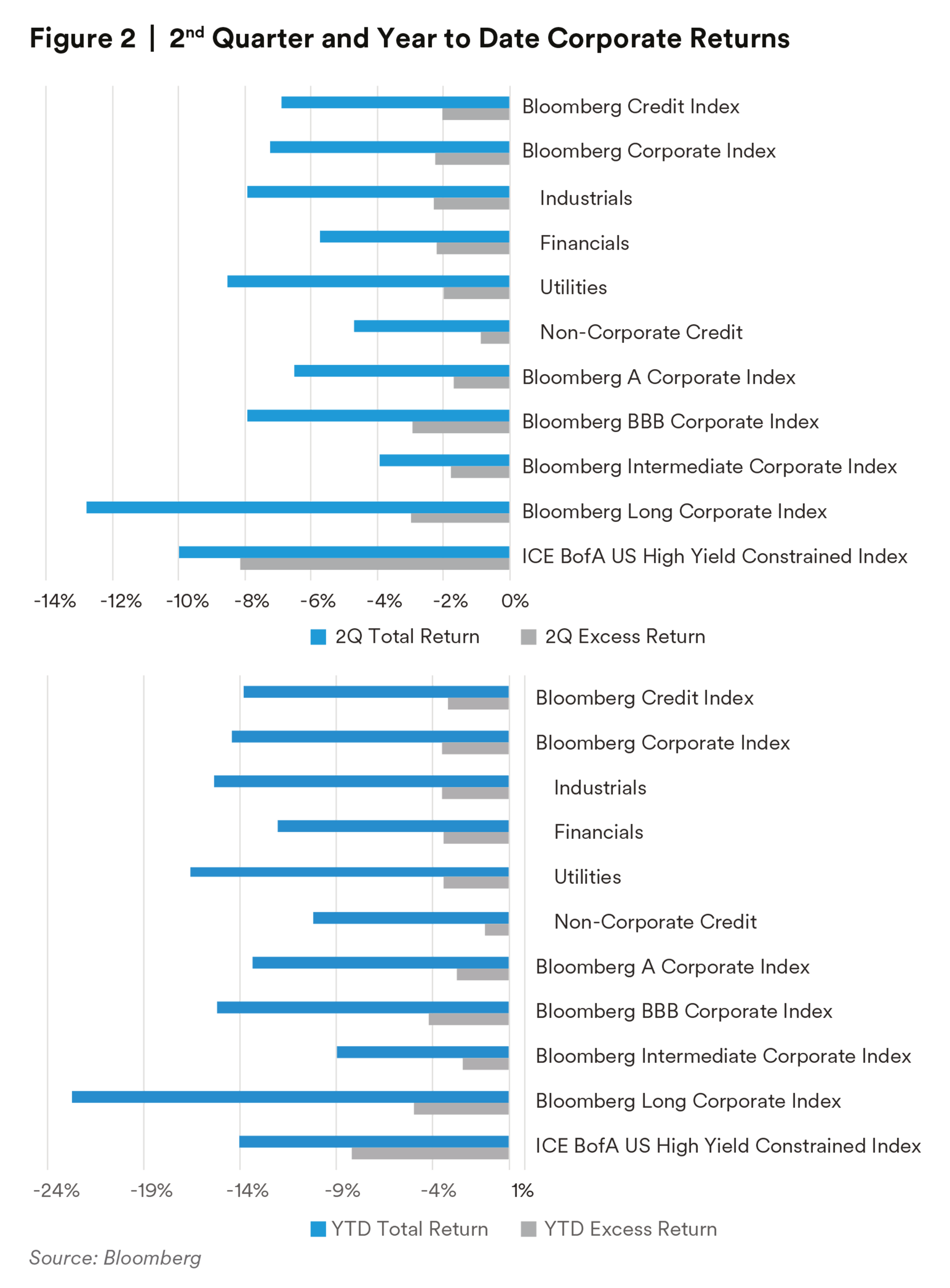

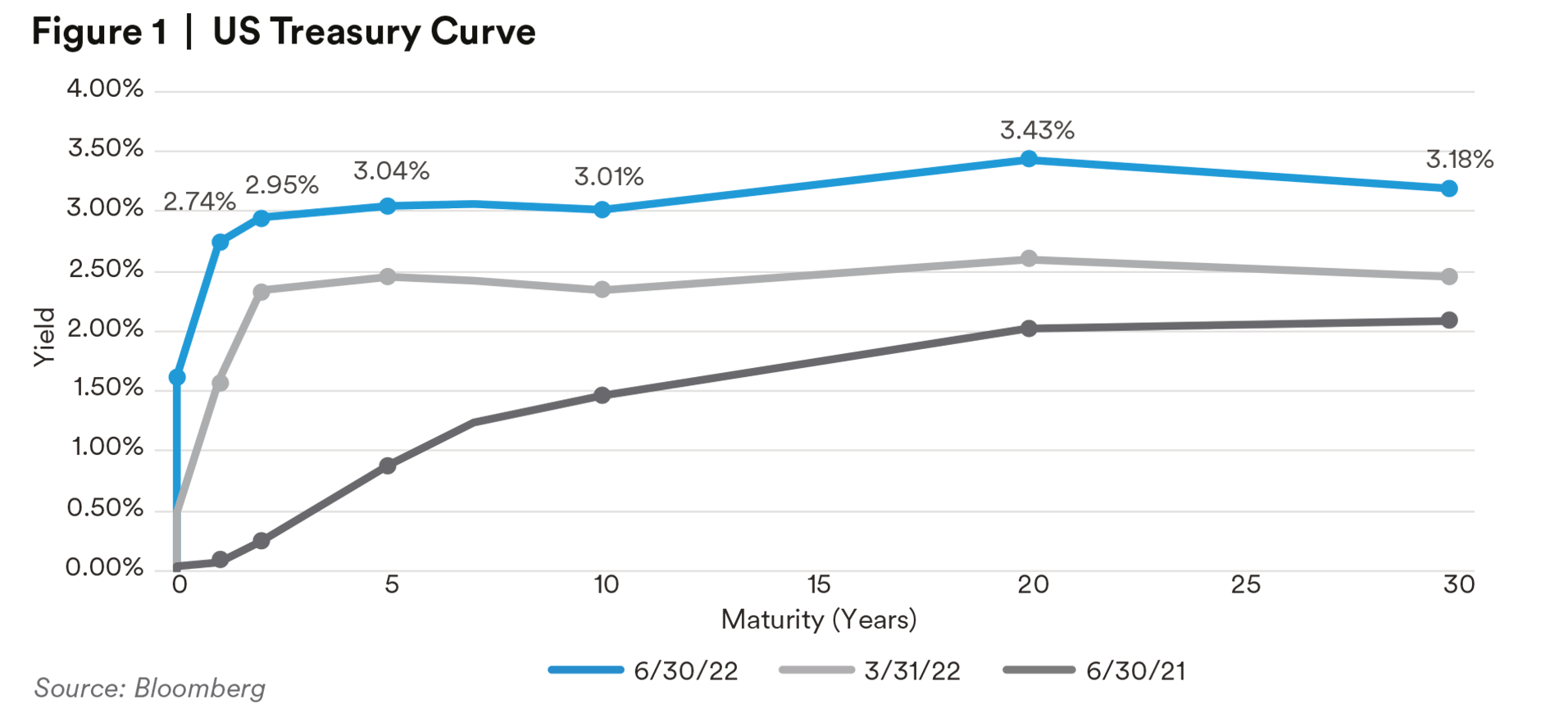

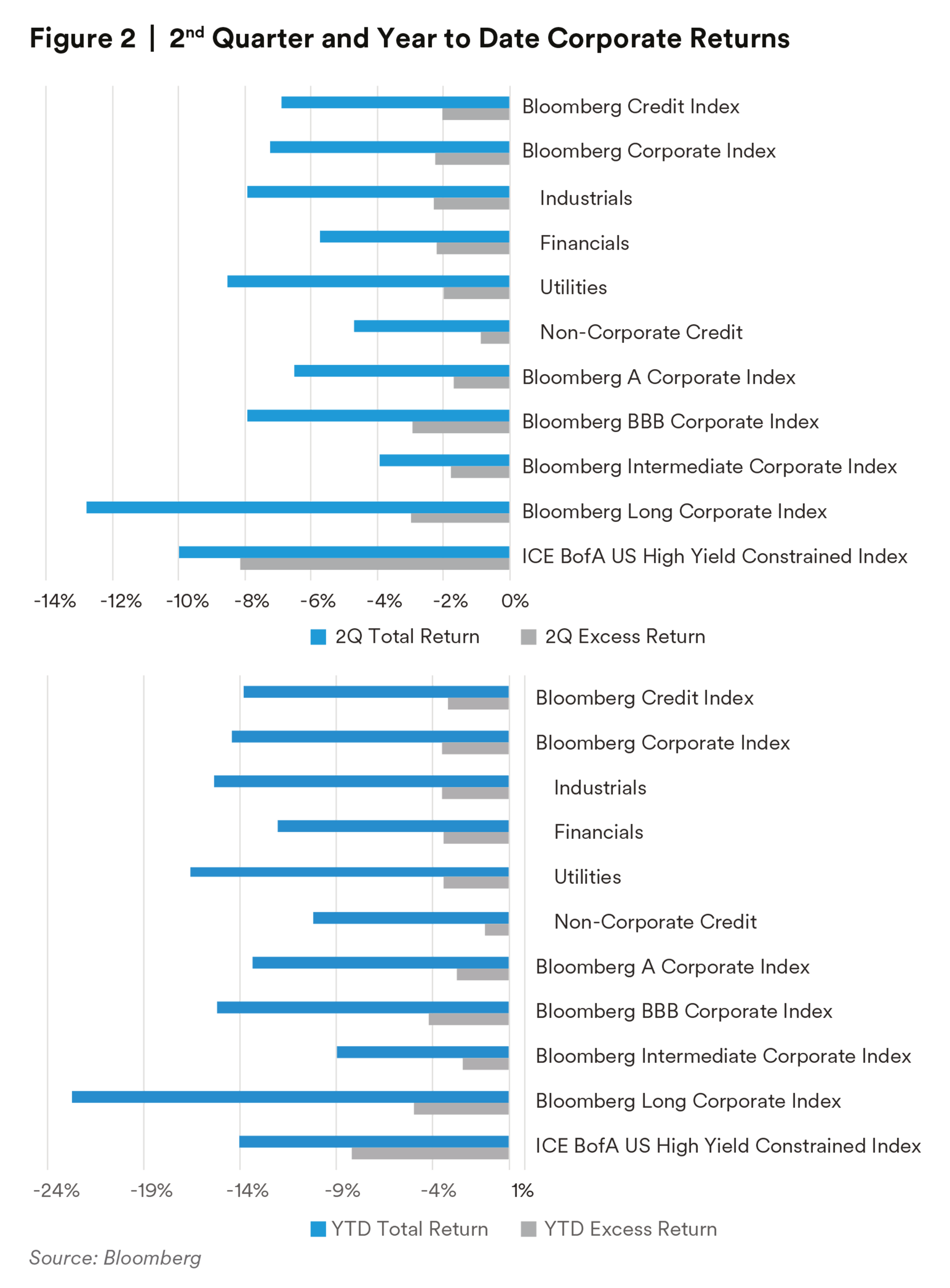

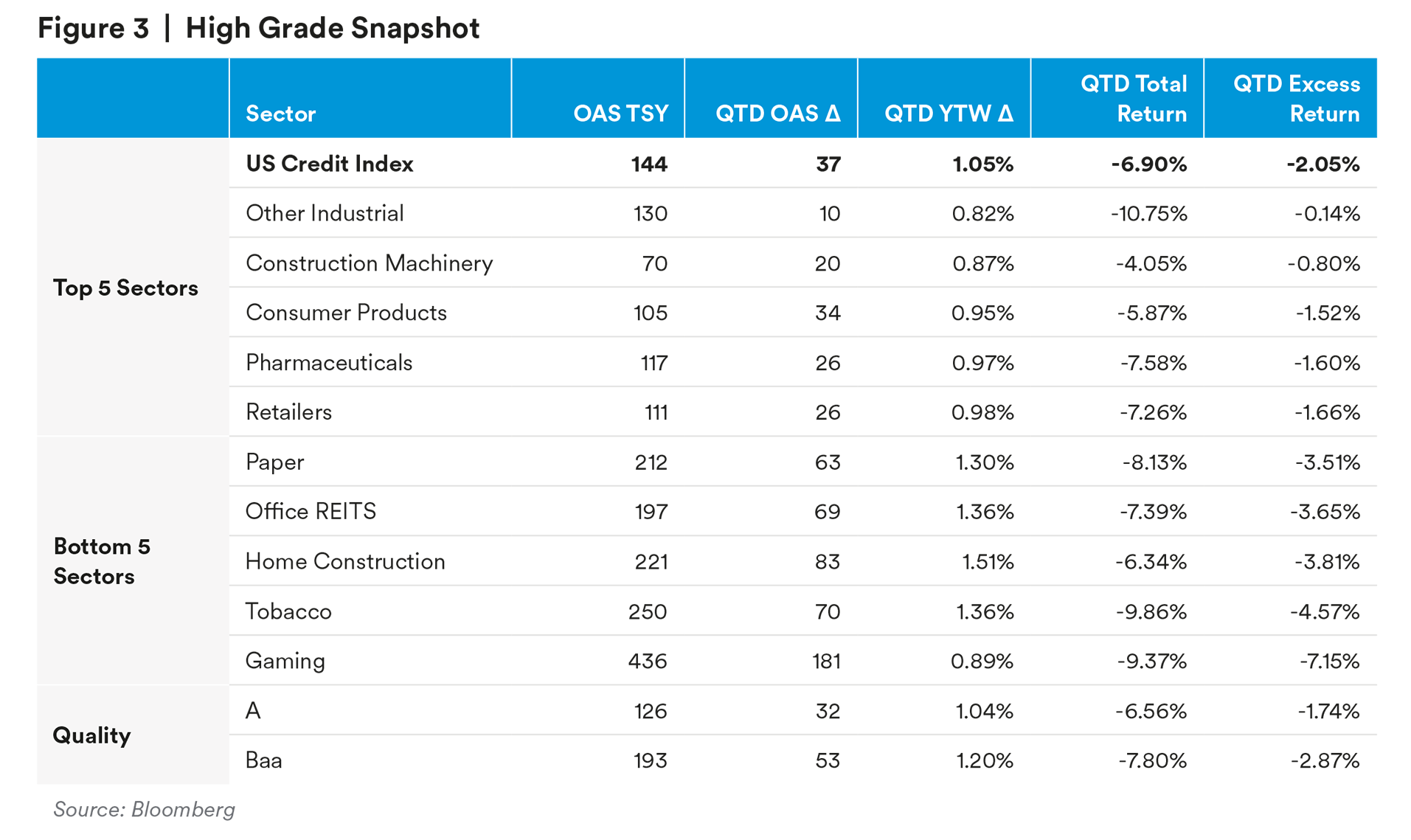

Credit markets were not immune to the macro volatility. Spreads widened substantially from 108 basis points at the beginning of the quarter to 143 at the end; although, the widening did not occur in a linear fashion. As shown in Figures 2 and 3, with spreads wider and yields higher, the Bloomberg US Credit Index posted a negative total return for the quarter, lagging similar duration Treasuries. Excess returns were negative across all sectors and maturities. Short and intermediate corporates outperformed their longer-dated counterparts. Looking at quality, BBBs underperformed higher quality AAAs, AAs, and As again this quarter. Non-corporate credit continued to outperform corporate credit, despite weakness in Sovereign debt. Within the corporate credit subsectors, Other Industrials and Construction Machinery relatively outperformed as these lower beta sectors fared better in market volatility. Essential Non-Cyclical Sectors also relatively outperformed, led by Consumer Products and Pharmaceuticals. Tobacco heavily underperformed as a series of regulations from the FDA continued to weigh on the sector. Gaming and Home Construction within Consumer Cyclicals were among the worst performing sectors as consumers slowed their consumption amidst rising prices.2

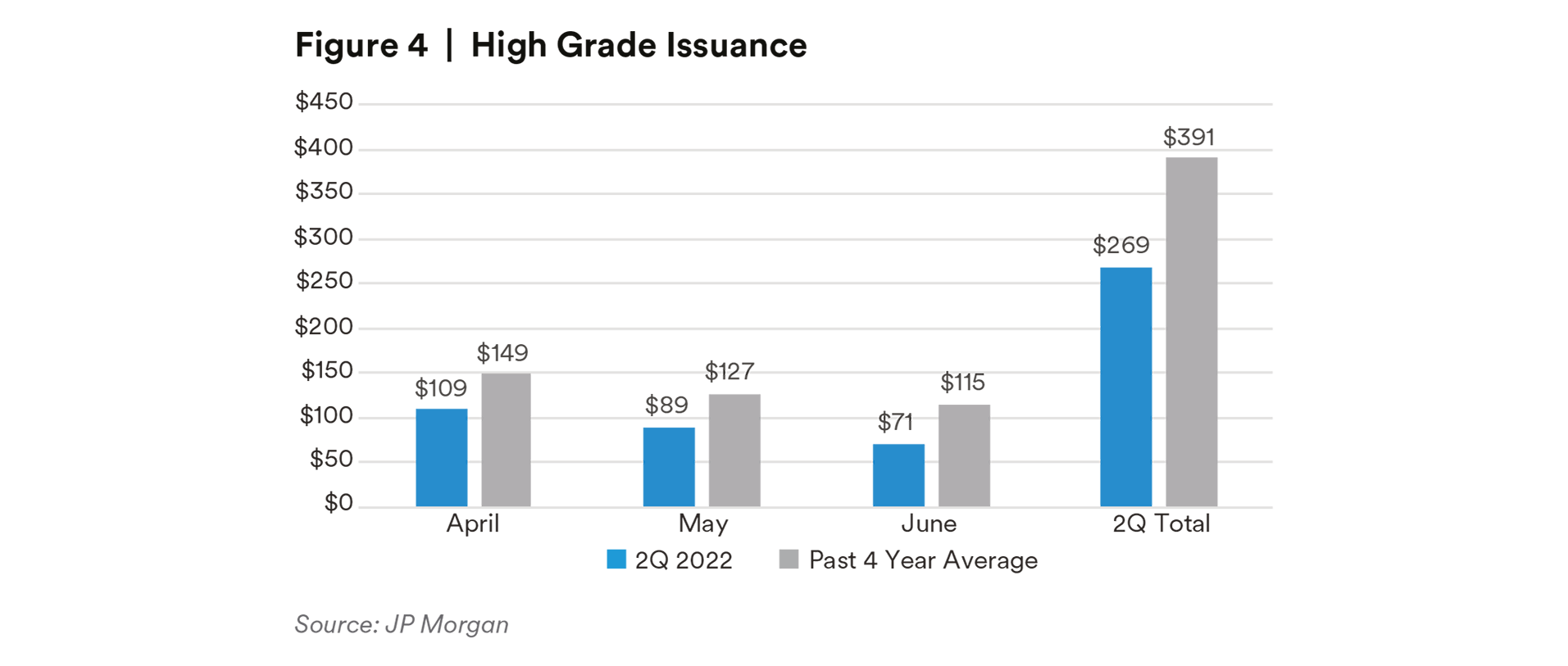

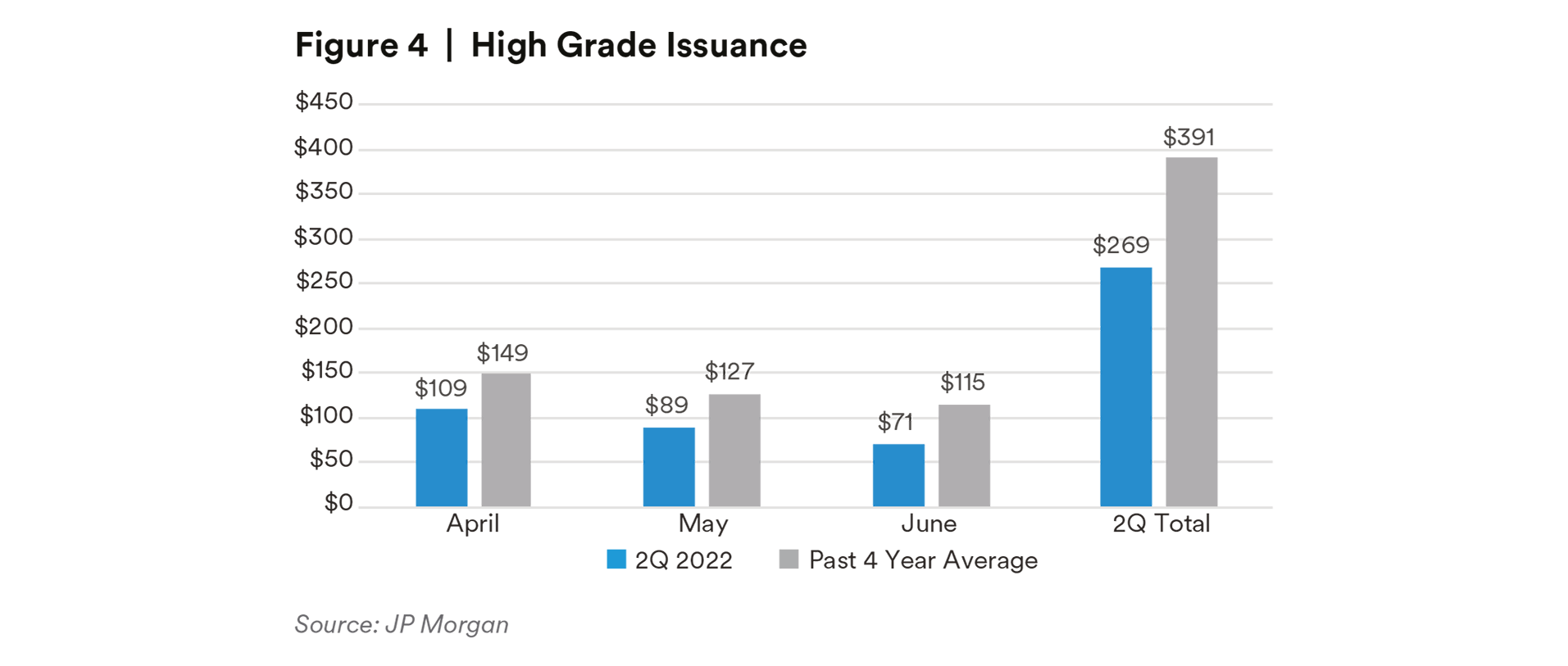

Looking at issuance in Figure 4, High Grade bond supply for the quarter was $269 billion. This was 23% lower than the second quarter of 2021 and 31% lower than the past four-year average.3

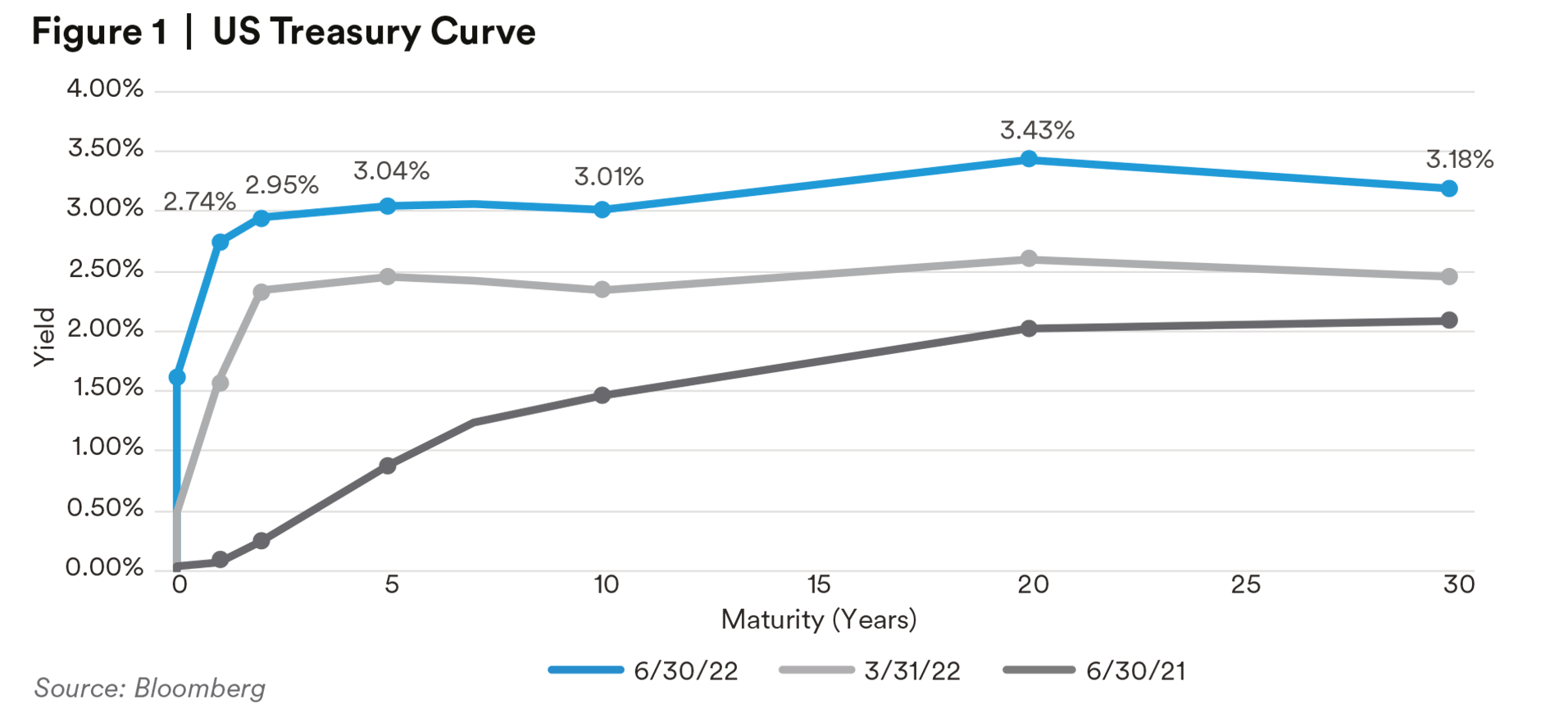

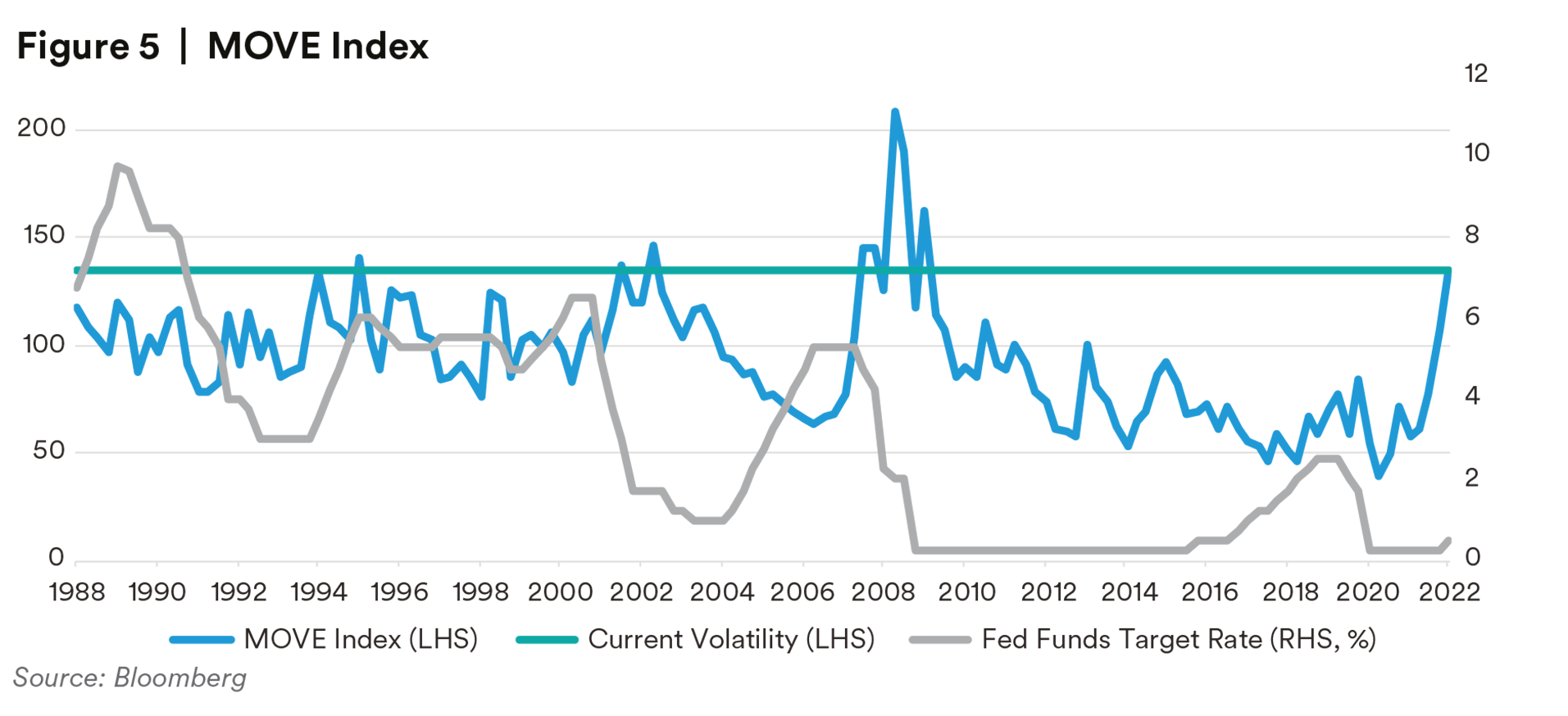

The Fed has also chosen to look at backwards and lagging data in their decision making, which will likely keep the voting members on a hawkish trajectory. The last minute and reactionary decision in the June meeting to go 75 basis points will only serve to increase market volatility around key data releases as market participants attempt to parse every piece of news in an attempt to divine how the FOMC will interpret it. Hardly an environment for stability and a critical policy mistake by Powell and team in our opinion. The market, however, may have other plans. Broad economic data has accelerated its descent faster than most have expected and is beginning to reprice the Fed. The July meeting, a lock for a 75 basis point increase just a few weeks ago, is now trending towards 50 basis points based on market pricing. Rates, as measured by the 10-year Treasury, have declined by over 60 basis points toward the end of the quarter after having come close to 3.5% only 2 weeks ago. Data such as retail sales, initial claims, regional manufacturing surveys, and inflation have softened and are picking up speed to the downside. Should the Fed raise 50 basis points in July and signal “normal” data dependent 25 basis point hikes after that, we would not be surprised to see a rather aggressive risk rally.5

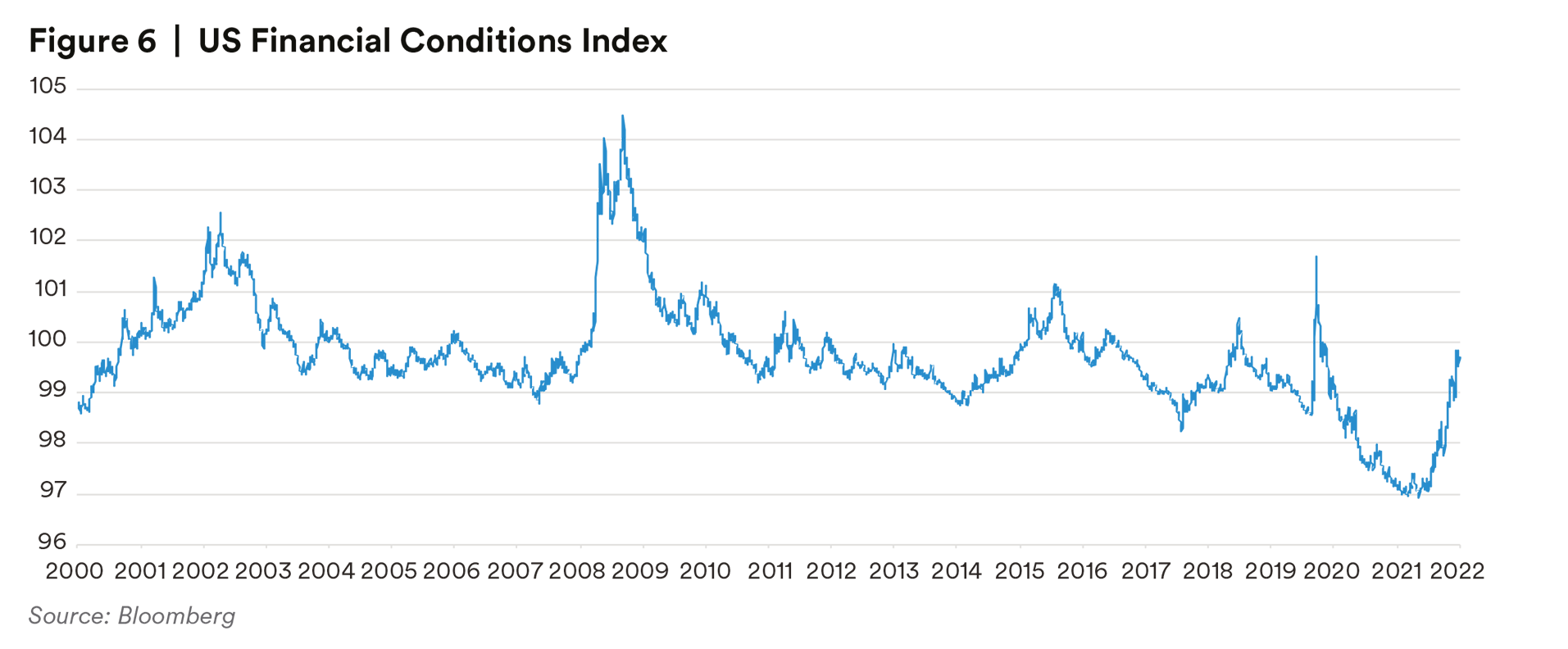

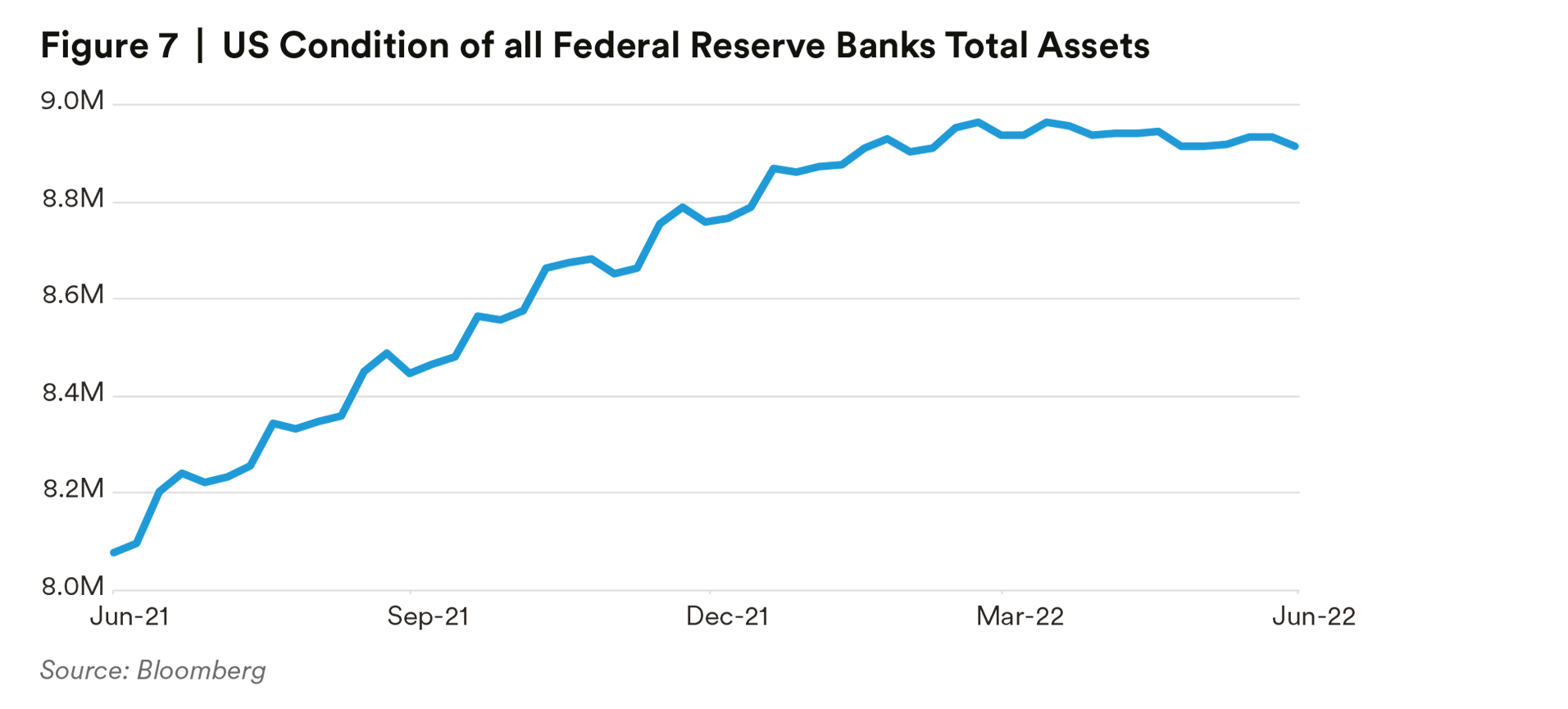

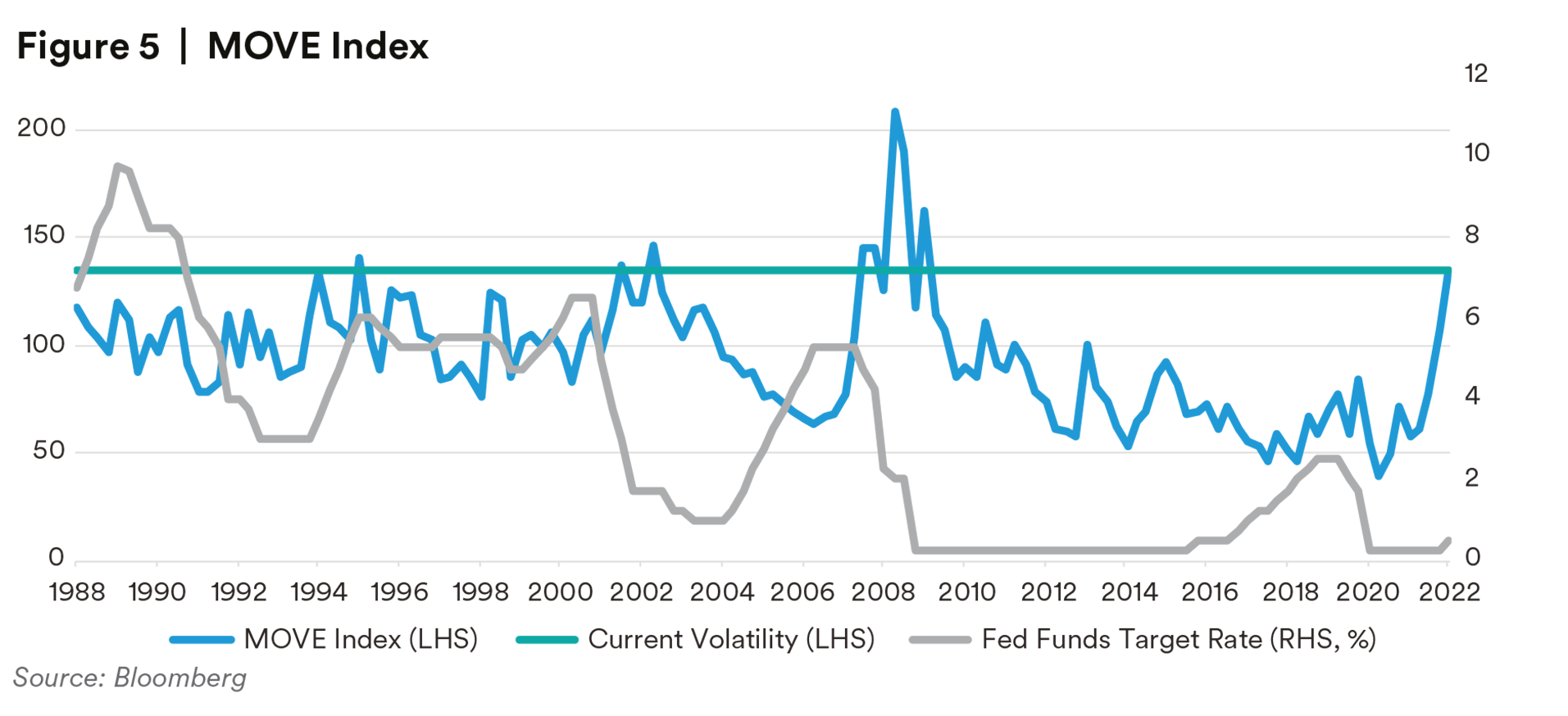

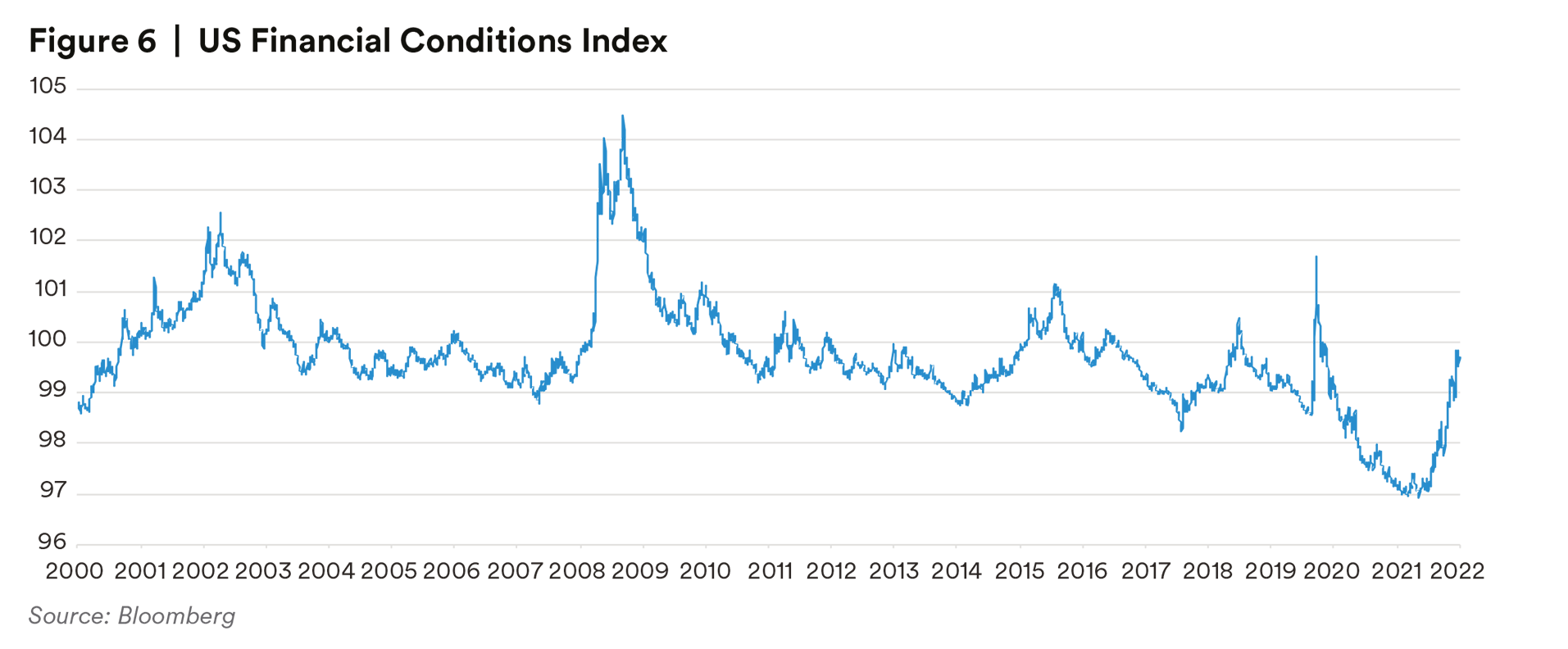

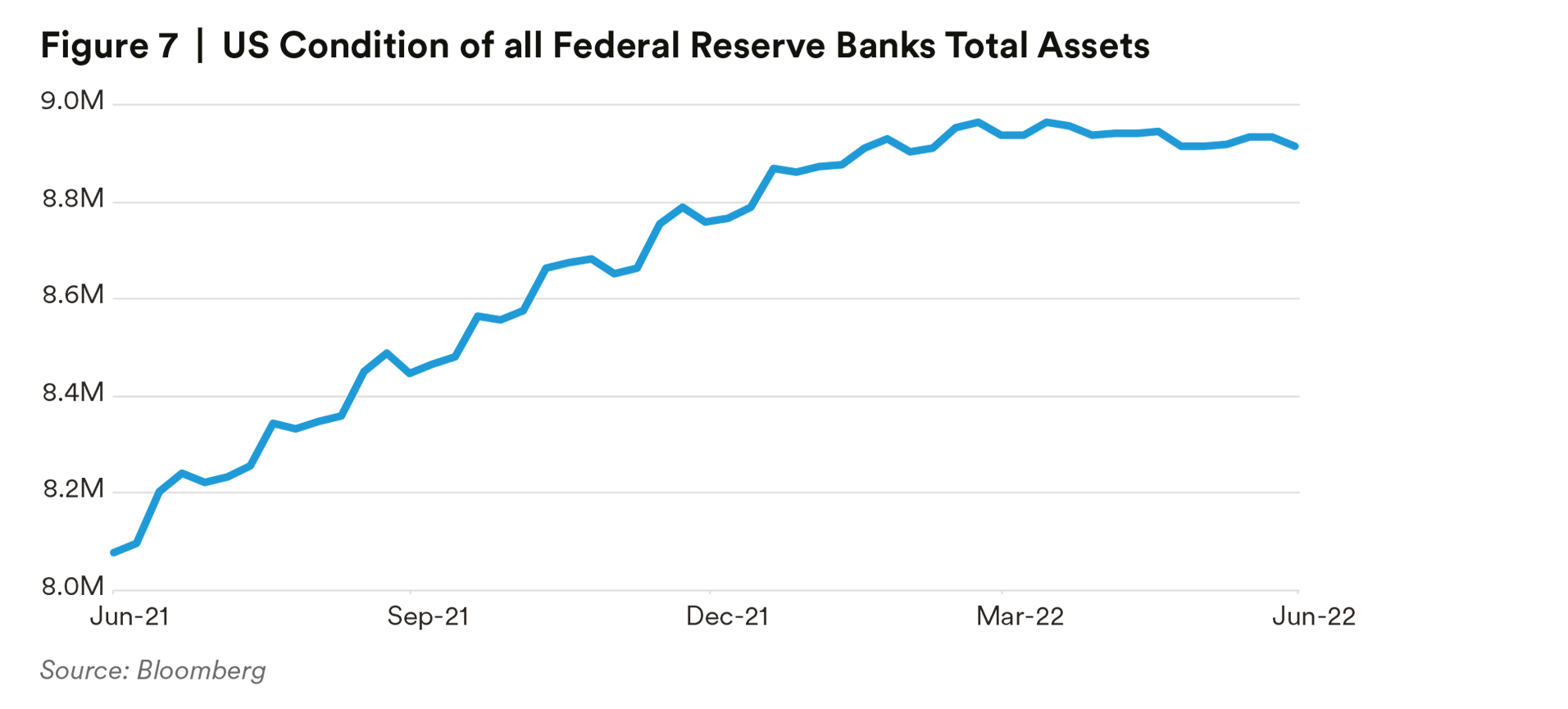

Additionally, the draining of liquidity via quantitative tightening will likely only further increase volatility. Financial conditions have already increased faster than in the past 2+ decades outside of the GFC and the COVID-19 Pandemic, and the balance sheet reduction has barely begun.

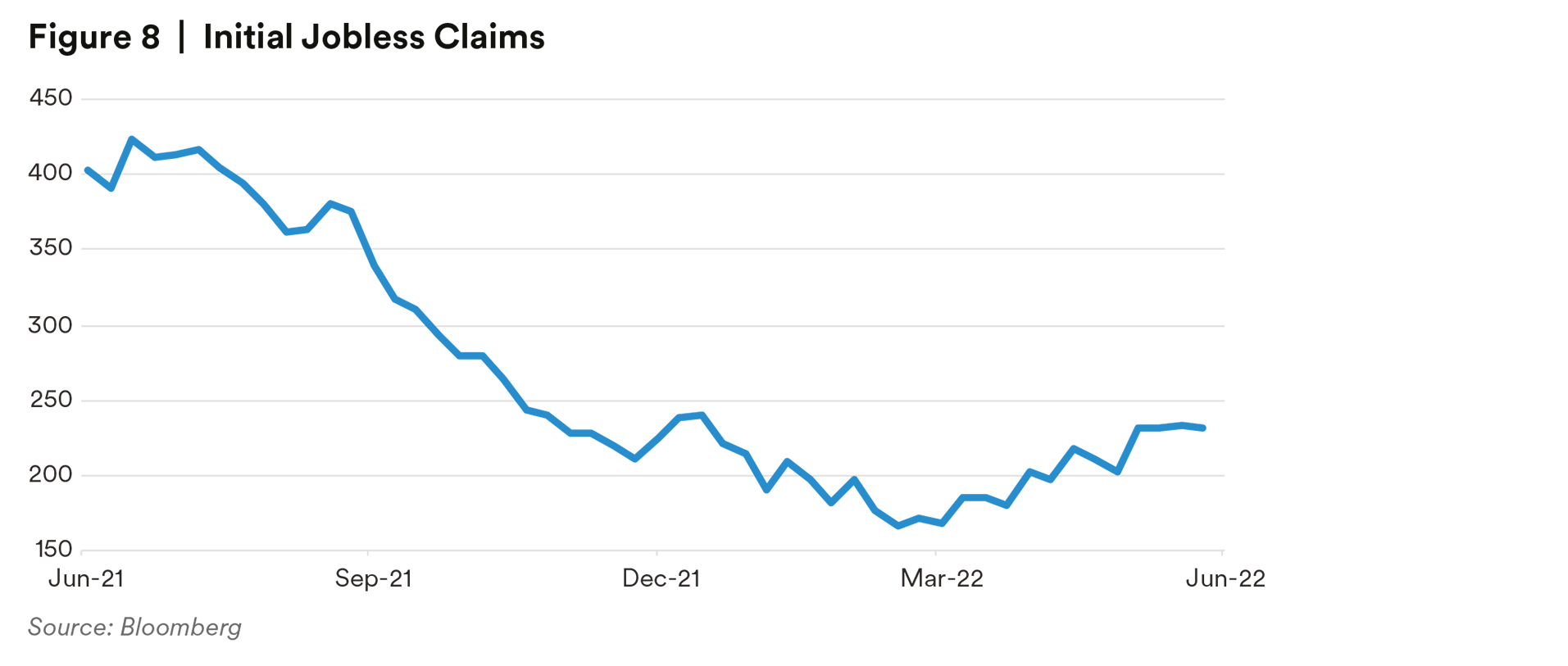

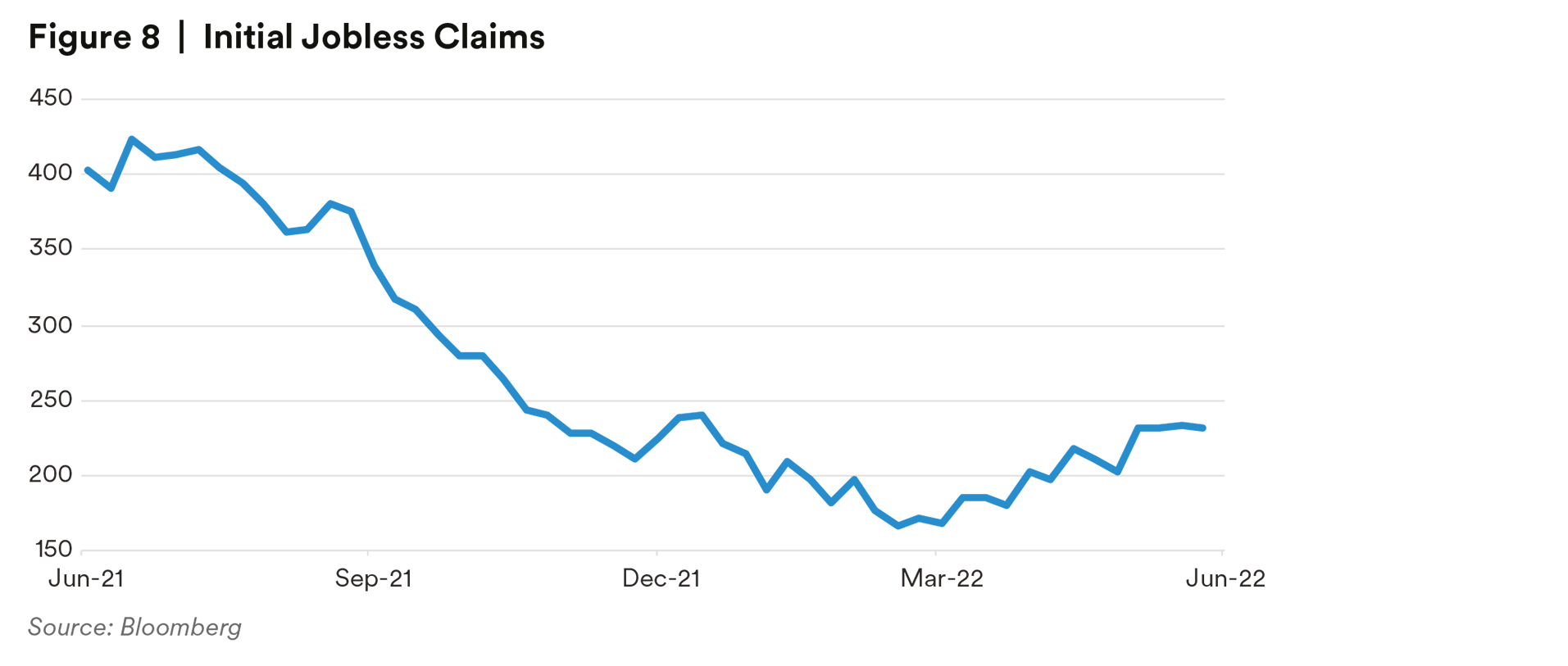

It will also be important to factor in unemployment and the Fed’s dual mandate going forward. Jobless claims, as shown in Figure 8, is a leading indicator and has started to gradually uptick over the quarter.

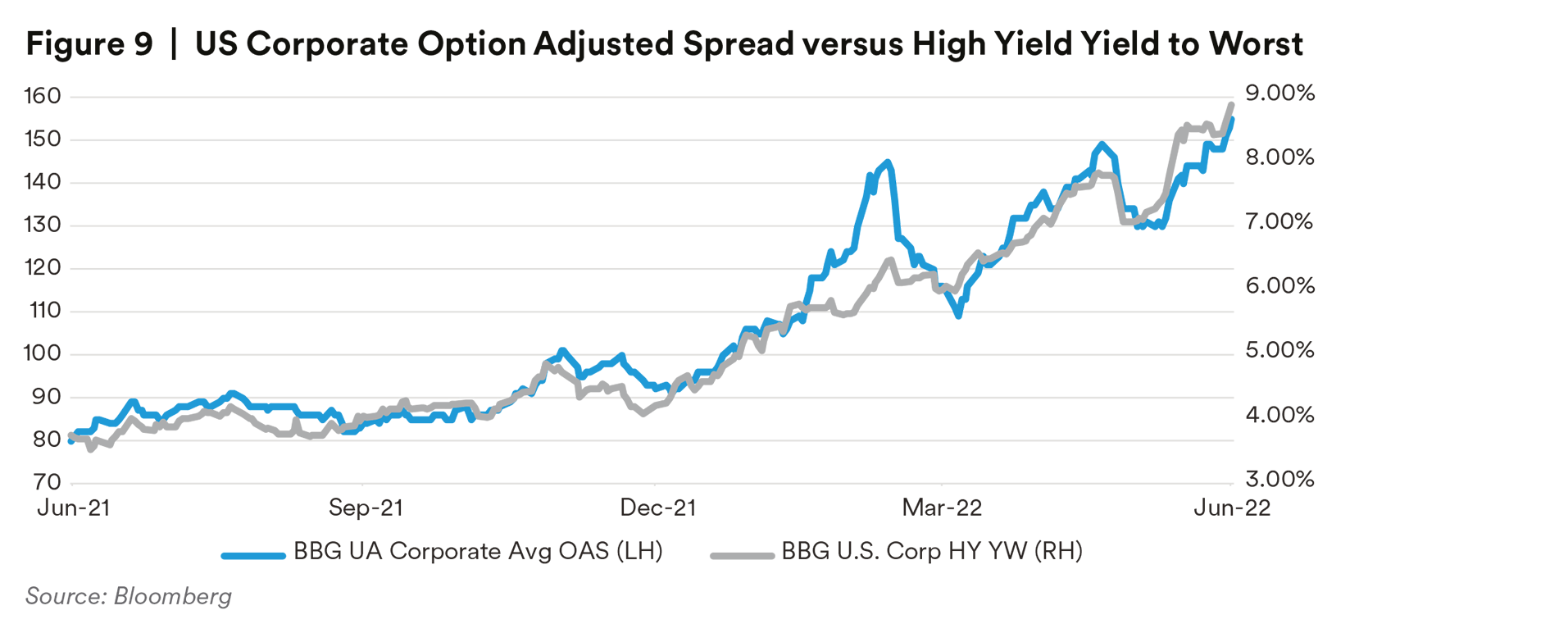

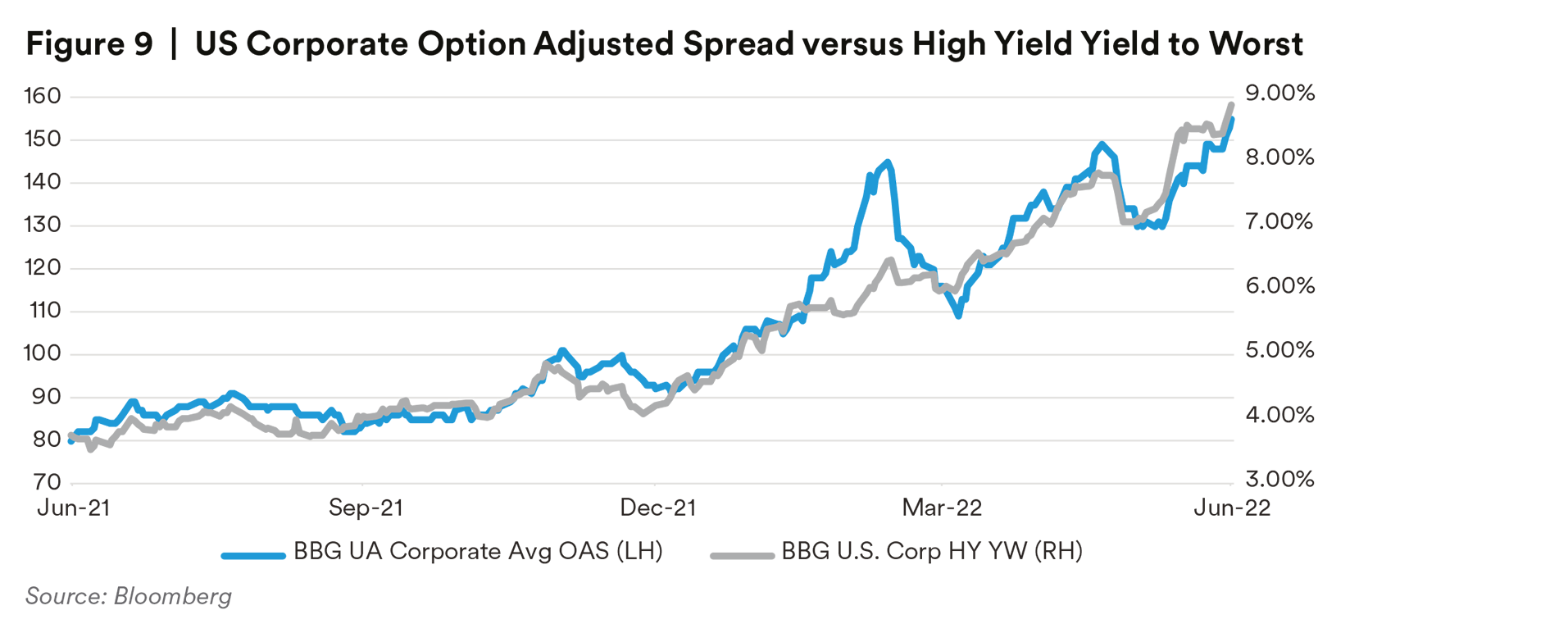

Already this year the corporate index OAS has gapped wider only to recover to higher lows twiAlready this year the corporate index OAS has gapped wider only to recover to higher lows twice and is currently on its third bout of widening to wider wides. We see no reprieve from this pattern in the intermediate term. Absent a recession, the chances of which are quite high, we would expect spreads to range between +125 and +175 OAS in this volatile pattern. Depending on the depth of the impending recession, spreads could approach +200 OAS or wider. U.S. High Yield has exhibited a similar patten and is closing in on a 9% yield.

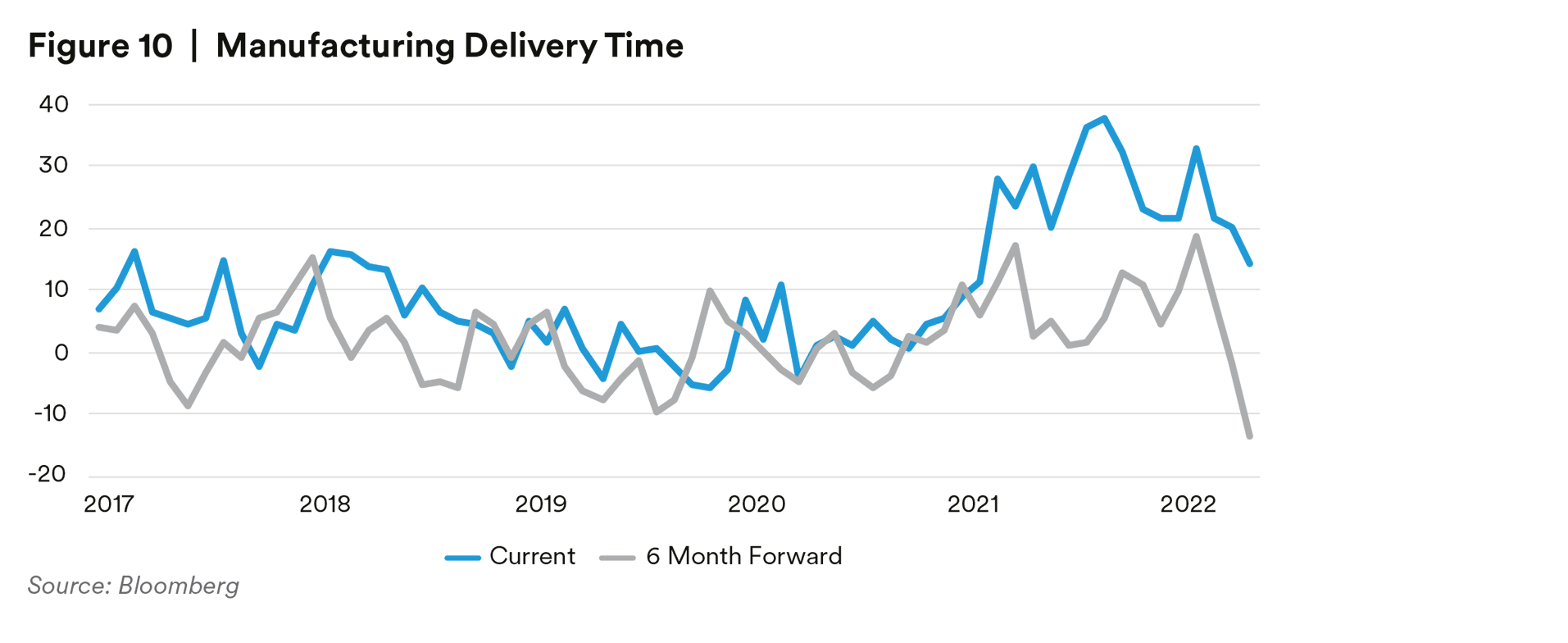

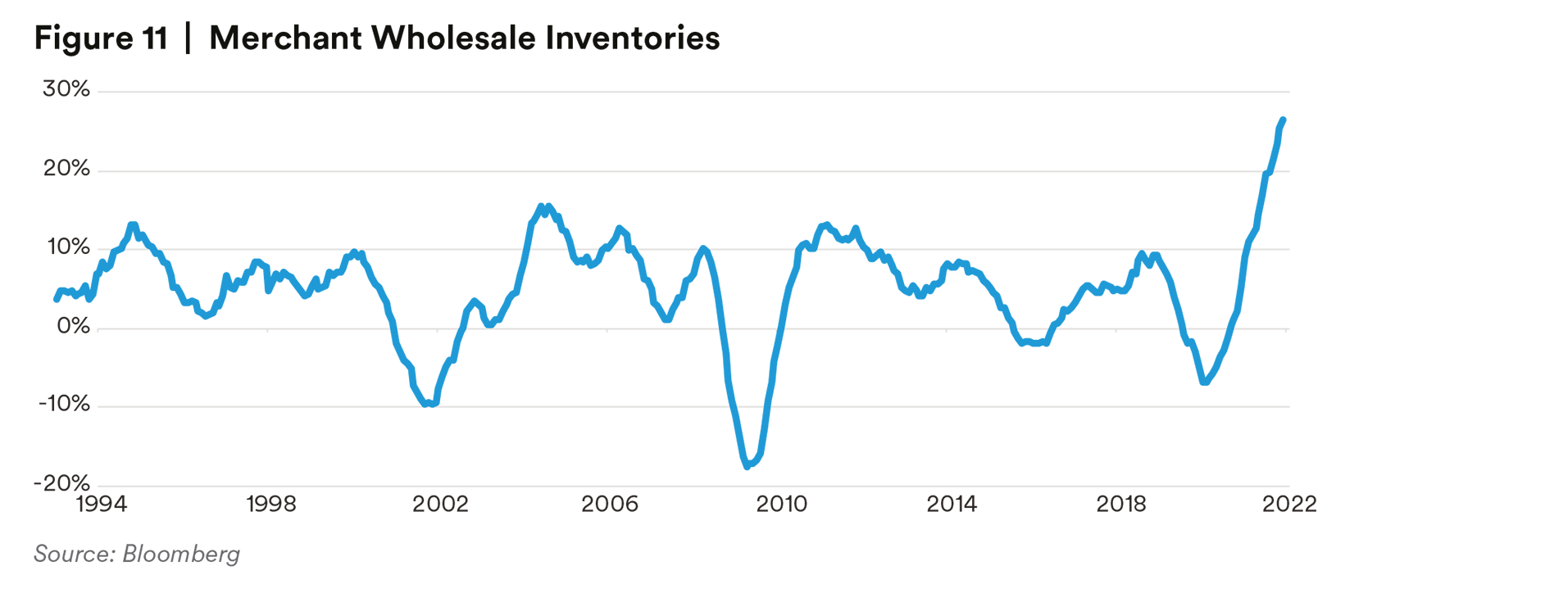

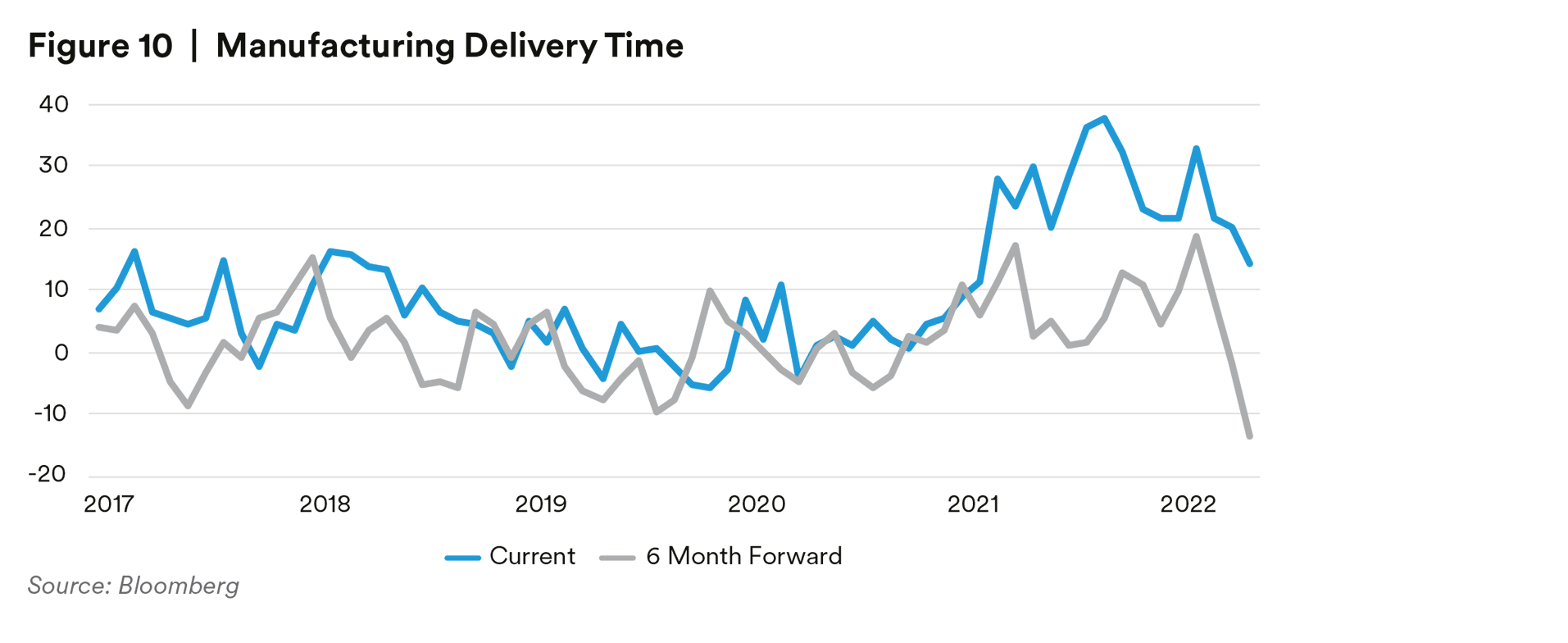

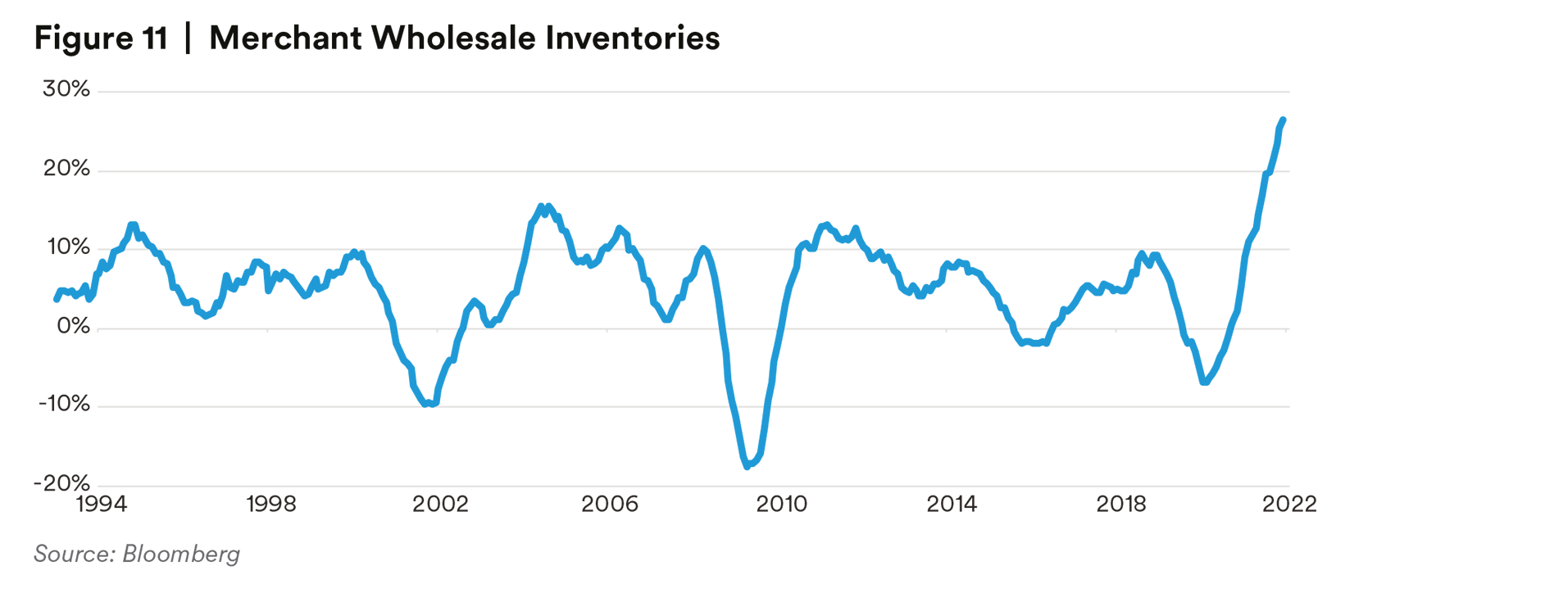

Corporate credit metrics are deteriorating. Although coverage ratios and corporate balance sheets are still relatively healthy, leverage is beginning to tick higher and we feel coverage ratios will decline with the increase in interest costs. The recent high profile profit warnings from major retailers are likely just the start of a more insidious pattern we expect to hear about with the round of second quarter earnings releases. In fact, as shown in Figures 10 and 11, supply chains are easing, and inventory is building.

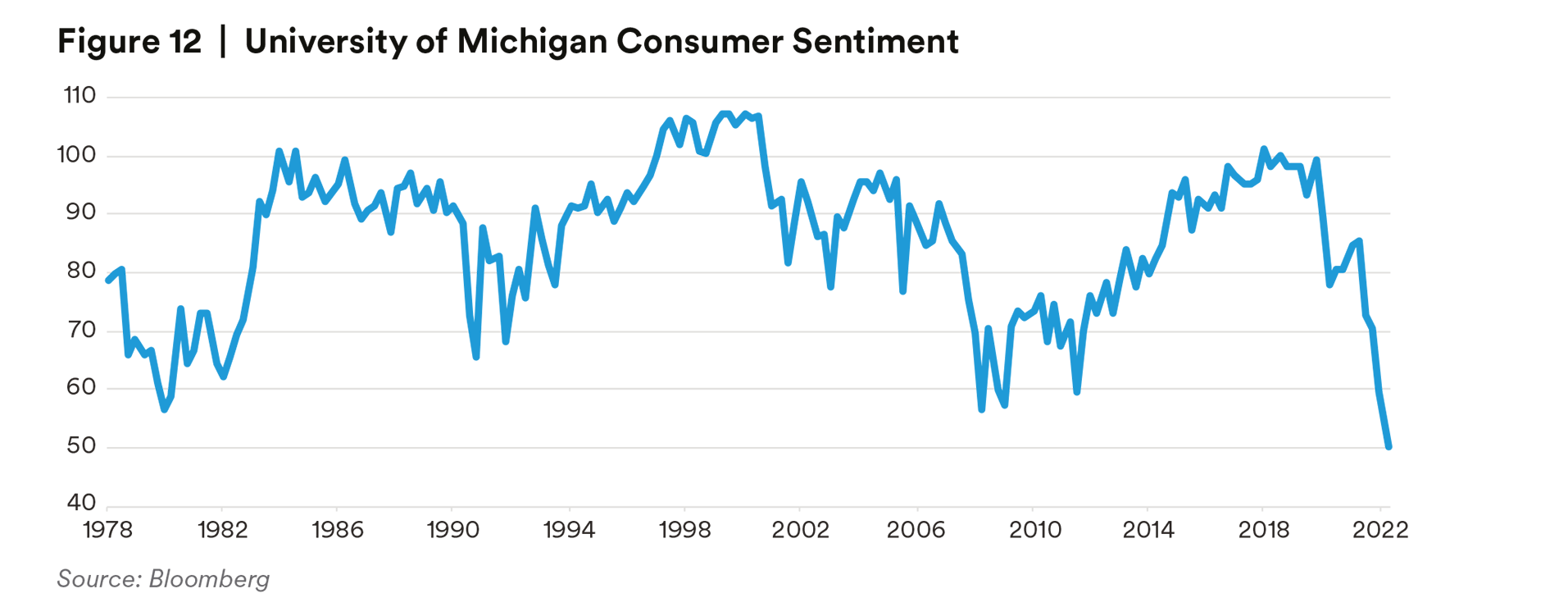

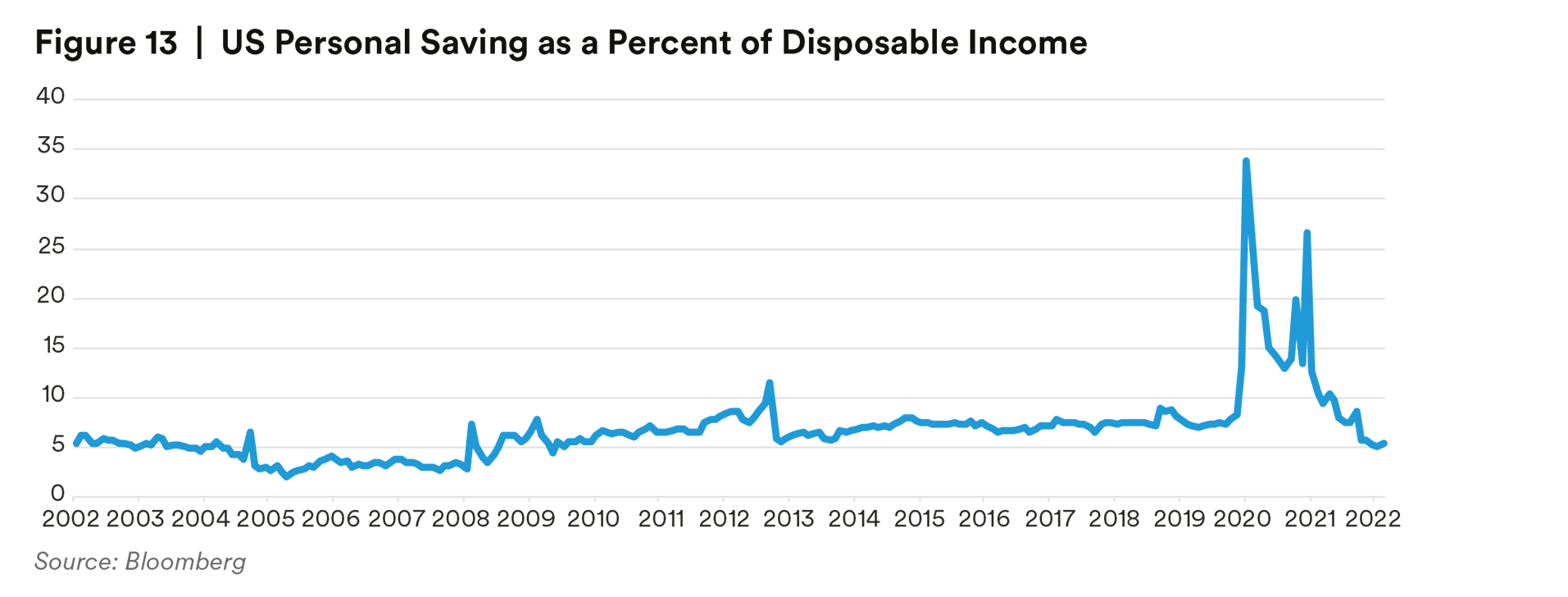

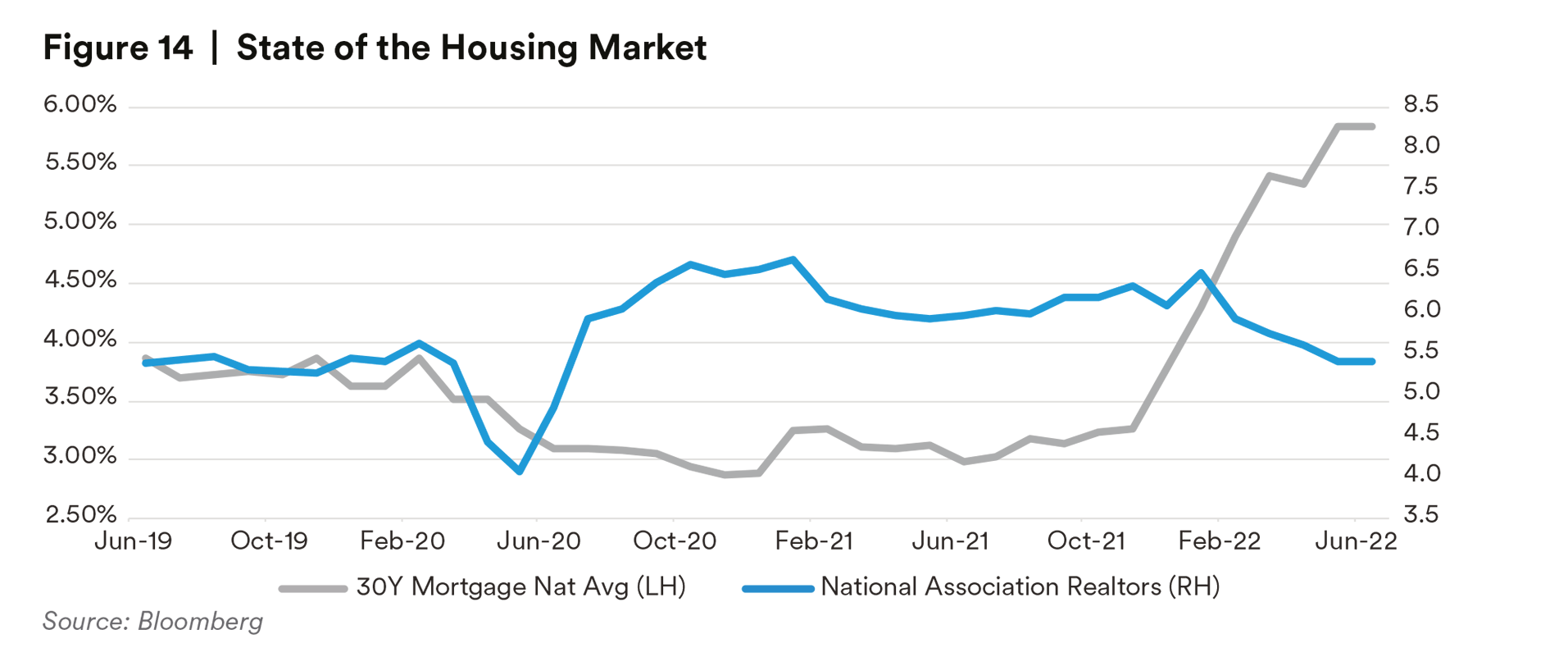

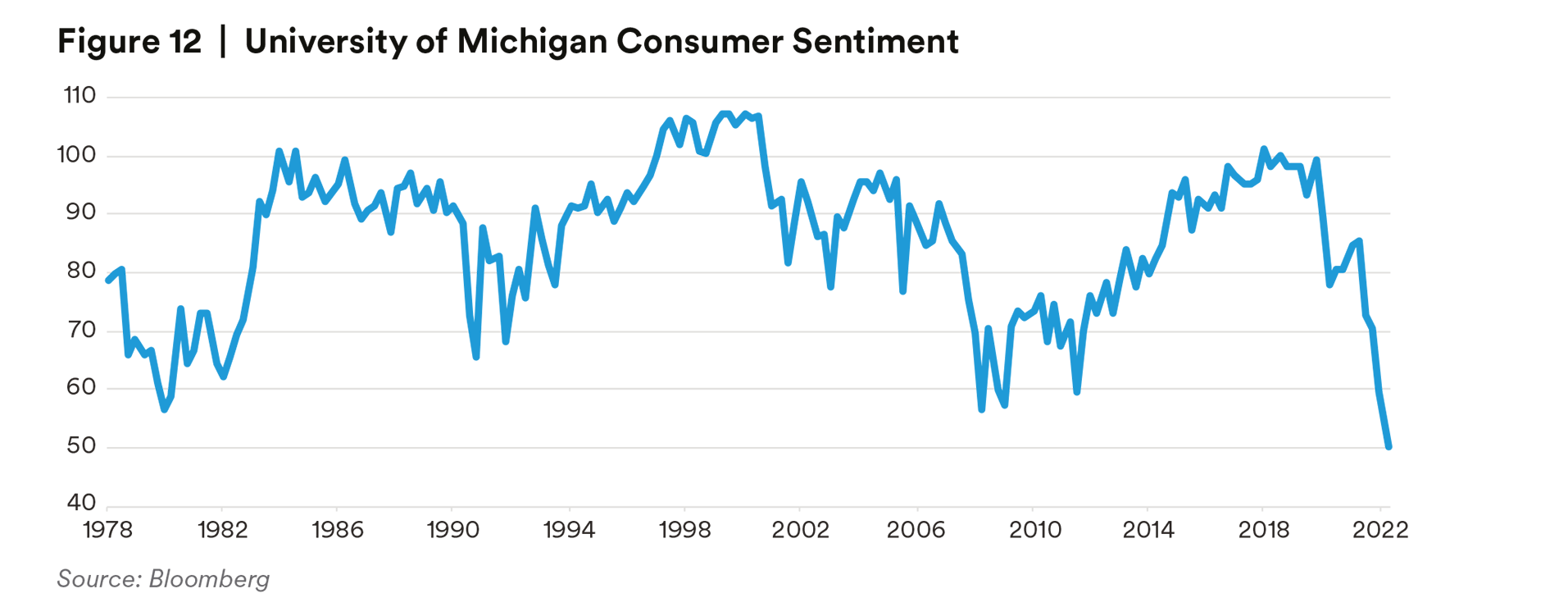

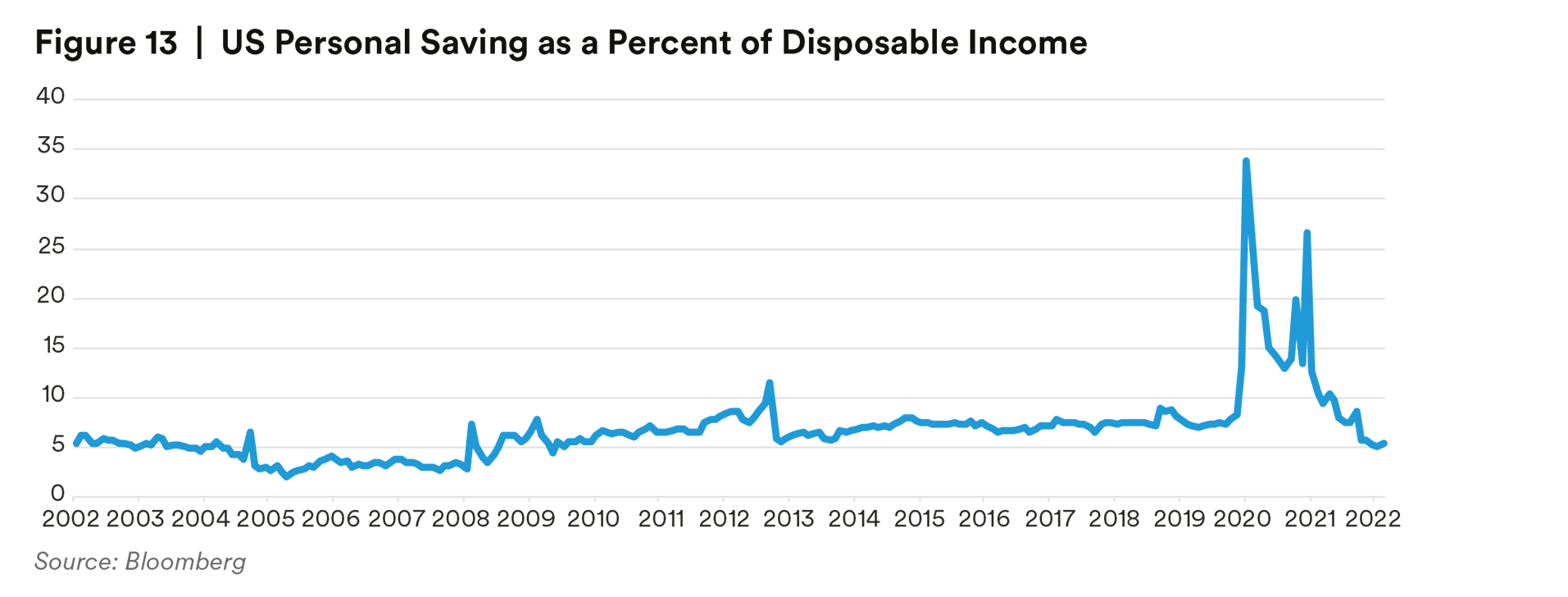

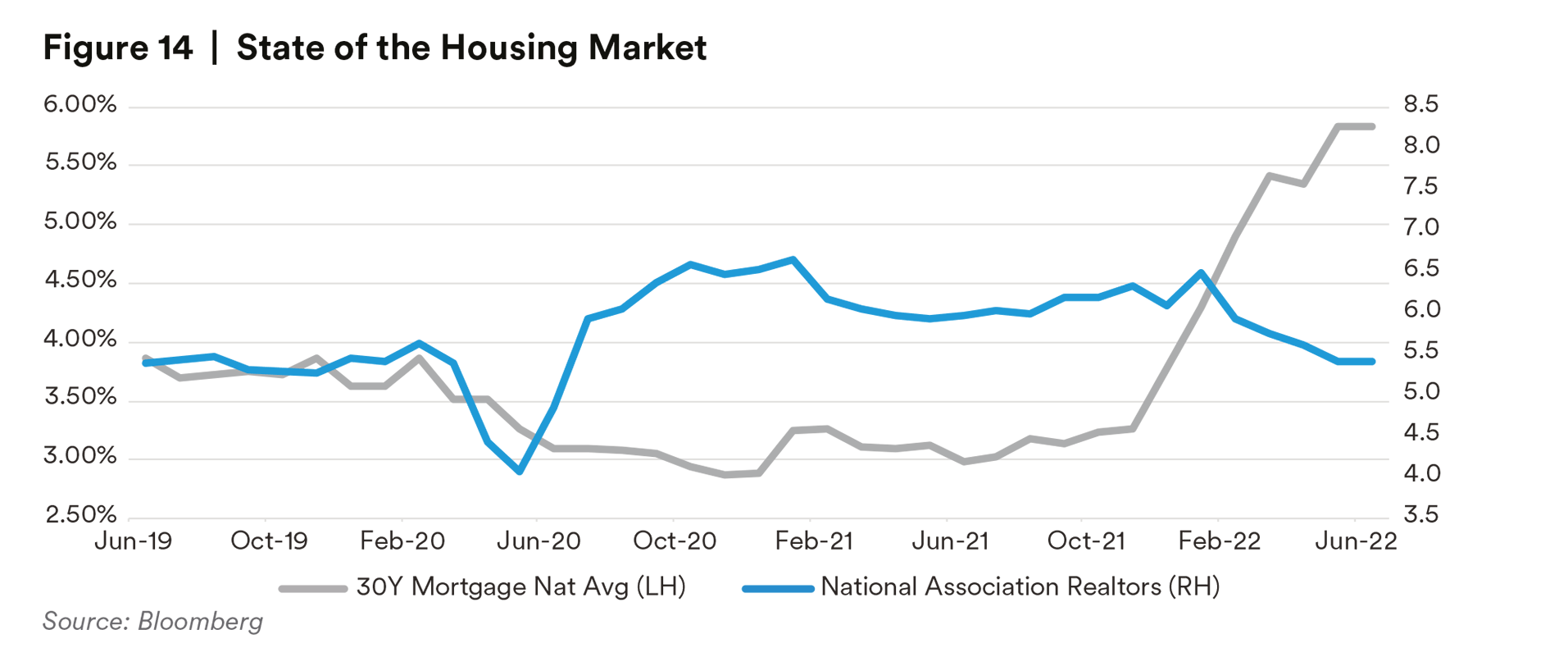

Additionally, the inflationary environment has caused consumers to increase borrowing to maintain their consumption and living standards. As demonstrated in Figures 12-14, higher prices for gas, food, and housing are taking their toll on consumers and savings cushions have been significantly reduced, especially for those in lower income brackets who are more apt to live paycheck to paycheck. Consumer sentiment is the lowest ever and US home sales are plunging as borrowing rates have spiked.

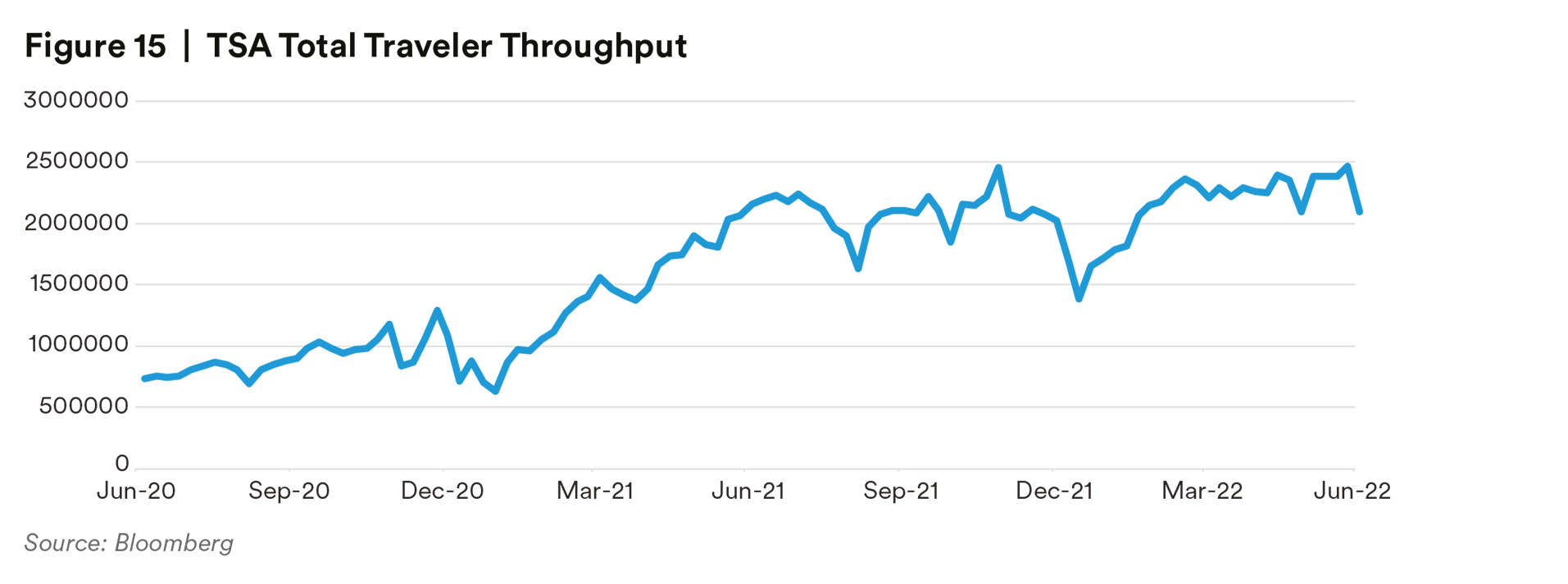

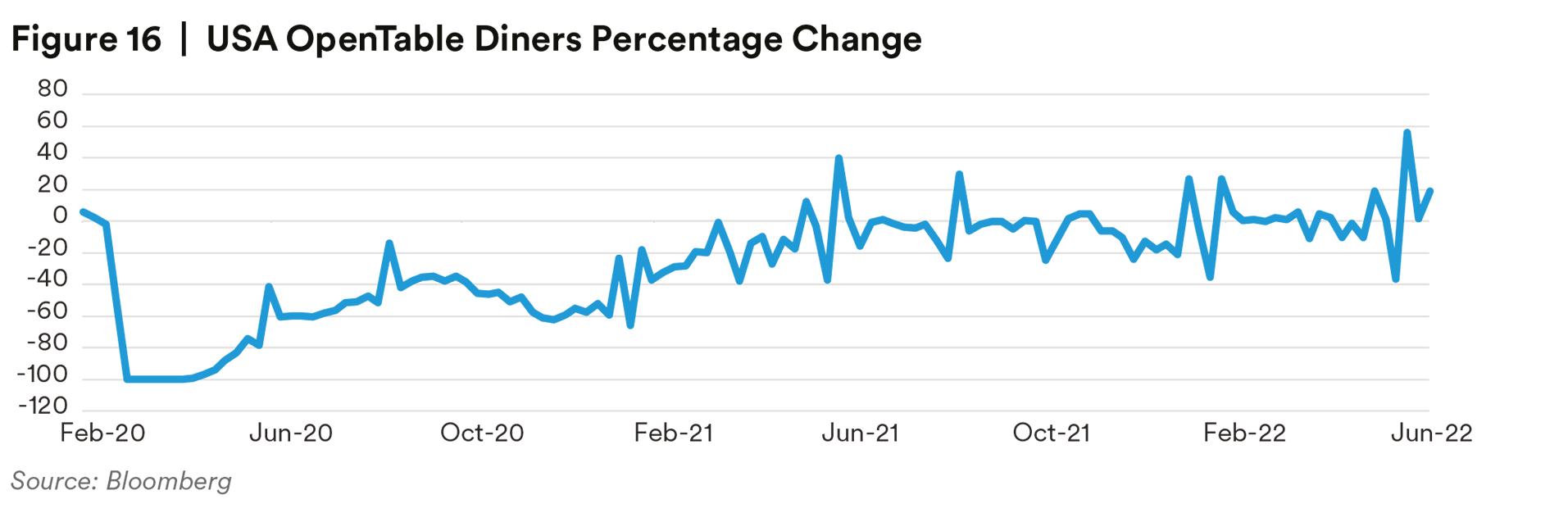

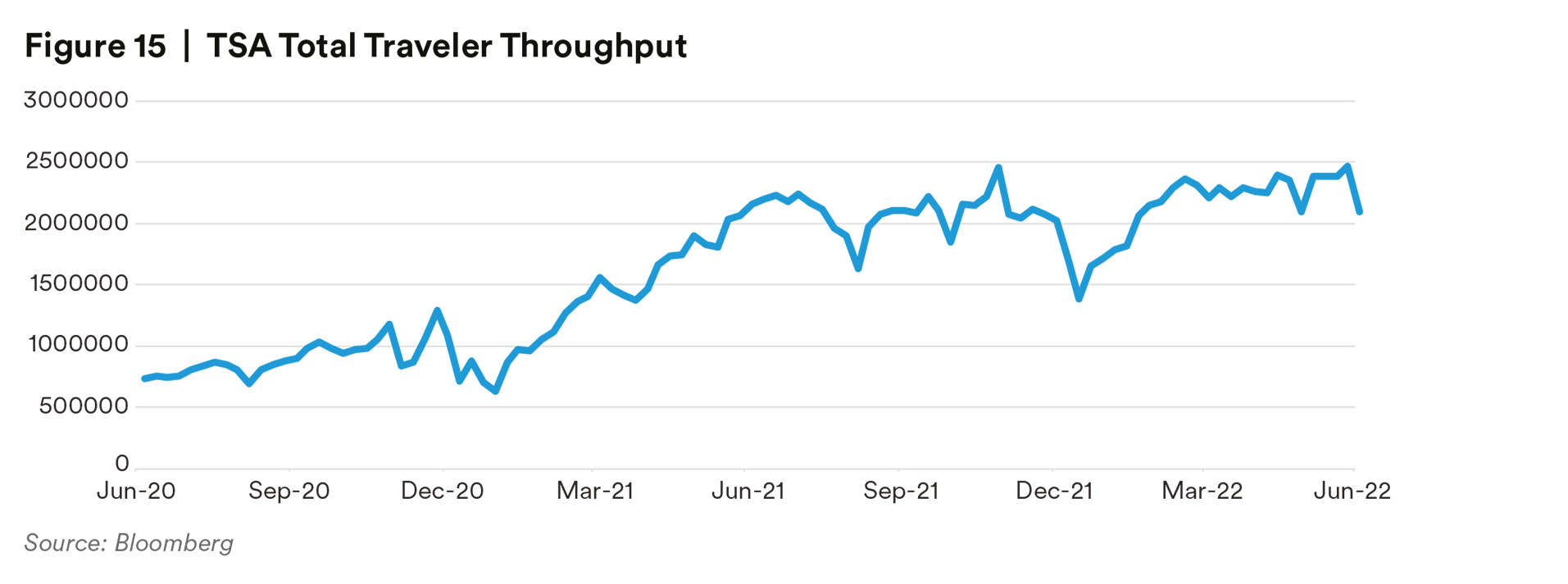

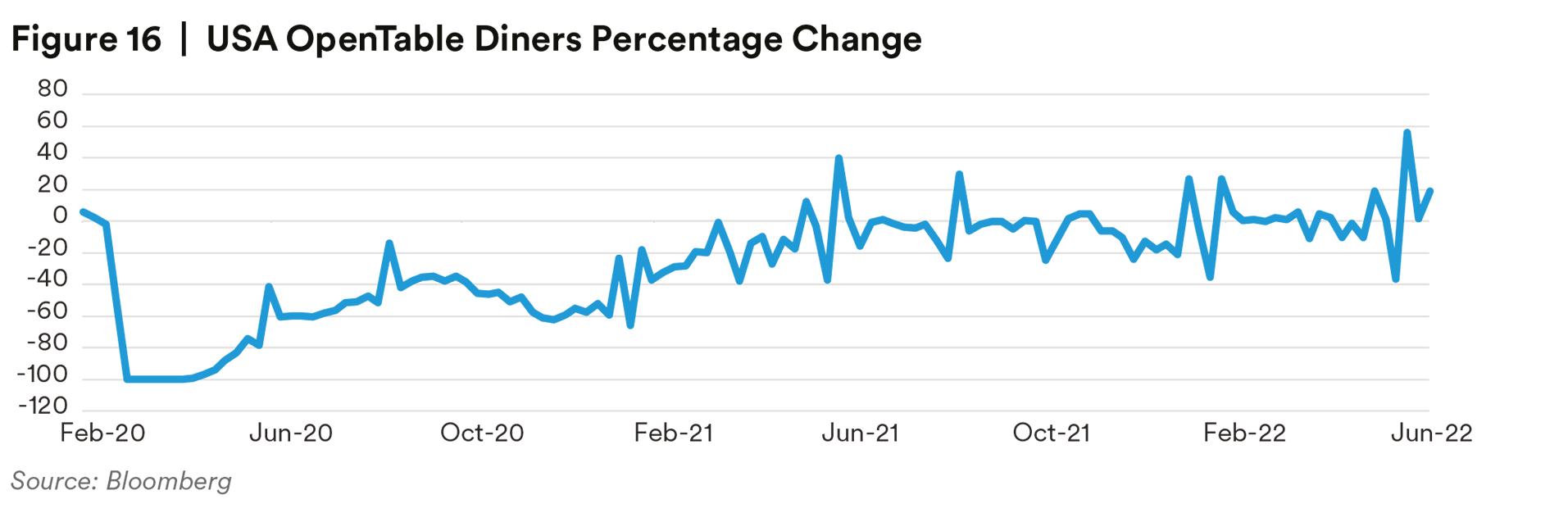

While consumption metrics such as TSA throughput and OpenTable dining still show strong US consumption, we note many of those plans were made long ago and we expect some weakness in this data to come soon.

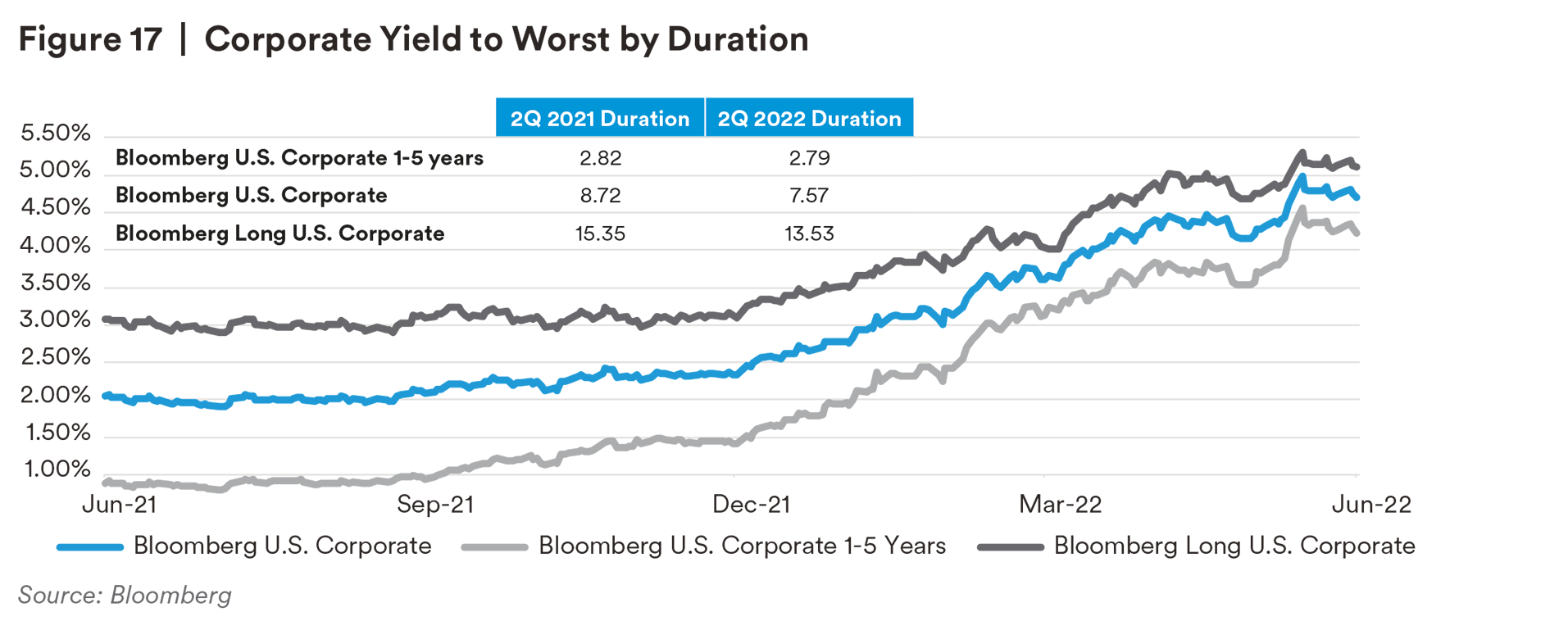

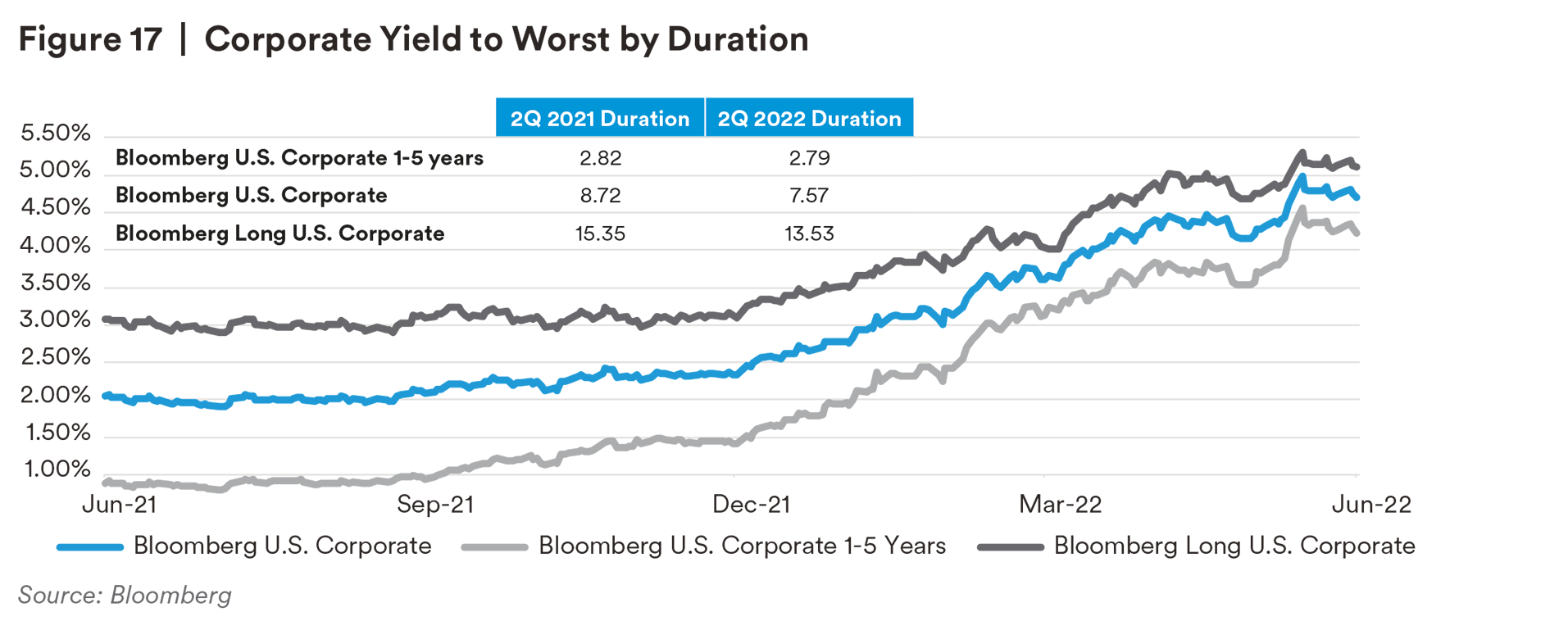

This will have a direct impact on corporate spread sectors such as Consumer Cyclicals, Technology, and Capital Goods. The balance of 2022 will require extreme caution by lenders in credit selection. While the above commentary is dire, we suggest the credit markets have priced in a substantial portion of the negative news and there are pockets of value and opportunity for fixed income investors. Value, as measured by yield and shown in Figure 17, is actually available in the market again after a long, QE suppressed slumber. Due to flat corporate credit curves on a flat Treasury curve, we feel attractive yields can be had without having to take significant duration risk. Corporates maturing inside of 5 years yield north of 4% with just a 2.7-year duration.6 Even if short rates continue to rise (not our view), corporate investors will have attractive reinvestment opportunities quickly.

Flat credit curves and flat yield curves also offer investors the opportunity to shift exposures without incurring large yield changes in portfolios. There are many situations that allow investors to shorten issuer exposure without having to give up yield, possible even increasing yield depending on issuer liquidity.

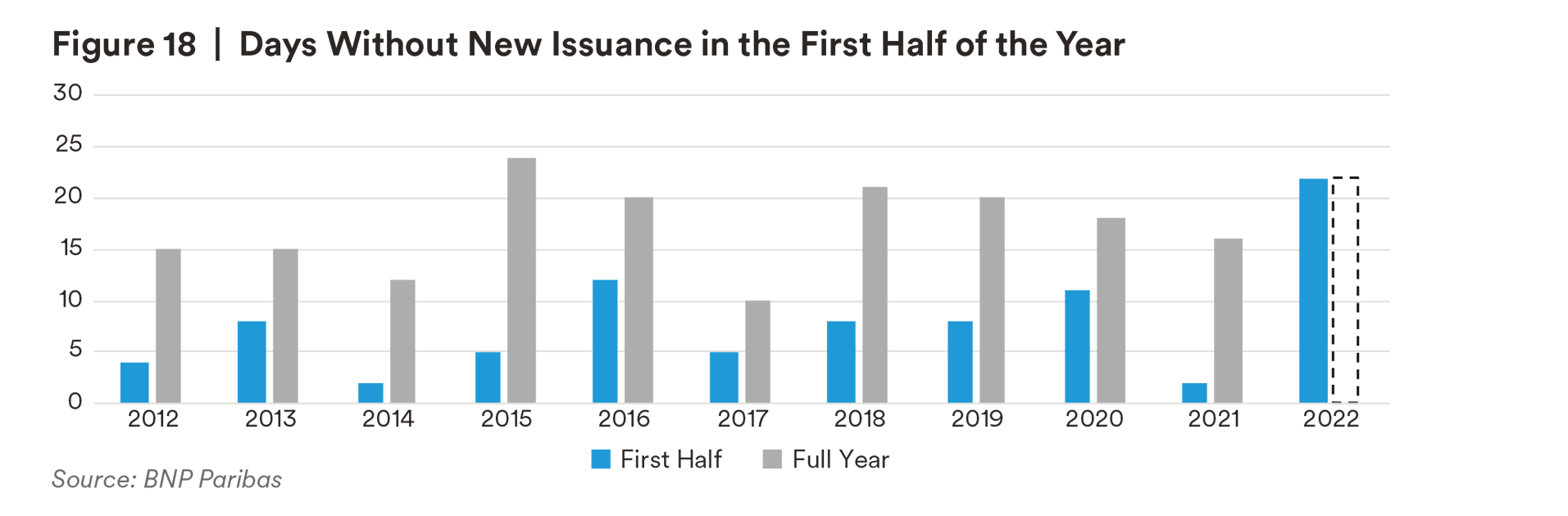

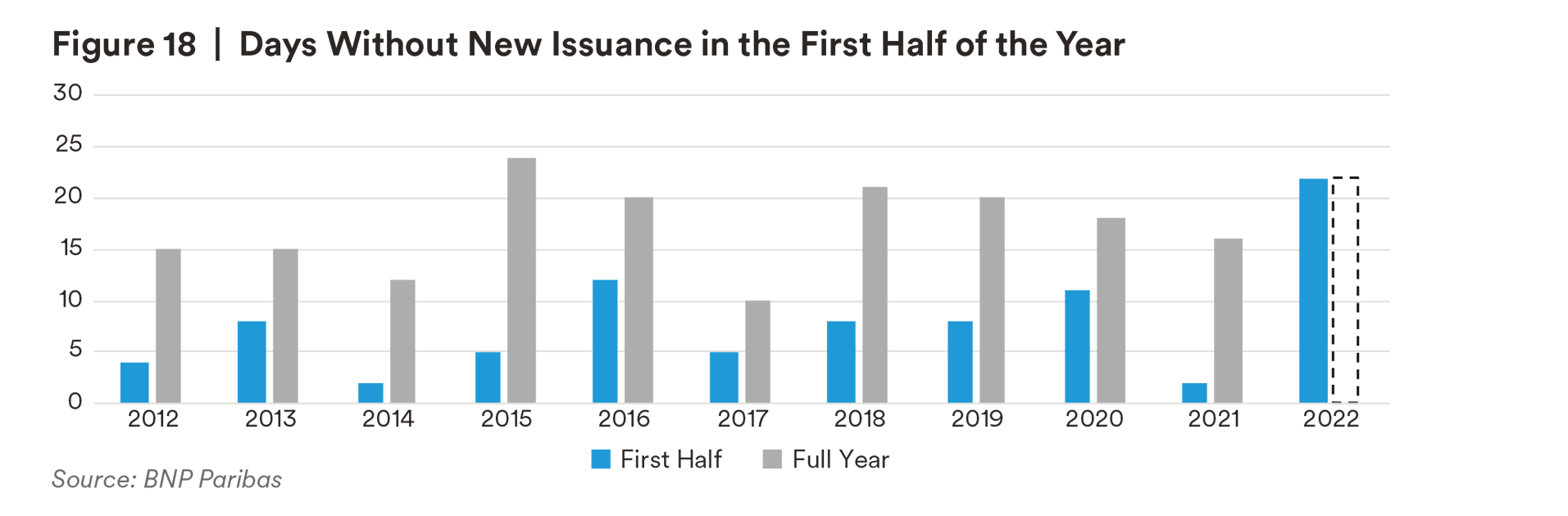

We have historically been quite active in the debt capital primary markets, but this year, we have been markedly less active. Issuance trends have slowed, leading many forecasters to lower their predictions for 2022 new issuance for both Investment Grade and High Yield corporates. In fact, as shown in Figure 18, the first half of this year saw more days of no new bonds issued since 2008 - certainly a byproduct of the aforementioned volatility. With capital markets intermittently closed, price discovery is poor, and we tend to see new bonds performing poorly. As a result, we expect our sources of idea generation in new issuance to remain relatively depressed for the remainder of the year.

Our risk remains at the low end of historical ranges. Due to the extreme flattening of the yield curve, we continue to find value in short-dated corporates that carry yields not seen in years. Alternatively, out the curve, and also due to the rapid rise in long term rates combined with low coupons of issuance the past few years, there are many securities trading at deep discount prices. Overall, we favor both high yielding, short duration bonds and low dollar price, longer duration corporates as attractive in the current environment. In terms of sector positioning, we are generally cautious around those sectors and names that are likely to face profitability pressures amid a slowdown in consumer spending.

Endnotes

1 Bloomberg

2 Bloomberg

3 Bloomberg

4 Bloomberg

5 Bloomberg Barclays

6 Bloomberg

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. You should consult your tax or legal adviser about the issues discussed herein. The investments discussed may fluctuate in price or value. Investors may get back less than they invested.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address Level 34 One Canada Square London E14 5AA United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102- 0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) No. 2414.

For Investors in Hong Kong: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”).

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for the following affiliates that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC and MetLife Investment Management Europe Limited.

Unless otherwise noted, none of the authors of the articles on this page are regulated in Ireland.