QT: How Low Can They Go?

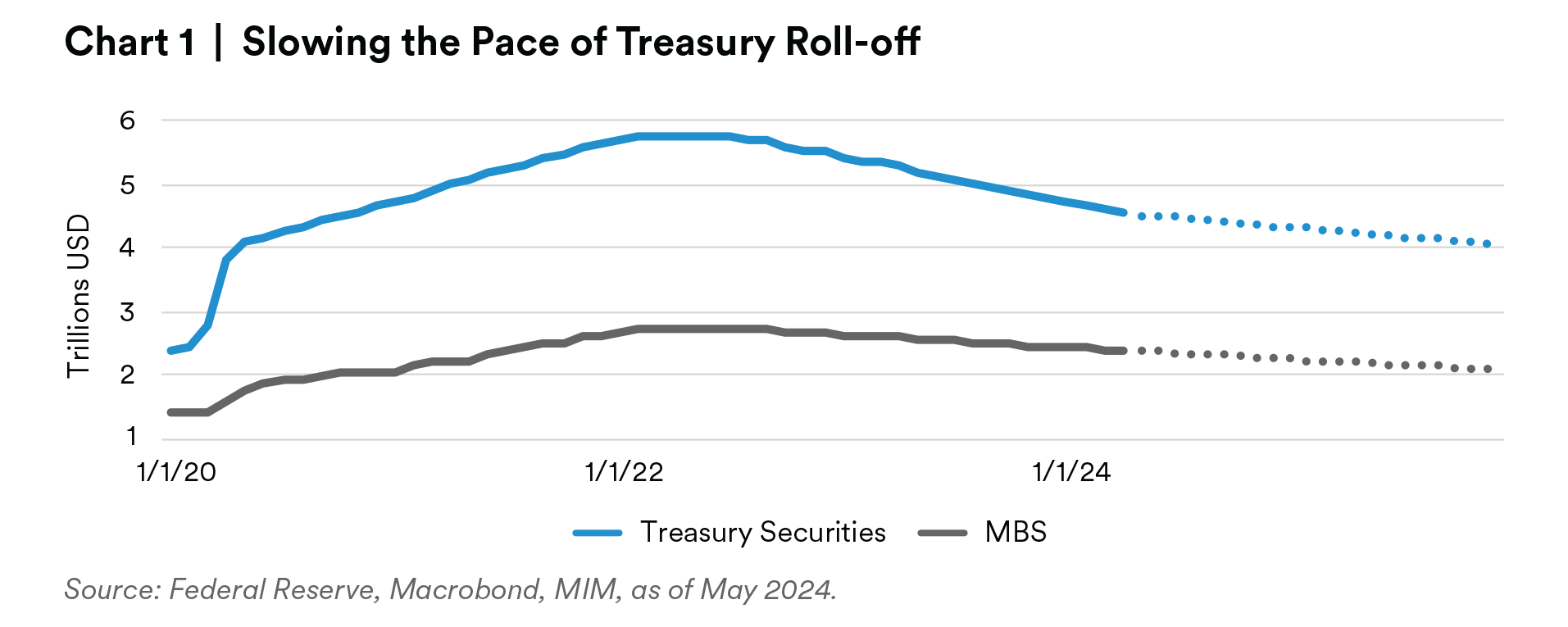

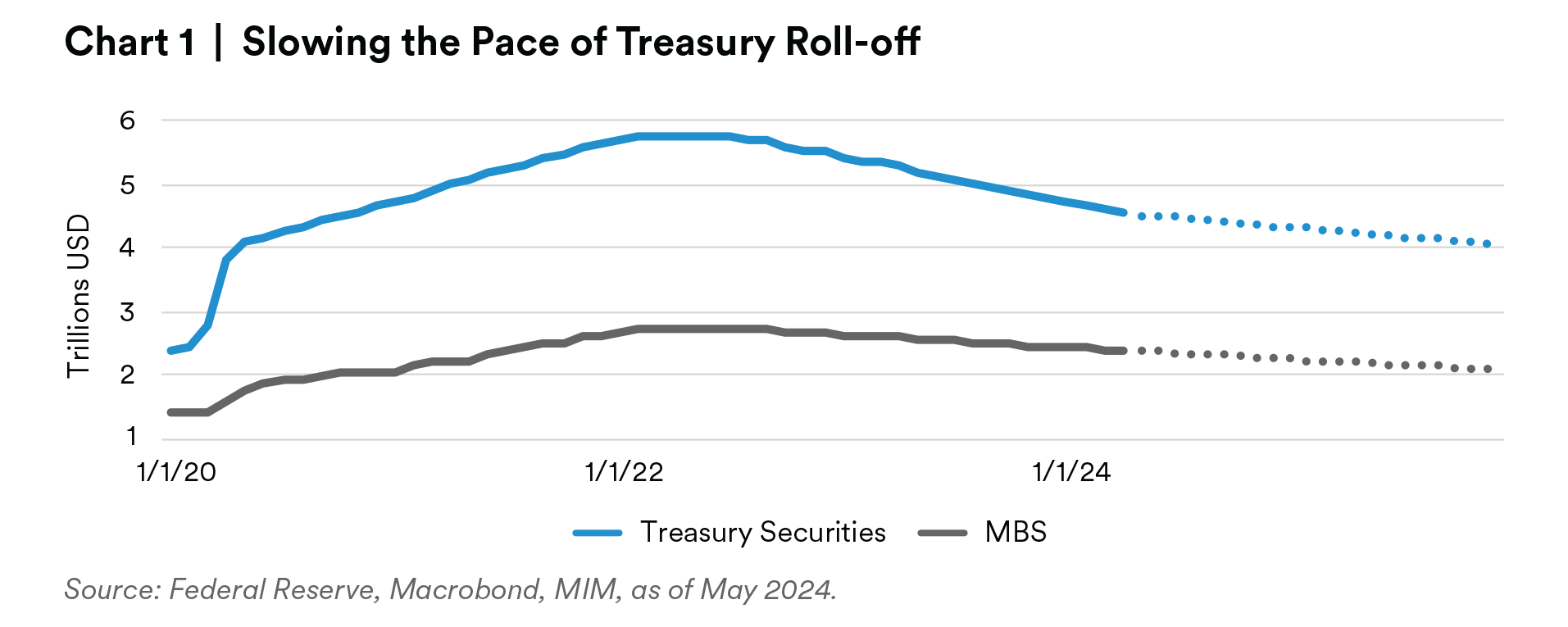

The FOMC reduced the pace of QT at the May meeting. The new cap allows $25 billion of Treasury securities to roll off each month, down from $60 billion. Including the recent pace of $15 billion a month reduction of mortgage-backed securities (MBS) means the total reduction will reach a monthly run rate of roughly $40 billion each month, $35 billion less than before.1

At the new pace, QT would have to continue through 2026 to reach a level of excess reserves matching the pre- pandemic level of just over 7% of nominal GDP.

While the slowdown in pace theoretically reduces monetary policy tightness, the Fed’s rationale is to ultimately lead to greater tightening by allowing the Fed to reduce its balance sheet gradually without causing economic disruption.

The Fed may slow the pace of QT further if it is forced to cut rates. That being said, the reason for the rate cut matters. If the cut is in response to abrupt or unexpected economic weakness, then further balance sheet reduction is likely to be quickly curtailed. If the cut is pre-emptive and is meant only to normalize monetary policy, ongoing balance sheet reduction is more likely.

Fed Funds: How Fast Can They Go?

It appears that we are better off taking the Fed seriously but not literally.

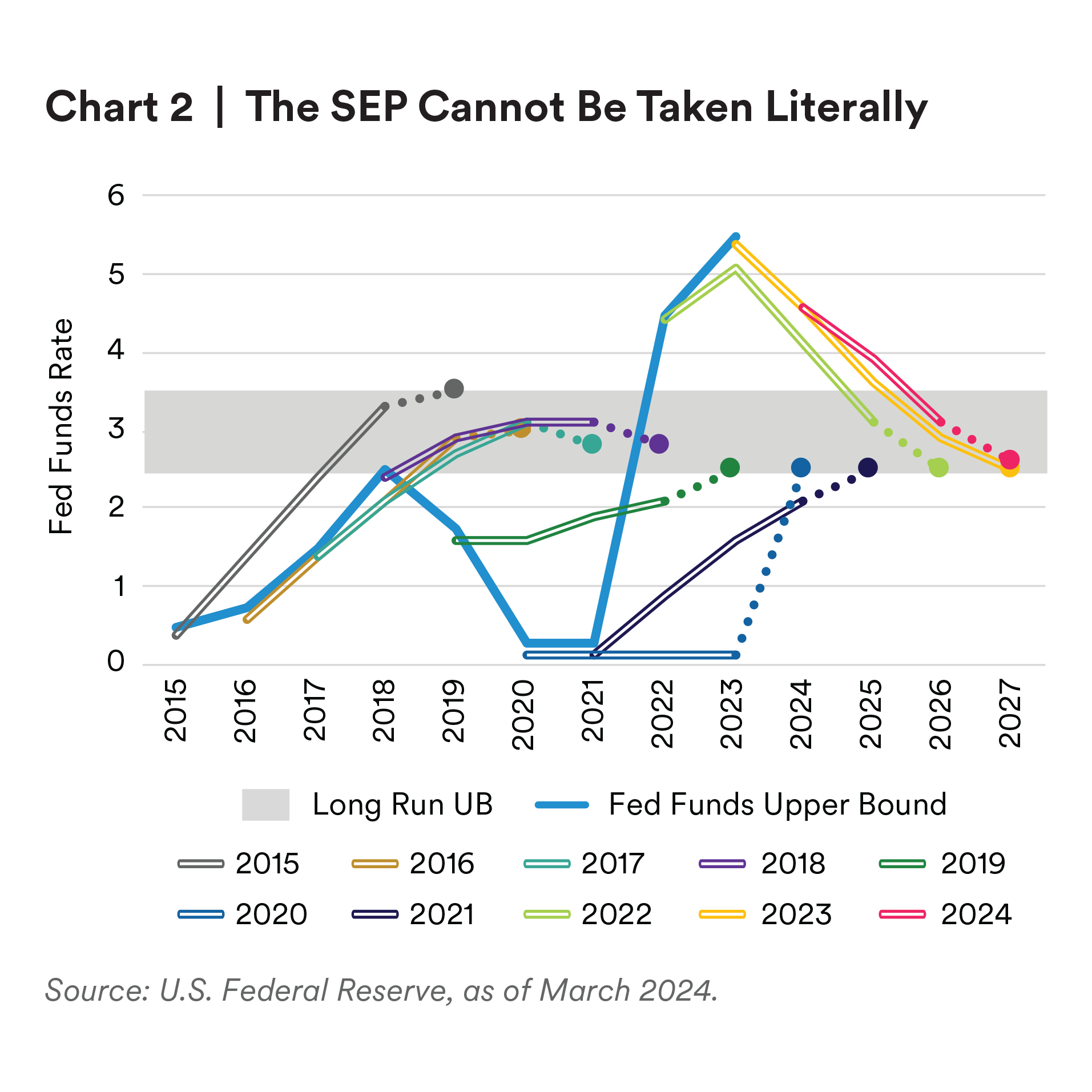

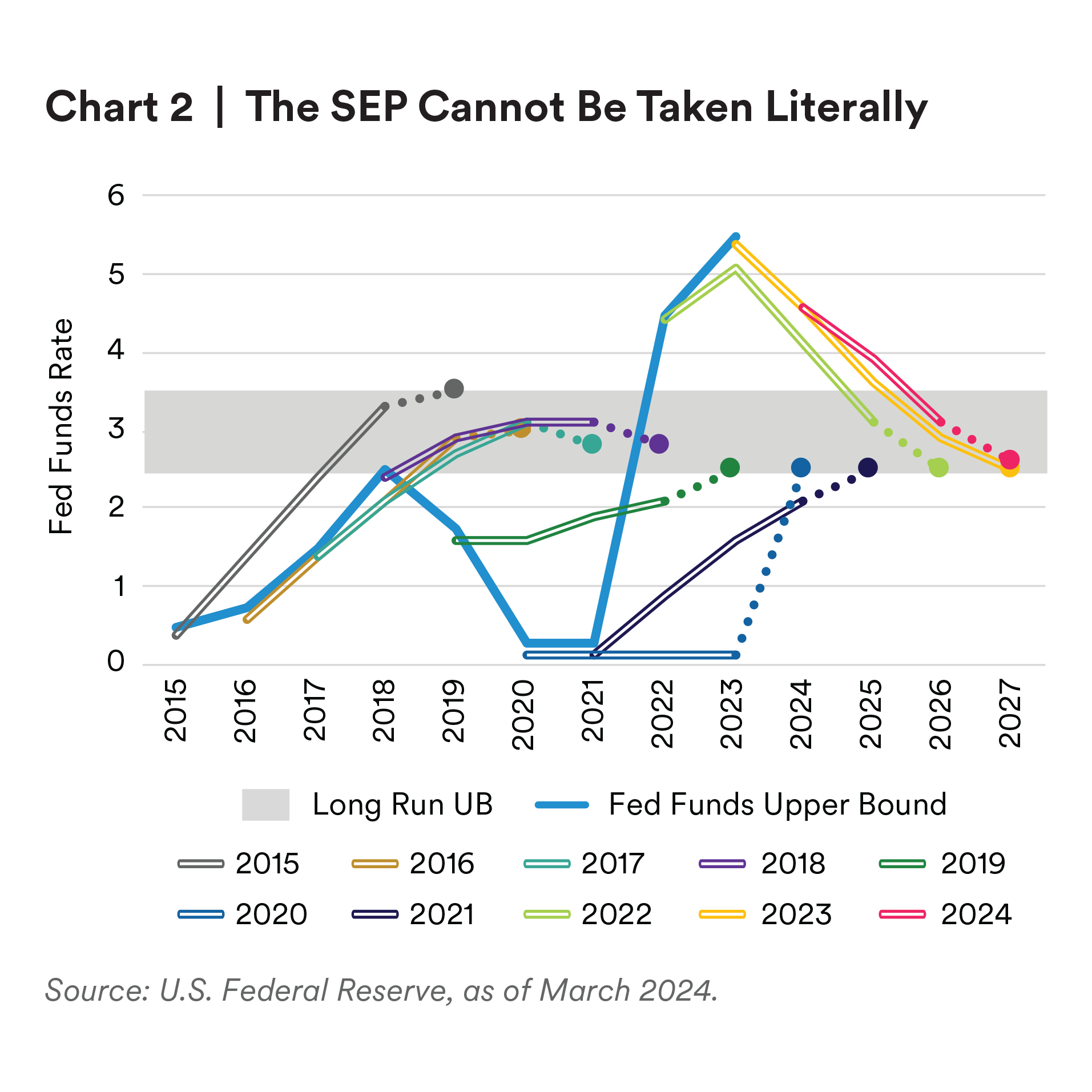

Chart 2 shows the actual fed funds rate (upper bound) alongside the median Summary of Economic Projections (SEP) forecasts for December of the relevant year. Their forecast for the longer-term neutral rate has been between 2.5-3.5 (shaded area) over the past 10 years.

This longer-term perspective provides an interesting lensthrough which to interpret the most recent SEP forecast (March 2024).

The FOMC is currently quite optimistic about its ability to revert to its median neutral rate of 2.6% from the current rate of 5.3%.2

Historically, the FOMC has been correct about the future direction of the fed funds rate—except in 2019 when it obviously failed to forecast the pandemic.

But it has also often been overly optimistic about how quickly it would be able to reach its neutral rate. Again, a major deviation occurred due to the pandemic, when at the end of 2020 the FOMC indicated that it would continue to keep the fed funds rate at zero for as long as needed to stabilize the economy.

The Fed may indeed be overly optimistic about the speed with which it approaches the neutral rate. It appears best to take the SEP as simply an indication of direction of travel, without taking too literally the number of rates hikes or cuts they provide in their forecasts.

ECB: Wie Gross Wird Die Zinssenkung Sein?

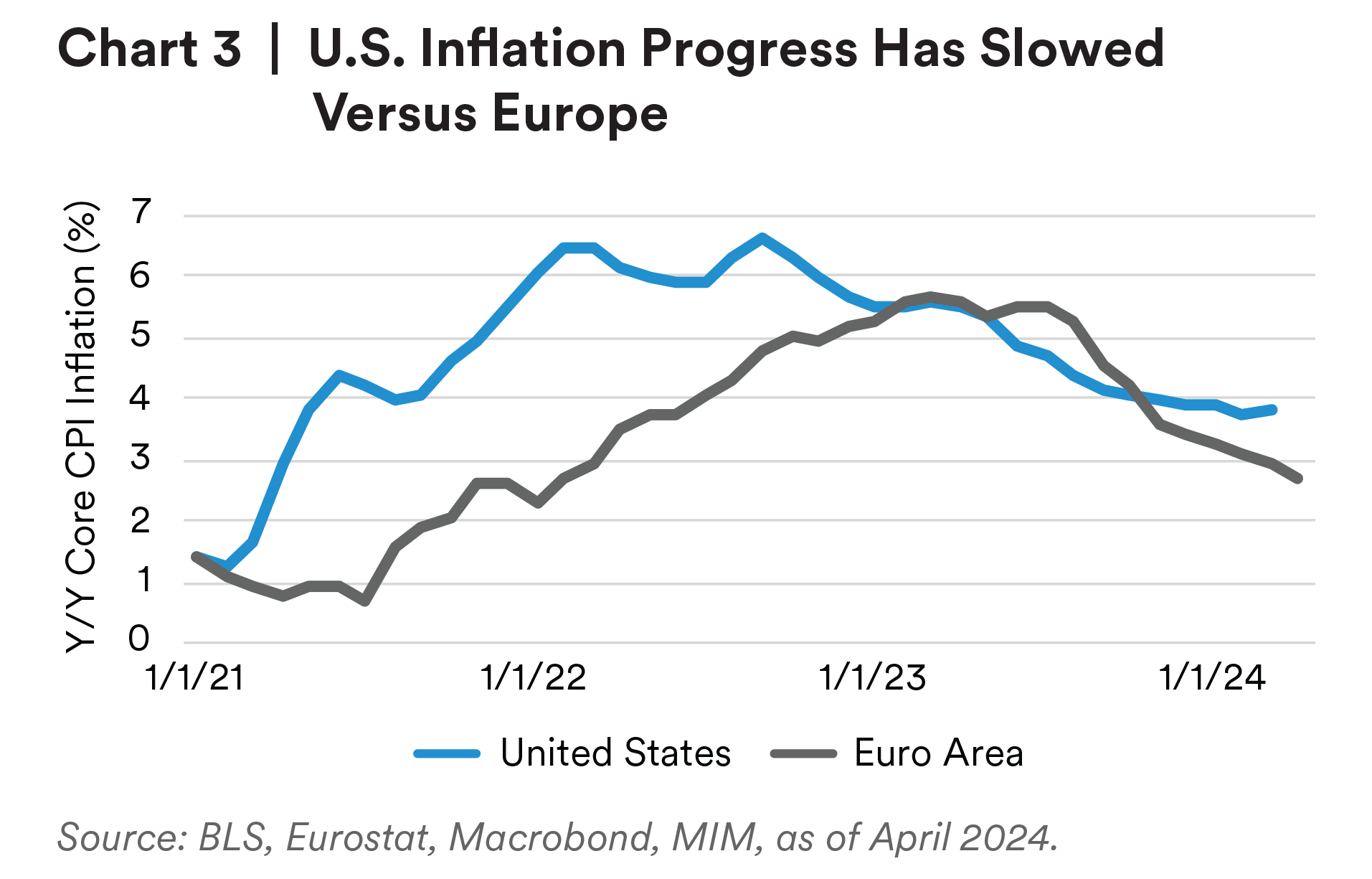

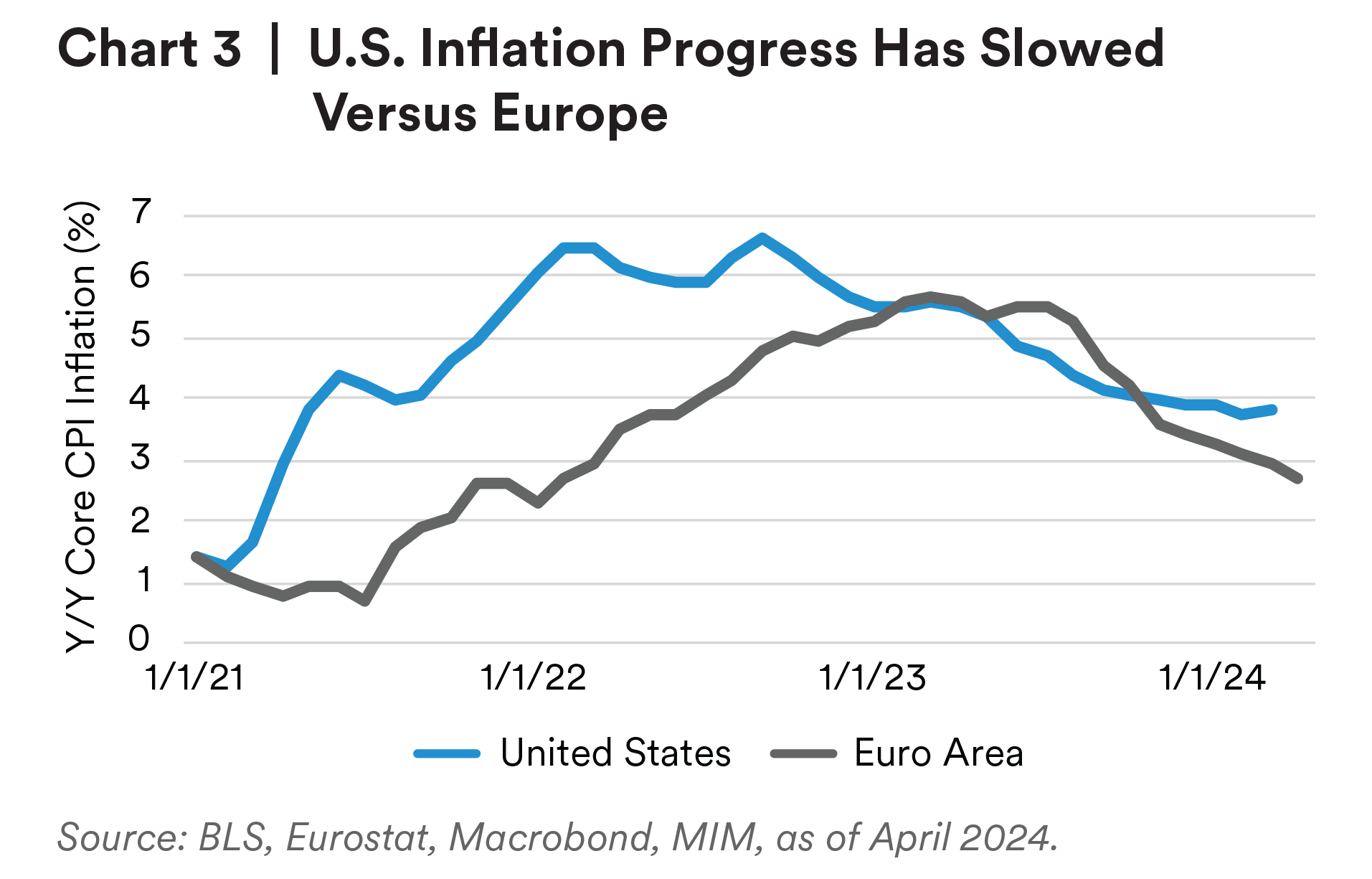

In recent months, progress on U.S. inflation has stalled to 3.8% year-over-year for core CPI, leading the FOMC to continue maintaining a high policy rate. Meanwhile, the ECB is poised to begin rate cuts in June, and Eurostat data show euro area core inflation fell to a 26-month low of 2.7% year-over-year in April.3 The BoE could also start cutting rates as soon as its June meeting, absent negative surprises from upcoming inflation or wage growth data.

Historically, other central banks have synchronized with the Fed in their monetary policy pivots.

The possibility of the ECB easing first has raised concerns of euro depreciation and excess upward pressure on euro area consumer prices.

This effect is likely to be moderate. Estimates of this so- called exchange rate passthrough effect range from a 0.12 to 0.8 cumulative percentage point effect on headline inflation over three years, given a 1% depreciation of the trade-weighted exchange rate.4 These estimated inflation effects are not likely large enough to disrupt the euro area’s inflation agenda.

One area of caution is that the strongest inflation effects have typically been seen when the domestic country (in this case the euro area) has initiated relatively looser monetary policy.5 However, on net, we believe stable euro area growth and stronger net exports can bolster the euro, and that the ECB can focus its attention on domestic concerns such as remaining (somewhat stickier) services inflation rather than the likely short-term divergence from Fed monetary policy.

Lastly, it is worth noting that an ECB cut would indicate an asynchronous rather than a truly divergent policy, as we might see if (for example) Europe was in expansion while the U.S. was in contraction.

U.S. Outlook Summary

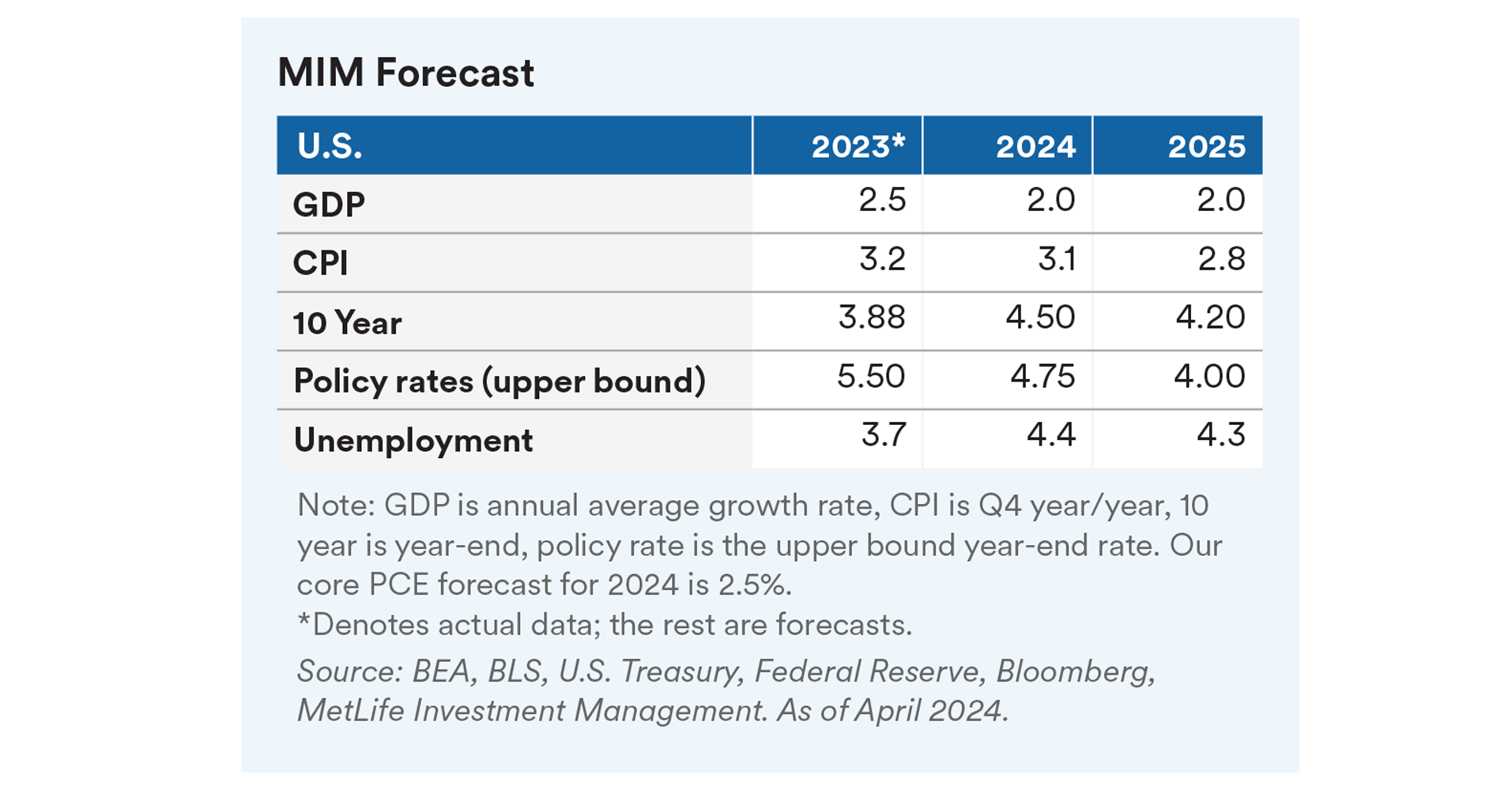

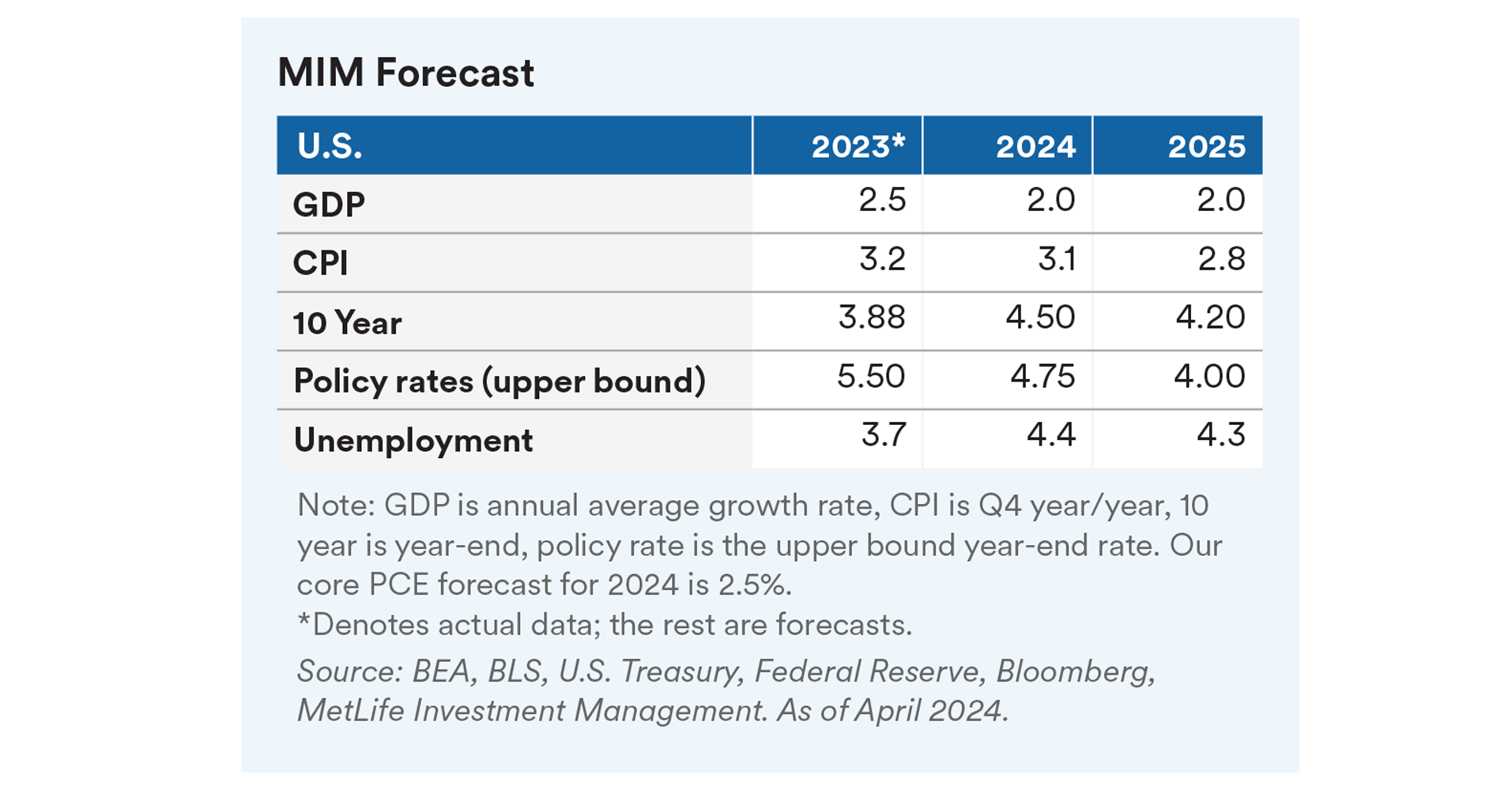

We expect growth in 2024 to be softer than 2023 but remain healthy. First quarter GDP, although lower than expectations, showed strong residential investment and weaker but still healthy consumption, especially in services. We expect corporate investment to be healthy in 2024, backed by strong profit margins and a growth outlook less clouded by recession.

Residential investment has improved since the beginning of the year, with residential investment contributing 50 basis points (bps) to Q1 2024 growth after contributing negatively to GDP in 2023.6

The government sector, while pulling back vis-à-vis 2023, is still expected to contribute quite a bit to growth as industrial policies at the federal level and continued tax revenue growth at the local level induce spending.

We expect the Fed to cut rates by a total of 75 bps by year end, although if it is not able to cut by July due to persistent inflation, this could decrease to 50 bps. We have revised our inflation forecast for 2024 from 2.8% to 3.1%, given higher recent inflation data but do not expect a further escalation in inflation.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of December 31, 2023, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/ or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited