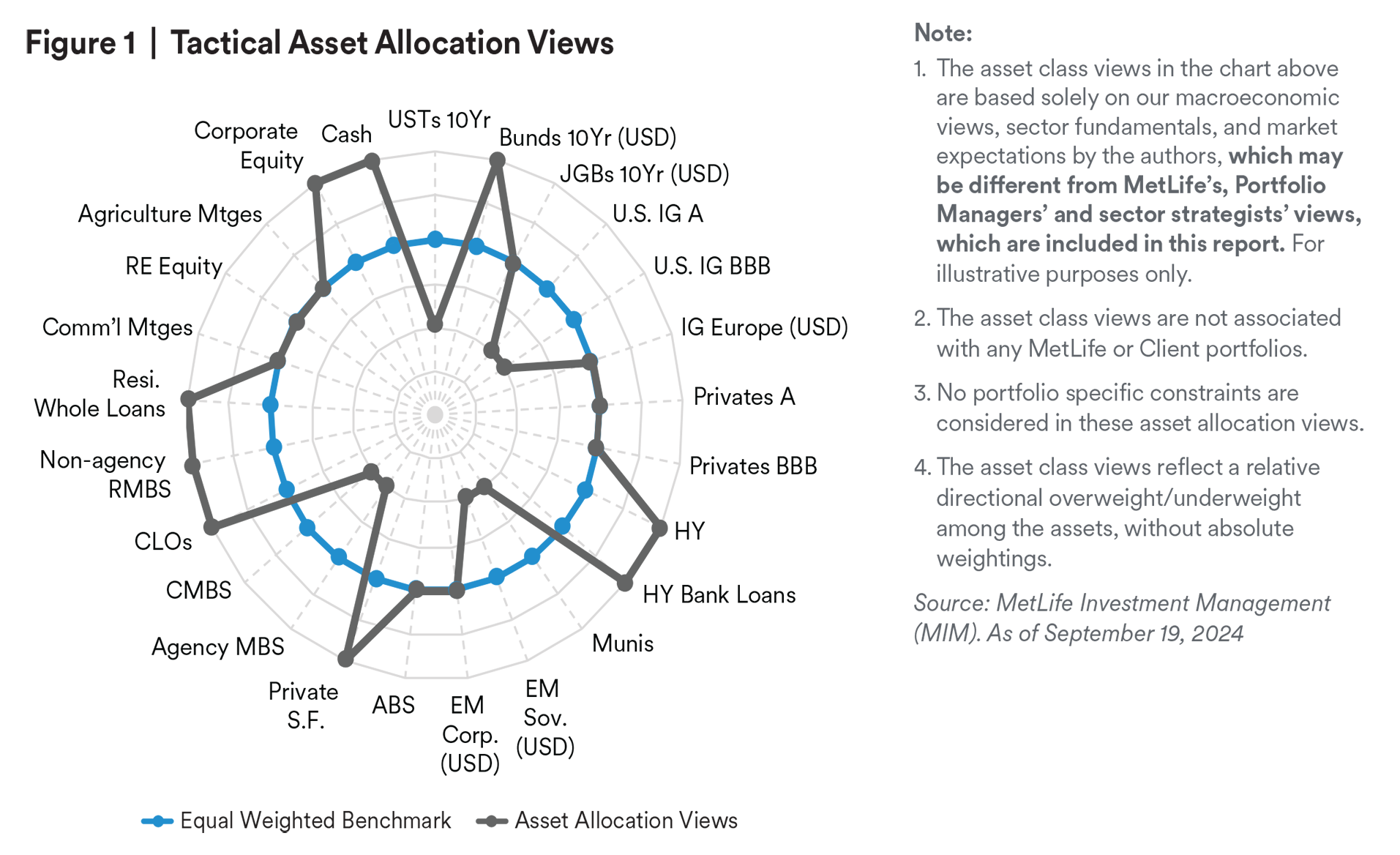

Risk-on, But Not All-in

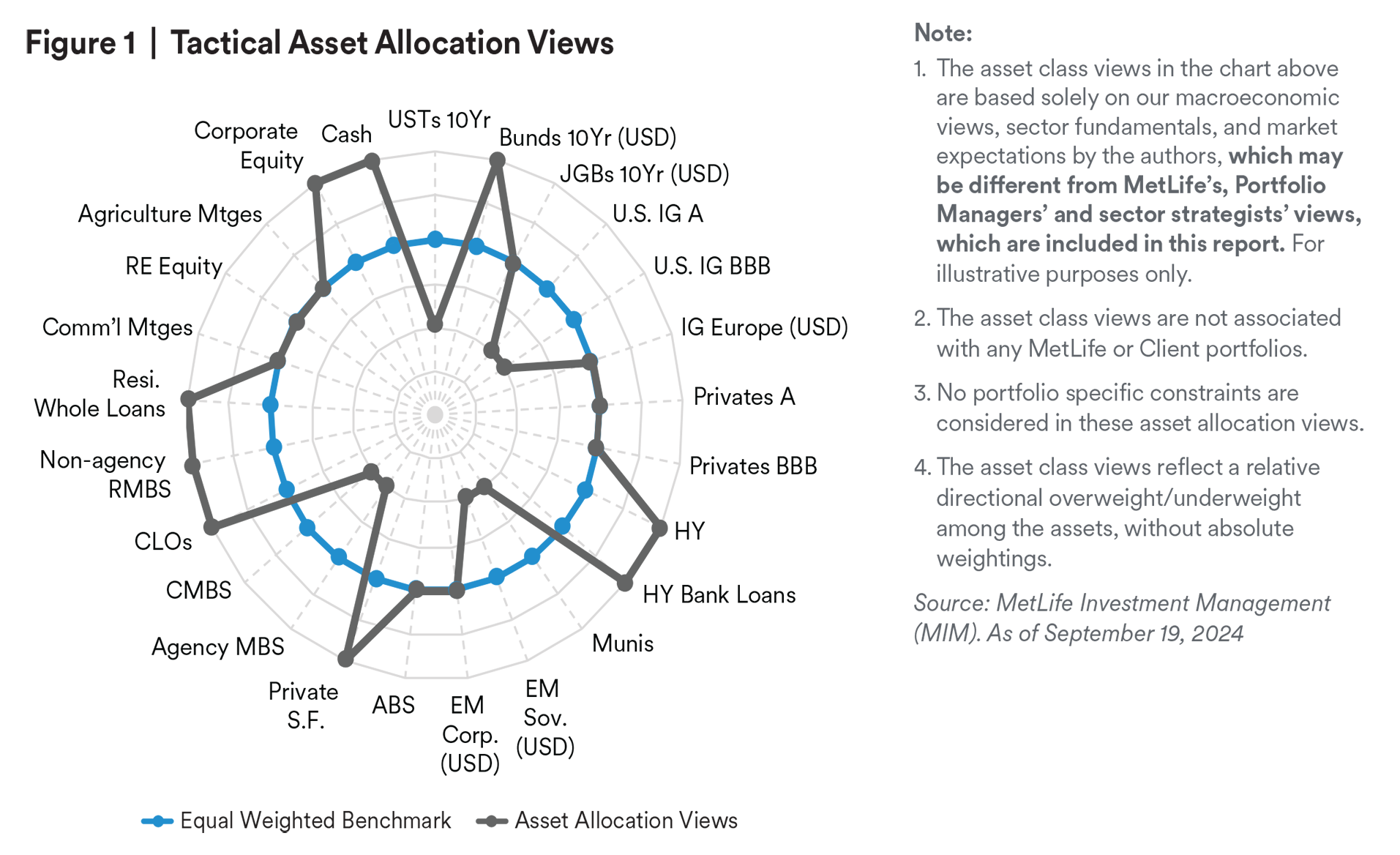

We are anticipating a stable macro environment in the near future, with some uncertainties stemming from U.S. elections and monetary policy. We continue to look for spreads to mostly remain range bound, with a low chance of further tightening. With a low risk of recession, a carry strategy is preferred in the next quarter or two, meaning we prefer investments with attractive yields, while remaining cautious about potential weakness.

We Anticipate Slower Economic Growth Globally

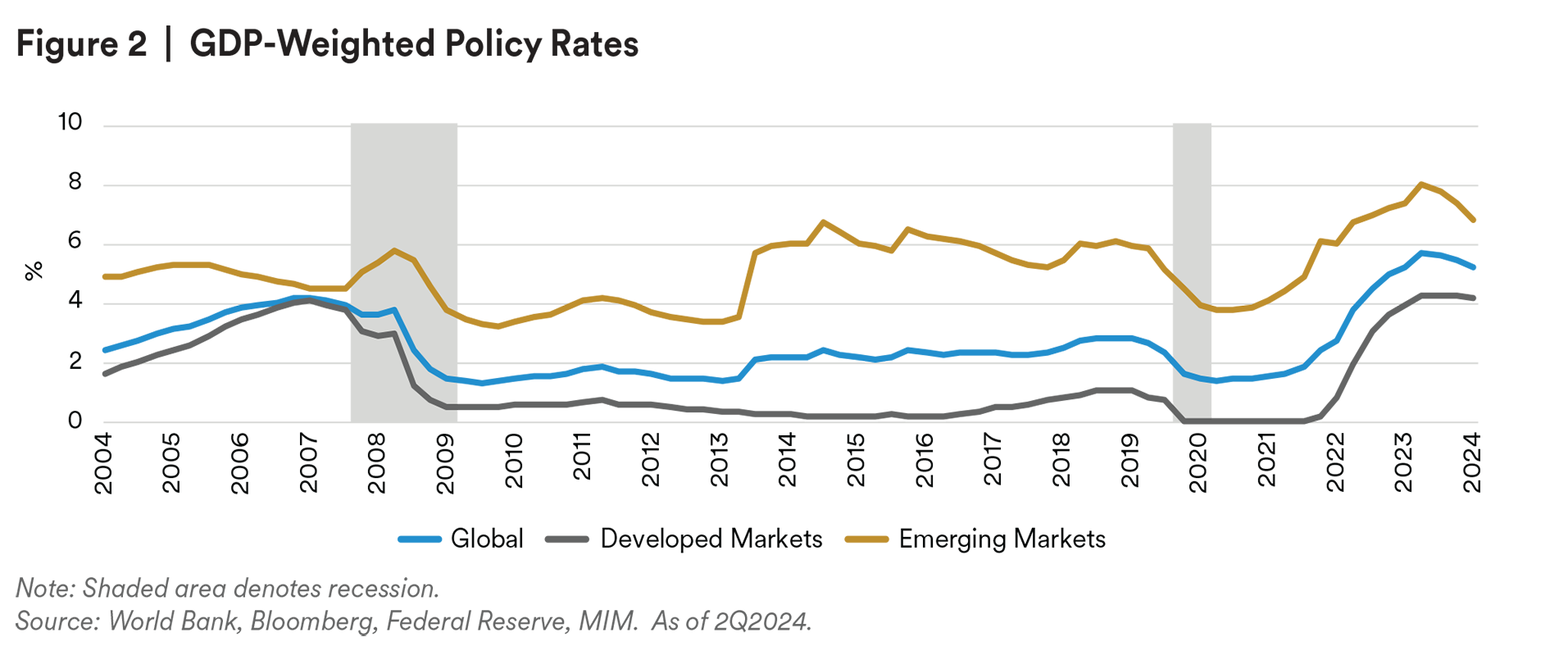

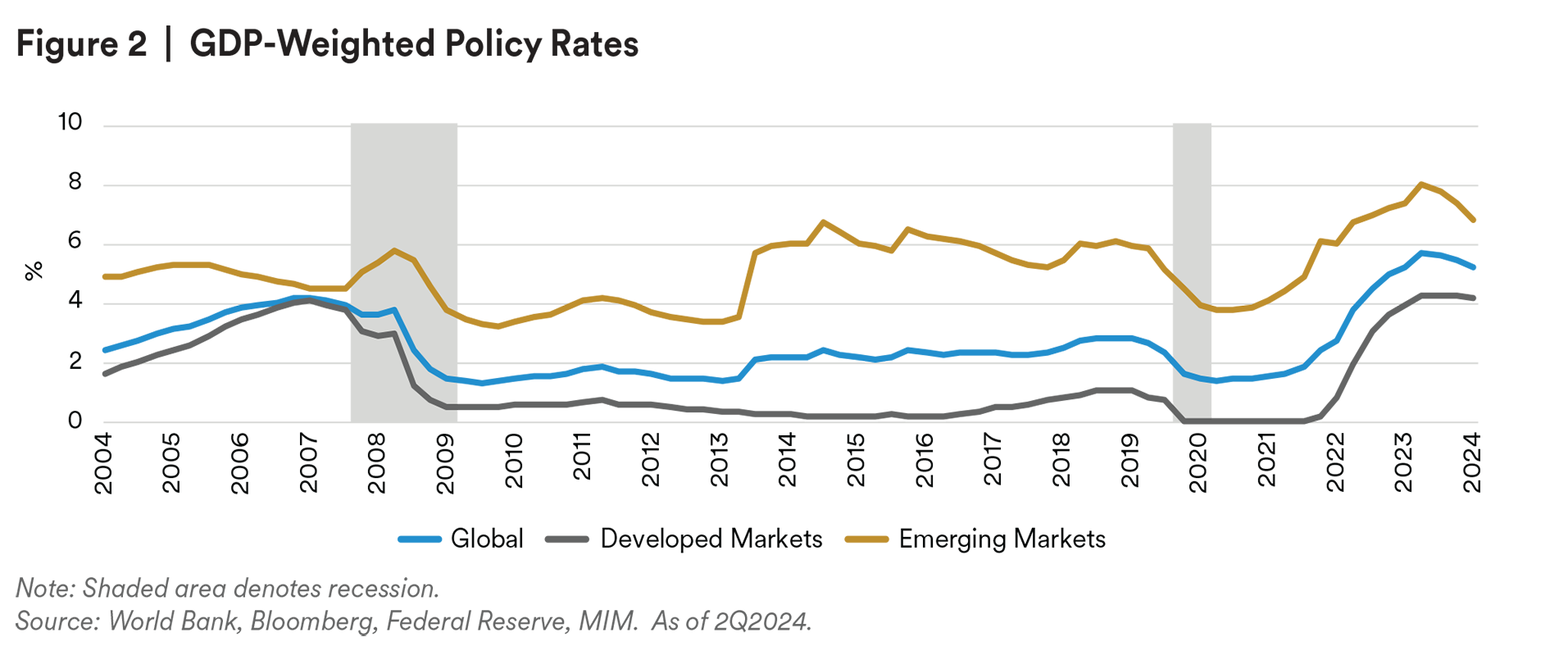

Global—Global manufacturing activities were cooling in the past three months, driven by declines in production, exports and demand, according to S&P Global. As the European Central Bank (ECB) cut rates again in September, we are looking for more major central banks to join the rate cut cycle, lowering GDP-weighted policy rates further in the short term (see Figure 2).

U.S.—Although consumer spending continues to support overall economic growth, the continued decline in the savings rate suggests that consumers may be reaching their limit. MIM sees growth in economic output in 2024 and 2025 to be roughly 2% while we expect inflation will remain close to 3%. While that leaves us with healthy nominal growth, it likely limits the ability and willingness of the Federal Reserve (Fed) to respond aggressively should growth disappoint. We look for the Federal Reserve to reduce the Fed funds rate to a range of 4.50-4.75% by year end 2024 and to 3.75-4.00% by year end 2025. We think that 10-year Treasury yields will remain at or above 4%.

Europe—The near-term outlook for the euro area economy has weakened, driven by weakening household consumption. Our base case expects household demand to pick up and investment activities to improve as the ECB continues to lower interest rates. UK households remain well positioned to support growth over the outlook horizon as real incomes rise, unemployment remains low, and interest rates start to fall. The disinflation process has broadly continued, but the near-term outlook for headline inflation remains bumpy. We continue to expect a further quarter point rate cut from the Bank of England (BoE) this year, with the pace of rate cuts accelerating in 2025 as core inflation continues to moderate.

Asia—Although there has been some slowdown in manufacturing activity across Asia, particularly in China, broader growth continues to hold up across the region. Inflation is less of an issue in the region with current levels for most countries well within central bank comfort zones. Following Fed rate cuts, we look for a few more central banks to start easing policy rates, except for Japan where monetary policy remains uncertain with the possibility of rate hikes. As we approach the U.S. presidential election, the trade relationship between the U.S. and China continues to be a main focus.

Latin America—Despite softer-than-expected economic activity in the second quarter, we believe easing monetary conditions could provide support for growth in 2H24. Inflation in Latin America ticked higher mostly driven by idiosyncratic shocks, which have led to more prudence among central banks in the region. As markets started pricing lower rates across the U.S. curve, local EM interest rates have been driven lower. Domestic policies as well as external developments (e.g., U.S. elections) pose risks to our forecasts.

The Federal Reserve Has Joined a Global Easing Cycle

U.S. Treasury (UST)—As the Federal Reserve has started cutting interest rates, we are looking for the UST yield curve to steepen further in the next quarter or two, with short-end interest rates decreasing significantly. We look for 10-year Treasury yields to remain at or above 4% in the near future.

Japanese Government Bonds (JGBs)—Despite our downward revision for year-end inflation, our baseline remains for another 25 basis points hike from the Bank of Japan (BoJ), thanks to recent positive wage trends. We think it also seems confident that firms will pass on these higher wage costs to consumers in coming quarters, underpinning the broader CPI basket. Given the above factors, we have retained our end-year JGB yield forecasts of around 1.0%.

Chinese Government Bonds (CGBs)—CGB yields have continued to test new lows due to the weak growth and inflation backdrop. The PBoC attempts to support the economy by keeping funding costs low while trying to avoid bubbles in the bond market. For this reason, the PBoC continued to intervene in the bond market via various measures to establish a floor for yields, which we believe is around 2.2%.

German Bunds—We see some scope for bunds to rally at the short end as the ECB continues its rate cutting cycle into 2025. Fiscal policy remains constrained by the re-introduction of Germany’s MetLife Investment Management 4 constitutional debt brake, which is unlikely to be reformed under the current three-way “traffic light” governing coalition. Bunds continued to be supported by strong demand, particularly during periods of heightened uncertainty.

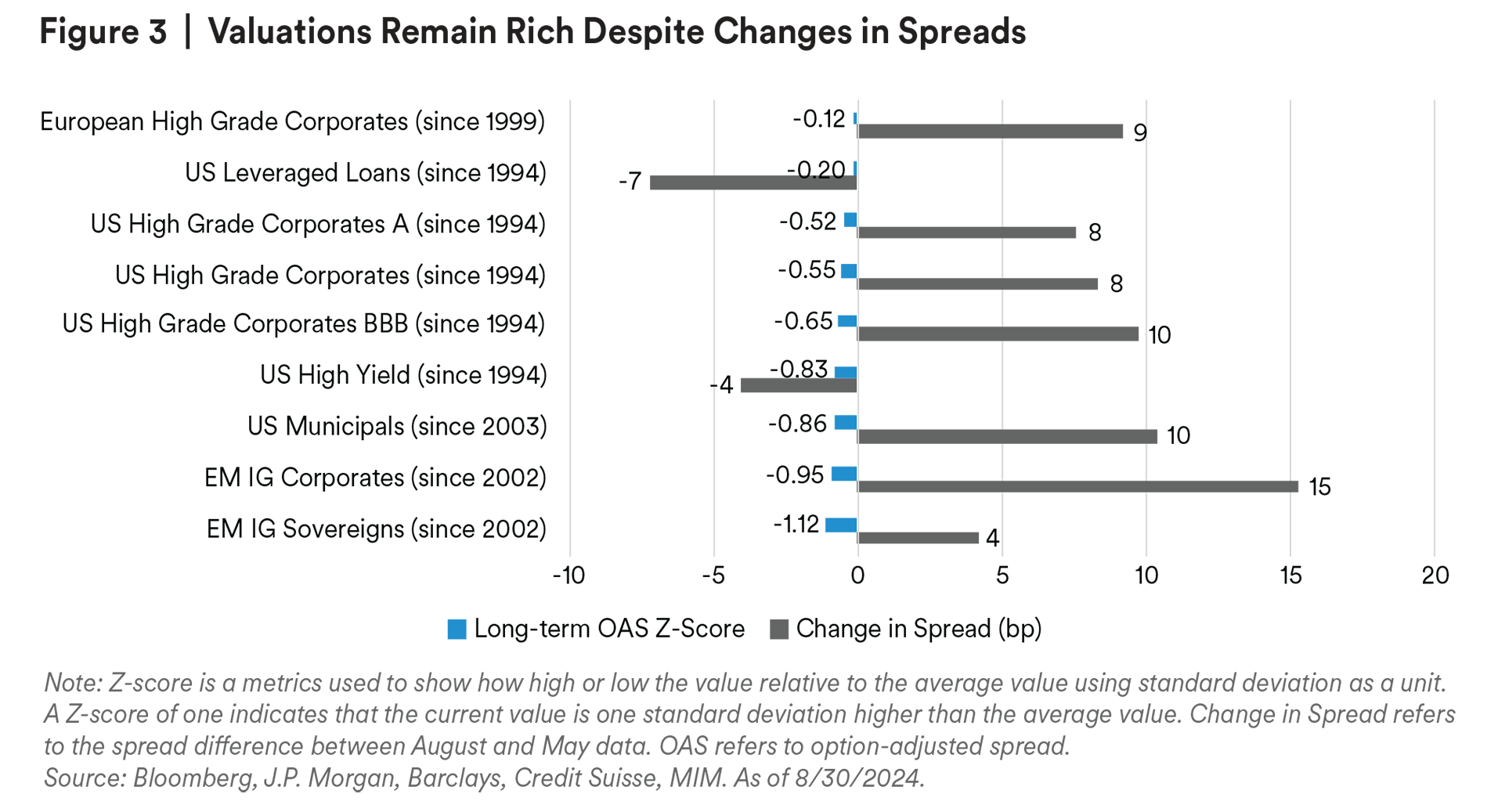

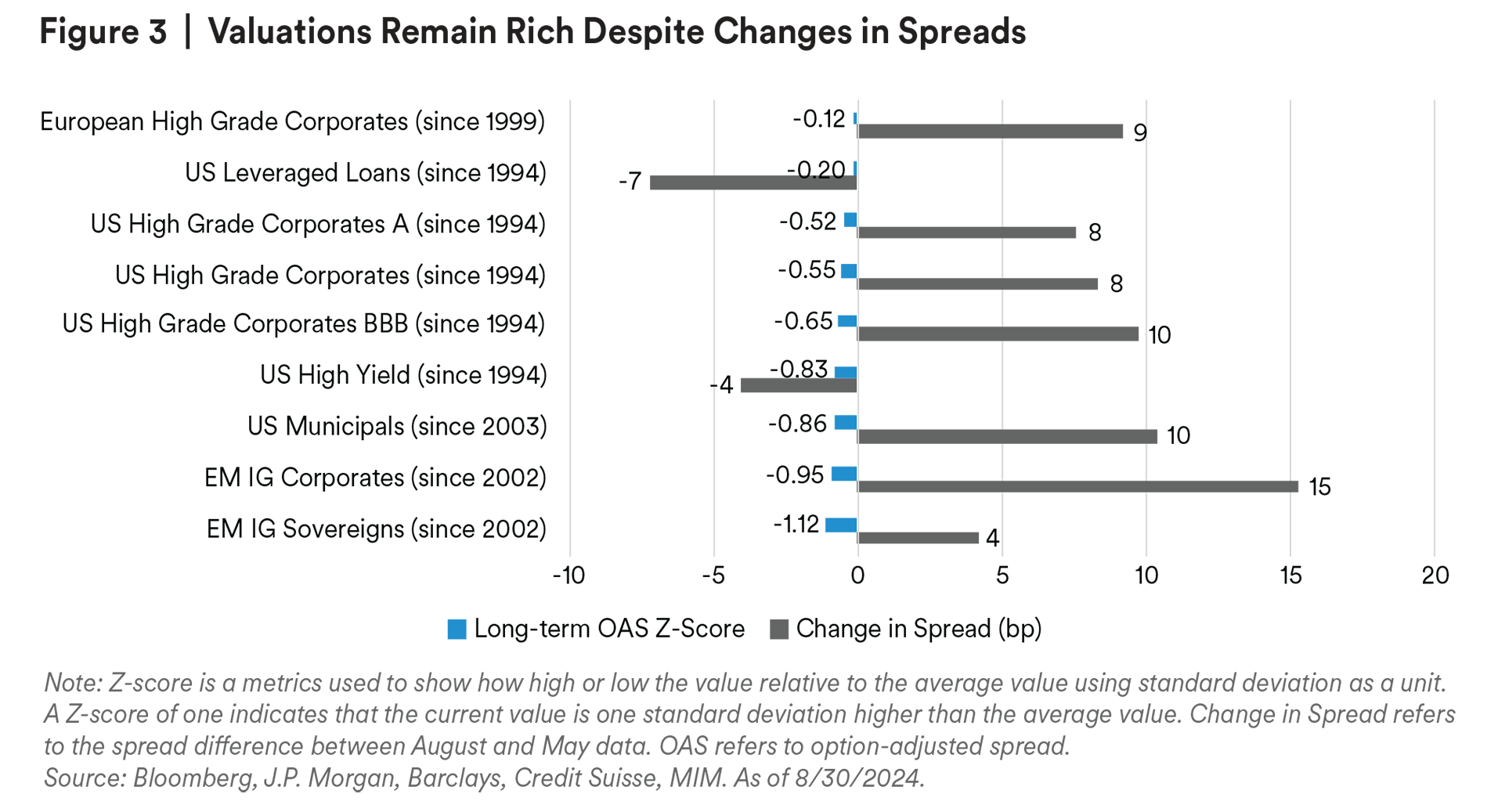

We Continue to Look for Credit Spreads to Remain Range Bound

Credit Macro—With a restrictive Fed policy, inverted yield curve (3-month, 10-year spread), and tightening bank lending standards as of August 2024, we believe we are still in a late cycle. Credit fundamentals mostly remained stable in the second quarter, with slight declines in leverage ratios, except in Europe. Fixed income markets are mostly seeing positive net flows year-to-date, according to the Investment Company Institute. Primary markets have been very active, due to lower interest rates in Q3. Credit spreads saw slight changes in the past quarter, in line with our initial anticipation, leaving valuations rich (see Figure 3). Looking forward, we continue to think that credit metrics will stay at healthy levels, and spreads to remain range bound in the near term.

U.S. Investment Grade (IG)—Credit fundamentals remain stable despite broader economic data signaling a potential slowing of growth. Spreads have modestly widened on weaker data and cautionary comments, but overall remain well supported given strong demand. This technical factor also helped to cap any weakness on spreads from the plethora of supply entering the market in the second quarter. All-in yields remain attractive on a historical basis but less attractive compared to other fixed income asset classes. We continue to stay cautious about risks to spreads including potential weakening in growth and potential volatility caused by the upcoming U.S. presidential election.

European IG—We started to see more weakness creeping into the quarterly fundamental data, primarily affecting profitability margins. While we are not seeing a wave of downgrades, it is noticeable that agencies are generally adopting a more cautious stance, despite a decent yield pickup of 1.26%, according to Bloomberg. Spreads have been remarkably stable over the past quarter. Flows into European credit remained strong, with investors continuing to expect the ECB to cut rates at the September and possibly October meetings.

High Yield (HY)—The high yield primary market remains active with year-to-date volume standing at $203.1 billion ($44.3bn non-refinancing) which compares with just $110.3 billion of issuance for the same period of 2023, according to JP Morgan. Fundamentals, like U.S. IG, continued normalizing but remained mostly stable. Despite a brief period of volatility in early August, spreads barely changed. The maturity wall continues to be manageable in 2024 and 2025. All-in yields remain very attractive given a stable macro backdrop.

Leveraged Loans—The higher-for-longer narrative around interest rates has been very supportive for loan demand in 2H24. The labor market did show some minor pockets of softness in Q2, which are expected to drive some imminent Fed rate cuts. From an outlook perspective, with balance sheets in a good position, we continue to believe that loans will provide a decent carry type of return over the next six months.

Municipals—The S&P Municipal Bond Index generated a year-to-date total return of 1.86% as of August 2024, even lower than the S&P U.S. Treasury Bond Index (+2.79%). August municipal supply came in at $49 billion, setting a record high according to The Bond Buyer. Although municipals fundamentals remained stable in 2Q24, we are seeing potential risks in the sector due to slower growth and U.S. elections. Although the spread widened by 10 basis points in the past quarter, Municipal bonds’ valuations remained rich.

Emerging Markets (EM)—As we head into the end of the year, the upcoming US election and, more importantly, the campaign rhetoric could keep inflows into Emerging Markets on the lighter side. EM sovereign fundamentals continued to stabilize. Due to China’s slower-than-expected growth, commodity exporters and those more exposed to China are seeing a drag. Valuation for EM IG sovereign remains the richest compared to other sectors. Fundamentals of EM corporates and banks remain healthy, and we expect that metrics may moderate while staying resilient. Balance sheets remain strong, and active liability management has led to reduced concerns over refinancing risks. The liability management has pushed out the maturity wall, notably for higher quality issuers. While we do not expect debt levels to change materially, we expect EBITDA to decline from recent highs. This may show an uptick in leverage, while remaining at manageable levels.

Prepayment Risk is Expected to be Higher Due to Lower Interest Rate

Residential Credit—Housing inventory appears to be normalizing, with months-supply of existing home sales metrics nearing pre-pandemic levels (see Figure 4). We believe the housing market mostly remains solid with national home prices increasing 5.4% year-over-year in June. Housing credit fundamentals (especially prime borrowers) continued to be supportive for the sector, despite stretched affordability. We look for home values to increase over the coming year, but the pace of appreciation may be lower.

Asset-backed Securities (ABS)—Higher costs, tighter bank lending standards, and an elevated debt burden continued weighing on consumers. Delinquency rates on auto loans and credit cards are trending higher across both prime and non-prime borrowers, according to the Federal Reserve. Supply-demand dynamics remained mostly balanced, and spreads have been supported. As we approach the 2024 presidential election, we are anticipating higher potential market volatility, and expect the pace of ABS issuance to decline.

Collateralized Loan Obligations (CLOs)—Fundamentals for the CLO sector have shown modest improvement over prior quarters. Loan defaults and the share of CCC exposure are both declining, according to Loan Syndications and Trading Association. While downgrades still outpace upgrades, the ratio is improving. Bank demand remains supportive. We find carry in this sector attractive despite future Fed rate cuts.

Commercial Mortgage-backed Securities (CMBS)—While the NCREIF All Property Index remains in a downward trend, the pace of declines is slowing. Price declines for the most recent quarter were the lowest since 2022, with the index posting 5.5% lower than a year ago mainly driven by weakness in office properties. The CMBS sector faces a variety of headwinds such as elevated rates and tighter lending standards. The delinquency rate for all CMBS loans increased to 5.43%, according to CREFC.

Agency MBS—Valuation remains very rich, thanks to strong demand due to declines in implied volatility. The recent decrease in the primary mortgage rate is likely to put upward pressure on prepayments, which have been relatively muted this year. The MBA (Mortgage Bankers Association) Refinance Index has trended higher as borrowers take advantage of lower mortgage rates. As we enter the rate cut cycle, prepayment risk is anticipated to be higher.

Private Structured Credit (PSC)—Demand remains robust and is anticipated to continue into 4Q24 which may in turn limit spread widening, unless the market experiences a risk-off event that dampens investor sentiment. Consumer credit performance metrics within our portfolio remain range bound. Anticipated Fed rate cuts are likely to provide relief to both consumer and commercial ABS borrowers, which could be supportive of fundamental performance in the near future.

Residential Whole Loans—Housing fundamentals remain unchanged with low housing supply keeping home prices stable in most areas of the country. Affordability continues to be a concern for newly originated loans, but credit availability remains low. The significant amount of equity that borrowers have in their homes has kept delinquencies at pre-pandemic levels. Spreads for residential whole loans and single-family rental debt financing remain attractive and offer strong relative value.

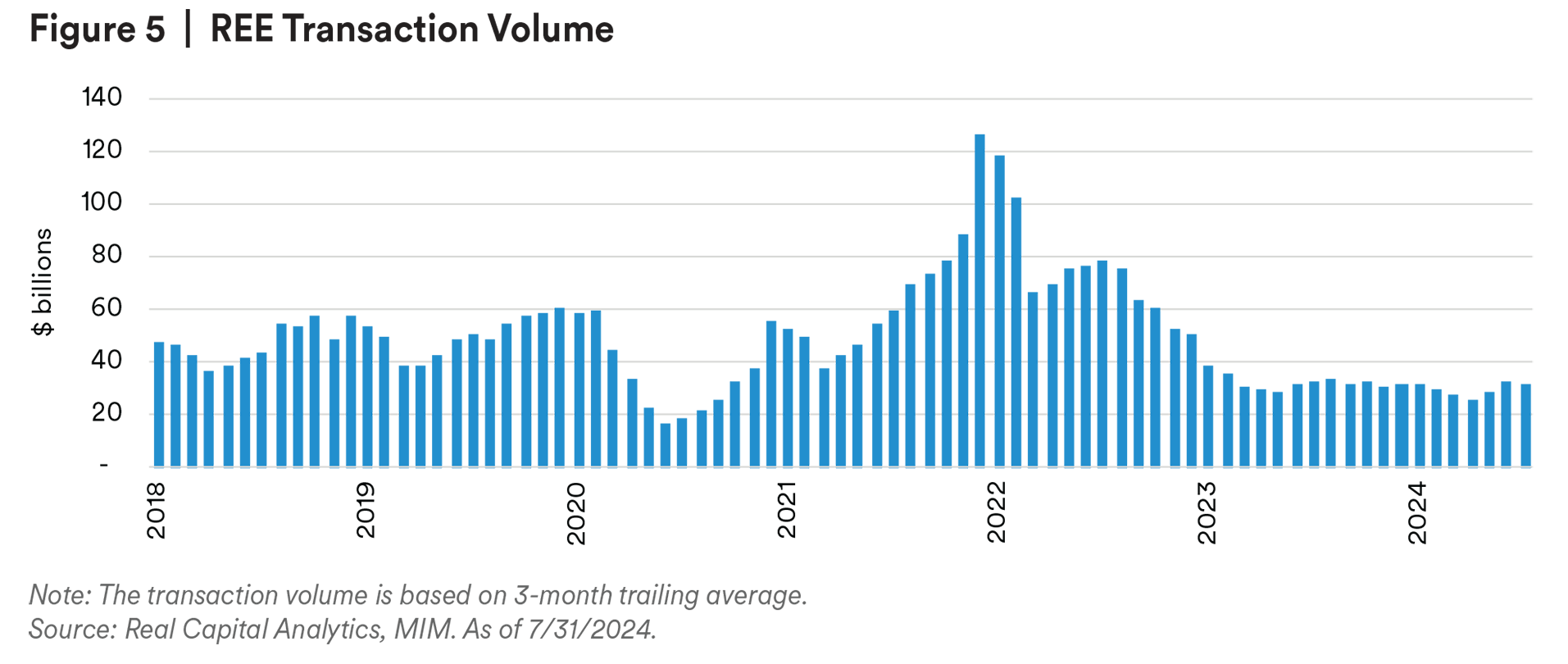

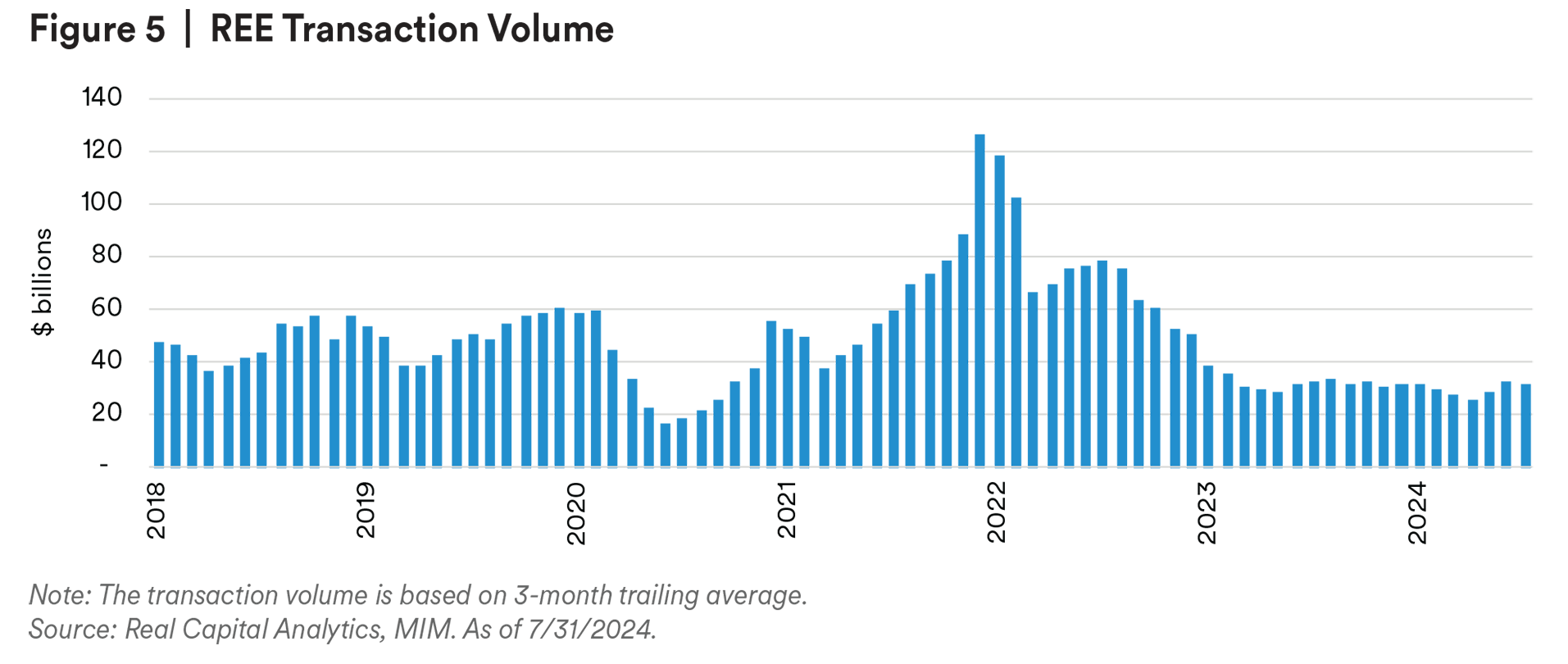

CRE Fundamentals Remained Stable with Low Transaction Volumes

Office—Fundamentals remained challenged, though the second quarter offered some clearer evidence that occupancy may be nearing the bottom. As we mentioned last quarter, sublease availability was beginning to decline, as was the time vacant space sat on the market. This quarter, we observed a wider swathe of markets experiencing vacancy declines. Multifamily—The sector benefited from elevated mortgage rates in Q2, as more potential home buyers have postponed their home purchase plan, strengthening demand for rental units. Markets like Austin will likely underperform this year, as elevated deliveries and normalizing demand dampen rent growth. Meanwhile, markets with less favorable demographics are not facing supply pressures, and investors are benefiting from higher occupancy levels and stronger rental growth. Industrial—The industrial sector has not been immune from elevated supply growth. In the second quarter of 2024, industrial vacancy rose 40 basis points to 8.2%, according to CBRE-EA. Vacancy is now above the recent low of 5% but remains below the long-term average of 9.4%. Markets with physical or legislative barriers to new construction like Miami and Baltimore are better positioned. Retail—Vacancies, except for the still-recovering mall subsector, are at the lowest level on record. Supply remains constrained. As a result, the outlook for retail income growth is anticipated to be positive, and we think this is particularly true for high-quality centers catering to experience-based tenants. Hotel—Demand remains stable but has slowed from the rapid pace of growth exhibited over the last two years. Expense growth has been a challenge for hotels.

We continue to believe CRE equity and debt investments have fair valuations, with some segments of the market (e.g., higher yielding debt) facing a liqudity crunch and offering attractive relative value. CRE transaction volumes for both equity (see Figure 5) and debt remained low, due to elevated interest rates, stress in the banking sector, and challenging office exposure. We expect transaction activity to begin recovering in a more meaningful way in 2025.

Agricultural Mortgage Demand is Anticipated to Increase

Farmland values remain above the inflation-adjusted trendline and are expected to appreciate more modestly going forward. The USDA forecasts net farm income to decrease 4% year-over-year in 2024, but individual performance differs materially across commodities, with livestock producers overperforming and crop growers underperforming. Strong USD continued to be a consistent headwind to U.S. agricultural exports. Valuations remain fair and close to the long-term average. Delinquency rates of agricultural mortgages remained at historical lows. The growth in agricultural mortgage volumes is expected to continue accelerating as credit demand rebounds.

Fed Rate Cuts are Expected to Support Equity Valuations

In the second quarter, S&P 500 earnings positively surprised by about 4%, with earnings growing at 10.5% year over year. Fundamentals remained strong, like corporate credit. With more central banks joining the rate cutting cycle, we look for equity valuations to remain stable. Thanks to steady growth and low recession risk, we think companies will continue to see decent earnings growth in the near future, with short-term volatility stemming from U.S. elections. Cash yields, on the other hand, remained elevated despite the Fed rate cut (50 basis points) at the September FOMC meeting. U.S. 3-month Treasury bills yielded at 4.74% as of September 19, according to Bloomberg, which we found attractive given its risk-free nature. However, as we appropach next quarter, we may consider downgrading the ranking for cash investments, especially after multiple rate cuts from the Fed.

Returns for Private Equity are Expected to be Lower Over the Near Term

We maintain our positive long-term outlook for private equity, while acknowledging that lingering economic uncertainty is continuing to impact return potential. Thus, we anticipate lower returns for private equity over the near term. The recent incremental increase in deal activity has been far from the rebound investors expected going into the second half of the year. We think that current and upcoming vintages may be primed to take advantage of opportunities arising from an economic reset.

The U.S. Dollar Stays Sensitive to Monetary Policy and U.S. Elections

In the third quarter, the USD gave way to all G10 currencies as well as most of emerging markets, due to expected Fed rate cuts, which also compressed rate differentials. Going into September, dollar selling activities and flows indicate a net short USD position overall, according to Morgan Stanley. In the short term, we are seeing various risks (e.g., slower-than-expected growth, European political risks, U.S. elections) to continue impacting the USD performance. We look for Asian pairs to outperform as the Fed has begun its rate cutting cycle. We think European pairs will largely be dependent on central bank moves, and we may see some divergence as the central banks all have different targets and outlooks. LatAm currencies were mostly flat in Q3, and we expect market volatility to persist in the region in the near future.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK, this document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”) a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border license, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL..