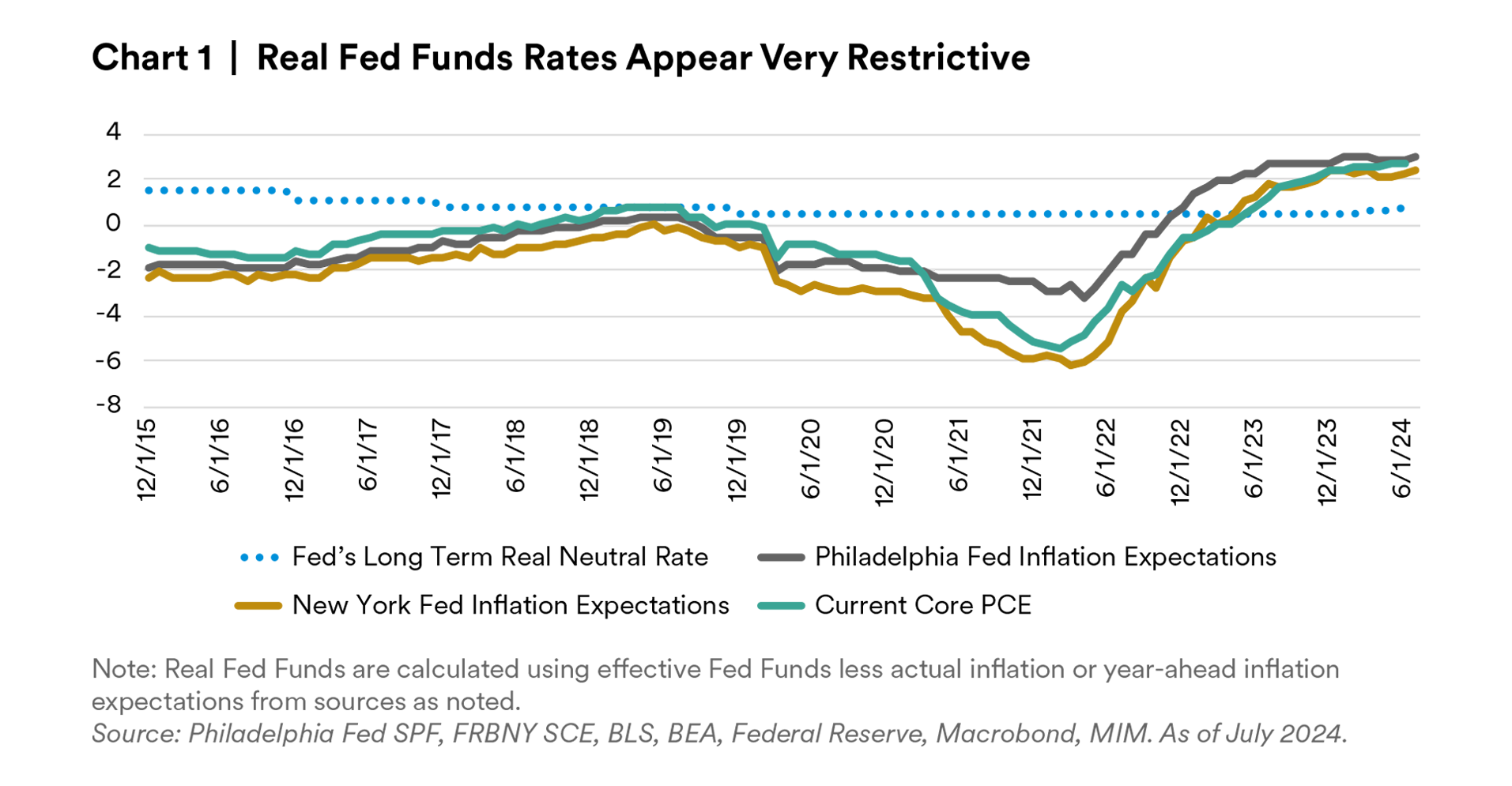

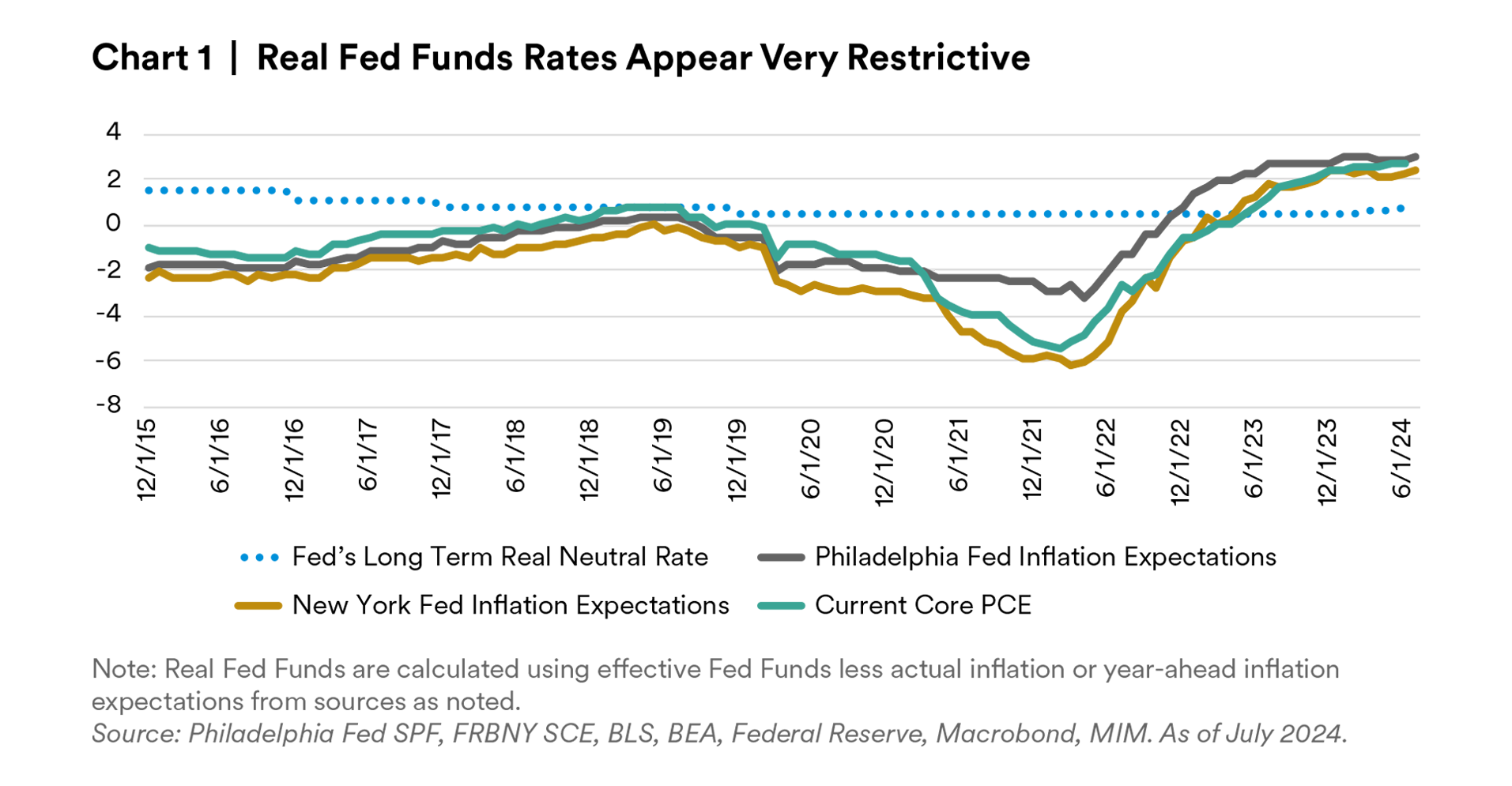

The U.S. Federal Reserve (the Fed) has in our opinion made a mistake by not cutting rates and they are likely to remain cautious in adjusting rates lower in the face of mixed data. The FOMC can easily justify up to 50bps of cuts as a corrective action: since the hiking cycle formally ended, we have seen approximately 50bps of tightening. Inflation expectations have declined, raising real rates and implicitly tightening policy.

However, triggering the Sahm Rule alone does not necessarily signal recession, although we see risks increasing. The markets appear to have forgotten the relative strength of other measures in the economy that instead point to a continued, if ugly, normalization period. In this monthly, we argue that generalized anxieties are driving the market overreaction.

Sahm Alarm

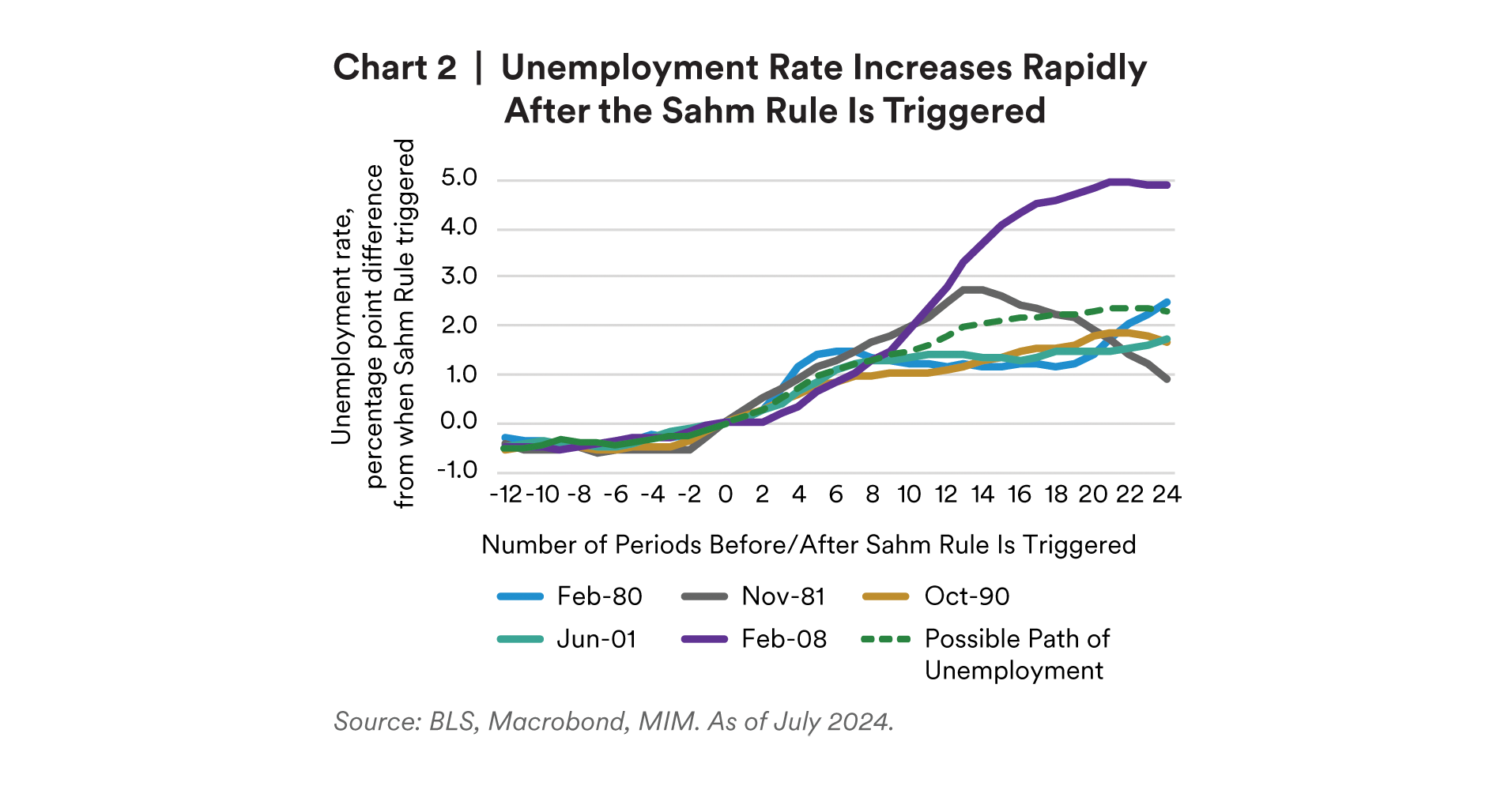

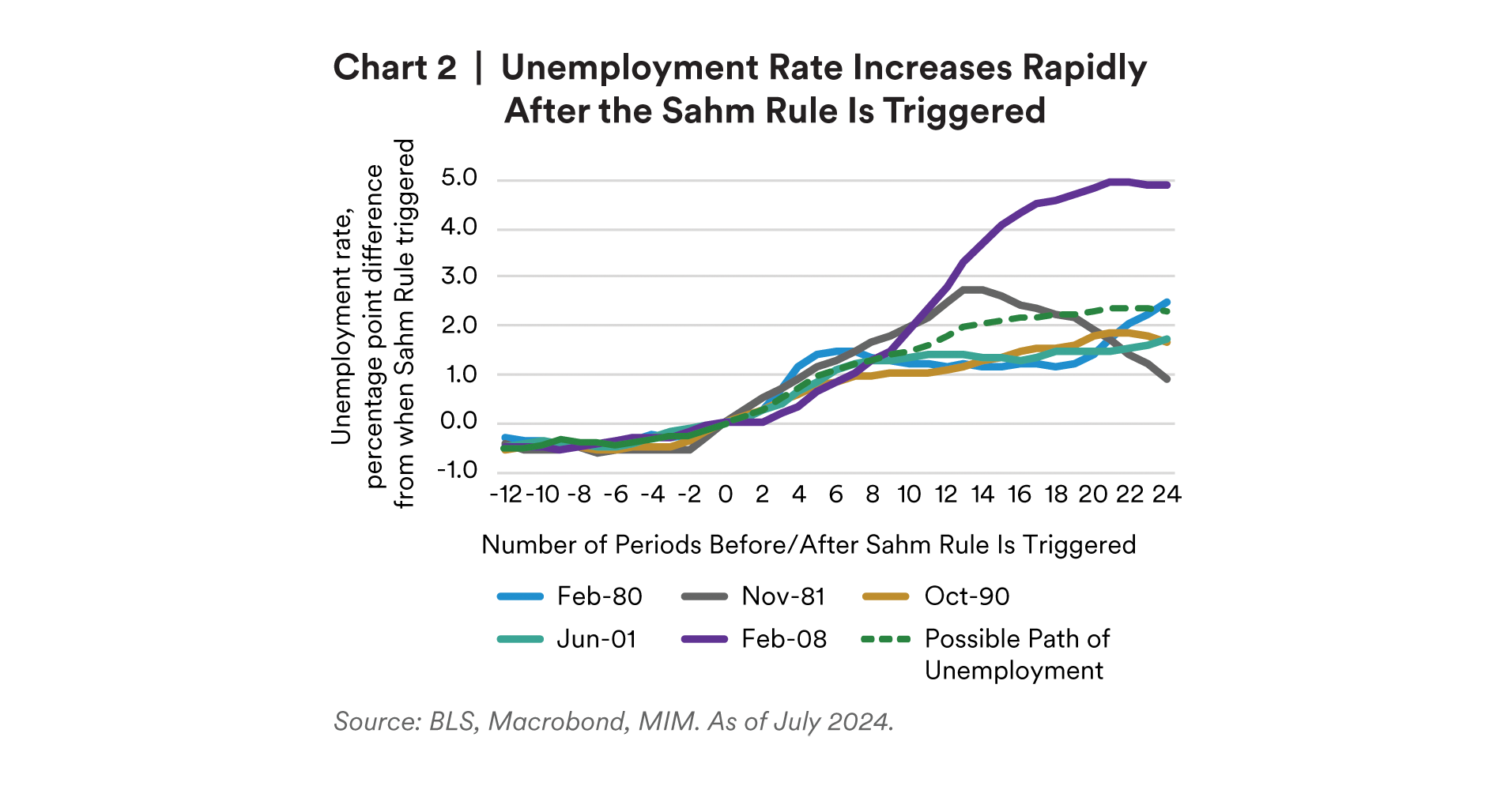

The Sahm Rule has been triggered: the three-month moving average unemployment rate has risen by 50 bps above its minimum in the last 12 months. The labor market historically reaches a tipping point—triggering the Sahm Rule—after which unemployment rises abruptly. Triggering the Sahm rule typically coincides with recession onset.

There’s no economic theory behind this rule, and nothing that “requires” or forces a recession. Indeed, this time could be different as the economy continues to normalize from the pandemic. But the rule neatly captures the way labor markets can suffer a sudden change: from a 50 bps increase in the unemployment rate versus the year before, the Sahm rule can presage double or triple that pace the following year.

If the Sahm Rule is correct in signaling a recession, then history would guide us to perhaps a 5% unemployment rate by year end 2025 and 5.5% over the next year.

Mimicking the unemployment path of the mildest recession over the last 50 years would still see peaks above 5%. We do not expect this as a base case but acknowledge increasing risks.

A note on soft landings, during the one “soft landing” that the Fed has managed in recent decades (a hiking cycle from 1993-1995), the unemployment rate never rose by more than 0.2 percentage points over the 12 months prior.

The markets, as usual, overreacted to the Sahm rule trigger. However, they are right to be more worried about unemployment than inflation: according to the U.S. Bureau of Labor Statistics (BLS), recent changes to nonfarm payrolls additions have been highly concentrated in just two sectors, and initial jobless claims continue to ratchet upward.

Not So Clear Cut

Despite the Sahm rule indicating a potential recession, the recent market volatility, calls for as many as four rate cuts by December, and fears of a downturn could all be more attributable to overwhelming uncertainty more than economic data.

The election has created fiscal and regulatory policy uncertainty, a potential mistimed Fed pivot has created monetary policy uncertainty and anxiety about whether the economy has truly escaped recession, and tension in the Middle East has elevated geopolitical uncertainty.

The Sahm rule simply tells us that unemployment has accelerated up from recent record lows. Even as the unemployment rate rises (to “only” 4.3%), the Job Openings and Labor Turnover Survey (JOLTS) job openings rate has been stable the last three months above pre- pandemic levels. Qualitative data including comments on ISM surveys, regional Federal Reserve surveys, and the Beige Book also indicate that manufacturing firms are still having difficulty finding adequately qualified workers to fill open positions. Firms responding to the most recent ISM services survey noted that labor was in short supply and going up in price. If labor demand is still strong, then the rise in unemployment may be a normalization and not a sign of “real” economic weakness.

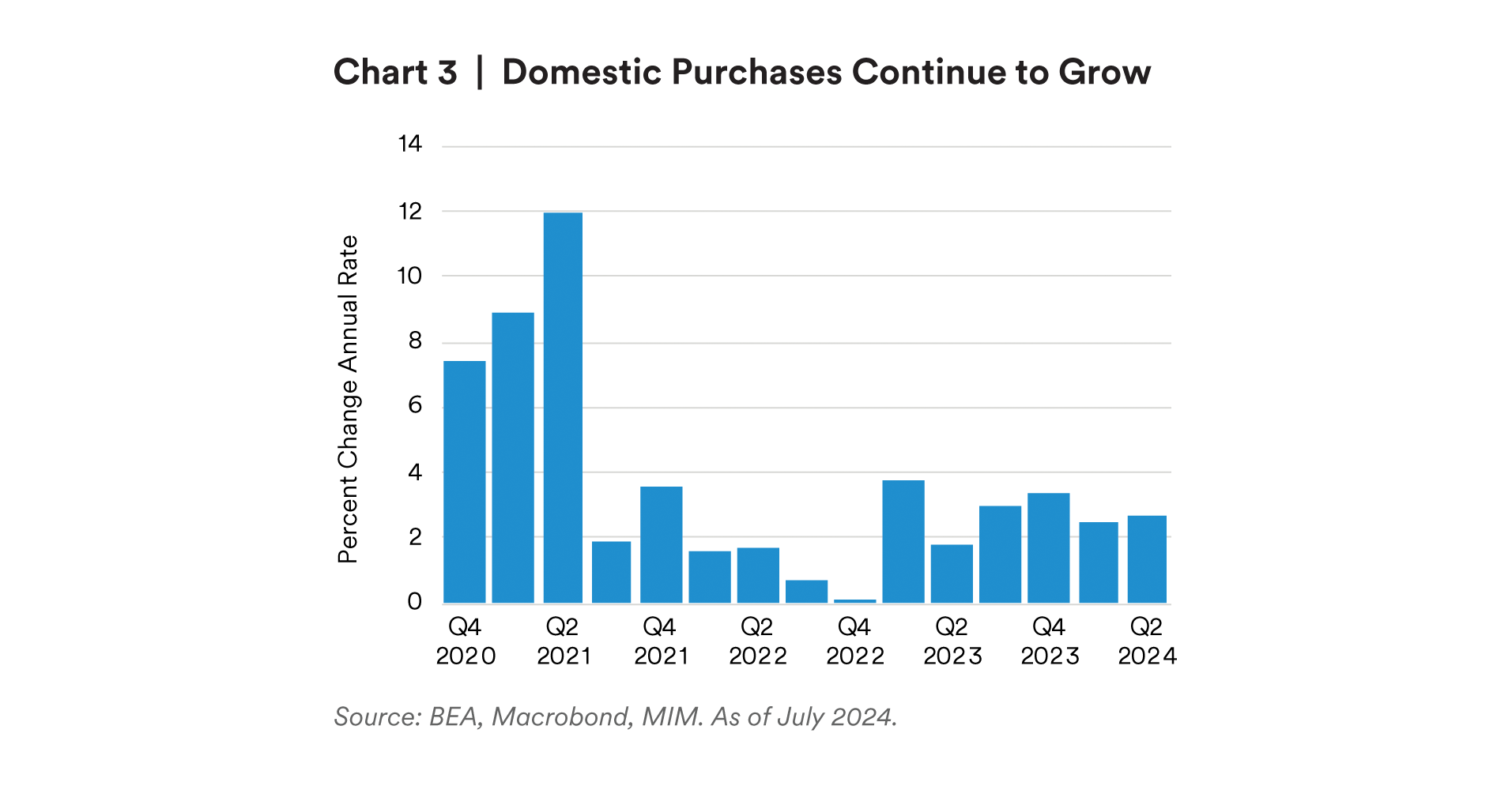

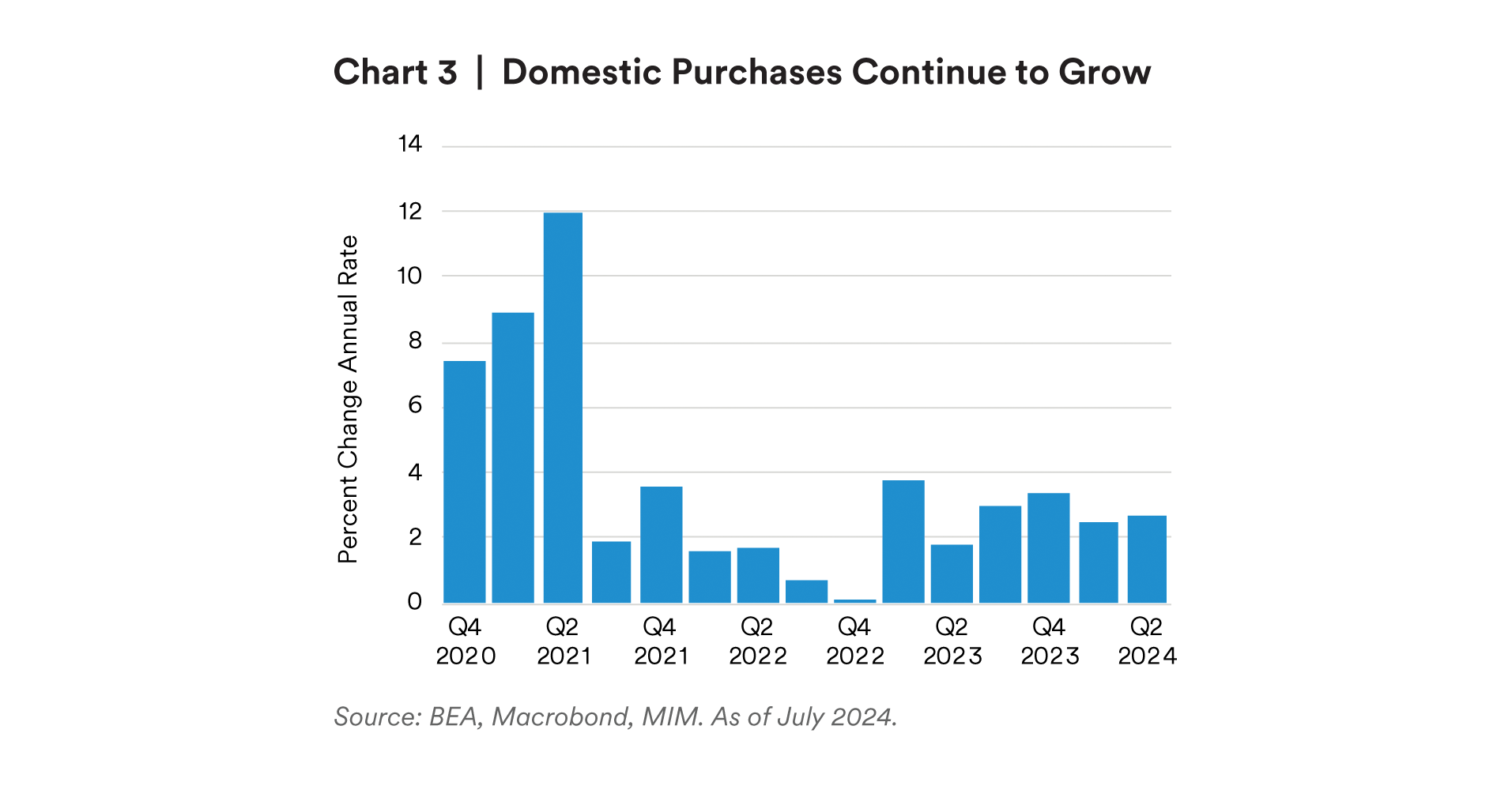

Other economic data points remain stable too. U.S. Bureau of Economic Analysis data shows GDP for the second quarter grew 2.8%, with Private Domestic Final Purchases (PDFP), the more stable component of GDP reflecting domestic consumption and investment, accelerating to 2.7%. The ISM services index moved back into expansion territory in July, and the services sector has expanded for 47 out of the last 50 months. Corporate profits, which in theory support employment, remain strong despite mild softening in the second quarter.

U.S. Outlook Summary

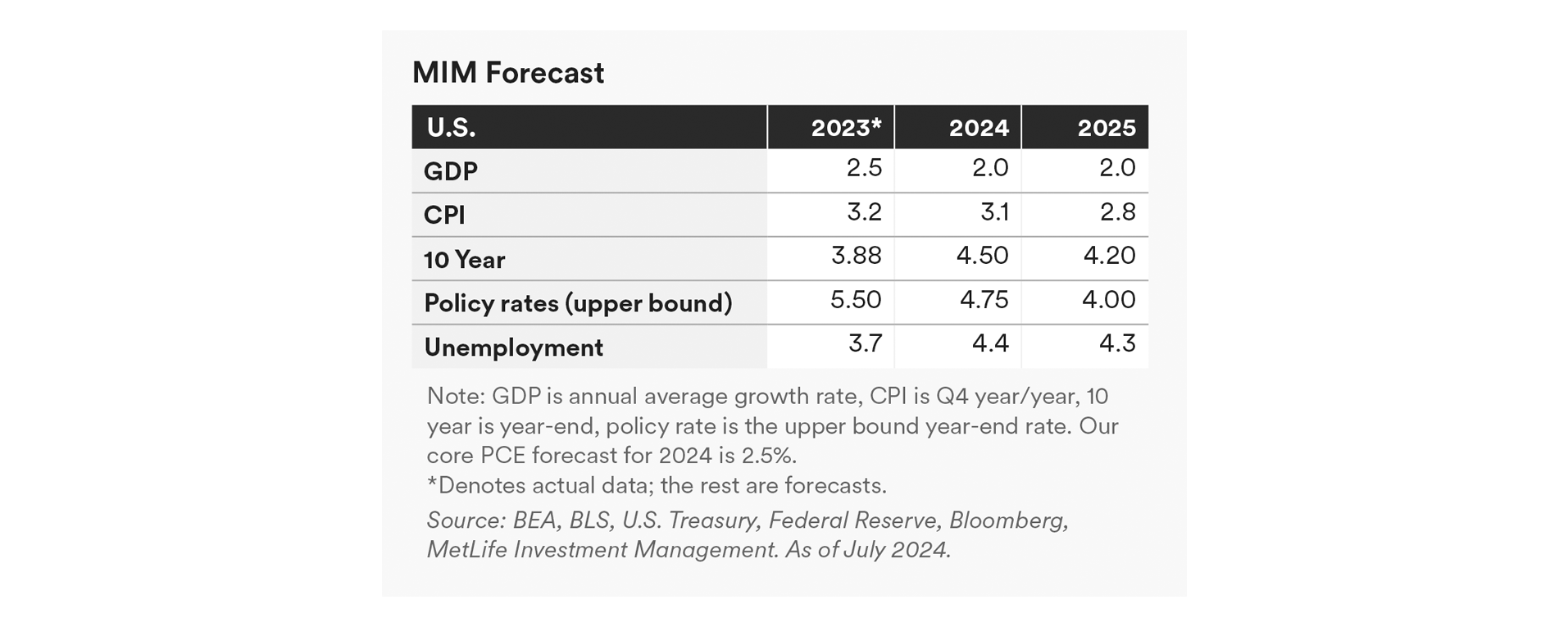

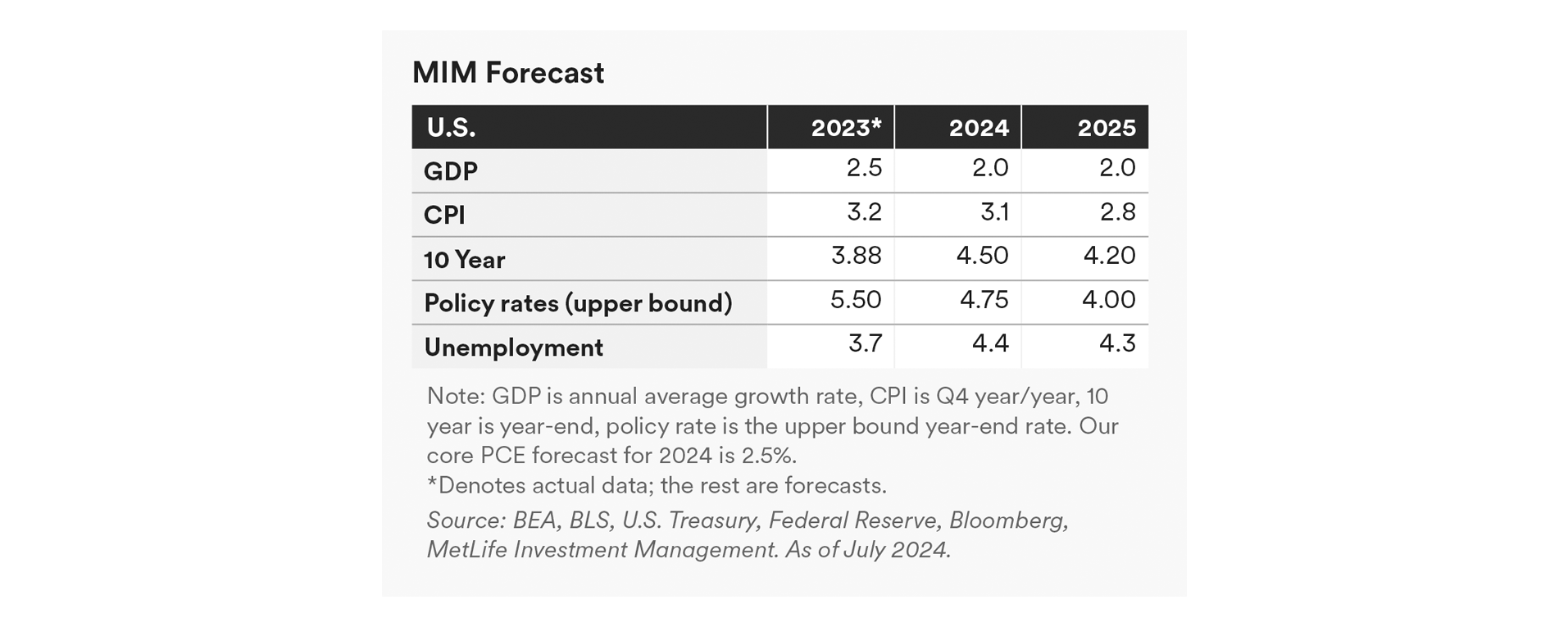

We continue to expect growth in 2024 to be softer than 2023 but remain at or above long-term trend growth with no recession this year. Second quarter GDP was strong, particularly with respect to private domestic final demand. Investment has been mixed this year, with Non- Residential Fixed Investment (NRFI) disappointing in Q1 and residential investment disappointing in Q2. Election uncertainty and Federal Reserve policy may dampen investment until there is more clarity around both.

The labor market has triggered the Sahm rule by rising to 4.3% unemployment in July. Although not a guarantee of a recession, this is certainly a warning to the Fed that labor market weakness has become urgent.

We continue to expect the Fed to cut rates by a total of 75 bps by year end. Recent pricing of as many as five cuts by year end are likely an overreaction to the coinciding poor employment report and lack of a Fed cut.

Risks to the Outlook

Recession risk has risen slightly. The Fed has already likely made a mistake, due to their desire to progress in a deliberate, foreseeable, and data-dependent way. They are likely to remain cautious in adjusting rates lower in the face of mixed data.

The labor market is in a precarious place but may be helped by the Fed, resilient profit margins, and wealthier consumers. Risks of a re-emergence of inflation remain a possible concern, although these risks are coming into greater balance with downside risks to economic growth.

The economy may be stronger than the recent rise in unemployment indicates, making the case for quickly loosening monetary policy not so clear cut.

Both geopolitical and political uncertainty remains elevated even though several of the many elections set for this year have already taken place—e.g. in Taiwan, India, U.K. and France. The long run fallout of these is still very unclear. Another key uncertainty is the potential spread of the conflict between Hamas and Israel.

Perhaps most consequentially for the U.S. economy, uncertainty around the U.S. elections has increased relative to early summer. The Democratic switch from the incumbent President Biden to Vice President Harris, and the additions of JD Vance and Tim Walz to the tickets have made both election outcome and the likely policies implemented more uncertain.

Polling is highly volatile now and we expect that polling starting in September will be more likely to provide a clearer view of election outcomes.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services.

The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK, this document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”) a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/ third party investors, including:

Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., and MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.