Proven Performance through Market Changes

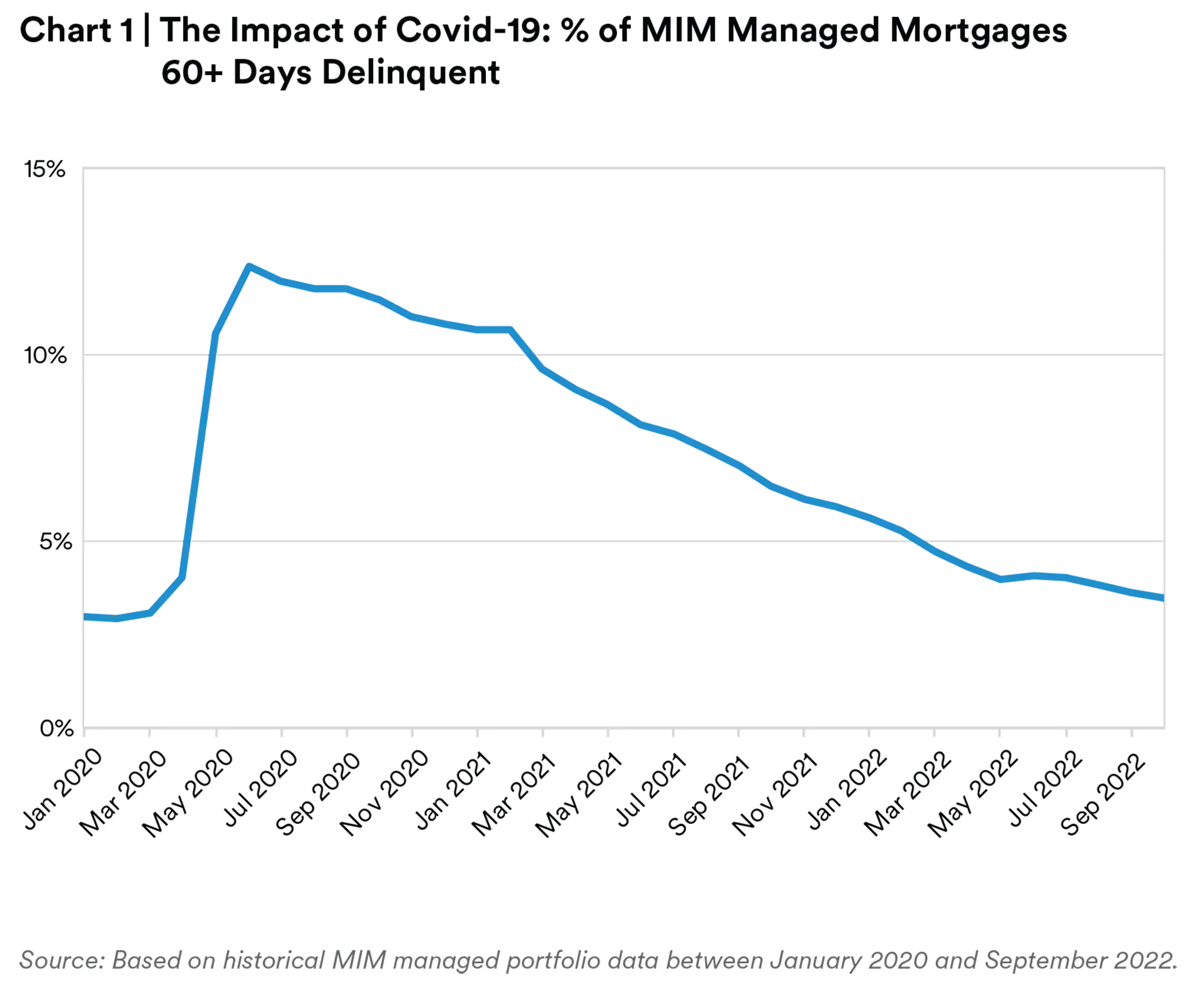

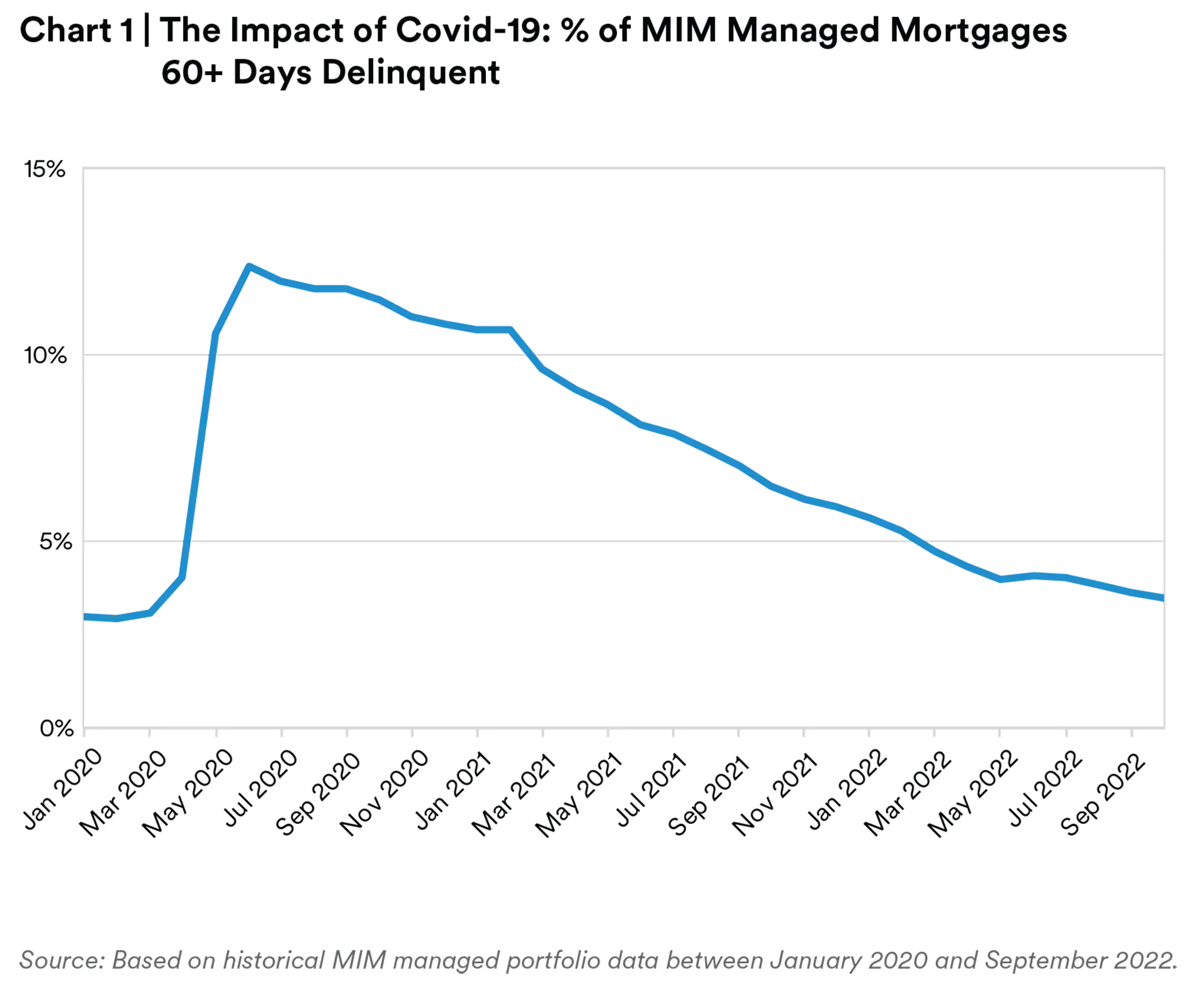

The strength and resilience of residential mortgages have been evident since the GFC, particularly as the market underwent unprecedented stress from the pandemic. Lenders, loan servicers and investors used lessons from the GFC to develop successful loss mitigation programs against borrower default or financial hardship that include modification, forbearance and/or deferral. This has kept delinquencies at all-time lows and was especially evident during the uncertainty of the COVID-19 pandemic when the industry at large navigated an uncharted systemic crisis and effectively managed a material increase in loan delinquencies2. The COVID-19 pandemic provided proof that servicers and the market can handle a material increase in loan delinquencies and keep borrowers in their homes. At MetLife Investment Management (MIM), our established relationships with servicers enabled nearly 90% of borrowers impacted by the pandemic to return to current and have their mortgages cash flow again, with only approximately 20% of those requiring a modification to loan terms.

Investments in Residential Whole Loans

The residential whole loan market offers investors a range of opportunities with unique attributes that continue to make investing in the asset class potentially attractive:

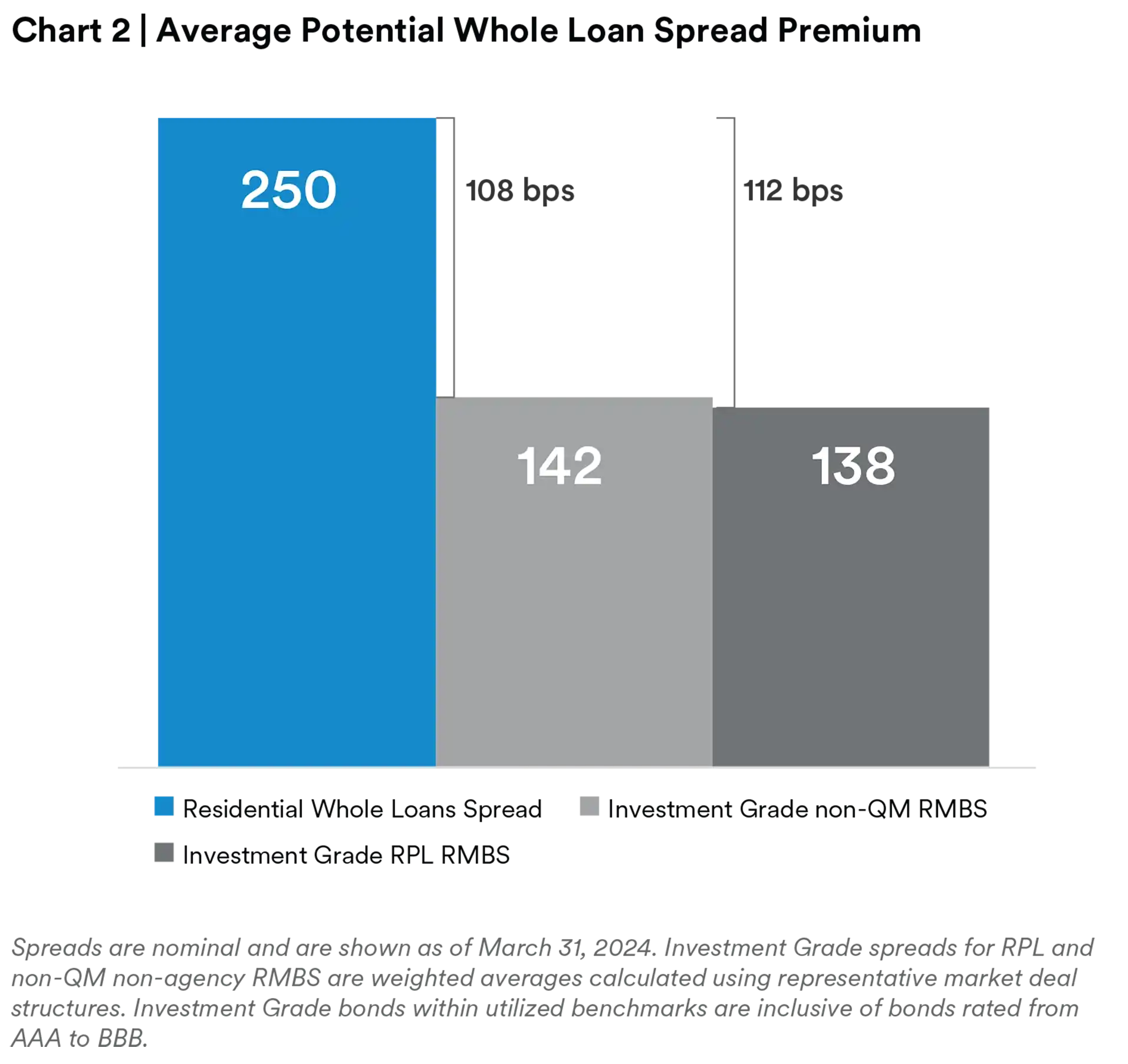

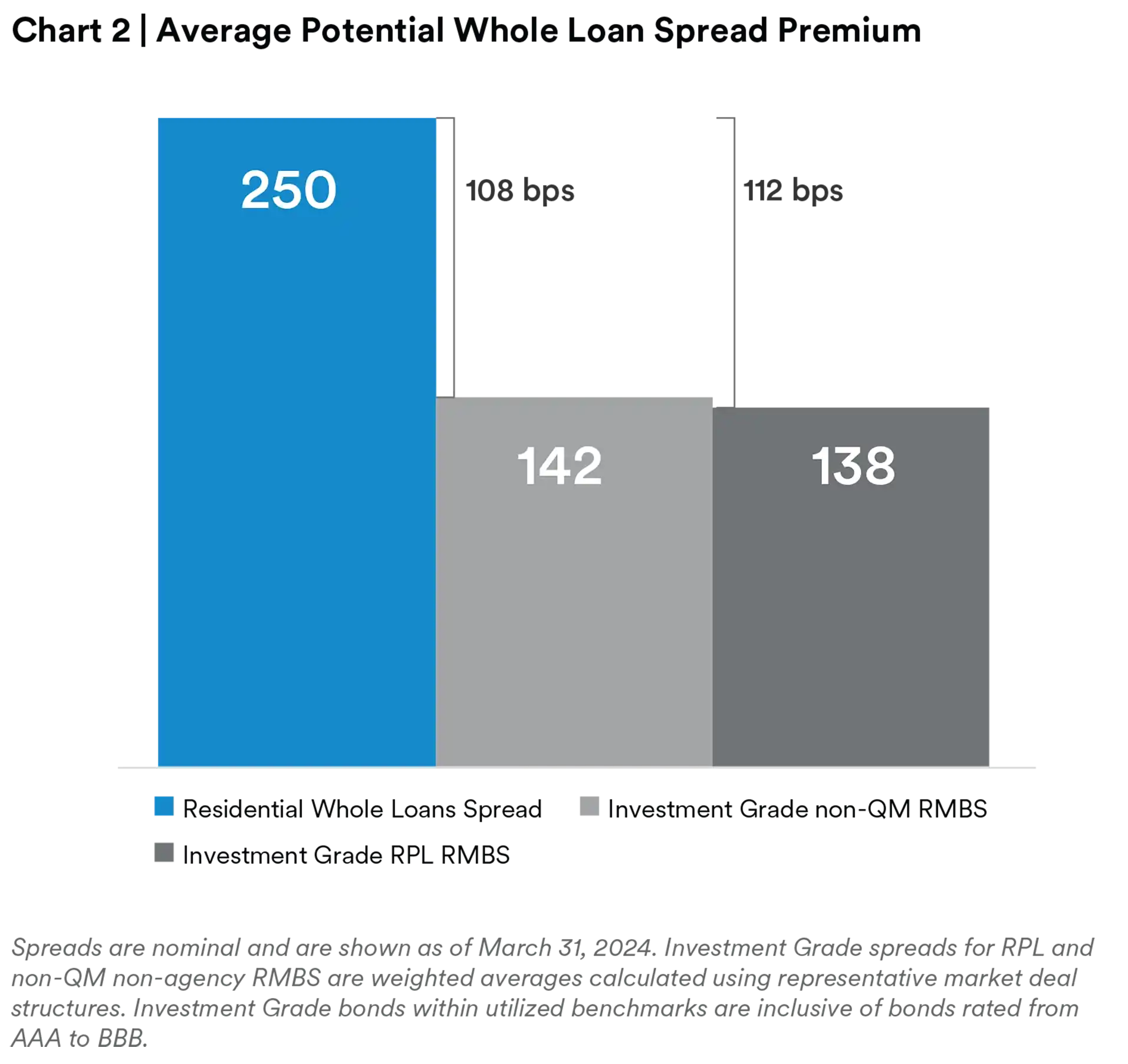

1) Originators obtain liquidity either via the public residential mortgage-backed securities (RMBS) market or by selling their loans into the whole loan market. Spreads remain wider for whole loans relative to public investments in residential credit, due to the management required of the underlying assets and the differences in market liquidity relative to structured products, as well as eliminating those costs associated with creating an RMBS structure. By purchasing whole loans, investors can capture a material portion of the coupon borrowers are paying, net of servicing fees. To highlight the juxtaposition against whole loans, there is a considerable difference between the coupon and the returns received by investors, as shown below.

2) Life insurance companies, in particular, have increasingly focused on residential whole loans because of their favorable capital treatment relative to RMBS bonds. With a capital charge just under 75 bps3, this capital efficiency offers investors for life insurance general accounts an attractive capital-adjusted return that includes a spread pickup to public RMBS.

3) There is a wide array of sub-sectors under the residential whole loan umbrella (see chart below). This provides flexibility around credit and prepayment risk profiles where an investor can pivot to any of these sub-sectors at any time depending on relative value. Strategies can also be tailored to fit investors’ requirements.

4) Investors who are members of the Federal Home Loan Bank (FHLB) can leverage their residential whole loan portfolios to access attractive financing through FHLB advances. The FHLB provides lines of credit at 70–75% of the collateral's market value, with financing rates typically just above SOFR (between 20–50 bps for 0–5 year tenors and 50–100 bps for 5–10 year tenors).4 These advances, available from overnight to 30–year terms, require pledged loans to meet specific eligibility criteria including maximum loan-to-value ratios, minimum credit scores and property type restrictions. This financing structure is particularly valuable because investors can deploy borrowed funds into higher-yielding investments while maintaining their original loan portfolio. Additionally, by pledging residential whole loans, investors can free up other high-quality collateral like U.S. Treasuries for alternative strategies. Regular mark-to-market requirements and potential collateral adjustments ensure prudent risk management, while the low cost of capital makes FHLB financing an attractive option for portfolio enhancement.

5) Residential whole loans not only offer potential for higher risk-adjusted yields but can also provide investors greater control over the investment process. The direct purchasing of loans offers increased transparency and control in investing in the underlying assets. Investors can determine their own credit criteria and portfolio risk tolerance by more selectively carving out loans for purchase. This type of investment allows for more creative purchasing structures that enable investors to manage their exposure to credit and interest rate risk — such as purchasing loans that meet specific attributes or reducing purchase premiums through seller- or servicer-retained excess servicing strips, thus mitigating the effects of negative convexity.

6) While many asset managers like MIM are ‘buy and hold,’ the flexibility of residential whole loans extends to exit strategies. If an investor decides to exit their position, e.g., to realize their portfolio gains or adjust their portfolio risk, they have options in determining how to do so, including securitization strategies through the public market or private targeted loan sales. The granularity allows investors to define which loan pools from their portfolio to sell, in contrast to RMBS holdings where investors must sell the entire rated security or tranche.

7) Investment strategies evolve by product type as market dynamics and relative value across loan products change over time. Investments across various product types show the advantage of having control over the credit criteria, allowing investors to focus on capturing better relative value and yield than that available in the public RMBS market. For example, MIM and other assets managers shifted to non-QM mortgages in 2022 due to a thorough understanding of the credit and prepayment risk profile, along with more attractive spread pickup compared to other sub-asset classes.

8) Lastly, the fundamentals of today’s housing market are much healthier than during the GFC, and residential whole loans offer a potentially attractive path for investors to diversify their exposure to U.S. housing, consumer credit and geography. National home supply continues to be below pre-crisis levels as approximately 80% of all outstanding mortgages were locked into sub-4% mortgage rates as of 2023 year-end.5 Combined with the post-pandemic increase in housing demand, the supply of homes for sale has been very constrained but in turn has kept property prices stable. Borrowers now have a substantial amount of equity built up in their homes, which has brought delinquencies and severities to all-time lows across MIM’s portfolio, as incentivized homeowners look to protect their gains.

Insurance Strategic Asset Allocation

In the context of strategic asset allocation, residential whole loans can offer several benefits to an insurance company portfolio:

- Diversification

- Portfolio Construction

- Steady Income Stream

- Attractive Risk-Adjusted Returns

- Inflation Risk Mitigation

- Customized Investment – Staple allocation

- Potential Increased Capital Efficiency

Diversification: Incorporating residential whole loans into an insurance company portfolio helps achieve a balanced mix of income, diversification and risk management aligned to long-term investment strategies. Residential whole loans provide a different risk and return profile compared to traditional investments like fixed income and equity. This diversification can smooth out returns while reducing overall portfolio risk and volatility.

Portfolio Construction: Residential Whole Loans offer distinct portfolio construction advantages that complement traditional fixed income and other risk assets in a diversified multi-strategy portfolio. While they exhibit negative convexity and prepayment risk during falling rate environments, these characteristics can be actively managed through careful loan selection, vintage diversification and creative purchasing structures that can enable investors to manage credit and interest rate risk exposures. Residential mortgages are often complementary because when interest rates are falling, other parts of the portfolio are performing well. In other words, the slower reaction of residential loans to interest rate movements, particularly in declining rate scenarios, can benefit portfolio performance when paired with non-callable bonds and other assets exhibiting positive convexity, such as bullet corporate bonds or Treasury securities. This lag effect creates a natural hedge against interest rate volatility.

Steady Income Stream: Whole loans generate regular principal and interest payments, which can offer a reliable source of income for insurance companies, helping to match their liabilities with steady cash flows. The consistent income streams and relatively higher yields compared to similarly rated corporate bonds enhance overall portfolio yield without significantly increasing credit risk. The secured nature of these loans, combined with their historically strong recovery rates in stressed conditions and granular exposure across geographic regions and borrower types make them particularly valuable for liability matching strategies in insurance portfolios.

Attractive Risk-Adjusted Returns: Whole loans, especially those with strong credit quality, which are typically purchased by traditional insurers, offer the potential for attractive risk-adjusted returns compared to other fixed-income alternatives. Rotation into residential mortgage loans can also help mitigate the effects of deterioration in fundamentals in the commercial office and retail sectors. Residential mortgages accounted for 11.2% of the mortgages held by life insurers at year end 2023, a 200% increase in industry-wide allocation over three years.6

Inflation Risk Mitigation: Residential whole loans often come with higher yields and spreads versus high-grade corporate bonds. Premiums to publics often range between 150–200 bps versus alternatives. Residential whole loans can also provide some degree of protection as a hedge against inflation, since the value of the underlying real estate generally rises with inflation, potentially preserving the real value of income and principal.

Customized Investment – Staple allocation: Insurance companies can easily tailor whole loan investments to fit their specific risk tolerance, return objectives and liquidity needs, aligning with their strategic asset allocation goals. This is especially true given the varied types of products within the residential mortgage loan space; examples include Non-Qualified Mortgages, Prime Jumbo, Second Liens and Residential Transition Loans.

Potential Increased Capital Efficiency: Whole loan investments offer favorable capital treatment under many regulatory frameworks, allowing life insurance companies to optimize their capital usage and improve overall capital efficiency.

MetLife Investment Management’s (MIM) Residential Whole Loan Strategy

We believe residential whole loans are an under allocated asset class within the insurance industry. MIM has established a record of performance and maintains relationships necessary to build tailored portfolios for clients. Clients must consider factors such as liquidity, duration and credit quality. MIM currently manages over $20 billion7 in residential loans and offers various client services, including sourcing, loan level due diligence, regular servicing oversight, reserve modeling and loss mitigation strategies. This includes providing accounting support during the onboarding process and assistance with pledging assets to the FHLB. The loan management process is designed to handle large amounts of data from various counterparties to monitor and manage asset performance. Using a data and systems-based approach, clients can tailor their whole loan investments to meet their specific objectives and strategic asset allocations.

Endnotes

1. St. Louis Federal Reserve “All Sectors; One-to-Four-Family Residential Mortgages,” Jun 30, 2024

2. MBA “Share of Mortgage Loans in Forbearance Decreases to 0.44% in June,” Jul 19, 2023

3. The capital charge across MIM’s residential portfolio

4. Based on the pledged loan portfolios of MIM and its clients

5. FHFA data analysis by Realtor.com “87% of Outstanding Mortgage Debt has a Sub-6% Rate”, Dec 31, 2023

6. S&P Global “Residential loan surge pushes U.S. life insurers’ mortgage holdings to new heights”, May 2, 2024

7. As of September 30, 2024. At estimated fair value. Includes all U.S. residential mortgage loans managed by MIM, excluding fair value option residential mortgage loans.

Disclaimers

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees’ pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities. For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1. As of July 22, 2024, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited