Introduction

Approximately 25% of the companies in the 2022 S&P Global Corporate Sustainability Assessment (CSA), set net-zero targets.1 The buildings sector, both operational and new construction, is responsible for 39% of global emissions.2 While some industry sectors can adopt clear-cut best practices for achieving their decarbonization goals, given real estate’s impact on global emissions, its strategies require additional consideration. Asset managers regularly acquire and sell assets, which means the makeup of their portfolio in a baseline year may be very different from the portfolio mix in the final year of a decarbonization goal or target. Determining how progress toward emissions reduction goals is tracked and reported can impact the overarching decarbonization strategy for that real estate portfolio.

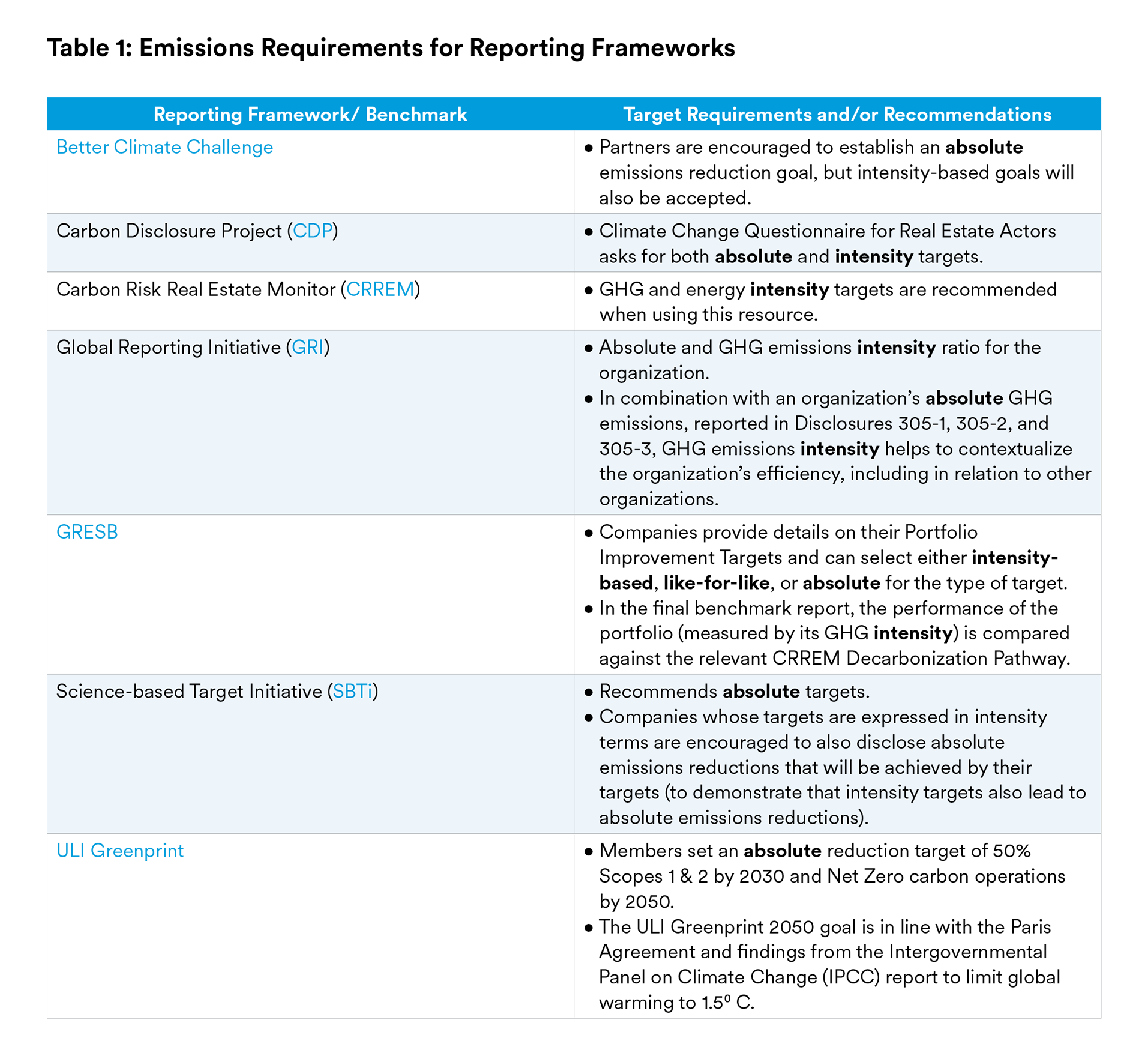

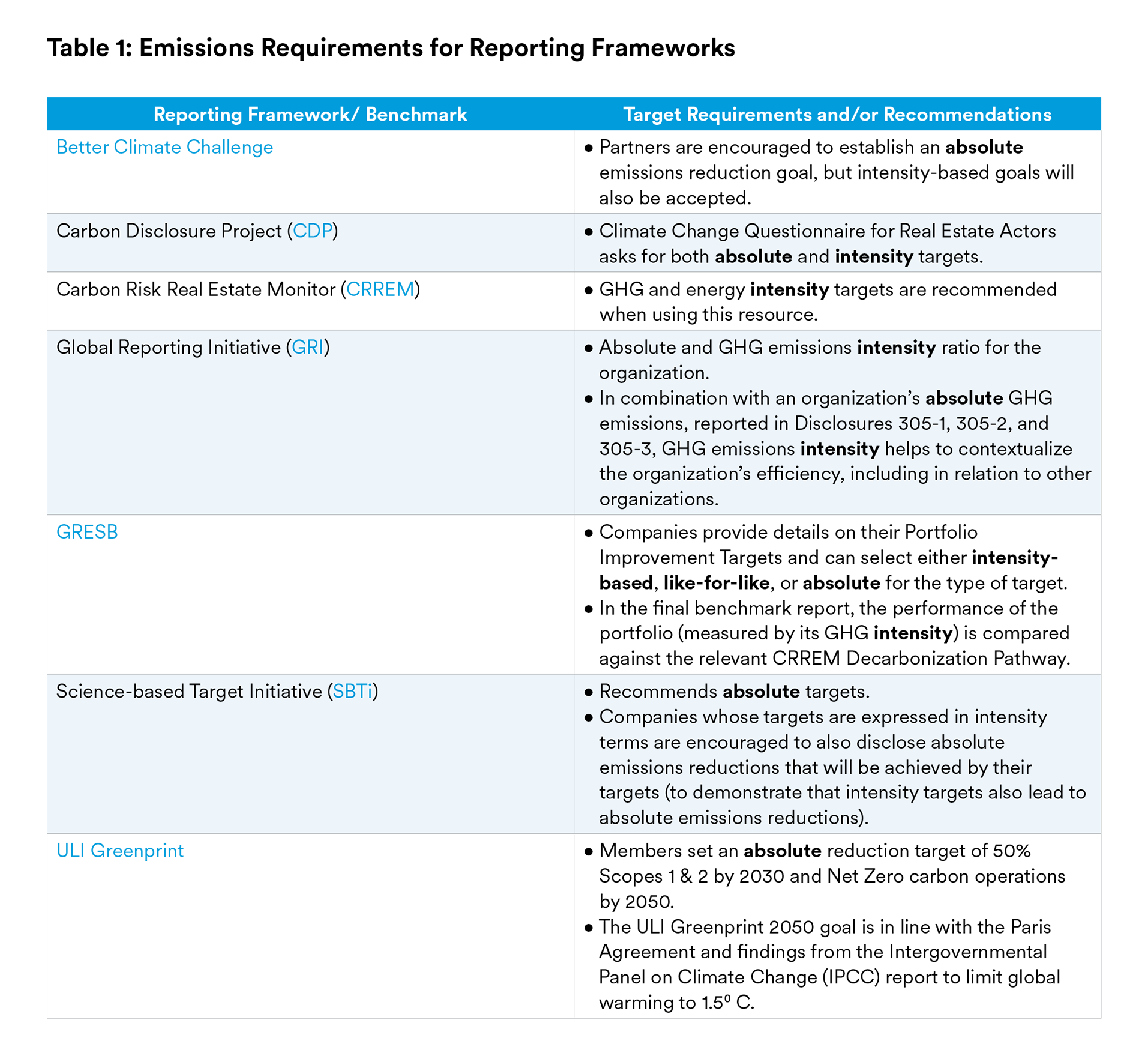

For buildings to decarbonize, similar strategies are adopted broadly that include practicing energy efficiency, adopting electrification strategies and investing in renewable energy, both on and offsite. Organizations can track progress through commitments to organizational goals and Environmental, Social, Governance (ESG) reporting frameworks (see Table 1 for details about these organizations/frameworks). Emission reduction targets are usually disclosed in two ways, each dictating progress differently: the absolute approach and the intensity-based approach. For commercial real estate, changes in portfolio composition add complexity around choosing an absolute or intensity-based metric—a conversation that we will explore further in this paper.

Absolute vs. Intensity Metrics Defined

Absolute Targets capture the total emissions reduced for a portfolio by a set amount or percentage by an established end date (with limitations on granularity). They specify emissions reductions relative to a historical baseline.³ Absolute emissions reduction targets can be the best option when the number of assets in a portfolio are not likely to change.

Advantages:

- Offer a direct approach to measure reductions against a target or a specified quantity of GHG emissions.

- Unambiguously communicate to stakeholders whether emissions are increasing or decreasing.

Disadvantages:

- Require regular target base-year recalculations as a result of substantial portfolio growth or asset changes, introducing complexity to tracking progress over time.

- If assets are sold after undergoing investments in decarbonization, those decarbonization efforts are not captured through absolute tracking.

- Does not allow for peer comparisons of carbon/energy use intensity or efficiency.

- Organizations can be rewarded for reducing emissions simply by decreasing production, output or the assets in a fund (organic decline).4 As a portfolio grows, their total emissions will also grow, seeming to negate any efforts or reductions made at individual properties/assets.

Intensity Targets normalize emissions reductions relative to a portfolio’s economic output such as total metric tons of CO2e emitted per square footage of a portfolio (MTCO2e/sq. ft.)1 or total emissions per dollar invested (financed emissions). We prefer this metric as it is particularly beneficial for organizations interested in understanding their relative impact across a diverse portfolio or when comparing to peers.

Advantages:

- Allow for performance comparison across diverse portfolios, companies and sectors.

- Highlight improvements in emissions reduction performance at the portfolio level, despite changes in portfolio size.

- Eliminate the need for base-year recalculations in most cases.

Disadvantages:

- Have the potential to misrepresent progress or actions taken to reduce emissions because shifts in portfolio composition may impact emissions intensity without direct property-level action.

- Complicate tracking progress across diverse operations and property types, as energy use per square foot varies depending on building type and use (operating hours, number of occupants, equipment, etc.).

Example of Absolute vs. Intensity: The below example distinguishes between these two target-tracking methods through the sample of a 10-property portfolio and highlights these methods through sample scenarios.

A company with 10 assets totaling 2,000,000 sq ft has set a goal to reduce its emissions by 50 percent by 2030 when compared to a 2020 baseline. Their total emissions in 2020 were 6000 metric tons of CO2e (MTCO2e). Using an absolute target, this portfolio would need its total emissions in 2030 to be 3000 MTCO2e regardless of the number and the type of properties in the portfolio at that time. Using an intensity target, the portfolio would need to reduce its total emissions relative to the total square footage of the portfolio, meaning it would require a 50% reduction in the metric tons of CO2e per square foot (baseline: 6000 MTCO2e/2,000,000 sq ft = 0.003 MTCO2e) (goal: 0.0015 MTCO2e per square foot).

In this example, if this company keeps the same 10 assets in its portfolio until 2030, it can undergo decarbonization strategies, track toward a 50% reduction and achieve both targets; however, if the company’s portfolio’s total square footage doubles, it would have a much more difficult time achieving a 50% reduction in emissions given the larger portfolio size. In contrast, an intensity metric may still be feasible. On the flip side, if this company were to sell half of its assets, in considering the absolute target, it may be able to achieve its target without undergoing any decarbonization measures, simply because of the reduced number of properties in the portfolio.

This example shows the limitations of both approaches—simply sharing a “percentage toward goal” progress update annually leaves much up to interpretation. Choosing between these two metrics is not always straightforward. An organization might need to decide between the simplicity of an absolute target over the comparability of intensity targets.

Targets in Practice

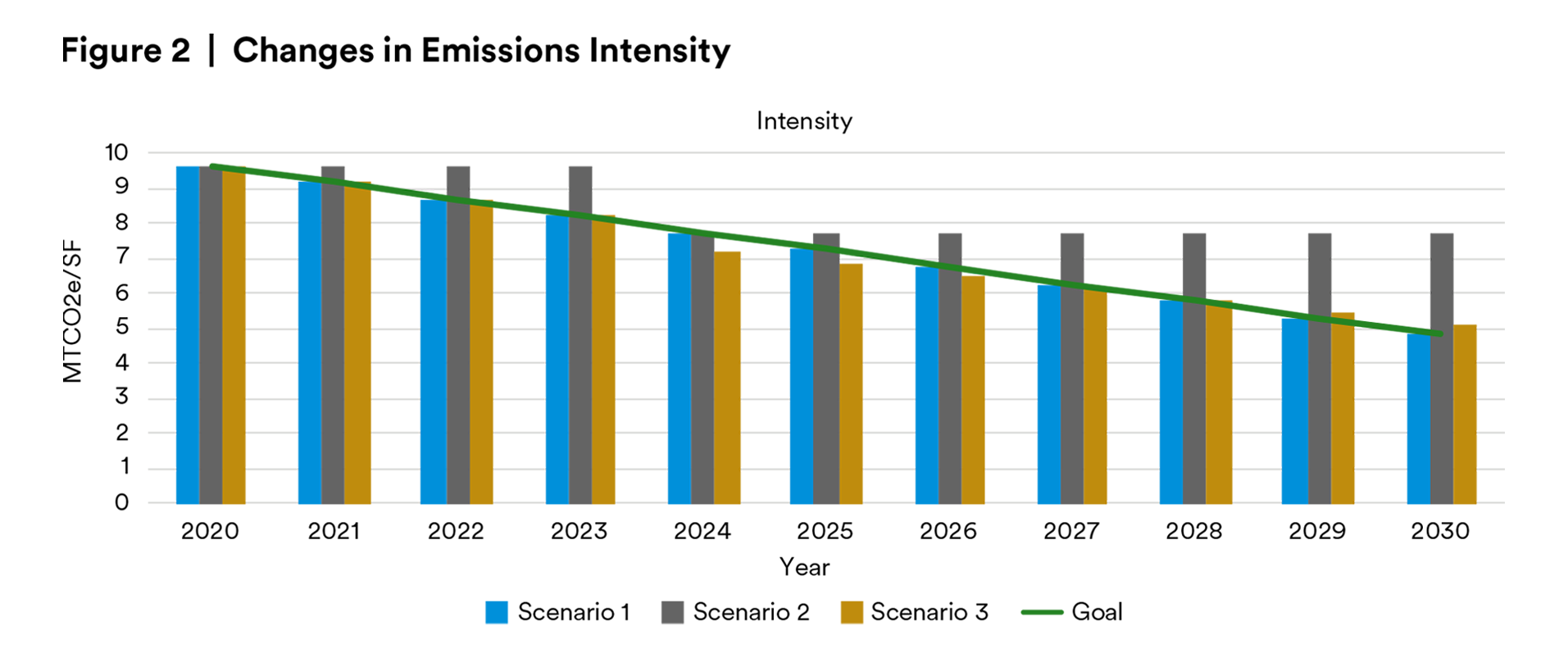

As we continue to consider the different options available for emissions reduction target-setting, we have created three hypothetical scenarios for a portfolio comprised of office and ndustrial warehouse assets to illustrate how different business practices can impact results. These two asset classes are used in this scenario intentionally, as office properties typically have a reater emissions intensity when compared to industrial warehouses; however, in most cases, it is easier to drive energy savings in an office building due to the lease structure of industrial properties.

In these three scenarios, we will be measuring against a portfolio’s target to reduce its common area emissions 50% over 10 years using both an absolute reduction approach and an emissions intensity approach. Note that the emissions being considered are market-based emissions, therefore the greening of the electric grid is not considered in these scenarios, although we did discuss this topic in a previous paper.

We examined the paths a building portfolio might take over a 10-year period, categorizing theseportfolios into three scenarios:

- Scenario One: The number of properties in the portfolio remains constant over time with an even split of office and warehouse assets. The warehouse properties do not undergo any decarbonization investments over time, and the office properties see a gradual reduction in emissions, year over year, to achieve the 2030 goal.

- Scenario Two: Portfolio migration to lower-emissions intensity properties and there are no energy efficiency improvements made: The portfolio maintains the same number of assets, but its composition changes in 2024 by selling office properties that have higher emissions intensities and replacing them with warehouse facilities with lower emissions intensities. No decarbonization efforts occur in this example.

- Scenario Three: Growing portfolio with energy efficiency improvements: The portfolio’s number of properties increases in 2024 when new warehouse assets are acquired, and office properties continue to experience the same reduction in emissions year over year as those office properties in Scenario One.

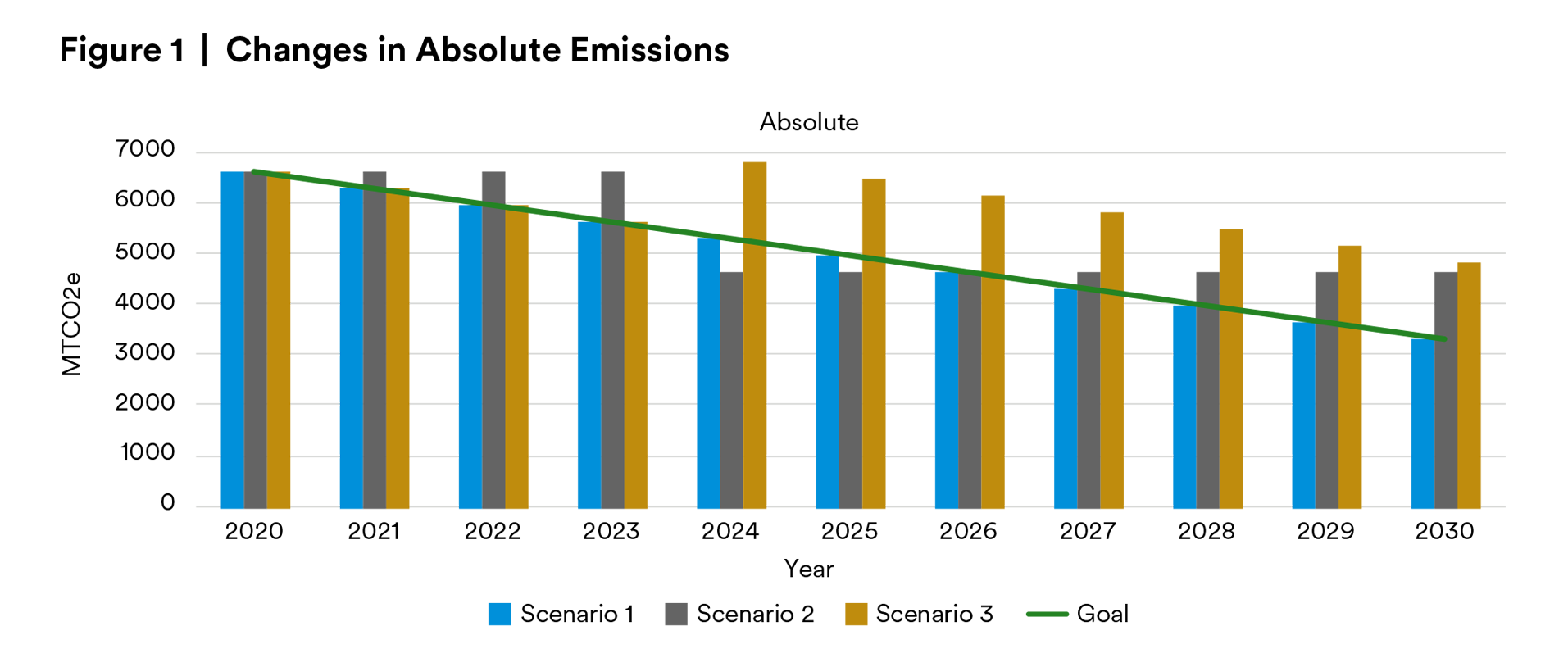

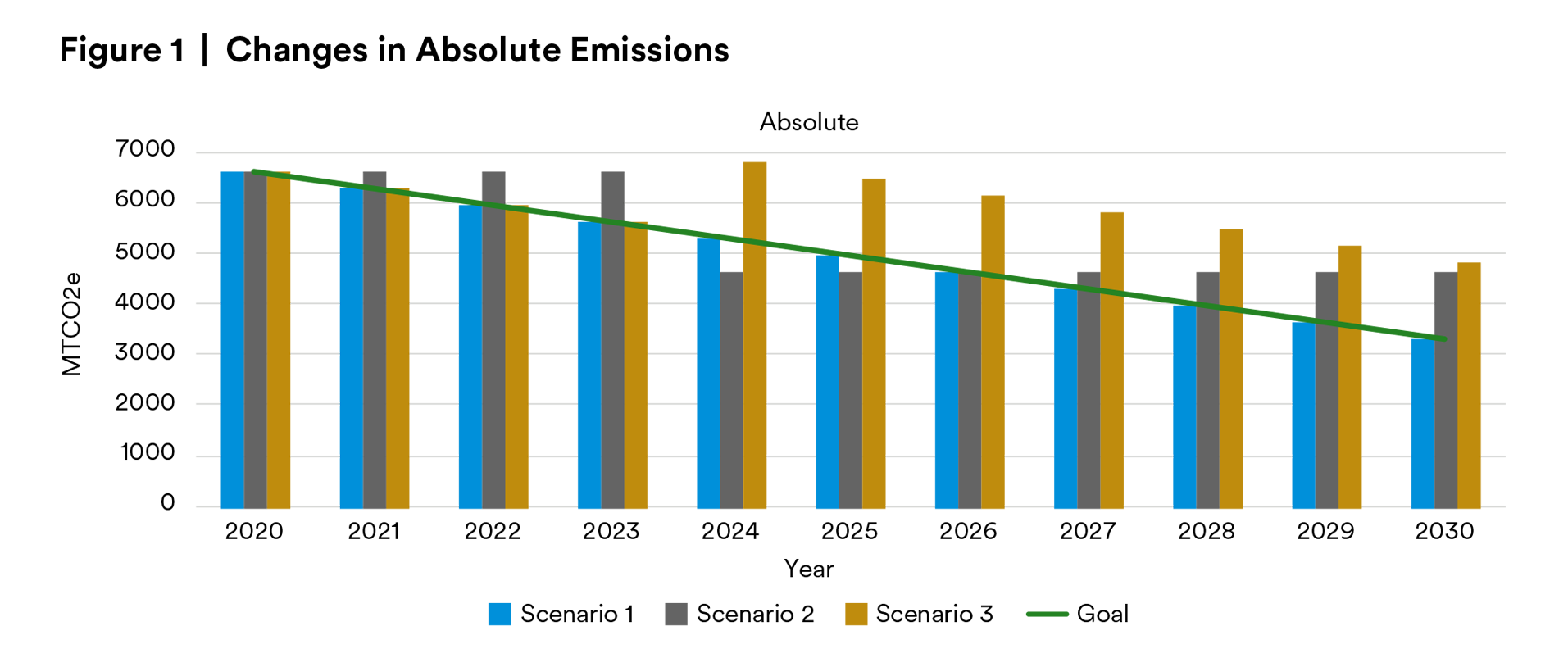

Absolute Emissions: Changes in Portfolio Composition Impact Results

As depicted in the graph below, when measuring progress using an “absolute” approach, the portfolio that is the most successful in remaining on track with its goal is Scenario One. In this scenario, the portfolio does not experience any changes in composition, and half of the assets see continuous energy improvement over time.

In Scenario Two, the portfolio was on track in years 2024-2026, following the change in building composition through the sale of the more energy-intensive office buildings and the acquisition of warehouse properties. But, after the portfolio composition changed in 2024, total emissions remained constant, as there were no investments in energy efficiency, causing the portfolio to no longer be in alignment with its goal by 2027.

In Scenario Three, the least successful example, while the portfolio was initially on track to achieve its goal due through investments in energy efficiency in the office properties, its progress was derailed in 2024 when new warehouse assets were acquired, increasing total portfolio absolute emissions. While emissions still declined in the years following 2024, due to decarbonization efforts at the office properties, the portfolio’s 2030 goal was no longer in reach when considered in absolute terms.

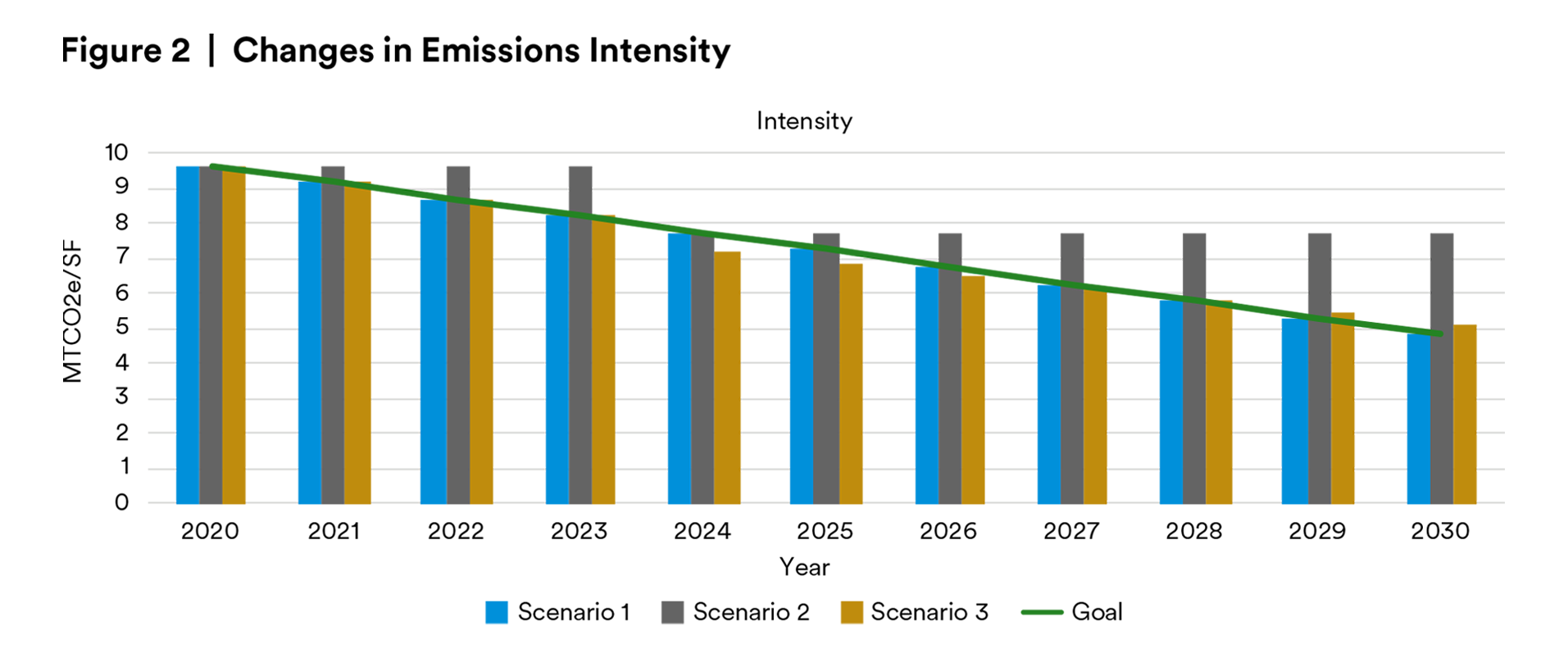

Emissions Intensity: Growth in a Portfolio’s Size Does Not Inhibit Progress Toward Decarbonization Targets

As depicted in the example below, when using an “intensity” metric, the scenarios in which there was the greatest success toward staying on track with this portfolio’s decarbonization target are Scenarios One and Three. Scenario Three included both growth in the total portfolio size through the acquisition of less energy-intensive assets, coupled with investments in energy efficiency of the more intensive assets.

When using an absolute metric, Scenario One is still successful and on track with its goal, given that the portfolio’s building composition does not change over the 10-year period, and because the office properties continue to see reductions in energy usage; however, no new business, including the acquisition of new properties was able to occur.

When measuring progress in consideration of emissions intensity, the least successful scenario was Scenario Two. While there was a decrease in portfolio emissions intensity when the office assets were replaced with industrial assets in 2024, the portfolio’s emissions intensity remained constant in years 2024 – 2030 due to no additional investments in energy efficiency, causing the portfolio to move off course when tracking towards its goal.

ESG Frameworks and Target Setting

The decision to measure progress via an absolute or an intensity metric is not limited to organizational decisions; there are a variety of ESG frameworks that real state portfolios may commit to, and each has their own method of tracking progress as illustrated in Table 1. Confusion can arise when a portfolio aligns with more than one framework because, due to differences in reporting styles of these frameworks, progress can appear differently for each.

What’s the Bottom Line?

As the scenarios demonstrate, absolute or intensity metrics alone cannot accurately capture the full picture. Pedro Faria, Technical Director of CDP, a global environmental disclosure system has reasoned: “[…] setting a meaningful emissions reduction target requires taking into account and communicating how these two relevant and largely complementary dimensions of a target will vary in the future: your absolute emissions and some meaningful physical indicator of your carbon efficiency.”5

At this time, entities submitting to leading ESG frameworks choose to report absolute or intensity metrics (or both). While each metric holds merit in simplifying the complicated nature of emissions across industries, assets and locations, they can be misleadingly simplistic. While we prefer the Intensity metric for real estate given that it offers normalization, a business experiencing growth or adapting to changing circumstances is bound to alter the composition of its portfolio and should avoid overreliance on either metric alone. Effective portfolio management should use all tools available to assess progress, including analyzing like-for-like asset performance and portfolio subdivisions, e.g., by asset class or acquisition cohort.

Organizations that aim to be true stewards of the built and natural environment improve upon the performance of their assets; however, the current frameworks do not have a universal way of acknowledging that stewardship. The market similarly struggles to fully attribute the impact of investments made to improve the emissions performance of an asset in an ever-changing portfolio.

Metrics and target-setting are only one piece of the puzzle for ESG-conscious asset managers. What matters most is an organization’s willingness to dedicate time and resources to use meaningful targets and integrate carbon reduction strategies into their decision-making processes to improve portfolio performance. Through these actions, fund managers can minimize climate-related risk, maximize returns over the long term and drive positive change across the industry as we strive toward a decarbonized economy.

Endnotes

1 Amid urgent climate warning from IPCC, few companies globally have net-zero targets | S&P Global (spglobal.com)

2 https://www.weforum.org/agenda/2022/09/construction-industry-zero-emissions/

3 Target: Intensity | World Resources Institute (wri.org)

4 GHG Protocol, Chapter 11 Target Setting

5 Are absolute or intensity targets better to curb your carbon footprint? | Greenbiz

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

In the UK, this document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges hat (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of December 31, 2023, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC.