A Clearer (and Possibly Brighter) Economic Outlook

At the start of 2023, economists believed there was a 63% probability that a recession would occur during the year (many estimated that the U.S. was already in a recession).i The path of inflation was uncertain, as was the impact of higher interest rates on consumers and U.S. businesses. The war in Ukraine was also relatively new, causing heightened geopolitical uncertainty and energy market volatility, further pressuring economic growth.

Today, progress on inflation and the associated monetary policy implications point towards a clearer, if not improving, economic outlook for 2024, relative to where we sat at the start of 2023.

The most recent Consumer Price Index (CPI) showed prices grew at just 3.4% year-over-year, down from a peak of 8.9%.ii Core Personal Consumption Expenditures (the Fed’s preferred inflation metric) registered 0.7% annualized growth in November, well below the 2% target.iii

A positive consequence of the Fed’s rate hiking campaign is the policy “space” afforded to the Fed to fight a recession should one occur this coming year. The Fed now has the power to lower interest rates to stoke economic growth if necessary and has signaled a shift away from combatting inflation towards a focus on preserving labor market stability. In the last FOMC meeting, the Fed hinted at 3 rate cuts in their forward guidance for 2024.

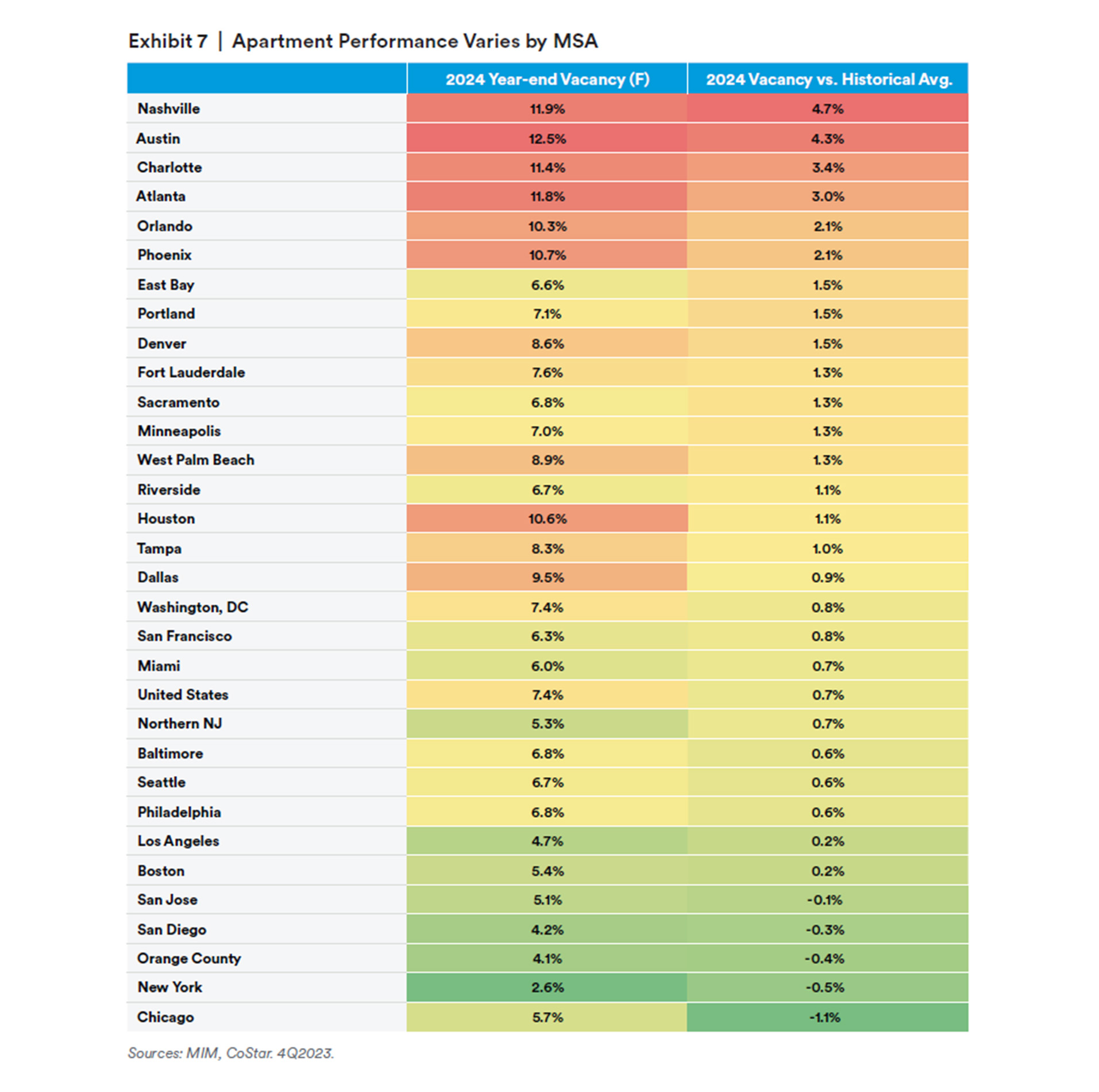

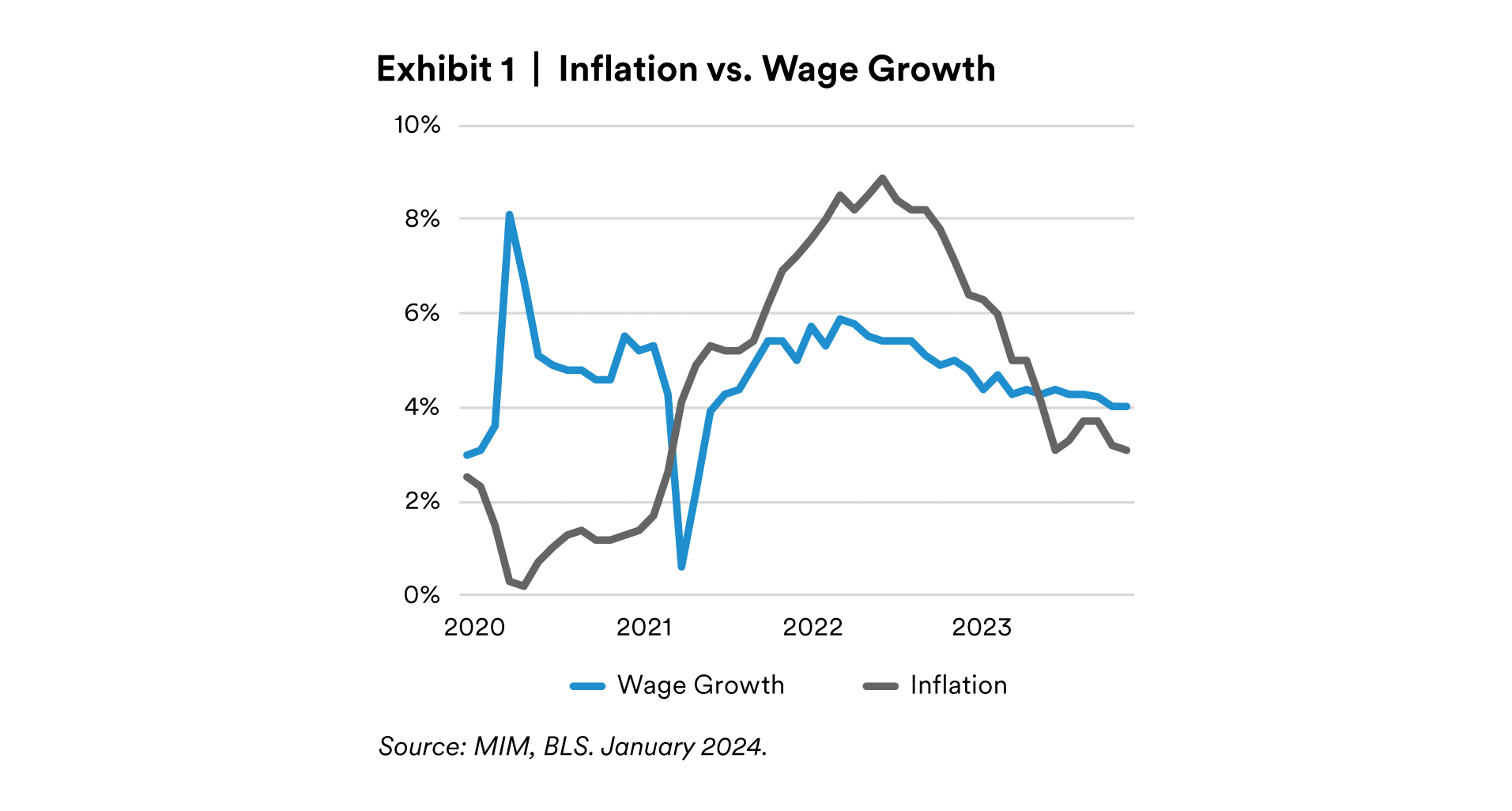

Along with progress on inflation, consumer health is stabilizing. This is partially due to the Fed’s own comments on supporting labor market conditions. Additionally, consumers are once again experiencing positive real wage growth (exhibit 1), a condition that could support stable labor markets and economic growth next year.

Accumulated savings and healthy household balance sheets helped bridge consumers through the high-inflation and high-interest rate period of 2021-2023. While pandemic-era accumulated savings have been mostly spent down, positive real wage growth should step in and act as a buffer against potential economic shocks this coming year.

For 2024, we welcome a clearer and potentially brighter outlook for the economy and commercial real estate relative to where we sat this time last year. We expect the 10-year treasury rate to remain near 4.0% and expect modest cooling in the labor market throughout the year.

Values Stabilizing

Values Stabilizing

We believe private commercial real estate prices may be near or past the trough and expect the benchmark NCREIF property index to report a roughly 20% value decline from the 2022 Q2 peak. Three factors that lead us to this conclusion include our proprietary relative value benchmark, active bidding/selling in the market today, and improvements in the public REIT market.

First, our oft-cited relative value benchmark that compares under-negotiation real estate discount rates to Baa yields + 200 bps shows that real estate is offering fair relative value (exhibit 2), meaning discount rates, or required returns, do not have to adjust in response to the returns offered by other investment sectors. Additionally, the rate outlook implies that corporate bond yields, and thus real estate required returns, could decline further in 2024iv, putting upward pressure on real estate prices.

The second signal we looked at is observations from transactions currently in the market (including MIM’s own experience and discussions with peers and brokers). For example, in early November 2023, MIM completed an initial underwriting of a core stabilized property that produced an internal rate of return (with moderate leverage) of 8.9%. The underwriting assumed a mortgage coupon of 6.6%.v

The underwriting completed in late December revealed that due to the improved rate environment, the actual mortgage rate that would be applied to the property was 6.0%, improving the levered IRR by 40 bps (assuming the same acquisition price as the original underwriting). MIM could have paid a 5% higher price for the property and achieved the same IRR as the original underwriting.vi

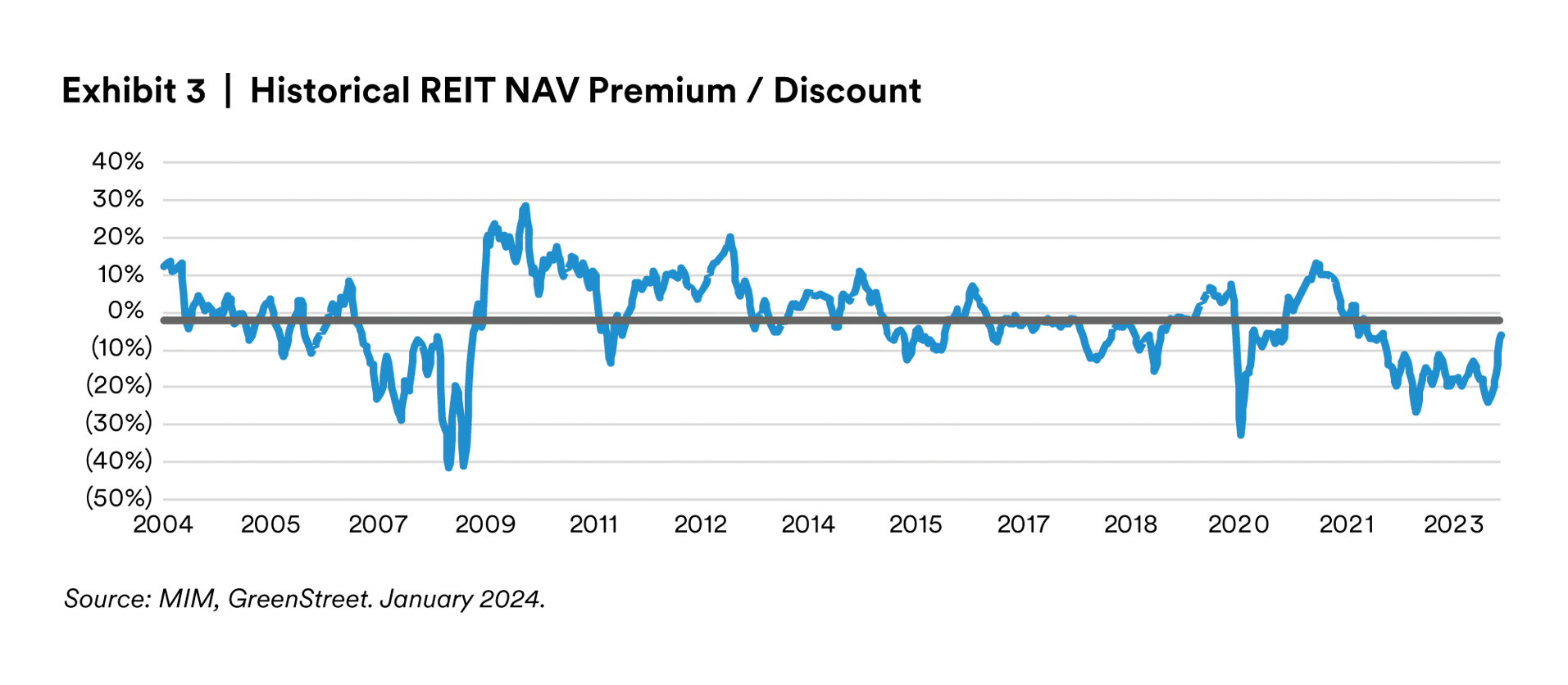

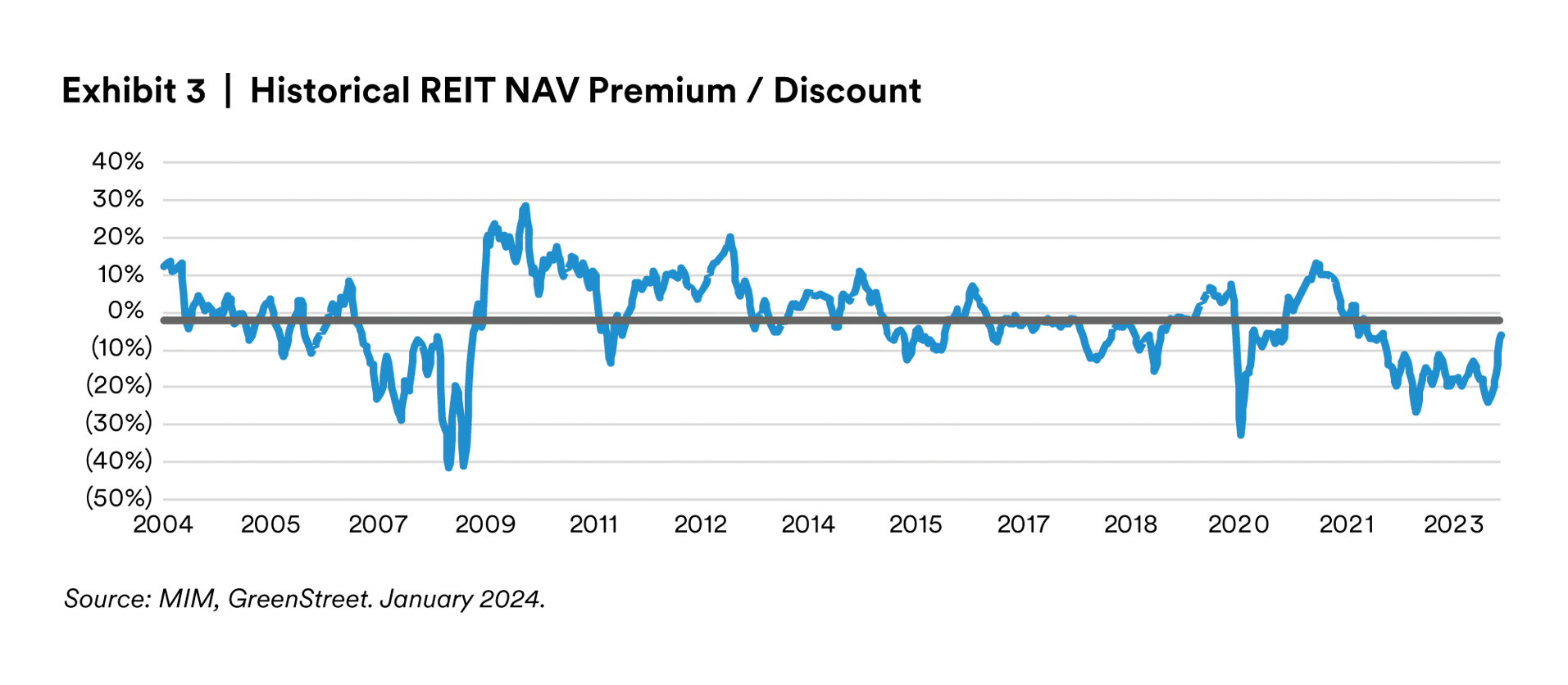

The final signal is the relationship between REIT stock prices and underlying net asset values (NAV). REITs have been trading at a discount to NAV since November 2021, making it difficult to raise newequity for acquisitions (exhibit 3).vii

The REIT price-to-NAV relationship has steadily improved over the past 3 months, and REITs are now trading close to parity with underlying Net Asset Values (NAVs). This is allowing many REIT managers to consider new acquisitions, and could draw institutional capital back into the market, helping both transaction activity and values to stabilize.viii

“Calling the bottom” can be a difficult endeavor. While there are many factors to consider, the three that give us the greatest pause include:

- Office sector uncertainty. As we will discuss later, we expect a continued deterioration in office fundamentals during 2024. It is unlikely that office values will reach a bottom until return to office (RTO) stabilizes and office occupancy finds a floor.

- Multifamily maturities. We estimate that 30% of the multifamily investable universe changed hands at peak valuations and peak underwriting assumptions during 2021-2022, and that most of the financing was based on a variable interest rate. Lenders’ willingness to work with multifamily borrowers in 2024 could determine if a large number of multifamily properties come to market at distressed prices, which adds downside risk to our forecast.

- Economic conditions: A more significant labor market deterioration than we are currently expecting could cause real estate demand, and values, to decline further.

Timing the Cycle?

Recoveries after the past several real estate downturns have been characterized by both a recovery in capital markets factors (with cap rates declining) and a rebound in real estate fundamentals (with vacancies declining and rent growth accelerating).

In the current market, we believe real estate cap rates / required returns are stabilizing (and possibly modestly declining), while real estate fundamentals are moderating. The lack of improving fundamentals implies that this recovery could be less “V-shaped” than a traditional real estate recovery.

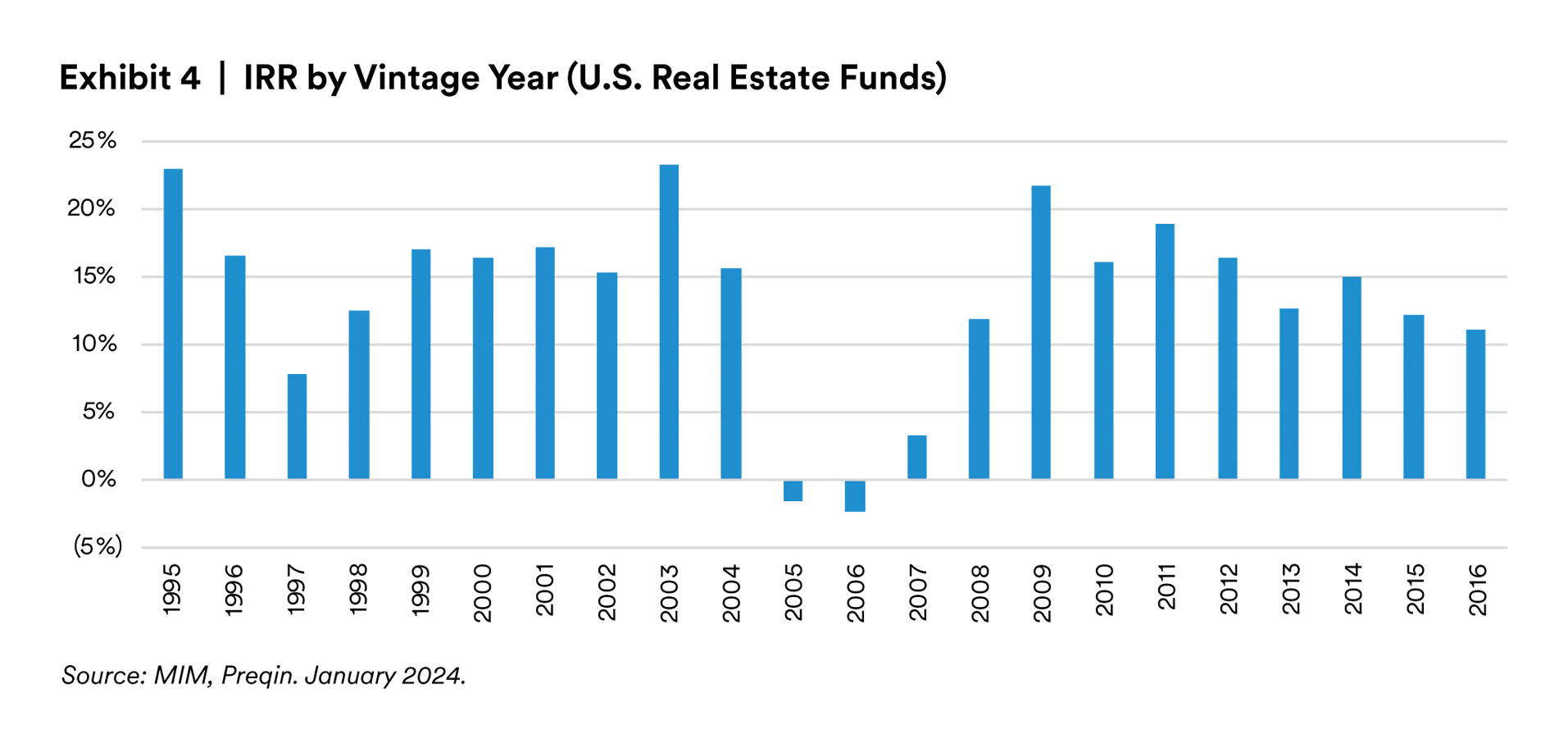

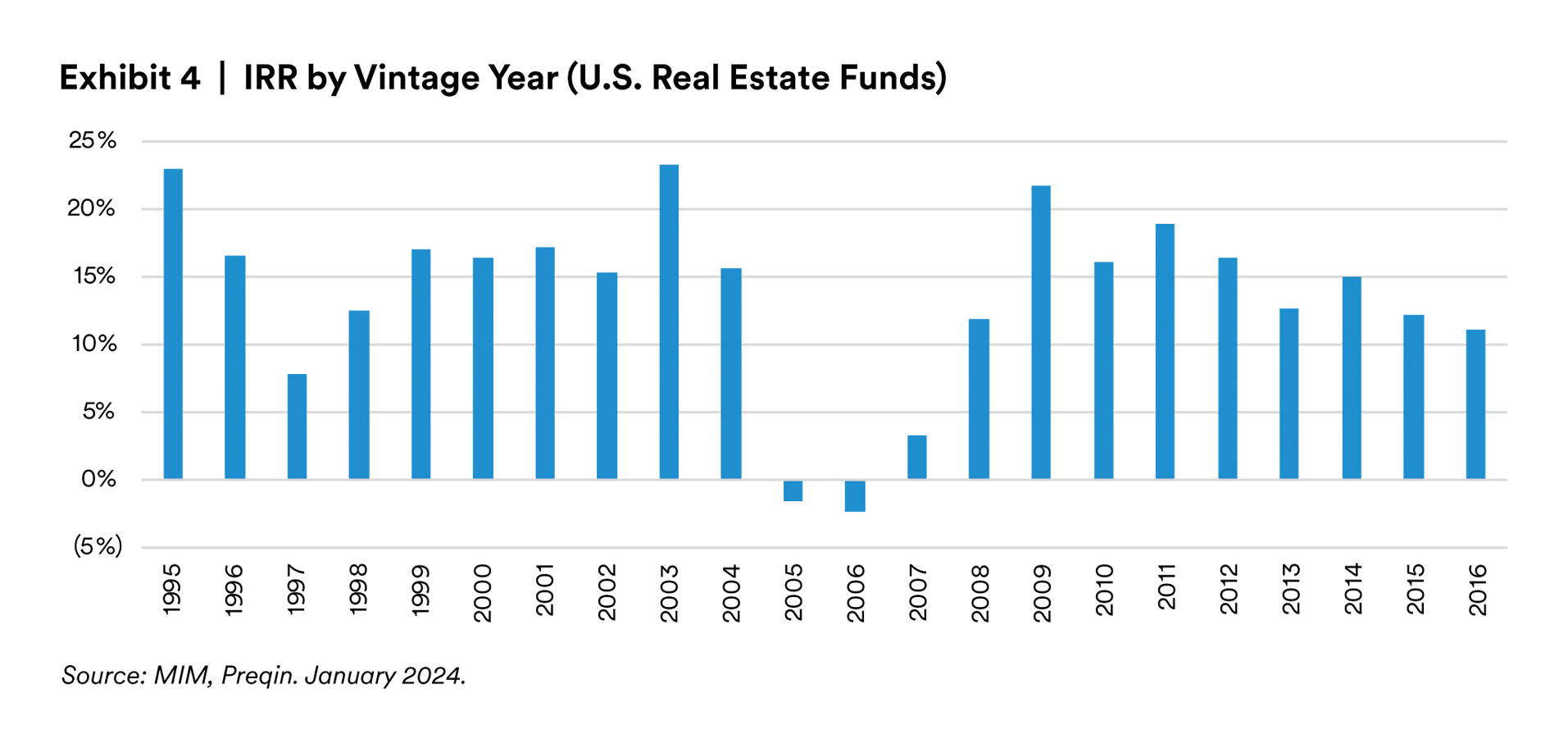

Entry point is particularly important for higher volatility strategies, like value-add or opportunistic /development funds. We observe fund vintages from the end of a cycle typically underperform, and fund vintages from the beginning of a new cycle typically outperform (exhibit 4).

If the recovery is not V-shaped, we believe high-volatility strategies may not experience the usual benefits associated with the beginning of a new cycle. As such, we think investors may want to consider maintaining a mid-cycle approach to exposure weights across debt, core/core+, value add, and development/opportunistic strategies, though this would not be a standard playbook in a typical recovery.

Exceptions to this could include tactical strategies offered by the current cycle, such as high-yield debt or preferred equity investments targeting funding gaps in the capital stack, or opportunistic strategies that capitalize on distressed office pricing.

Cooling Construction…

Capital market conditions are the driving force behind today’s shifting commercial real estate cycle, but we believe property fundamentals will increasingly come into focus as the fog lifts on pricing.

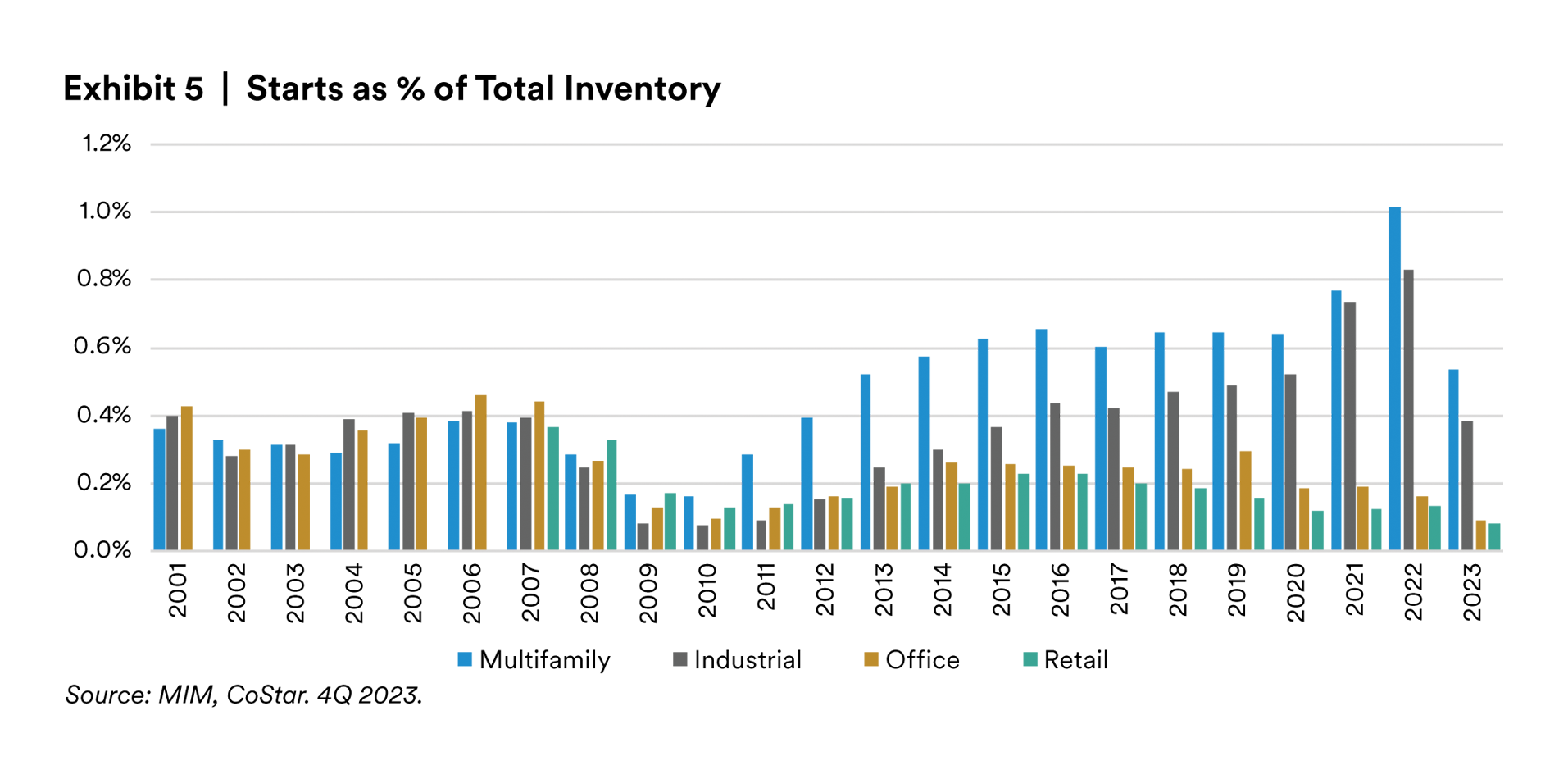

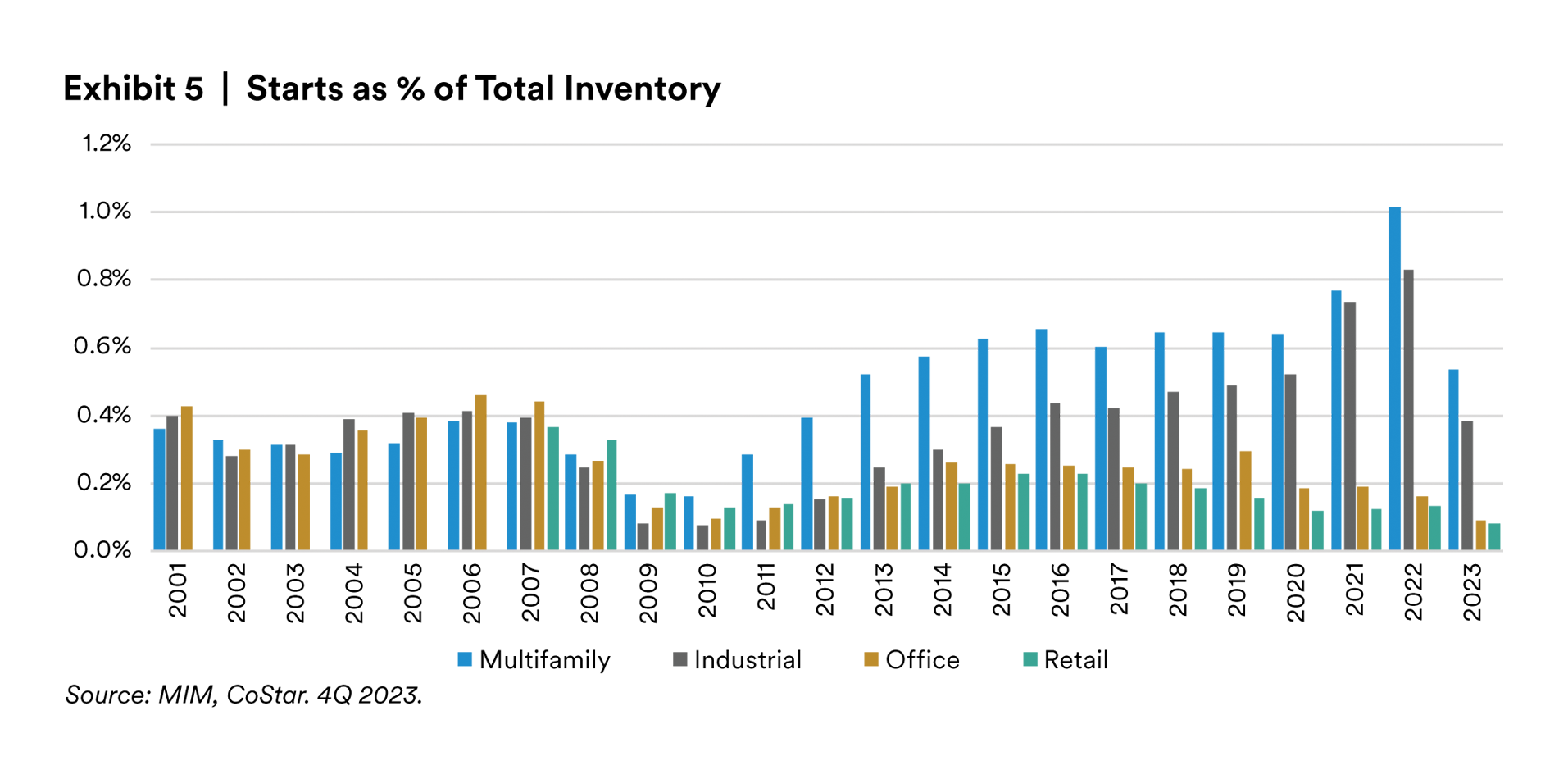

Higher inflation and higher interest rates have had a chilling effect on construction activity. This is a common theme across all property types (exhibit 5).

The downshift in construction activity is more significant than the declines that occurred following the global financial crisis and is happening at a time when vacancies for most property types (outside of office) are generally healthy.

Many market participants underwrite inflationary 2-3% rent growth in outer years of their forecast period, however this sharp reversal in project starts could lead to supply shortages later in the decade, meaning inflationary rent growth assumptions for the late 2020’s may be overly conservative. Even in the case of the office sector, we think this supply dynamic may cause the office vacancy rate to return to its pre-pandemic norm faster than many expect.

…and Varying Vacancy

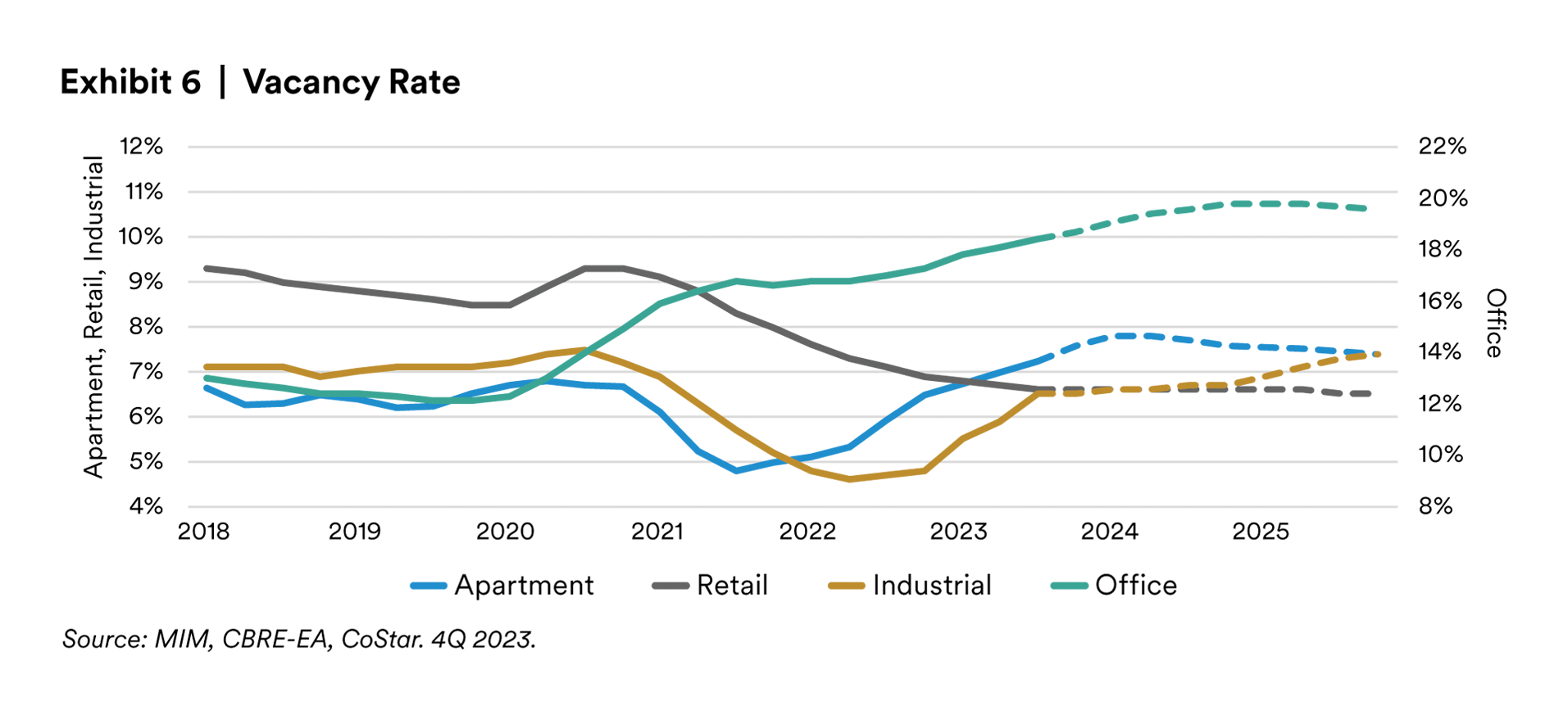

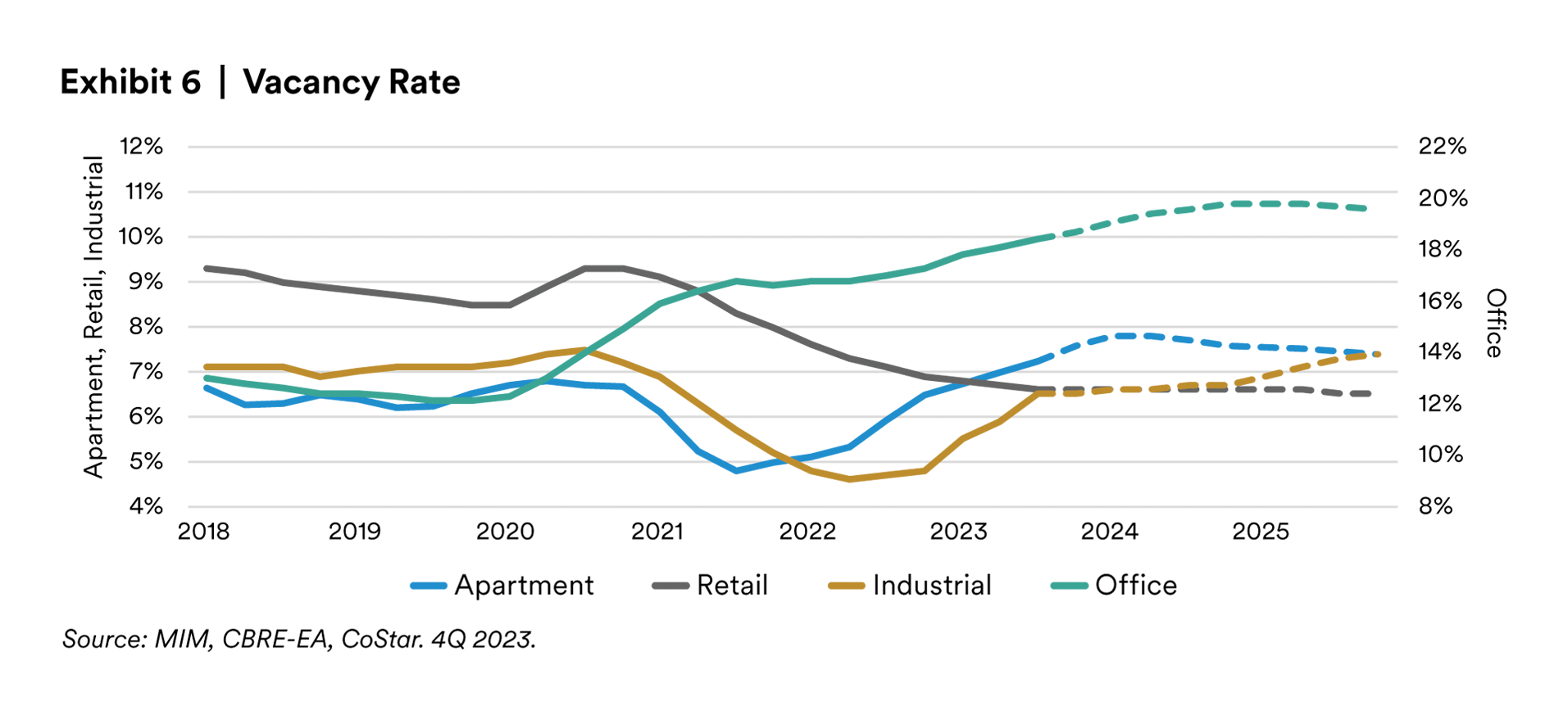

While new construction starts are cooling, the elevated pipeline from 2021-2023 could contribute to a divergent vacancy picture across property types in 2024.

Somewhat counterintuitively, the retail sector appears the least likely to see vacancies rise this year. Vacancies are now at an all-time low, thanks to a combination of healthy consumers and limited new construction (see constructions stats above). At the other end of the spectrum is the office sector. While office construction began declining following the onset of COVID, demand growth remains negative as [1] office users continue to re-think space utilization needs and [2] last year’s murky economic outlook further dampened office demand. The office vacancy rate currently sits at 18.6%ix, and we expect it to rise an additional 100-150 bps in 2024 before leveling off in 2025.

The industrial sector is at a moderate risk of rising vacancies given the large supply pipeline and normalization in demand following years of record growth. However, the industrial vacancy rate at 7.1% is still well below the historical average of 9.4%.x If the vacancy rate rises to 7.5% this year (our base case forecast), the industrial sector could still be considered under-supplied, and will likely continue to generate healthy rent growth (but perhaps not the double-digit annual rent growth we observed in the last several years).

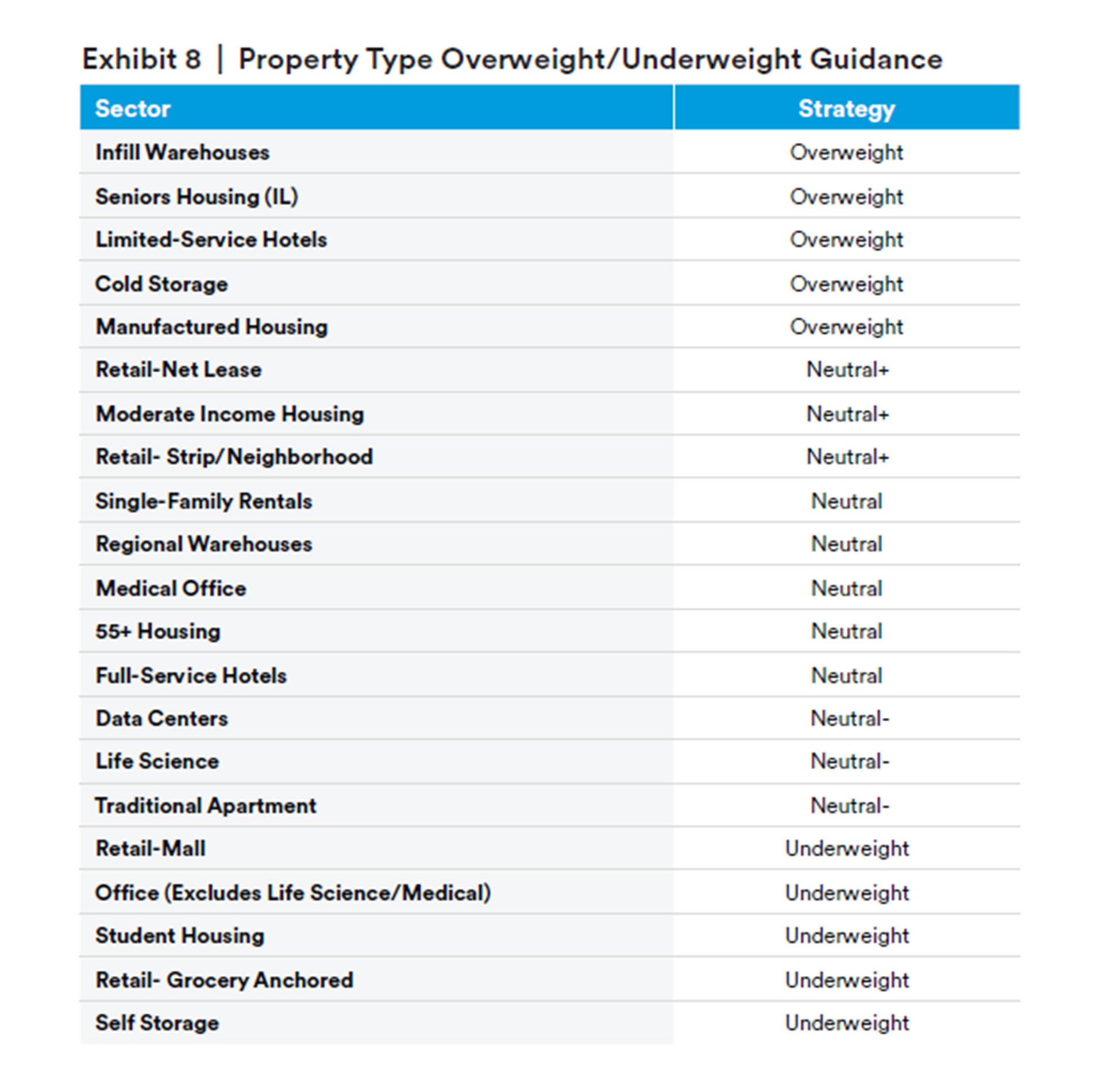

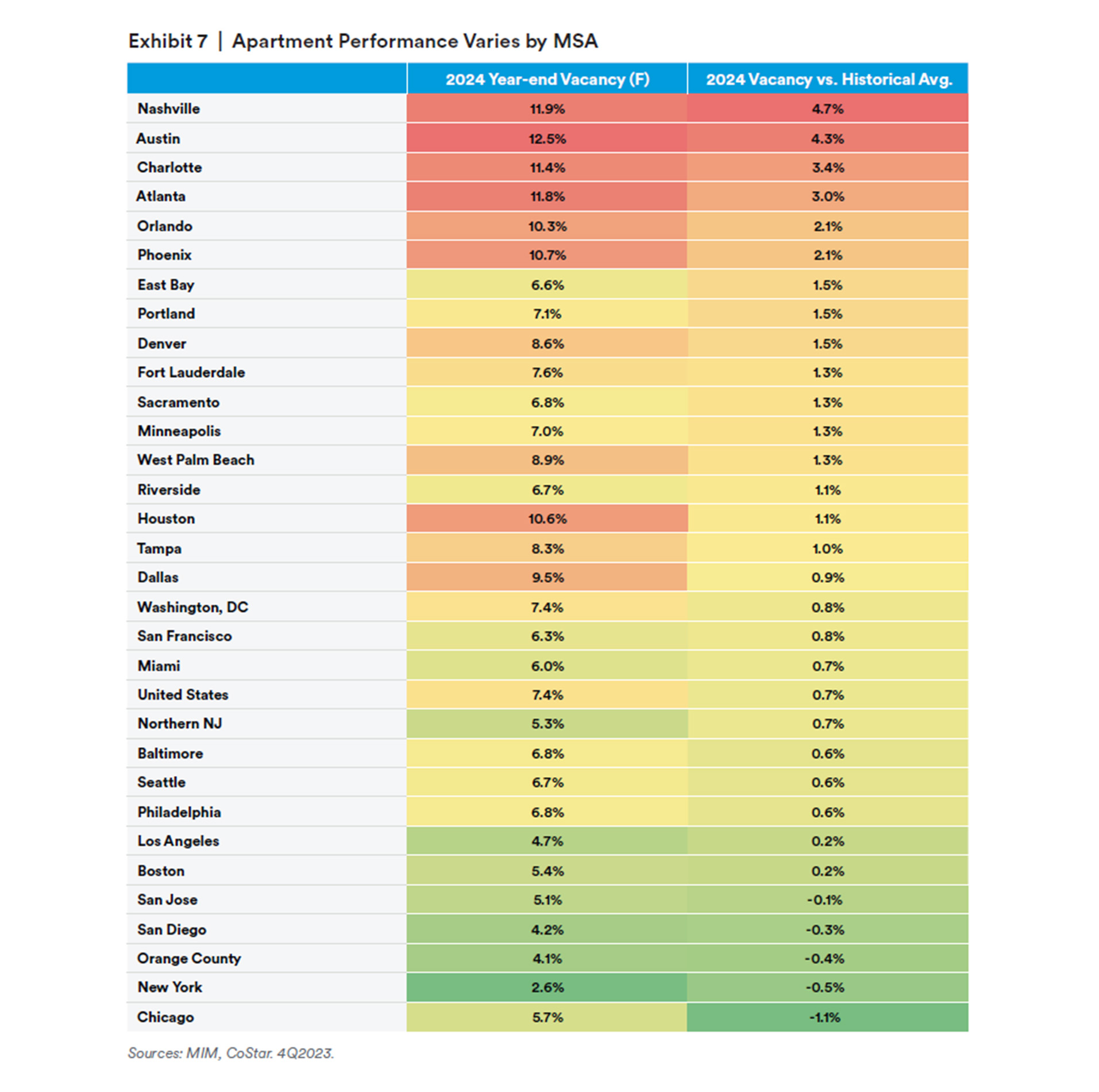

The multifamily sector has become increasingly divergent due to a concentration of high construction activity in a number of growing sunbelt markets. Markets like Nashville, Austin, Charlotte, and Atlanta could see 2024 vacancy well-exceed their respective markets’ historical average, and we expect several of these markets to realize negative rent growth. Combining this effect with still-elevated expense growth, we would not be surprised to observe several over supplied markets experience net operating income declines of 5-10%.

While growth markets are outperforming, several coastal and gateway markets like Chicago, New York, and Orange County are experiencing stable vacancies and rent growth, which should persist into 2024 given limited supply pipelines in these markets.

In general, we would characterize real estate fundamentals for 2024 as a stable outlook with some pockets of risk, not dissimilar from performance in 2023.

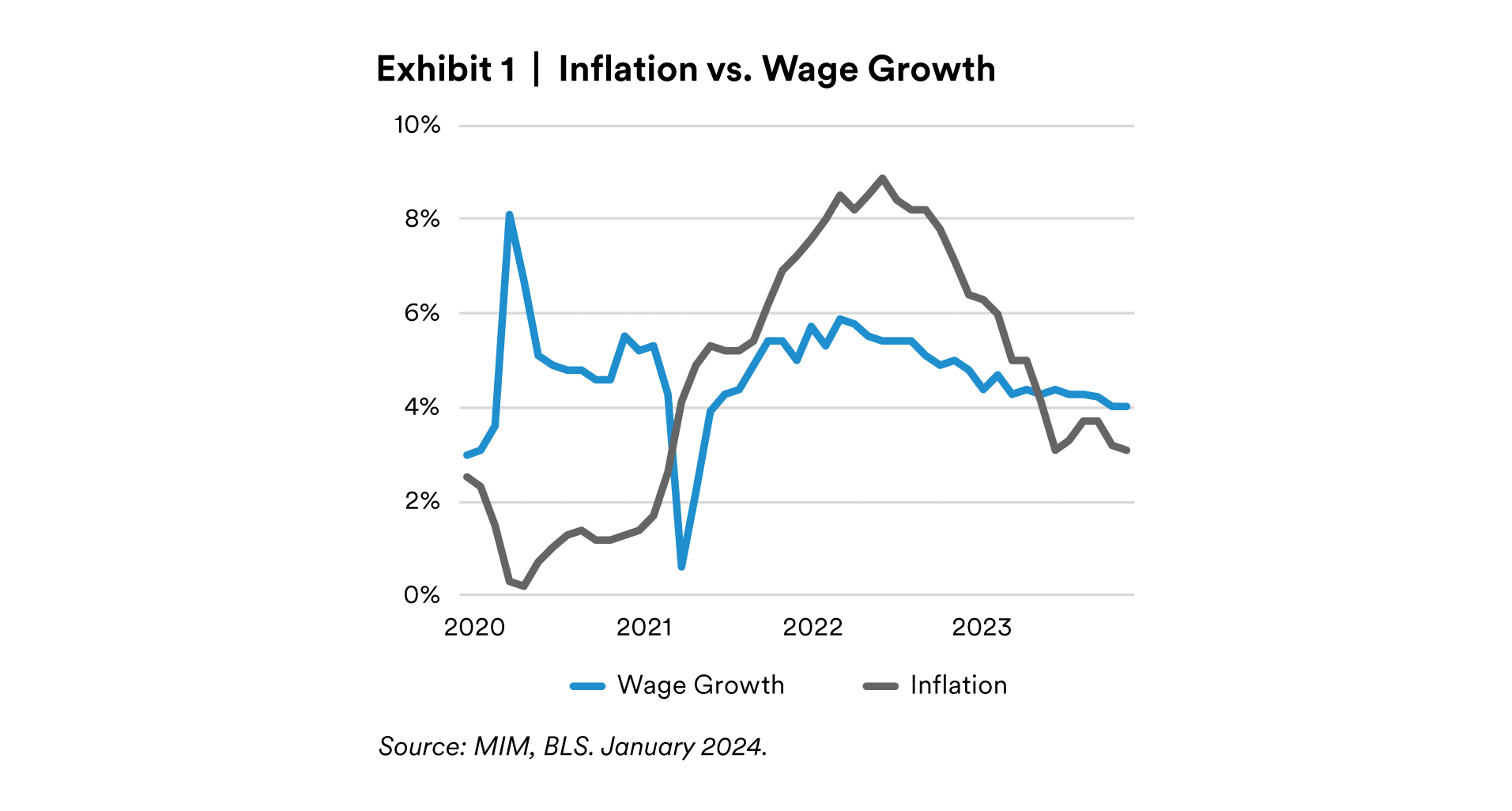

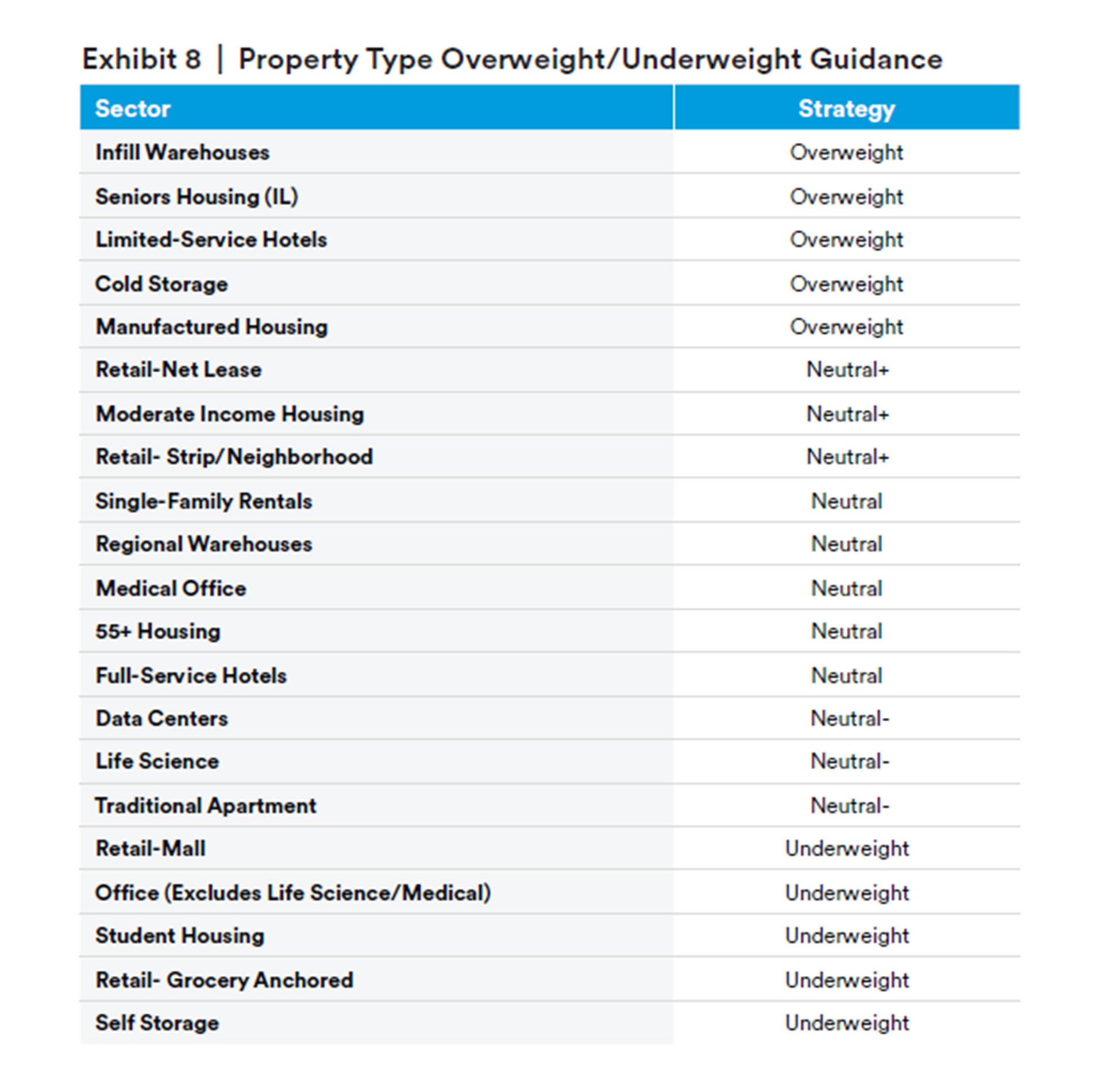

Alternative Property Type Update

We frequently survey MIM’s regional acquisitions teams to assess current spot market yields for stabilized properties across all the core and alternative property types. We then apply risk adjustments based on forecasted supply/demand conditions, historical investment performance volatility, operating expense loads and average CapEx needs to estimate the risk-adjusted returns being offered in the market. The exhibit below highlights the property types with the best to worst risk-adjusted returns, and corresponding overweight/underweight recommendation.

This analysis suggests the most favorable opportunities in the current market exist in infill warehouses, cold storage, limited service hotels, and net-lease retail. Residential alternatives like seniors housing, manufactured housing, and moderate income housing also receive favorable scores.

Importantly, this analysis is an unconstrained view that does not consider critical factors like debt availability, portfolio diversification, liquidity, operational challenges, MSA exposures (i.e., Life Science may only be available in several markets), or higher yielding strategies such as value-add or new development, etc.

Conclusion

We believe 2024 will be a year of lifting fog for commercial real estate. While that will be a welcome development from the obscurity of 2023, fog can lift to reveal the challenges on the road ahead. This is especially true when considering the potentially new normal pricing regime.

Still, we think the clarity offered by the coming year will be a step in the right direction of healing real estate capital markets. We expect transaction activity to begin recovering during the year as buyers and sellers agree on the outlook for interest rates and thus real estate values. The recovery may feel more like a mid-cycle period than a typical real estate recovery.

We believe a moderating construction pipeline will benefit all property types, though office and some pockets of multifamily will work through vacancy challenges this year. Alternative property types are becoming more mainstream staples of institutional investment portfolios, and we expect that trend to continue this year. Opportunities in infill industrial, residential alternatives, cold storage, limited-service hotels, and net-lease retail are high on our list, offering an attractive combination of fundamentals and pricing.

Although many macroeconomic factors remain unresolved, we believe that the resilience of the U.S. consumer will enable the U.S. economy and real estate sector to successfully overcome the challenges of the year ahead.

Endnotes

i WSJ Economic Forecast Survey. January 2023.

ii BLS. January 2024.

iii BEA. January 2024.

iv Oxford Economics. January 2024.

v MIM. November 2023.

vi MIM. December 2023.

vii GreenStreet. January 2024.

viii Ibid.ix CBRE-EA. 4Q2023.

x Ibid.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended fordistribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of anycompany mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well asthose included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute orform part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construedas such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before makingthe investments. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and marketconditions, the total amount nor the calculation methods cannot be disclosed in advance. Investors should obtain and read the prospectus and/ordocument set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has notbeen reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G ofthe Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorisedand regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financialinstruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only bedistributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated inIreland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries ofMetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/ third partyinvestors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife AssetManagement Corp. (Japan), and MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management PartnersLimited and Raven Capital Management LLC.

Values Stabilizing

Values Stabilizing