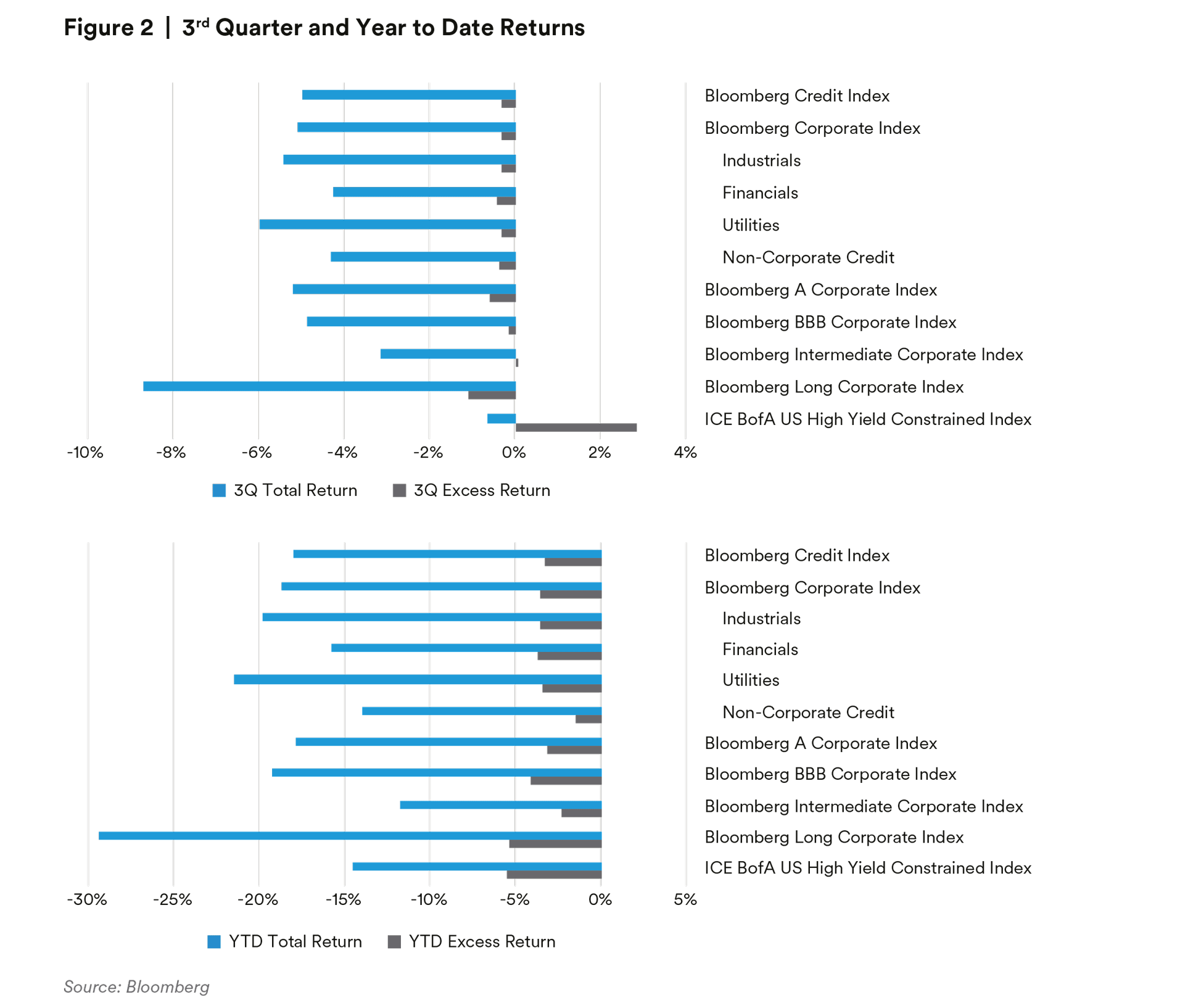

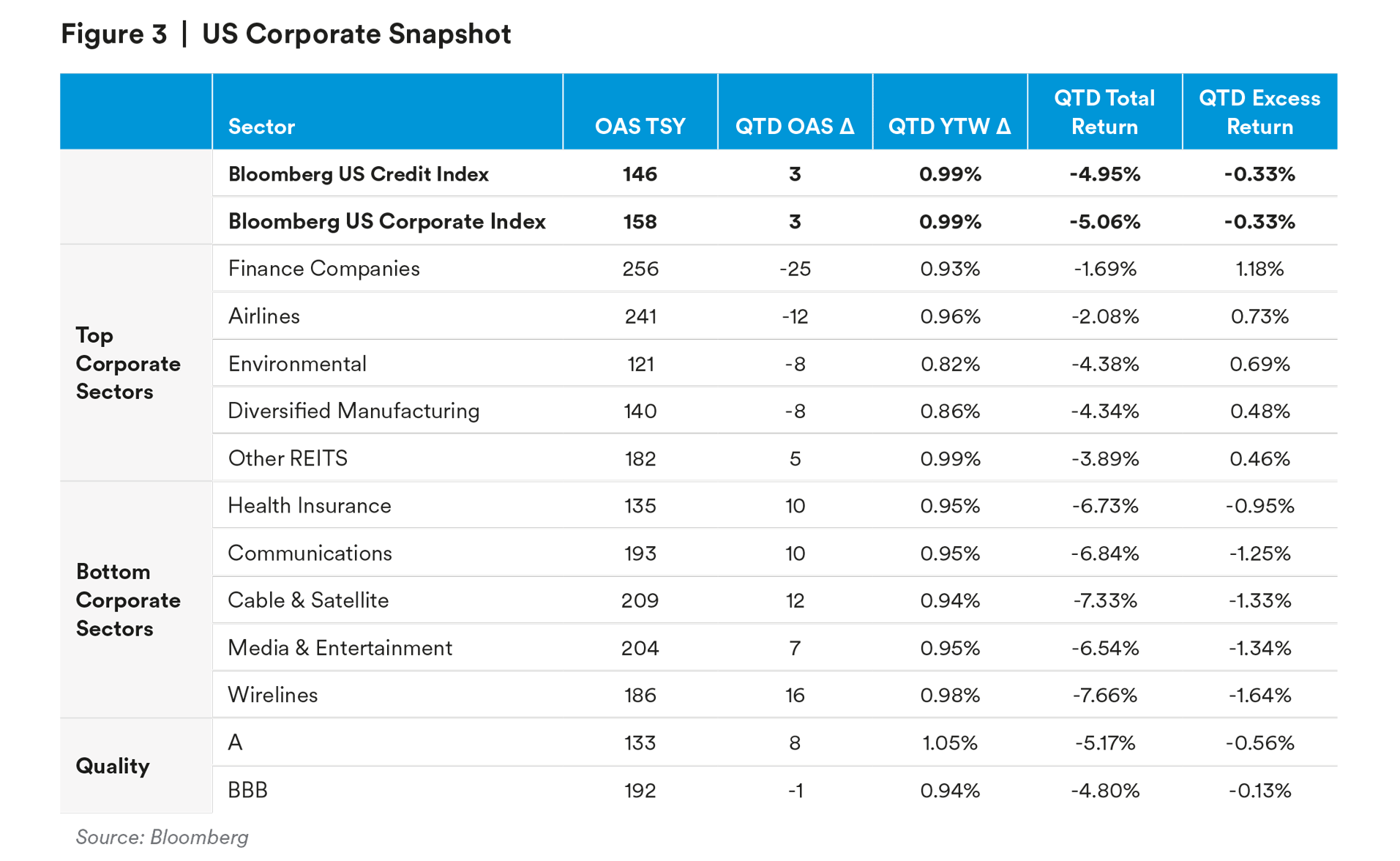

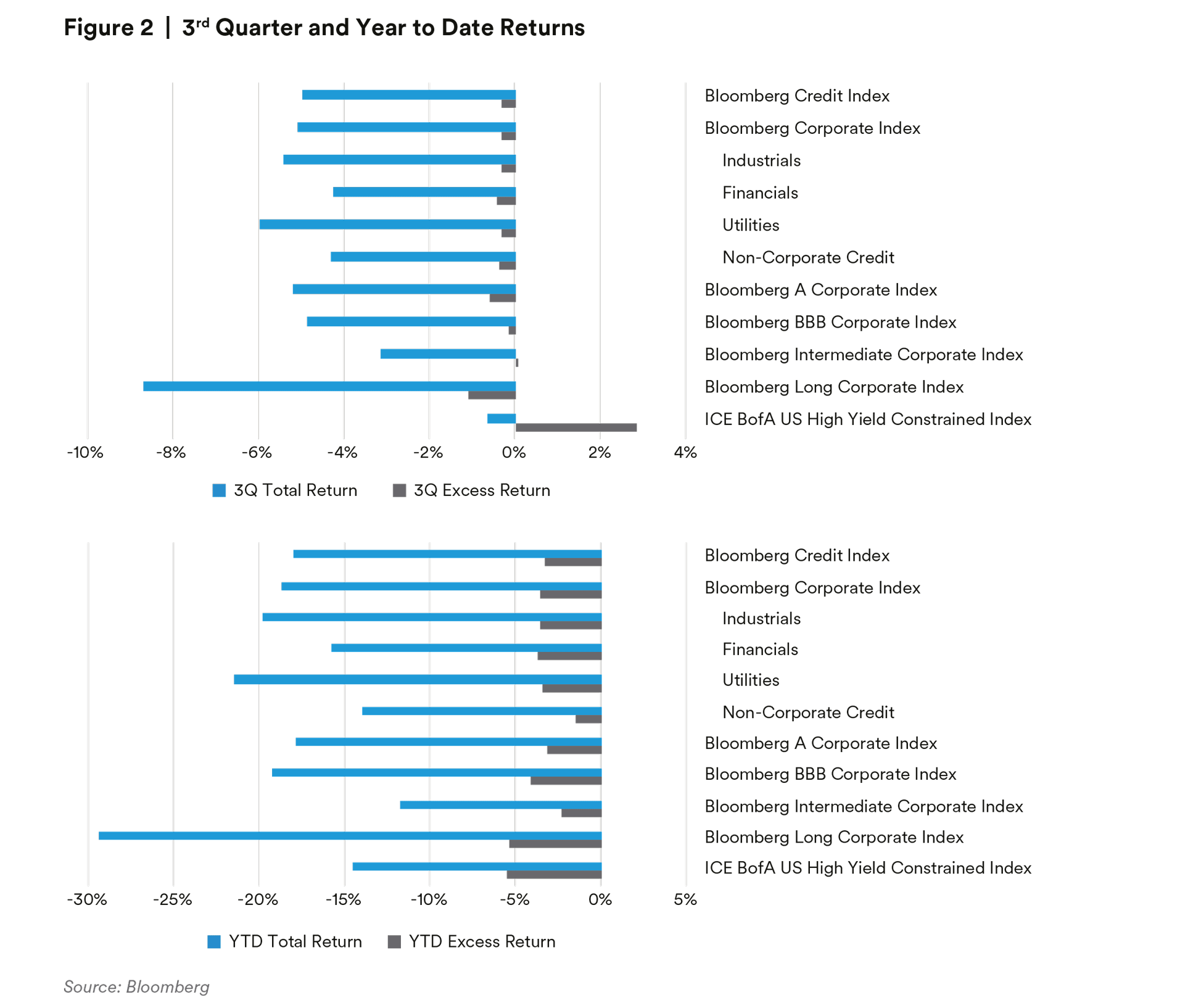

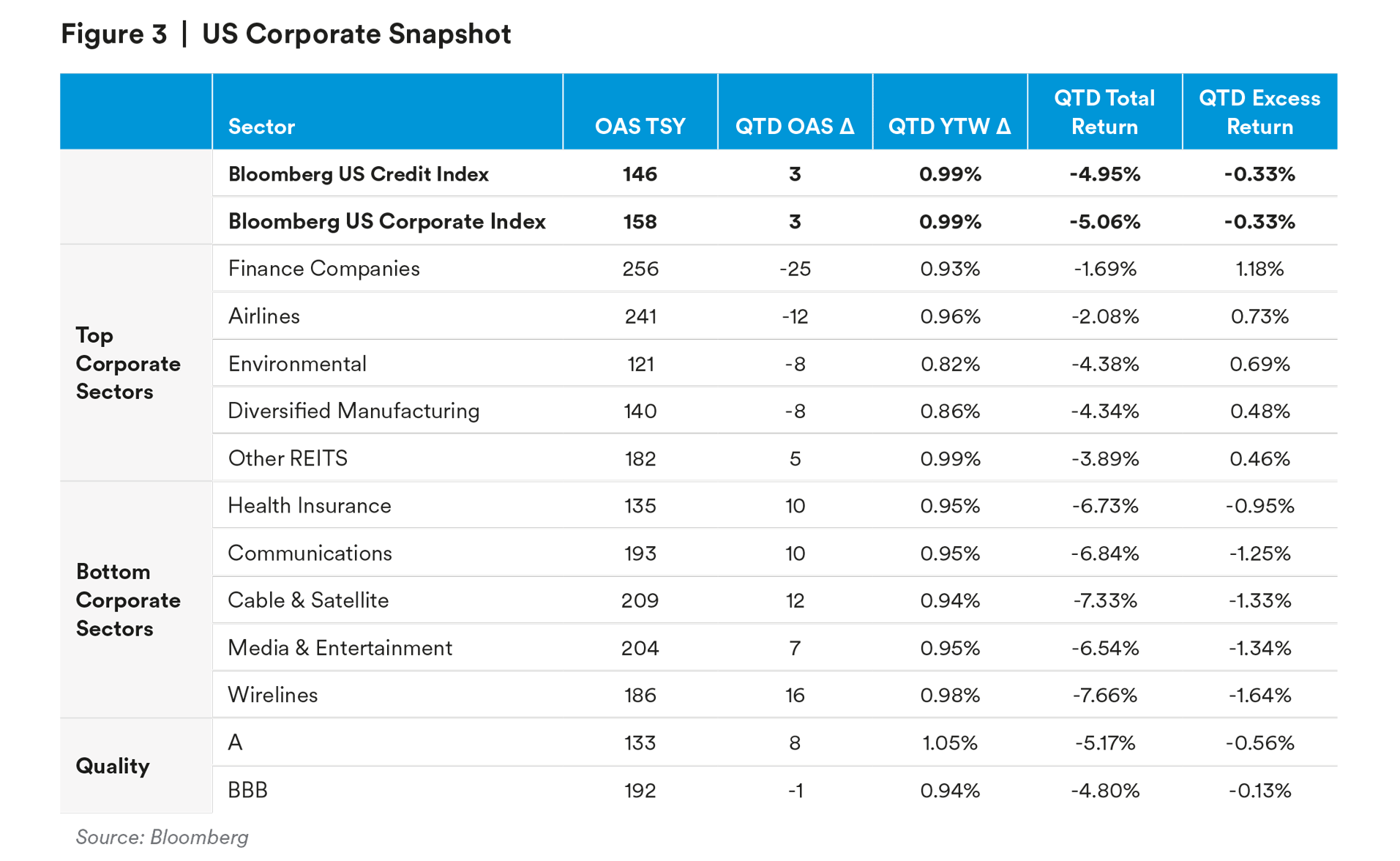

Credit markets continued to be affected by macro volatility. The Bloomberg US Credit Index generated a negative total return of -4.95% for the quarter, lagging similar duration Treasuries with an excess return of -0.33%. Spreads tightened from 143 basis points at the beginning of the quarter to a tight of 123 basis points in August, only to widen back out to 146 basis points at the end the quarter. Within the index, excess returns were mixed across sectors and maturities. Short and intermediate corporates outperformed their longer-dated counterparts. BBBs tightened over the quarter and outperformed higher quality AAAs, AAs and As. Breaking a trend from the previous two quarters, corporate credit outperformed non-corporate credit. Within the corporate credit subsectors, Finance Companies was the top performer as heavy index weighted names involved in aircraft leasing benefitted from an increase in global demand amid aircraft shortages. Airlines outperformed due to an uptick in consumer demand over the summer months, which was met with increased staffing levels and less flight cancellations. Capital Goods also relatively outperformed, led by Diversified Manufacturing and Environmental. On the flip side, Communications was the worst performing sector, with Wirelines, Media & Entertainment, and Cable & Satellite posting the worst performances of the quarter. Overall, the sector saw corporate credit fundamentals deteriorate amid a challenging macroenvironment.2

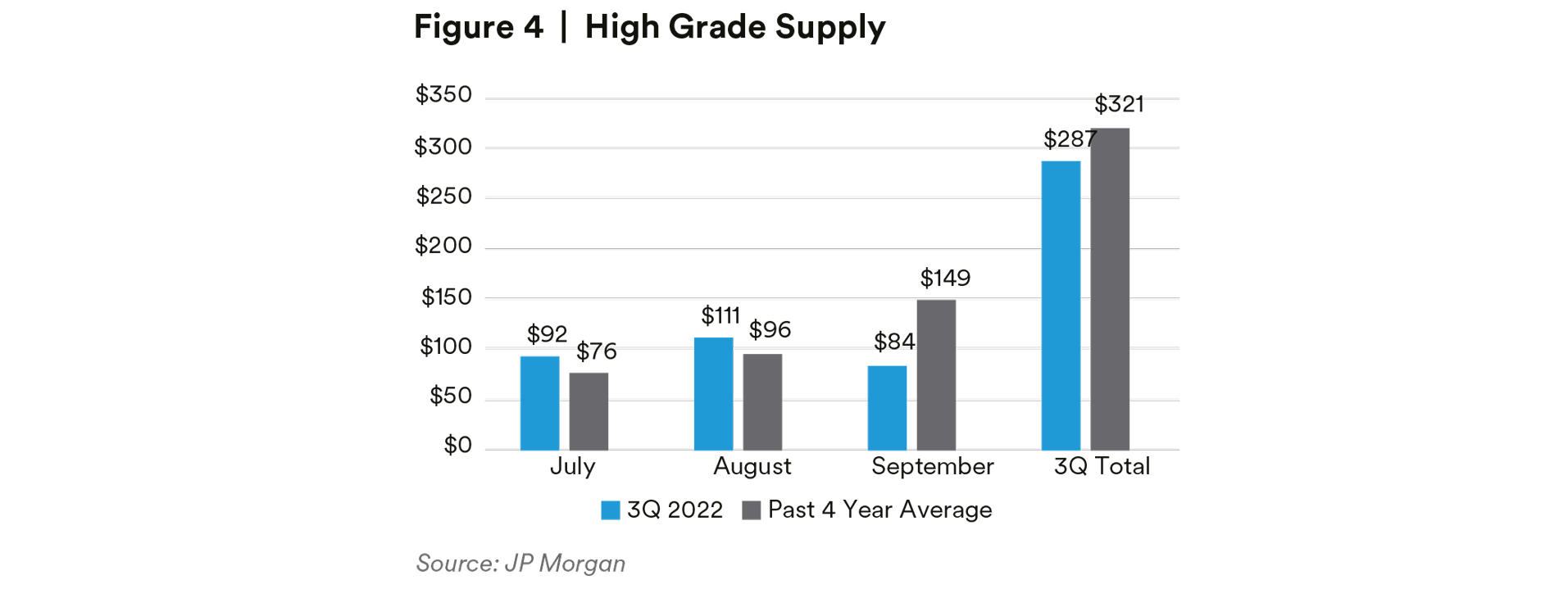

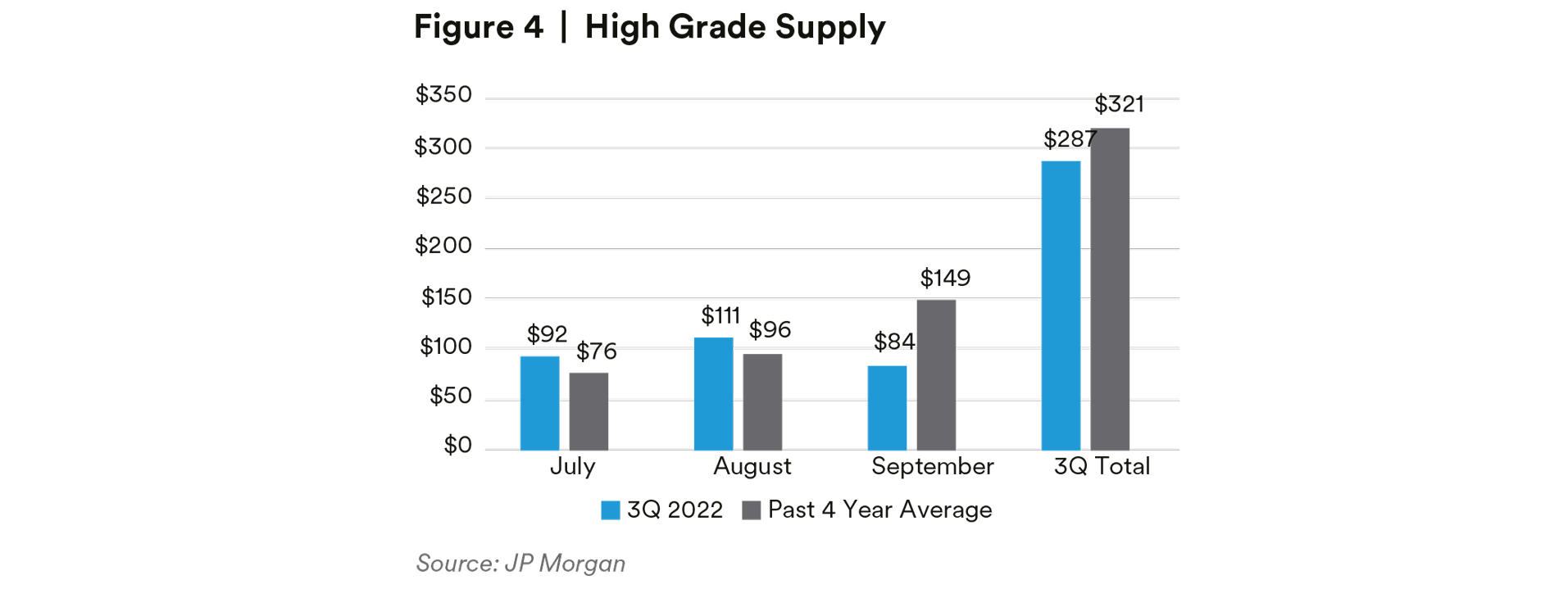

High Grade bond supply for the quarter was $287 billion. As shown in Figure 4, this was 11% lower than the past four-year average of $321 billion as September issuance was the second lowest on record driven by non-Financials, which was 50% if its past four-year average.3

Looking ahead, it is hard to ignore the irrefutable truth that the Federal Reserve has one goal right now (and one goal only), and that is to temper inflation. To accomplish this will require more restrictive monetary policy and slower growth—which is not supportive of risk assets. To get the pendulum to shift to a more attractive environment for risk taking, the market will need to be able to better grasp both the timing of achieving peak inflation and the duration of the adjustment period necessary to return to the Fed’s targeted level of inflation. Neither of those signposts seem imminent. Brief rallies in the market have generally been accompanied by murmurs of Fed easing. We believe these to be misguided. Fed speakers are going out of their way to emphasize that their job will not be done until inflation is tamed—and we believe them. To us, the inflation battle is the overarching risk factor in the market right now, but that is not to diminish the quantity or severity of the other risks present. The war in Ukraine, the European gas crisis, and COVID lockdowns in China are part of a myriad of “knowns” in the market. What is more troubling are the second, third, fourth derivative “unknowns”. The recent UK pension fund crisis was a sobering reminder of the intertwined nature of markets, with collateral calls in the UK being met by selling of US credit (which is a much deeper market for the long duration assets owned in these funds). It is hard enough to assess the value of credit amidst the known issues—but the likelihood of further knock-on effects is too high to not anticipate a further discount for spreads.

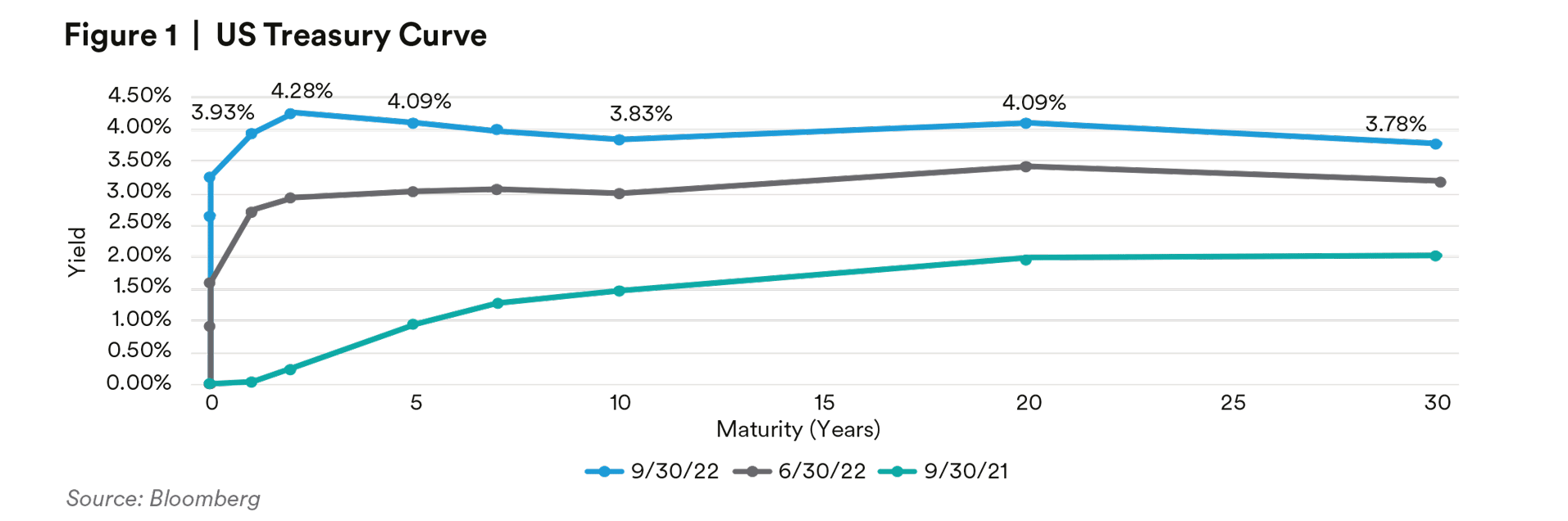

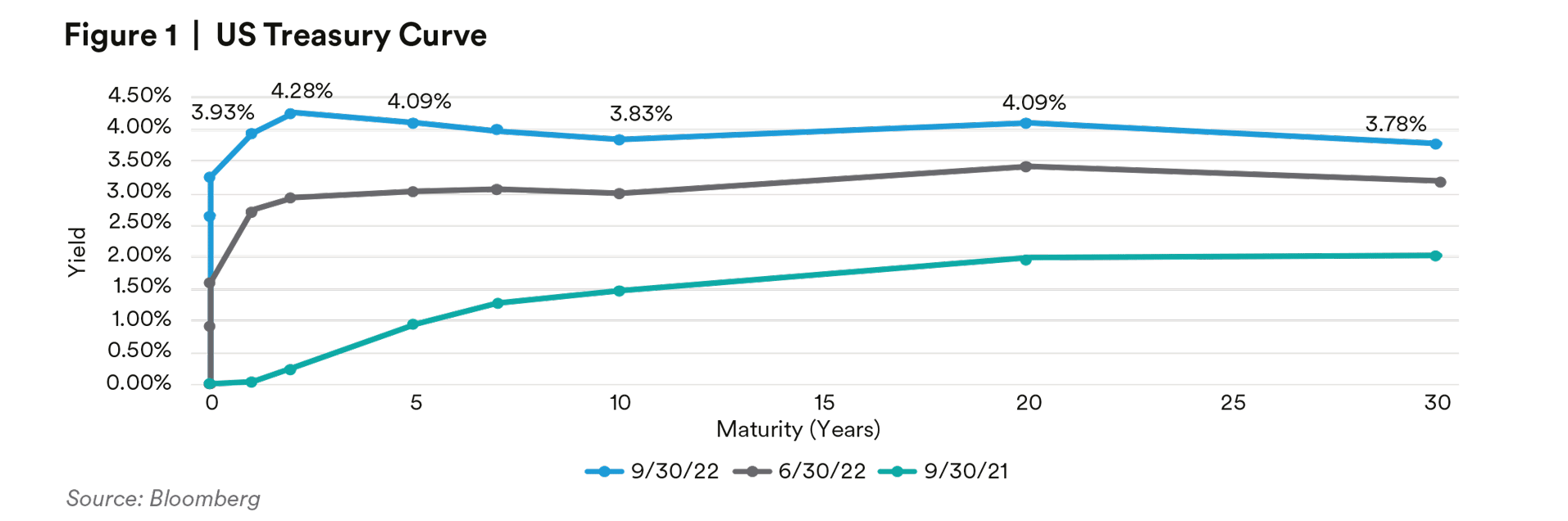

It is not all bad news for credit investors. Valuations are getting more attractive by the day. Investment grade corporates ended the quarter at +159 OAS—67 basis points wider year-to-date. More eye-popping is the 5.69% yield of the Bloomberg Corporate Index.4 That is 336 basis points higher on the year. The phrase “There is No Alternative” or “TINA” was in vogue for the last few years when there seemed to be no attractive alternative for equities. We are not creative enough to invent new acronyms, but we feel comfortable suggesting TINA can be retired for now because the alternatives are plentiful. If you wanted 4% yields at the start of 2022 you had to buy high yield. Now you can get 4% from T-Bills. The resetting of valuations in 2022 should ultimately provide some level of support for fixed income assets—though the buyer base is likely to shift. Yield hungry domestic buyers—both institutional (e.g., pension, insurance) and retail are likely to welcome the new paradigm of a higher rate environment, while foreign investors are pulling back. They are pulling back due to the rapidly changing economics of hedged yields which have made US corporates hedged back to their local currency increasingly unattractive. It is too early to decipher which flow dynamic is likely to win out—but there are likely to be periods of uneven transition to add to an already volatile environment.

As we evaluate current valuations, we are reticent to get too mesmerized by spreads and yields that we have not seen since the onset of COVID. Historically there has been no magic ceiling for spreads, but credit has been no stranger to visiting OAS levels in the low 200s during periods of elevated volatility and recession. We may not reach those levels this time around due to the health of consumer and corporate balance sheets, but we believe there is enough global uncertainty that a future moment of capitulation could ultimately propel spreads towards those levels.

This process could take some time. There has been a well-defined trend this year of wider wides and wider tights in credit spreads. We would expect this pattern to persist within a broader widening trend. We recognize the difficulty in picking the lows, and so we will use these backups to gradually add risk back to the portfolio. One area of the market we feel comfortable adding to right now is short-dated credit. Flatter rate and spread curves have created extremely attractive opportunities to allocate capital in a maturity window in which we believe we can get very comfortable with the trajectory of the balance sheet. We believe we can structure portfolios to continue to add some yield advantage to the portfolio (at the expense of cash and Treasuries) while still maintaining a generally conservative risk posture until valuations cheapen further. Away from these front-end opportunities, we are intensely focused on the fundamental outlooks for the credits in which we are invested, and their ability to generate attractive risk adjusted returns in the context of a recessionary environment. To the extent that we can identify better opportunities, we are going to reposition into those more resilient credits. We will also continue to be active in the new issue market. Primary issuance has slowed dramatically as many issuers are waiting for calmer conditions, but elevated volatility has resulted in elevated concessions that offers us an opportunity to allocate to liquid credit at attractive valuations. Liquidity is valuable in this market, and so any tactical trading opportunities will likely be concentrated in the primary market, whereas we recognize that relative value trades into less liquid curve points will take longer to monetize.

The “all clear” for credit remains just a dot in the distance, but we believe this to be an environment where fundamental credit research will be critical to not only picking winners, but also avoiding the losers in what is likely to be a period of elevated volatility.

Endnote

1 Bloomberg

2 Bloomberg

3 JP Morgan

4 Bloomberg

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border license, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyodaku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.

Unless otherwise noted, none of the authors of the articles on this page are regulated in Ireland.