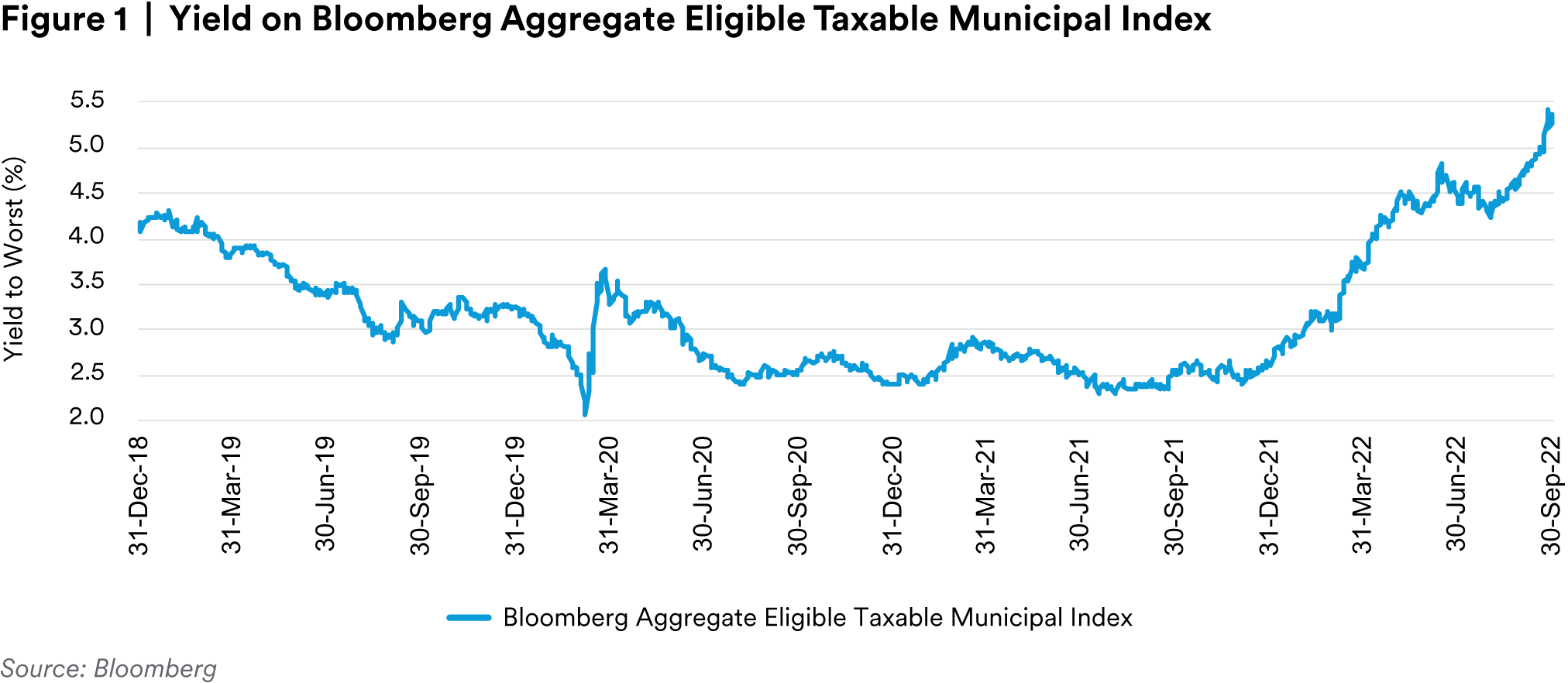

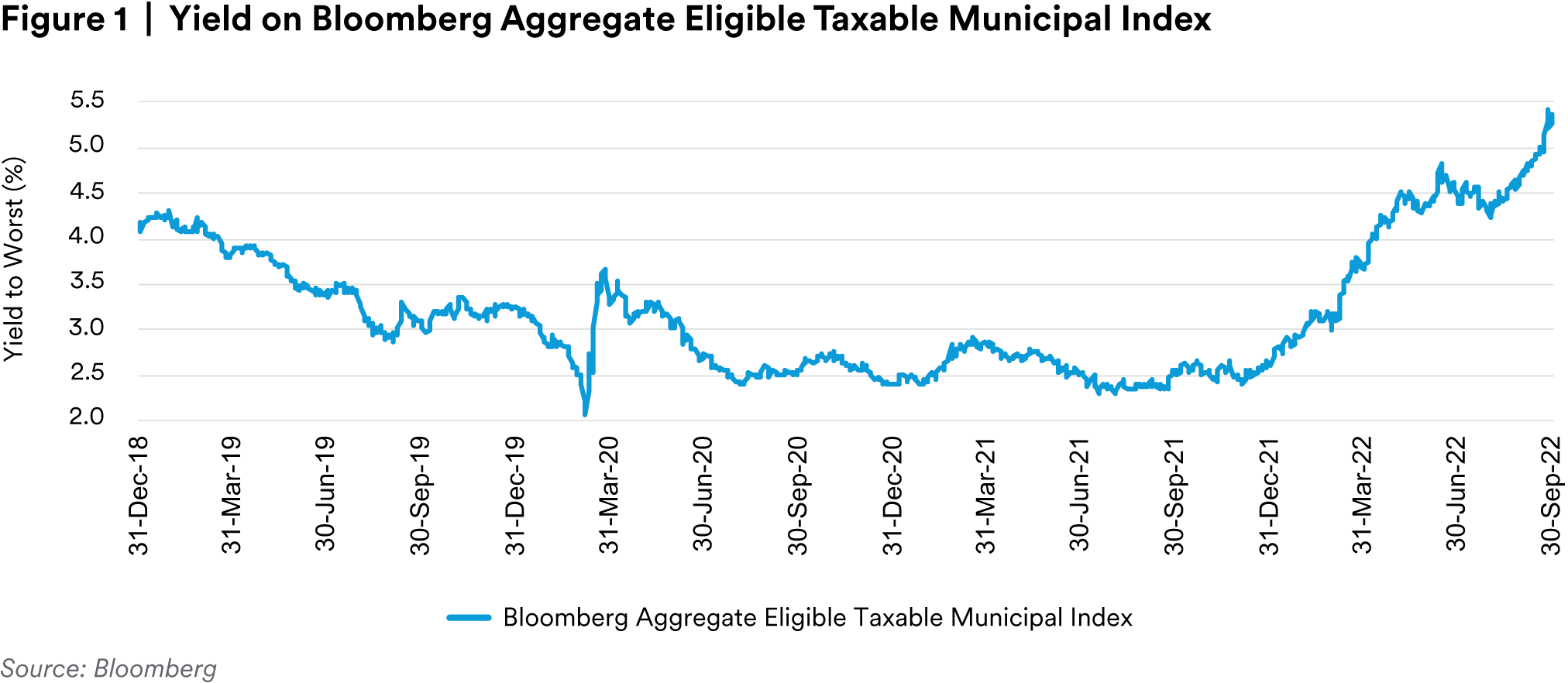

The surge in rates continues to hammer municipal returns. The longer duration Bloomberg Taxable Municipal Index returned -6.18% in the third quarter, bringing the year-to-date total return to -19.28%. As expected in light of the 2.32% surge in the 10-year Treasury year-to-date through September 30, rates were the primary culprit. Consider that the duration of the index was 8.21 as of September 30. Simple bond math indicates that 19.05% of the 19.28% in the negative year-to-date total return (8.21 years x 232 basis points = 19.05%) is explained by rates alone, ignoring curve and convexity effects. This may be cold comfort, but it does come with a silver lining: municipal fundamentals remain solid, and with higher rates come higher yields and lower dollar prices. As of September 30, the yield-to-worst of the Bloomberg Aggregate Eligible Taxable Municipal Index was 5.36%, compared to 2.60% on January 1. Similarly, the average dollar price of the index has plunged from $114.76 on December 31 to $89.71 as of September 30—a 25 point decline. We think the combination of higher yields and lower dollar prices will be supportive for Taxable Municipal spreads, particularly considering the limited supply of high-quality spread assets in a challenging economic environment.2

In the tax-exempt space, the Bloomberg Municipal Bond Index (7.9 year duration as of September 30) posted a quarterly return of -3.46%, bringing the year-to-date total return to -12.13%.3 The narrative driving the tax-exempt market has been the relentless rate-driven fund outflows, which totaled a record $92 billion year-to-date through the third quarter.4 In our view, outflows are likely to persist until rates peak or until the volatility in rates subsides. Until that happens, we believe yield-focused institutional investors should be looking at opportunities in long tax-exempts as the traditional retail investor base sells indiscriminately. In particular, we see value in lower coupon tax-exempt securities that trade at nominal yields that are higher than the nominal yields on fully taxable bonds from the same issuers. After including the benefit of the tax-exemption (tax-exempt yield / (1 – tax rate)), the taxable equivalent yields on highly rated long tax-exempt securities can significantly exceed the yields on similar maturity taxable municipals or the yields on long corporate securities rated multiple notches lower.

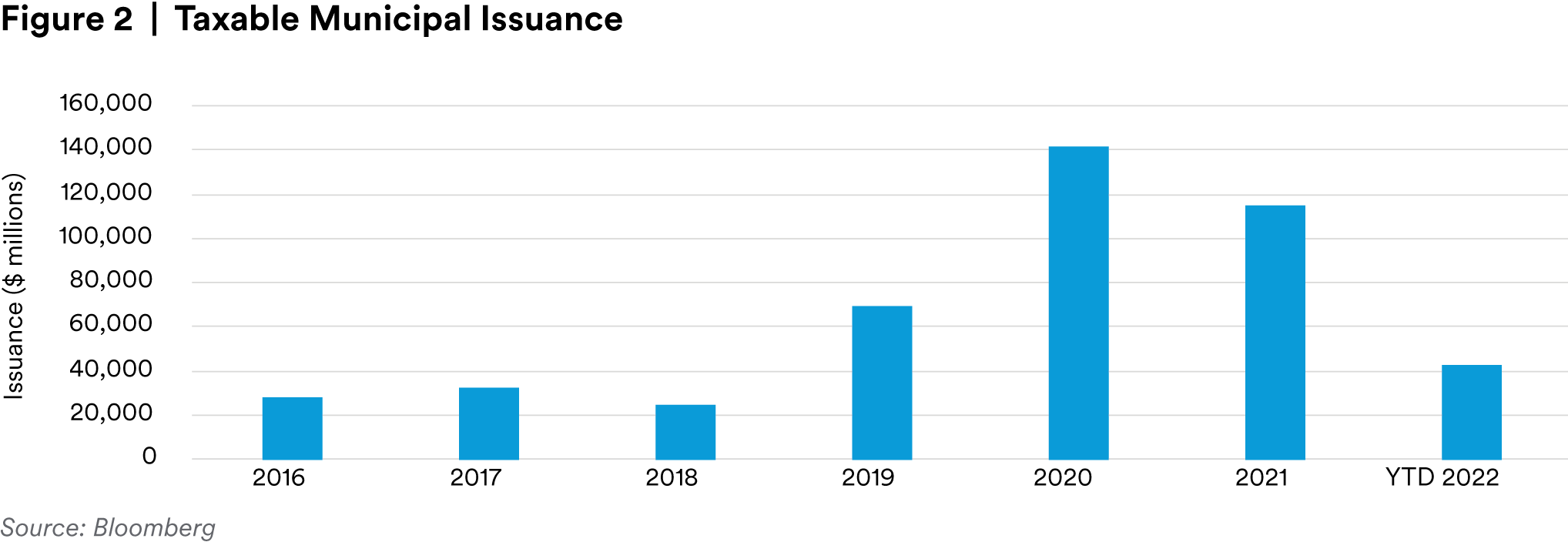

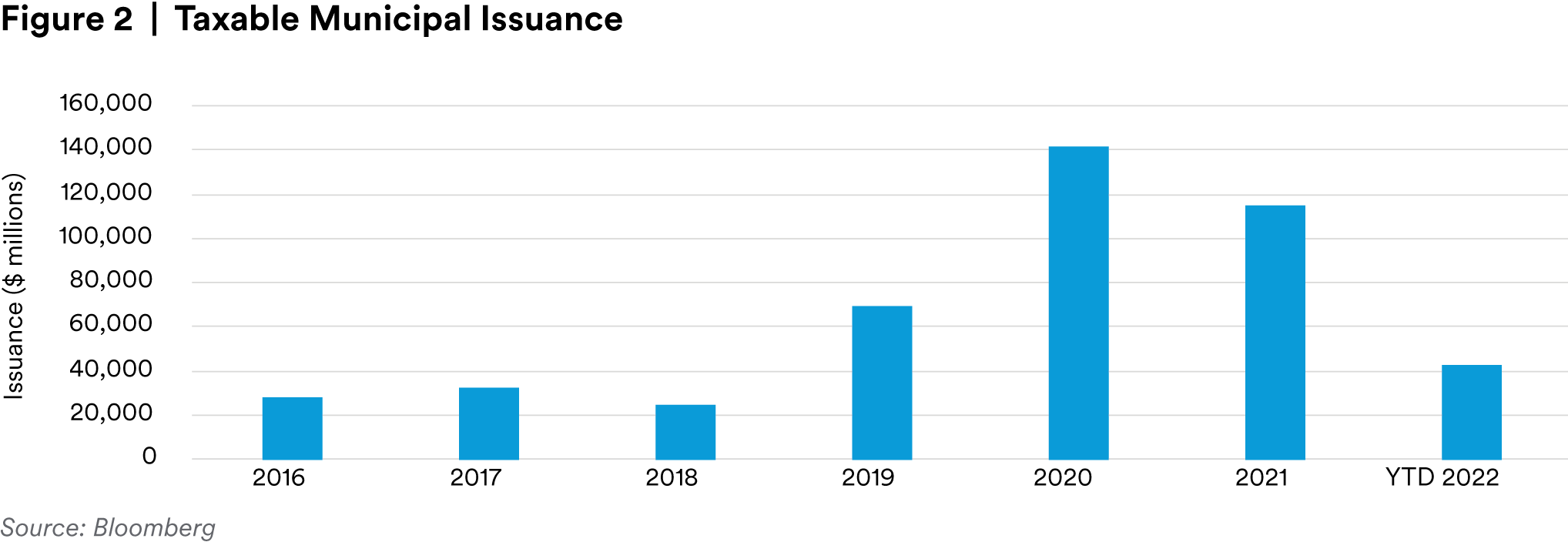

One interesting dynamic in the Taxable Municipal market this year has been the dearth of new issuance, driven by a surge in rates and a corresponding decline in taxable advanced refundings that previously fueled a surge in taxable issuance in 2019-2021. Through the third quarter and as shown in Figure 2, issuance of Taxable Municipals (municipal CUSIPs only) stands at $42.6 billion—a 49% decline year-over-year and a whopping 59% year-to-date decline relative to the record year in 2021. The most recent quarter is the first quarter we can recall in years with precisely zero issuance of Taxable Municipals with corporate CUSIPs (these are typically issued by nonprofit hospitals, universities, and not-for-profit institutions like foundations or museums). The decline in issuance has made price discovery for Taxable Municipals more challenging, which in turn has hampered liquidity. The pockets of liquidity that do exist have become more bifurcated, whereby large Taxable Municipal securities are relatively liquid but the trading volume for smaller securities and/or less well-known issuers is scarce. This is not in itself surprising given that CUSIP size is a logical proxy for potential liquidity. However, it does highlight an interesting predicament for the Taxable Municipal market, where only 309 (or 3.2%) of the almost 10,000 securities in the Bloomberg Taxable Municipal index are eligible for the broad US Credit Index by virtue of the $300 million minimum CUSIP size: liquidity is concentrated in a narrow segment of the market. This observation is supported by our examination of trading data for the three largest and the three smallest securities in the Bloomberg Taxable Municipal Index. We find that despite a 49% decline in Taxable Municipal issuance year-to-date through the third quarter, the trading volume for the three largest Taxable Municipal CUSIPs in the Bloomberg Aggregate Eligible Index increased by an average of 340% in third quarter of 2022 relative to the third quarter of 2021. Conversely, the trading volume for the three smallest Taxable Municipal CUSIPs in the index decreased by an average of 80% over the same time period (source: Bloomberg, MIM). We see this bifurcation as a potential risk to returns from the mispricing of less liquid securities in the short-term. However, we also see it as an opportunity for long-term investors to lock in significantly higher yields by providing liquidity on highly rated but smaller, less liquid securities at significantly wider spreads. In a market that prioritizes liquidity, we like taking some amount of liquidity risk over credit risk in portfolios heading into a likely recession in 2023.

In the fourth quarter we expect Taxable Municipal spreads to follow Investment Grade corporates wider as the Fed’s stated tolerance of “below-trend real GDP growth” (read: recession) to drive inflation back toward the 2% target takes a toll on the labor market and corporate earnings. Taxable Municipals must also compete with the larger tax-exempt market, which remains pressured by a historic outflow cycle, and which continues to attract capital from institutional investors like banks and insurance companies. As long as long tax-exempts offer considerably higher taxable equivalent yields, the path for tighter Taxable Municipal spreads is a very narrow one. At the same time, the supply of Taxable Municipals has been scarce and the dynamic of low dollar prices, spreads near the year-to-date wides, and yields well over 5% for high quality assets will likely help keep institutional demand firm, and spreads contained. We have a year-end target of +150 OAS on the Bloomberg Index Eligible Taxable Municipal index.

In tax-exempts, we believe the market will recover when rates stabilize, and the cycle of fund outflows ends. We are reluctant to predict the exact moment when rates stabilize but we suspect it will coincide with evidence that inflationary pressures are receding, which would reduce the level of uncertainty related to Fed policy that is driving volatility. As of September 30, Fed Funds Futures estimate a terminal policy rate of 4.53% in the first quarter of 2023. When rates do stabilize, we envision a fast and aggressive rally in tax-exempts as the marginal buyer in the market switches from institutional buyers at a 21% corporate tax rate back to individual investors at much higher state and federal tax rates. Since retail investors get a much larger tax benefit from the tax-exemption, they are likely to drive valuations much tighter from current levels to lock in yields on quality assets that are difficult to match in any other market. Consider that to an individual in California in the 37% federal and 13.3% state tax brackets, the taxable equivalent yield of a AA-rated tax-exempt bond that yields 4.5% is over 9% (4.5%/(1-0.053)). We emphasize that we feel municipal fundamentals are strong and that the dislocation in tax-exempts has been entirely rate-driven. We have seen this dynamic before. Retail investors do not like to lose money in their municipal portfolios. When they do, they sell. But when rates stabilize, animal spirits typically return quickly to capitalize on compelling yields on high quality assets that are well-positioned to withstand a recession.

Endnotes

1 Bloomberg

2 Bloomberg

3 Bloomberg

4 Bloomberg

Disclosures

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border license, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyodaku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC and MetLife Investment Management Europe Limited.

Unless otherwise noted, none of the authors of the articles on this page are regulated in Ireland.