We expect CEE countries to embark on fiscal consolidation paths, albeit at a slow pace, which will require multiple years of fiscal adjustment. All of these countries may face some ratings pressure but will we believe maintain their investment grade status throughout this transition period. Meanwhile, we view elevated issuance as a rare opportunity for investors to gain exposure to the CEE region and across the respective sovereign curves.

Slower Growth due to Weak Exports, but Poland is a Standout

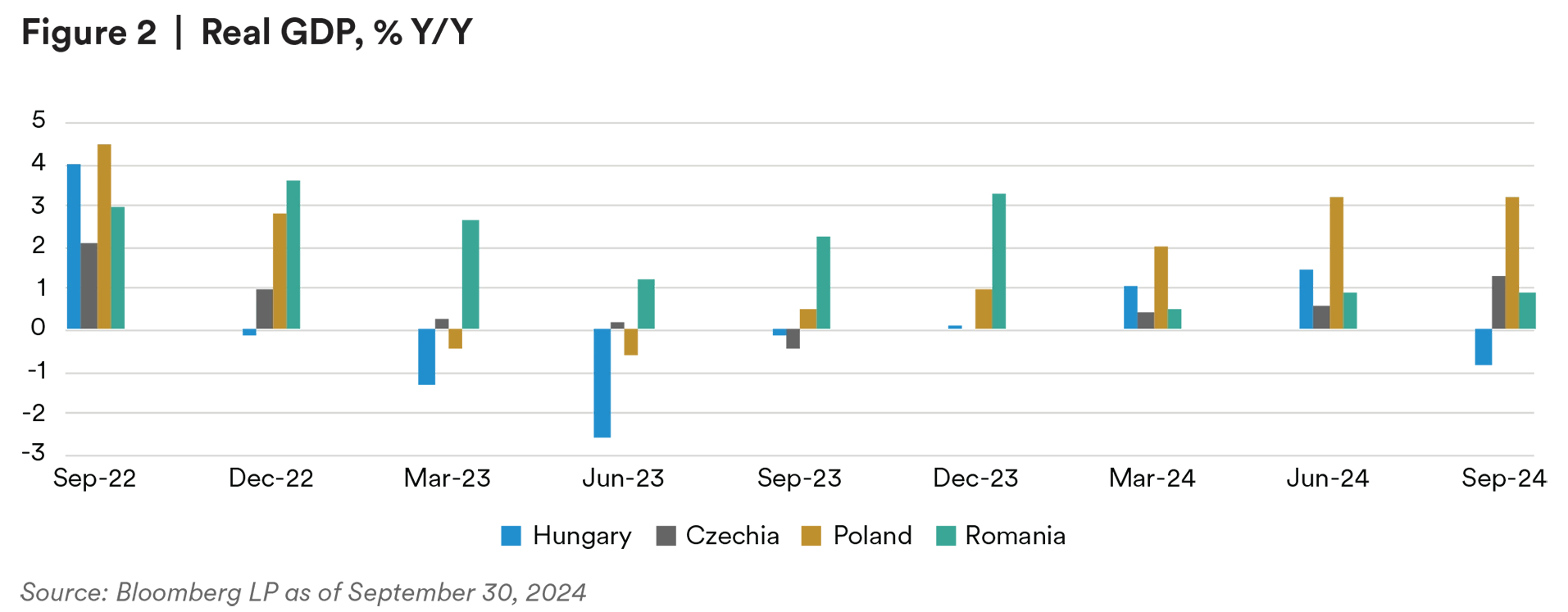

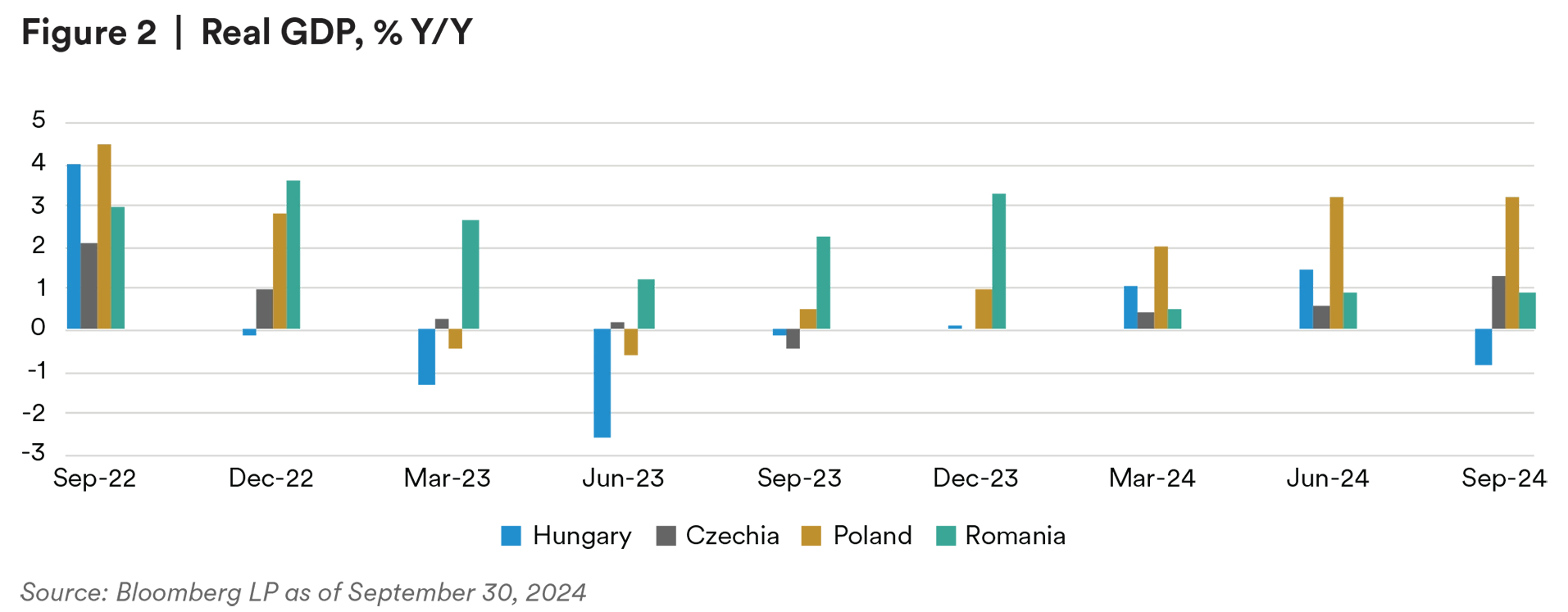

Private consumption remains the primary driver of growth across the region. High real wages, tight labor markets and continuing disinflationary trends have been supportive factors for domestic demand. Investments are also an important driver of growth, but they will be more significant in 2025 when public investment will pick up due to the disbursement of EU (RRF) funds. Poland is particularly well positioned to benefit in 2025, while Hungary’s investment levels are currently very weak, and no significant pickup is expected in 2025. Weak external demand is the biggest detractor from growth in the region due to sluggish activity in the Eurozone. Czechia and Hungary are the most exposed to the automotive sector, as their share of exports to Germany is close to 30%. Poland’s exports to Germany are also close to 30% but are better diversified across sectors. With respect to growth in 2024, Poland is a clear standout (3.1% year-over-year GDP growth estimated by Ministry of Finance), while Hungary is a laggard (1.4% year-over-year GDP growth estimated by The National Bank of Hungary).

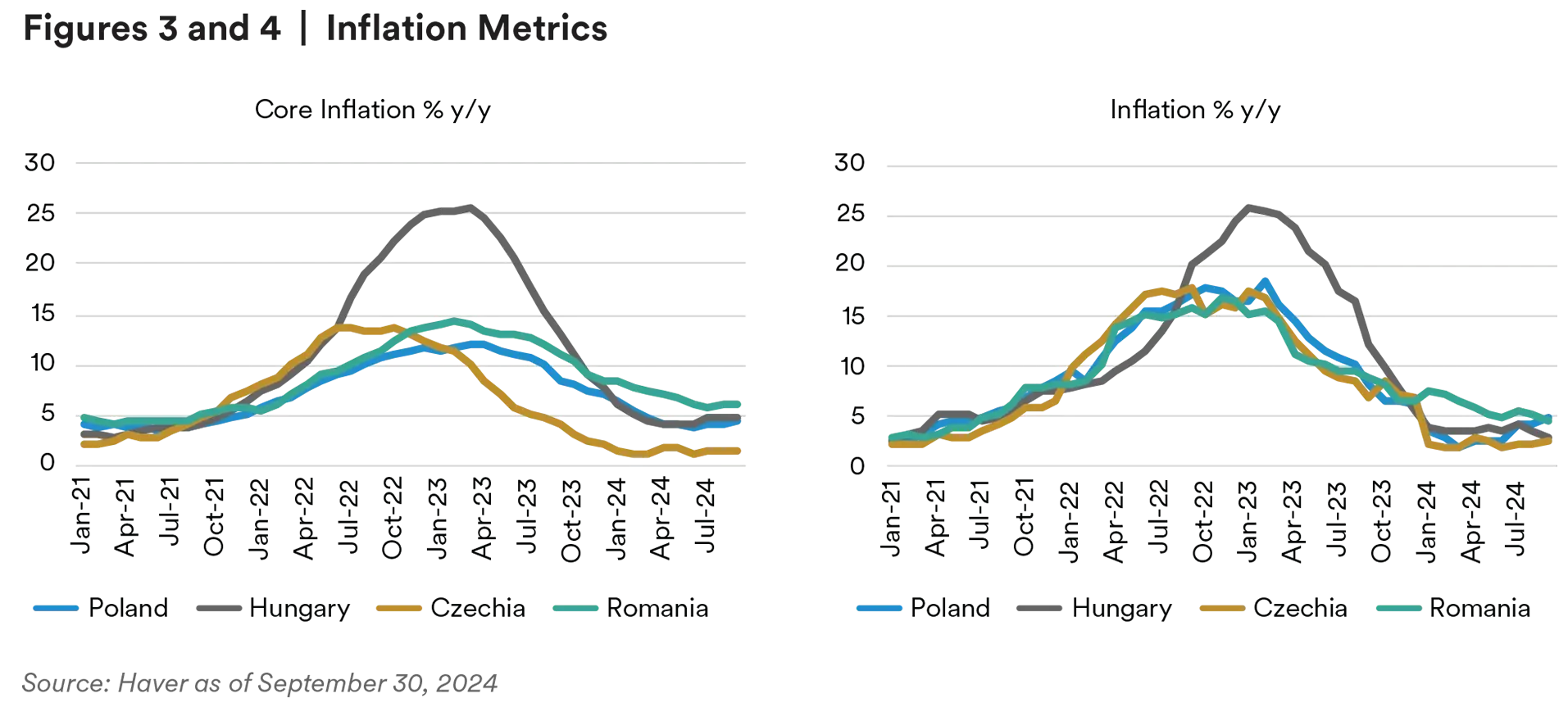

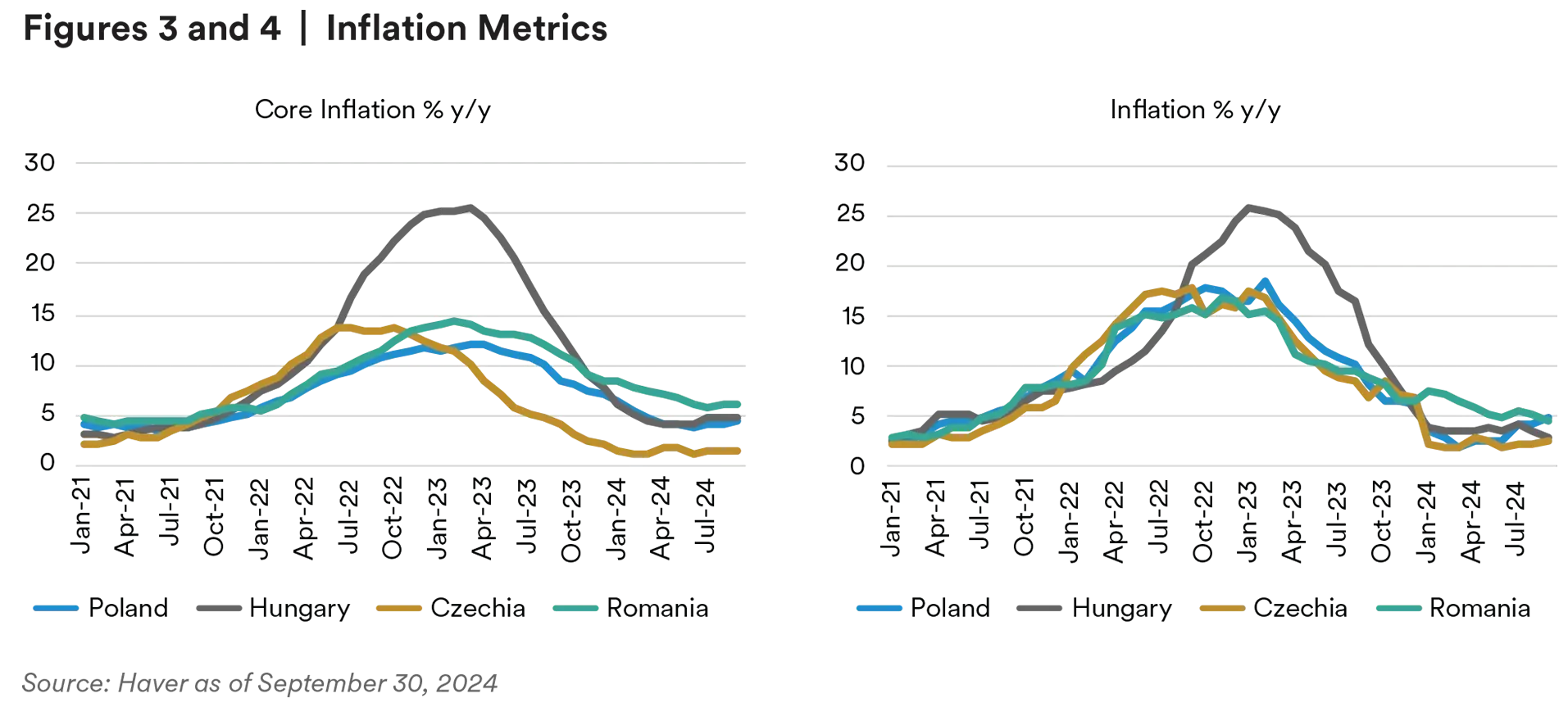

Disinflation Trends will Continue, but Core Pressure Warrants Caution

The CEE region has seen strong disinflation trends in the last two years on the back of restrictive monetary policy. Over the summer, the disinflation trend slowed, while core inflation (especially services) remained stubborn and above target levels across the region. On the positive side, lower core market rates have allowed CEE Central Banks to continue cutting rates without disrupting their own currencies. Further cuts are dependent on both data and sentiment (especially in Hungary), while Central Banks are adopting a cautious stance due to possible inflationary pressures from a loose fiscal stance (particularly in Romania, Poland and Hungary). National Bank of Poland (NBP) stands out as the most hawkish among its peer group, as it has kept its key rate on hold for eleven consecutive months. Pressure to cut rates, however, has mounted, and NBP is expected to start a cutting cycle in mid-2025 at the latest. National Bank of Romania is likely to remain on hold for the remainder of the year due to significant fiscal uncertainty, while further rate cuts in Hungary will be severely constrained by the recent pressure on the forint.

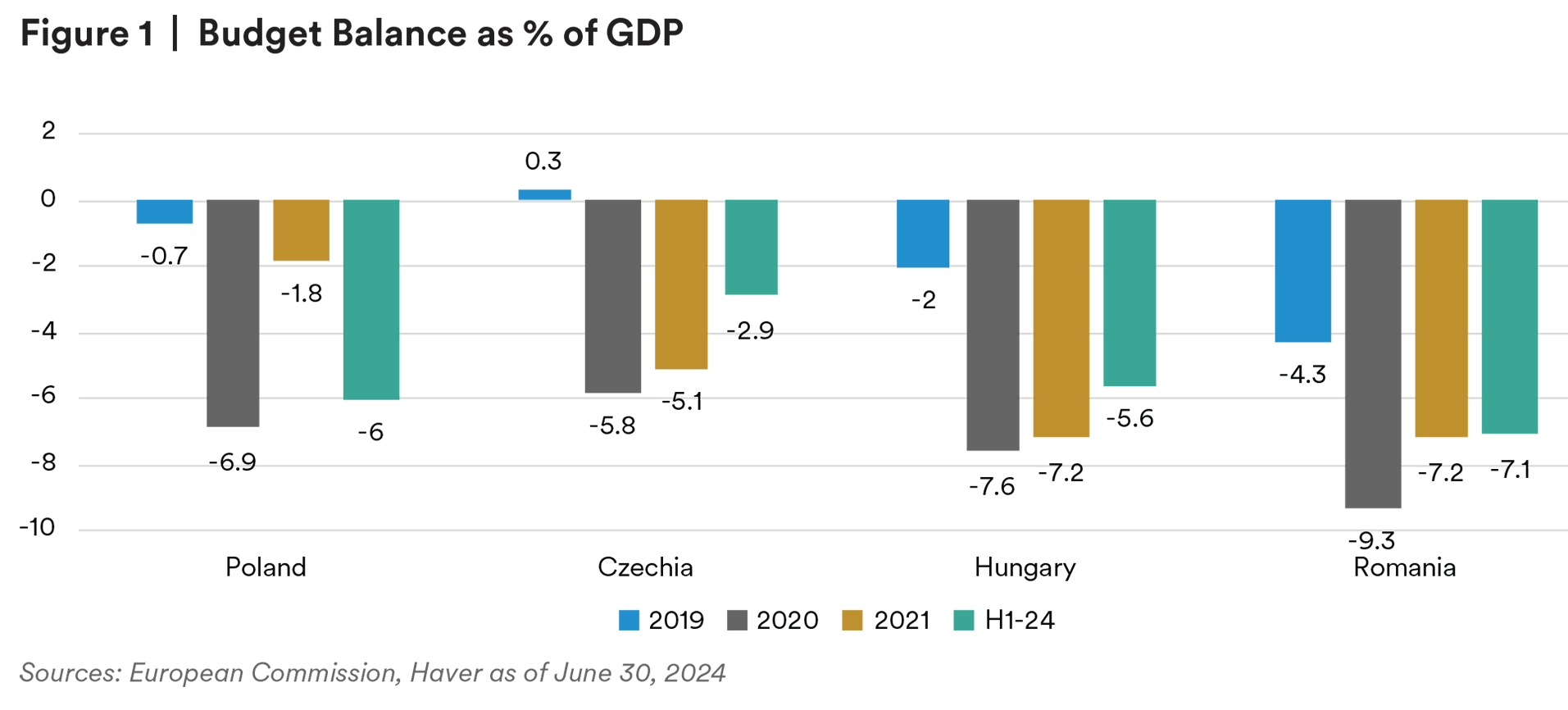

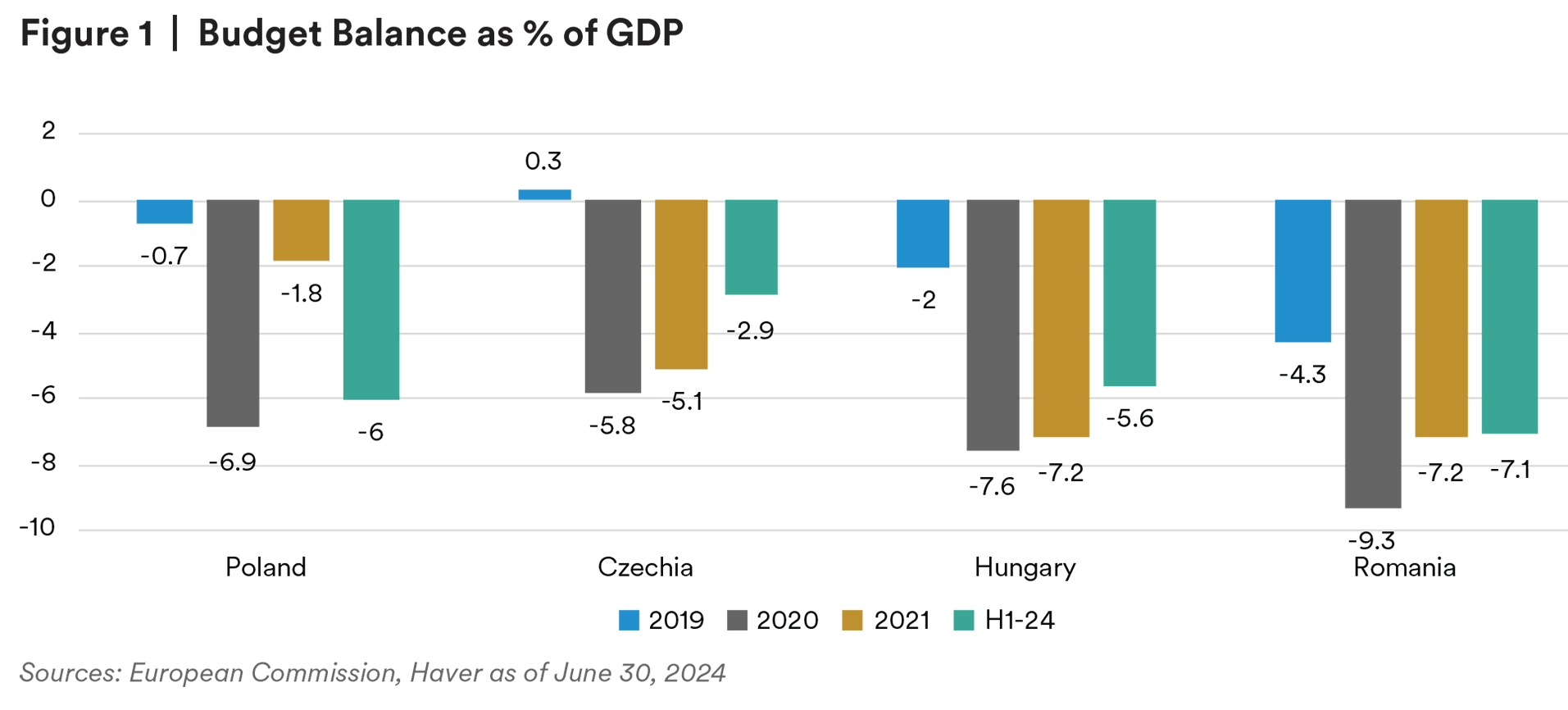

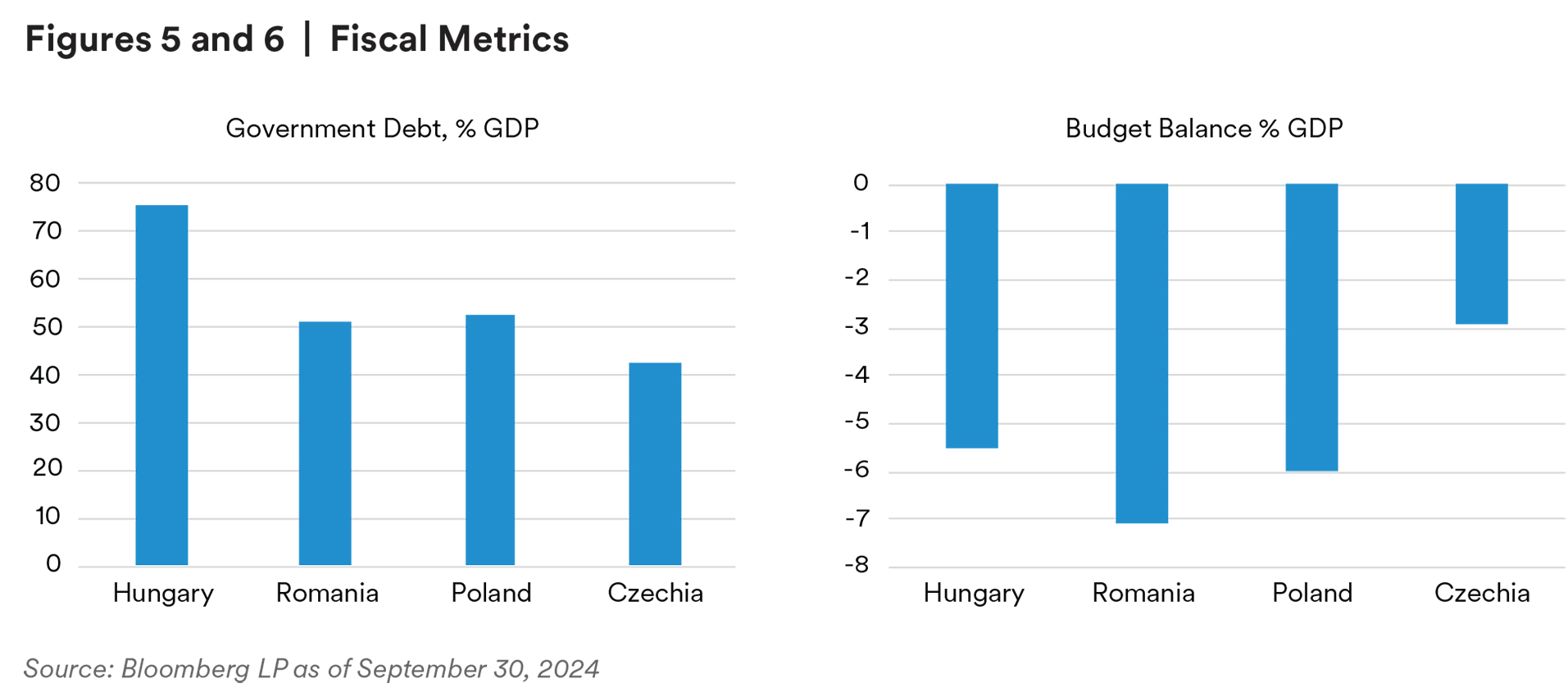

Large Fiscal Deficits Require Fiscal Consolidation in Post-Election Cycles

CEE sovereigns (except Czechia) are running large and expansionary deficits, which have fueled domestic demand in 2024. Budget deficits are expected to expand in 2024 in Poland and Romania, as governments have been reluctant to cut populist spending before elections. In Hungary, there is a risk of loose fiscal policy in 2025, ahead of the 2026 parliamentary elections. Poland, Hungary and Romania are all subject to the excessive deficit procedure (EDP) by the European Commission and need to start fiscal consolidation in 2025 or risk delay of EU funding and rating downgrades.

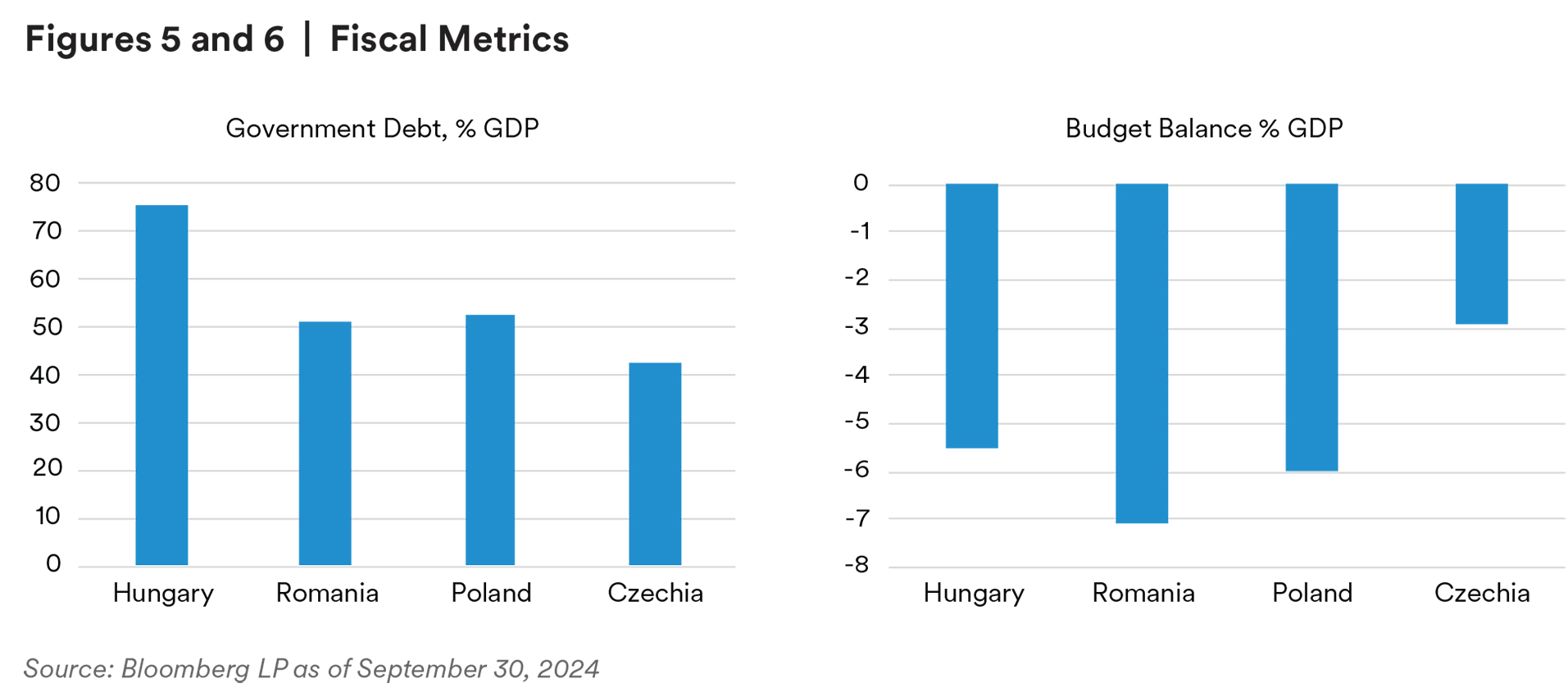

Romania has the highest fiscal deficit in the CEE and one of the highest in Europe. In a super election year such as 2024, the government is not committed to deliver a much-needed fiscal adjustment, which means the fiscal gap could reach 8% of GDP by year-end. However, the importance of its investment-grade credit rating, the conditionality of the EU funds and market pressures have pushed Romania into a slow budget consolidation over a seven-year period through to 2031. The more popular budget consolidating options that are expected to save at least 1.1% of GDP, as per the fiscal plan, include raising the flat tax from 10% to 16%, increasing property taxes and hiking the VAT from 19% to 21%. Despite the high fiscal deficit, Romania’s investment-grade rating is anchored on a modest debt/GDP, and there is capacity to add more debt versus its peer group in the same rating category.

Poland’s fiscal slippage in 2024 is explained with high social and military spending, as PM Tusk is delivering on his pre-electoral promises, while also eyeing the upcoming presidential elections in 2025. The proposed 2025 budget was disappointing, as it showed a marginal decrease in the deficit to 5.5% in 2025, despite expectations that 2025 will be a high growth year. Poland’s efforts to reign in the deficit will be focused more on fostering growth rather than cutting spending, and the deficit is expected to fall below 3% of GDP in 2028 (five-year fiscal adjustment plan).

In Hungary, the government is targeting fiscal deficits of 4.5% and 3.7% in 2024 and 2025, respectively. The reduction in 2025 will come from a lower interest bill as expensive CPI-linked retail bonds will reprice. There is the risk, however, that in 2025, the primary deficit will widen ahead of the parliamentary elections in 2026 and due to the poor growth outlook. Hungary’s fiscal space is limited due to an already higher debt/GDP than its similarly rated peer group.

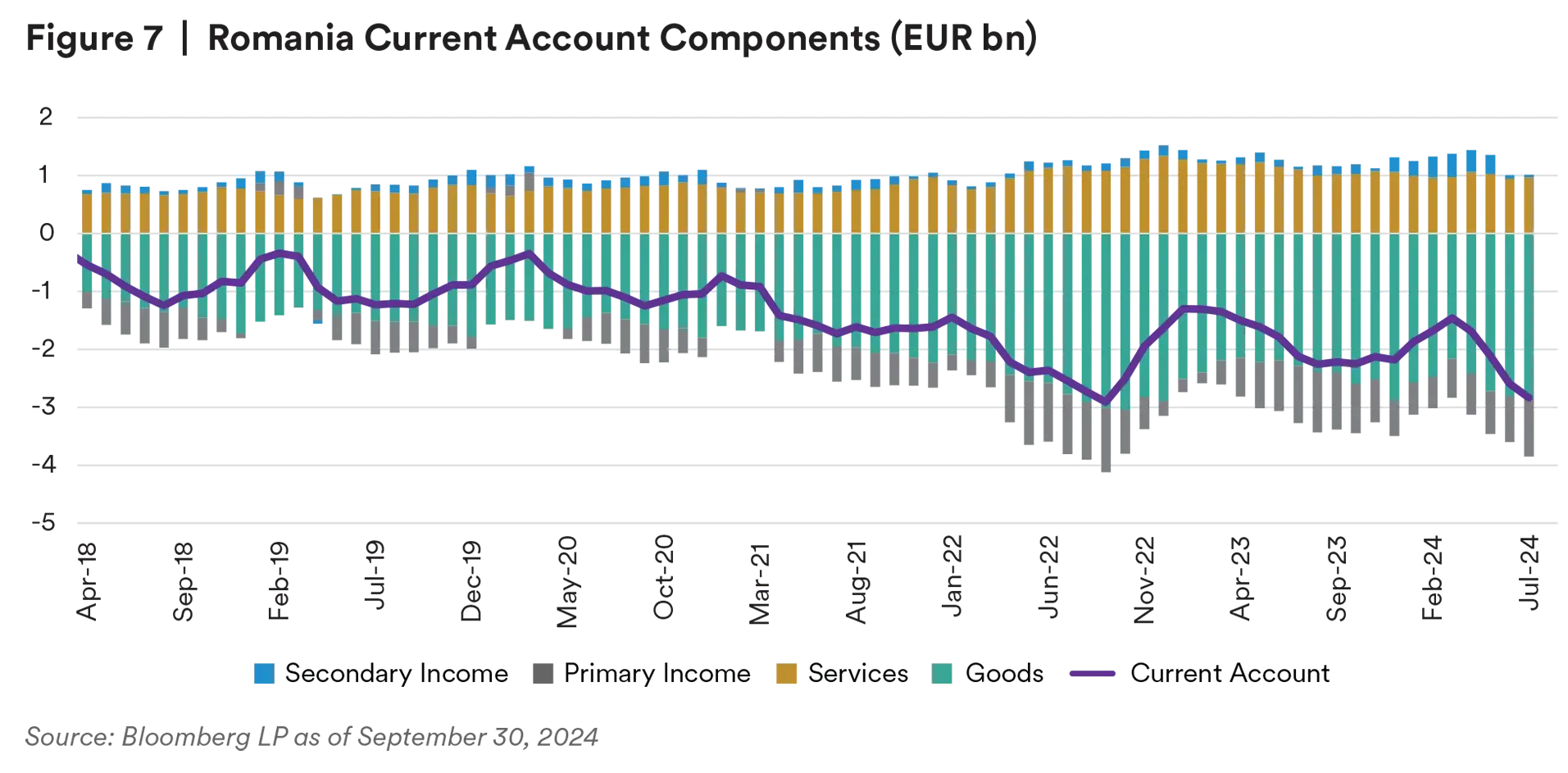

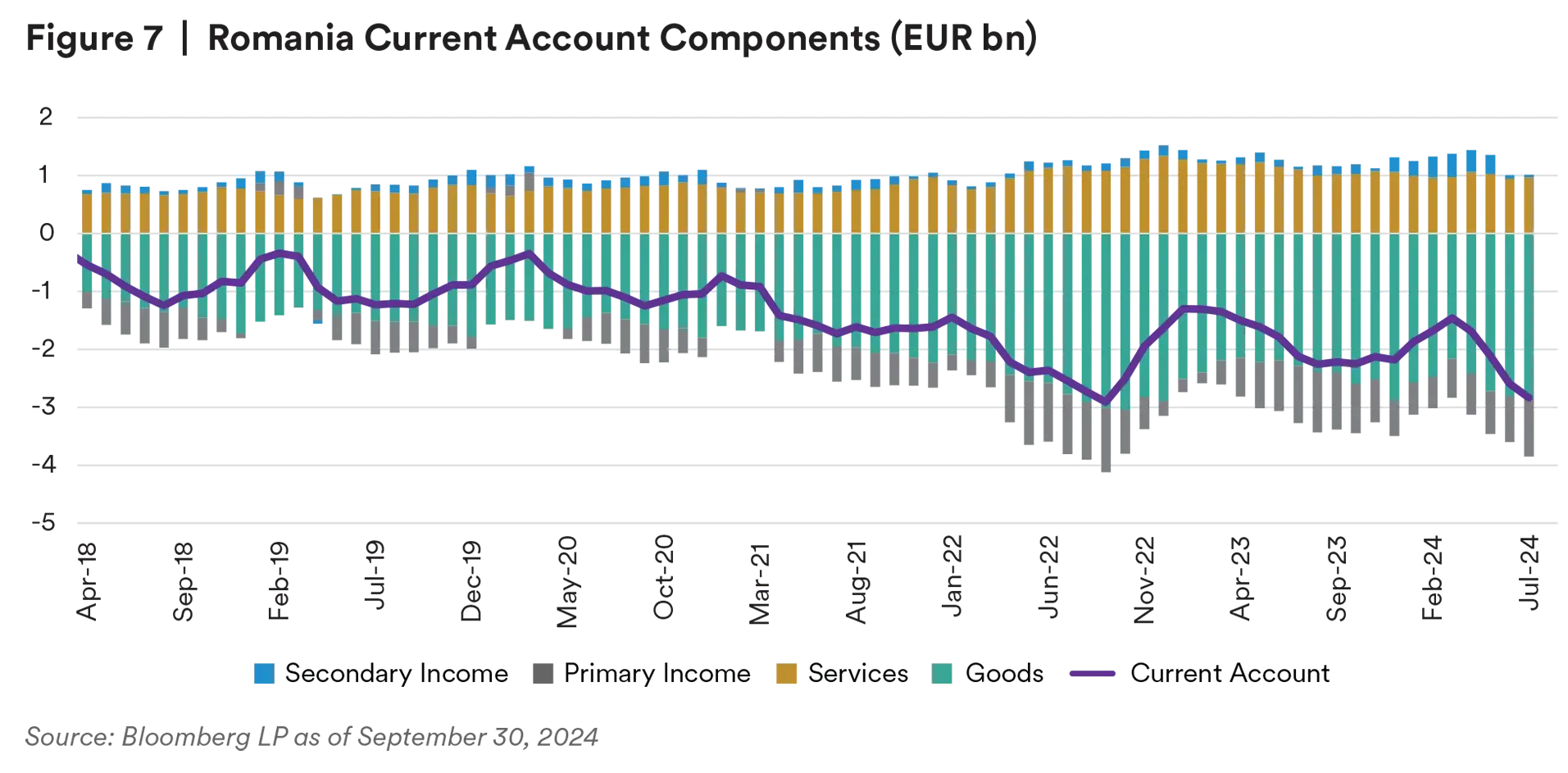

EU Funds Provide a Backstop to a Large Current Account Deficit in Romania

Romania has a structural current account deficit that is largely driven by strong domestic demand fueled by a large fiscal deficit. While exports remain weak and demand for imported goods persists, almost 60% of the current account deficit is covered by non-debt-creating inflows such as EU transfers and net foreign direct investment (FDI), while the rest of the gap is mostly funded by long-term external borrowing. The wide current account deficit is less concerning and will naturally shrink when Romania tackles its fiscal imbalances.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

For investors the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a "professional client" as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees' pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1. As of July 22, 2024, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited