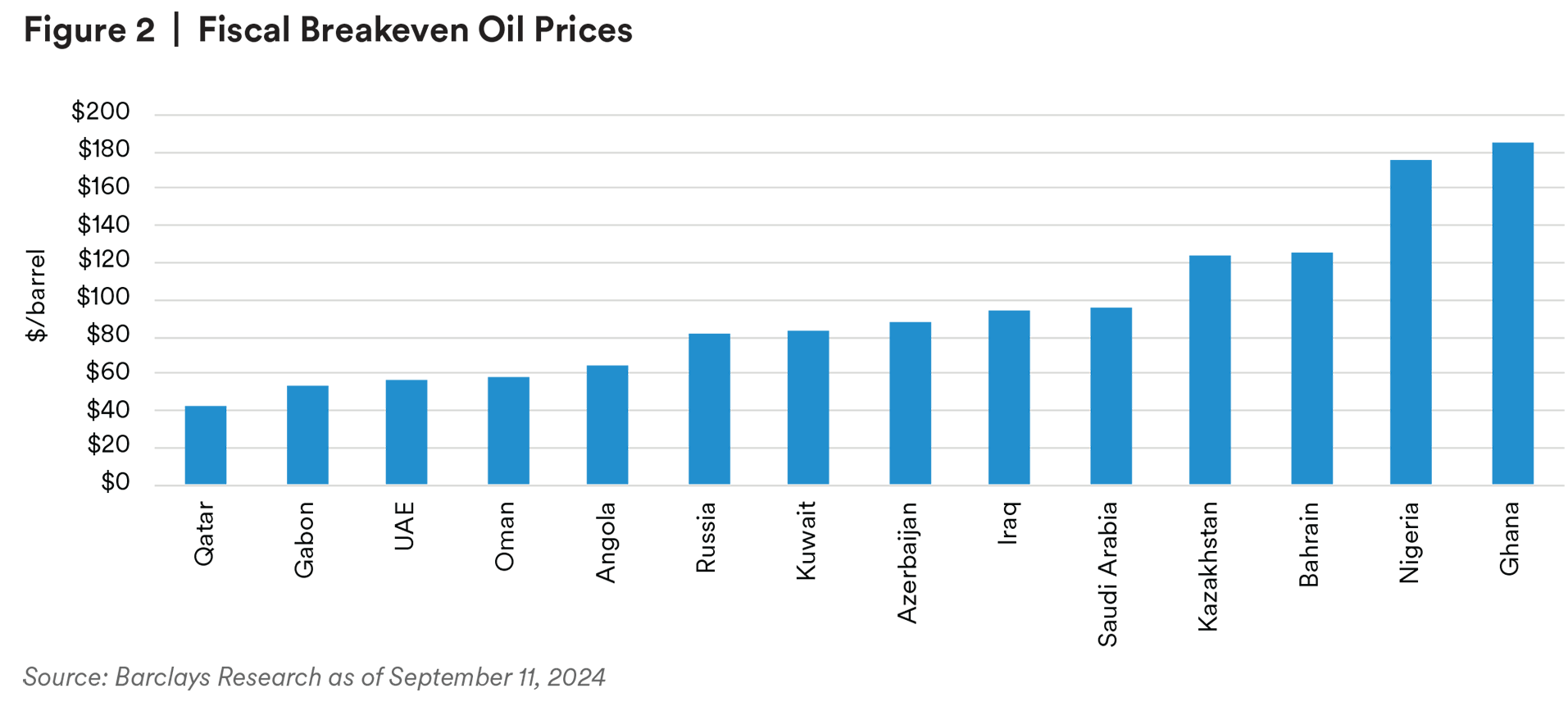

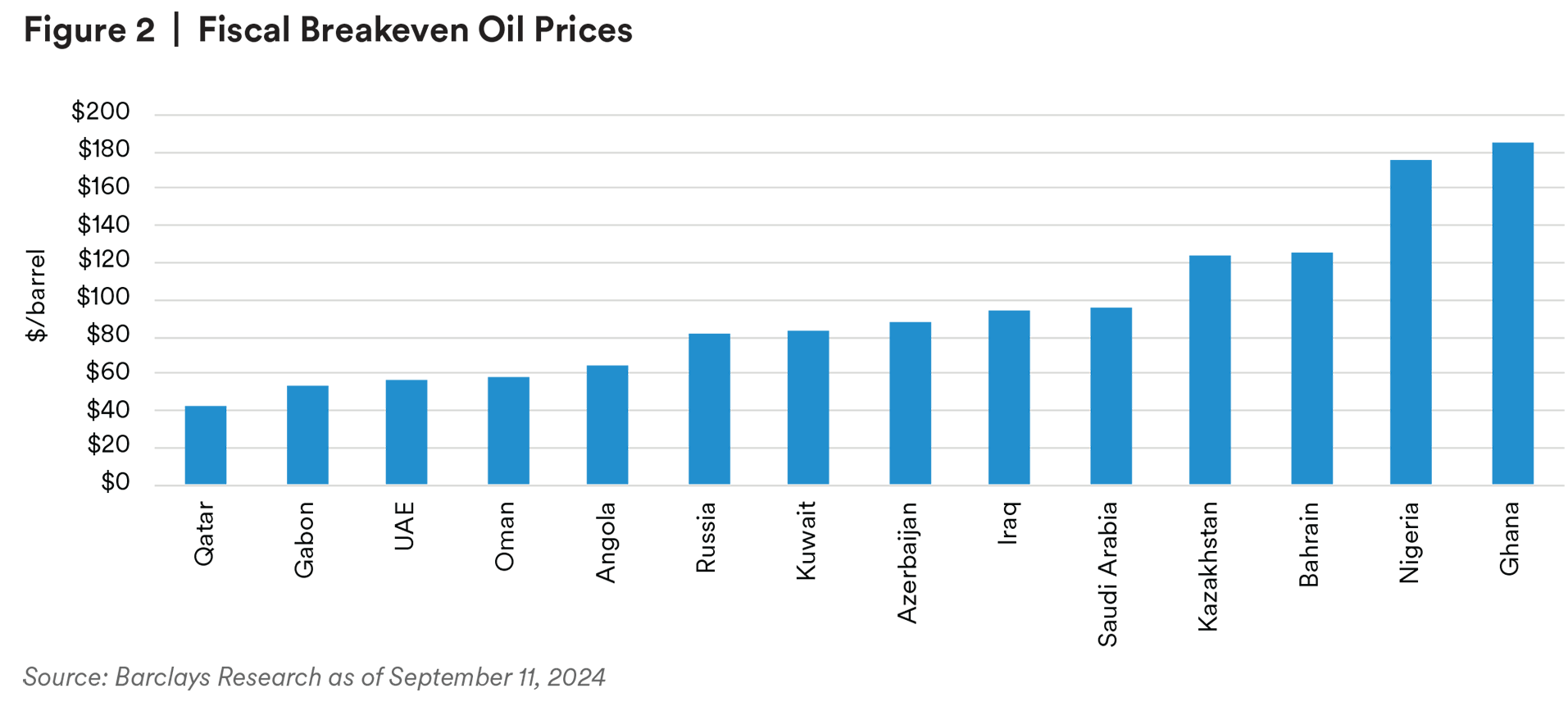

Energy prices started to experience the strain from decelerating global growth forecasts, resulting in their poorest quarterly performance of the year. Brent crude, which had reached a high of $87 per barrel, saw a significant decline, concluding the quarter with a 17% drop to $71.8 per barrel.2 A lack of demand put pressure on prices, while concerns around a Middle East-driven supply disruption provided some support at lower levels. On the other hand, copper prices took a round trip during the quarter. The initial decline due to China’s economic conditions and anticipated drop in demand was later countered by a combination of the Fed’s rate cut and optimism around more significant Chinese stimulus.

Following the most recent Politburo meeting in China, Beijing’s tone around economic policy shifted. Policymaking institutions in the country are expected to announce as many measures as needed until the country sees stabilizing growth, with the first round including lowering down payments on homes, supporting more state-owned enterprises (SOEs) and preparing for more infrastructure development.

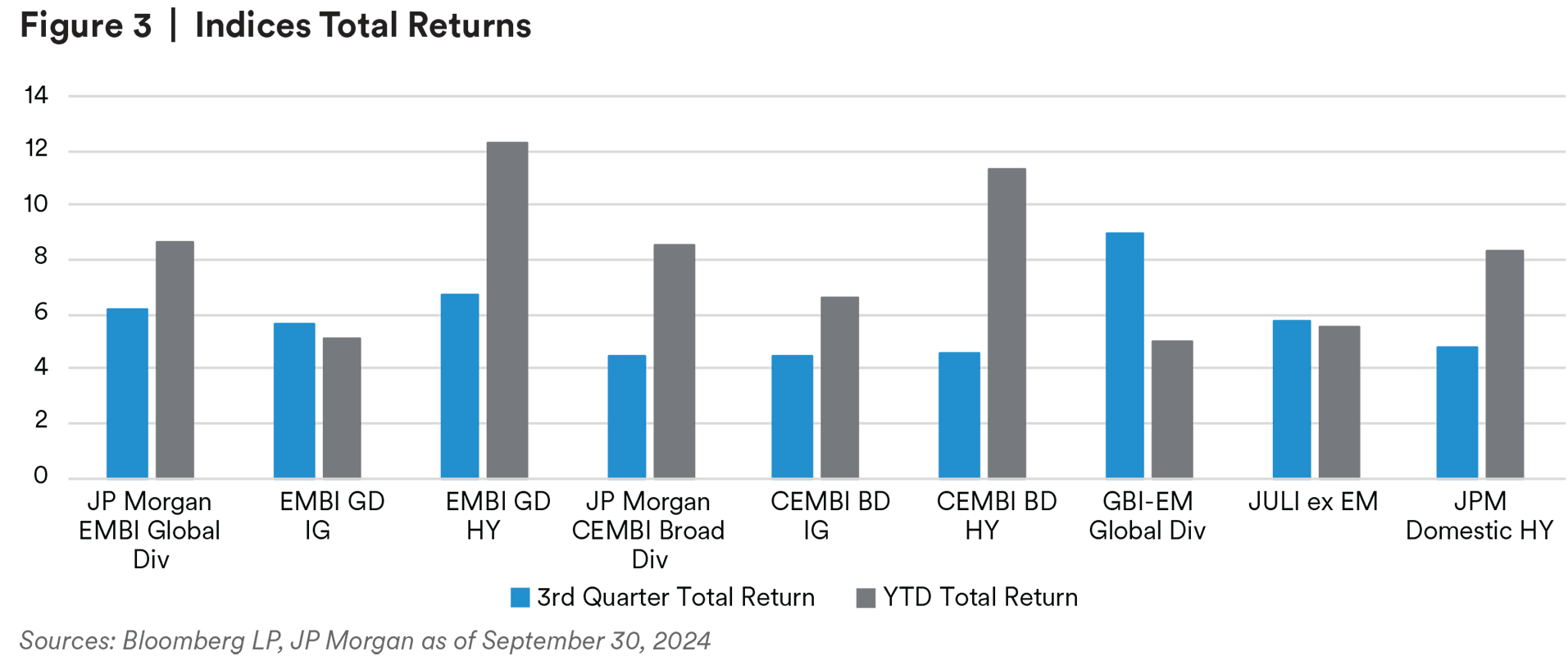

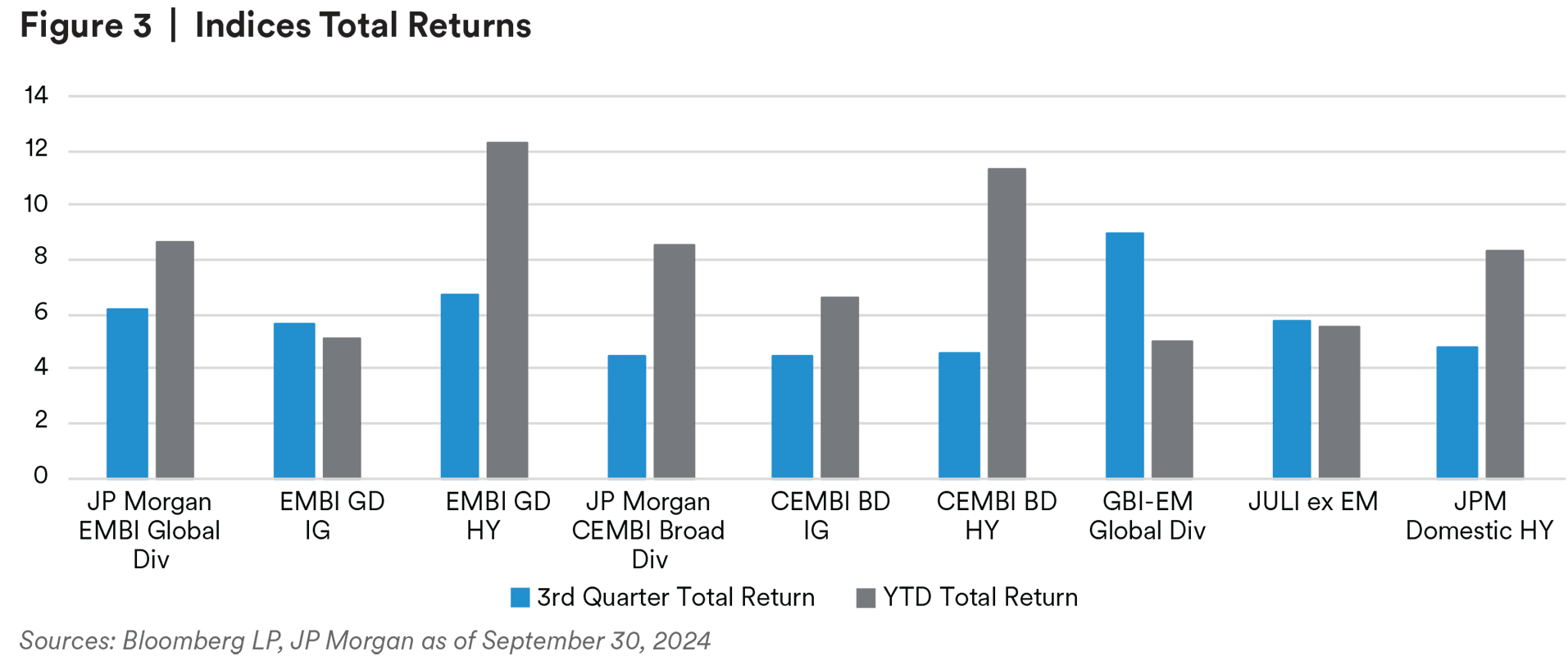

EM indices experienced a dual benefit in Q3, with investment-grade (IG) assets supported by the rally in interest rates and high yield assets boosted by the demand for yield out the curve, with the soft-landing view firmly in play. This, along with storied credits, drove strong positive returns. Latin America was the best-performing region across both hard currency sovereigns and corporates. High-yield (HY) sovereigns, including Argentina, El Salvador and Ecuador, recorded double-digit returns in the third quarter, driven by positive policy changes following elections over the past year. The Oil & Gas sector even posted strong returns, as attractive carry kept investors interested in the space despite pressure on prices. The local currency index was the best performer, with inflation data, lower U.S. yields and Fed policy all leading to a weaker U.S. dollar.3

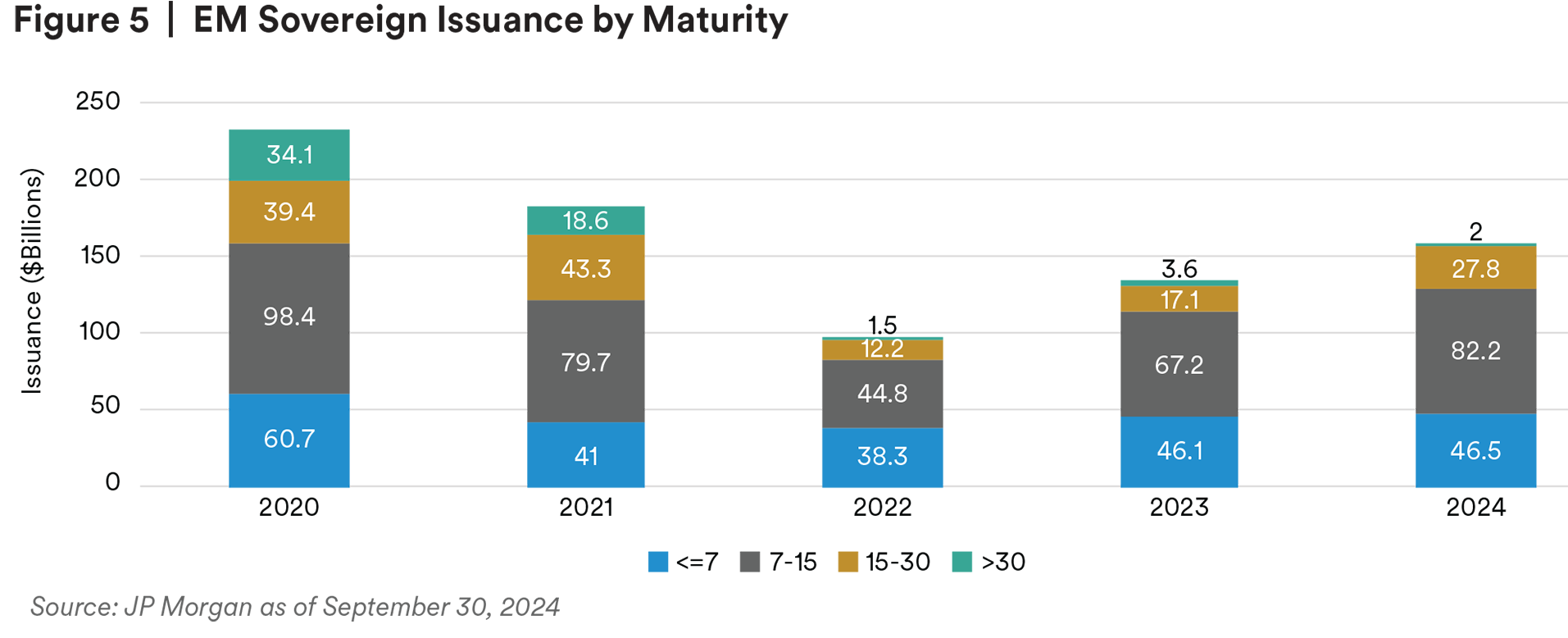

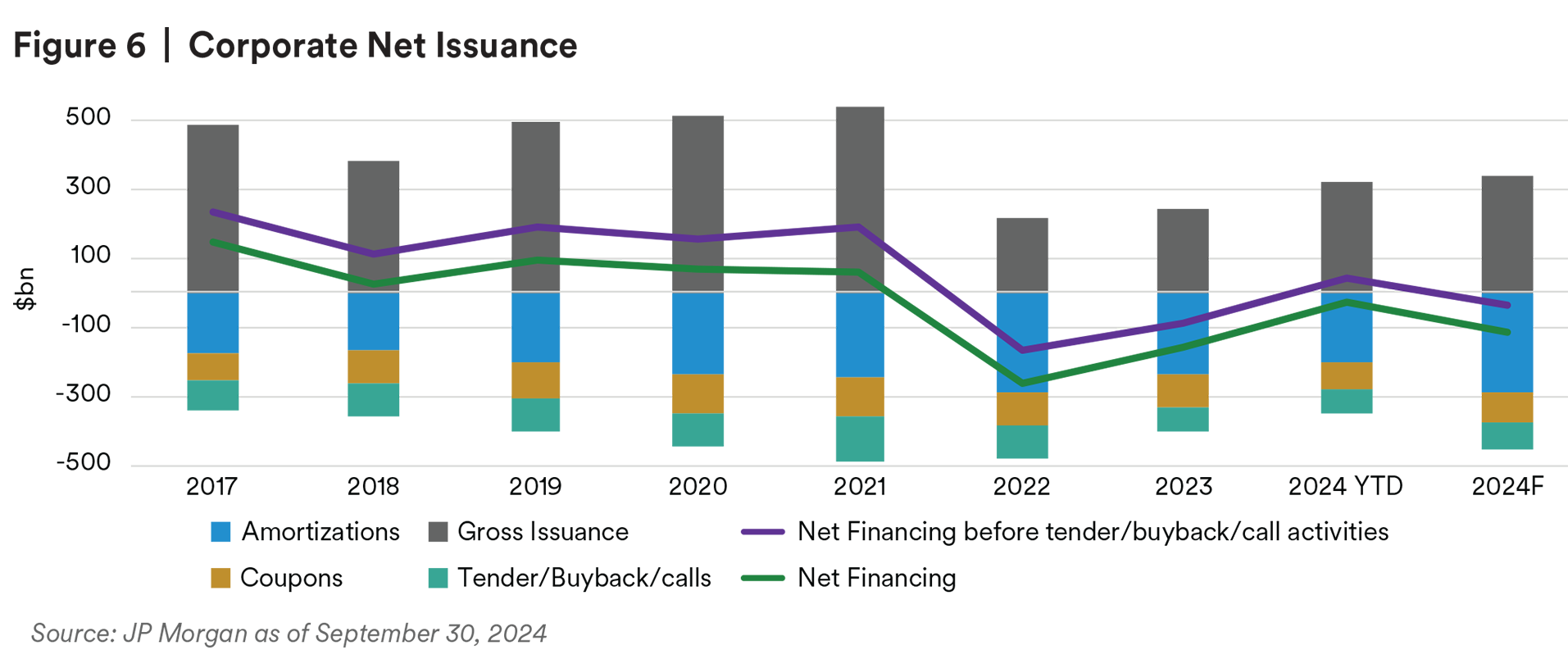

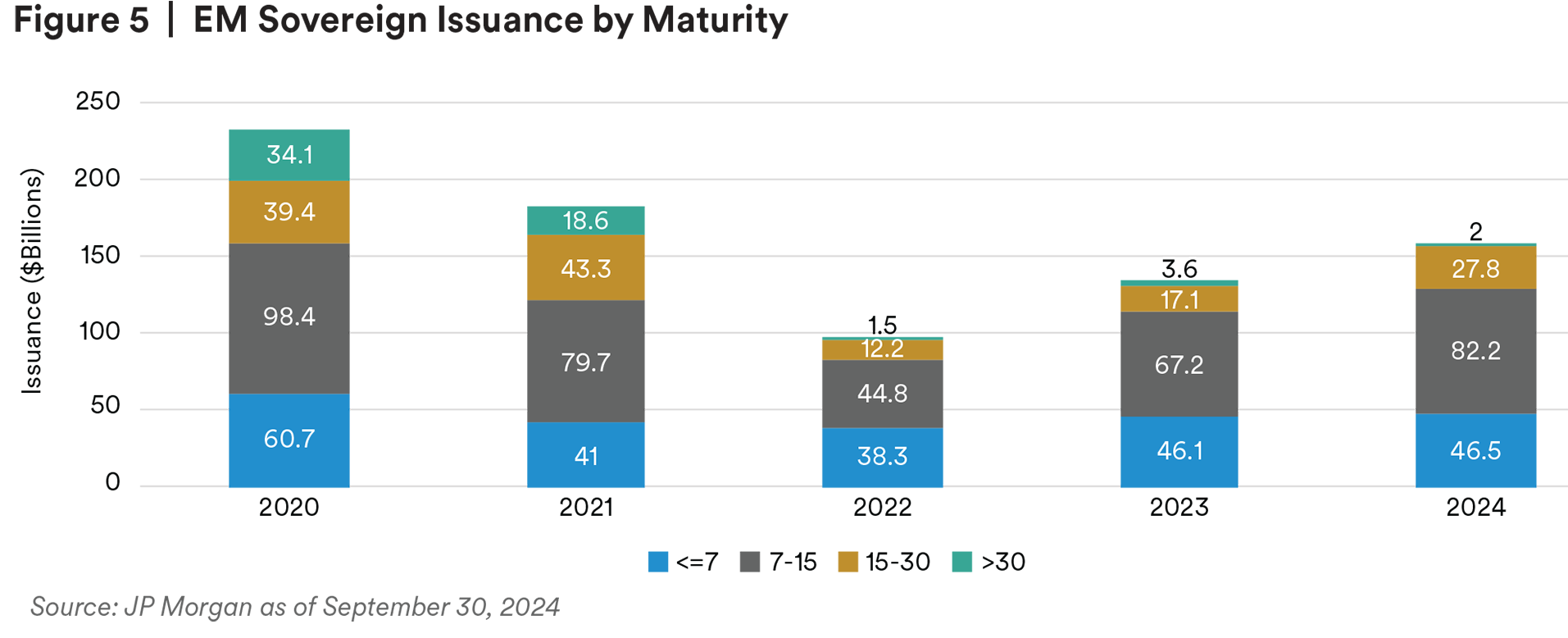

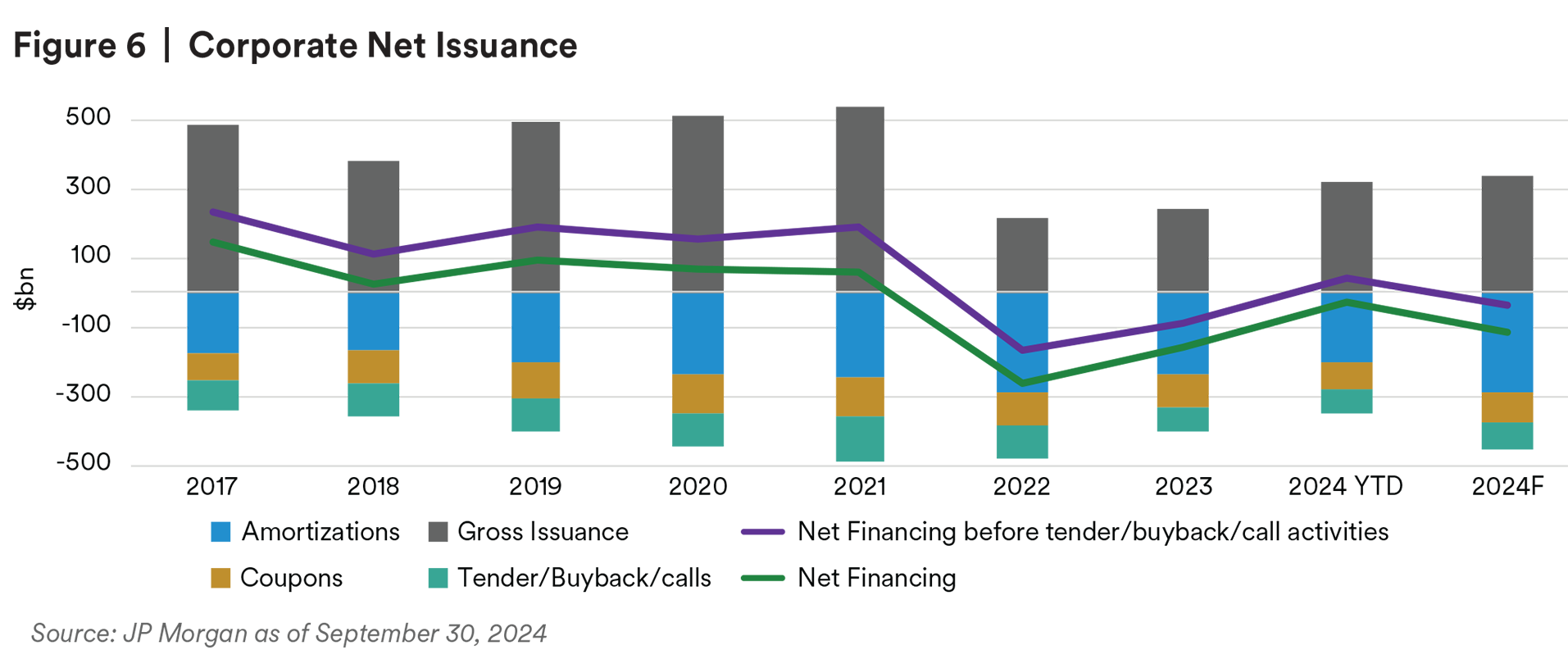

September issuance made up for the quiet summer months. Sovereigns and corporates across all regions took advantage of the firm market and rate rally, creating favorable conditions for issuers. Q3 issuance of $114 billion surpassed the five-year average ($97 billion). Net financing year-to-date (YTD) continues to remain negative (-$30 billion), including China, but remained positive ($39 billion) when excluding the country. Similarly to corporates, half of the $35.1 billion of Q3 sovereign deals came to market in September. Issuance was primarily seen among investment-grade issuers, with no high-yield sovereigns entering the market in September and 77% of YTD sovereign issuance from IG countries. Issuance has been concentrated in the 15–30-year maturity bucket, enabling issuers to extend maturity walls at the current lower rates.4

Outlook

U.S. economic data has been strong but softening from previously elevated levels. The Fed continues to be very data dependent, and the path for interest rate cuts remains intact but it remains unclear at what pace. Given the thoughtfulness of the Fed during this most recent cycle with regards to its path and speed of rate moves, it continues to play the see-saw game of preventing a hard landing, while not being too accommodative in the short term so that inflation expectations reaccelerate. While China has historically been a major driver for markets, especially within EM, the impact has been minimal with the market waiting on stimulus details and the U.S. election banter yet to impact prices.

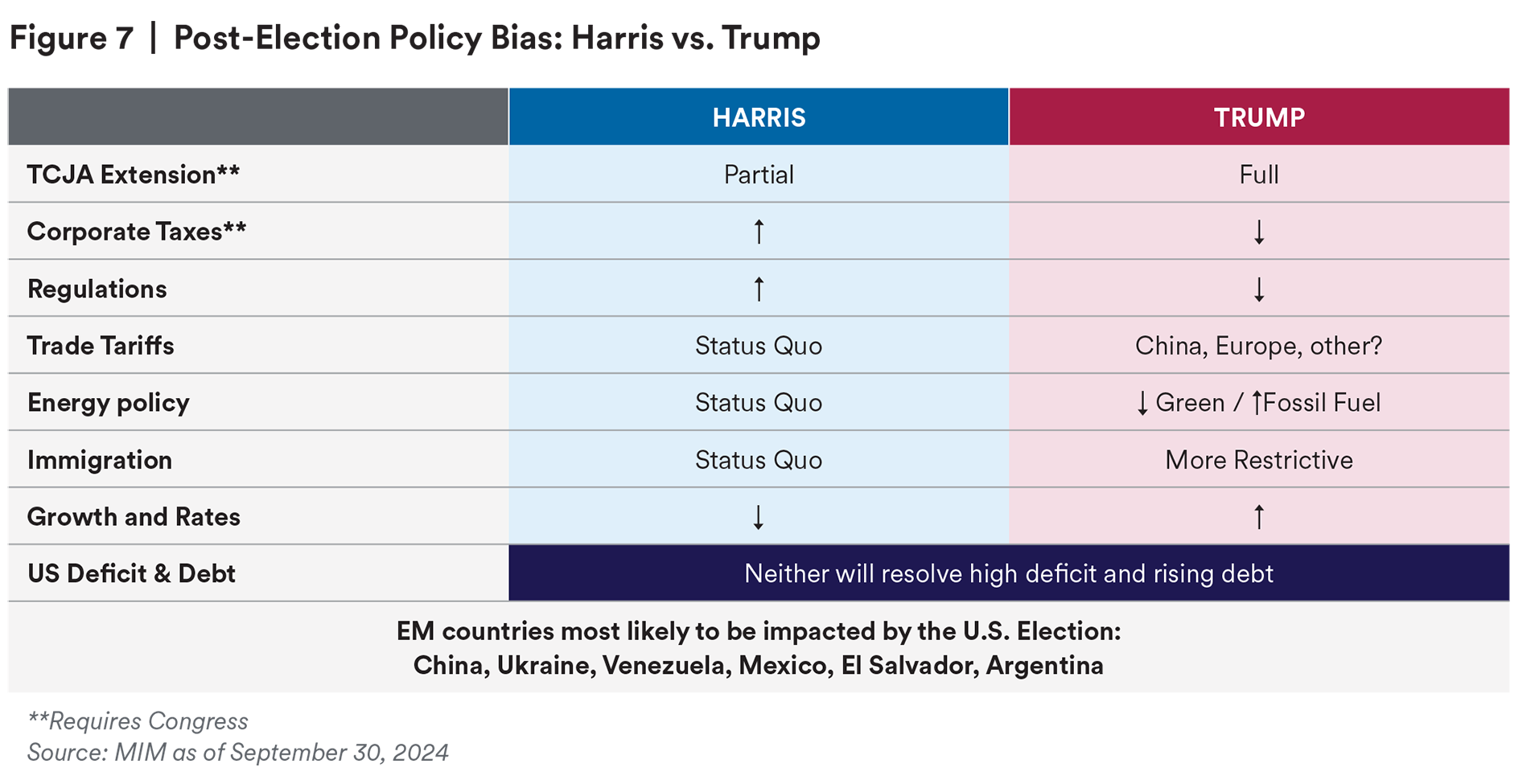

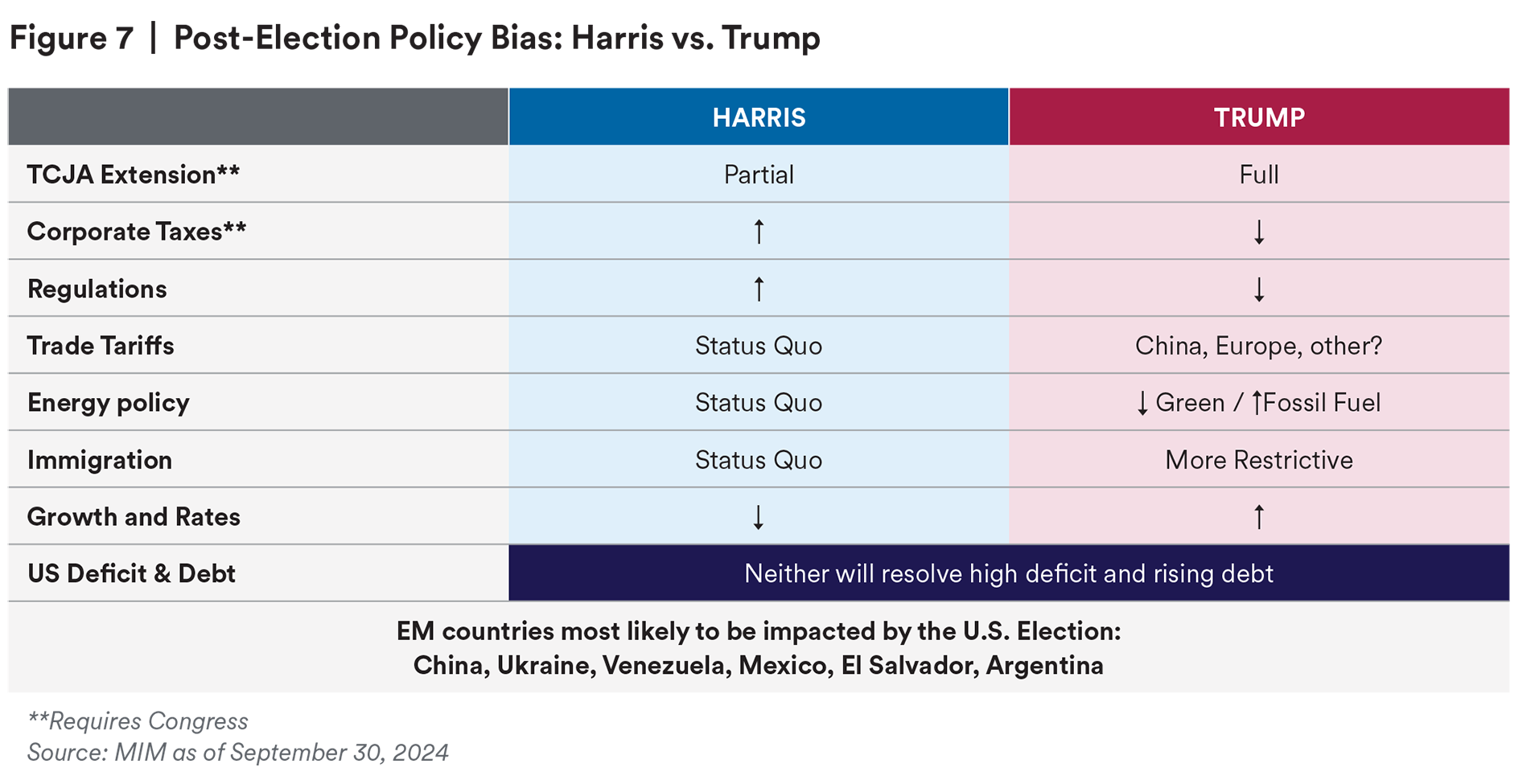

Now that the majority of EM and global DM elections are behind us, all eyes are shifting to the upcoming U.S. election in November. Topics, including trade, globalization, defense spending and China, will be highly anticipated themes surrounding campaign rhetoric. The ongoing conflict in the Middle East will be a fine line for both candidates to walk, given the U.S.’ historical stance with Israel, coupled with navigating the localized war and ensuring no further escalation. The war developments further impact the energy sector, where concerns around the conflict and supply disruptions have supported energy prices that were previously pressured by the softening macro outlook. With polls not pointing to a clear favorite at this time, we expect to see some volatility heading into the election and even afterward, as markets digest the results and the trickle effect across the globe. At large, we are comfortable with how Emerging Markets are fundamentally positioned for this election in either outcome.

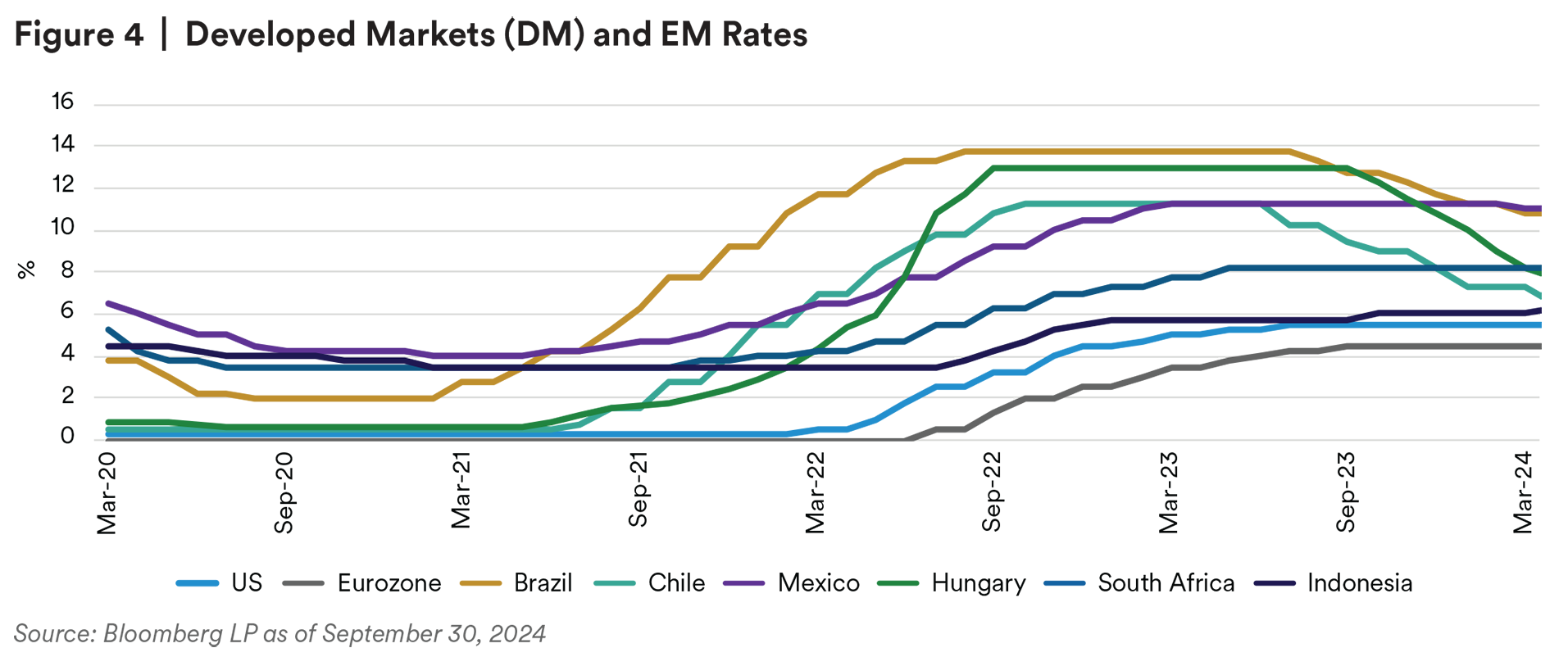

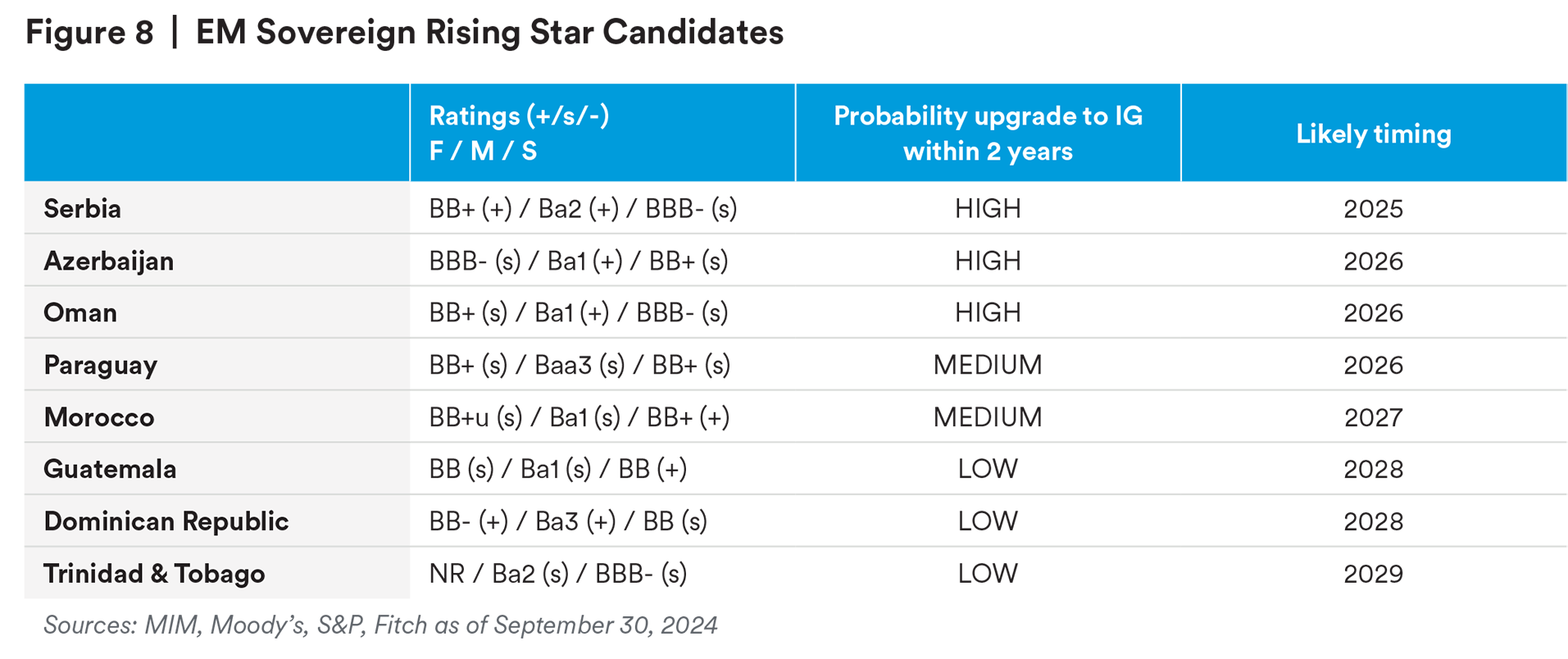

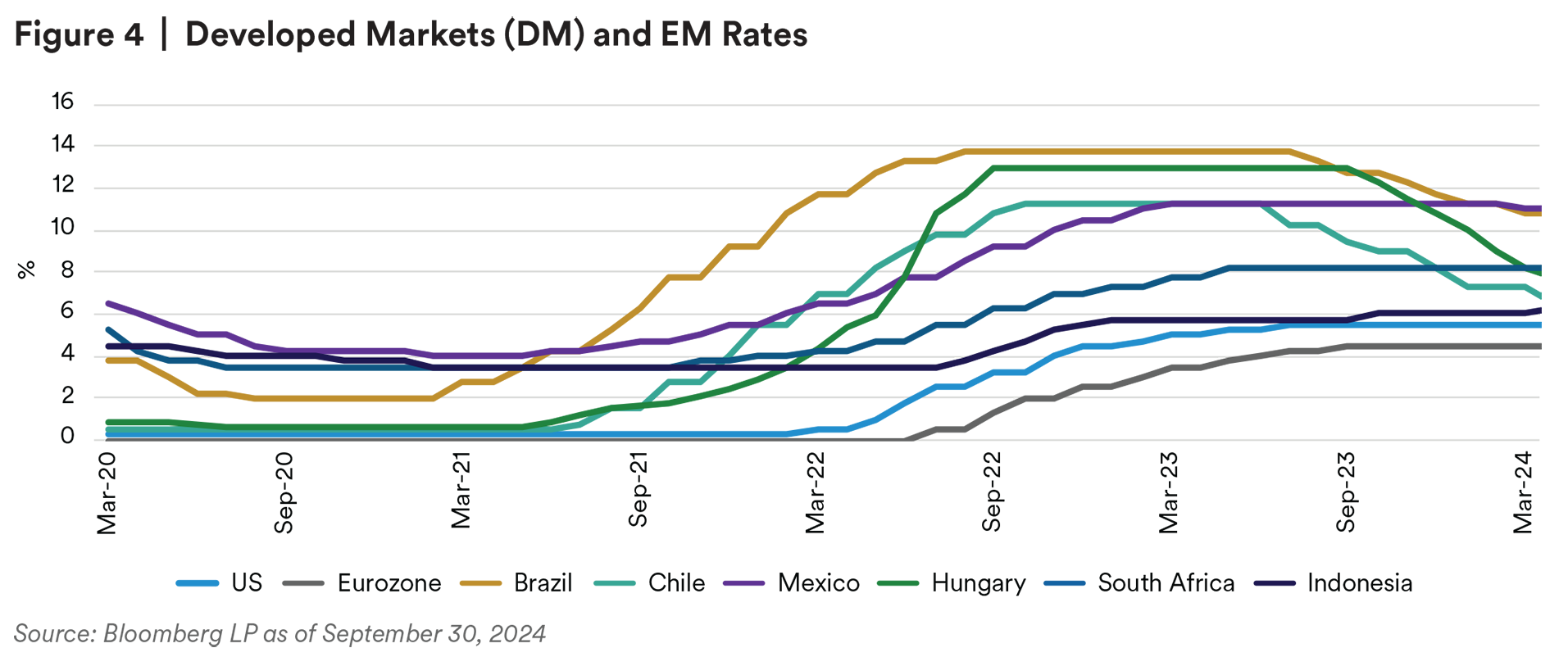

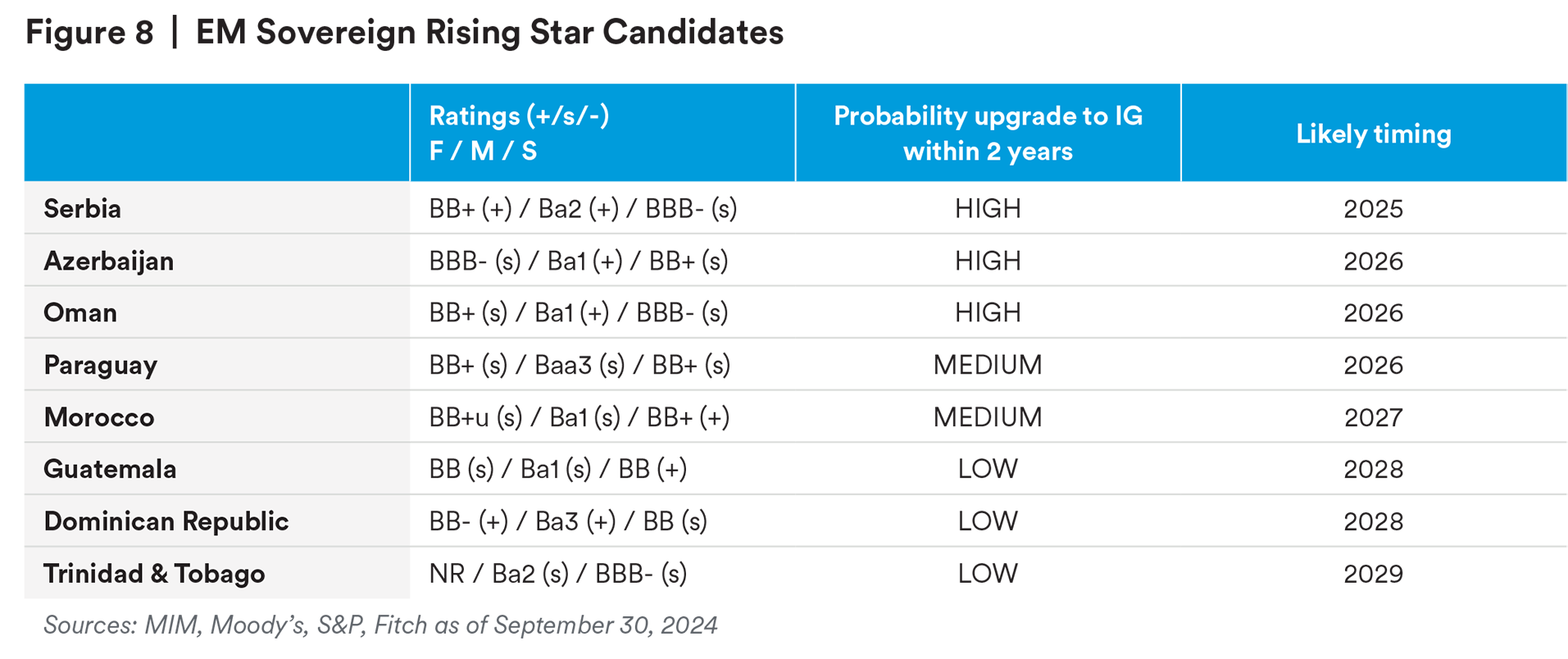

EM sovereign fundamentals have largely stabilized from the growth and inflation shocks that were trigged by the global pandemic. Aggressive central bank hiking early in the cycle has given central banks room to begin easing rates to support growth. We have seen some higher-quality, high-yield BB-rated countries demonstrate strong consistent fundamental performance, fiscal discipline and minimal political risk, which have led to improved debt characteristics and the potential for ratings upgrades.5 The sovereign team has been laser focused on identifying the candidates well before the upgrade is on the market’s radar, leading to spread compression across a few of our larger BB positions.

Fundamentals of EM corporates and banks remain healthy, and we acknowledge that metrics may moderate while staying resilient. Balance sheets remain strong, and active liability management has led to reduced concerns over refinancing risks. The liability management has pushed out the maturity wall, notably for higher-quality issuers. While we do not expect debt levels to change materially, we expect earnings before interest, taxes, depreciation and amortization (EBITDA) to decline from recent highs. This may show an uptick in leverage, while remaining at manageable levels. We expect margins to remain healthy, even as revenues decline from their recent peaks. Free cash flow should remain strong, as capital expenditures continue to focus on maintenance rather than expansion.

We continue to have a bias toward high-yield (HY) over investment-grade (IG) sovereigns based on valuations coupled with current risk appetite. We like opportunities including restructuring stories, as well as countries that have been witnessing encouraging policy reform and the potential for subsequent positive rating momentum. Within the IG space, we like low-BBB sovereigns in the 7-10 year part of the curve where all-in-yields screen attractive, and where we see the most new issuance opportunities.

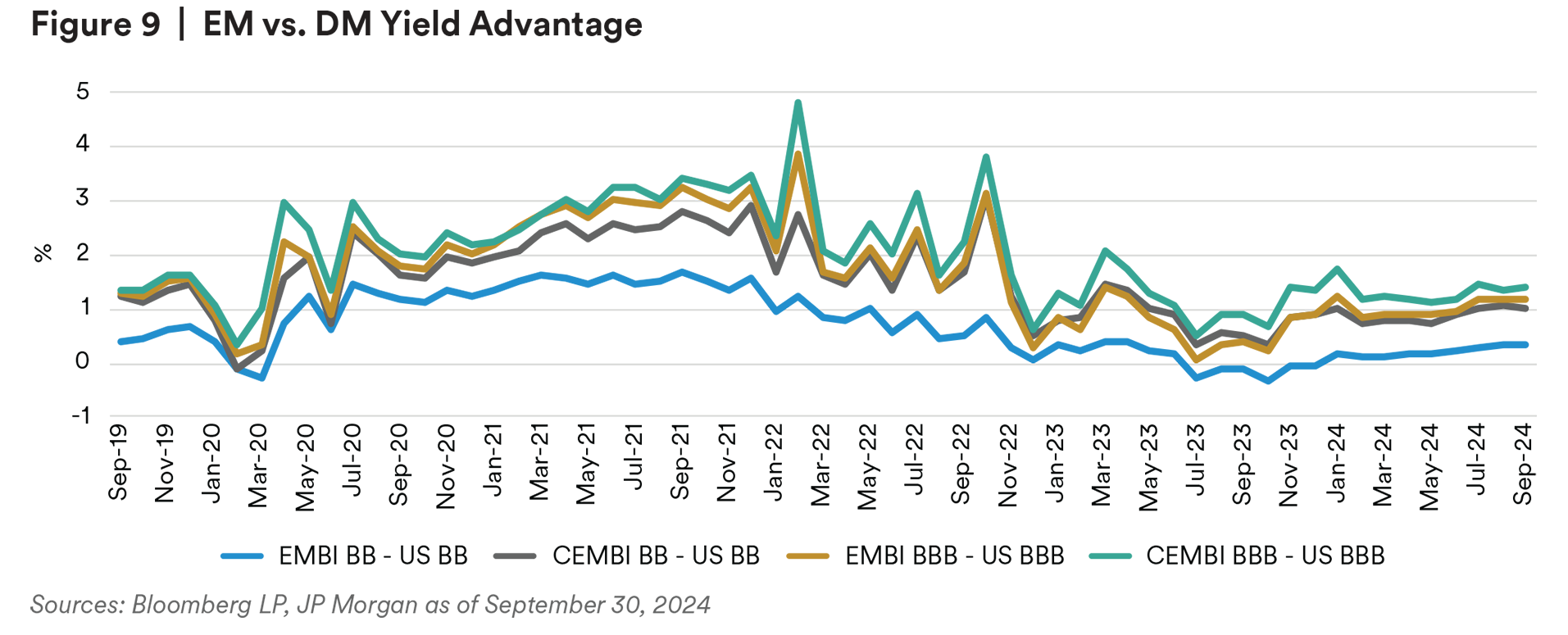

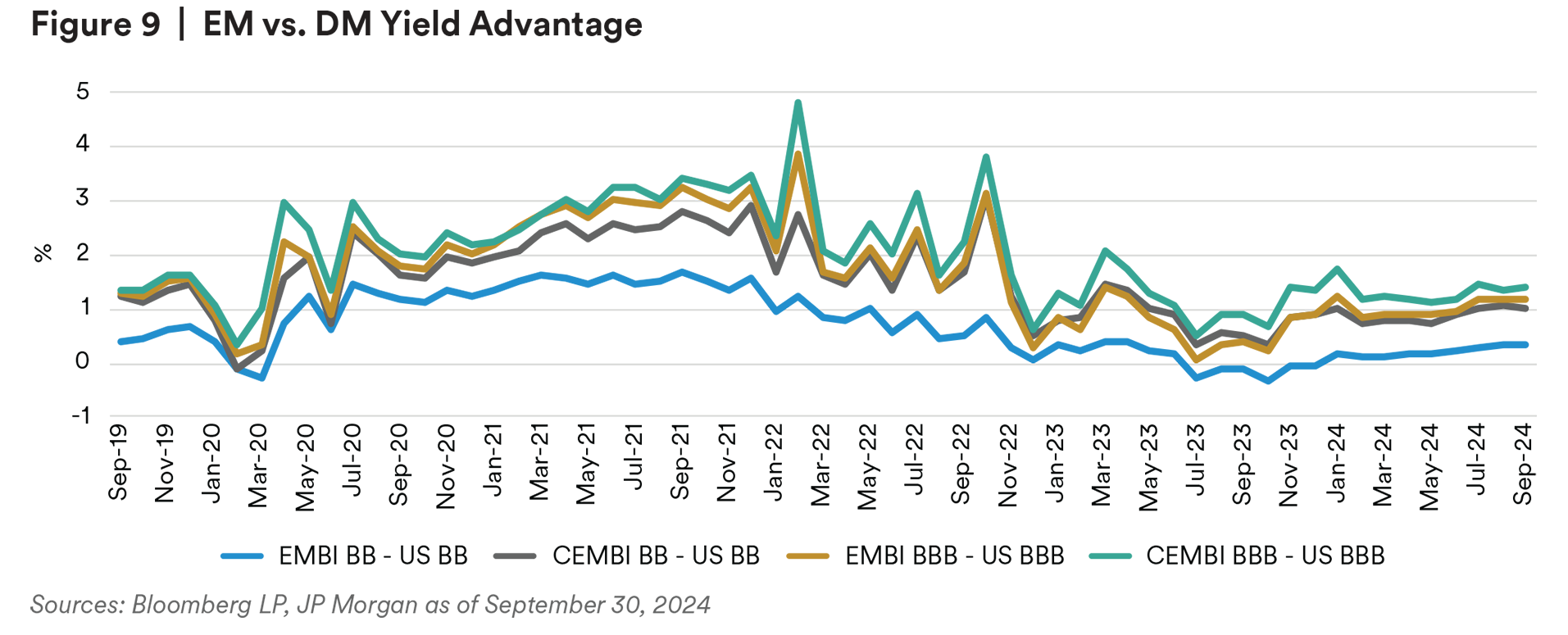

We see opportunities in BB and BBB corporates, in sectors that generate hard currency revenues or have effective FX liability management. Even with the outperformance of EM corporates relative to DM corporates year to date, the spread per turn of leverage remains over double—46 bps/x for U.S. credits versus 115 bps/x for Global EM.6 In the utility space, we see value in assets with consistent cash flows that have strong structures, especially within Latin America. Infrastructure projects in the Middle East are enticing, where we can get a pickup of ~100 bps over comparable DM credits.

Local currency valuations look attractive relative to hard currency assets. While EM inflation has been steadily receding, EM bond yields have not moved at the same rate, leaving us with enticing real yields. The converging environment between EM and DM has allowed investors to begin capitalizing on attractive real yields across the local space, with more room to go. Our preference is within local currency markets, which are less U.S. rate sensitive and rather more of a real yield carry play. The compelling real rate environment in Latin America is most enticing, while Europe is valued more fairly. While regional yields in Asia are lower, the currencies appear undervalued, as growth rates and trade flows are improving. Further, Asia benefits more directly from a lower U.S. rate environment.

Endnotes

1. Bloomberg LP as of 9/30/2024

2. Bloomberg LP as of 9/30/2024

3. Information in this paragraph sourced from JP Morgan as of 9/30/2024

4. Information in this paragraph sourced from JP Morgan as of 9/30/2024

5. MIM as of 9/30/2024

6. BofA Research as of 9/30/2024

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK, this document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees’ pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/ or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities. For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1. As of July 22, 2024, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited