Part 1: Capturing Alpha Through Differentiation

We believe the size and composition of the JP Morgan EMBI indices provides many opportunities to capture alpha through differentiation, especially when considered in the context of the broader EM universe including EM corporates and non-USD sovereigns. So, what do we mean by “capturing alpha through differentiation”? Essentially, by having a clear understanding of the innate return drivers living in each index, we can partition the index components into “risk buckets” by credit quality, duration, and geography. This allows us to match exposures that should behave similarly in a certain market environment (“beta”) and separate them from other issuers with more idiosyncratic drivers (“alpha”).

For example, one of our strategies for capturing alpha is by taking an active position on a specific risk bucket such as, “overweight investment grade versus high yield”. Or we can take active positions on specific idiosyncratic stories that are pricing a wider range of outcomes, like “overweight Hungary” or “underweight Petroleos Mexicanos”.

Furthermore, we can differentiate within the same geography by expressing a view that a certain corporate issuer may outperform the sovereign, or that a sovereign position denominated in local currency may outperform its security in hard currency.

When we apply differentiation to assess the current investment environment for EM sovereigns, we find the following to be evident:

Higher quality bias: We can clearly differentiate by credit quality, with fundamental drivers having mostly stabilized in the Investment Grade (IG) space post the pandemic. Here we refer to stabilization of debt metrics, ratings trajectory, and primary market access. This is also true within the higher quality portion of the High Yield (HY) space; many BB sovereigns are positioned for upgrades, and some are potentially rising stars with the chance of reaching investment grade over the next 2-3 years. In the nearer term we see Serbia, Paraguay, and Morocco as promising rising star candidates, with Dominican Republic, Costa Rica, and Oman showing some potential over the longer term.

Idiosyncratic opportunities within IG sovereigns: We have several preferences within the higher quality space, with a bias for Latin America (LatAm) and Central and Eastern Europe (CEE). Both regions have experienced thematic region-specific spread widening over recent years that has been, in our view, excessive.

- In LatAm, the “leftist wave” that commenced in 2019 has proven to be more moderate than feared. In virtually every country with a leftist president, we have seen institutional balance as legislative or judicial opposition has effectively defused more extreme policy shifts. We see an attractive mix of fundamentals and valuations in Chile and Mexico, and stand cautiously optimistic on Brazil, Colombia, and Peru.

- The CEE space has changed significantly over the past 2-3 years, having evolved from quiet on fundamentals and rich on valuations (with very infrequent sovereign issuance) to dramatic and cheap, respectively. The drama was fueled by the Russia-Ukraine war, which negatively impacted growth, inflation, and financing needs in these countries, leading to more frequent issuance. Since then, conditions have stabilized, and we view sovereign and quasi-sovereign opportunities in Hungary, Poland, and Romania with interest based on asset prices versus fundamental views.

Differentiation among the lowest quality: Herein lies, potentially, the greatest source of alpha in the sovereign universe, comprised of 38 countries and representing ~25% of the EMBI. As mentioned above, we do have an overall higher quality bias and believe the risk/reward favors more cautious positioning in the higher beta space. However, differentiation is key in the higher beta space as we assess who will be able to survive the current cycle without defaulting on their sovereign debt. This cycle has been very difficult for the more vulnerable EM sovereigns that had to endure a pandemic, global liquidity tightening, and a war with profound impact on food and energy markets. It is also critical to understand the restructuring process to predict recoveries. We discuss these points below:

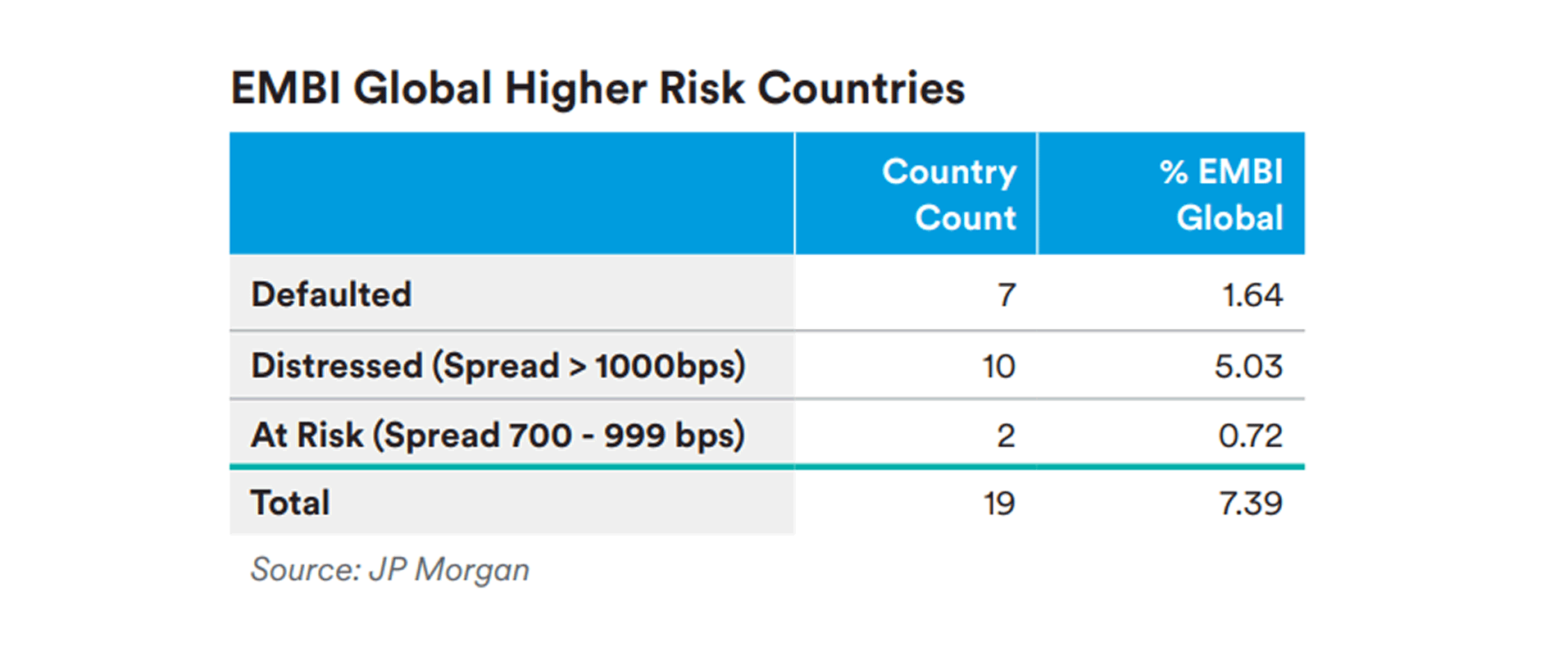

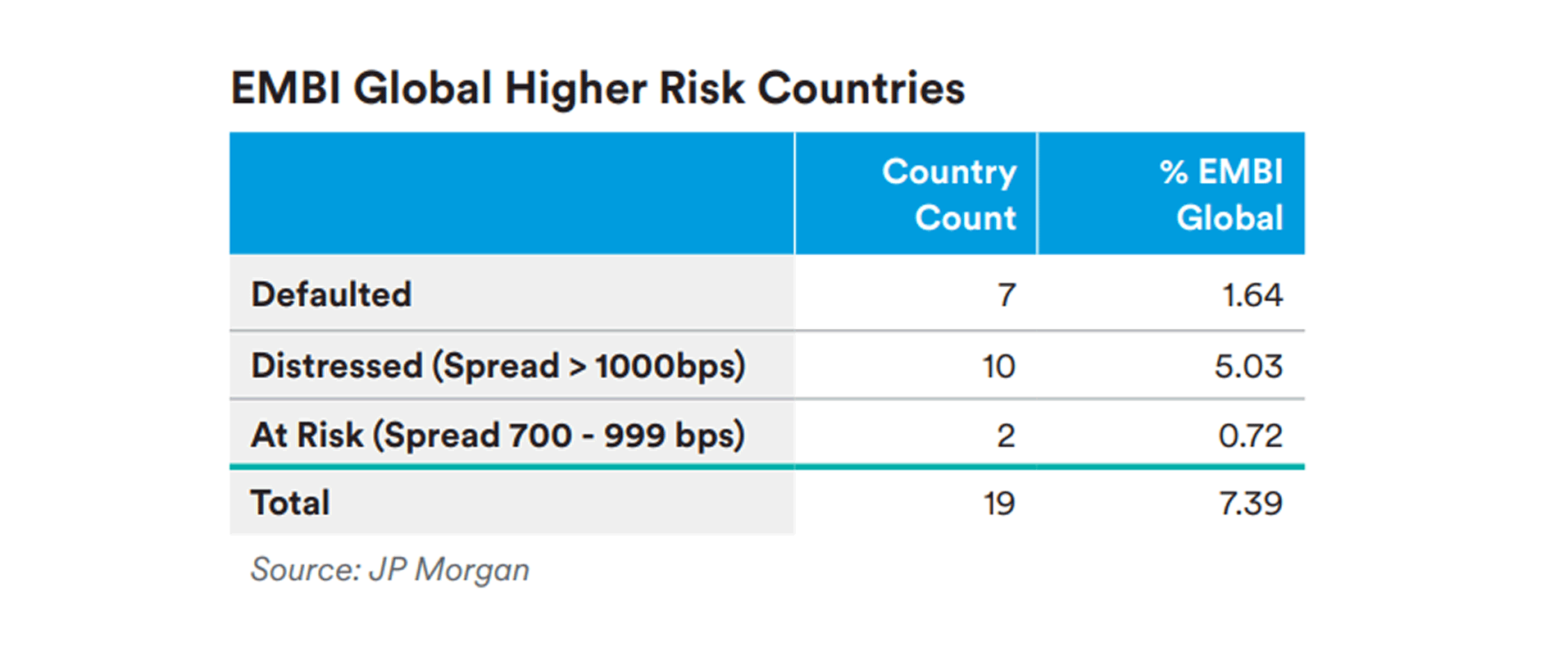

Several sovereigns in default— Currently there are seven EMBI sovereigns in default and two others that were removed from the index (Russia and Belarus). Each of these countries is at a different place along the path to restructuring, ranging from “no progress” (Lebanon and Venezuela) to “quite advanced” (Ghana, Sri Lanka, Zambia, Suriname). There is real hope that this latter group could complete their restructurings during 2023, although further delays are certainly possible. We provide more thoughts on the restructuring process below. Finally, Ukraine is currently in a consented standstill until August 2024, and its restructuring will most likely take place before then but could be delayed if the war extends. Today these defaulted names still make up 1.34% of the EMBI, down from 4.14% at the end of 2019.1

The survivors… for now. We believe the current cycle will continue to strain EM sovereigns and therefore more defaults are likely. As of 6/15/23 there are 11 EMBI countries “in distress” as measured by bond spreads >1000bps.2 These include Pakistan, Ecuador, Argentina, El Salvador, Tunisia and Egypt. These are perhaps the most interesting names in our universe since they continue to pay debt service, in some cases with extremely attractive current yields of 15-25% and stand to gain substantially if default risk subsides. Still, they are “cheap for a reason” and pose impactful downside risks from current prices if a default does eventually transpire.

- The restructuring process, vintage 2022/2023– Following Ecuador and Argentina’s restructurings in 2020 and 2021, respectively, the three “active” restructurings in Zambia, Ghana and Sri Lanka are progressing much slower by comparison. It was largely believed that the IMF would pursue a coordinated and comprehensive approach to address restructuring “once and for all” for defaulted sovereigns. However, this has not been the case and instead each country is on a different path. Zambia and Ghana are going through the common framework, which was supposed to facilitate a quicker resolution with comparable treatment among different investor groups, but instead has suffered delays due to disagreements among bilateral creditors on a number of critical issues. Nonetheless, we are hopeful around news of recent progress on this front which is important for moving on to direct talks between issuers and bondholders around actual restructuring terms.

- What will the recovery be? Predicting recoveries is a complex analysis. The goal of a successful restructuring is that the sovereign will not need to restructure again and can eventually regain market access. To achieve this, a robust Debt Sustainability Analysis (“DSA”) should be built that can conservatively predict future cash flows and estimate the total amount of debt and the schedule of debt payments a country can accommodate. Once these cash flows are known a discount rate is applied (the exit yield). Currently 11-12% is the standard, but reality can be very different depending on the prevailing market environment and the individual credit story at time of restructuring completion. We have noticed investors punishing restructured bonds that have very low cash flows (or none at all) during the first few years after restructuring with very high yields to maturity of 15+%, but very low current yields. This can result in restructured bonds trading at distressed prices (below $50) for a prolonged period. Investors would like to see higher coupons sooner but making higher debt payments in the early years is challenging for countries working to balance debt sustainability with other domestic priorities.

Adding alpha through “off-index” corporates and local currency securities: We see many opportunities in the EM space away from EMBI sovereigns and quasisovereigns to earn additional alpha with only marginal increase in idiosyncratic risk. While fundamental drivers are often similar, it is important to understand the different drivers of return.

- EM Corporates are very interesting right now, standing out favorably versus sovereigns when comparing valuations, technical drivers (very little new issuance expected) and fundamentals. Relative to their own history and also compared to today’s Developed Market (DM) corporates, EM corporates boast strong balance sheets and operating results, even as we expect some cyclical reversion from here of both margins and leverage ratios. We see value in adding corporates to EMBI focused portfolios by substituting sovereign holdings with “proxy” corporates that demonstrate high standalone credit quality and low idiosyncratic risk relative to their home country sovereign. Examples include senior unsecured obligations of large banks in Brazil and Panama, utility companies in Chile and Colombia, renewable energy projects in the Middle East, or port operators in Indonesia.

- EM Local Currency sovereign bonds (EMLC) have been an inconsistent alpha generator over cycles relative to hard currency bonds, but do frequently outperform over shorter time horizons, making them an excellent tactical security for EMBI investors. We believe EMLC is best held under the right set of macro conditions, both global and EM specific, many of which we observe now, such as: a peak in the Fed hiking cycle, a stable/weaker US dollar trend versus other DM FX, falling EM inflation, high EM real rates, and likely EM rate cuts. In this environment, and based on current valuations, we think local currency bonds can outperform hard currency bonds in countries including Brazil, Peru, South Africa, Indonesia and Hungary.

Part 2: EMBI 2023—Bigger, Broader, & More Differentiated

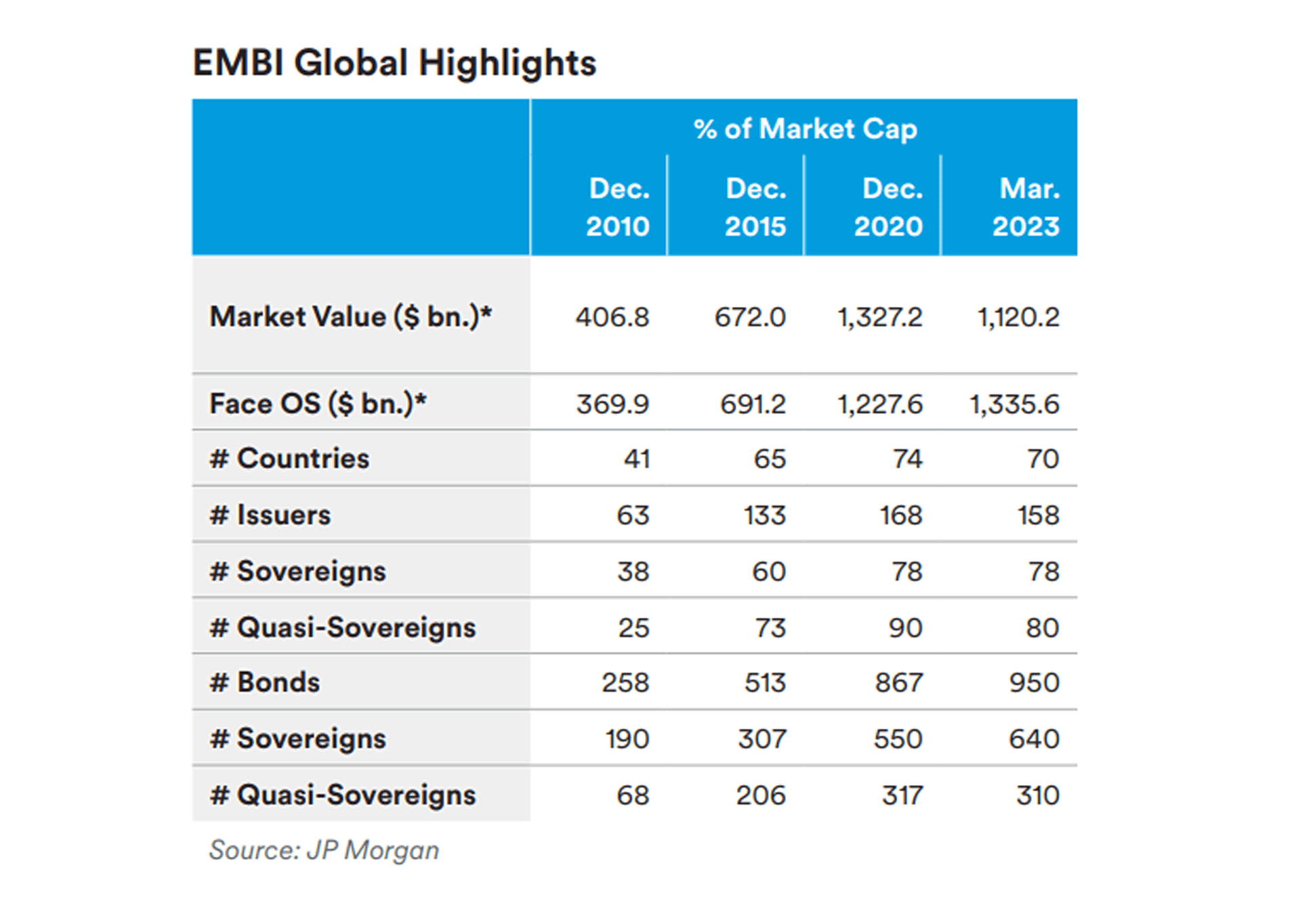

Since 2010, the EMBI index itself has undergone significant changes, such that longtime EMBI investors are encouraged take a moment to review the changes and understand the current set of risk factors. In short, the EMBI has grown significantly in total notional dollars outstanding, number of issuers (particularly quasi-sovereigns and below investment grade sovereigns), and number of securities, while also extending maturities. The impact of these changes challenge investment teams to assess credit quality and relative value across a much broader universe. Below we provide statistical data and commentary on the EMBI Global bond index3 from 2010, 2015, 2020, and today.

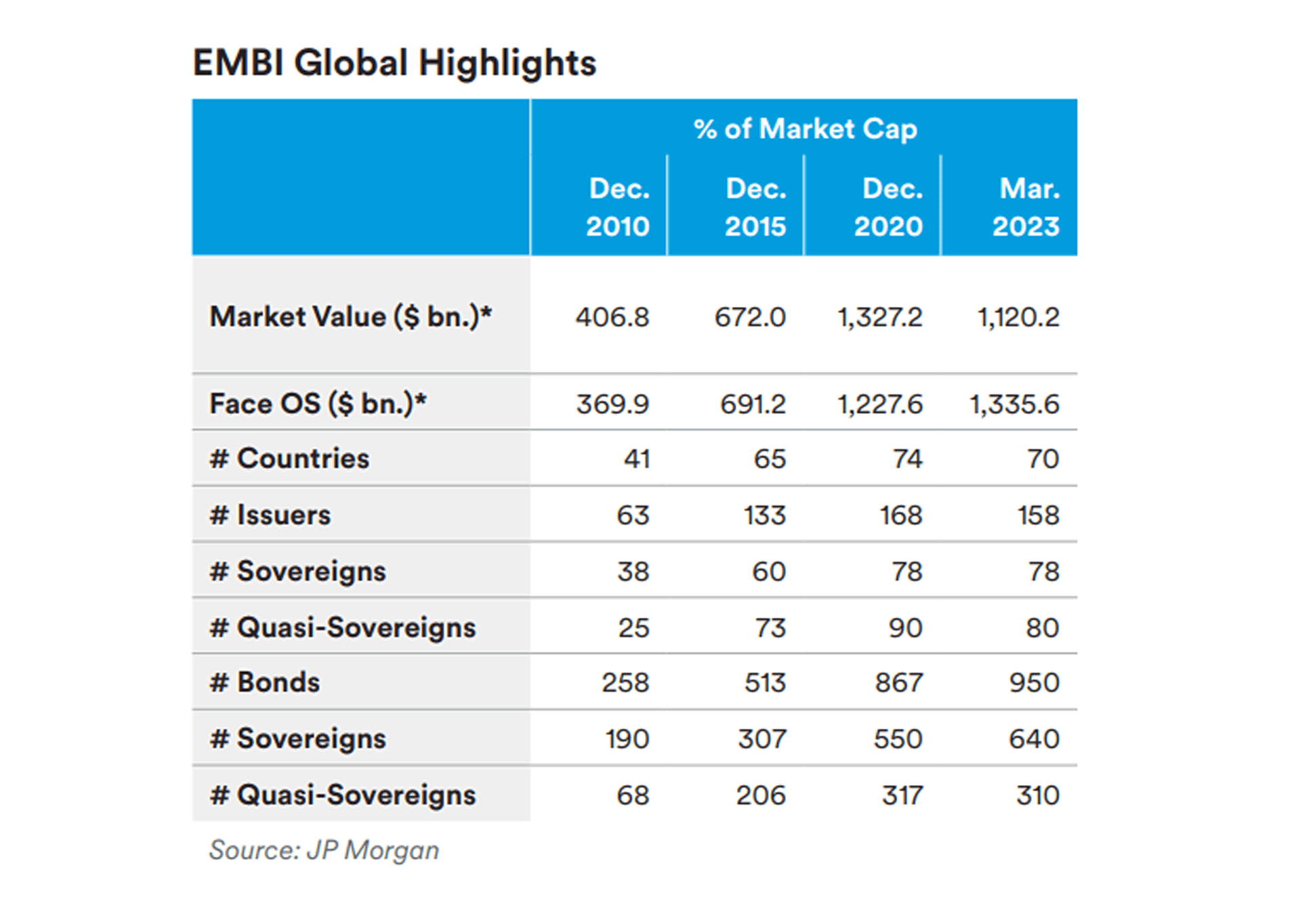

EMBI size, as measured in notional dollars outstanding, has nearly quadrupled since 2010, from $370 billion to over $1.3 trillion today. The number of issuers has also increased significantly, from 63 to 158, with a healthy contribution from both sovereign (+40) and quasi sovereign (+55) index eligible names. Similarly, the number of outstanding index-eligible bonds has risen from 258 to 950.4

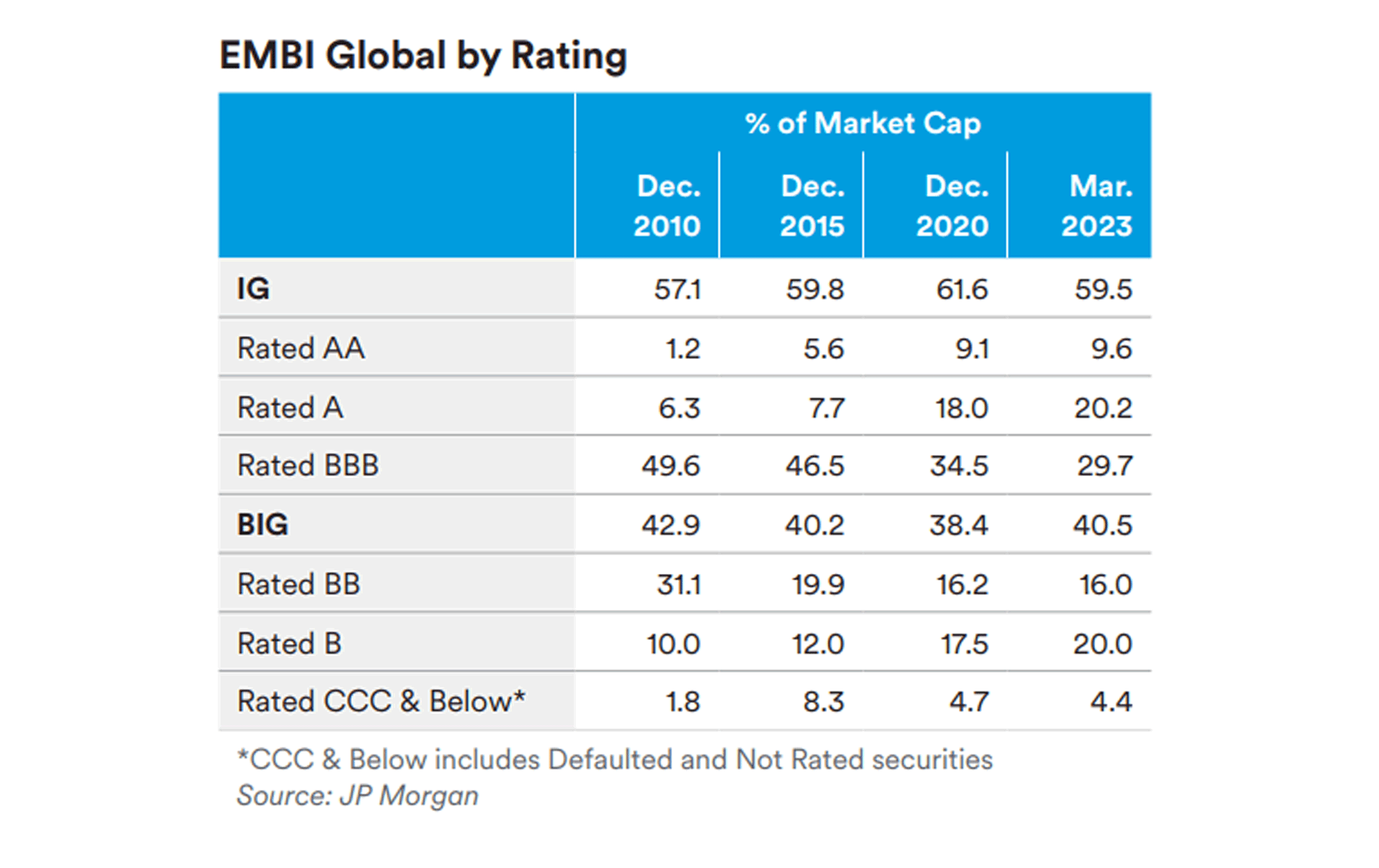

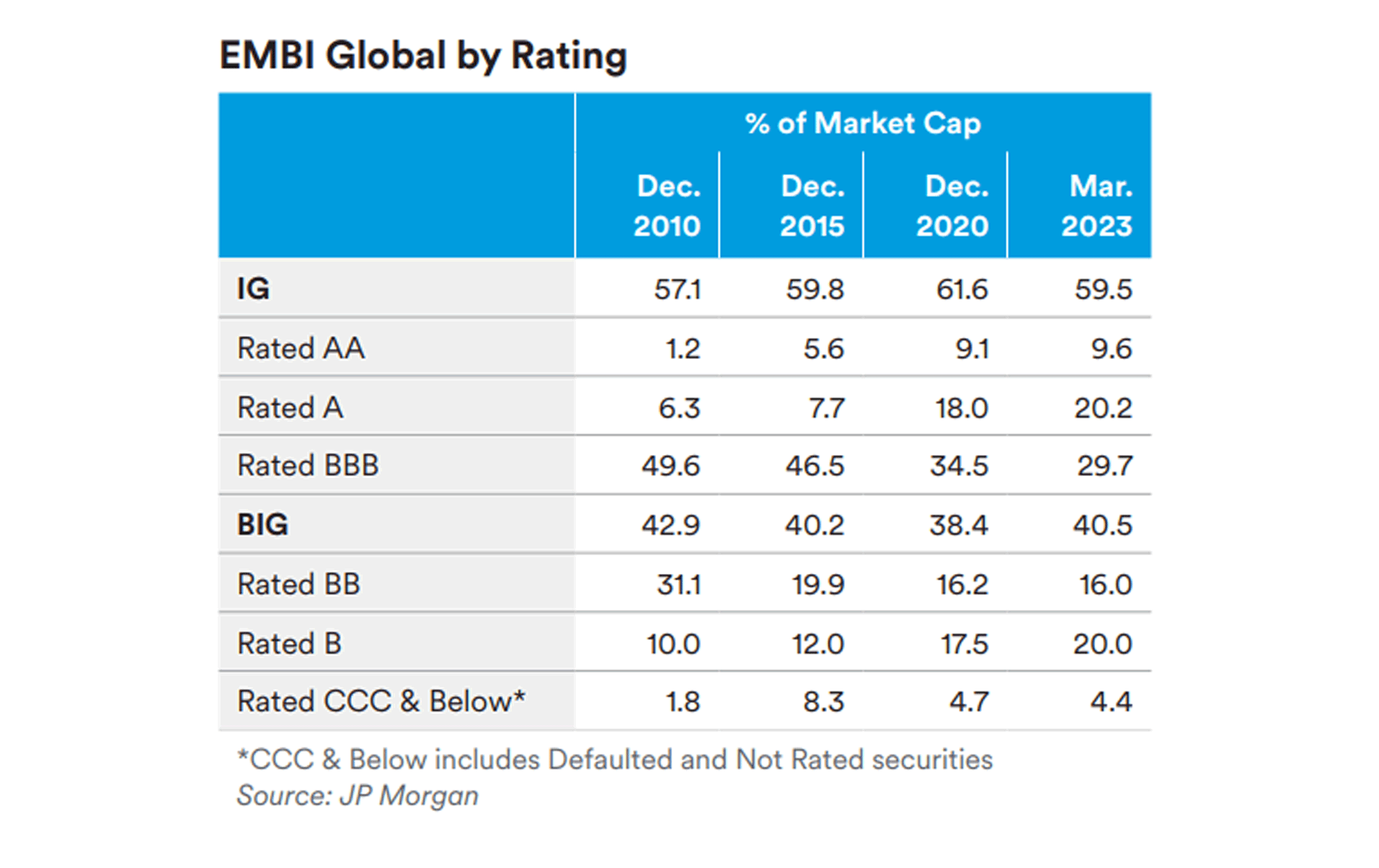

EMBI quality composition has changed little on the surface, with investment grade rated securities increasing moderately from 57% to 60%, and below investment grade decreasing from 43% to 40%. However, the composition of quality has changed quite a bit, leading to greater dispersion by credit rating. The group of traditional “core EM” securities, those rated BBB/BB, has fallen from 81% of the EMBI to 46% over the last decade, with a meaningful increase of both higher and lower quality securities5

Some highlights from our analysis across rating buckets include6:

- Ultra-High Quality: The highest quality bucket (AA/A) has risen by over 22 percentage points to 30% of the EMBI, mostly due to a 2019 shift in index eligibility criteria that brought the inclusion of several large middle eastern (GCC) issuers. These issuers have issued heavily since then.

- Mid-Tier: The share of BBB rated bonds in the EMBI has fallen nearly 20 percentage points to 30% on several large downgrades to junk status, most occurring since 2015. These include Brazil (2015), Turkey and South Africa (2017), Oman (2018) and Morocco (2020). There are two countries that fell to junk and later recovered the IG rating over this period: Hungary (2011 and 2016) and Russia (2015 and 2018), although Russia was later pulled from the index altogether in 2022 due to sanctions related to the war in Ukraine.

- High Yield: Issuers rated single-B and below have seen a large increase, from 12% of the EMBI to over 24%. This is largely due to 16 new country issuers in the single-B space, along with some notable downgrades from BB (Turkey, Bahrain, Costa Rica) and heavier issuance from existing sovereigns (Egypt, Ghana, Ukraine). Defaulted sovereigns, which do not leave the index despite non-payment, have seen an uptick to 1.34% as of the end of March 2023.7

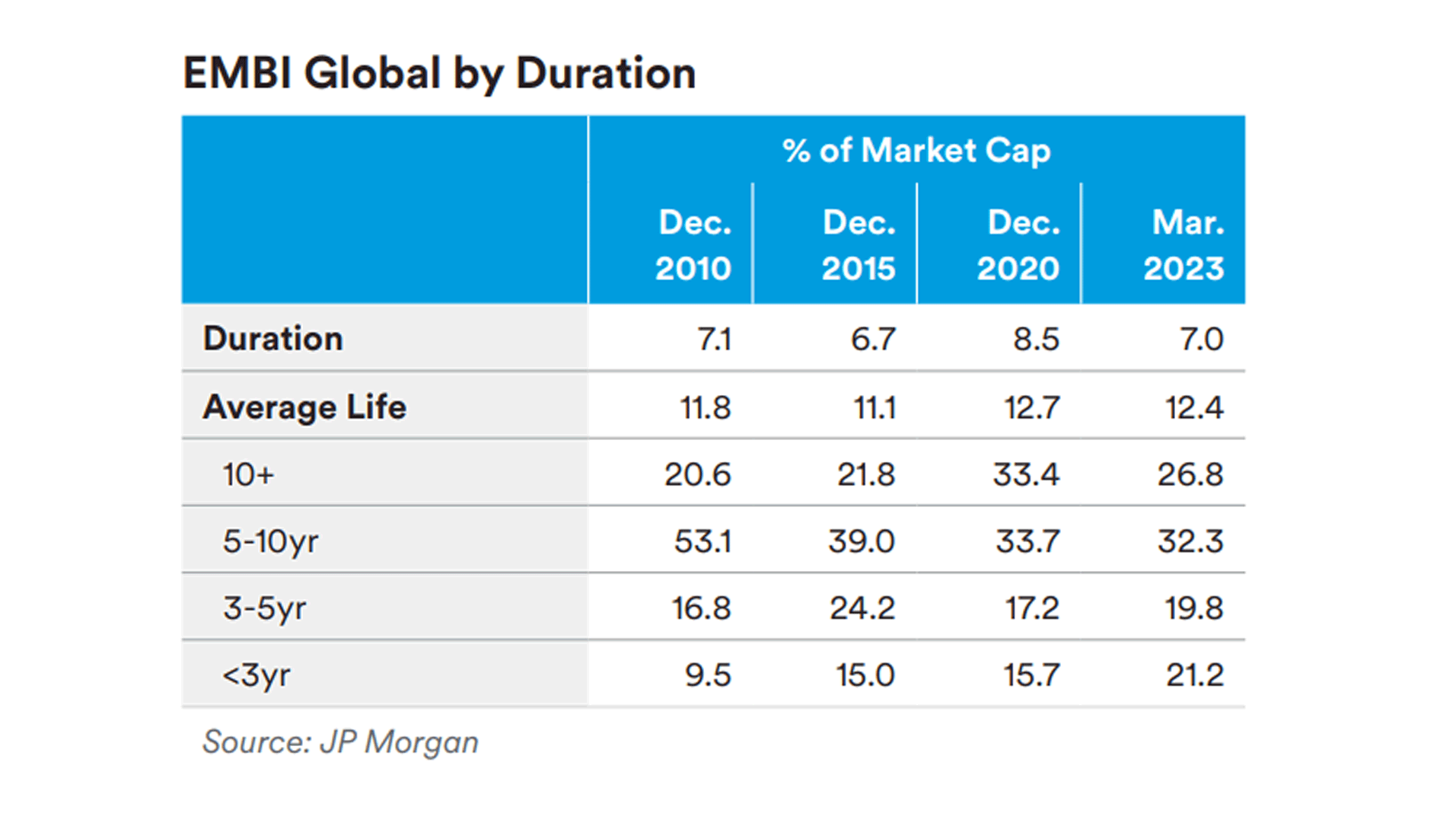

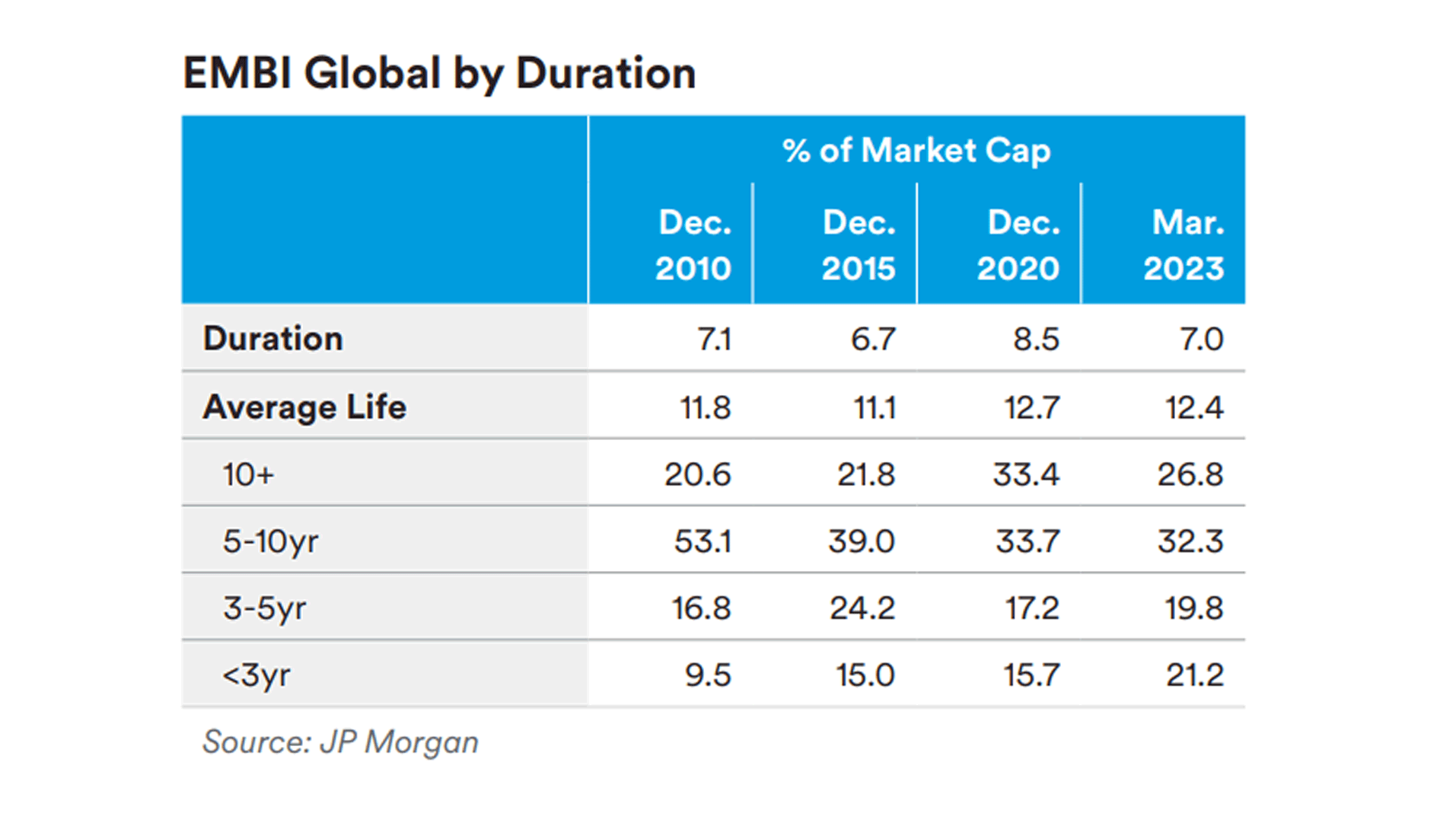

The EMBI’s maturity profile has historically trended toward longer tenors, resulting in a 1.4-year extension in average index duration through 2020. The allure of longer duration securities can be a double-edged sword. Longer bonds, with higher spread duration, offer the potential for attractive income and return enhancement, especially given the steepness of some credit curves. However, this comes with the risk of greater price volatility, as we have seen over the last 3 years. The story from 2020 to 2023 has been an aggressive move in rates plus spread widening, both factors combining to push index duration back down to 7.0 after peaking in 2020 at 8.5. Additionally, issuance as of late has been more focused in the 5-10 year space. Nonetheless, bonds with duration over 10 years have increased from 21% of the EMBI in 2010 (45 securities) to 27% today (219 securities). There has also been a tick up in issuance of ultra-long maturity bonds, with approximately 4% of the EMBI now having a tenor of more than 30-years. Logically, these longer tenors tend to be concentrated among investment grade issuers. However, sub-IG issuers have been more active out the curve as of late, and now make up around one-quarter of all long bonds, equivalent to ~6% of the overall EMBI. This is a significant difference versus the DM high yield opportunity set where only approximately 2% of the universe has a weighted average life over 10 years, compared to 30% of the EMBI HY index.8 The maturity disparity can increase an EM manager’s flexibility when thinking about both curve shape and recovery values, with the long end of many high yield curves offering convexity options that are not available in other markets.

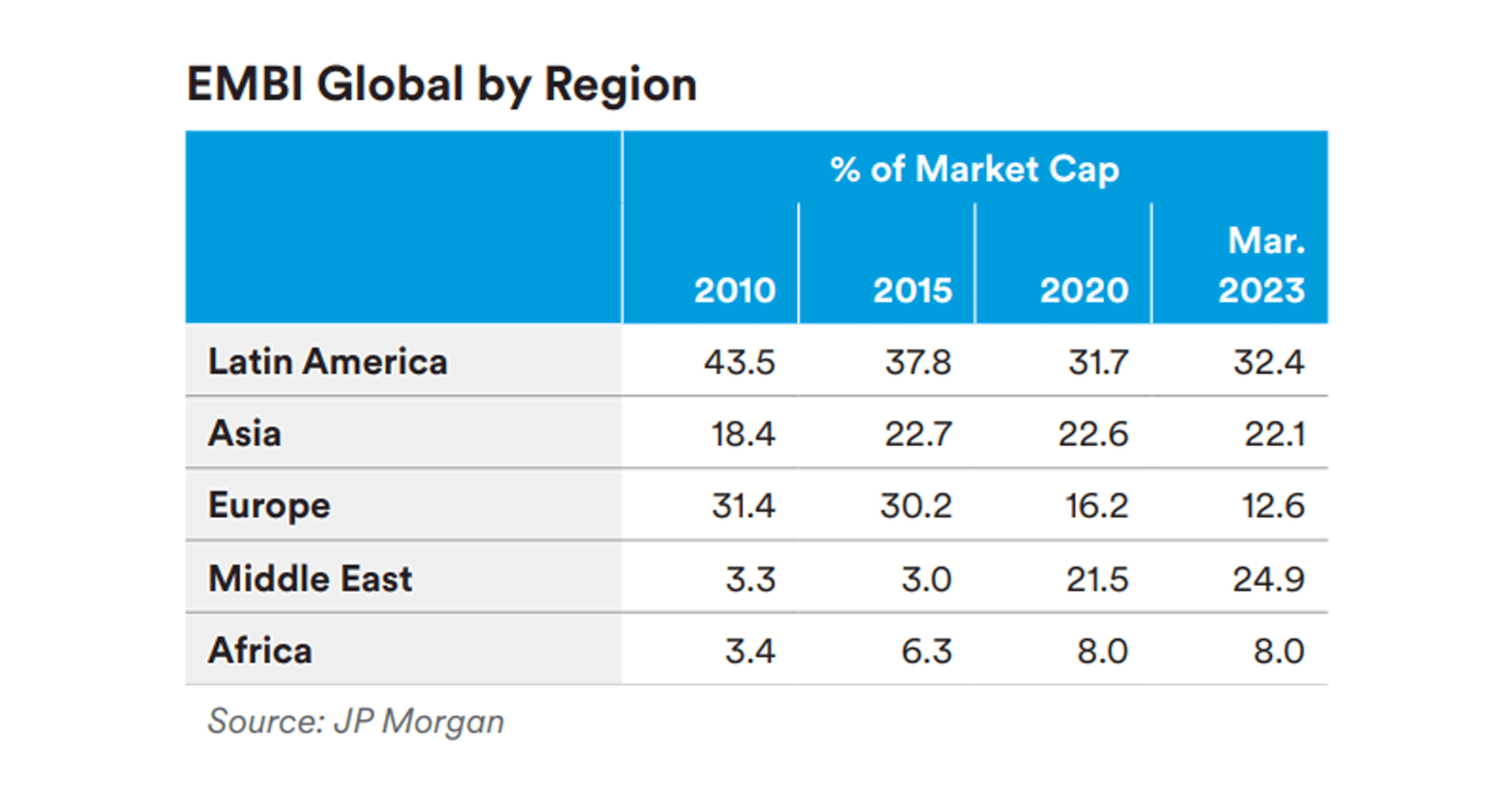

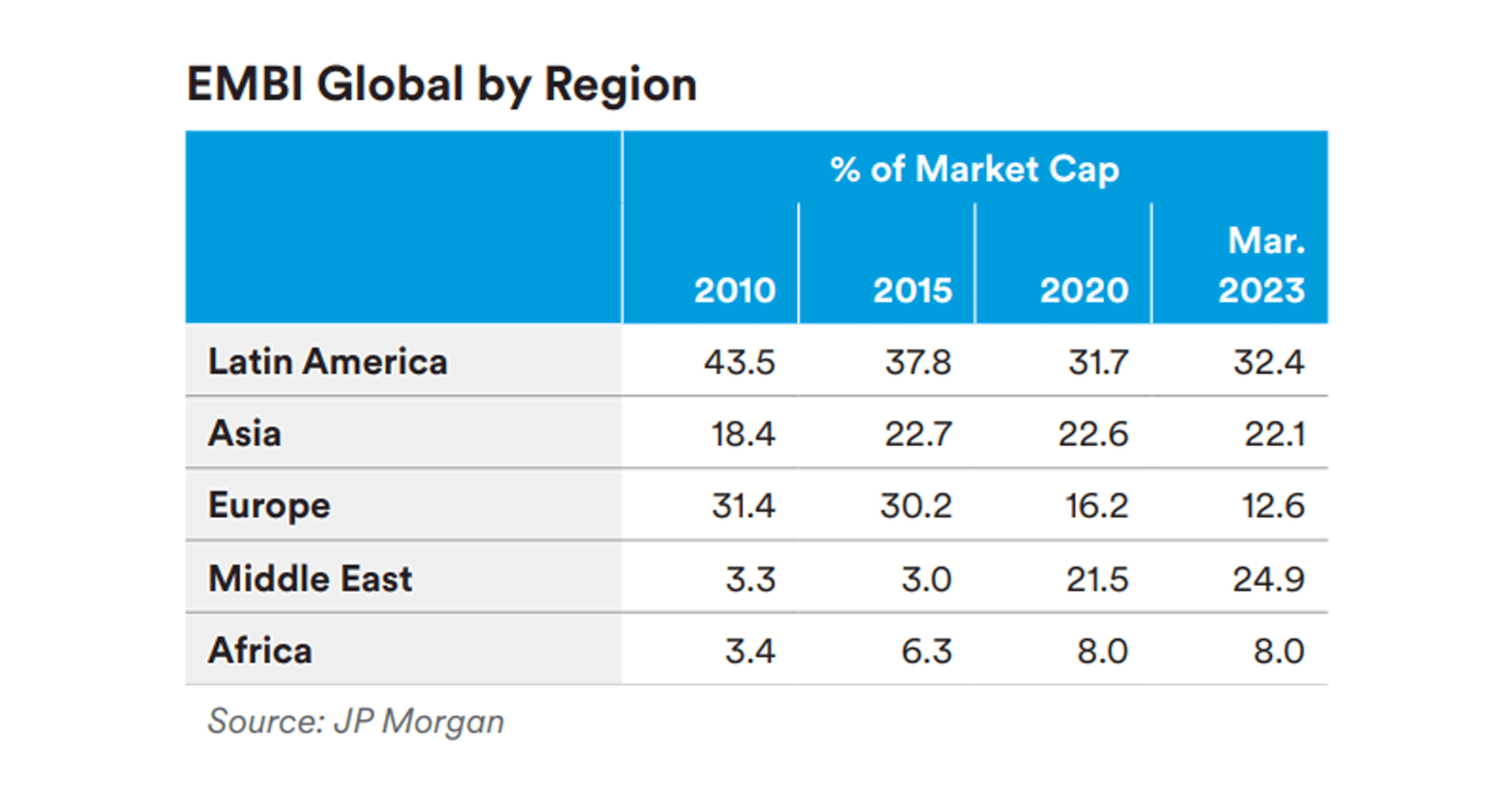

The composition of EMBI issuers has expanded and evolved, resulting in 78 sovereign and 80 quasisovereign issuers. The biggest increase was seen in the middle east as mentioned previously, and we also highlight the notable increase in Sub-Sahara Africa, with 10 new issuing countries added since 2010 (for a total of 16) and an EMBI market cap of 8% (up from 3.4%). Meanwhile, the CEE/CIS9 region posted the biggest decline from 31.4% to 12.6%, mostly due to a regional bias to issue bonds in euros, which aren’t captured in the USD EMBI.10

EMBI quasi-sovereign issuers have more than tripled to 80 names and currently 23.5% of index weight. There is some notable concentration here, with outsized participation in the index from China (6.1%), Mexico (5.1%), United Arab Emirates (2.6%), and Indonesia (2.3%).11

EM universe crossover opportunities: The EMBI includes over $1.3 trillion in outstanding securities, but this represents less than one fifth of the entire EM fixed income space when considering outstanding EM corporates ($2.6 trillion estimated) and index-eligible GBI-EM Global local currency bonds ($3.2 trillion estimated).12 We believe both corporates and local sovereigns, at times and selectively, are interesting crossover options for EMBI investors as an extension of the same sovereign risks we take in the hard currency space.

Endnotes

1 Excludes Russia and Belarus

2 Source JP Morgan

3 We understand that most investors typically benchmark against the EMBI Global Diversified index, which caps larger issuers. However, when assessing the overall universe, we believe the EMBI Global is the most representative, with minor differences in the composition of the two indices.

4 Source JP Morgan

5 Source JP Morgan

6 Information in this section sourced from JP Morgan

7 Default number includes Ukraine, which has remained in standstill since mid-2022, effective until August 2024.

8 Source JP Morgan

9 CEE region includes Central and Eastern Europe, CIS region represents the Commonwealth of Independent States

10 Source JP Morgan

11 Source JP Morgan

12 Source JP Morgan

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment.

Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities. For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/ third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC.