Underwriting, negotiating, documenting and monitoring these investments is labor intensive. Extensive relationships with issuers, deal sponsors and bank agents are the key to sourcing transactions and building a diversified and well-structured portfolio with attractive yields. As an investment grade asset class offering a range of maturities from as short as 3 years to as long as 30 years or more, private placements are an attractive fixed income investment for insurance companies, pension funds, and other institutional investors.

What is Privately Placed Debt?

Under the Securities Act of 1933, any offer to sell “securities” in the United States must either be registered with the Securities and Exchange Commission (“SEC”) or the bond offering must meet certain qualifications to exempt the bonds from such registration. If such exemptions are met, issuers are permitted to offer and sell their bonds in the private market to accredited investors without registration.

Private placement debt is akin to a cross between a bank loan and a public bond. Deals allow for upfront due diligence, engagement with the borrower, and contain financial covenant protections, while also offering a fixed maturity date and fixed rate coupons. Issuance is typically documented in either note or loan format.

The private placement debt market allows companies to raise capital without the need to meet the legal and financial requirements of the public market. This can be seen as attractive for unrated public companies with limited access to other capital markets, borrowers who do not want to widely publicize their financial statements, companies whose financing needs are small and therefore do not justify the costs of a typical SEC registration or companies wishing to have greater flexibility over the terms of their debt offering.

Both medium-sized and large companies access the private placement debt market. Oftentimes, they do so to diversify their funding sources away from the more traditional banks or public market, or to simply supplement other funding options. During times of market dislocation, many corporations come to appreciate the value of having a wide variety of financing sources, including the private placement debt market.

Private placement debt securities have characteristics of both the public bond and commercial bank loan markets as described below:

Characteristics of the Private Placement Market

- Estimated 2023 issuance of over $100 billion in over 275 transactions1

- Average deal size of $324 million, including 12 deals of $1 billion+2

- Buyers are typically insurance companies, pension funds, or other long-term oriented investors

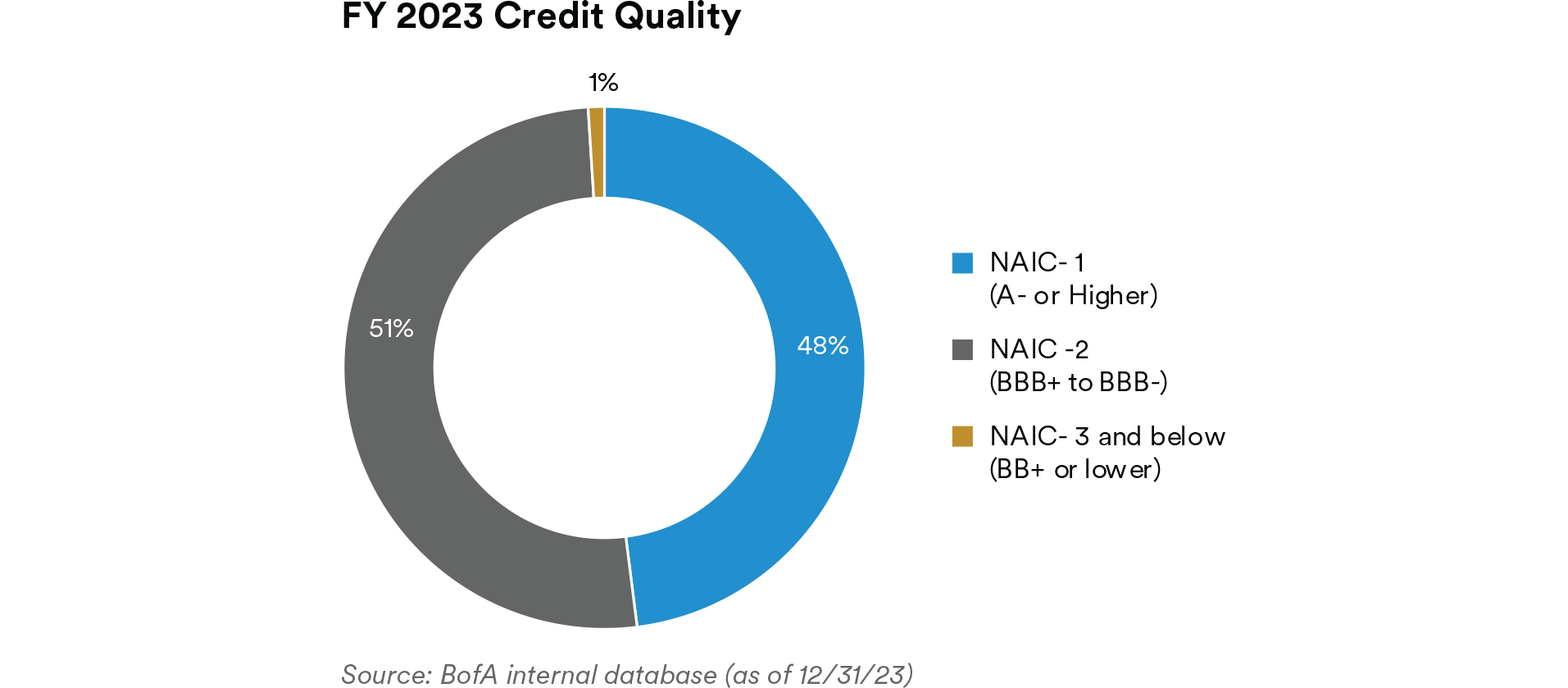

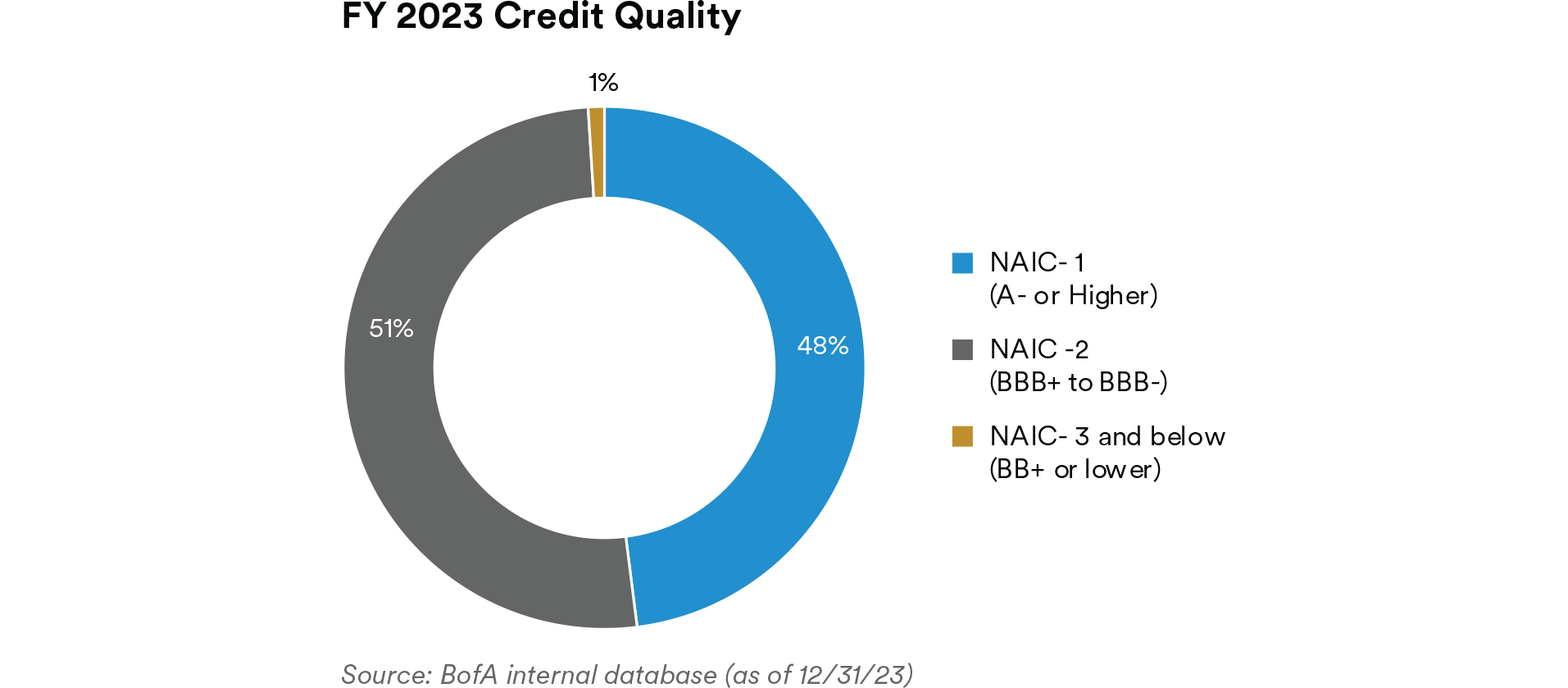

- Primarily, although not exclusively, an investment grade market3

- Intermediate to long-term maturities; mostly fixed rate

- Protective financial covenants that are typically not available in the public market

- Consistent demand for non-USD currencies

- Uses model form of Note Purchase Agreement (“NPA”)

- Physical settlement vs DTC or Euroclear

Market Size – Issuers in the private placement debt market are able to raise a significant amount of capital with deals ranging from $25 million to well over $1 billion in size. Total issuance in this market is estimated at around $100 billion annually;4 however, many transactions are negotiated directly between the borrower and the investor and are not always captured in the market statistics. Therefore, the true size of the market is probably even greater.

2023 reported issuance in the private placement debt market was $90.7 billion based on preliminary data, with over 275 deals completed5. The final tally is expected to be over $100 billion6.

Average Deal Size – The average deal was $324 million for 2023.

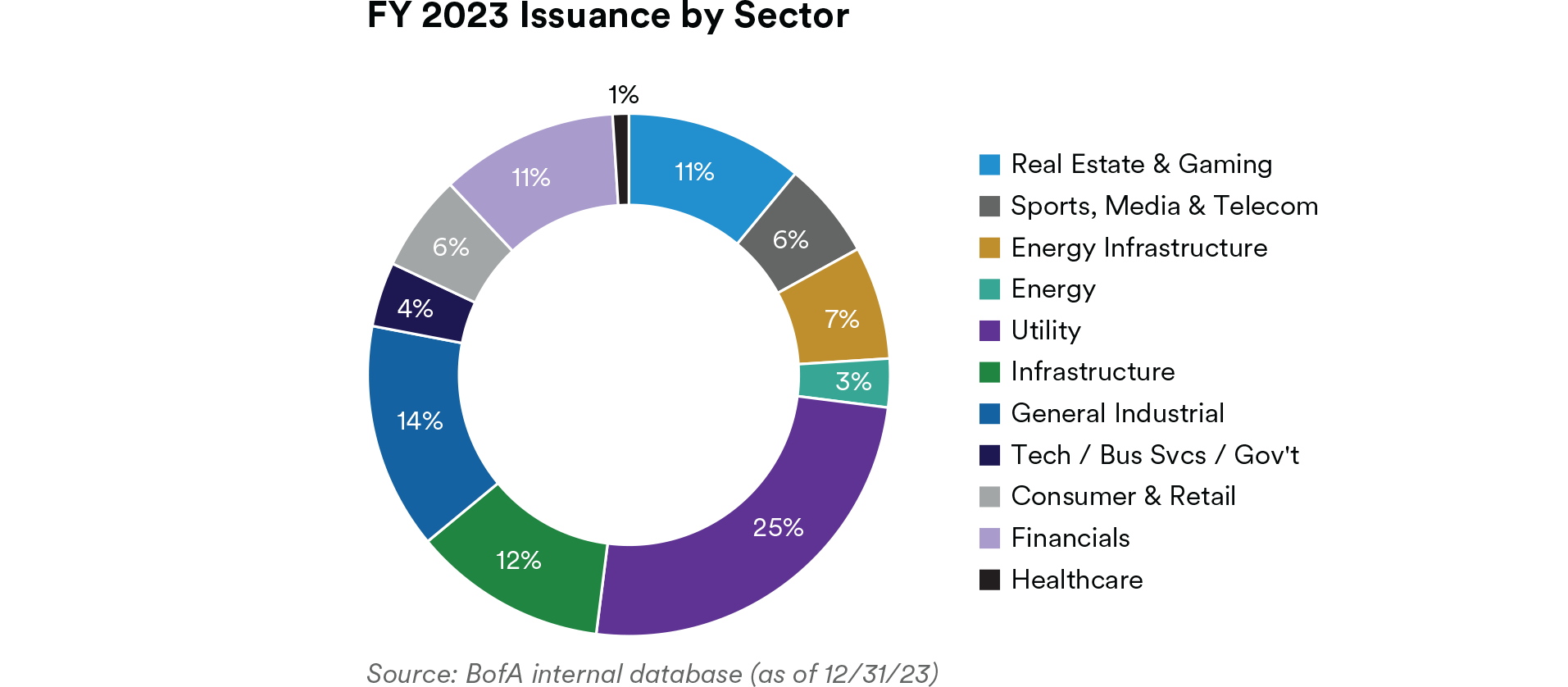

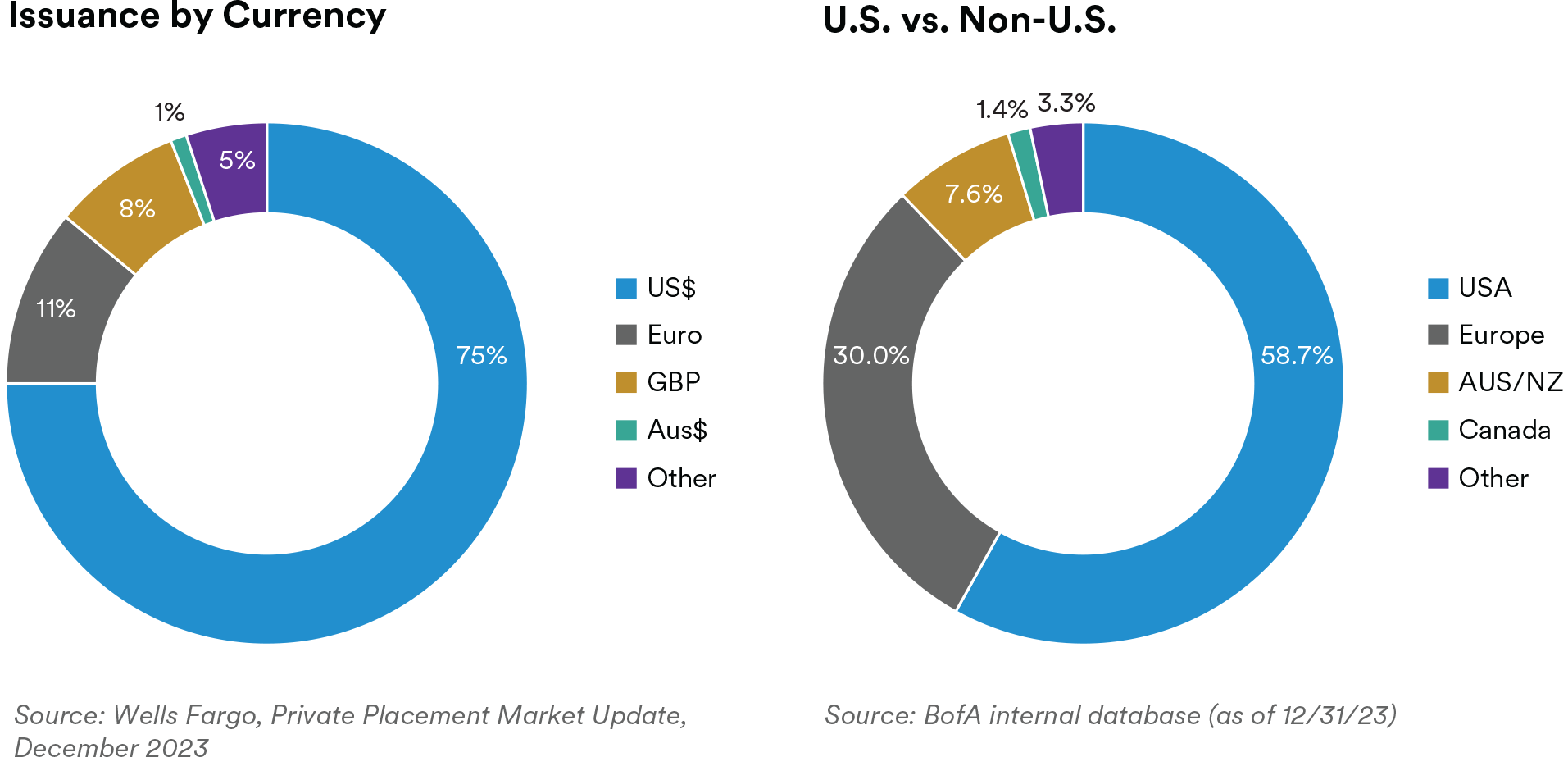

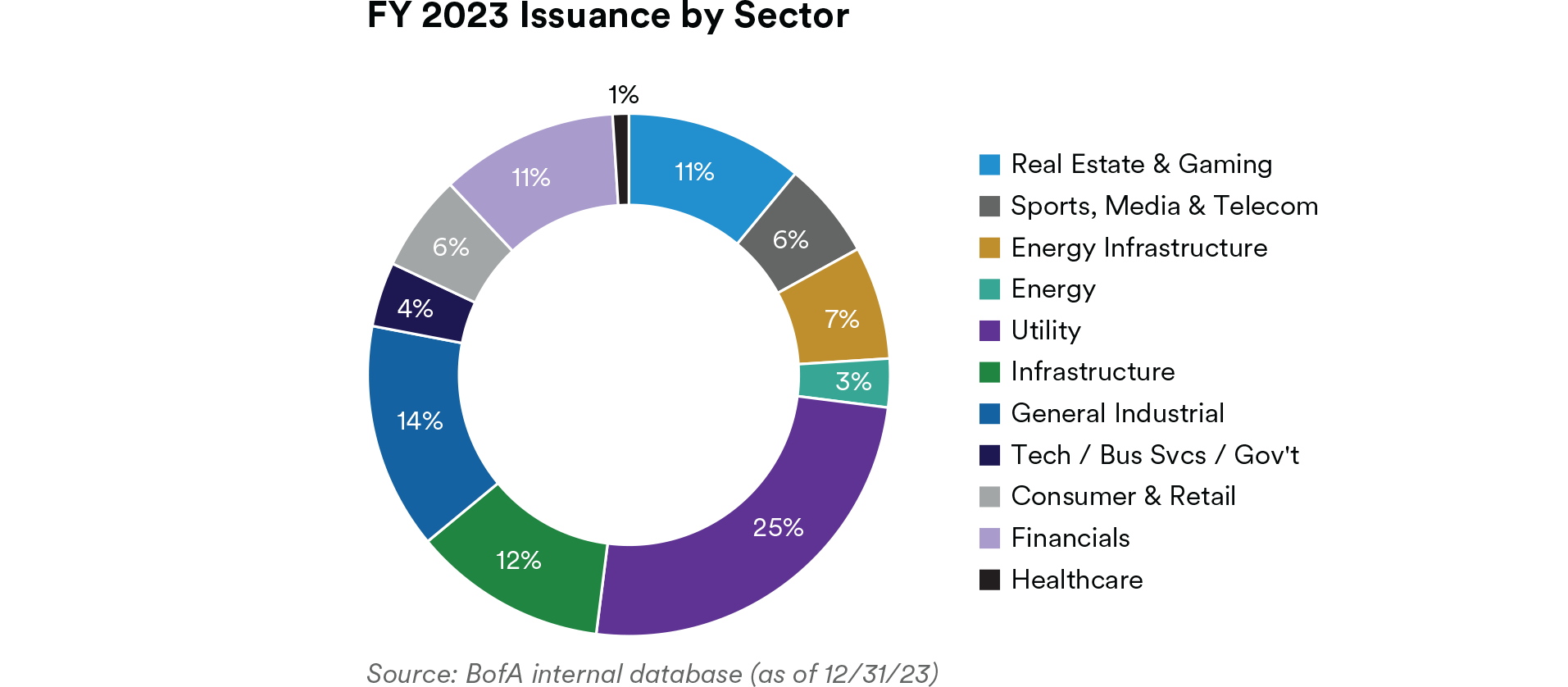

Sector Diversification – The mix of sectors available in the private placement debt market offers excellent diversification compared to the US IG Corporate Index.

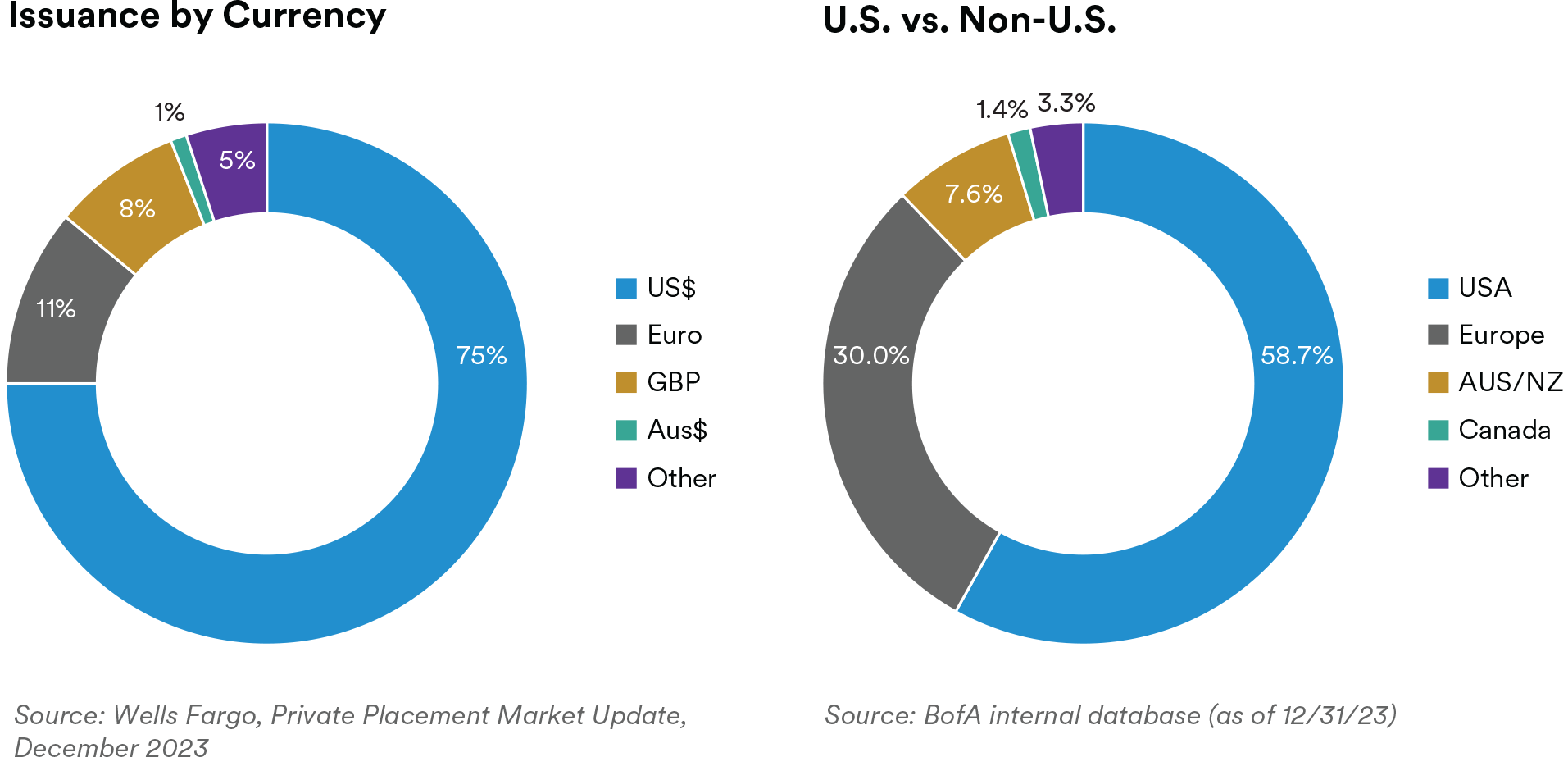

Currency – The private placement debt market is still weighted towards USD issuance. However, foreign currency has become an increasingly important component of issuance as the market has evolved.

Geographic Diversification – Private placement debt issuance by companies domiciled outside the USA has increased over time. The ‘cross-border’ volume is primarily from developed markets such as the UK, Europe, Australia, and Canada.

Quality – Primarily an investment grade market, overall 2023 private placement debt issuance was comprised of 48% NAIC-1 (rated A- or higher), 51% NAIC-2 (BBB+ to BBB-) and a limited amount of below investment grade (BB+ or lower).7

Maturity – Average maturities in the private placement market are around 11 years with 2023 seeing less long-dated issuance than prior years, a consequence of higher market rates.

Sourcing – The majority of private placement debt transactions are brought to the market by investment bankers who offer them on an agented (not fully underwritten) basis. However, certain larger investors like MIM complement agented deals with deals originated directly, leveraging strong relationships with issuers built over many years. Directly originated deals can provide numerous benefits to a portfolio, including greater diversification, improved allocations compared to agented deals which are often oversubscribed, and greater ability to tailor transaction terms to suit investor preferences. In addition, the close relationship with a borrower’s management and/or ownership developed during the direct deal process can be very helpful in monitoring the credit’s performance and can lead to future exclusive investment opportunities. Long-term partnerships between a borrower and its lenders are often formed in this market and valued by both parties.

Buyers – Historically, the principal buyers of private placement debt were mainly life insurance companies. Today, however, pension investors are showing growing interest as private placement debt is seen as a complement to the public fixed income component of pension fund portfolios. Private placements are valued for the diversification they bring, the upfront spread premium to comparable public bonds, and the downside protection afforded by financial covenants.

Ratings – Borrowers are not required to obtain ratings from a rating agency in order to issue debt in the private placement market. Most investors assign their own internal rating to each transaction and therefore do not require or need an issuer to have an external rating. However, issuers with an external rating, public or private, still account for a significant portion of total market volume.

Documentation – Most private placement transactions begin with what is known as the “model form loan agreement” to make the process more efficient. The model form contains boilerplate language on all important provisions such as representations and warranties of the issuer and the lender(s), reporting requirements and other affirmative covenants, etc. From this starting point, each deal is then privately negotiated with assistance from both internal and external counsel. Financial covenants, for instance, are tailored to each unique transaction.

Why do Companies Borrow via the Private Placement Debt Market?

- Diversification of funding sources

- Can customize the issue (size, maturity, funding date, currency, amortization)

- Longer maturities available than in bank market

- No need for external ratings

- Lower all-in costs vs. public market

- Standardized loan documentation templates

- Confidentiality / Privacy

- Other considerations (size, structure, story credits, etc.)

Diversified Funding Sources – Lessons learned during times of market dislocation have led borrowers to appreciate a wider variety of funding vehicles, including the private placement debt market.

Customization – Borrowers have the flexibility to issue in sub-benchmark size; choose amortizing or bullet maturity structures; customize the maturity profile to fit into their existing debt maturity schedule; issue in various major currencies based on their needs; and select either fixed or floating rate formats. Delayed funding draws are also possible in the private placement market, allowing issuers to lock in today’s rates for an additional charge, subject to investor demand.

Longer Maturities – While bank loans are typically 5-7 years or shorter, private placement financing can give issuers the opportunity to borrow up to 30 years or longer.8 These longer maturities may allow the issuer to more appropriately match their liabilities to the useful lives of their assets.

No Need for External Ratings – In most cases, the private market does not require such ratings as most buyers maintain an internal team of credit analysts who assess the credit and establish internal ratings for each issue.

Cost Savings – Borrowers seeking private placement debt capital can save the time and legal fees associated with filing a registration statement. Cost savings are also available if an issuer chooses to forego external debt ratings. Further savings are possible if the borrower chooses to negotiate directly with an investor rather than hiring a bank agent to market the transaction.

Standardized Documentation – The private market utilizes “model” forms to document transactions. These templates contain standard provisions and provide an efficient starting point, reducing the need for lengthy and costly negotiation.

Confidentiality – While investors expect to see financial statements of the borrower on a regular basis, the dissemination of that financial information and other proprietary company information is required to be submitted only to the lender base, not to the broader market. This may be particularly appealing to privately held borrowers or companies who are in the midst of an acquisition and are interested in lining up their financing prior to the market’s knowledge of the transaction. Confidentiality provisions are typically part of the loan documentation, restricting noteholders from sharing such financial information with the public.

Why Invest in Private Placement Debt (vs. Public Bonds)?

- Diversification of issuers and geographies vs. public market

- Senior position, pari passu with other senior lenders such as banks

- Downside protection – affirmative and financial covenants

- Economics – Spread over public bonds – Lower historical losses – Incremental income

- Asset liability matching

- The ability to conduct in-depth due diligence on borrowers, including on sustainability

Diversification – MIM estimates less than 10% overlap in issuers between our private placement debt portfolio and the US IG corporate bond index. Therefore, the private placement market expands the universe of investment grade lending opportunities and can help add valuable diversification to a fixed income investor’s portfolio. On a geographic basis, in recent years private placement debt issuance from outside the US has been approximately 40% of total volume.9

Seniority – Typically, private placement debt occupies a senior position within an issuer’s capital structure and ranks pari passu to other senior creditors such as bank debt. Private placement debt also has financial covenants that may allow the private debt investors to be in voice ahead of public bond noteholders. This factor has proven beneficial in stressed market conditions as financial covenants serve as an early warning signal, potentially increasing recovery rates.

Downside Protection Features – Financial covenants are a critical feature of the private placement market and an important difference relative to the public bond market. These covenants are similar to those on the issuer’s bank facilities and enable the private placement lenders to have an early discussion with issuer management when a business underperforms or is going through some type of capital structure change. They are designed to ensure pari passu treatment relative to other senior lenders such as banks (i.e., protect against subordination), and alongside other limitations on certain actions of the issuer, help increase the probability that the notes will be paid.

Economics – The potential economic benefits for investors looking at private placement debt as an asset class are:

- Spread: There is usually a higher yield offered on private placement debt vs public bonds of similar credit quality to compensate investors for the reduced liquidity. This incremental spread varies over the full market cycle and is subject to a number of factors such as supply/demand dynamics and market fundamentals.

- Lower historical losses: Due to the financial covenants and other structural protections on each individual private placement debt issuance, historical loss rates have been favorable vs. comparable investment grade public debt. Private placement debt has a 14% absolute advantage in ultimate recovery rate for senior unsecured debt versus public bonds, according to a 2019 Society of Actuaries study.10

- Incremental income potential: The structural protections offered on private placement notes may provide investors with additional income. When a borrower’s business underperforms, or if leverage rises due to a large dividend payment or ownership change, it may request that lenders temporarily loosen financial covenants in order to remain in compliance. In return, lenders may negotiate amendment fees, coupon bumps, or mandatory prepayments, depending on the severity of the situation. Negotiations may also allow private placement lenders to protect their position with new temporary or permanent enhancements to terms. Make-Whole amounts due upon prepayment of debt above the market value of the notes can also offer additional income. We believe that over time, the combination of lower losses and incremental income can add to private placement debt’s favorable economic value versus public bonds.

Asset–Liability Matching – Many investors in the private placement debt market require long-term credit securities with fixed cash flows that they can match against their liabilities. The longer duration and typically higher yielding issues of the private placement debt market vs the public bond market make the asset class a natural home for liability matching investment strategies.

Additionally, a standard feature of private placement debt is call protection that allows an issuer to call the bonds only with Make-Whole (i.e. at a price that protects against reinvestment risk), thereby protecting the investor’s cash flow.

Active Secondary Market – Investors in the private placement debt market tend to be long-term buy and hold investors. It is this long term buy and hold nature that gives rise to the perceived illiquidity of the market. This is more a function of the reluctance of noteholders to sell rather than a lack of interested buyers. MIM is an active secondary market participant and estimates volumes of about $2.5 billion to $3.0 billion are traded annually in the private placement debt secondary market.11

Due Diligence – Private placement debt transactions, owing to their structure and covenant protections, are usually negotiated over a longer period than typical public bond transactions.

This enables investors to conduct in depth due diligence on the borrowers, generally over a period of weeks. In addition to an introductory “road show” conducted in person or via conference call, investors also benefit from an in person due diligence meeting prior to funding their investment.

This latter meeting typically involves an on-site visit to the company’s headquarters or principal manufacturing facility as well as access to a wide spectrum of senior management. This provides the investor with substantial opportunity to build up a detailed understanding of the company as well as establish a relationship with issuer management. The relationship-based nature of the private placement debt market creates opportunities for borrower engagement on sustainability and ESG risk factors, too.

What Skills and Resources are Needed to Invest in USPPs?

- Credit and underwriting

- Legal and documentation

- Pricing comparisons

- Relationships to source deals

- Support services / infrastructure

Potential investors in the private placement debt market should be aware that investing in this asset class is labor intensive. Investors in these deals are skilled in the above areas or tend to outsource their private placement debt investing to others who have the appropriate relationships and skill set.

Credit and Underwriting – The ability to undertake the necessary credit analysis to determine whether or not an opportunity is a money-good investment is a key requirement. In-depth analysis of the specific issuer and the industry in which it operates are critical determinants of whether an investment opportunity is suitable and attractive. Assigning an internal credit rating to the transaction is an important step in evaluating private placements as oftentimes the issuer does not have ratings from a rating agency.

These skills are not only useful at the onset when the initial “buy” decision is made, but also on an ongoing basis in order to effectively monitor the investment, follow up with questions of management when performance is not as originally contemplated, to negotiate amendments (if any) over the life of the investment, and to potentially make “sell” recommendations if warranted. A strong risk management culture embedded in the organization is necessary in order to effectively manage credit risk and exposure. MIM further believes that a local market presence, with offices in various countries and regions, offers the advantage of being closer to the borrower and the benefit of local knowledge.

Legal and Documentation – Evaluation of the terms, covenants and conditions of the bonds are critical to ensuring that the purported protections are indeed in place. External counsel representing the entire investor group to make sure that the business agreement is satisfactorily documented is important. Most asset managers also have in-house counsel who look after their investors. It is critical to have experienced analysts and legal staff to negotiate key provisions such as financial covenants and default language.

Pricing Comparisons – The ability to evaluate the suggested pricing on the private placement debt transaction relative to other opportunities in the public and private markets is important to ensure that the deal is priced appropriately for the risk involved and offers sufficient relative value.

Deal Sourcing Relationships – Deals are obtained both through investment bankers as well as through opportunities directly negotiated with the borrowers. Extensive relationships with both sources are essential to ensuring good access to deal flow. Not all investors supplement their banker deal flow with transactions that they directly negotiate with borrowers; however, those who do find it an important source of attractive transactions which add diversification and typically more meaningful allocations.

Support Services / Infrastructure – Of course, it is essential to have support to handle various and sundry items such as insuring receipt and review of periodic financial statements and newsworthy items, tracking wire payments between the borrower and the investor, interacting with regulators on ratings (if applicable), pricing the portfolio, handling amendment requests, etc.

Myths about the Private Placement Debt Market

- It is a below investment grade market

- There is no liquidity in the asset class

- Pricing is opaque

Credit Quality – In recent years much of the attention in private credit markets has focused on below investment grade segments, particularly as investors reached for higher yields following the global financial crisis. The private placement debt market, however, is mainly an investment grade market, offering an upfront yield pickup to comparable investment grade public corporate bonds.

While historically it may have been the case that only small to medium sized companies sought capital in the private placement debt market, this has not been true for many years. The market has seen large companies with household names turn to private placement debt for capital and is seen as a viable funding option for large multinational corporates.

No Liquidity – While private placements are less liquid than public bonds, it is a common misconception that private placement debt is completely illiquid. The principal reason for lower trading volume in the private debt market is that many investors are “buy and hold” investors and, therefore, there are more buyers than sellers. In reality, there is a well-developed secondary market for private placements, with annual volumes estimated at $2.5 billion to $3.0 billion each year.

Pricing – Some investors, such as MIM, are able to provide daily mark-to-market pricing of their private placement debt portfolios. A market price can be determined by mapping the private placement debt instrument against the market yields of comparable public corporate bonds, similar in rating, tenor, industry, and geography, and adding a spread premium for the reduced liquidity in the private market. The resulting discount yield is then used to determine a price.

Conclusion

While there is very little press about the private placement debt market, it continues to grow and evolve and is an important source of funding for both corporations and infrastructure projects alike. And as an investment grade asset class offering the potential for higher income, lower historical losses, and credit and geographic diversification vs. comparable public bonds, private placements can be an attractive fixed income investment for insurance companies, pension funds, and other institutional investors.

Underwriting, negotiating, documenting and monitoring these investments is labor intensive and requires market expertise. Extensive relationships with issuers, deal sponsors and bank agents are the key to sourcing transactions and building a diversified and well-structured portfolio with attractive yields. We believe it is therefore critical to work with an experienced manager with a global presence and sufficient scale to take advantage of all this market has to offer.

Endnotes

1 Source: Private Placement Monitor based on preliminary data; MIM estimates.

2 Source: Bank of America USPP Market Snapshot FY23; Bank of America 2024 USPP State of the Industry Briefing.

3 Source: Bank of America 2024 USPP State of the Industry Briefing; MIM internal ratings.

4 Source: Private Placement Monitor; MIM estimates.

5 Source: Private Placement Monitor based on preliminary data; MIM estimates.

6 Source: Private Placement Monitor based on preliminary data; MIM estimates.

7 Source: Bank of America USPP Market Snapshot FY23

8 MIM estimates combined with information from Private Placement Monitor

9 MIM estimates combined with information from Private Placement Monitor

10 Society of Actuaries 2003-2015 Credit Risk loss Experience Study: Private Placement Bonds, April 2019, Section 2.5.4 Loss Severity.

11 MIM estimates, based on information compiled from secondary brokers.

DisclaimerThis material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

In the UK this document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of December 31, 2023, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC.