To operationalize these objectives the staff recommendation suggests that two additional RBC categories be created beyond the current sole category of 30% RBC: a 75% and a 100% RBC category. This component will be referred to separate groups inside the NAIC responsible for the framework of RBC categories.

Market participants may have many questions regarding this recommendation: why was it developed in the first place? What do we know so far, what’s missing, and what are the next steps? How may this recommendation look in practice, and how impactful will it be? We’ll attempt to answer these questions in the following sections.

Why Was This Recommendation Developed in the First Place?

Ever since the Global Financial Crisis (“GFC”) the NAIC has been looking for ways to reduce its reliance on rating agencies as the sole mechanism to assess risk exposure in insurers’ portfolios, especially for structured securities. This broader objective was a key catalyst behind the development of the modeling approach to determine NAIC designations for RMBS and CMBS securities that was implemented shortly after the GFC.

Separately, the NAIC had engaged in a multi-year process to revise their long-standing framework of six RBC categories (“NAIC designations”) for insurer investments, and in 2021 it implemented a revised framework that increased NAIC designations from six to twenty. These new designations were developed based on the historical performance of corporate bonds. The NAIC identified other investments, including structured securities, as the target for a second phase of its RBC framework revision.

With these two elements as a backdrop, in late 2021 and early 2022 the NAIC started discussing alternative approaches to refining RBC for structured securities, including the expansion of the modeling approach currently used for RMBS and CMBS to other structured sectors. In response to the NAIC’s request for public comment on the alternative paths to determine RBC specific to structured securities, the American Council of Life Insurers (“ACLI”) submitted a comment letter supporting the review and recommending that the NAIC start with cash-flow modeling CLO securities to determine their appropriate RBC as a first step. The ACLI letter went on to recommend that a “no arbitrage” principle be applied to structured securities so that the RBC of the underlying assets in a securitization – to the extent they have a prescribed treatment – is comparable to the blended RBC of that securitization’s tranches.

On a parallel track, the NAIC had been discussing the appropriate way to assess RBC for residual tranches of securitizations. The regulator’s concern was that by securitizing assets an insurer may be able to significantly reduce the RBC of these assets while retaining essentially the same amount of credit risk. The confluence of all these factors led to the NAIC staff recommendation presented at their recent VOSTF meeting.

What Do We Know So Far, What’s Missing, and What Are the Next Steps?

Details regarding the NAIC staff recommendation to model CLOs for RBC determination are limited. At this point, the recommendation seems only directional in nature, and we believe the regulator is simply trying to understand if market participants see any fatal flaws with pursuing this approach. Assuming that the regulator doesn’t identify any insurmountable flaws with the recommendation we would anticipate that NAIC staff will be asked to outline more precise implementation plans to be exposed for comment and discussion in the coming months. Here are some of the details that we would anticipate NAIC staff begins to develop:

- Detailed scope. Will the modeling process be applied to all CLOs (i.e. Broadly Syndicated Loan CLOs, Middle Market CLOs, Hybrid CLOs, etc.), or only a subset of these? If the latter, how will the non-modeled CLOs be assigned NAIC designations? Will the process apply only to newly issued securities, or existing securities as well?

- Modeling parameters. What are the scenarios that NAIC staff will model and what probabilities will be assigned to each of these scenarios? What are the specific modeling variables that each scenario will use and how will these be determined? What system will be used for modeling?

- Process. What steps will regulated entities and NAIC staff need to follow for each modeling exercise? What format and details on modeling results be provided to insurers so that they can prepare their filings?

- Timeline. Will the modeling process become effective in 2023 or later? When will sample results be made available so that industry can understand (and discuss if needed) the impact of the proposed change?

The NAIC will hold its 2022 summer meeting the second week of August, and we think that the CLO modeling recommendation will likely be a topic of discussion at the meeting along with written comments that the NAIC will have received on the proposal. We anticipate that we’ll have much greater visibility on the path forward after this meeting.

How May This Recommendation Look in Practice, and How Impactful Will It Be?

There are still too many missing pieces of the puzzle to conclusively outline the true impact of the recommendation to determine RBC for CLOs via modeling. We do, however, have multiple clues from the NAIC’s modeling of RMBS and CMBS, and from the stress testing it has published based on insurers’ holdings of CLOs, that can help market participants make educated guesses on possible outcomes. In this section we offer one such educated guess that we hope may shed some light at least around the order of magnitude of a possible impact of the recommendation.

Scenarios and Model Variables

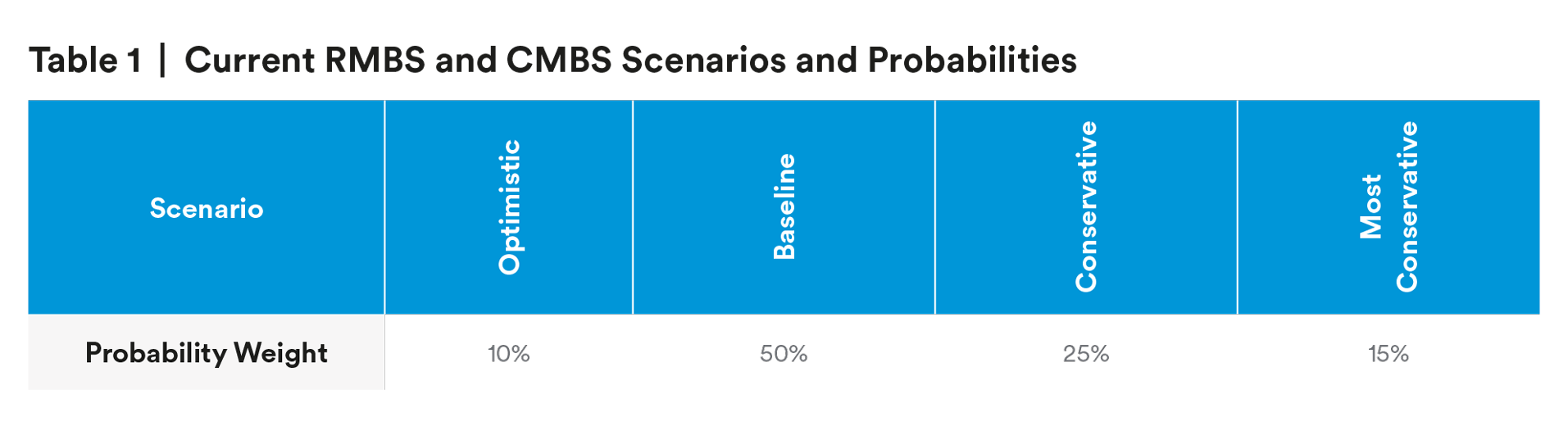

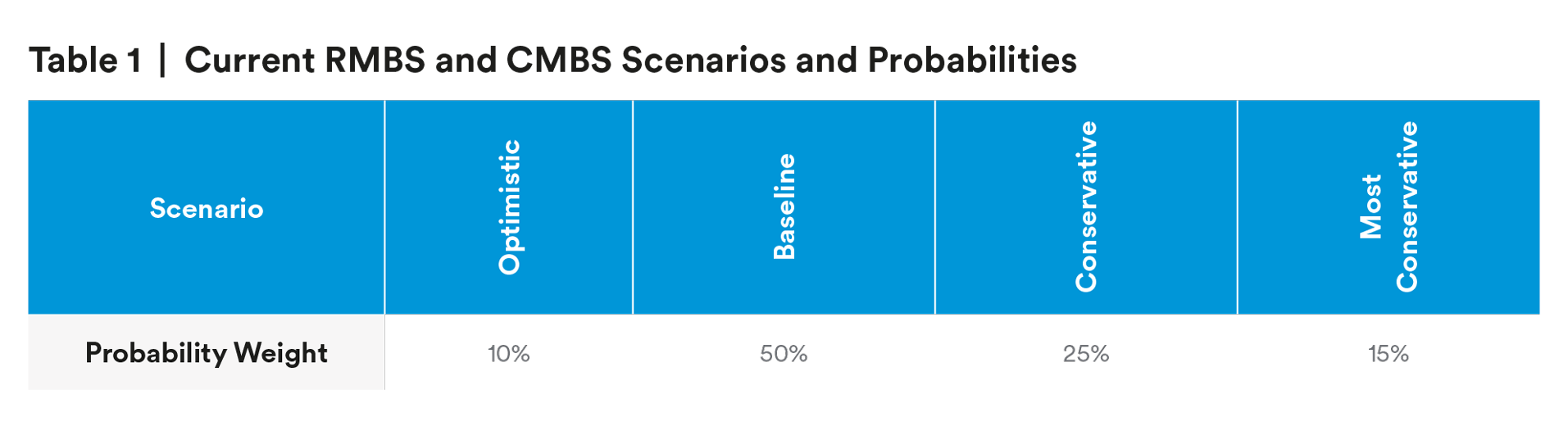

The NAIC staff recommendation indicated that they may consider eight to twelve scenarios for their proposed modeling. If the modeling of RMBS and CMBS can serve as a reference point, we know that the NAIC currently uses four scenarios with different probabilities assigned to each one as outlined in Table 1 below:

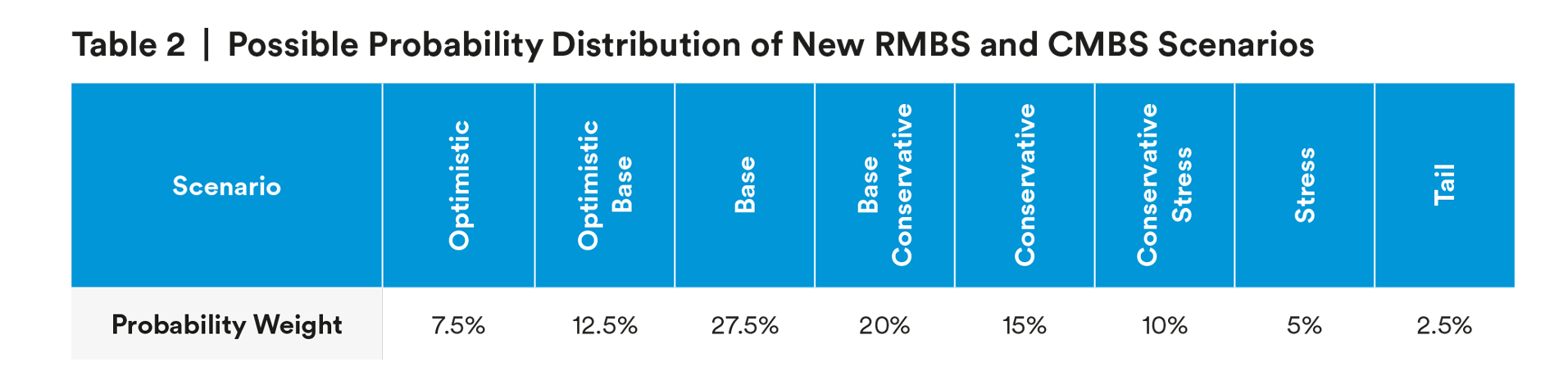

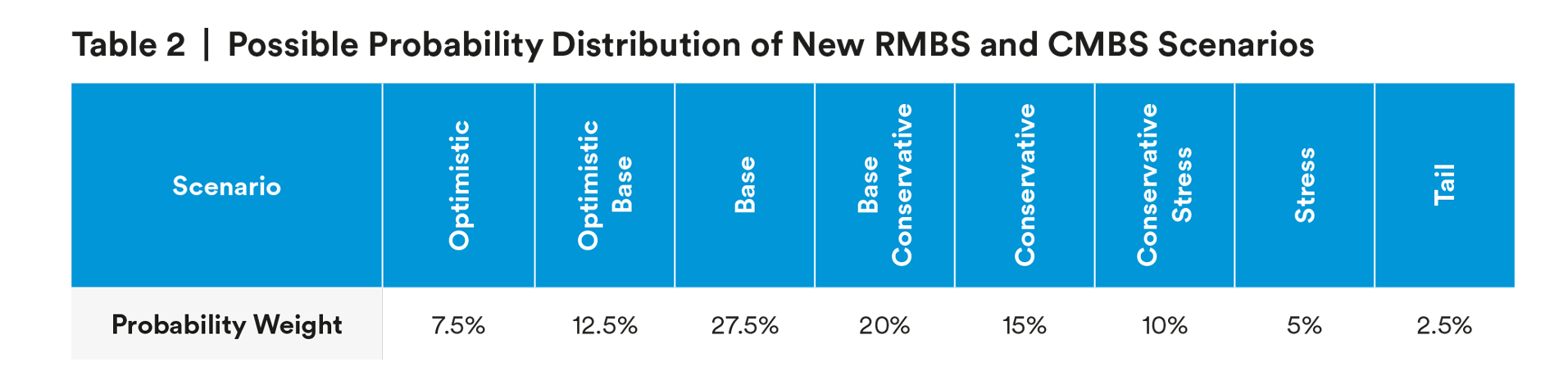

Based on materials discussed at the last VOSTF meeting, we also know that NAIC staff plans to add four additional scenarios for RMBS and CMBS modeling, for a total of eight scenarios expected for their 2022 modeling exercise. While the exact probabilities that each of these scenarios will carry is unknown, NAIC staff have provided some directional guidance that can help market participants estimate approximately what these may look like. Table 2 shows a possible interpretation of this guidance:

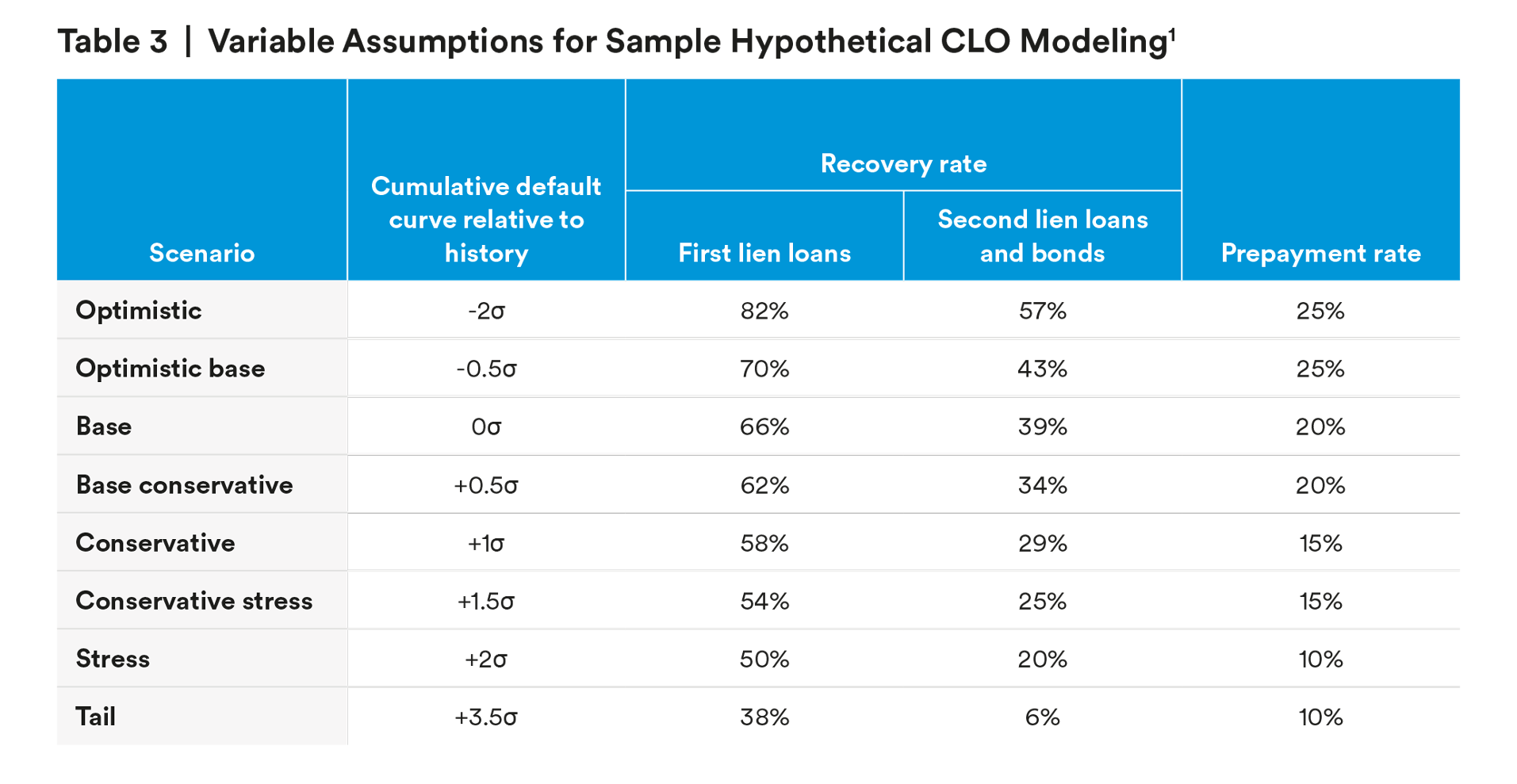

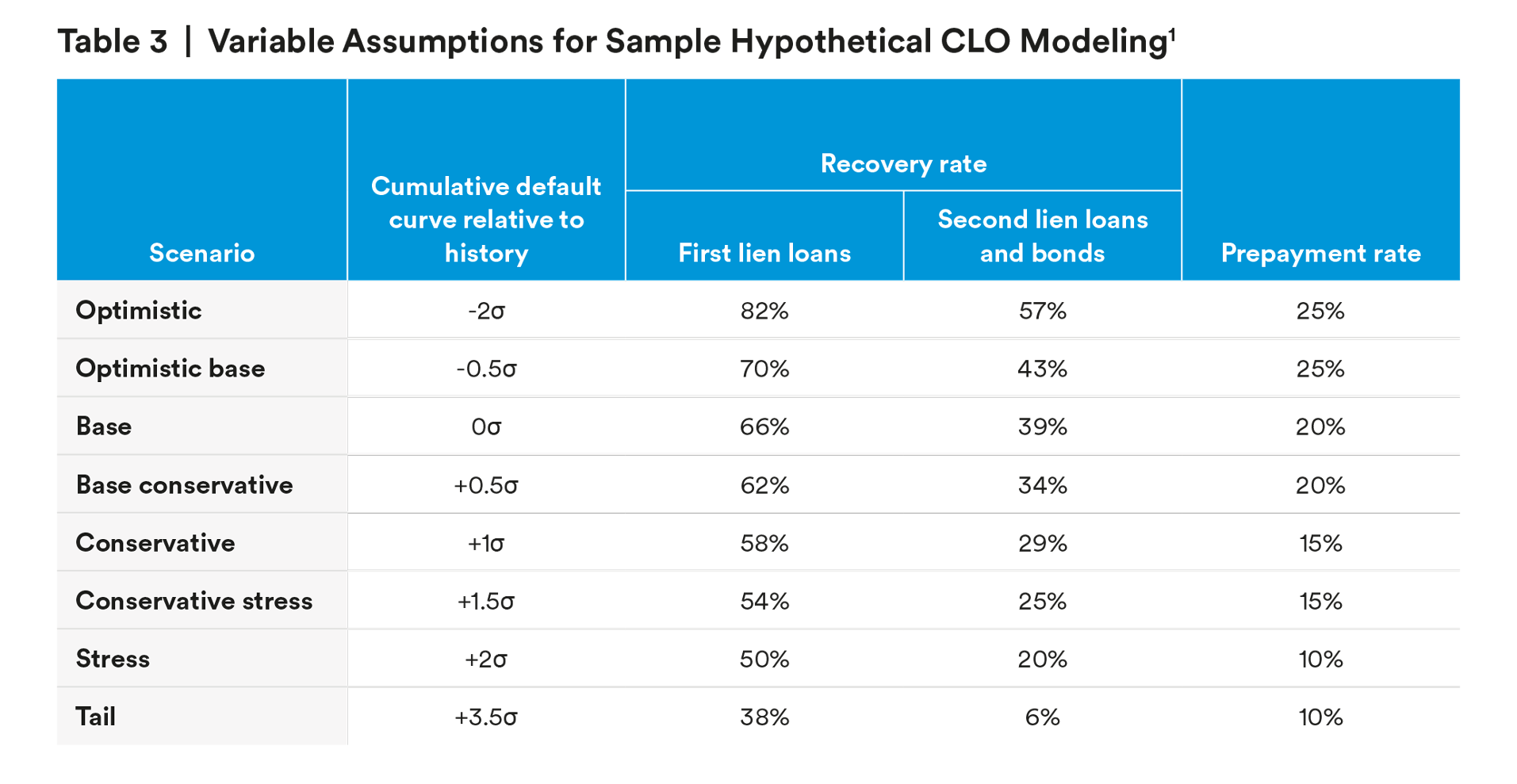

Since the NAIC staff indicated it would plan to use eight to twelve scenarios in an eventual CLO modeling framework, we used the above distribution of eight scenarios to model a hypothetical CLO deal using the variable assumptions outlined in Table 3:

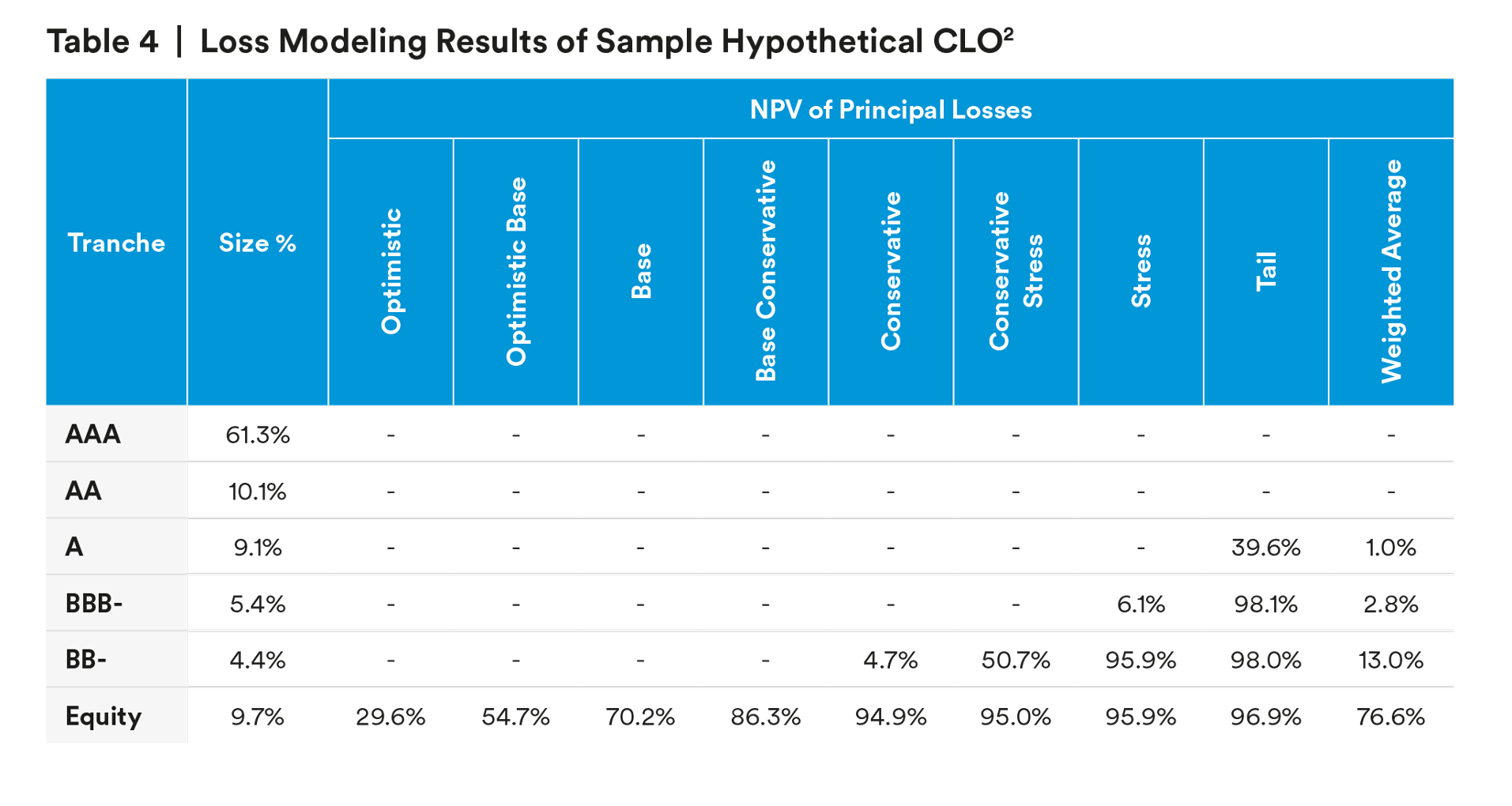

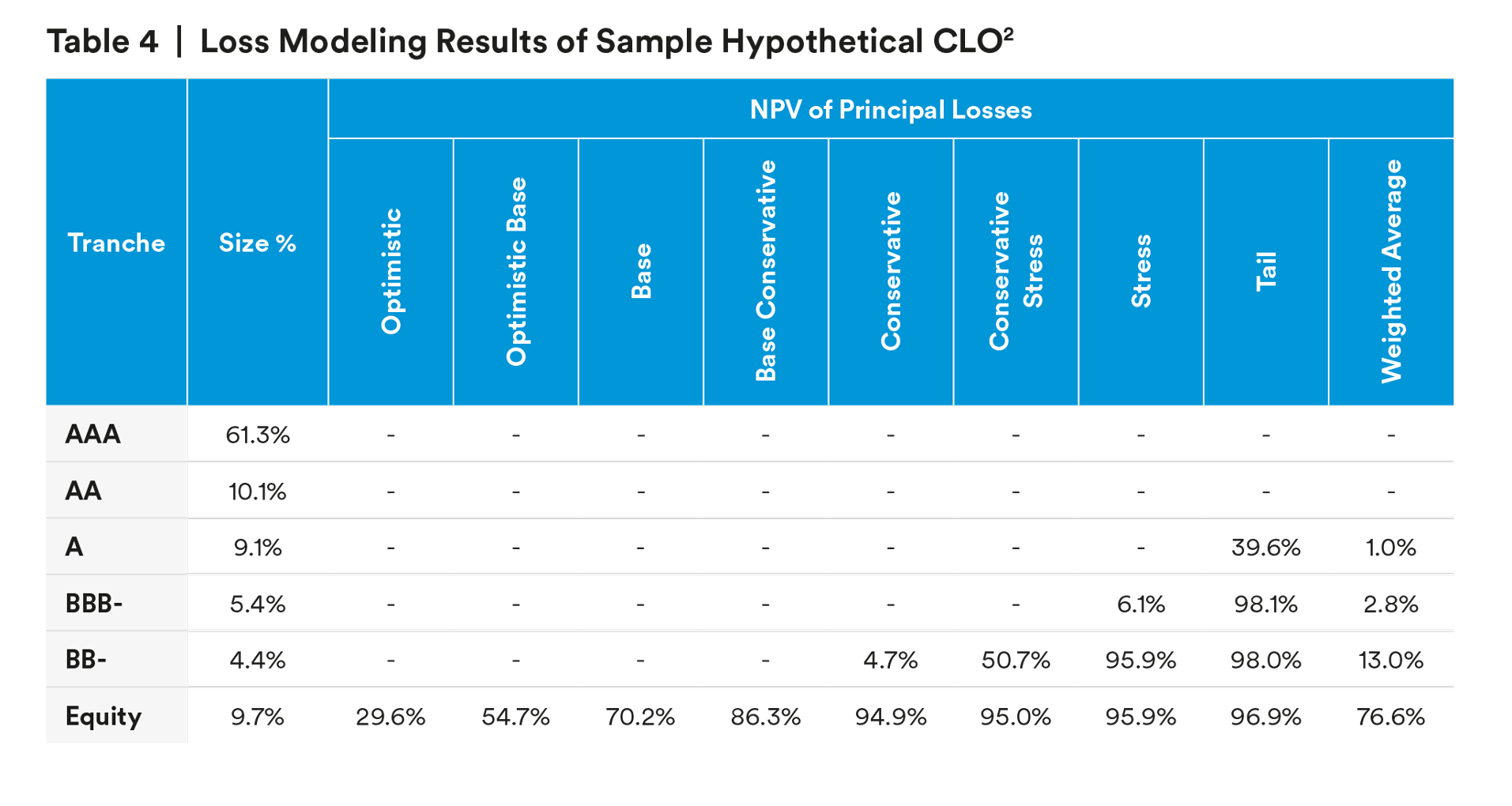

The default modeling was done based on the individual rating of each loan in the sample CLO using the Moody’s historical default curve for that rating – this is the same basic default curve methodology the NAIC used in their CLO stress testing analysis. The recovery and prepayment rates used were constant and reflect the same point in the distribution curve of historical rates applicable to each scenario. We used Intex to model our sample transaction using the variable vectors above, and found the results laid out in Table 4:

Quantifying the Potential Impact

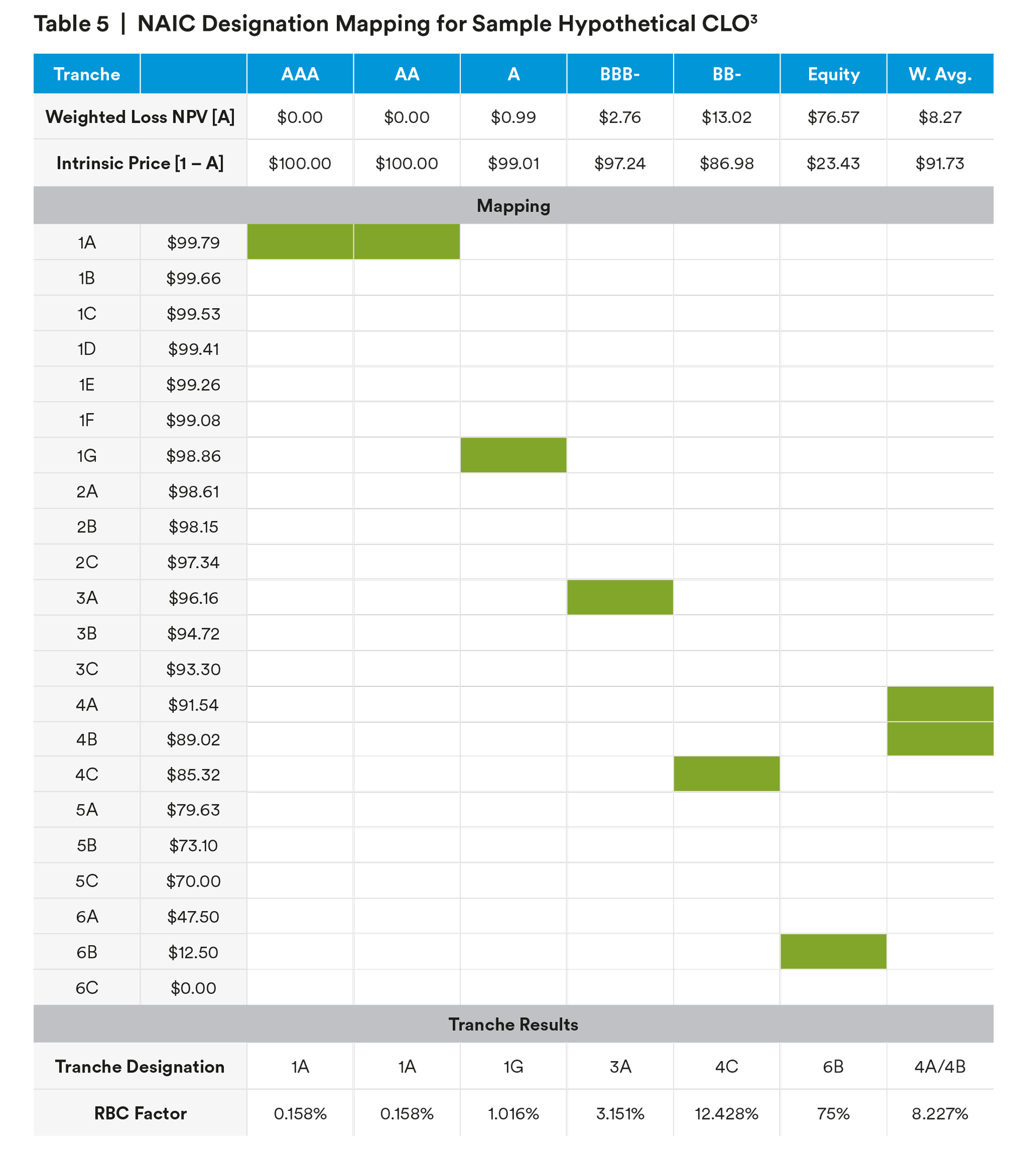

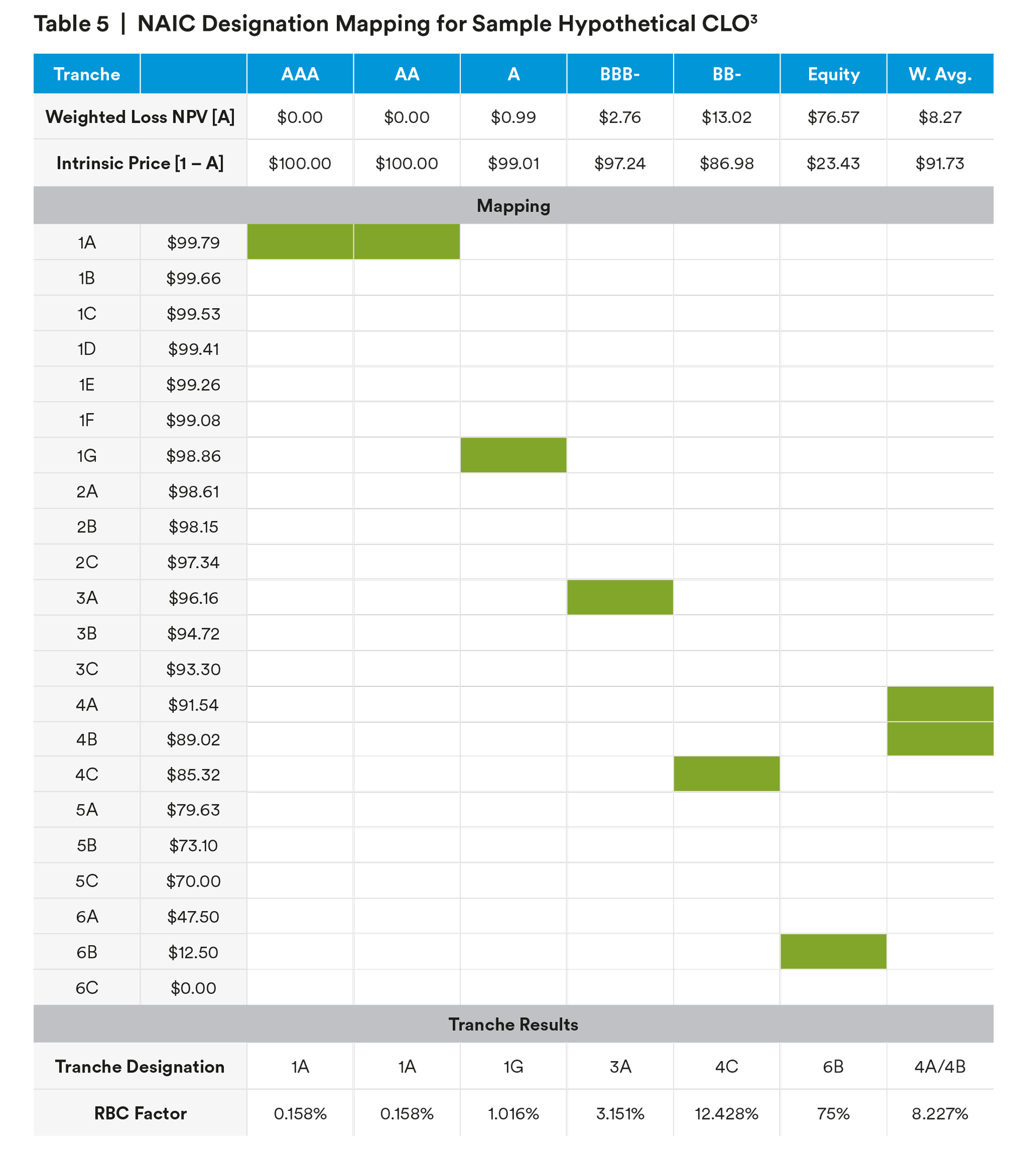

From these results we can easily use the NAIC’s intrinsic price mapping process and map out the weighted average net present value of principal loss of each tranche to an NAIC designation. To do that we would compare each tranche’s intrinsic price (i.e. par minus the weighted loss of that tranche) to the implied intrinsic price for each NAIC designation (i.e. par minus the midpoint RBC for the designation). Each security will map to the designation where the security’s intrinsic price is higher than or equal to the designation’s implied intrinsic price, but lower than the implied intrinsic price for the designation above it (details on that process can be found here). Table 5 below shows the mapping results for our sample CLO:

In the hypothetical example above we see that the AAA and AA tranches perform very well relative to other tranches, as would be expected given their robust structural protection, and map out to the 1A designation. The single-A tranche has a very small weighted average loss, which causes it to map to the 1G designation, and similarly the BBB- tranche drifts down one designation to 3A. The BB- and equity tranches, unsurprisingly, are most affected by losses and map out to 4C and 6B, respectively – it’s worth noting that the table above incorporates the new NAIC 6B and 6C from the staff recommendation for purpose of this analysis. On a weighted average basis, the full CLO structure has an RBC that maps between a 4A and a 4B designation and is much closer to the average designation of the collateral in this transaction which is 4B (i.e. collateral loans have an average single-B rating). As mentioned before, minimizing the gap between the RBC of the underlying collateral and the blended RBC on a CLO deal was one of the objectives of the NAIC staff recommendation.

We use a 2018 vintage CLO with a single-B average collateral rating for this hypothetical exercise because it had enough seasoning to show some collateral quality drift that may not be present in new transactions. While this deal can’t represent every CLO outstanding, we believe it can give us a sense for the orders of magnitude of the RBC impact on insurers that this NAIC staff recommendation could have.

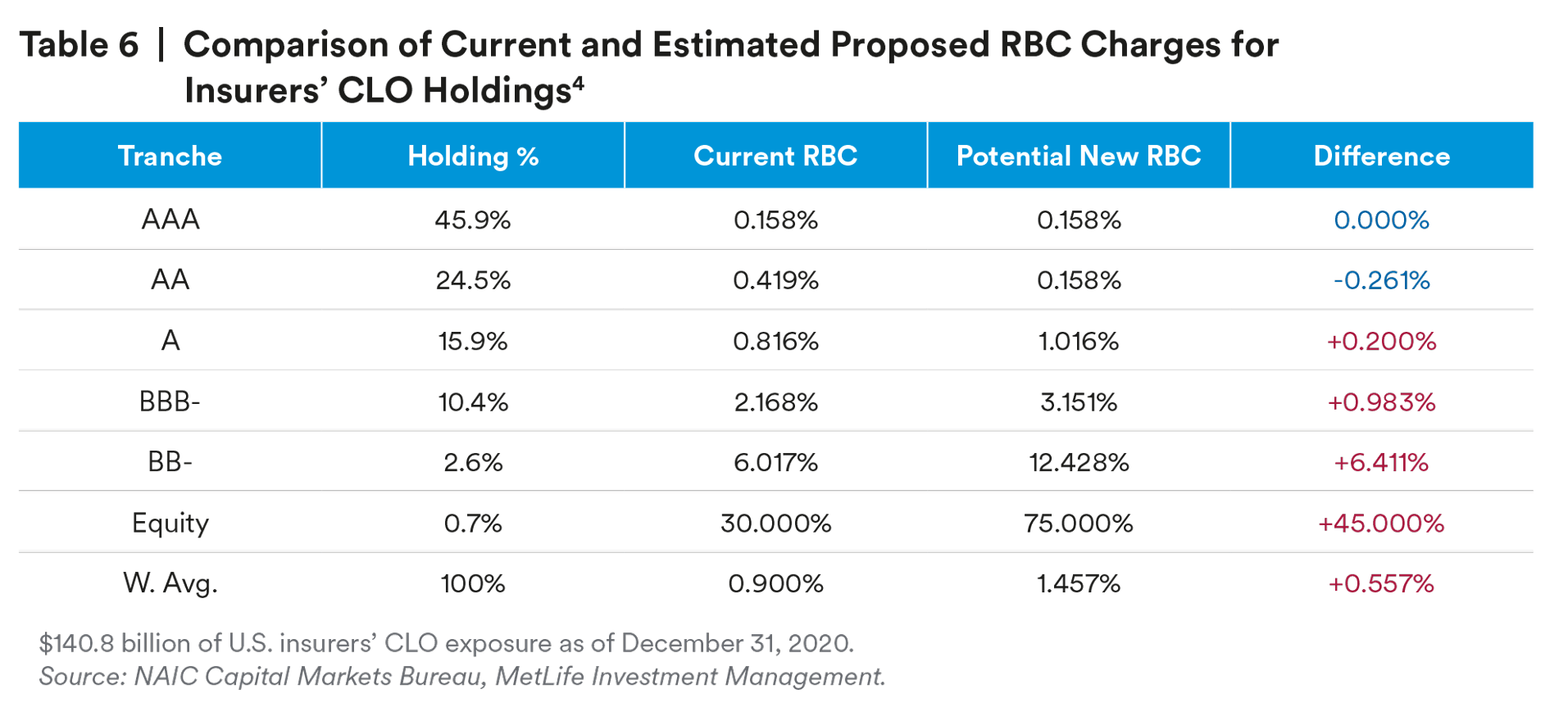

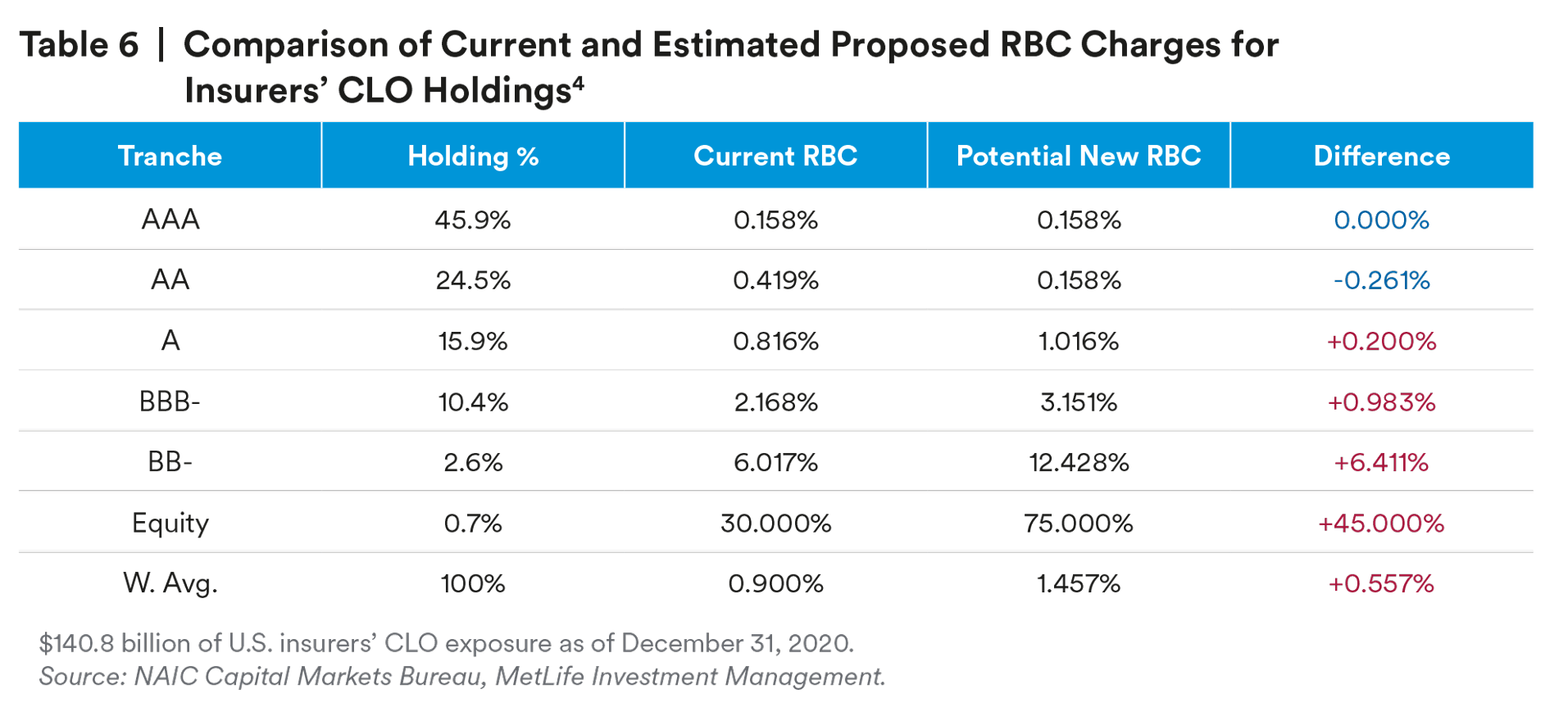

In Table 6 below we take the insurance CLO holdings that the NAIC Capital Markets Bureau considered as “in scope” for modeling in its latest published stress testing and calculated the industry’s percentage allocation to each rating category. We then use the current RBC methodology and the resulting RBC from our modeling of the sample CLO to show the magnitude of change in capital for the industry that this one transaction could imply:

From the table above we initially surmise that while the RBC impact of the proposed changes on specific tranches may be material, it’s much more modest for the broader CLO portfolios held by US insurers. As noted in the latest NAIC stress test of insurers’ CLO portfolios, US insurers’ exposure to this asset class is fairly small (2.6% of total cash and invested assets per the NAIC document), making the impact of this limited possible increase in RBC quite immaterial for the overall industry. But let’s dig in a little deeper into how insurers’ incentives surrounding the most adversely affected tranches may change.

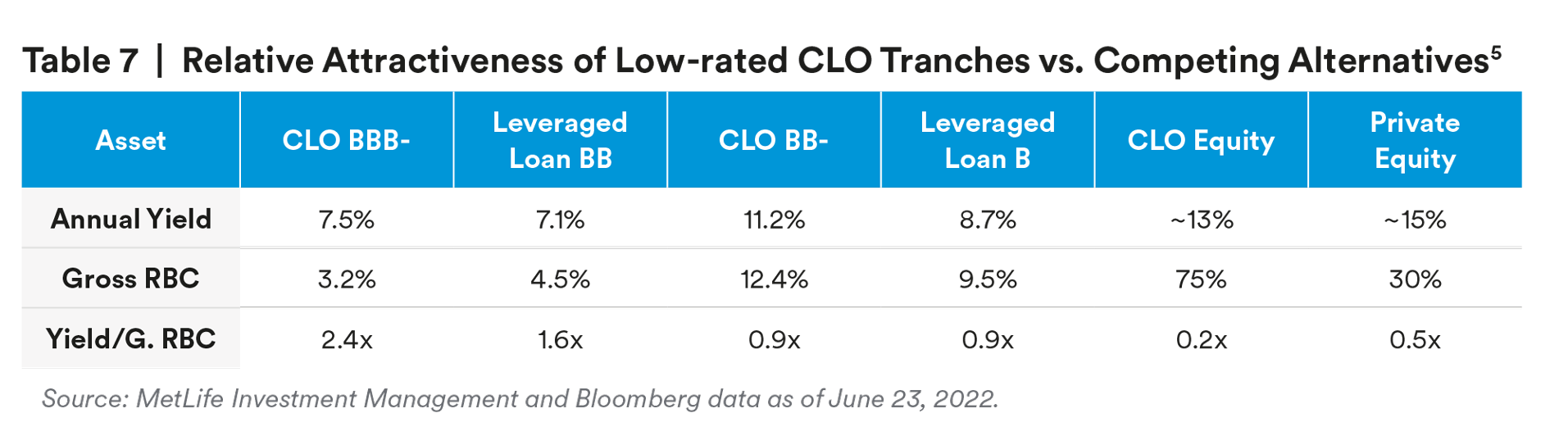

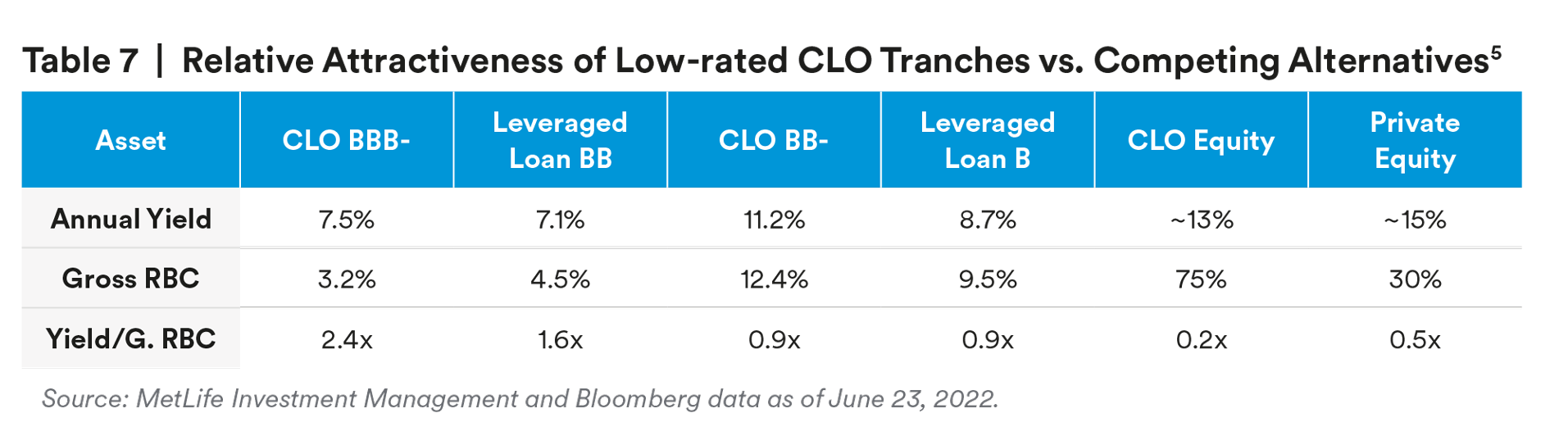

Insurers pursue multiple objectives with their investment decisions: asset-liability matching, income generation, portfolio diversification, capital efficiency, etc. Because of these varied objectives, there is no one hard and fast rule regarding which investments meet insurers’ needs and which don’t. However, if we were to solely focus on income generation and capital efficiency, we can get some sense for the relative attractiveness of lower-rated CLO tranches under the proposed RBC treatment. Table 7 below compares the yield offered by the lowest tranches in a CLO versus other investment alternatives that carry similar RBC to what we found in our sample modeling exercise:

We chose the competing alternatives in Table 7 based on their yield and risk comparability: leveraged loans are the underlying collateral of CLOs so they share many sources of risk, and private equity represents a risk category below that of rated bonds in the same way that CLO equity does. Based on the comparison above, we can see that the BBB- and BB- tranches in our sample CLO would remain a competitive investment alternative even after the change in RBC that our modeling produced. The equity tranche of our sample CLO, on the other hand, looks comparably unattractive. Having said that, we’re unconvinced that insurers will completely stop investing in CLO equity tranches if this RBC recommendation is adopted, as several of the insurers that buy these tranches do so in support of their affiliated CLO management business.

Assessment of Common Criticisms to the Recommendation

Unsurprisingly this NAIC staff recommendation has received a lot of market attention in recent weeks, including several criticisms from industry participants. We provide our view on the more common criticisms that we’ve seen so far:

- CLOs are actively managed and therefore have a better risk profile than a portfolio of leveraged loans, so the current comparably lower RBC for CLOs is justified.

We can see instances where this argument may have some merit, but those instances require us to make speculative assumptions. An insurer that has investments in leveraged loans is also an active manager that will try to exit weakening credits ahead of a default, buy loans with attractive prices relative to their risk, and actively diversify their portfolio of loans. Suggesting that the blended RBC in a CLO should be a fraction of the RBC in an insurer’s managed portfolio of leveraged loans – as it is today – would require the assumption that the CLO manager will do a far better job than the insurer in managing their portfolio of loans. While there may be cases where this could conceivably be true, we find it difficult to hang our hat on this assumption.

- CLOs have had lower historical losses than similarly rated securities from competing asset classes, and therefore should not carry higher RBC charges than those alternatives.

The historical credit performance of CLOs has, in fact, been stronger versus many competing asset classes. We observe, however, that: 1) CLOs have a much shorter history than corporates, Table 7 | Relative Attractiveness of Low-rated CLO Tranches vs. Competing Alternatives5 Asset CLO BBB- Leveraged Loan BB CLO BB- Leveraged Loan B CLO Equity Private Equity Annual Yield 7.5% 7.1% 11.2% 8.7% ~13% ~15% Gross RBC 3.2% 4.5% 12.4% 9.5% 75% 30% Yield/G. RBC 2.4x 1.6x 0.9x 0.9x 0.2x 0.5x Source: MetLife Investment Management and Bloomberg data as of June 23, 2022. MetLife Investment Management 8 and 2) some of the comparably weaker sectors cited include US RMBS and CMBS that follow a similar modeling approach to the one the NAIC staff is recommending for CLOs and therefore the rating comparison is irrelevant – also these modeled sectors may see some changes in designations versus prior years as the NAIC plans to incorporate additional modeling scenarios this year that better align with the more granular scale of 20 RBC designations adopted in 2021. More importantly, this argument does not address the significant structural leverage of lower-rated CLO tranches that, unlike most similarly rated corporates, will face a binary loss behavior in a tail event that can’t possibly be captured by ratings in the relatively short performance history of CLOs.

- The NAIC’s stress testing methodology is too onerous and produces results that are inconsistent with the historical performance of CLOs.

There seems to be an implicit assumption that the NAIC will use the same scenarios or variable values from its annual CLO stress testing exercise for the modeling of CLOs for RBC purposes. While there may be some overlap of scenarios and values in both exercises, we don’t believe the two will be identical based on the information that the NAIC has publicly shared. The prior section above outlined how we interpret the NAIC may conduct its modeling for RBC. While certain scenarios in this exercise will necessarily be onerous given what they need to capture (i.e. tail events), we believe that the approach will be quite different than simply replicating their previous stress testing exercises.

- Insurers are the main investors in CLO mezzanine tranches, and this proposal may cause insurers to back away from these investments and disrupt the broader CLO market.

We’ll have to see more details around this NAIC staff recommendation to be able to conclusively agree or disagree with this view. If our educated guess of how the NAIC may model CLOs happens to be close to the final outcome we doubt that we’ll see a wholesale pull back in purchases of these tranches. As noted in previous sections, CLO mezzanine tranches will likely continue to offer a competitive return for their possible revised RBC charges, and we feel insurers will likely continue to support their affiliated CLO management business through equity tranche purchases when needed.

Conclusion

Our main takeaway at this point is that a lot more information is needed before we can confidently assess the merits of the NAIC staff recommendation to determine RBC for CLOs through a modeling approach. While this proposal may cause an increase in RBC for equity and lower mezzanine CLO tranches, the initial clues that we’re getting from the NAIC seem to indicate that, if adopted, this proposal is unlikely to have a large impact on overall RBC requirements for the broader industry. We also suspect that, if properly implemented, a modeling approach to determine RBC for CLOs can help the NAIC better align capital requirements with the actual economic risks that insurers undertake with their investments in this space. The potential impacts to individual insurance companies are at this stage unclear, but outcomes may vary materially depending on portfolio positioning and strategy

Endnotes

1 Please see “Disclosures” at the end of this article regarding the presentation of hypothetical information.

2 Please see “Disclosures” at the end of this article regarding the presentation of hypothetical information.

3 Please see “Disclosures” at the end of this article regarding the presentation of hypothetical information.

4 Please see “Disclosures” at the end of this article regarding the presentation of hypothetical information.

5 [Note that competing alternatives may or may not present appropriate investments for a specific investor as a result of a variety of factors including availability of investment opportunities, risk, fees and expenses, liquidity and tax, accounting or regulatory requirements.]

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. The investments discussed may fluctuate in price or value. Investors may get back less than they invested.

The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. You should consult your tax or legal adviser about the issues discussed herein.

This material contains results for a hypothetical CLO structure. These results are shown are for illustrative purposes only, and do not reflect actual historical trading results for any product or investment strategy. Hypothetical results are calculated in hindsight, invariably show positive performance, and are subject to various modeling assumptions, statistical variances and interpretational differences. No representations are made as to the reasonableness of the assumptions used and any change in these assumptions would have a material impact on the hypothetical performance results portrayed. Hypothetical results have other limitations including: they do not reflect actual trading and therefore reflect the impact that actual market conditions may have had on the investment manager’s decision making process; regulatory or tax rules that may have existed during the periods modeled; and it also does not take into account an investor’s ability to withstand losses in a down market and assumes the strategy was continuously invested throughout the periods modeled. There is no guarantee that any actual product or strategy that followed any of the hypothetical portfolios modeled herein would have had similar performance. A decision to invest in an investment strategy should not be based off of hypothetical or simulated performance results.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK. MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.