Two commonly used categorizations of commercial real estate investing that emerged or became formalized in the late 1980s and early 1990s include “gateway markets” and “core property types.” They largely help institutional investors like pensions and sovereign wealth funds to understand the types of investments that could have the best liquidity, transparency and expected stable returns. These terms were never intended to mean the best returns, in our view, and indeed, investors can target higher returns in markets that are less liquid and less transparent. The “core” property type nomenclature was partially an extension of more established investment strategies where core referred to low risk/return strategies—and opportunistic to higher risk/return strategies.

During the 1980s, core property types included office, industrial and malls, and in the early 1990s, the definition was expanded to include apartments. Gateway markets have included New York, Boston, Washington D.C., Chicago, San Francisco and Los Angeles. Although these property types and markets arguably had the largest available investment pools, there wasn’t enough information at the time for investors to understand if they were necessarily the lowest risk. (Or, perhaps put another way, because the markets and property types were so large, they were the only ones that had a semblance of transparency, which made the risk profile at least seem more understandable).

Today, the commercial real estate world is very different, with organizations like the National Council of Real Estate Investment Fiduciaries (NCREIF), the Commercial Real Estate Finance Council (CREFC) and the National Association of Real Estate Investment Trusts (NAREIT) offering decades of standardized performance information across many segments of commercial real estate. This has given investors the power to better evaluate and rank what the lowest risk and most transparent property types and markets are—which we will attempt to do in this report. Going forward, as transparency into commercial real estate performance continues to improve, we believe these definitions should be refreshed every five to ten years.

Defining and Ranking “Gateway Markets”

Although there is a consensus on what the gateway markets are, to our knowledge, there has never been an authoritative definition of what a gateway market should be. One often cited characteristic includes the size of the market, as measured by population or real estate transaction volume, and we believe this may have been the primary characteristic as the terminology was formalized 30 years ago. Another is a location where international investors tend to visit when traveling to another country—to the benefit of locations like San Francisco but to the detriment of other large markets like Houston. Another may include the historical stability of the local economy.

Despite the lack of a consensus methodology, there are generally accepted U.S. gateway markets, which include Boston, New York, Washington D.C., Los Angeles, San Francisco and Chicago.1

Detailed assessments of each market by property type might point in different directions on the same gateway market. For example, Houston office has historically had high price volatility and generally would not be considered a “gateway office market.” However, given the size and magnitude of Houston’s industrial real estate, Houston could be justified as a “gateway industrial market.” Nonetheless, we believe gateway market-sorting at the market level, as opposed to—the market-property-type level—is still a useful categorization tool.

We believe gateway markets should be defined as the markets that are the most transparent, have a history of stable returns and offer the most liquidity. Transparency and liquidity are probably aligned with existing notions of what a gateway market should be, while the addition of stability may or may not be. We believe stability is important, however, as it helps to capture where new global investors may want to target or set a benchmark to, when entering a new country.

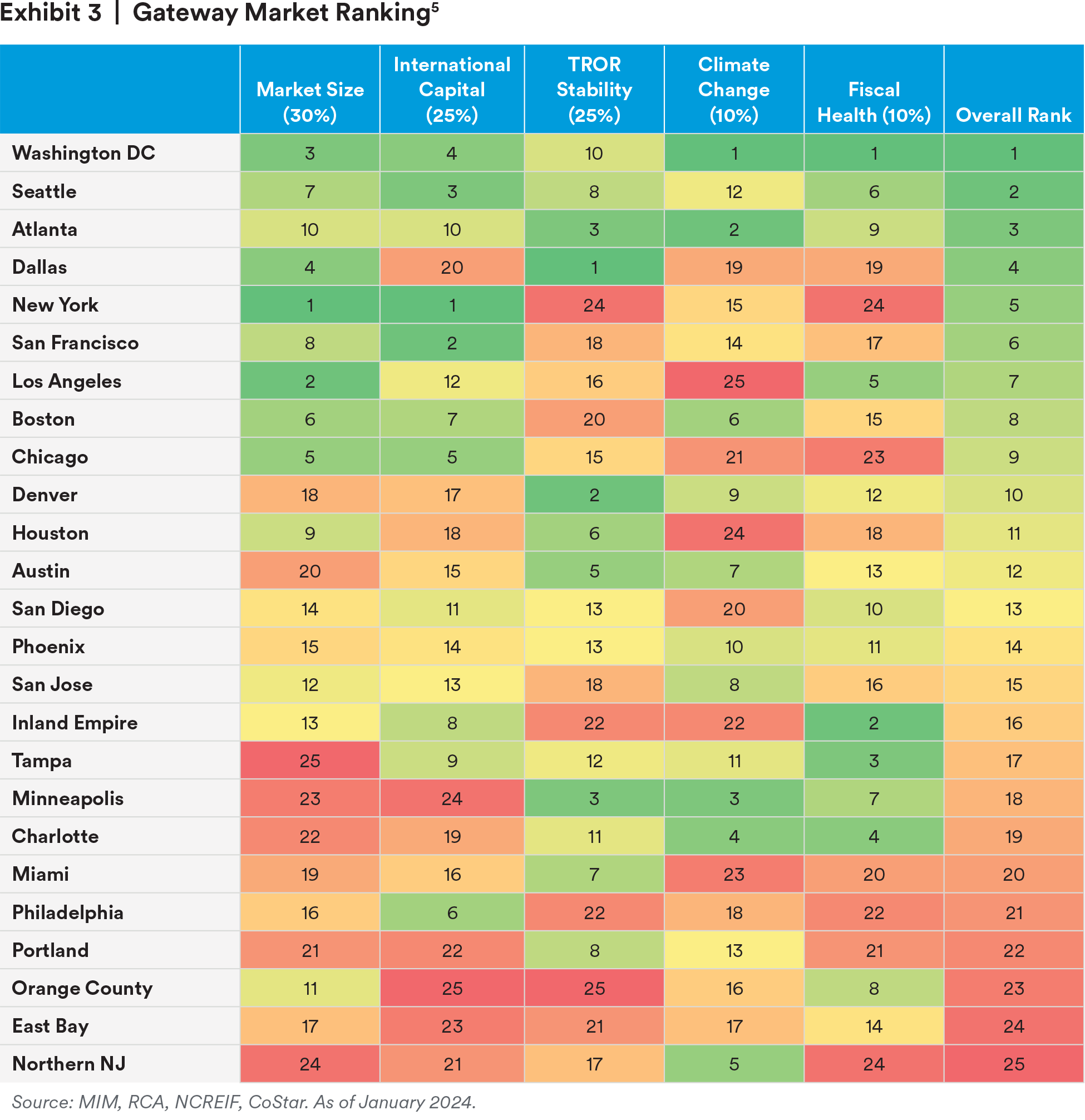

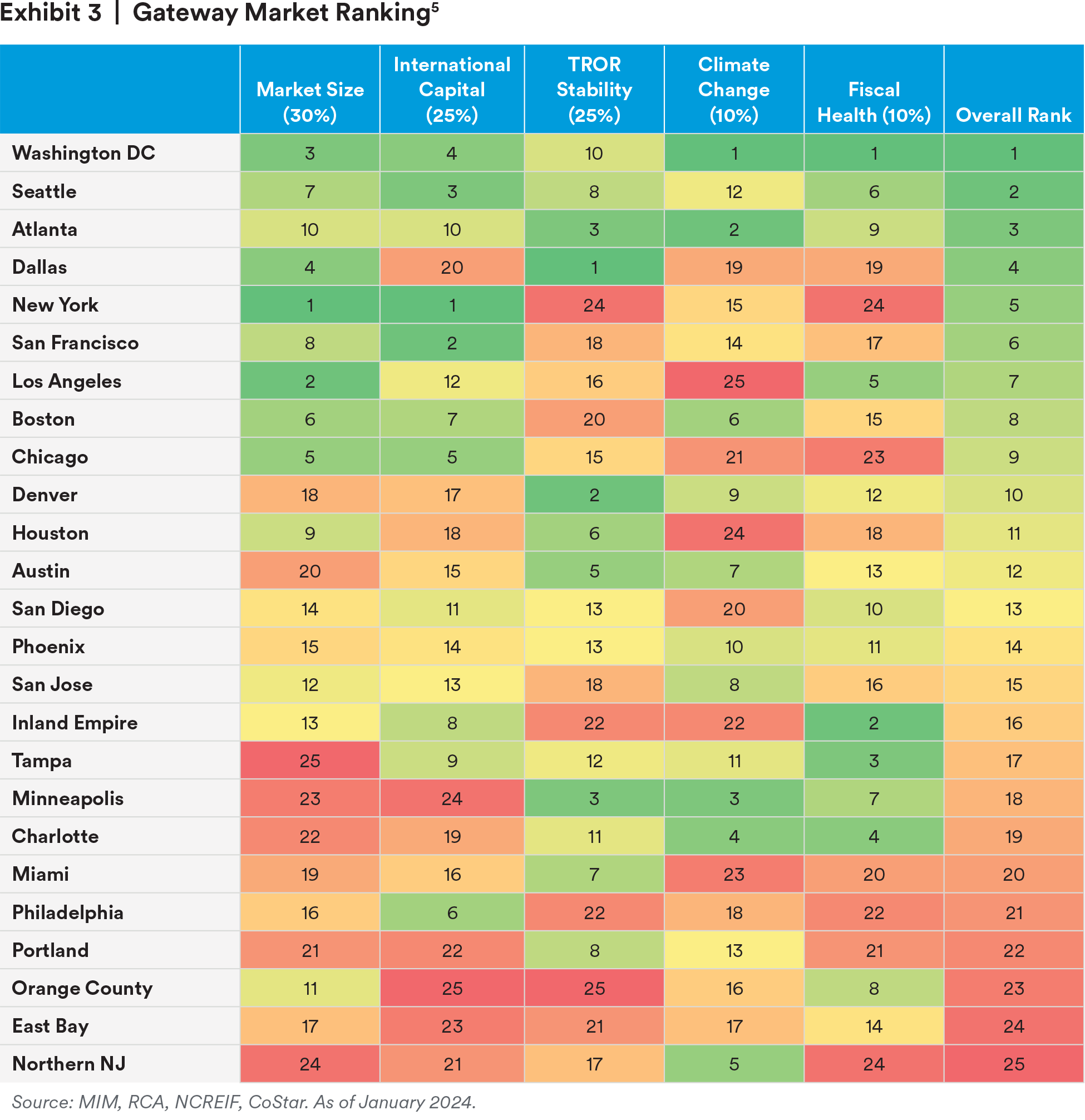

To help identify the markets with the highest transparency, return stability and liquidity, we thought the available information could be best explained and ranked in five subcategories, which are outlined below. Although we believe transparency, return stability and liquidity should always be the hallmarks of gateway markets, we think the five measures below should be periodically revisited to reflect changing risks in the market, to be replaced as newer datasets or information become available, or to be completely changed as different factors may be more relevant in non-U.S. countries. We acknowledge the concept of gateway markets is international, but we only focus on U.S. markets in this report.

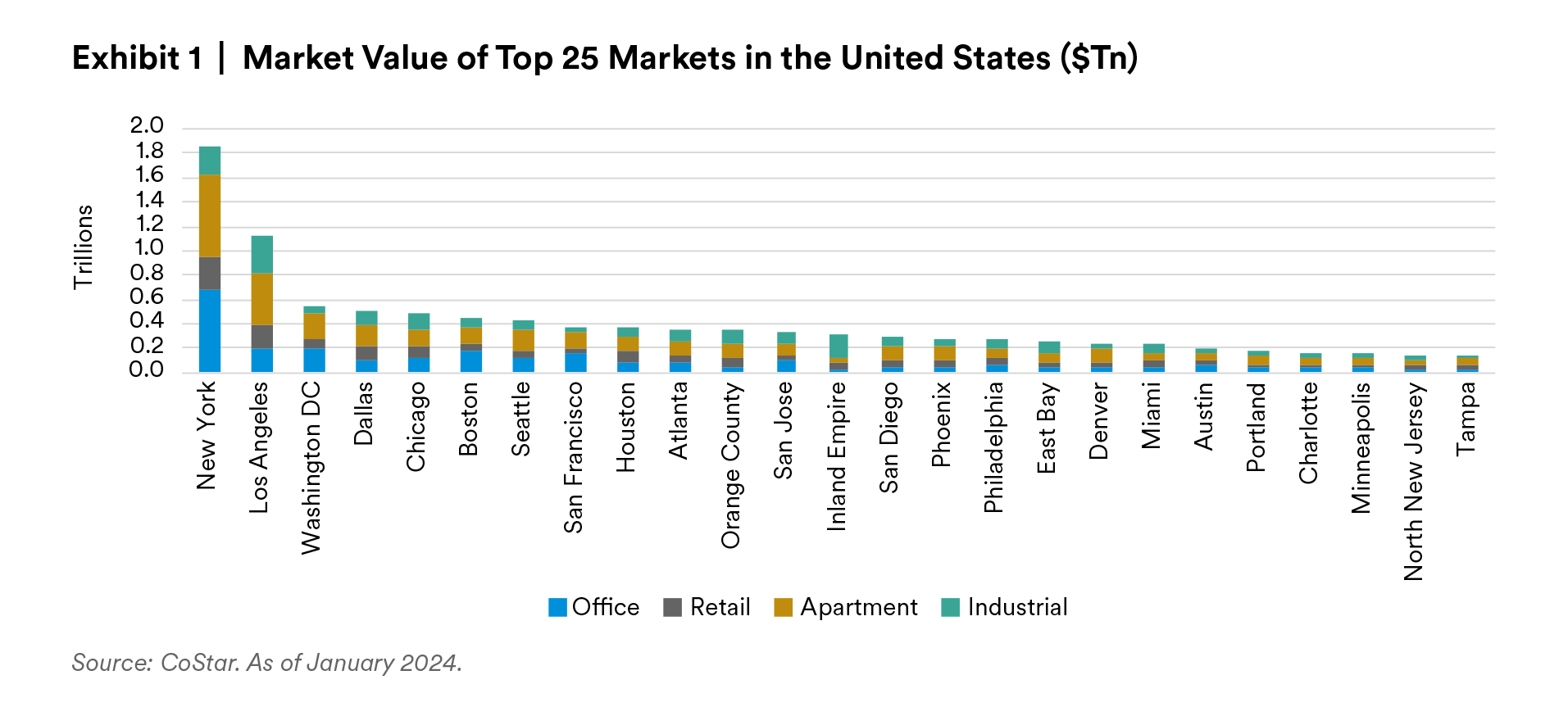

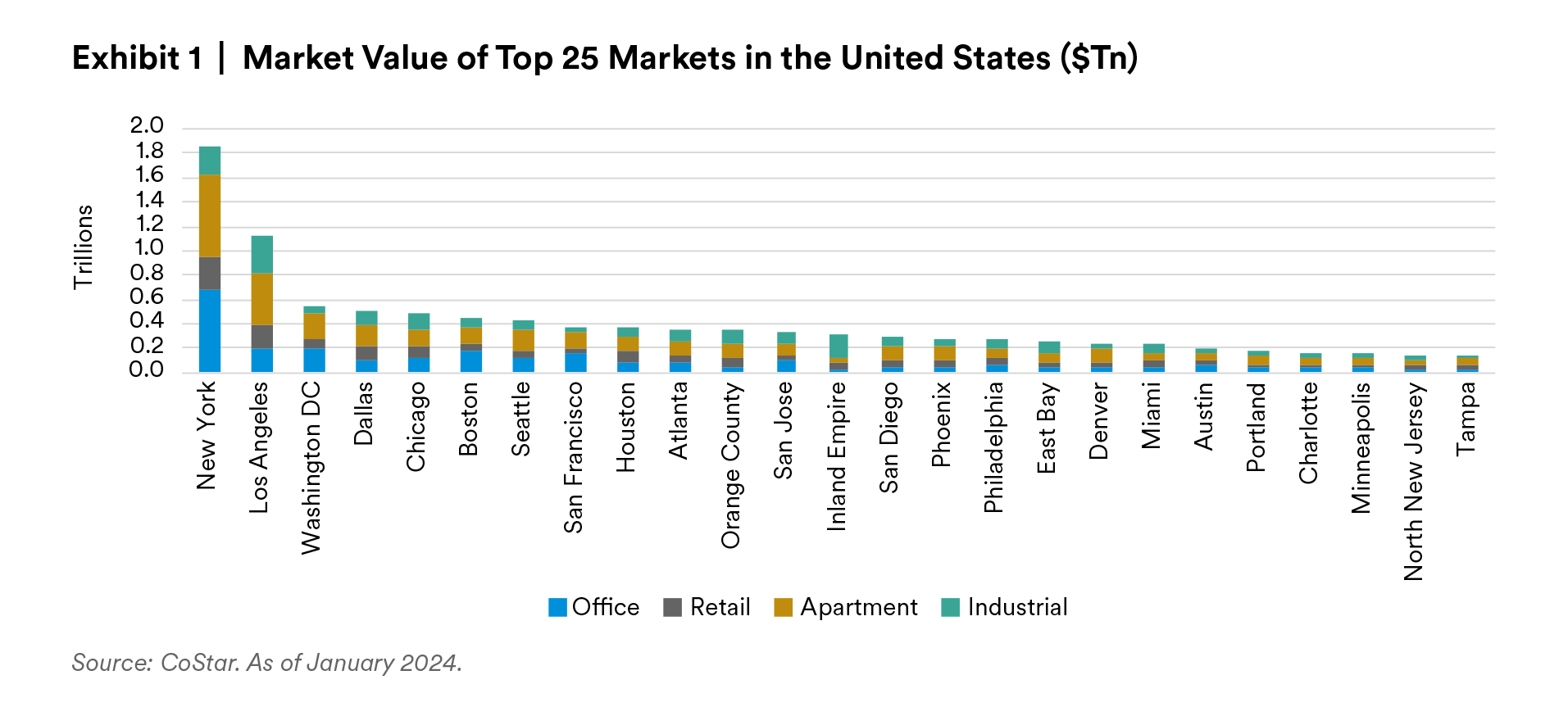

1. Market size. To support the goal of transparency, we start by examining commercial real estate asset value estimates for each of the top 25 markets in the United States, which is shown in Exhibit 1. Although this is just a single measure, we believe it is an effective proxy for other factors that could be relevant such as an MSAs population, economic size or transaction volume. We considered using transaction volume directly, but found it did not add value along with the asset value measurement. Using equities as an analogy, the S&P 500® Index is comprised of the largest 500 publicly traded stocks in the United States, and this exercise ranks the top 25 commercial real estate markets in the United States.

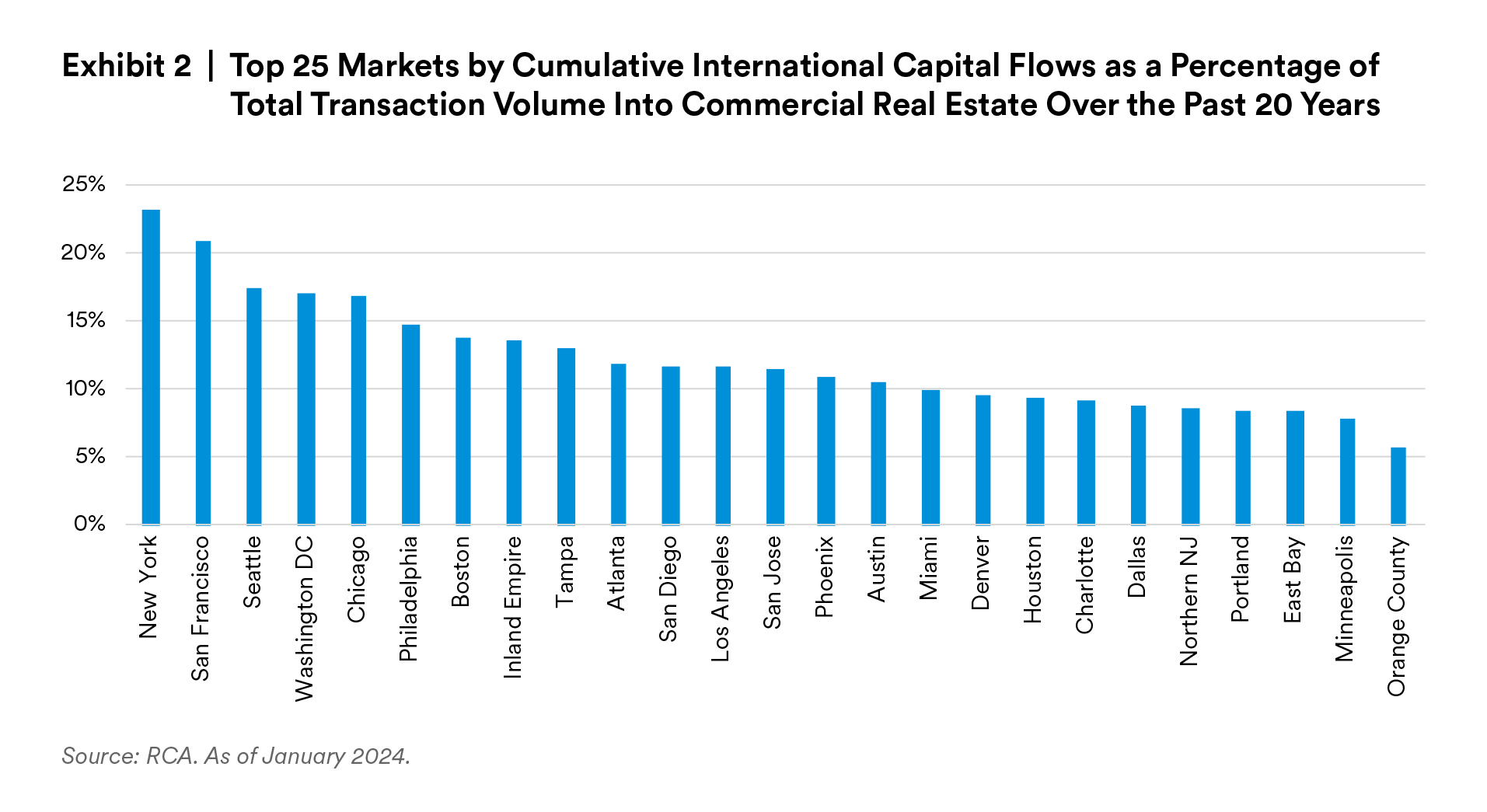

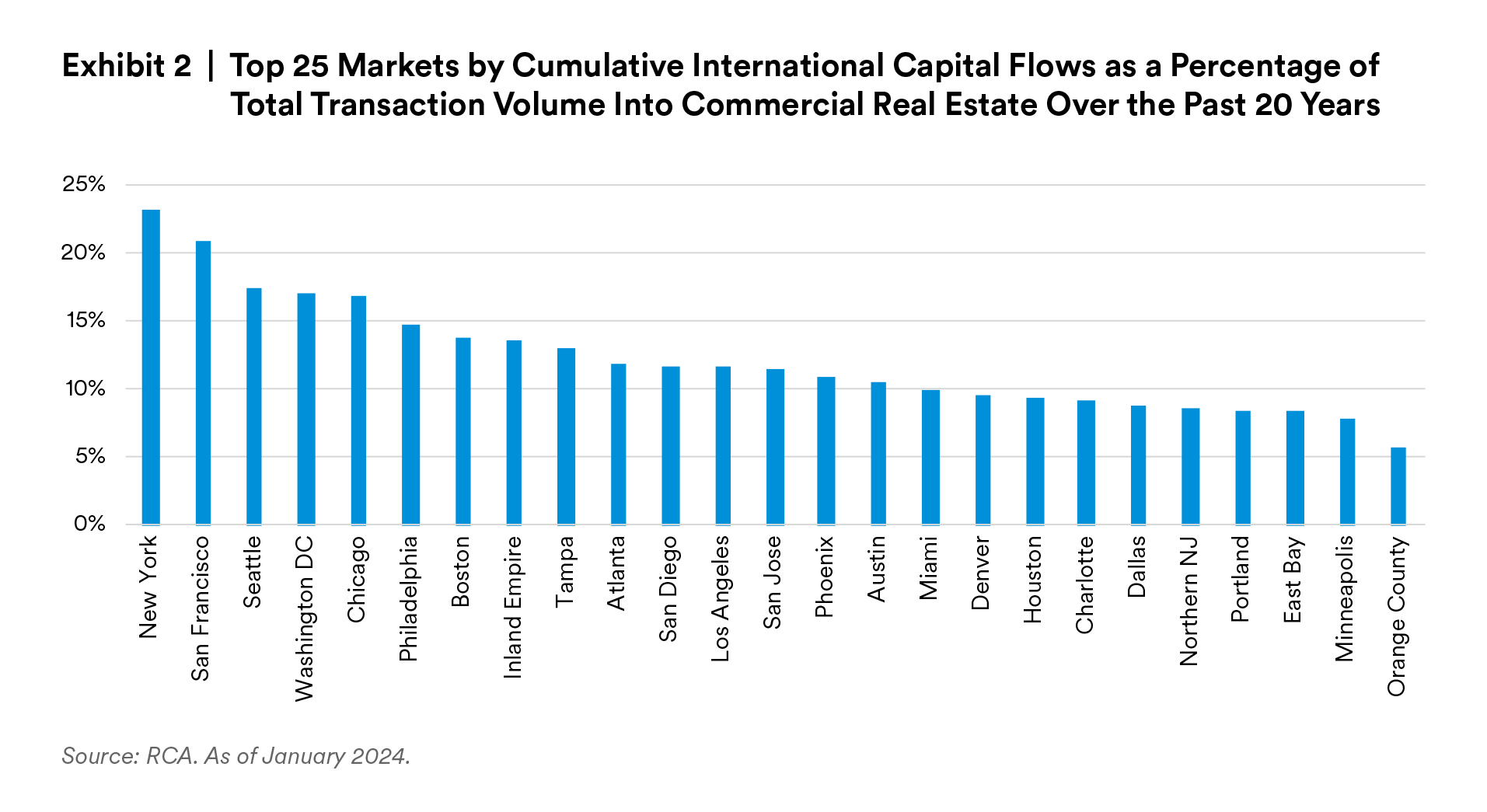

2. International capital is an indication of the global stature of a city and can help to define a gateway market. Also, the presence of international capital indicates more depth of buyers and sellers and enhanced liquidity. In Exhibit 2, we rank the top 25 markets based on the amount of international capital as a percentage of total transaction volume since Real Capital Analytic estimates were first available 21 years ago. In addition to markets like New York and San Francisco that are generally known to have large international capital flows, markets such as Tampa, Seattle and the Inland Empire stick out with this analysis.

3. Total rate of return stability is another key element of this analysis. Gateway markets are typically thought to be more stable with lower cap rates. However, lower cap rates do not always accurately reflect the size or stability of the market at present. We used NCREIF NPI2 total return data over the past 20 years to stratify markets by price stability (lowest standard deviations of returns). While larger markets are considered to be more stable, our analysis doesn’t conclude this. For example, Minneapolis and Chicago rank as the two markets with the lowest standard deviation of return, and both differ on the spectrum in terms of market size. As a result, we believe that 10-year expected population growth rates are positively correlated with TROR stability and encapsulate demographic shifts in each market, and incorporate these forecasts into our market stability ranking. Additionally, we believe that 10-year expected population growth rates are a forward looking measure of return stability and have also incorporated these forecasts into our market stability ranking.

4. Climate change is making future commercial real estate returns less predictable in some markets. Real estate owners face risks from climate change in the form of physical risk as well as the transition to a low-carbon economy. Transition risk includes federal and local legislation and regulations. Several cities, counties and states have already established various types of carbon or energy laws.3 Rising physical risks, such as storms, wildfires, drought, flooding and storm surge can all have impacts on the viability of commercial real estate investments, even if the impact is only to the surrounding community and not to the actual asset.

To integrate climate change factors into our gateway market framework, we utilized the FEMA National Risk Index (NRI), which estimates the average annual loss from natural hazards and measures each location’s unique vulnerability and resilience to such events.4

Although we believe investors are generally considering climate change when making new investments, this factor is meant to capture the possible “error margin” of higher underwriting in markets with more climate risk, in our view. We think this factor is not meant to capture which markets are better investments, or which markets may be mispriced because of too much fear or not enough fear from climate change.

5. Fiscal health could be important for U.S. markets today, with many markets reaching stress levels as a result of expanding debt and limited or negative population growth. Markets with strong fiscal health likely have a better ability to respond to climate risks, grow needed infrastructure and keep property taxes stable. Similar to climate change, in our view, this factor is not meant to capture which markets are better investments, or which markets may be mispriced. Instead, we think it is meant to capture which markets have more predictable underwriting, which we believe are those with a healthier fiscal situation.

These five factors and subsequent scores are outlined in Exhibit 3. The weights are 25% Market Volatility, 25% International Capital, 30% Market Size, 10% Climate Change, 10% Fiscal Health.

As a final point of clarification on gateway markets, MIM does not always recommend overweighting gateway markets. Indeed, investors with a greater risk tolerance, and investors who view market selection as a way to add alpha, may want to actively avoid the lower and more stable returns generally offered in gateway market real estate. Gateway markets should therefore not be thought of as a proxy for where the best relative value resides. Gateway markets serve as a useful benchmark or consideration for portfolio management but do not replace the analysis needed to develop informed market allocation strategies.

Defining Core Property Types

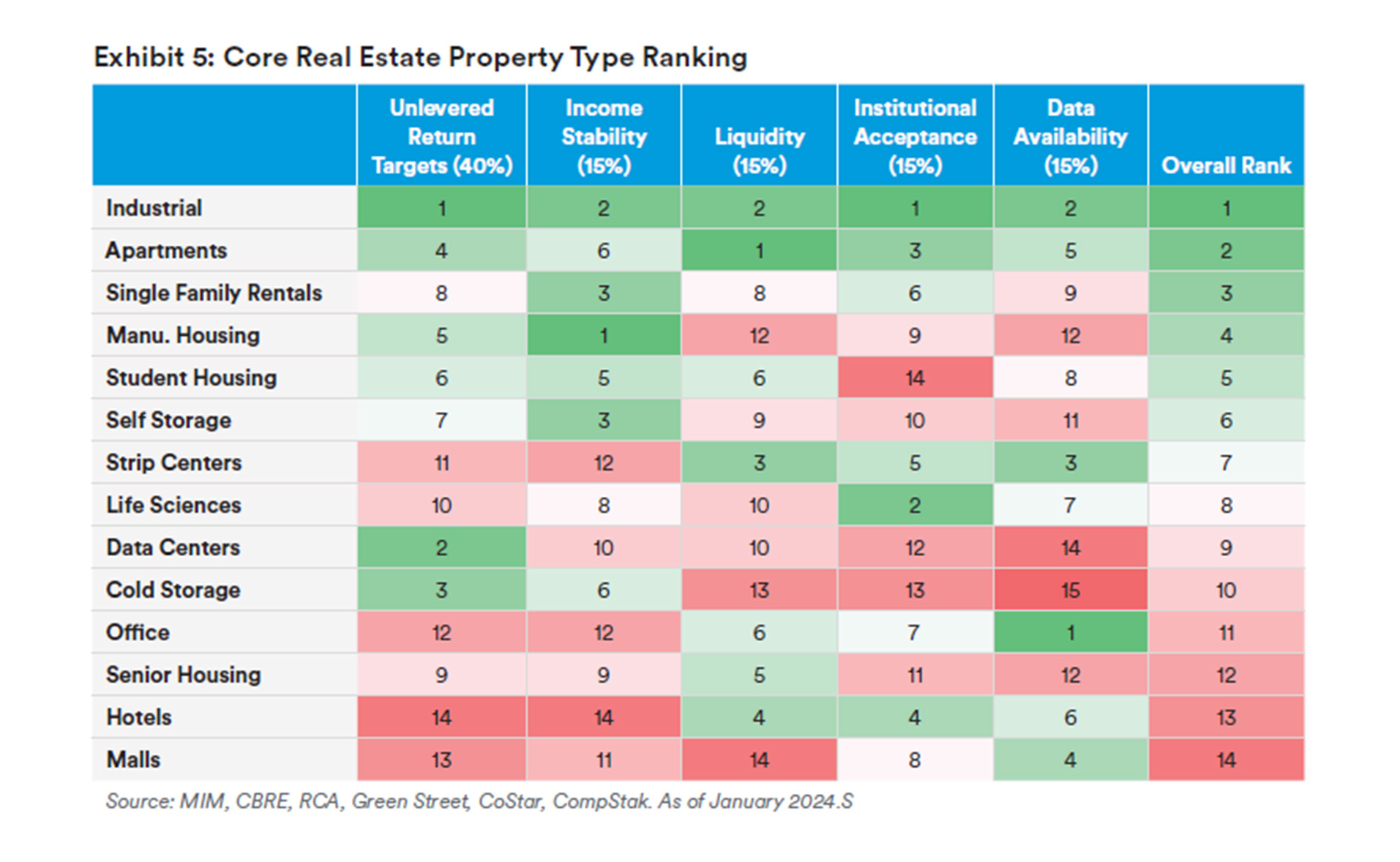

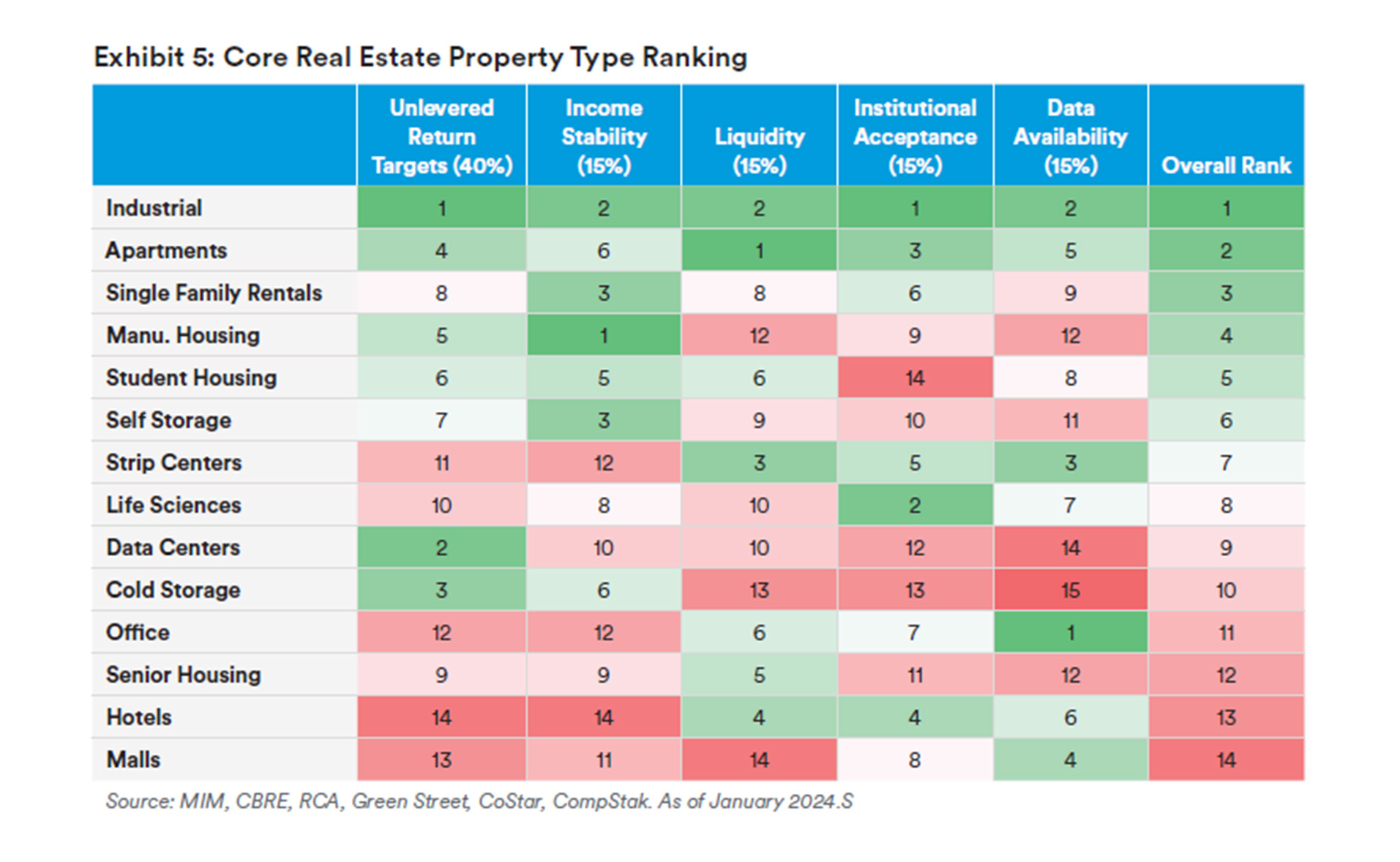

Similar to gateway markets, we do not believe that what was true 30 years ago is necessarily true today. Due to the maturation of the commercial real estate sector, we think that there should be more than just four core property types. We believe core property types should generally be those that offer the most transparency and that have the most stable returns. We used six measurements to help evaluate the new core property types. Weights for each variable are as follows: 40% unlevered return targets, 15% income stability, 15% liquidity, 15% institutional acceptance, 15% data availability.

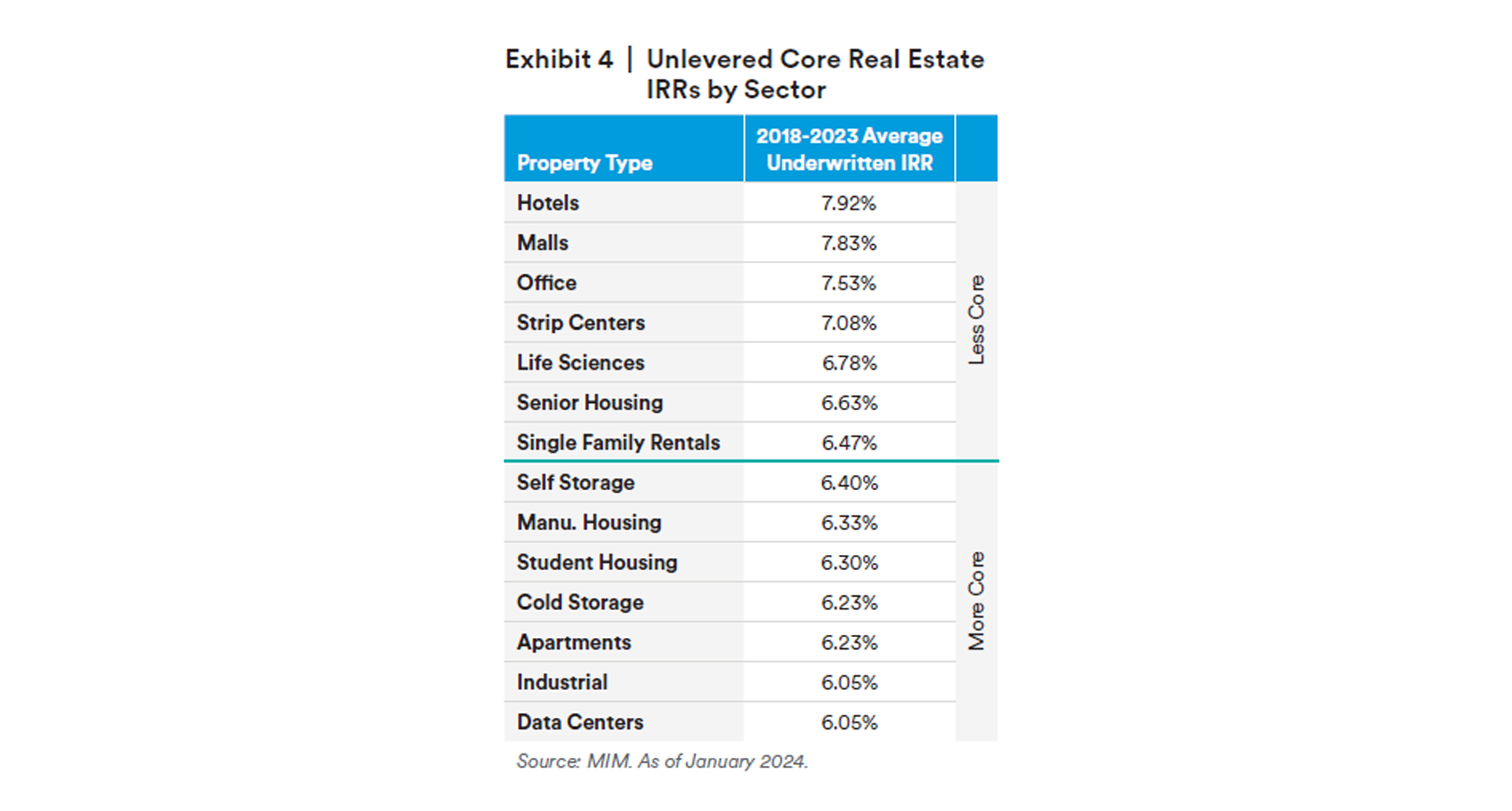

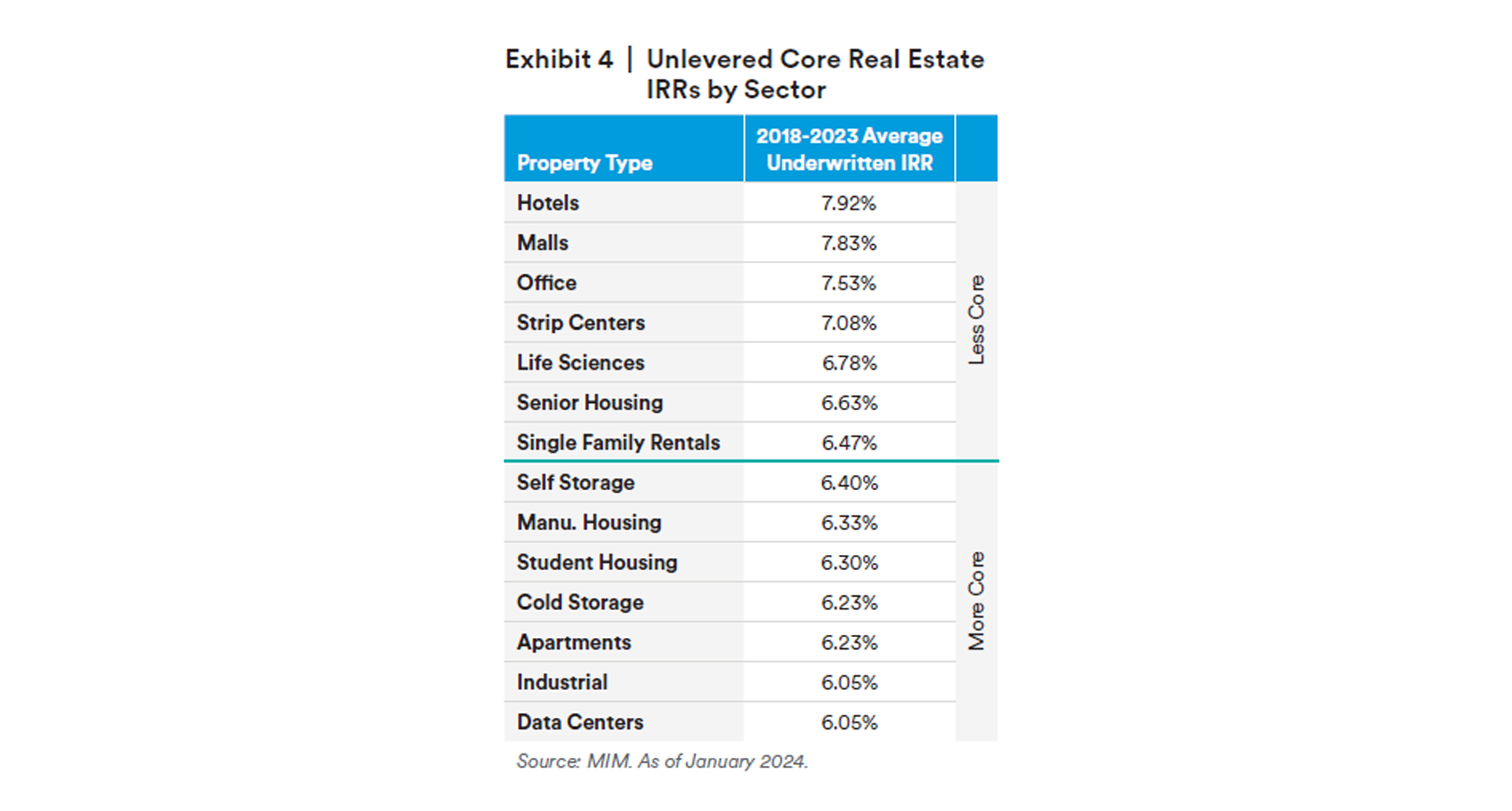

Unlevered return targets is one of our criteria. MIM has internally tracked unlevered 10-year return targets (Exhibit 4) that most brokers are offering, or investors are requiring. In our view, lower-return targets are partially a function of how investors view the outlook for risk across the various property types, with lower-return targets indicating less of a risk premium. Since at least 2016, sectors like manufactured housing, industrial, apartments and data centers have traded at lower discount rates than sectors like hotels or office buildings. Pre-pandemic unlevered IRRs and current market IRRs were each given a 50/50 rating. Unlevered return targets hold the most weight (40%) in our ranking, as we believe this is the most comprehensive variable for ranking core property types.

Income stability is a key factor in our core property type ranking. Over the past 10 years, core investors have gravitated to high income/low capital expenditure sectors, such as manufactured housing, self-storage and single-family rentals, and away from low income/high capital expenditure sectors like office and malls. We estimated NOI stability utilizing historical Green Street NOI data. For sectors that are not tracked by Green Street, we estimated volatility using REIT share volatility and MIM experience, as well as consideration of average operating expense loads. In addition to NOI volatility, we estimated historical capital expenditures by property type using NCREIF and MIM experience.

Liquidity is another component in our core property type ranking. We try to rank each sector based on the ability to buy and sell $250 million. We estimated liquidity using transaction volume as reported by Real Capital Analytics (RCA) between 2018−present. We also consider the days on the market for a property to sell, as measured by CoStar. For sectors that are not covered by RCA, we estimated transaction volume by using the size of the market as a proxy, as well as JLL data on alternative property type transaction volume. While the office sector currently has its liquidity issues, it still ranks fifth due to historically high transaction volumes.

Institutional acceptance is based on the historical role that institutions have played in each of the sectors. To calculate this factor, we applied a 50% weight to historical ownership by institutions and a 50% weight to what institutional investors have been targeting according to institutional surveys and observations from MIM’s institutional real estate clients, including many of the largest pension funds, sovereign wealth funds, insurance companies and others. Multifamily, office and industrial markets have been dominated by institutions for decades, but smaller sectors like manufactured housing and single-family rentals are also accepted by most institutional investors. Office has historically been one of the most institutionally accepted sectors but in recent years has been shunned, with large institutional investors looking to diversify away from the sector. Since our rankings are not just a reflection of the market today, office ranks seventh in this institutional acceptance category.

Data availability was evaluated using data vendors including Green Street, CoStar, Moody’s, MSCI, CompStak and CBRE-EA. Additionally, NCREIF’s NPI+ proposed property types, CMBS reporting, Yardi Matrix reporting and single-sector REIT performance were also considered. Finally, MIM applied professional judgement to evaluate what types of datasets and industry organizations still need to emerge in order to give similar levels of confidence across each sector.

In Exhibit 5, we show the results of our core property type ranking.

Conclusion

Despite the seemingly slow-moving nature of real estate, the investment universe is ever evolving and can do so rapidly. We believe that many of the markets and property types that have long been considered gateway or core should evolve too. These labels should not be confused with appropriate market strategies, however. Indeed, MIM has often recommended property types and markets that are outside of both the old and new definitions, but we believe the core and gateway classifications remain important identifiers to help investors frame portfolio compositions and risk levels. While this paper proposes a useful guide, investors should consider the fact that core investments can exist in cities and property types that fall further down the list, such as a newly constructed and well-leased market-dominant mall, or a LEED platinum office building with more than 10 years of term remaining on leases, to growing investment-grade tenants. As with all real estate analyses, property-level evaluations trump all.

Endnotes

1. The Risk and Reward of Investing in Secondary Markets - Urban Land Magazine (uli.org)

2. The NCREIF Property Index (NPI) measures the performance of real estate investments on a quarterly basis.

3. The regulations are often referred to as Building Performance Standards (BPS) that can result in significant annual penalties for properties that perform below a stated metric. At least 38 cities (Top Stories of the National Building Performance Standards Coalition - IMT) have announced plans to implement BPS laws, and we believe that most primary and secondary markets will implement BPS laws within the next ten years.

4. We recognize that this index (or any index) cannot encapsulate all of the climate change risk factors present in a given market, but we believe it is the best available at the present time. As with all of the factors used to determine gateway markets, all assets within a market are not similarly impacted. For instance, Miami’s score is influenced by the vulnerability of Miami Beach.

5. Weights for each variable are as follows: 25% Market Volatility, 25% International Capital, 30% Market Size, 10% Climate Change, 10% Fiscal Health. Market volatility is 50% based on the standard deviation of returns as tracked by NPI from 2000-2022, and 50% based on 10-year projected population growth as tracked by Moody’s. International Capital is based on transaction volume averages non-U.S. investors between 2000 and 2021 as tracked by MSCI’s RCA divided by the total transaction volume. Market Size is based on CoStar’s total commercial real estate market value.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for generalcirculation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/ third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC.