Globally, the Federal Reserve, European Central Bank (ECB), and Bank of England (BoE) are expected to continue easing: the Federal Reserve moderately and the ECB and BoE more rapidly in the face of a negative growth shock caused by U.S. tariffs.

Turning to risks, many of the risks to our outlook come from policy uncertainty about what the incoming U.S. administration will actually implement.

On trade, tariff impact could be lessened if the U.S. is able to reach some kind of negotiated settlement with China. Alternatively, the impact could be outsized if McKinley style tariffs are implemented to replace income tax, or if the administration is able to pass significant tariffs on free trade agreement countries like Canada and Mexico.

Other policy uncertainties abound. If President-elect Trump is able to cancel or slow funding from the Biden administration’s industrial policy bills, it could disincentivize private investment in certain sectors and drag down our expectation of investment growth. Enforcement of new immigration rules could upset the balance of the labor market, putting upward pressure on inflation and wages.

Monetary policy is expected to reach a critical juncture next year. We believe that the first half of the year will be dominated by discussions of r*, the natural rate of interest, and when central banks should stop cutting. We believe there is still room for a policy misstep.

Risk 1: Evolution or Revolution in Global Trade?

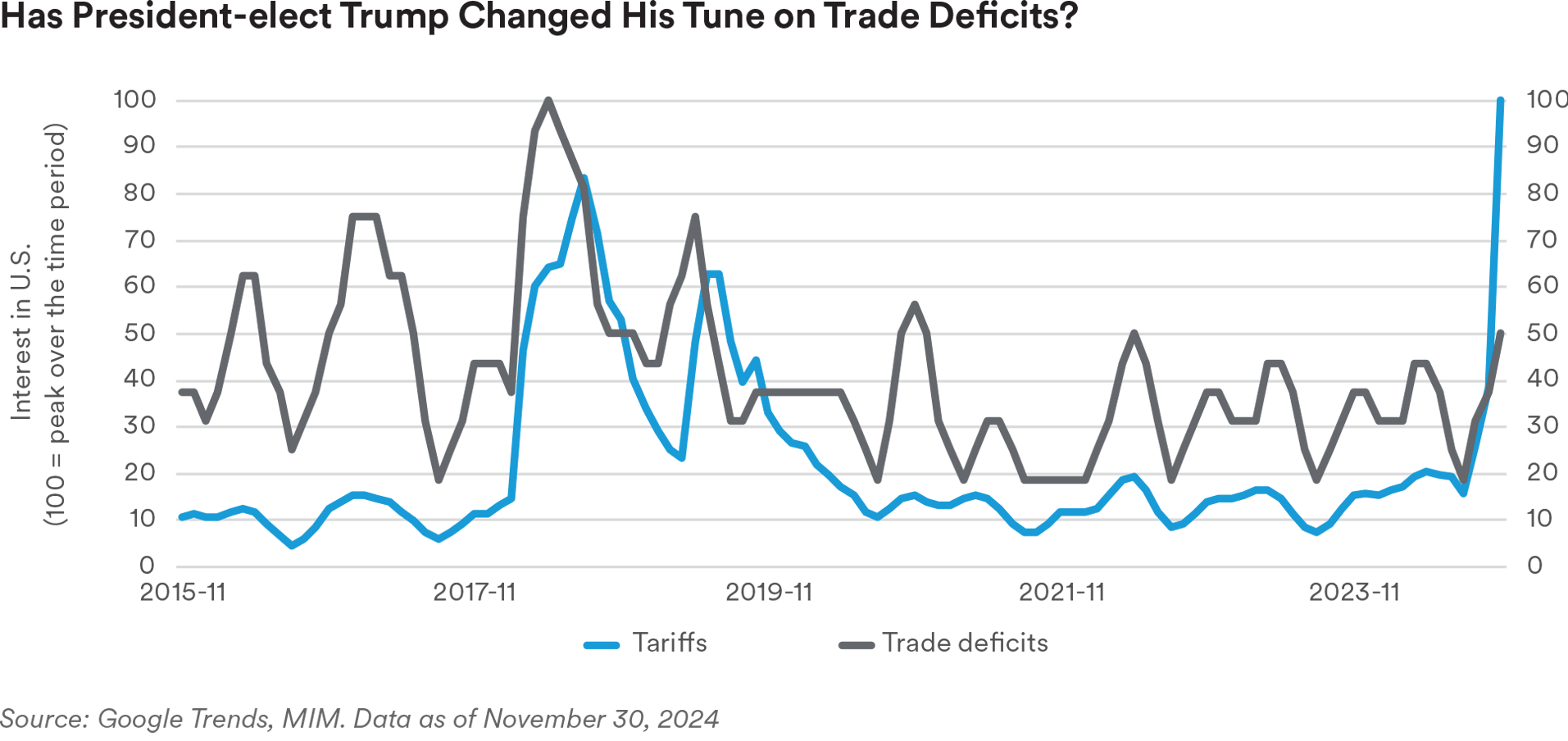

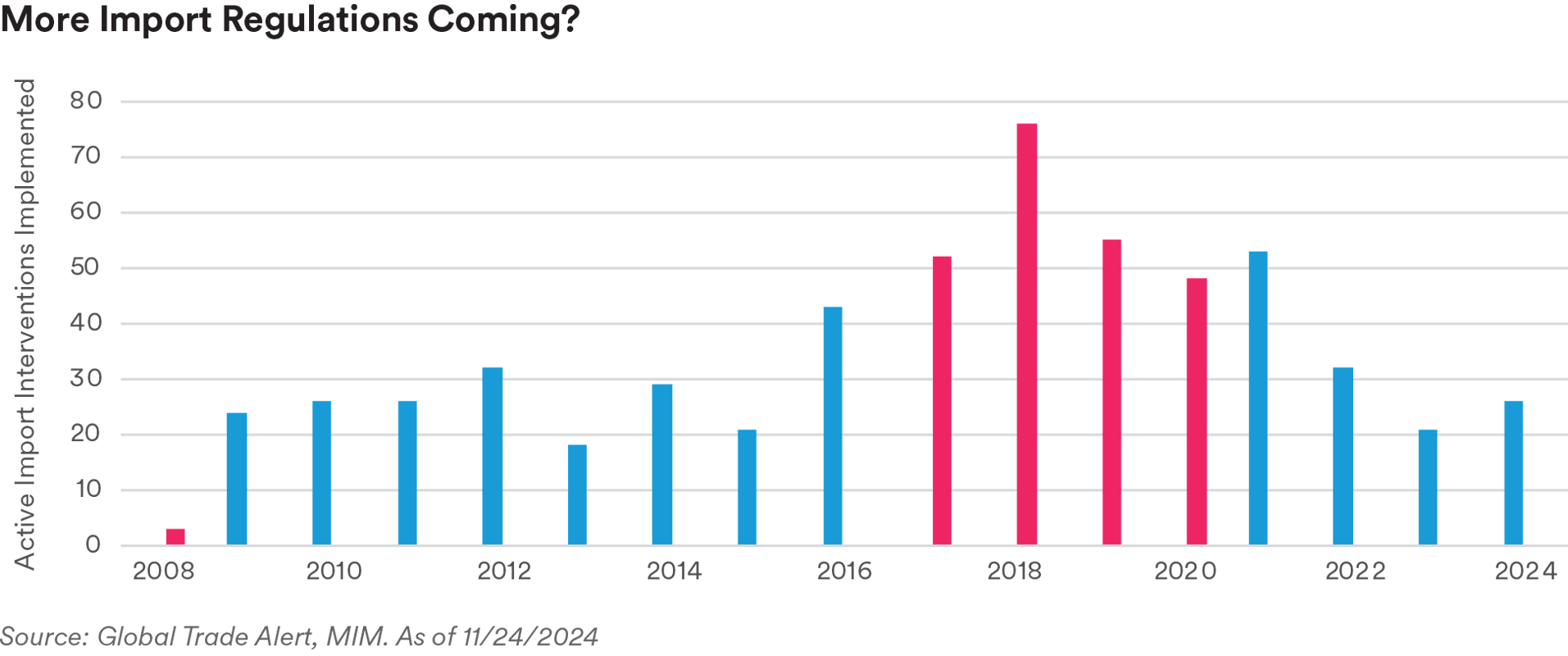

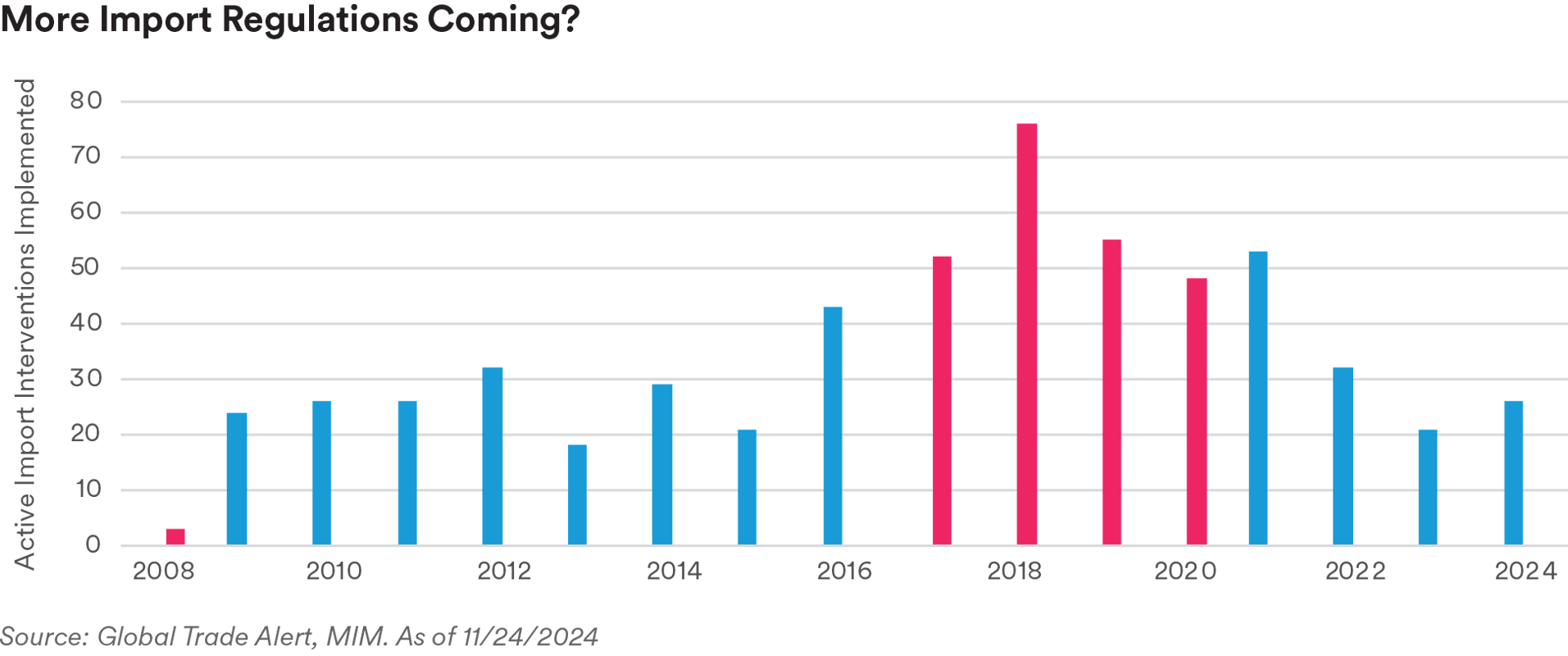

We expect tariffs to be widely implemented in 2025. While tariff “peaks” may hit 60% or 10% for China and the rest of the world, respectively, we expect weighted-average tariffs to be substantially lower.1 President-elect Trump has shifted away from arguing against trade deficits (which expanded in his first term) toward a stricter focus on tariffs and reshoring.

There is likely to be fierce domestic pushback against blanket tariffs on FTA countries particularly Mexico, Canada and South Korea. This wouldn’t exempt FTA countries from tariffs but may limit their reach.

We would expect European countries to counter higher U.S import tariffs with selected increases in tariffs charged on U.S. imports, while the region would also likely need to raise tariffs on some third-party country imports (particularly from China) to counter its exposure to trade diversion from the U.S. market. Our forecasts for 2025 assume U.S. tariffs of 10%, which ultimately drove a 40bps reduction in our full-year euro area growth forecast to 0.6% (reflecting the impact of slower global trade growth and a negative hit to sentiment). The risk of a European recession would likely rise sharply next year if U.S. tariffs were raised much beyond 10%, likely triggering a more forceful monetary and fiscal policy response than currently expected.

In Asia, under our baseline of the U.S. levying 60% tariffs on China, we assume a similar strategy to that seen during the first Trump administration: tariffs on U.S. goods that China can easily substitute from other countries with an aim to target more sensitive U.S. constituencies in the process (China’s reliance on imports of U.S. soybeans, grains and aluminum have declined over time).

Since China cannot match U.S. tariffs directly due to its trade imbalance with the U.S., Beijing will likely consider non-tariff retaliation as well. This could include regulatory actions and investigations targeting U.S. companies in China, and restricting critical materials needed for U.S. industry such as rare earth exports. In conjunction with these measures, China may roll out policy stimulus as needed, paired with controlled CNY depreciation. Given that Trump’s re-election was in part due to a popular backlash against inflation, Beijing may look for ways to exacerbate inflation pressure in the U.S., including policy measures to drive up the price of global commodities. Although China would suffer collateral damage as well, we believe it could buffer the impact by pre-emptively stockpiling key commodities. As possible evidence of this, recent monthly oil imports have been increasing.

Many Chinese companies have invested more into manufacturing hubs in the region (e.g., Vietnam, Indonesia and Thailand) as they diversify their supply chains away from China (China +1) to hedge their risks amid rising U.S.-China tensions. Given the focus on tariff evasion, countries with a large Chinese manufacturing presence will likely also be vulnerable to U.S. tariffs.

Countries in the region with which the U.S. has large trade deficits (e.g., Vietnam, Malaysia) are more likely to be targeted with tariffs. We believe that Vietnam is particularly vulnerable, where its U.S. surplus has nearly doubled since the first Trump administration, and is likely — along with China and others — to be redesignated a “currency manipulator” by the U.S. Treasury under the incoming administration.2

From the U.S. perspective, there are potential unintended consequences stemming out of a renewed trade war with China. Given the unpredictability around the incoming Trump administration, companies in the Asia region may want to align themselves more with China, as the largest trading partner for several Asian economies. Increased uncertainty around U.S. policies could further erode trust in the U.S., strengthening China’s economic and political influence at the core of an integrated Asian economy.

Off Base-case Risks:

There’s a negotiated settlement of sorts between the U.S. and China. President-elect Trump’s rhetoric vis-à-vis trade with China has changed since his first term. Trump’s goal in his second presidency seems to be much more about reshoring manufacturing jobs to the U.S. This is number 5 on his Agenda 47 list of goals; there is no mention of trade deficits or trade negotiation.3

However, Trump negotiated with China in his prior term, and he might yet accept a reduced tariff for certain items, especially those that are more critical to U.S. manufacturing as inputs.

As part of a negotiated settlement on China’s side, there may be offers to purchase U.S. goods, invest in U.S. infrastructure, encourage Chinese companies to invest in the U.S. manufacturing segment or buy U.S. Treasuries. On the security front, a negotiated settlement could include efforts to resolve the Russia-Ukraine conflict. That said, there are high hurdles for compromise given Beijing’s sensitivities around the loss of face and Xi Jinping’s recent messaging around China’s redlines such as Taiwan where more friction is likely to emerge.

McKinley tariff regimes are implemented. This would be an attempt to establish a McKinley-type tariff regime where import duties materially replace federal income taxes. Although President-elect Trump discussed this at length during the campaign, we expect tariffs on other countries to be far too small to be a material source of government revenue. It would take tariffs of at least 44% on countries aside from China to replace income taxes, and that only if businesses and individuals are completely inelastic in their consumption of foreign goods.4 More realistically, tariff levels might have to be raised by more than 100%, at least for certain goods, to wring enough out of the system. Moreover, these would be deeply regressive and quite inflationary for many day-to-day items that working- and middle-class voters purchase.

Risk 2: Signal Versus Noise and the Incoming U.S. Administration

Aside from tariffs, the incoming Trump administration and the full Republican control of Congress present policy risks.

The new administration will be able to pass budgets via reconciliation, which would allow for substantial policy changes and larger near-term deficits. We expect that the Tax Cut and Jobs Act is extended in some form, and that the retained tax cuts act as a stimulus with mild growth and inflation effects.

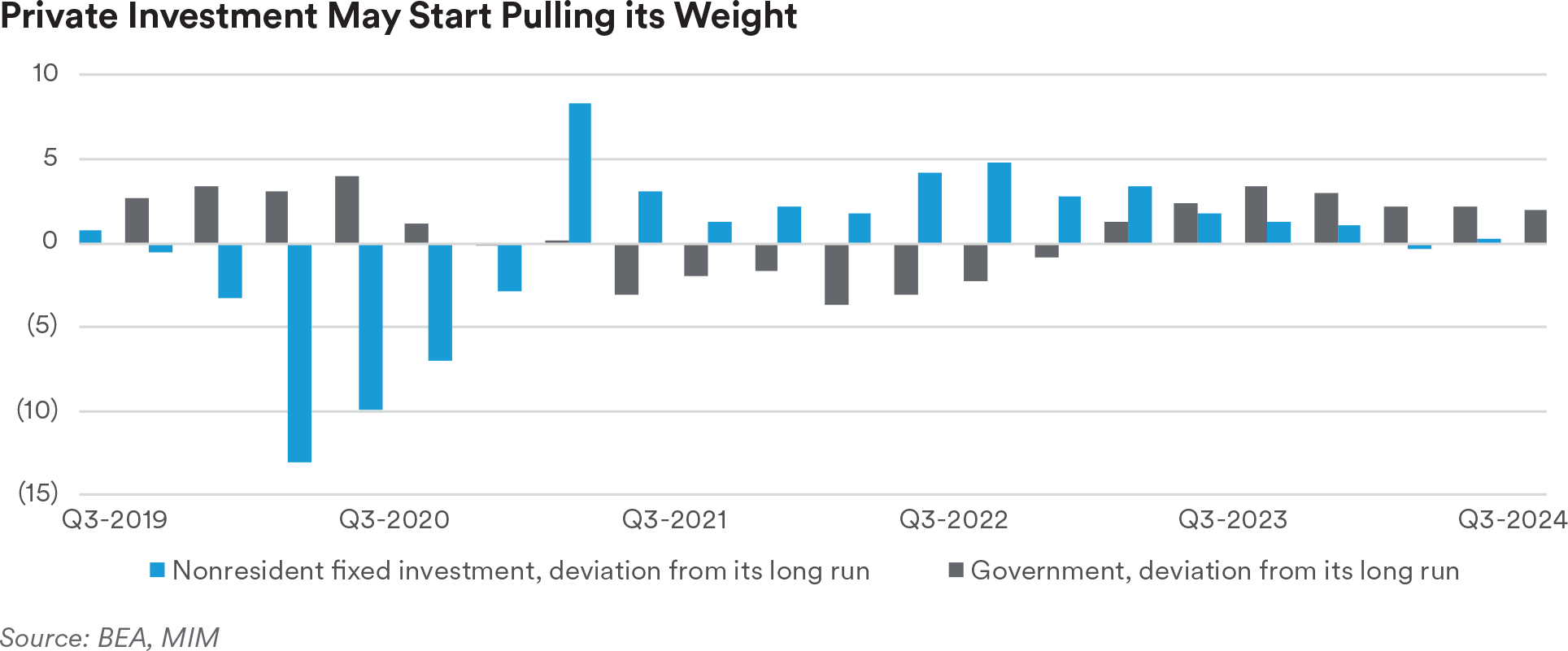

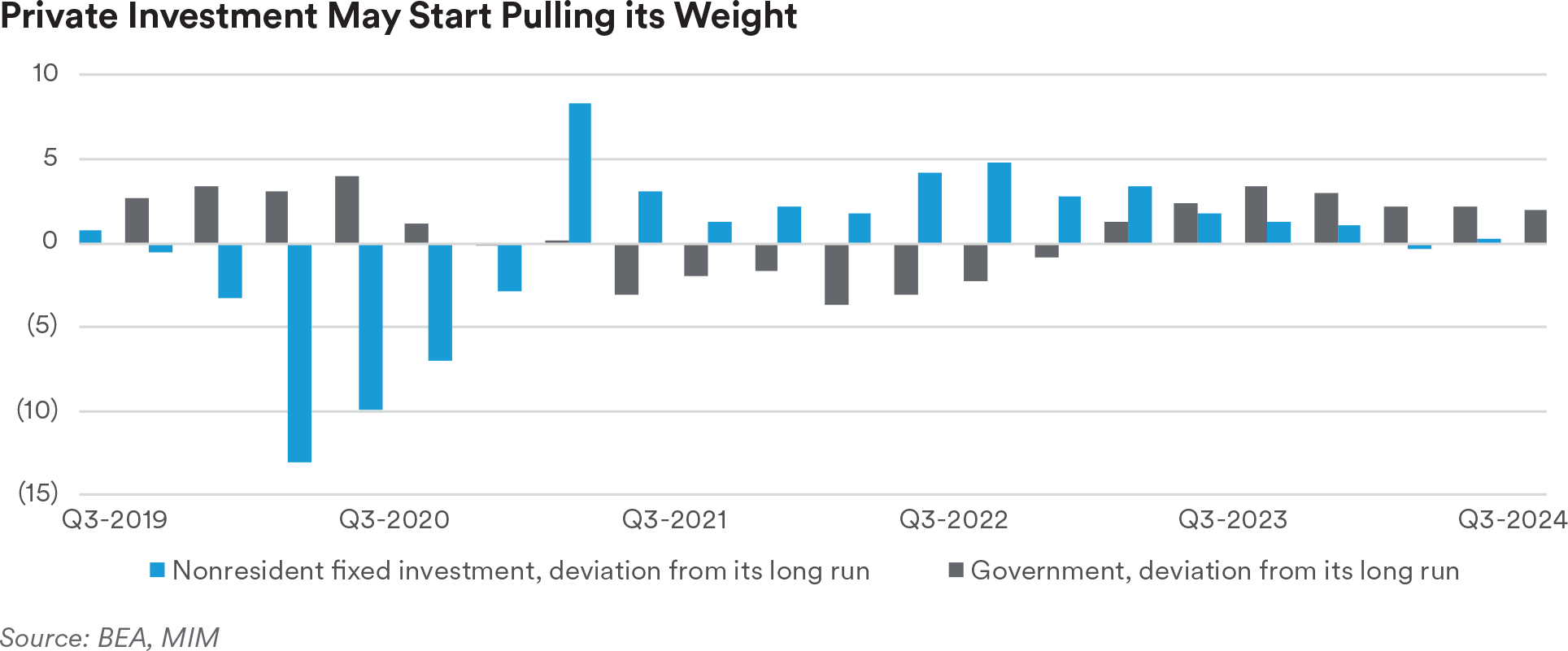

In the private sector, many firms appeared to be holding off investment until election uncertainty was resolved. We expect that with the decisive election outcomes, firms will accelerate their investments, either in organic growth or via mergers or acquisitions. This investment increase would have to replace the large government expenditures that have taken place over the last two years in the Biden administration and support continued growth.

We expect the Trump administration to attempt to impound or claw back as many of the Inflation Reduction Act funds it can. This is expected to show up as a shift from substantial government investment toward private capital investment. The influence of the Federal Trade Commission’s intense scrutiny over mergers and acquisitions under Chair Lina Khan is likely to dissipate, creating a better M&A environment.5

Off Base-case Risks:

Private investment falls short of expectations. If private businesses’ confidence does not improve, and the post-election investment boom we expect never materializes, growth could be threatened as supportive government expenditures are removed. Clawing back non-obligated loans, grants, and other incentives from the Biden administration’s industrial policy bills could dampen investment. The Inflation Reduction Act, in addition to provisioning direct spending, was designed to encourage private investment. The removal of their incentives could lower business investment in certain areas such as clean energy, particularly if the replacement technology-neutral credits are not as large.

Furthermore, mergers and acquisitions may not rebound. One key risk here is that Vice-President-elect JD Vance, who has repeatedly spoken in praise of certain aspects of Khan’s approach to antitrust, is tasked with finding her replacement via his aide, Gail Slater.6 Although the markets appear to expect a relaxation of scrutiny, the change in administration may not bring as much relaxation as they expect.

Upside risks to inflation remain. A number of priorities of the incoming U.S. administration may — in the current environment — be inflationary. This is particularly the case for the labor market and immigration policy. A sudden shift in enforcement, such as effective and widespread deportations, would have a chilling effect on immigrant employment and potentially upset the labor market that has just now come into balance. Labor markets would tighten once again, likely pushing up wages and inflation.

Risk 3: The Coming Pause in Monetary Policy

As major central banks continue their cutting cycles, there is room for policy missteps resulting in a resurgence of inflation or a recession. In 2025, the most pressing question around the globe will likely be when, and at what level, central banks will (or should) stop cutting rates. The degree of uncertainty around neutral rates is particularly pronounced and entails a high degree of risk.

During the first half of 2025, we believe the main point of focus will be the speed rather than the direction of policy rate movements. The second half of the year is expected to be characterized by more uncertainty as central banks reach the end of their cutting cycles and the neutral rate falls into focus. The true neutral rate is unobservable and changing, but we believe that the current nominal neutral rate for the U.S. and the UK is around 3%. However, estimates vary widely. For the Fed, September’s Summary of Economic Projections shows members expect a long-run policy rate between 2.4–3.8% with outside estimates even higher. For the ECB, estimates range between 1.5–2.5%.

In Europe, our base case is that the ECB and BoE will step up the pace of rate cuts next year in the face of negative growth spillovers emanating from higher U.S. import tariffs. However, we suspect that central banks would see through any near-term bump in import price pressures and be more concerned about the negative hit to demand (and therefore inflation) over their 2-3 year policy horizons, leading us to expect both the ECB and BoE to cut rates by 125bps next year. The risk is, of course, that they do not see through near-term import price pressures and do not cut rates enough.

Risk 4: Turning Points in Geopolitical Crises?

Middle East

Our baseline scenario assumes President-elect Trump’s administration will return to its policy of “maximum pressure” on Iran, ratcheting up sanctions next year. The first order effect of these sanctions would be to reduce Iranian oil exports, which have increased to around 1.5 million from 400,000 bpd in 2020. A re-tightening of sanctions could reduce these exports by around 1 million bpd, although the balance of the global oil market is likely to be tilted towards a surplus in H1 2025, which should ease the impact on global prices. The ceasefire deal announced in November between Hezbollah and Israel is an important step toward improving regional stability, but without stringent enforcement by UNIFIL and the Lebanese army to prevent Hezbollah reoccupying southern Lebanon, it could prove short-lived.

Off Base-case Risks:

An overly emboldened Israel. In our downside scenario, Israeli foreign policy becomes overly emboldened by the Trump administration, potentially leading to several volatile outcomes. First, Israel could push ahead with plans to annex substantial parts of the West Bank. Second, Israel could convince the U.S. to provide it with the military support needed to attack Iran’s underground nuclear facilities. This would mark a significant escalation in the conflict and could drive Iran to follow through with its threats to retaliate against hydrocarbon infrastructure across the Gulf Cooperation Council (GCC), which would have significant spillovers to the global energy market. There is also the possibility that, with some of its foreign proxies like Hamas and Hezbollah crippled, Iran could make a final push to manufacture nuclear weapons to regain some leverage. Attacks by Iran’s Houthi proxies on shipping in the Red Sea could also intensify.

Unexpected resolutions. In our upside scenario, Iran, having already lost significant regional military influence through the degradation of Hamas and Hezbollah, and facing a further economic shock in the form of oil export sanctions, comes to the table to negotiate a new nuclear deal with the U.S. in exchange for sanctions relief. Another area of potential upside is if the Trump administration can negotiate a resolution to the Gaza conflict and a solution to Palestinian statehood sufficiently palatable to the GCC rulers. This could reopen the door to a normalization of relations between Israel and Saudi Arabia, which would also likely entail the formation of a U.S.-Saudi Arabia security pact.

Ukraine-Russia War

Our base-case scenario assumes that the current phase of the Russia — Ukraine conflict will end in 2025. It looks highly likely that the Trump administration will significantly curtail military and financial resources to Ukraine, which Europe and other countries will struggle to replace (particularly the provision of military equipment). The loss of U.S. support is ultimately expected to force Ukraine to the negotiating table.

However, while the current phase of the conflict will likely end, a durable political settlement still seems unlikely in 2025. President Putin has been adamant in his public speeches that Russia is ready to engage in peace talks based on the Istanbul Communiqué and respecting the “reality on the ground.” We believe this means that Russia wants to retain the territory it has captured to date as well as deny Ukraine future NATO membership or any other substantive security guarantees.

Ukraine, on the other hand, has a diametrically opposed set of goals. An imposed peace agreement or ceasefire is likely to raise the risk of heightened domestic political and social instability in Ukraine over the near term — given that a large part of the population and current political leadership would oppose any settlement on Russia’s terms — and potentially significantly increase security risks over the longer term should Russia use a 2025 ceasefire as an opportunity to rearm and be in a stronger position to attack Ukraine again at some point in the future.

Short-term market implications from a potential ceasefire are positive for Ukraine assets. However, we do not expect any imminent loosening of sanctions on Russia even in the case of a ceasefire. Implications for the wider region are varied. Ongoing security concerns would likely keep up pressure on Europe to continue to raise defense spending even in the event of a Russia-Ukraine ceasefire, particularly as one would be associated with reduced confidence in the U.S.’s ongoing commitment to the region’s security.

Off Base-case Risks:

The war of attrition continues. Risks around our base-case view include a continuation of the current war of attrition, ultimately until Ukraine can no longer sustain its military capability to withstand Russia’s attacks, or a renewed all-out attack by Russia once it has rearmed, should the imposed peace agreement unravel.

Endnotes

1 E.g., the 25% tariffs on China of the first Trump administration resulted in trade-weighted tariffs of approximately 10% (Source: “Section 301 (China) Tariffs Causing a Fourfold Increase in Tariff Rates, ” American Action Forum, July 18, 2022.)

2 “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States,” various issues

3 Platform | Donald J. Trump

4 MIM calculations based on 2023 income taxes and imports, USITC, U.S. Treasury

5 M&A in 2025: Opportunity with a Side of Scrutiny, MIM, December 5, 2024

6 Lina Khan’s Replacement at FTC to Be Vetted by an Aide to Vance, Bloomberg

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK, this document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”) a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border license, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of July 22, 2024, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.