The Rise of Data Centers

In recent years, data centers have undergone a remarkable transformation, shifting from overlooked utility infrastructure to becoming one of the most sought-after property classes in the institutional real estate market. These specialized facilities serve as the backbone of our digital world, housing the essential components of computing systems, networking equipment and storage infrastructure. The history of data centers dates back to the 1940s when a single computer filled entire floors.

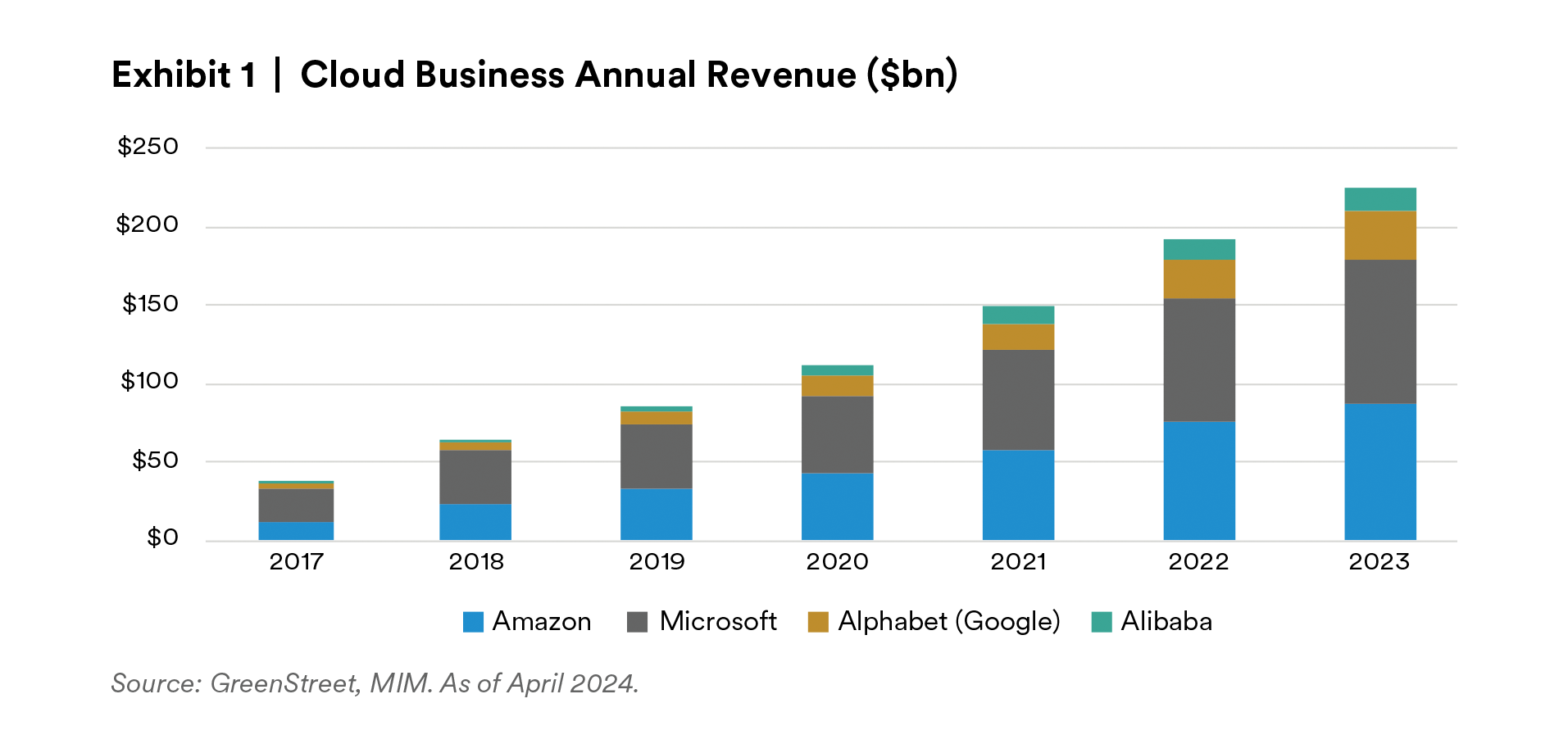

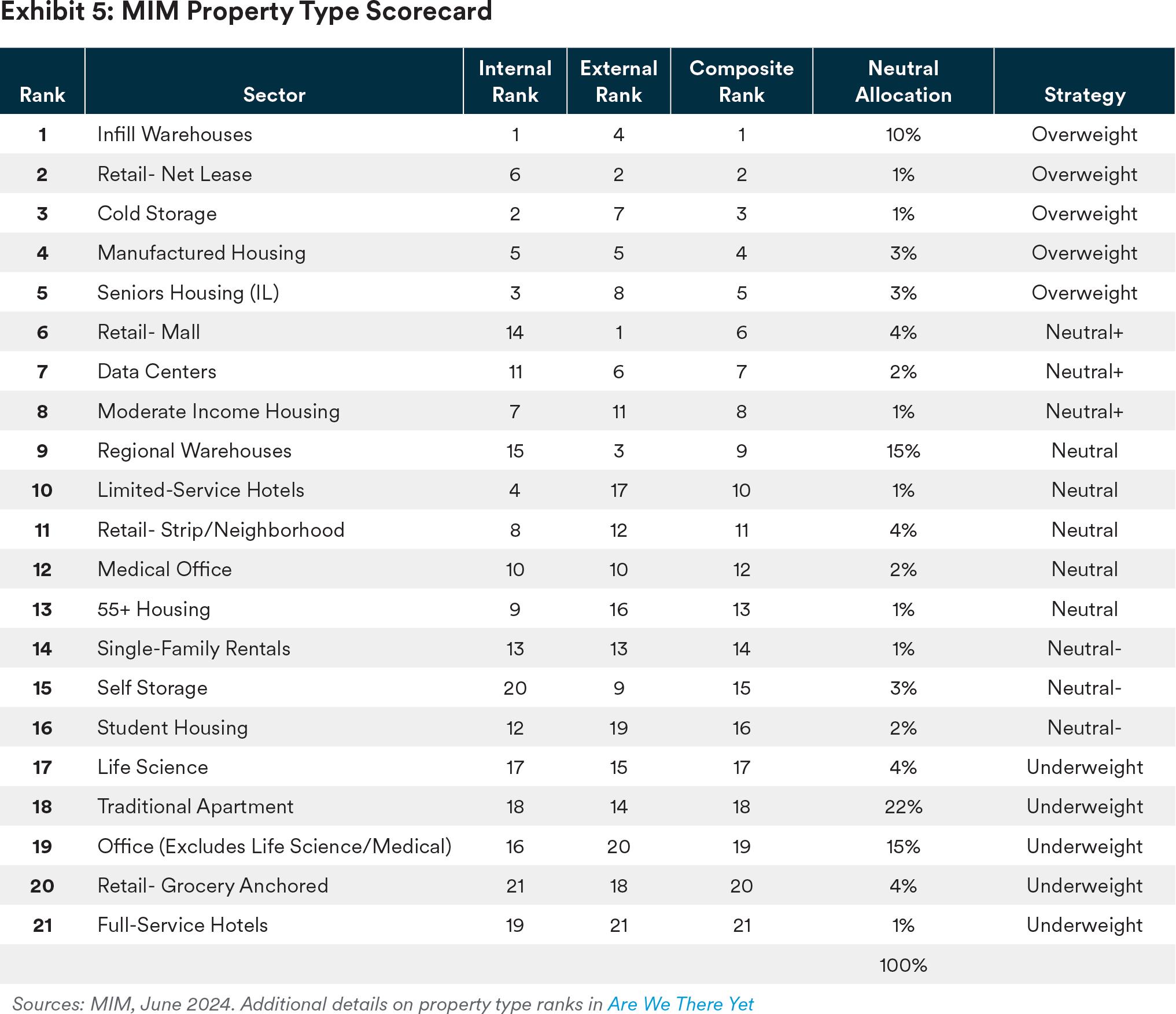

As technology advanced, the required space for operation shrank significantly. Today, data centers come in various sizes, ranging from small server rooms to sprawling hyperscale facilities spanning millions of square feet. The surge in demand for data center services has been fueled by the proliferation of cloud computing, big data analytics and artificial intelligence (AI). These technological advancements, particularly in the post-pandemic era, are increasing demand and increased revenue for big tech cloud businesses (Exhibit 1).

Third-party landlords own 55% of U.S. data centers (with the remainder owner-users)1. Within the third-party landlord space, there is a large concentration of ownership by a few data center REITS, including Equinix and Digital Realty. This concentration allows these REITs to have considerable influence over pricing, service offerings and market trends.

We estimate the investable universe2 is similar to other smaller property-type segments like self- storage and cell phone towers.

Types of Data Centers

Data centers, with their diverse physical characteristics and usage patterns, offer a tapestry of opportunities for investors. They can be categorized based on their physical characteristics, such as powered shell and turnkey facilities. Powered shells comprise landlord-owned finished structures, connected to power and fiber, rented to a tenant that installs, maintains and owns the long-lived infrastructure (generators, batteries, cooling equipment, power equipment) and short-lived infrastructure (servers, racks, networking equipment) needed to operate the data center. Powered shells typically have a net rent per square foot lease structure. Turnkey data centers offer a fully built- out exterior and landlord-owned long-lived infrastructure; tenants own and maintain their own short- lived infrastructure. Leases are typically structured as gross plus electric, although net leases are not uncommon but nearly always on a $/KW/month basis. Due to the significant capital investment by turnkey landlords, turnkey tenants pay substantially more rent than powered shell tenants, regardless of the lease structure. Typically, turnkey data centers are priced with higher returns to compensate the investor for the risk of owning the equipment, which can depreciate quickly. MIM is biased toward powered shell facilities, given that they are less susceptible to obsolescence risks associated with owning technology infrastructure.

Data centers can also be categorized by use, including:

- Hyperscale Data Centers—These data centers, operated by tech giants like Amazon Web Services, Microsoft and Google, boast extreme scalability capabilities. Engineered for large- scale workloads, they feature optimized network infrastructure, streamlined connectivity and minimal latency. Hyperscale data centers tend to have a larger physical footprint and are often entirely leased to a single major tenant.

- Colocation Data Centers—Colocation data centers offer an alternative option for organizations with in-house or on-premises servers and/or workloads that don’t require vast power consumption that require an entire data center, or whose capital allocation strategy doesn’t prioritize the hardware investment. These facilities are occupied by multiple tenants who share operational costs such as power, cooling, bandwidth, communications and security. This shared approach makes colocation data centers a cost-effective solution.

These two types of data centers present different risk profiles. Hyperscale data centers, with their single-tenant leases, may lack the tenant diversification found in colocation data centers. However, hyperscale tenants generally boast excellent credit quality, as they are some of the most profitable and largest companies globally. On the other hand, leases for colocation centers tend to be shorter compared to hyperscale data centers, which are actually favored in the current market conditions as they offer rental rate mark-to-market opportunities. The use, tenant diversity and lease terms across different types of data centers make them suitable for various investors based on their risk tolerance and investment objectives.

How to Select a Site

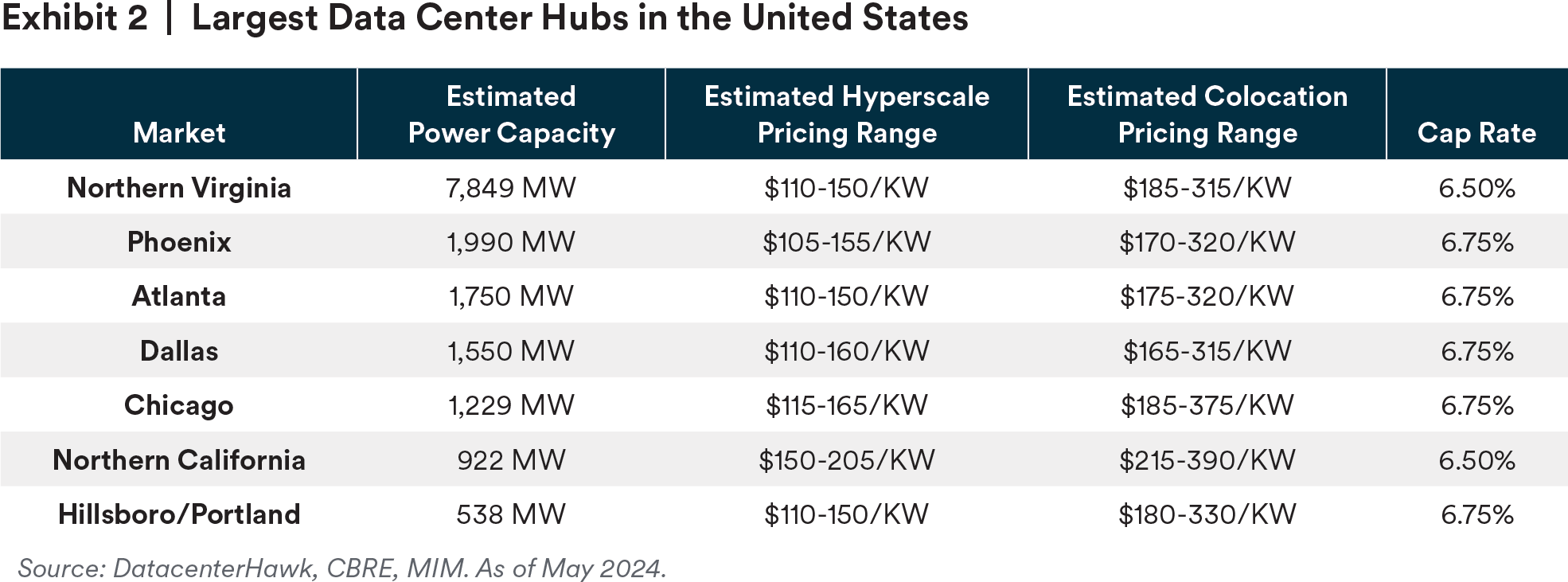

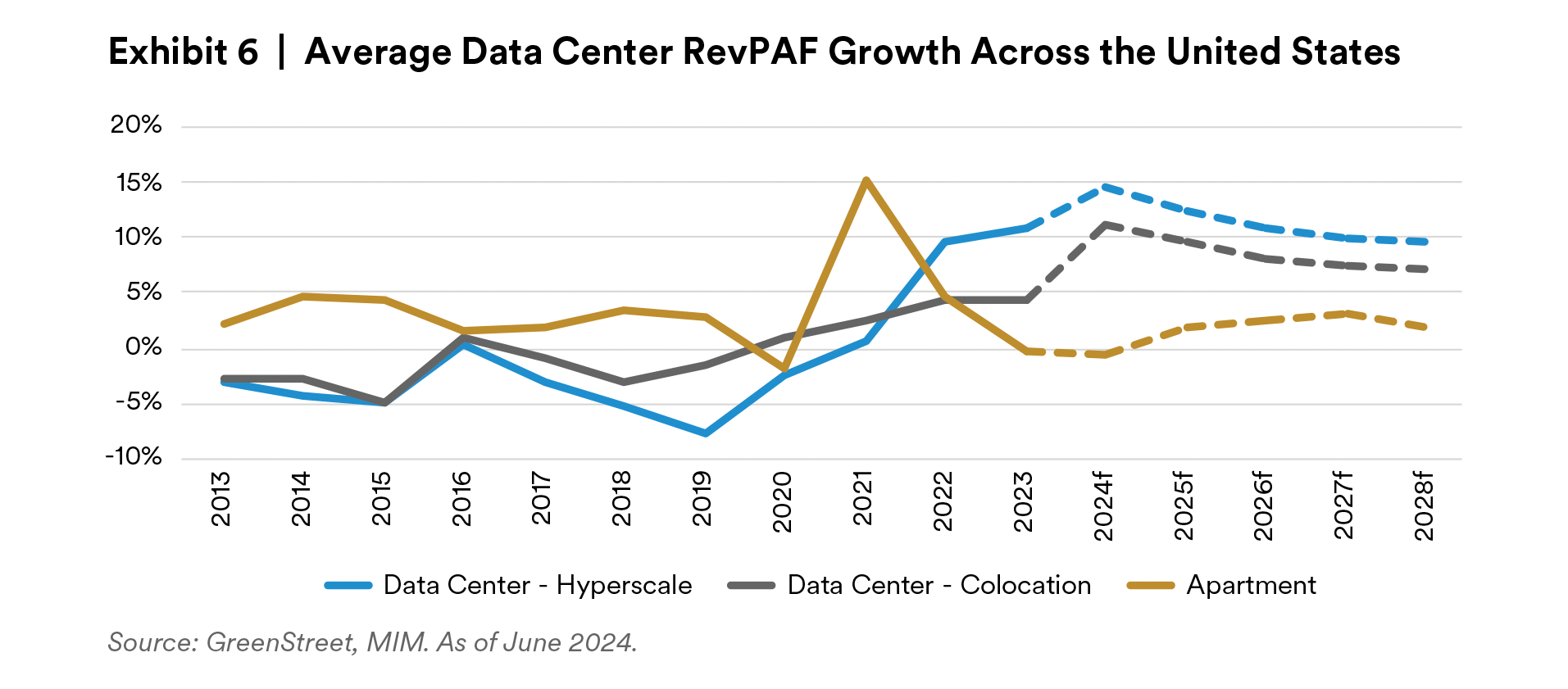

Considerations for data centers include power, size/footprint, fiber connectivity/latency, fundamentals and regulation/environmental that all have separate impacts on data center investment decision making. Due to their unique set of requirements, data center markets are currently highly concentrated, with several MSA’s serving the majority of U.S. computing needs (see Exhibit 2).

Power—Power availability is the single-most critical factor for investing in data centers. Unlike many real estate investments that are often evaluated on a per square foot or per unit basis, turnkey data center rents are charged on a dollar-per-kilowatt basis. Powered shell data centers are commonly charged on a $/sf basis. Power per site is heavily influenced by the utility provider, and new developments must oftentimes wait in a queue (that can vary based on jurisdiction) for utility providers to build out the necessary infrastructure for a given property.

The overall power capacity of a given market can indicate the attractiveness of a data center site. Regions with large amounts of untapped, ready-to-use power are desirable locations for new data center developments. Additionally, as environmental considerations grow, jurisdictions that source their power from renewable sources like wind, solar and hydroelectric, have become more in-demand.

Size/Footprint—The size or footprint of data centers varies widely, ranging from small server rooms to massive campuses spanning several football fields. Small-scale data centers may serve local businesses or organizations, housing a limited number of servers and networking equipment. In contrast, hyperscale data centers operated by tech companies and modern colocation facilities can house tens of thousands of servers and consume vast amounts of energy to support their operations. Generally, the size of the building can help dictate the price of the data center, and which type of tenant it caters toward.

Fiber Connectivity / Network Latency—In between data centers and end users lies a vast network of fiber optic infrastructure serving as the backbone to global communication networks, the internet and at its core — data transmission. Sites should offer redundant fiber paths from multiple carriers. Dark fiber (point-to-point fiber over a defined physical path) should also be available for users requiring a dedicated path for its sole use. Any given carrier may offer slightly different routes to major internet exchanges and long-haul cables, thus introducing varying levels of latency.

Latency refers to the delay in the transmission of data between users’ devices and the servers in a data center. Networks with a longer delay or lag have high latency, while those with fast response times have low latency. It encompasses various factors including the distance between the user and the data center, network congestion and server performance. Low latency is crucial for applications requiring real-time interactions, such as autonomous driving, financial trading, GPS navigation, online gaming and video conferencing. Reducing latency ensures smoother and more responsive interactions, ultimately improving overall efficiency and satisfaction for users accessing services hosted in data centers. Since not all data center workloads have equal latency tolerance thresholds, a site offering access to multiple fiber carriers will appeal to the widest array of data center lessees.

A data center located closer to the end-user will typically have lower latency, which is a key reason why the major data center hubs in the United States are situated close to population nodes. The Northern Virginia region boasts the highest concentration of data centers in the United States, partially driven by the desire to optimize data transmission for the region’s government data needs. While certain uses like AI model training don’t require low latency, the computing requirements to support widespread consumer adoption of AI lead us to believe that companies looking to reduce latency will increasingly lead to a more-heavily concentrated data center network across a handful of markets across the United States.

Jurisdictional Regulations and Environmental—Local sentiment toward data centers can differ and choosing a location with a friendly regulatory environment is crucial. Water usage, noise complaints, lack of jobs produced and the relative tax-base accretion are all reasons cited against new data center developments. For example, in Atlanta, power constraints and state legislation that paused targeted tax breaks for data centers could impede further growth in the data center market.

As companies push to decrease their environmental impact, there is an increased initiative to locate data centers in jurisdictions that generate power from renewable power sources. We expect that this focus will only increase in the years to come.

Real Estate Fundamentals—The supply-and-demand dynamics of data centers are influenced by various factors in the current landscape. The demand for data centers continues to grow as businesses, governments and individuals increasingly rely on digital services. The emergence of cloud computing, big data, AI and machine learning, and digital streaming are all major factors contributing to an increased need for data centers. In 2018, the total amount of data created, captured, copied and consumed in the world was 33 zettabytes (ZB). This grew to 59ZB in 2020 and is predicted to reach 175ZB by 20253. We expect that these demand drivers will cause data needs to continue to grow exponentially in the future, and with it, demand for data centers.

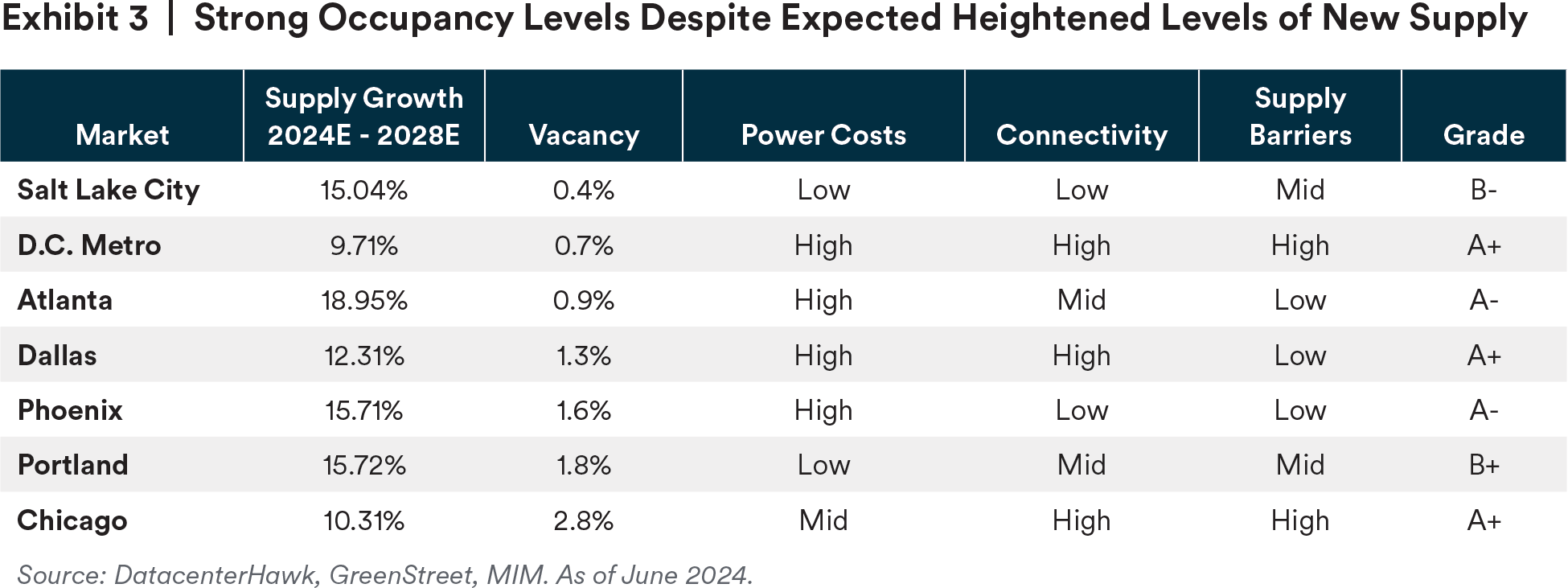

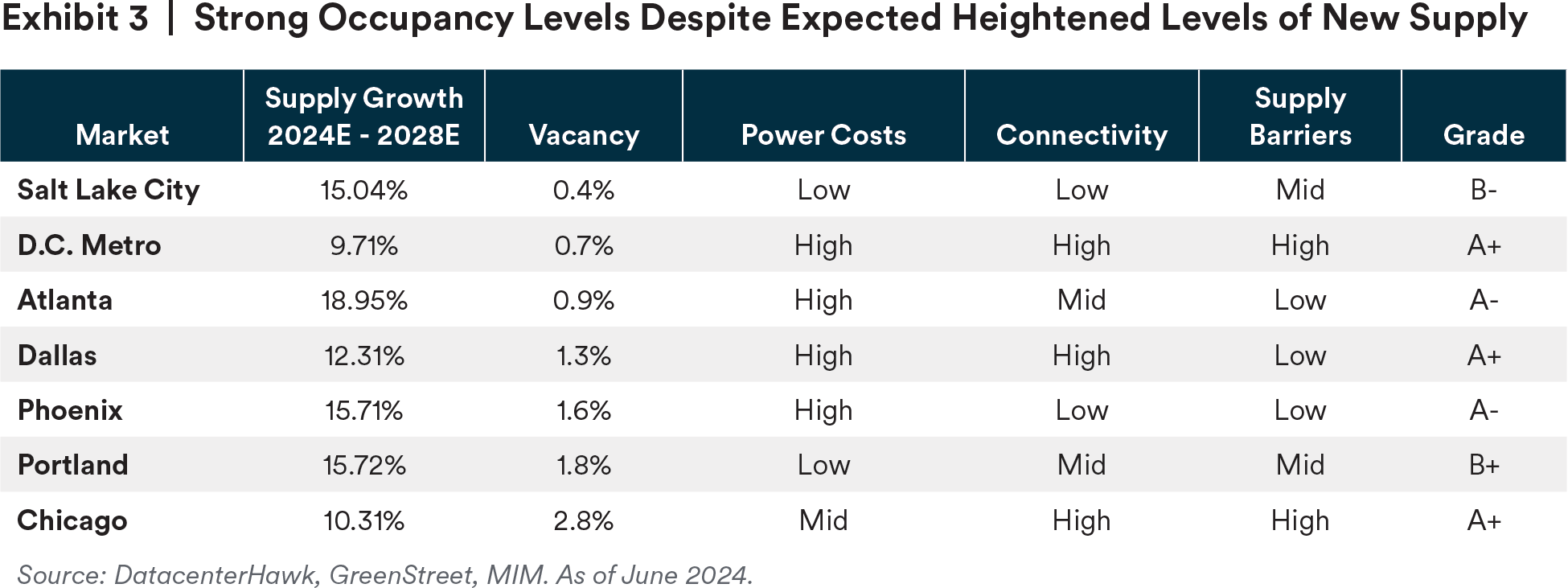

In tandem, supply continues to grow, with supply growth across many key markets projected to average ~10% annually for the next five years (Exhibit 3). Vacancy levels are at record lows across nearly every market, with little evidence they will return to average historical levels in the near term. Exhibit 3 indicates MIM’s data center market grade for a select group of markets based on several key factors. The overall market grade suggests where we think the best markets are for stabilized data center investments.

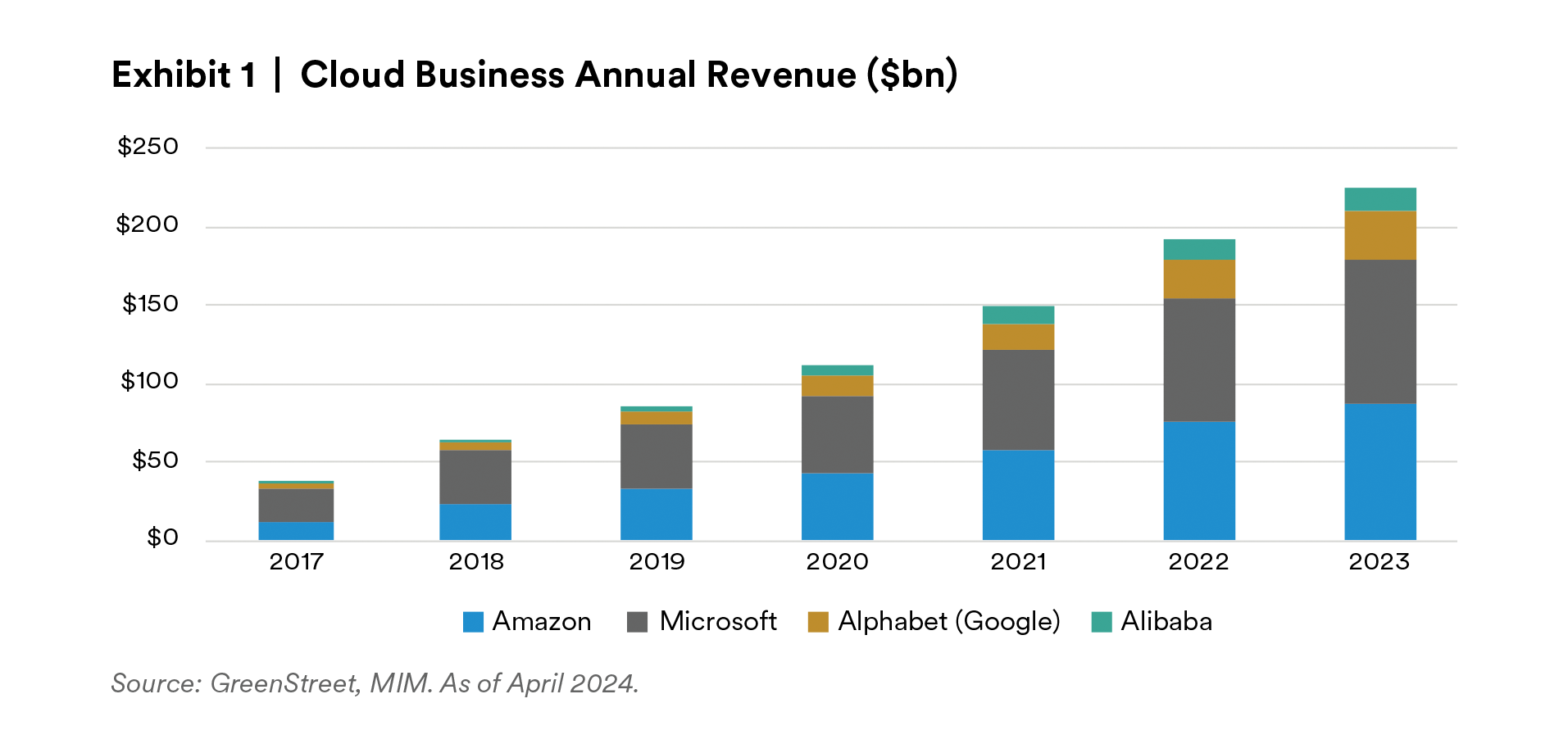

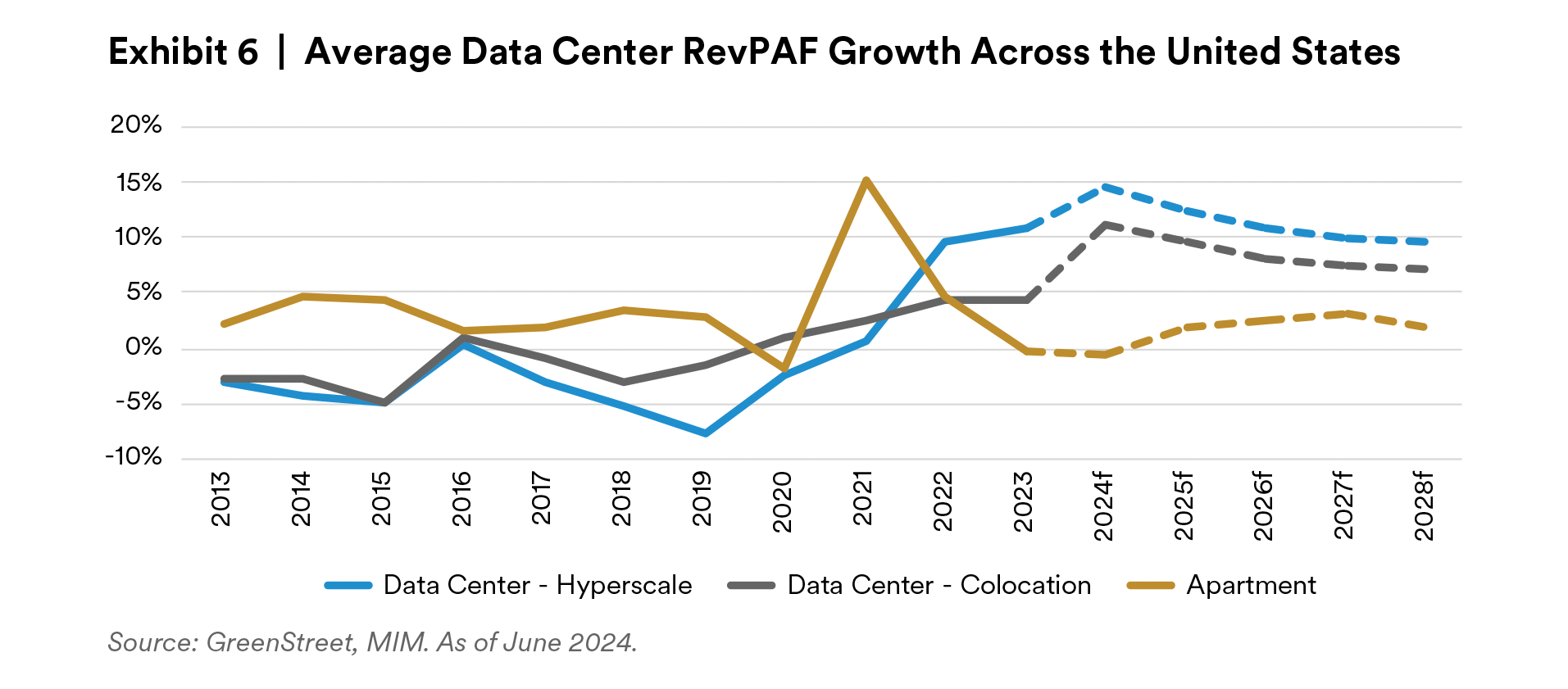

Given the known supply pipeline and current occupancy rates, we anticipate that most markets will continue to be undersupplied through 2028. As a result, we expect hyperscale data center revenue per available foot (RevPAF) growth to average at least 10% per year over the next three years.

Challenges and Risks

Although the short- to medium-term outlook for data centers appears positive, investing in this sector carries inherent risks. A significant concern is the potential for technological obsolescence. Rapid advancements in technology, such as hardware innovation, software optimization and breakthroughs in areas like quantum computing, pose substantial risks. Furthermore, progress in energy efficiency or data transmission could make developing data centers in less traditional locations, such as rural Oregon, more economically viable, potentially leading to a rapid increase in supply. Lastly, the risk of obsolescence extends to smaller, single tenant-powered shells where the users have a tendency to consolidate into newer colocations and hyperscale data centers.

We believe there is a 25% chance of commercially viable and disruptive quantum computing breakthroughs in the next decade.

A downside risk to data center investors includes technological breakthroughs in quantum computing and quantum data storage that could allow computers to do more with less power and space. Based on a review of recent company press releases and academic publications, as well as discussions with experts in industry, we believe there is a 25% chance of commercially viable and disruptive quantum computing breakthroughs in the next decade.

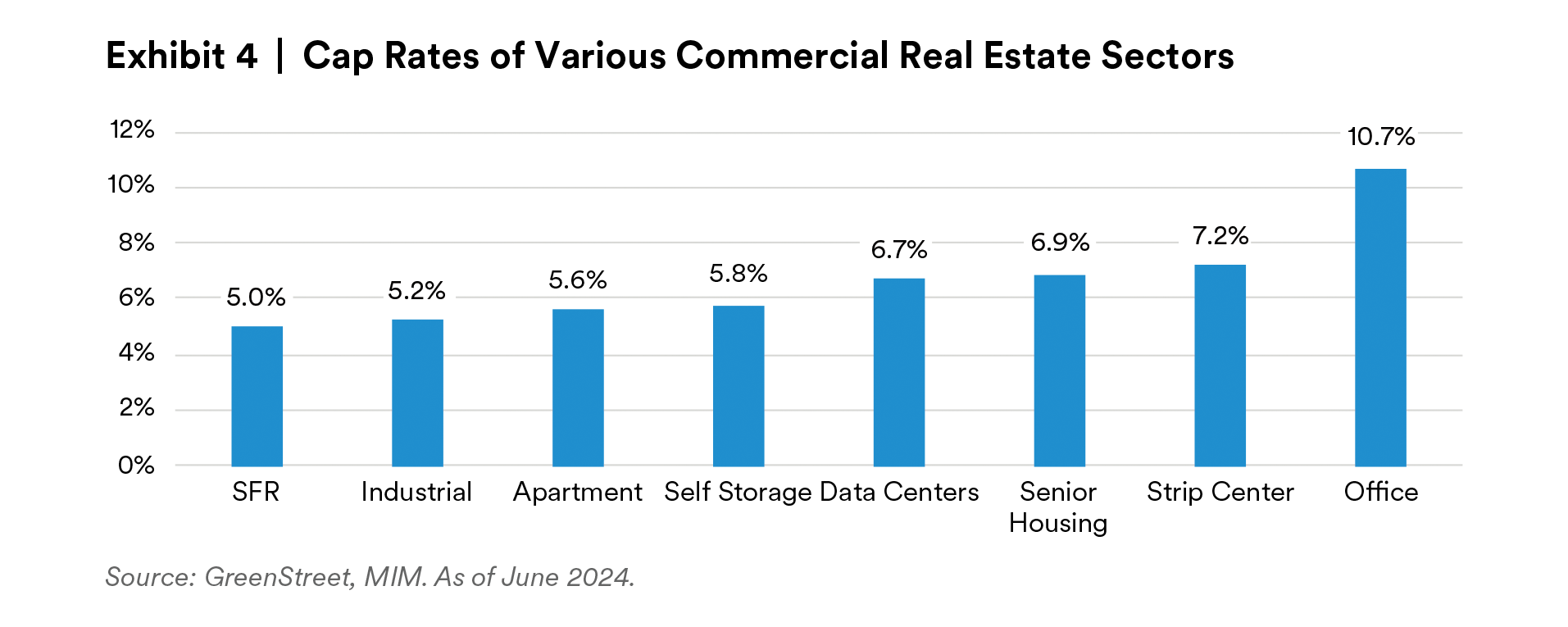

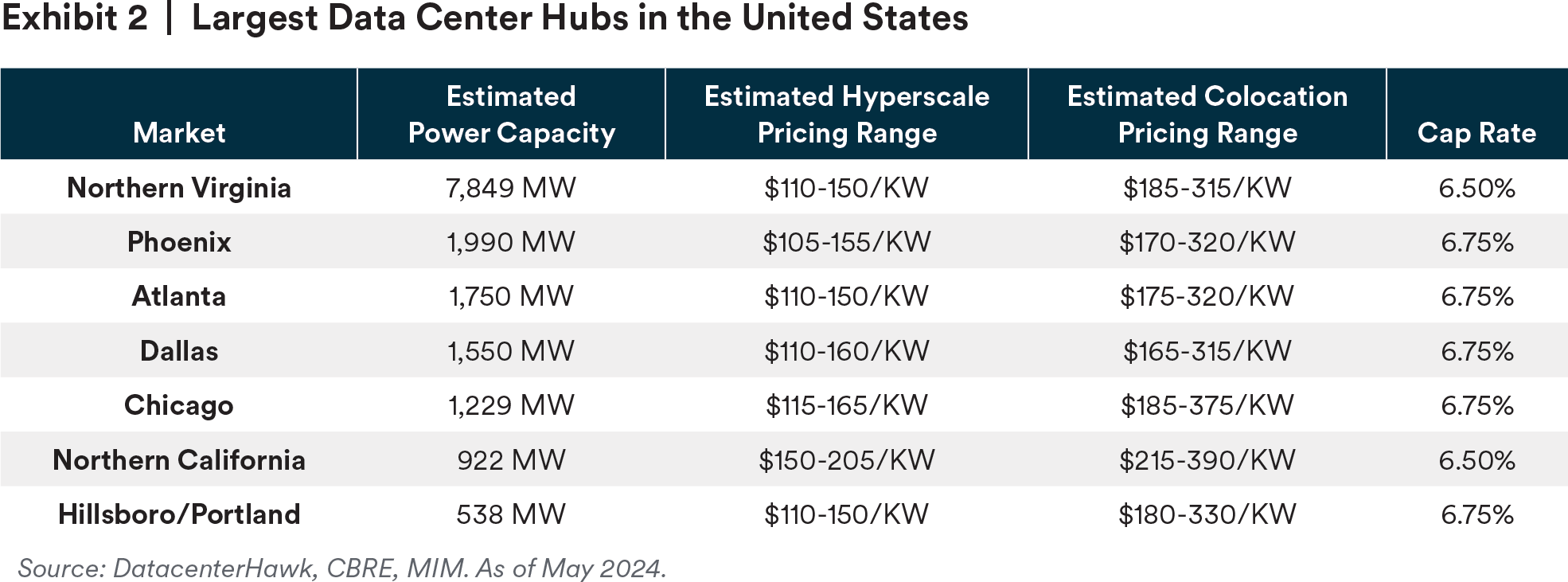

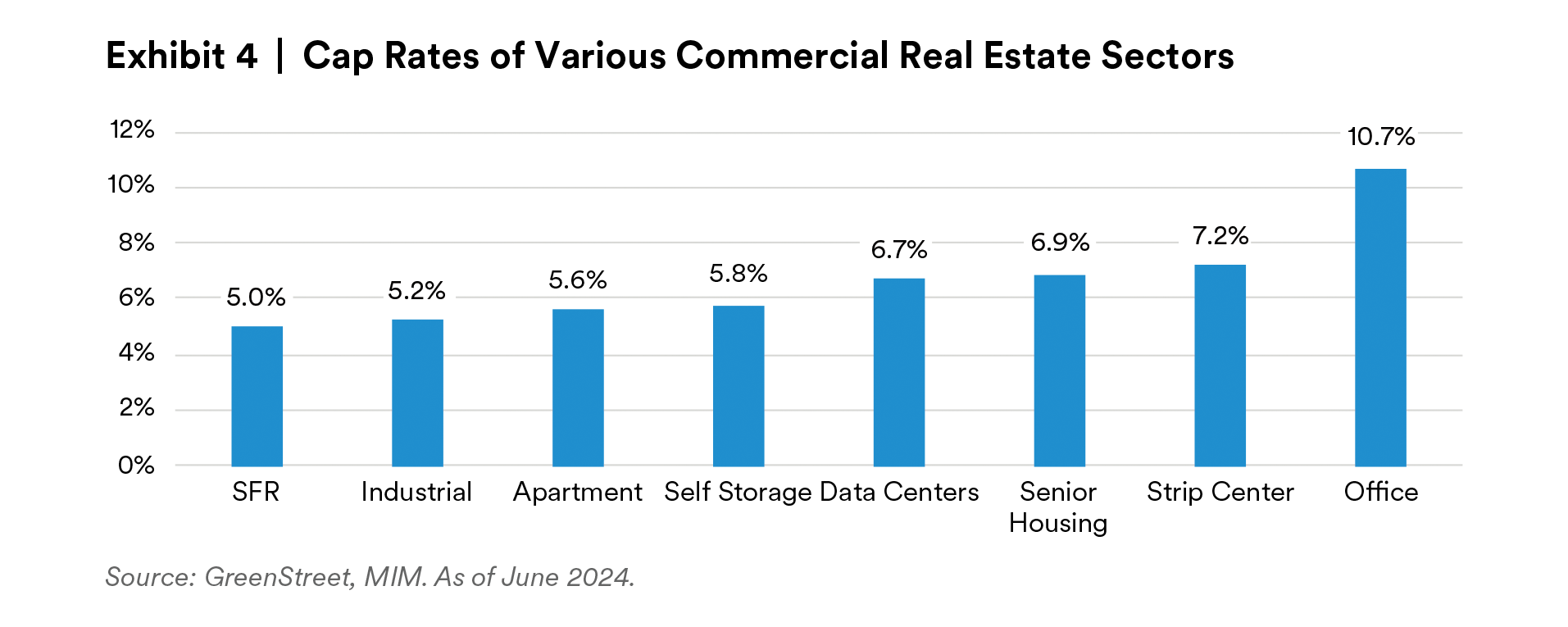

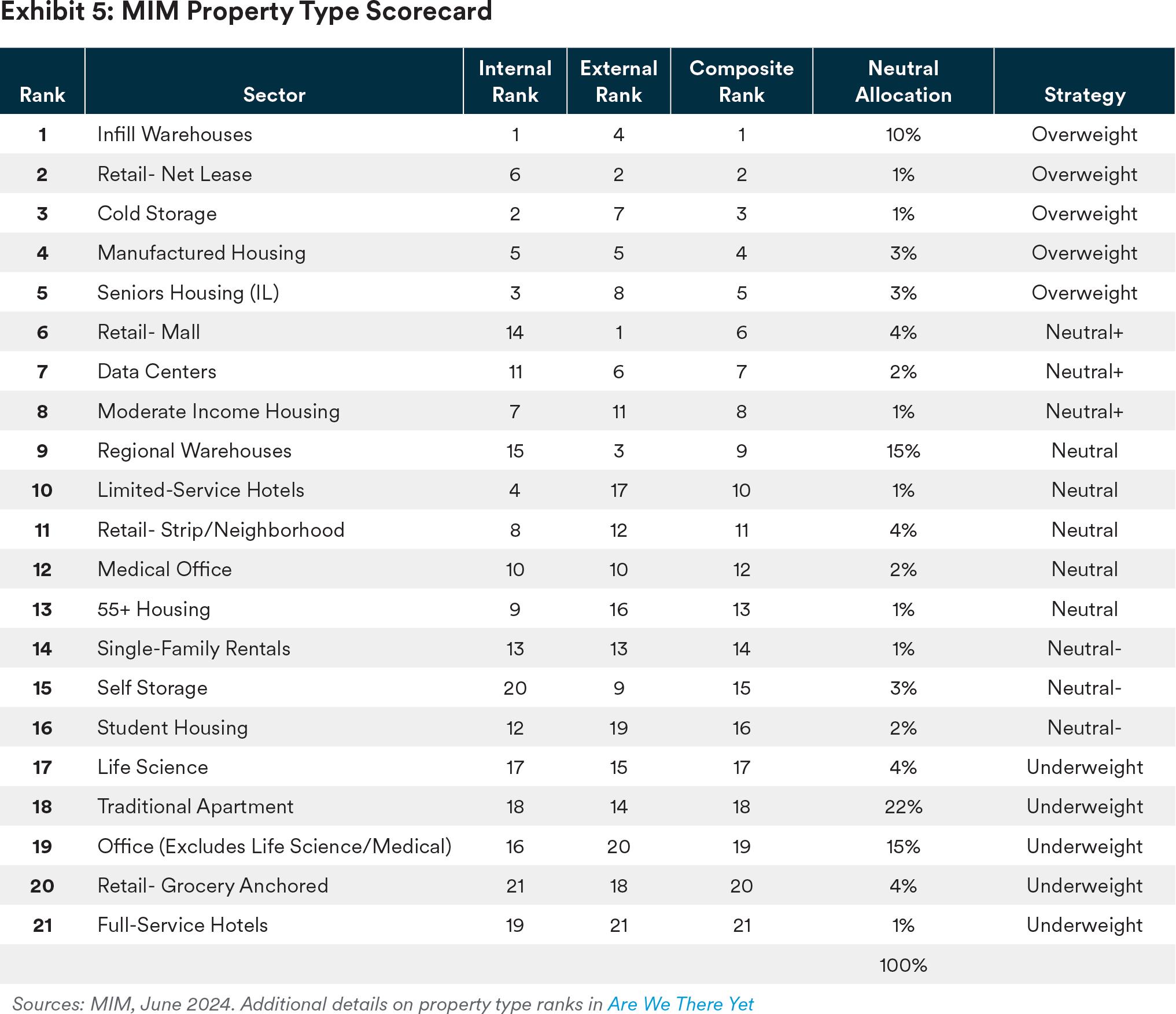

Pricing for data centers suggest that cap rates are in the middle of comparable commercial real estate sectors (Exhibit 4), despite the positive outlook for the sector. We estimate the US commercial real estate market to be $17trn, and data centers are $350bn, or roughly 2%. A neutral weight on data centers supports a 2% allocation in a diversified commercial real estate portfolio (Exhibit 5), although we are currently recommending a modest overweight and a 3% allocation to data centers. Proper diversification is harder to achieve for smaller portfolios, so allocations above our suggested target may be required for direct real estate investments.

The evolving demands of AI on data infrastructure could accelerate obsolescence. An AI data center may require up to three times the power of a traditional cloud facility, suggesting that future data centers will need to meet different specifications. For instance, a standard data center setup might use 30 kilowatts to power cloud servers, whereas an AI-enhanced version could need 100 kilowatts. This increase necessitates additional cooling equipment and extra servers for AI processing, meaning AI-focused data centers could demand more space, higher ceilings or raised floors.

Managing data centers involves a complex array of operating risks that can impact performance, security and reliability, which require an experienced operator. For example, data centers rely heavily on continuous power supply. Power outages, even brief ones, can cause significant disruptions.

As such, backup generators are critical but can fail if not properly maintained. Data centers also generate substantial amounts of heat, requiring robust cooling systems that can prevent overheating that can damage equipment. They also require security from cyberattacks or physical security breaches. There are a multitude of additional risks to data centers, including natural disaster risk, hardware and software failures, regulatory compliance, etc. that all require an experienced operator.

Another risk involves tenant concentration in hyperscale data centers and its impact on pricing power. Hyperscale tenants, with their robust financials, present low credit risk. However, their limited number grants them significant pricing leverage, potentially securing favorable rental rates and terms. Should the data center market weaken, these hyperscale tenants might gain even more pricing power. This was hinted at before the pandemic-induced surge in demand when RevPAF growth for data centers was flat or negative (Exhibit 6), in part reflecting the pricing influence of hyperscale providers.

Lastly, the sector faces challenges related to underwriting and performance forecasting due to limited data availability. The scarcity of comprehensive and standardized information across the industry hampers efforts to understand data center operations, sustainability, economic impact and investment prospects. While some operators voluntarily disclose data on their facilities, such as energy consumption and efficiency measures, the industry lacks transparency compared to more established sectors like industrial, residential, retail, hospitality and office. This opacity complicates benchmarking performance, assessing environmental impacts and making informed investment decisions in the sector.

Conclusion

Investing in data centers offers compelling opportunities to capitalize on the digital transformation of industries and the exponential growth of data-driven technologies. While data center investments entail challenges and risks, strategic allocation of capital to data centers can enhance returns, while offering portfolio diversification, given that the sector is driven by a unique set of economic and technological factors. As businesses and consumers increasingly rely on digital services and applications, data centers will play an integral role in shaping the future of the digital economy.

Endnotes

1 Global Data Center Outlook, GreenStreet, April 2024.

2 Estimating the Size of the Commercial Real Estate Market (reit.com), North America Data Center Report | H2 2023 (jll.com).

3 The world’s data explained: how much we’re producing and where it’s all stored (theconversation.com).

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services.

The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein.This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”) a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of July 22, 2024, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/ or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.