Buckle Up for a Bumpy Ride

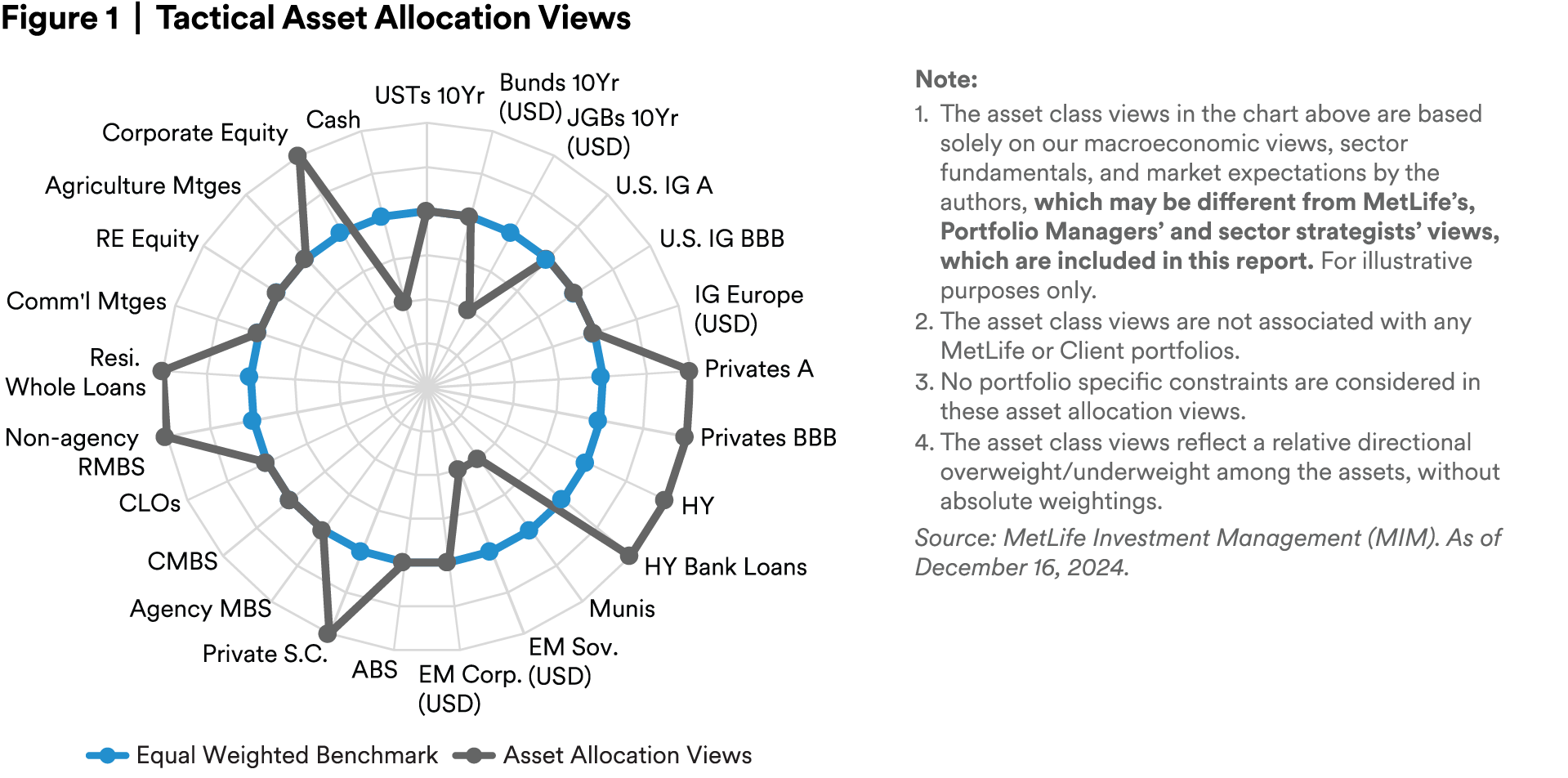

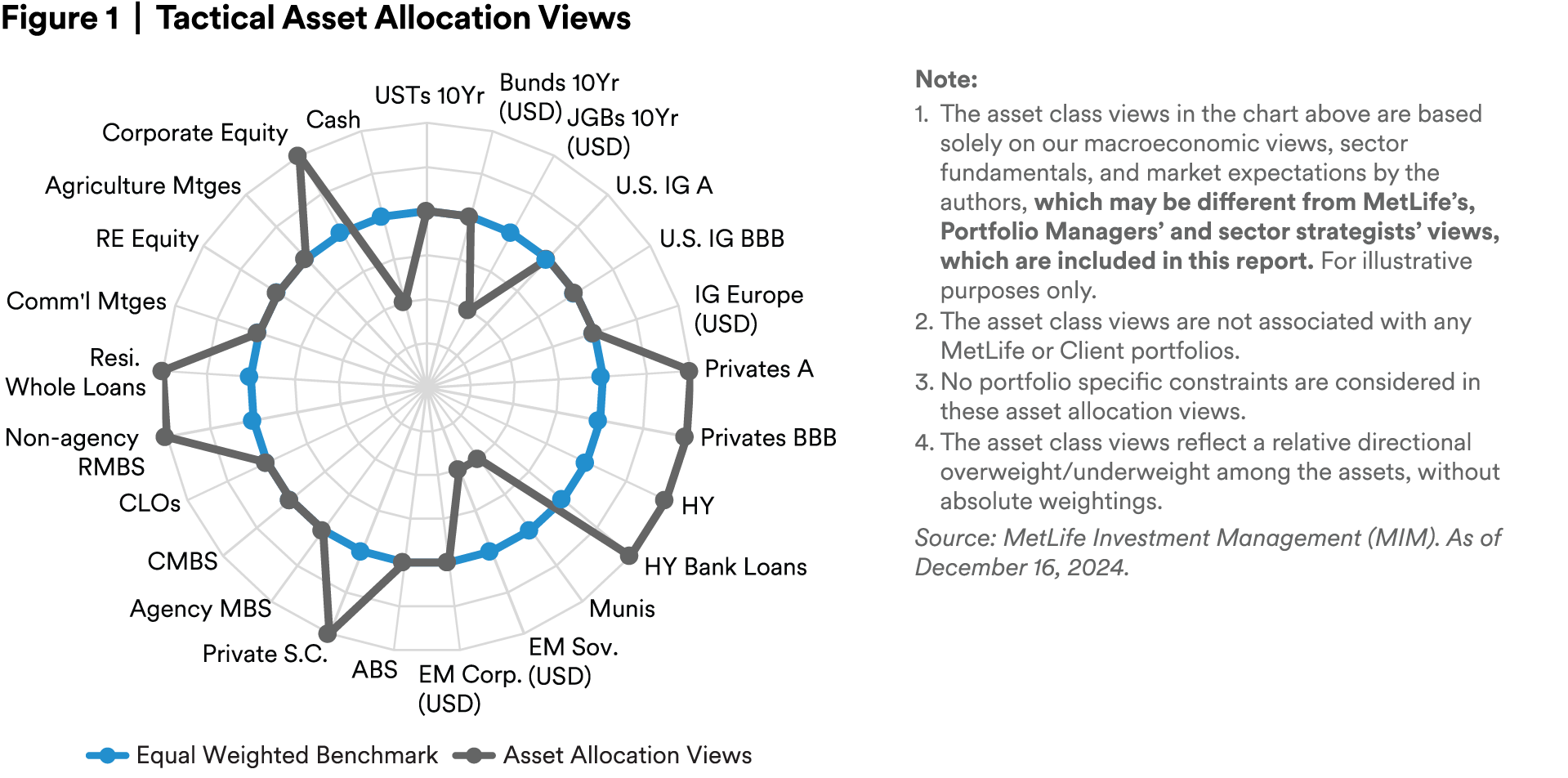

Although the uncertainty of the U.S. election is over, uncertainty regarding the prioritization of announced policies creates a broader range of possible outcomes in 2025. An anticipated deregulatory environment should be positive for overall growth, while tariffs could work against global economic activity and temporarily boost inflation pressures. Timing and pace matter and can impact the interactions between these policies and the Federal Reserve’s monetary policy, resulting in changes to the growth and inflation outlooks. We continue looking for spreads to remain mostly rangebound. With a low risk of recession, a carry strategy is preferred for the backend of the curve, while opportunities also exist for asset classes with intermediate terms.

Tariffs Take Center Stage

United States — The outlook for the U.S. economy remains clouded but cautiously optimistic. Within the labor market, non-farm payrolls continue to expand at a healthy pace, accompanied by decent wage growth. However, the unemployment rate has been moving higher, labor force participation has been gradually declining, and continuing unemployment insurance claims have been steadily increasing. We expect the U.S. economy to post another year of moderate growth coupled with above-trend inflation of 2.8%, resulting in a healthy pace of nominal GDP growth of 5%+ in 2025. MIM expects the fed funds rate to be 3.75%–4.00% by year-end of 2025.

Europe — The euro area's growth outlook has deteriorated after Trump's reelection, primarily because of expected changes in U.S. trade policy, including a proposed 10% import tariff. This has reduced the 2025 real GDP growth forecast for the euro area by 40 basis points (bps) to 0.6%. In addition to direct economic impacts, renewed trade tensions may negatively influence European consumer and business sentiment and investment activities. Other regional political uncertainties in Germany and France have also contributed to the weakening of confidence. The European Central Bank (ECB) is expected to accelerate rate cuts due to a weaker growth outlook, with a forecast deposit rate of 1.75% by the end of 2025. The UK economy has limited net exposure to the U.S. market (See Figure 2). While it may be spared from higher U.S. tariffs due to its balanced trade position, forecasts assume it will face similar tariff increases as the EU, potentially impacting GDP growth. Despite this, the 2025 GDP growth forecast remains at 1.1%, bolstered by a stimulative budget from the new Labour government. Current economic indicators show moderate expansion, supported by a strong labor market and easing inflation, although core inflation remains high. This sets the stage for a cautious rate-cutting approach by the Bank of England, with expectations for a total reduction of 125 bps in 2025, bringing the Bank Rate to 3.5%.

Asia — Growth headwinds have been building in Asia, with further turbulence in store for next year, as China and other large trade surplus countries are potentially targeted with U.S. tariffs. Given uncertainties around what eventually emerges from the incoming Trump administration, MIM’s baseline for U.S. tariffs on China is 60%, and 10%–20% for high trade surplus countries (See Figure 2). Currently, there is broad-based weakness with five of eight regional economies now having a PMI reading below 50. MIM has revised down our 2024–25 GDP growth forecasts for several countries in the region, reflecting our baseline for rising tariffs, which will affect not only Asia’s top-line export growth but also investment and broader sentiment. MIM’s inflation forecasts are more of a mixed bag, reflecting crosscurrents coming from weaker growth on the one hand and possible supply shocks on the other. Meanwhile, weaker regional currencies will delay the rate-cutting cycle for many central banks in Asia, hence our upward revisions in terminal rates and government bond yields for next year.

Latin America — The Latin American markets experienced a mixed performance in the past quarter, with economic growth slowing in Mexico and Brazil, while the Andean countries showed growth close to trend. Inflation remained a significant concern, with consumer prices rebounding due to higher food and energy costs, although a gradual easing of inflation pressures is expected in 2025. Central banks in the region faced challenges from tighter global financial conditions, with limited room for monetary easing due to relatively high U.S. interest rates. Long-term interest rates in Latin America have risen, driven by expectations of higher U.S. rates and fiscal challenges. Fiscal accounts improved in 2024, but additional efforts are needed to stabilize debt metrics.

Central Banks Around the Globe Remain in the Easing Cycle

U.S. Treasury (UST) — MIM expects the Federal Reserve to continue cutting policy rates as it continues to transit toward a neutral policy rate, which MIM would estimate is near 4% by year-end 2025. MIM is looking for the UST yield curve to steepen further in the next quarter or two, with short-end interest rates decreasing significantly, even as the long end holds near 4.25%.

Japanese Government Bonds (JGBs) — MIM revised upward both 2024 and 2025 year-end inflation forecasts, and our baseline remains for another BOJ hike of 25 bps by 2025. Negative wage growth in recent quarters has contributed to declining political support for the Liberal Democratic Party (LDP). Last year's overall wage growth was 5.1%, with a 3.6% rise in base pay — the highest in over three decades. A similar increase next year could help sustain inflation at the 2% target. Additionally, tariff risks are eased by a weak Japanese yen (JPY), which benefits export competitiveness. MIM has raised our end-year 10Y JGB yield forecasts to around 1.3% by the end of 2025.

Chinese Government Bonds (CGBs ) — Market sentiment has shown marginal improvement due to a positive shift in policy tone, although the fundamental economic improvement remains to be seen. The upside potential for interest rates appears limited despite expecting a larger Chinese Government Bond (CGB) supply. Liquidity remains neutral. MIM expects CGB yields to be around 1.8% at the end of 2024 and 1.6% by the end of 2025.

German Bunds — There is potential for German bunds to rally further at the shorter end, as the European Central Bank (ECB) continues rate cuts into 2025. However, with ongoing ECB quantitative tightening (QT) set to accelerate in late 2024, significant gains at the longer end seem limited, except in cases of downside risks to growth or inflation. Political support for a moderate loosening of Europe’s fiscal stance is expected to rise, particularly in Germany. The federal elections on February 23, 2025, may result in a coalition government more open to easing fiscal regulations (the debt brake), allowing for increased investment and military spending. This could lead to higher government financing needs of around half a percentage point of GDP heading into 2026.

Credit Spreads Are Less Likely to Be Decompressed Very Soon

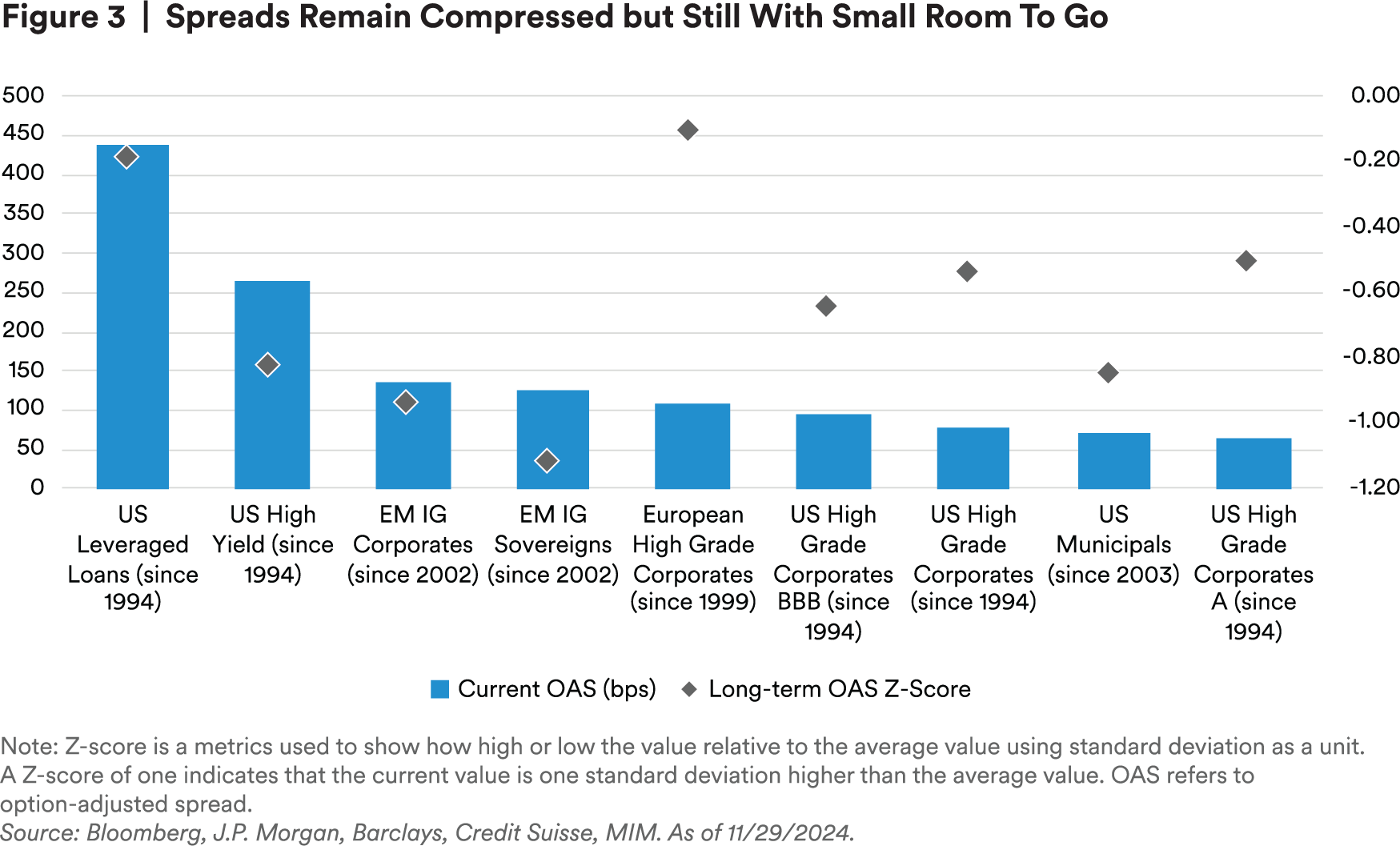

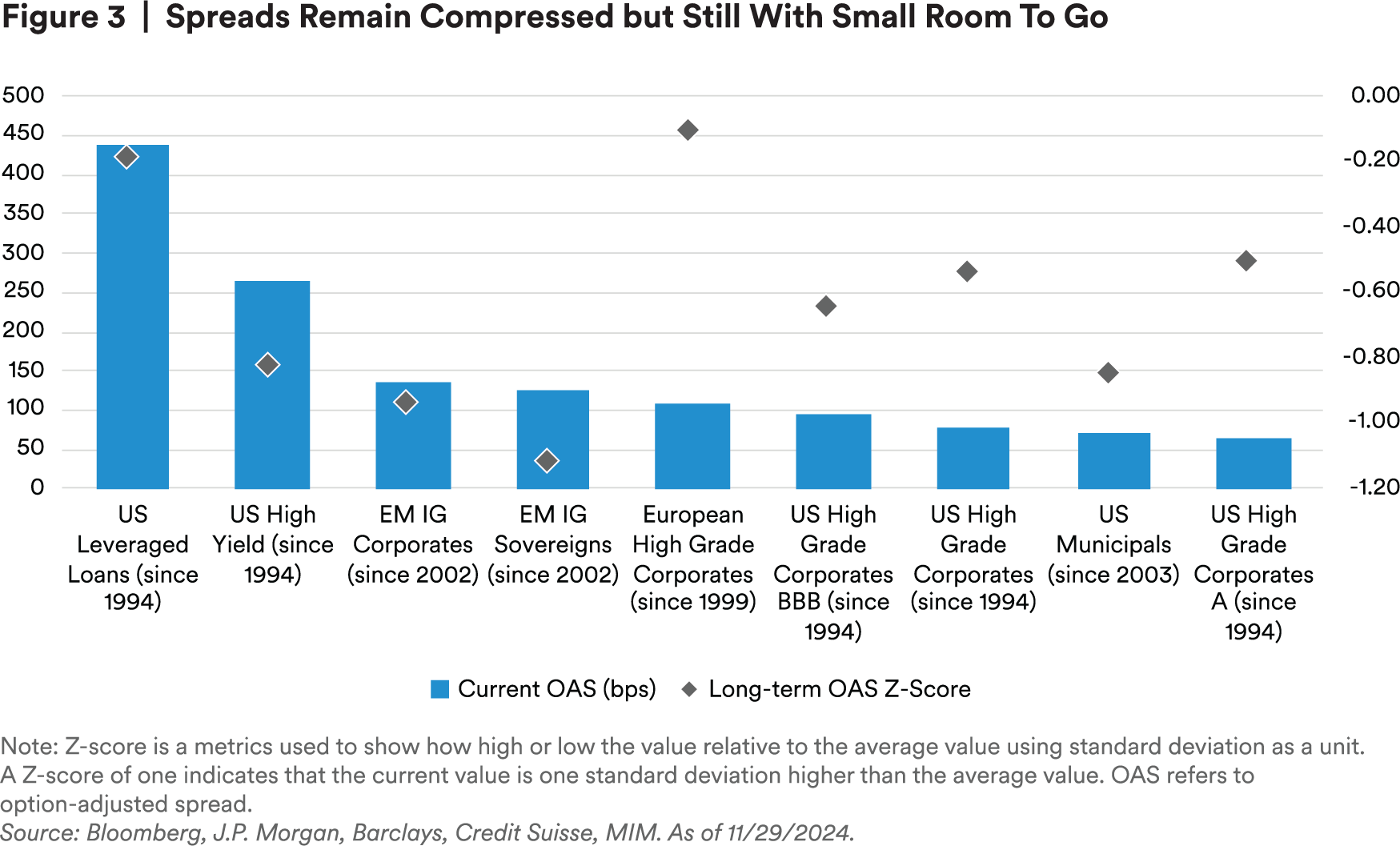

Credit Macro — The current credit cycle condition improved slightly from the last quarter. With a less restrictive Fed policy, less inverted yield curve (3-month 10-year spread) and neutral bank lending standards as of November 2024, we are still in a late cycle. Credit fundamentals mostly remained stable in the third quarter, with strong earnings and stable leverage ratios below the long-term average. According to the Investment Company Institute, fixed-income markets mostly see positive net flows, year to date. The focus for credit investors has shifted toward yields rather than spreads, a trend expected to persist into 2025. Technical dynamics remain supportive, with reduced FX hedging costs boosting overseas demand and a slowdown in net issuance, despite rich valuations (see Figure 3). Looking forward, credit metrics are likely to stay healthy, which suggests spreads remain rangebound or even tighter in the near term.

U.S. Investment Grade (IG) — The immediate market reaction within IG Credit to President Trump’s victory was very much “risk-on,” with spreads gapping tighter in select sectors and index spreads nearing their all-time tights. Credit fundamentals have remained intact despite tighter financial conditions over the past two years, and near-term uncertainties appear to be diminishing. Revenue and EBITDA growth remain healthy. Spreads have largely ignored weaker data except for a few idiosyncratic stories, and recent spread movements have been influenced by increased demand from buyers of fixed income, which has helped cap any weakness from the high supply entering the market over 2024. All-in yields became more attractive, compared to the last quarter, and thus comparable to other fixed-income asset classes.

European IG — Fundamentals in the Euro IG market have shown increasing dispersion in earnings, with cyclicals such as autos and retailers underperforming, although upgrades continue to outpace downgrades. Rates have remained relatively stable despite increasing political noise in the eurozone, particularly with a new Prime Minister recently nominated in France, and Germany facing a general election in February 2025. This political uncertainty has led to a rapid widening of spreads between OATs and Bunds. The euro primary market has seen record issuance, reaching €590 billion year to date, driven by strong inflows into European credit markets. The 25-bp yield discount versus the USD market has held steady, which we view as fair, given the geopolitical aspects and increasing political noise. Overall, our call for the Euro IG sector is neutral to slightly negative due to the political uncertainties and spread widening in France.

High Yield (HY) — Despite a considerable drop in November, the high-yield primary market remained active, with year-to-date volume standing at $277 billion ($66 billion non-refi), compared to $161 billion ($56 billion ex-refi) during the same period in 2023. The high-yield market remained resilient amid significant global political and economic events, with OAS tightening by 37 bps quarter to date. Supported by accelerating retail inflows, resilient fundamentals, benign earnings, receding growth concerns and expectations for near-term rate cuts, high yield spreads migrated inside 300 bps for the first time since July 2007. With year-to-date returns approaching 9%, the maturity wall continues to be manageable in 2024 and 2025; we expect the all-in yields to remain very attractive, given a stable macro backdrop.

Leveraged Loans — MIM prefers an up-in-quality approach within bank loans, expecting macro moderation to remain supportive in 2025, as growth remains robust and policy easing continues. Anticipated corporate M&A activities, driven by falling debt costs, a rebound in earnings, potential deregulations and lower corporate taxes, set the stage for more deal-making and capital raising. This approach mitigates against potential challenges in the second half of 2025, as corporate confidence grows and economic outcomes vary. MIM expects spreads to tighten further in Q2, with recovering earnings and lower rates normalizing default rates. Leveraged loans are up 8.7% year to date, with 2025 also pointing toward a carry-type year.

Municipals — In MIM’s base-case scenario, the performance in 2025 is likely to resemble that of 2024. Investors should not anticipate much beyond their regular coupon payments, with minimal or no increase in price. Significant supply will coincide with institutional investors probably remaining inactive, resulting in retail investors bearing the burden once again. As a result, the market outlook will be particularly responsive to the backend interest rates on the U.S. yield curve, given the overall muni sectors' relatively long duration. Spreads are extremely tight (see Figure 3) and exposed to almost the same monetary and fiscal policy risks as U.S. Treasuries. The marginal reward/risk is not appealing. MIM projects an uneven path for Munis in 2025.

Emerging Markets (EM) — The past quarter has seen a stabilization in EM sovereign fundamentals following the growth and inflation shocks since 2020. The growth differential between EM and Developed Markets (DM) is expanding, with EM growth being more balanced. Commodity exporters and countries with significant exposure to China have experienced some drag, but aggressive, early central bank actions have helped bring inflation down from its 2022 peaks. This has allowed for supportive policy easing as needed. The ratings trajectory is balanced, with some countries facing downgrade risks due to rising debt dynamics, while others show potential for positive rating momentum. EM corporates and banks remain healthy, with strong balance sheets and active liability management, reducing refinancing risks. Despite expected declines in EBITDA and revenues, margins should remain healthy and free cash flow strong. EM financials have maintained prudent loan growth and strong Tier 1 capital ratios. The subdued net issuance and high principal and interest payments have supported demand and positive price reactions. Looking ahead, as the U.S. begins its rate-cutting cycle, EM corporate fixed income offers attractive yield and duration exposure, providing a comparable investment opportunity outside of DM.

A Bottom of MBS and CMBS Markets May Finally Arrive

Residential Credit — The housing market continues to grow, albeit at a slower pace, with a 4.6% year-over-year increase in home prices. Affordability remains a significant issue, particularly for first-time buyers, who now represent a record low of 24% of purchases. Credit fundamentals in the residential mortgage-backed securities (RMBS) sector are strong, with low delinquency rates among prime borrowers and stable rates among non-prime borrowers. Issuance is expected to increase by over 30% in 2025, driven by strong investor demand.

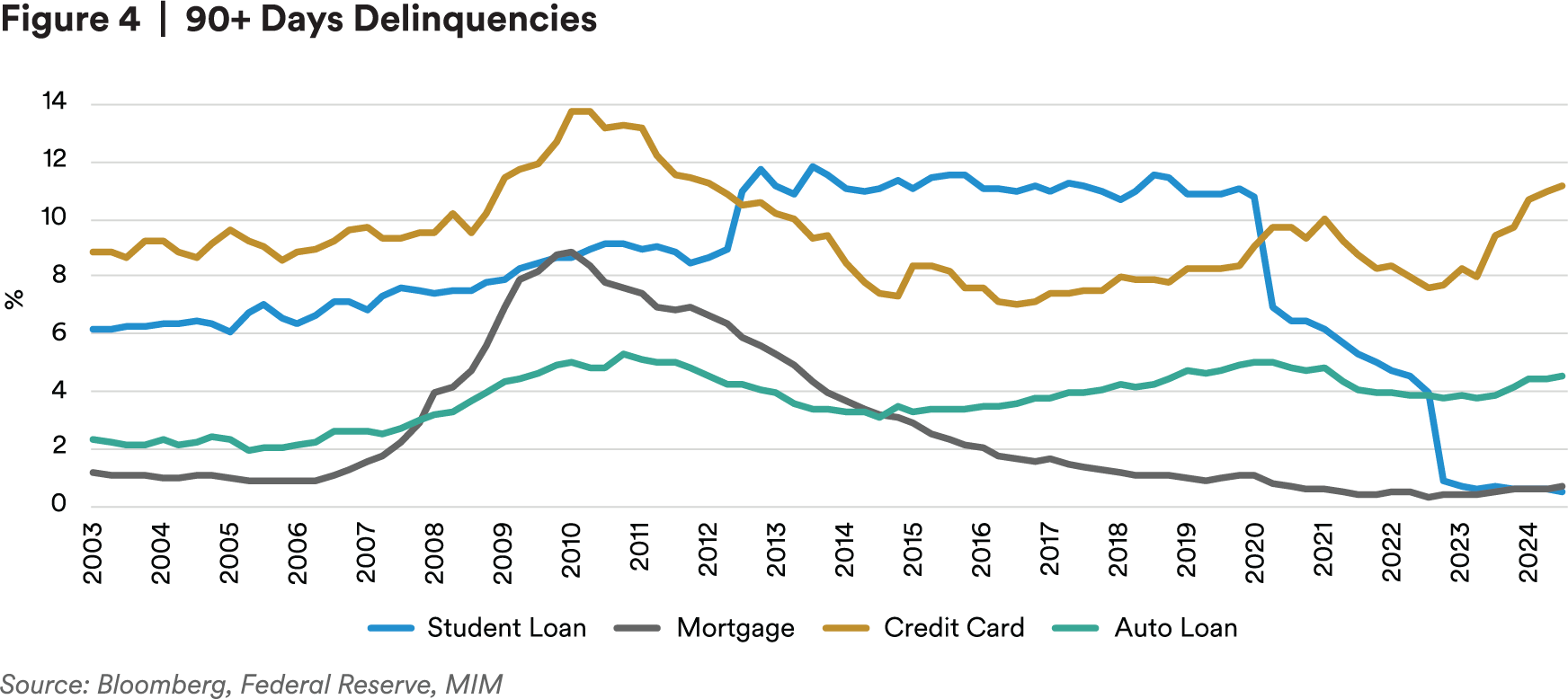

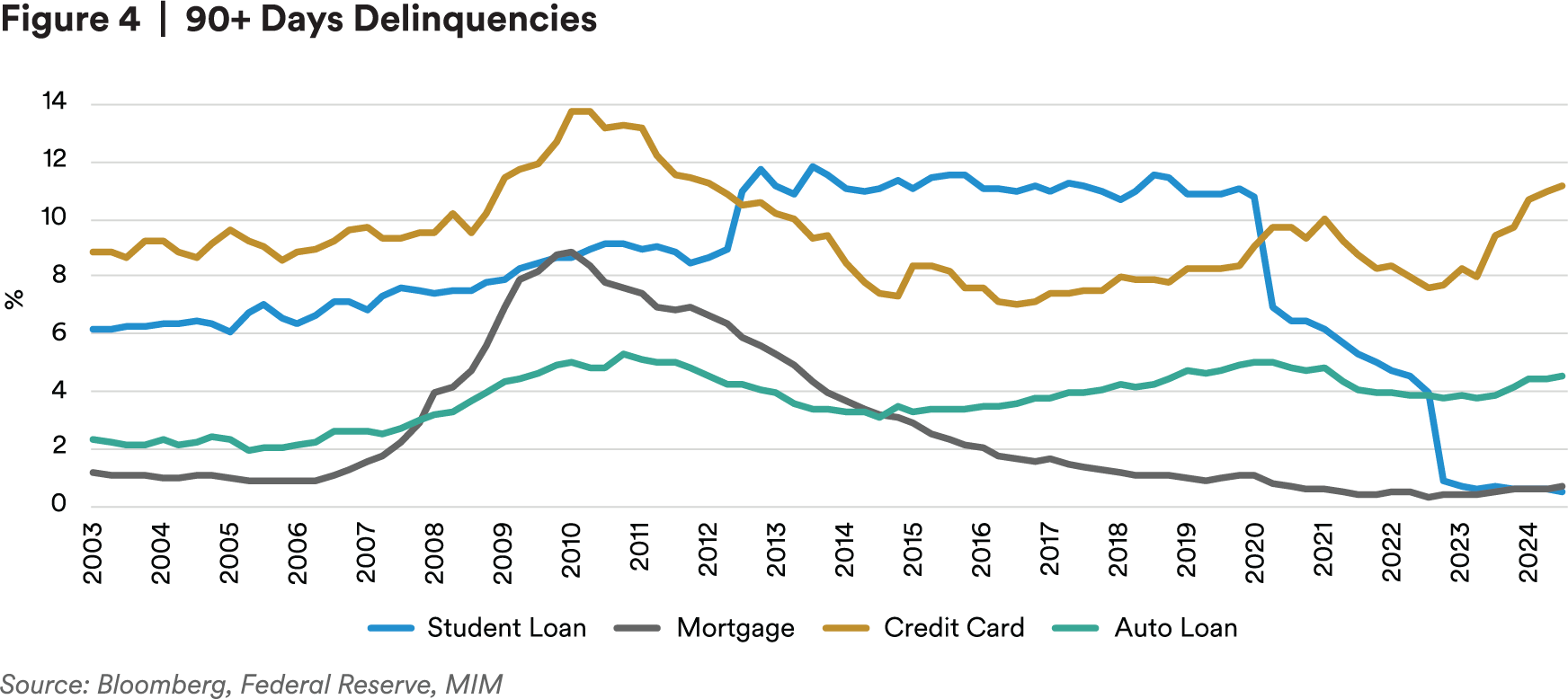

Asset-Backed Securities (ABS) — The asset-backed securities market benefits from strong economic data, a stable labor market and real wage growth, although younger and lower-income households face financial pressures. Delinquency rates for auto and credit card loans remain high (see Figure 4). ABS issuance is projected to decline slightly in 2025 after a record year in 2024, influenced by political factors and potential deregulation.

Collateralized Loan Obligations (CLOs) — Collateralized loan obligation issuance reached record levels in 2024, with strong investor demand and tightening spreads. While refinancing activity may decrease in 2025, new issuance is expected to remain steady. Fundamentals have stabilized, significantly reducing the issuer default rate, although downgrades still outpace upgrades. Loan prices are rising, with a high percentage of loans trading at a premium. We expected less overall yield from a bigger impact of the rapid Fed rates cut on the short-end yield curve and overall tightening spread, leading to a less attractive rating than over the last quarter.

Commercial Mortgage-Backed Securities (CMBS) — The commercial mortgage-backed securities market shows signs of stabilization, with the NCREIF All-Property Index posting its first positive quarterly return in two years. However, the office sector continues to struggle, with significant year-over-year price declines and high delinquency rates. Despite these challenges, demand has outpaced supply, leading to strong performance and expected issuance growth in 2025. We believe the lowering of intermediate-term points on the U.S. yield curve and falling spreads would benefit the CMBS sector.

Agency MBS — Despite volatile spread movements around the U.S. election, agency MBS recovered all prior widening as volatility decreased, and MBS performance improved alongside other risk assets. Despite the recent recovery, fundamentals for conventional MBS remain challenging. October prepayments surged 30%, marking the highest aggregate monthly paydown since 2022, driven by higher coupon borrowers responding to falling rates. However, the post-election sell-off and rising primary mortgage rates signal a shift to a slower prepayment environment in the future. MIM expects mortgages should be able to clip a decent amount of carry. We expect the 1-year/10-year spread will decrease by 15–20 bps next year, potentially resulting in an additional point of return without triggering a hike in prepayment. Additionally, according to the JP Morgan Agency MBS 2025 Outlook, surveyed investors still put mortgages near the top of the list of positions they want to add to or maintain, which would increase demand. Overall, our base case appears favorable for mortgage-backed securities (MBS), although mortgages may be vulnerable to any resurgence of inflation that drives interest rates higher.

Private Structured Credit — As we enter 2025, the outlook remains optimistic, with expectations of solid supply and compressed credit spreads. The demand for ABS is expanding, particularly in esoteric/high-yielding opportunities, attracting strong interest from insurance investors. Despite some weakening in consumer credit performance across prime and non-prime segments, delinquencies and defaults are stabilizing due to tighter credit underwriting standards and relatively low, though rising, unemployment rates. However, market sentiment may shift based on new administration policies, particularly those affecting tariffs, infrastructure spending and deregulations, which could impact the ABS sectors differently. Inflationary pressures from policy changes could affect the economy, especially the non-prime consumer segment.

Residential Whole Loans — Housing fundamentals are unchanged from last quarter. Limited supply has kept home prices stable. Delinquencies are also stable, with some pickup in Florida due to hurricane activity, but given our experience with natural disasters, the pick-up in delinquencies resolves over time. Spreads for residential whole loans and single-family rental debt financing have moved sideways recently with loss-adjusted spreads in the low- to mid-200s, where we still see this as a strong relative value to public opportunities in residential credit.

CRE Fundamentals on Track of Recovery, Except Office Sector

Office — Office fundamentals are challenged, though the third quarter offered some clearer evidence that occupancy may be nearing the bottom. The national vacancy rate was unchanged at 19.0% from last quarter, bringing the trailing four-quarter increase in vacancy to 60 bps. Remote work and macroeconomic uncertainty continue to impact leasing, and we may be at or near peak office vacancy.

Multifamily — Markets like Austin, Nashville and Charlotte will likely underperform in upcoming quarters due to high deliveries and normalizing demand, dampening rent growth. Conversely, markets like Chicago, New York and Orange County, with less favorable demographics, are not facing supply pressures and are benefiting from higher occupancy levels and more substantial rental growth.

Industrial — The industrial sector has also experienced elevated supply growth. In Q3 2024, industrial vacancy rose by 10 bps to 8.3%, up from a recent low of 5% but still below the long-term average of 9.4%. Markets with physical or legislative barriers to new construction, such as Miami and Baltimore, are better positioned.

Retail — Retail vacancy remained flat at 6.5% in the third quarter — a record low since data became available in 1990. Limited new construction and a significant amount of demolition of non-competitive stock have played a significant role in bringing retail fundamentals into a steady equilibrium.

Hotel — fundamentals are healthy. MIM believes that the adoption of hybrid or fully remote work has provided a boost to hotel demand. “Work-from-anywhere” has allowed consumers to combine work and leisure travel and has also increased the need to visit central office locations at least several times per year. We believe this is a permanent tailwind for the hotel sector, even as firms rein in hybrid work policies. Large coastal markets that have been slower to recover post-COVID and cater more to business/group travel may outperform in the near term. Continued recovery in business travel should boost the outlook for conference destinations still recovering from COVID.

Commercial real estate (CRE) equity and debt investments are fairly valued. However, certain market segments, particularly higher-yielding debt, are experiencing a liquidity crunch, which presents attractive relative value opportunities. CRE transaction volumes for equity and debt have remained low, primarily due to elevated interest rates, banking sector stress and office space difficulties. MIM anticipates that transaction activity may begin to recover more significantly in 2025.

Agricultural Profitability in 2025 Mirrors 2024 Levels Despite Ongoing Export Challenges

The agricultural sector showed mixed performance in the past quarter. Net Farm Income (NFI) fell by 4%, year over year, but remains 36% above the inflation-adjusted long-term average. The strong U.S. dollar continues to negatively impact agricultural exports, compounded by fluctuations in the Mexican peso. Farmland values rose by 5%, year over year. Agricultural mortgage spreads slightly decreased to 216 bps. Looking ahead, profitability in 2025 is expected to mirror 2024 levels, with accelerated growth in agricultural mortgage volume as credit demand rebounds. Overall, the relative value in the agricultural sector remains neutral, with stable fundamentals but persistent headwinds from the strong dollar.

Fed Rate Cuts Left Cash Less Attractive

The U.S. equity market may experience challenges and increased volatility due to potential policy shifts in 2025, but the advantages are expected to surpass the disadvantages. The benefits of deregulation, a more favorable business climate and opportunities for enhancing productivity and deploying capital support the U.S. continuing as the global growth engine. In the third quarter, S&P 500 earnings surprised by about 3.7%, with earnings growing at 9.8%, year over year. The fundamentals continue to be solid, particularly in corporate credit. As more central banks participate in rate cuts, we anticipate that equity valuations most likely stay stable. MIM believes that steady growth and a low risk of recession will allow companies to experience reasonable earnings growth moving forward, although short-term fluctuations may arise due to the uncertainties from the coming Trump administration policies. On the other hand, we find cash yields less attractive in light of Fed rate cuts (75 bps), and U.S. 3-month Treasury bills yielding at 4.49% as of Nov 29, according to Bloomberg, and given our expectation of further 50-bp cuts in 1H 2025.

Private Equity Sentiment Improved

The private equity market experienced a mixed performance in the past quarter, with U.S. buyout activity reaching $84.3 billion in 3Q24, the highest in two years, and European deal value and count showing significant growth. However, Asia's activity was skewed by a large infrastructure deal, and overall returns are expected to be lower in the near term due to economic uncertainty. Despite this, the market sentiment has improved, and investor appetite for megadeals has returned. The exit market showed a modest increase globally, but Europe remained lackluster, and the U.S. Venture Capital (VC) exit market saw a significant decline. Fundraising also faced challenges, particularly in Asia and the VC sector, where liquidity issues persist. Looking ahead, MIM anticipates lower returns in the near term but remain optimistic about long-term opportunities, especially as economic conditions stabilize.

Anticipated Fiscal Expansion and Trade Policy Changes May Push Dollar Higher

In the fourth quarter, the USD demonstrated strength against all G10 and EM currencies, driven primarily by the U.S. election results, which suggest expansionary fiscal policies, potential global tariffs and higher inflation leading to increased Fed policy rates. The outlook for the USD remains bullish due to anticipated trade policy changes, tariffs and fiscal impacts that are not yet fully priced in, along with European growth pessimism and uncertainties in China. However, risks to a weaker USD include the U.S. fiscal and current account deficits, potential challenges to Fed independence and unexpected shifts in U.S. fiscal policy. In Asia, the CNY and other regional currencies face pressure from U.S. tariffs, though the PBoC has shown resilience. European currencies are under pressure from global tariffs and political uncertainties, though potential resolutions in the Russia-Ukraine conflict could provide some relief. In Latin America, Mexico faces significant uncertainty due to tariffs and immigration policies, while global tariffs also impact commodity exporters like Colombian peso (COP) and Chilean peso (CLP). Despite weak fiscal fundamentals, the region may see fewer central bank cuts, maintaining attractive carry.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a "professional client" as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees' pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

For investors in the EEA: This document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of July 22, 2024, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.