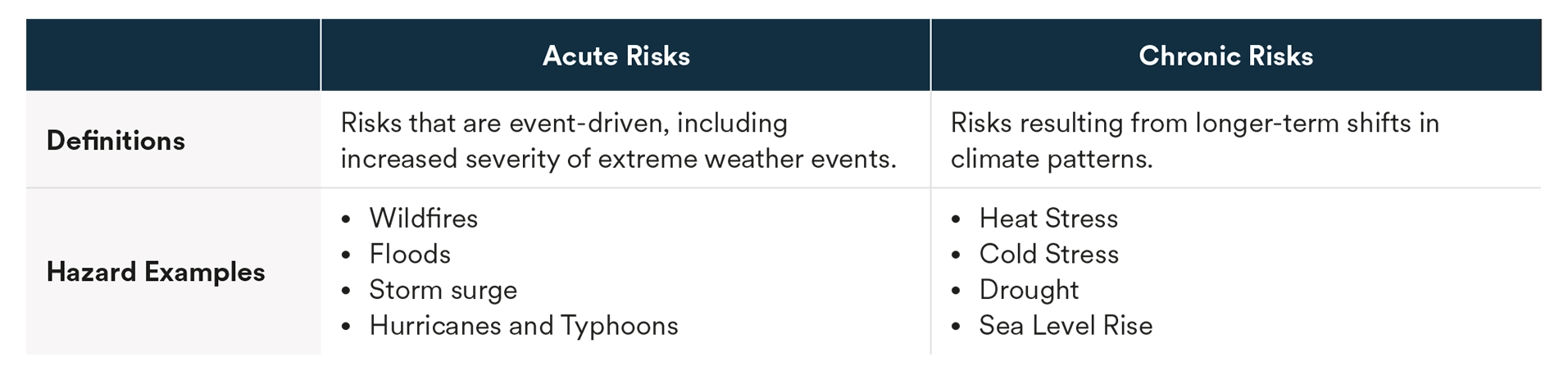

Acute and Chronic Climate Hazards

Physical climate risk incorporates two broad hazard categorizations: acute and chronic. Climate risk software and analysis tools typically forecast each hazard individually and across multiple timeframes and scenarios.

Evaluating Risk with Future-Looking Projections

Various sectors within the real estate industry rely on different models and data sources to assess climate risk.

Early physical risk assessments were performed by property insurers to determine protection against catastrophic risk from extreme weather events. For this analysis, insurers complete event-based modeling, which includes an analysis of historical events through tools such as FEMA1 flood maps, as well as a review of historical weather patterns. Although these tools are useful for assessing past damage and identifying current physical risks, they often do not account for changing climate conditions that will drive future risks.

Today’s climate-change modeling tools used by asset managers and sustainability professionals take a forward-looking approach, projecting future scenarios over time to evaluate the impacts of climate change. These models typically integrate climate change scenarios such as the IPCC’s2 Shared Socioeconomic Pathways (SSPs)3 or Representative Concentration Pathways (RCPs)4 to assess each hazard under different climate-change scenarios over time.

Both historical and forward-looking approaches to measuring physical risks are valuable, but confusion can arise when insurers and underwriters focus on historical data, while asset managers and sustainability professionals consider future scenarios. This trend is changing as some insurers have developed models that incorporate RCPs or SSPs and assess impact at various periods of time, up to 2100.

Challenges

Aside from accounting for the differing perspectives offered by the backward- and forward-looking approaches, the forward-looking modeling tools adopted by asset managers today present additional challenges, including:

- Information Overload: Oftentimes, an analysis presents ratings for properties at multiple SSP/RCP values, as well as different timelines for each type of chronic and acute risk. Asset managers can be left perplexed when determining which SSP/RCP value and timeline to focus on and how best to translate those results into a mitigation strategy. Additionally, it may be unclear whether it is best to assign a risk value to an asset based on the results of each chronic and acute risk or on an aggregation of the full results.

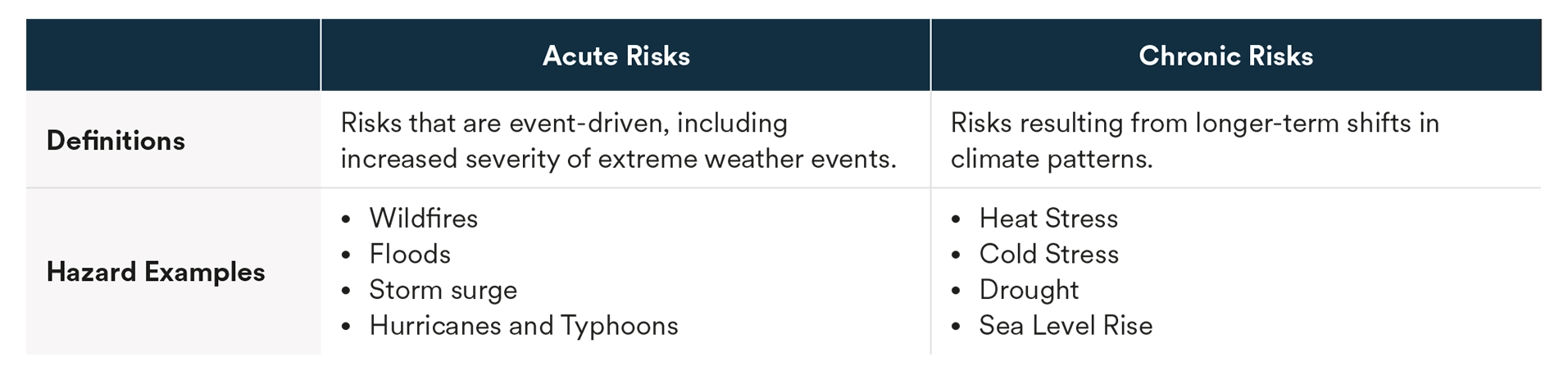

The graph below demonstrates different increases in heat stress to an asset over time, depending on the SSP/RCP climate scenario. Higher SSP or RCP values indicate higher global surface temperatures.

Munich Re’s Heat Stress Score is the categorized average of select parameters5 normalized onto a 0-10 scale.

- Conflicting Information: With the increase in proprietary risk-modeling software, the predictions offered by software tools can vary widely. This is covered in the Urban Land Institute’s How to Choose, Use, and Better Understand Climate-Risk Analytics publication, which discusses how seven assets tested for risks using three separate modeling tools resulted in inconsistent outcomes.6

- Property-Specific Details and Characteristics: While models have been developed to assess the climate risks specific to a certain location, software programs are often unable to differentiate risk depending on property-specific details and characteristics such as unique resilient or vulnerable qualities of each building. This will be discussed in more detail later.

- Location accuracy, point vs. polygon locations and map resolution score variation: Current geocoding capabilities of the software platforms present limitations. Address searches may not ping the exact location of the building, instead displaying results for a point on the street beside the building, or a parking or landscaped area. Furthermore, properties are typically scored with a single point rather than the whole footprint of the building. When one point represents a whole building, it presents challenges for hazards with significant meter-to-meter variation. For example, with flood risk, if one corner of the building is at high risk of flooding while the rest of the building is not, pinging a point on top of that corner will provide a higher risk score than pinging a different point on the same building. While polygon search is possible, it is difficult to scale across a portfolio.

- Impact on cash flow, value and hold: A property may be at risk during the current hold or during a future hold. Property owners can explore mitigation strategies or may decide to let a future owner assess the risk at a later date and determine if mitigation is still necessary or financially feasible. Because buyers typically run a physical risk analysis during diligence, an asset that scores high physical risk in 15 or 25 years may be discounted by the buyer through capital expense costs or a higher reversion capitalization rate, either of which results in a lower property value.

Development of a Physical Risk Assessment and Mitigation Strategy

Despite the various challenges noted above, software modeling tools remain valuable. They offer big-picture portfolio risk assessments for quickly identifying possible risks and for screening potential equity acquisitions and loan originations as part of due diligence. To balance the broad nature of the risk scores from these software tools, a physical risk assessment and mitigation strategy should include the following additional steps to create a holistic approach.

- Create an inventory of property-specific details and characteristics.

- Consider the surrounding built environment..

- Research community or regional resilience efforts.

Property-Specific Details and Characteristics

Physical attributes specific to individual assets can indicate the level of intervention and capital planning that is necessary to ensure resilience. For instance, two adjacent office properties may be located in a high-risk flood zone and earn the same score when assessed using climate-modeling software. However, one office building may have been designed with its critical electrical and HVAC equipment located in a basement below grade, while the other may have its critical equipment in a penthouse central plant above the 100-year flood zone and have incorporated backup power supplies that do not rely on the local grid. Similarly, an assessment could offer the same scores for two buildings located in the same hurricane-prone area, even if one has vintage jalousie windows, while the other has windows rated to withstand multiple 100-year hurricane events.

The Built Environment

Certain aspects of the built environment can affect a building’s vulnerability to different climate risk hazards. Taking into account a building’s surroundings is important context for understanding an asset’s level of risk, resilience and potential mitigation strategies. An analysis should consider large built environment features such as levees, public transportation infrastructure and nearby buildings that can redirect the flow of flood waters or provide shade to the property. To assess potential vulnerability of nearby buildings to precipitation stress and flash floods, surrounding features to take stock of include paved roads, which are impermeable to rainwater, and parks with plants and landscape, which are able to absorb stormwater runoff. In addition to providing shade and reducing runoff, a dense urban tree canopy can also reduce a building’s vulnerability to heat stress.

Beyond asset-specific built environment features, jurisdictional-level resilience plans may help to protect assets from the physical risks of climate change. Understanding these plans and whether they benefit an asset requires research. Denver, for instance, has emerged as one of the most climate-resilient cities in the United States.7 One effort that the city is undertaking includes the Cherry Creek Restoration Project, which aims to restore a one-mile stretch of the Cherry Creek corridor by addressing severe erosion issues. This will provide improved flood protection, reducing flood risks to nearby properties, and offer community benefits such as improved water quality and increased tree canopy.8

Community Resilience Efforts

While some cities are adopting resiliency strategies, the Carbon Disclosure Project found in a survey of 800 cities that 43 percent of cities do not have the budget or resources available to adapt to anticipated future climate events.9 While this paper has largely focused on the impacts that physical risks could pose to an asset directly, a prudent researcher will consider the indirect impacts of such events. These may be challenging to forecast and therefore can be misjudged. For example, in 2020, McKinsey Global Institute modeled expected changes in flooding due to climate change in Bristol, England. In their analysis, the one area central to the headquarters of multiple corporations remained physically unharmed, yet critical routes required for travel to-and-from the area were jeopardized.10 While the actual properties in this area could remain physically unharmed, they could risk high vacancy due to a future accessibility issue. This is an example of how assets in markets with high exposure to physical risk need to consider every component of how these risks could impact cash flow and, therefore, value. Property revenues can suffer when tenants opt to relocate to less risky markets, and property expenses can increase through investment in mitigation strategies.

Case Studies

The case studies below provide examples of the research required to categorize a property’s climate risk, once flagged by the climate-risk software tools.

Plano, TX, Retail Shopping Center

The asset team for a retail shopping center in Plano, Texas was alerted to the property’s high exposure to flood risk. A further analysis was undertaken to research historical flood patterns, elevation and the local community’s mitigation efforts. This research, which was simply performed via a Google search, uncovered physical mitigation measures already in place, including the construction of a nearby flood wall and levee that were not identified in the climate-modeling tool. Although the asset was rated “high-risk” by the model, further analysis suggested the model may not be accurately taking these other factors into consideration.

Washington, D.C., Office Property

An asset manager was notified via multiple climate-risk modeling tools that two adjacent office assets located in Washington, D.C. were at an extremely high flood risk with a 99% chance of flood occurring at the properties within the next 30 years. Further analysis determined that the topographic data built into the different tools was likely outdated and included the condition of the site at the time of the properties’ construction. The models indicated a 30-foot elevation discrepancy at the sites, which was indicative of a deep excavation pit that had been in place during construction. After review, the risk level was downgraded.

Post-Analysis Strategy

While these examples display false-positive findings regarding the actual physical risks, similar results cannot be assumed for all assets. The following strategies can occur following an asset’s analysis.

- Planning for capital expenditures. Assess the amount of capital needed to mitigate or improve a property’s physical attributes to make the asset climate-change ready. This analysis should also consider the costs associated with inaction, including costs for repairs, potential downtime and higher insurance premiums.

- Evaluating property insurance. Work with insurers to expand existing coverage if necessary. Determine the risk of coverage availability, if located in an area at risk to the halting of new policy sales.

- Adjusting exit and reversion cap rates. In the absence of a mitigation strategy, exit capitalization rates may require adjustment to reflect increased risk resulting from some combination of mitigation costs and impacts on current and future occupants. .

Moving Forward

Discussion of climate-change-related risks to real estate is accelerating. Although, post-election, federal actions may be postponed, the trend is likely to continue at the state and local level as new reporting requirements mandate the disclosure of material impacts from potential climate risks. We believe the following trends will persist:

- Improvement in tools used for climate risk identification: Most climate risk software tools available to commercial real estate professionals have been in use for less than a decade. Improvements may include more regular geographic and geospatial information updates, inclusion of more built environment features and a better database of local mitigation projects. We also expect that AI will accelerate the improvement of the tools’ abilities to assess a broader scope. For example, assessing a community’s entire built and natural environment to incorporate the impacts of local physical features on a property’s flood risk score.

- Greater consistency in the classifying and underwriting of physical risks: While many leading firms incorporate some form of analysis into their underwriting of physical risks, there is a general lack of consistency in strategies used. Over time, there may be more agreement about best practices for SSP/RCP values and risk indicators. Additionally, new approaches used to underwrite capital expenditures for resiliency purposes may be available.

- Regular disclosure of physical risks: With the increase in regulatory frameworks and with more firms adopting strategies concerning physical risk, moving forward, a risk evaluation may be more likely to be disclosed in offering memorandums and incorporated into property valuations. We anticipate that the SEC’s11 required reporting on material climate risks may not survive ongoing legal challenges. However, some jurisdictions may require the disclosure of property physical risk scores, similar to reporting on transition risks through building-performance-standards disclosures.

- Greater investment in municipal resilience efforts: Investments in mitigation and resilience require funding. With the passing of the Bipartisan Infrastructure Law in 2021, approximately $47 billion was specifically allocated for resilience and climate-related programs. We anticipate future government funding streams will continue to support these jurisdictional efforts.

Conclusion

Developing a holistic risk assessment and management strategy requires more than a score from a database, it requires deeper research to understand a property’s specific details and characteristics, the surrounding built environment and community resilience efforts.

Physical risk can impact an asset due to the need for mitigation, repair and insurance premiums. Assets can incur costs during their hold, and various climate scenarios can increase risk due to future impacts. This may be factored into current or future cash flows or to a reversion cap rate, impacting an asset’s net present value.

The implications of physical risk from climate change have become a key consideration of real estate investors and asset managers. We anticipate that the software tools available for identifying physical climate risks will continue to become more sophisticated as data resources and processing capabilities increase, meeting demand as concern regarding climate risk continues to grow.

Endnotes

1. https://www.fema.gov/flood-maps

2. https://www.ipcc.ch/

3. https://www.ipcc-data.org/guidelines/pages/glossary/glossary_s.html

4. https://www.ipcc-data.org/guidelines/pages/glossary/glossary_r.html

5. Munich Re’s Heat Stress Score Parameters: Annual Days In Heat Wave, Annual Maximum Temperature, Annual Mean Daily Maximum Temperature, Annual Days Above 40°C and Annual Tropical Nights

6. https://knowledge.uli.org/en/reports/research-reports/2022/how-to-choose-use-and-better-understand-climate-risk-analytics

7. https://milehighcre.com/denver-is-the-most-climate-resilient-city-in-the-u-s/

8. https://mhfd.org/residents/work-in-your-area/cherry-creek-restoration-project/

9. https://www.theguardian.com/environment/2021/may/12/one-in-four-cities-cannot-afford-climate-crisis-protection-measures-study

10. https://www.mckinsey.com/capabilities/sustainability/our-insights/can-coastal-cities-turn-the-tide-on-rising-flood-risk

11. https://www.sec.gov/newsroom/press-releases/2024-31

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

For investors in the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a "professional client" as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees' pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1. As of July 22, 2024, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited