Treasuries / Agencies

- Volatility remains high around key data releases, especially inflation and employment as these remain the principal drivers for Federal Reserve policy

- Yield curve to “bull steepen” as the first cut approaches, as we expect front-end rates to decline and long-term yields to be range bound or move higher

- Reasonable risk exists such that economic conditions could mix with political dynamics to trigger renewed inflation pressures

ABS

- ABS ended the quarter mixed with heavy new issue supply weighing on prime auto spreads

- Weakness in trust collateral performance metrics persisted

- We maintain our preference for defensive tranches across the most liquid sub-sectors

CMBS

- CMBS spreads widened as commercial real estate prices continued to decline

- SASB deals dominated non-agency new issue supply

- At current levels, we continue to avoid agency CMBS and remain selective in conduit tranches

RMBS

- Mortgages posted negative excess returns in the second quarter

- Persistently high mortgage rates and limited supply continue to constrain home sales

- We find value in single family rental (SFR) tranches in non-agencies and 20-year collateral in specified pools

Municipals

- S&P rating upgrade to downgrade ratio slowed to 1.5 to 1 over the first two months of the second quarter from 2.2 to 1 in the first quarter

- In the higher education sector, we favor comprehensive universities and research institutions with strong brand recognition.

- We consider taxable municipals a defensive alternative to other spread sectors and will increase our exposure opportunistically

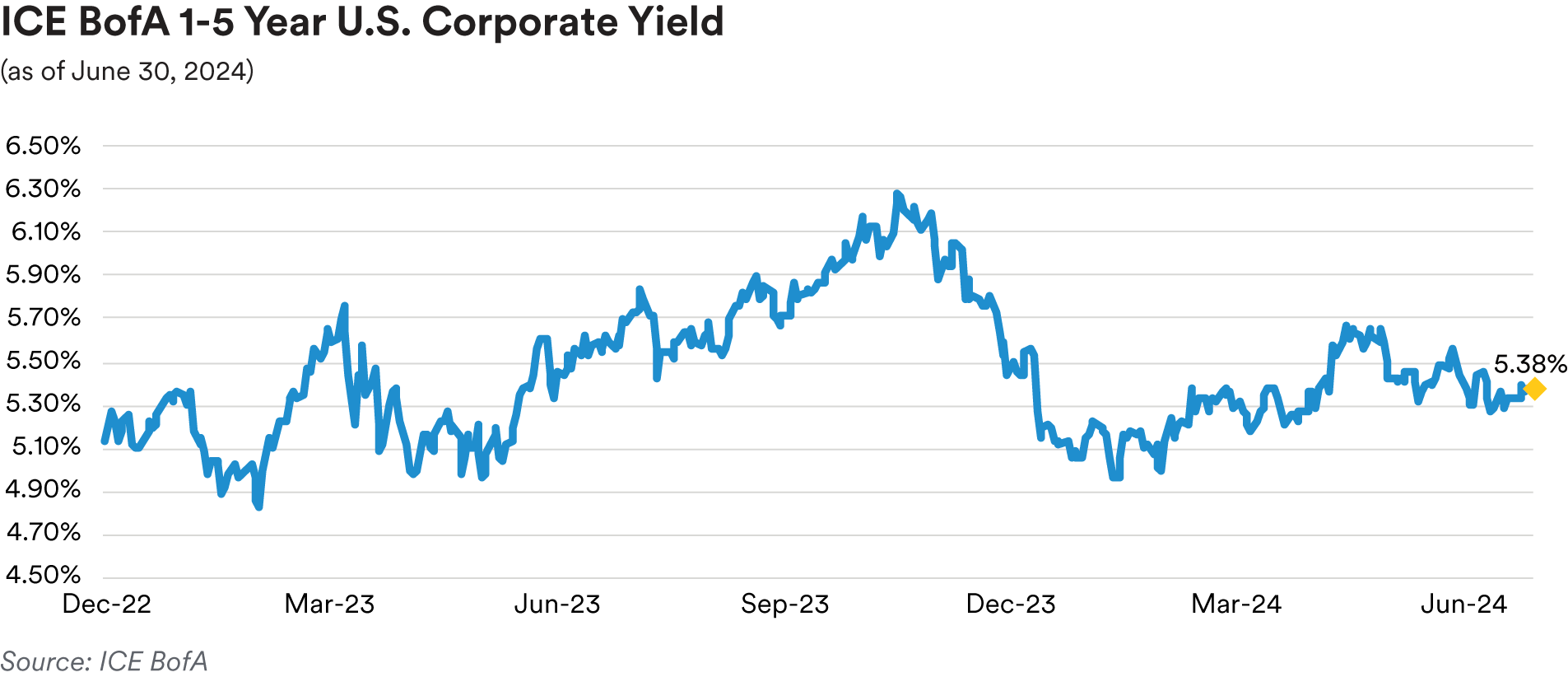

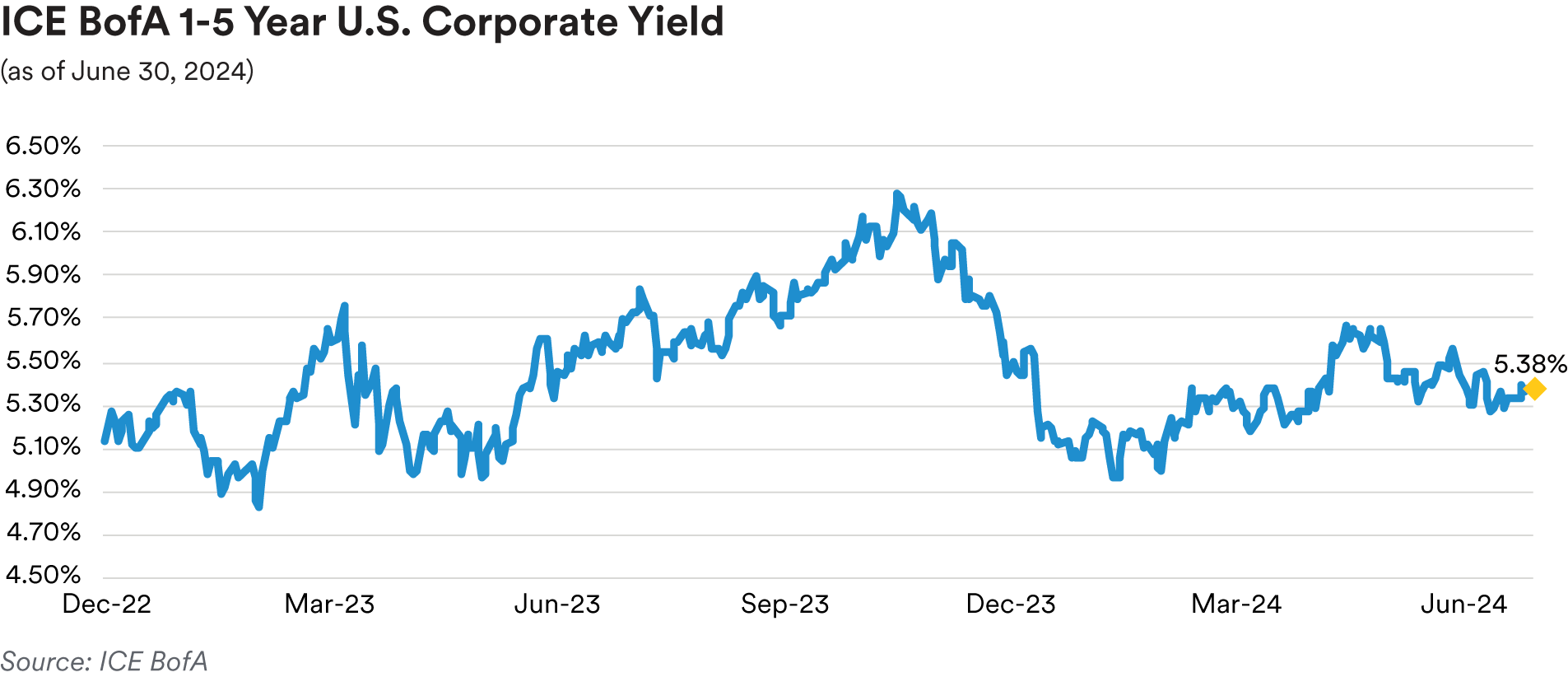

Investment Grade Credit

Recap: Over the second quarter, we saw front-end investment grade credit continue to perform well with its benchmark U.S. corporate index posting a fifth consecutive quarter of positive excess return even as credit spreads ended slightly wider. The resilient performance was driven by generally steady, robust investor demand as all-in yields reapproached decade-plus highs with Treasury yields peaking at the end of April. This came against a backdrop of weakening, though solid economic growth, mediocre corporate earnings and perpetuation of a higher-for-longer rates environment with the Federal Reserve yet to declare victory in its fight to bring stubbornly high inflation down towards its 2% target.

April’s choppy market landscape, geopolitical turbulence, uptick in volatility and rates sell-off gave way to markets regaining their footing in May with front-end corporate bonds enjoying their seventh month in a row of incremental spread tightening and positive excess return. Pushing into June, in terms of economic data, we saw some further deterioration as evidenced by the broad U.S. Citi Economic Surprise Index falling well into negative territory, to its lowest level since third-quarter 2022 amid additional signs that cracks may be forming in the U.S. labor market and consumers are throttling back spending offset by eased financial conditions and supportive wealth effects. Notwithstanding market worries about slowing economic growth, the Federal Reserve’s median dot plot was adjusted downward at the June FOMC meeting to one projected rate cut before year-end from March’s forecast of three cuts, reflecting their confidence that the U.S. economy’s resilience will persist and a recognition that the Fed can be patient and remain data dependent in reading the economic tea leaves before embarking on cutting their policy rate.

Heading into quarter end, markets were thrown for a bit of a loop by unexpected results in France’s EU elections favoring the country’s right-wing National Rally party, which prompted President Macron to boldly call for snap national elections in an attempt to challenge French voters to reject the right-wingers’ more hardline policies. This spike in macro volatility and uncertainty surprised markets and caused spreads to reverse course and widen off their recent lows, leaving front-end credit spreads a few basis points wider than where they began the quarter.

Corporate credit fundamentals as illustrated in first-quarter earnings reports that arrived throughout the second quarter continued to show mild deterioration in investment grade issuer credit metrics with leverage edging higher and interest coverage declining. First-quarter corporate earnings looked solid at a high level with year-over-year earnings growth of 5.9%, led by strength seen in the communications services, utility, technology and consumer discretionary subsectors, according to FactSet. However, earnings growth effectively disappears when backing out the impact of some large technology names like Alphabet, Meta Platforms, Microsoft, NVIDIA, etc. Thus, despite headline strength in earnings, we believe some of the top-line and operating margin headwinds facing many companies like wage pressures, lingering supply chain issues and heightened debt refinancing costs may intensify, weighing on earnings over coming quarters as we anticipate economic growth will slow further.

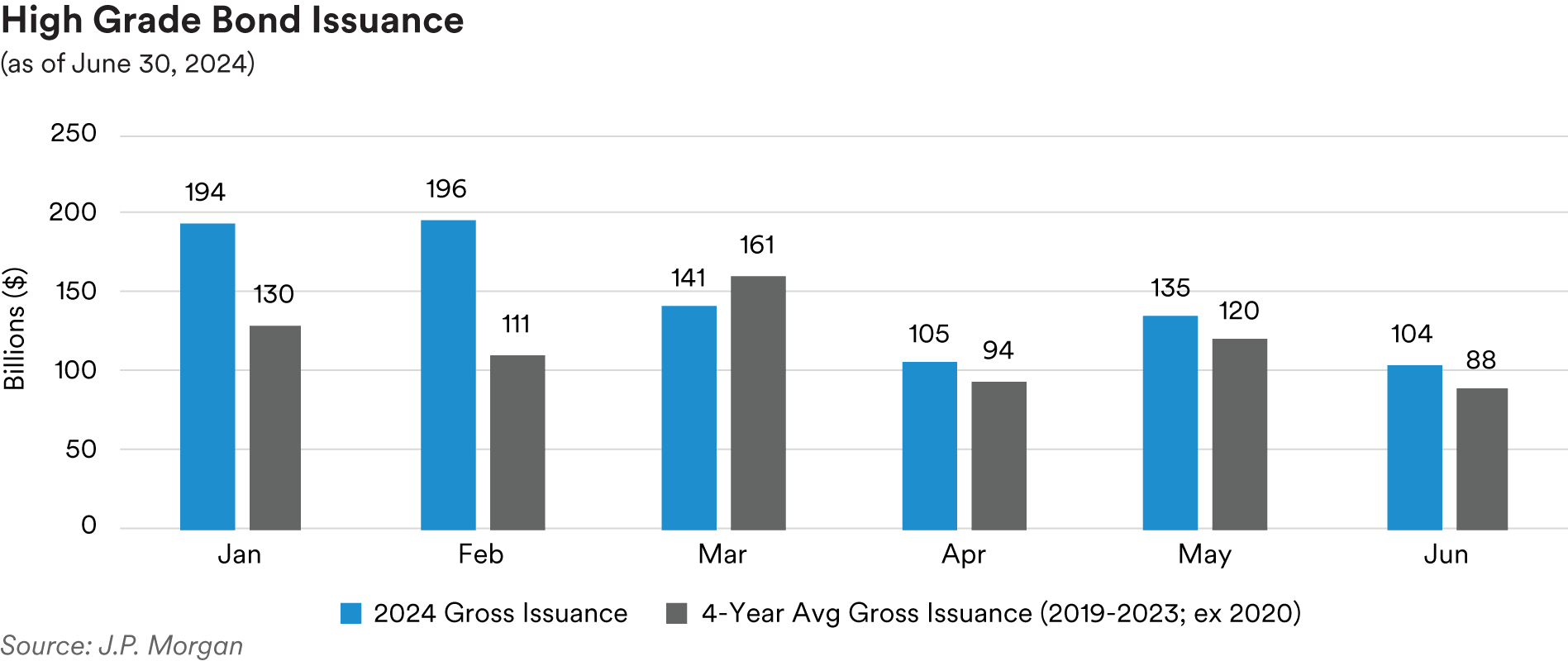

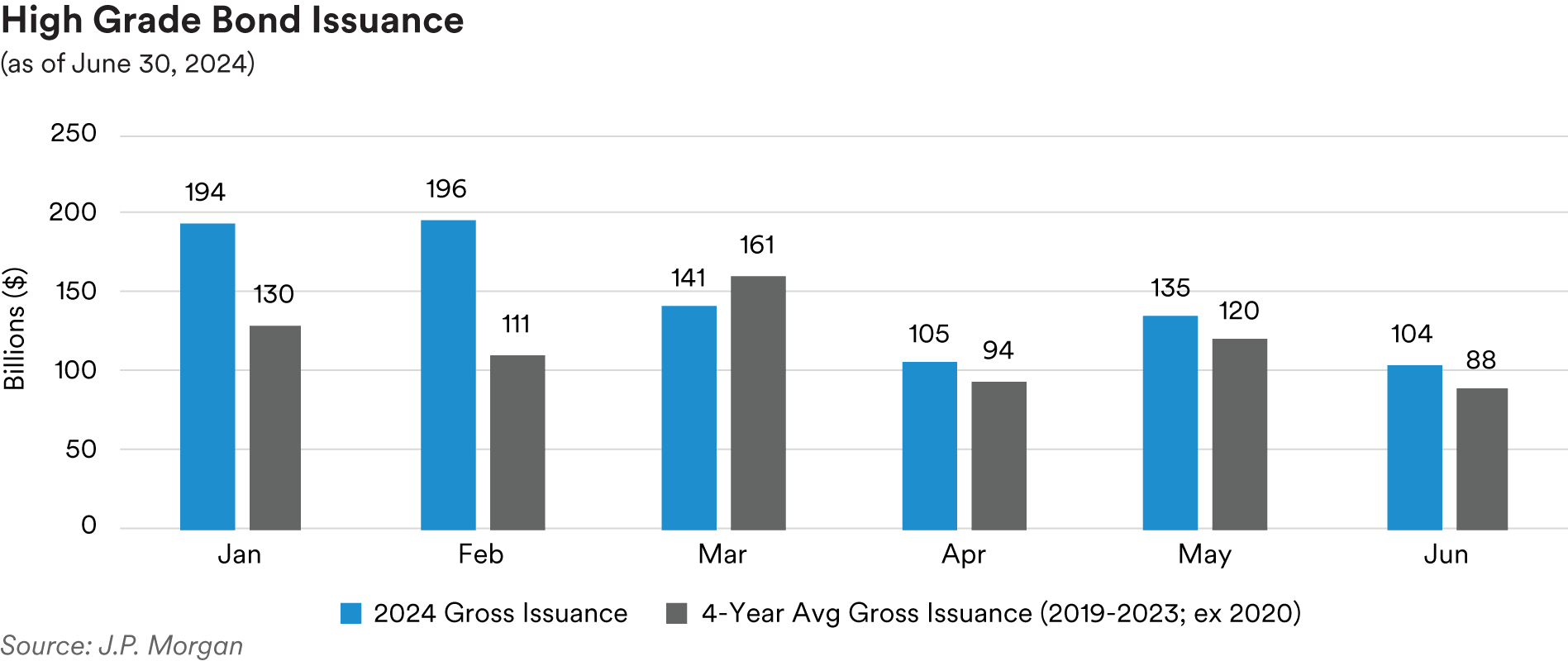

Corporate new issuance continues to be a bright spot and positive indicator for market health as shown in first-half investment grade bond issuance reaching a record high of $874 billion (ignoring first-half 2020’s COVID-related spike of activity), up 23% vs. 1H2023, according to J.P. Morgan.

The second quarter saw $344 billion in new issues come to market, 9% higher than 2Q2023. Yield- driven buyers predominated in their desire to lock in what have been deemed to be attractive all-in yields before the Federal Reserve eventually begins its rate-cutting program.

Portfolio Actions: We entered the second quarter with the view that corporate credit spreads did not hold much room for additional tightening based on where valuations were and where we believed us to be in the economic cycle. Consequently, we had been positioned somewhat more defensively than what has been our norm over multiple credit cycles in the belief that we would have the opportunity to add risk at more attractive entry points. In addition, in any environment there are always opportunities to take advantage of perceived relative value situations while maintaining our discipline and being selective as we did in the second quarter while remaining defensively positioned.

In the Cash Plus strategy in the second quarter we saw our weighting in investment grade corporates decline modestly as our secondary purchases of primarily one-year duration bonds as well as a two-year floating-rate automotive sector new issue at what we deemed attractive yields were more than offset by matured and called securities coupled with attractive opportunities in other spread sectors. In the Enhanced Cash strategy portfolios, our Credit weightings ticked down slightly while adding roughly one-year duration secondary corporate bonds and purchasing a home improvement retailer’s 18-month floating-rate new issue at attractive yields funded by selling shorter duration fixed and floating-rate bonds. We slightly raised our sector weighting in the 1-3 year strategy portfolios in selling less than or approximately one-year duration corporate bonds while selectively adding two-year new issues from a life insurance company (secured funding agreement-backed notes), domestic oil and gas producer, two automotive OEMs’ finance subsidiaries, and an aircraft lessor. We also purchased a three-year duration new issue brought to market by another life insurance company (secured funding agreement-backed notes also) and carried out a secondary extension trade from a one-year duration bond into a two-year duration instrument issued by a money center bank. We kept our sector weightings relatively constant over the quarter in the 1-5 year strategy portfolios by swapping out of shorter duration securities and purchasing a money center bank’s four-year / non-call three-year new issue in addition to the aforementioned domestic oil and gas producer’s three-year new issue. In June we also swapped out of some early-2026 maturity bonds into a pharmaceutical sector issuer’s nearly five-year bond before benchmark yields generally moved lower into quarter end, notwithstanding a divergent move in Treasury yields higher on the quarter’s last trading day.

Outlook: Although corporate credit spreads backed off their year-to-date tight levels sufficiently in June, the first move wider since last October, to finally produce a month of negative excess return, investment grade credit index excess returns remained in positive territory for the second quarter. The slight widening in spreads coincided with a decline in benchmark Treasury yields and the reemergence of geopolitical volatility centered around France’s unsettled political and fiscal situations. The greatest impact on spreads fell on French banks and bled into spread widening in other Yankee banks as well as the market in general. The U.S. was also not immune from driving a pickup in volatility into quarter end in the wake of a surprising turn of events at the first presidential debate, as the market’s handicapping of the November election outcome tilted more decidedly in former President Trump’s favor, which drove interest rates higher based on speculation about some of his proposals. With the election four months away and unexpected questions over the presumptive Democratic nominee at this late stage, we expect that this could be a source of market and spread volatility in the months ahead, especially given we currently are at relatively tight overall spread levels historically.

These recent episodes highlight the danger of being over-exposed or offside in the current spread environment marked by heightened uncertainties and the benefit of being able to capitalize on the emergence of so-called “unknown unknowns” if warranted by holding some dry powder in the form of a reduced risk positioning. They also help color our sector outlook as we see softening corporate credit fundamentals not quite lining up with relatively rich valuations while global central banks seek to maintain sufficiently high policy rates to wring out above-target inflation. While economic growth appears on a slowing trajectory with the U.S.’s ability to achieve a characteristically elusive soft landing an open question, we still believe we are relatively late in the credit cycle. However, even though we are certainly not as evidently bullish on the investment landscape as many equity investors with equity markets seemingly establishing new record highs weekly, we see the lasting impact of COVID-related distortions and spending to help companies and consumers, including massive fiscal support driving record government deficits, serving to prolong the cycle and help (so far) avert a long-anticipated recession. Nonetheless, we resist sounding the alarm on valuations in maintaining our view that spreads, while biased to ultimately move higher, may stay in the range in which they have resided this year for a time, offering opportunities to adjust exposure downward on spread tightening moves and vice versa on spread widenings.

Moving forward, we will continue to favor lower beta, less cyclically exposed subsectors and issuers skewed toward more up-in-quality names in maintaining our disciplined approach while also opportunistically participating in new issue offerings. Capitalizing on upward interest rate moves to add exposure selectively to lock in higher yields for longer across strategies will also continue to be a focus. Overall, we anticipate holding a lessened investment grade credit sector weighting and spread duration compared to our historic norms, especially in our longer 1-3 year and 1-5 year strategies, until credit spreads and fundamentals are more in sync or credit spreads reset meaningfully wider.

Performance: The investment grade credit sector contributed positively to relative performance across all strategies in the second quarter vs. Treasury benchmark indices. Positive excess returns from the sector were driven by credit spread tightening seen in April and May in addition to security selection before spreads, as gauged by the benchmark 1-5 year credit index, broke their seven-month tightening string in June, the longest such stretch in nearly 10 years, by more than retracing May’s quarter-to-date tightening. As noted above, credit spreads tightened in April and May before giving all the tightening back and more in June with the OAS of our front-end benchmark ICE BofA 1-5 Year U.S. Corporate Index widening 2 basis points over the quarter to finish at 73 basis points. After the second quarter’s modest spread widening and rise in benchmark yields, the index’s quarterly total return and excess return were 1.03% and 0.20%, respectively.

Investment grade credit subsectors that drove positive excess returns across strategies included Banking, Finance Companies, Insurance, Automotive, Health Care, and Electric Utilities.

Treasuries / Agencies:

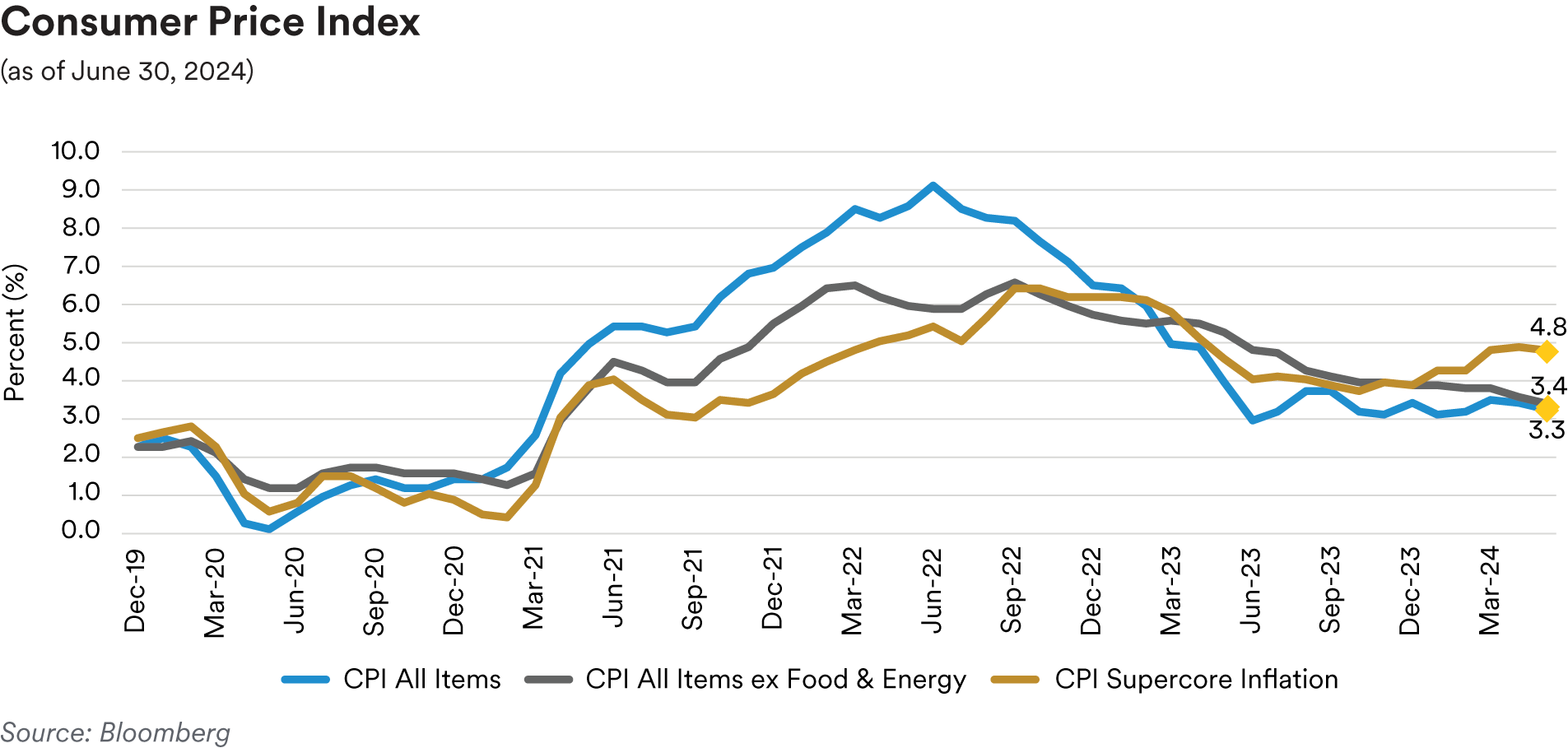

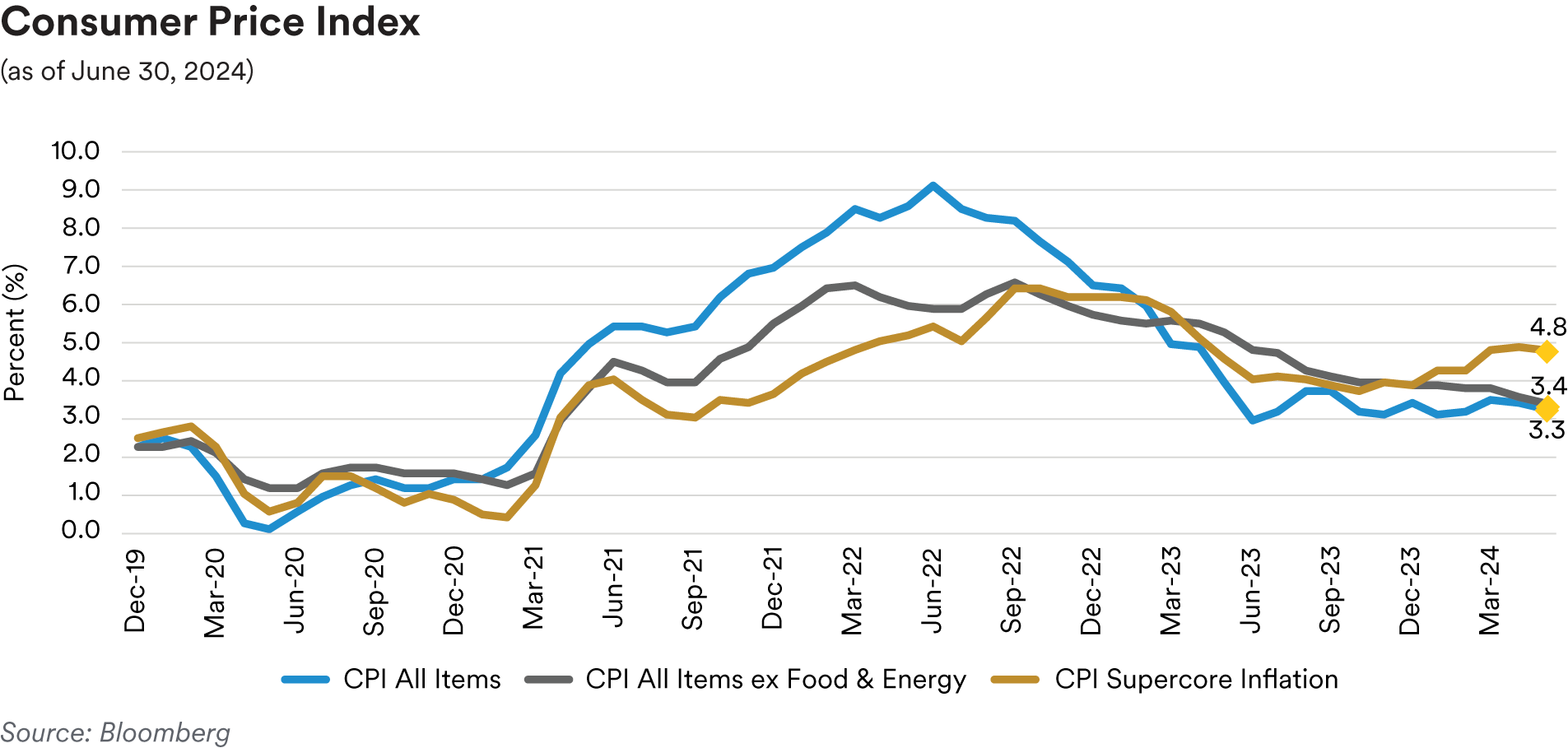

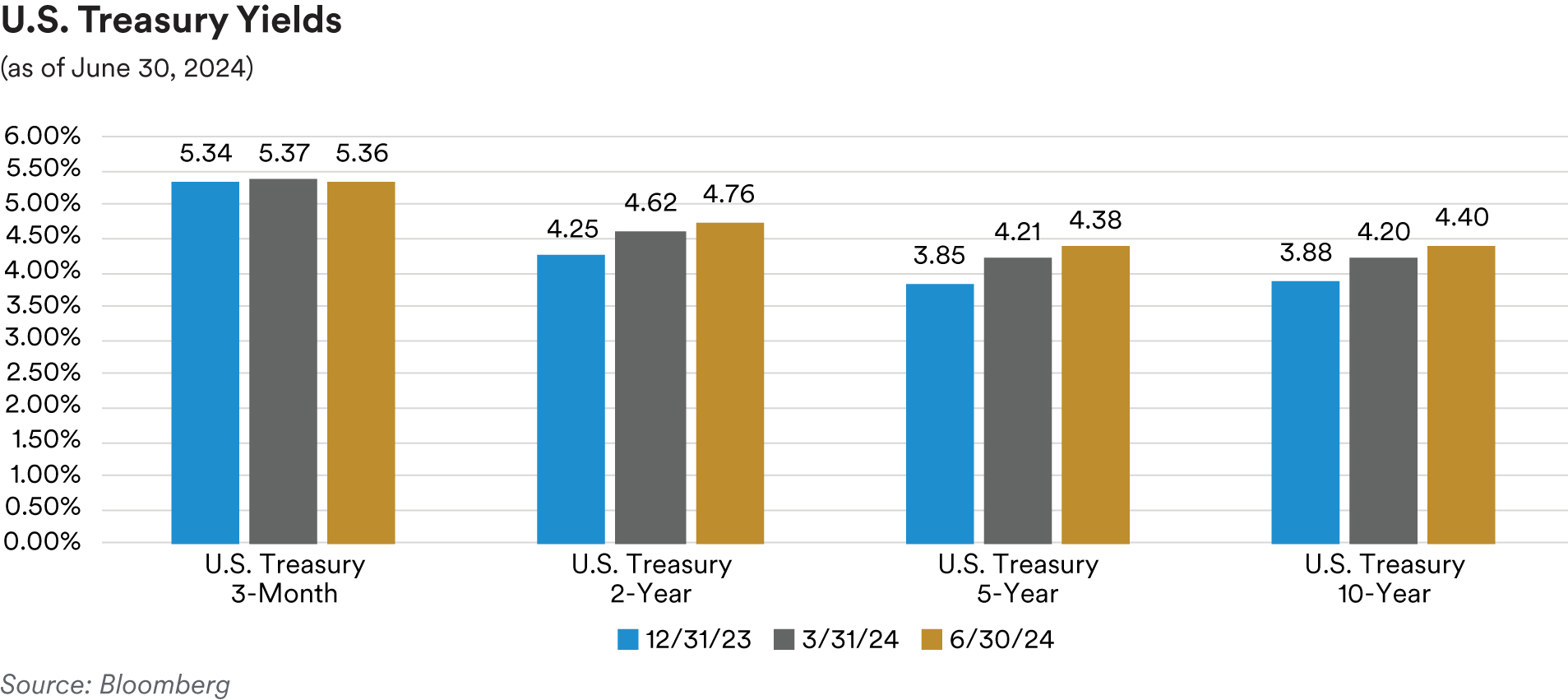

Recap: The Treasury market sold off in the second quarter as the markets saw a surprise uptick in the March Consumer Price Index (CPI) report, released in April. Both headline and core CPI climbed by 0.1 percentage point more than forecast, each coming in at 0.4%. A reacceleration in Federal Reserve Chair Powell’s preferred measure of inflation, “supercore” services excluding housing, to 0.65% on the month, on top of 0.47% and 0.85% readings the previous two months, continued a trend of elevated readings. Yet another hot inflation report caused two-year Treasury yields to surge 23 basis points towards 5%. This momentum would help push two-year yields to a year-to-date high of 5.04% during the quarter.

As expected, the Fed’s June FOMC meeting saw the committee vote unanimously to keep the federal-funds policy rate unchanged at the 5.25% to 5.50% target range, a two-decade high, for a seventh straight meeting. The median “dot plot” now projects just one quarter-point cut in 2024, two less than the previous forecast in March. The FOMC also lifted their forecasts for where they see rates migrating over the long term, raising their median long-term estimate to 2.8% from 2.6% in March. Powell said the Fed is “coming to the view that rates are less likely to go down to their pre-pandemic level”. He pointed out that the so-called neutral rate is a long-term rate, and that the Fed continues to see current rates as restrictive. The median forecast for PCE inflation, the Fed’s preferred gauge, rose to 2.6% for 2024 while the core PCE projection increased 0.2% to 2.8% and the real GDP projection for 2024 was left unchanged at 2.1%. The Fed’s statement repeated prior language saying the FOMC does not expect to cut rates “until it has gained greater confidence that inflation is moving sustainably toward 2%”. Fed members tweaked the statement’s language to acknowledge “modest further progress” toward their inflation target in recent months.

The Fed’s statement repeated prior language saying the FOMC does not expect to cut rates “until it has gained greater confidence that inflation is moving sustainably toward 2%.”

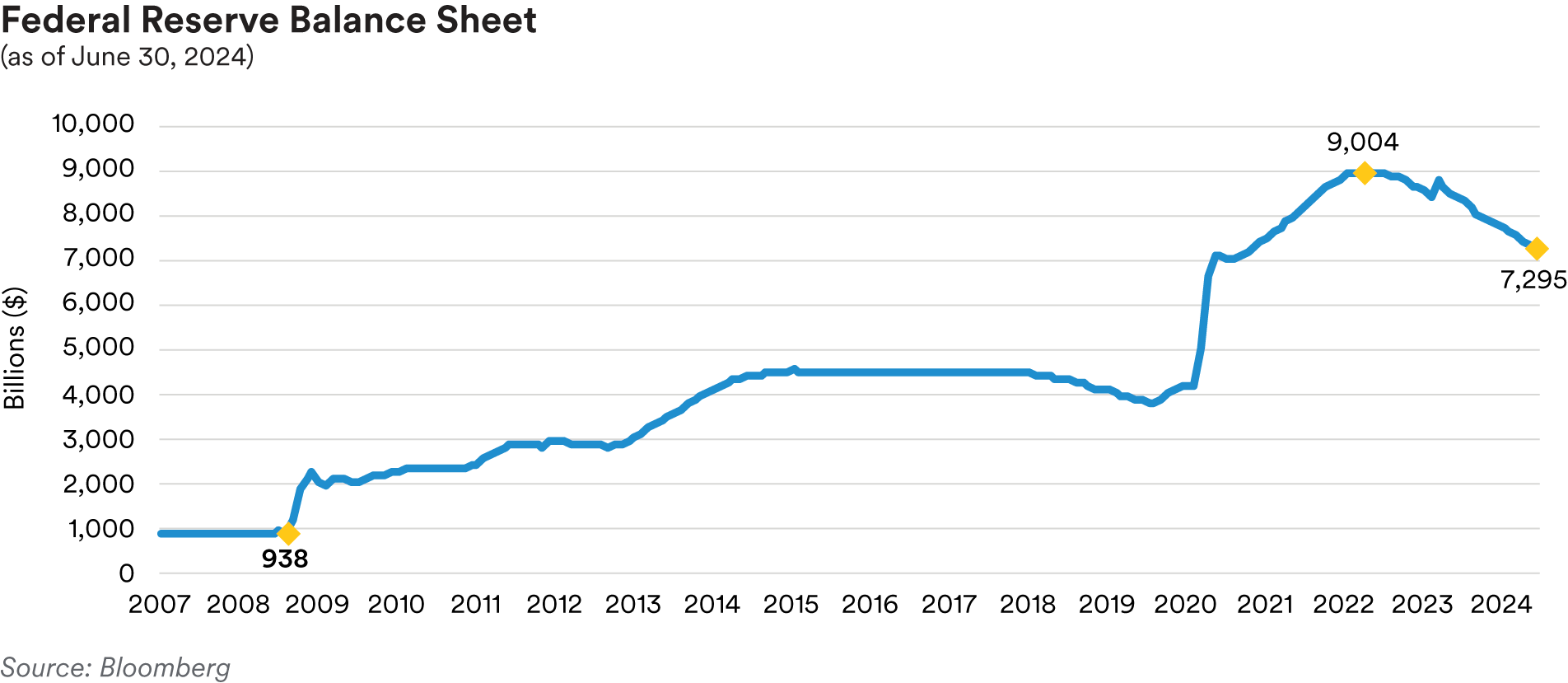

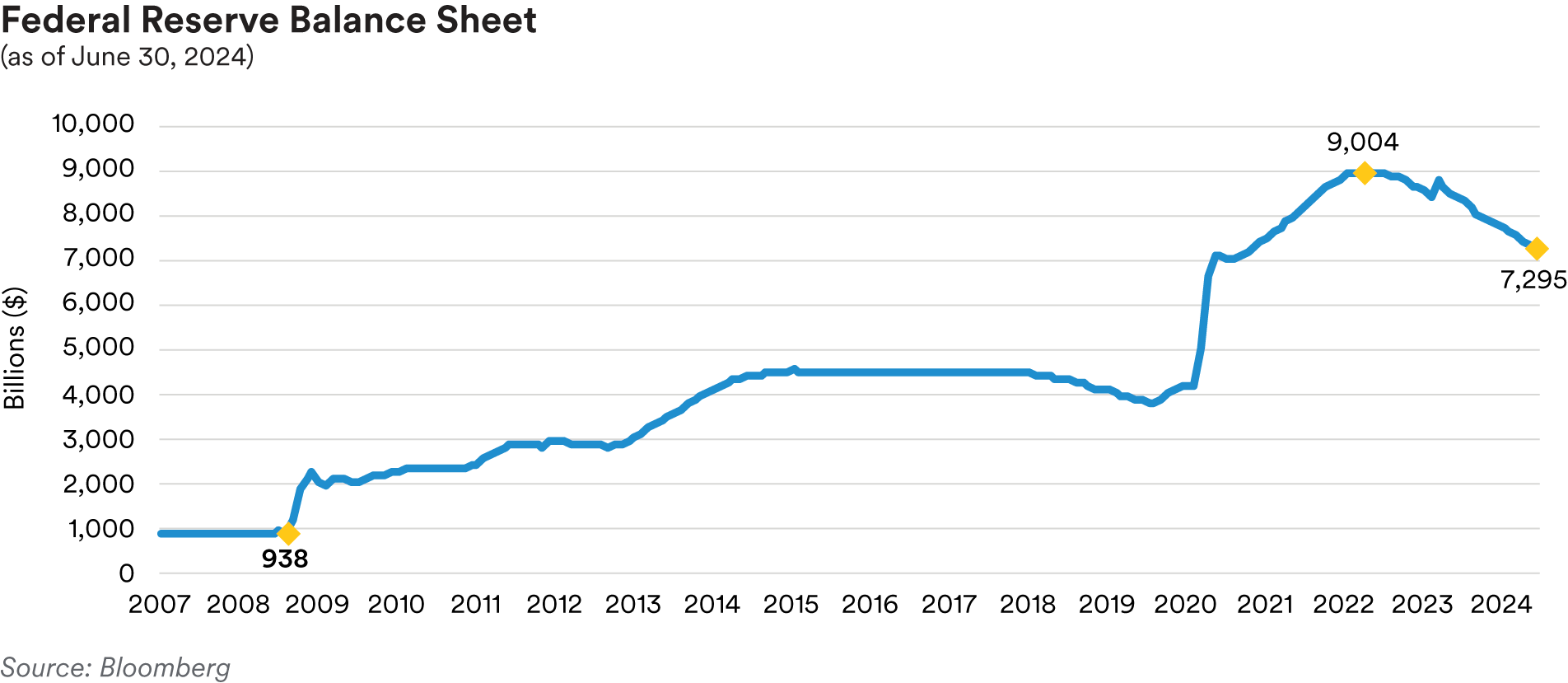

On the issue of the size of the Fed’s balance sheet, officials said they will “continue reducing its holdings of Treasury securities and agency debt and agency mortgagebacked securities”. In June the Fed slowed the pace at which it is allowing bonds to run off its balance sheet. Powell explained that this move enables officials to proceed more cautiously to prevent their holdings from dropping too low. Policymakers aim to avoid a repeat of 2019 when a reserve shortage caused a spike in short-term borrowing costs.

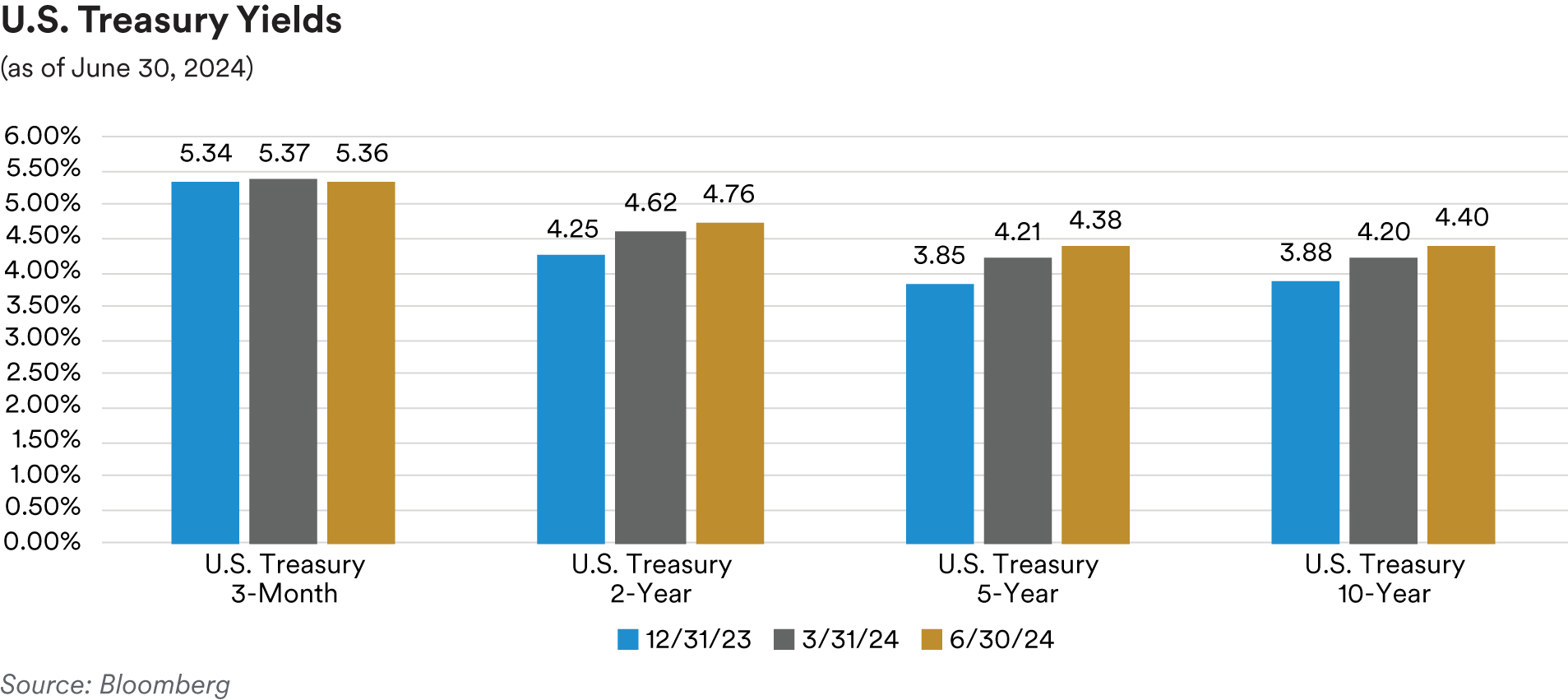

In the very front end of the maturity spectrum where we operate, short Treasury bill yields were somewhat mixed over the second quarter. Three-month and six-month bill yields were essentially unchanged while one-year bill yields rose 9 basis points during the quarter. The two-year Treasury moved 13 basis points higher, ending the quarter at 4.75%. The five-year Treasury rose by 17 basis points and closed the quarter at 4.38% while the ten-year Treasury climbed 20 basis points higher to finish the quarter at 4.40%. The spread between the 10-year Treasury and the 2-year Treasury steepened from -42 basis points at the start of the quarter to -35 basis points at the end of the quarter. The spread between the five-year Treasury and two-year Treasury also steepened from -41 basis points at the start of the quarter to -37 basis points at the close of the quarter.

Treasury Inflation-Protected Securities (TIPS) breakeven inflation rates decreased during the quarter. Five-year TIPS breakeven rates moved lower to 228 basis points from 244 basis points at the start of the quarter while the ten-year TIPS breakeven moved to 229 basis points from 240 basis points over the same period. The five-year real yield increased from 182 basis points at the beginning of the quarter to 211 basis points at the end of the quarter. The ten-year real yield also moved higher from 188 basis points to 211 basis points over the quarter.

Front-end Government-Sponsored Enterprise (GSE) agency spreads tightened over the second quarter as the OAS of the ICE BofA 1-5 Year U.S. Bullet (fixed maturity) Agency Index ended the quarter at 2 basis points, 1 basis point tighter from the start of the quarter. In the SSA (Sovereigns, Supranationals & Agencies) subsector, U.S. dollar-denominated fixed-maturity security spreads were marginally wider by 1 basis point and finished the quarter on average at 26 basis points over comparable-maturity Treasuries. Agency callable spreads relative to Treasuries were slightly wider as short-dated and short-expiry volatility in the upper left portion of the volatility surface was mostly unchanged over the quarter. Two- and three-year maturity “Bermudan” callables, which feature quarterly calls with lockout periods of three months, saw spreads over Treasuries move 3 basis points wider from 75 and 110 basis points at the start of the quarter to 78 and 113 basis points at the end of the quarter, respectively.

Portfolio Actions: In the second quarter, in our longer 1-3 and 1-5 year strategies, we continued to trim our allocation to Treasuries in favor of high-quality spread sector alternatives, mainly increasing our asset-backed and corporate sector weightings. By contrast, in our shorter Cash Plus and Enhanced Cash strategies we slightly increased our Treasury holdings by 3-4%. As yields reached their year-to-date highs over the quarter, we sought to extend our portfolio durations by swapping out of shorter-duration Treasuries and into Treasuries and various high-quality securities further out the yield curve. In our shorter Cash Plus and Enhanced Cash strategies, we took the opportunity to add some two and three-year maturity Agency callables at attractive spreads of 100 basis points over matched-maturity Treasuries.

Outlook: As we start the third quarter, we think the Fed will continue to leave their options open on when they will begin to cut interest rates, which the markets are pricing in as likely to occur at the September FOMC meeting. Although Chair Powell has said he does not expect the next move will be a hike, he has declined to provide a timeline for cuts saying, “I’m not going to be sending any signals about the timing of future actions”. Powell has emphasized that there are risks associated with both moving too soon and moving too late regarding policy decisions. By repeatedly highlighting the Fed’s mandates, full employment and price stability, Powell has kept the possibility of a September rate cut on the table without fully committing to it. He stated that the Fed will make its decisions on a “meeting by meeting” basis. Recent inflation data have provided evidence of some reasonable progress, but we think there will have to be more favorable inflation readings before the Fed would gain enough confidence in inflation being reliably on track toward returning to their 2% target, a condition for cutting the federal-funds policy rate. Powell has called the labor market “strong, but not overheated”, a sign that the Fed is not trying to curb the job market any further. We do think an unexpected shock or weakness in the labor market would likely prompt a cut. We should get more insight into a possible rate cut for September come the Fed’s next FOMC meeting at the end of July. We will also continue to scrutinize future inflation reports alongside developments in the labor market as these will remain the principal drivers for Fed expectations and the direction of Treasury yields. We are also thinking about how uncertainty surrounding the elections in the second half of the year will impact how we position our portfolios. Issues like trade, immigration, and tax policy could all be affected by the presidential and congressional elections in November. We view another potential Trump presidency as probably bringing a combination of higher spending, tax cuts and faster inflation. TIPS breakeven rates are likely to be remain relatively well supported over the next few months and we anticipate maintaining our TIPS positions.

Given we expect the yield curve to bull steepen as the first cut approaches, we will continue to “bullet up” our yield curve posture in the coming months. We will also be watching technical support levels for two-year Treasuries at 4.75% and five-year Treasuries at 4.45% to continue to opportunistically lengthen our portfolio durations. We believe GSE and SSA spreads will continue to take their cues from risk sentiment but think further tightening should be muted. We also expect new issue supply to remain light over the near term and slow in the second half of the year as SSA issuers generally front-load their issuance needs in the first half of the year.

Performance: As rates sold off and the yield curve steepened over the quarter, our slightly long duration bias vs. benchmark indices produced negative excess returns across our strategies.

The agency sector saw neutral excess returns across all our strategies which hold mainly agency callable securities.

ABS

Recap: Short-tenor ABS spreads showed mixed performance over the second quarter. Three- year, fixed-rate AAA-rated credit card and subprime auto tranches ended the quarter at spreads of 44 basis points and 72 basis points over Treasuries, 2 basis points and 5 basis points tighter, respectively. Three-year, floating-rate AAA-rated private student loan tranches ended the quarter at a spread of 85 basis points over SOFR, 20 basis points tighter. In contrast, three-year, fixed-rate AAA-rated prime auto tranches ended the quarter 7 basis points wider, at a spread of 64 basis points over Treasuries. We attribute the relative underperformance of prime auto tranches to the heavy volume of new issue supply seen in that sector over the course of the quarter as issuers front-loaded their new deal calendar in order to avoid possible market disruptions triggered by the upcoming presidential election. The second quarter saw over $89 billion of new deals price, which was essentially flat to the first quarter of the year but 26% higher than last year’s second-quarter volume. Following the usual pattern, auto issuance was the main contributor with almost $46 billion of new auto deals pricing in the second quarter, 25% ahead of last year’s second-quarter volume. Following autos were the “other ABS” subsector (a catch-all category which includes deals collateralized by cell phone payment plans, timeshares, mortgage servicer advances, insurance premiums, aircraft leases, etc.) with almost $20 billion of new issuance and the equipment subsector with $8.8 billion of new issuance. In comparison, in the second quarter last year, “other ABS” and equipment priced $10.6 billion and $4.8 billion of new deals, respectively. In notable new issue transactions, a major U.S. multi-state auto dealer and prolific prime auto issuer, came to the market with its inaugural subprime auto securitization, a $625 million SEC-registered public deal. We participated in the new deal and anticipate more follow-on subprime deals from this issuer going forward.

In regulatory news on the student loan front, two separate court decisions in late June blocked implementation of parts of the Biden administration’s student loan debt reduction plan (the “SAVE” plan launched by the Department of Education in August 2023). The U.S. District Court for the District of Kansas granted an injunction that blocked the monthly payment reduction portion of the SAVE plan and the U.S. District Court for the Eastern District of Missouri issued an injunction blocking the debt cancellation portion of the SAVE plan. The administration appealed both decisions and issued a press release stating that the Department of Education will continue to enroll more borrowers into the SAVE plan to help them access those benefits of the plan that still remain available such as zero payments for people making $16 an hour or less, lower monthly payments for many more borrowers and protecting borrowers from rising interest rates if they are making their monthly payments. In our view, the two court decisions will have minimal impact on FFELP prepayment speeds as borrowers will continue to consolidate FFELP loans into Federal Direct loans in order to gain access to the remaining benefits offered by the SAVE program.

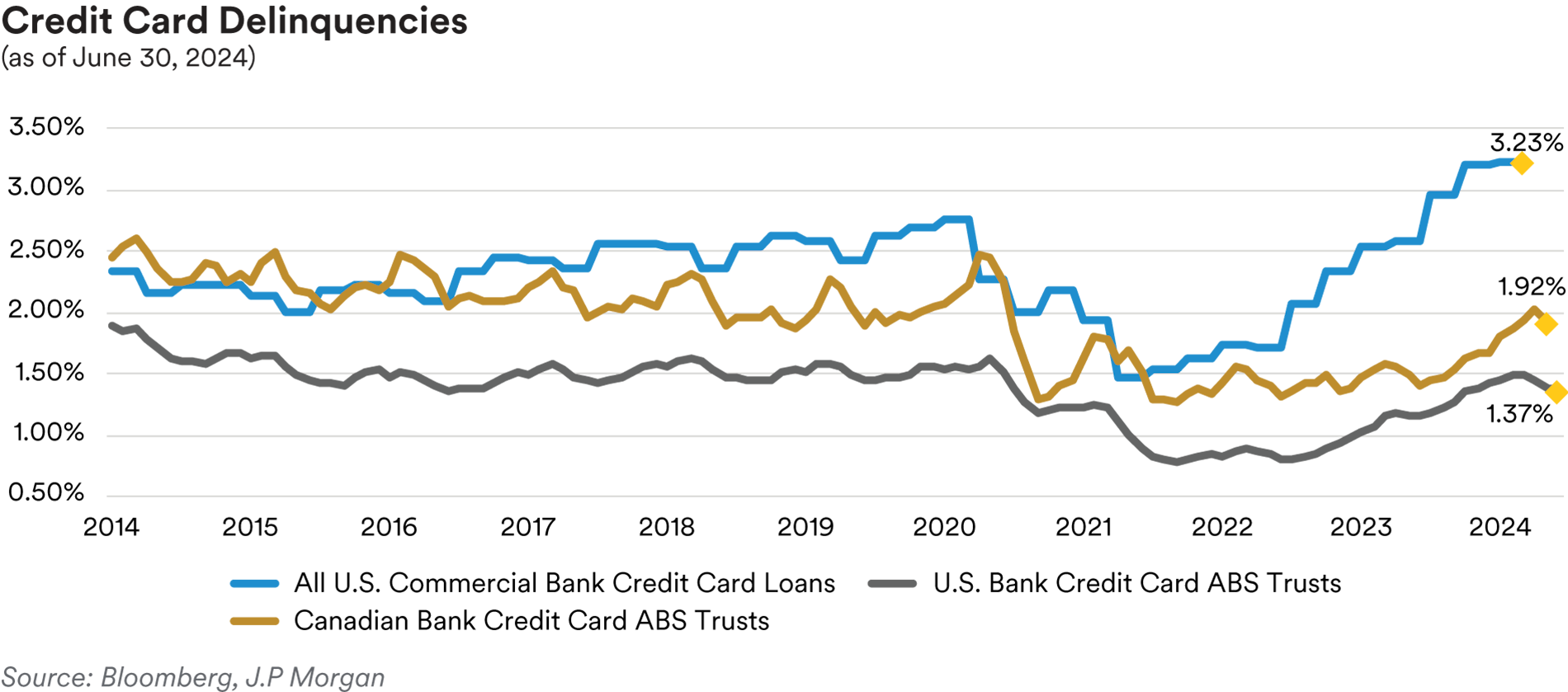

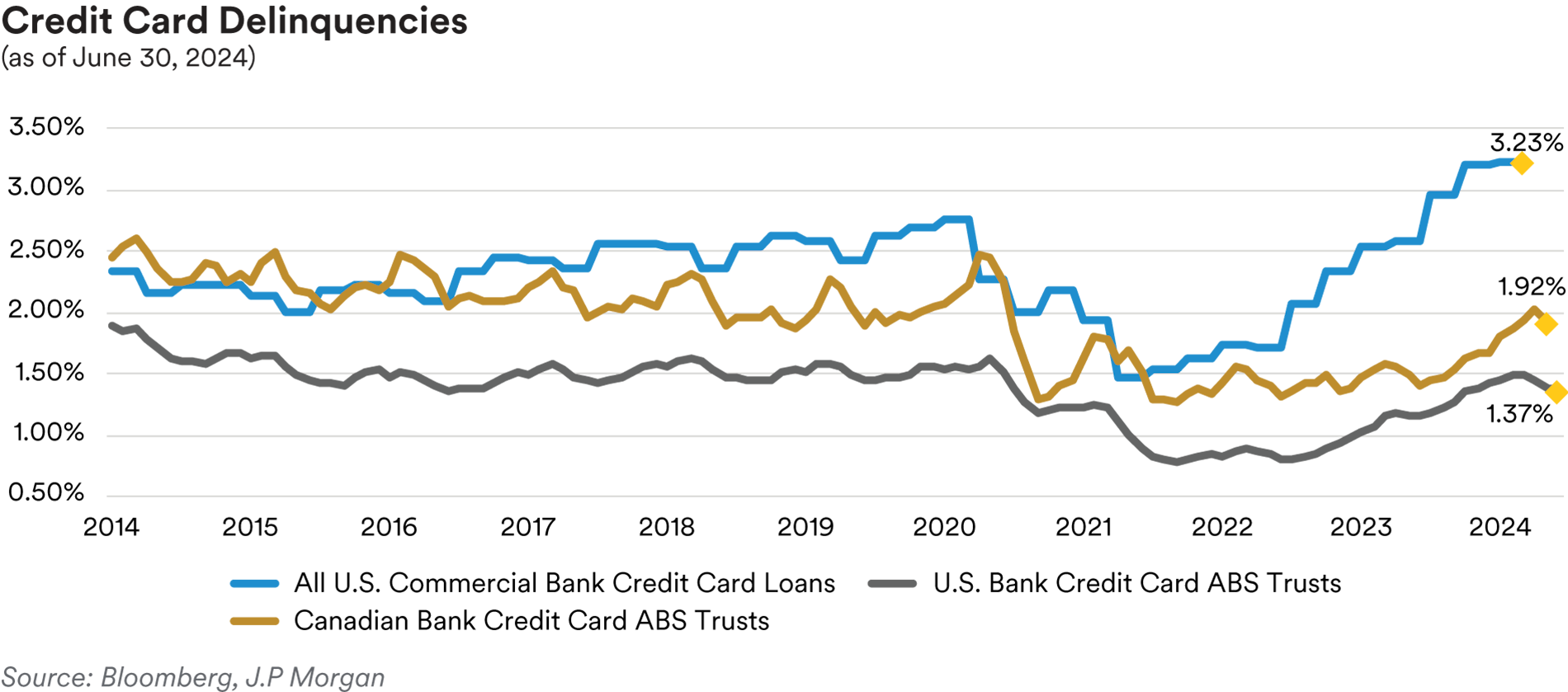

Credit card performance was generally stable over the second quarter but has worsened on a year-over-year basis. At the end of the quarter, data from the J.P. Morgan credit card performance indices reflecting the June remittance cycle showed charge-offs and 60+-day delinquencies on bank credit card master trusts flat and falling 7 basis points, respectively, over the quarter, at 2.23% and 0.99%. Despite the stable performance this quarter, charge-offs and delinquencies are still 45 basis points and 21 basis points above last year’s levels. As we have noted in prior commentaries, although charge-offs and delinquencies have been moving higher from the pandemic’s historic lows, they still remain below long-term averages. Further, we note that credit card ABS trust performance (for both domestic and Canadian card trusts) remains better than that of the broader credit card universe due to the seasoned nature of ABS credit card collateral accounts. For example, in comparison to the 1.37% and 1.92% 30+-day delinquency rates currently reported for domestic and Canadian ABS credit card trusts, respectively, the St. Louis Fed reported that the 30+-day delinquency rate for all commercial bank credit card portfolios was 3.16% at the end of the first quarter.

Going forward, we continue to expect further deterioration in credit card performance for both ABS trust and non-trust accounts for the foreseeable future as consumers struggle with high interest rates, inflationary pressures and a likely slowing economy. At the end of the second quarter, bank credit card master trust balances stood at $151.7 billion, $19.0 billion higher than year- ago levels.

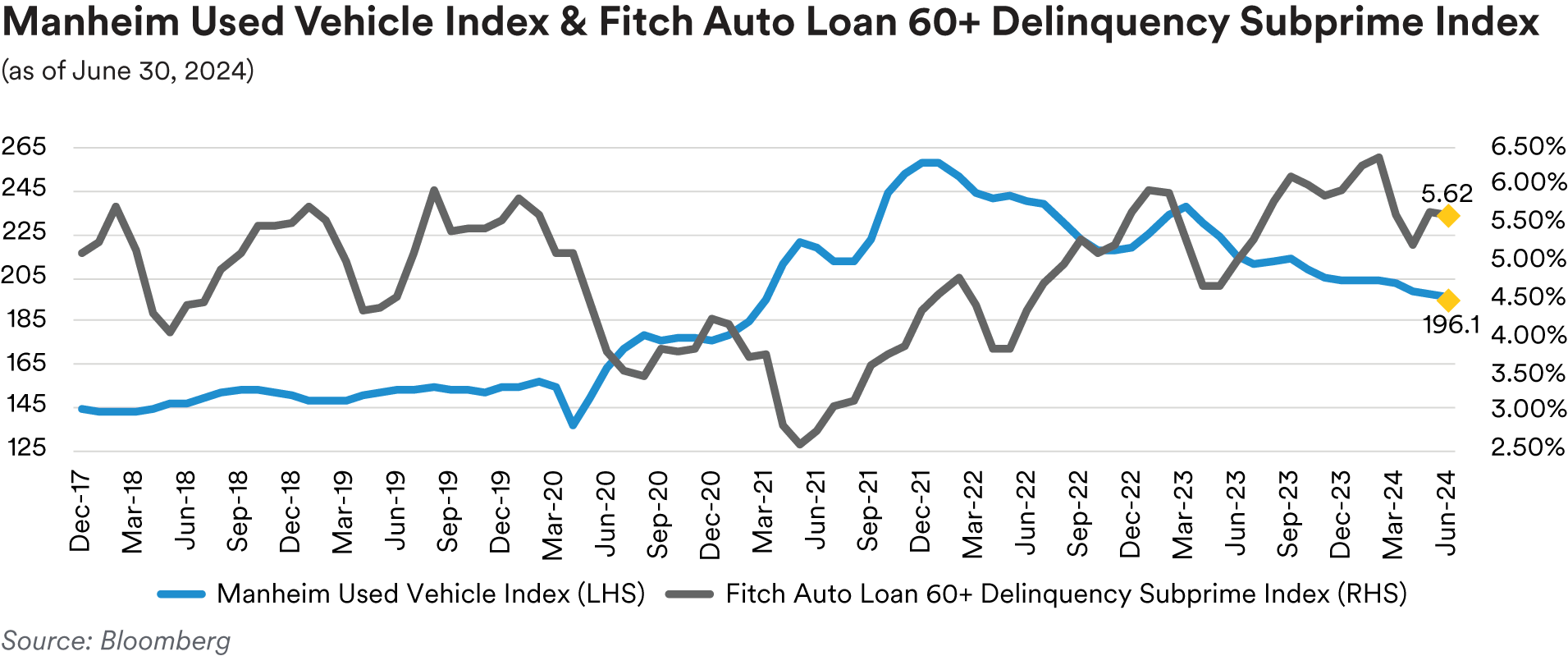

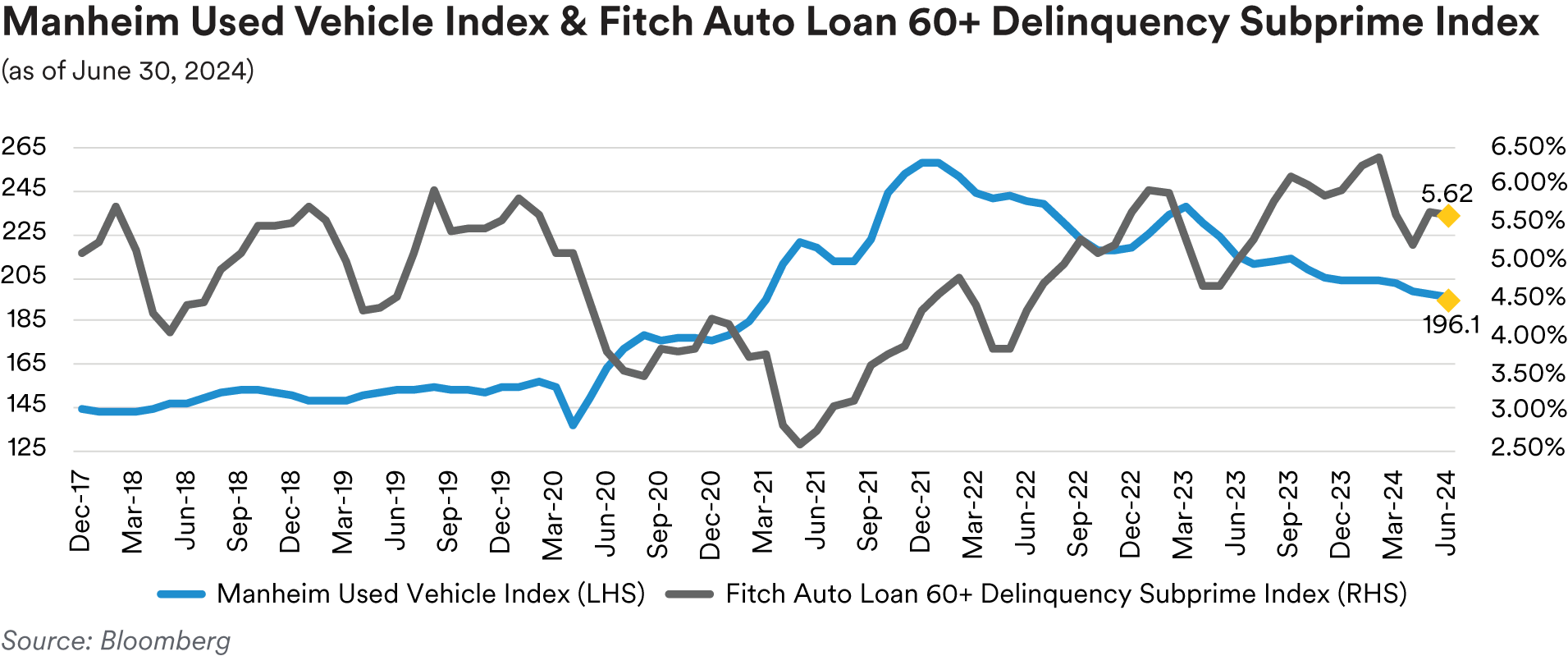

New vehicle sales remained rangebound over the quarter at levels consistent with the 15.0 – 16.0 million SAAR (seasonally-adjusted annualized rate) pace seen since the early summer last year. June’s sales numbers came in at a 15.3 million SAAR which followed 15.9 million and 15.7 million prints in April and May, respectively. June’s number reflected a 2.5% year-over-year decline in the sales rate and was well below the 15.8 million SAAR consensus projected by forecasters. Sales in June were negatively impacted by a cyberattack on CDK Global, a company that provides dealer management software services for over 15,000 dealers in the U.S. and Canada. Commenting on the numbers, Cox Automotive noted that while the shutdown of the CDK software system contributed to the weakness, other factors were also at play. Cox pointed to a slowdown in the fleet market and theorized that many retail customers were taking a wait-and-see approach to buying a new car given the possibility of lower loan rates on the horizon, the uncertainty of the upcoming election and continued downward pressure on vehicle prices. Cox noted that the average transaction price (“ATP”) of a new vehicle increased to $48,644 in June, the highest price since December. As we mentioned in our first- quarter commentary, our view is that higher interest rates and high vehicle prices are the main constraints on sales volumes as inventory issues have largely abated. With CDK recently announcing that the software disruptions have been mostly resolved, we would expect a boost to July’s new vehicle sales volumes. Used vehicle prices, as measured by the Manheim Used Vehicle Index, drifted steadily lower over the quarter, declining each month to end June at 196.1, a level 8.9% lower than a year ago.

In line with softening used vehicle prices, ABS auto credit metrics continued to worsen over the second quarter despite the positive seasonal impact of tax refunds. June’s data showed the 60+- day delinquency rates on the Fitch Auto ABS indices were 0.29% for the prime index and 5.62% for the subprime index, 4 basis points and 61 basis points higher than year-ago levels, respectively. Similarly, annualized net loss rates for the indices stand at 0.39% for the prime index and 7.57% for the subprime index, reflecting year-over-year increases of 19 basis points and 166 basis points, respectively. As we have noted in prior commentaries, we project further deterioration in auto credit metrics as used vehicle prices decline further and borrowers (subprime borrowers in particular) grapple with higher interest rates and persistent inflationary pressures. However, despite our negative outlook for the sector, we believe our holdings of AAA and AA-rated auto tranches will perform well as, in our opinion, they possess more than ample credit enhancement to protect senior bondholders.

The most recent Fed Senior Loan Officer Opinion Survey reflecting sentiment as of the first quarter, showed banks generally reporting tighter lending standards for all consumer loan categories. A “significant share” of banks reported raising the minimum credit score requirements for new credit card loans while a “moderate” share of banks also reported doing so for auto and other consumer loans. Banks also reported weaker demand for auto loans, credit card loans and other consumer loans.

Portfolio Actions: Over the second quarter we increased ABS exposure across all of our strategies except our shortest (Cash Plus) strategy where we decreased exposure. Due to their short duration profile, our Cash Plus portfolios typically have the highest ABS weighting of all our strategies and even after this quarter’s decrease, they continue to have a relatively high ABS exposure, second only to our slightly longer Enhanced Cash strategy. The reduction in exposure in the Cash Plus strategies was implemented via the reinvestment of portfolio paydowns into other spread sectors rather than the outright sale of ABS securities. Notably, in the first quarter we actively added many front-pay ABS CP tranches of various auto and equipment deals to our shorter strategies (CP tranches stand at the top of the payment waterfall and carry short-term commercial paper ratings equivalent to AAA. Since they are structured to receive the first principal payments from the deal, they are the safest tranches in ABS deal structures from a credit perspective). However, in the second quarter with spreads tighter on these tranches, we were much less active. As our Cash Plus held relatively more CP tranches than our other strategies and with these securities rapidly paying off (due to their front-pay nature), the lack of replacement accounted for much of the overall topline reduction in ABS exposure in the strategy. We were active in both the primary and secondary markets, although we participated in fewer new issue deals than in the first quarter. Notable new issues in which we participated included the inaugural subprime auto deal from the large U.S. multi-store auto dealer mentioned above. In that deal we purchased the 0.2-year A1+/ F1+ (“AAA”)-rated CP tranche at a spread of 25 basis points over Treasuries, the 0.9-year and 2.1-year AAA-rated tranches at spreads of 73 and 80 basis points over Treasuries, respectively and the 2.9-year AA-rated subordinate tranche at a spread of 95 basis points over Treasuries.

We also purchased the 1.9-year AAA-rated tranche of a fleet lease deal at a spread of 105 basis points over Treasuries. Late in the quarter we purchased four tranches from two cell phone device payment deals for our longer strategies. We believe that device payment deals offer a compelling credit story since consumers seem to prioritize paying their cell phone bills ahead of other debt obligations. We purchased the AA and A-rated subordinate tranches from the 2.0-year deal at spreads of 75 and 95 basis points over Treasuries, respectively, and the AA and A+-rated tranches of the 5.0-year deal at spreads of 105 and 130 basis points over Treasuries, respectively.

Outlook: Our outlook remains unchanged from the first quarter. We expect economic conditions to slow and the Fed to be biased towards easing. Accordingly, we anticipate deterioration in ABS credit metrics, causing us to continue to prefer liquid, defensive tranches and more resilient subsectors of the market. As in the prior quarter, ABS spreads remain relatively attractive compared to other spread sectors, but we remain mindful of the high levels of ABS exposure within the portfolios so are unlikely to materially increase our weightings. Instead, we are likely to use sales of existing ABS holdings to fund new purchases. We reiterate our preference for prime borrowers over subprime. We continue to avoid adding CLO exposure as should the economy deteriorate as we predict, we believe leveraged loans will suffer heightened downgrades and defaults which could push CLO spreads wider.

Performance: After adjusting for their duration and yield curve positioning, our ABS holdings posted strong positive excess returns across all of our strategies in the second quarter. All subsectors were positive with our fixed-rate auto and “other ABS” holdings the top performers. Within autos, notable strength came from holdings in one of our issuer’s prime auto tranches that benefited from the improved financial outlook of the sponsor. Within “other ABS”, our device payment and floorplan tranches were among the top performers. Our private student loan holdings were also positive although they did not exhibit the same degree of outperformance seen in the first quarter. In most of our accounts, CLO exposure has dropped to levels that no longer materially impact performance although our CLO holdings were positive overall.

CMBS

Recap: Short tenor CMBS spreads widened over the course of the second quarter as continued worries about the health of the commercial property market (and office properties, in particular) weighed on market sentiment. At the end of the quarter, spreads on three-year AAA-rated conduit tranches stood at 93 basis points over Treasuries, 7 basis points wider than at the start of the quarter. Spreads on five-year AAA-rated conduit tranches were 104 basis points over Treasuries, 15 basis points wider. Three-year Freddie Mac “K-bond” agency CMBS tranches ended the quarter at a spread of 29 basis points over Treasuries, 7 basis points wider. Three-year, AAA-rated, floating- rate single asset, single borrower (“SASB”) tranches ended the quarter at a spread of 135 basis points over SOFR, 10 basis points wider. In addition to the broader worries about commercial real estate properties, SASB spreads were pressured by heavy supply in that subsector. Over $21 billion of new SASB deals came to the market during the quarter, compared to just under $4 billion in the second quarter last year. In the current market, borrowers currently prefer the flexibility offered via optional extension periods in floating-rate SASB tranches relative to fixed-rate alternatives.

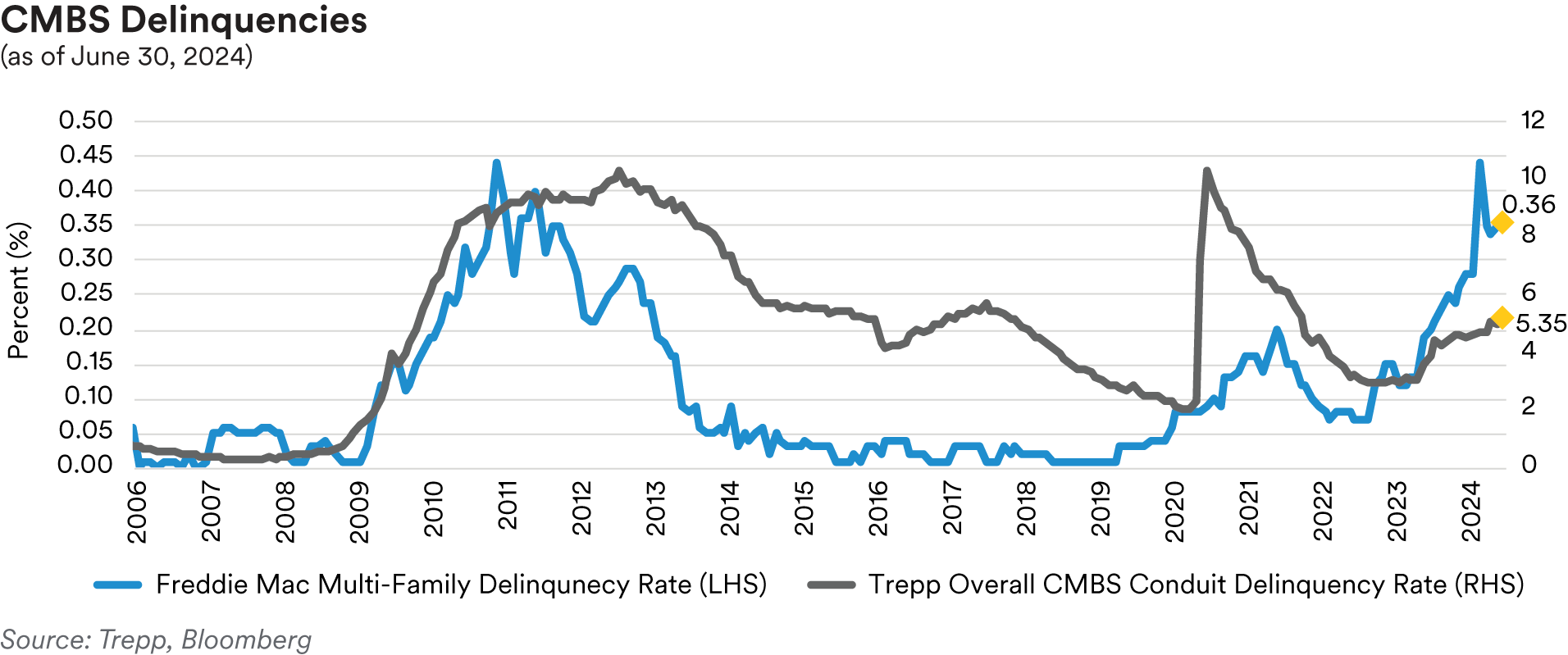

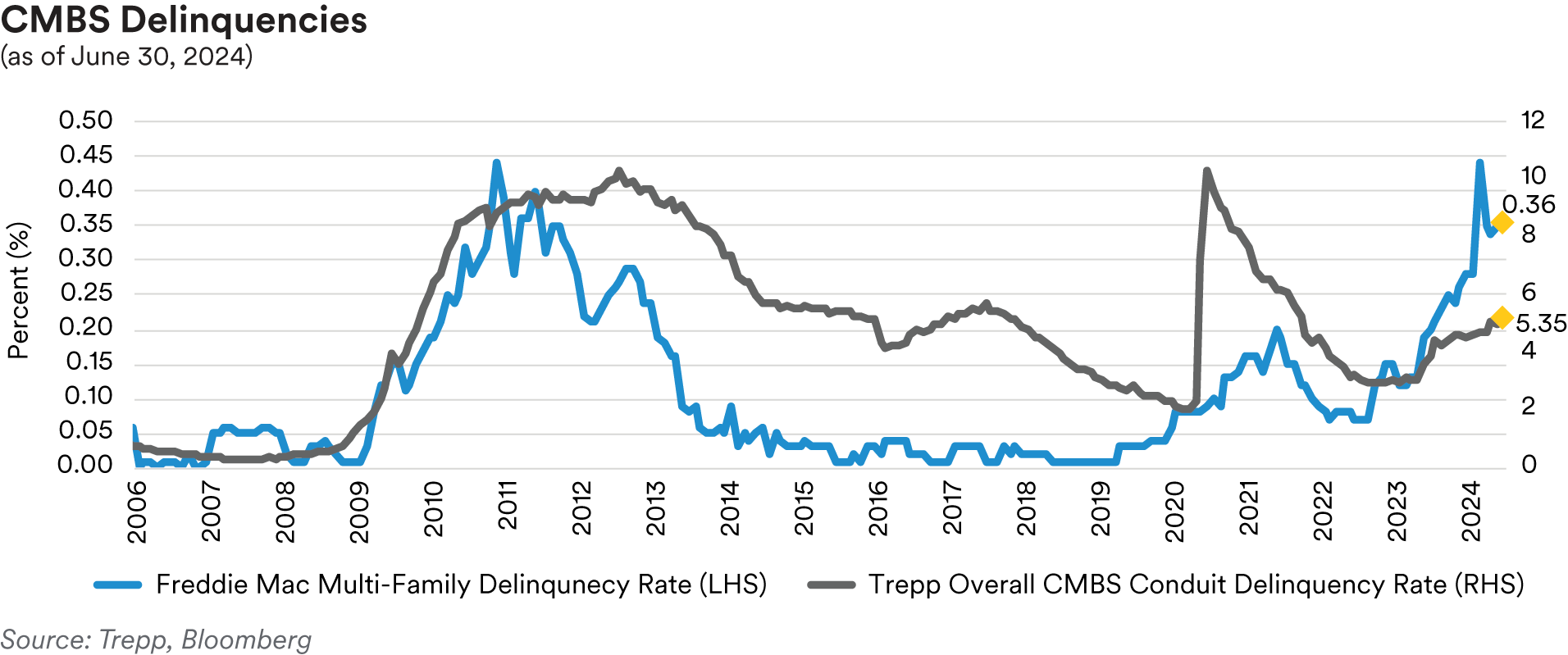

After rising above 5% in April to 5.07%, CMBS delinquencies (as measured by the Trepp 30+-day delinquency rate) dropped slightly in May to 4.97%, before surging 38 basis points higher in June to end the quarter at 5.35%. Delinquencies have been on a consistent upward trend, moving higher in four of the last six months. Year-over-year, the overall delinquency rate has risen 145 basis points. Trepp noted that the office subsector was responsible for over half of the net increase in June’s delinquency numbers, with delinquencies on retail and multifamily properties composing most of the other half. The four largest loans to become delinquent in June were all mall properties with balances over $100 million. Giving back most of the improvement we saw in the first quarter, retail delinquencies ended the quarter at 6.42%, just 5 basis points lower than at the start of the year.

Office properties are still the worst performing subsector with 7.55% delinquencies at quarter end, 305 basis points higher than year-ago levels. Industrial properties remain the best performing subsector with only 0.62% delinquent at quarter end, 20 basis points higher year-over-year. Lodging properties deteriorated significantly over the quarter with delinquencies increasing 87 basis points to 6.32%. Year-over-year, lodging delinquencies are up 97 basis points.

Commercial property prices continued their slump, moving lower each month during the course of the second quarter. Prices, as measured by the RCA CPPI National All-Property Composite Index, have now fallen 2.3% year-over-year through May. June’s release saw the index print at 143.1 in May, a decline of 12.5% compared to the high of 163.5 seen in July 2022. Not surprisingly, the office sector remains the worst performer with office prices now down 16.9% year-over-year led by weakness in central business district (“CBD”) properties. CBD properties have declined 30.8% year-over-year, in contrast with suburban office properties which are down 10.9%. Industrial properties are the only sector posting positive annual price gains, with industrial prices up 8.7% year-over-year. Apartment prices have dropped 8.9% from year-ago levels, the same rate of annual decline we saw in the first quarter. The Non-Major Metros continue to outperform the six Major Metros (Boston, Chicago, Los Angeles, New York, San Francisco, and Washington, D.C.) with year- over-year prices down 5.2% and 0.7%, respectively.

The most recent Fed Senior Loan Officer Opinion Survey, reflecting sentiment as of the first quarter, showed banks reporting tighter lending standards for all types of commercial real estate (“CRE”) loan categories with tightening more widely reported by “other banks rather than large banks.” Our interpretation is that dynamic reflects the greater pressure that local and regional banks are facing from their exposure to commercial loans relative to larger financial institutions. A “moderate” share of banks reported weaker demand for construction and land development loans, while a “significant” share of banks reported weaker demand for multifamily loans. The survey also contained a set of special questions asking banks about changes in their credit policies for each major CRE loan category over the past year and their rationale for making these changes (these questions have been asked in each April survey for the past eight years). Banks reported tightening all terms surveyed for each CRE loan type. The most widely report change was a widening of interest rate spreads on loans over the cost of funds. A “significant” share of banks reported tightening maximum loan sizes, lowering loan-to-value ratios, increasing debt service coverage ratios, and shortening interest-only payment periods for all CRE loan types.

The CRE Finance Council (“CREFC”) industry conference held in New York City in June saw investors more constructive compared to their mood at January’s Miami conference. Market participants have started to adjust to the higher interest rate environment and are focused on resolving the challenges facing the industry with progress being made in some areas. Attendees agreed that CMBS offers value compared to alternatives but was not as compelling an opportunity as it was at the beginning of the year. Participants believe that the 5-year conduit structure (which comprised about 70% of year-to-date conduit issuance) has the potential to persist even if rates were to normalize at lower levels. Regarding office properties, some attendees seem to view the slowdown in new groundbreakings and the slow removal of older office stock as positive for office fundamentals and potential support for a bottoming of office prices over the next year or two.

However, few attendees expect delinquency rates on office properties to improve in the near term given the current interest rate environment.

We continue to believe that the CMBS market will face headwinds for the foreseeable future and expect continued worsening collateral metrics…therefore, we expect to maintain our current defensive posture.

Portfolio Actions: We reduced our portfolio exposure to CMBS across all of our strategies in the second quarter with the exception of our 1-5 year strategy. The reduction was targeted towards the agency CMBS subsector as, in our view, spreads in that subsector remain relatively unappealing compared to other spread product sectors. We used both the outright sale of agency CMBS tranches and the reinvestment of agency CMBS paydowns into other spread product to accomplish the reduction. In the 1-5 year strategy portfolios, we also reduced our agency CMBS positions but we increased our exposure to non-agency conduit tranches which more than offset the reduction and accordingly, increased overall CMBS exposure. Our non-agency conduit purchases were focused around adding fixed-rate conduit “ASB” CMBS tranches across all our strategies, although at current spreads we have become more selective around ASB tranches generally (as we have noted in prior commentaries, ASB tranches have more stable average life profiles compared to other conduit CMBS tranches). Our activity consisted of secondary market trades as we did not participate in any new issue deals and with our focus on adding duration to all our strategies, we avoided adding to our floating-rate SASB exposures.

Outlook: We continue to believe that the CMBS market will face headwinds for the foreseeable future and expect continued worsening collateral metrics. Therefore, similar to recent quarters, we expect to maintain our current defensive posture. We are unlikely to materially increase our non-agency CMBS exposure and are likely to continue to avoid participating in most new issue conduit and SASB deals. We believe conduit ASB tranches are still attractive, but current ASB spreads are less appealing than at the beginning of the year. As noted above, we currently find agency CMBS spreads unappealing relative to opportunities in other spread sectors so are unlikely to add to the subsector.

Performance: Our CMBS holdings showed mixed performance across our strategies after adjusting for their yield curve and duration exposure. CMBS was positive in our Cash Plus strategy and in our 1-3 and 1-5 year strategies. In contrast, CMBS underperformed in our Enhanced Cash strategy. In our Enhanced Cash portfolios, the negative excess return was driven by underperformance of our AA-rated floating-rate SASB positions which saw wider benchmark spreads and an isolated 2016-vintage conduit sequential tranche that experienced extension due to the workout of troubled collateral properties. For the balance of our portfolios, positive excess performance was generally driven by our fixed-rate conduit tranches with the exception being our 1-5 year strategy which like Enhanced Cash was impacted by exposure to the troubled 2016-vintage conduit tranche. This resulted in very slight negative performance for fixed-rate conduit tranches in our 1-5 year strategy in contrast to the positive performance seen elsewhere. Our Freddie Mac “K-bond” tranches were slightly negative in our Cash Plus strategy, effectively flat in our Enhanced Cash strategy and positive in our longer strategies. Our Fannie Mae “DUS” holdings were positive but generally did not perform as well as our “K-bond” holdings.

RMBS

Recap: The second quarter saw negative performance for residential mortgage-backed securities as spreads moved wider. The Bloomberg mortgage index posted 6 basis points of negative excess return for the quarter as positive performance in May (+49 basis points) and June (+6 basis points) was insufficient to offset the significant weakness seen in April (-61 basis points) when the negative convexity impact of that month’s selloff in rates punished mortgages. On a spread basis, generic 30-year collateral ended the quarter at a spread of 148 basis points over ten-year Treasuries (8 basis points wider) and 15-year collateral ended the quarter at a spread of 92 basis points over five- year Treasuries (17 basis points wider). We attribute the worse performance of 15-year collateral to investor preference for longer duration assets in anticipation of future Fed rate cuts. Non-agency spreads were rangebound in May and June after tightening in April. Prime jumbo front cashflow tranches ended the quarter at a spread of 155 basis points over Treasuries (15 basis points tighter).

The Fed’s mortgage portfolio ended the quarter at $2.33 trillion following paydowns of $17.4 billion in April, $18.7 billion in May and $17.9 billion in June. To lessen potential market disruptions from the shrinkage of its balance sheet portfolio, on May 1 the Fed announced plans to slow the pace of reduction by lowering the cap on the runoff of Treasury securities from its portfolio from $60 billion to $25 billion effective on June 1. In line with our expectations, the Fed did not reduce the cap on MBS runoff from the current $35 billion level and will reinvest MBS paydowns into Treasuries (moving the Fed towards its preferred outcome of an all-Treasury balance sheet.) We expect this program to continue for the foreseeable future since with interest rates at their current levels, prepayments on the Fed’s mortgage portfolio remain far below the MBS reinvestment cap.

Tracking the broader April selloff in interest rates, mortgage rates (as measured by the Freddie Mac Primary Mortgage Market Survey) rose sharply in April (ending the month at 7.17%) before drifting lower in May and June to finish the quarter at 6.86%, just 7 basis points higher than at the start. Supported by healthy seasonals but constrained by the April increase in rates, prepayments were rangebound. July’s prepayment report showed both 30-year and 15-year Fannie Mae mortgages paying 6% slower in June than in May. 30-year prepayments printed at 6.0 CPR and 15-year prepayments at 6.8 CPR in June, compared to 6.4 CPR and 7.3 CPR in May, respectively. At current levels, mortgage rates remain considerably higher than the 3.78% average effective rate on currently outstanding mortgages so we continue to expect prepayments to remain muted for the foreseeable future. Supported by limited inventories, home prices moved higher over the quarter, with the Case-Shiller National Home Price Index rising for three straight months. June’s release showed home prices on a national level rising 0.3% in April (after a 0.3% increase in March) and up 6.3% year-over-year. All twenty cities tracked by Case-Shiller showed year-over-year price gains with San Diego (+10.3%), New York (+9.4%) and Chicago (+8.7%) the top performers and Minneapolis (+2.9%), Denver (+2.0%) and Portland (+1.7%) posting the smallest gains. We continue to project low to mid-single digit home price increases going forward due to the frictions between low inventories and higher mortgage rates.

Constrained by high mortgage rates, existing home sales fell each month of the quarter. June’s release showed sales in May fell 0.7% to a 4.11 million annualized pace, after falling 1.9% in April and 4.3% in March. June’s data also showed that sales prices reached a record high, with the median home price sold reaching $419,300, 5.8% higher than a year ago. Inventories have increased each month this year and with 1.28 million homes now on the market, supply stands 18.5% above last year’s level. With this increase, at the current sales pace it would now take 3.7 months to sell all the homes on the market, the highest level seen in four years. Nonetheless, realtors consider anything below 5 months as indicative of a tight housing market. New-home sales slumped at the end of the quarter with June’s data showing May new-home sales falling 11.3% to a 619,000 annualized pace, the lowest level since last November. The decline was broad-based with lower sales in all four major U.S. regions. While more volatile, new-home sales numbers are seen as a more timely measurement of market sentiment than existing home sales numbers as the sales data is calculated from when contracts are signed rather than when they close which is the case for sales of existing homes. Home builder sentiment slipped over the quarter, with the National Association of Home Builders Market Index drifting lower each month to end June at 43, the lowest level of the year.

The NAHB attributed the decline in sentiment to persistently high mortgage rates keeping buyers sidelined while builders grapple with higher rates for construction and development loans, chronic labor shortages and a dearth of buildable lots.

The April release of the Federal Reserve’s Senior Loan Officer Survey, reflecting sentiment during the first quarter of the year, showed banks tightened lending standards for non-agency non-QM and subprime residential real estate loans but mostly held standards unchanged for GSE-eligible mortgages and QM jumbo mortgages. Banks also reported generally weaker demand for most residential real estate loans and HELOCs.

In the regulatory space, in June the FHFA approved an 18-month pilot program in response to Freddie Mac’s April proposal to begin securitizing second-lien loans. Notably, the new program is just a pilot and not a permanent program as Freddie had proposed. It is also limited in scope to $2.5 billion. Given these limitations, we anticipate that Fannie Mae will wait for the FHFA’s final analysis at the conclusion of the pilot program before launching its own second-lien securitization initiative. In our view, the limited scope of the pilot program should have minimal impact on agency MBS or the private label non-agency market and reflects the concerns expressed by many market participants in public comments after Freddie’s proposal was announced. For context, the GSEs guaranteed many second-lien mortgages prior to the Great Financial Crisis, but this market disappeared after 2008.

Comments received from market participants in response to Freddie’s April proposal were diverse but a majority came out as opposed. The strongest support came from credit unions, community lenders and the Urban Institute. Arguments in favor of the proposal noted that it would provide the scale, efficiency and standardization needed to grow the second-lien market, offer an affordable means for homeowners to tap home equity compared to more expensive cash-out refinancings and support market liquidity. Arguments against the proposal centered around the fact that it would increase the “lock-in” effect for current mortgages, create adverse selection for the private label second-lien market, is inflationary and not consistent with Freddie Mac’s mission in that it decreases housing affordability by benefitting existing homeowners at the expense of prospective homeowners. We note that the concerns about the program being inflationary have been eased by limiting the size of the pilot program to only $2.5 billion.

Portfolio Actions: Over the course of the quarter we generally maintained or slightly decreased our RMBS exposure across most of our strategies. The exception was in our 1-5 year strategy where we increased our exposure by adding to our specified pool holdings. For those portfolios that saw a reduction in exposure, it reflected the impact of paydowns rather than the outright sale of MBS investments. Overall, our agency CMO holdings continued to decline as we generally prefer specified pools to agency CMOs due to their superior liquidity profile. Through secondary market trades, we added opportunistically to our non-agency holdings of short-tenor NPL/RPL tranches, but these trades were small in size and did not materially impact overall exposures. We did not participate in any new issue non-agency deals as we do not find current spreads sufficiently compelling given the liquidity concession of non-agency tranches relative to specified pool alternatives.

Outlook: We have moved to a more benign view around RMBS as it appears that regional banks are managing through the challenges created by rising interest rates. We do not expect widespread MBS selling from banks in the foreseeable future which should be supportive of mortgage spreads. With the Fed likely moving towards an easing bias, we are inclined to modestly increase exposure should MBS spreads become more attractive relative to other spread product alternatives. We expect to concentrate mostly on specified pools as we are reluctant to increase non-agency exposure given our outlook for the general economy. However, within non-agencies, we remain favorably disposed towards SFR tranches as the structural shortage of single family housing is broadly supportive of that subsector of the market. As we noted in our first quarter commentary, we think seasoned 20-year pools (which are deliverable into the 30-year TBA market) offer attractive relative value compared to 15-year specified pools and continue to evaluate both outright purchases and potential swaps out of our 15-year holdings into seasoned 20-year pools.

Performance: Our RMBS positions generated positive excess returns across all strategies in the second quarter. Our non-agency positions were generally the best performers led by our holdings in select subordinate tranches. Our 1-3 year strategy portfolios saw better performance from their specified pool holdings than our other strategies due to their greater exposure to seasoned 2.5% and 3.0% 15-year collateral although specified pools were positive in all strategies other than our 1-5 year strategy. There, specified pool performance was hurt by the underperformance of 15-year 2.0% collateral. Within agency CMOs, performance was flat or slightly positive across all the portfolios.

Municipal

Recap: Total municipal new issue supply was $139 billion in the second quarter and as a component of total supply, taxable municipal issuance was $11.6 billion, 54% lower on a year- over-year basis. Even as new issue supply was limited, wider credit spreads in the front part of the municipal market curve resulted in slightly negative excess returns for the sector. For the quarter, the ICE BofA 1-5 Year U.S. Taxable Municipal Securities Index had a total return of 0.81%, with OAS widening 12 basis points to end the quarter at 43 basis points, compared to the ICE BofA 1-5 Year U.S. Treasury Index’s total return of 0.82%.

Credit fundamentals, as demonstrated by S&P’s upgrade-to-downgrade ratio of 1.5 to 1 over the first two months of the second quarter, have continued to be resilient. During the quarter, there were quite a few noteworthy rating upgrades across different sectors. The State of New Hampshire was upgraded to AA+ from AA by S&P. The rating agency’s rationale for the upgrade was the State’s focus on building and maintaining its reserve levels, active budget monitoring, as well as efforts to control expenditure growth. Other positive ratings actions at the state level included Connecticut and Oregon’s outlook revisions to positive by Fitch, Illinois’ outlook revision to positive by Moody’s, and Arkansas’ outlook revision to positive by S&P. In the Airport sector, S&P upgraded Miami International Airport’s rating to A+ from A reflecting recovery in enplanements as the airport’s passenger demand has surpassed pre-pandemic levels. In the healthcare space, S&P upgraded Memorial Hermann Health System to AA- from A+ citing positive operating performance, leading Houston market share, strong operating model, and healthy balance sheet.

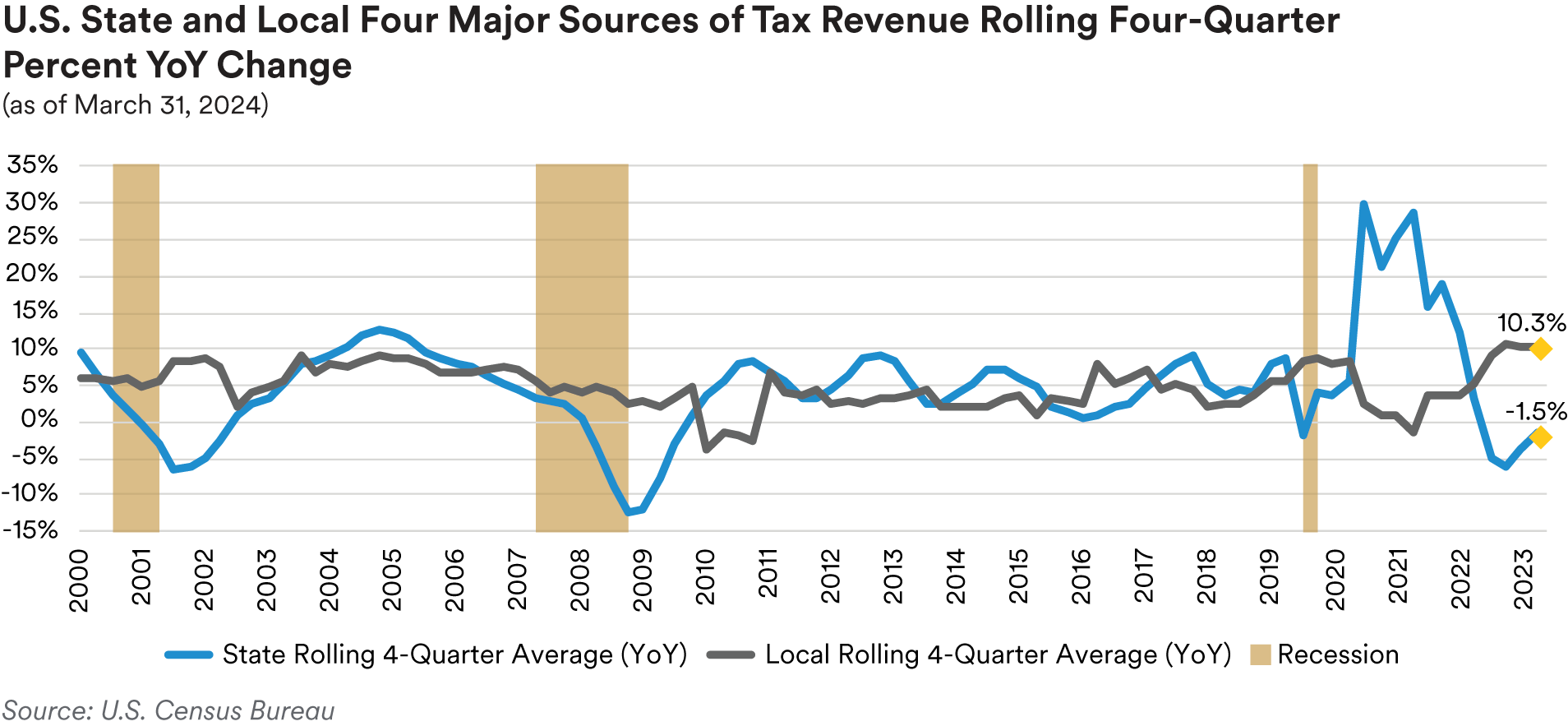

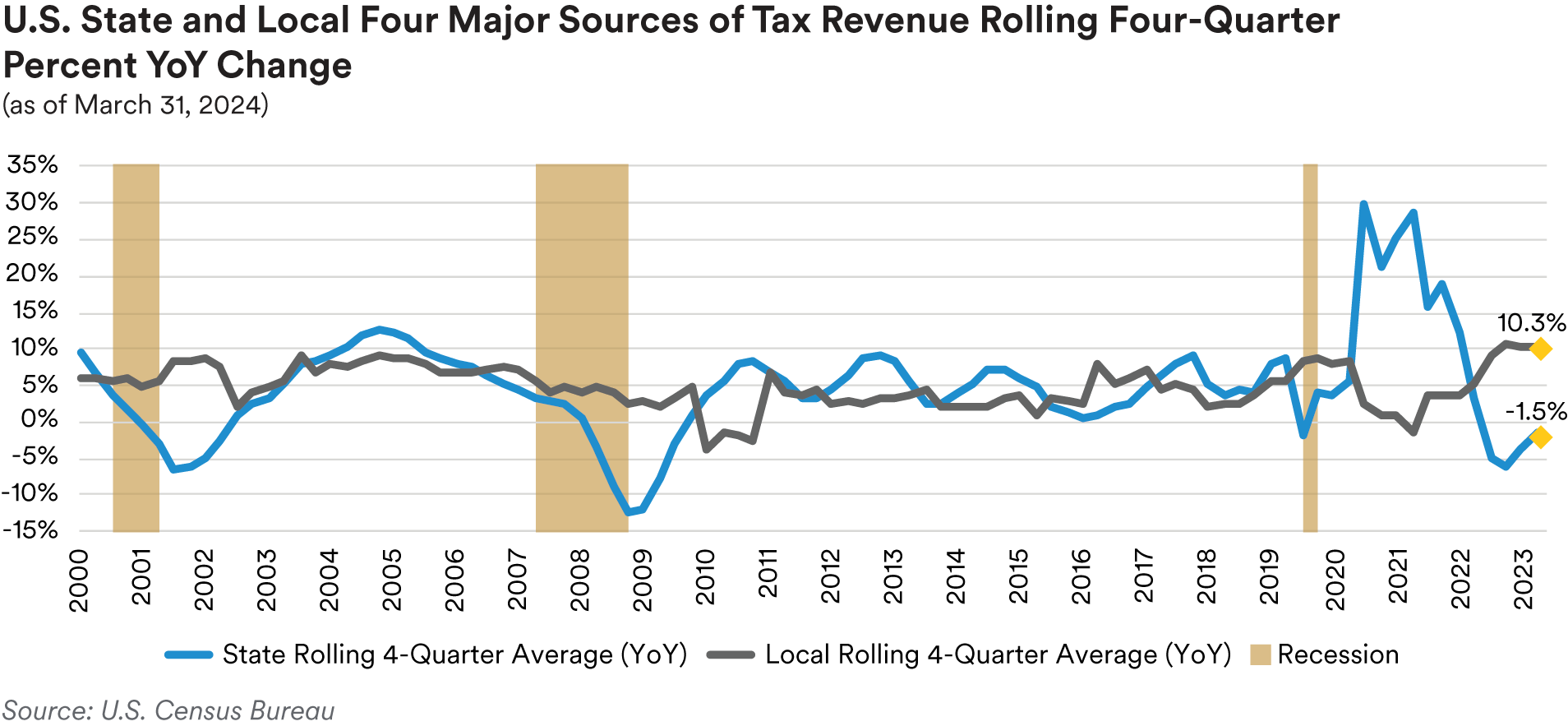

Overall, based on U.S. Census Bureau data collected for state and local tax revenues through March 31, 2024, state receipts reversed their positive trajectory while receipts at the local level improved quarter-to-quarter from the four major tax sources (personal income, corporate income, sales and property taxes). The graph below highlights an improvement in revenue receipts at the state level and a modest decrease in revenues at the local level when comparing year-over-year percentage change in revenues from these major sources on a trailing four-quarter average basis. On a comparable year-over-year basis, personal income taxes were up 0.2%, corporate income tax collections were up 2.4%, sales taxes were up 1.0%, and property tax receipts were up 6.9% versus the first quarter of 2023.

We continue to monitor pension funding levels that can impact state budgets with lower levels having the potential to stress balance sheets. One indicator we track is Milliman’s Public Pension Funding Index, which is comprised of the 100 largest U.S. public pension plans. This index fluctuated during the first two months of the quarter, ending slightly lower than levels reported for the end of the first quarter of 2024. The index increased to 79.7% (the highest level since April 2022) at the end of March from 78.6% in February, and then declined to 77.6% at the end of April.

The index rebounded in May to an estimated 79.4%, due to overall positive investment returns. The index remains well below its 85.5% peak, however, reached at year-end 2021.

Portfolio Actions: Our allocation to taxable municipals was maintained in our Cash Plus and Enhanced Cash strategies and decreased in our 1-3 year and 1-5 year strategies over the second quarter. On the new issue front, we added to exposure in the airport, higher education, housing, and state and local obligation sectors. In the secondary market, we were active in adding to high- quality issuers in the airport, essential service, healthcare, highway, and state and local obligation sectors. In regard to our sale activity, our strategy remains centered on accessing liquidity using the municipal market. This involved selling shorter-duration bonds to capitalize on more favorable opportunities in the other spread sectors in which we invest.

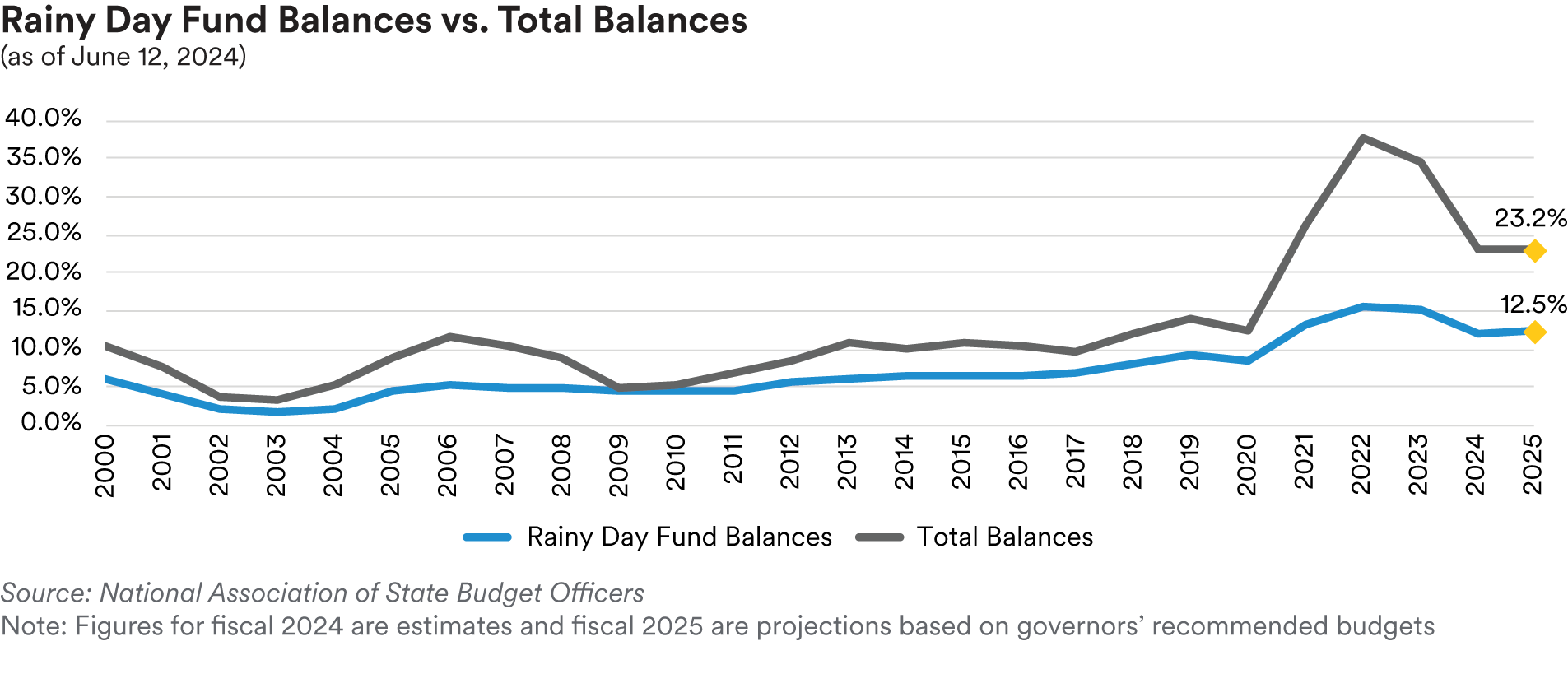

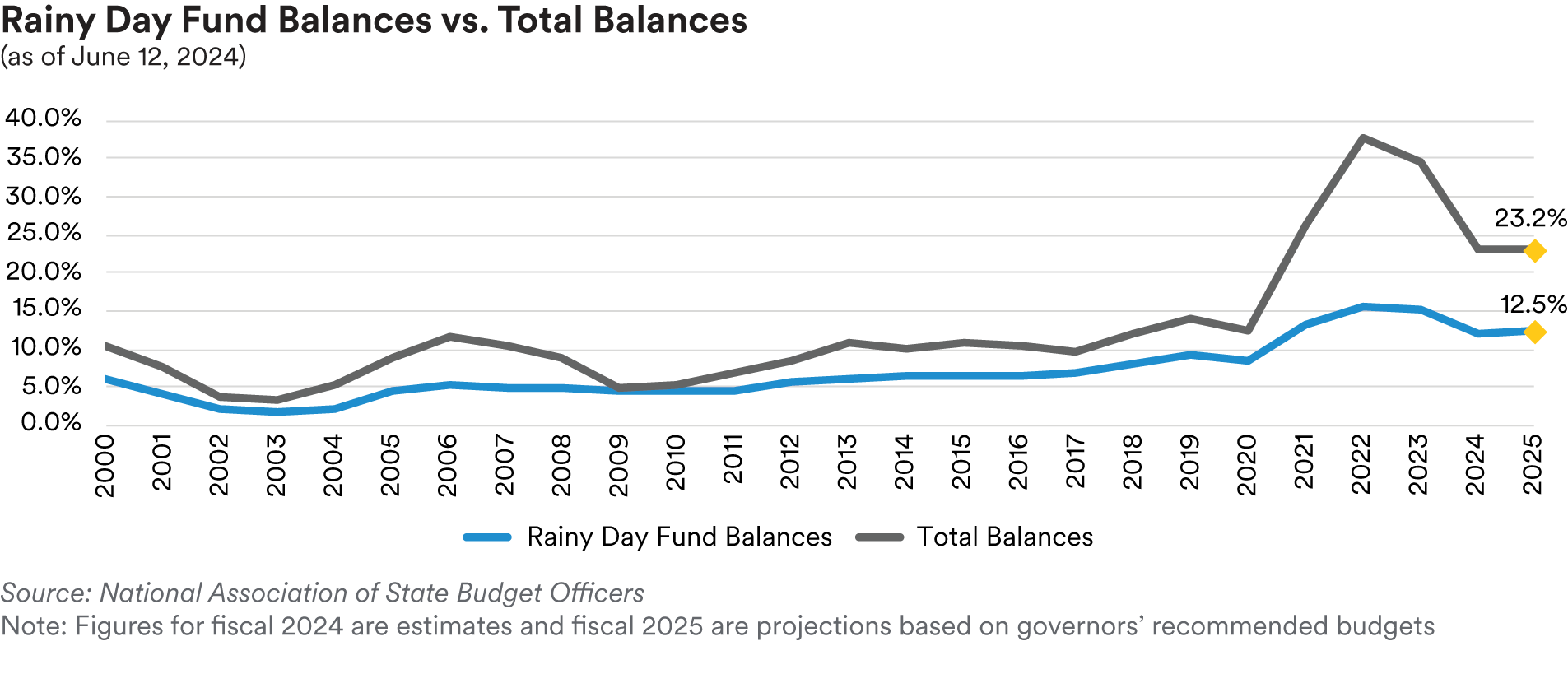

Outlook: The National Association of State Budget Officers published their Fiscal Survey of States in June 2024. The report suggests that recent trends in general fund spending, revenue, and balances indicate a steady shift towards a more stable budget environment for fiscal 2025. This transition is characterized by limited new funding, revenue collections closely aligning with states’ forecasts, and modest growth expected in rainy day funds across most states. States’ total balances, comprising general fund and rainy-day funds, have experienced growth in recent years due to revenues consistently surpassing forecasts used in enacted budgets. As slowing revenue is expected, fund balances are estimated to decline as states are expected to draw on these funds for debt repayment, pension fund contributions, capital projects, and other expenditures.

Policymakers are currently faced with a series of challenges, including slowing tax revenue growth, tight monetary policies, inflation, growing migrant costs, and the phasing out of federal pandemic aid. Leveraging fund balances will aid in alleviating states’ fiscal pressures. Considering potential budget stress, we favor state and local governments that demonstrate financial flexibility, diverse economies, and experience growing populations. Conversely, we are cautious on those states with declining revenues and tax systems susceptible to economic downturns, particularly if they carry substantial pension liabilities or other significant fixed costs.

In revenue bonds, the higher education sector has come under pressure due to fundamental challenges, including declining enrollment and affordability issues. The decline in the U.S. birthrate that started during the Global Financial Crisis in 2007 will result in smaller cohorts of high school graduates seeking enrollment as college freshmen in coming years. Second-tier universities and small private colleges with limited endowments are experiencing multi-year declines in enrollment, as a diminishing pool of high school graduates increasingly choose higher-ranked institutions. We are witnessing a growing number of small private colleges closing their doors or consolidating with another institution, while second-tier state universities are scaling back degree programs that fail to attract sufficient student interest. We feel that eliminating outdated educational capacity represents a rational industry response that should ultimately benefit better-positioned colleges and universities in the long term. The sectors within higher education experiencing steady to rising demand include flagship state public universities and private colleges and universities that offer generous financial aid and prioritize reinvestment in modern, updated facilities. We favor comprehensive universities and research institutions with strong brand recognition. Additionally, we value schools that attract students from across multiple states and those with academic medical centers. Institutions that have the resources and infrastructure necessary to consolidate with or acquire struggling schools are well-positioned to capitalize on opportunities in the higher education sector.

In maintaining a defensive bias and prioritizing liquidity, we continue to concentrate on issuers with robust or improving credit fundamentals. While we remain optimistic about municipal credit fundamentals, we recognize there are potential budgetary pressures building in the current environment. Consequently, we are cautious and selective in our approach to increasing exposure to the sector. We prioritize issuers with strong financial and operational flexibility, as well as a proven track record of prudent management capable of making necessary budget adjustments in line with changing revenue forecasts. Given macro market volatility and uneven economic data, we consider taxable municipals a defensive alternative to other spread sectors and will only increase our exposure to this sector opportunistically.

Performance: Our taxable municipal holdings were neutral to performance in our shorter-duration strategies and generated slightly negative performance in our 1-5 year strategy in the second quarter. On an excess return basis, positive excess returns generated by State Tax-backed issues were offset by mixed excess returns in our Airport holdings and negative excess returns in Local Tax-backed and Highway issues.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK, this document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/ EU), as per the retained EU law version of the same in the UK..

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”) a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/ third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited. L0724041566[exp0726][All States]© 2024 MetLife Services and Solutions, LLC