Treasuries / Agencies

- Volatility remains high around key economic releases, especially inflation and employment data as the market weighs their upside risks

- Reasonable chance exists such that economic conditions could mix with geopolitical dynamics and election results to trigger renewed inflation pressures

- Yield curve is expected to continue to steepen as the Federal Reserve is forecast to continue to lower the federal-funds rate, as we expect front-end rates to decline and long-term yields to be range-bound or move higher

ABS

- We expect Heavy ABS issuance continued ahead of the November election

- We maintain our preference for liquid, defensive tranches

- We expect further deterioration in credit card and auto performance and continue to focus on prime-type borrowers

CMBS

- CMBS spreads are expected to widen as commercial real estate prices continue to drop

- Single Asset Single Borrower deals dominate non-agency new issue supply

- At current spreads, we continue to avoid agency CMBS and remain selective in conduit tranches

RMBS

- Mortgages posted positive excess returns in the third quarter

- High mortgage rates and limited supply continue to constrain home sales

- We find value in single family rental (SFR) tranches in non-agencies

Municipals

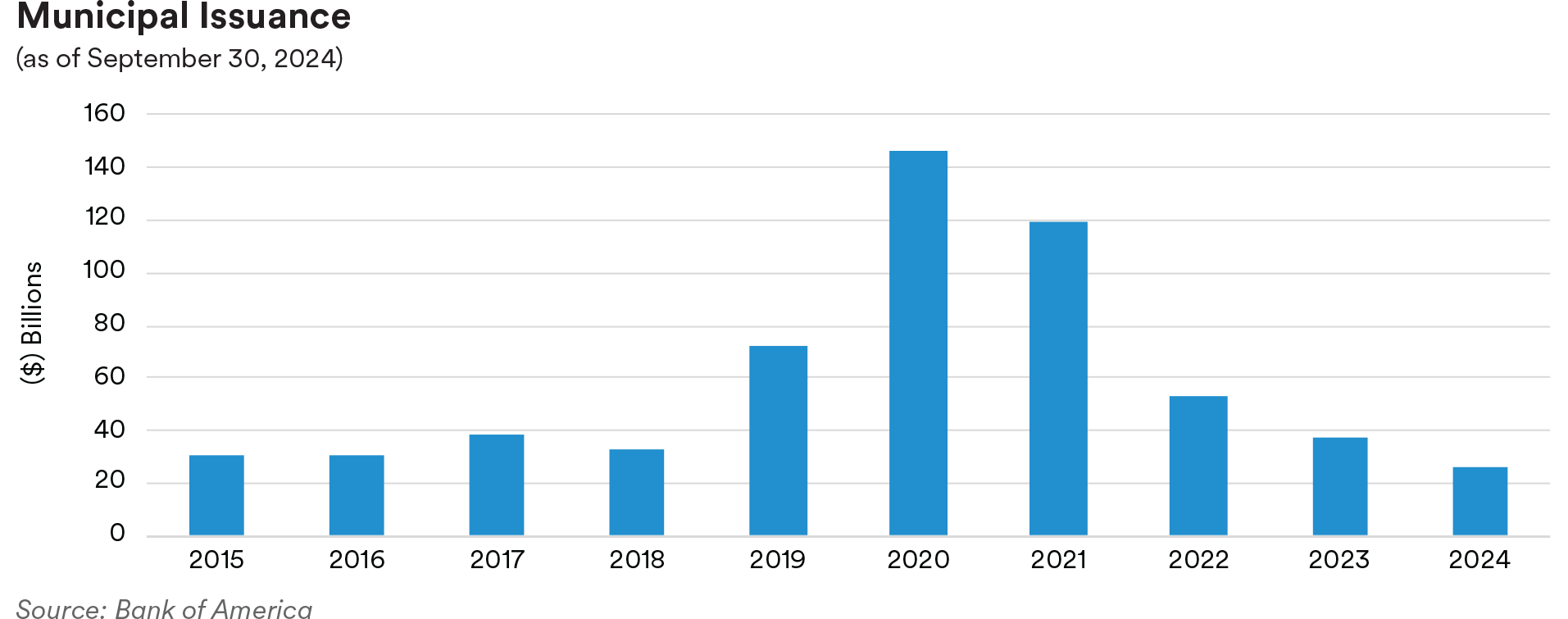

- Taxable municipal supply remains lower on a year-to-date basis than 2023

- States are relying on general fund balances rather than on rainy-day funds to balance their budgets

- We did not have concerns that the dockworker strike would have a significant impact on the credit metrics of larger municipal debt issuers in the sector

Investment Grade Credit

Recap: We experienced somewhat of a bumpy third quarter in investment grade credit in terms of headline risk, macro noise, growing global unrest, surprise U.S. presidential election developments, a market clearly on the fence when it came to pricing in September’s Federal Reserve outcome of whether we would see a half-point or quarter-point rate cut, which was highly unusual. Despite all those crosscurrents, the corporate bond market maintained its resiliency in powering through a continuation of the record pace of new issue activity and hardy investor inflows. Much of the seemingly insatiable demand from investors to invest in corporate bonds stemmed from the desire to front-run the Fed commencing its rate cutting cycle, which finally kicked off with September’s half percentage point cut.

Front-end investment grade credit over the third quarter continued to perform decently with its benchmark U.S. corporate index marking a seventh quarter in a row of positive excess return as credit spreads tightened modestly. This came against the above-mentioned backdrop characterized by bouts of macro-driven volatility, surprisingly solid economic growth, stabilizing corporate fundamentals amidst overall decent corporate earnings, and a Federal Reserve satisfied with its mission setting inflation on track towards its 2% target while turning its attention more decidedly toward a labor market showing tentative signs of tiring.

Though some may argue we never really entered a summer lull, July was fairly quiet before early August arrived with a disappointing July non-farm payrolls report that called into question the soft-landing narrative and ramped up market expectations for the number and size of Federal Reserve cuts before the end of the year and into 2025 with a panicked few even calling for an immediate or emergency 50 basis point cut. That also roughly coincided with a surprise decision by the Bank of Japan to raise rates, combining to drive Treasury yields lower and the value of the yen higher, escalating fears of a disorderly unwind to the yen carry trade, which many global investors had utilized for years, and seeing the Nikkei Index drop 20% inside of a week. Such violent moves also impacted the investment grade credit market, causing front-end spreads to widen out 13 basis points over three trading days before order was restored and spreads reversed course, ending August actually 1 basis point tighter on the month. The market also benefited from Chair Powell maintaining a more patient stance while setting the market up at the annual Jackson Hole conference for an expected policy rate cut at the September FOMC meeting by indicating the time had finally arrived to embark on reducing the fed-funds rate from its restrictive level.

In September corporate spreads ticked lower as risk assets generally continued to perform well, supported by coordinated easing efforts from a number of global central banks. Economic data was also reassuring with a turn higher in the U.S.’s Citi Economic Surprise Index coupled with benign inflation and labor market readings. Despite indications the Fed may continue to be on track to deliver a soft landing, at quarter-end the bond market remained aggressive in pricing in nearly three more rate cuts by the end of the year at the two remaining FOMC meetings, perhaps getting too far ahead of itself and preserving somewhat of a disconnect with economic growth holding up relatively well.

Corporate credit fundamentals as seen in second-quarter earnings reports that printed throughout the third quarter also reflected an economic growth picture that has repeatedly defied expectations of impending weakness. At a high level, second-quarter year-over-year earnings growth was 11.3% for the S&P 500 Index’s constituents, led by continued strength from communications services, utility, technology and consumer discretionary subsectors, according to FactSet. However, removing some of the main drivers skewing overall growth like so-called Magnificent Seven members Alphabet, Meta Platforms and NVIDIA, left overall earnings growth in the low single digits. Turning to credit metrics, according to J.P. Morgan, gross leverage was flat on a quarter-over-quarter basis helped by modest growth in EBITDA while interest coverage continued its steady, though not alarming decline as low-cost debt gets refinanced at higher coupons.

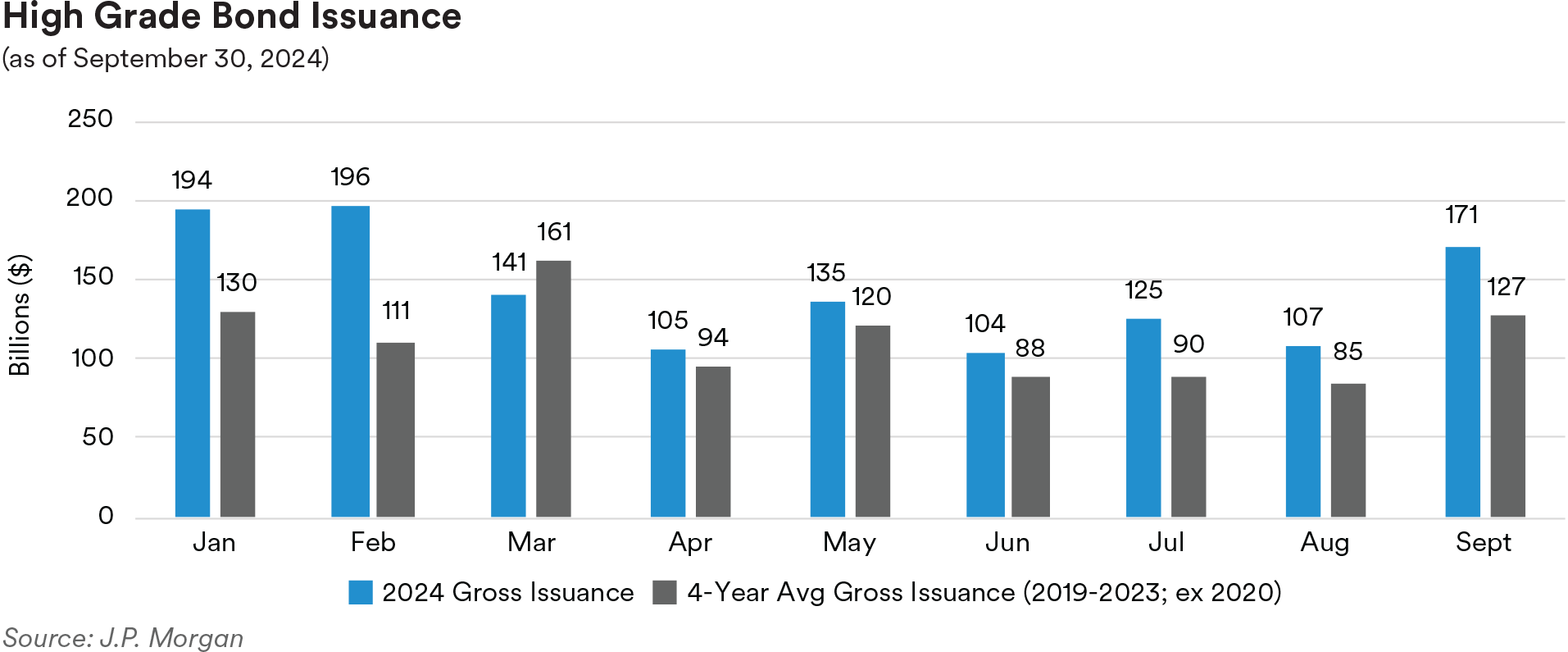

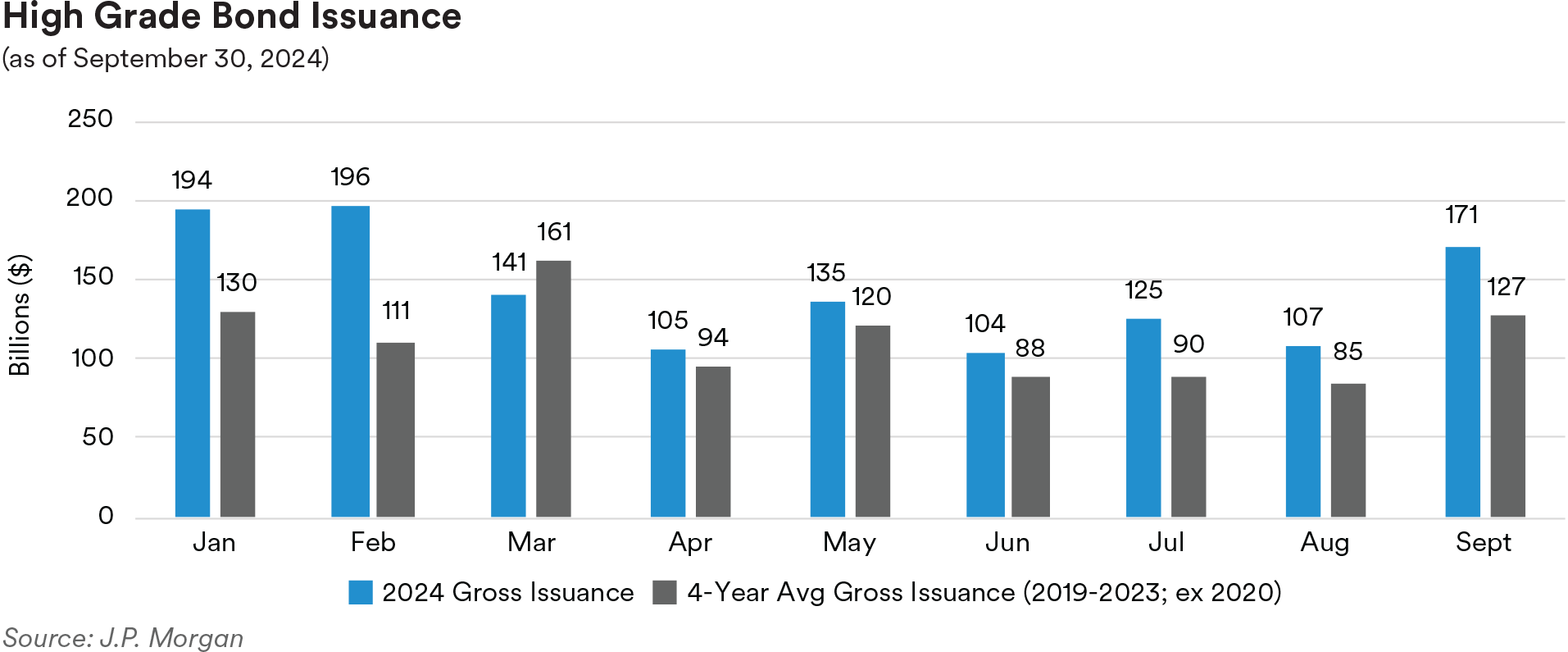

Looking at the technical landscape for the corporate bond market, rarely have we seen such a favorable environment, although experience has taught us that it can turn on a dime. With investors’ base case a soft landing or no landing scenario, the market has evidenced no worries over an imminent turn in the credit cycle as best reflected in historically tight credit spreads in both the investment grade and high yield markets. We remain on a record pace for issuance, reaching $1.275 trillion year-to-date and up 28% year-over-year through the third quarter, closing out with a record for the month of September of $171 billion in new issue volume to bring total issuance to $404 billion for the quarter. Supply continues to be embraced by domestic and foreign investors eager to put money to work, funneling consistently strong inflows into the space.

Portfolio Actions: As we have held to the view that corporate credit spreads have not offered much in the way of incremental spread tightening potential since rallying off last Fall’s recent wides, we have been somewhat cautious in adding spread risk at prevailing valuations and generally remained on that path in the third quarter.

In the Cash Plus strategy we moved our weighting in investment grade corporates a bit higher by adding approximately one-year duration fixed-rate secondary bonds to lock in attractive all-in yields and selected floating-rate new issues from a money center bank and California-based utility as a hedge on the Fed being forced to be less aggressive in their rate cutting than the market had priced in. These purchases were funded by selling very short-dated maturities.

In the Enhanced Cash strategy portfolios, our Credit weightings also edged higher as we purchased the aforementioned California-based utility’s new issue one-year floating-rate first-mortgage bond in addition to a handful of roughly one-year duration secondary corporates. In the 1-3 year strategy portfolios, we slightly increased our sector weighting as we were very active in extending into two-year duration bonds across both new issues and secondaries, adding in the banking, consumer non-cyclical, captive auto finance, and technology subsectors, chiefly funded by selling one-year corporates. We also lifted our sector weightings modestly over the quarter in the 1-5 year strategy portfolios via the new issue calendar, purchasing bonds issued by a technology company, Canadian bank, two German captive auto finance entities, and another a U.S. technology services provider that came to market to finance an acquisition.

Outlook: Given the incremental move lower in corporate credit spreads over the third quarter to approach yearly lows reached early in the second quarter and levels previously last seen in early-2022, we see valuations, or a lack of opportunity for spreads to meaningfully tighten in the short run, as the main impediment preventing us from increasing our risk budget in the sector. The third quarter marked the ninth consecutive quarter of positive excess returns for the corporate bond market with the sharp drop in benchmark yields and perhaps investors chasing returns as adding more fuel to the fire in continuing to spur demand for corporates and other spread product. This comes as global central bank monetary policy loosening has taken hold to help extend the cycle and perhaps avoid a marked economic growth slowdown or recession altogether to at worst complete a soft landing, often sought but rarely achieved.

"We see valuations, or a lack of opportunity for spreads to meaningfully tighten in the short run, as the main impediment preventing us from increasing our risk budget in the sector."

Overall, the corporate bond market has demonstrated remarkable resiliency and continued to power through several more bouts of macro or economic data-driven interest-rate volatility and election-related turbulence in the third quarter. At this point, we see the sector as more vulnerable to a shock, such as a more decided breakout of war in the Middle East and its impact on the energy market, than is typically the case given the tight level of spreads. Nonetheless, spreads may remain range-bound and grind lower into year-end aided by the tailwinds of robust investor demand, tapering new issue supply, further anticipated Fed easing, and favorable economic growth outlook before ultimately moving higher.

Looking ahead, we will continue to favor less cyclically exposed subsectors and favor more up-in-quality issuers given BBB’s remain near the tighter end of the historical range in terms of OAS or spread compared to single A corporates, and we will be better positioned to protect returns in a spread widening environment. Thus, we hew to our disciplined approach while opportunistically participating in new issue offerings where we see relative value. Taking advantage of upward interest rate moves or temporary dislocations to add exposure selectively to lock in higher yields for longer across strategies will also remain part of our playbook. We anticipate maintaining a reduced investment grade credit sector weighting and spread duration compared to our historic norms, especially in our longer 1-3 year and 1-5 year strategies as long as spread compensation above risk-free Treasuries remains relatively paltry until credit spreads reset satisfactorily wider.

Performance: The investment grade credit sector contributed positively to relative performance across all strategies in the third quarter vs. Treasury benchmark indices. Positive excess returns from the sector were driven by security selection in addition to credit spreads grinding lower. As noted above, credit spreads tightened modesty each month with our front-end benchmark ICE BofA 1-5 Year U.S. Corporate Index’s OAS tightening 4 basis points over the quarter to finish at 69 basis points. The index’s quarterly total return and excess return were 3.73% and 0.29%, respectively, in the wake of the third quarter’s slight spread tightening and sharp decline in benchmark yields. Strongly performing investment grade credit subsectors that drove positive excess returns across strategies included Banking, Finance Companies, Insurance, Wireless, Automotive, Pharmaceuticals, Technology, and Electric Utilities.

Treasuries / Agencies

Recap: The Treasury market staged a strong rally in the third quarter as the markets had put even odds on whether the Fed would cut by 25 basis points or go with a supersized half-point cut in September while disappointing data raised the concerns over an abrupt downshift in the economy. The Fed’s September FOMC meeting saw 11 of the 12 voting committee members vote to cut the federal-funds policy rate by 50 basis points to the 4.75%-5.00% target range, the first cut in more than four years. One Fed board member, Michelle Bowman, voted for a quarter-point cut, marking the first dissent by a governor since September 2005, when Governor Marc Olson opposed a rate increase following Hurricane Katrina, citing the devastation and uncertainty caused by the natural disaster. Chair Powell did make it a point to mention no one should assume that “this is the new pace” for reductions going forward. Powell also said that had the FOMC known of the weakness in the July jobs report, which painted a notably weaker-than-expected labor market picture at the July 31 meeting, they might have cut rates at that time. He described the 50 basis point cut as “a sign of our commitment not to get behind” the curve in normalizing rates and “it’s a strong move”.

The FOMC also updated their projections with the median estimate projecting a total of 50 basis points of cuts through the end of the year, implying quarter point cuts at each of their November and December meetings. They also forecast another 100 basis points of cuts next year as the median estimate fell to 3.4% from 4.1% in June’s Summary of Economic Projections. The Fed members’ median long-term estimate continues to drift higher. Over the course of the year, it has risen from last December’s 2.50% estimate to its current 2.875%. The median forecast for PCE inflation, the Fed’s preferred gauge, saw a slight downgrade (2.6% vs 2.8%), as did GDP (2.0% from 2.1%), while there was a big jump in the unemployment estimate (4.4% from 4%). The Fed’s statement revealed that “in considering additional adjustments” to rates, officials will assess incoming data, evolving outlook and balance of risks. Fed members tweaked the statement’s language to note job gains “have slowed” in addition to indicating that inflation “has made further progress toward the Committee’s 2% objective but remains somewhat elevated”.

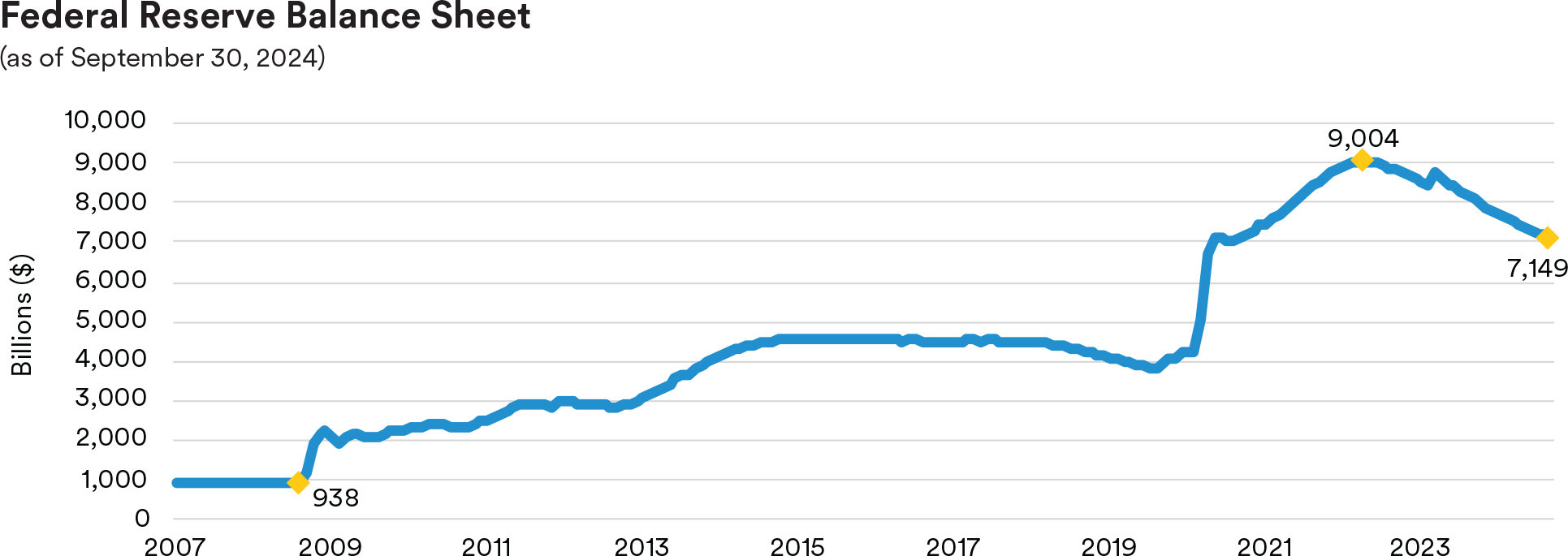

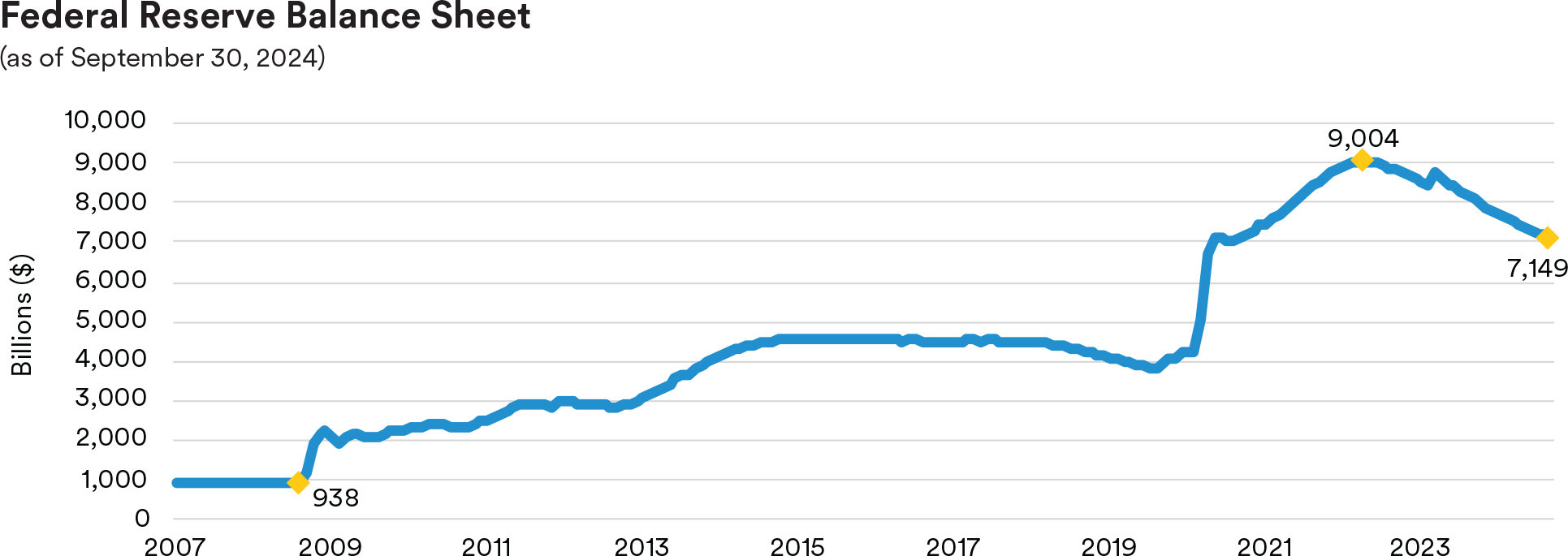

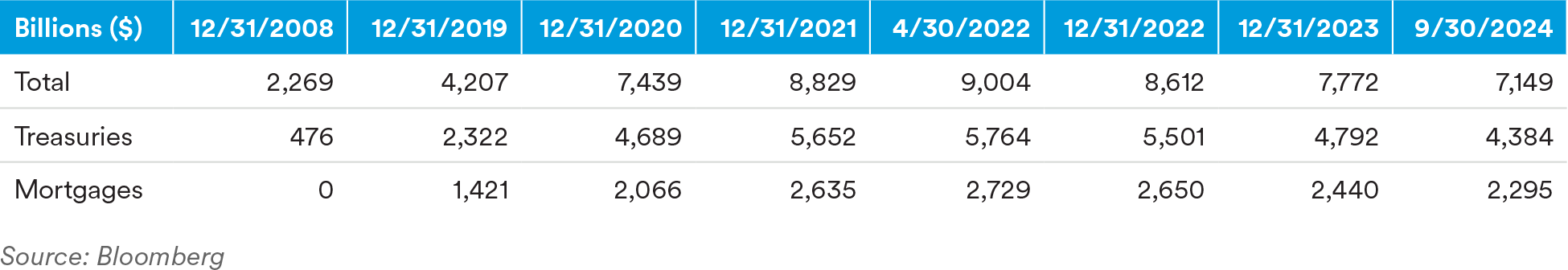

As for quantitative tightening, the Fed’s process of letting bond holdings run off its balance sheet without replacing the full amount, Powell said “we’re not thinking about stopping runoff” just because the Fed is now cutting rates. These two things can happen side-by-side, he stated. In a sense, they both represent steps in the process of normalization. The balance sheet is shrinking to a more normal state while the Fed’s primary monetary policy tool, the fed-funds rate, is being reduced from a restrictive level and returned to a range closer to its terminal rate.

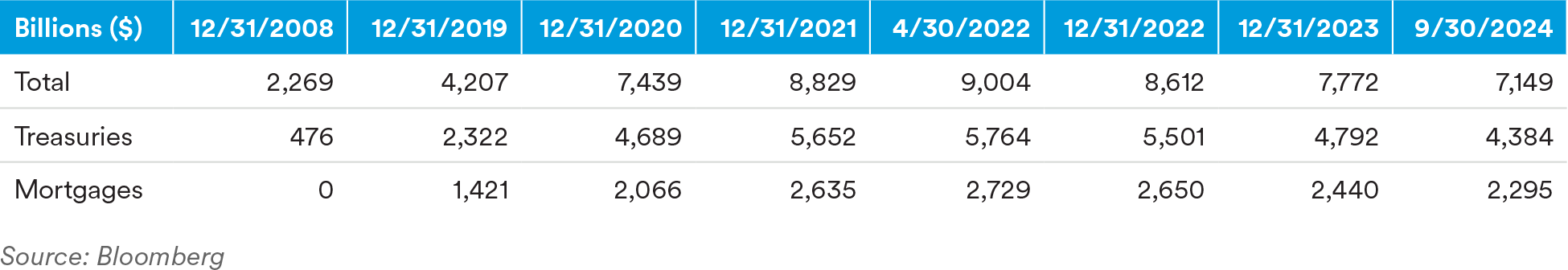

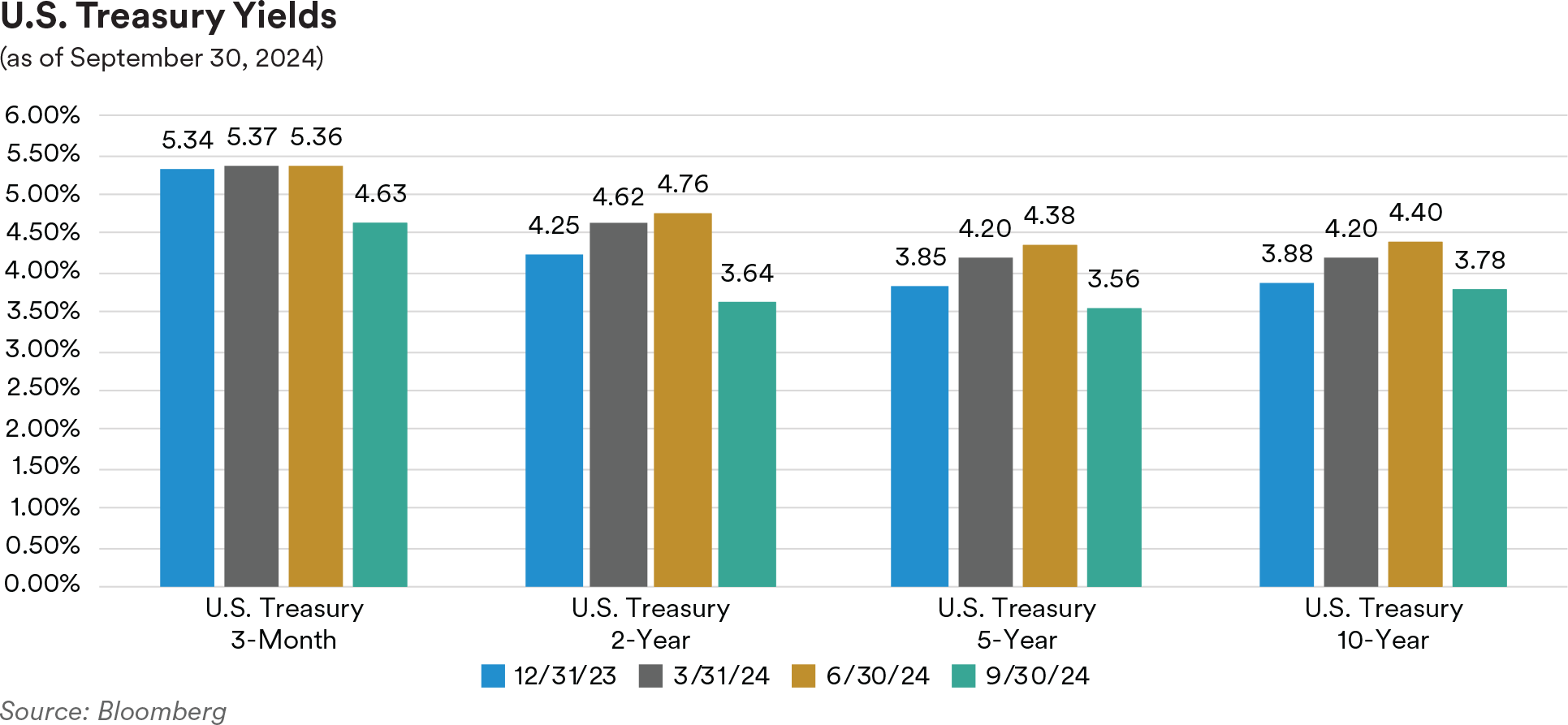

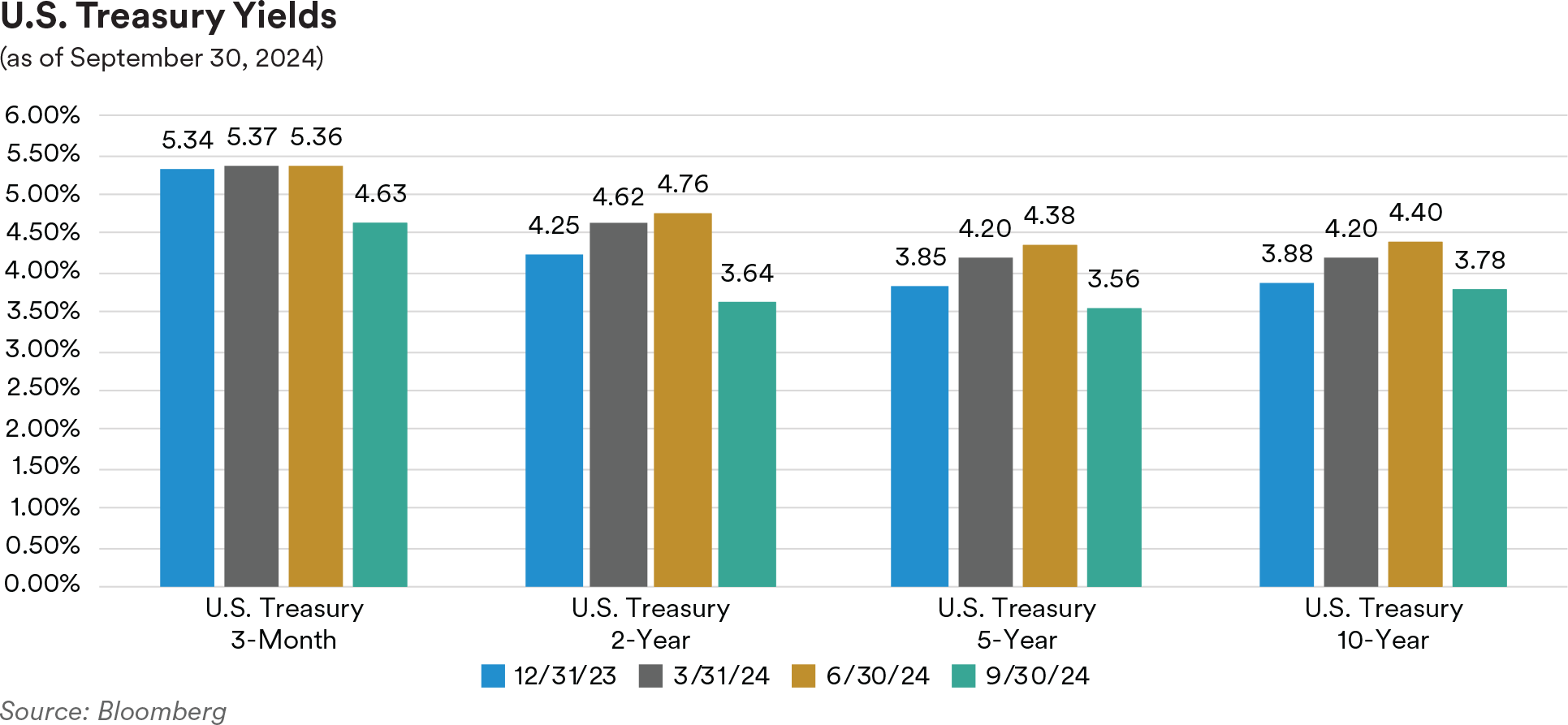

In the very front end of the maturity spectrum where we operate, short Treasury bill yields were markedly lower over the third quarter. Three-month, six-month and one-year bill yields declined by 74, 92 and 111 basis points respectively during the quarter. The two-year Treasury also moved 111 basis points lower, ending the quarter at 3.64%. The five-year Treasury yield dropped 82 basis points and closed the quarter at 3.56%, while the ten-year Treasury declined 62 basis points to finish the quarter at 3.78%. The spread between the 10-year Treasury and the 2-year Treasury steepened from -35 basis points at the start of the quarter to +14 basis points at the end of the quarter. After being mostly inverted since July 2022, the reversion or normalization of the 2s/10s yield curve turned positive in September. The spread between the five-year Treasury and two-year Treasury also steepened from -37 basis points at the start of the quarter to -8 basis points at quarter-end.

Treasury Inflation-Protected Securities (TIPS) breakeven spreads decreased during the quarter. Five-year TIPS breakeven spreads moved lower to 209 basis points from 228 basis points at the start of the quarter while the ten-year TIPS breakevens moved down to 219 basis points from 229 basis points over the same period. The five-year real yield decreased from 211 basis points at the beginning of the quarter to 148 basis points at the end of the quarter. The ten-year real yield also moved lower from 211 basis points to 160 basis points over the quarter.

Front-end Government-Sponsored Enterprise (GSE) agency spreads marginally tightened over the third quarter as the OAS of the ICE BofA 1-5 Year U.S. Bullet (fixed maturity) Agency Index ended the quarter at 1 basis point, a basis point tighter from the start of the quarter. In the SSA (Sovereigns, Supranationals & Agencies) subsector, U.S. dollar-denominated fixed-maturity security spreads were unchanged and finished the quarter on average at 26 basis points over comparable-maturity Treasuries. Agency callable spreads relative to Treasuries were wider as short-dated and short-expiry volatility in the upper left portion of the volatility surface ticked higher over the quarter. Two- and three-year maturity “Bermudan” callables, which feature quarterly calls with lockout periods of three months, saw spreads over Treasuries widen from 78 and 113 basis points at the start of the quarter to 100 and 118 basis points at the end of the quarter, respectively.

Portfolio Actions: In the third quarter, in our Enhanced Cash, 1-3 and 1-5-year strategies, we generally maintained our allocation to Treasuries while executing some small extension trades to add duration around the edges to maintain a mostly neutral stance vs. benchmark indices. By contrast, in our shorter Cash Plus strategy we slightly decreased our Treasury holdings by 3-4% as we rotated into the various spread sectors. The decrease in the agency sector was a mix of selling shorter duration callables and some of the higher coupon bonds that were open to being called by the issuers.

Outlook: As we start the fourth quarter, there has already been a dramatic repricing in front-end rates from the lows seen at the end of September. The employment report for September topped all estimates, the unemployment rate unexpectedly declined, and wage growth accelerated, reducing the odds the Fed will opt for another half point rate cut in November. We agree with the Fed’s updated projections of 50 basis points of cuts by year end, 25 basis points each in November and December. We think strength in the labor market and growth data will not discourage the Fed from continuing to cut this year. Some of the near-term headwinds we are focused on as we move toward year-end center on geopolitical risks as tension in the Middle East ramps up and with the election less than one month away, the potential shift back towards medium-term inflationary risks. We think there might be some upside risks to inflation triggered by immigration, tariffs, shelter and higher energy prices as the price of oil is likely to stay elevated. With two-year yields north of 4%, we think this looks attractive and will continue to add duration across the portfolios. We will also be watching technical support levels for two-year Treasuries at 4.10% and five-year Treasuries at 4.00% to shade our portfolios slightly longer. We anticipate that spreads for GSEs and SSAs will continue to reflect risk sentiment; however, further tightening is likely to be limited. Additionally, we expect new issue supply to remain subdued for the remainder of the year as most SSA issuers have already met their funding needs.

Performance: As rates rallied throughout the quarter, our neutral to slightly long duration bias relative to benchmark indices generated positive excess returns across all our strategies. While the steepening yield curve partially offset our gains from duration in most strategies, our Cash Plus strategy portfolios benefited from our curve positioning. Additionally, the agency sector delivered positive excess returns across all strategies where we are primarily invested in agency callable securities.

ABS

Recap: The new issue calendar was busy throughout the third quarter as issuers continued to make their way to the market. Auto issuance was the main contributor comprising $39 billion of the total $77.5 billion of new deals. Following autos were the “Other ABS” subsector (a “catch-all” category which includes deals collateralized by cell phone payment plans, timeshares, mortgage servicer advances, insurance premiums, aircraft leases, etc.) with almost $18 billion of new issuance and the equipment subsector with $8.3 billion of new issuance. The last month of the quarter was the busiest the primary market had seen since January with year-to-date issuance reaching $256 billion, the same amount issued in the entirety of 2023. New deals have remained in high demand, with many ending up multiple times oversubscribed across various sectors and rating buckets. ABS spreads ended the third quarter largely unchanged to slightly wider. Three-year, fixed-rate AAA-rated credit card and subprime auto tranches ended the quarter at spreads of 45 basis points and 73 basis points over Treasuries, respectively, 1 basis point wider in both cases. Three-year fixed-rate AAA-rated prime auto tranches ended the quarter at a spread of 67 basis points over Treasuries, 3 basis points wider. Three-year, floating-rate AAA-rate private student loan tranches ended the quarter at a spread of 88 basis points over SOFR, 3 basis points wider.

The “Other ABS” bucket has been gaining a lot of traction with the category continuing to expand as new issuers seek to access the asset-backed market for funding. As previously mentioned, the subsector saw almost $18 billion in issuance this quarter, almost double third-quarter 2023’s $9.3 billion. It is poised to record the highest annual issuance total with year-to-date supply standing at $53.3 billion, 16% higher than 2023’s total volume. The range of yields, maturity profiles and ratings draw in a variety of investors. Aircraft ABS has seen a rise in supply driven by firmer lease rates and higher demand and the digital infrastructure segment, spanning data centers and fiber deals, continues to capitalize on the ABS financing pipeline for various project needs. Verizon is the largest “Other ABS” issuer and generates a secondary ABS market with 29.8% annualized turnover in 2024. The next largest “other ABS” issuer is Subway, which has $5.7 billion outstanding, having just launched its inaugural deal about four months ago.

Student loans remain topical especially with the “on-ramp period”, a 12-month transition period where servicers did not report delinquent payments, expiring at the end of September. We expect the end of the on-ramp option to have negative knock-on effects on federally held student loans, in-school private student loans, and to a lesser extent, overall consumer debt as the financial stress relieved by the option may reemerge and create headwinds for some borrowers. On the student loan regulatory front, the Consumer Financial Protection Bureau (CFPB) filed a proposed order against Navient, a student loan servicer, which if finalized in court, would ban the company from servicing federal direct loans and from acquiring additional Federal Family Education Loan Program (FFELP) loans. In our view, the executed order would lead Navient to concentrate on its private student loan business which is less strictly regulated than government-guaranteed student loans.

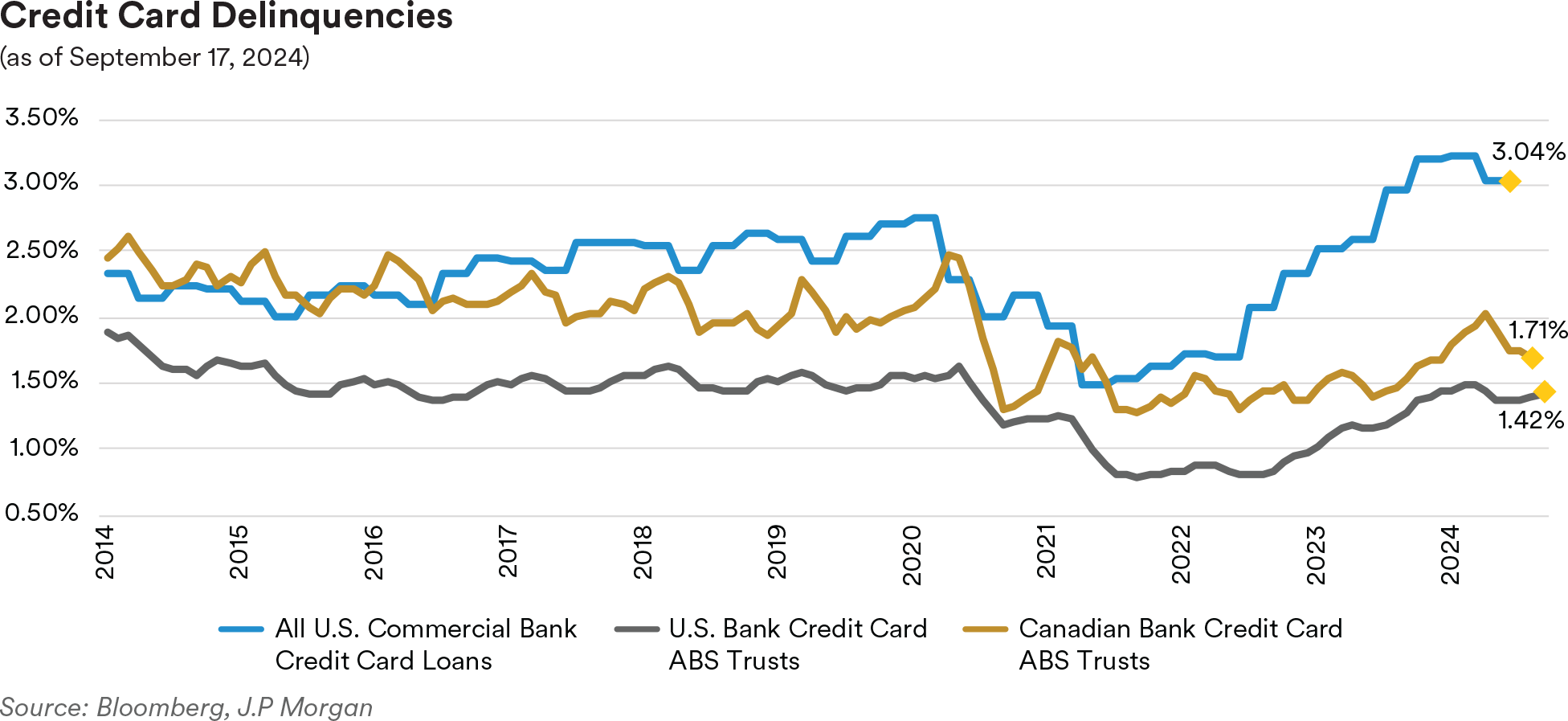

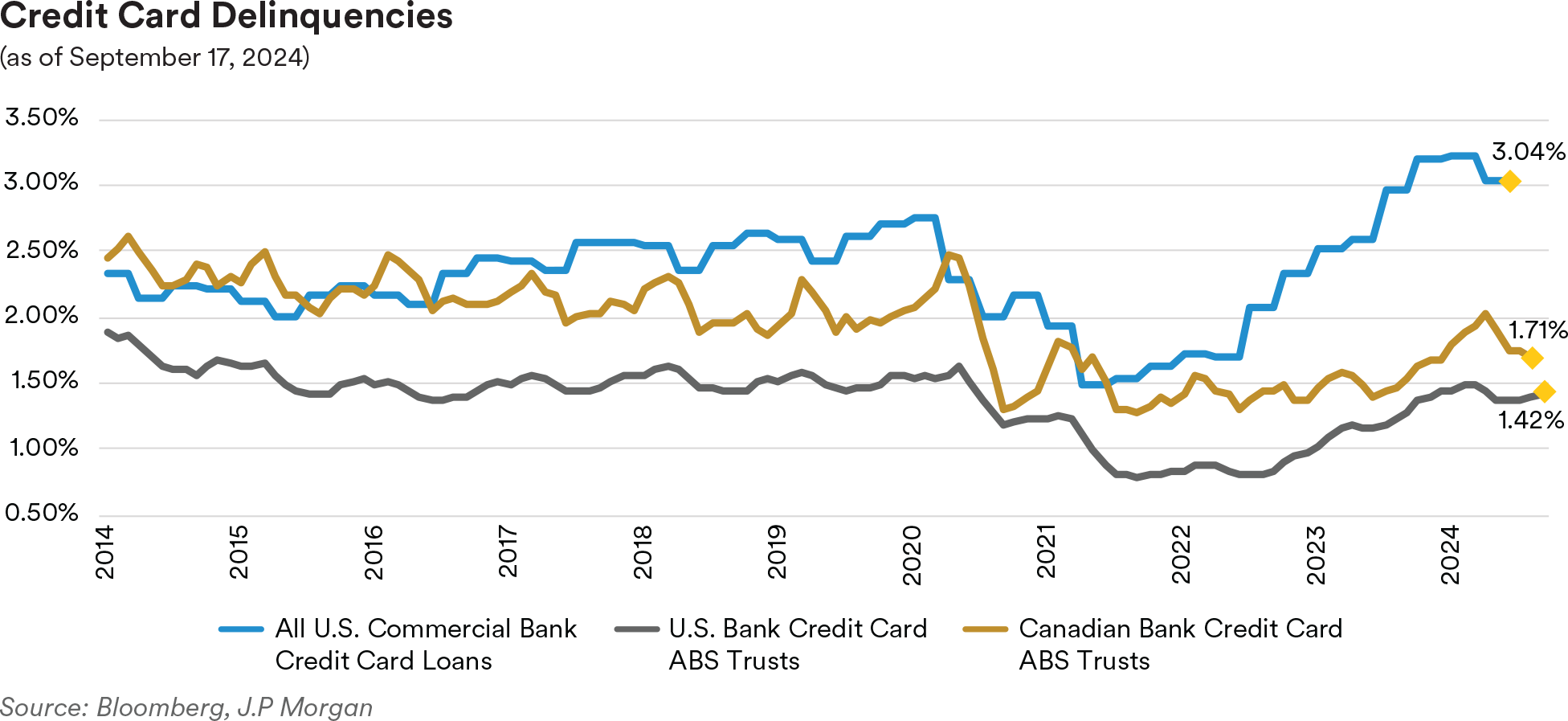

Credit card performance over the quarter was generally stable, with the JP Morgan credit card performance indices reflecting the September remittance cycle showed charge-offs and 60+-day delinquencies on bank credit card master trusts rising 6 and 1 basis point(s), respectively, over the quarter, at 2.29% and 1.00%. As we have noted in prior commentaries, although charge-offs and delinquencies have been moving higher from the pandemic’s historic lows, they still remain below historic averages. Further, we note that credit card ABS trust performance (for both domestic and Canadian card trusts) remains better than that of the broader credit card universe due to the seasoned nature of ABS credit card collateral accounts. Going forward, we continue to expect further deterioration in credit card performance for both ABS trust and non-trust accounts for the foreseeable future as consumers struggle with high interest rates, inflationary pressures and a likely slowing economy. At the end of the second quarter, bank credit card master trust balances stood at $150.8 billion, $16.2 billion higher than its year-ago level.

"We continue to expect further deterioration in credit card performance for both ABS trust and non-trust accounts for the foreseeable future as consumers struggle with high interest rates, inflationary pressures and a likely slowing economy."

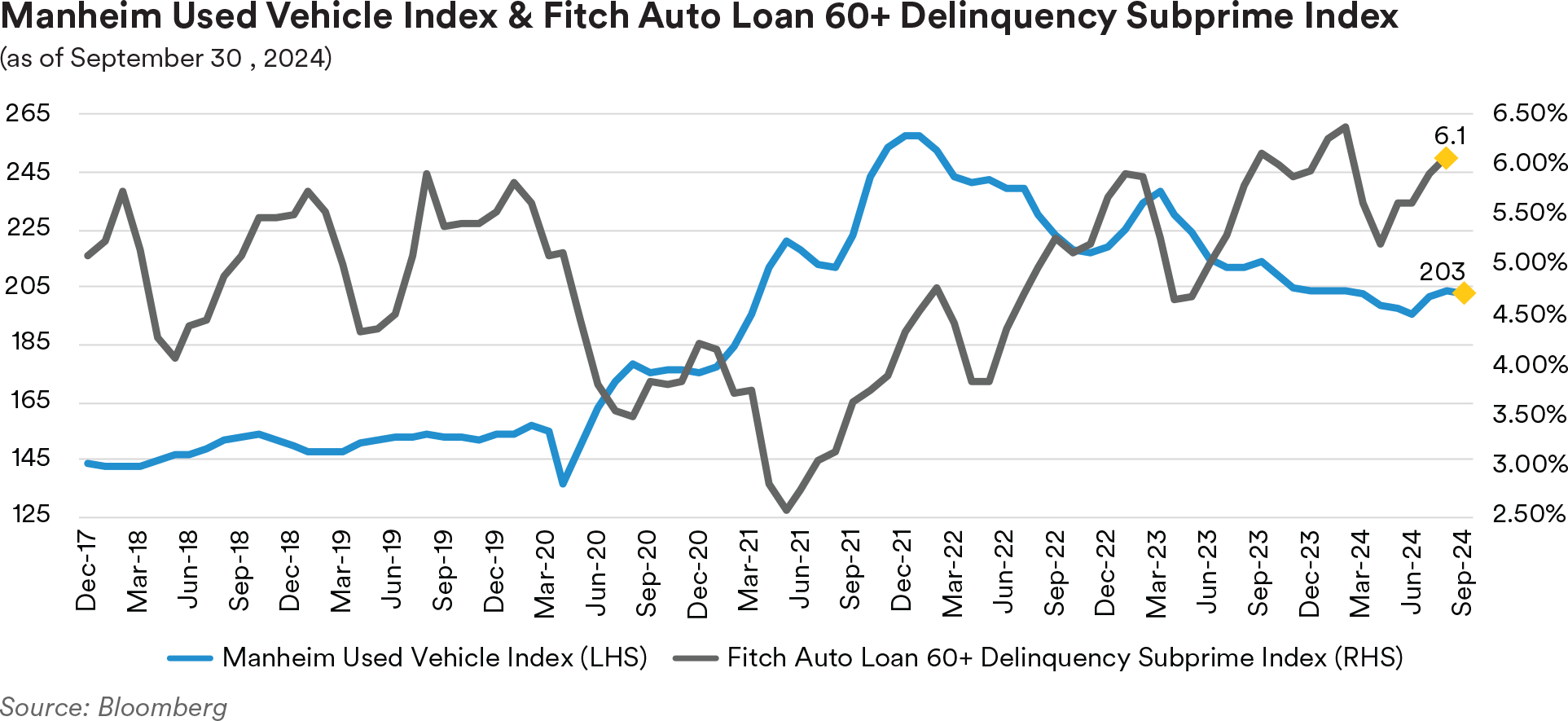

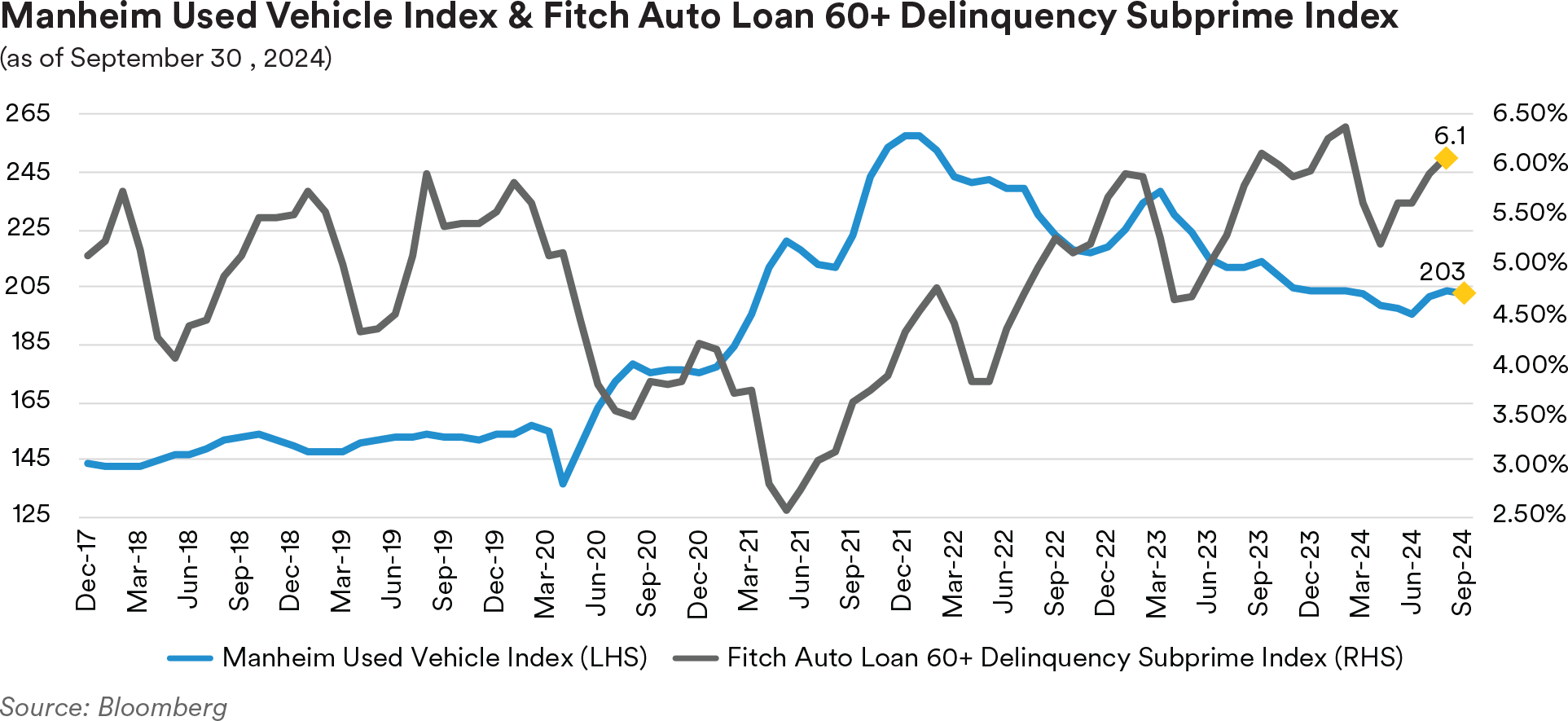

New vehicle sales rebounded in September to a 15.8 million SAAR (seasonally adjusted annualized rate) pace, following a dip in August to 15.1 million SAAR, the same pattern observed last year. September’s number was 0.5 million higher quarter over quarter. Sales over the past six months have generally drifted lower while inventories continued to rise. Affordability and a slowdown in fleet orders have been drags on growth. September saw the continuation of gains in the most affordable segments, but it was more than offset by weakness among higher priced vehicles – a theme of the past two quarters. Hurricane Helene also slightly dampened deliveries in September. Consumer spending growth has turned negative since mid-June and remains weak with spending trends fluctuating week over week. The Index of Consumer Sentiment increased slightly in August and September, influenced by falling gas prices. The national average price for unleaded gas dropped by 3.4% from the end of August. Auto loan rates evidenced little change in September with the average interest rate for new and used auto loans being 9.54% and 13.93%, respectively.

The most recent Fed Senior Loan Officer Opinion Survey reflecting sentiment as of the second quarter, showed banks generally reported tightened lending standards for credit card and other consumer loans, while standards were basically unchanged for auto loans.

Portfolio Actions: Over the third quarter we increased ABS exposure in all our strategies except our Enhanced Cash and 1-3 year strategies, where levels stayed relatively unchanged. Year to date we have increased ABS exposure across all strategies as we continued to use paydowns and sales to buy liquid, defensive tranches. We were active in both the primary and secondary markets, although we participated in fewer new issue deals than in the second quarter. A large multi-location auto dealer came to market with their third prime auto deal of the year, and we purchased the 1.15-year AAA-rated tranche at a spread of 47 basis points over Treasuries as well as the 2.70-year AAA and 3.88-year AA+-rated tranches at spreads of 62 and 93 basis points over Treasuries, respectively. We also purchased a cellular telephone service provider’s sixth and seventh device payment deals of the year as we believe they offer a compelling credit story. Consumers seem to prioritize paying their cell phone bills ahead of other debt obligations so defaults and losses in this subsector remain low relative to available credit enhancement. We purchased the AA and A-rated 2.92-year tranches at 92 basis points and 117 basis points over Treasuries, respectively. We also participated in the 4.92-year A-rated tranche at 140 basis points over Treasuries. On the credit card side, we purchased a AAA-rated 2.96-year private-label credit card company’s deal at 72 basis points over Treasuries.

Outlook: Our outlook remains largely unchanged from the second quarter. We expect economic conditions to slightly weaken, and the Fed to continue gradually easing. Accordingly, we anticipate deterioration in ABS credit metrics so continue to prefer liquid, defensive tranches and more resilient subsectors of the market. As in the prior quarter, ABS spreads remain relatively attractive compared to other spread sectors, but we remain mindful of the levels of ABS exposure within the portfolios so are unlikely to materially increase our weightings. Instead, we are likely to use sales of existing ABS holdings to fund new purchases. We reiterate our preference for prime borrowers over subprime. We continue to avoid adding CLO exposure as should the economy deteriorate as we predict, we believe leveraged loans will suffer heightened downgrades and defaults which could push CLO spreads wider.

Performance: Similarly to last quarter, after adjusting for their duration and yield curve positioning, our ABS holdings posted strong positive excess returns across all our strategies. All subsectors were positive with our fixed-rate auto and “Other ABS” holdings representing the top performers. Within autos, notable strength was seen throughout the subsector led by the large multi-location auto dealer’s inaugural auto deal we purchased in the previous quarter. In “Other ABS”, floorplans were a top performer across strategies. Student loans were also positive, performing better than last quarter.

CMBS

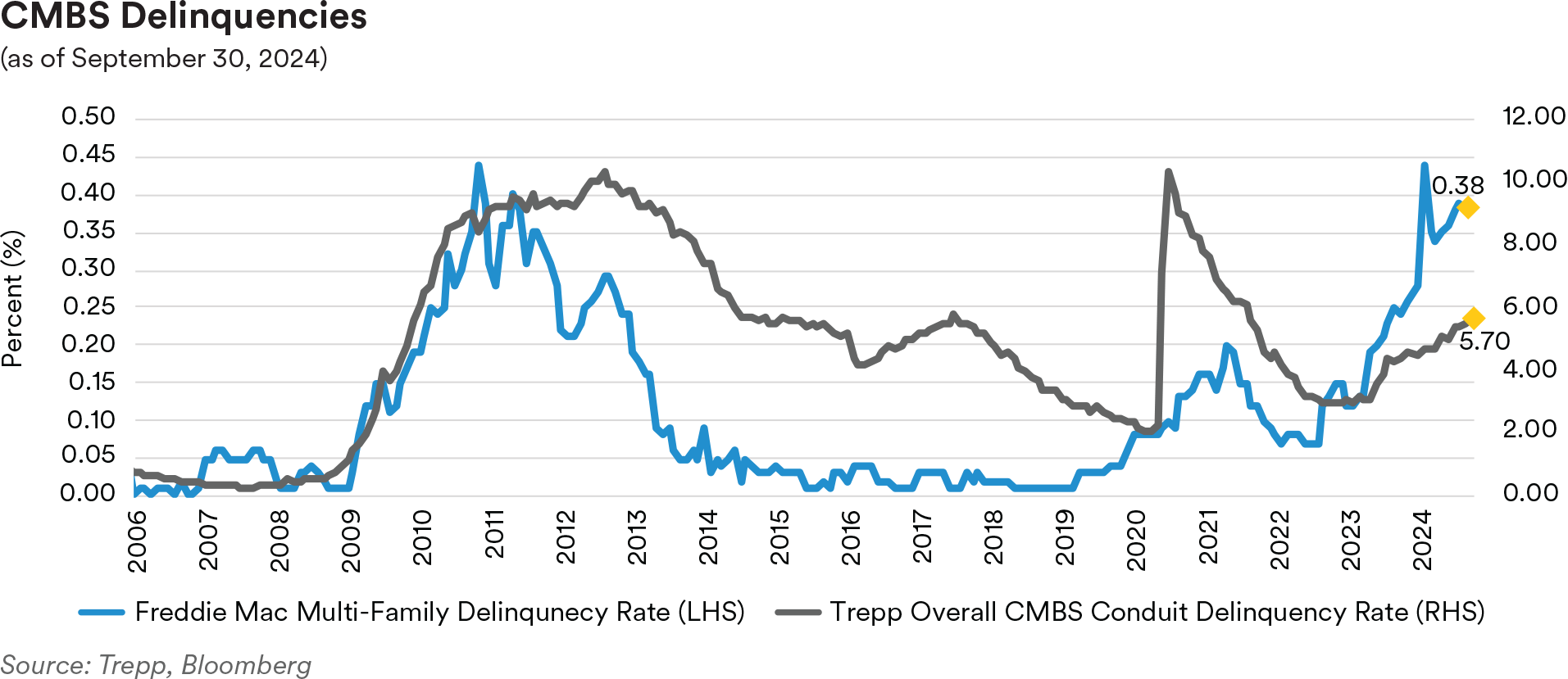

Recap: With the exception of five-year Freddie Mac “K-bond” tranches, short tenor CMBS spreads widened due to lingering worries about the health of the commercial property market (and office properties in particular). At the end of the quarter, spreads on three-year AAA-rated conduit tranches stood at 102 basis points over Treasuries, 9 basis points wider than at the start of the quarter. Spreads on five-year AAA-rated conduit tranches were 108 basis points over Treasuries, 4 basis points wider. Three-year “K-bond” tranches ended September at a spread of 29 basis points over Treasuries, unchanged from last quarter. Three-year, AAA-rated, floating-rate single asset, single borrower (“SASB”) tranches ended the quarter at a spread of 152 basis points over SOFR, 17 basis points wider. Similar to last quarter, SASB spreads were pressured by heavy supply within that subsector. At $46 billion, 2024 SASB year-to-date issuance has already more than doubled full-year 2023’s total issuance, with 80% of issuance coming as floating-rate deals. Notably, 2024 SASB issuance has been dominated by refinancings, which have accounted for 77% of the total.

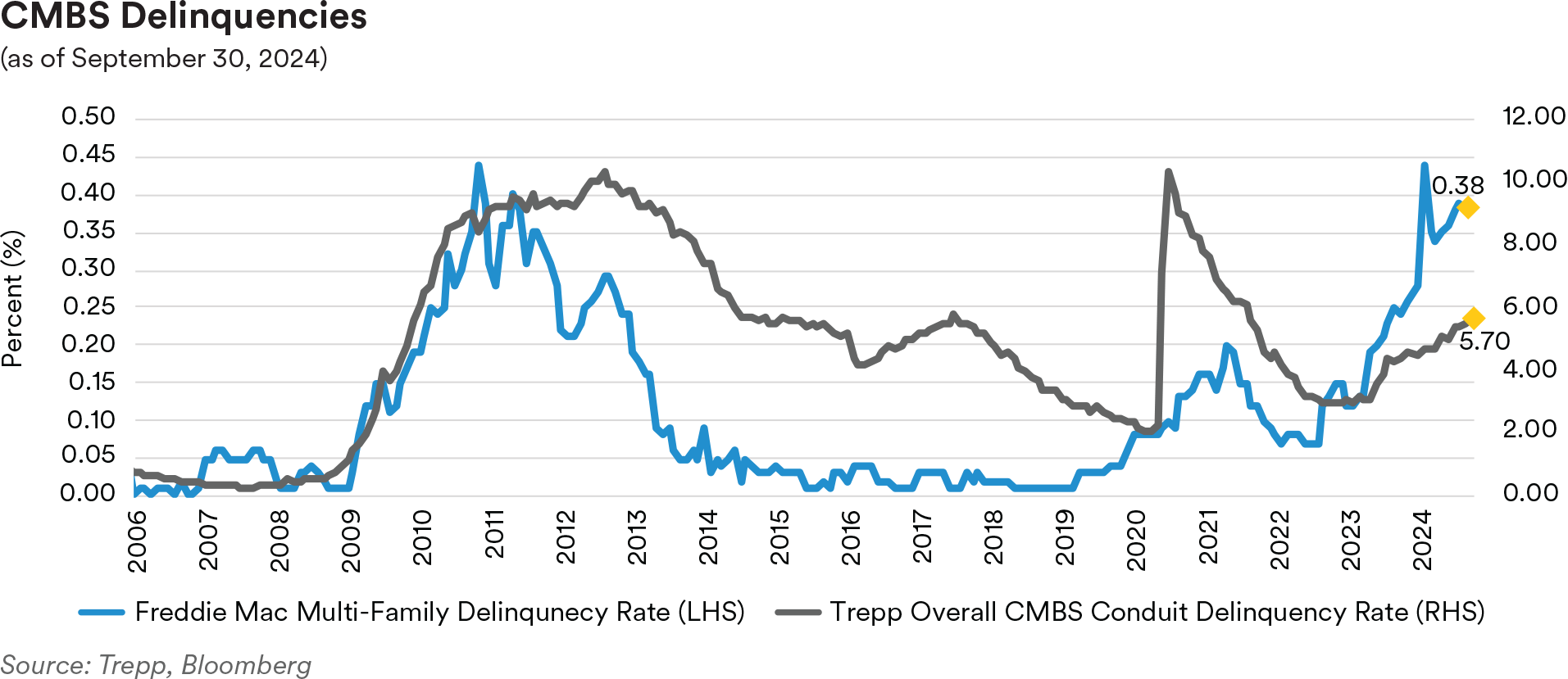

CMBS delinquencies (as measured by the Trepp 30+-day delinquency rate) rose to 5.70%, 35 basis points higher than last quarter. Year-over-year, the overall US CMBS delinquency rate is up 131 basis points. According to Trepp, a majority of the major property types contributed to the rise in the overall rate, but the retail sector contributed to approximately 50% of the net change. The retail delinquency rate rose to 7.07% in September, 86 basis points higher than the previous month. A large SASB deal that had previously been current on payments was one of many retail loans to turn delinquent in September. The office sector accounted for 37% of the $2 billion net increase in the overall dollar amount of delinquent loans in September, with the office delinquency rate increasing 39 basis points to 8.36%.

In August, the RCA CPPI National All-Property Composite Index showed prices rising 0.6% from July, the fourth consecutive month of growth. Despite the rise in the headline number, Central Business District (CBD) office prices continued their slump, falling 1.5% from July and reflecting a 27.4% decrease from last August’s level. Apartment prices have also dropped 5.7% over the last year. Prices in the Major Metros (Boston, Chicago, Los Angeles, New York, San Francisco and Washington, D.C.) are flat year-over-year while the Non-Major Metros have seen a small 0.1% increase in prices.

The most recent Fed Senior Loan Officer Opinion Survey, reflecting sentiment as of the second quarter, showed that banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories. Large banks reported that lending standards were basically unchanged for all types of CRE loans while other banks reported tightening lending standards. Our interpretation is that this disparity reflects the greater pressure facing local and regional banks from their exposure to commercial real estate loans relative to larger financial institutions. Historically, tightening lending standards precede periods of rising delinquencies and charge-offs for CRE loans.

Portfolio Actions: Aside from our 1-5 year strategy, we increased exposure to CMBS over the third quarter. Our non-agency conduit purchases were focused around adding fixed-rate “ASB” tranches across all our strategies, although at current spreads we have become more selective generally (as we have noted in prior commentaries, ASB tranches have more stable average life profiles compared to other conduit CMBS tranches). The reduction in CMBS exposure in our 1-5 year strategy was targeted towards the agency CMBS subsector as, in our view, spreads in that subsector remain relatively unappealing compared to other spread product. We used both the outright sale of agency CMBS tranches and the reinvestment of agency CMBS paydowns into other spread product to accomplish the reduction. We participated in one primary deal this quarter, a 4-year fixed rate SASB collateralized by a midtown-Manhattan office building. This $400 million deal was priced at 150 basis points over Treasuries and was an opportunistic addition to some of our portfolios.

Outlook: Given CMBS spreads tightened across the board in September, we expect to use the sale of agency CMBS as a funding source for further purchases in other spread sectors. At current levels we are neutral on ASBs and are content to maintain our current portfolio weightings, only adding additional exposure if an appealing prospect presents itself. We continue to believe that the CMBS market will face headwinds for the foreseeable future and expect a further deterioration in collateral metrics. We are unlikely to materially increase our non-agency CMBS exposure and are likely to continue to avoid participating in most new issue conduit and SASB deals.

Performance: Our non-agency and agency CMBS holdings both generated positive performance in all our portfolios after adjusting for their yield curve and duration exposure. In our Enhanced Cash strategy, the positive performance was led by our floating-rate non-agency SASB tranches. Multi-family agency tranches were the main contributor to performance in our 1-5 year strategies.

RMBS

Recap: Residential mortgage-backed securities had positive performance in the third quarter. The Bloomberg mortgage index posted 67 basis points of positive excess returns as positive performance in July (+34 basis points) and August (+35 basis points) was enough to offset the slight weakness seen in September (-2 basis points). On a spread basis, generic 30-year collateral ended the quarter at a spread of 118 basis points over ten-year Treasuries and 15-year collateral ended the quarter at a spread of 64 basis points over five-year Treasuries, both 29 basis points tighter. Non-Agency spreads were wider in September after tightening in August. Prime jumbo front cashflow tranches ended the quarter at a spread of 195 basis points over Treasuries, 40 basis points wider on the quarter.

In the recent past, higher mortgage rates have caused refinancing activity to dissipate, heavily skewing new originations towards purchase loans. This trend has resulted in a meaningfully higher share of first-time home buyer (FTHB) loans relative to total originations, but with the Fed beginning an easing cycle, the share of refi loans has begun to rise. The Fed’s mortgage portfolio ended the third quarter at $2.27 trillion following paydowns of $16.2 billion in September, $17.7 billion in August and $18.2 billion in July.

The July release of the Federal Reserve’s Senior Loan Officer Survey showed generally weaker demand for residential real estate loans. However, banks reported that demand for HELOCs was basically unchanged over the quarter.

In mid-September, Fed Vice Chair Barr gave a speech outlining the updates to Basel III Endgame, a proposal for stricter bank capital requirements with a focus on credit, market and operational risk. On credit risk, regulators are seeking to end banks' ability to use their own internal risk models when determining how much capital should be held against lending activities, like mortgages or corporate loans. In his speech, Vice Chair Barr took a conciliatory tone towards Basel III’s critics. He described certain modifications to the Basel III Endgame that he intended to recommend to the Federal Reserve Board as part of a major re-proposal, which would then be open to a new round of vigorous comment and debate. Among those modifications is a softening of the required capital to be held against mortgage-related assets and certain retail loans.

Portfolio Actions: Our MBS weighting remained relatively unchanged over the quarter and stands in the low single digits across all strategies. We opportunistically added exposure to several non-agency prime, closed end second-lien deals in our longer strategies. Collateralized by loans to high FICO score borrowers, these deals offer attractive spreads and benefit from the positive credit fundamentals supporting the residential housing market.

Outlook: For existing holdings, the risks in both agency and non-agency mortgages appear manageable in our view compared to the uncertainty seen around commercial real estate (most notably in office properties) and worsening consumer delinquency metrics (particularly for subprime borrowers). We remain predisposed to increase our exposure to second-lien deals collateralized by high FICO borrowers and owner-occupied properties. We are likely to avoid recent-vintage non-agency deals with significant exposure to investor properties due to early signs of possible worsening credit performance in that subsector. We would also likely increase portfolio exposure to agency specified pools but, as we have noted in prior commentaries, at present spreads do not appear compelling relative to other spread sectors so we are content to wait for a better entry point.

Performance: RMBS saw positive performance across all strategies this quarter led by excess returns from our seasoned 2.5% and 3.0% 15-year specialized pool holdings. Within agency CMOs, performance was flat or slightly positive across all the portfolios. Non-agency CMOs saw mixed performance while there was slight to flat outperformance in the shorter and longer strategies and slight underperformance in the 1-3 year strategies.

Municipal

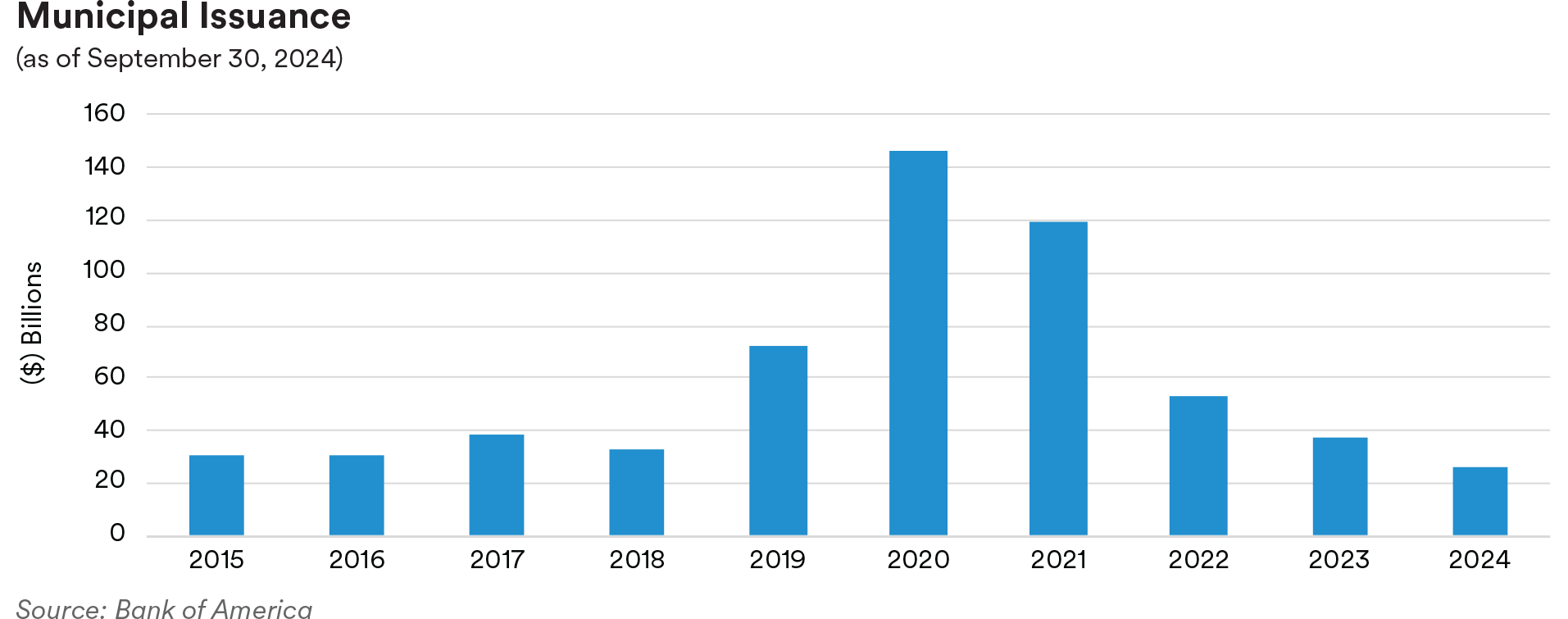

Recap: Total municipal new issue supply was $140 billion in the third quarter and as a component of total supply, taxable municipal issuance was $8.9 billion, 30% higher on a year-over-year basis for the quarter; however, on a year-to-date basis, taxable issuance is 6% lower than 2023. Even as taxable new issue supply was limited, modestly wider credit spreads in the front part of the municipal market curve resulted in negative excess returns for the sector. For the quarter, the ICE BofA 1-5 Year U.S. Taxable Municipal Securities Index had a total return of 3.23%, with OAS widening 1 basis point to end the quarter at 44 basis points, compared to the ICE BofA 1-5 Year U.S. Treasury Index’s total return of 3.39%.

Credit fundamentals, as demonstrated by S&P’s upgrade-to-downgrade ratio of 1.7 to 1 over the first two months of the third quarter, continued to be resilient. During the quarter, there were quite a few noteworthy rating upgrades across different sectors. The State of Kentucky was upgraded to Aa2 from Aa3 by Moody’s. The rating agency’s rationale for the upgrade was the State’s stronger fiscal governance, commitment to structural balance, and high reserve levels, along with continued paydowns of unfunded pension liabilities. Other positive ratings actions at the state level included Oklahoma’s upgrade to Aa1 from Aa2 by Moody’s, New Jersey’s and New Mexico’s outlook revisions to ‘positive’ by Moody’s, and Arizona’s outlook revision to ‘positive’ by S&P. In the Airport sector, S&P upgraded Dallas-Fort Worth International’s rating to AA- from A+, while Moody’s revised the airport’s outlook to ‘positive’, reflecting continued strong operational and financial performance.

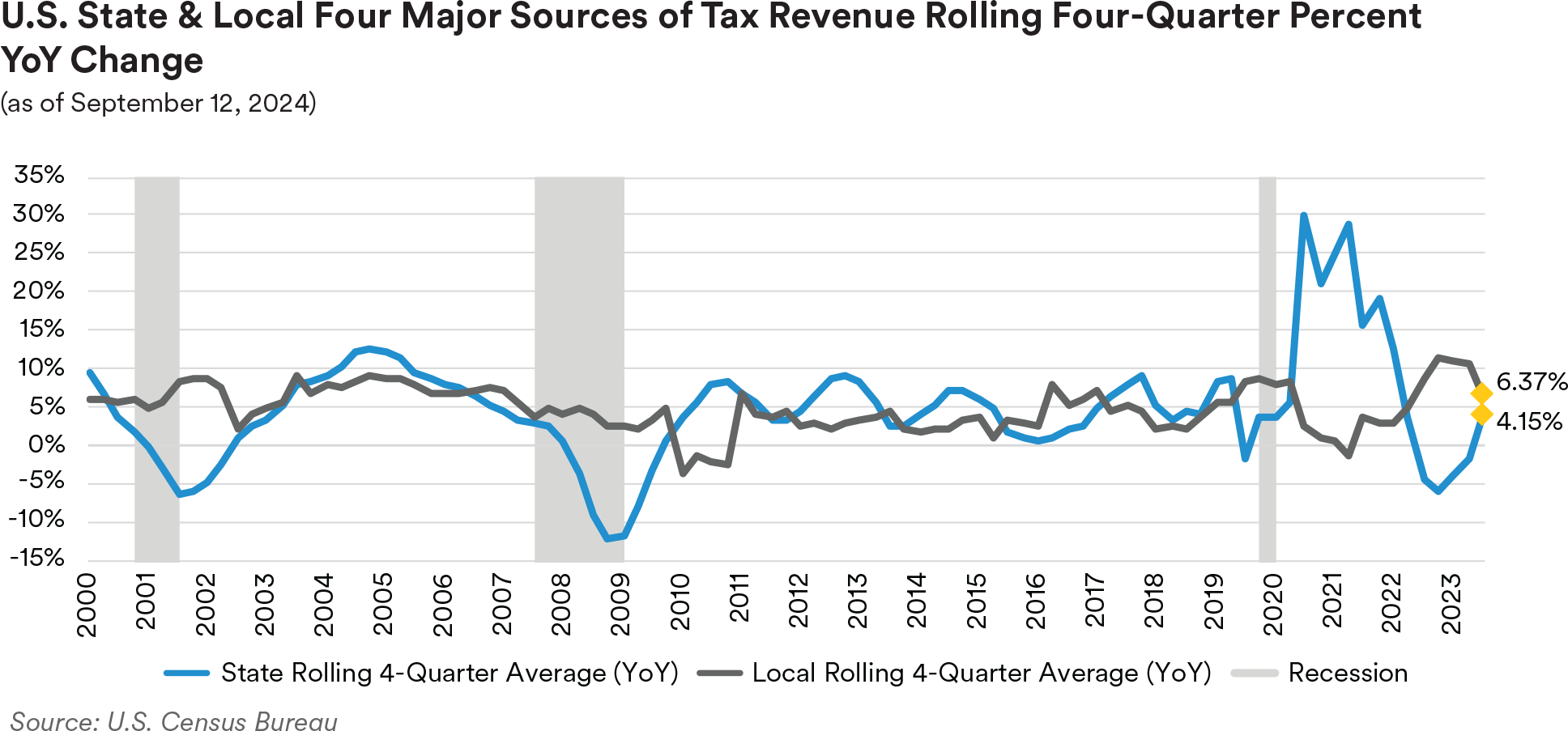

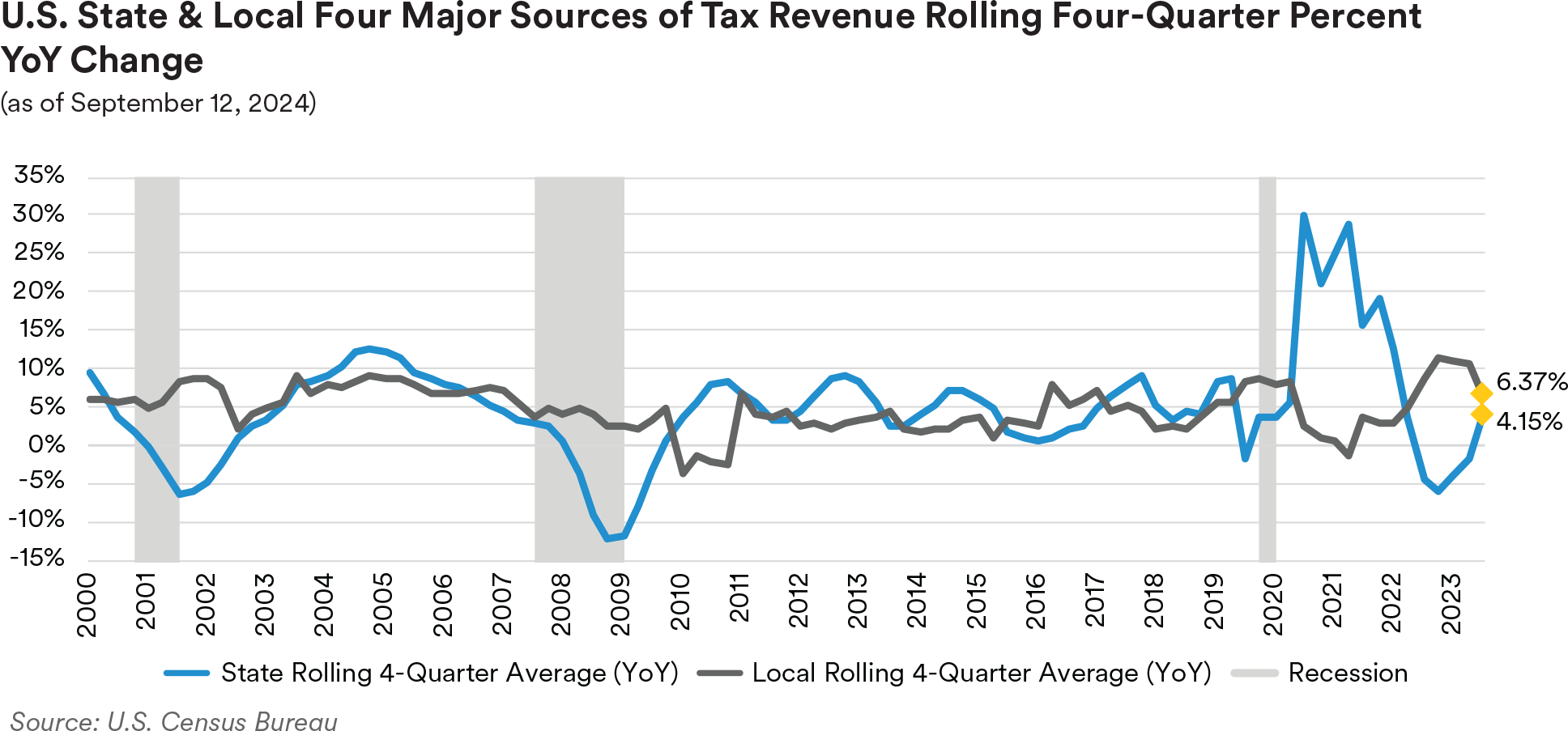

Overall, based on U.S. Census Bureau data collected for state and local tax revenues through June 30, 2024, state receipts reversed their negative trajectory while receipts at the local level declined quarter-to-quarter from the four major tax sources (personal income, corporate income, sales and property taxes). The graph below highlights an improvement in revenue receipts at the state level and a decrease in revenues at the local level when comparing year-over-year percentage change in revenues from these major sources on a trailing four-quarter average basis. On a comparable year-over-year basis, personal income taxes were up 12.5%, corporate income tax collections were up 9.2%, sales taxes were up 2.3%, and property tax receipts were up 7.0% versus the second quarter of 2023.

We continue to monitor pension funding levels that can impact state budgets with lower levels having the potential to stress balance sheets. One indicator we track is Milliman’s Public Pension Funding Index, which is comprised of the 100 largest U.S. public pension plans. This index had positive momentum during the first two months of the quarter, ending higher than level reported for the end of first-quarter 2024, which was 79.7%. The index increased to 79.9% at the end of June from 79.4% in May, and then further increased to 80.8% at the end of July and 82.0% at the end of August due to robust investment returns over the previous four months. The index remains well below its 85.5% peak, however, reached at year-end 2021.

Portfolio Actions: Our allocation to taxable municipals was maintained in our Cash Plus strategy, increased in our Enhanced Cash strategy and reduced in our 1-3 year and 1-5 year strategies over the third quarter. On the new issue front, we added to exposure in the Local Obligation, Sewer, and Water sectors. In the secondary market, we were active in adding to high-quality issuers in the Airport, Essential Service, Local Obligation, Port, and Tax-backed sectors. In regard to our sale activity, our strategy remains centered on selling shorter-duration bonds to capitalize on more favorable opportunities in the other spread sectors in which we invest.

Outlook: In our previous commentary, we referenced a report from The National Association of State Budget Officers, which suggested recent trends in general fund spending, the pace of revenue growth, and overall balances indicate a steady shift towards a more stable budget environment for fiscal 2025. Along with an expected decline in revenue growth, they estimated a decline in fund balances as states are expected to draw on these funds. The Pew Charitable Trusts recently published an article that supports our stance. They stated that the growth rate of reserves is slowing, referencing that in fiscal 2024, the median increase in rainy day fund balances was 5.7%, a significant decrease from 15.8% the previous year. Notably, only 33 states boosted their rainy-day funds in fiscal 2024, the lowest number in eight years. By the close of the 2024 budget year, states marked a turning point in their fiscal flexibility as they reduced their ending general fund balances by 41% from the previous year, relying more on these funds than on rainy-day funds to balance their budgets. While this decline is partly due to weakening revenues and growing expenditure pressures, it also reflects a common practice of utilizing surplus funds to pay down debt or finance one-time projects. As a result, for many states, this spending trend aligns with standard budget practices. However, the overall reduction in total balances limits states’ fiscal flexibility. Considering potential budget stress, we favor state and local governments that demonstrate financial flexibility, possess diverse economies, and experience growing populations. Conversely, we are cautious on those states with declining revenues and tax systems susceptible to economic downturns, particularly if they carry substantial pension liabilities or other significant fixed costs.

In revenue bonds, the port sector experienced a short-lived strike impacting port operations along the eastern U.S. seaboard from Maine to the Gulf Coast. The International Longshoremen’s Association workers union and the United States Maritime Alliance (the employer group) reached a tentative agreement, extending their master contract until January 15, 2025. The tentative agreement addressed a wage hike, however, one of the key issues that remains unresolved is the use of automated machinery that workers fear will lead to job losses. There are several large issuers of municipal debt in this sector along the eastern U.S. coast, including issuers in Florida, Massachusetts, and New York. While a prolonged strike would have adversely affected the U.S. economy, we did not expect it would have had a notably negative impact on the credit metrics of larger municipal debt issuers in the sector. In Florida, the Port of Miami generates only about 30% of its revenues from cargo, with the remaining 70% coming from cruise ship operations, parking, and related activities. In 2023, debt service coverage was nearly 3 times, and approximately 25% of the debt is subordinated. This structure not only offers additional support for senior debt in a stressed environment, but any withdrawals from the subordinated debt’s reserve account are replenished by the unconditional pledge from Miami-Dade County. The Massachusetts Port Authority‘s issuance reflects consolidated debt with the Maritime segment contributing 8.5% of operating revenues and Boston Logan Airport providing 88% of the authority’s revenues. Debt service coverage on Massachusetts Port bonds was just under 4 times in 2023 and 2024. In regard to The Port Authority of New York/New Jersey, their debt is also consolidated and secured by the New York City area airports, tunnels, bridges, terminals, WTC, PATH and finally seaport revenues, the latter of which accounts for less than 7% of total net revenues. While there is some risk that the final negotiations could break down, we remain comfortable adding to the sector should spreads widen as a consequence.

We remain committed to prioritizing liquidity while maintaining a defensive bias. Given the current economic and political environments, we recognize municipal issuers may face budgetary pressures and policy changes. Therefore, we will continue to be selective in our approach in identifying issuers and sectors to add to our portfolios. Taking the market landscape and credit fundamentals into consideration, we maintain our view that overall spreads remain relatively tight to other spread sectors in which we invest but will opportunistically increase our exposure as favorable opportunities arise.

Performance: Our taxable municipal holdings were neutral to performance in our Enhanced Cash and 1-3 year strategies and generated positive performance in our Cash Plus and 1–5 year strategies in the third quarter. On an excess return basis, positive excess returns were generated by Airport, Highway, and State Tax-backed issues.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK, this document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a "professional client" as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees' pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.